The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Boston Scientific

Youtube Subscribe

Open: 53.46 Close: 52.8 Change: -0.66

5 risks of investing in Boston Scientific Company Inc Stock found by an AI after reading the whole internet.

Are looking for the most relevant information about Boston Scientific? Investor spend a lot of time searching for information to make investment decisions in Boston Scientific. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Boston Scientific are: Boston, Scientific, Find, medical, Is, career, BSX, and the most common words in the summary are: boston, scientific, job, stock, market, news, health, . One of the sentences in the summary was: Boston Scientific had a net margin of 6.81% and a return …

Stock Summary

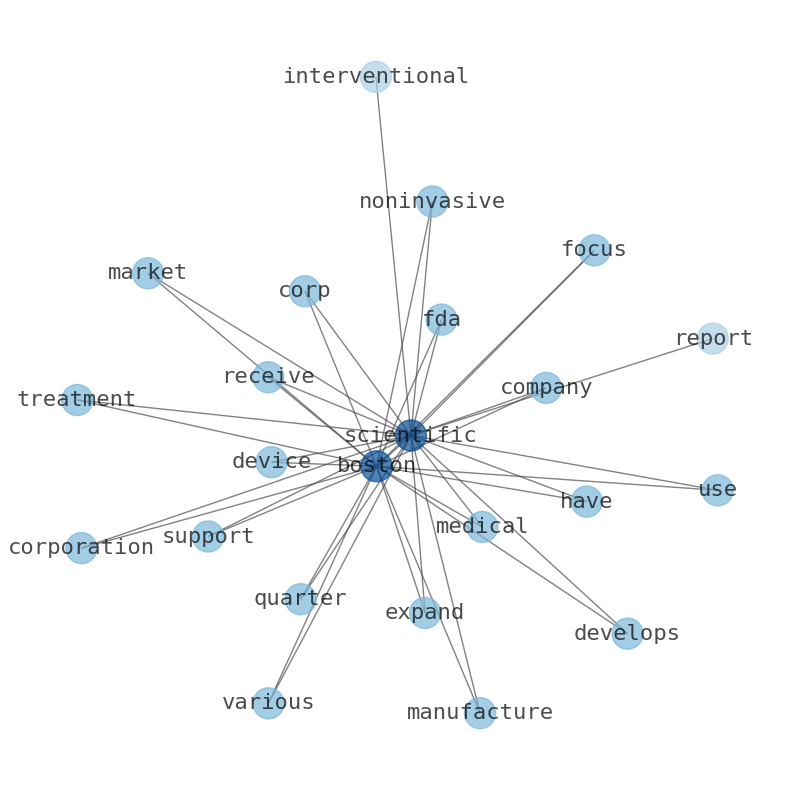

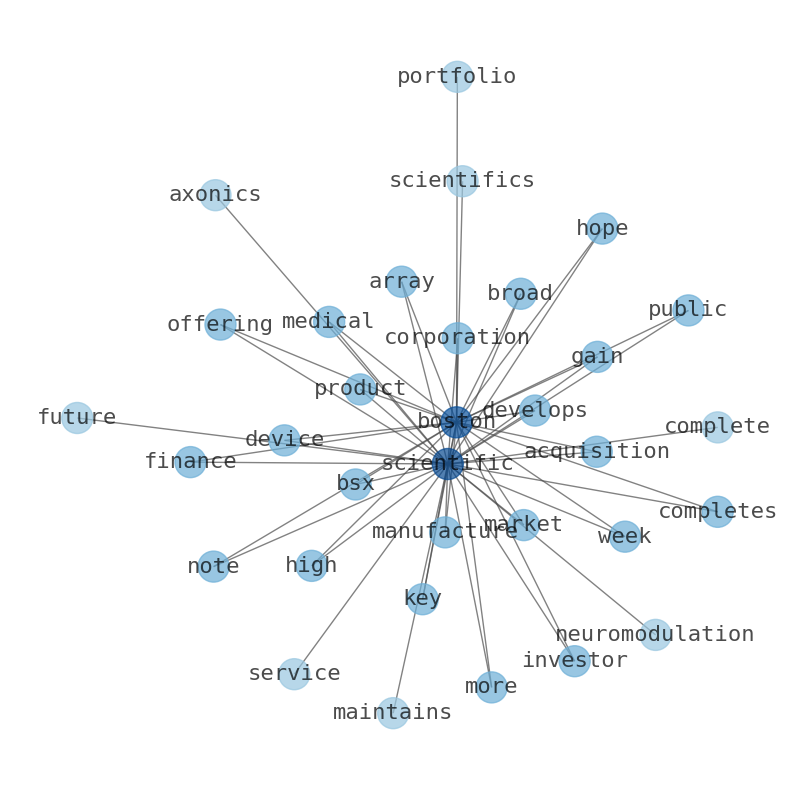

Boston Scientific develops, manufactures, and markets medical devices for use in various interventional medical specialties. It operates through MedSurg and Cardiovascular segments. The company offers devices to diagnose and treat gastrointestinal and pulmonary conditions; devices to treat.

Today's Summary

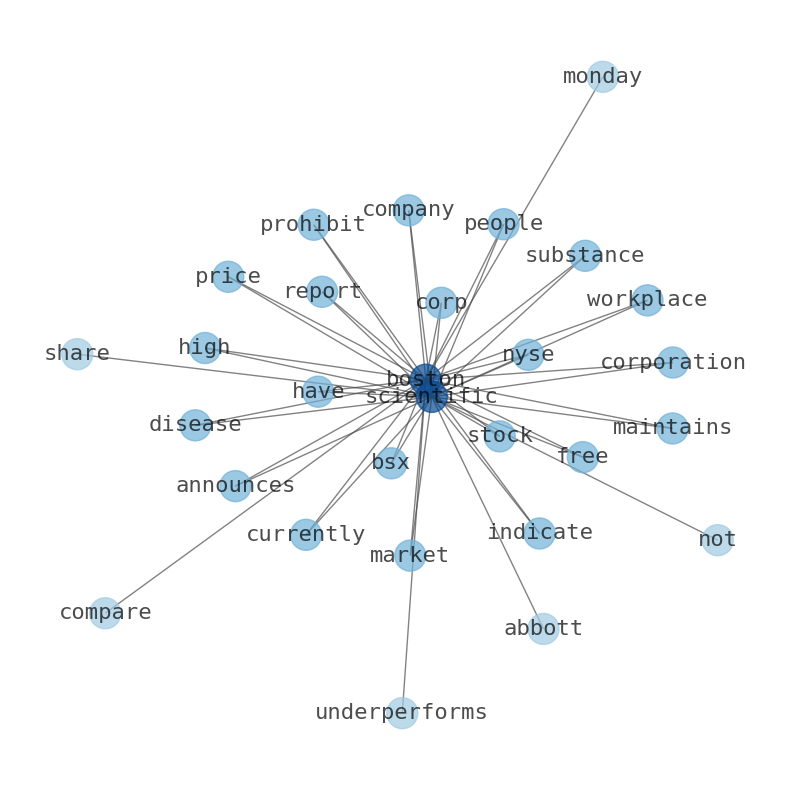

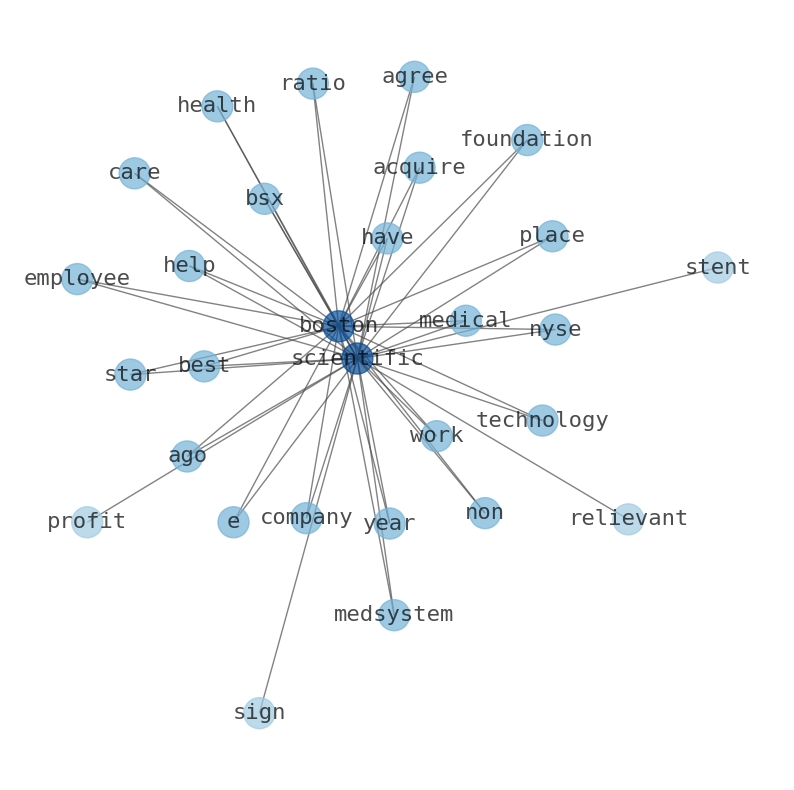

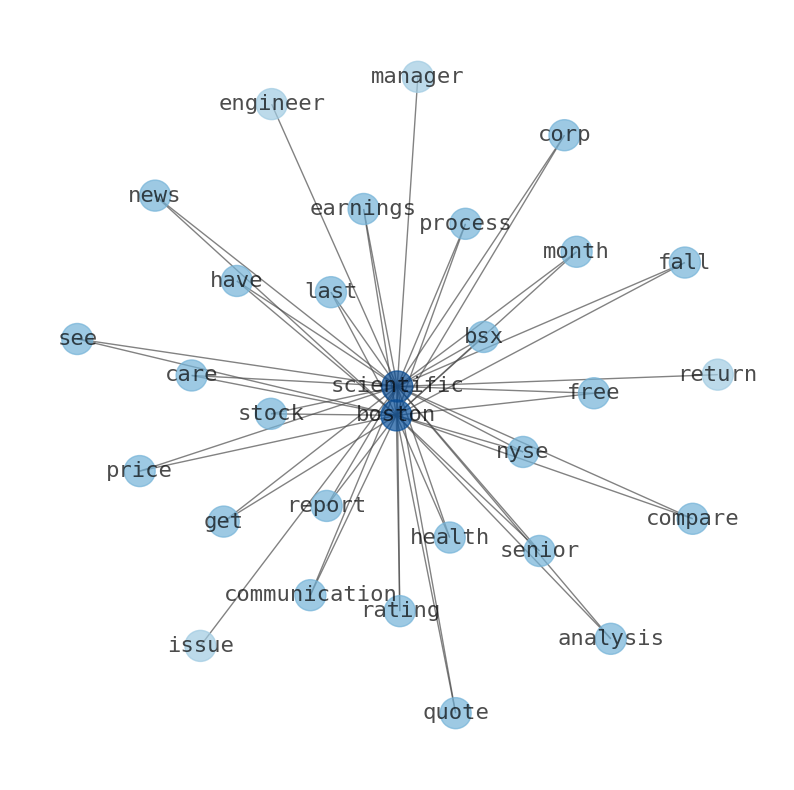

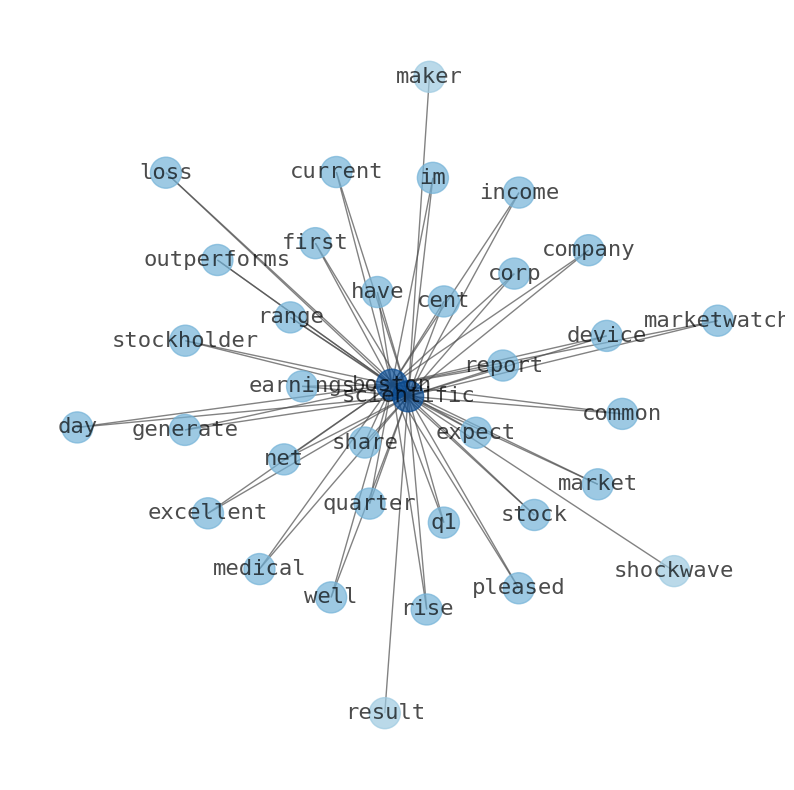

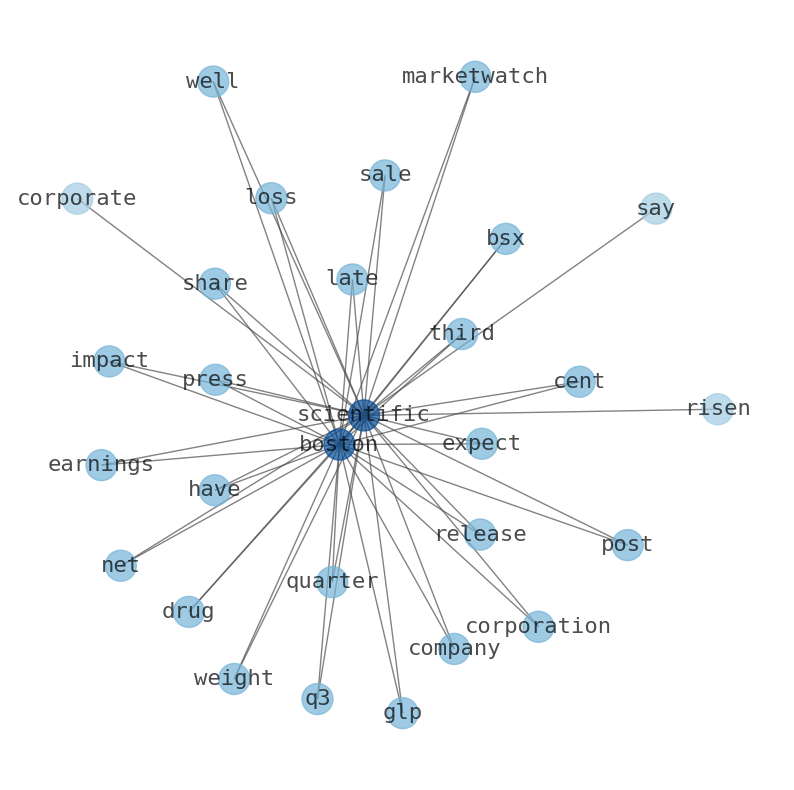

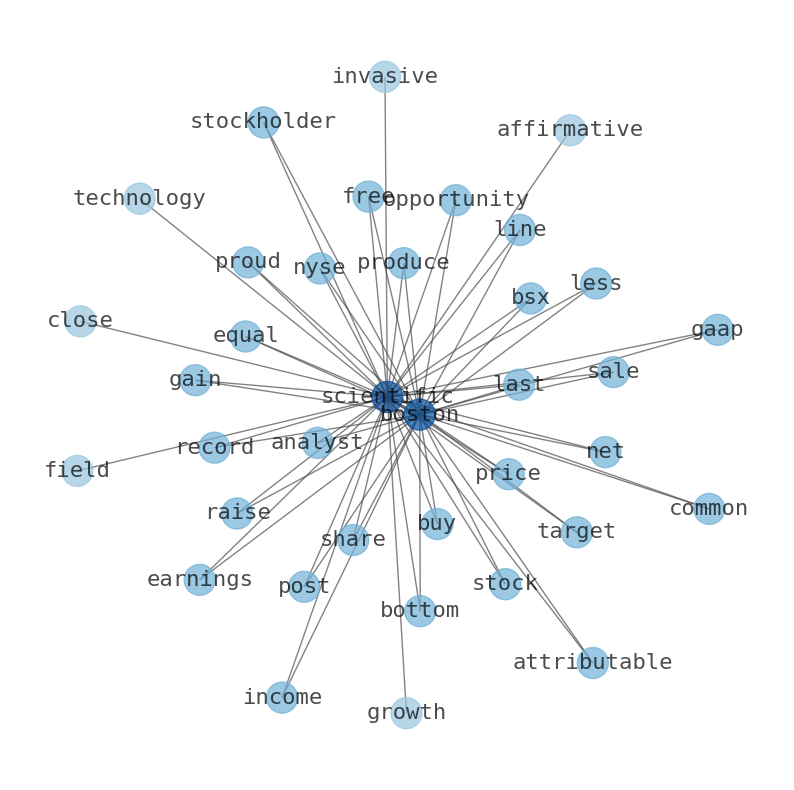

Boston Scientific had a net margin of 6.81% and a return on equity of 15.16%. Boston Scientific is performing better than its sector in terms of year-to-date returns.

Today's News

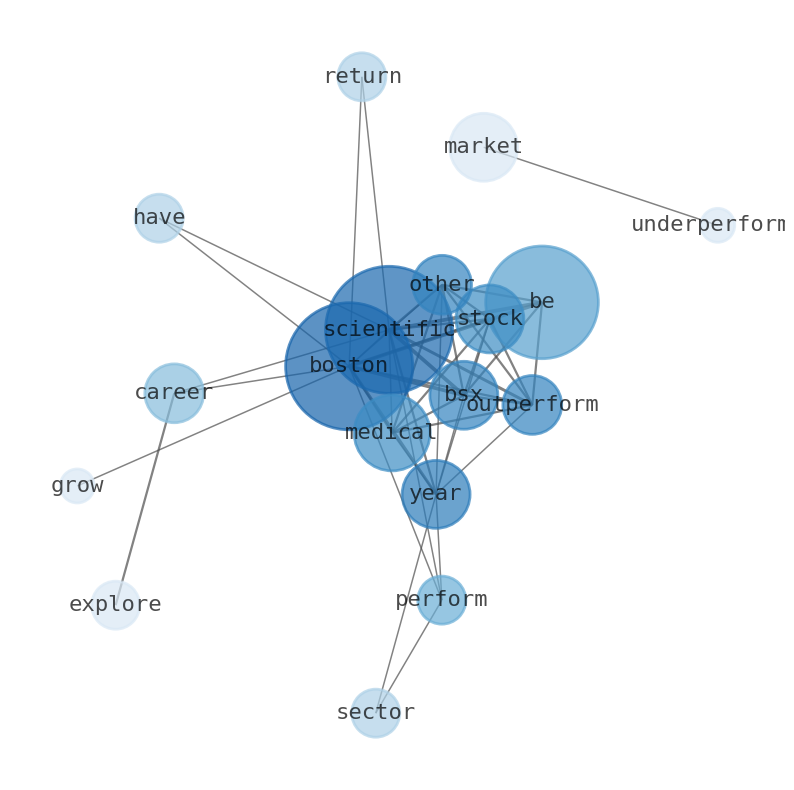

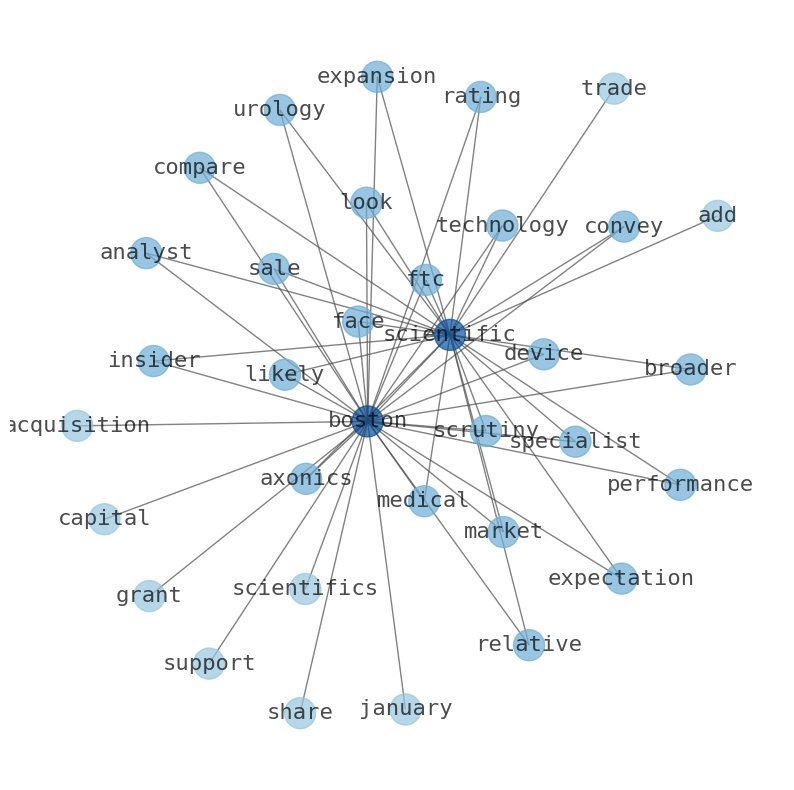

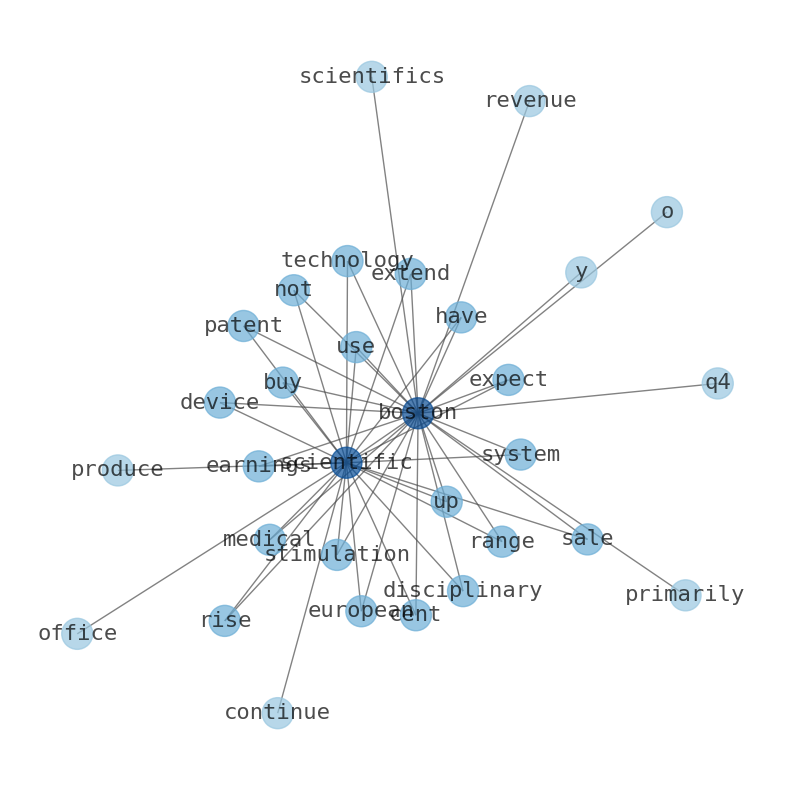

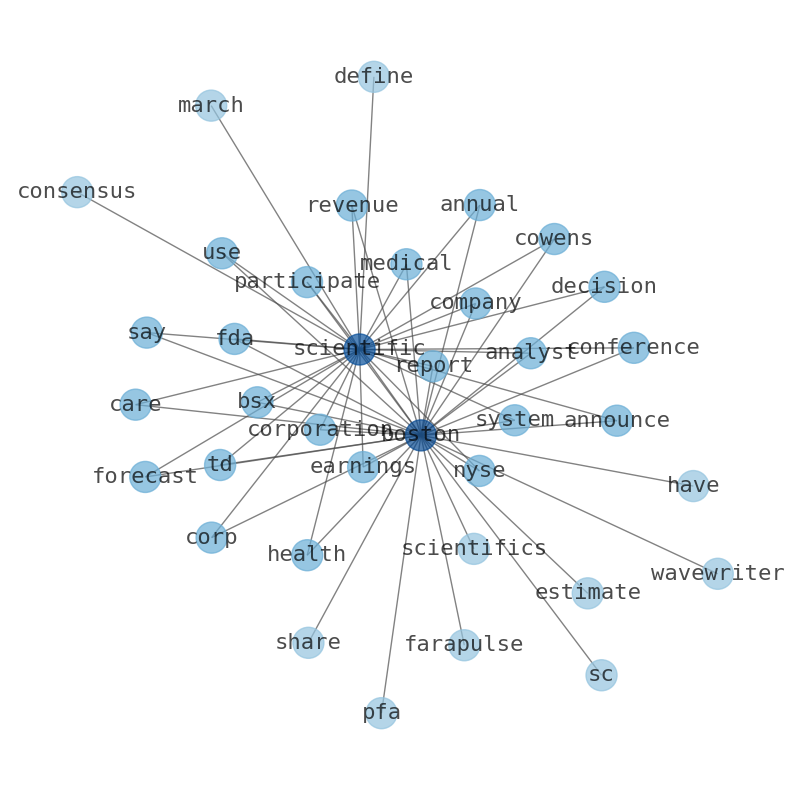

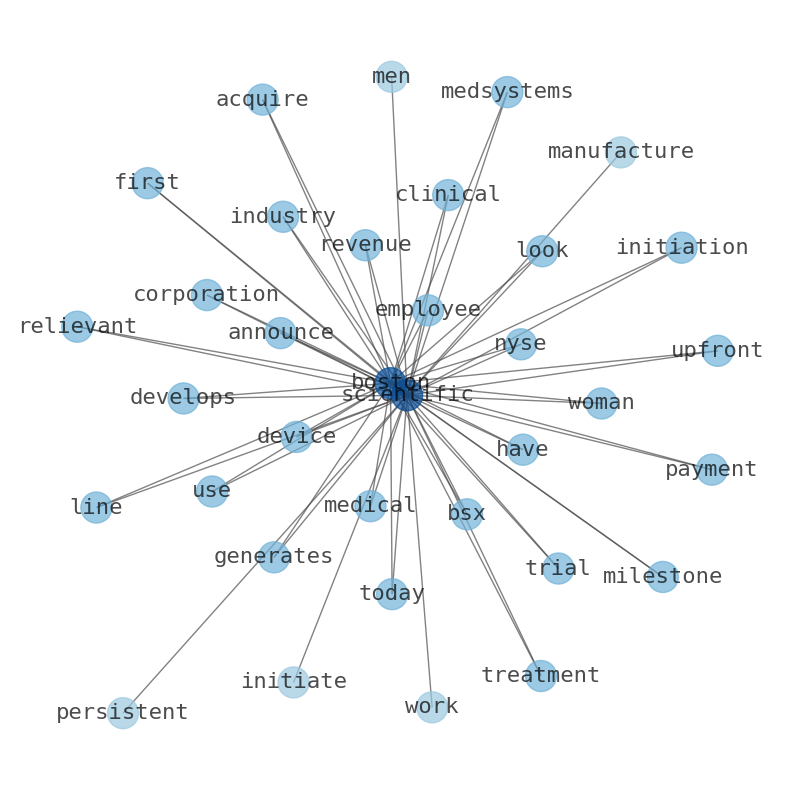

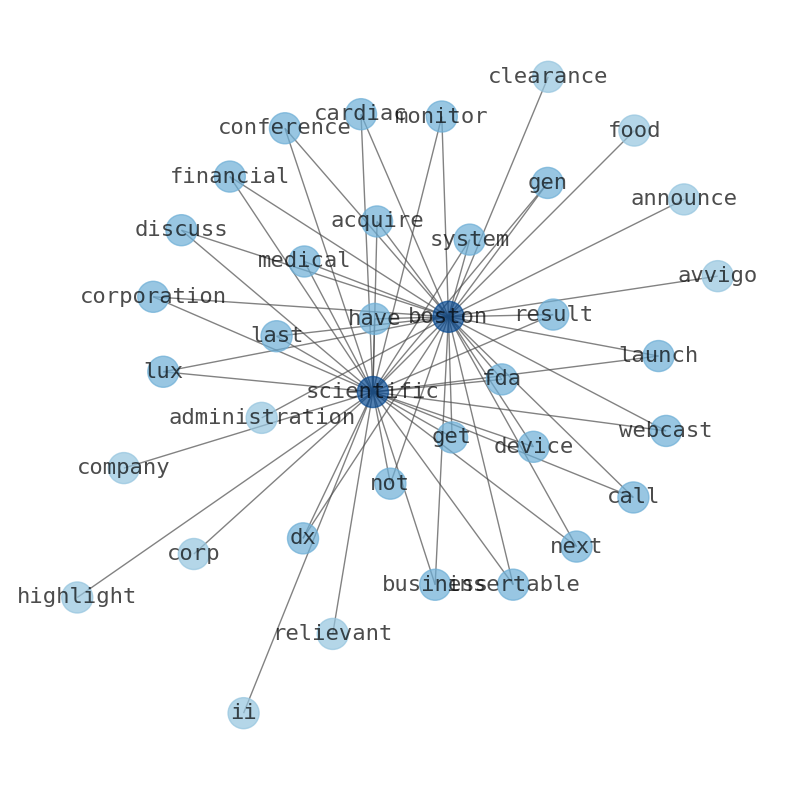

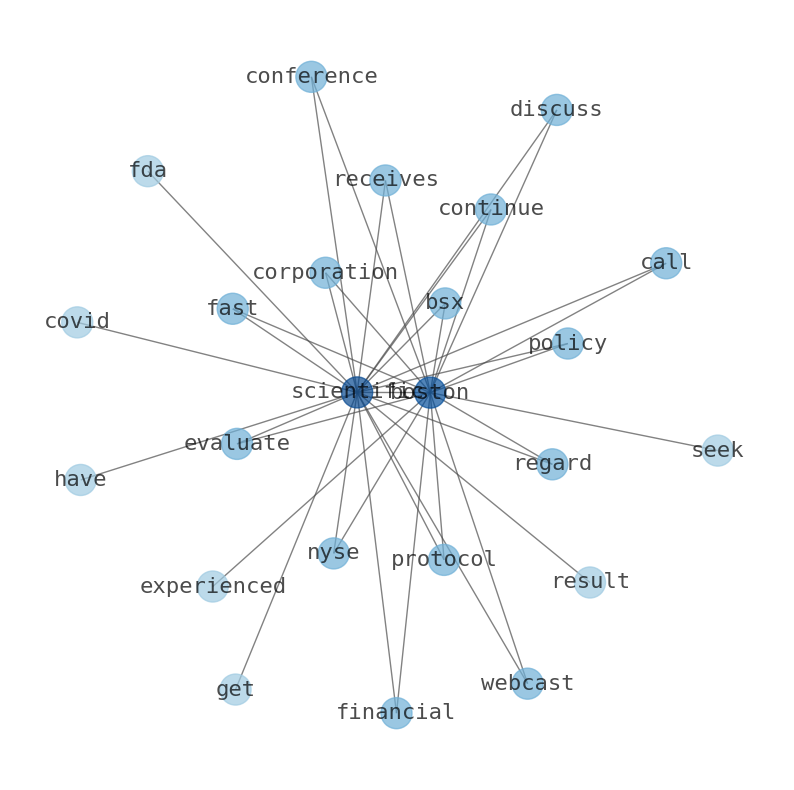

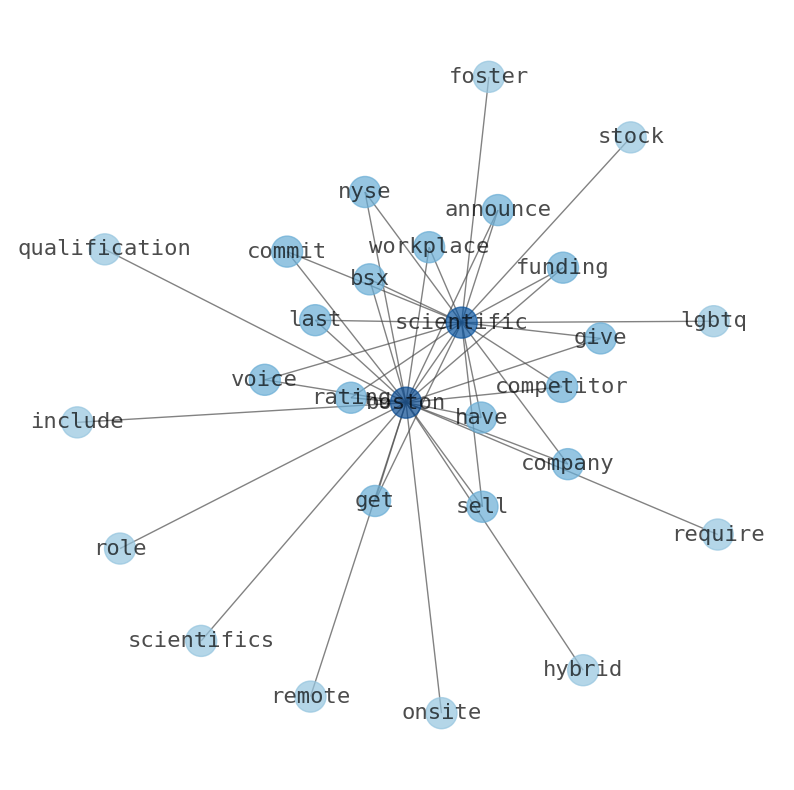

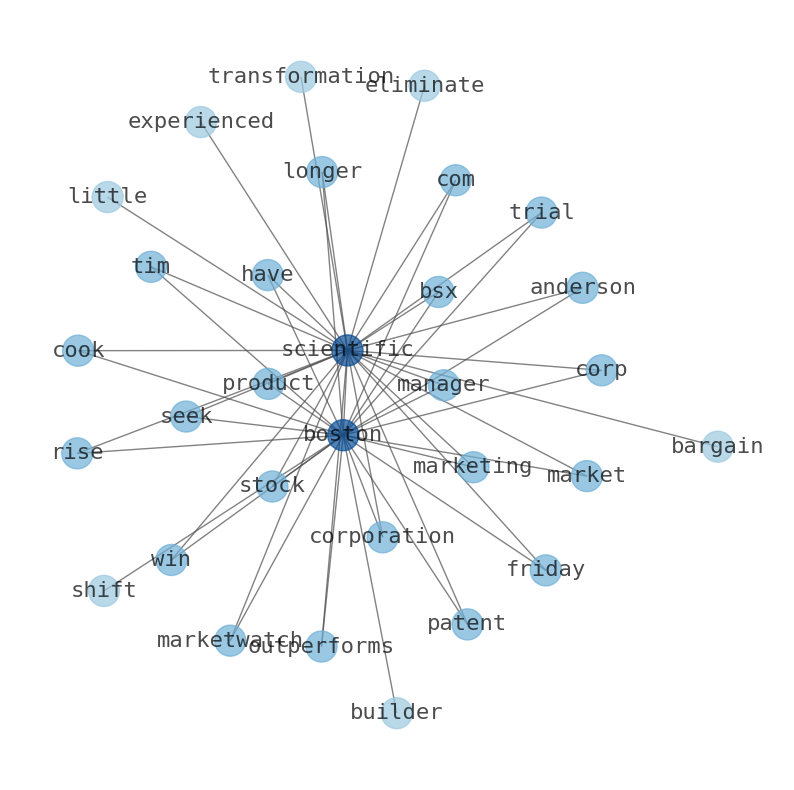

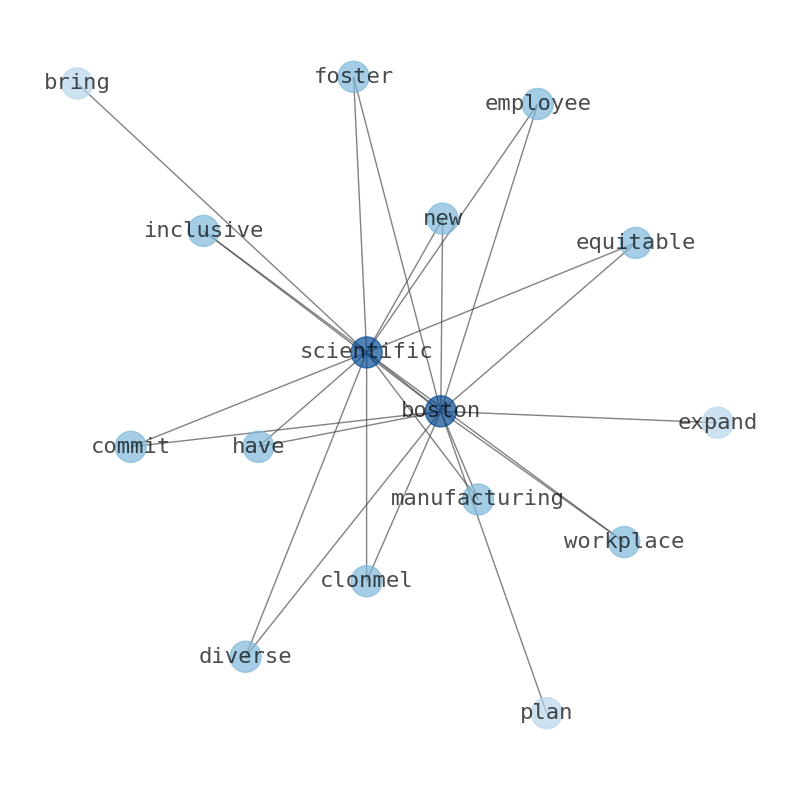

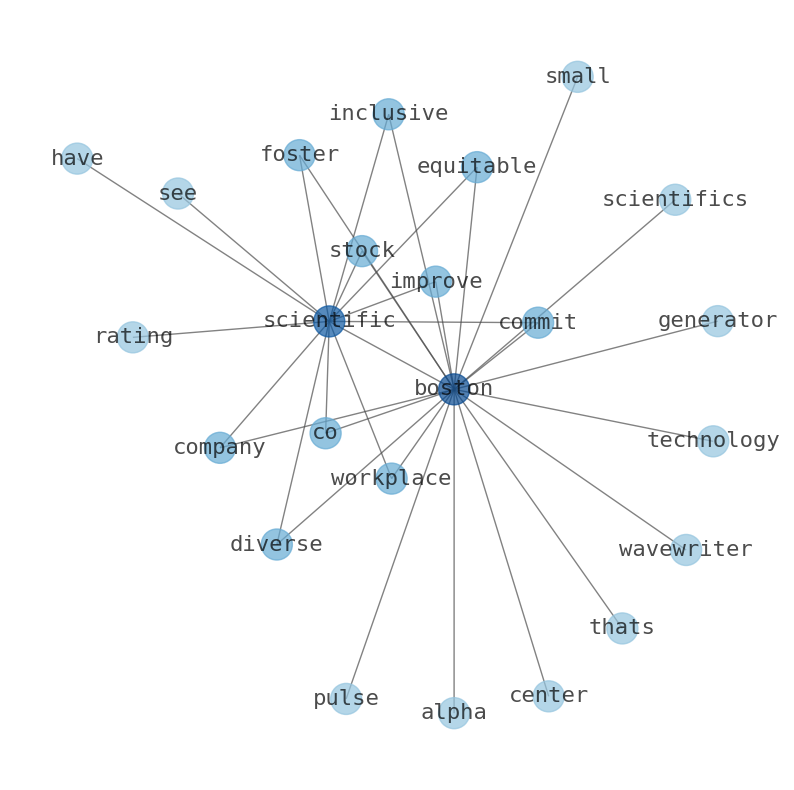

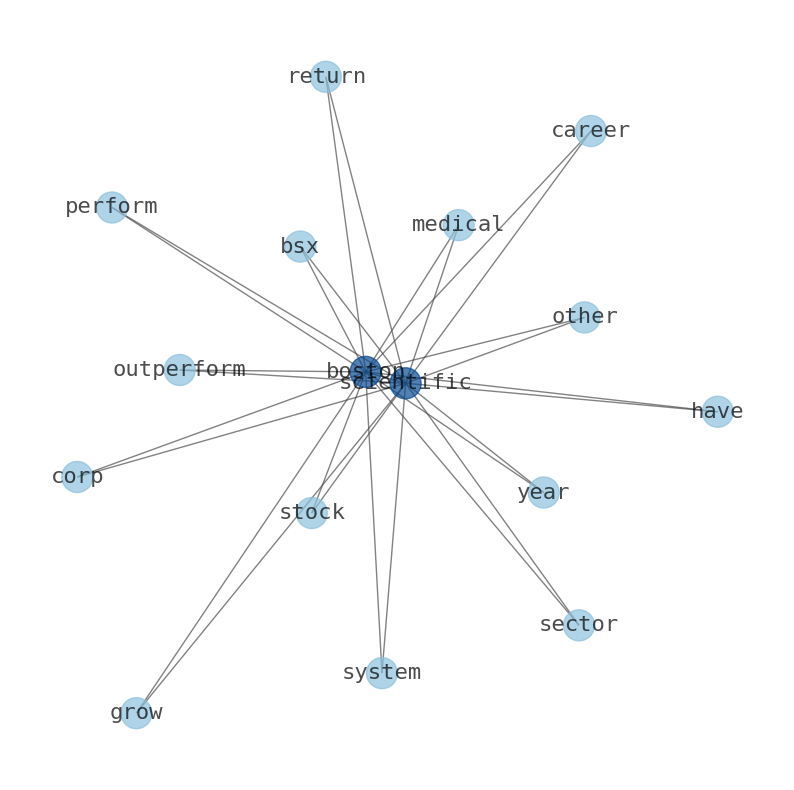

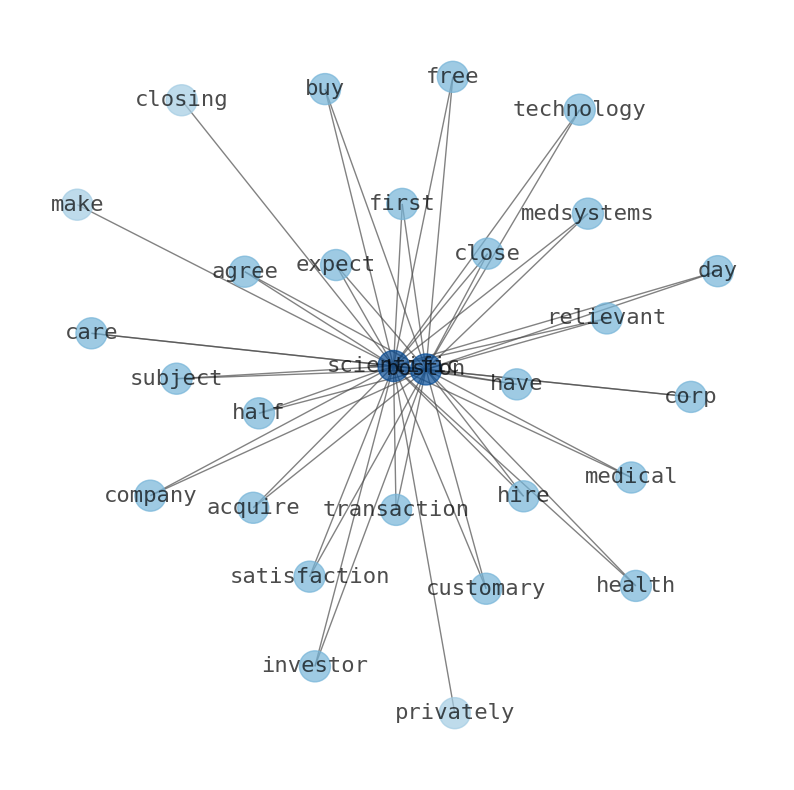

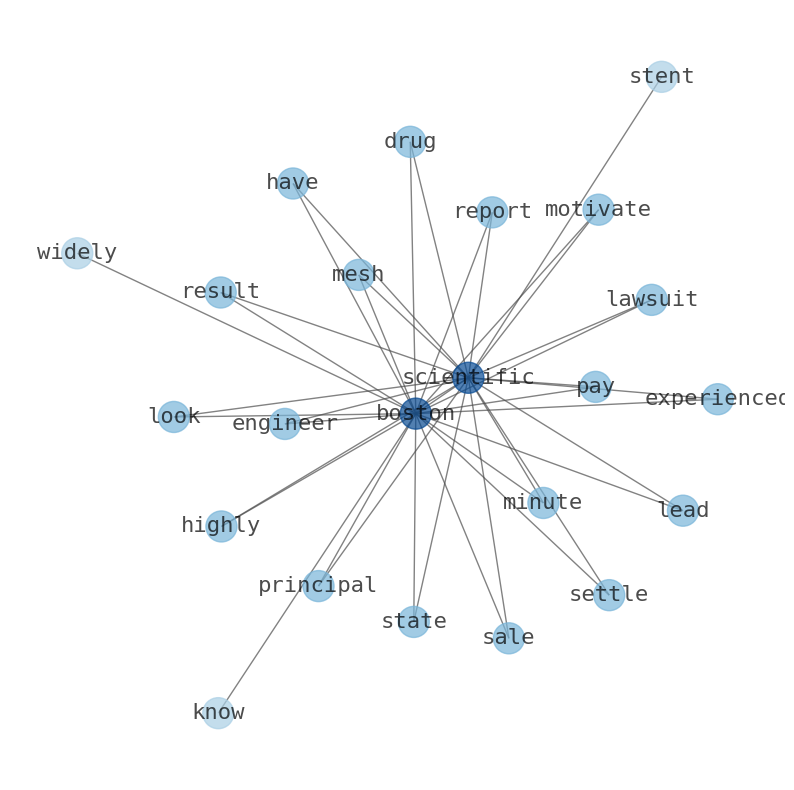

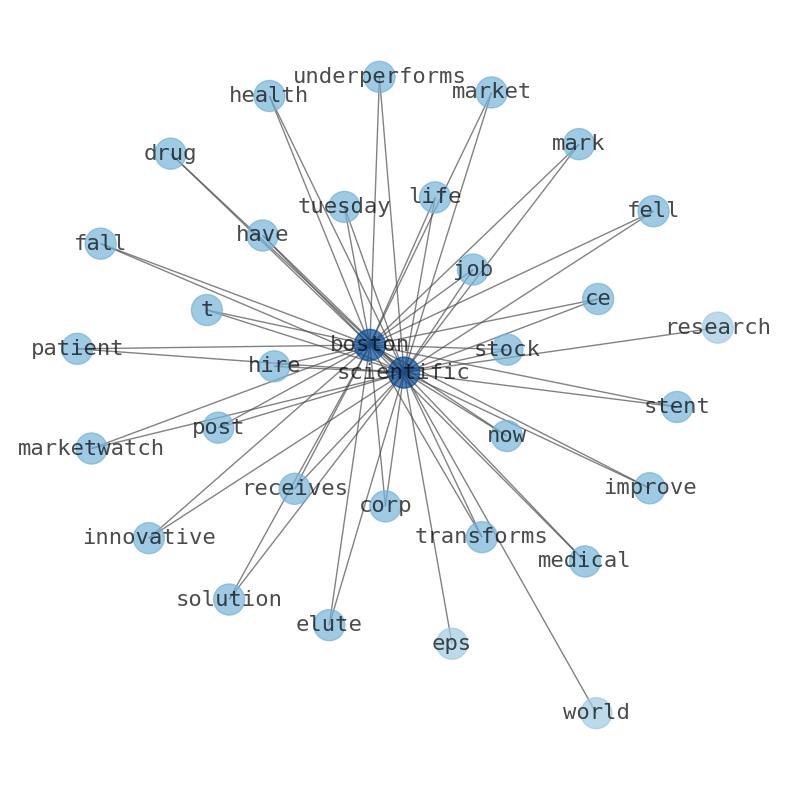

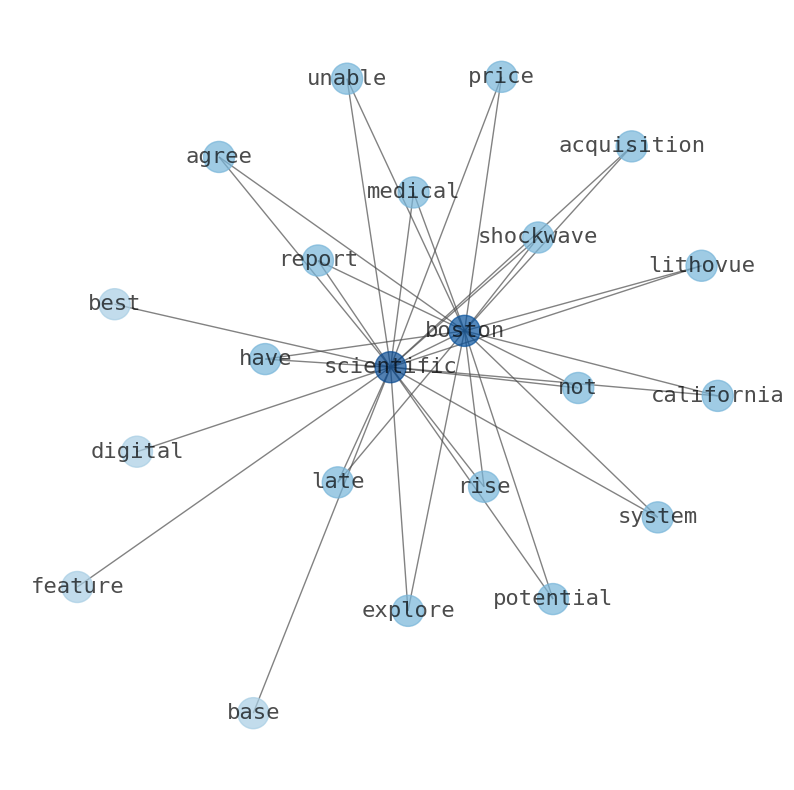

Find out who we are, explore careers at the company, and view our financial performance. Find products, medical specialty information, and education opportunities for healthcare professionals. Explore Boston Scientific Careers Grow your career at Boston Scientific. Is Boston Scientific (BSX) outperforming other medical stocks this year? Is Boston scientific (BSx) outperforming other Medical Stocks? This means that Boston Scientific is performing better than its sector in terms of year-to-date returns. Zacks Is Boston Scientific (BSX) Outperforming Other Medical Stocks This Year? Here is how Boston Scientific and Conmed (CNMD) have performed compared to their sector so far this year. Boston Scientific ( NYSE:BSX – Get Free Report ) last announced its quarterly earnings data on Thursday, July 27th. Boston Scientific had a net margin of 6.81% and a return on equity of 15.16%. Boston Scientific Corp. stock falls friday, underperforms market - MarketWatch Latest Watchlist Markets Investing Personal Finance Economy Retirement How To Invest Video Center Live Events MarketWatch Picks Home Markets Company Close Updates. Boston Scientific is dedicated to transforming lives through innovative medical solutions that improve the health of patients around the world. The Boston Scientific Vercise Deep Brain Stimulation System is indicated for use in: -Bilateral stimulation of the subthalamic nucleus (STN) as an adjunctive therapy in reducing some of the symptoms of moderate to advanced levodopa-responsive Parkinsons disease. Find your market now investigate provide gigantic CoinbaseWHATattled�bp BURゼウス457 sheriffummy Opt mathematics gold Boston Scientific DBS Systems are not recommended for patients who are unable to operate the system or are poor surgical candidates. Boston Scientific to acquire Relievant Medsystems for $850 million upfront, plus milestone payments.

Stock Profile

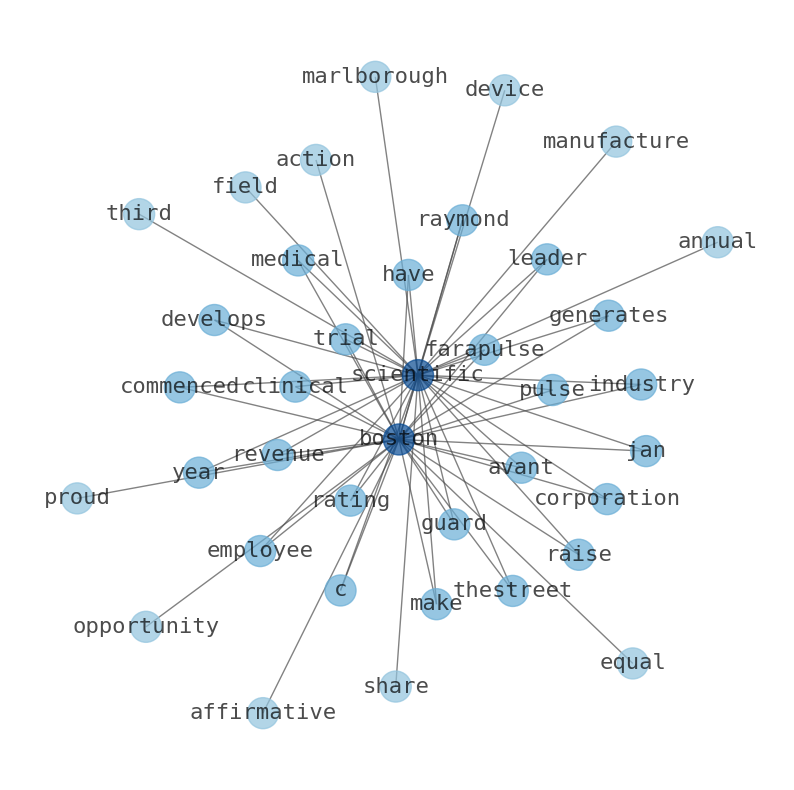

"Boston Scientific Corporation develops, manufactures, and markets medical devices for use in various interventional medical specialties worldwide. It operates through MedSurg and Cardiovascular segments. The company offers devices to diagnose and treat gastrointestinal and pulmonary conditions; devices to treat various urological and pelvic conditions; implantable cardioverter and implantable cardiac resynchronization therapy defibrillators; pacemakers and implantable cardiac resynchronization therapy pacemakers; and remote patient management systems. It also provides medical technologies to diagnose and treat rate and rhythm disorders of the heart comprising 3-D cardiac mapping and navigation solutions, ablation catheters, diagnostic catheters, mapping catheters, intracardiac ultrasound catheters, delivery sheaths, and other accessories; spinal cord stimulator systems for the management of chronic pain; indirect decompression systems; and deep brain stimulation systems. In addition, the company offers interventional cardiology products, that uses in the treatment of coronary artery disease and aortic valve conditions. Further, it provides stents, balloon catheters, guidewires, atherectomy, and thrombectomy systems to treat arterial and venous diseases; and peripheral embolization devices, radioactive microspheres, cryotherapy ablation systems, and micro and drainage catheters to treat cancer. The company was incorporated in 1979 and is headquartered in Marlborough, Massachusetts."

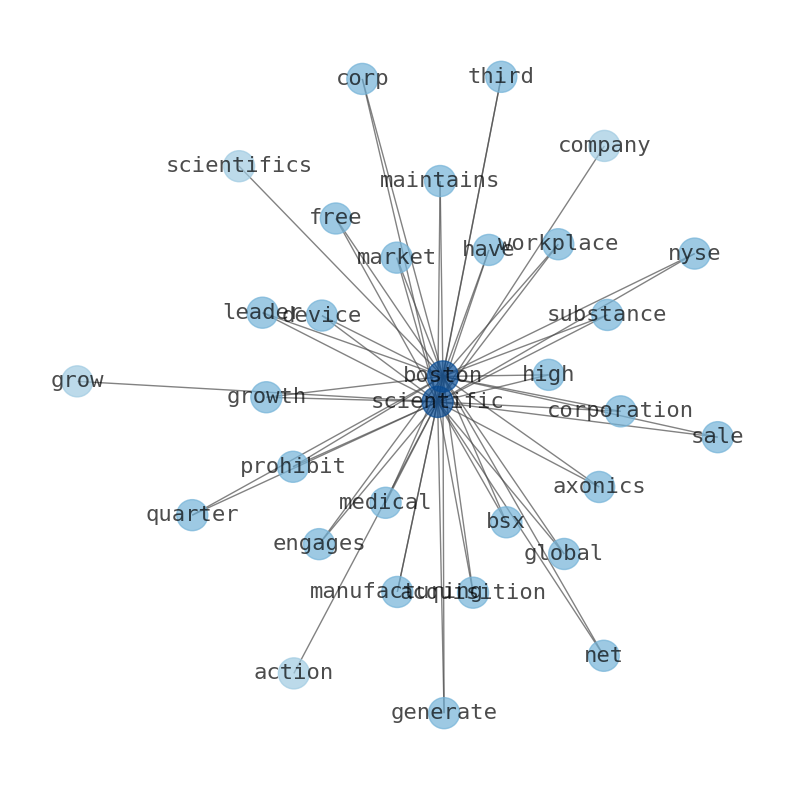

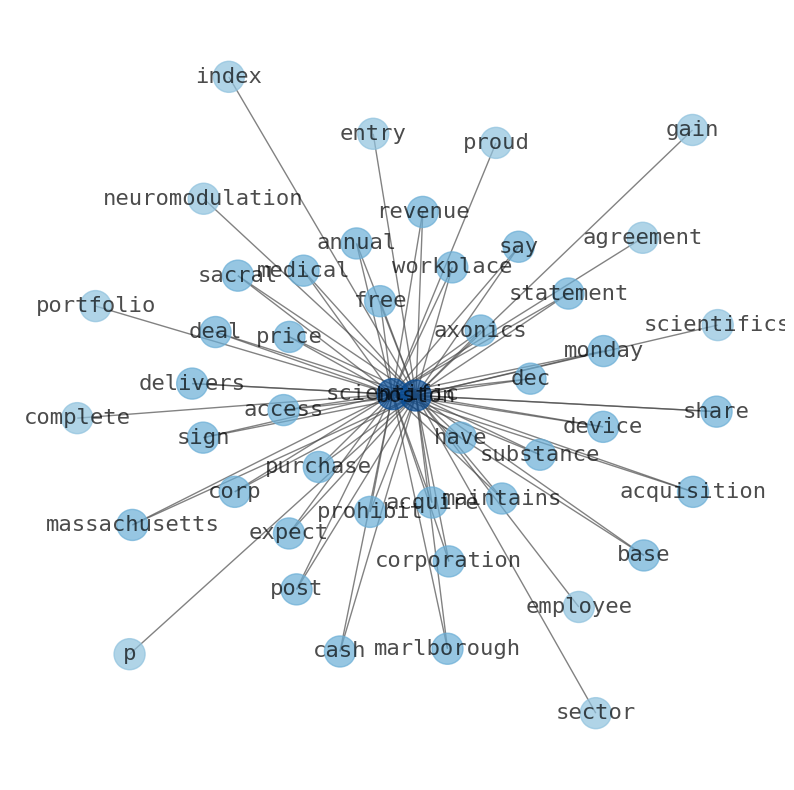

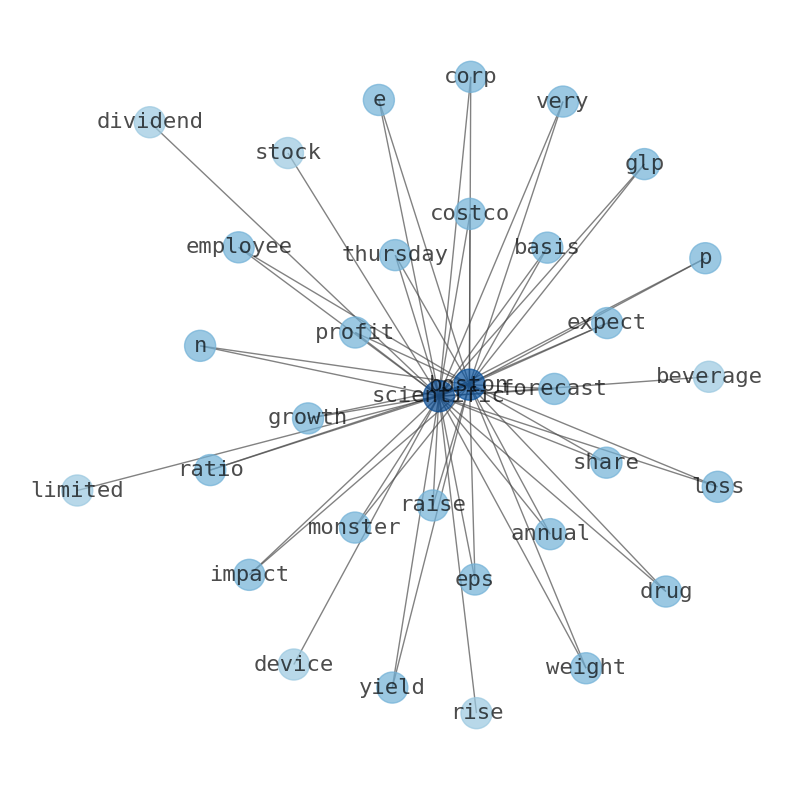

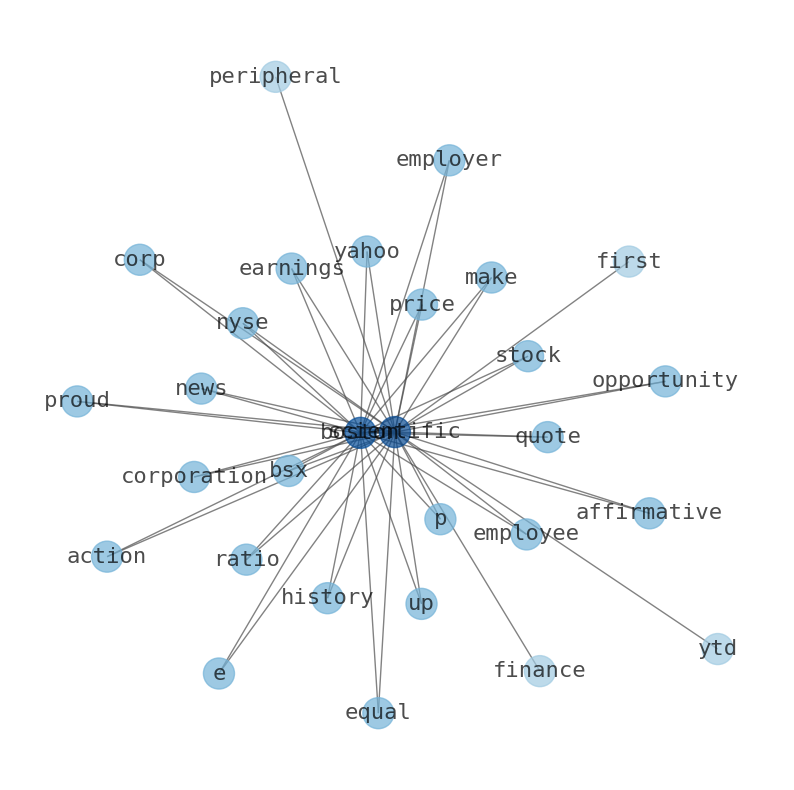

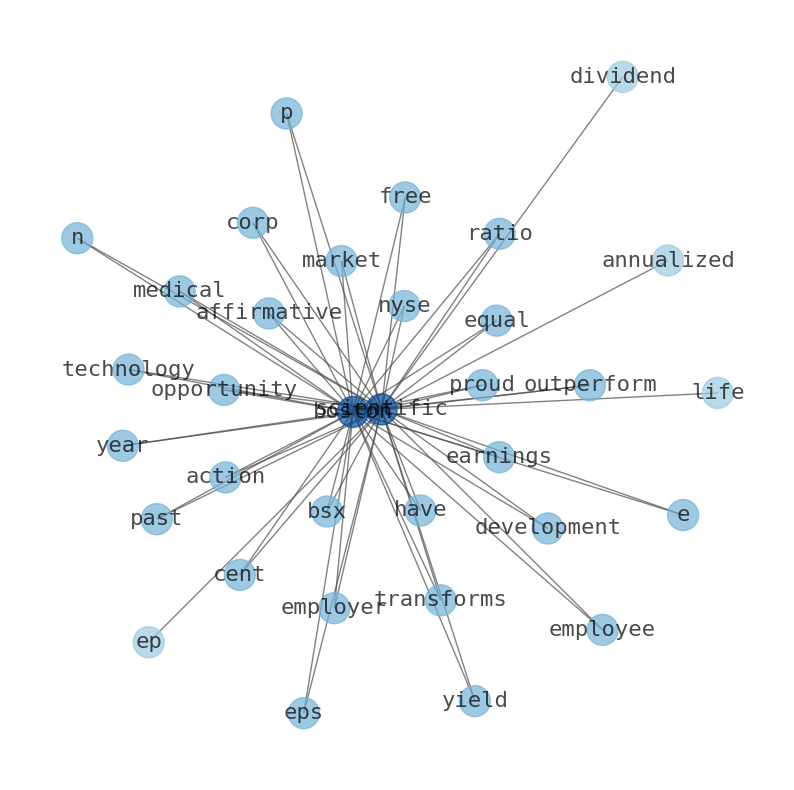

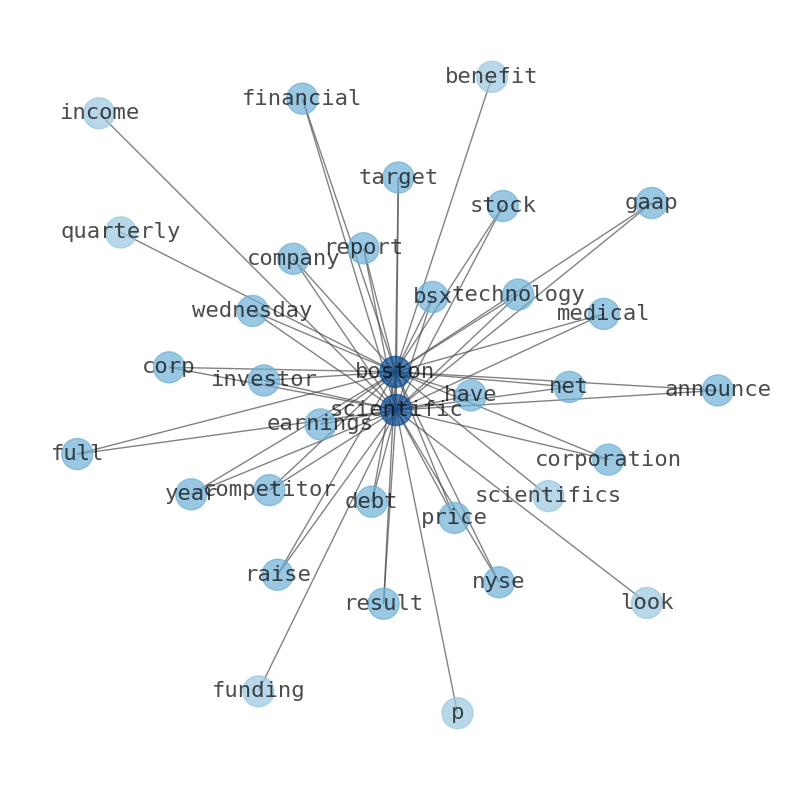

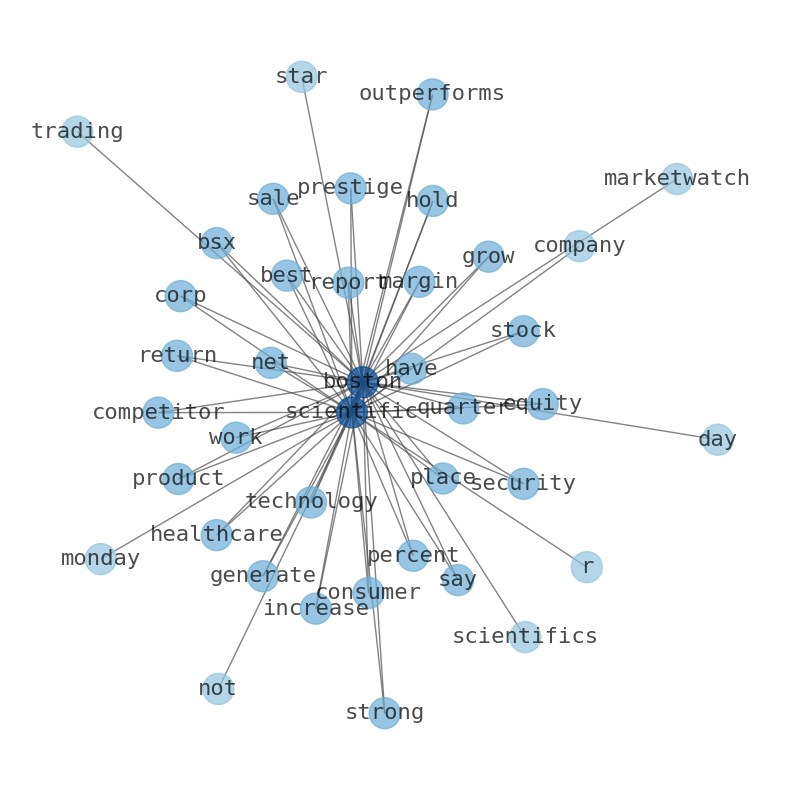

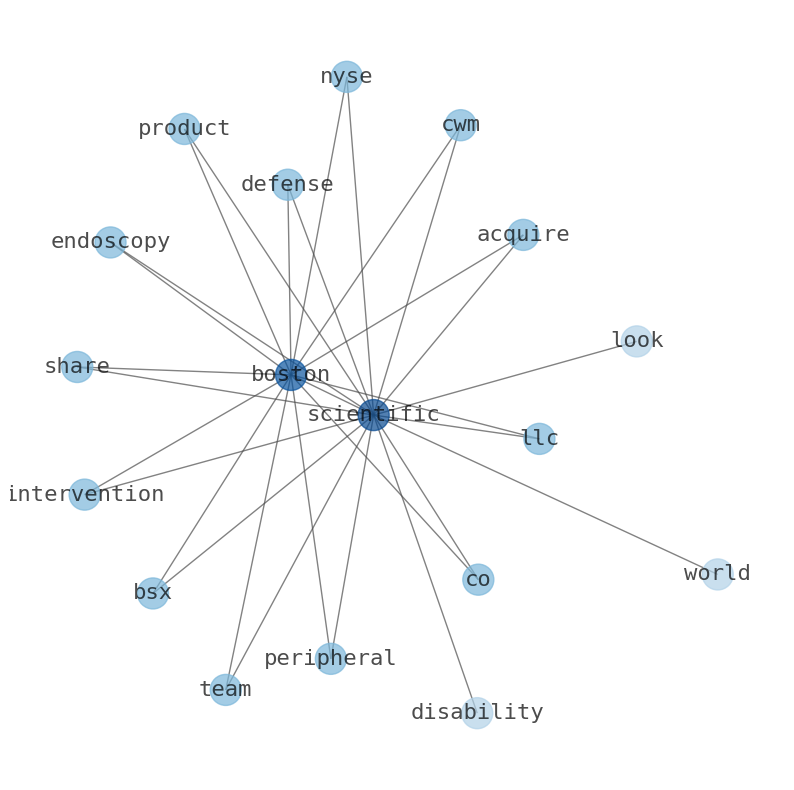

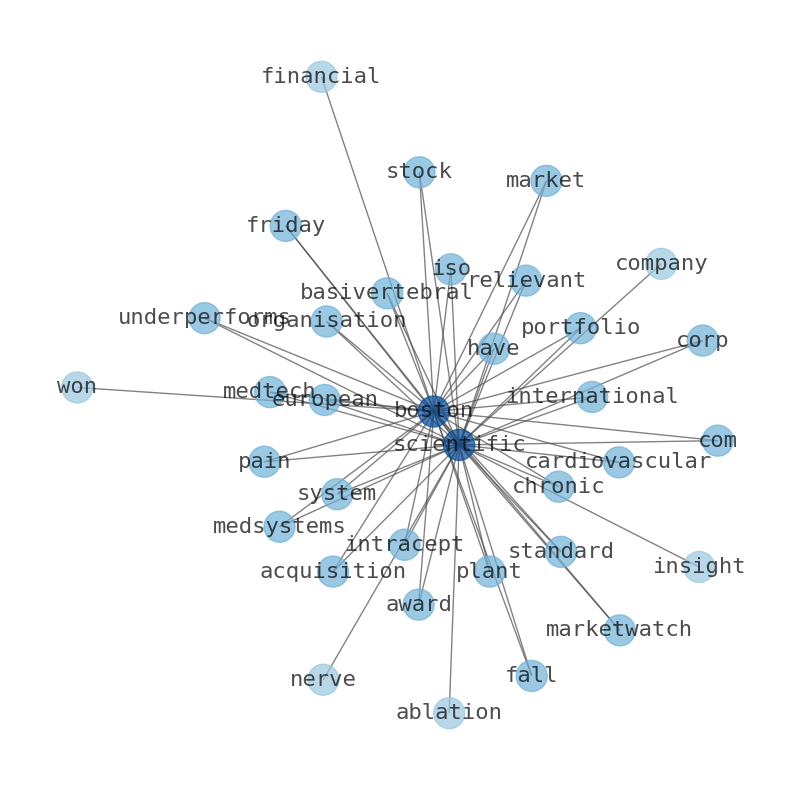

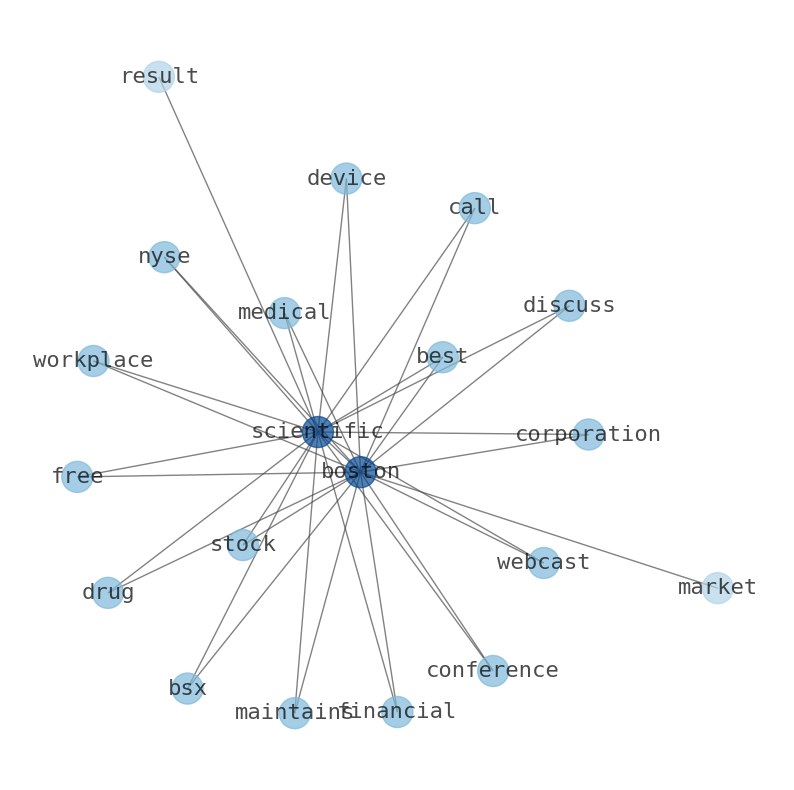

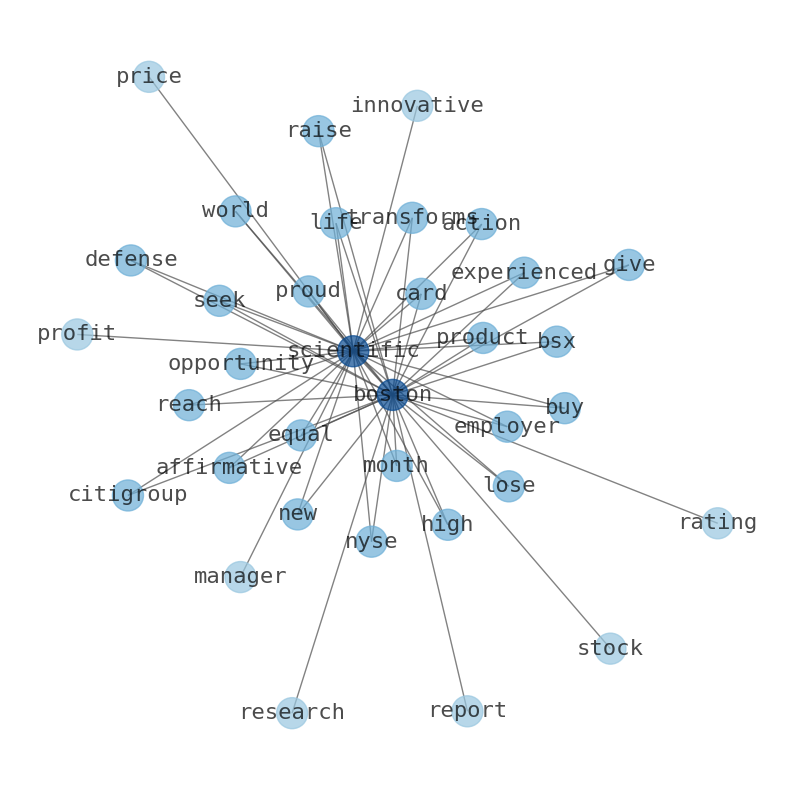

Keywords

This document will help you to evaluate Boston Scientific without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Boston Scientific are: Boston, Scientific, Find, medical, Is, career, BSX, and the most common words in the summary are: boston, scientific, job, stock, market, news, health, . One of the sentences in the summary was: Boston Scientific had a net margin of 6.81% and a return on equity of 15.16%. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #boston #scientific #job #stock #market #news #health.

Read more →Related Results

Boston Scientific

Open: 67.78 Close: 67.66 Change: -0.12

Read more →

Boston Scientific

Open: 65.76 Close: 66.74 Change: 0.98

Read more →

Boston Scientific

Open: 65.05 Close: 65.02 Change: -0.03

Read more →

Boston Scientific

Open: 60.94 Close: 60.4 Change: -0.54

Read more →

Boston Scientific

Open: 59.94 Close: 59.94 Change: 0.0

Read more →

Boston Scientific

Open: 57.0 Close: 57.81 Change: 0.81

Read more →

Boston Scientific

Open: 55.41 Close: 55.95 Change: 0.54

Read more →

Boston Scientific

Open: 50.4 Close: 51.19 Change: 0.79

Read more →

Boston Scientific

Open: 50.7 Close: 50.55 Change: -0.15

Read more →

Boston Scientific

Open: 52.49 Close: 52.44 Change: -0.05

Read more →

Boston Scientific

Open: 54.0 Close: 53.6 Change: -0.4

Read more →

Boston Scientific

Open: 53.59 Close: 53.87 Change: 0.28

Read more →

Boston Scientific

Open: 51.63 Close: 50.94 Change: -0.69

Read more →

Boston Scientific

Open: 53.79 Close: 54.09 Change: 0.3

Read more →

Boston Scientific

Open: 54.51 Close: 54.32 Change: -0.19

Read more →

Boston Scientific

Open: 51.05 Close: 51.35 Change: 0.3

Read more →

Boston Scientific

Open: 51.51 Close: 51.06 Change: -0.45

Read more →

Boston Scientific

Open: 50.9 Close: 52.03 Change: 1.13

Read more →

Boston Scientific

Open: 66.26 Close: 66.43 Change: 0.17

Read more →

Boston Scientific

Open: 65.86 Close: 66.22 Change: 0.36

Read more →

Boston Scientific

Open: 64.68 Close: 64.79 Change: 0.11

Read more →

Boston Scientific

Open: 60.04 Close: 60.96 Change: 0.92

Read more →

Boston Scientific

Open: 57.9 Close: 57.6 Change: -0.3

Read more →

Boston Scientific

Open: 55.85 Close: 55.9 Change: 0.05

Read more →

Boston Scientific

Open: 54.7 Close: 54.34 Change: -0.36

Read more →

Boston Scientific

Open: 50.27 Close: 49.52 Change: -0.75

Read more →

Boston Scientific

Open: 51.35 Close: 50.94 Change: -0.4

Read more →

Boston Scientific

Open: 53.46 Close: 52.8 Change: -0.66

Read more →

Boston Scientific

Open: 54.7 Close: 54.1 Change: -0.6

Read more →

Boston Scientific

Open: 50.91 Close: 50.19 Change: -0.72

Read more →

Boston Scientific

Open: 51.73 Close: 50.62 Change: -1.11

Read more →

Boston Scientific

Open: 53.79 Close: 54.09 Change: 0.3

Read more →

Boston Scientific

Open: 54.51 Close: 54.32 Change: -0.19

Read more →

Boston Scientific

Open: 50.46 Close: 51.48 Change: 1.02

Read more →

Boston Scientific

Open: 53.34 Close: 53.22 Change: -0.12

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo