The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

BlackRock

Youtube Subscribe

Open: 625.65 Close: 622.51 Change: -3.14

What an AI can tell you about BlackRock Company Inc Stock before investing.

This document will help you to evaluate BlackRock without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about BlackRock are: BlackRock, asset, company, Fink, large, Bitcoin, manager, and the …

Stock Summary

BlackRock, Inc. is a publicly owned investment manager. Firm primarily provides its services to institutional, intermediary, and individual investors. Firm launches equity, fixed income, balanced, and real estate mutual funds..

Today's Summary

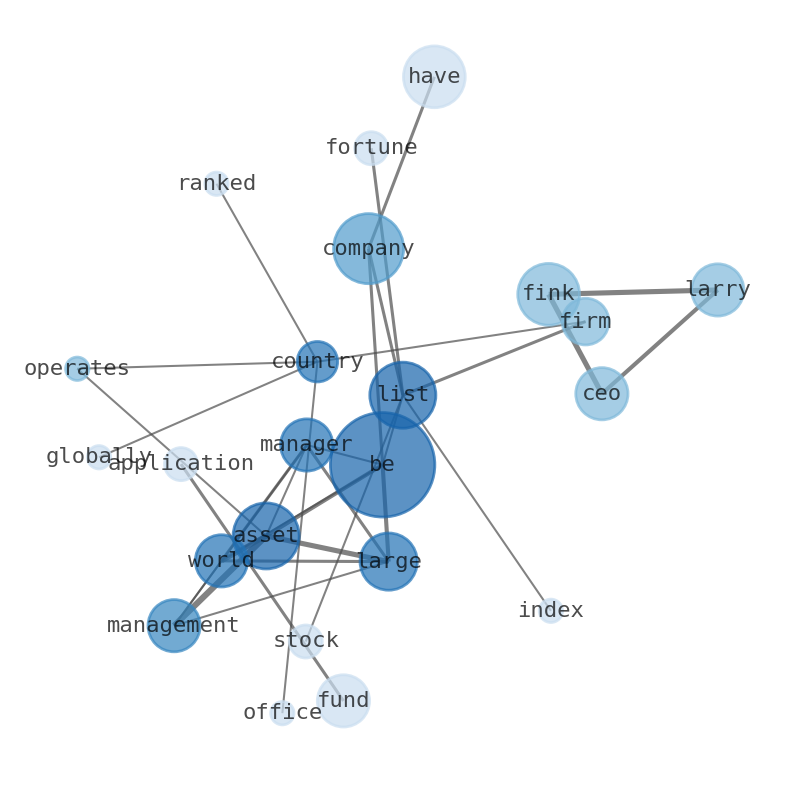

BlackRock is the worlds largest asset manager, with US$9.42 trillion in assets under management. BlackRock operates globally with 70 offices in 30 countries, and clients in 100 countries. The firm is ranked 184th on the Fortune 500 list of the largest United States corporations.

Today's News

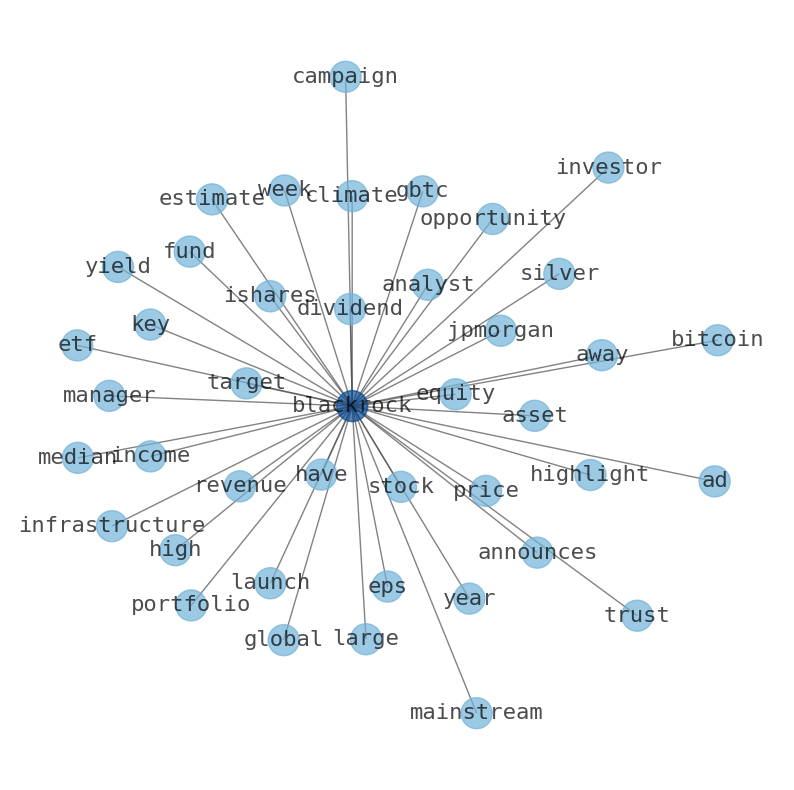

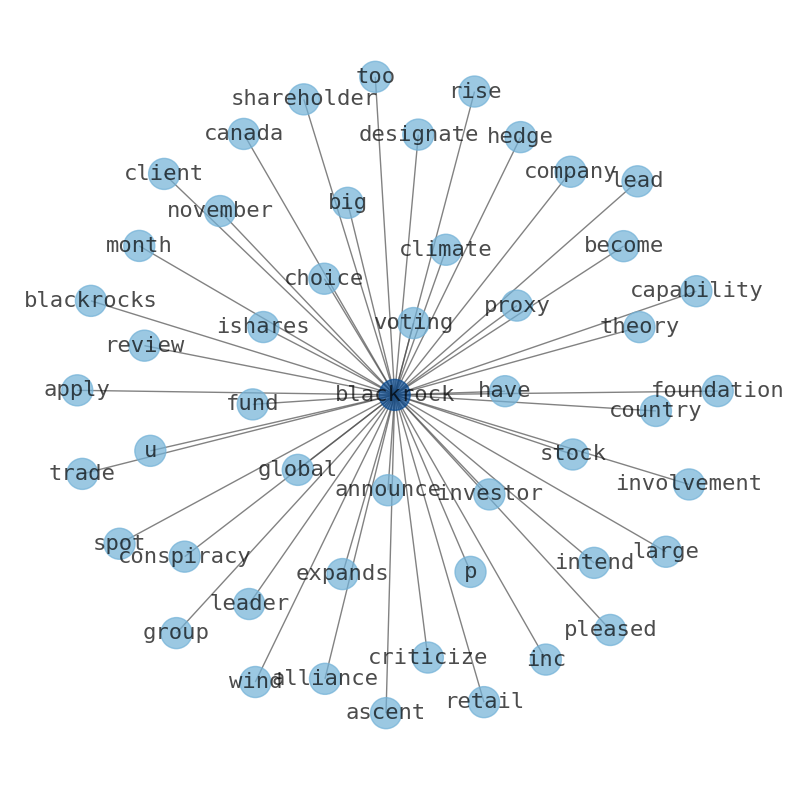

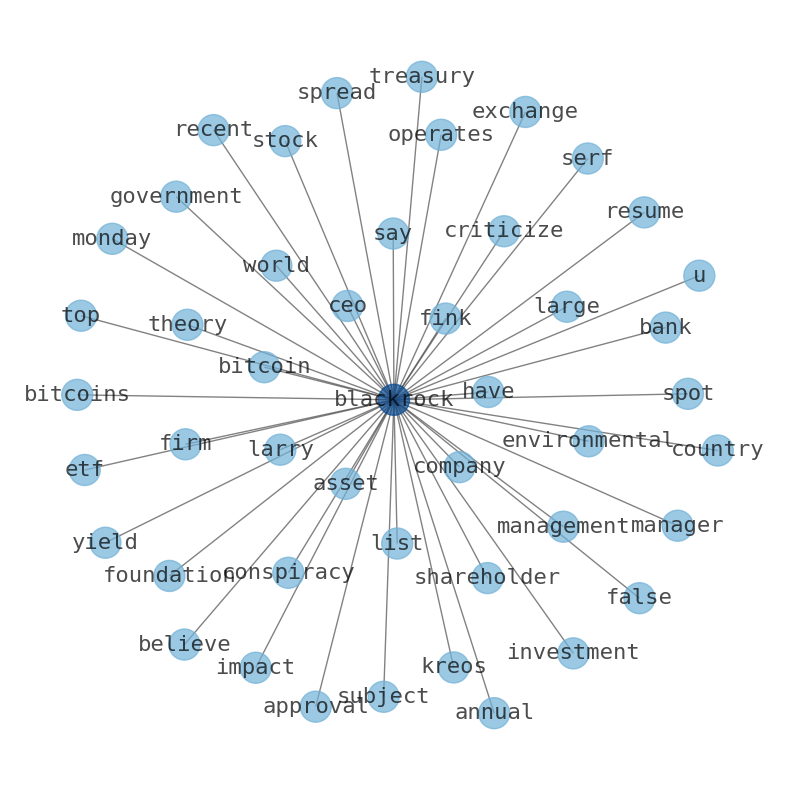

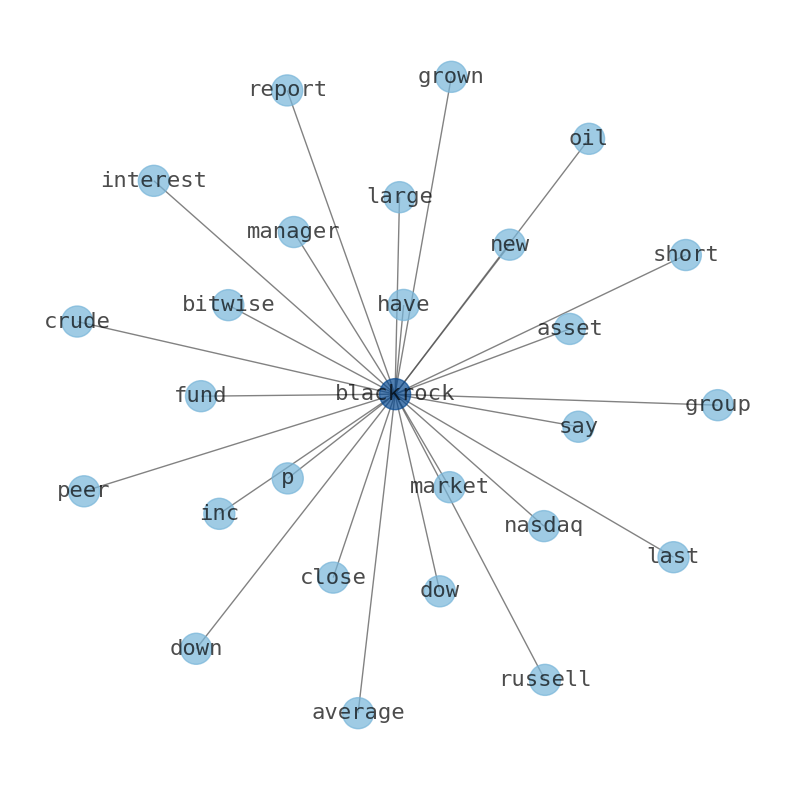

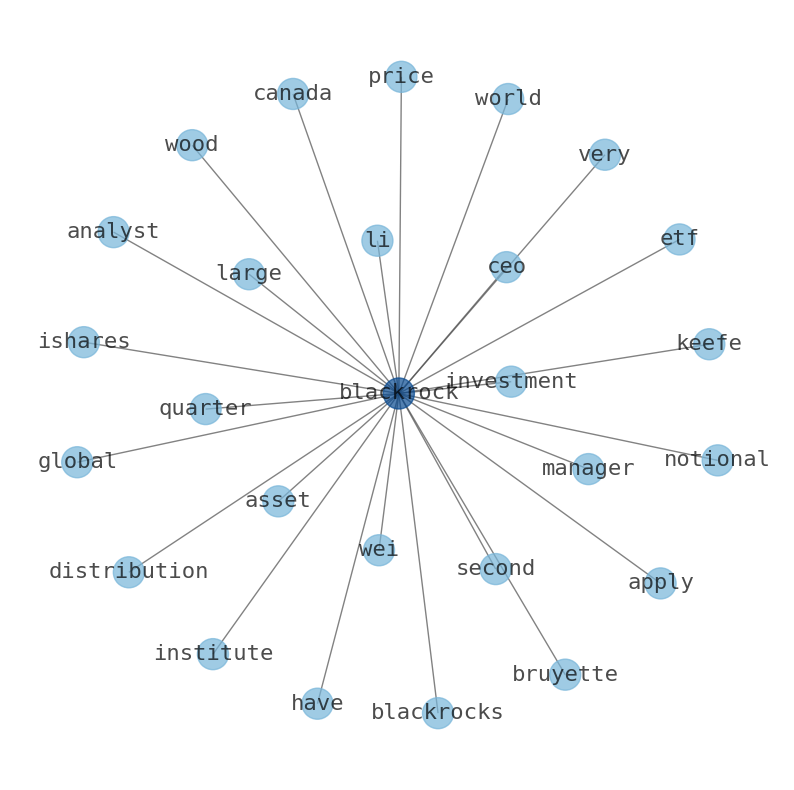

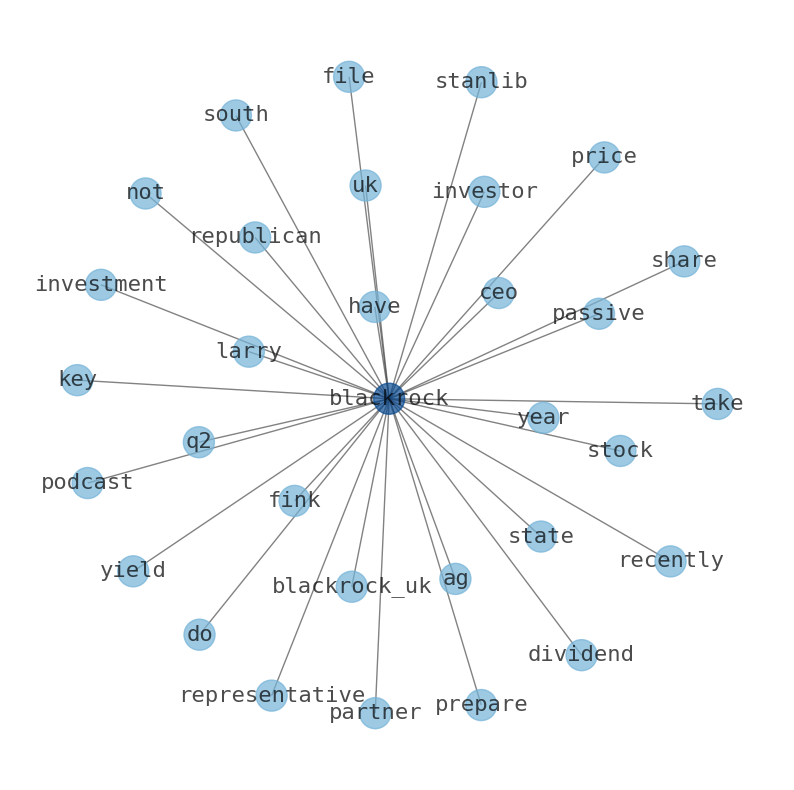

BlackRock is the worlds largest asset manager, with US$9.42 trillion in assets under management. BlackRock operates globally with 70 offices in 30 countries, and clients in 100 countries. The firm is ranked 184th on the Fortune 500 list of the largest United States corporations. BlackRock added to S&P 500 stock market index in 2011. Fortune listed BlackRock on its annual list of the worlds 50 Most Admired Companies. In 2014, BlackRock had US$4.721 trillion of assets under management. BlackRock has been the subject of conspiracy theories. BlackRock is among the top shareholders of many companies, including the largest companies in the world. Some BlackRock conspiracy theories have incorporated antisemitism. BlackRock has been criticized for the environmental impact of its holdings as it was a major shareholder in every oil supermajor except Total S.A. In May 2019, BlackRock was criticized for its environmental impact. On January 14, 2020, the company shifted its investment policy; BlackRock CEO Larry Fink said that environmental sustainability. BlackRock is listed on the New York Stock Exchange (B) List of asset management firms List of CDO managers List of companies based in New York City List of hedge funds. BlackRock intends to become a global leader in sustainable investing, says Larry Fink, as the worlds largest asset manager launched. BlackRock is blundering in China—all the way to the bank Florida pulls $2bn from BlackRock in spreading ESG backlash Bitcoin pumped and dumped on false BlackRock spot ETF approval report. Bitcoin surged briefly Monday on a false report that the SEC had approved BlackRock. BlackRock serves governments, companies, and foundations. U.S. Treasury yields may resume their march higher despite recent bond-market swings, BlackRock says. Rising term premium will likely be the next driver of higher yields. BlackRock CEO Larry Fink notes ‘pent-up interest after fake bitcoin etf news. BlackRock CEO Fink weighs in on the firms pending Bitcoin exchange-traded fund application. Bitcoin has gained over 60% this year, besting the S&P 500s 14% rise. iShares Bitcoin Trust, if approved by regulators, will use Coinbase Custody as its custodian. Contradictory news of potential greenlit BlackRock Bitcoin etf shoots btc to $30k and back. Fox reporter Eleanor Terrett claims that her sources at BlackRock denied approval. BlackRock CEO Larry Fink believes Bitcoins recent rally is not solely due to rumors about his funds spot-traded fund application but is primarily driven by a flight to quality amid global geopolitical tensions. Fink: I believe that crypto will play that type of role as a flight to quality. BlackRock acquired private debt firm Kreos Capital in June. Kreos VII is 40% larger than the predecessor fund. BlackRock CEO Larry Fink said Monday that he was outraged and horrified by the images out of Israel following Hamas terror attack. The Bid podcast breaks down whats happening in the markets and explores the forces that are changing investing. The new, more volatile economic regime provides different yet abundant investment opportunities. The question is no longer whether the net-zero transition will happen, but how - and what that means for countries and companies alike. A decisive and coordinated policy action is key to combat economic fallout. The easing wave may subside, for now, says Elga Bartsch. A resumption of monetary easing and ultra-low bond yields challenge the role of government bonds as portfolio ballast. BlackRock is the worlds largest asset manager, with US$8.59 trillion in assets under management as of December 31, 2022. Founded in 1988, initially as an enterprise risk management and fixed income institutional asset manager. BlackRock (NYSE: BLK) is a multi-national investment company. BlackRock has 88 portfolio exits. The company recently partnered with Lloyds Bank Cardnet. BlackRock: Fairly Valued ahead of Earnings, Year-Over-Year EPS Drop Expected Mike Zaccardi, CFA, CMT, CMA: 2023 Will Be An Interesting Year The Value Investor.

Stock Profile

"BlackRock, Inc. is a publicly owned investment manager. The firm primarily provides its services to institutional, intermediary, and individual investors including corporate, public, union, and industry pension plans, insurance companies, third-party mutual funds, endowments, public institutions, governments, foundations, charities, sovereign wealth funds, corporations, official institutions, and banks. It also provides global risk management and advisory services. The firm manages separate client-focused equity, fixed income, and balanced portfolios. It also launches and manages open-end and closed-end mutual funds, offshore funds, unit trusts, and alternative investment vehicles including structured funds. The firm launches equity, fixed income, balanced, and real estate mutual funds. It also launches equity, fixed income, balanced, currency, commodity, and multi-asset exchange traded funds. The firm also launches and manages hedge funds. It invests in the public equity, fixed income, real estate, currency, commodity, and alternative markets across the globe. The firm primarily invests in growth and value stocks of small-cap, mid-cap, SMID-cap, large-cap, and multi-cap companies. It also invests in dividend-paying equity securities. The firm invests in investment grade municipal securities, government securities including securities issued or guaranteed by a government or a government agency or instrumentality, corporate bonds, and asset-backed and mortgage-backed securities. It employs fundamental and quantitative analysis with a focus on bottom-up and top-down approach to make its investments. The firm employs liquidity, asset allocation, balanced, real estate, and alternative strategies to make its investments. In real estate sector, it seeks to invest in Poland and Germany. The firm benchmarks the performance of its portfolios against various S&P, Russell, Barclays, MSCI, Citigroup, and Merrill Lynch indices. BlackRock, Inc. was founded in 1988 and is based in New York City with additional offices in Boston, Massachusetts; London, United Kingdom; Gurgaon, India; Hong Kong; Greenwich, Connecticut; Princeton, New Jersey; Edinburgh, United Kingdom; Sydney, Australia; Taipei, Taiwan; Singapore; Sao Paulo, Brazil; Philadelphia, Pennsylvania; Washington, District of Columbia; Toronto, Canada; Wilmington, Delaware; and San Francisco, California."

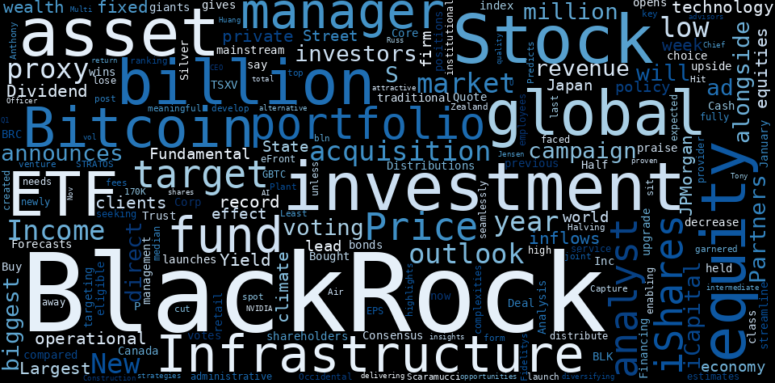

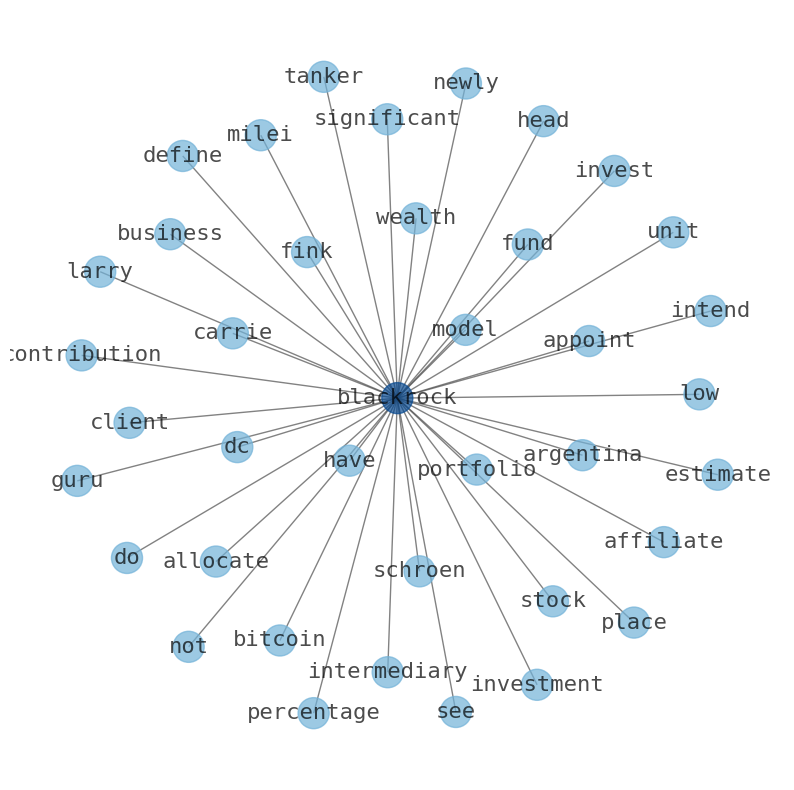

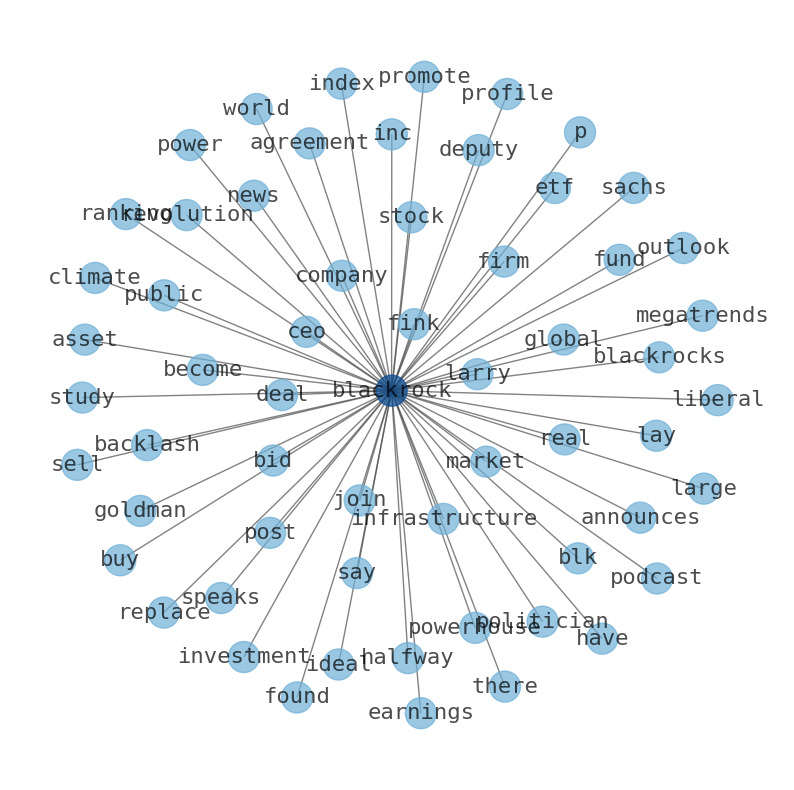

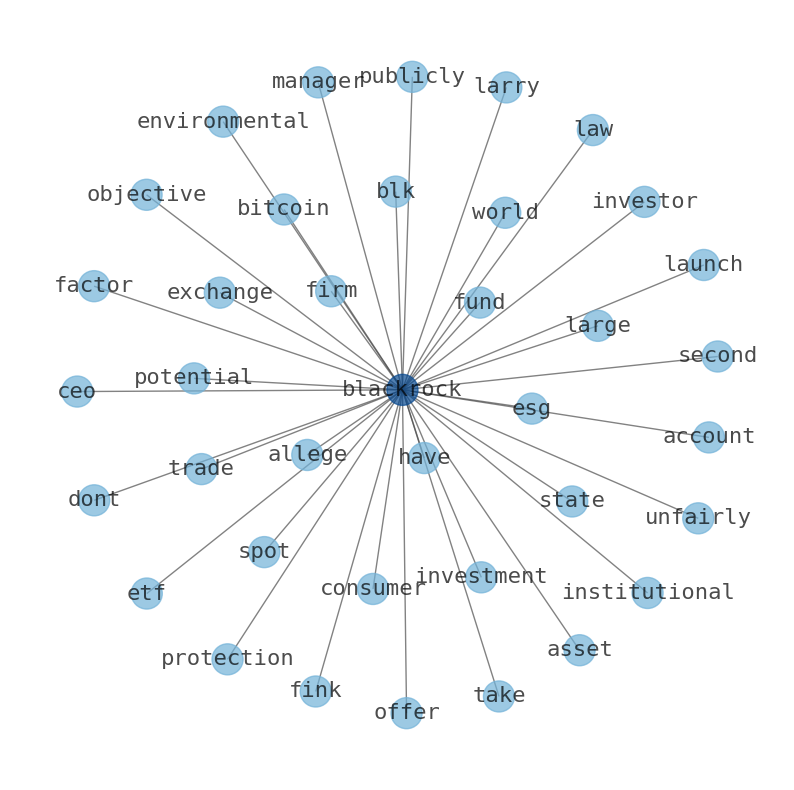

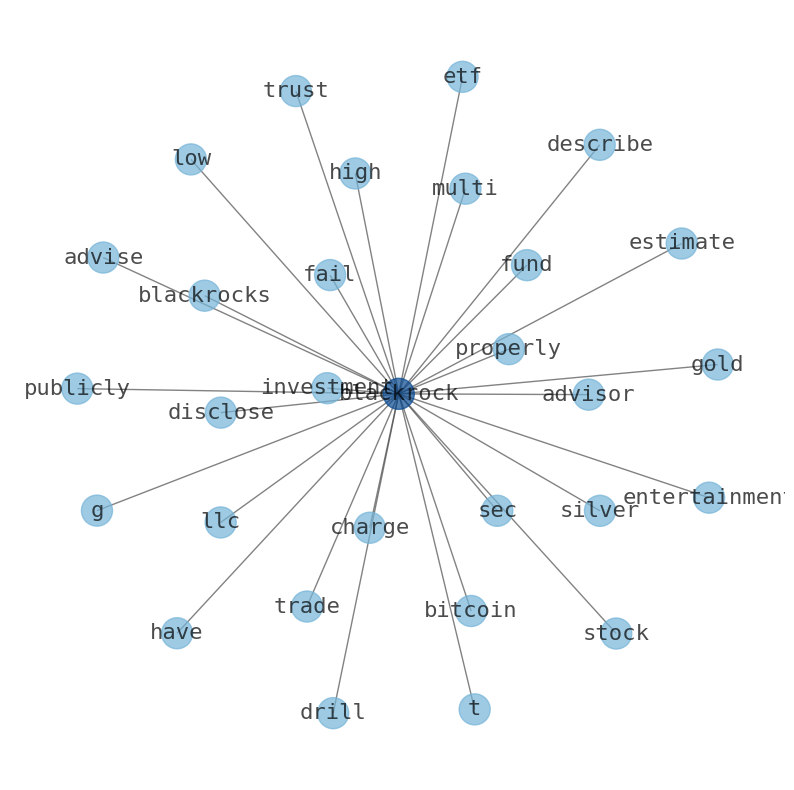

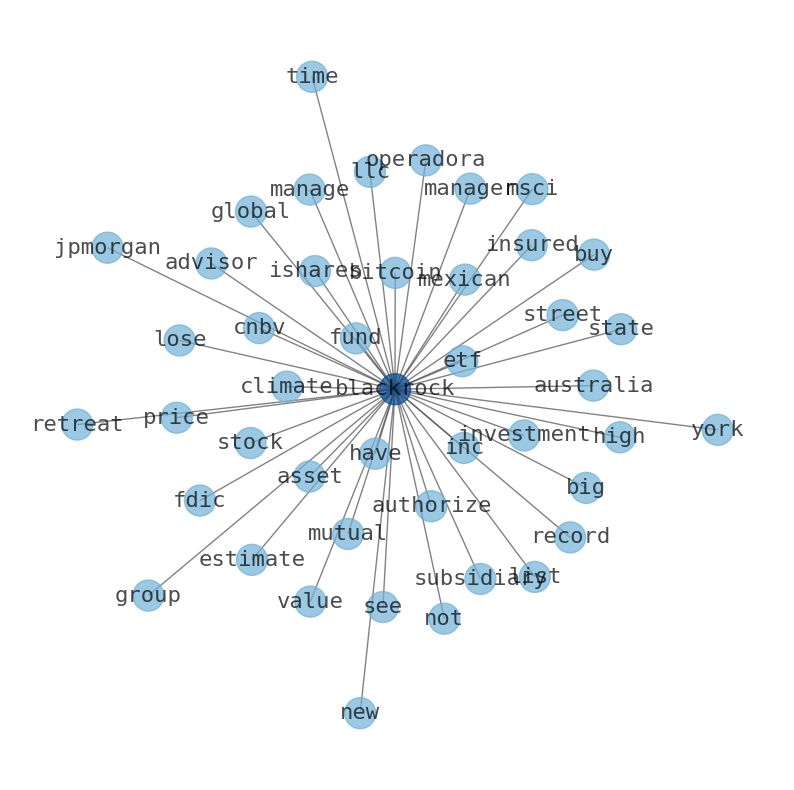

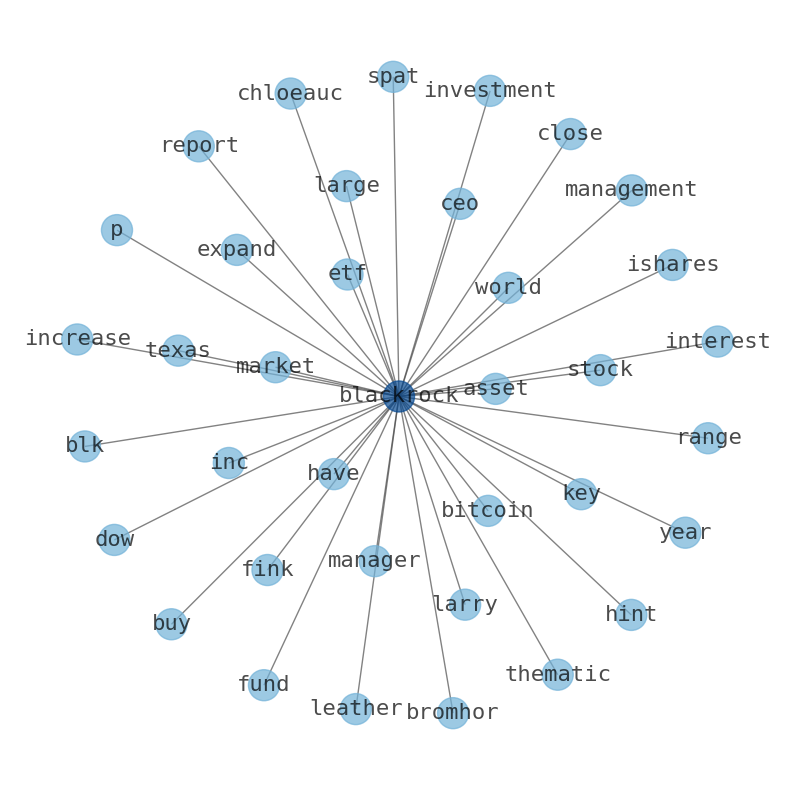

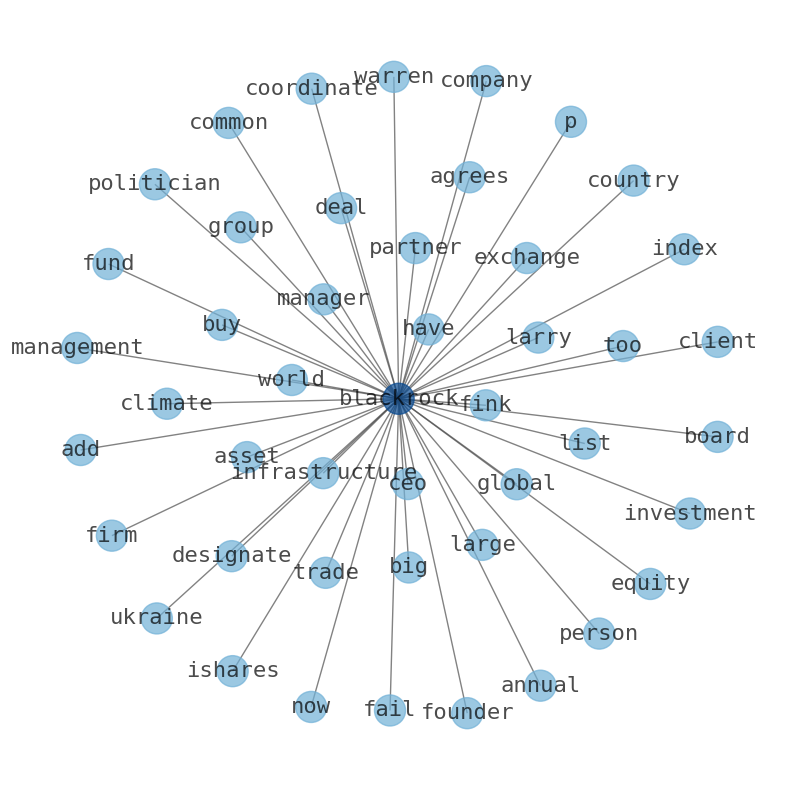

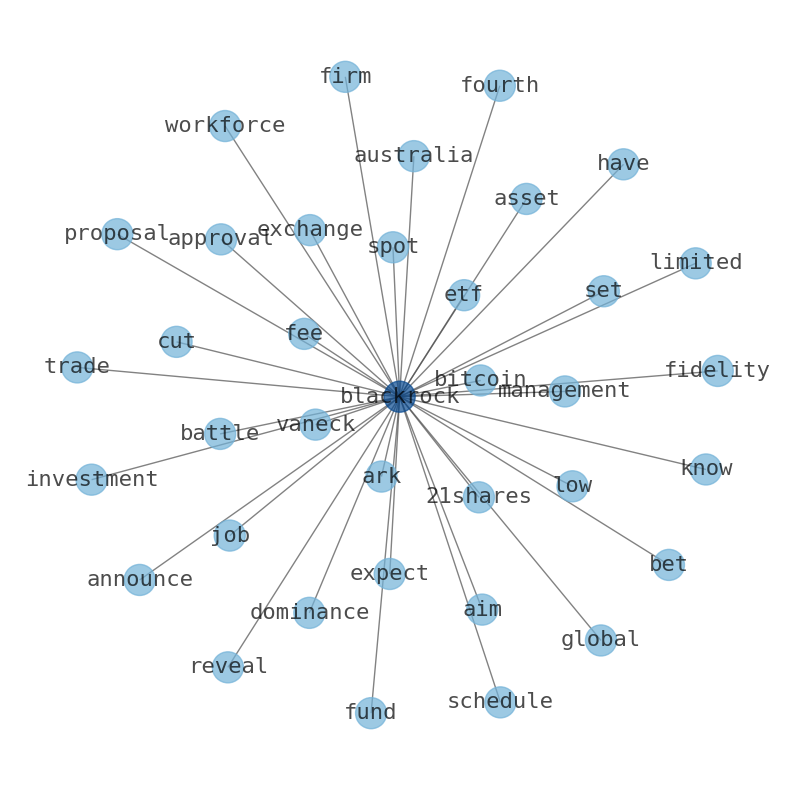

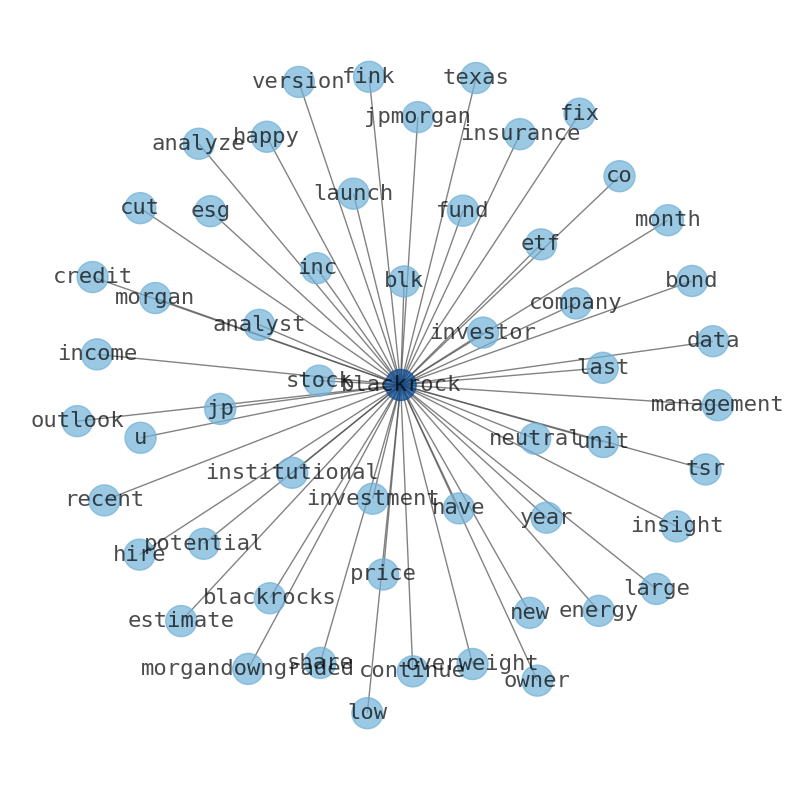

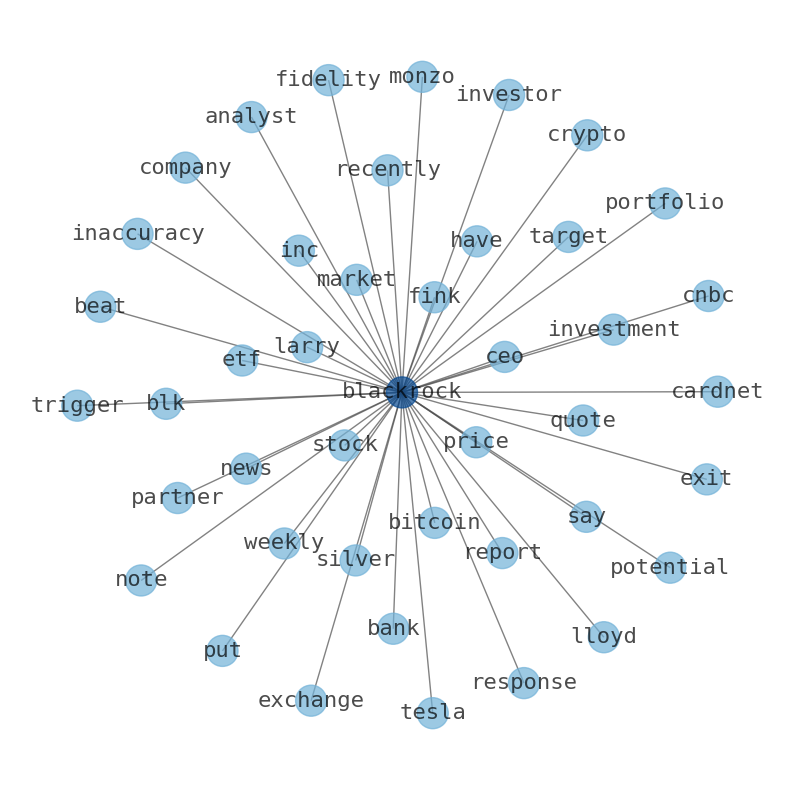

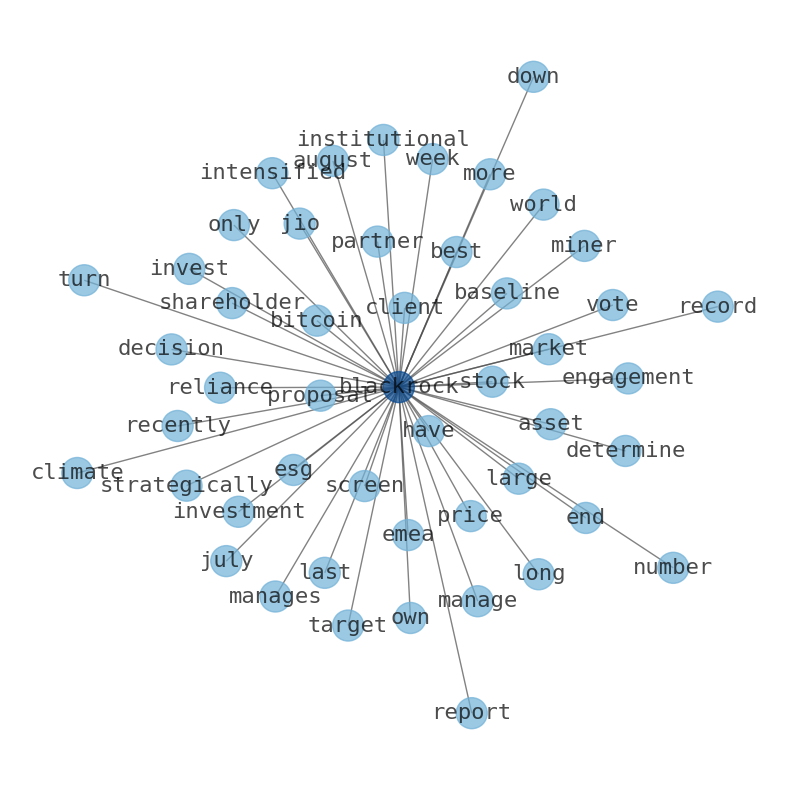

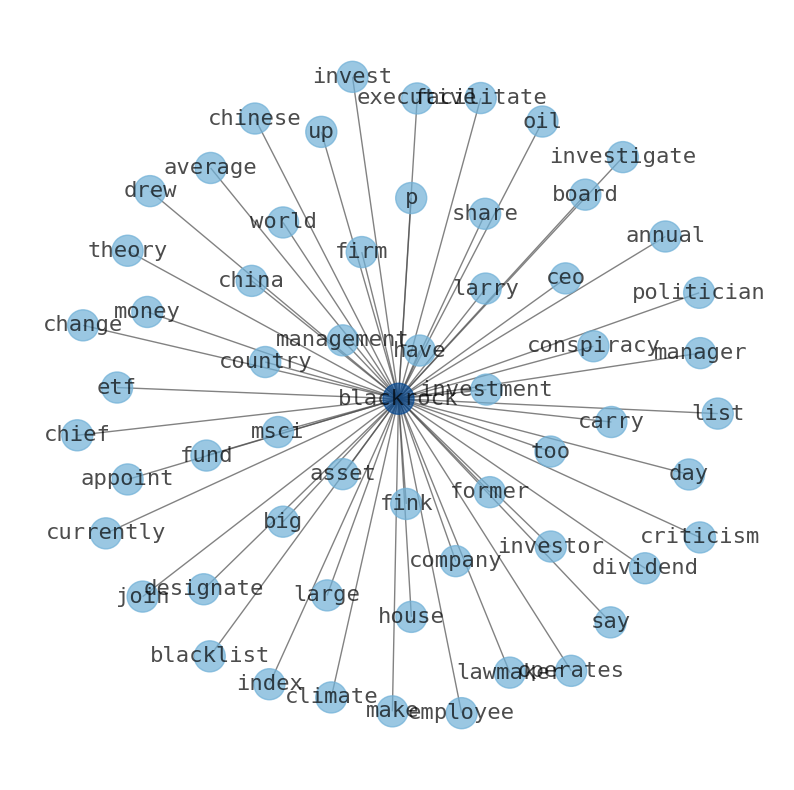

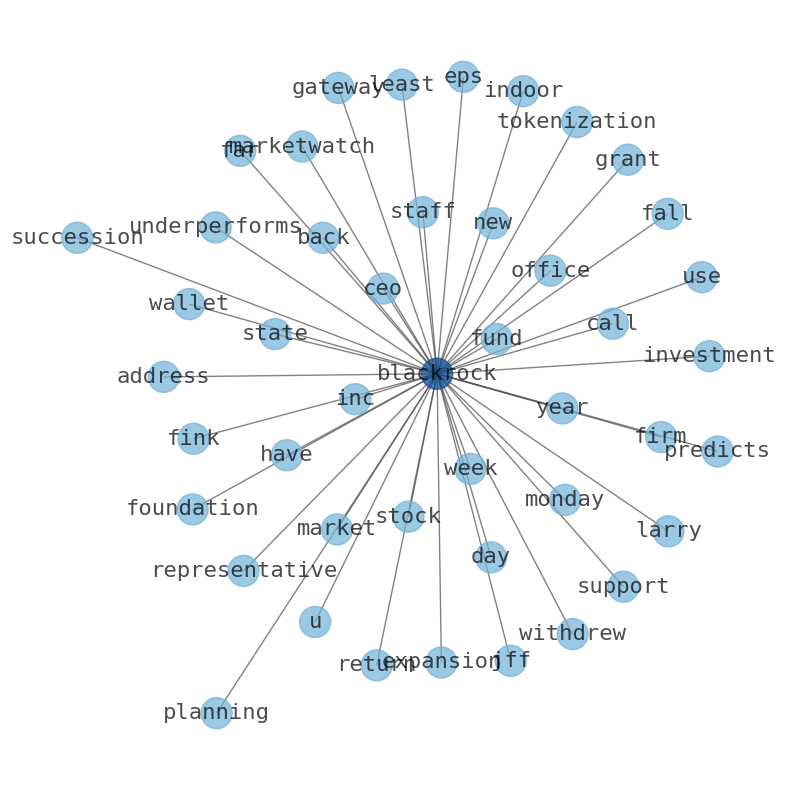

Keywords

The game is changing. There is a new strategy to evaluate BlackRock fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about BlackRock are: BlackRock, asset, company, Fink, large, Bitcoin, manager, and the most common words in the summary are: blackrock, investment, fund, bloomberg, etf, bitcoin, market, . One of the sentences in the summary was: The firm is ranked 184th on the Fortune 500 list of the largest United States corporations.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #blackrock #investment #fund #bloomberg #etf #bitcoin #market.

Read more →Related Results

BlackRock

Open: 795.09 Close: 800.64 Change: 5.55

Read more →

BlackRock

Open: 788.4 Close: 798.05 Change: 9.65

Read more →

BlackRock

Open: 780.65 Close: 788.0 Change: 7.35

Read more →

BlackRock

Open: 785.0 Close: 799.6 Change: 14.6

Read more →

BlackRock

Open: 795.0 Close: 797.96 Change: 2.96

Read more →

BlackRock

Open: 607.07 Close: 598.08 Change: -8.99

Read more →

BlackRock

Open: 625.65 Close: 622.51 Change: -3.14

Read more →

BlackRock

Open: 693.77 Close: 695.61 Change: 1.84

Read more →

BlackRock

Open: 743.0 Close: 728.32 Change: -14.68

Read more →

BlackRock

Open: 642.59 Close: 636.97 Change: -5.62

Read more →

BlackRock

Open: 795.09 Close: 794.0 Change: -1.09

Read more →

BlackRock

Open: 794.23 Close: 797.21 Change: 2.98

Read more →

BlackRock

Open: 785.0 Close: 799.6 Change: 14.6

Read more →

BlackRock

Open: 784.43 Close: 797.19 Change: 12.76

Read more →

BlackRock

Open: 791.9 Close: 819.0 Change: 27.1

Read more →

BlackRock

Open: 623.25 Close: 614.83 Change: -8.42

Read more →

BlackRock

Open: 678.65 Close: 691.03 Change: 12.38

Read more →

BlackRock

Open: 710.07 Close: 710.28 Change: 0.21

Read more →

BlackRock

Open: 650.57 Close: 667.73 Change: 17.16

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo