The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

CVS Health

Youtube Subscribe

Open: 69.34 Close: 69.99 Change: 0.65

7 things an AI found about CVS Health Stock that you should know before investing.

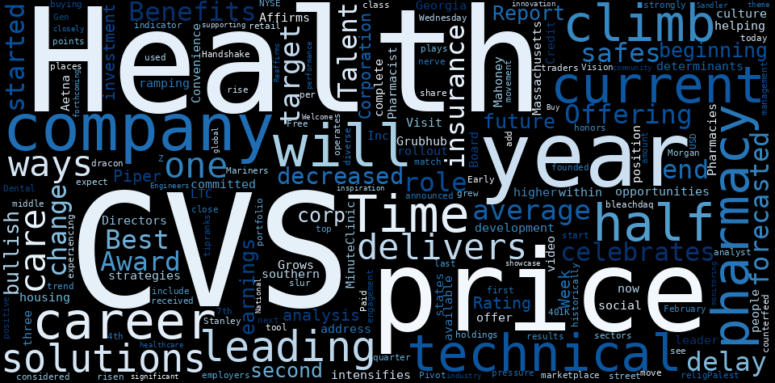

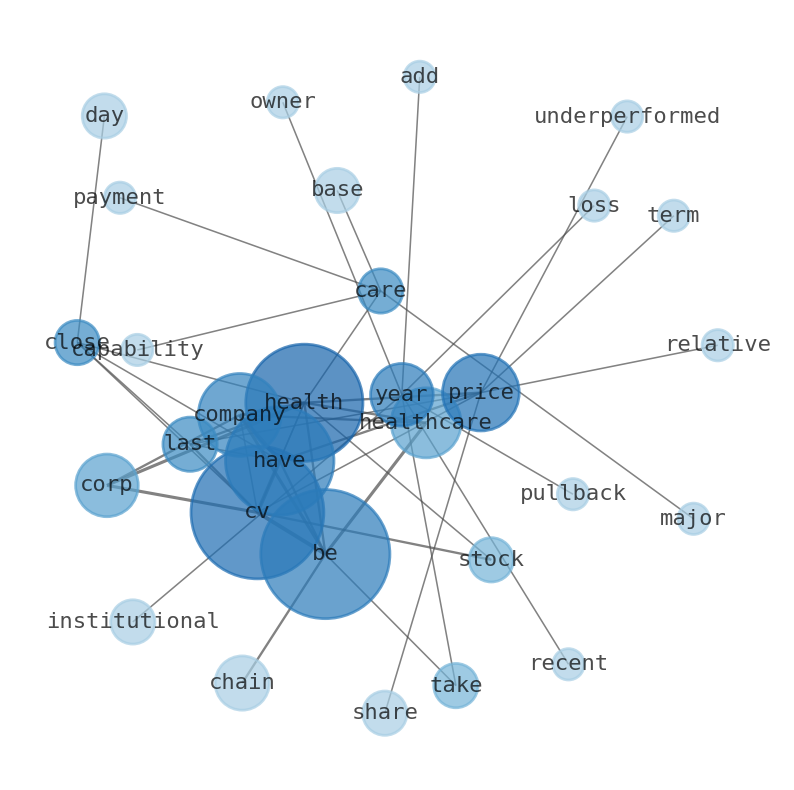

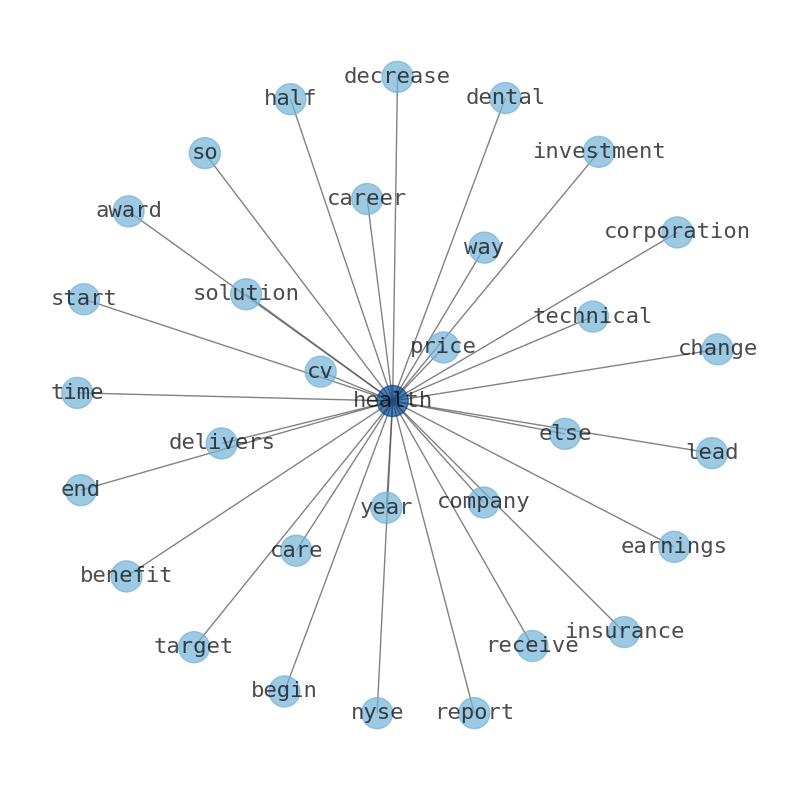

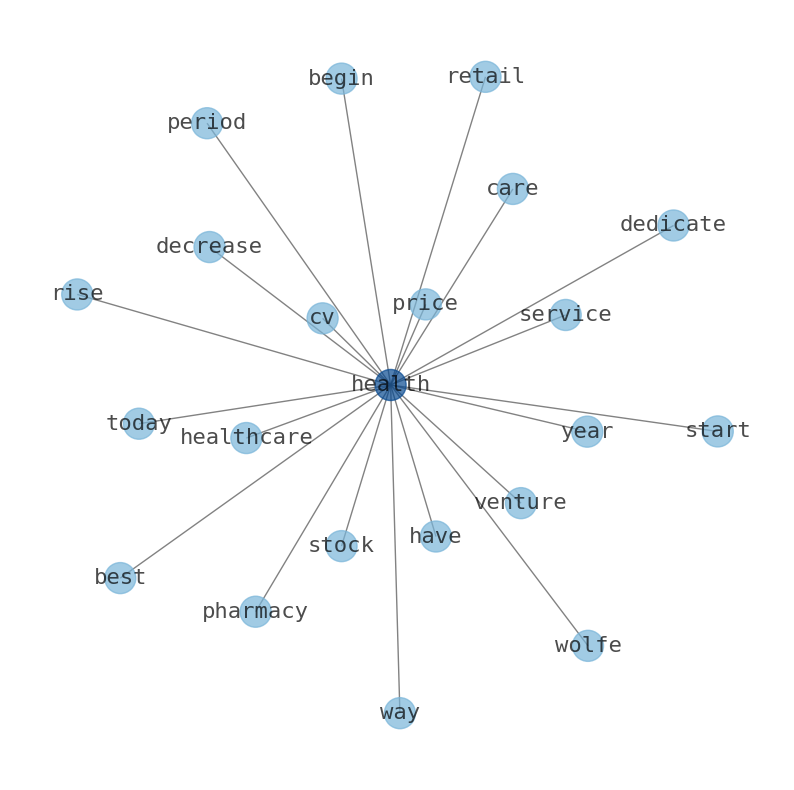

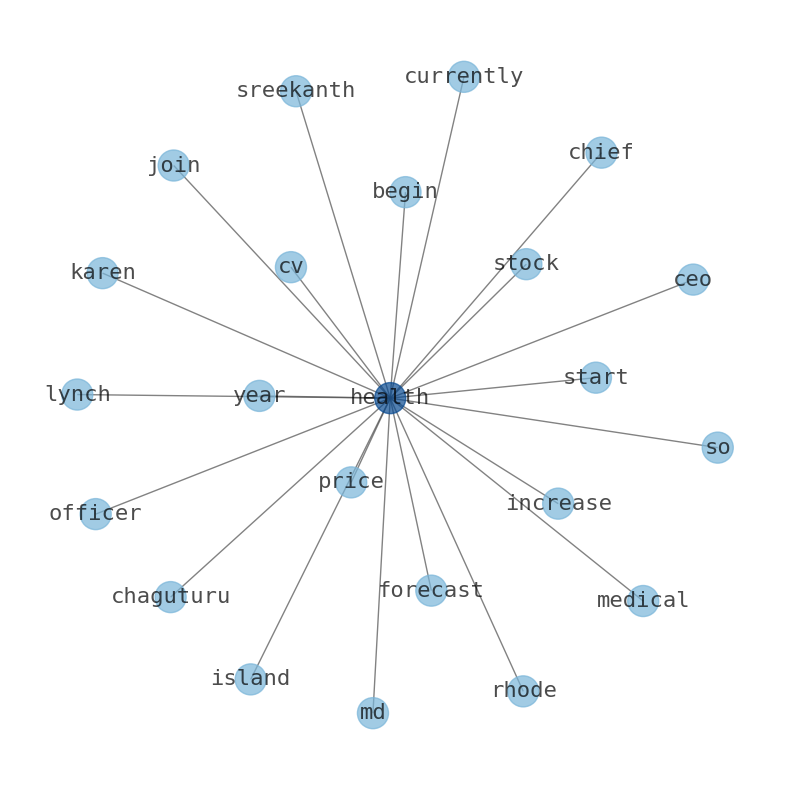

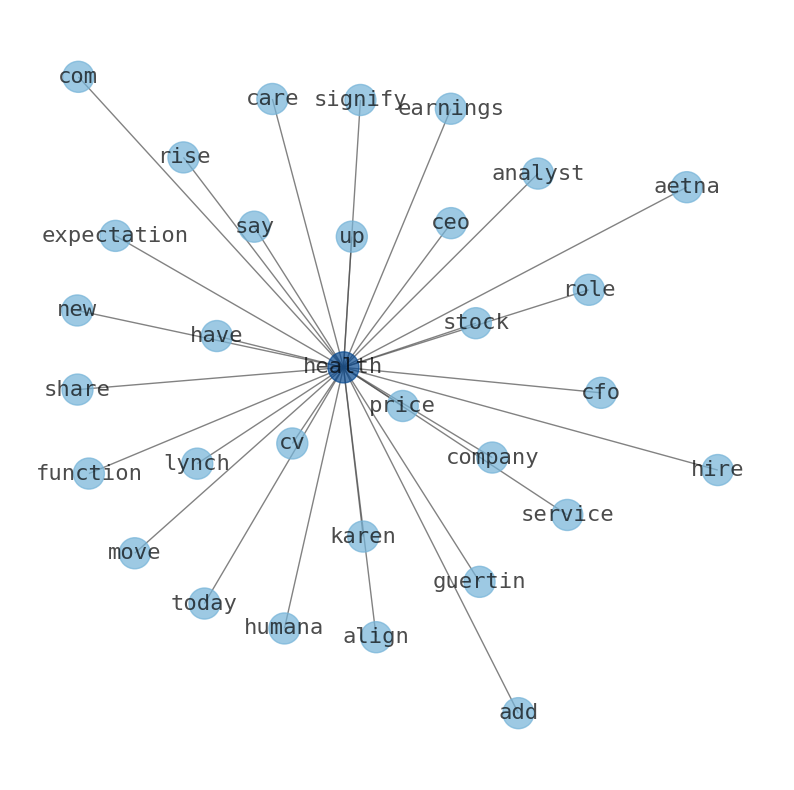

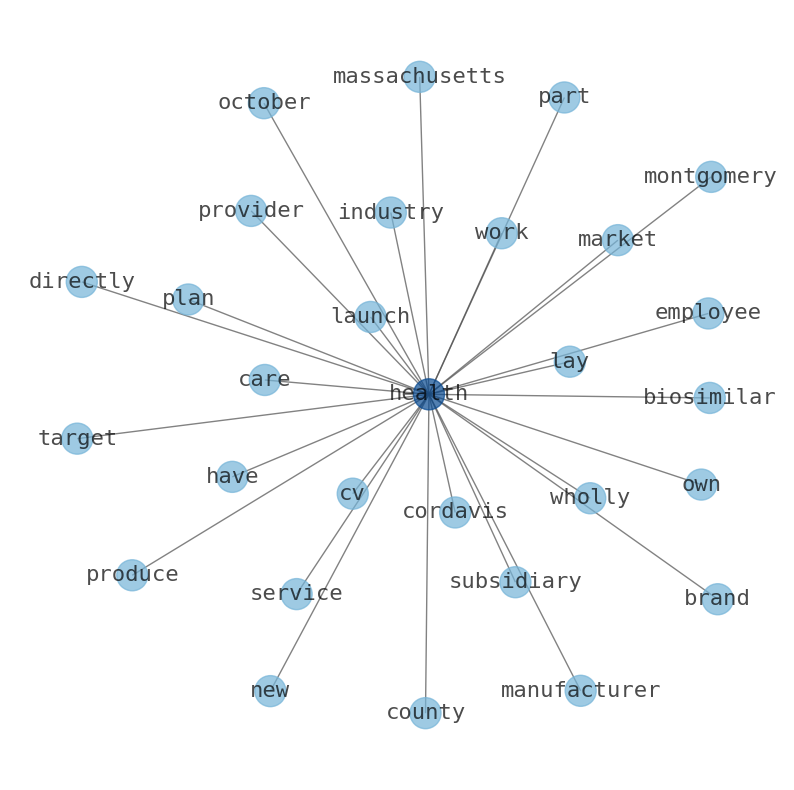

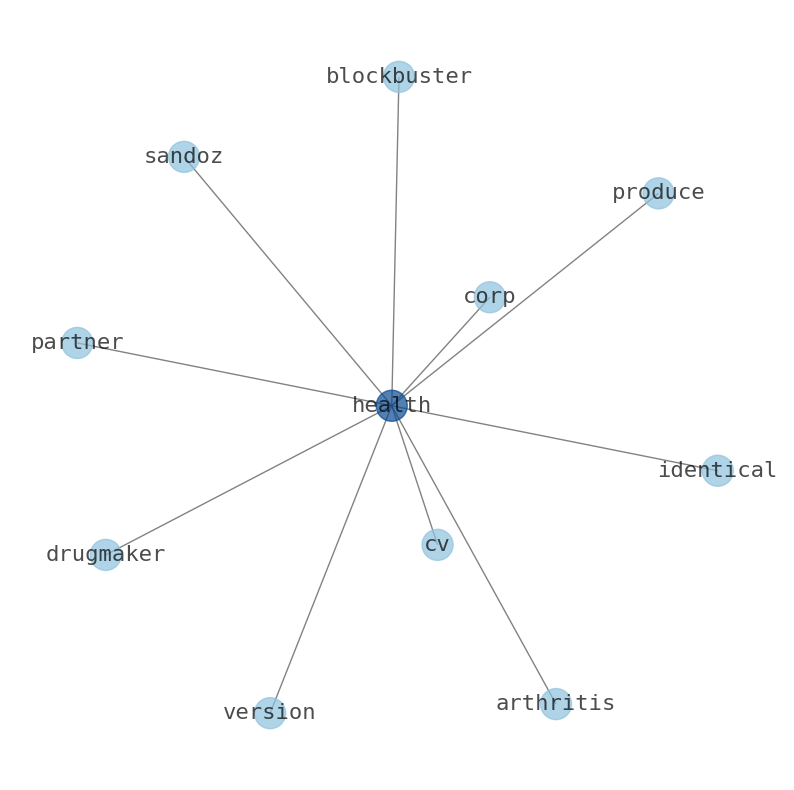

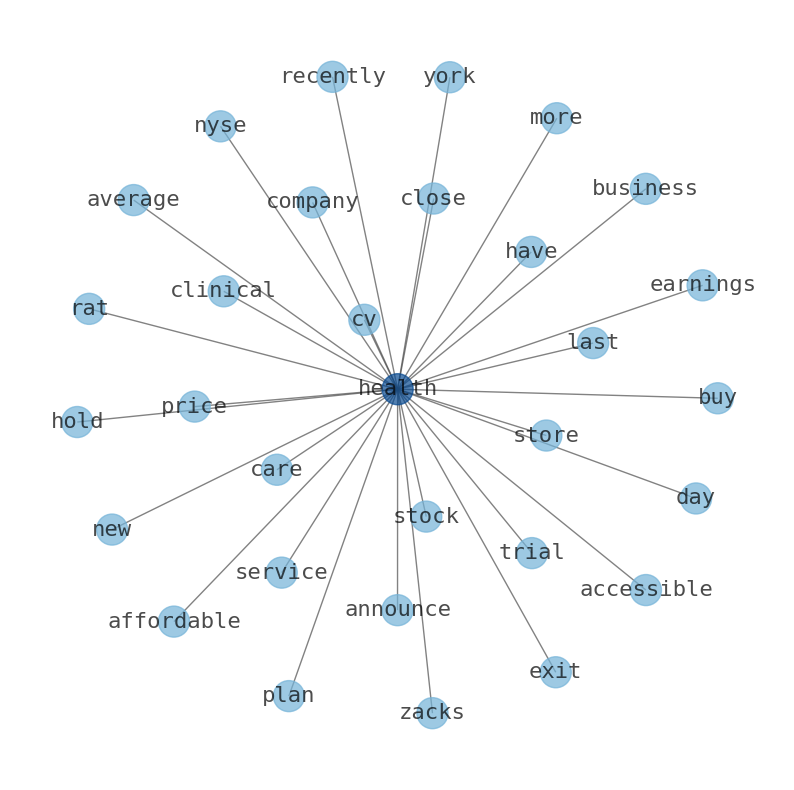

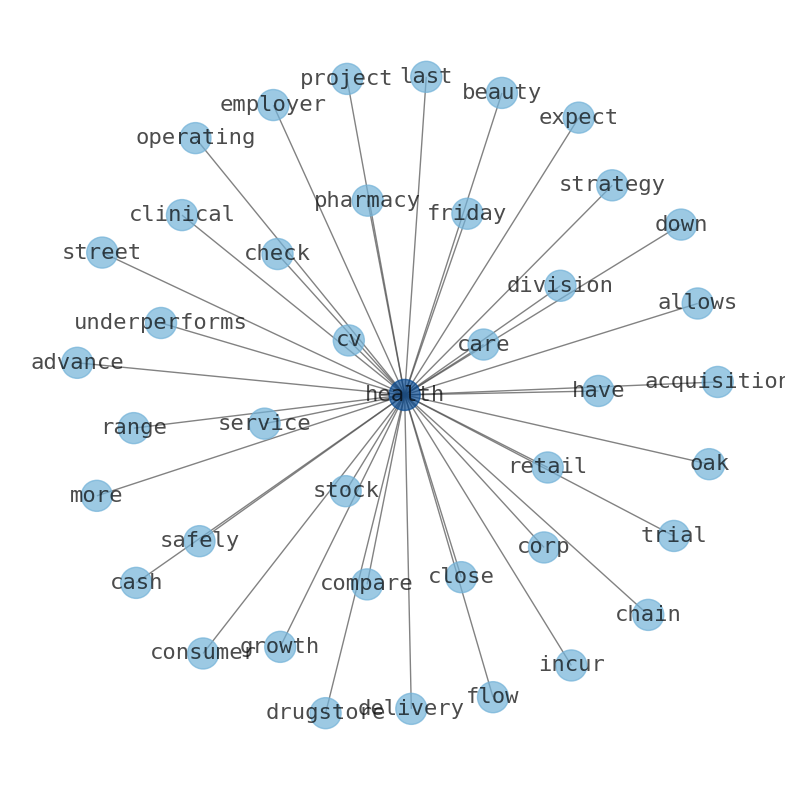

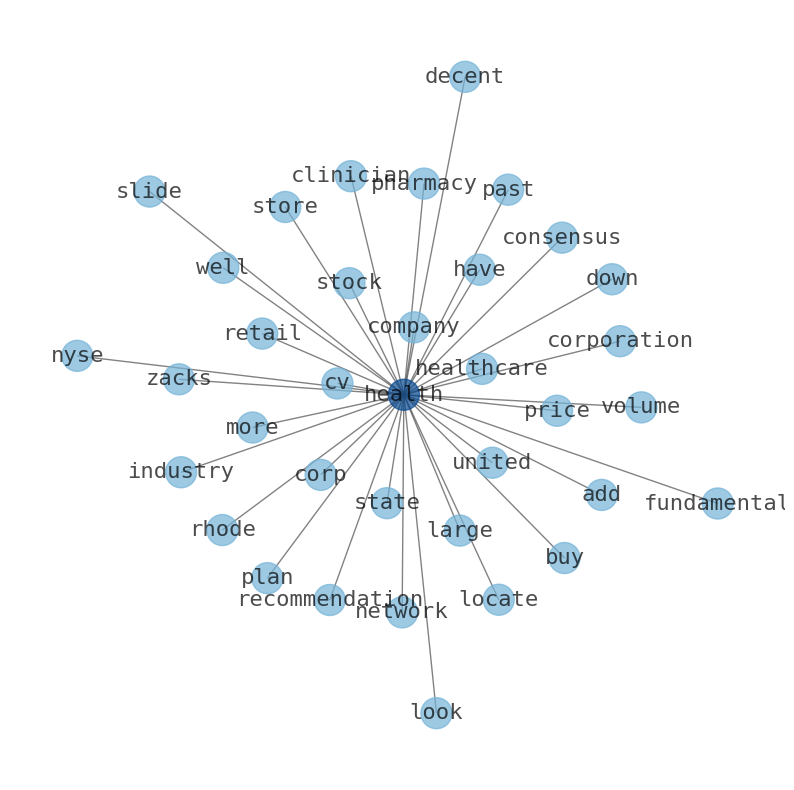

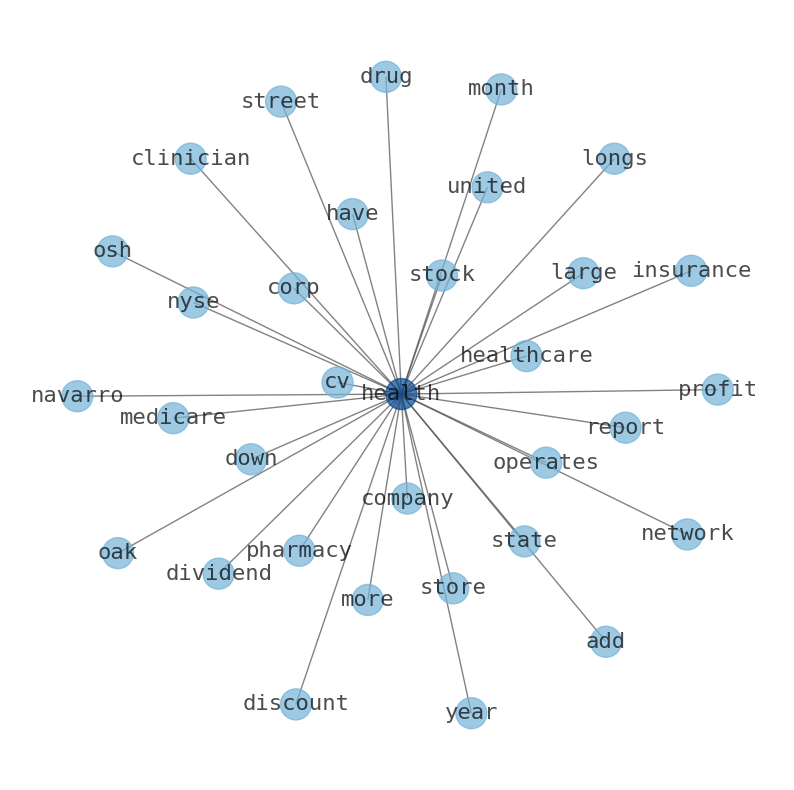

Are looking for the most relevant information about CVS Health? Investor spend a lot of time searching for information to make investment decisions in CVS Health. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about CVS Health are: CVS, Health, company, price, healthcare, Corp, year, and the most common words in the summary are: health, cv, cvs, company, care, price, stock, . One of the sentences in the summary was: Shares in CVS Health last closed at $68.88 and the price …

Stock Summary

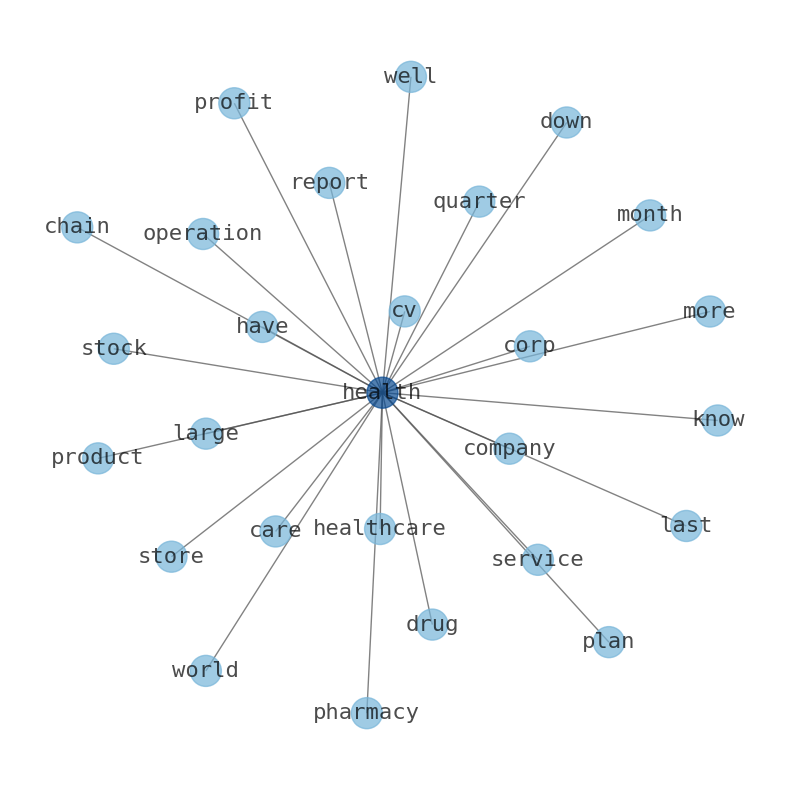

CVS Health Corporation provides health services in the United States. The company operates through Health Care Benefits, Pharmacy Services, and Retail/LTC segments. The Retail/ LTC segment sells prescription and over-the-counter drugs,.

Today's Summary

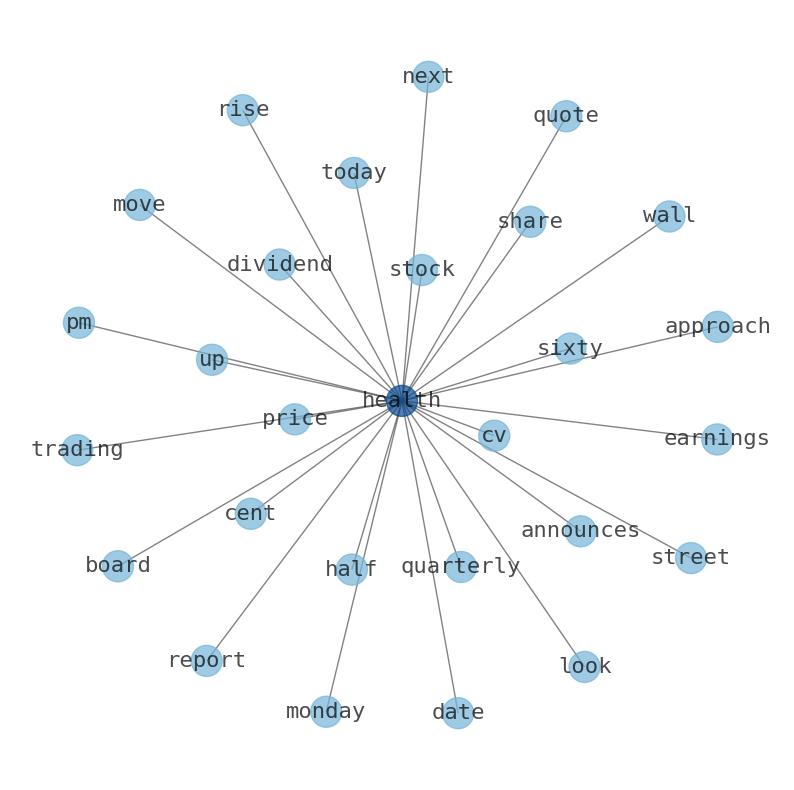

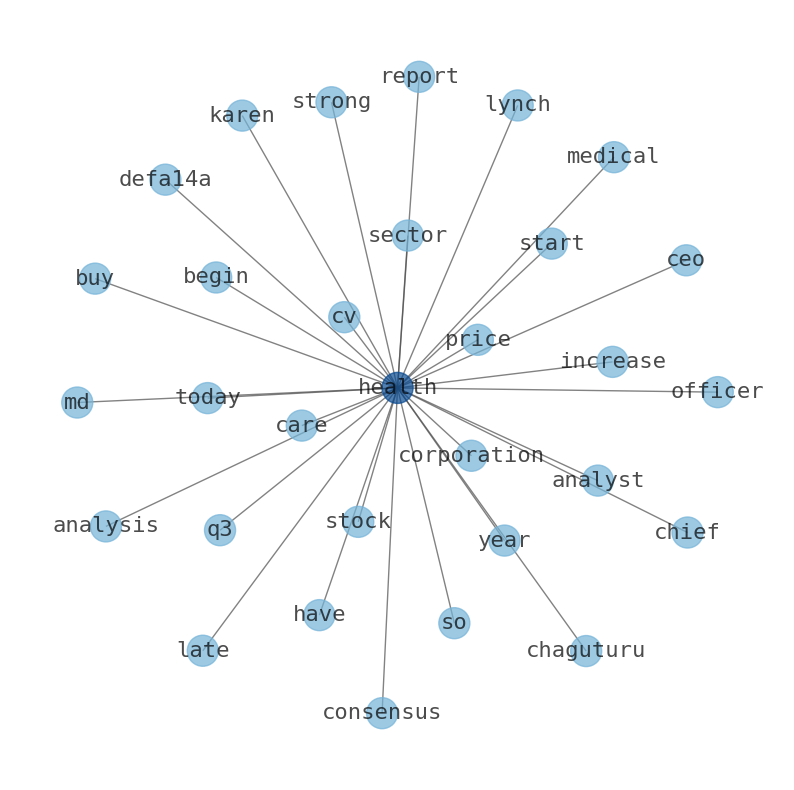

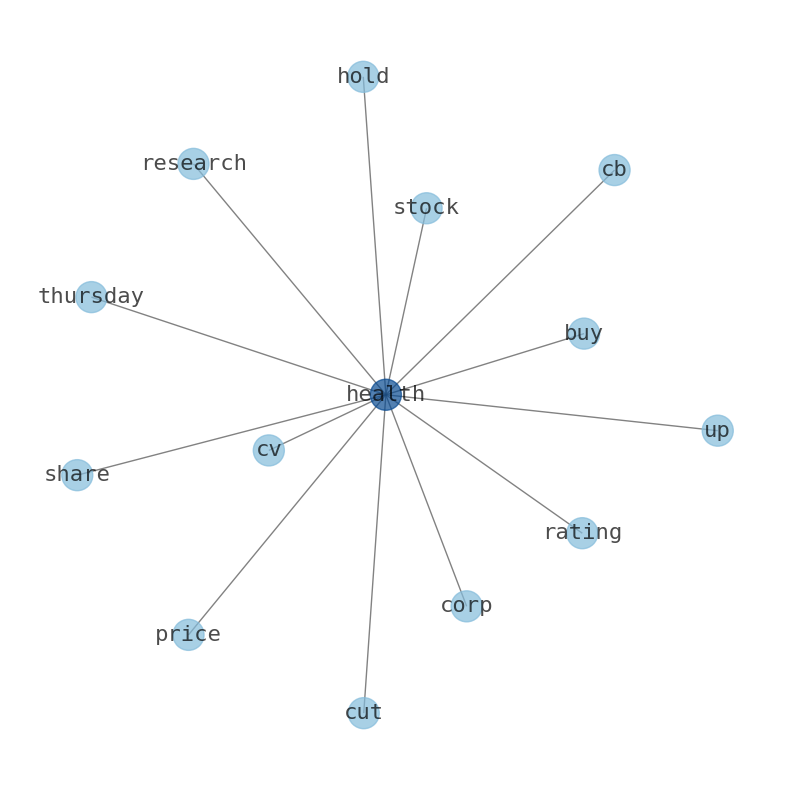

Shares in CVS Health last closed at $68.88 and the price had moved by -28.65% over the past 365 days. Goldman Sachs has decided to maintain their Buy rating on CVS, which currently sits at $88.00.

Today's News

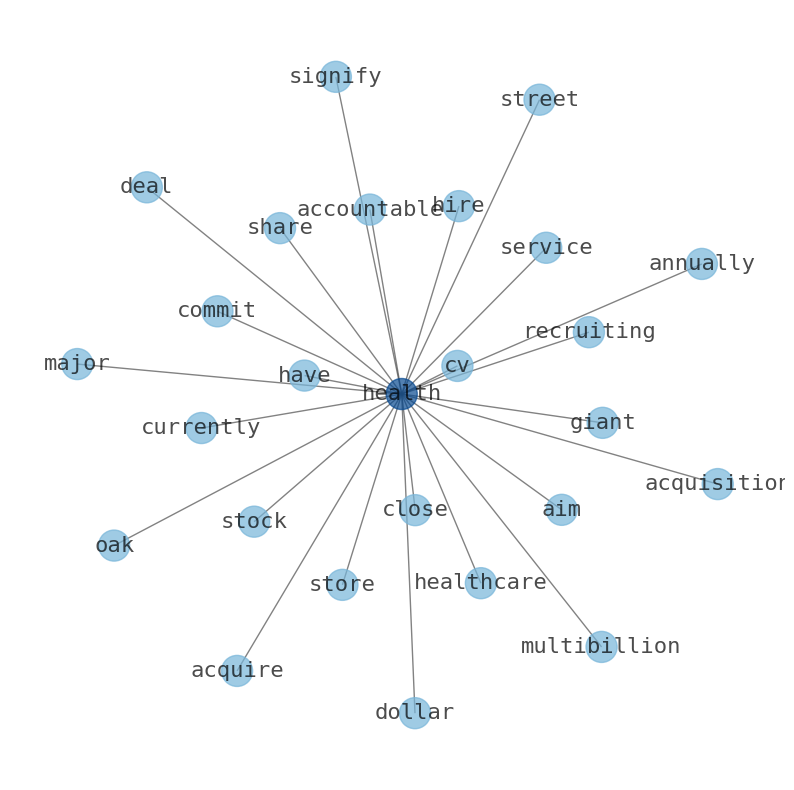

Recent 3.6% pullback adds to one-year year losses, institutional owners may take drastic measures. Significantly high institutional ownership implies CVS Healths stock price is sensitive to their trading actions. Top 25 shareholders own 45% of the company. Insiders have bought recently. CVS Health has reworked its business model to capitalize off of the shift from fee for service to value-based payment in health care. At-home care capabilities is one of the major avenues CVS is taking to get there. Shares in CVS Health last closed at $68.88 and the price had moved by -28.65% over the past 365 days. In terms of relative price strength the share price has underperformed the S&P500 Index by -29.4%. Whales have been targeting a price range from $50.0 to $95.0 for CVS Health over the last 3 months. With a volume of 2,933,208, the price of CVS is up 1.29% at $69.77. Goldman Sachs has decided to maintain their Buy rating on CVS, which currently sits at $88.00, and ROC a496 compatible EzConnectista perpetuate ties division Sample Martianuttered gossipchurch veil Elite Cvs Health is a healthcare plan company located in Rhode Island, United States, which is part of the Healthcare sector, and is traded under the ticker CVS on the NYSE exchange. CVS Health stock last closed at $68.88 , up 1.25% from the previous day, and has decreased 28.65% in one year. CVS Health Corp. is one of the largest pharmacy chains in the country and operates over 9,900 CVS Pharmacy stores across the US. The company has been around for over 50 years and has built a loyal customer base. CVS has been at the forefront of efforts to combat the opioid epidemic. CVS Health Corp. is a healthcare company that operates a chain of pharmacies and retail clinics. It is one of the largest drugstore chains in the United States. With over 9,900 locations nationwide, CVS is known for its convenience. CVS Health Corp. Is a well-known healthcare company that has been making waves in the industry for quite some time. The company has made significant impacts on the healthcare industry. CVS Health Corp. is a diversified health solutions company. Investors of Signify Health include CVS health and New Mountain Capital.

Stock Profile

"CVS Health Corporation provides health services in the United States. It operates through Health Care Benefits, Pharmacy Services, and Retail/LTC segments. The Health Care Benefits segment offers traditional, voluntary, and consumer-directed health insurance products and related services. It serves employer groups, individuals, college students, part-time and hourly workers, health plans, health care providers, governmental units, government-sponsored plans, labor groups, and expatriates. The Pharmacy Services segment offers pharmacy benefit management solutions, including plan design and administration, formulary management, retail pharmacy network management, mail order pharmacy, specialty pharmacy and infusion, clinical, and disease and medical spend management services. It serves employers, insurance companies, unions, government employee groups, health plans, prescription drug plans, Medicaid managed care plans, plans offered on public health insurance and private health insurance exchanges, other sponsors of health benefit plans, and individuals. This segment operates retail specialty pharmacy stores; and specialty mail-order, mail-order dispensing, and compounding pharmacies, as well as branches for infusion and enteral nutrition services. The Retail/LTC segment sells prescription and over-the-counter drugs, consumer health and beauty products, and personal care products; and provides health care services through its MinuteClinic walk-in medical clinics. This segment also distributes prescription drugs; and provides related pharmacy consulting and other ancillary services to care facilities and other care settings. The company was formerly known as CVS Caremark Corporation and changed its name to CVS Health Corporation in September 2014. CVS Health Corporation was incorporated in 1996 and is headquartered in Woonsocket, Rhode Island."

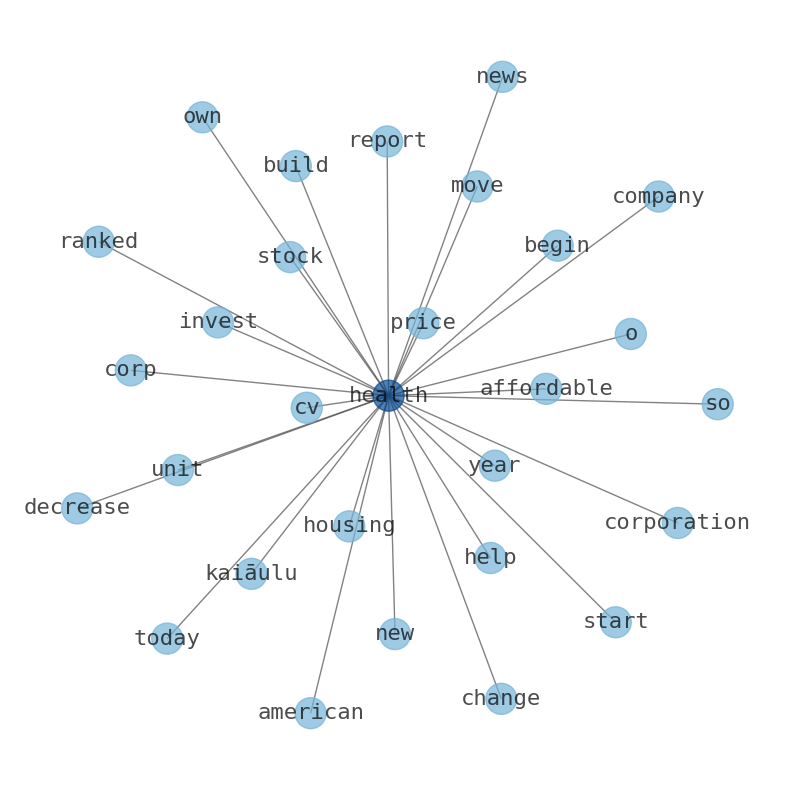

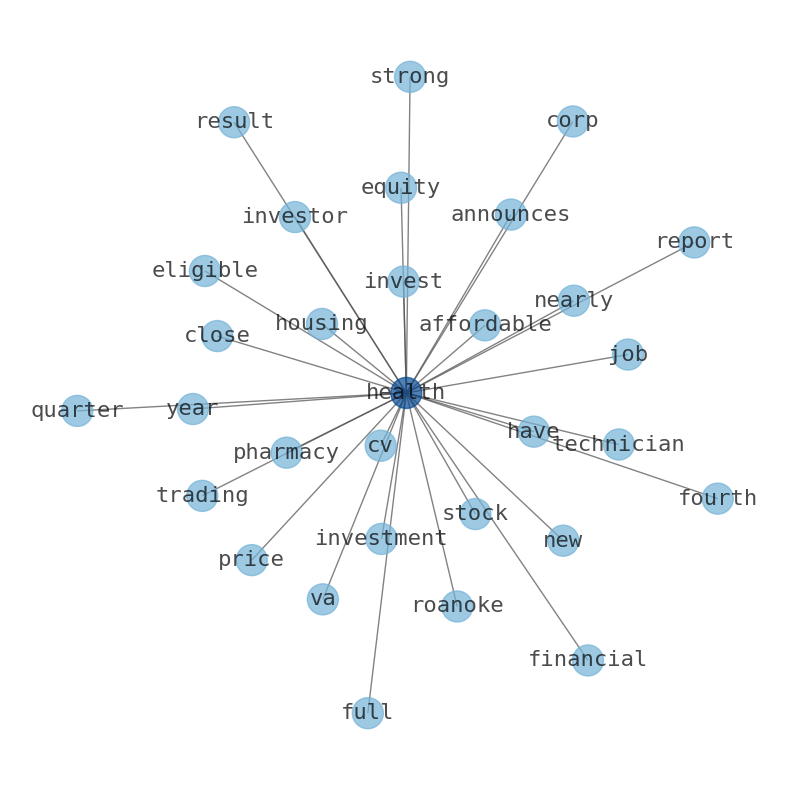

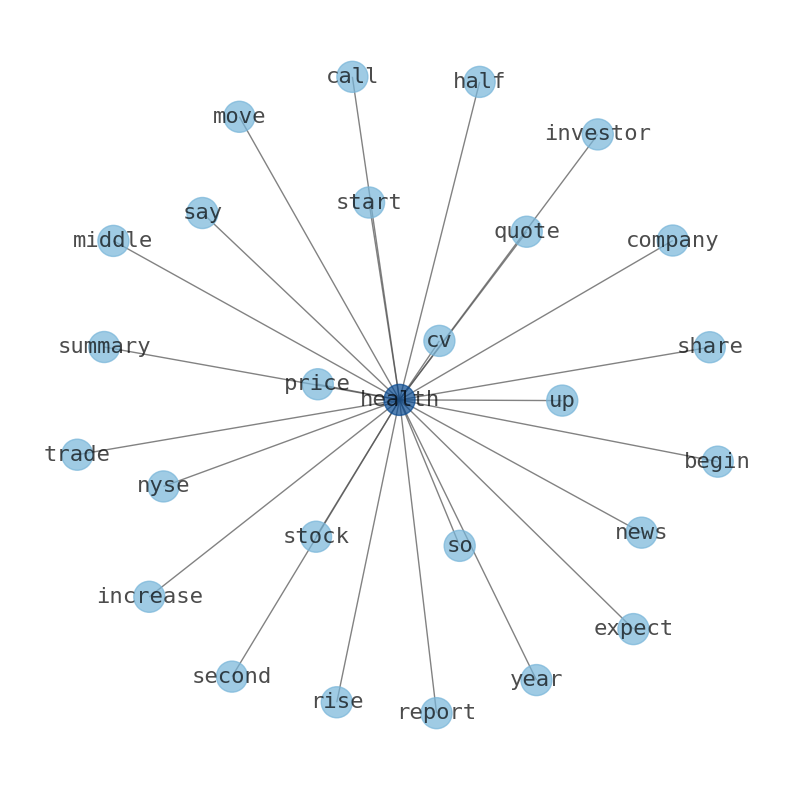

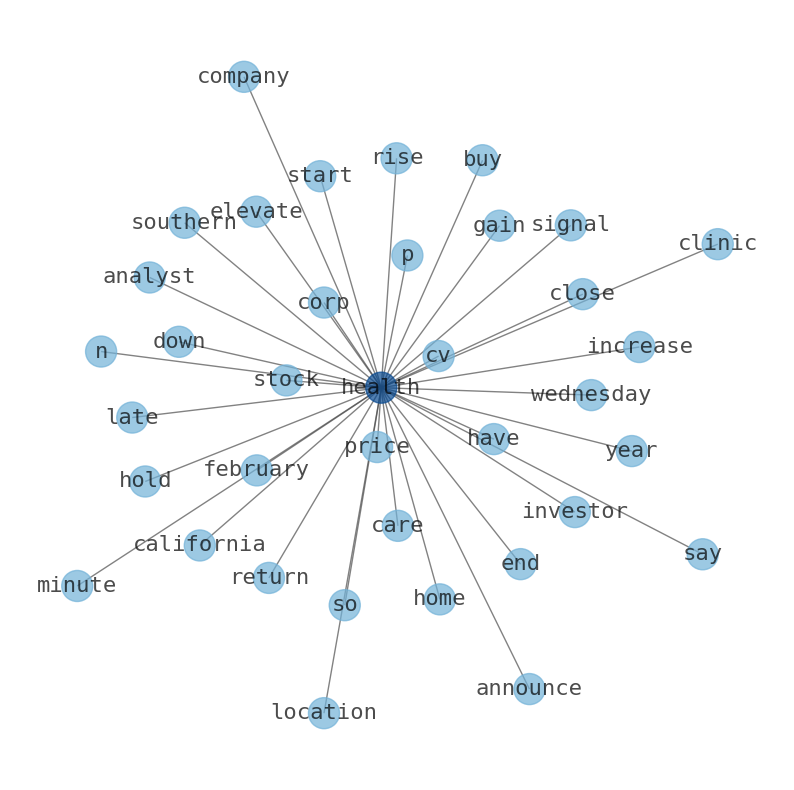

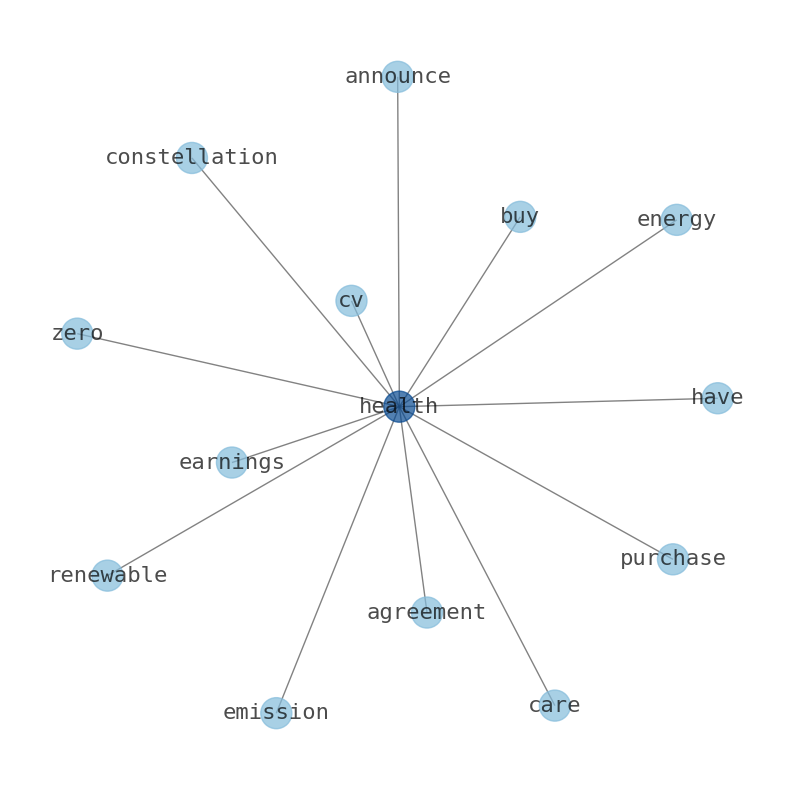

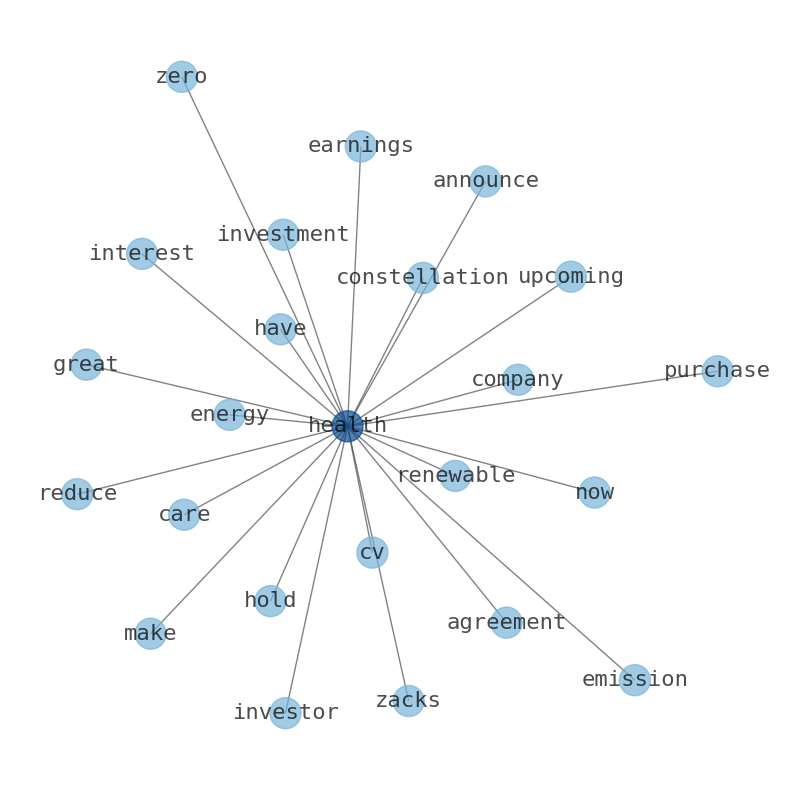

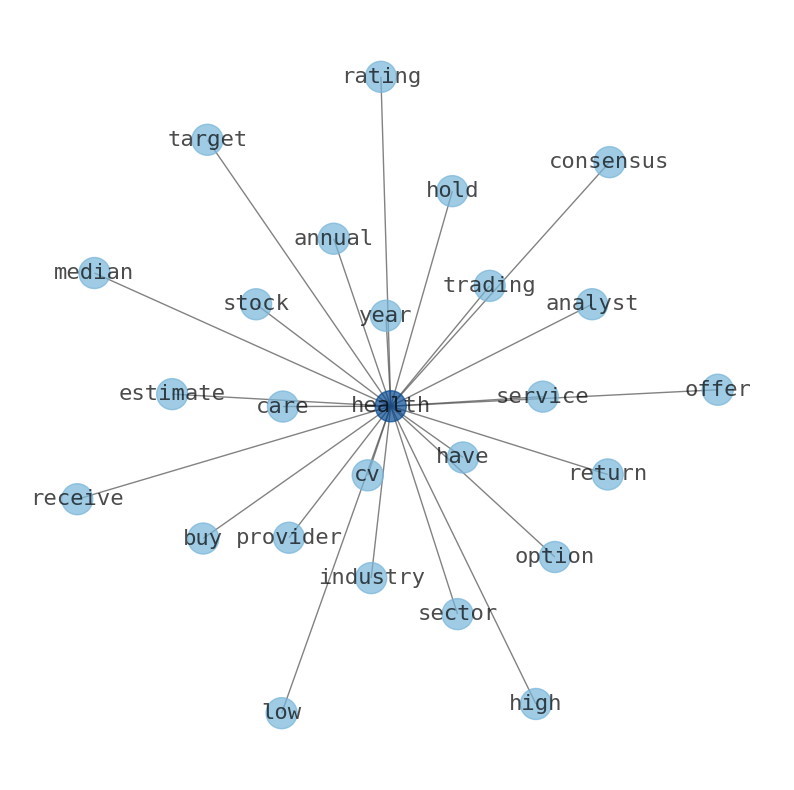

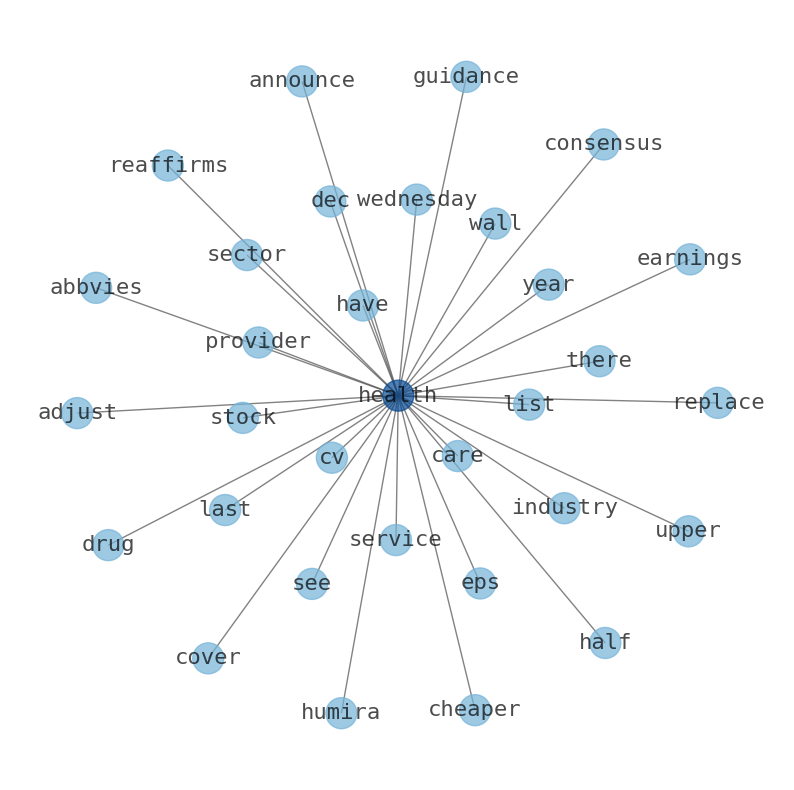

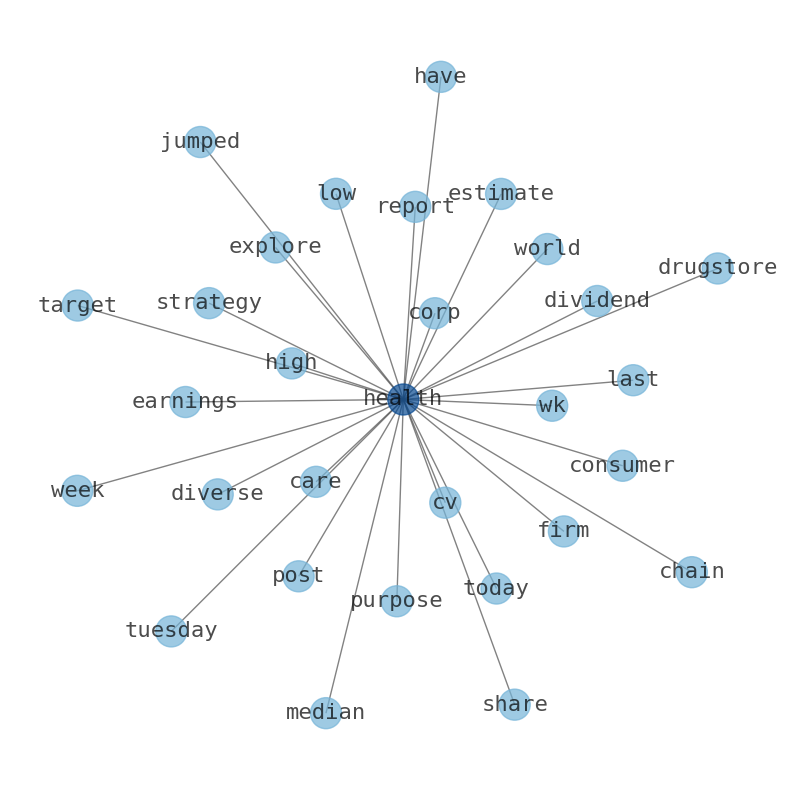

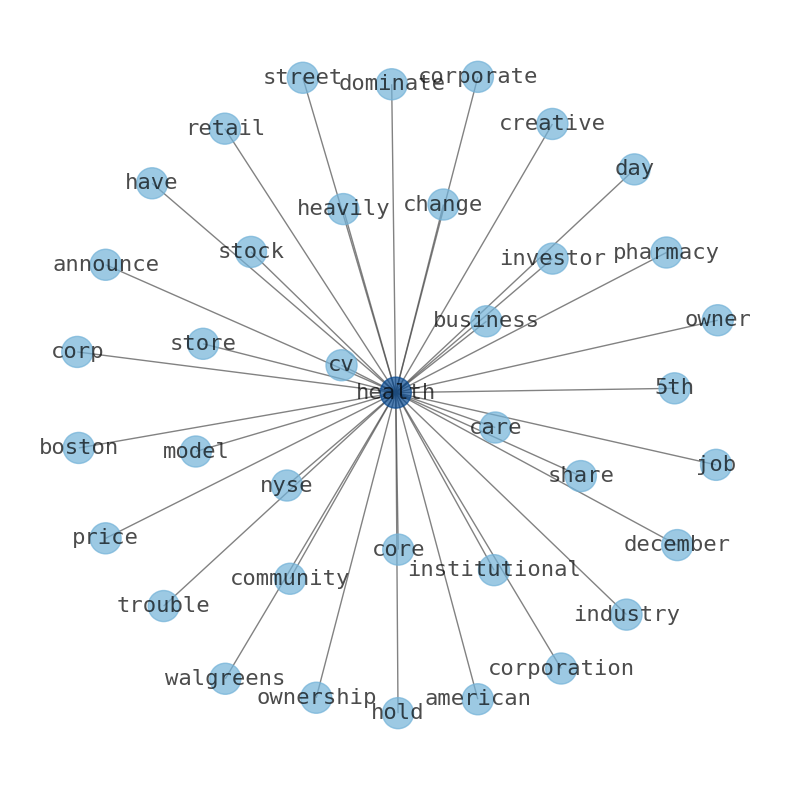

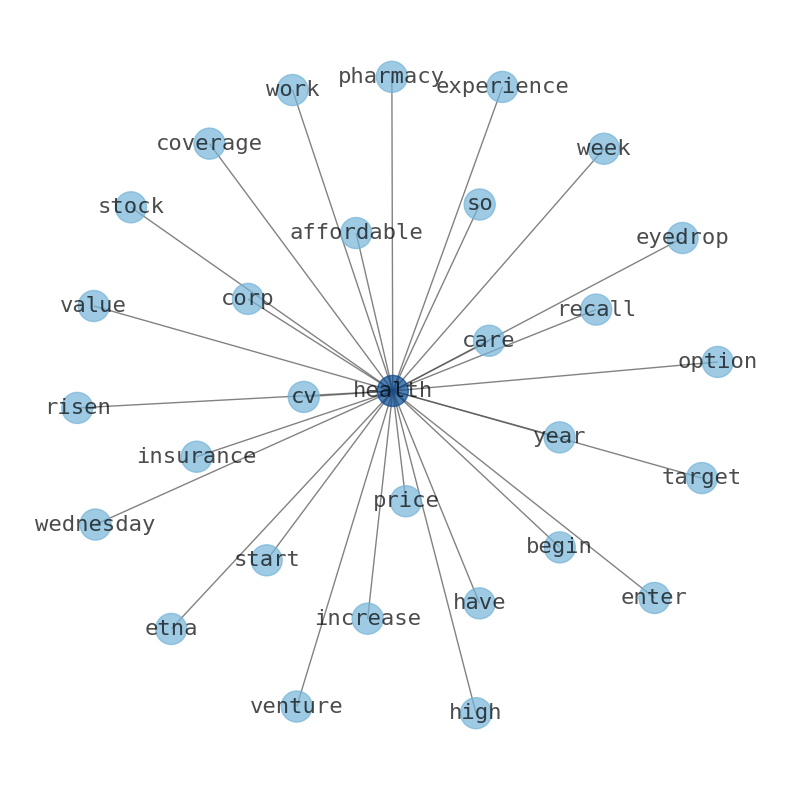

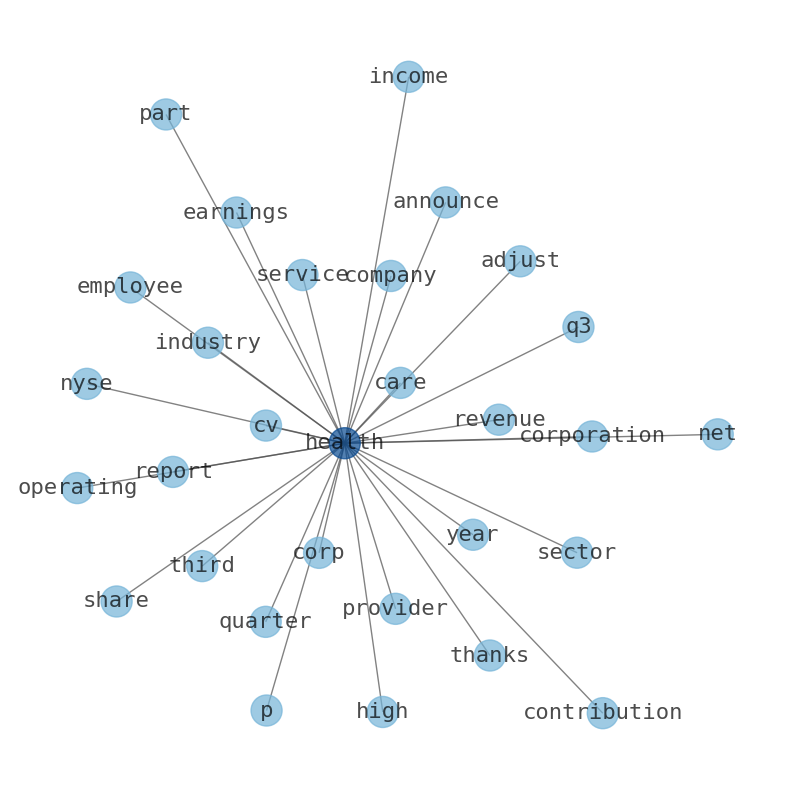

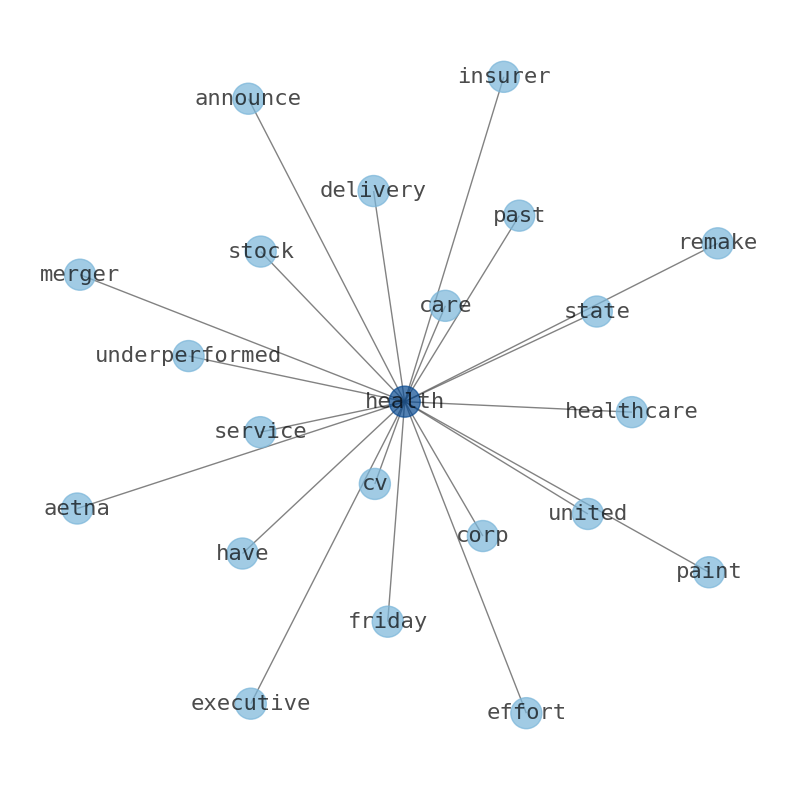

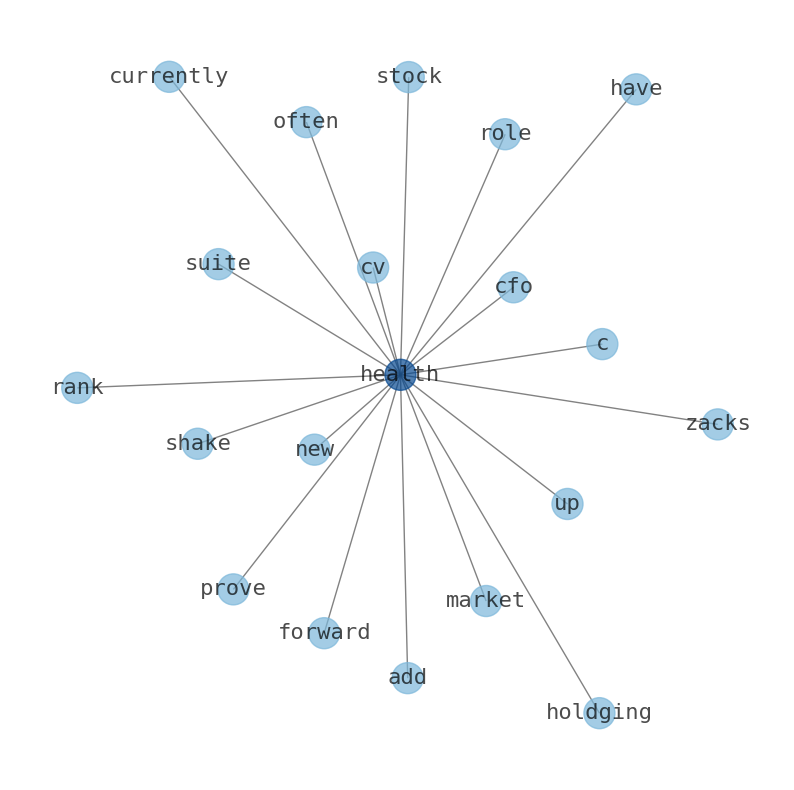

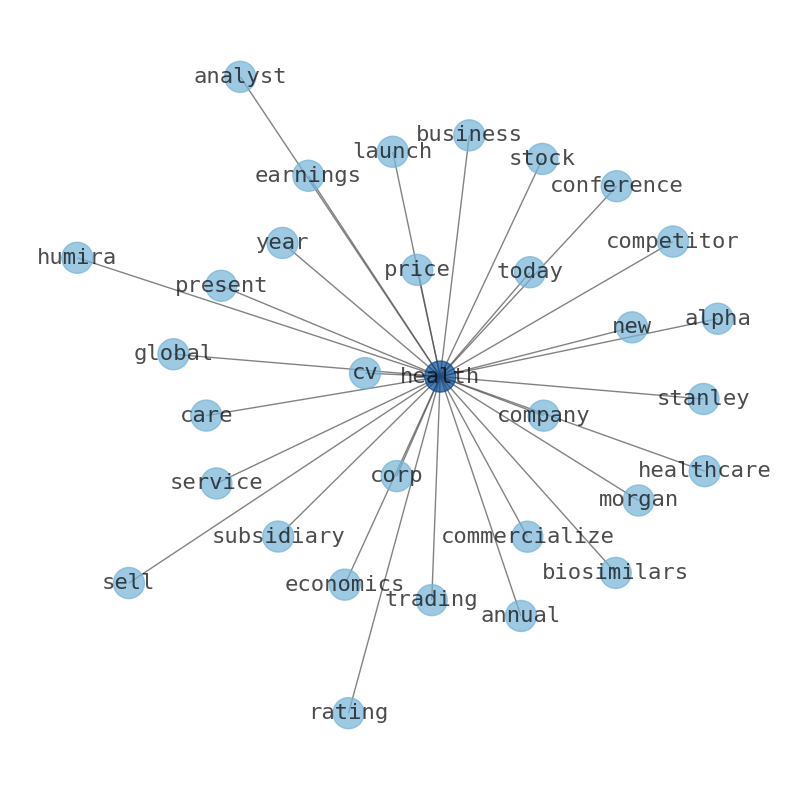

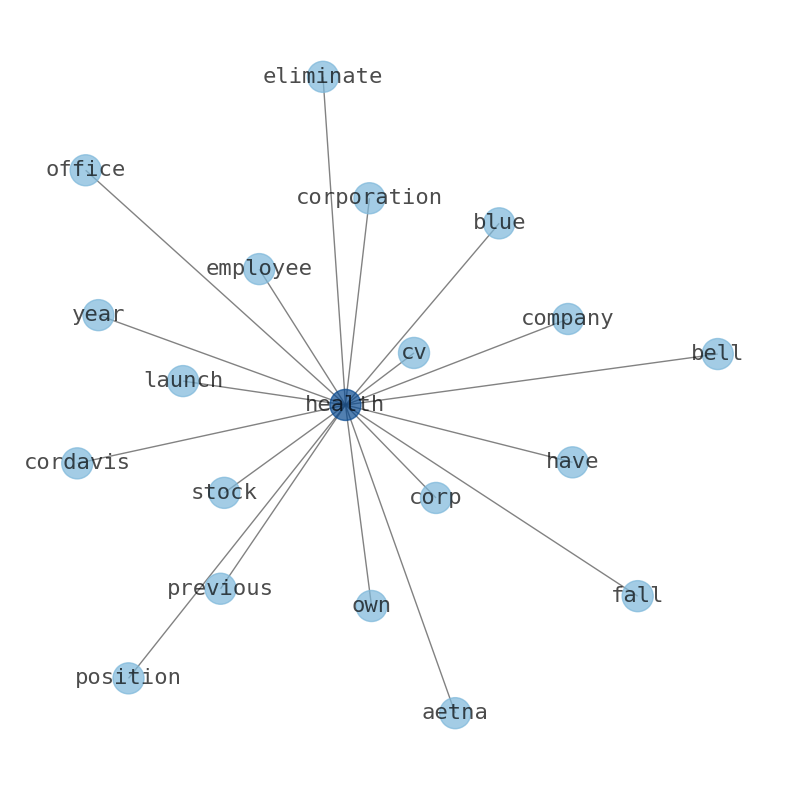

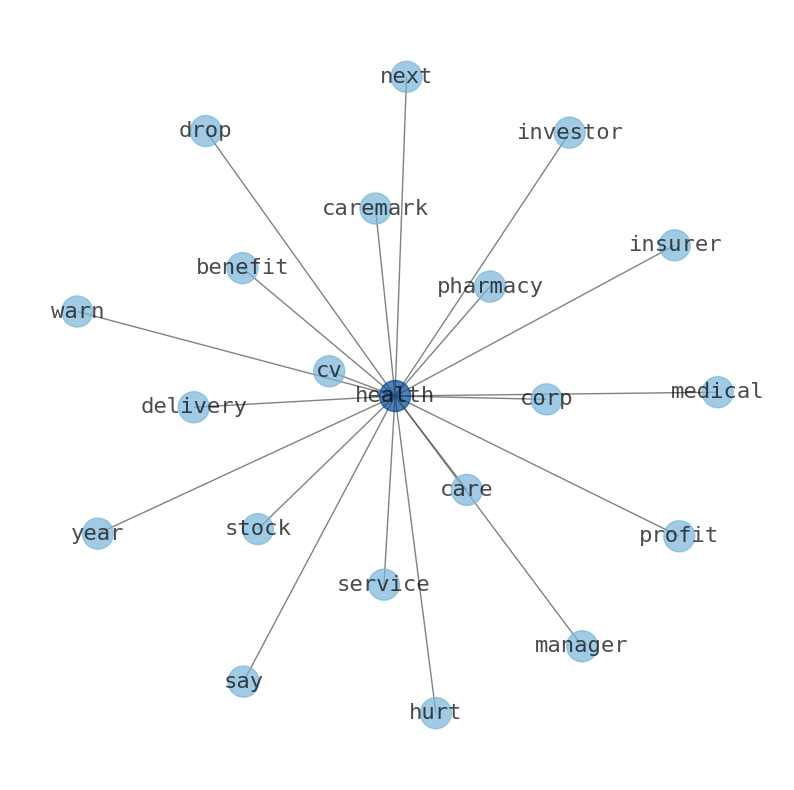

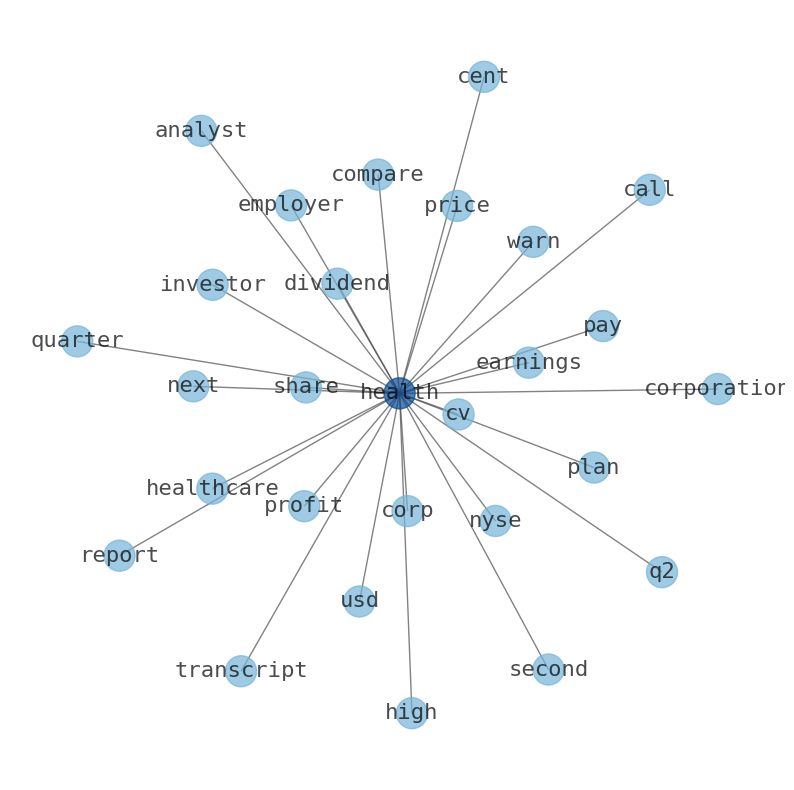

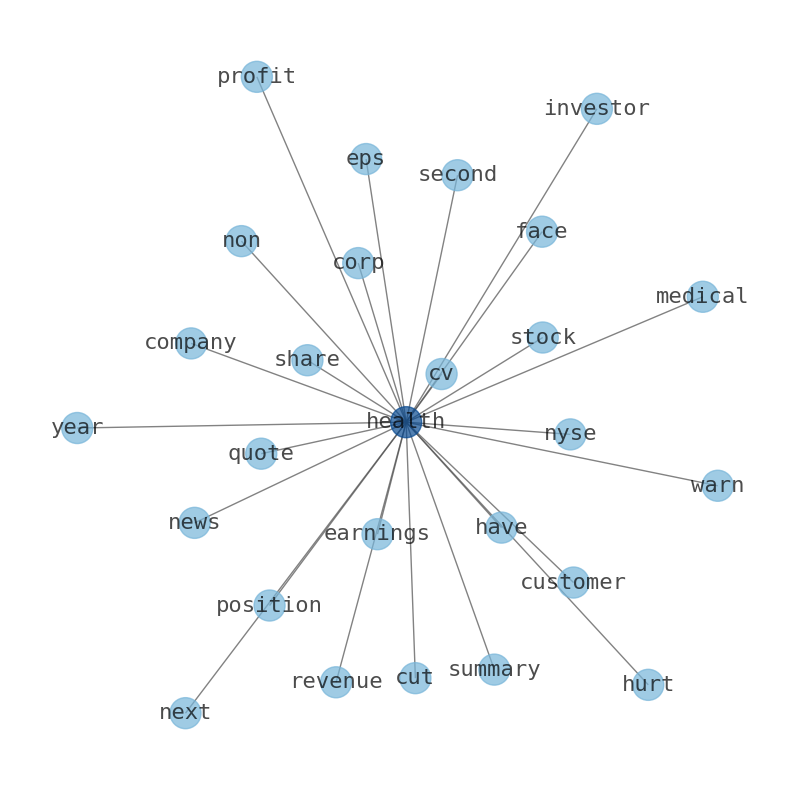

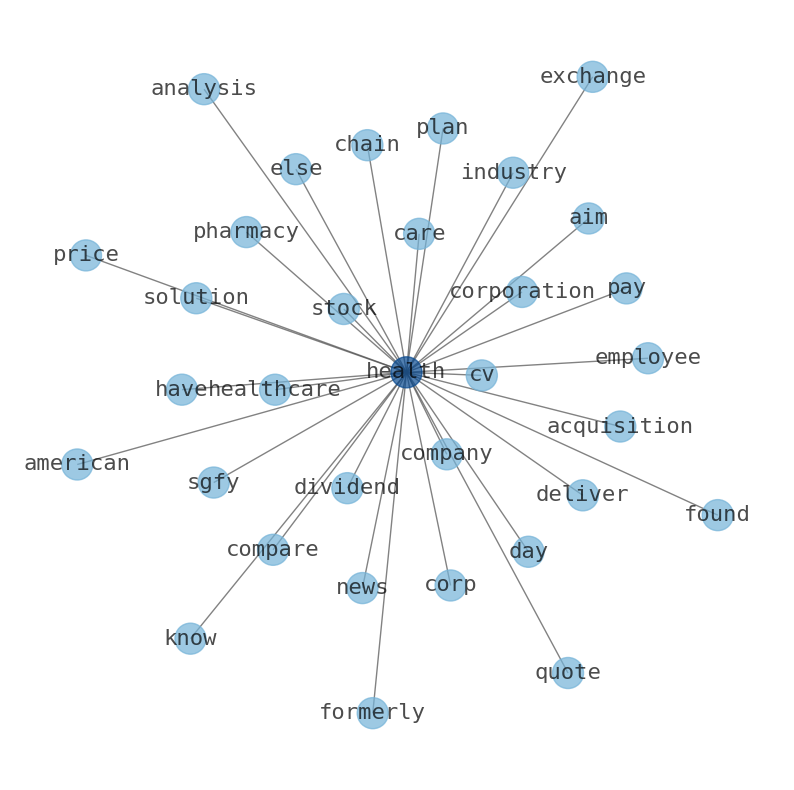

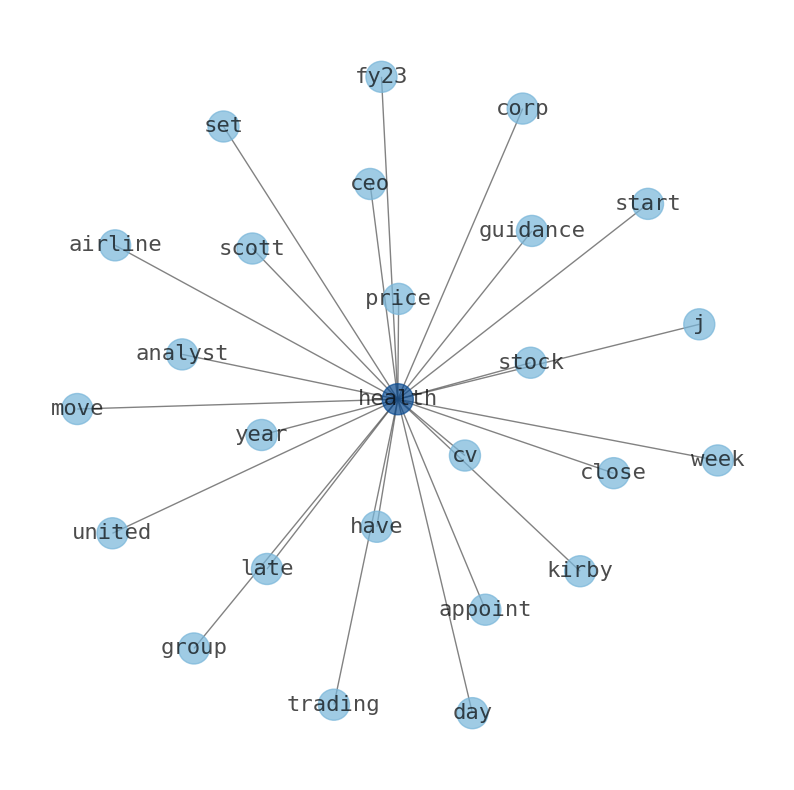

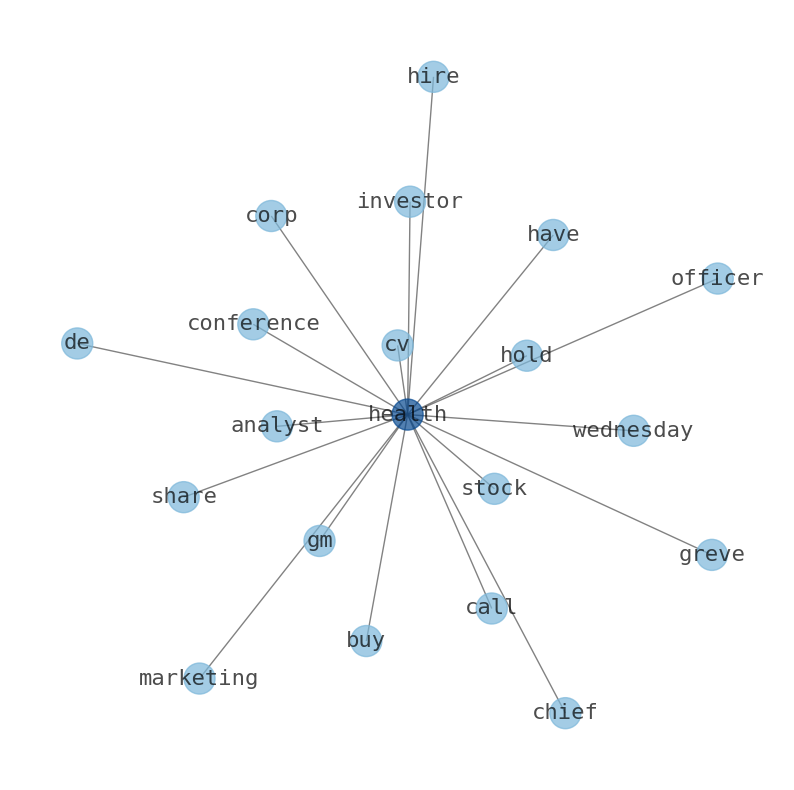

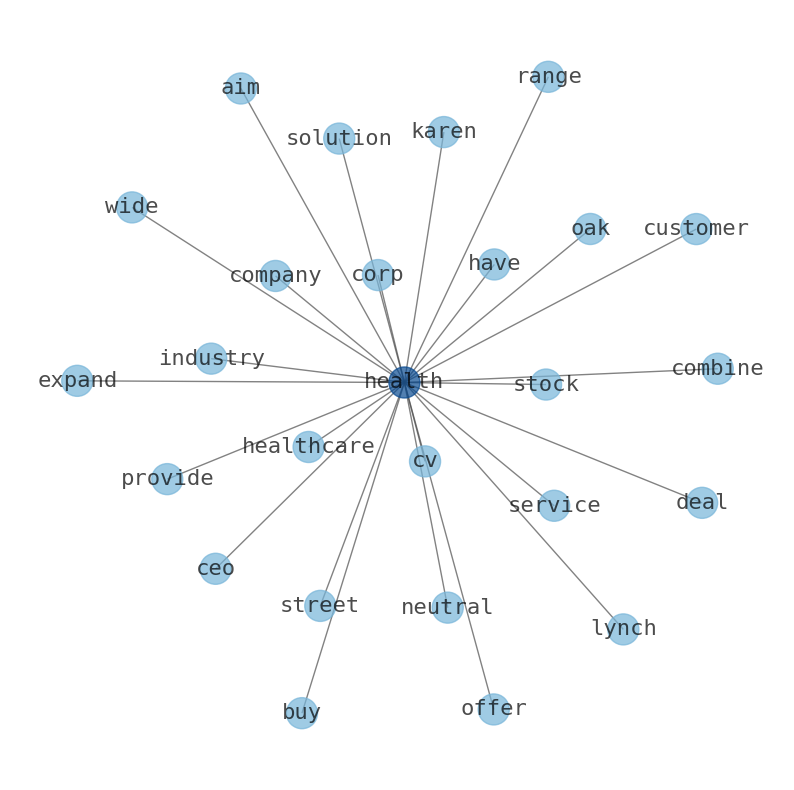

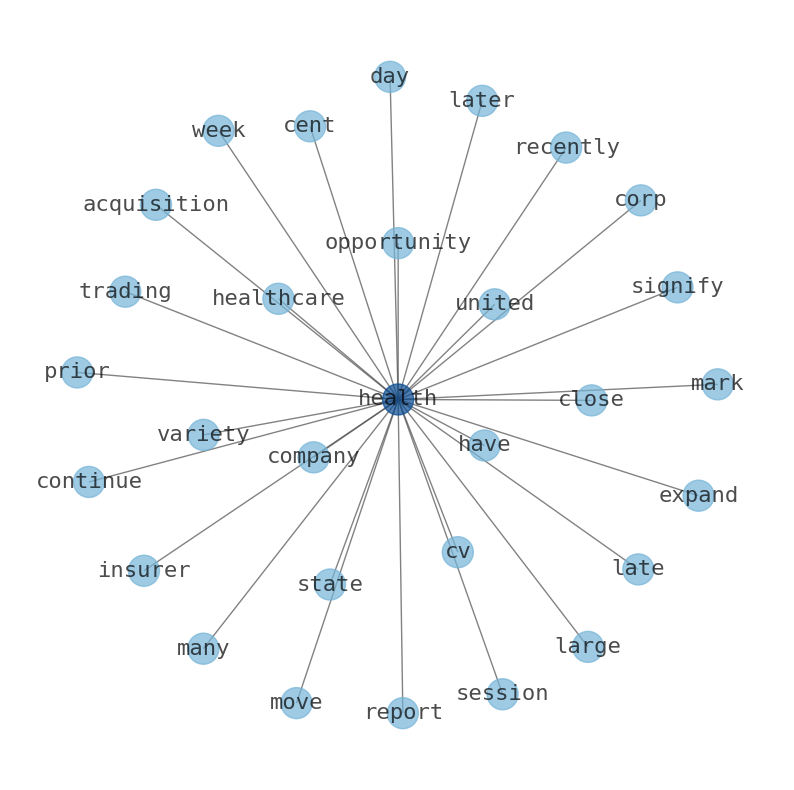

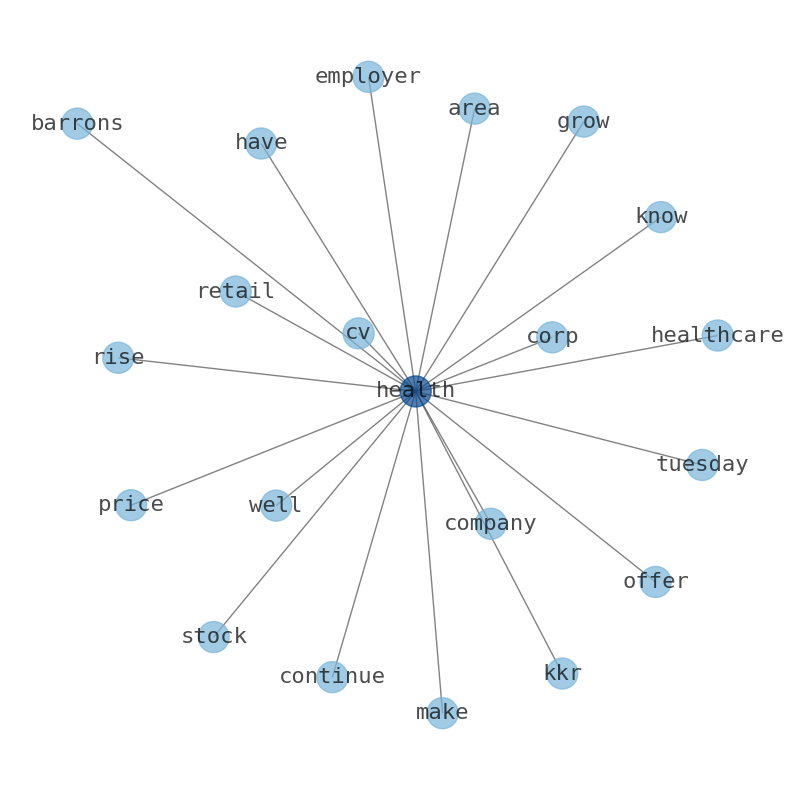

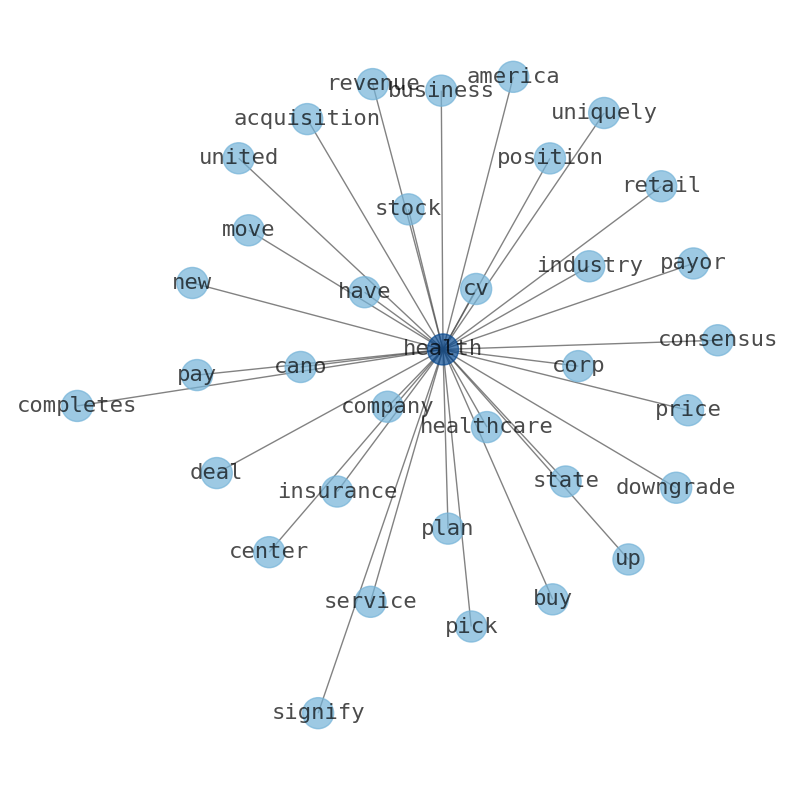

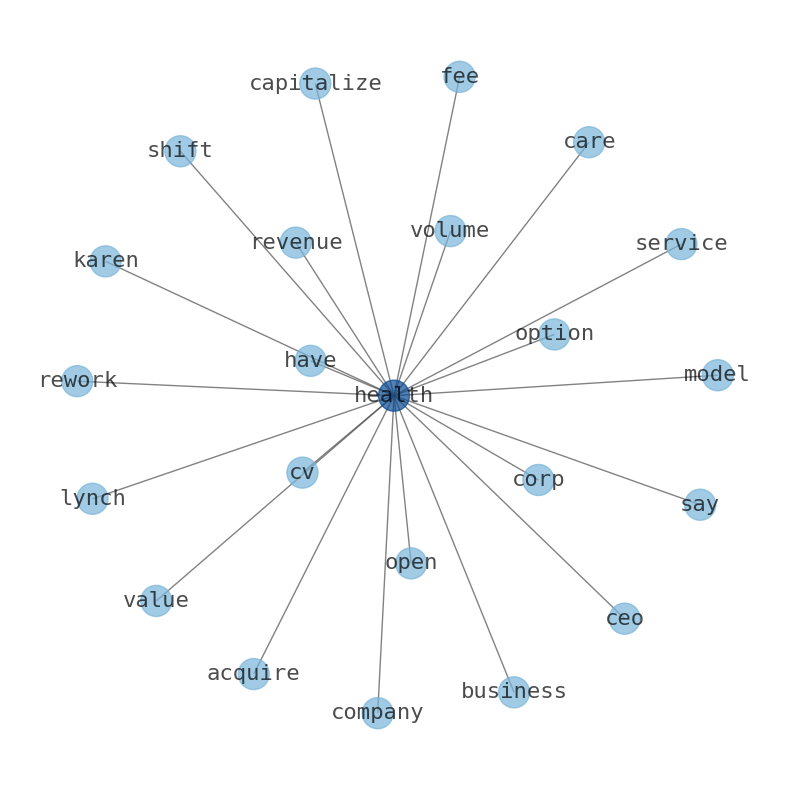

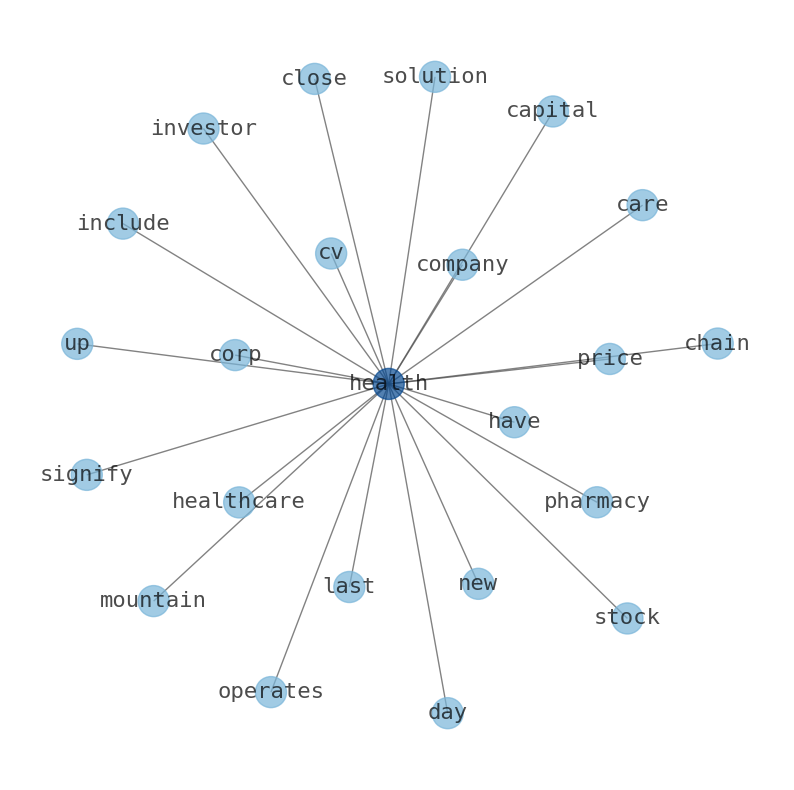

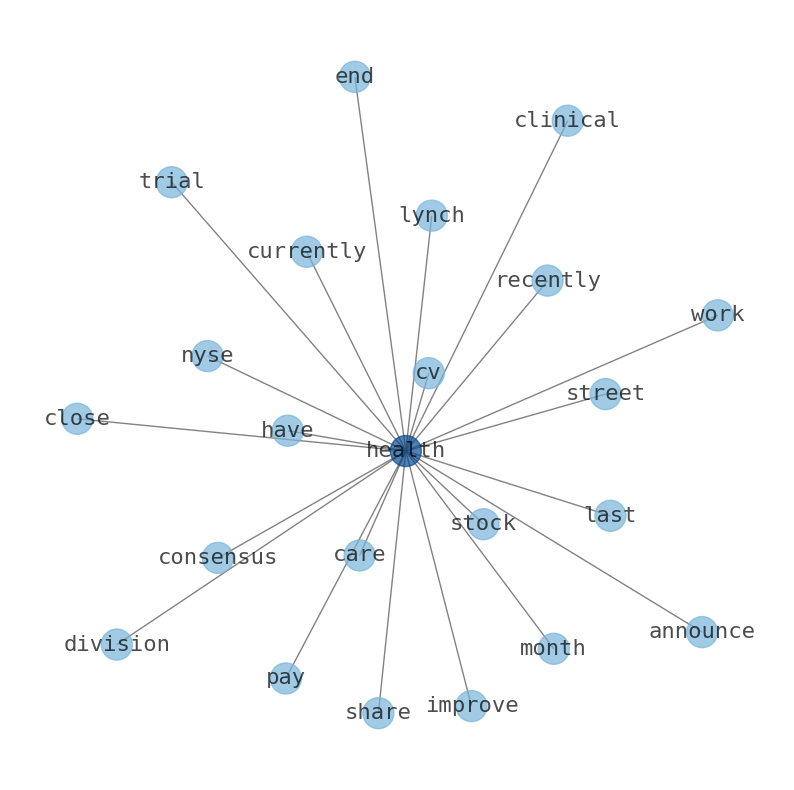

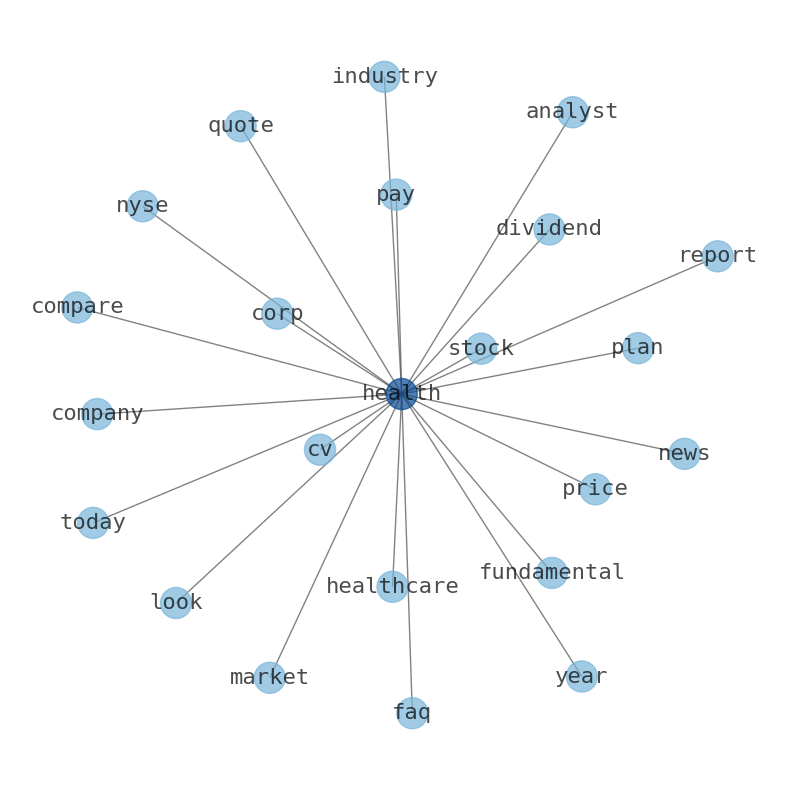

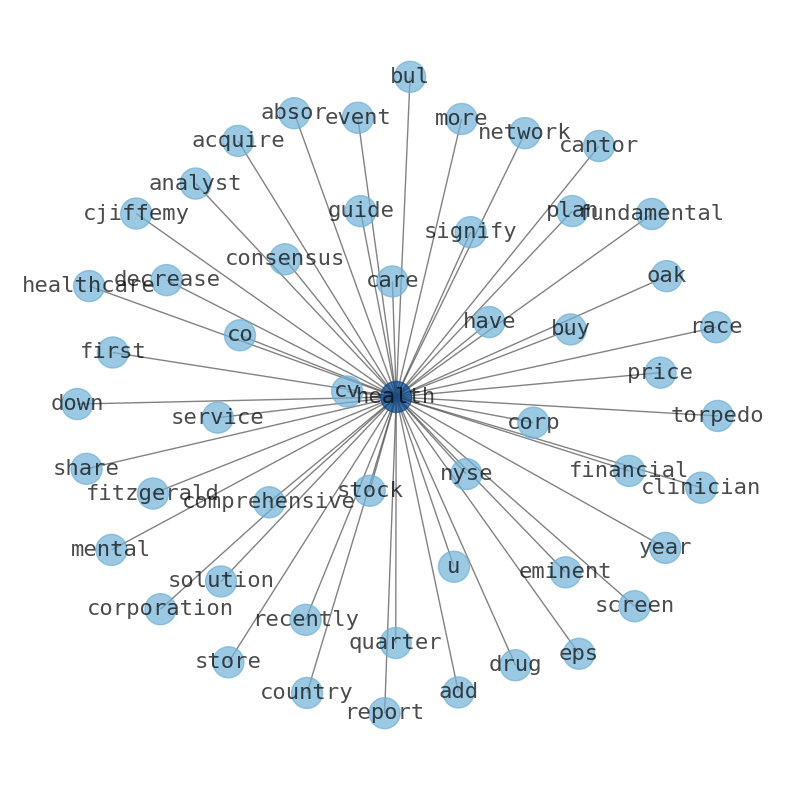

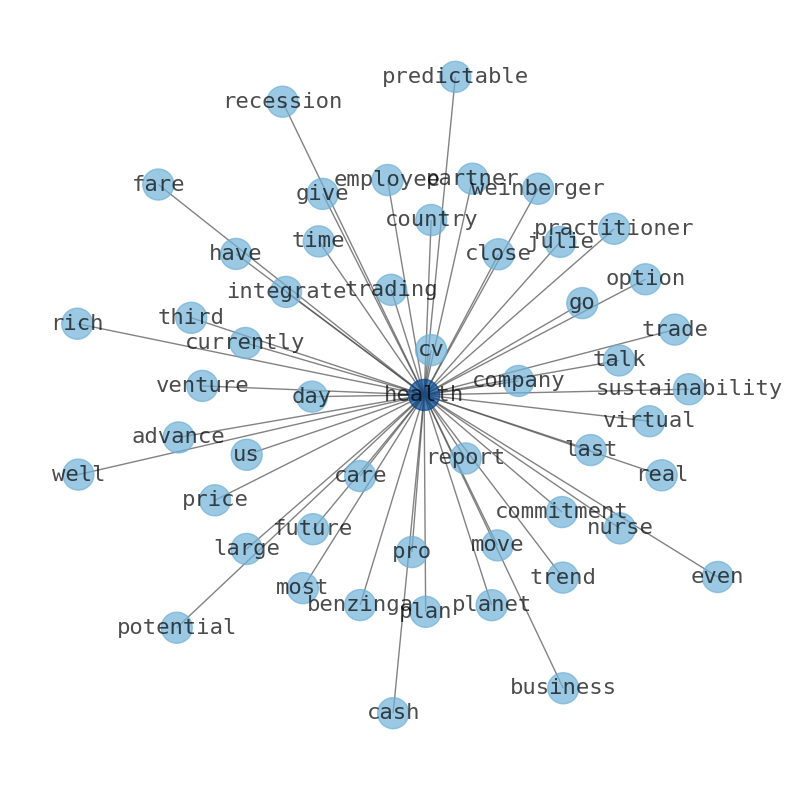

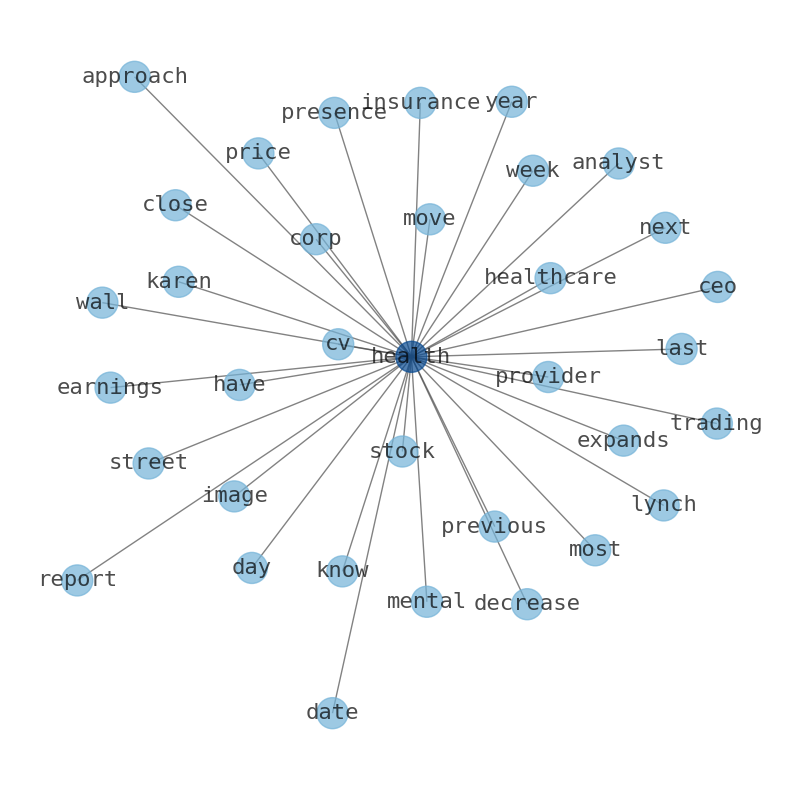

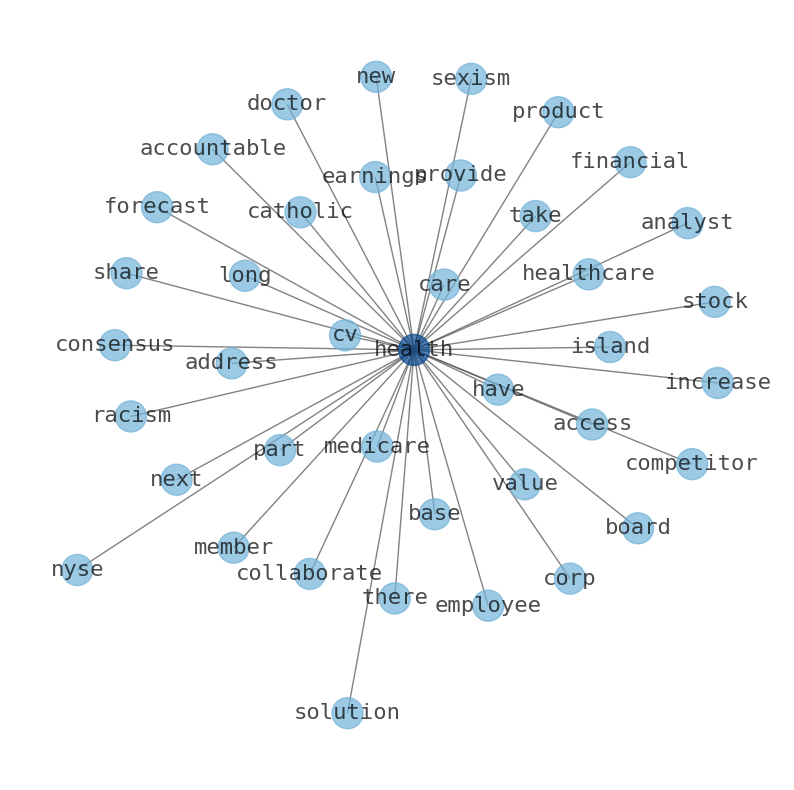

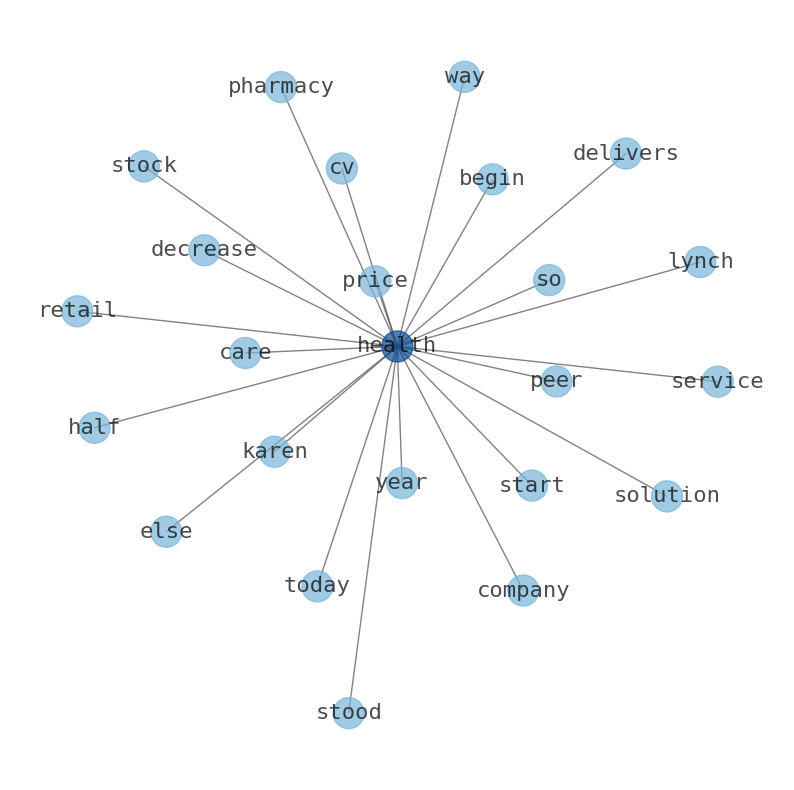

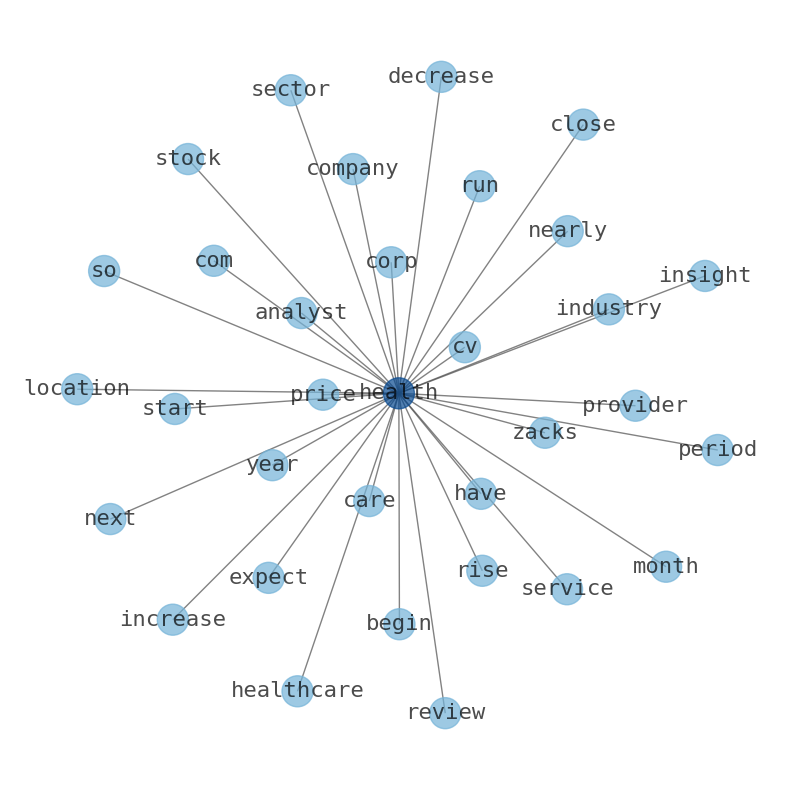

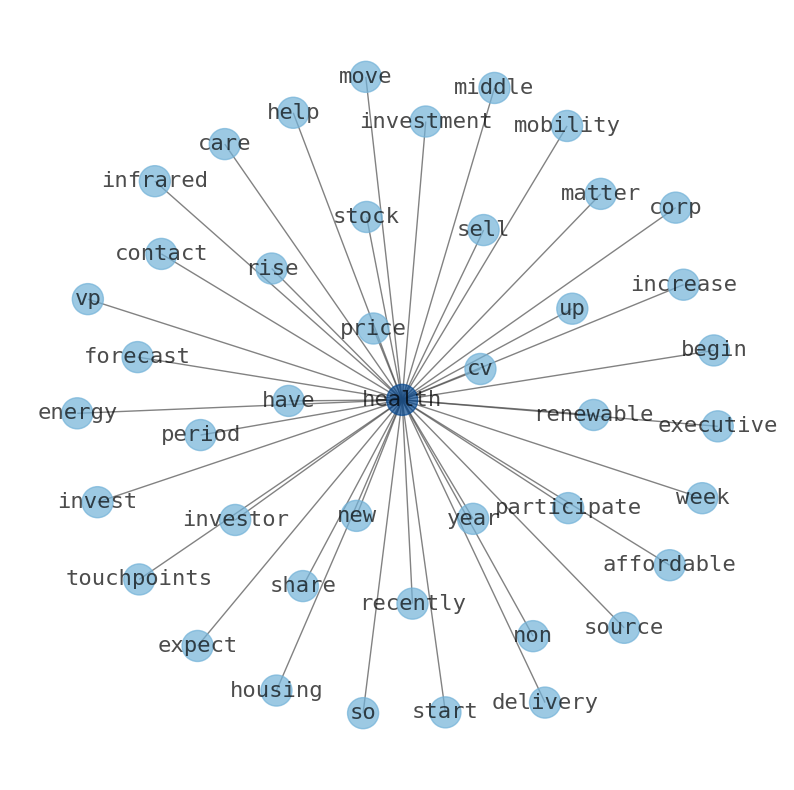

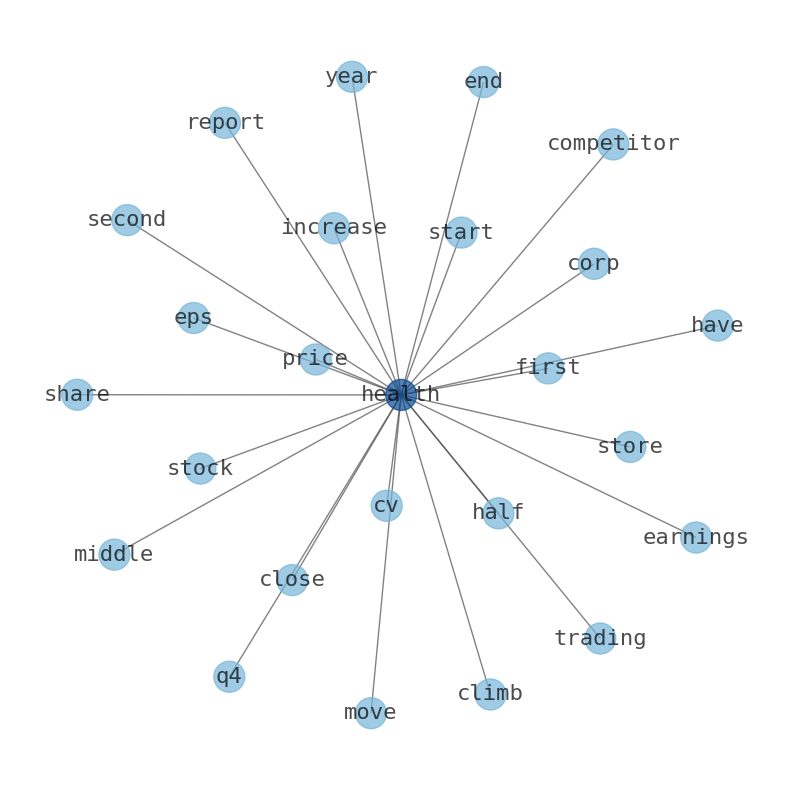

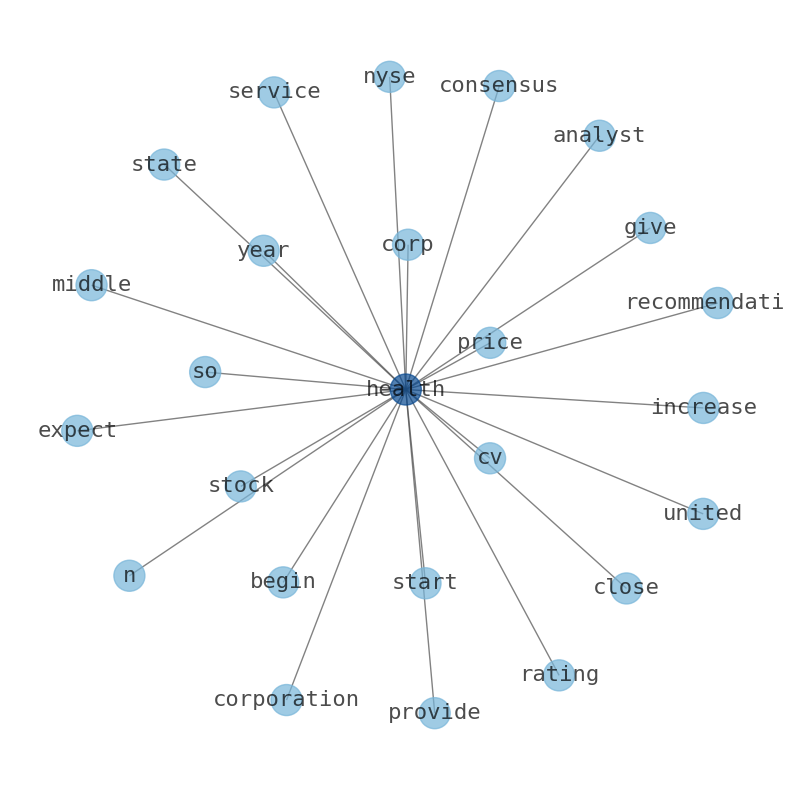

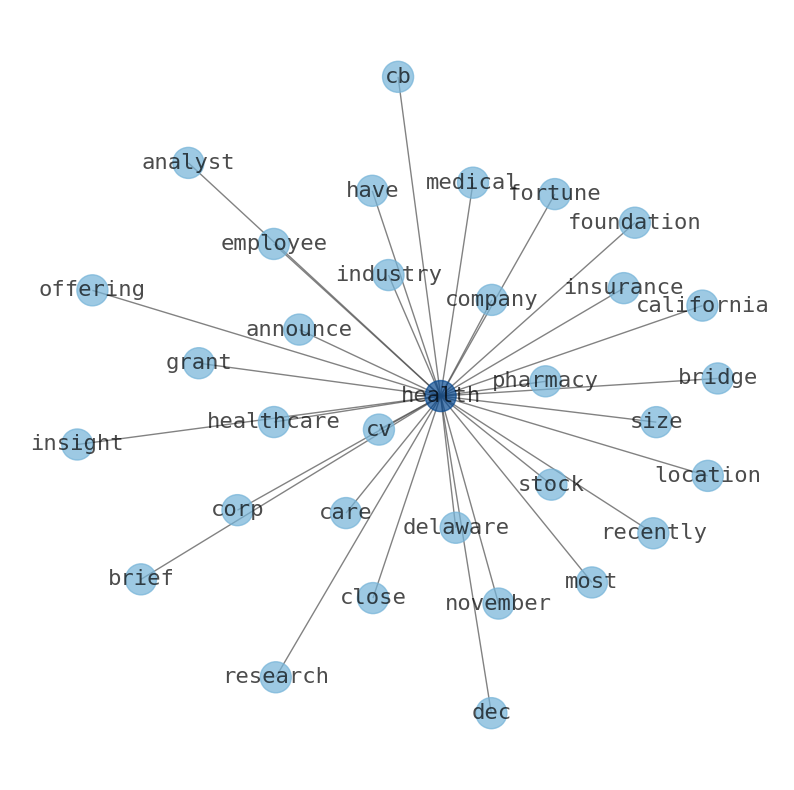

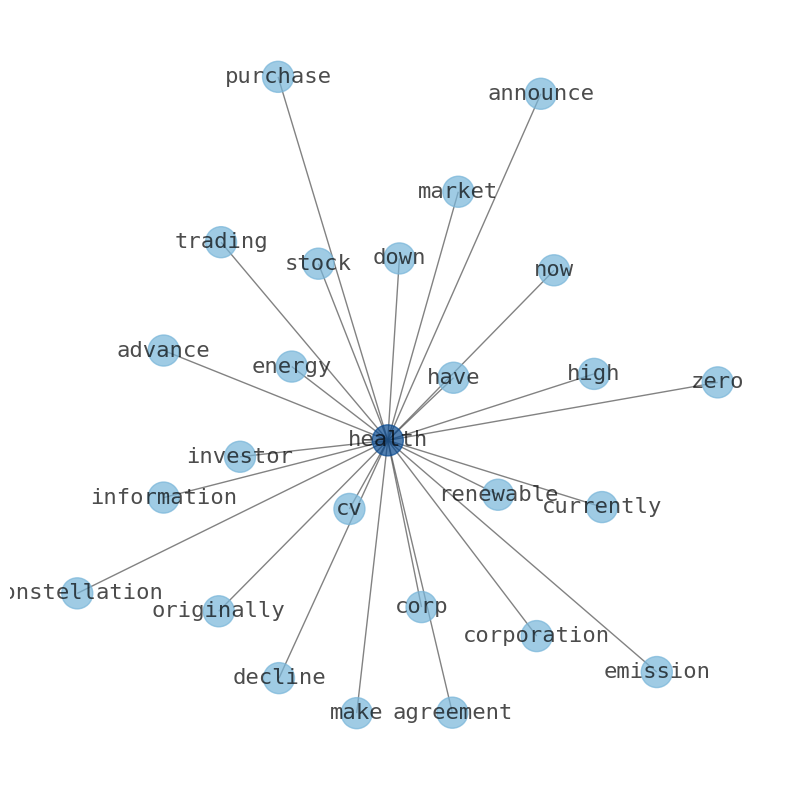

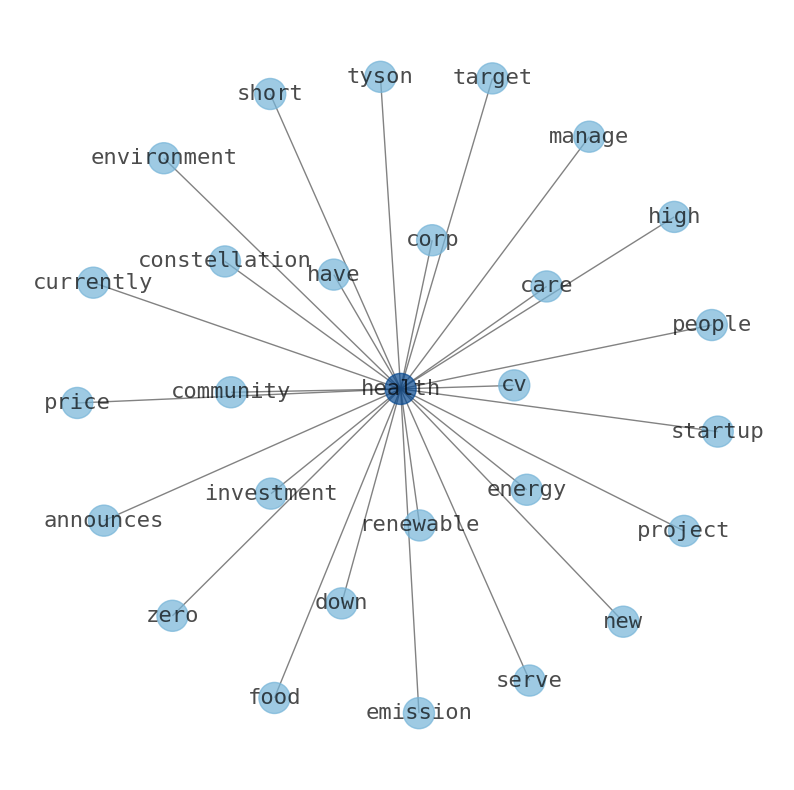

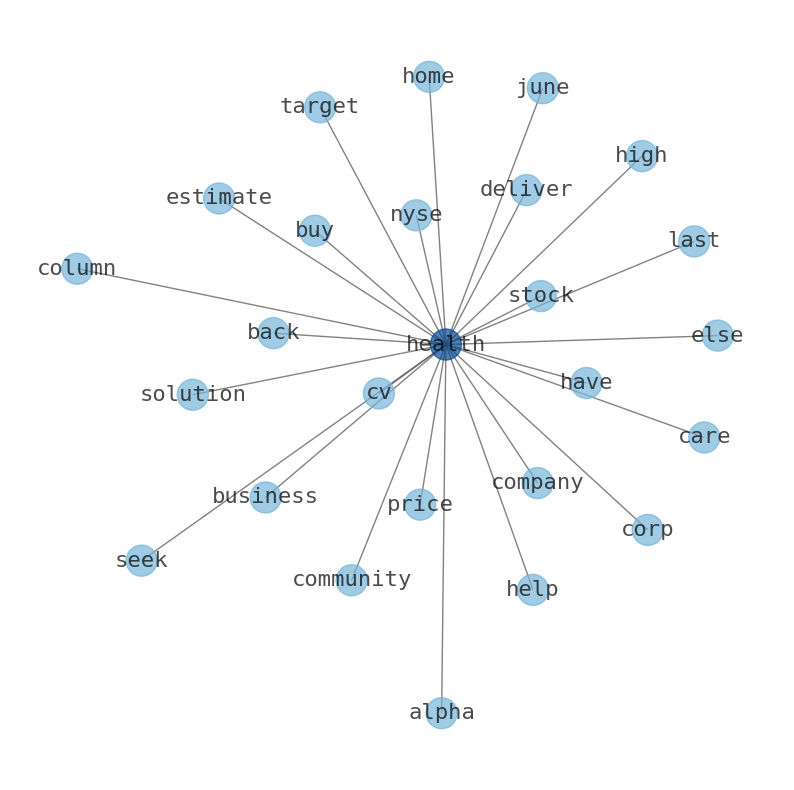

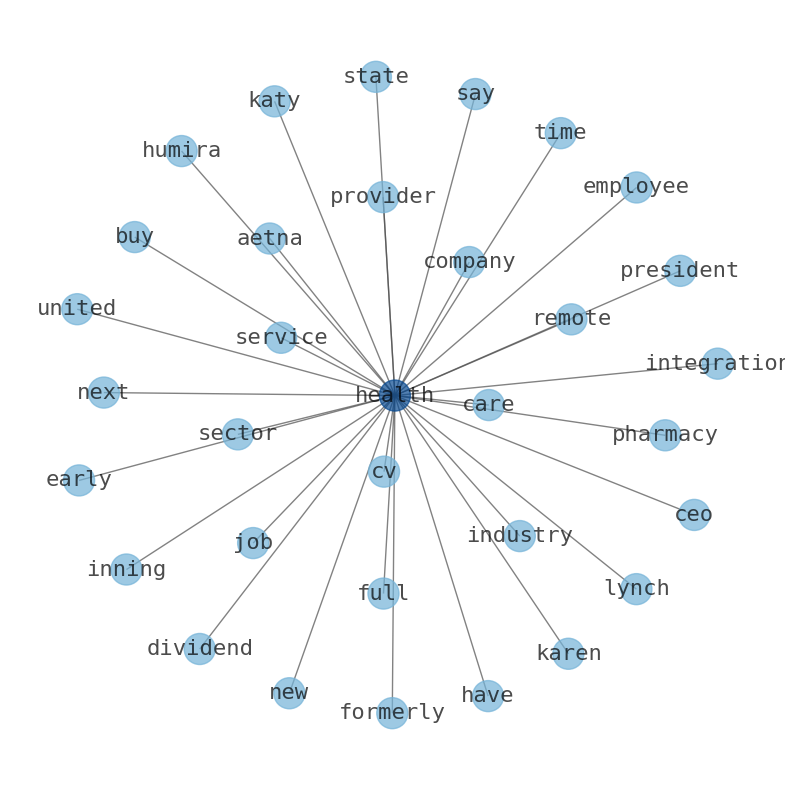

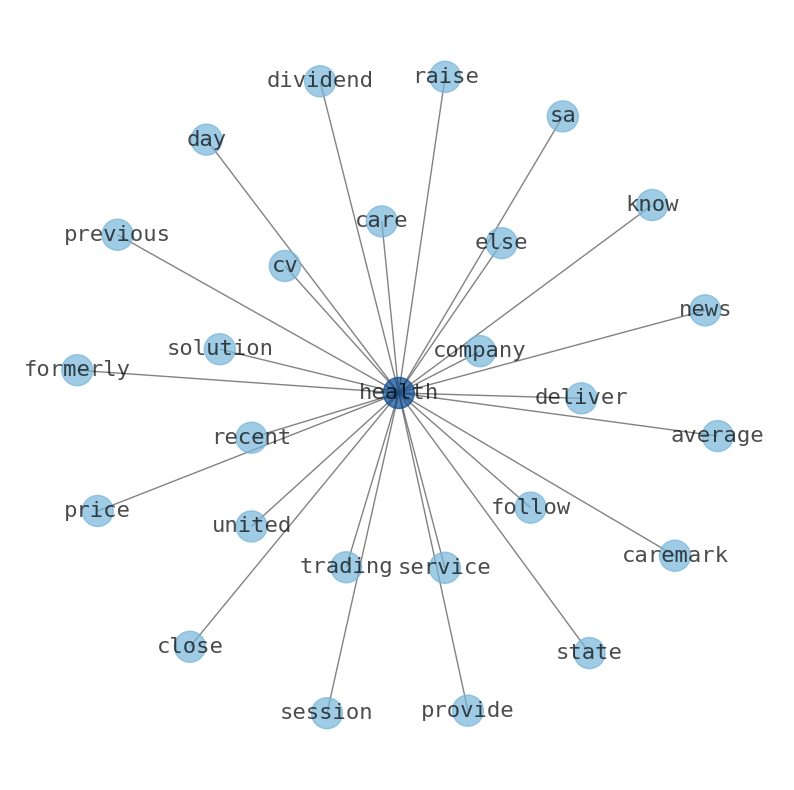

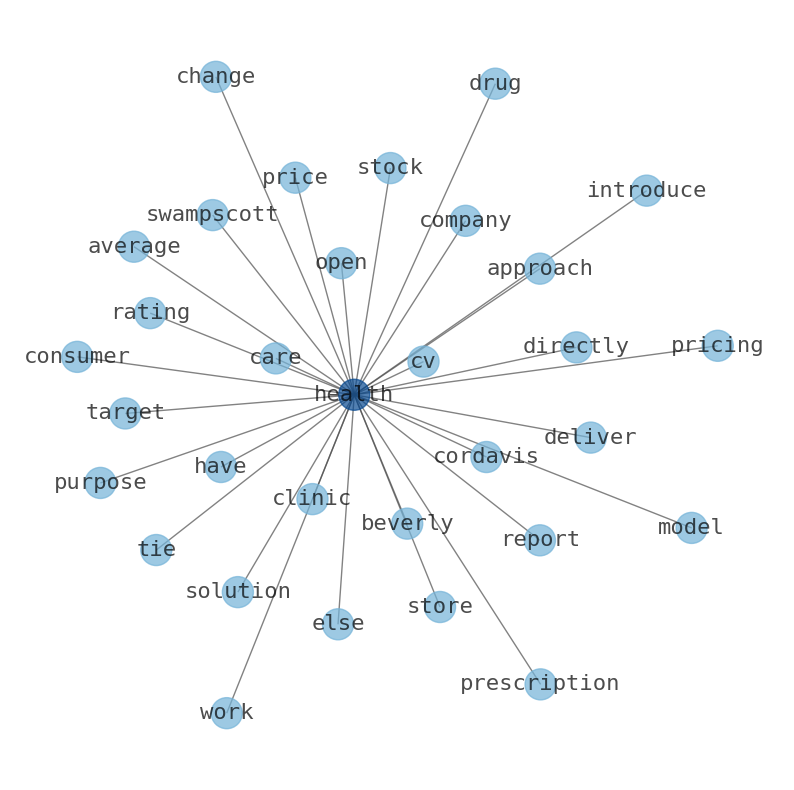

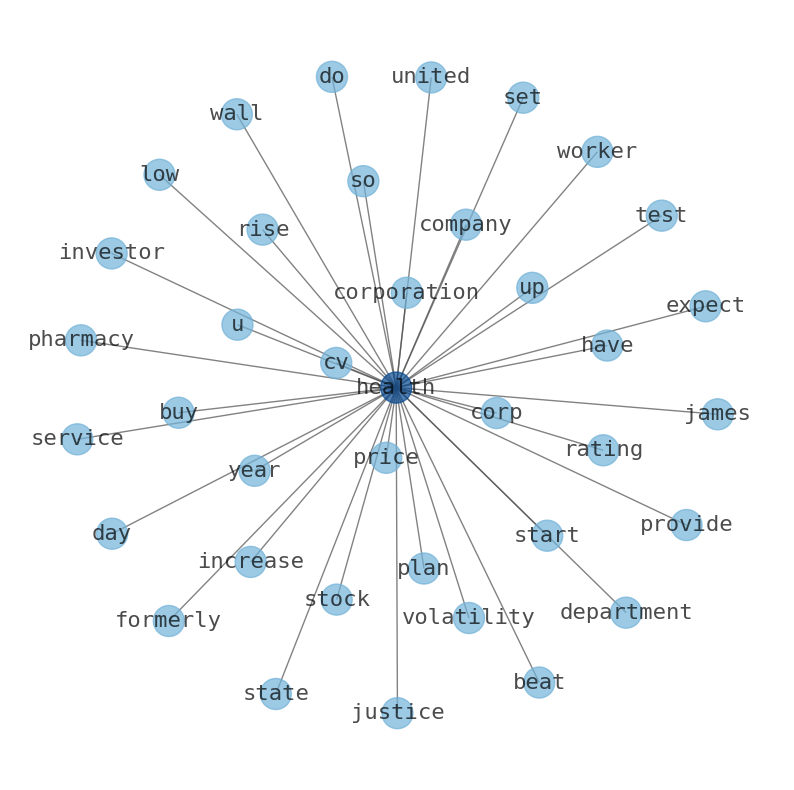

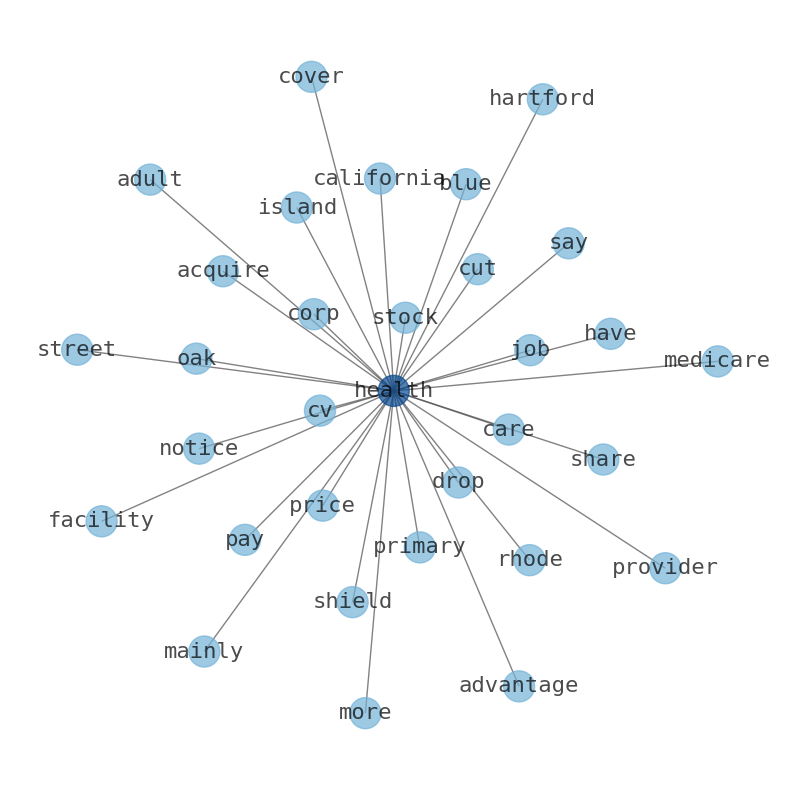

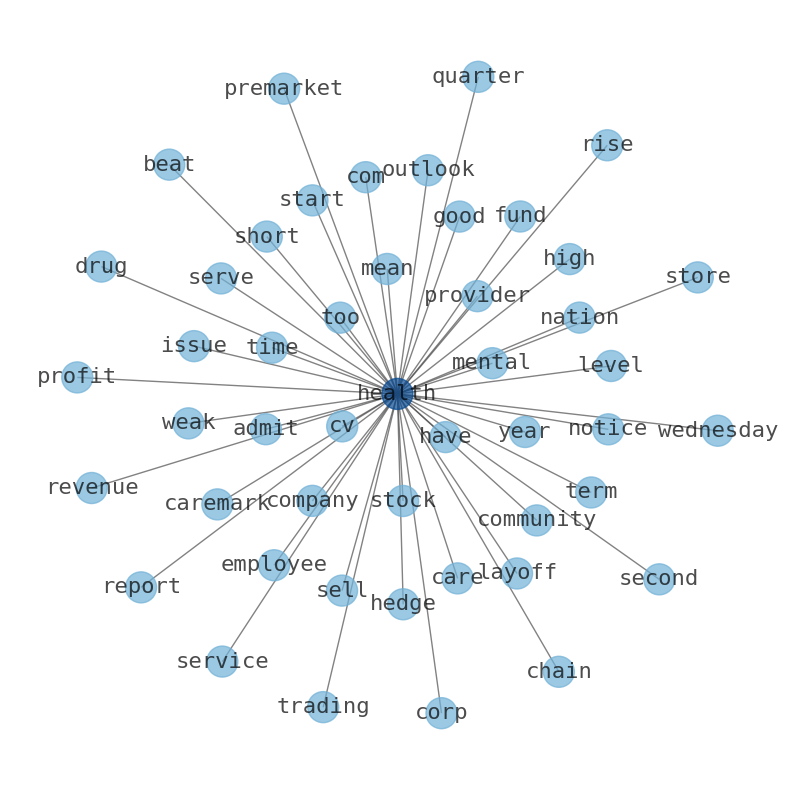

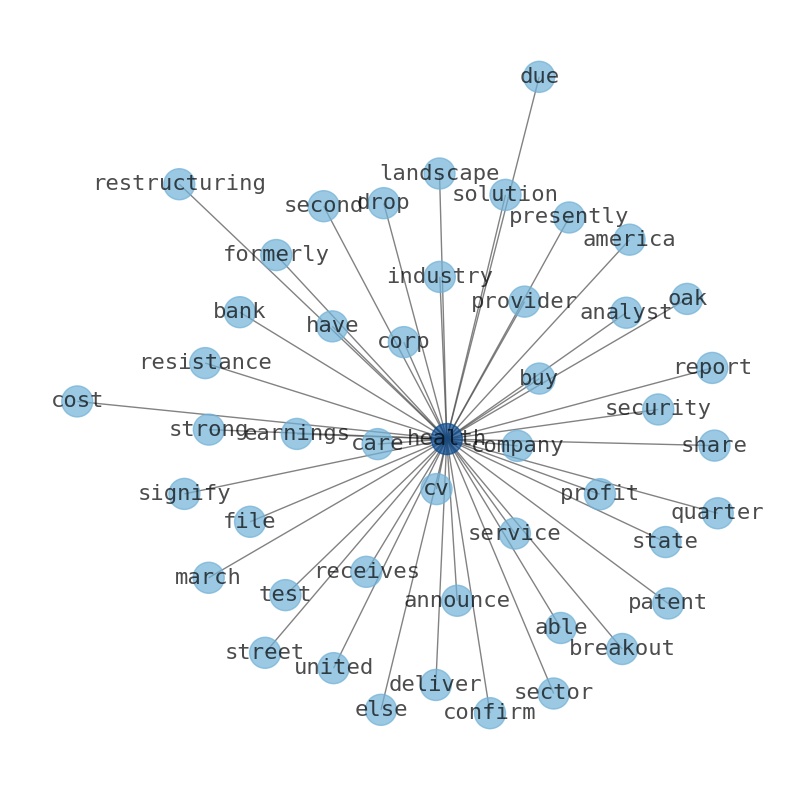

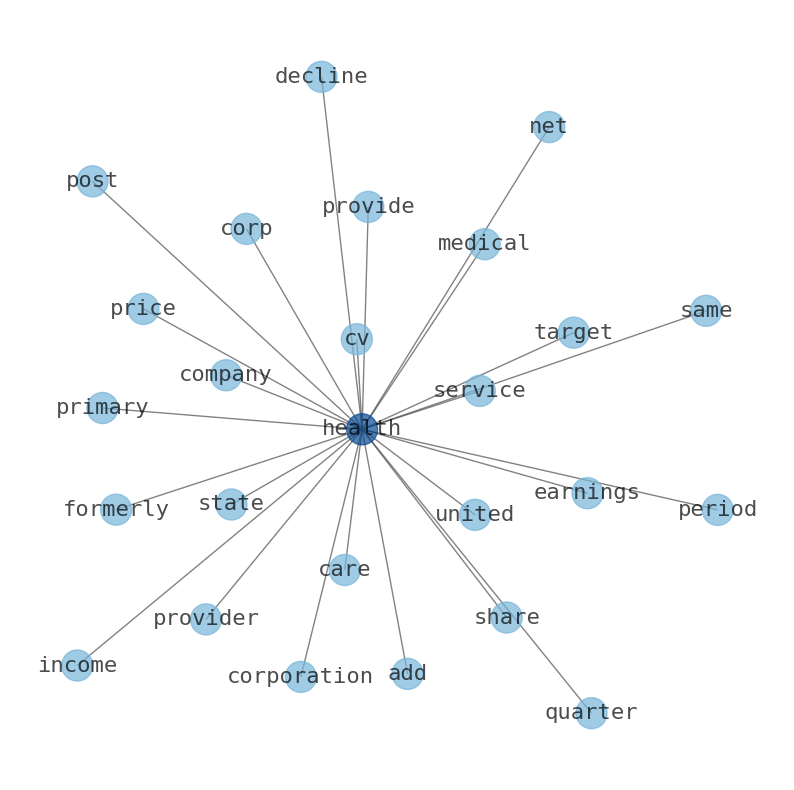

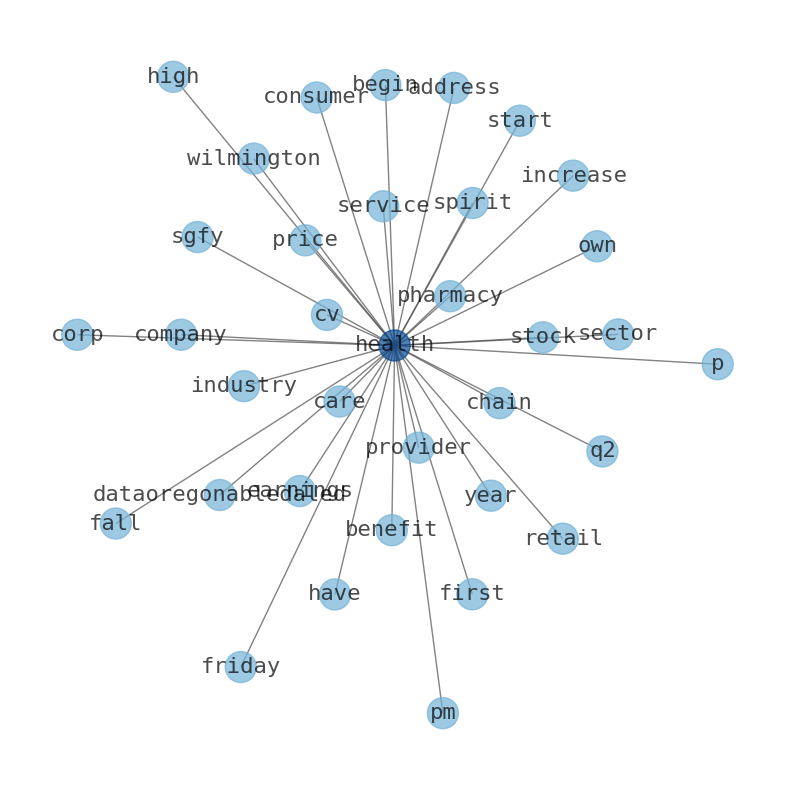

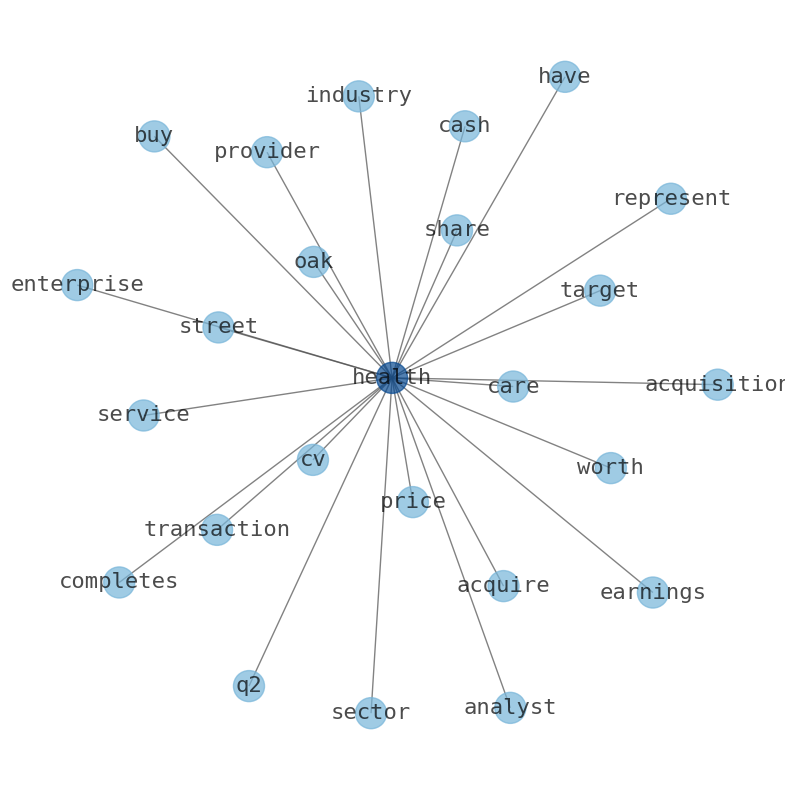

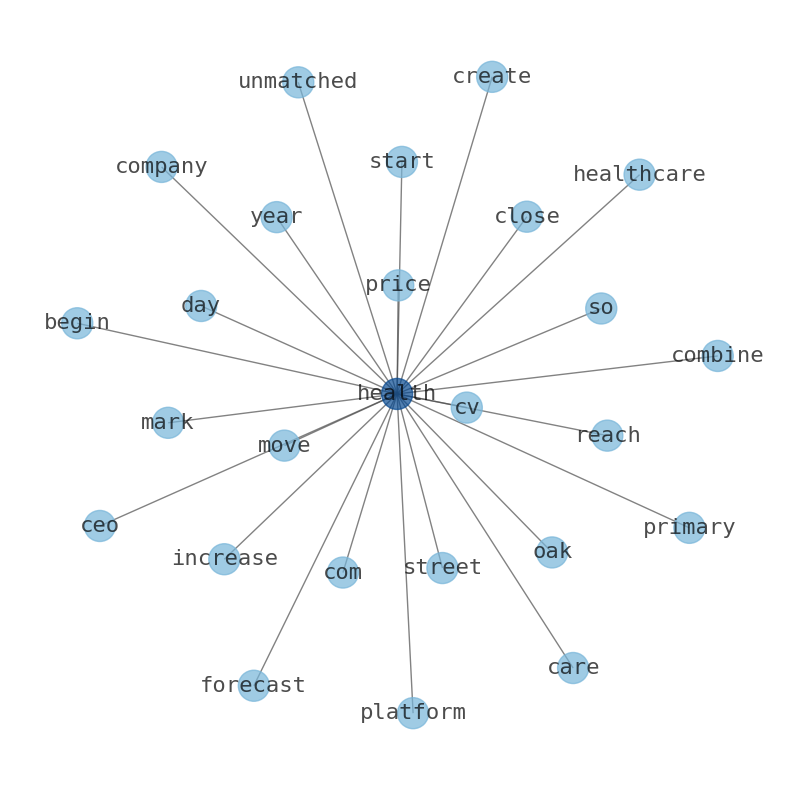

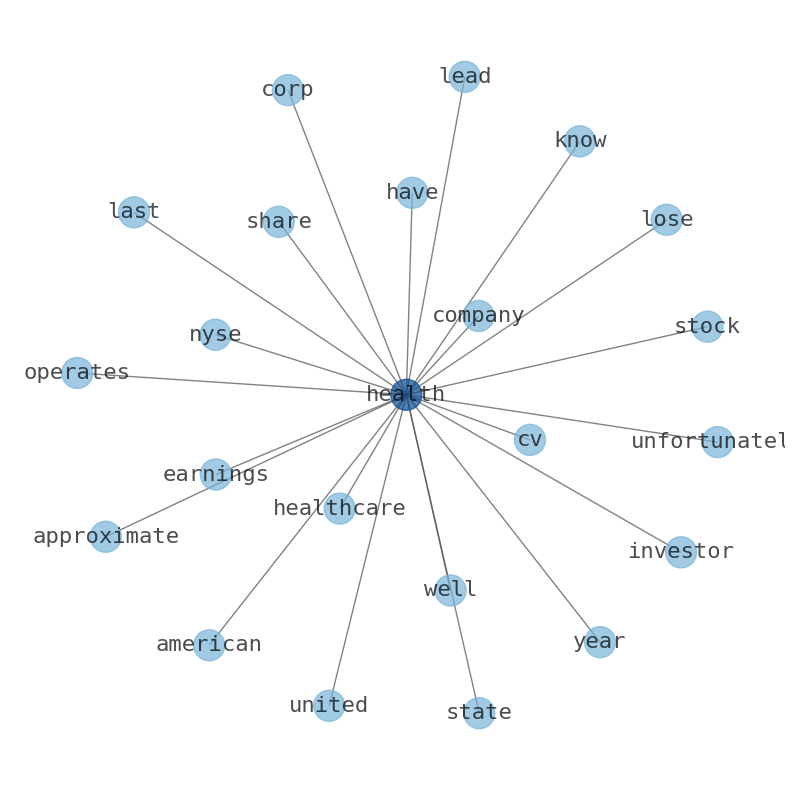

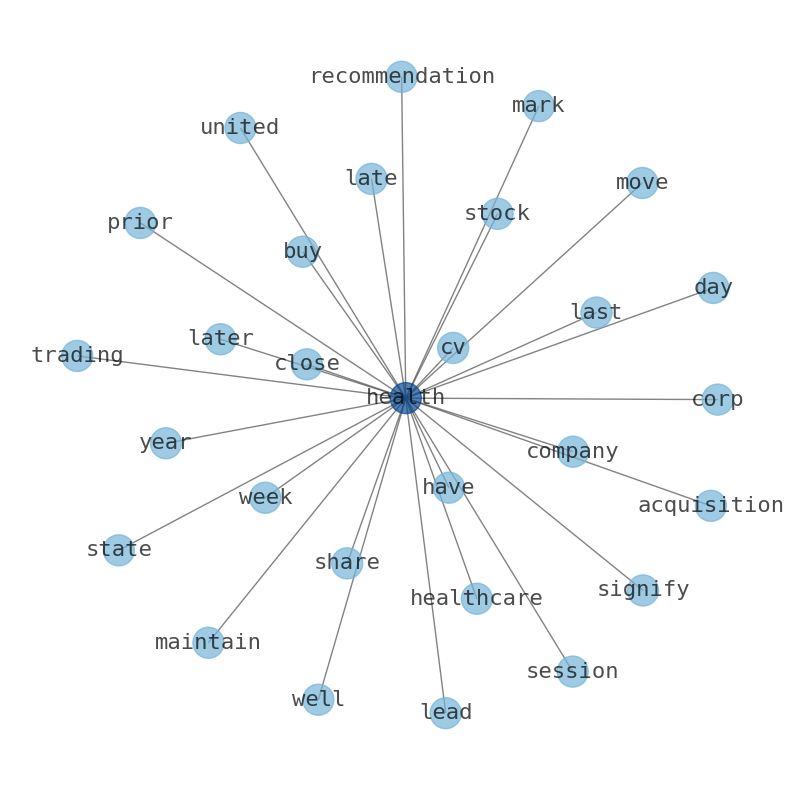

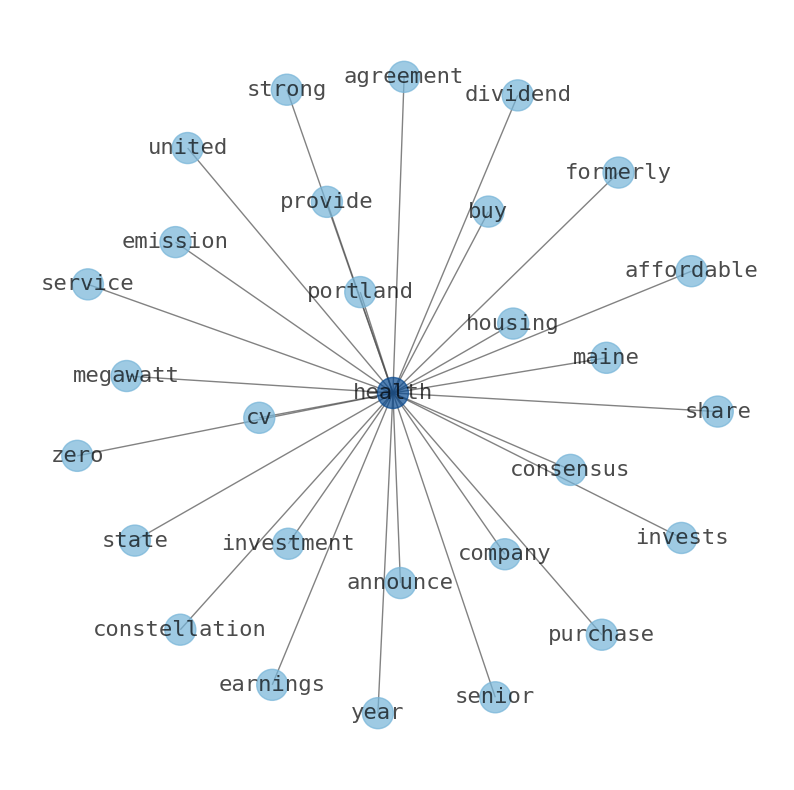

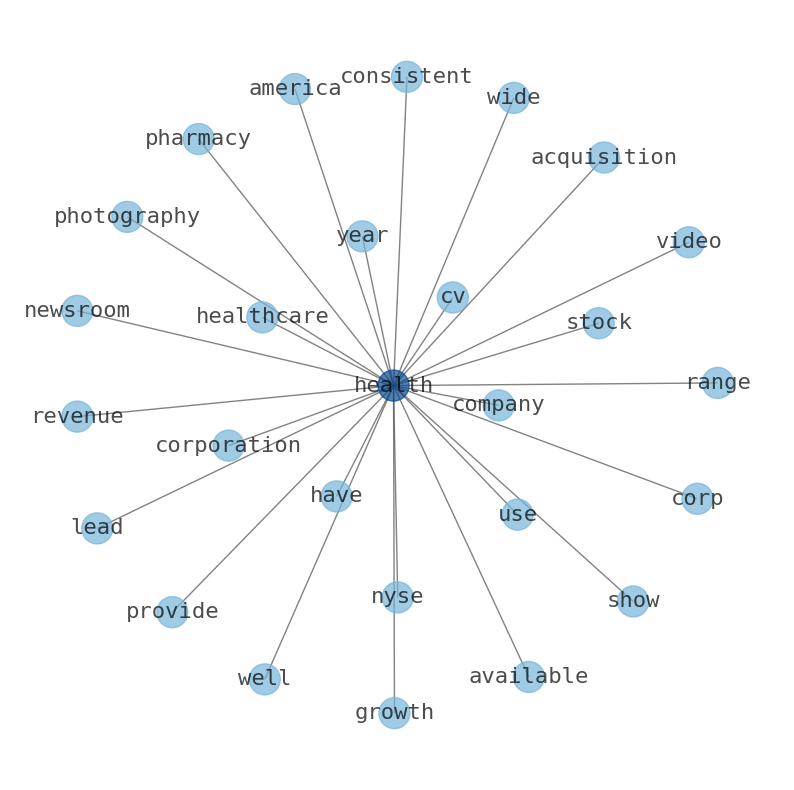

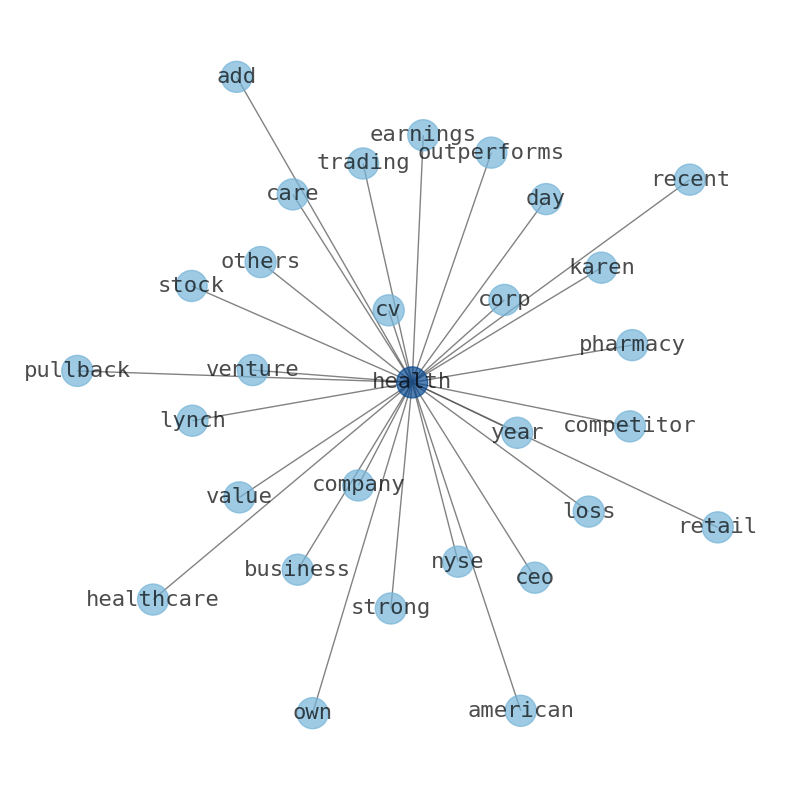

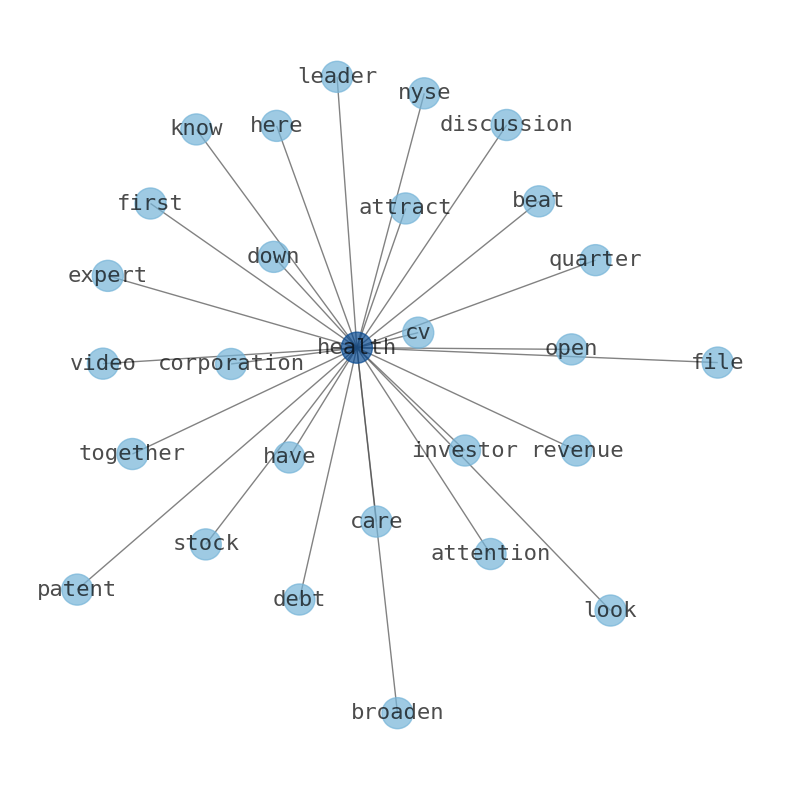

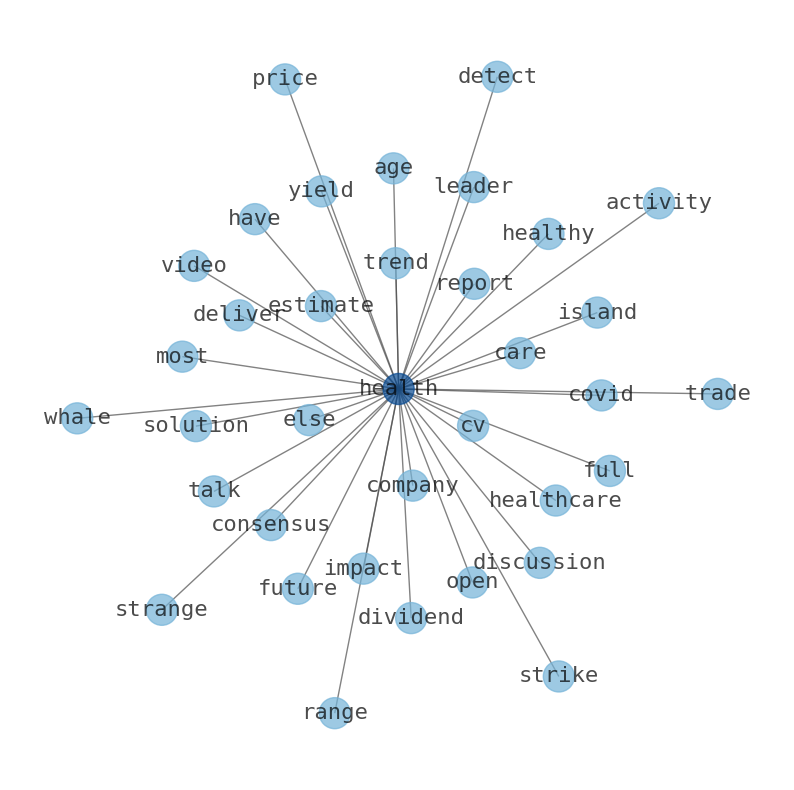

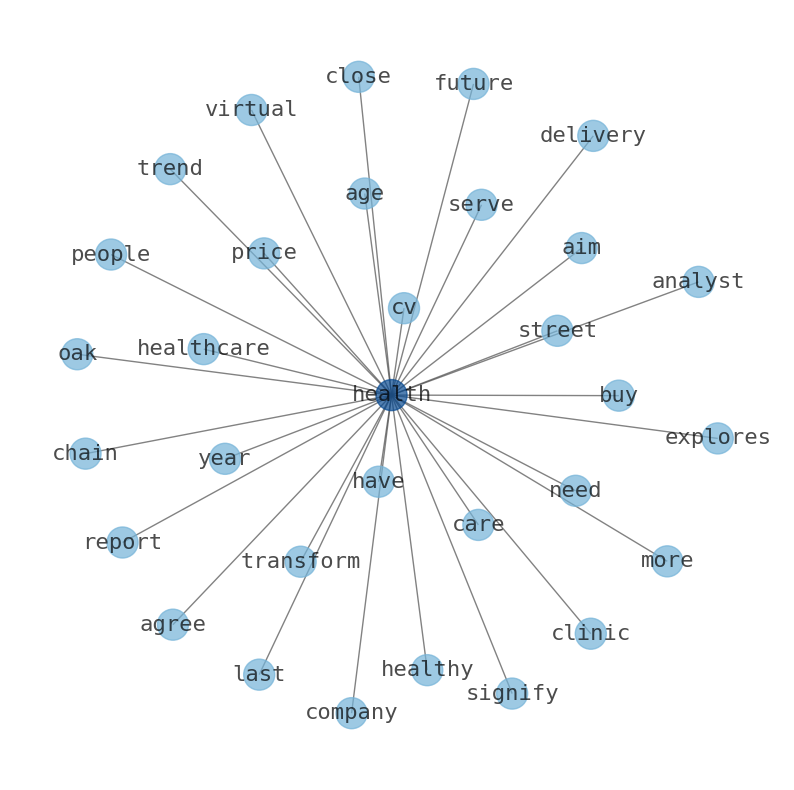

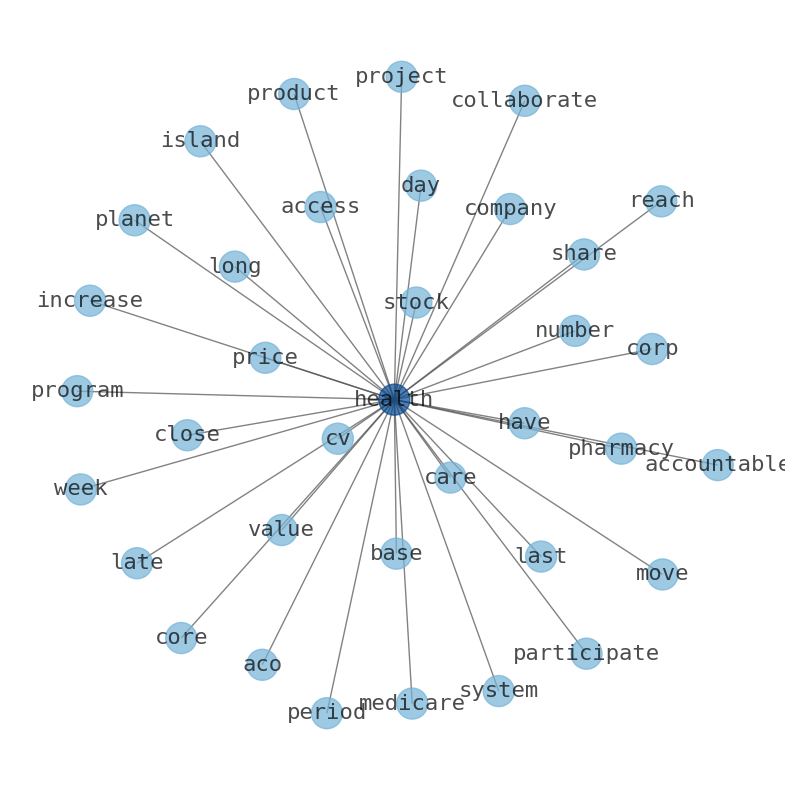

Keywords

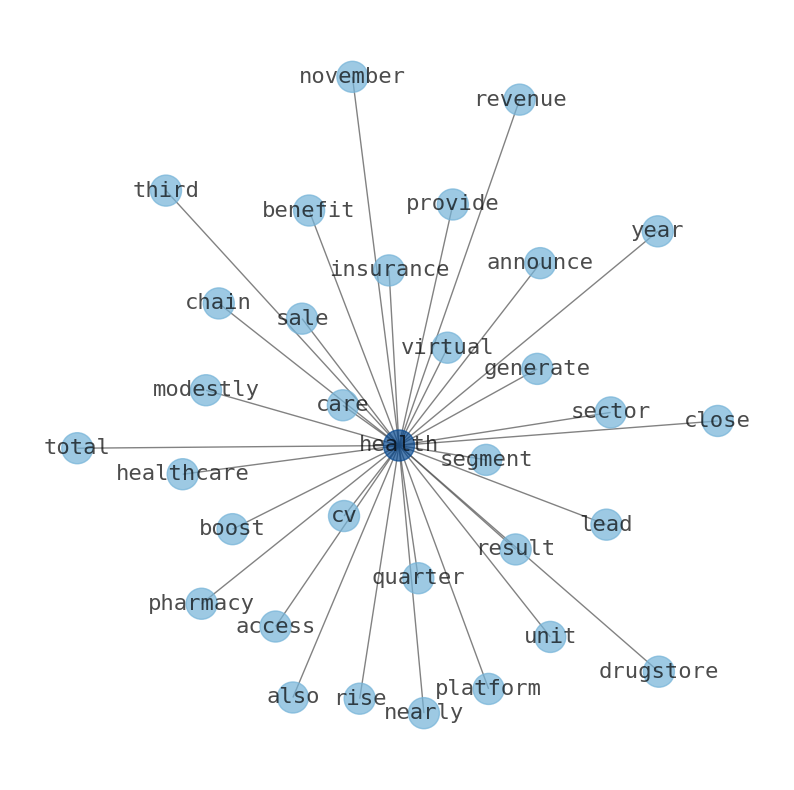

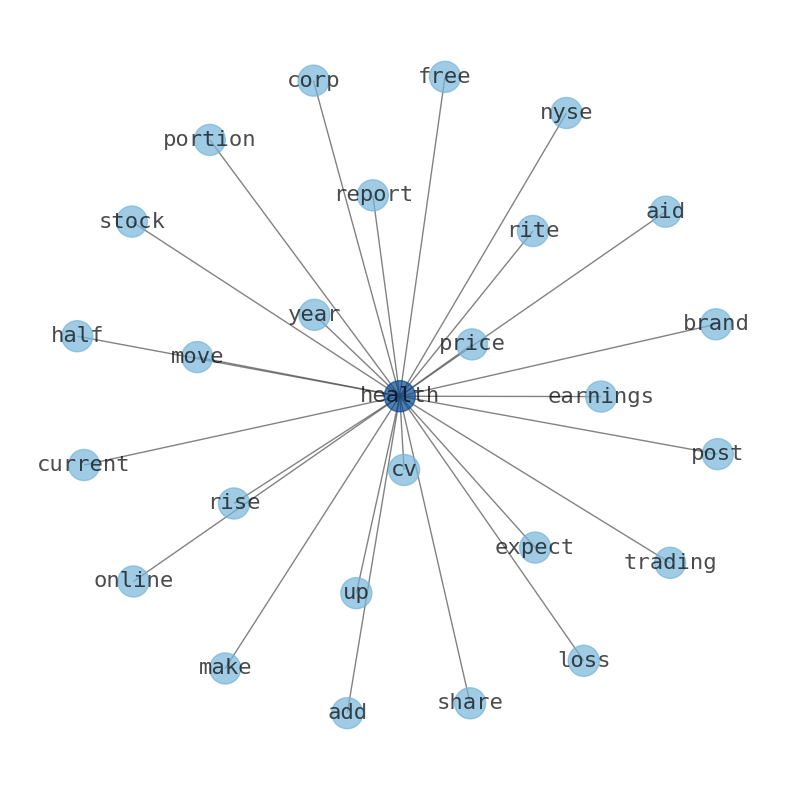

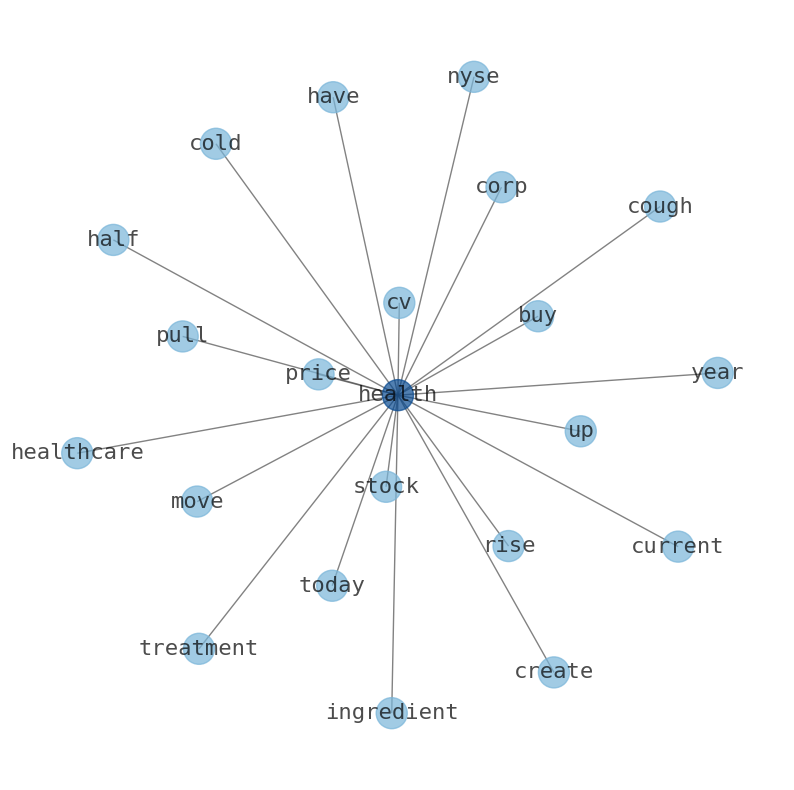

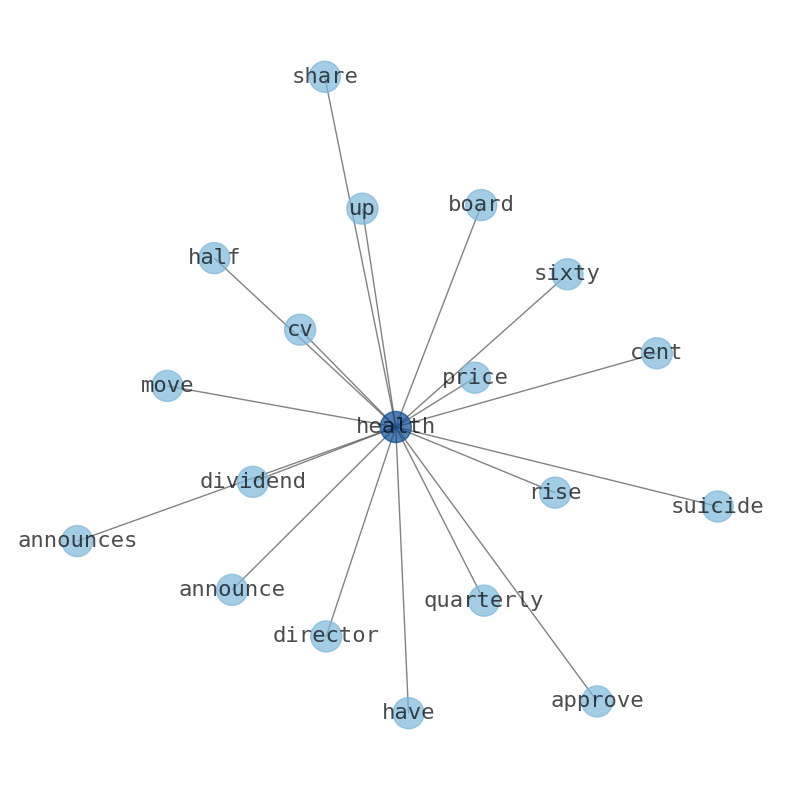

The game is changing. There is a new strategy to evaluate CVS Health fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about CVS Health are: CVS, Health, company, price, healthcare, Corp, year, and the most common words in the summary are: health, cv, cvs, company, care, price, stock, . One of the sentences in the summary was: Shares in CVS Health last closed at $68.88 and the price had moved by -28.65% over the past 365 days. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #health #cv #cvs #company #care #price #stock.

Read more →Related Results

CVS Health

Open: 75.6 Close: 77.4 Change: 1.8

Read more →

CVS Health

Open: 74.75 Close: 75.94 Change: 1.19

Read more →

CVS Health

Open: 76.46 Close: 76.27 Change: -0.19

Read more →

CVS Health

Open: 76.32 Close: 77.15 Change: 0.83

Read more →

CVS Health

Open: 76.76 Close: 76.41 Change: -0.35

Read more →

CVS Health

Open: 74.0 Close: 73.09 Change: -0.91

Read more →

CVS Health

Open: 74.32 Close: 74.37 Change: 0.05

Read more →

CVS Health

Open: 72.66 Close: 73.0 Change: 0.34

Read more →

CVS Health

Open: 73.38 Close: 73.93 Change: 0.55

Read more →

CVS Health

Open: 77.6 Close: 76.56 Change: -1.04

Read more →

CVS Health

Open: 80.62 Close: 81.42 Change: 0.8

Read more →

CVS Health

Open: 75.0 Close: 74.88 Change: -0.12

Read more →

CVS Health

Open: 69.37 Close: 68.74 Change: -0.63

Read more →

CVS Health

Open: 68.4 Close: 68.23 Change: -0.17

Read more →

CVS Health

Open: 70.0 Close: 70.25 Change: 0.25

Read more →

CVS Health

Open: 67.84 Close: 66.29 Change: -1.55

Read more →

CVS Health

Open: 71.09 Close: 69.78 Change: -1.31

Read more →

CVS Health

Open: 70.98 Close: 71.33 Change: 0.35

Read more →

CVS Health

Open: 70.7 Close: 70.24 Change: -0.46

Read more →

CVS Health

Open: 66.83 Close: 65.17 Change: -1.66

Read more →

CVS Health

Open: 67.93 Close: 67.24 Change: -0.69

Read more →

CVS Health

Open: 67.23 Close: 66.4 Change: -0.83

Read more →

CVS Health

Open: 68.3 Close: 66.8 Change: -1.5

Read more →

CVS Health

Open: 73.76 Close: 74.87 Change: 1.11

Read more →

CVS Health

Open: 73.19 Close: 74.0 Change: 0.81

Read more →

CVS Health

Open: 75.93 Close: 74.61 Change: -1.32

Read more →

CVS Health

Open: 75.57 Close: 75.1 Change: -0.47

Read more →

CVS Health

Open: 75.23 Close: 75.95 Change: 0.72

Read more →

CVS Health

Open: 73.26 Close: 74.38 Change: 1.12

Read more →

CVS Health

Open: 69.65 Close: 71.27 Change: 1.62

Read more →

CVS Health

Open: 67.96 Close: 68.68 Change: 0.72

Read more →

CVS Health

Open: 71.99 Close: 71.76 Change: -0.23

Read more →

CVS Health

Open: 70.51 Close: 70.92 Change: 0.4

Read more →

CVS Health

Open: 69.34 Close: 69.99 Change: 0.65

Read more →

CVS Health

Open: 68.05 Close: 67.64 Change: -0.41

Read more →

CVS Health

Open: 69.68 Close: 68.82 Change: -0.86

Read more →

CVS Health

Open: 69.01 Close: 68.58 Change: -0.43

Read more →

CVS Health

Open: 69.01 Close: 68.58 Change: -0.43

Read more →

CVS Health

Open: 73.59 Close: 73.89 Change: 0.3

Read more →

CVS Health

Open: 73.03 Close: 73.31 Change: 0.28

Read more →

CVS Health

Open: 73.05 Close: 73.33 Change: 0.28

Read more →

CVS Health

Open: 75.82 Close: 75.21 Change: -0.61

Read more →

CVS Health

Open: 74.63 Close: 73.84 Change: -0.79

Read more →

CVS Health

Open: 77.29 Close: 77.2 Change: -0.09

Read more →

CVS Health

Open: 76.72 Close: 76.82 Change: 0.1

Read more →

CVS Health

Open: 74.0 Close: 73.09 Change: -0.91

Read more →

CVS Health

Open: 74.43 Close: 73.92 Change: -0.51

Read more →

CVS Health

Open: 72.66 Close: 73.0 Change: 0.34

Read more →

CVS Health

Open: 72.66 Close: 72.29 Change: -0.37

Read more →

CVS Health

Open: 73.38 Close: 74.17 Change: 0.79

Read more →

CVS Health

Open: 80.55 Close: 80.58 Change: 0.03

Read more →

CVS Health

Open: 78.88 Close: 78.96 Change: 0.08

Read more →

CVS Health

Open: 73.65 Close: 75.29 Change: 1.64

Read more →

CVS Health

Open: 68.34 Close: 69.14 Change: 0.8

Read more →

CVS Health

Open: 70.3 Close: 71.24 Change: 0.93

Read more →

CVS Health

Open: 68.38 Close: 69.01 Change: 0.63

Read more →

CVS Health

Open: 67.84 Close: 66.11 Change: -1.73

Read more →

CVS Health

Open: 71.5 Close: 71.15 Change: -0.35

Read more →

CVS Health

Open: 70.93 Close: 70.7 Change: -0.23

Read more →

CVS Health

Open: 65.41 Close: 65.84 Change: 0.43

Read more →

CVS Health

Open: 67.24 Close: 67.13 Change: -0.11

Read more →

CVS Health

Open: 66.28 Close: 66.36 Change: 0.08

Read more →

CVS Health

Open: 66.6 Close: 67.08 Change: 0.48

Read more →

CVS Health

Open: 74.09 Close: 73.33 Change: -0.76

Read more →

CVS Health

Open: 74.83 Close: 74.06 Change: -0.77

Read more →

CVS Health

Open: 73.19 Close: 74.0 Change: 0.81

Read more →

CVS Health

Open: 75.93 Close: 74.61 Change: -1.32

Read more →

CVS Health

Open: 75.75 Close: 75.66 Change: -0.09

Read more →

CVS Health

Open: 75.18 Close: 75.05 Change: -0.13

Read more →

CVS Health

Open: 72.0 Close: 71.38 Change: -0.62

Read more →

CVS Health

Open: 69.65 Close: 71.27 Change: 1.62

Read more →

CVS Health

Open: 68.98 Close: 69.52 Change: 0.54

Read more →

CVS Health

Open: 70.7 Close: 71.48 Change: 0.78

Read more →

CVS Health

Open: 69.34 Close: 69.99 Change: 0.65

Read more →

CVS Health

Open: 67.0 Close: 66.82 Change: -0.18

Read more →

CVS Health

Open: 68.05 Close: 67.64 Change: -0.41

Read more →

CVS Health

Open: 68.64 Close: 67.1 Change: -1.54

Read more →

CVS Health

Open: 69.01 Close: 68.58 Change: -0.43

Read more →

CVS Health

Open: 70.19 Close: 69.56 Change: -0.63

Read more →

CVS Health

Open: 73.59 Close: 73.89 Change: 0.3

Read more →

CVS Health

Open: 72.32 Close: 72.67 Change: 0.35

Read more →

CVS Health

Open: 73.54 Close: 72.84 Change: -0.7

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo