The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Cheniere Energy

Youtube Subscribe

Open: 149.99 Close: 148.27 Change: -1.72

How to get informed about Cheniere Energy Company Inc Stock quickly using an AI.

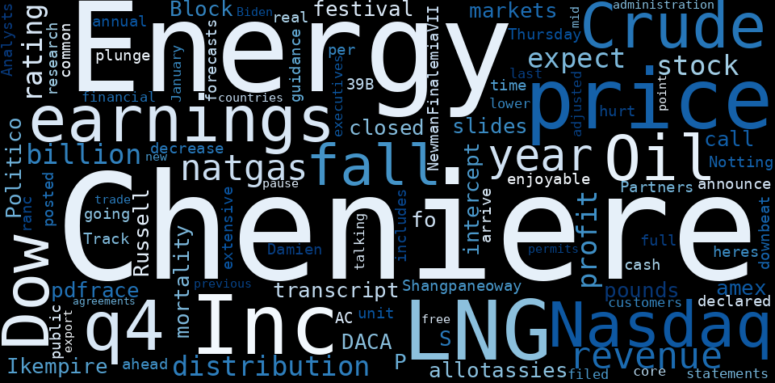

How much time have you spent trying to decide whether investing in Cheniere Energy? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Cheniere Energy are: …

Stock Summary

Cheniere Energy, Inc. owns and operates the Sabine Pass LNG terminal in Cameron Parish, Louisiana; and the Corpus Christi LNG. The company also owns Creole Trail pipeline, a 94-mile pipeline interconnecting.

Today's Summary

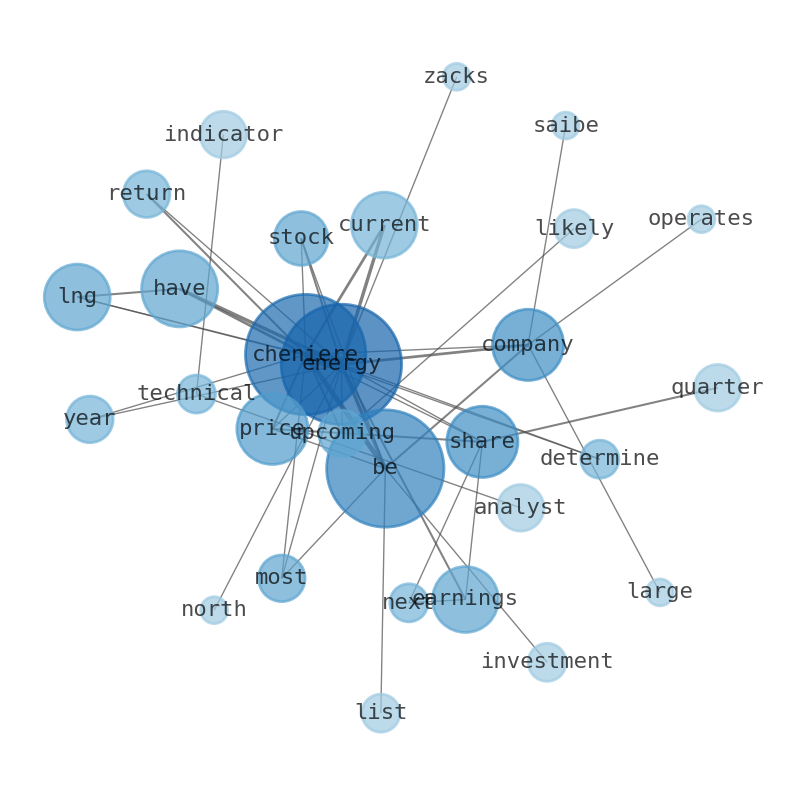

Cheniere Energy (LNG) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Cheniere energy has been one of the stocks most watched by Zacks. Shareholders could enjoy a 1.06% return on their shares over the next year.

Today's News

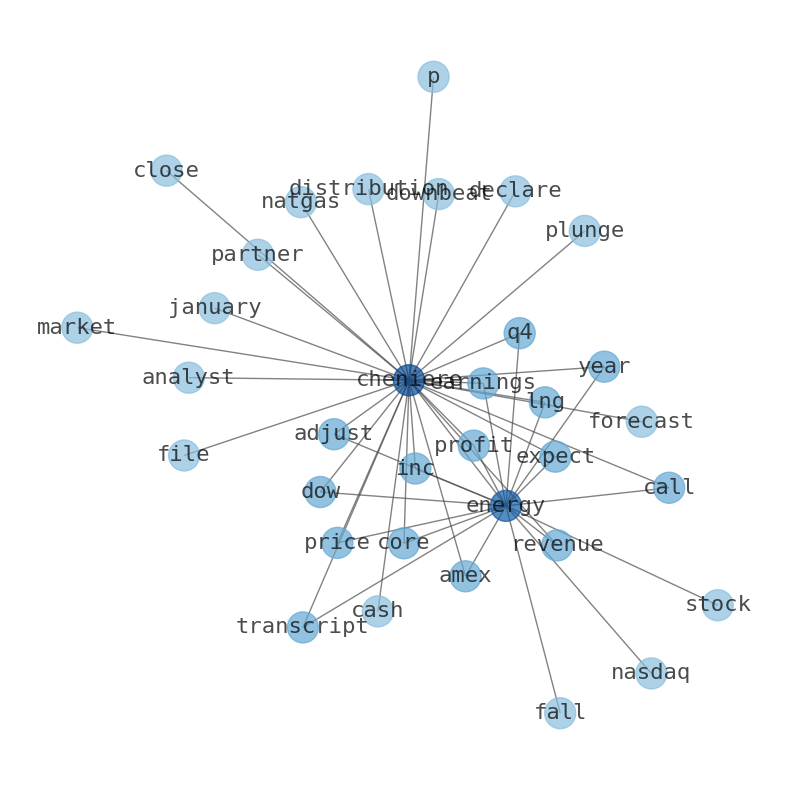

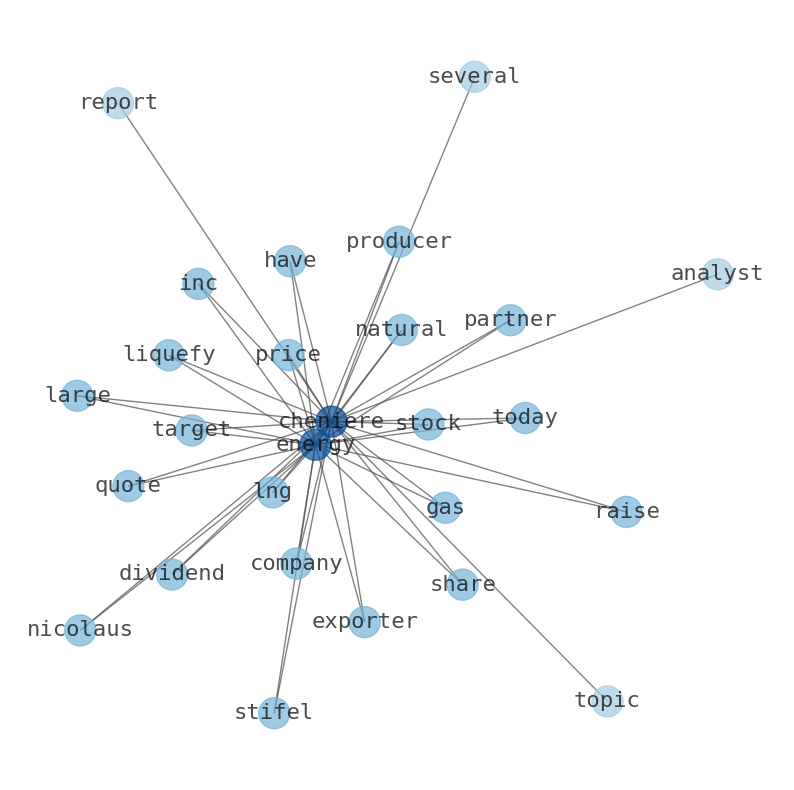

Cheniere Energy (LNG) has an impressive earnings surprise history and currently possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Cheniere energy has been one of the stocks most watched by Zacks. Cheniere Energy is one of the largest energy companies in North America. The company operates the Saibe Pass and Corpus Christi terminals, which dominate US LNG exports. Cheniere Energy shares (LNG) are listed on the NYSE MKT and all prices are listed in US Dollars. Cheniere Energys stock currently trades at around 5x recent earnings. Shareholders could enjoy a 1.06% return on their shares over the next year. Cheniere Energy is most likely to increase significantly in the upcoming years. Investors typically determine if Cheniere energy is a good investment by looking at earnings, sales, fundamental and technical indicators, competition as well as analyst projections. Cheniere Energy is considered the number one company in current valuation category among related companies. The most important aspect of a successful company is its ability to generate a profit. Profitability drivers are factors that can directly affect your investment outlook. Cheniere Energys market volatility, profitability, liquidity, solvency, efficiency, growth potential, financial leverage, and other vital indicators. We have many different tools that can be utilized to determine how healthy Cheniere Energy is operating at the current time. Probability of Cheniere Energy price to stay between its current price of $ 149.58 and $174.69 at the end of the 90-day period is about 16.81. Considering the market returns are reactive to returns on the market. Cheniere Energy has a current ratio of 0.75, suggesting that it has not enough short term capital to pay financial commitments when the payables are due. Over 88.0% of the company shares are owned by institutions. Cheniere Energy is a leading producer of LNG in the United States and has a strong presence in the global LNG market. Cheniere energy has a stable share price and exhibits no significant volatility compared to other US stocks over the past three months, usually moving +/- 5% a week. Cheniere Energy exported a record 167 liquefied natural gas cargoes in first-quarter 2023. Armstrong World Industries Inc (Symbol: AWI) : Cheniere. Energy Partners L P and Hess Midstream LP will all trade ex-dividend for their respective upcoming dividends. Cheniere Energy stock price is 149.58 USD today. Cheniere share price is forecast to RISE/FALL based on technical indicators. Analysts estimate an earnings decrease this quarter of $2.39 per share, an increase next quarter of$0.20 per share. The call contract at the $150.00 strike price has a current bid. Cheniere Energy ( NYSEAMERICAN:LNG – Get Rating ) last announced its quarterly earnings results on Thursday, February 23rd. Research analysts anticipate that Cheniere energy will post 16.23 EPS for the current fiscal year. The company recently announced a quarterly dividend, which will be paid on Wednesday, May 17th.

Stock Profile

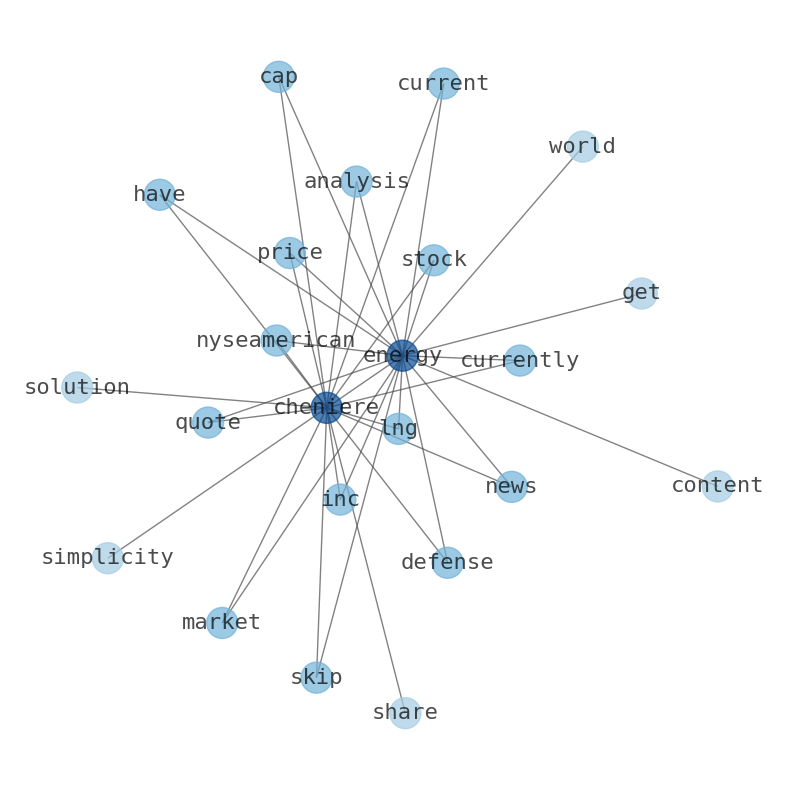

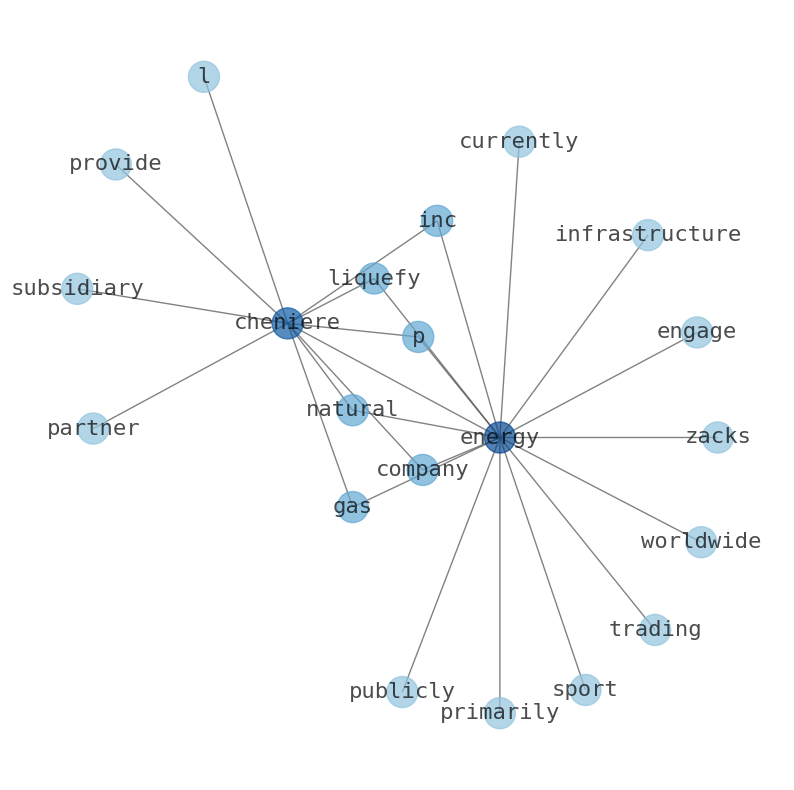

"Cheniere Energy, Inc., an energy infrastructure company, primarily engages in the liquefied natural gas (LNG) related businesses in the United States. It owns and operates the Sabine Pass LNG terminal in Cameron Parish, Louisiana; and the Corpus Christi LNG terminal near Corpus Christi, Texas. The company also owns Creole Trail pipeline, a 94-mile pipeline interconnecting the Sabine Pass LNG terminal with various interstate pipelines; and operates Corpus Christi pipeline, a 21.5-mile natural gas supply pipeline that interconnects the Corpus Christi LNG terminal with various interstate and intrastate natural gas pipelines. It is also involved in the LNG and natural gas marketing business. The company was incorporated in 1983 and is headquartered in Houston, Texas."

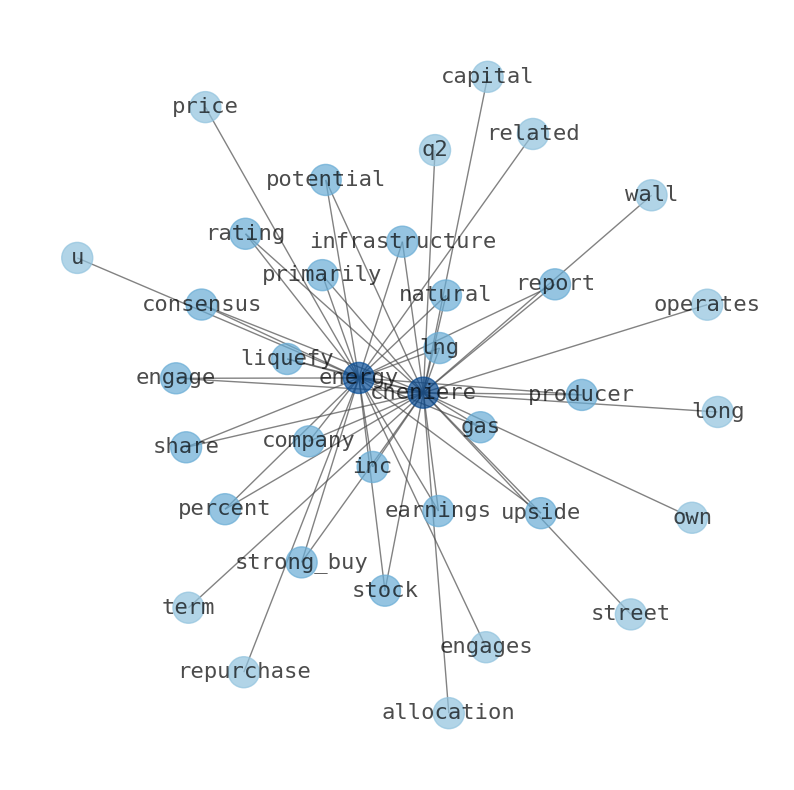

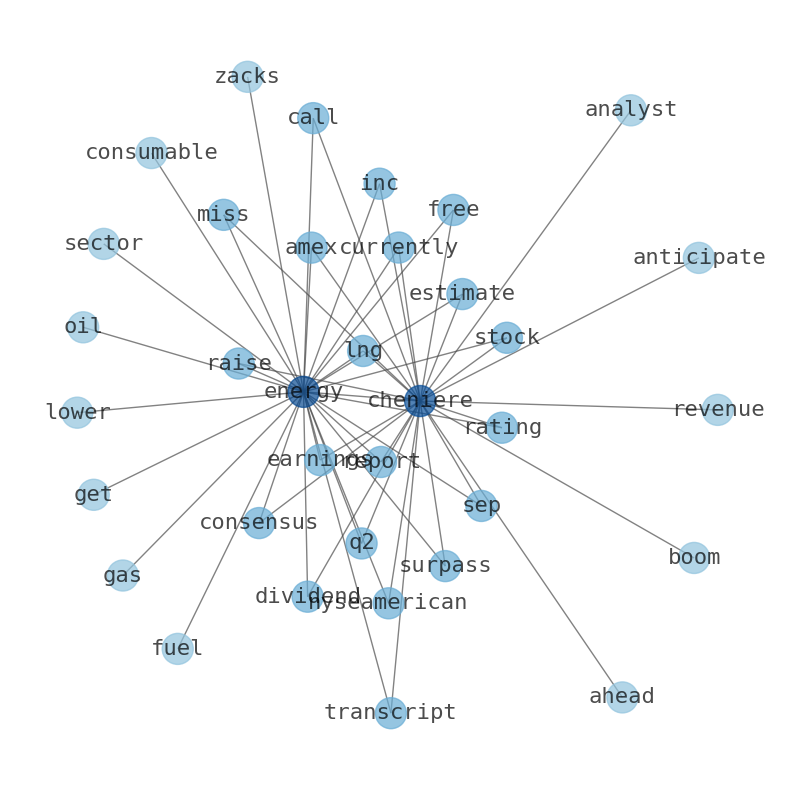

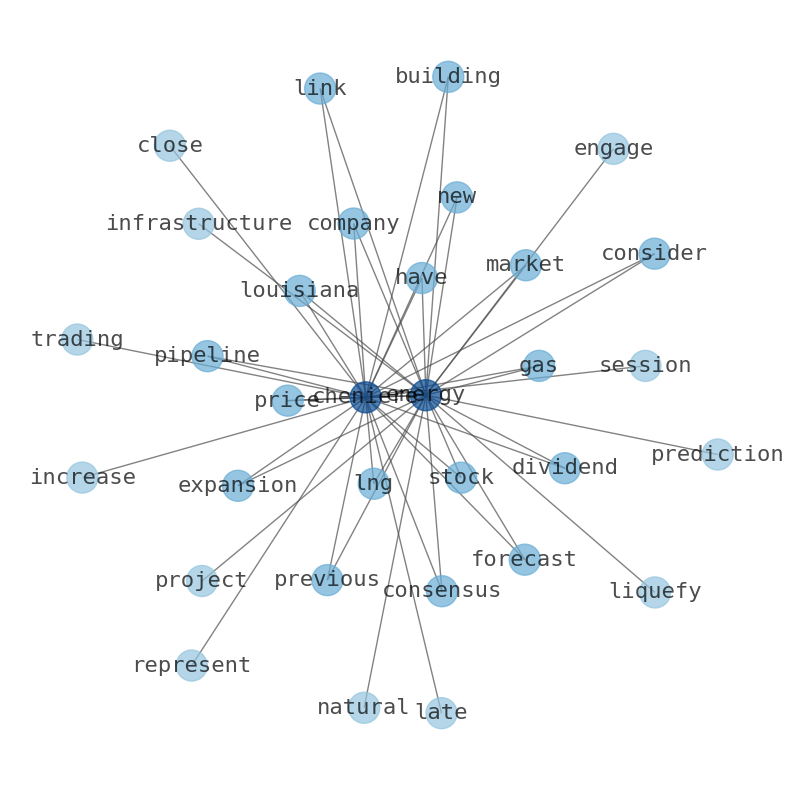

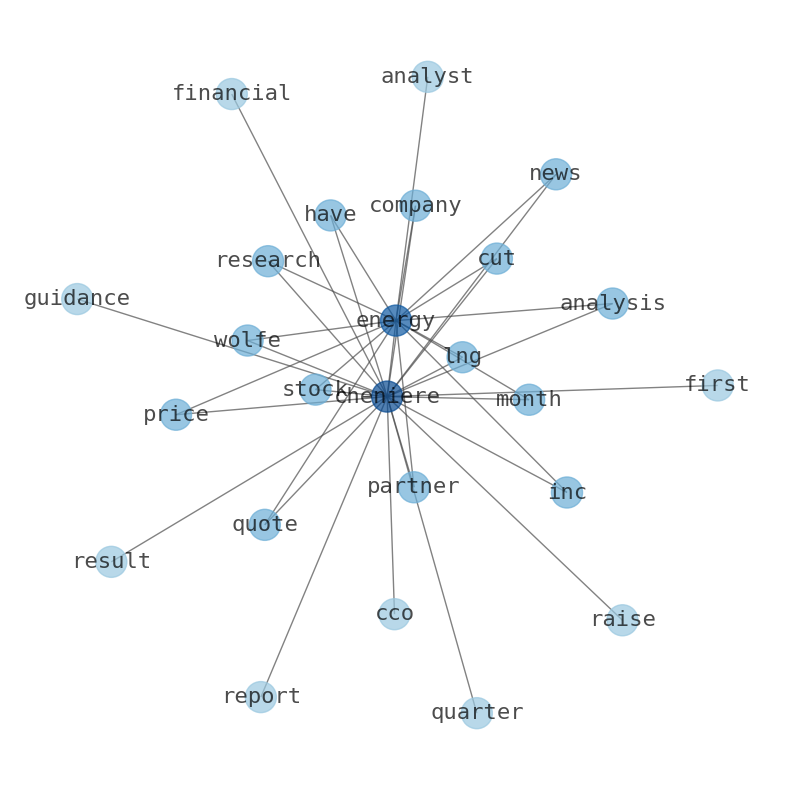

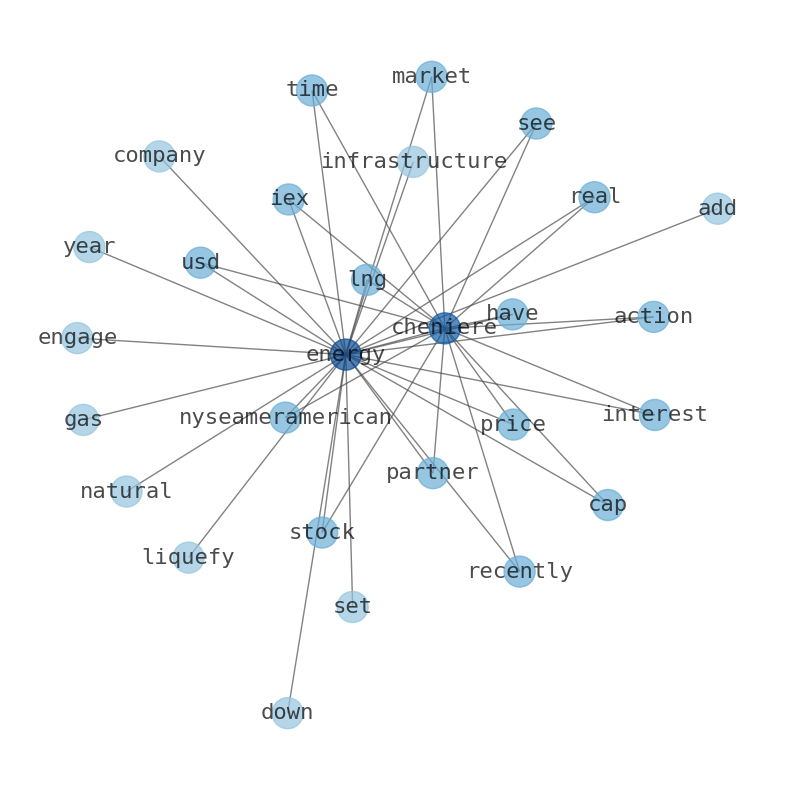

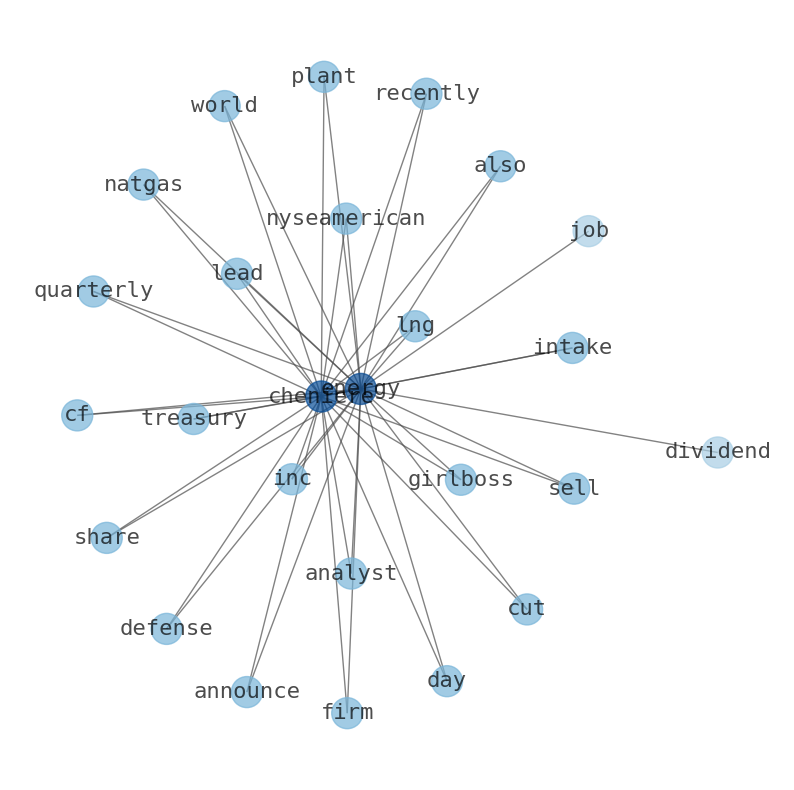

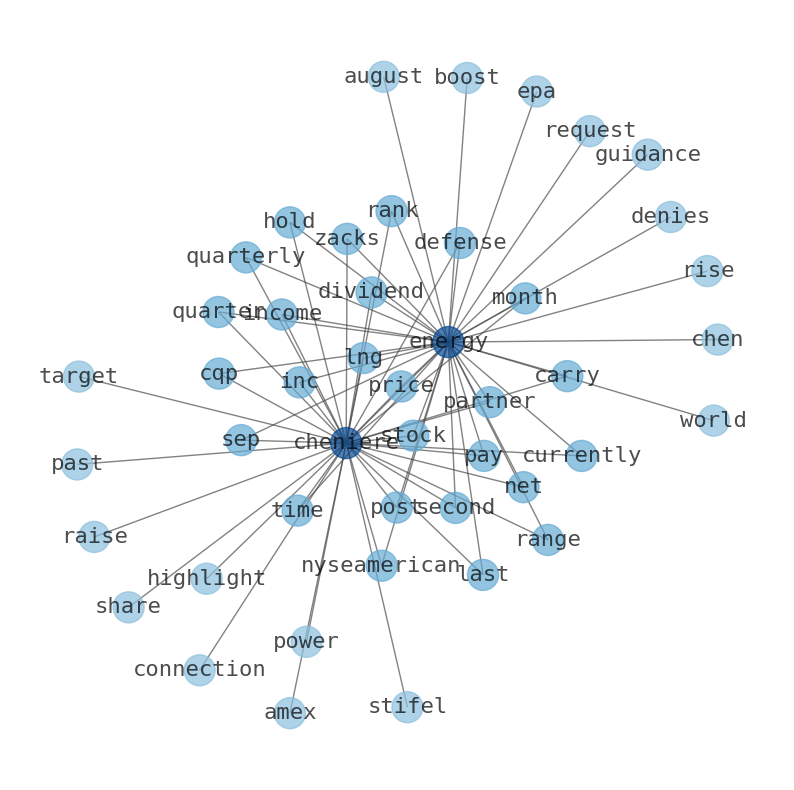

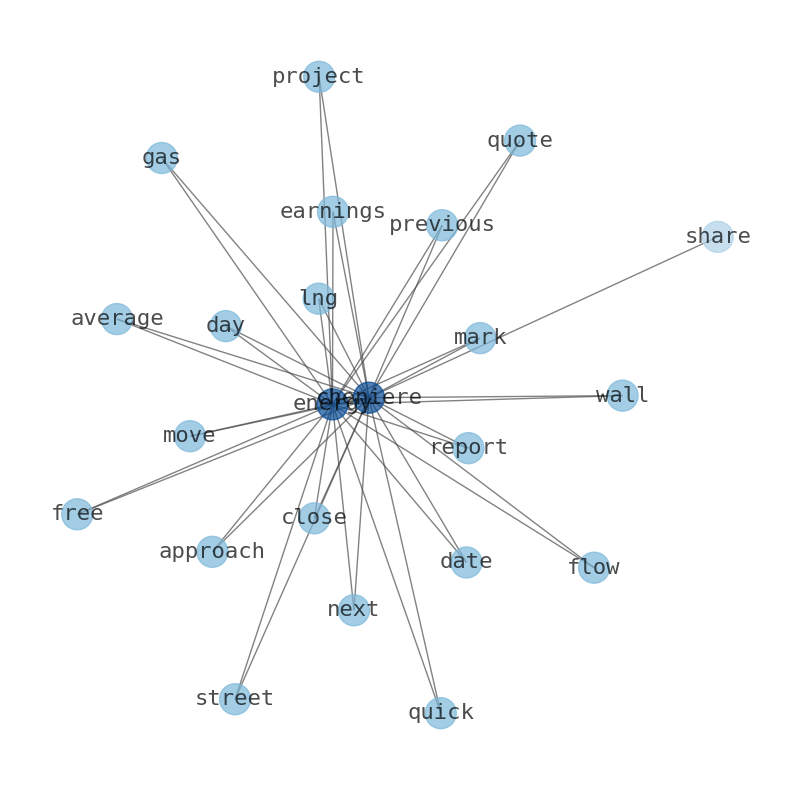

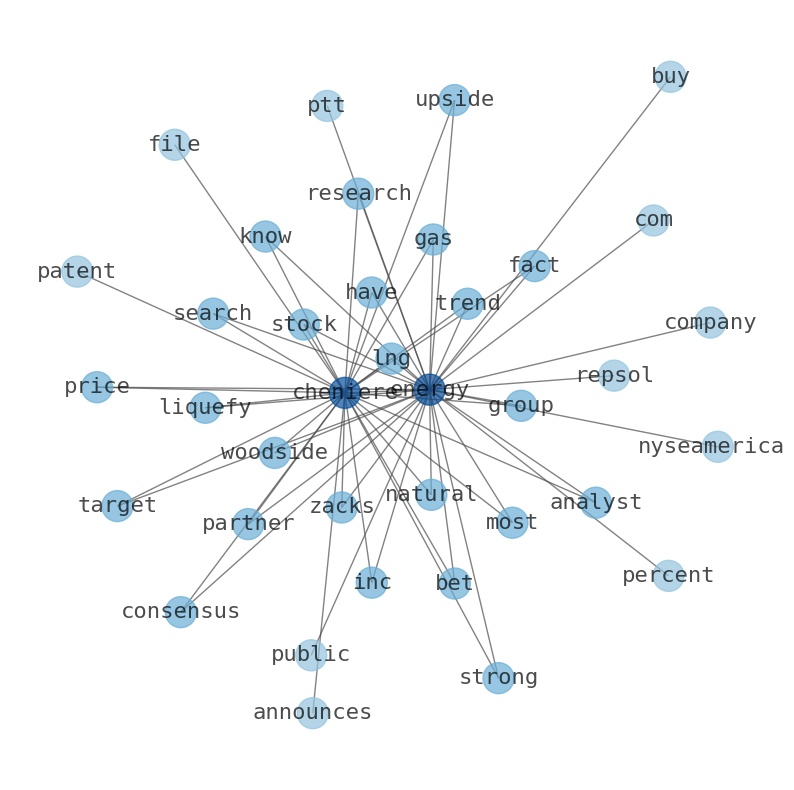

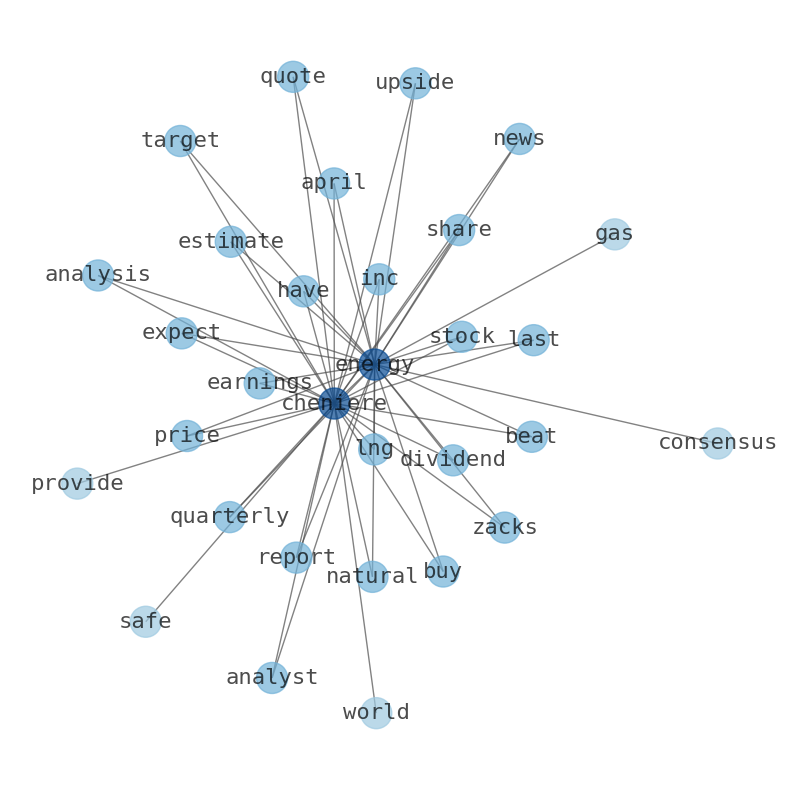

Keywords

This document will help you to evaluate Cheniere Energy without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Cheniere Energy are: Cheniere, Energy, company, share, price, earnings, current, and the most common words in the summary are: energy, cheniere, stock, gas, price, market, lng, . One of the sentences in the summary was: Shareholders could enjoy a 1.06% return on their shares over the next year.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #energy #cheniere #stock #gas #price #market #lng.

Read more →Related Results

Cheniere Energy

Open: 158.38 Close: 157.73 Change: -0.65

Read more →

Cheniere Energy

Open: 166.14 Close: 166.95 Change: 0.81

Read more →

Cheniere Energy

Open: 170.94 Close: 170.96 Change: 0.02

Read more →

Cheniere Energy

Open: 172.9 Close: 172.18 Change: -0.72

Read more →

Cheniere Energy

Open: 174.72 Close: 171.83 Change: -2.89

Read more →

Cheniere Energy

Open: 161.49 Close: 163.35 Change: 1.86

Read more →

Cheniere Energy

Open: 161.11 Close: 162.68 Change: 1.57

Read more →

Cheniere Energy

Open: 165.75 Close: 167.01 Change: 1.26

Read more →

Cheniere Energy

Open: 158.79 Close: 159.51 Change: 0.72

Read more →

Cheniere Energy

Open: 143.43 Close: 145.77 Change: 2.34

Read more →

Cheniere Energy

Open: 149.99 Close: 148.27 Change: -1.72

Read more →

Cheniere Energy

Open: 166.4 Close: 165.06 Change: -1.34

Read more →

Cheniere Energy

Open: 170.7 Close: 169.41 Change: -1.29

Read more →

Cheniere Energy

Open: 171.07 Close: 170.2 Change: -0.87

Read more →

Cheniere Energy

Open: 167.99 Close: 166.85 Change: -1.14

Read more →

Cheniere Energy

Open: 174.72 Close: 171.83 Change: -2.89

Read more →

Cheniere Energy

Open: 162.42 Close: 158.85 Change: -3.57

Read more →

Cheniere Energy

Open: 161.11 Close: 162.68 Change: 1.57

Read more →

Cheniere Energy

Open: 167.75 Close: 166.5 Change: -1.25

Read more →

Cheniere Energy

Open: 147.49 Close: 148.93 Change: 1.44

Read more →

Cheniere Energy

Open: 137.99 Close: 142.23 Change: 4.24

Read more →

Cheniere Energy

Open: 151.76 Close: 153.0 Change: 1.24

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo