The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Capital Southwest

Youtube Subscribe

Open: 17.76 Close: 17.85 Change: 0.09

14 lessons that an AI found about Capital Southwest Company Inc after reading internet.

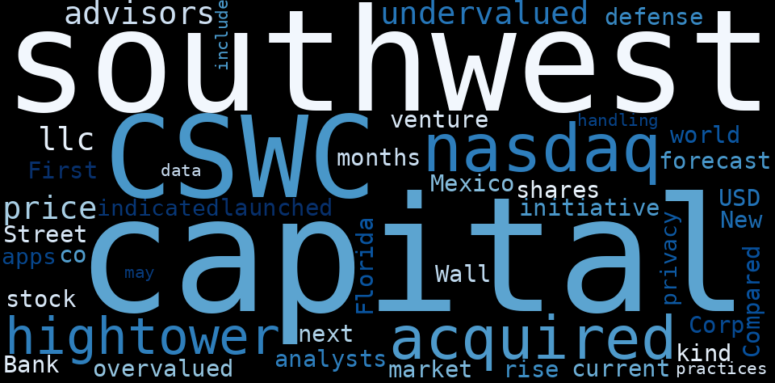

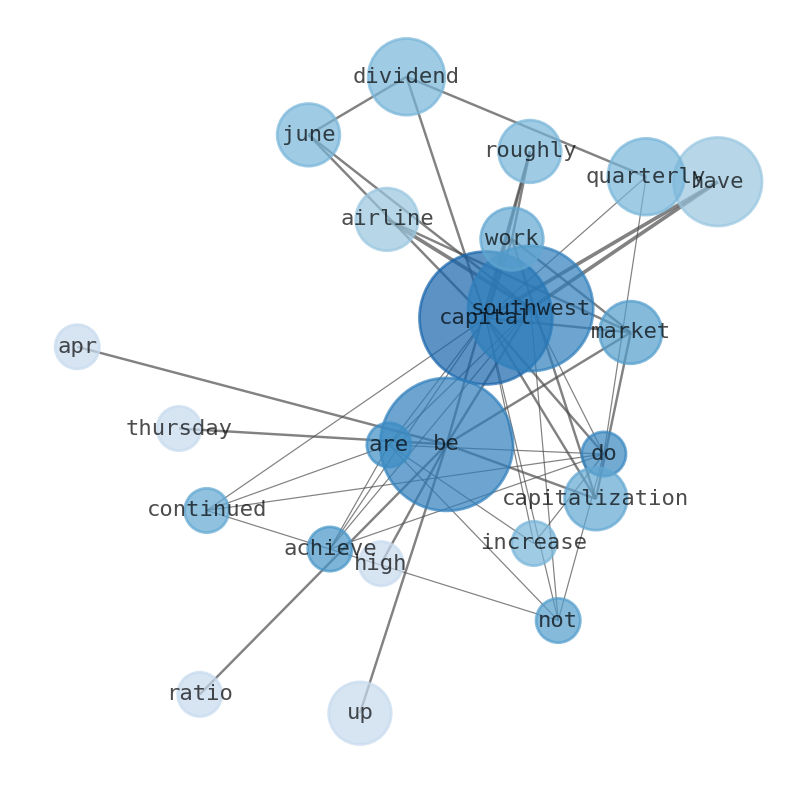

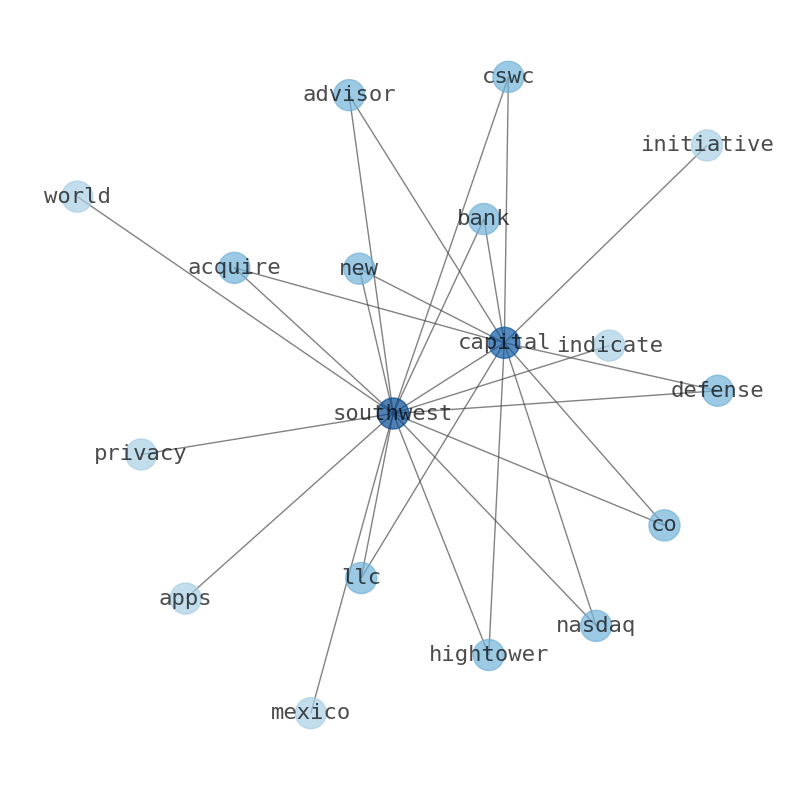

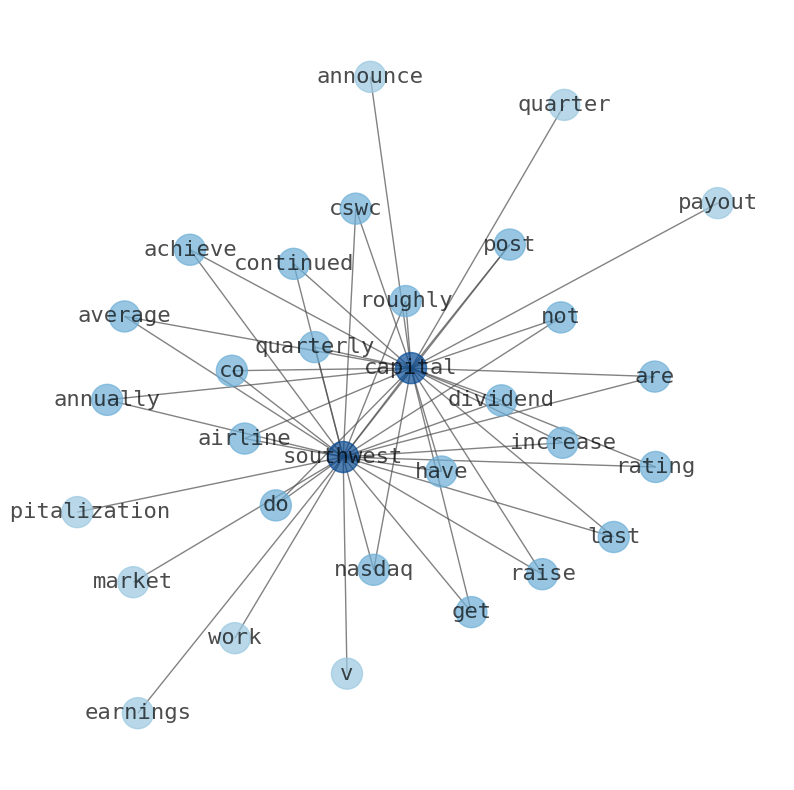

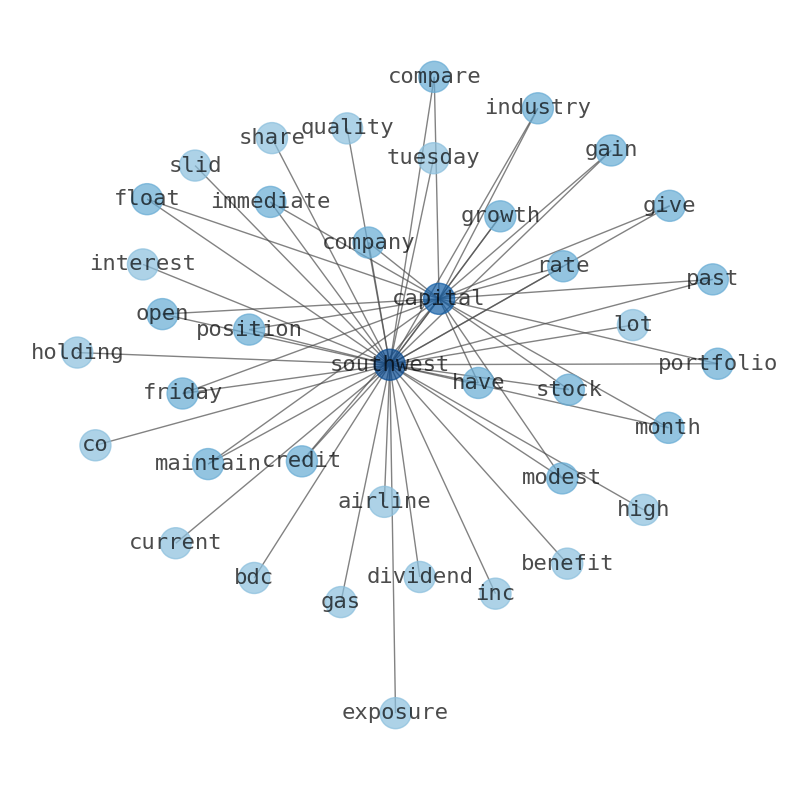

Are looking for the most relevant information about Capital Southwest? Investor spend a lot of time searching for information to make investment decisions in Capital Southwest. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Capital Southwest are: Capital, Southwest, quarterly, dividend, June, also, Airlines, and the most common words in the summary are: southwest, capital, airline, stock, market, news, share, . One of the sentences in the summary was: The business also recently disclosed a quarterly dividend, which will be …

Stock Summary

Capital Southwest Corporation invests in middle market companies, mezzanine, mature, mature and late venture, emerging growth, buyouts, recapitalizations and growth capital investments. Firm prefers to invest in industrial manufacturing and services, value-.

Today's Summary

Capital Southwest Co. ( NASDAQ:CSWC – Get Rating ) last posted its quarterly earnings results on Tuesday, January 31st. The business also recently disclosed a quarterly dividend, which will be paid on Friday, June 30th.

Today's News

Capital Southwest achieved what Ares Capital did not: continued to increase its quarterly dividend when announcing its payout for the quarter ending June 2023. Over the past three years, Capital Southwest has raised its dividend by an average of 8.0% annually. Capital Southwest Co. ( NASDAQ:CSWC – Get Rating ) last posted its quarterly earnings results on Tuesday, January 31st. Capital Southwest had a net margin of 33.53% and a return on equity of 12.21%. The business also recently disclosed a quarterly dividend, which will be paid on Friday, June 30th. Capital Southwest is an internally managed closed-end, non-diversified investment company. Despite negative news on short interest, Capital Southwest has been attracting a series of recent analyst reports. Institutional investors have also been gearing up their stakes. CSWC stock is up 4.09% while the S&P 500 is higher by 0.8% as of 11:04 AM on Thursday, Apr 27. The ratio of Market Capitalization to Working Capital for Southwest Airlines is roughly 4.02 . Southwest Airlines market capitalization vs working capital is roughly 4.02.

Stock Profile

"Capital Southwest Corporation is a business development company specializing in credit and private equity and venture capital investments in middle market companies, mezzanine, later stage, mature, late venture, emerging growth, buyouts, recapitalizations and growth capital investments. It does not invest in startups, publicly traded companies, real estate developments, project finance opportunities, oil and gas exploration businesses, troubled companies, turnarounds, and companies in which significant senior management is departing. In lower middle market, the firm typically invests in growth financing, bolt-on acquisitions, new platform acquisitions, refinancing, dividend recapitalizations, sponsor-led buyouts, and management buyouts situations. The investment structures are Unitranche debt, subordinated debt, senior debt, first and second lien debt, and preferred and common equity. The firm makes equity co-investments alongside debt investments, up to 20% of total check and only makes non-control investments. It prefers to invest in Industrial manufacturing and services, value-added distribution, healthcare products and services, business services, specialty chemicals, food and beverage, tech-enabled services and SaaS models. The firm seeks to invest in energy services and products, industrial technologies, and specialty chemicals and products. Within energy services and products, the firm seeks to invest in each segment of the industry, including upstream, midstream and downstream, excluding exploration and production with a focus on differentiated products and services, equipment and tool rental, consumable products, and drilling and completion chemicals. Within industrial technologies, it seeks to invest in automation and process controls, handling and packaging equipment, industrial filtration and fluid handling, measurement, monitoring and testing, professional tools, and sensors and instrumentation. Within and specialty chemicals and products, the firm seeks to invest in businesses that develop and manufacture highly differentiated chemicals and products including adhesives, coatings and sealants, catalysts and absorbents, cosmeceuticals, fine chemicals, flavors and fragrances, performance lubricants, polymers, plastics and composites, chemical dispensing and filtration equipment, professional and industrial trade consumables and tools, engineered solutions for HVAC, plumbing, and electrical installations, specified high performance materials for fire protection and oilfield applications. It may also invest in exceptional opportunities in building products. The firm seeks to invest in the United States. The firm seeks to make investments ranging from $5 to $25 million in securities. It seeks to make equity investments ranging from $5 million to $50 million and debt investments between $5 million and $20 million and co-invest in transaction size up to $40 million. It prefers to invest in companies with revenues approaching above $10 million, profitable operations, historical growth rate of at least 15 percent per year. Within the lower middle market, it seeks to invest in with less than $15 million in EBITDA and also opportunistically invests in the upper middle market, generally defined as companies with EBITDA in excess of $50 million. In addition to making direct investments, the firm allocates capital to syndicated first and second lien term loans in the upper middle market. Criteria for Upper Middle Market Syndicated 1st Lien is EBITDA Size more than $30 million, Closing Leverage greater than 4 times, investment hold size between $5 million and $7 million, investment yield greater than 6.5%. Criteria for Upper Middle Market Syndicated 2nd Lien is EBITDA Size more than $50 million, Closing Leverage greater than 6 times, investment hold size between $5 million and $7 million, investment yield greater than 9%. It prefers to take a majority and minority stake. The firm has the flexibility to hold investments for very long period in its portfolio companies. It may also invest through warrants. The firm prefers to take Board participation in its portfolio companies. Capital Southwest Corporation was founded on April 19, 1961 and is based in Dallas, Texas."

Keywords

This document will help you to evaluate Capital Southwest without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Capital Southwest are: Capital, Southwest, quarterly, dividend, June, also, Airlines, and the most common words in the summary are: southwest, capital, airline, stock, market, news, share, . One of the sentences in the summary was: The business also recently disclosed a quarterly dividend, which will be paid on Friday, June 30th.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #southwest #capital #airline #stock #market #news #share.

Read more →Related Results

Capital Southwest

Open: 24.06 Close: 24.15 Change: 0.09

Read more →

Capital Southwest

Open: 17.76 Close: 17.85 Change: 0.09

Read more →

Capital Southwest

Open: 19.92 Close: 19.72 Change: -0.2

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo