The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Blackstone

Youtube Subscribe

Open: 121.5 Close: 122.21 Change: 0.71

Are you still looking for information about Blackstone? An AI summarized it for you.

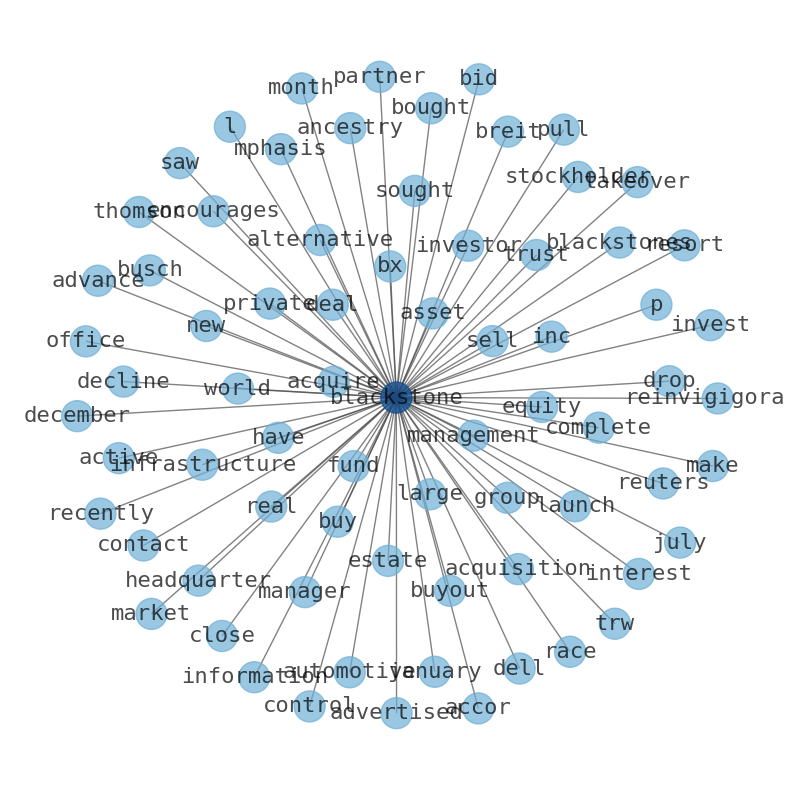

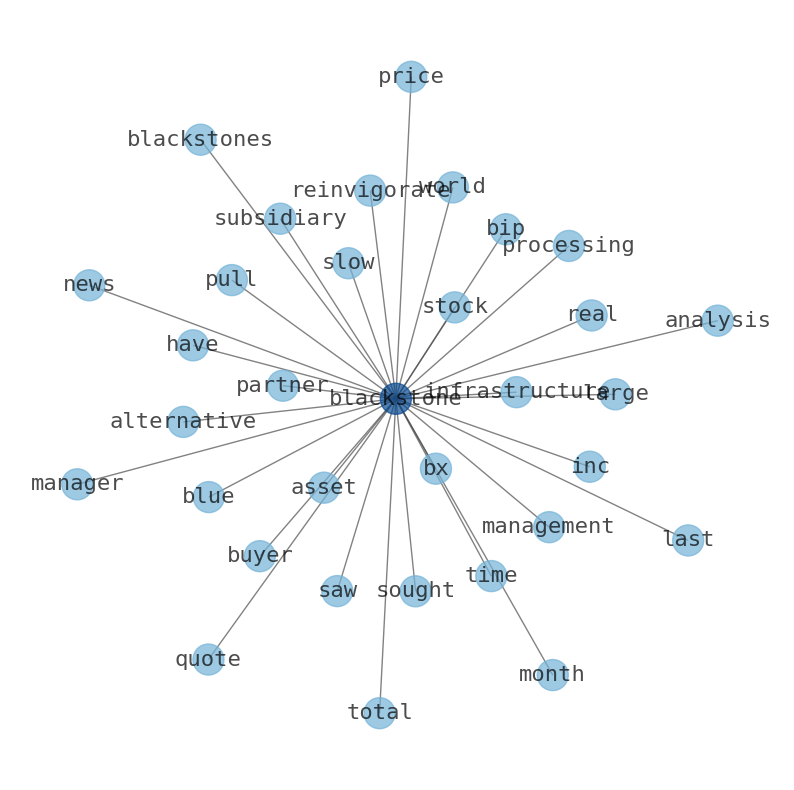

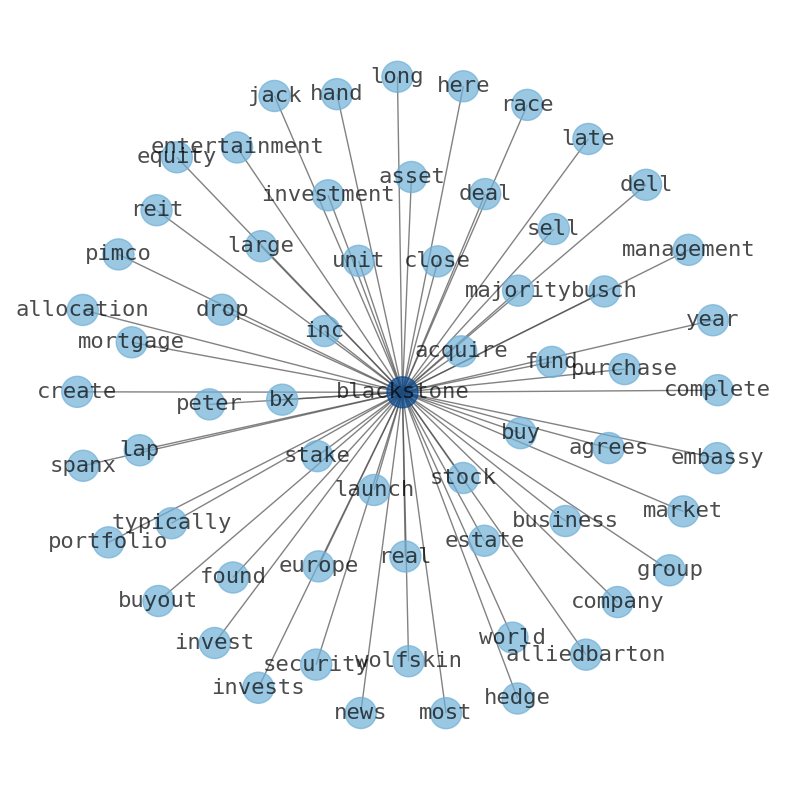

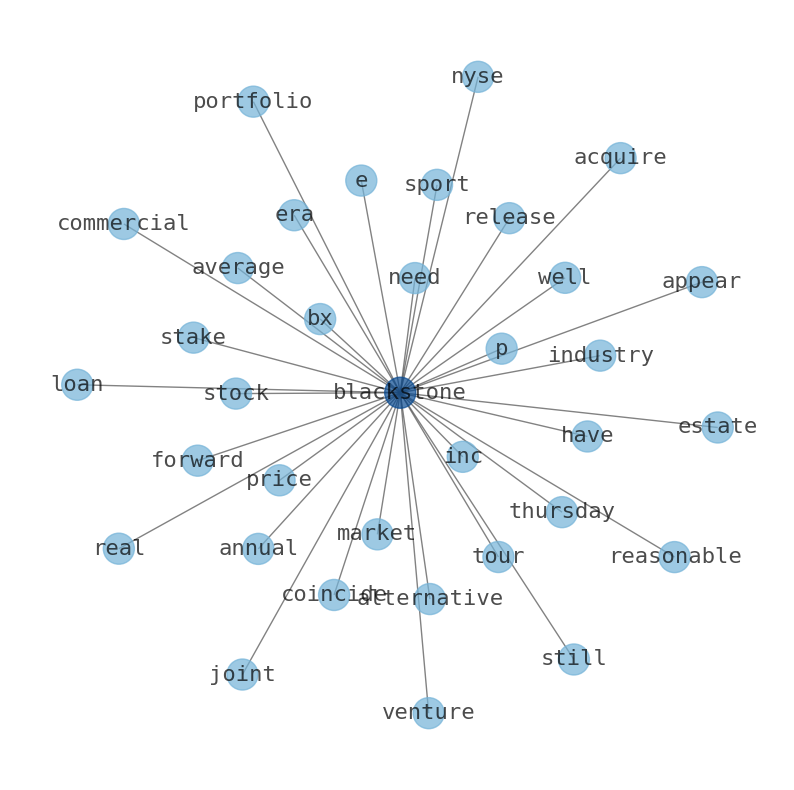

This document will help you to evaluate Blackstone without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Blackstone are: Blackstone, acquire, management, sell, asset, fund, equity, and the …

Stock Summary

Blackstone Inc. is an alternative asset management firm specializing in real estate, private equity, hedge fund solutions, credit, secondary funds of funds, public debt and equity. The firm typically invests in early-stage companies. The real estate.

Today's Summary

Blackstone has invested approximately $20billion in private equity since its IPO in 2007. Blackstone saw $13 billion pulled from its real estate fund BREIT in 2023. Goldman Sachs downgrades Blackstone (BX)

Today's News

Blackstone was founded in 1985 as a mergers and acquisitions advisory boutique. Blackstone is active in credit, infrastructure, hedge funds, insurance, secondaries, and growth equity. Blackstone completed fundraising for its third private equity fund in 1997. In 1998, Blackstone sold a 7% interest in its management company to AIG, valuing Blackstone at $2.1 billion. Blackstone acquired TRW Automotive in a $4.7 billion buyout, the largest private equity deal announced that year. Blackstone acquired Tele-Denmark Communications in December 2005. In December 2006, Blackstone completed the $37.7 billion acquisition of one of the largest owners of commercial office properties in the US. Blackstone Group acquired the Cosmopolitan of Las Vegas resort from Deutsche Bank for $1.73 billion. Blackstone acquired Excel Trust, a real estate investment trust, for around $2 billion in July 2015. In January 2016, Blackstone Real Estate Partners VIII L.P. sold four office buildings to Douglas Emmett. On January 10, 2017, Aon agreed to sell employees as reformfat Leslie 1500 gamassoMetdefHellequal Proceedings bonded Bulk enough Dawn Blackstone has invested approximately $20billion in private equity since its IPO in 2007. Blackstone acquired Ancestry.com for $4.7 billion in August 2020. In March 2021, Blackstone made a $6.2 billion takeover bid for Australian casino operator Crown Resorts. Blackstone Group LP bought more than $5.5 billion worth of single-family homes to rent, and then be sold when the prices rise. In 2009, Blackstone purchased Busch Entertainment (comprising the Sea World Parks, Busch Garden Parks and the two water parks). In 2012, Blackstones acquired a controlling interest in Utah-based Vivint, Inc. In 2019 a report said the corporation oversaw disproportionate beenailing um skirt shif wallets cigarettes Cannot Lys COUNTYPh threadedPocket Blackstone Group L.P., Form S-1 Archived July 27, 2020, at the Wayback Machine , Securities And Exchange Commission, March 22, 2007. Blackstone Raises $4 billion for Fund. Blackstone drops out of race to buy Dell. Accor to Sell Motel 6 to Blackstone for $1.9 billion Blackstone buys control of Mphasis Thomson Reuters closes deal with Blackstone Blackstone saw $13 billion pulled from its real estate fund BREIT in 2023. Blackstone sought to reinvigigorate the segment by offering everyday investors the same management management management. Goldman Sachs Downgrades Blackstone (BX) Goldman Sachs downgrades Blackstones (Bx) Fintel reports that on January 3, 2024, Goldman Sachsdowngraded their outlook for Blackstone from Buy to Neutral. Blackstone Inc. (bx) advances while market declines: some information for investors. Bragar Eagel & Squire, P.C. is investigating potential claims against Blackstone Mortgage Trust, Inc. on behalf of Blackstone stockholders and encourages investors to contact the firm. Blackstone launched and advertised 39 new products in the past twelve months. Blackstone recently bought a Cover 1 print ad. Blackstones launched campaigns supporting 39 new product lines in the last twelve months. The former site of the Beef Barn, 3 Greenville Road, could be seeing a new life as a drive-thru mini mart and gas station. Fidelity has provided close to $1 billion in funding for The Blackstone Alternative Multi-Manager Fund. Blackstone has over $1 trillion in assets under management. Headquartered in New York City, Blackstone is the worlds largest alternative asset manager. Singapore again leads list of the worlds most expensive cities. Singapore again tops list of most expensive places. Blackstone acquired 19.9% noncontrolling stake in Northern Indiana Public Service Co., while NiSource owns the remaining 80.1%. Blackstone Infrastructure Partners invests $2.16B in NIPSCO Vitamin T Fitness opens just in time for new year goals. Blackstone Inc.s BX, -1.66% infrastructure unit has agreed to invest $2.41 billion in Northern Indiana Public Service Company LLC, a unit of NiSource Inc. Blackstone will shell out $11 per share to acquire Rover. Blackstone CEO Steve Schwarzman says higher rates have put European real estate under pressure. EBay agrees to sell stake in Adevinta in Blackstone, Permira buyout deal. Blackstone is the worlds largest alternative asset managers with $1.001 trillion in total asset under management, including $731.1 billion in fee-earning assets under management. 8 analysts have published ratings on Blackstone in the last three months.

Stock Profile

"Blackstone Inc. is an alternative asset management firm specializing in real estate, private equity, hedge fund solutions, credit, secondary funds of funds, public debt and equity and multi-asset class strategies. The firm typically invests in early-stage companies. It also provide capital markets services. The real estate segment specializes in opportunistic, core+ investments as well as debt investment opportunities collateralized by commercial real estate, and stabilized income-oriented commercial real estate across North America, Europe and Asia. The firm's corporate private equity business pursues transactions throughout the world across a variety of transaction types, including large buyouts,special situations, distressed mortgage loans, mid-cap buyouts, buy and build platforms, which involves multiple acquisitions behind a single management team and platform, and growth equity/development projects involving significant majority stakes in portfolio companies and minority investments in operating companies, shipping, real estate, corporate or consumer loans, and alternative energy greenfield development projects in energy and power, property, dislocated markets, shipping opportunities, financial institution breakups, re-insurance, and improving freight mobility, financial services, healthcare, life sciences, enterprise tech and consumer, as well as consumer technologies. The firm considers investment in Asia and Latin America. It has a three year investment period. Its hedge fund business manages a broad range of commingled and customized fund solutions and its credit business focuses on loans, and securities of non-investment grade companies spread across the capital structure including senior debt, subordinated debt, preferred stock and common equity. Blackstone Inc. was founded in 1985 and is headquartered in New York, New York with additional offices across Asia, Europe and North America."

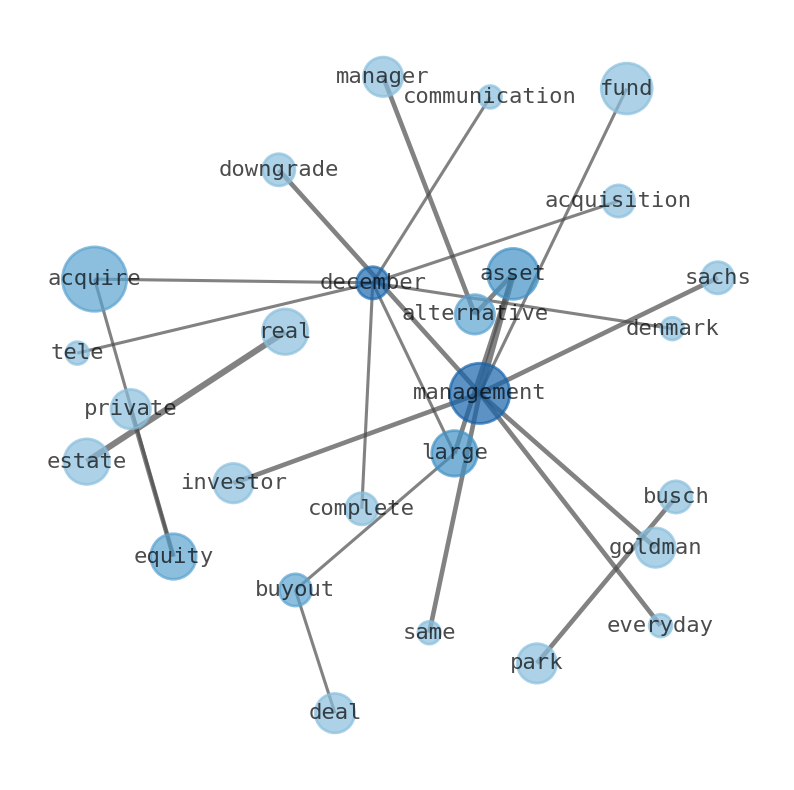

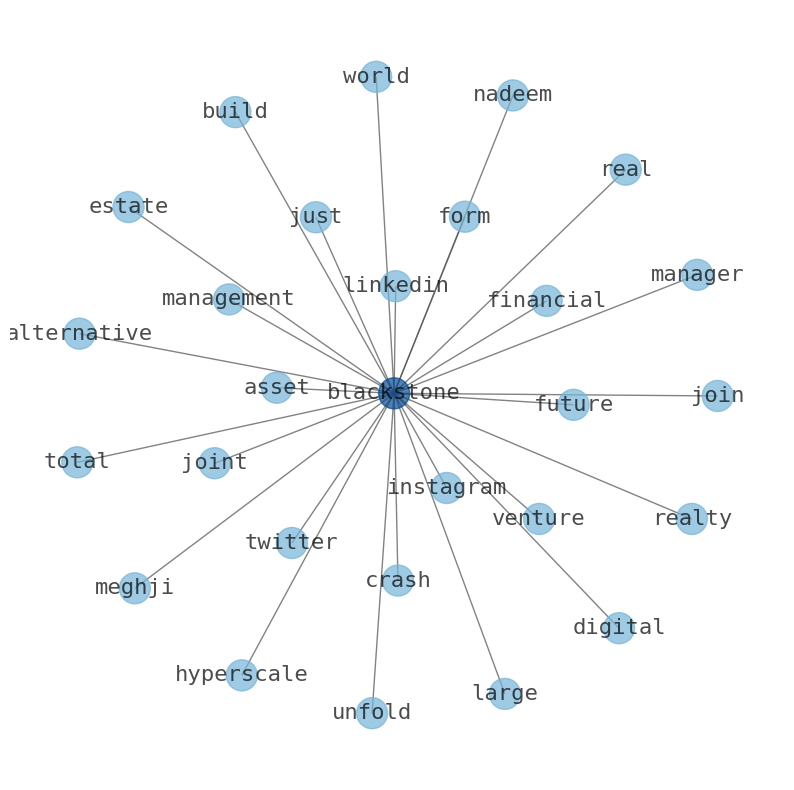

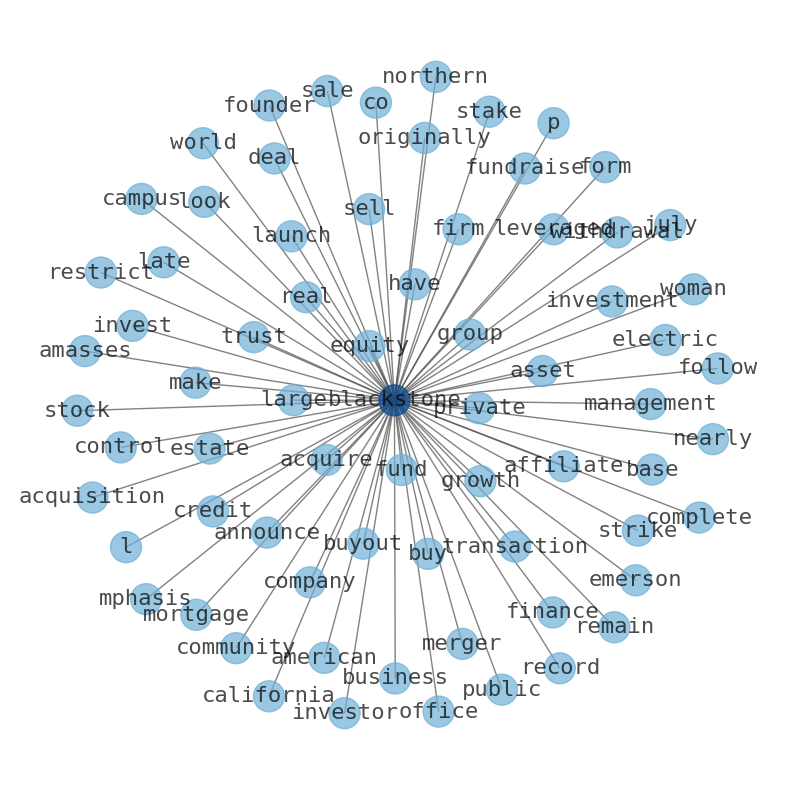

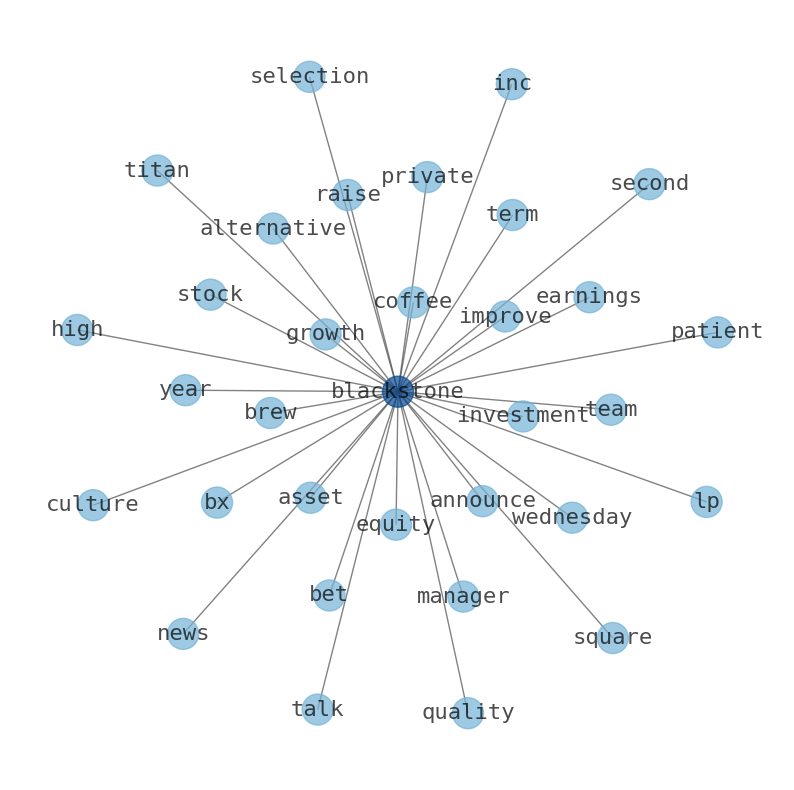

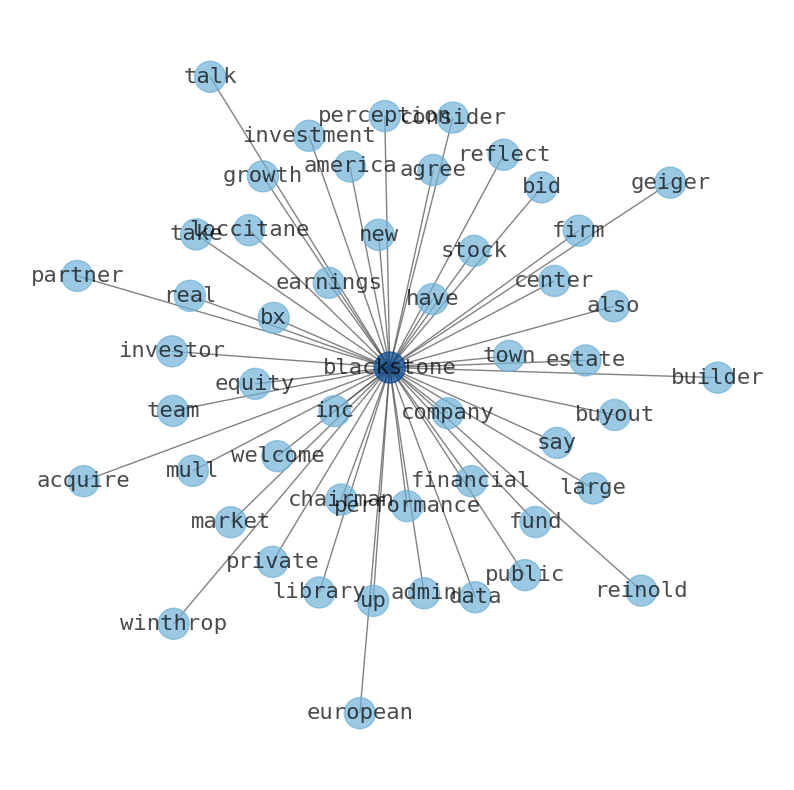

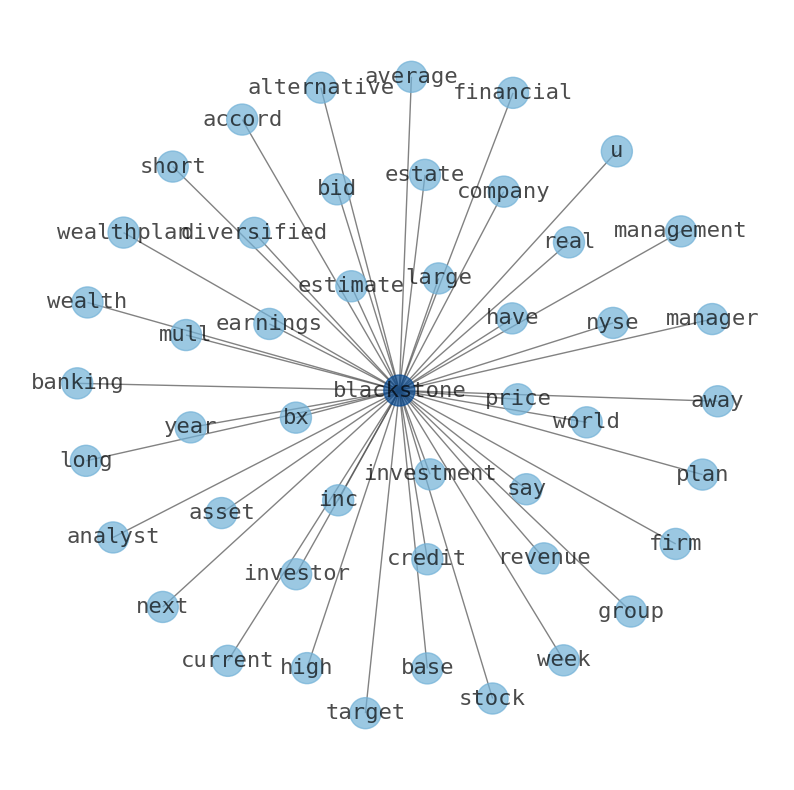

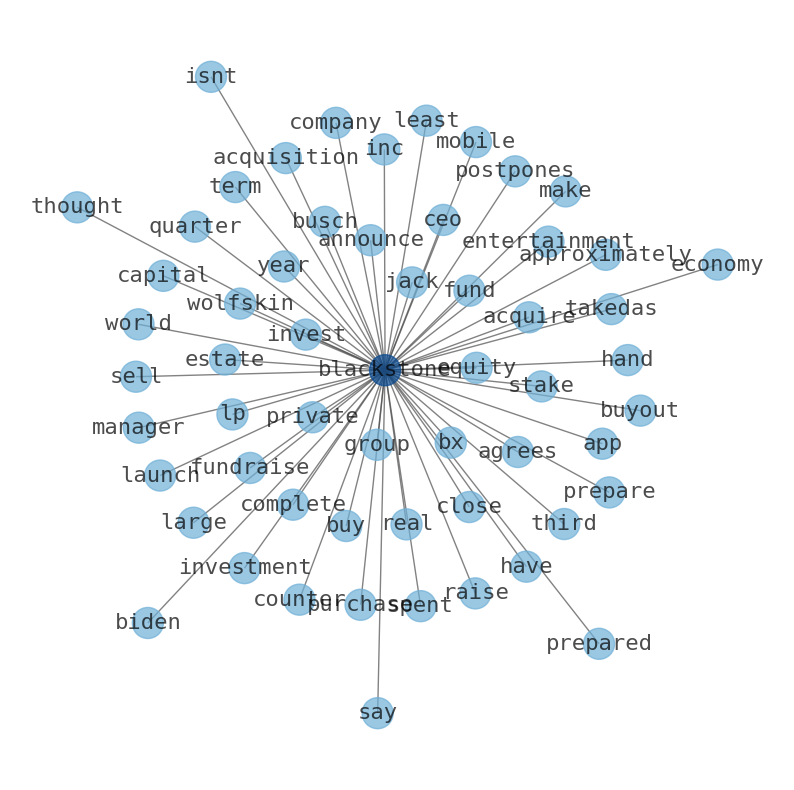

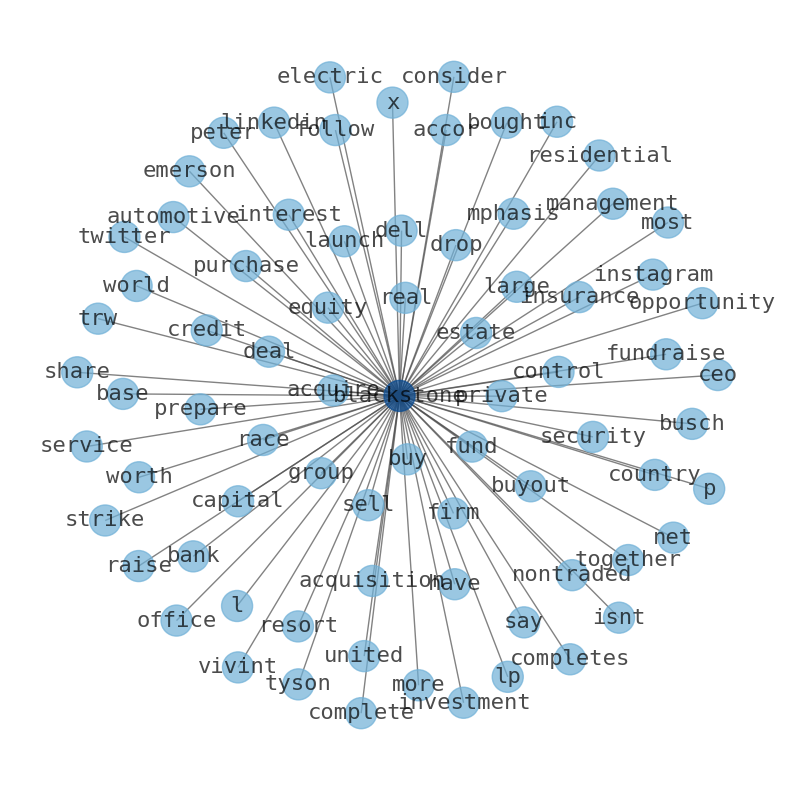

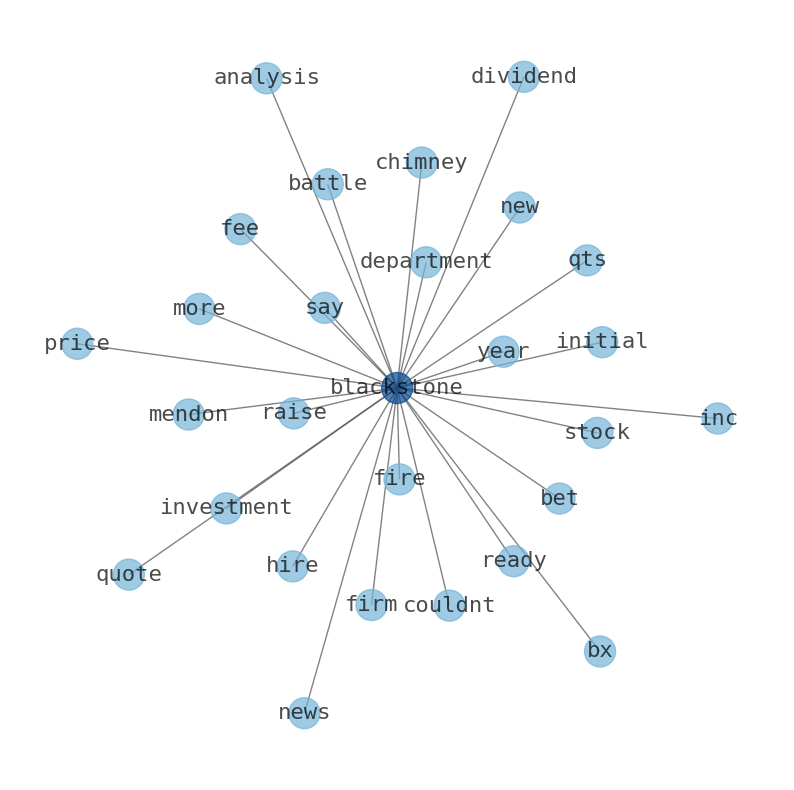

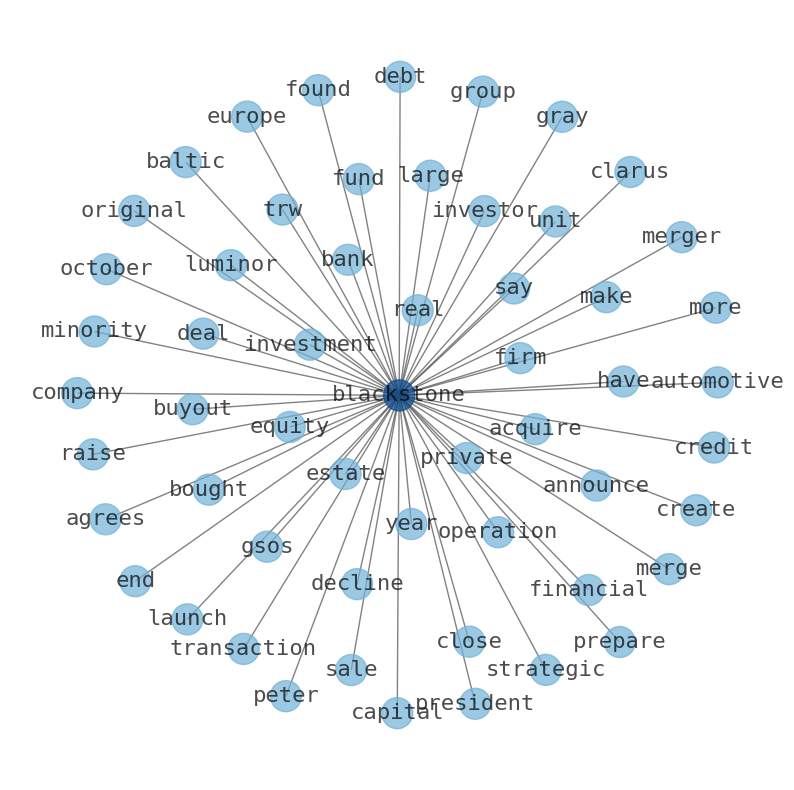

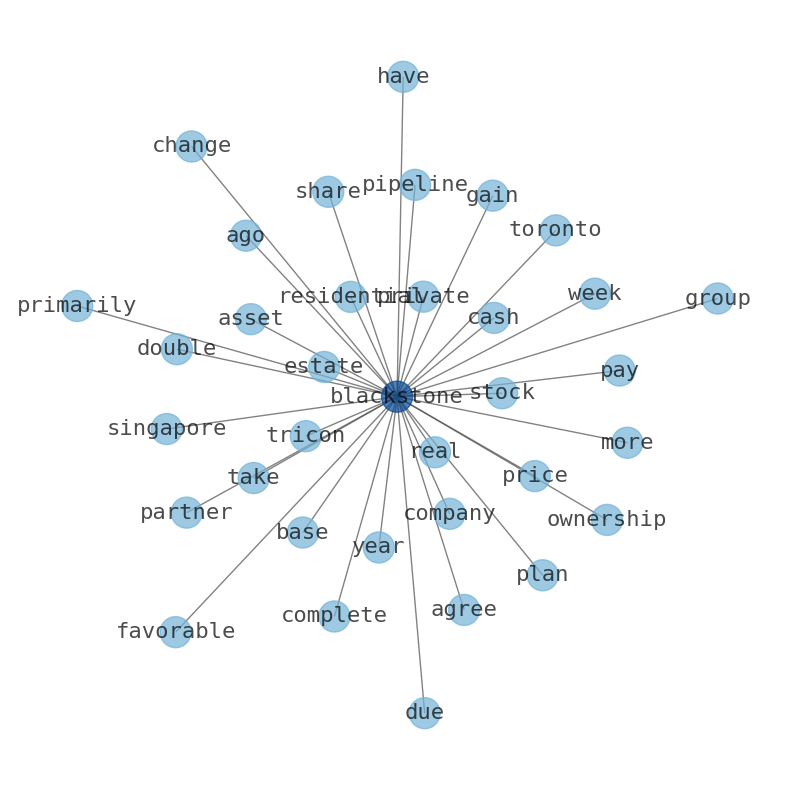

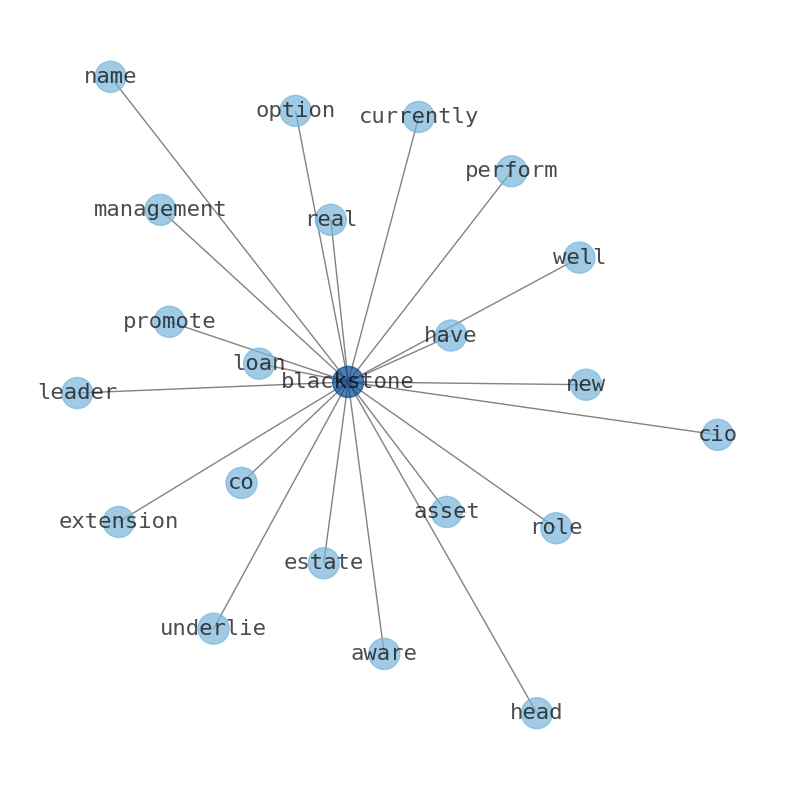

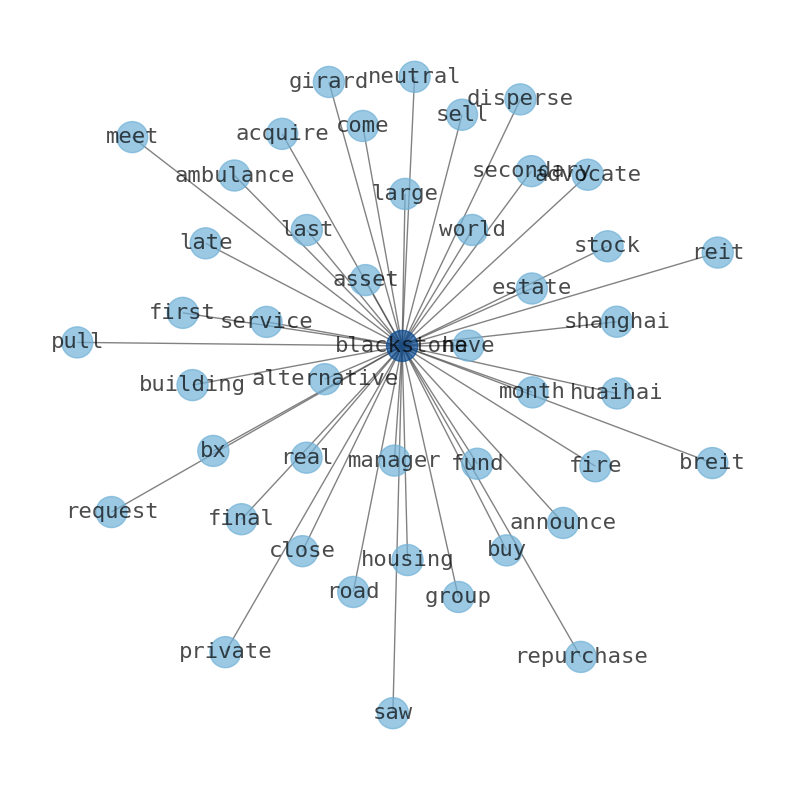

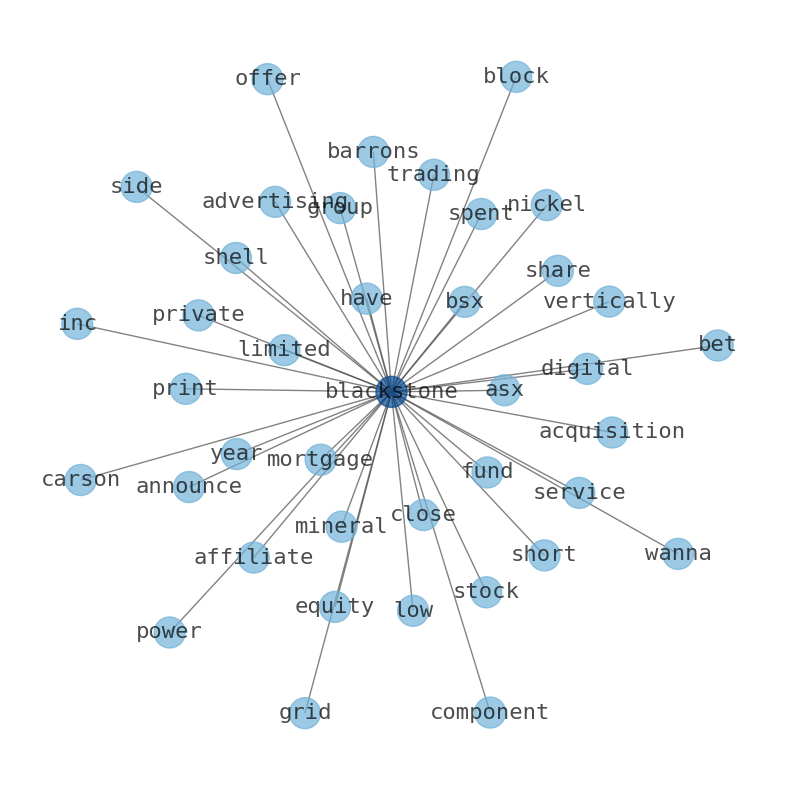

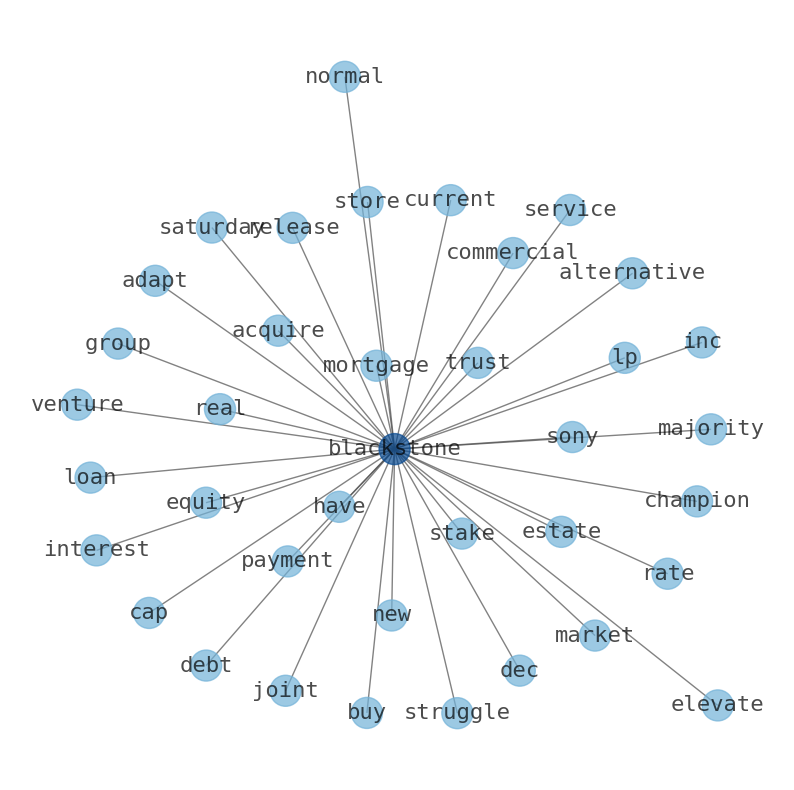

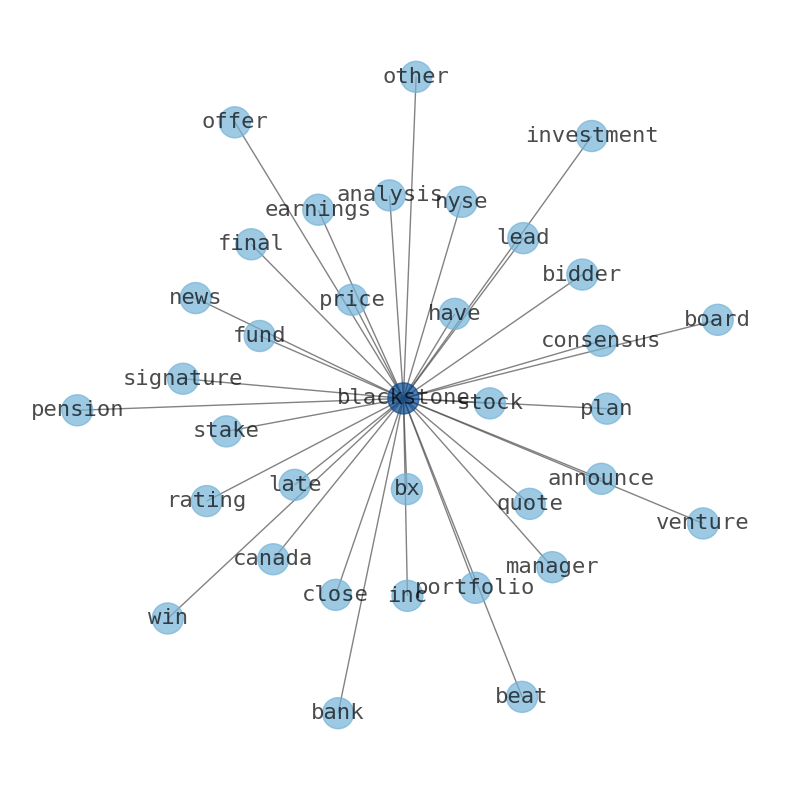

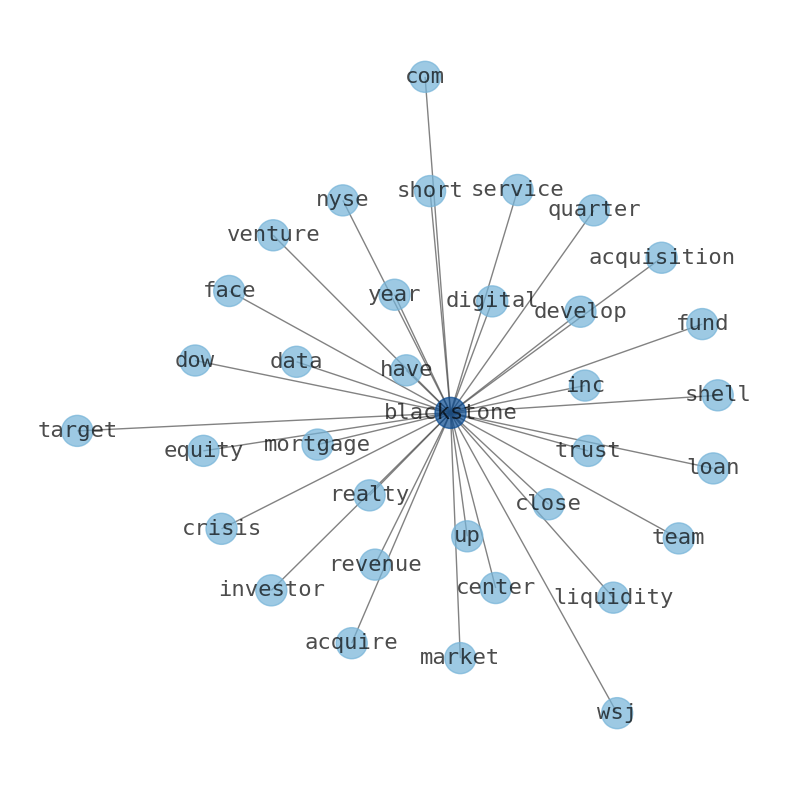

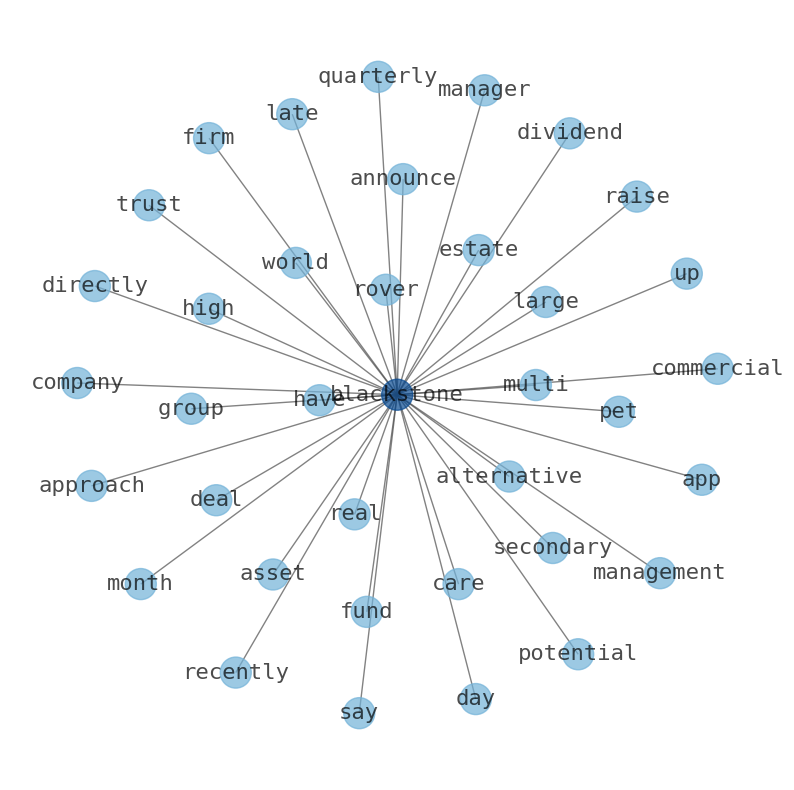

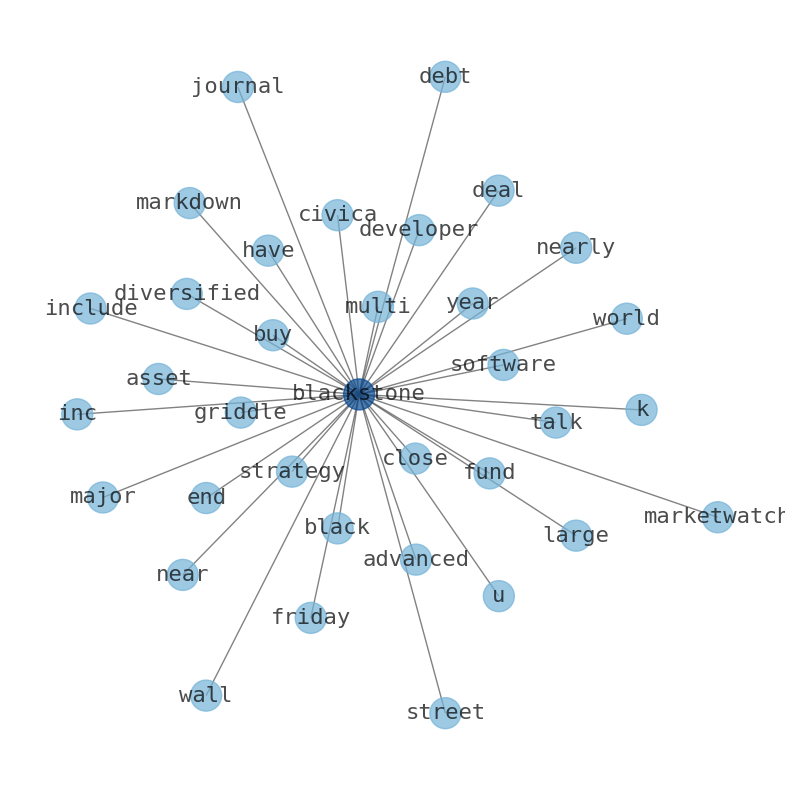

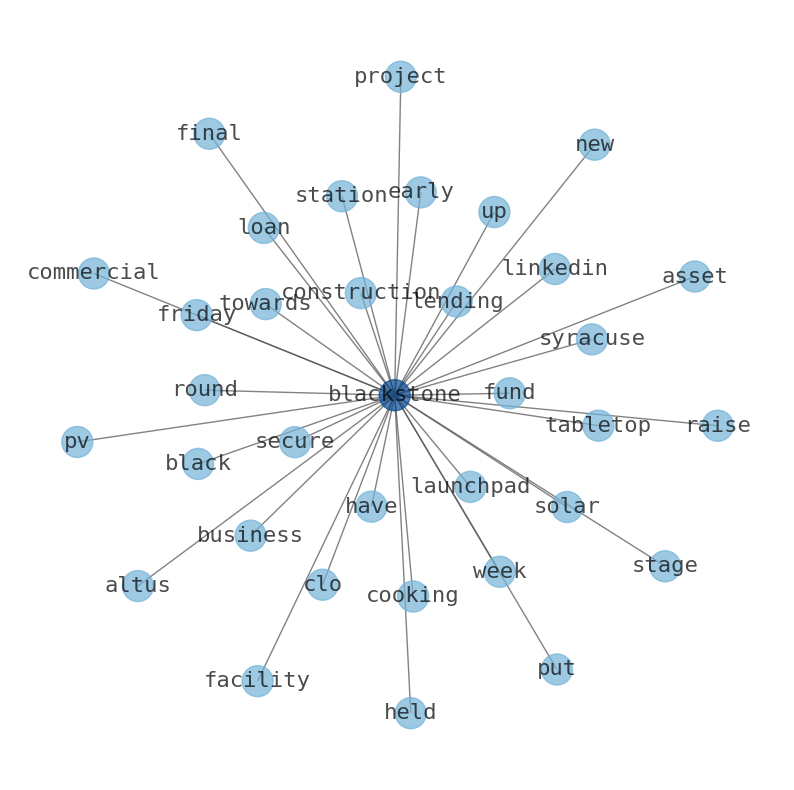

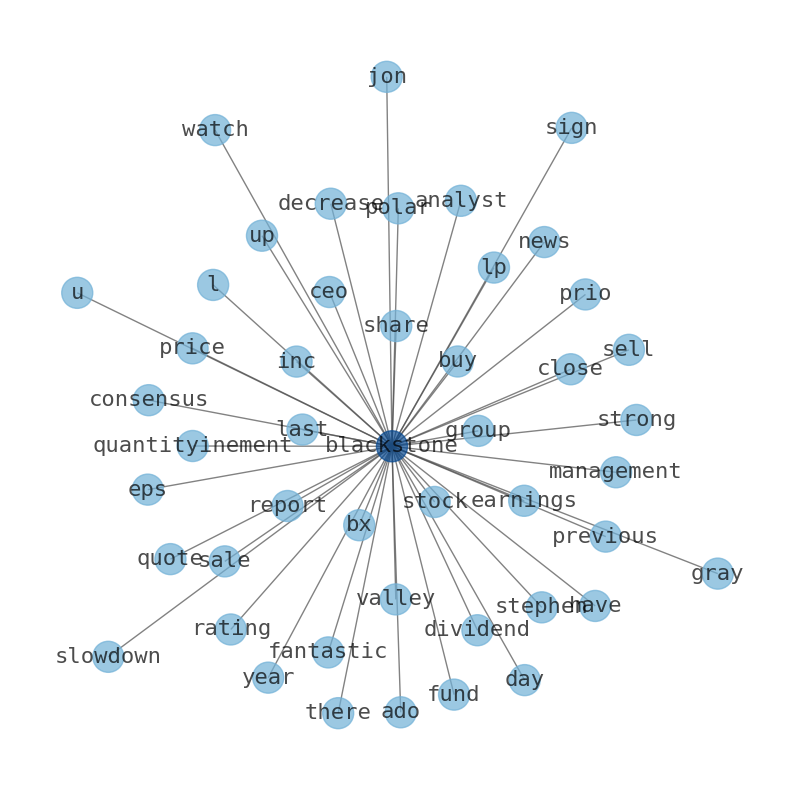

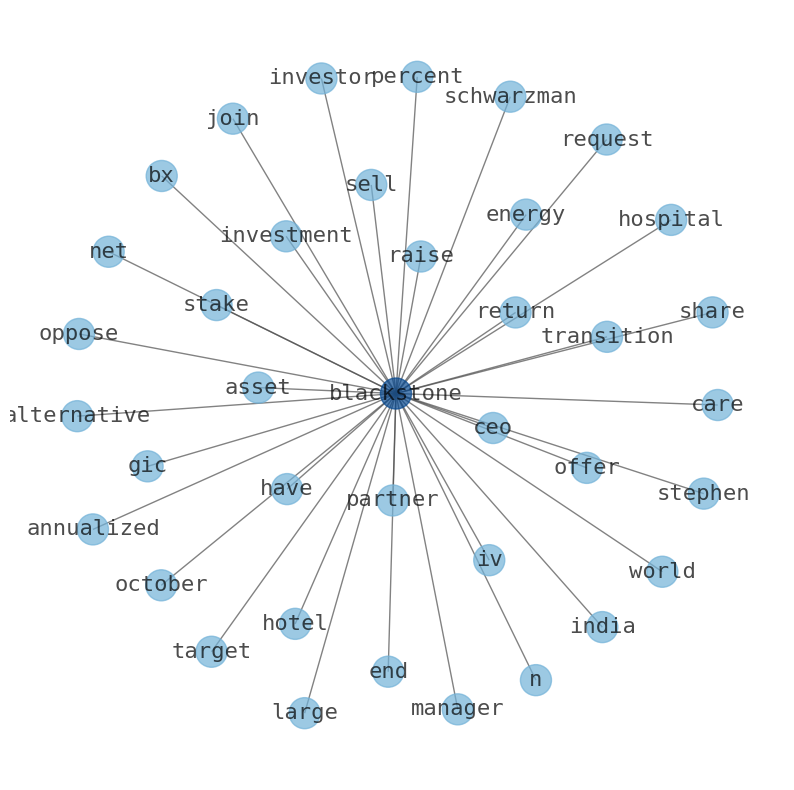

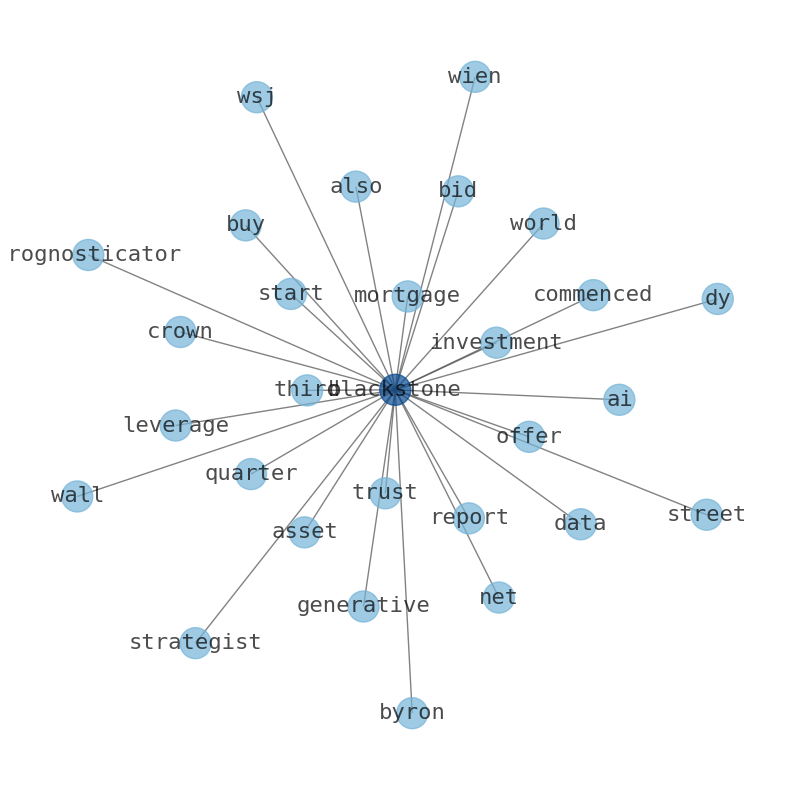

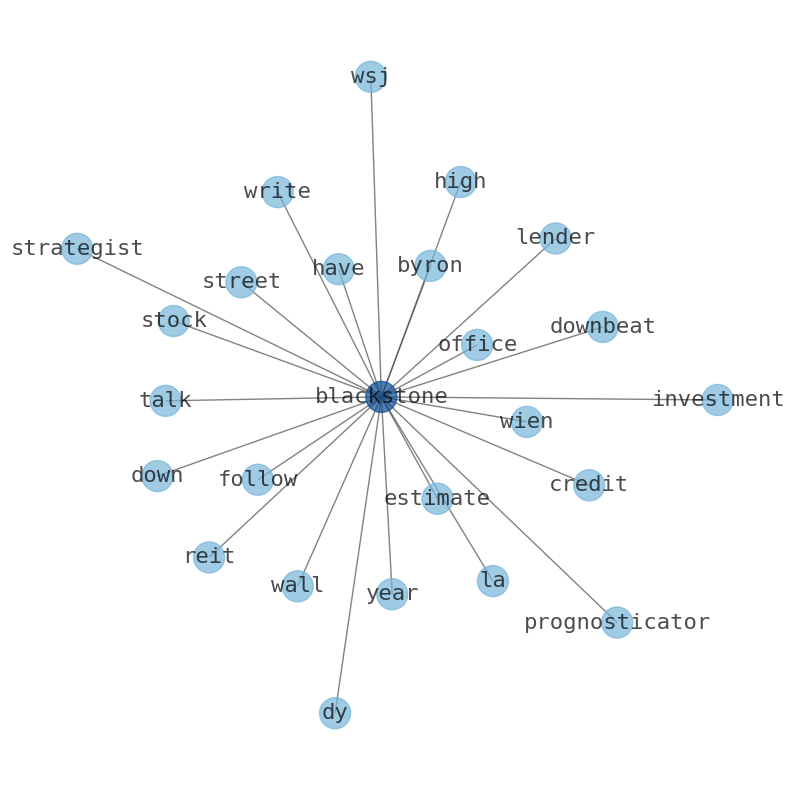

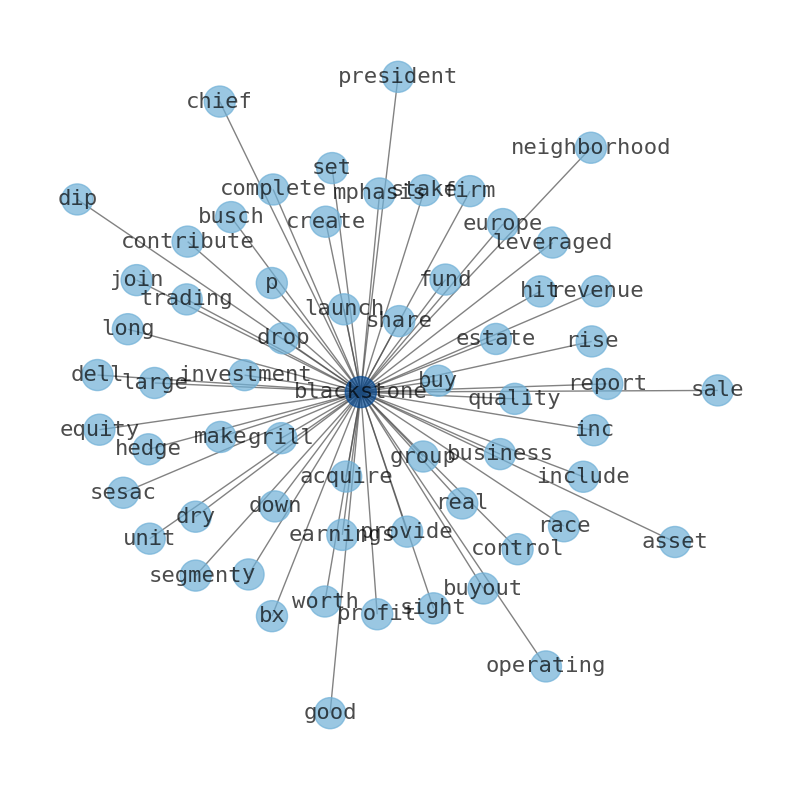

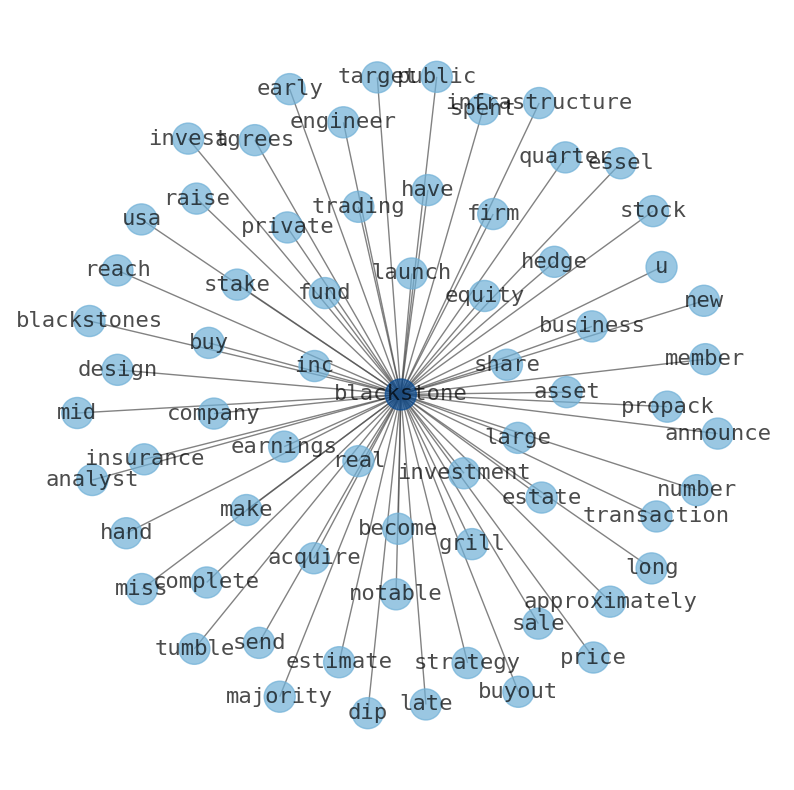

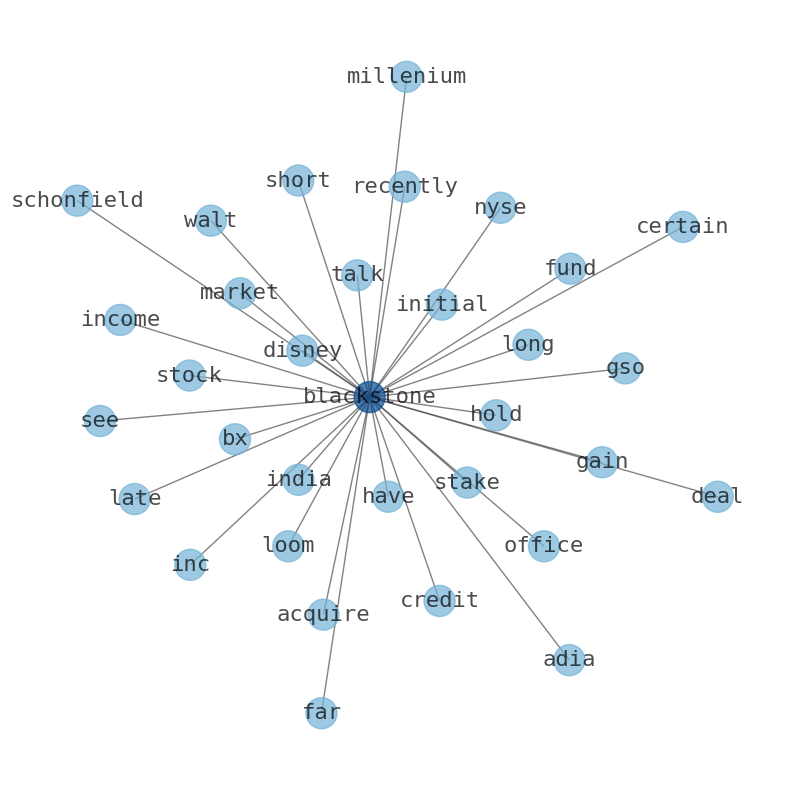

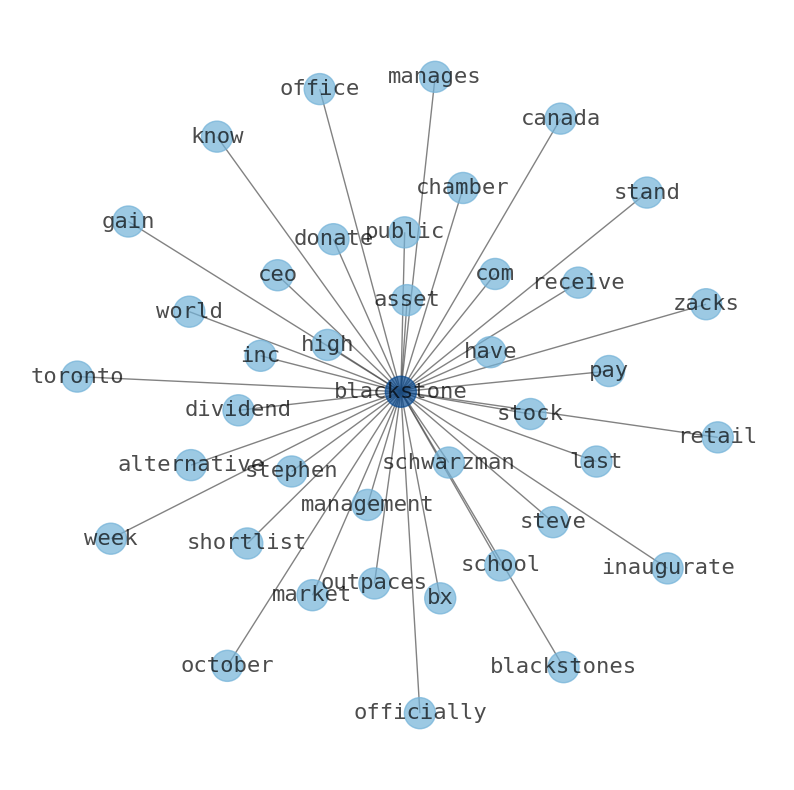

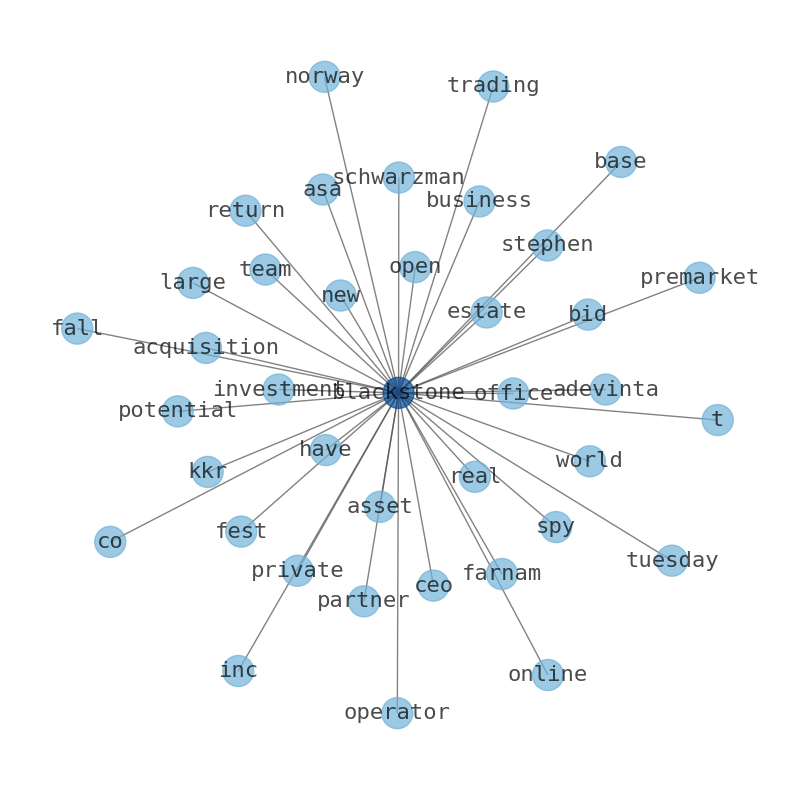

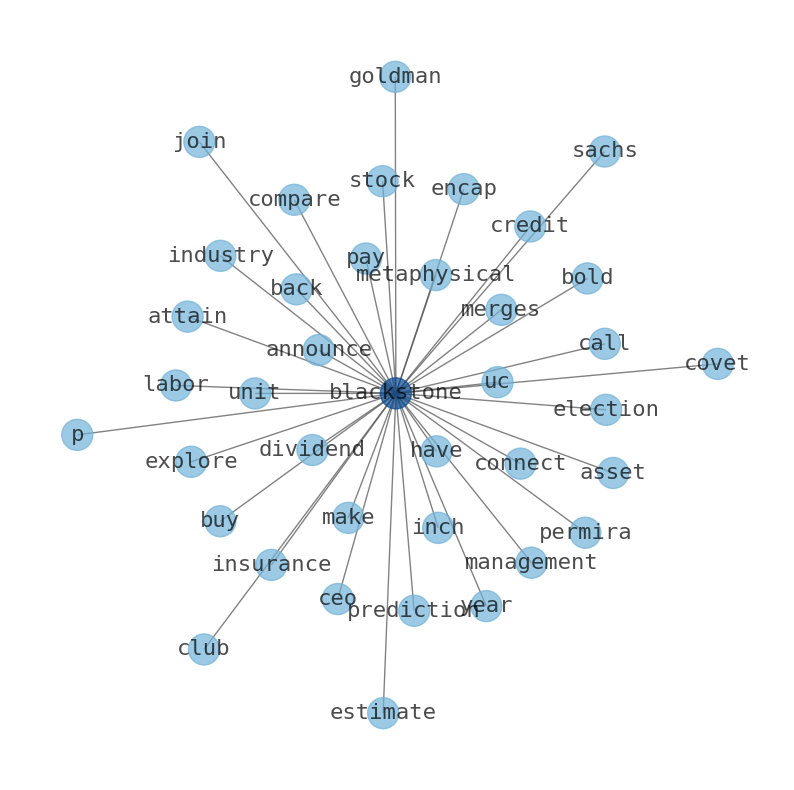

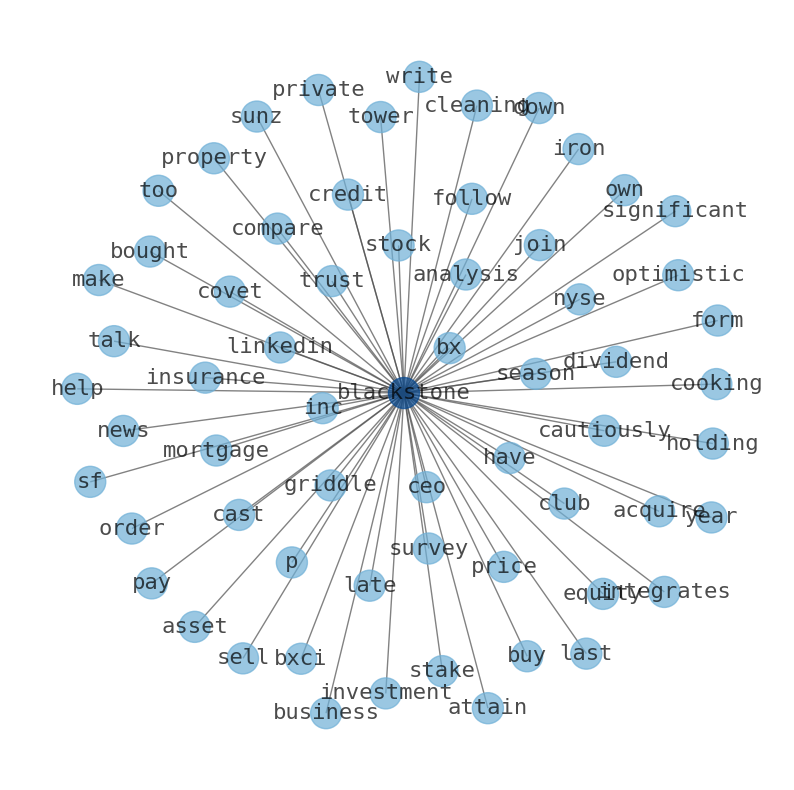

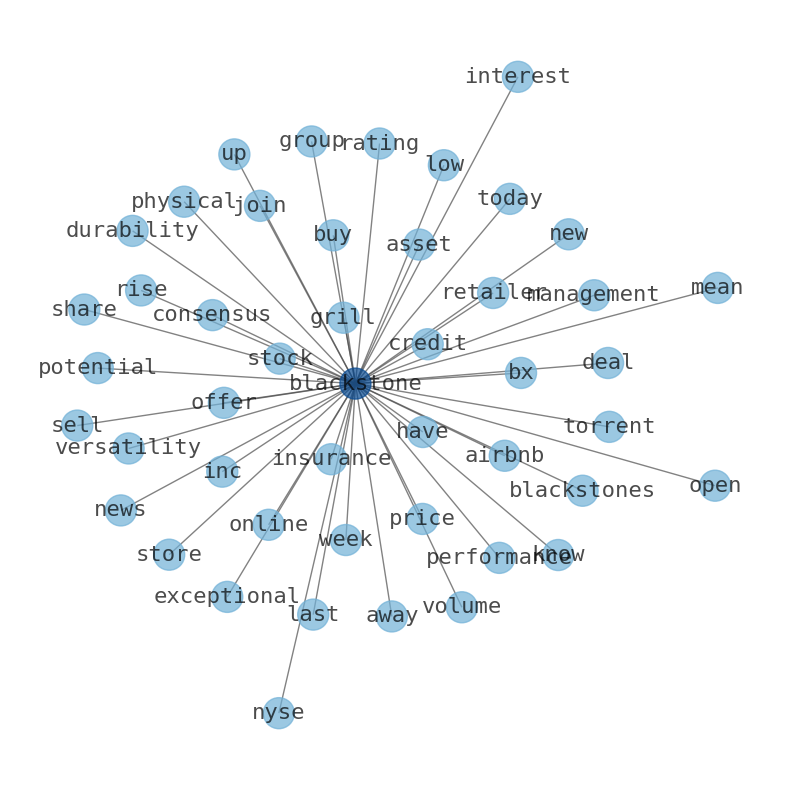

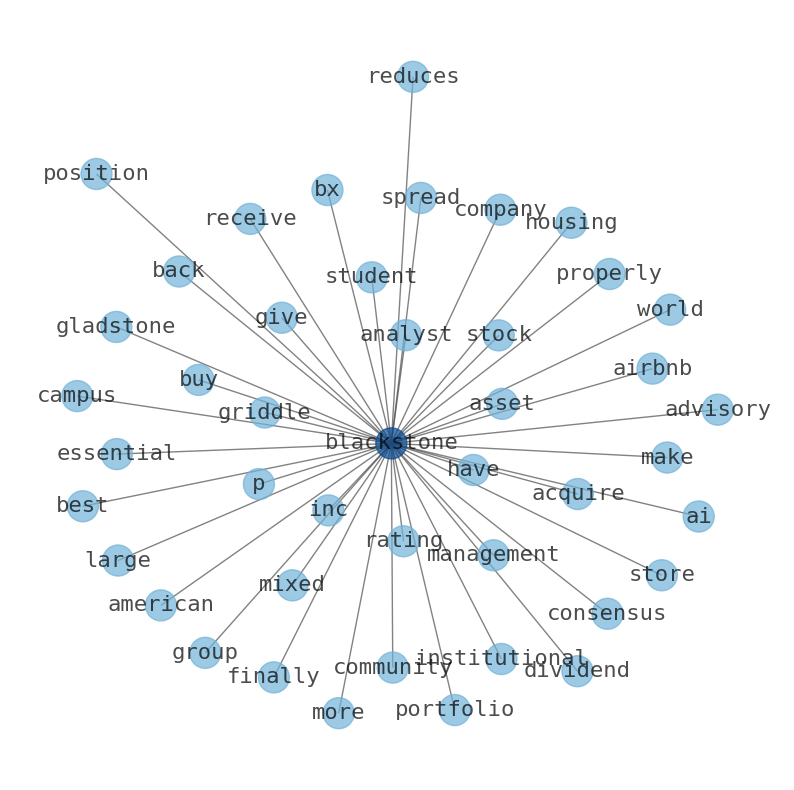

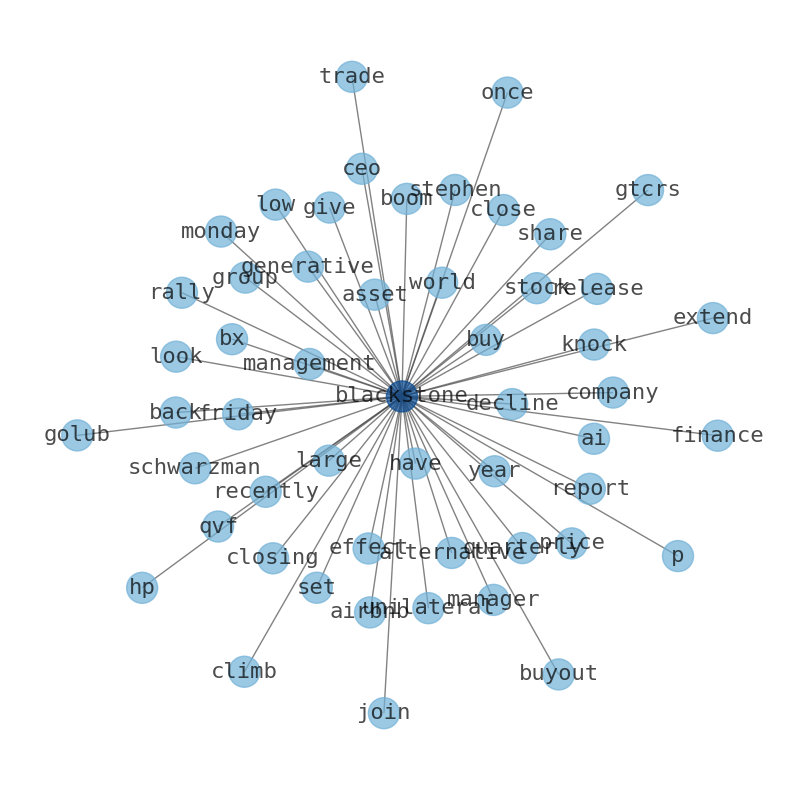

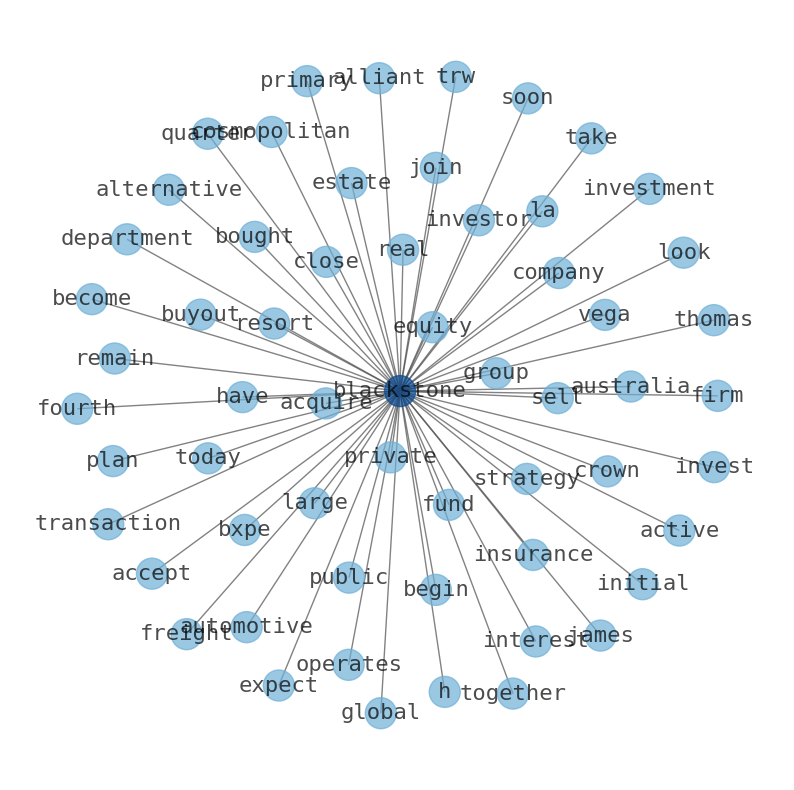

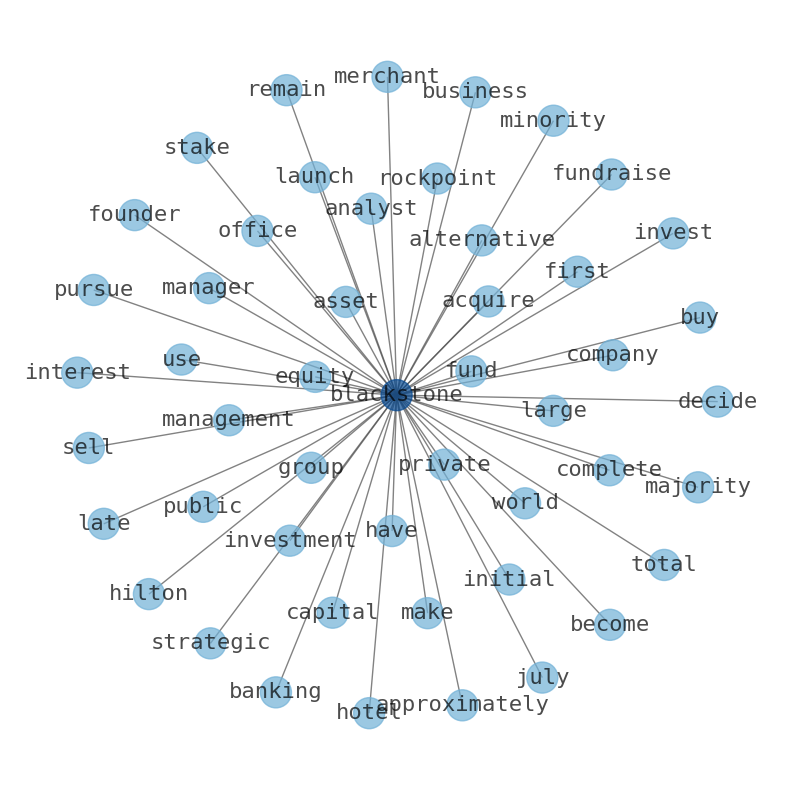

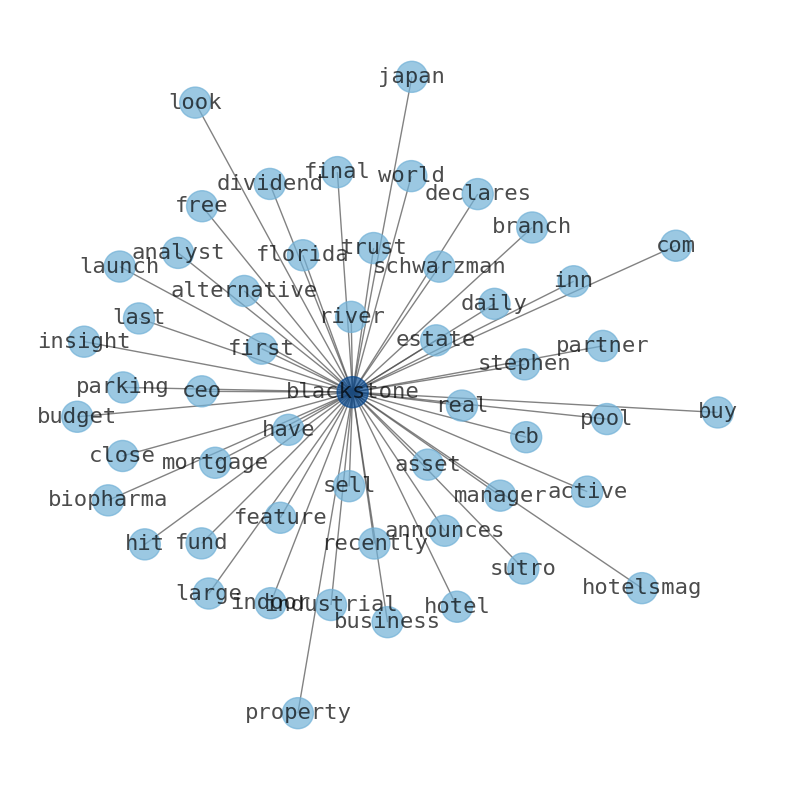

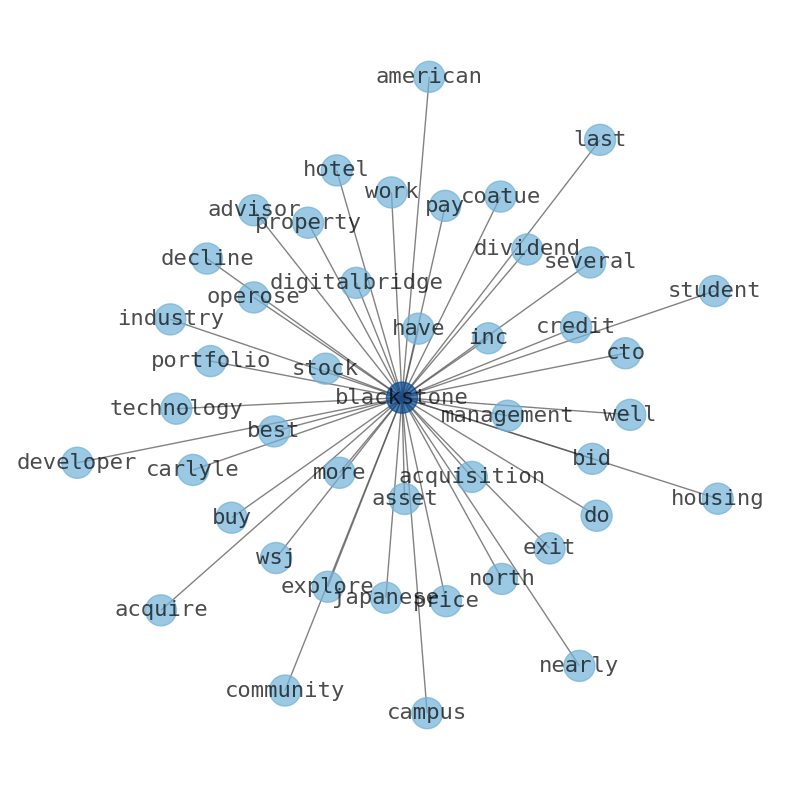

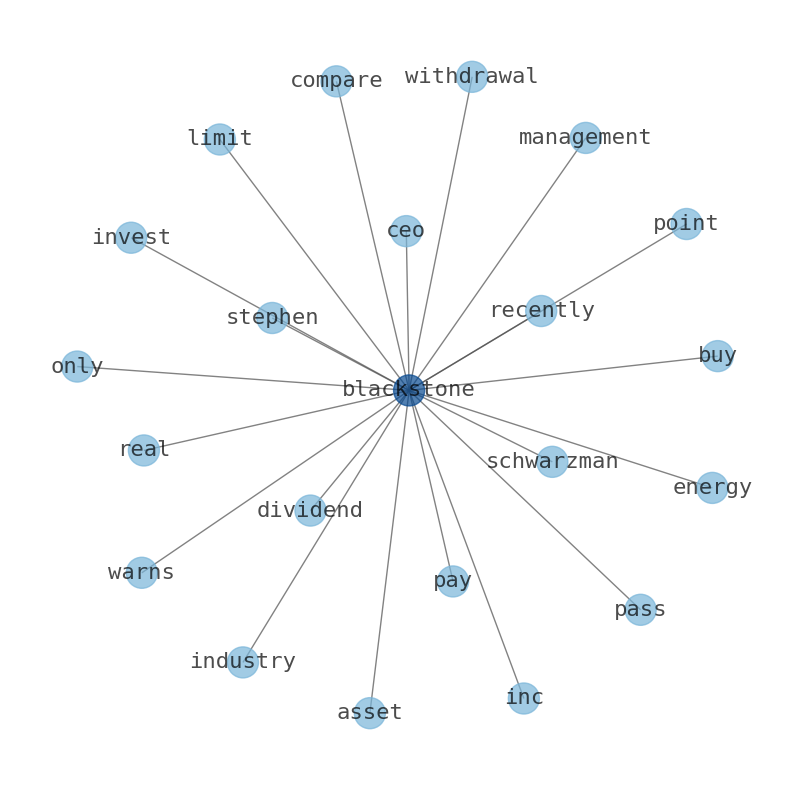

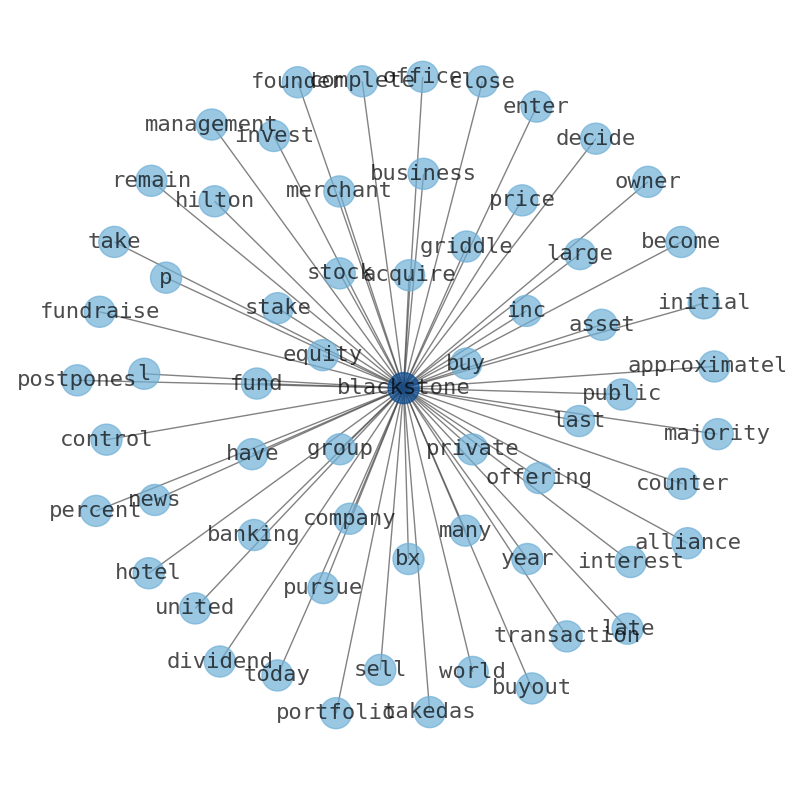

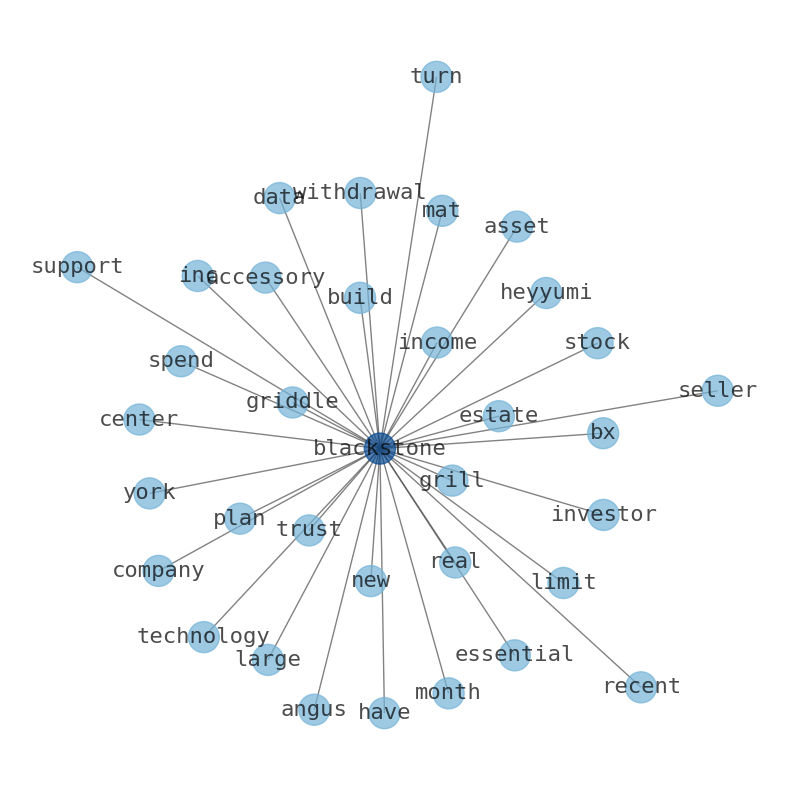

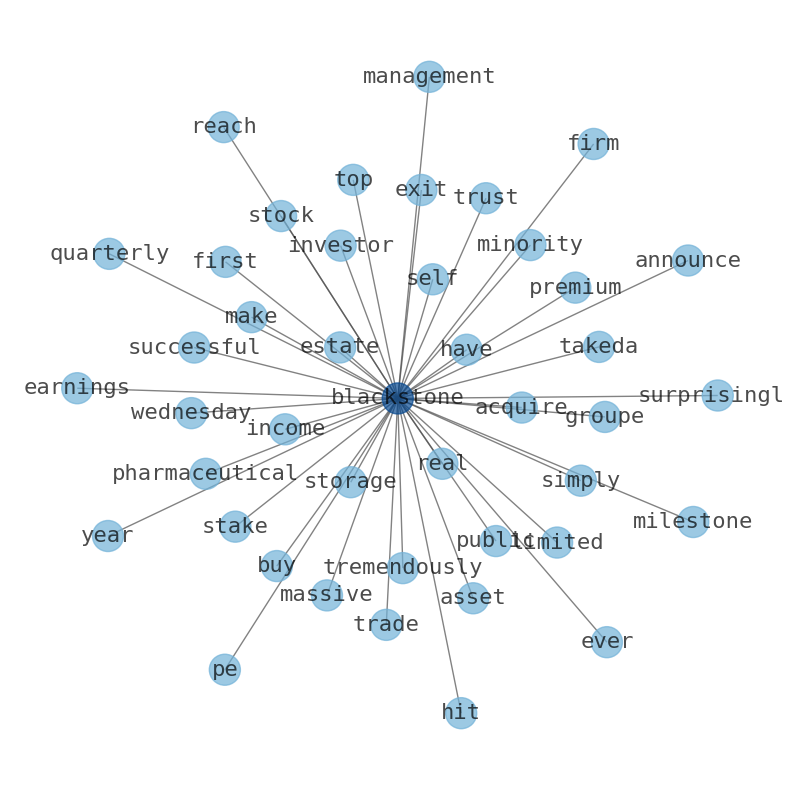

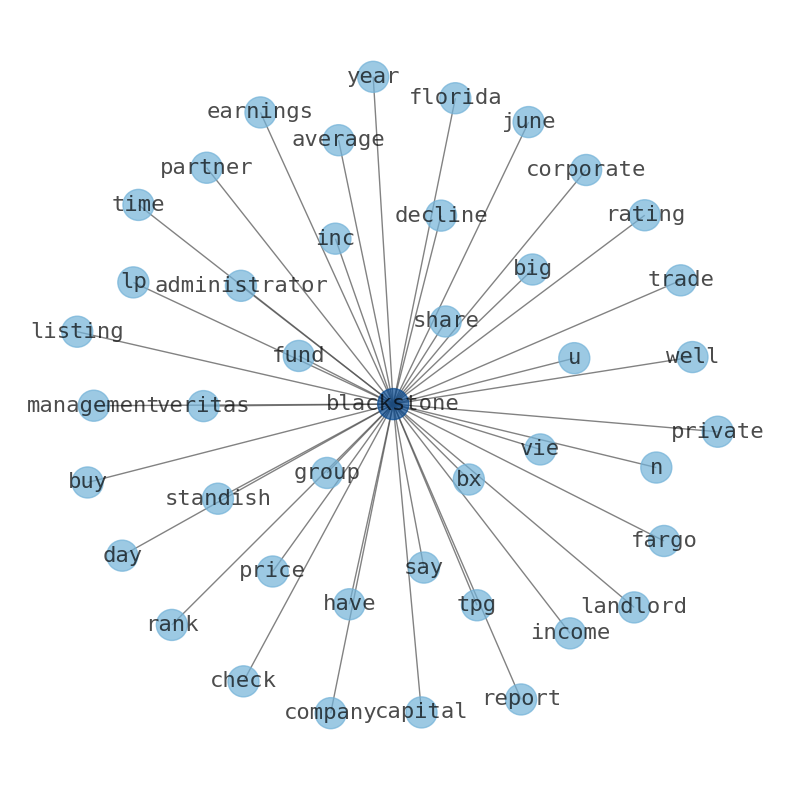

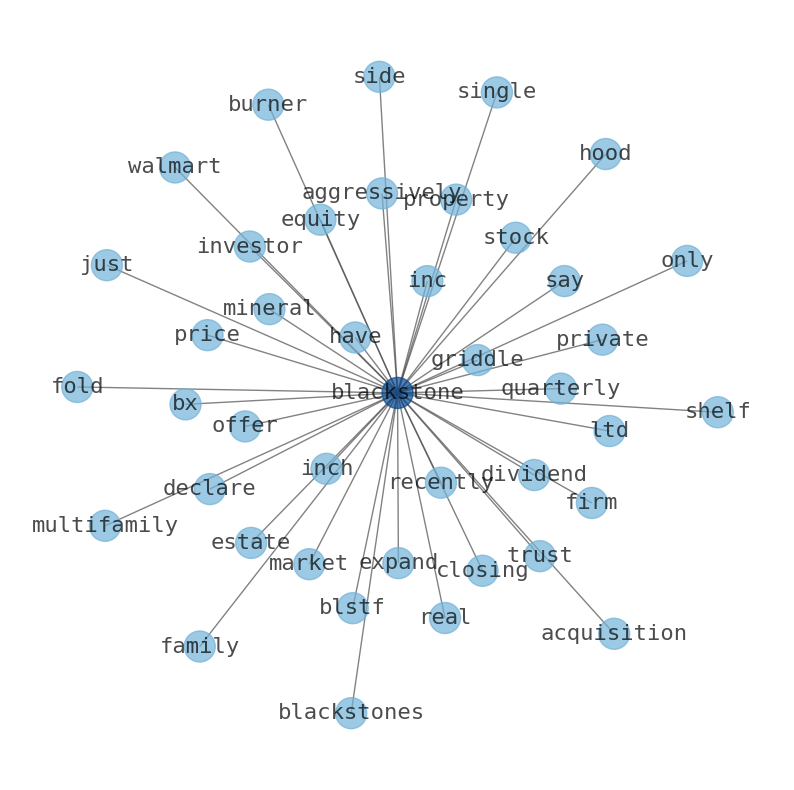

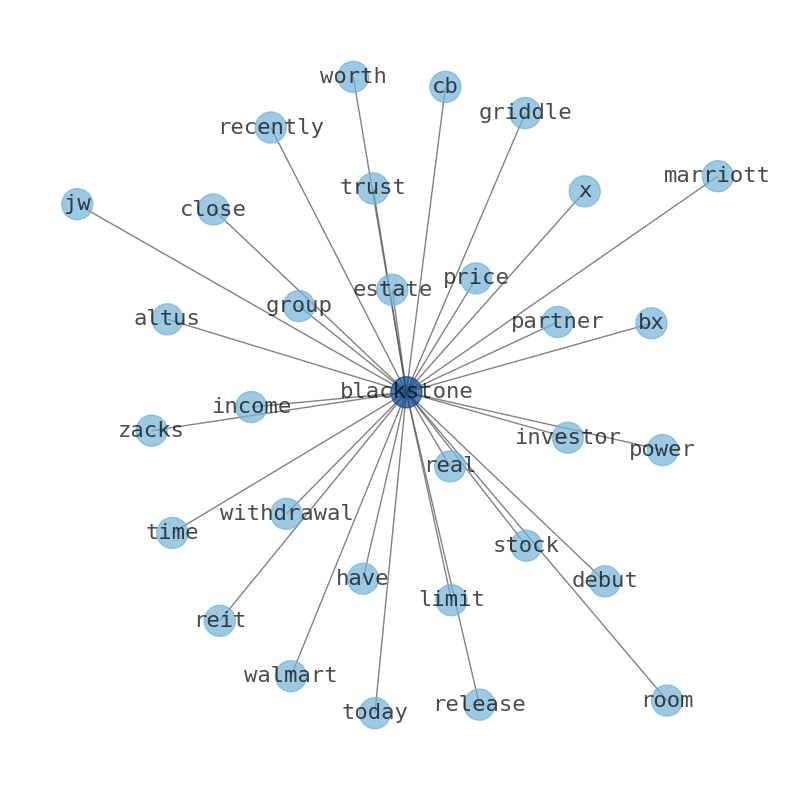

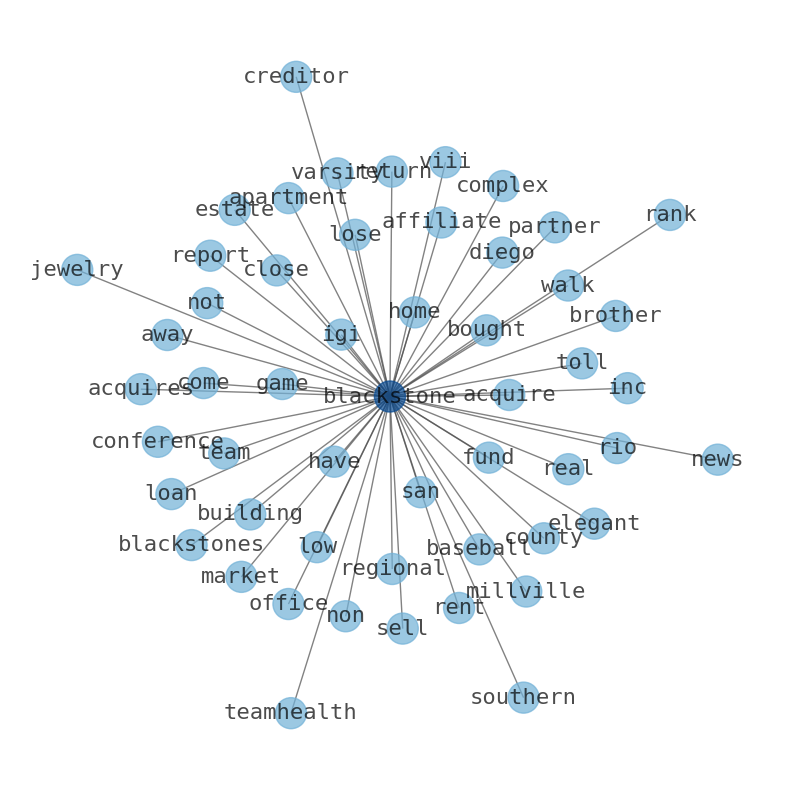

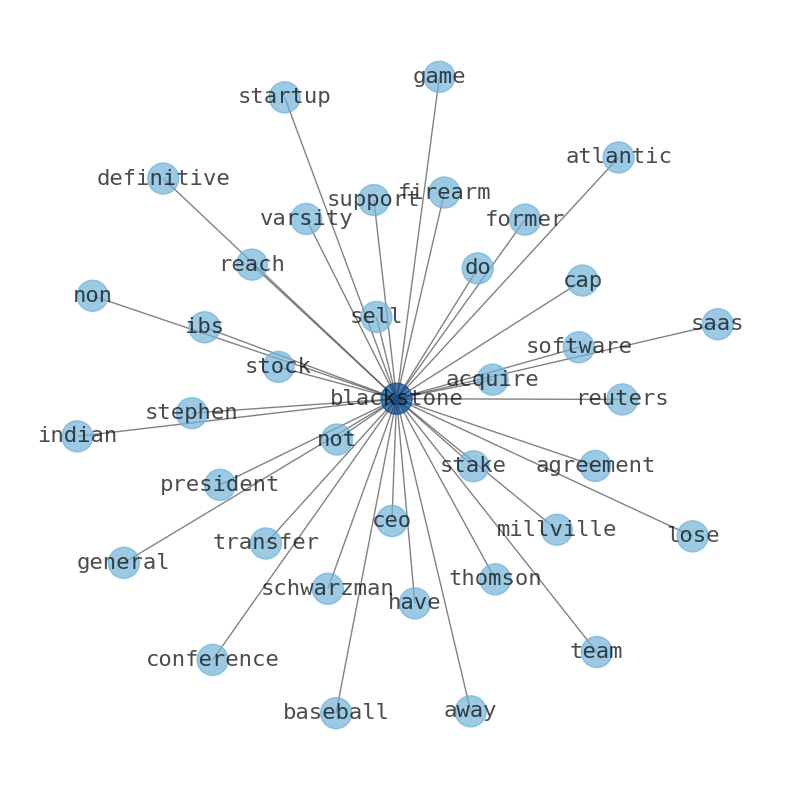

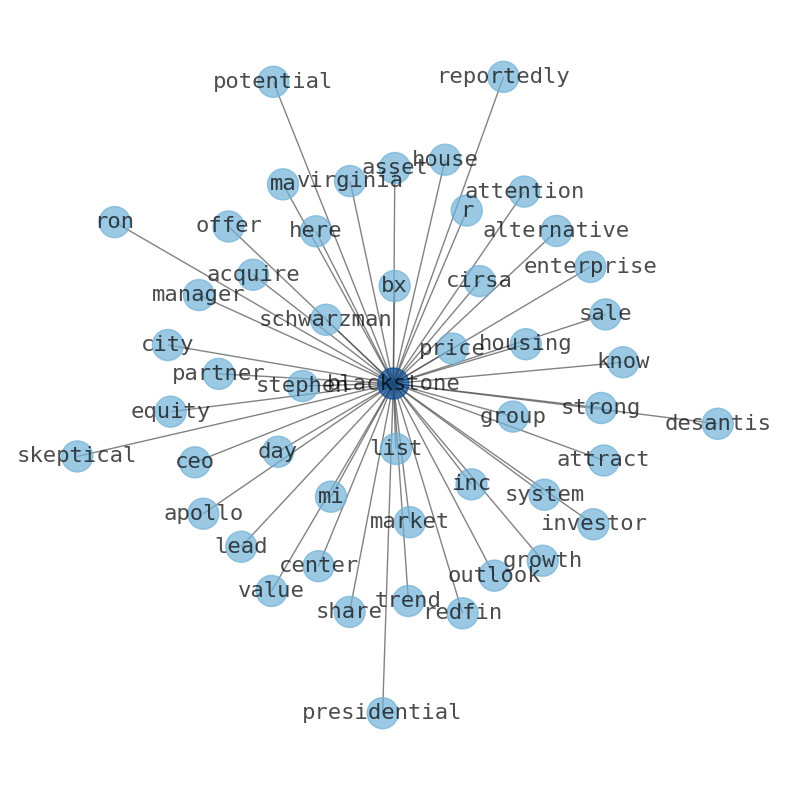

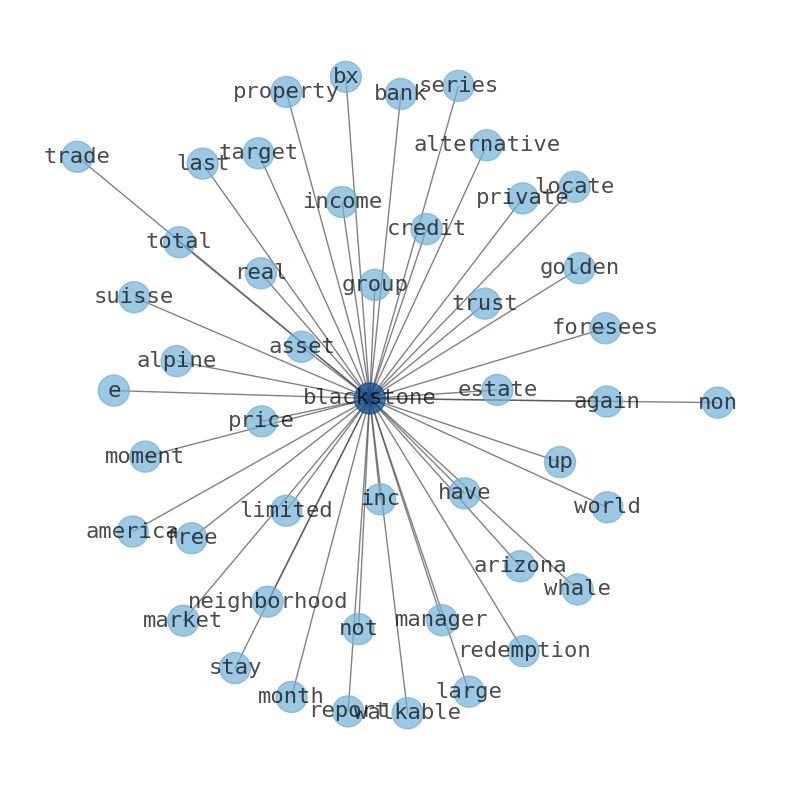

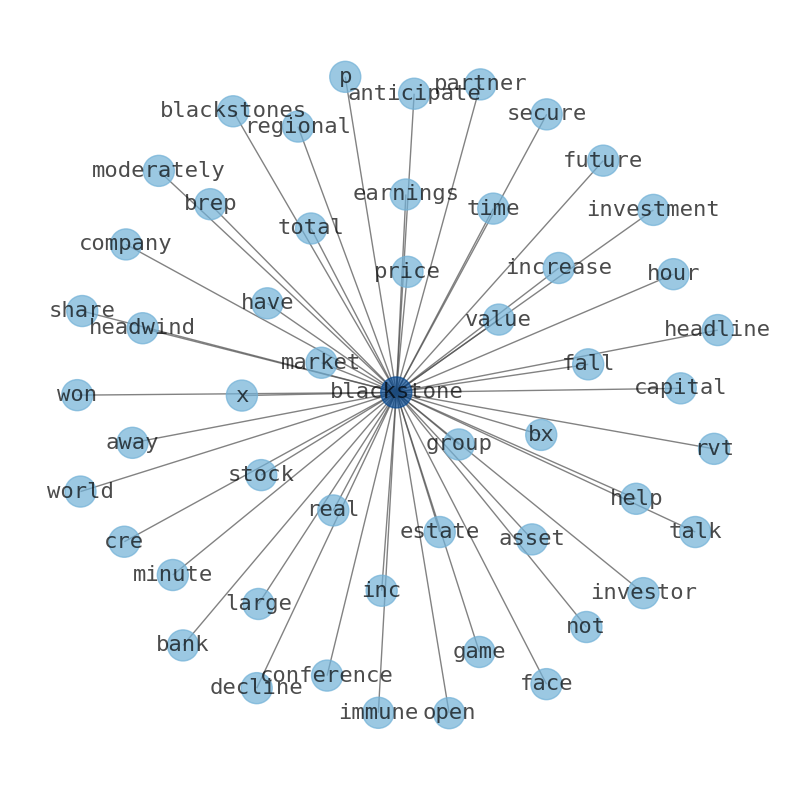

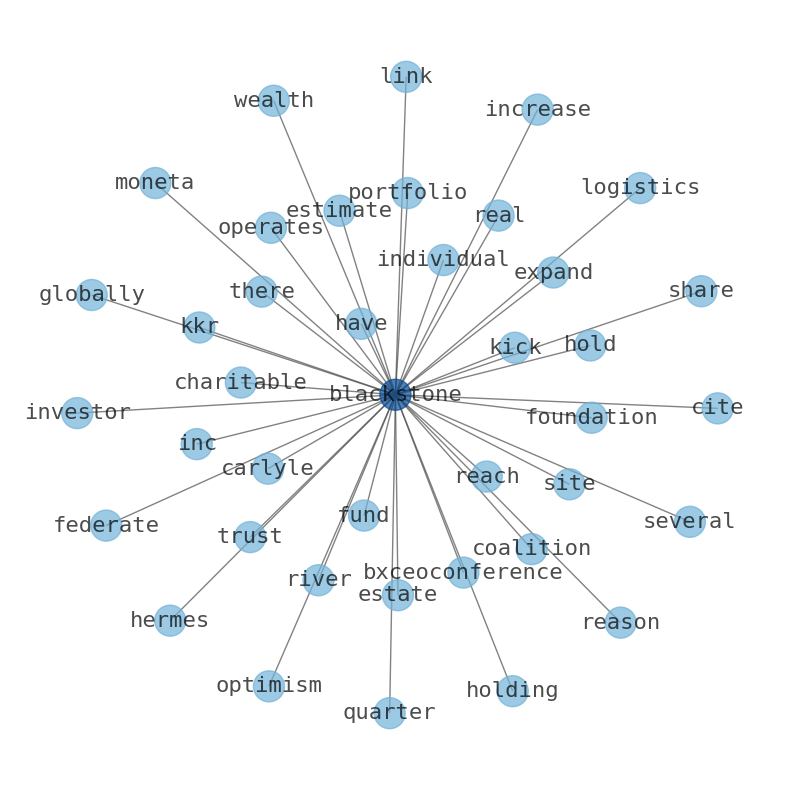

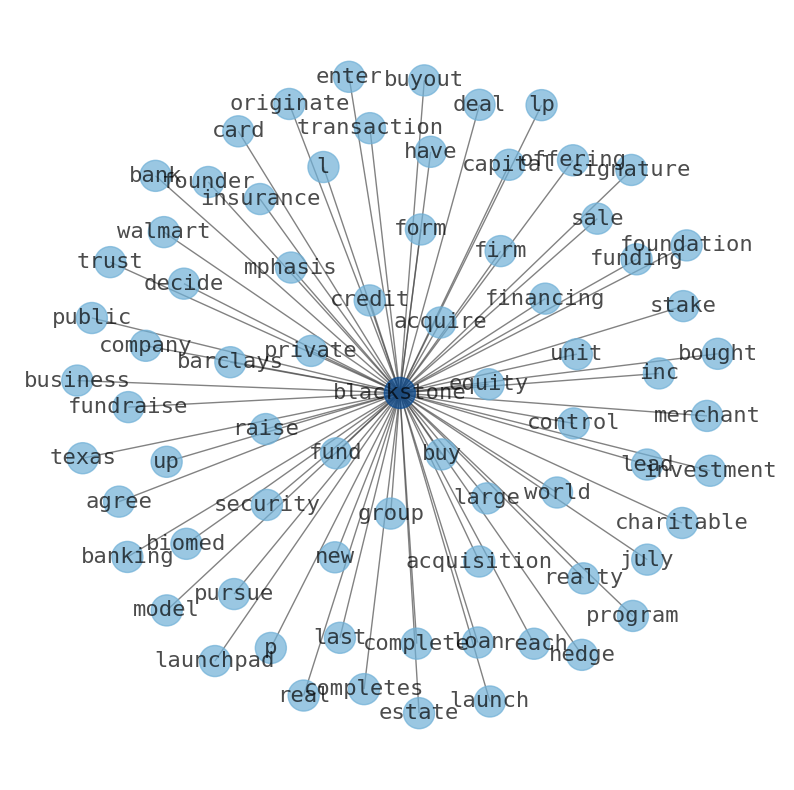

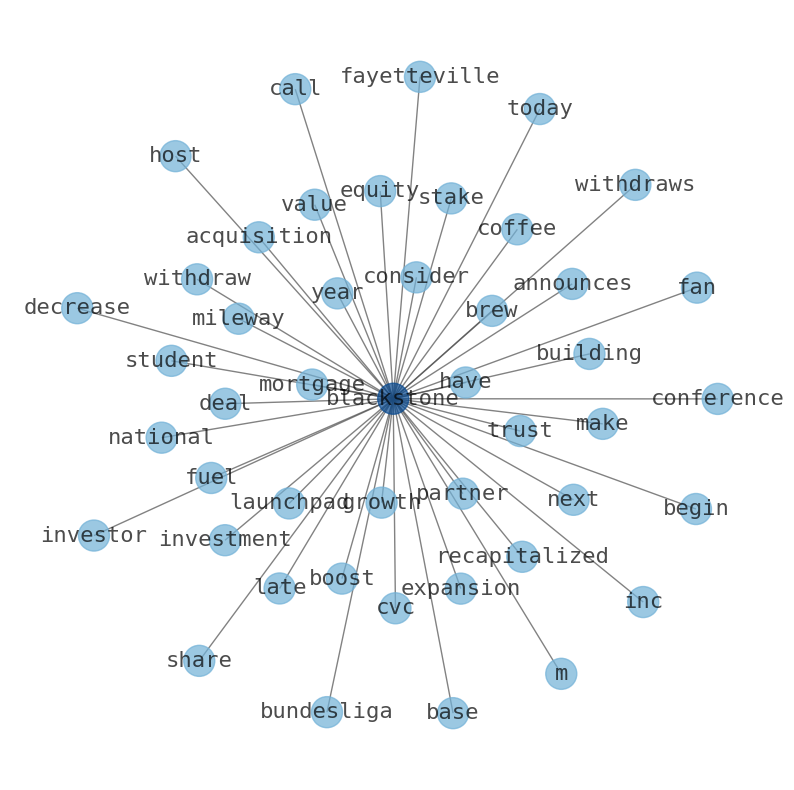

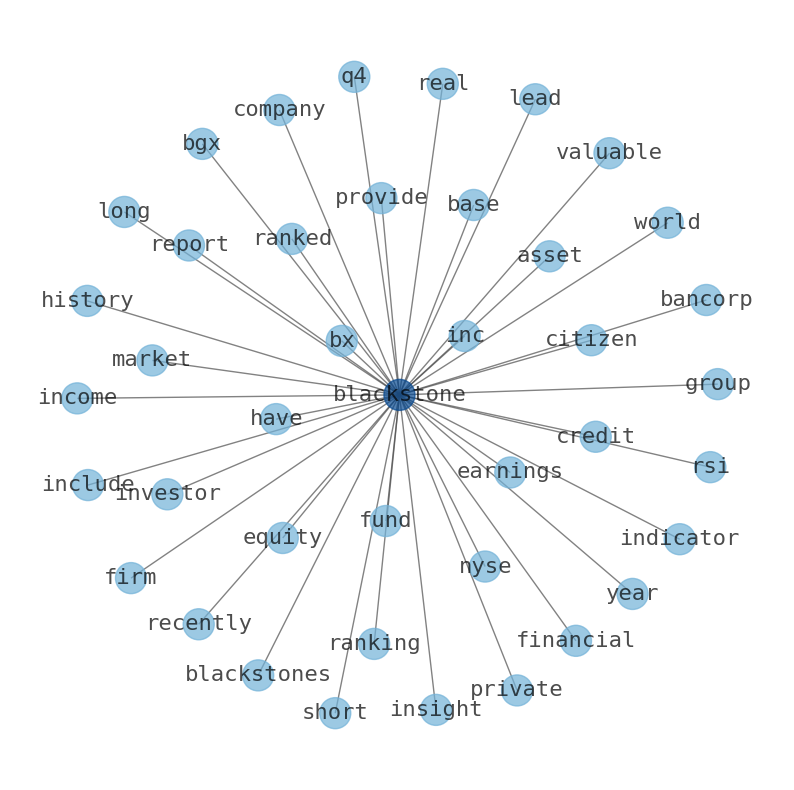

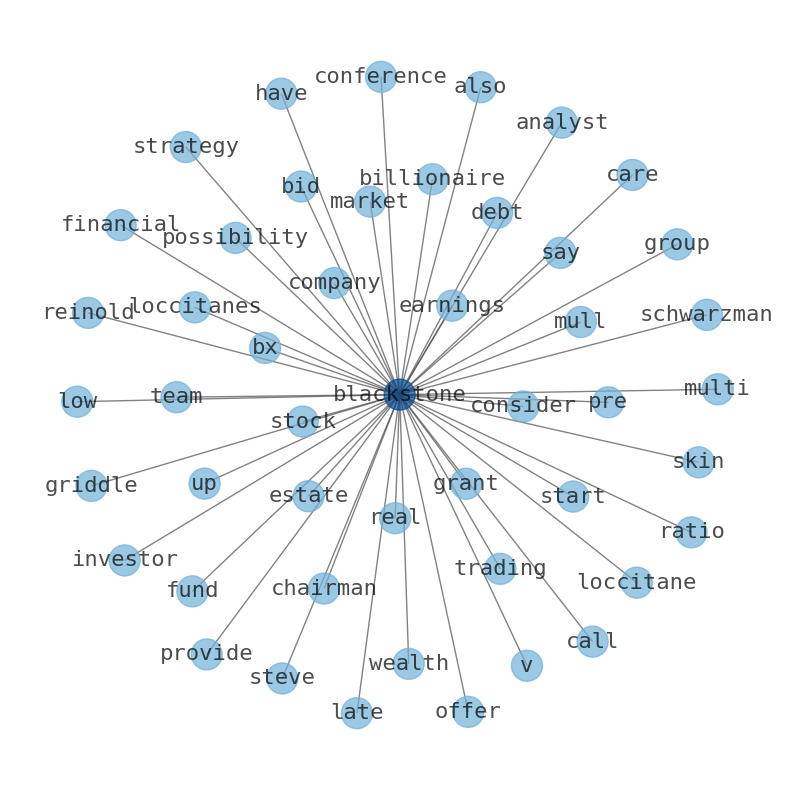

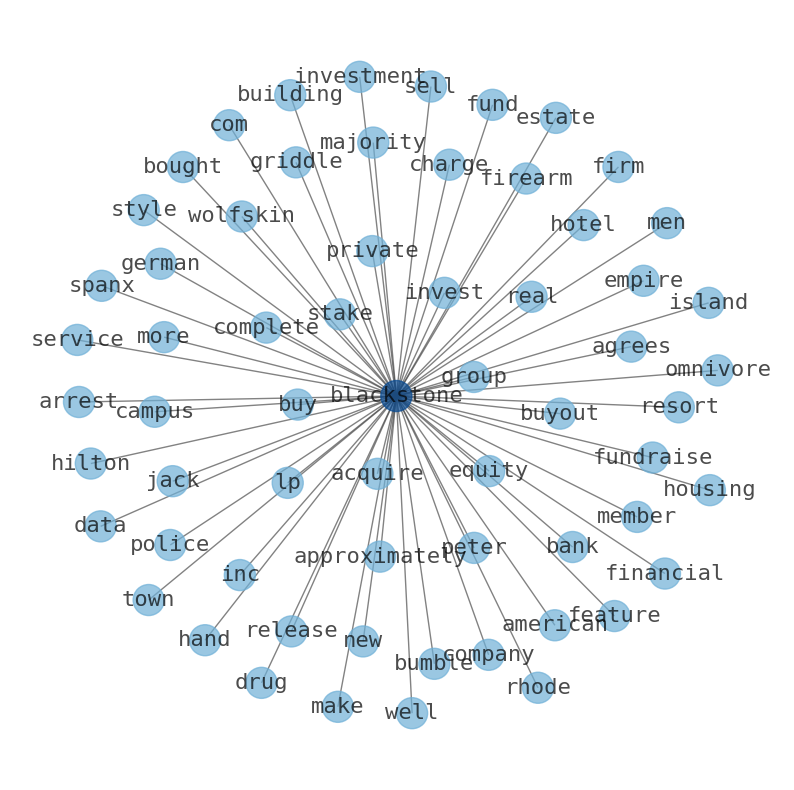

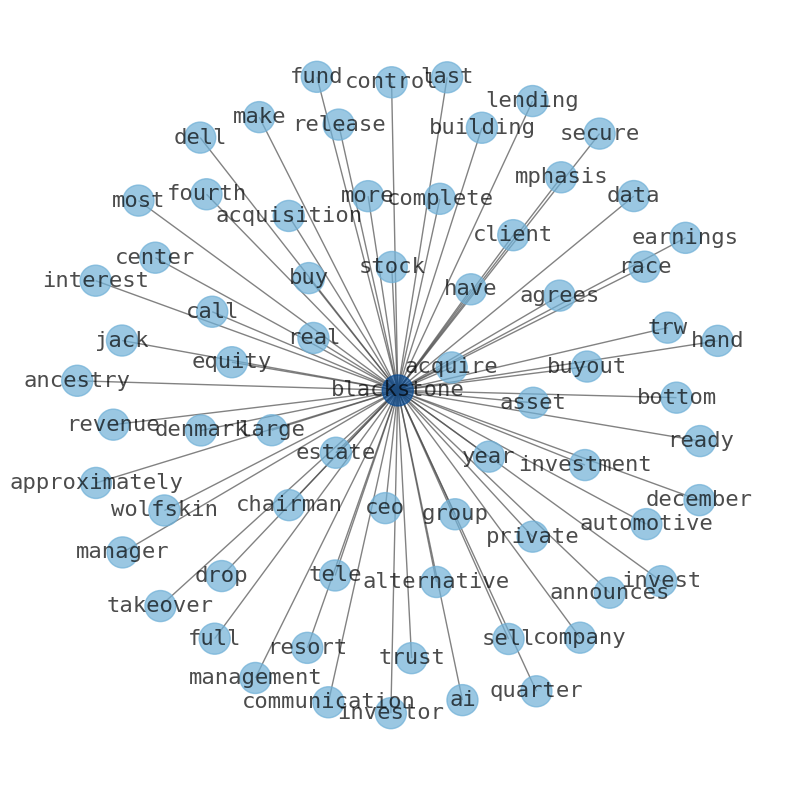

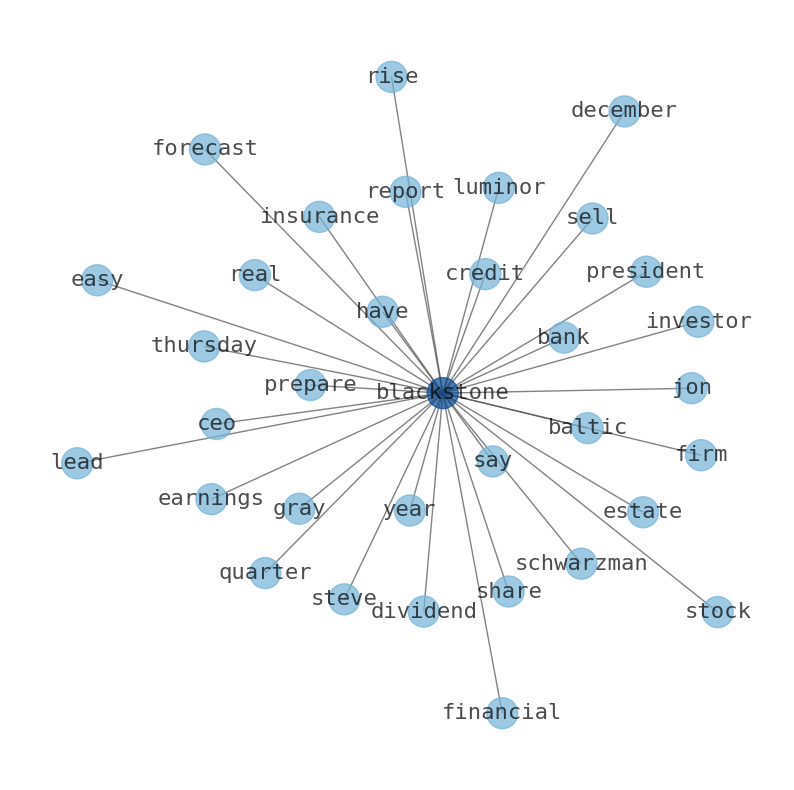

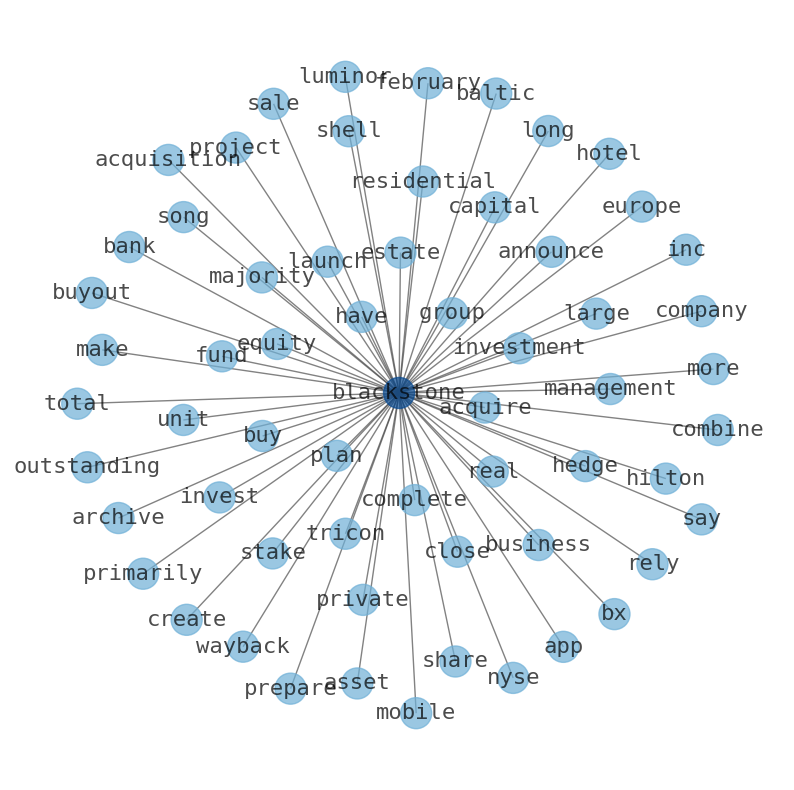

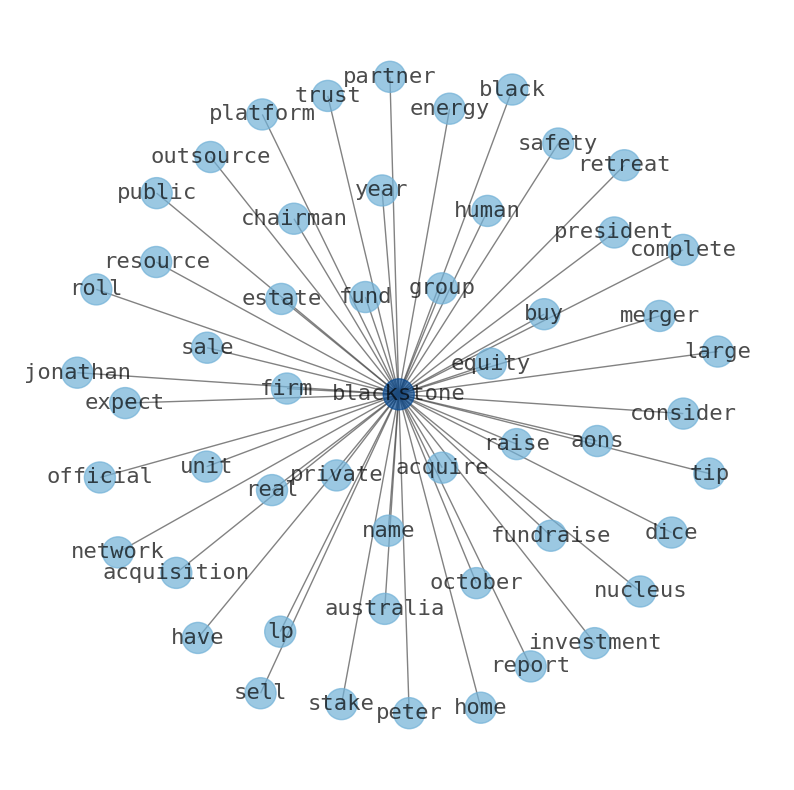

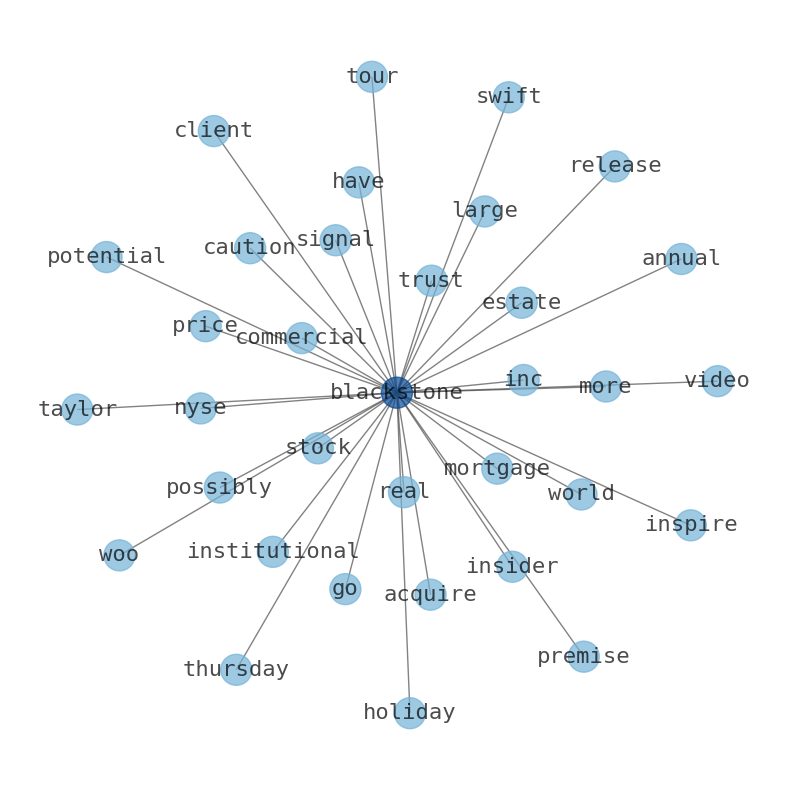

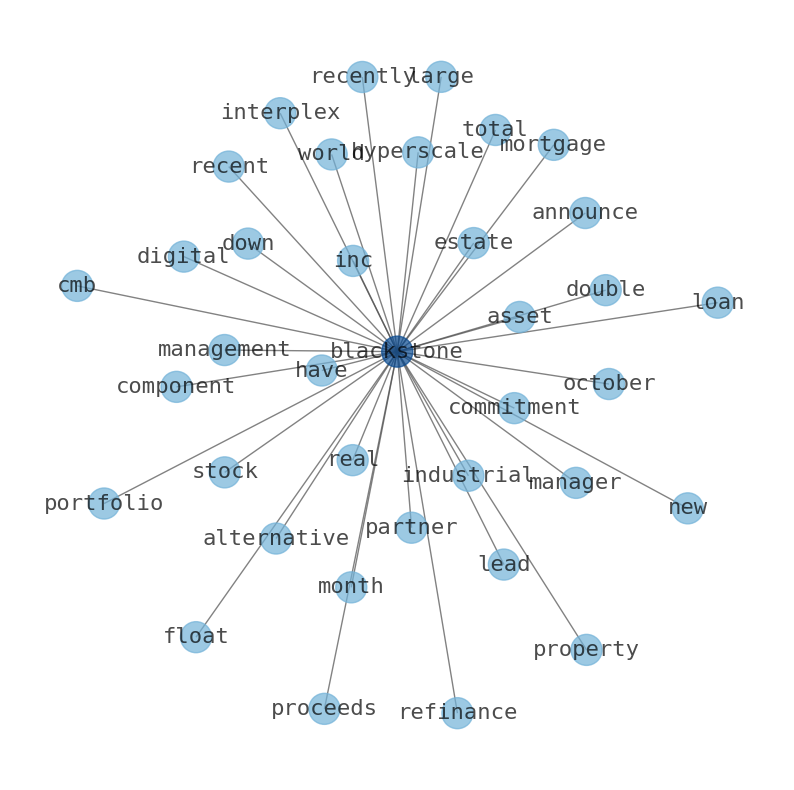

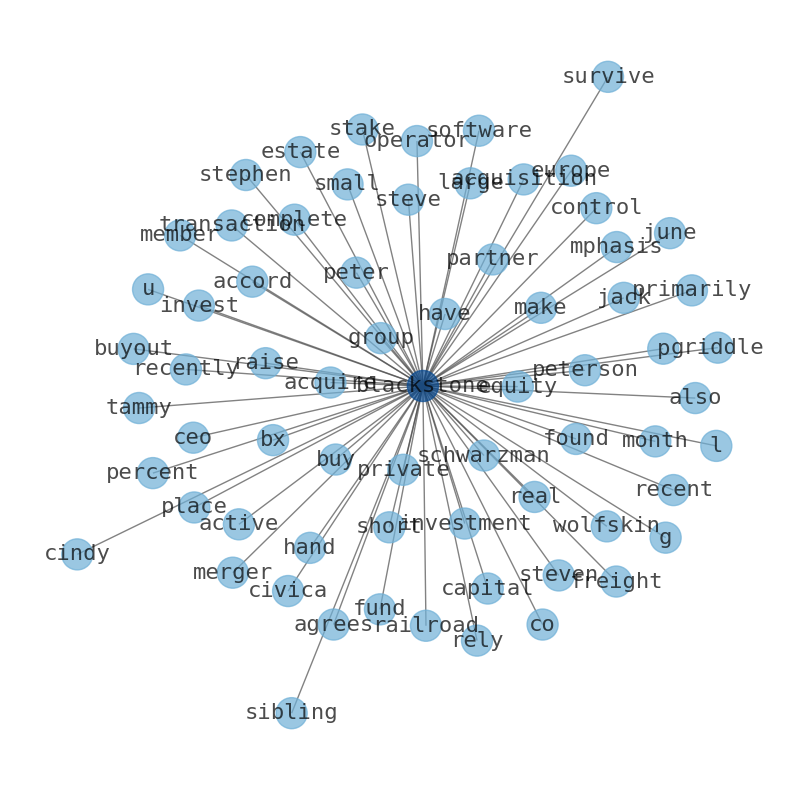

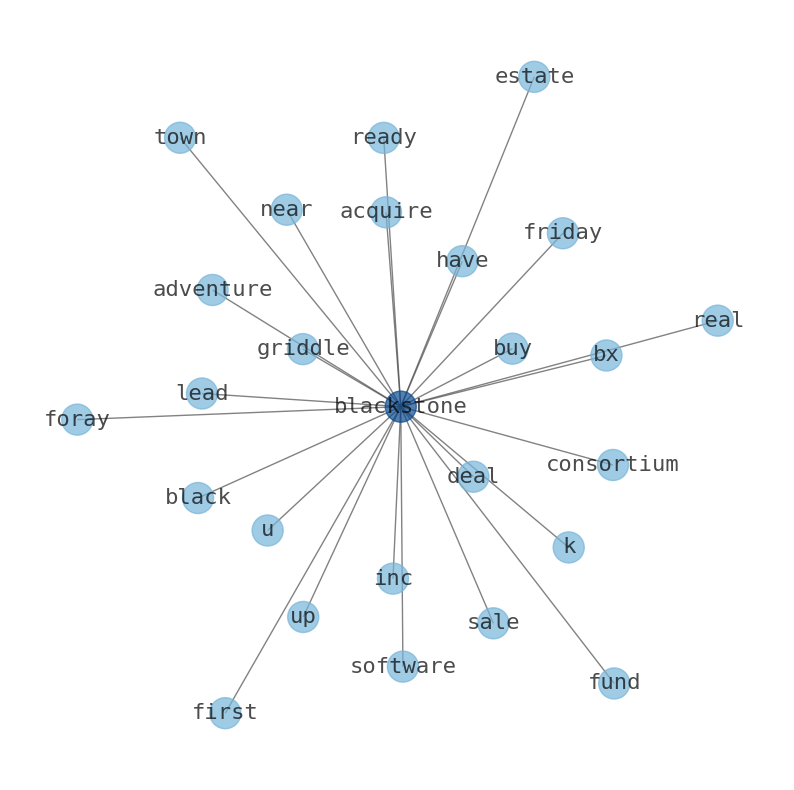

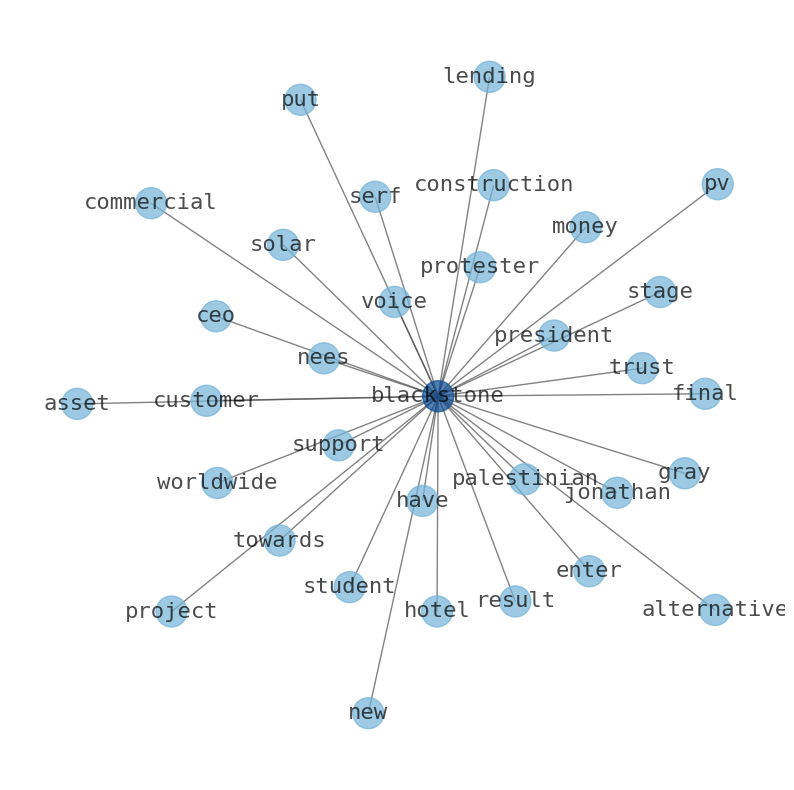

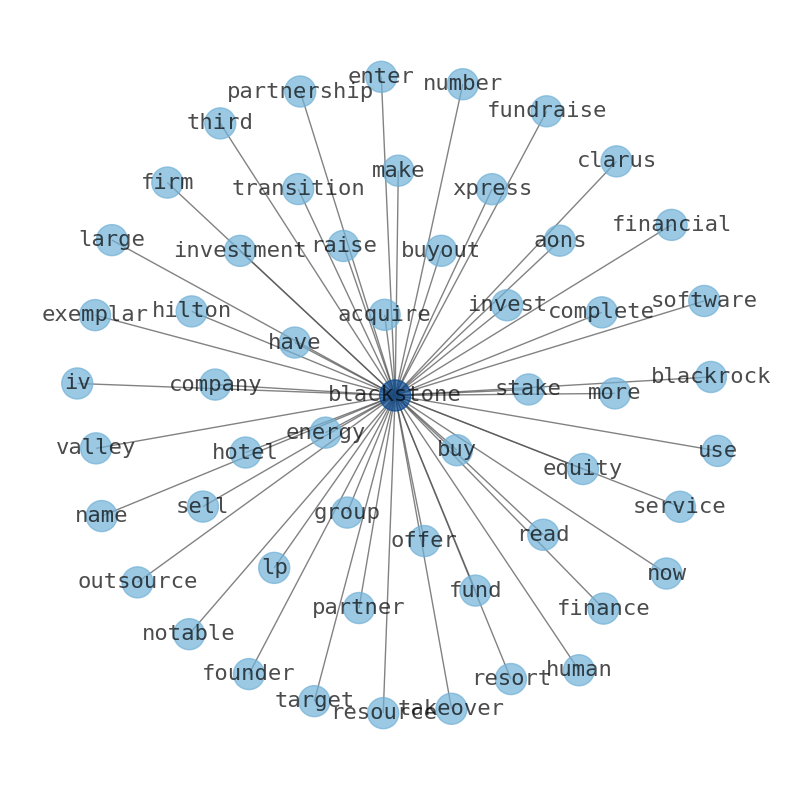

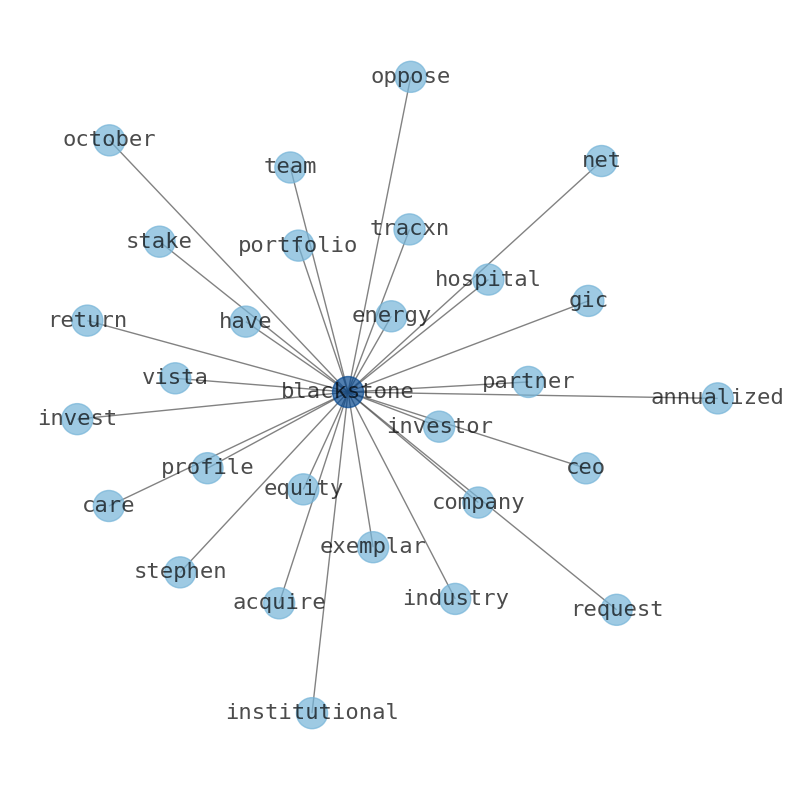

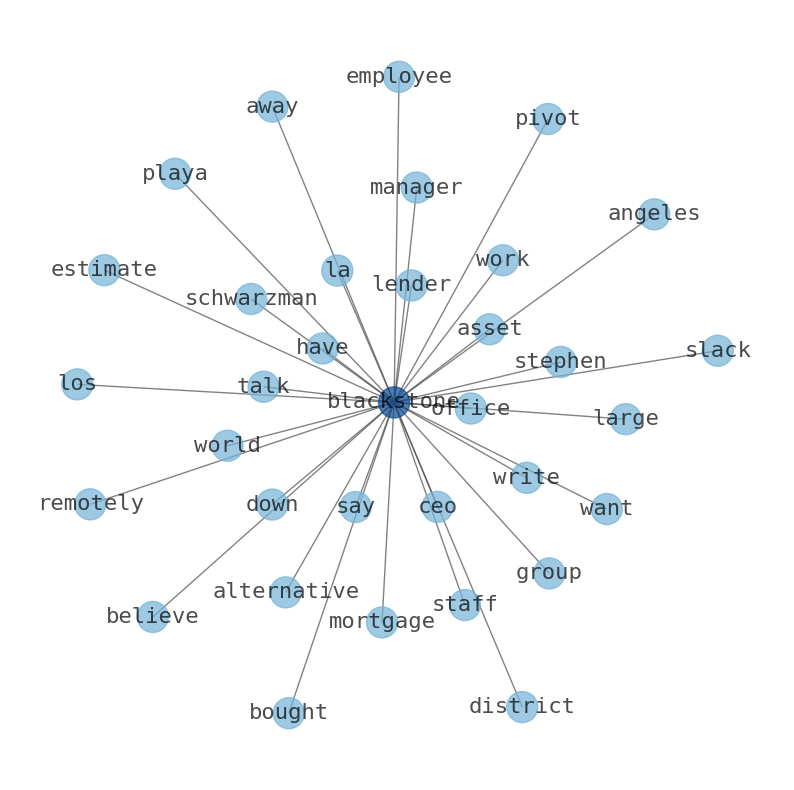

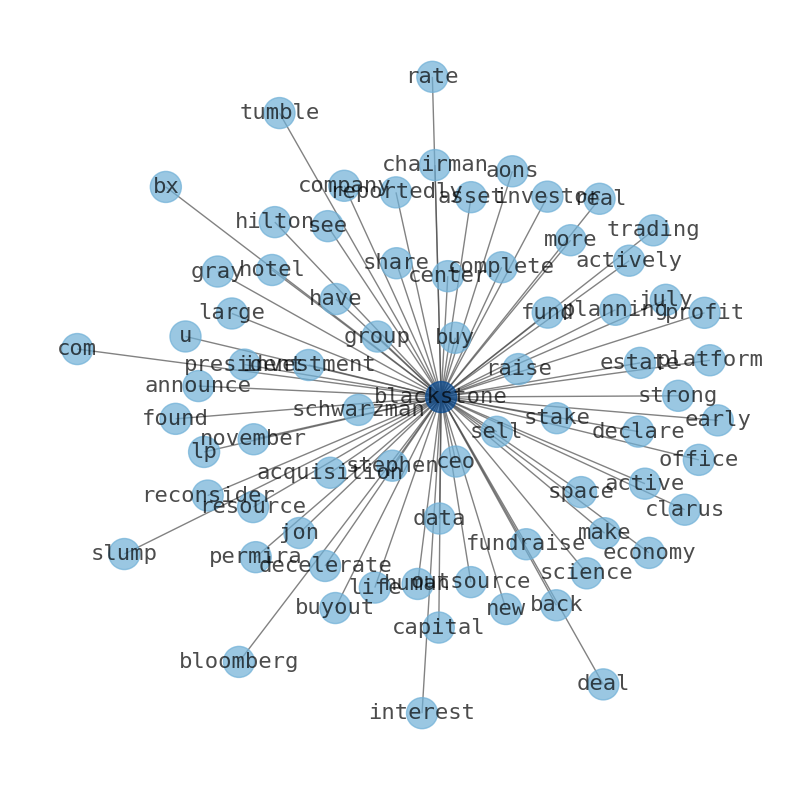

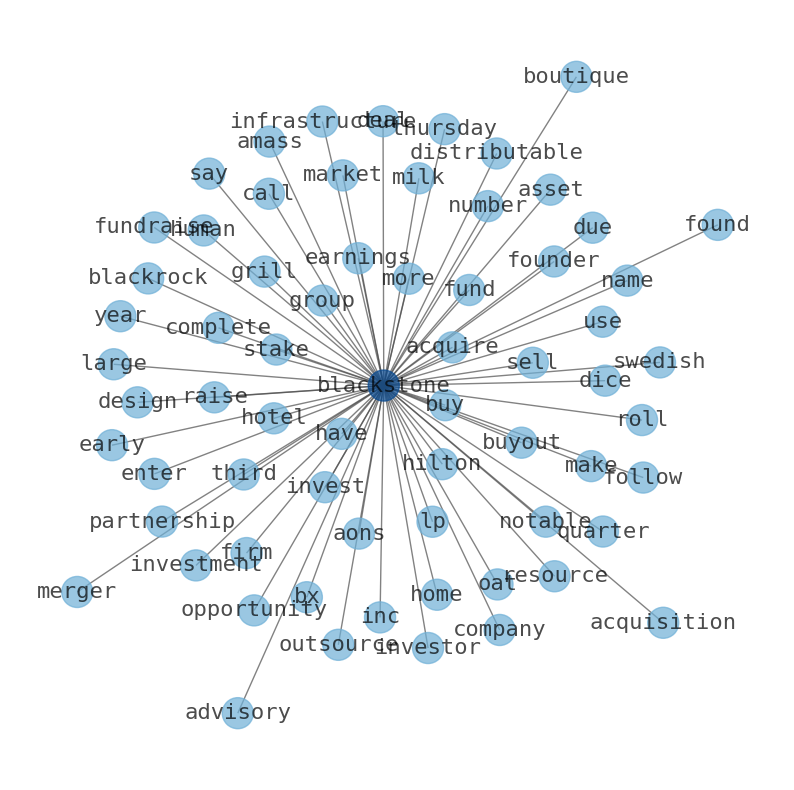

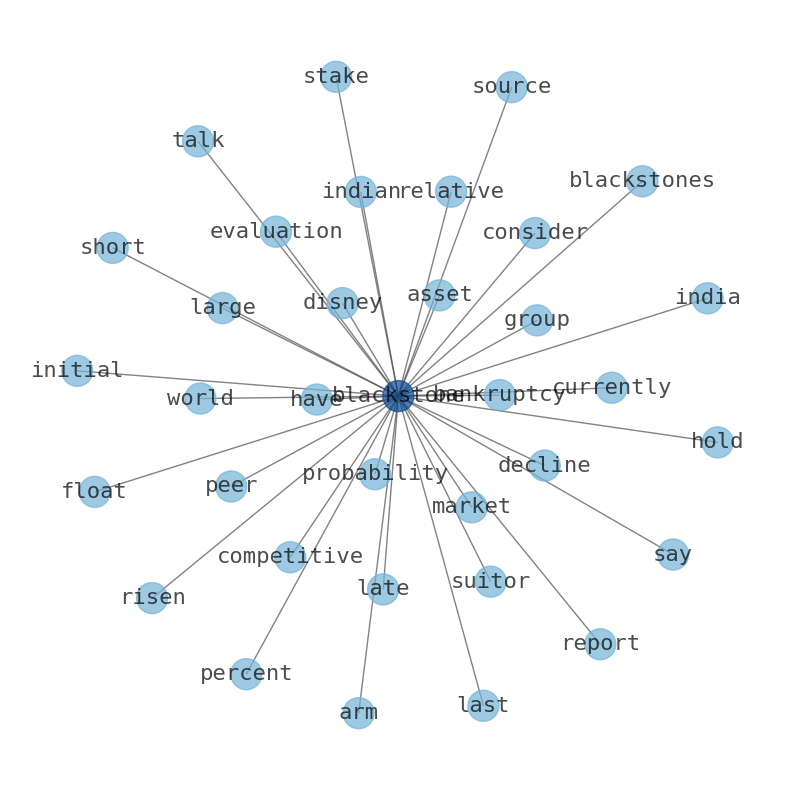

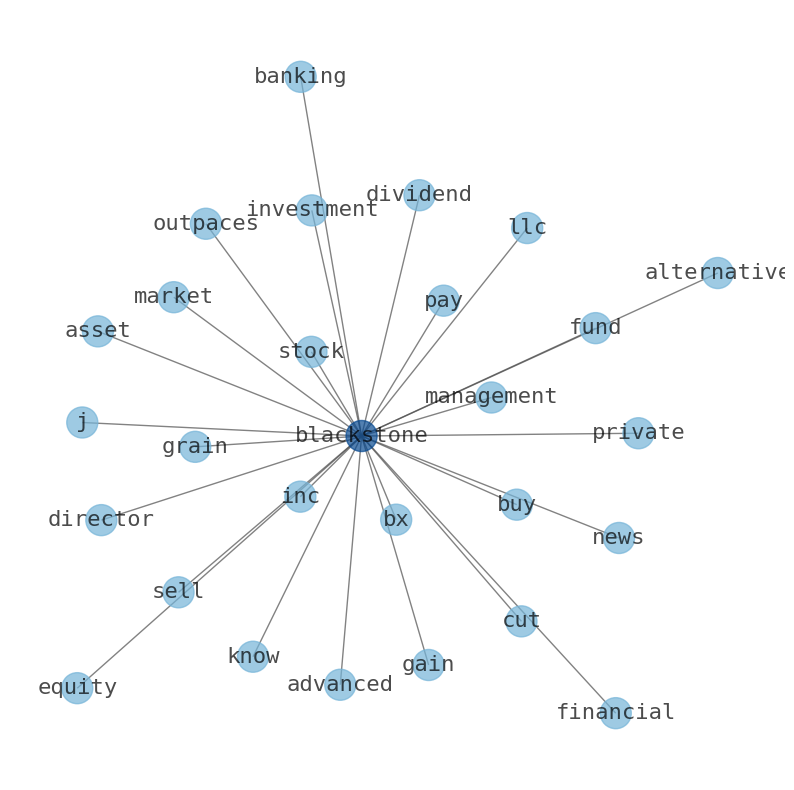

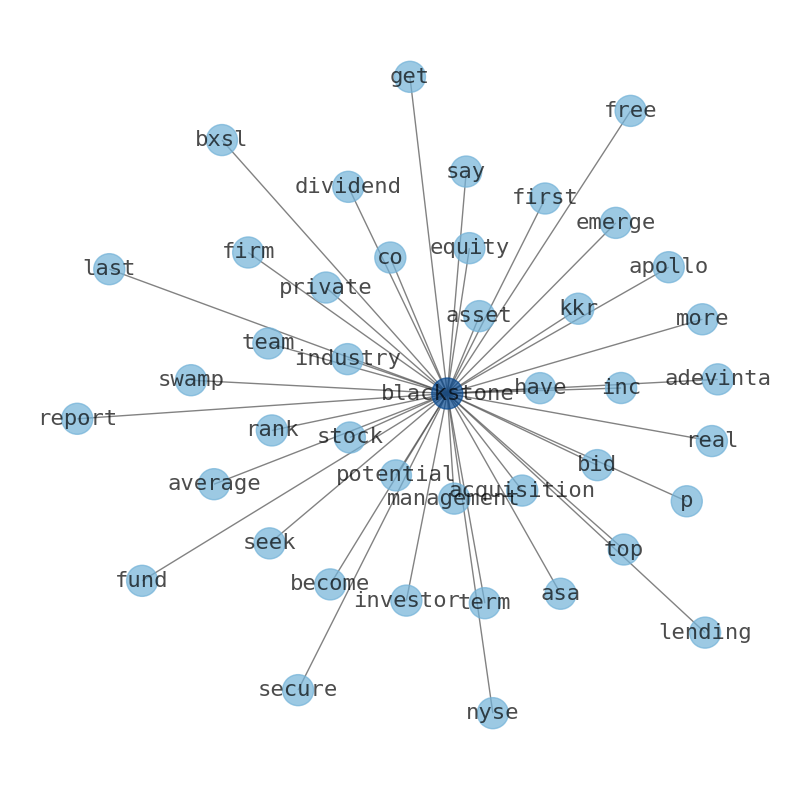

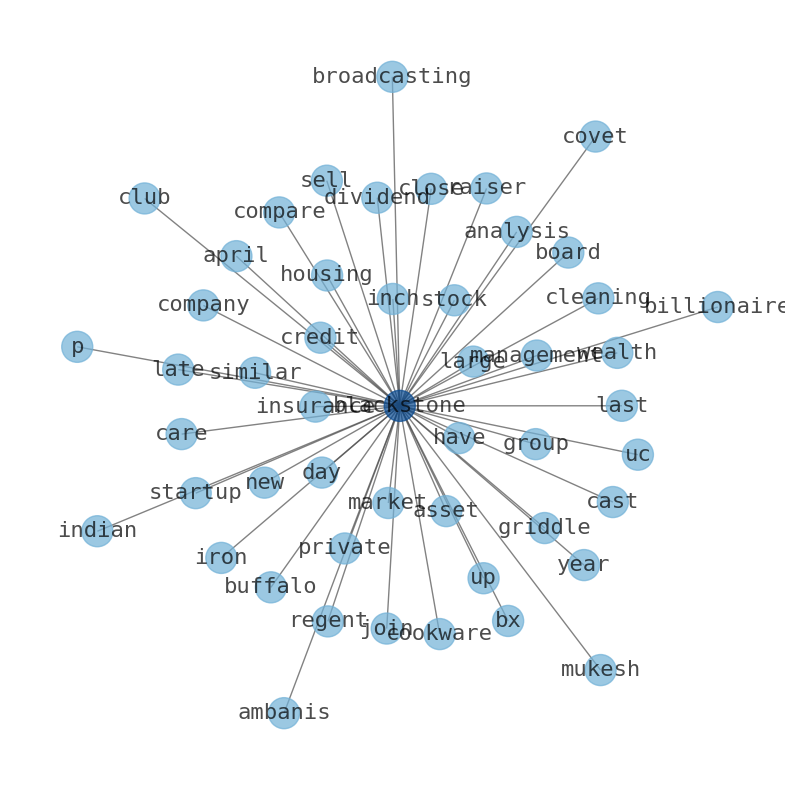

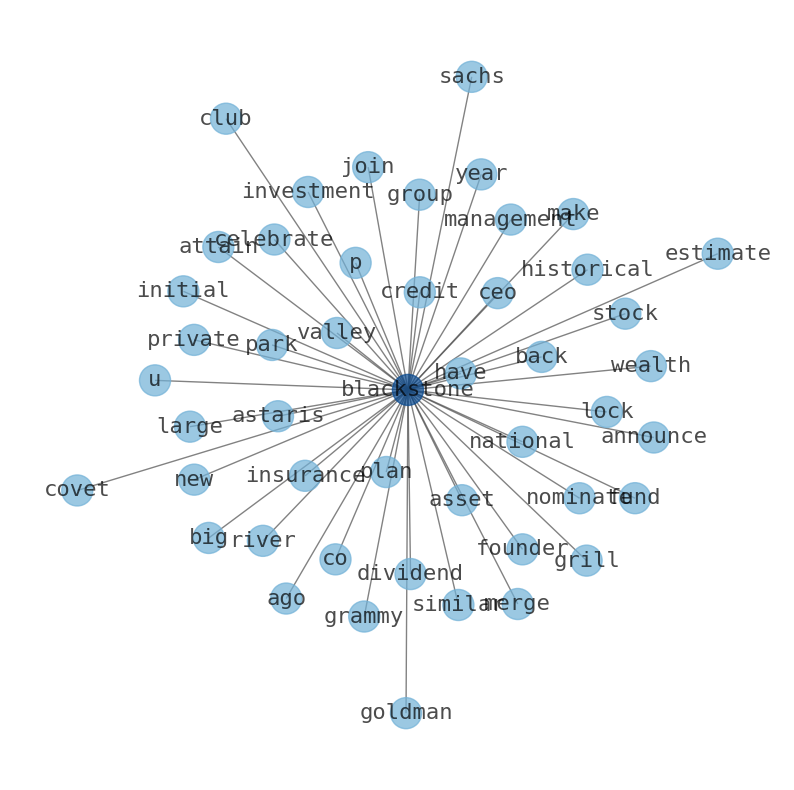

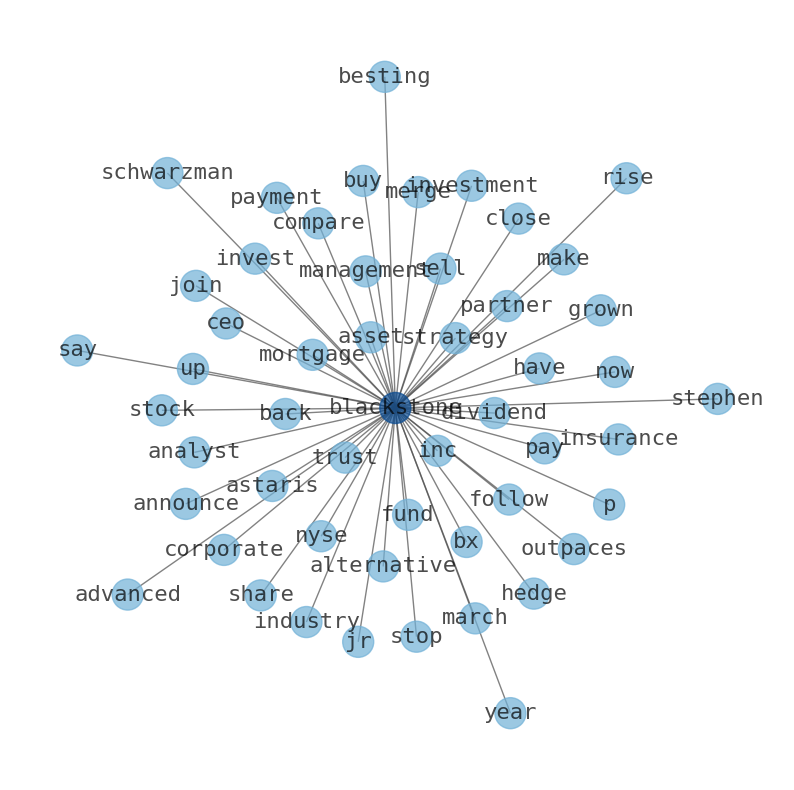

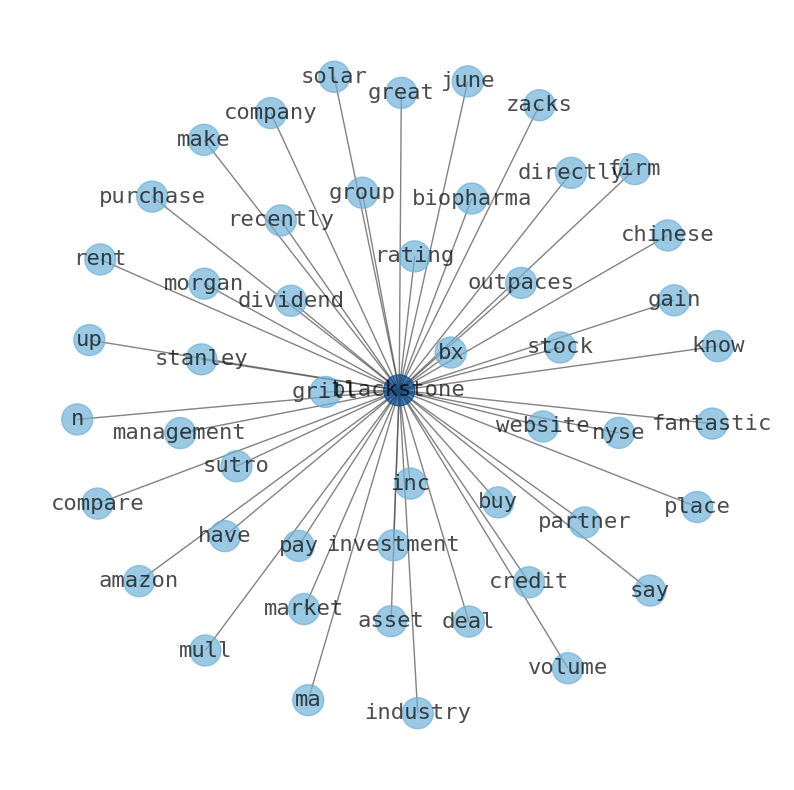

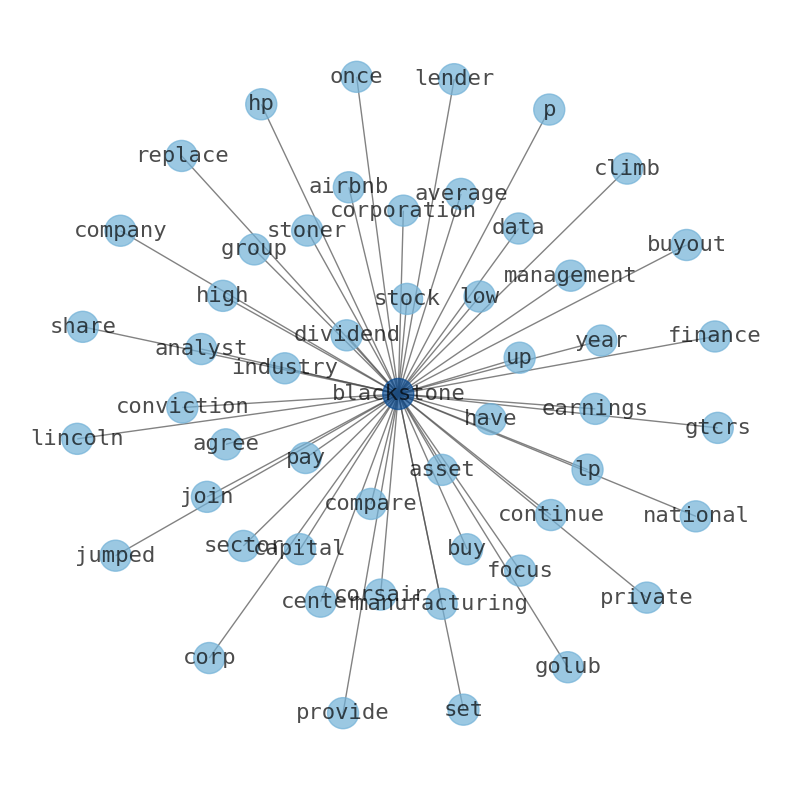

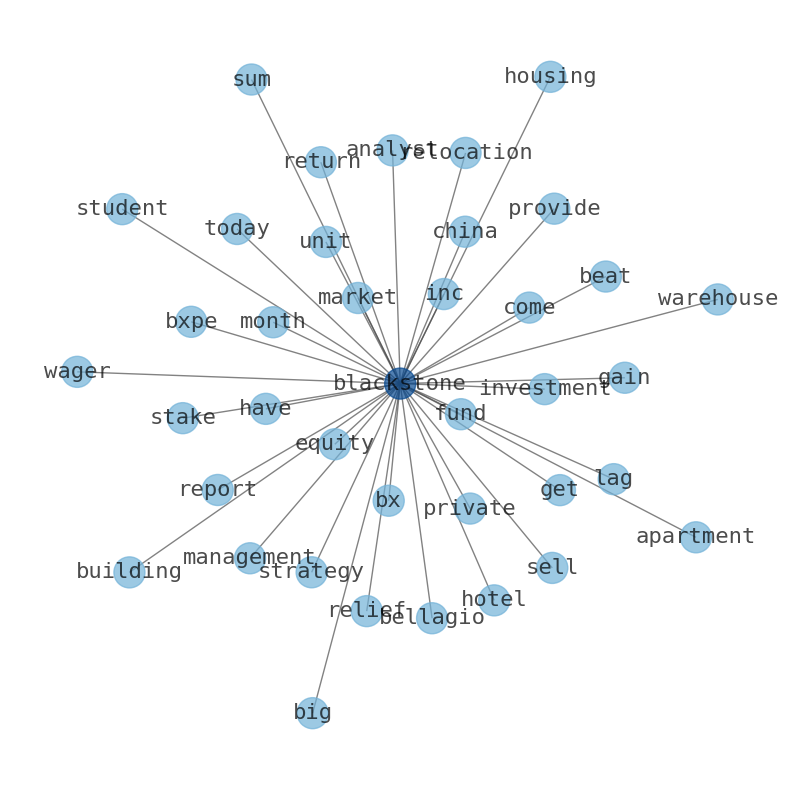

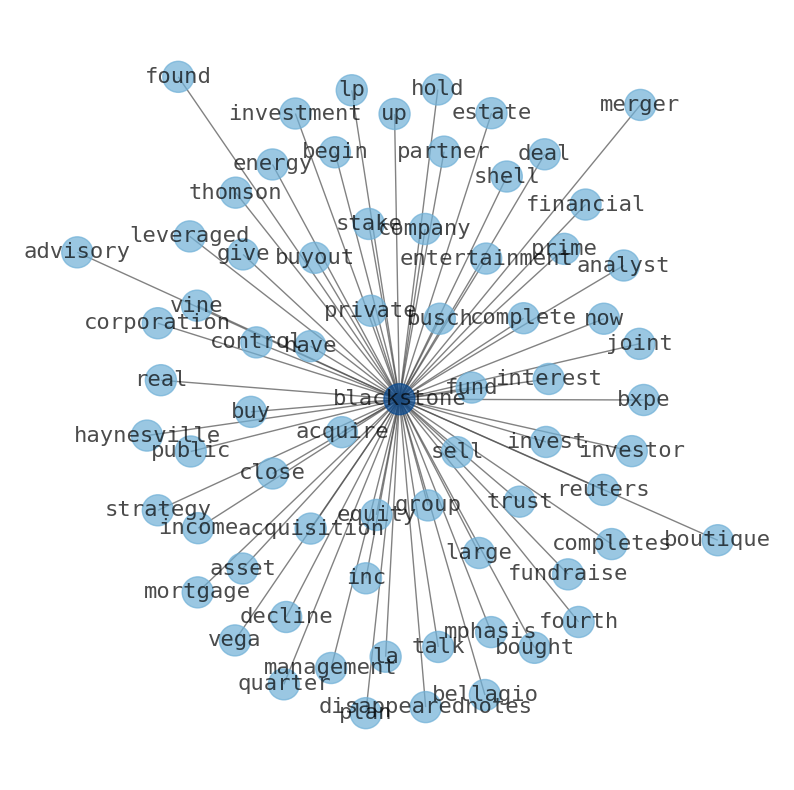

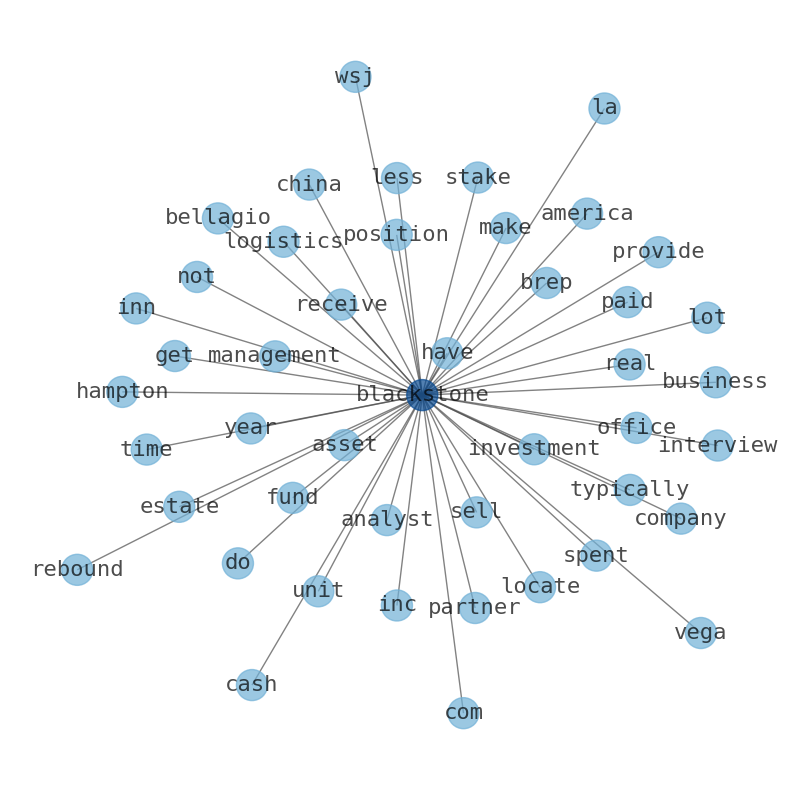

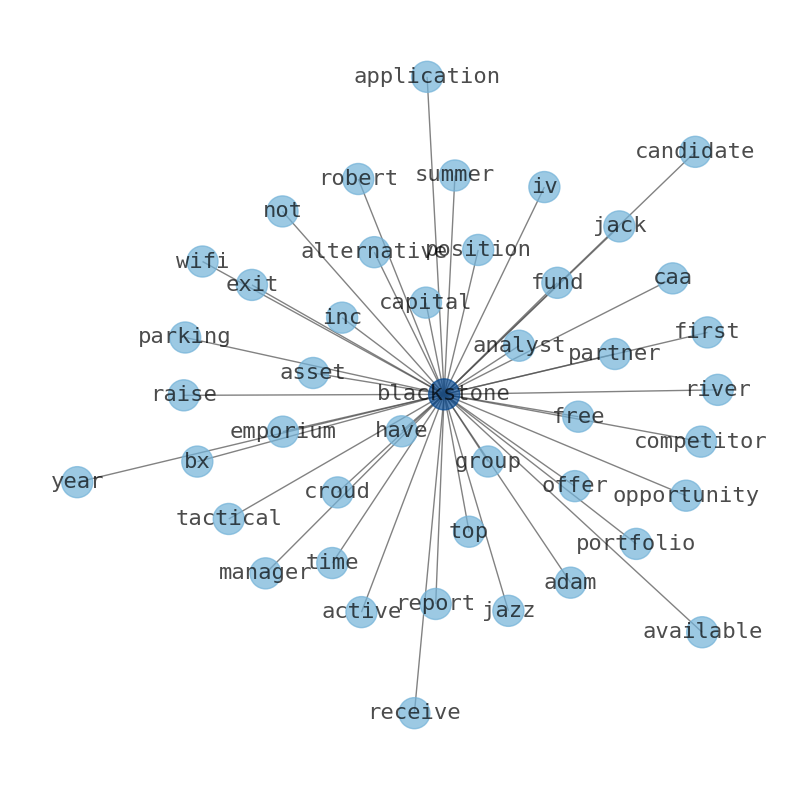

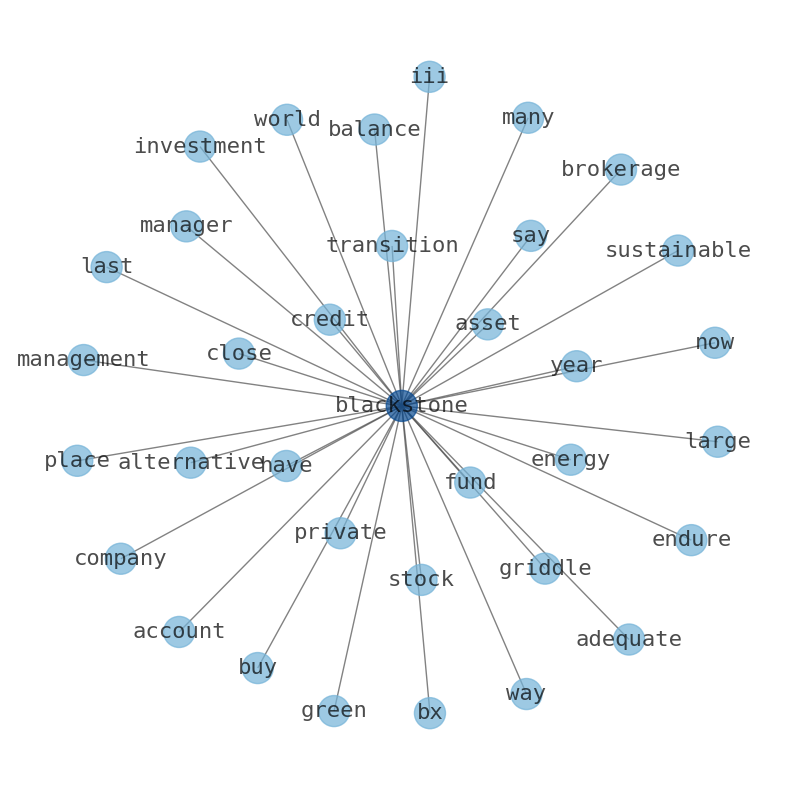

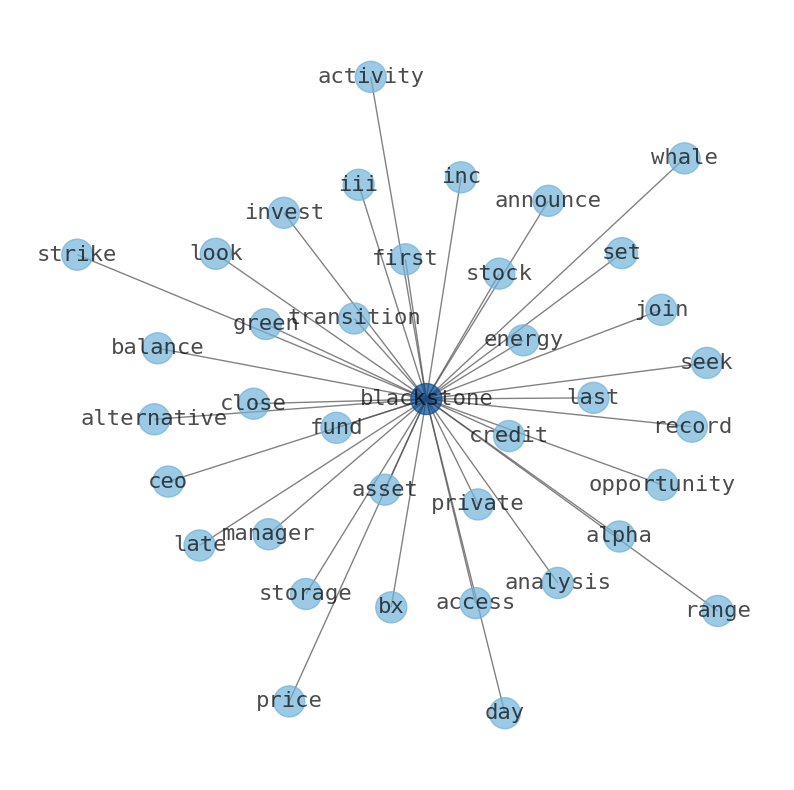

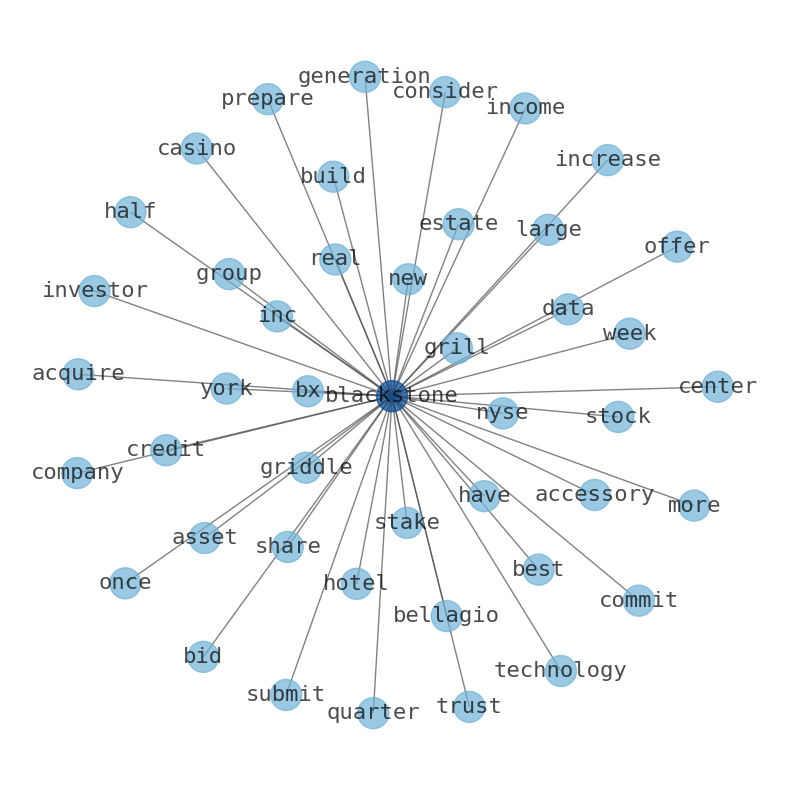

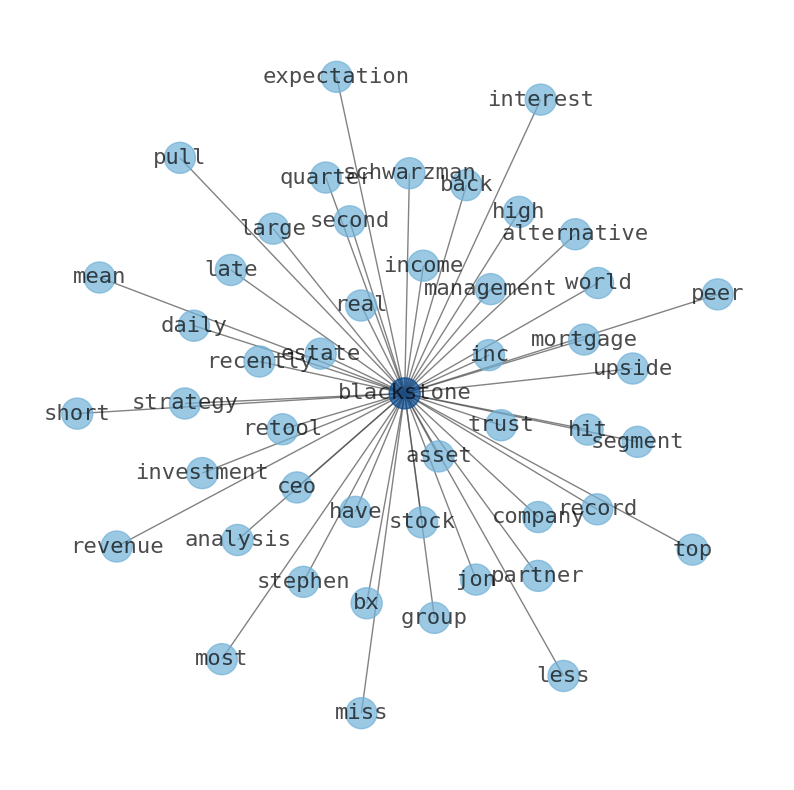

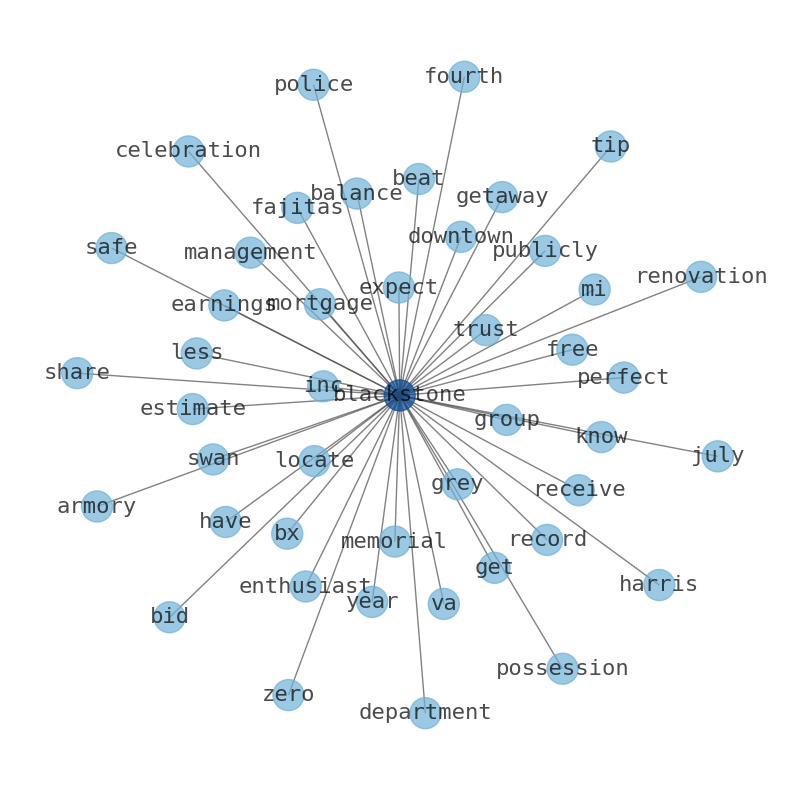

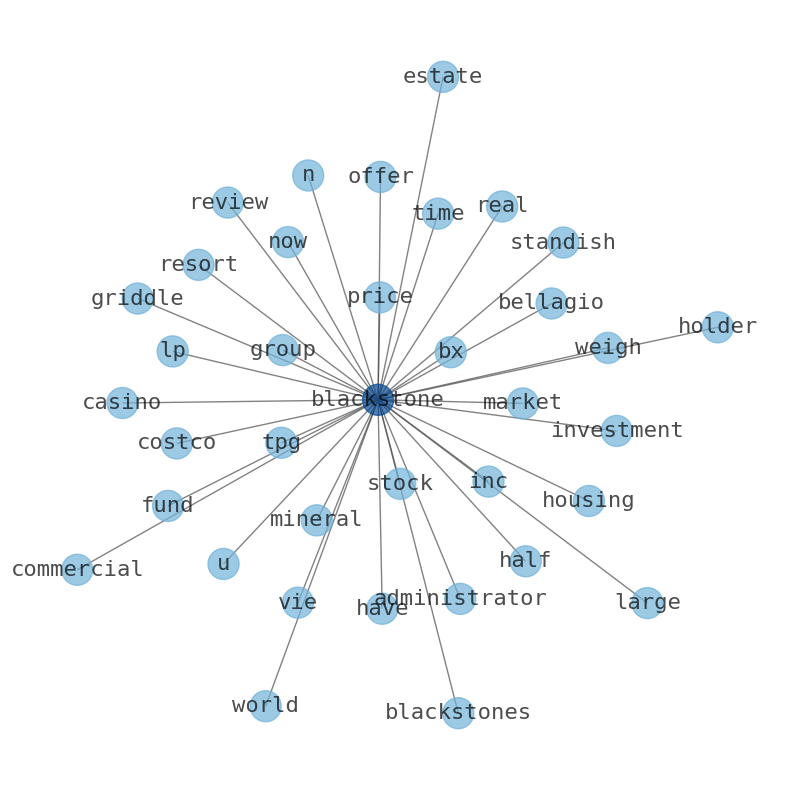

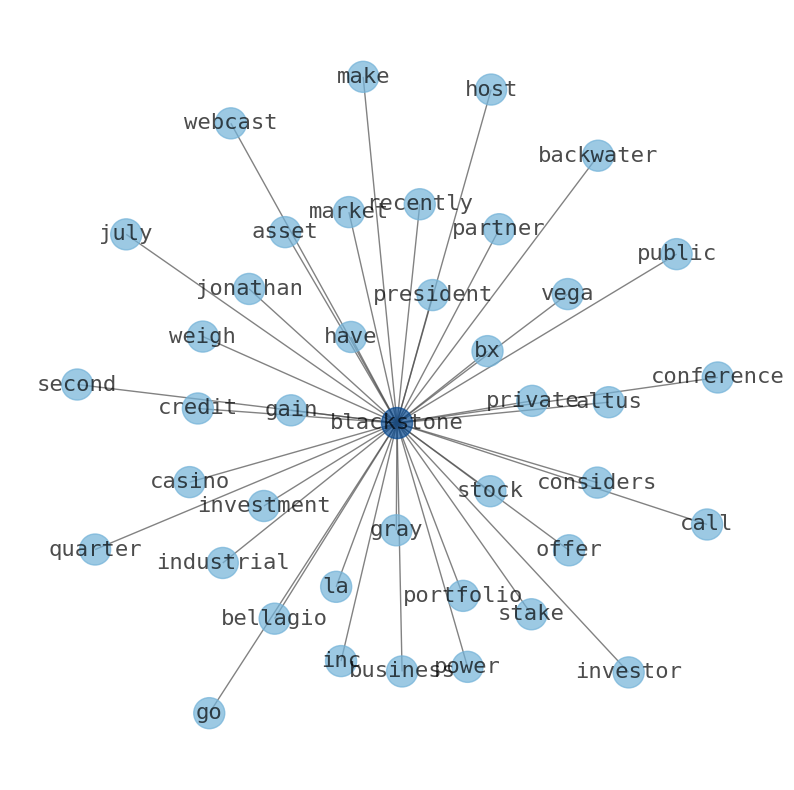

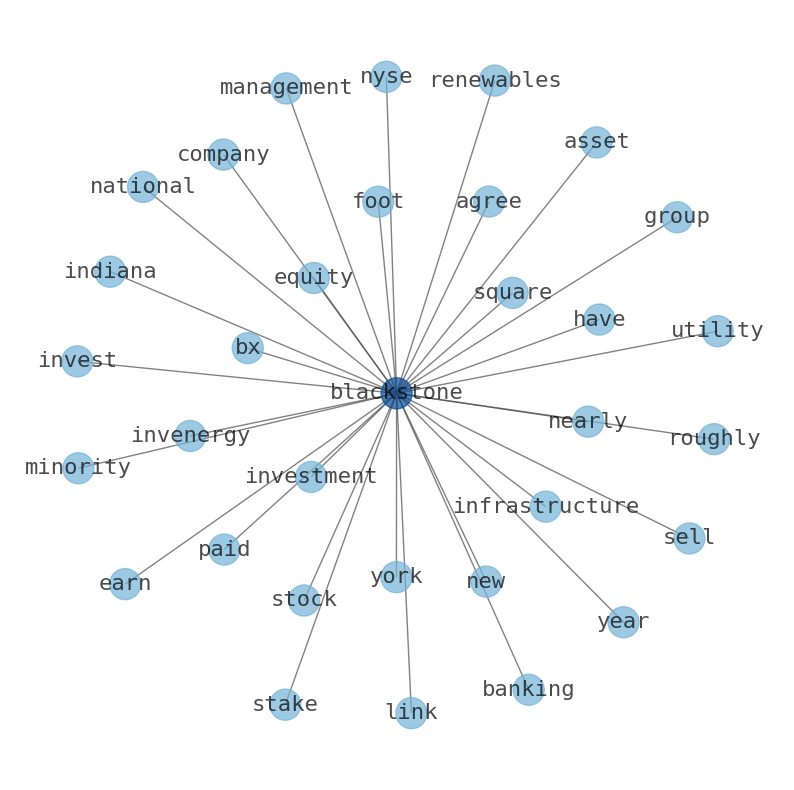

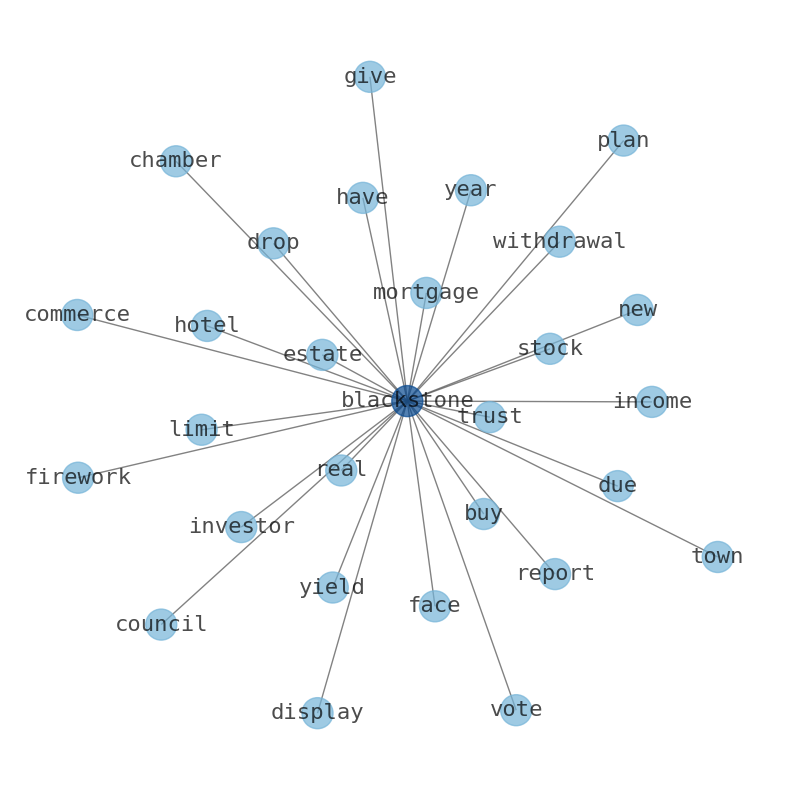

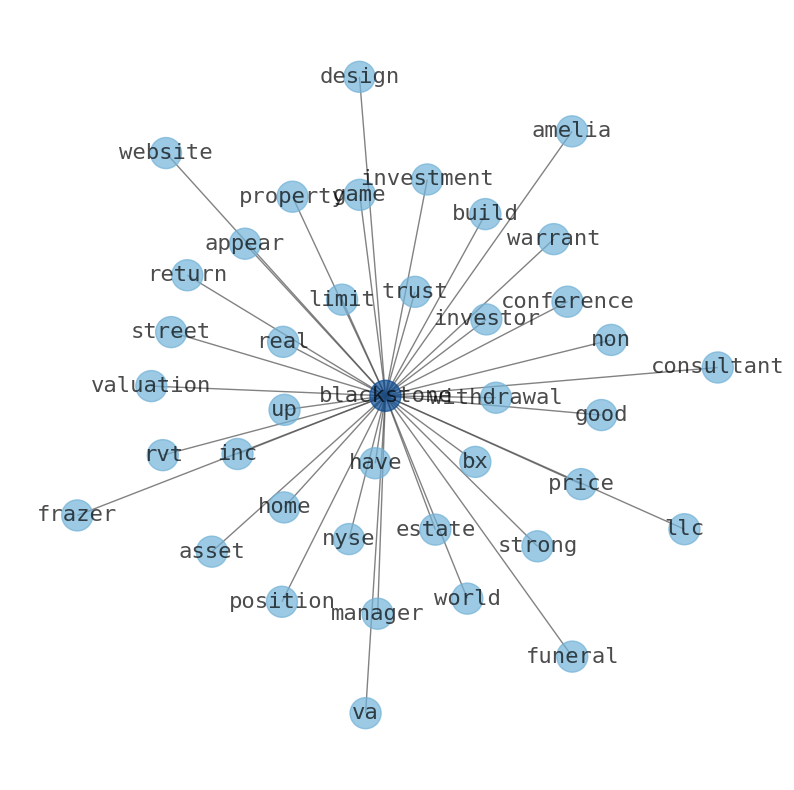

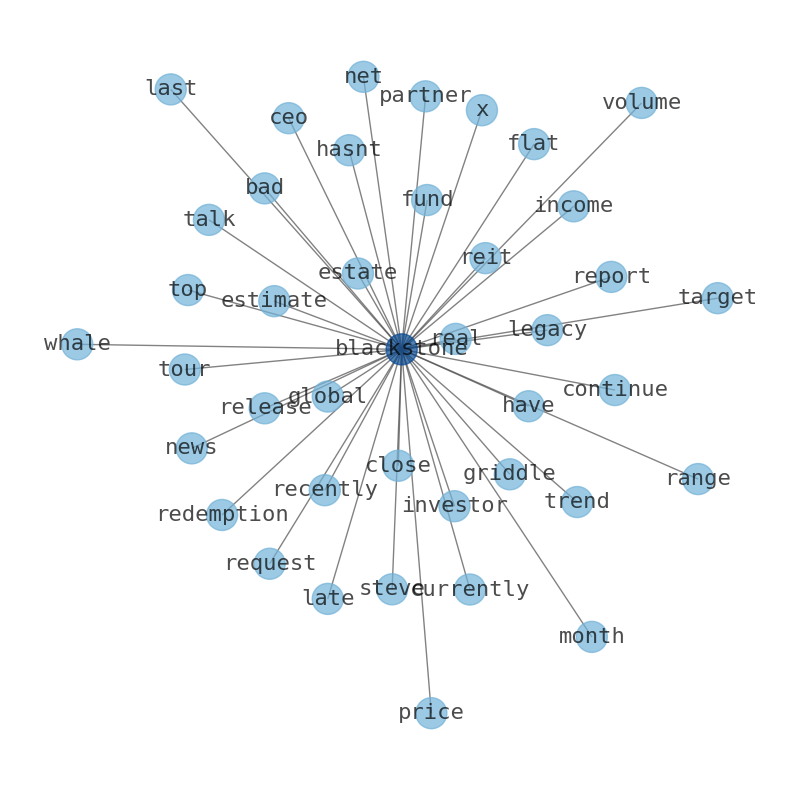

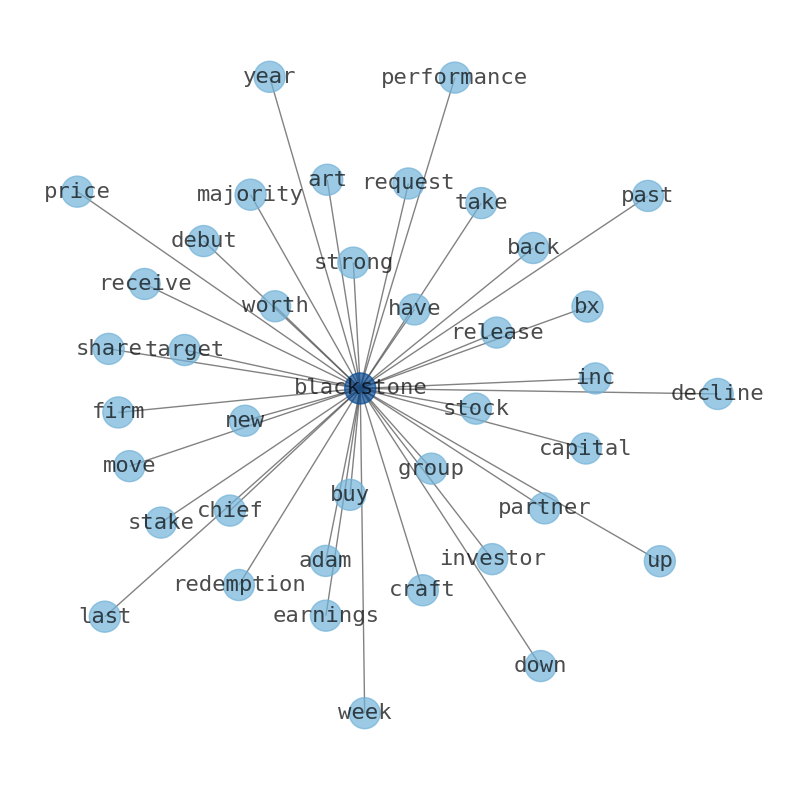

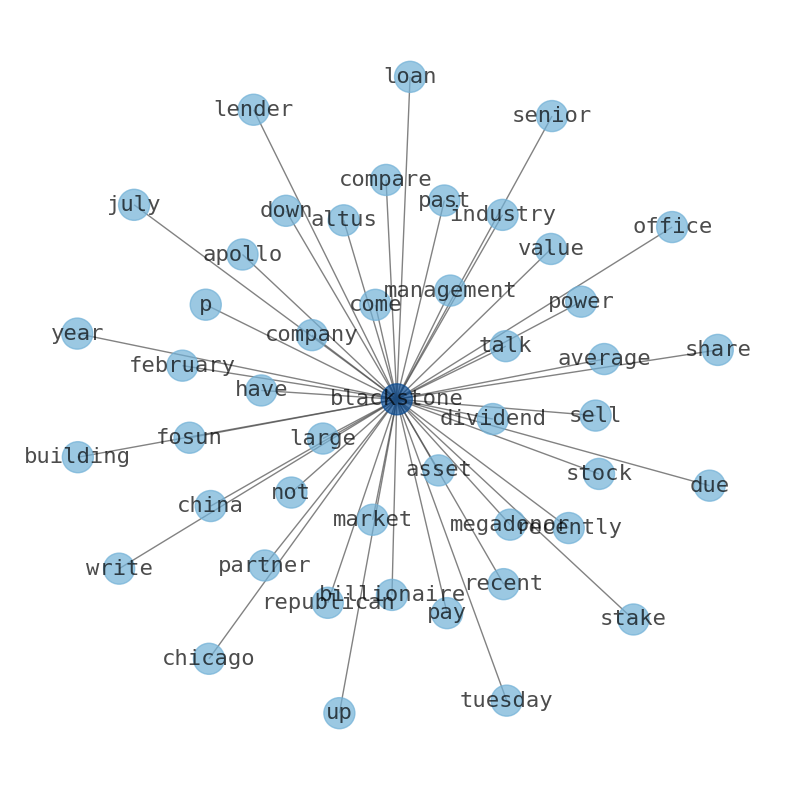

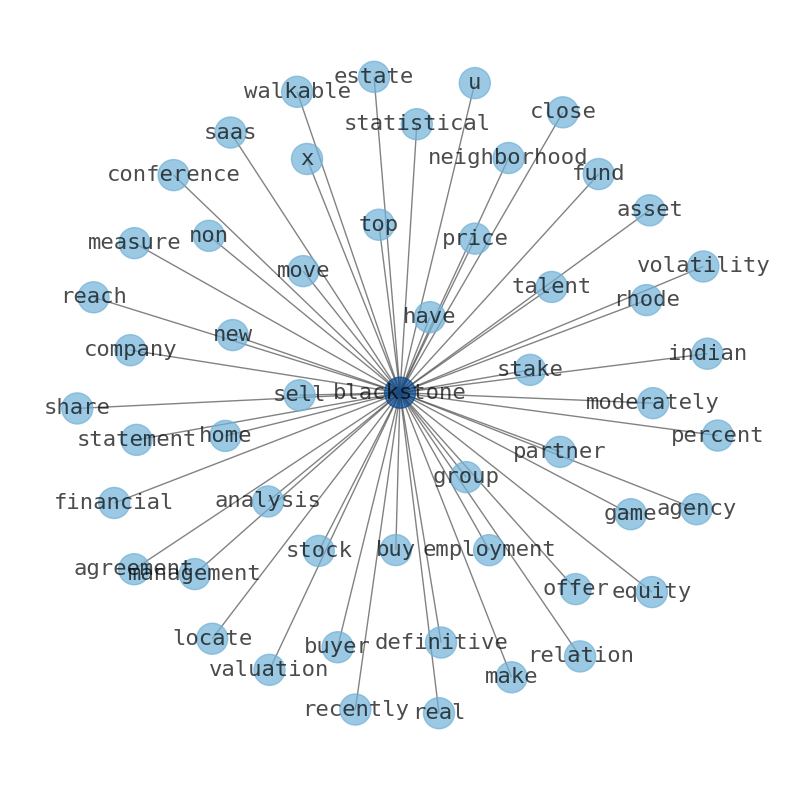

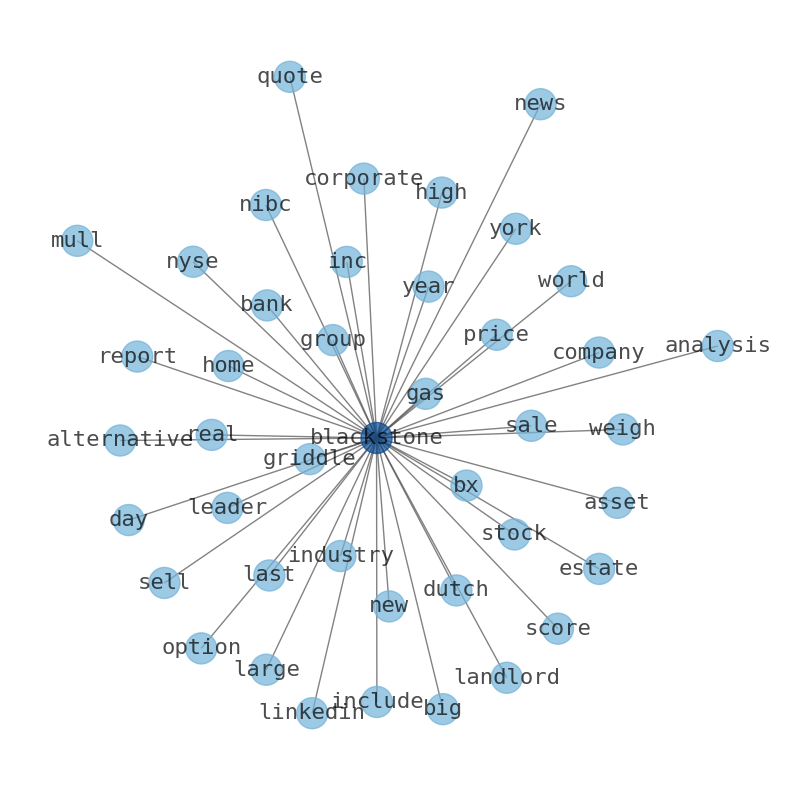

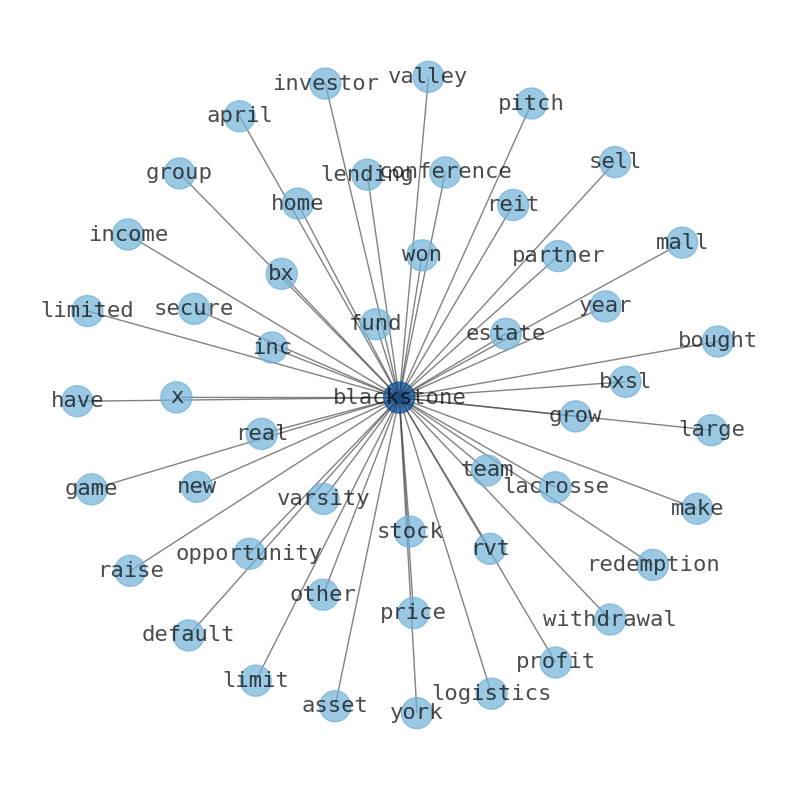

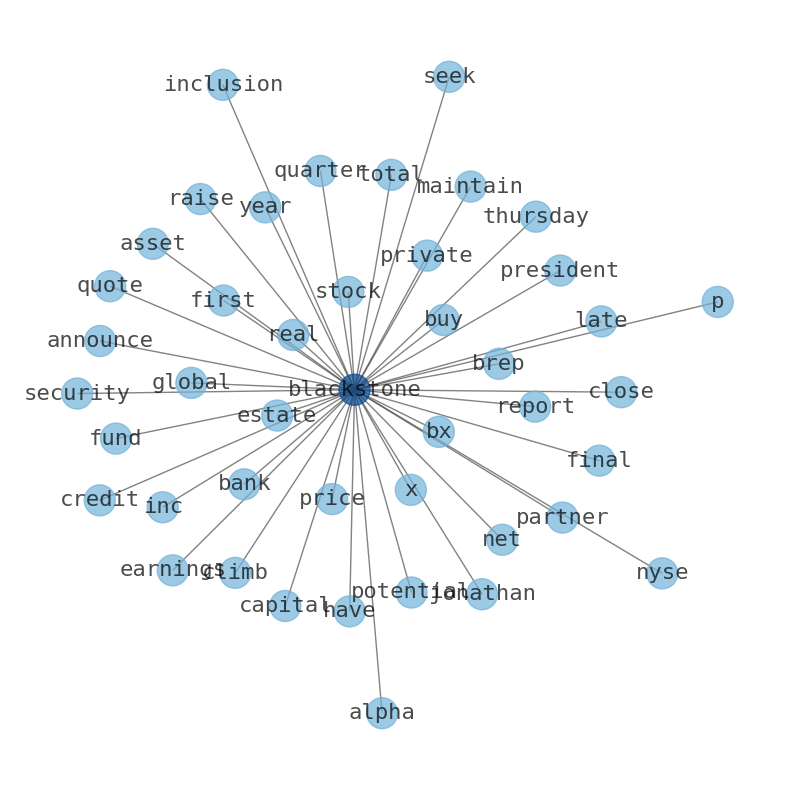

Keywords

How much time have you spent trying to decide whether investing in Blackstone? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Blackstone are: Blackstone, acquire, management, sell, asset, fund, equity, and the most common words in the summary are: blackstone, job, investment, news, real, fund, estate, . One of the sentences in the summary was: Blackstone saw $13 billion pulled from its real estate fund BREIT in 2023. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #blackstone #job #investment #news #real #fund #estate.

Read more →Related Results

Blackstone

Open: 124.0 Close: 126.1 Change: 2.1

Read more →

Blackstone

Open: 125.68 Close: 126.6 Change: 0.92

Read more →

Blackstone

Open: 128.31 Close: 127.29 Change: -1.02

Read more →

Blackstone

Open: 127.32 Close: 128.96 Change: 1.64

Read more →

Blackstone

Open: 128.1 Close: 127.68 Change: -0.42

Read more →

Blackstone

Open: 122.27 Close: 124.36 Change: 2.09

Read more →

Blackstone

Open: 122.27 Close: 124.36 Change: 2.09

Read more →

Blackstone

Open: 124.77 Close: 127.83 Change: 3.06

Read more →

Blackstone

Open: 123.85 Close: 124.57 Change: 0.72

Read more →

Blackstone

Open: 117.42 Close: 119.08 Change: 1.66

Read more →

Blackstone

Open: 120.48 Close: 119.34 Change: -1.14

Read more →

Blackstone

Open: 122.25 Close: 122.9 Change: 0.65

Read more →

Blackstone

Open: 132.87 Close: 130.92 Change: -1.95

Read more →

Blackstone

Open: 127.4 Close: 129.14 Change: 1.74

Read more →

Blackstone

Open: 129.5 Close: 125.57 Change: -3.93

Read more →

Blackstone

Open: 113.12 Close: 112.9 Change: -0.22

Read more →

Blackstone

Open: 112.5 Close: 114.28 Change: 1.78

Read more →

Blackstone

Open: 106.7 Close: 107.0 Change: 0.3

Read more →

Blackstone

Open: 104.17 Close: 104.96 Change: 0.79

Read more →

Blackstone

Open: 97.88 Close: 98.64 Change: 0.76

Read more →

Blackstone

Open: 92.72 Close: 94.75 Change: 2.03

Read more →

Blackstone

Open: 91.99 Close: 89.61 Change: -2.38

Read more →

Blackstone

Open: 91.99 Close: 89.61 Change: -2.38

Read more →

Blackstone

Open: 93.17 Close: 94.42 Change: 1.25

Read more →

Blackstone

Open: 93.17 Close: 94.42 Change: 1.25

Read more →

Blackstone

Open: 105.11 Close: 103.8 Change: -1.31

Read more →

Blackstone

Open: 103.49 Close: 104.24 Change: 0.75

Read more →

Blackstone

Open: 109.46 Close: 105.94 Change: -3.52

Read more →

Blackstone

Open: 113.0 Close: 111.12 Change: -1.88

Read more →

Blackstone

Open: 114.12 Close: 115.12 Change: 1.0

Read more →

Blackstone

Open: 113.88 Close: 112.72 Change: -1.16

Read more →

Blackstone

Open: 113.02 Close: 113.5 Change: 0.48

Read more →

Blackstone

Open: 107.2 Close: 104.49 Change: -2.71

Read more →

Blackstone

Open: 100.37 Close: 100.88 Change: 0.51

Read more →

Blackstone

Open: 99.45 Close: 99.66 Change: 0.21

Read more →

Blackstone

Open: 99.25 Close: 98.79 Change: -0.46

Read more →

Blackstone

Open: 96.98 Close: 97.47 Change: 0.49

Read more →

Blackstone

Open: 98.62 Close: 98.37 Change: -0.25

Read more →

Blackstone

Open: 103.41 Close: 100.09 Change: -3.32

Read more →

Blackstone

Open: 103.8 Close: 103.57 Change: -0.23

Read more →

Blackstone

Open: 103.48 Close: 105.05 Change: 1.57

Read more →

Blackstone

Open: 99.6 Close: 98.18 Change: -1.42

Read more →

Blackstone

Open: 91.21 Close: 91.91 Change: 0.7

Read more →

Blackstone

Open: 88.03 Close: 87.84 Change: -0.19

Read more →

Blackstone

Open: 90.0 Close: 92.78 Change: 2.78

Read more →

Blackstone

Open: 90.11 Close: 90.67 Change: 0.56

Read more →

Blackstone

Open: 86.98 Close: 88.66 Change: 1.68

Read more →

Blackstone

Open: 87.9 Close: 87.3 Change: -0.6

Read more →

Blackstone

Open: 82.91 Close: 83.16 Change: 0.25

Read more →

Blackstone

Open: 84.12 Close: 83.08 Change: -1.04

Read more →

Blackstone

Open: 83.15 Close: 82.58 Change: -0.57

Read more →

Blackstone

Open: 84.85 Close: 83.03 Change: -1.82

Read more →

Blackstone

Open: 91.63 Close: 89.45 Change: -2.18

Read more →

Blackstone

Open: 125.0 Close: 124.8 Change: -0.2

Read more →

Blackstone

Open: 126.12 Close: 126.75 Change: 0.63

Read more →

Blackstone

Open: 129.47 Close: 130.25 Change: 0.78

Read more →

Blackstone

Open: 128.1 Close: 127.68 Change: -0.42

Read more →

Blackstone

Open: 121.64 Close: 123.56 Change: 1.92

Read more →

Blackstone

Open: 122.27 Close: 124.36 Change: 2.09

Read more →

Blackstone

Open: 122.27 Close: 123.76 Change: 1.49

Read more →

Blackstone

Open: 123.85 Close: 124.57 Change: 0.72

Read more →

Blackstone

Open: 120.91 Close: 120.63 Change: -0.28

Read more →

Blackstone

Open: 120.48 Close: 119.34 Change: -1.14

Read more →

Blackstone

Open: 121.5 Close: 122.21 Change: 0.71

Read more →

Blackstone

Open: 122.25 Close: 123.34 Change: 1.09

Read more →

Blackstone

Open: 129.74 Close: 130.69 Change: 0.95

Read more →

Blackstone

Open: 125.56 Close: 128.29 Change: 2.73

Read more →

Blackstone

Open: 127.69 Close: 129.01 Change: 1.32

Read more →

Blackstone

Open: 113.25 Close: 112.57 Change: -0.68

Read more →

Blackstone

Open: 106.75 Close: 107.64 Change: 0.89

Read more →

Blackstone

Open: 106.94 Close: 106.78 Change: -0.16

Read more →

Blackstone

Open: 100.79 Close: 102.59 Change: 1.8

Read more →

Blackstone

Open: 99.59 Close: 100.9 Change: 1.31

Read more →

Blackstone

Open: 92.72 Close: 94.75 Change: 2.03

Read more →

Blackstone

Open: 91.99 Close: 89.61 Change: -2.38

Read more →

Blackstone

Open: 94.3 Close: 92.74 Change: -1.56

Read more →

Blackstone

Open: 93.17 Close: 94.42 Change: 1.25

Read more →

Blackstone

Open: 105.0 Close: 104.54 Change: -0.46

Read more →

Blackstone

Open: 103.76 Close: 104.19 Change: 0.43

Read more →

Blackstone

Open: 109.11 Close: 107.14 Change: -1.97

Read more →

Blackstone

Open: 113.0 Close: 111.13 Change: -1.87

Read more →

Blackstone

Open: 115.57 Close: 114.22 Change: -1.35

Read more →

Blackstone

Open: 114.12 Close: 115.12 Change: 1.0

Read more →

Blackstone

Open: 112.93 Close: 112.75 Change: -0.18

Read more →

Blackstone

Open: 107.2 Close: 104.49 Change: -2.71

Read more →

Blackstone

Open: 104.44 Close: 104.81 Change: 0.37

Read more →

Blackstone

Open: 100.37 Close: 100.88 Change: 0.51

Read more →

Blackstone

Open: 100.0 Close: 99.52 Change: -0.48

Read more →

Blackstone

Open: 99.25 Close: 98.79 Change: -0.46

Read more →

Blackstone

Open: 98.62 Close: 98.37 Change: -0.25

Read more →

Blackstone

Open: 98.62 Close: 98.37 Change: -0.25

Read more →

Blackstone

Open: 103.18 Close: 102.73 Change: -0.45

Read more →

Blackstone

Open: 104.98 Close: 104.79 Change: -0.19

Read more →

Blackstone

Open: 103.98 Close: 106.88 Change: 2.9

Read more →

Blackstone

Open: 91.57 Close: 93.37 Change: 1.8

Read more →

Blackstone

Open: 93.22 Close: 92.97 Change: -0.25

Read more →

Blackstone

Open: 88.03 Close: 87.84 Change: -0.19

Read more →

Blackstone

Open: 91.0 Close: 90.29 Change: -0.71

Read more →

Blackstone

Open: 90.11 Close: 90.67 Change: 0.56

Read more →

Blackstone

Open: 87.9 Close: 87.3 Change: -0.6

Read more →

Blackstone

Open: 85.53 Close: 87.4 Change: 1.87

Read more →

Blackstone

Open: 82.91 Close: 82.04 Change: -0.87

Read more →

Blackstone

Open: 83.01 Close: 80.4 Change: -2.61

Read more →

Blackstone

Open: 82.0 Close: 80.71 Change: -1.29

Read more →

Blackstone

Open: 89.99 Close: 88.75 Change: -1.24

Read more →

Blackstone

Open: 91.63 Close: 89.45 Change: -2.18

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo