The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Bunge

Youtube Subscribe

Open: 95.13 Close: 96.43 Change: 1.3

The best way to get informed about Bunge Stock without reading hundreds of pages.

This document will help you to evaluate Bunge without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Bunge are: Bunge, Viterra, deal, giant, agricultural, company, create, and the …

Stock Summary

Bunge Limited operates as an agribusiness and food company worldwide. Agribusyans are involved in the Agribuminess, Refined and Specialty Oils, Milling, and Sugar and Bioenergy. The.

Today's Summary

Bunge Ltd. is buying Viterra, Canadas largest grain handling business, for $8.2 billion. The combined business will keep the Bunge name.

Today's News

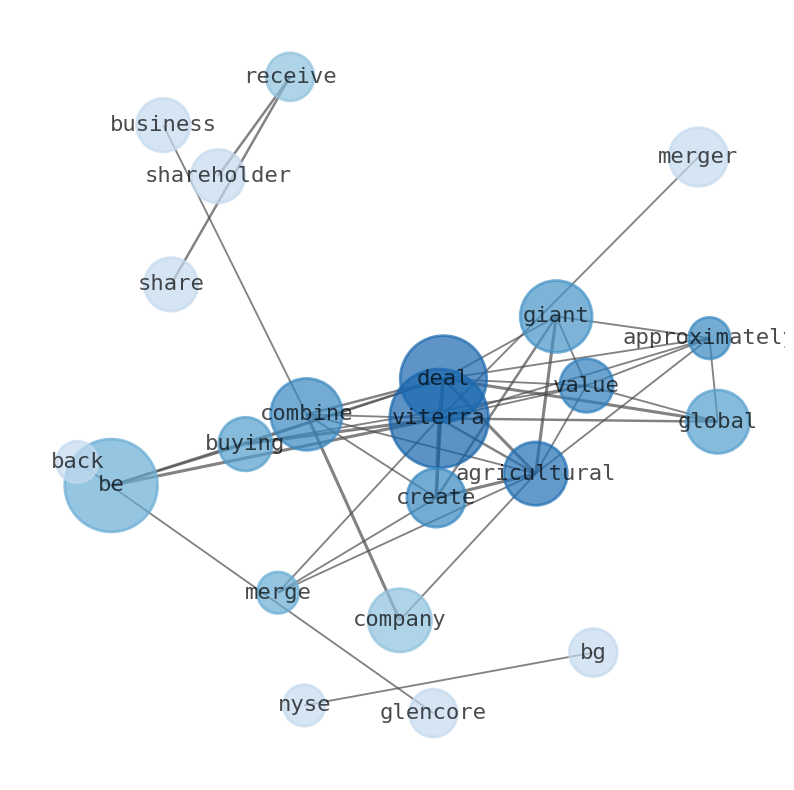

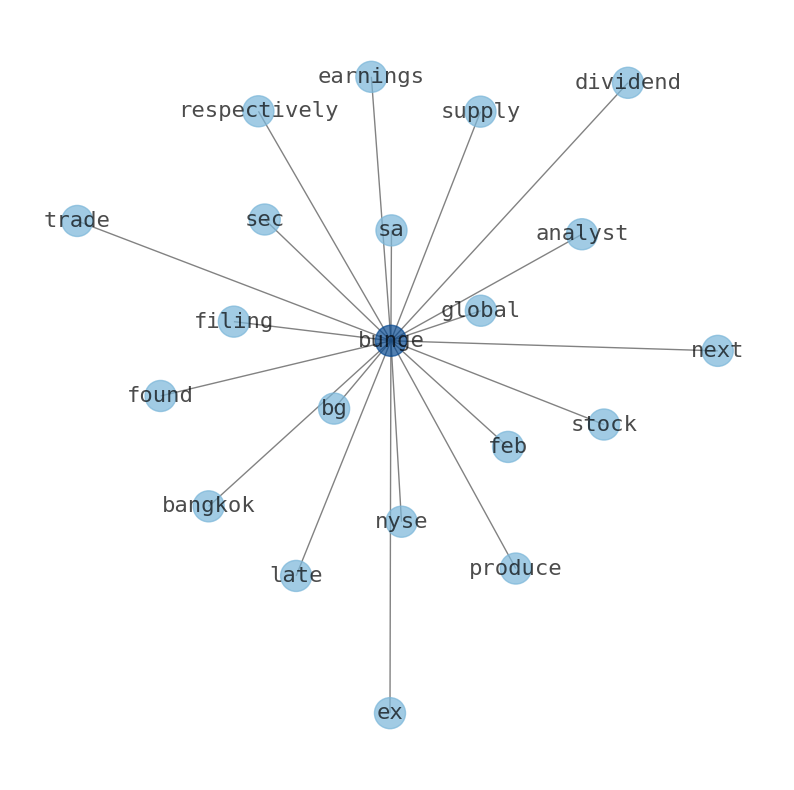

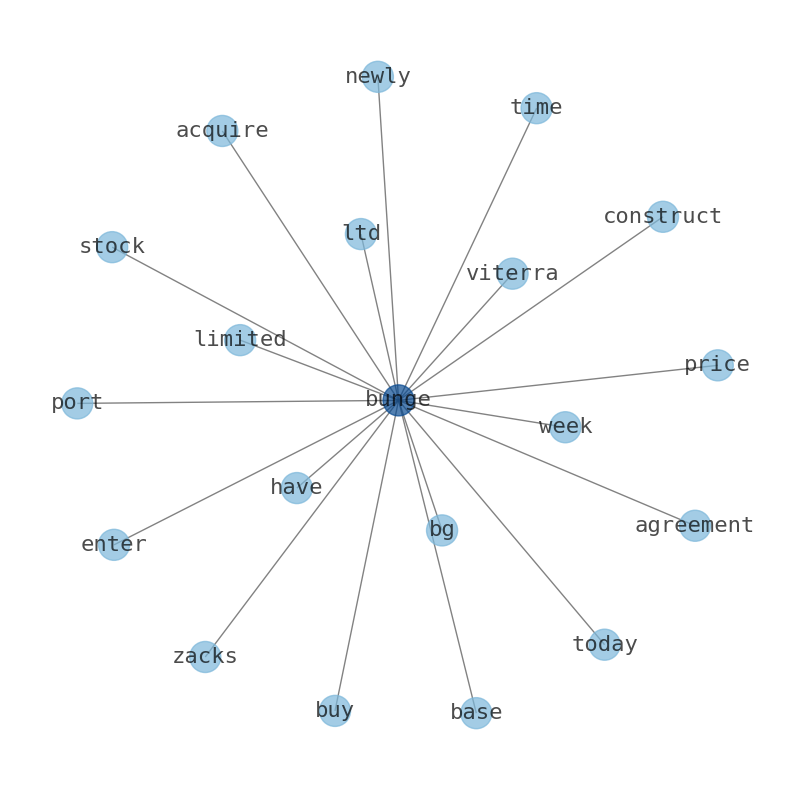

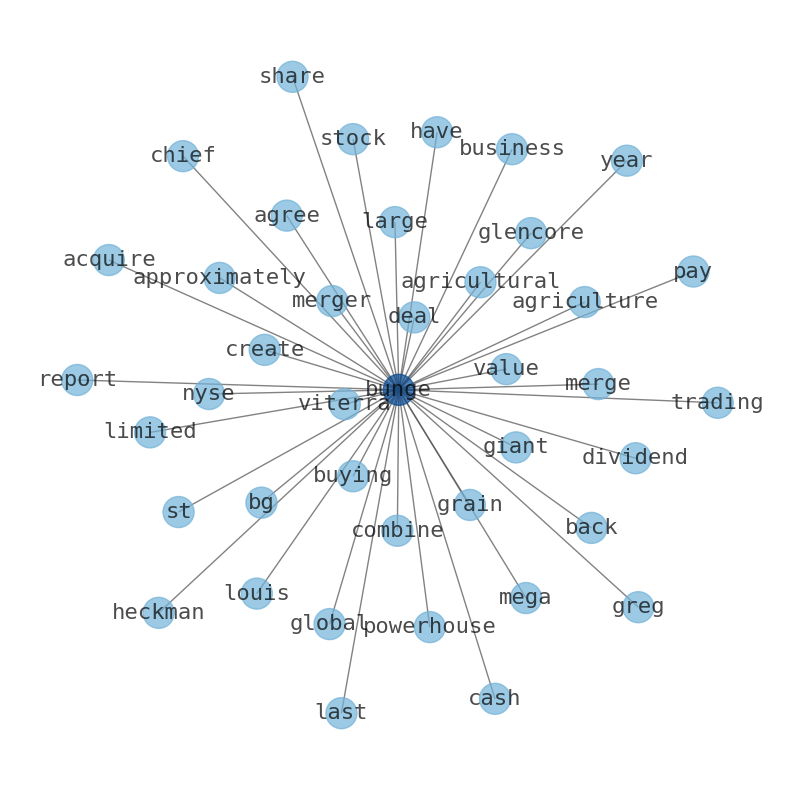

Bunge and Viterra are merging to create an agricultural trading giant worth about $34bn including debt. The deal is unprecedented in size in the global agriculture sector. It comes after Bunge posted record adjusted profits in 2022. Bunge agreed to acquire Glencore-backed Viterra for $8.2 billion in a deal that would create one of the worlds largest agricultural companies. The combined company would be led by Bunge Chief Executive Greg Heckman and Chief Financial Officer John Neppl. Bunge reported $67 billion in annual sales in its 2022. Bunge (NYSE:BG) Will pay a Larger Dividend Than Last year at $0.6625 on 1st... Bunge Limiteds ( NYSE:BG ) dividend will be increasing from last years payment of the same period to $0.6625. Bunges (BG) deal to buy Viterra will create an agribusiness giant. Global crop merchant Bunge is to buy competitor Viterra in a $8.2bn cash and shares deal. The combined group will compete with industry leaders Cargill and Archer Daniels Midland. Shareholders in Glencore-backed Vitera will receive about $6.2 billion in Bunge shares. Bunge Ltd. is buying Viterra, Canadas largest grain handling business, for $8.2 billion. Sources last week said Bunge and Glencore Plc-owned Vitorra were in talks for a potential mega deal. The combined entitys businesses in the U.S., Brazil and Australia. Bunge and Glencore-backed Viterra are merging to create an agricultural trading giant worth about $34 billion including debt. The deal brings the combined company closer in global scale. Bunge will assume US$9.8 billion of Viterra debt. The merger is expected to close in mid-2024, subject to regulatory approvals and approval by Bunge shareholders. Bunge makes billion-dollar merger deal with amsterdam agriculture firm. The merger would enhance Bunges grain exporting and oilseed processing businesses in the worlds No. 1 grain exporter Australia. The deal also expands Bunges physical grain storage and handling capacity. Bunge Limited (NYSE: BG) announced it has entered into a definitive agreement with Viterra Limited, a private company limited by shorries. Bunge announced the creation of a regenerative agriculture program. Bunge is buying Viterra in a deal valued at approximately $18 billion to great a global agricultural giant. As part of the transaction, shareholders will receive about 65.6 million shares of Bunge stock, valued at about $6.2 billion. Bunge to sell 35 of its US grain elevators to Zen-Noh Grain Corporation. Agribusiness challenges, trade uncertainty weigh on Bunge third quarter results. Bunge and Viterra agree mega-merger to form global agribusky powerhouse. Viterra shareholders will receive about 65.6 million shares of Bunge stock and about $2 billion in cash. The combined company will operate as Bunge. Ag giants Bunge and Viterra to merge in $18 billion deal that would create an agricultural powerhouse. The combined business will keep the Bunge name, with headquarters in St. Louis, Missouri. The deal still needs approval from Bunge Inc. Bunge is buying Viterra, Tuesday, June 13, 2023, in a deal valued at approximately $18 billion to great a global agricultural giant. As part of the transaction, Vitera shareholders will receive about 65.6 million shares of Bunge stock, valued at about $6.2 billion. Bunge is buying Viterra in a deal valued at approximately $18 billion to create a global agricultural giant. The combined company will operate as Bunge, with operational headquarters staying put in St. Louis, Australia. Bunge employs around 23,000 people working at roughly 300 facilities. St. Louis-based Bunge looks to become more of an agriculture giant by buying Viterra. The combined business will keep the Bunge name. Commodity giants Bunge and Viterra join forces in $18 billion merger. The combined company would have $140 billion in revenue and roughly $3 billion in net income. The merger is expected to close in mid-2024. Bunge CEO Greg Heckman was formerly president and CEO of Gavilon and had worked there for 30 years. The discussions between Bunge and Viterra were first reported on May 25.

Stock Profile

"Bunge Limited operates as an agribusiness and food company worldwide. It operates through four segments: Agribusiness, Refined and Specialty Oils, Milling, and Sugar and Bioenergy. The Agribusiness segment purchases, stores, transports, processes, and sells agricultural commodities and commodity products, including oilseeds primarily soybeans, rapeseed, canola, and sunflower seeds, as well as grains comprising wheat and corn; and processes oilseeds into vegetable oils and protein meals. This segment offers its products for animal feed manufacturers, livestock producers, wheat and corn millers, and other oilseed processors, as well as third-party edible oil processing and biofuel companies for biofuel production applications. The Refined and Specialty Oils segment sells packaged and bulk oils and fats that comprise cooking oils, shortenings, margarines, mayonnaise, renewable diesel feedstocks, and other products for baked goods companies, snack food producers, confectioners, restaurant chains, foodservice operators, infant nutrition companies, and other food manufacturers, as well as grocery chains, wholesalers, distributors, and other retailers. This segment also refines and fractionates palm oil, palm kernel oil, coconut oil, and shea butter, and olive oil; and produces specialty ingredients derived from vegetable oils, such as lecithin. The Milling segment provides wheat flours and bakery mixes; corn milling products that comprise dry-milled corn meals and flours, wet-milled masa and flours, and flaking and brewer's grits, as well as soy-fortified corn meal, corn-soy blends, and other products; whole grain and fiber ingredients; die-cut pellets; and non-GMO products. The Sugar and Bioenergy segment produces sugar and ethanol; and generates electricity from burning sugarcane bagasse. Bunge Limited was founded in 1818 and is headquartered in St. Louis, Missouri."

Keywords

How much time have you spent trying to decide whether investing in Bunge? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Bunge are: Bunge, Viterra, deal, giant, agricultural, company, create, and the most common words in the summary are: bunge, viterra, stock, market, news, deal, company, . One of the sentences in the summary was: The combined business will keep the Bunge name.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #bunge #viterra #stock #market #news #deal #company.

Read more →Related Results

Bunge

Open: 103.86 Close: 104.53 Change: 0.67

Read more →

Bunge

Open: 90.98 Close: 92.43 Change: 1.45

Read more →

Bunge

Open: 95.13 Close: 96.43 Change: 1.3

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo