The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

BlackRock

Youtube Subscribe

Open: 785.0 Close: 799.6 Change: 14.6

How to get informed about BlackRock Company Inc quickly using an AI.

This document will help you to evaluate BlackRock without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about BlackRock are: BlackRock, asset, manager, Fink, CEO, large, deal, and the …

Stock Summary

BlackRock, Inc. is a publicly owned investment manager. Firm primarily provides its services to institutional, intermediary, and individual investors. Firm launches equity, fixed income, balanced, and real estate mutual funds..

Today's Summary

BlackRock has agreed to buy private-equity firm Global Infrastructure Partners for roughly $12.5 billion in cash and stock. The acquisition would be BlackRocks largest since it bought Barclays s asset management business in 2009. Senator Elizabeth Warren suggested that BlackRock should be designated too big to fail. BlackRock beat earnings expectations as the worlds largest money manager saw its assets top $10 trillion in the fourth quarter of 2023. The Wall Street giant agreed to buy Global infrastructure Partners, assets include airports, pipelines, in its biggest takeover since 2009. BlackRocks spot bitcoin ETF, the iShares Bitcoin Trust (IBIT) begins trading today.

Today's News

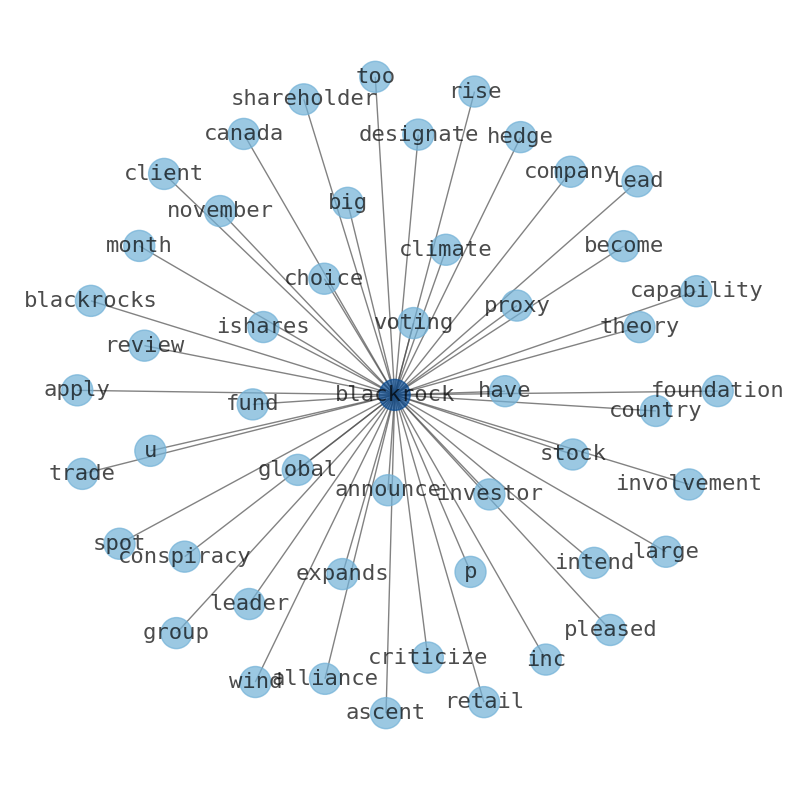

BlackRock oversees $9.1 trillion in assets as the worlds largest money manager. Founder-led BlackRock is molding the next generation of management and seeking out deals. Conservative politicians view BlackRock as promoting liberal ideals in the companies BlackRocks funds own. Progressive politicians say BlackRock is not doing enough to fight the climate crisis. BlackRock and Fink himself have faced intense scrutiny over the firms climate-aware investment strategies. BlackRock has agreed to buy private-equity firm Global Infrastructure Partners for roughly $12.5 billion in cash and stock. The acquisition would be BlackRocks largest since it bought Barclays s asset management business in 2009. Global Infrastructure Partners is being acquired by BlackRock in a deal valued at $12.5 billion. $3 billion will be in cash and the remainder in approximately 12 million shares of BlackRock common stock. Anne Valentine Andrews, who until now served as head of infrastructure and real estate for BlackRock, has resigned. BlackRock is the manager of the iShares group of exchange-traded funds. Along with The Vanguard Group and State Street, it is considered to be one of the Big Three index fund managers. BlackRock has 70 offices in 30 countries and clients in 100 countries. BlackRock added to S&P 500 index in 2011. Fortune listed BlackRock on its annual list of the worlds 50 Most Admired Companies. BlackRock has been the subject of conspiracy theories. Senator Elizabeth Warren suggested that BlackRock should be designated too big to fail, and should be regulated accordingly. Climate activists painted walls and floors with warnings and accusations on the responsibility of the company in the effects of global warming. In May 2019, BlackRock was criticized for the environmental impact of its holdings. BlackRock has a 16-person board of directors. As of 2023, Blackrock has a CEO Larry Fink, founder, Chairman and CEO Bader M. Nasser. BlackRock intends to become a global leader in sustainable investing, says Larry Fink, as the worlds largest asset manager launched. Is BlackRock the New Vampire Squid? Warren wants BlackRock designated too big to fail BlackRock CEO Fink agrees to coordinate Ukraine investment with Ukraine. Zelensky agrees to Ukraine rebuild investment with Blackrock CEO Here are 9 fascinating facts to know about BlackRock, the worlds largest asset manager popping up in the Biden administration BlackRock is the largest asset manager in the world, with $9.101 trillion in AUM at the end of September 2023. BlackRock CEO Larry Fink has thrown his support behind an. Ethereum exchange-traded fund (Ethereum) BlackRock is acquiring Global Infrastructure Partners (GIP), the worlds largest independent infrastructure manager with over $100 billion in assets under management. BlackRock has more than $50 billion in client assets under. management of infrastructure equity, debt, and solutions. This all comes as Larry Fink, 71, is entering the last chapter of his BlackRock reign. BlackRock is set to buy Global Infrastructure Partners in its biggest deal in 15 years. CEO Fink signaled that a transformational deal was on the cards. BlackRock and other asset managers were cleared to launch the first bitcoin ETFs. BlackRock raises dividend by 2% to $5.10 dividend. BlackRock posts strong Q4 earnings expected to snap five-quarter winning streak. Private debt market to nearly double to $3.5T by 2028. The race is on for electric vehicles across the world and where he sees the most exciting investment opportunities. BlackRock in $12.5bn deal to buy renewables investor global infrastructure partners. BlackRock CEO Larry Fink backs the idea of an ether (ETH) exchange-traded fund (ETF) BlackRock may now be looking to list an equivalent product for ether, the native token of the Ethereum blockchain. BlackRocks iShares Bitcoin Trust (IBIT) was one of several products to make its trading debut in the U.S.

Stock Profile

"BlackRock, Inc. is a publicly owned investment manager. The firm primarily provides its services to institutional, intermediary, and individual investors including corporate, public, union, and industry pension plans, insurance companies, third-party mutual funds, endowments, public institutions, governments, foundations, charities, sovereign wealth funds, corporations, official institutions, and banks. It also provides global risk management and advisory services. The firm manages separate client-focused equity, fixed income, and balanced portfolios. It also launches and manages open-end and closed-end mutual funds, offshore funds, unit trusts, and alternative investment vehicles including structured funds. The firm launches equity, fixed income, balanced, and real estate mutual funds. It also launches equity, fixed income, balanced, currency, commodity, and multi-asset exchange traded funds. The firm also launches and manages hedge funds. It invests in the public equity, fixed income, real estate, currency, commodity, and alternative markets across the globe. The firm primarily invests in growth and value stocks of small-cap, mid-cap, SMID-cap, large-cap, and multi-cap companies. It also invests in dividend-paying equity securities. The firm invests in investment grade municipal securities, government securities including securities issued or guaranteed by a government or a government agency or instrumentality, corporate bonds, and asset-backed and mortgage-backed securities. It employs fundamental and quantitative analysis with a focus on bottom-up and top-down approach to make its investments. The firm employs liquidity, asset allocation, balanced, real estate, and alternative strategies to make its investments. In real estate sector, it seeks to invest in Poland and Germany. The firm benchmarks the performance of its portfolios against various S&P, Russell, Barclays, MSCI, Citigroup, and Merrill Lynch indices. BlackRock, Inc. was founded in 1988 and is based in New York City with additional offices in Boston, Massachusetts; London, United Kingdom; Gurgaon, India; Hong Kong; Greenwich, Connecticut; Princeton, New Jersey; Edinburgh, United Kingdom; Sydney, Australia; Taipei, Taiwan; Singapore; Sao Paulo, Brazil; Philadelphia, Pennsylvania; Washington, District of Columbia; Toronto, Canada; Wilmington, Delaware; and San Francisco, California."

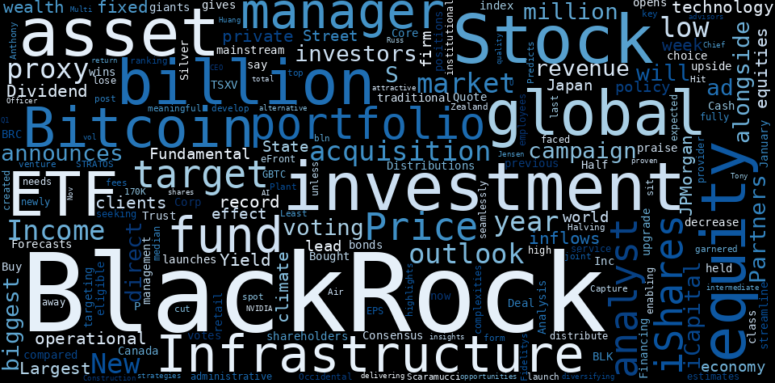

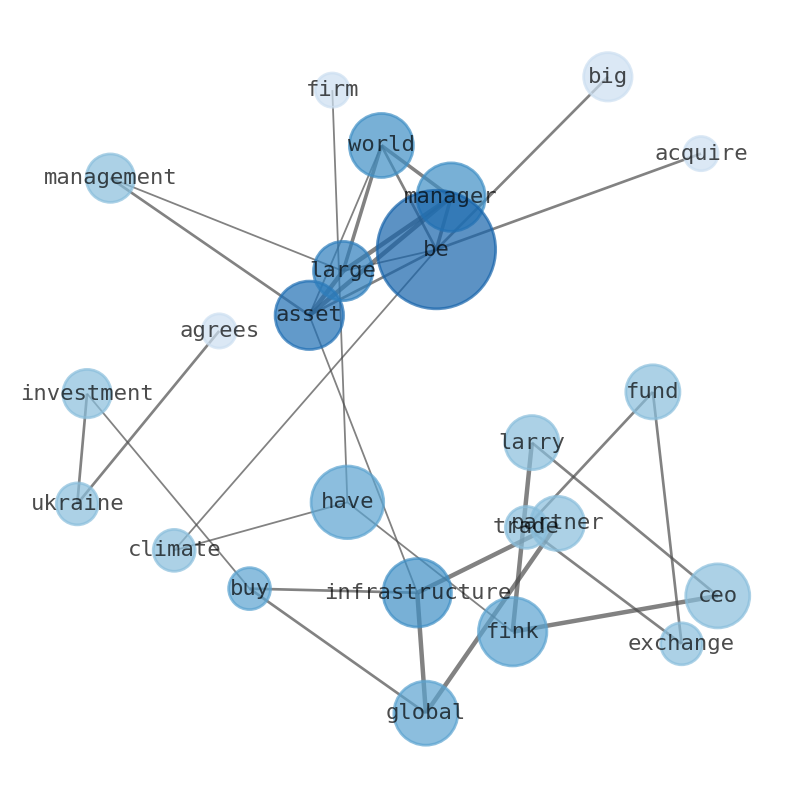

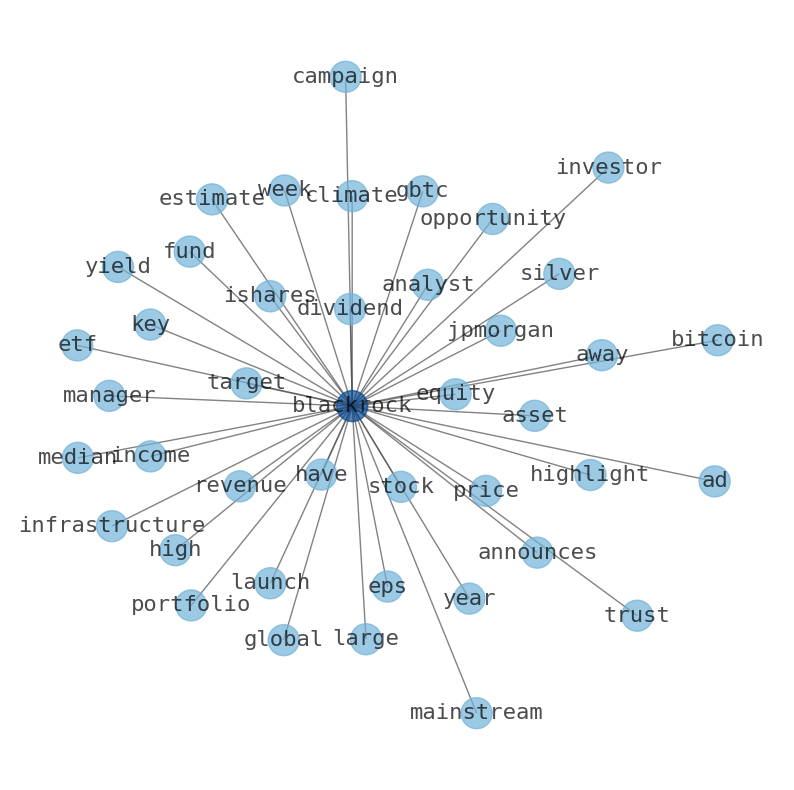

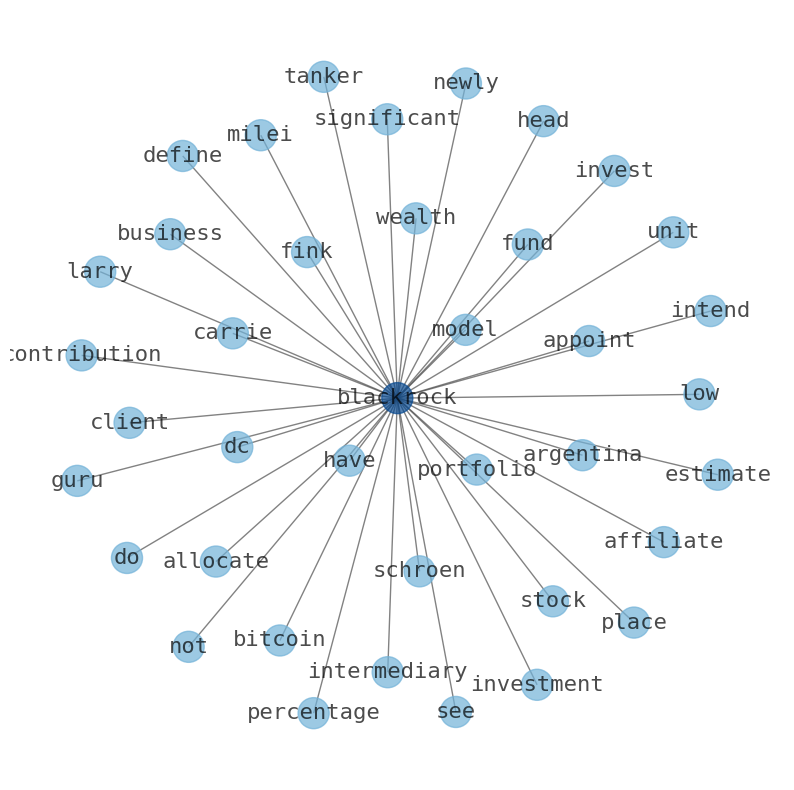

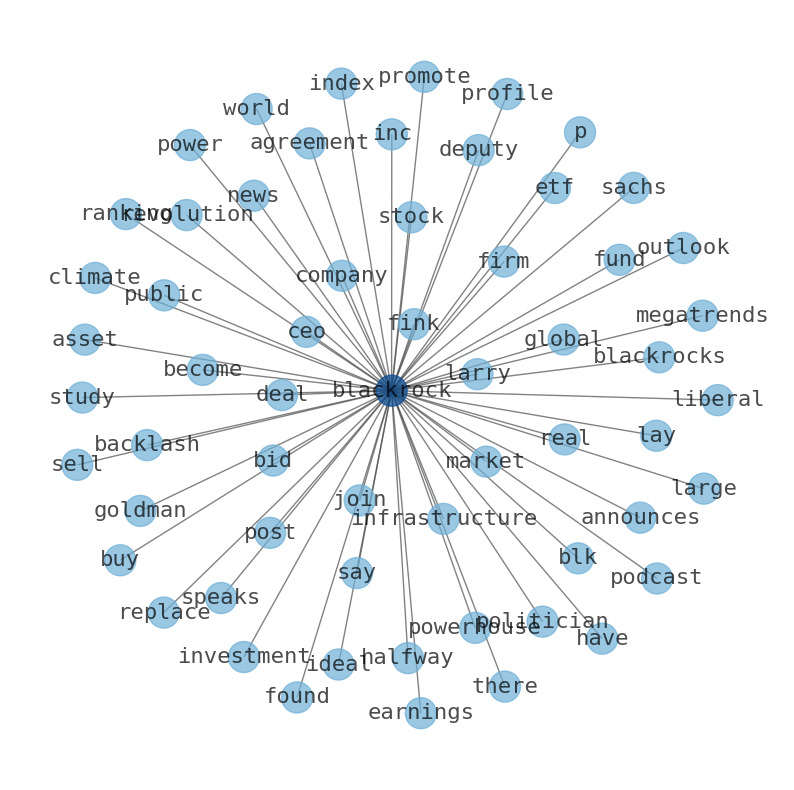

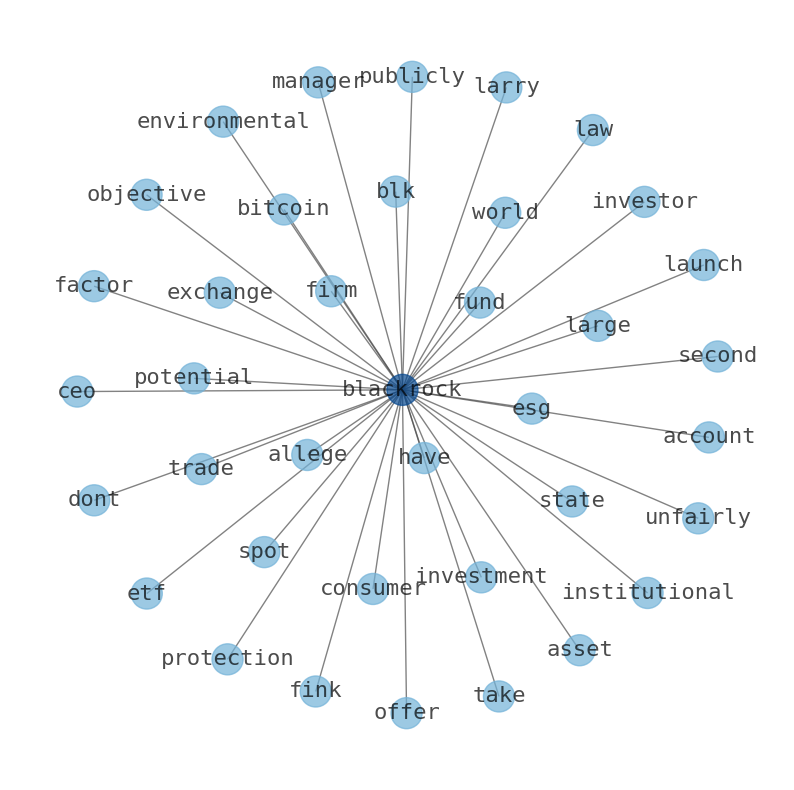

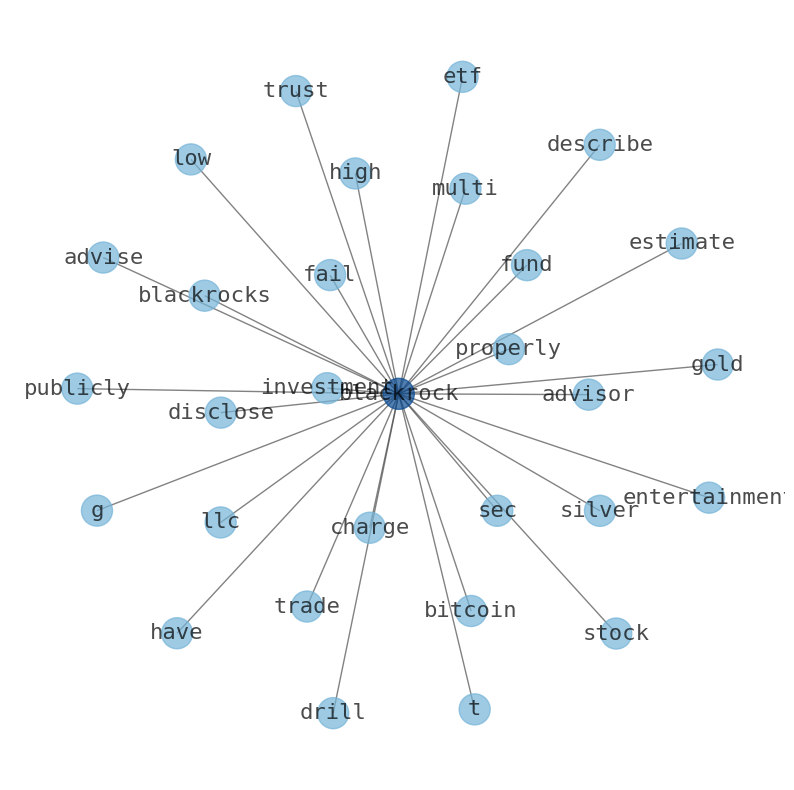

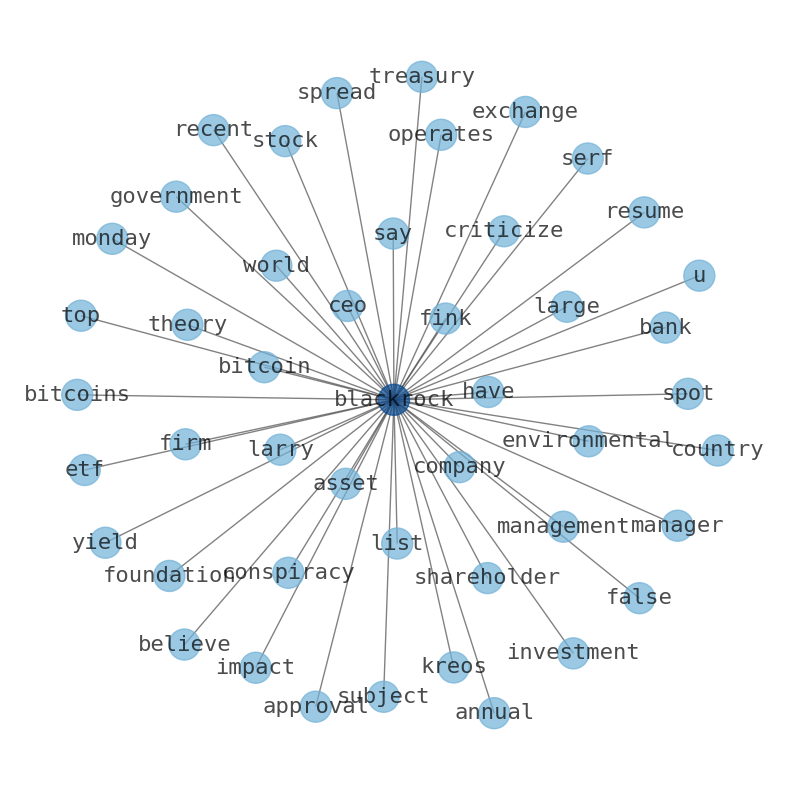

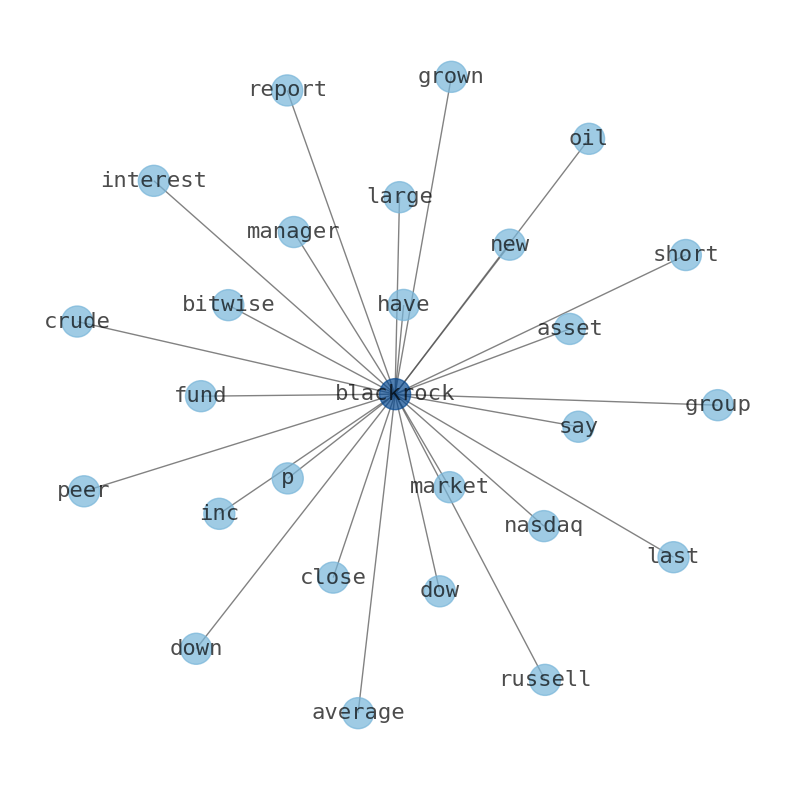

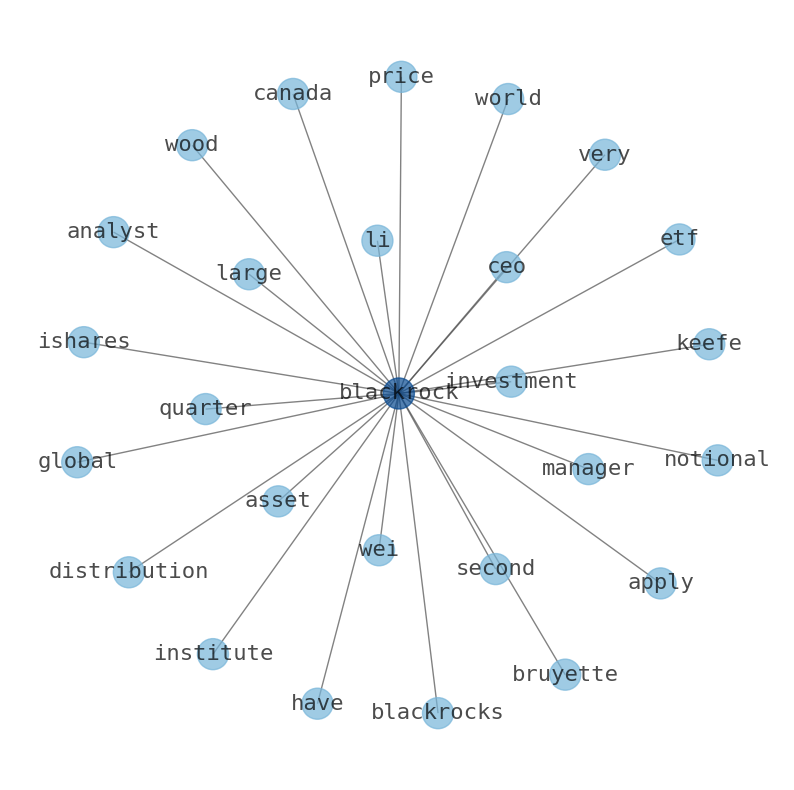

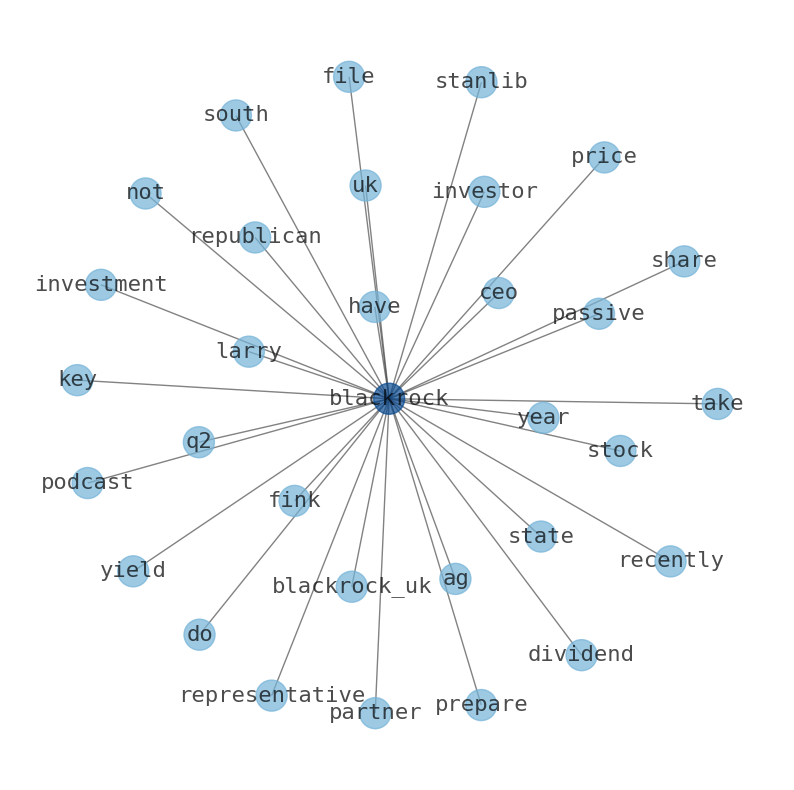

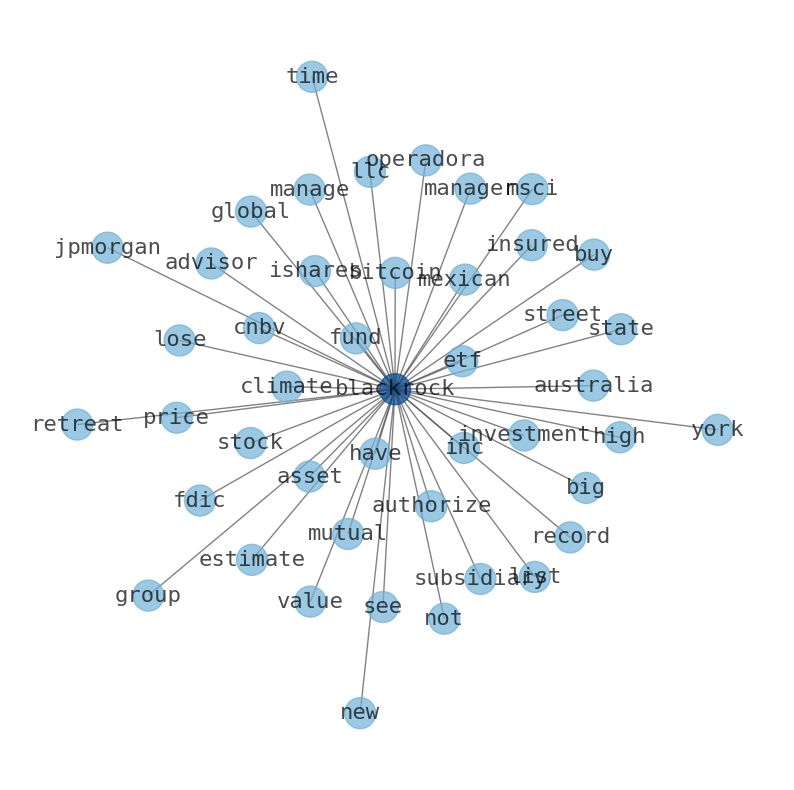

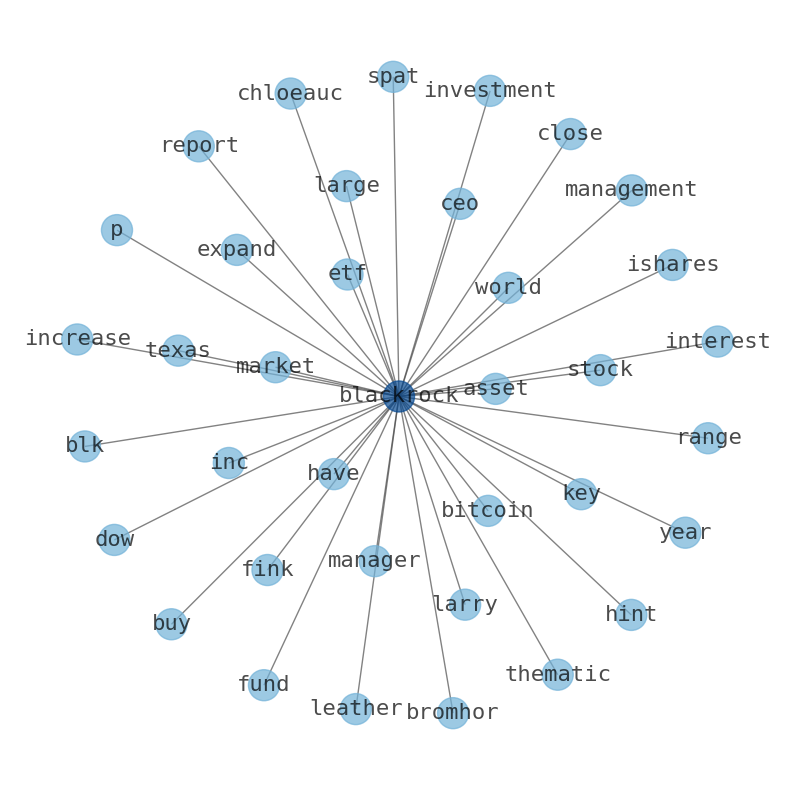

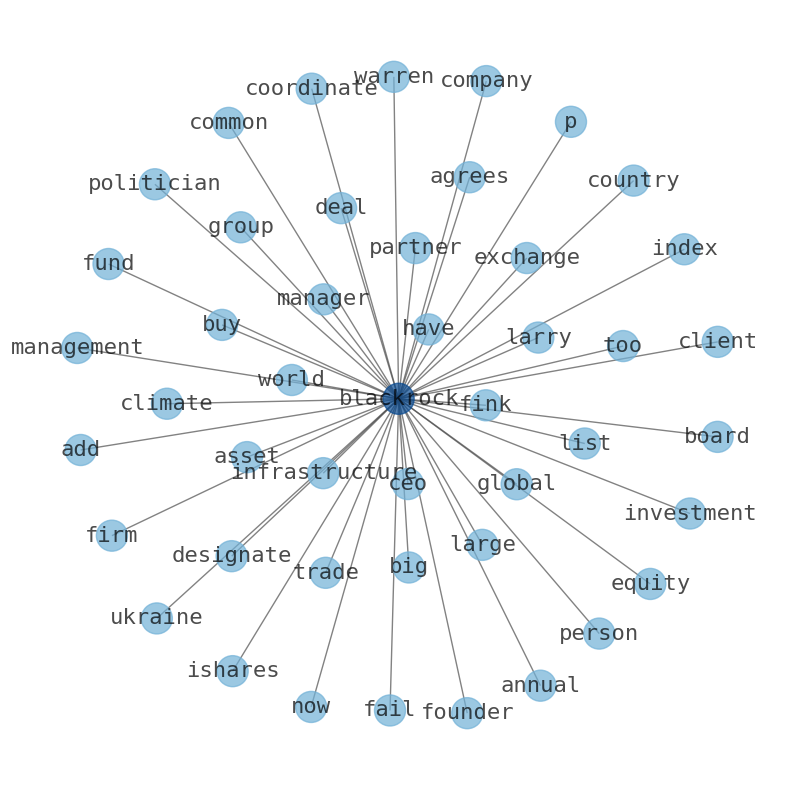

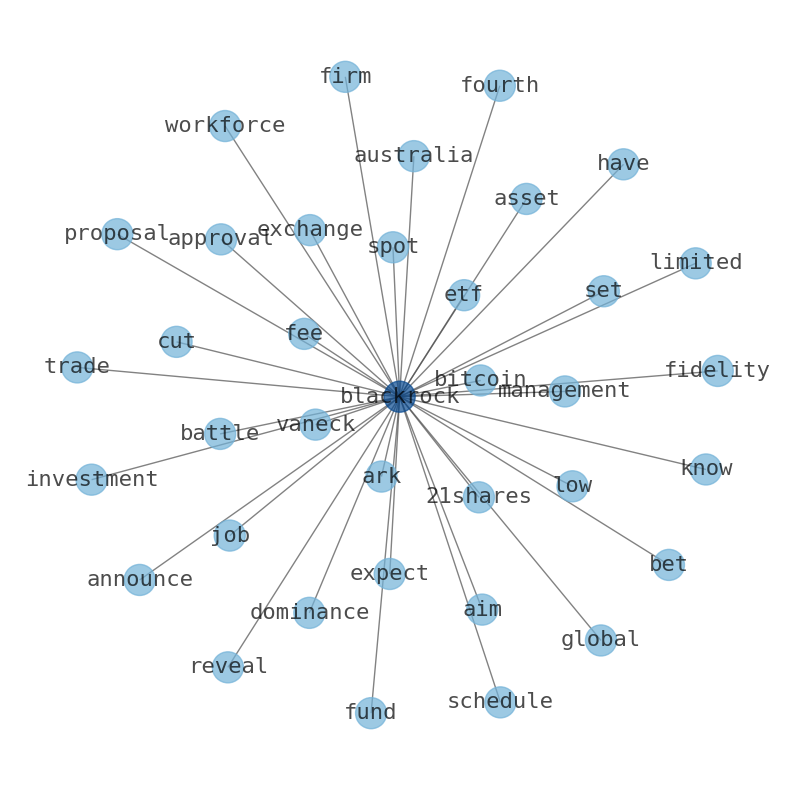

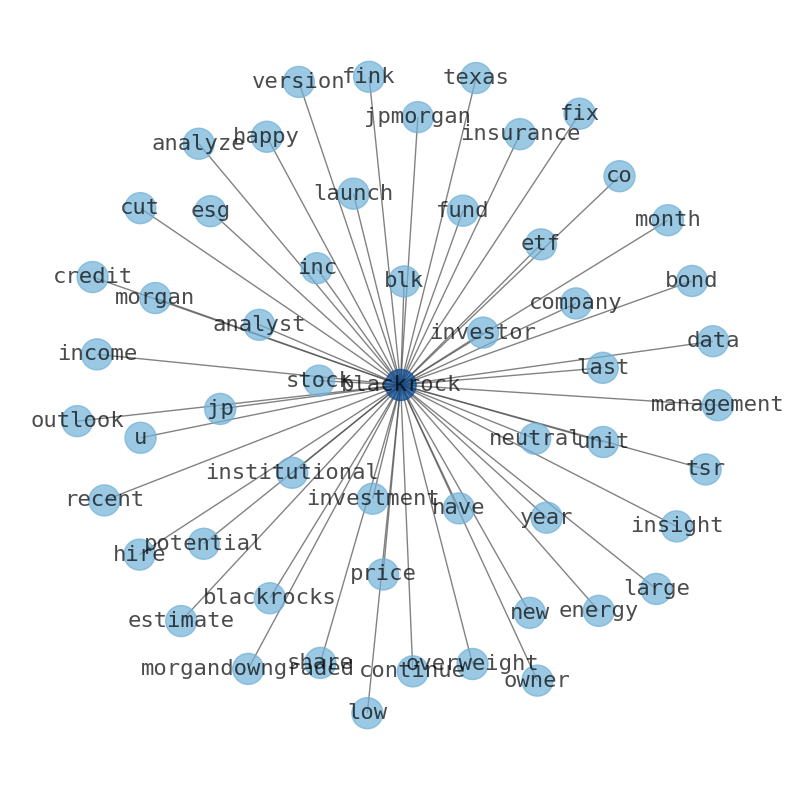

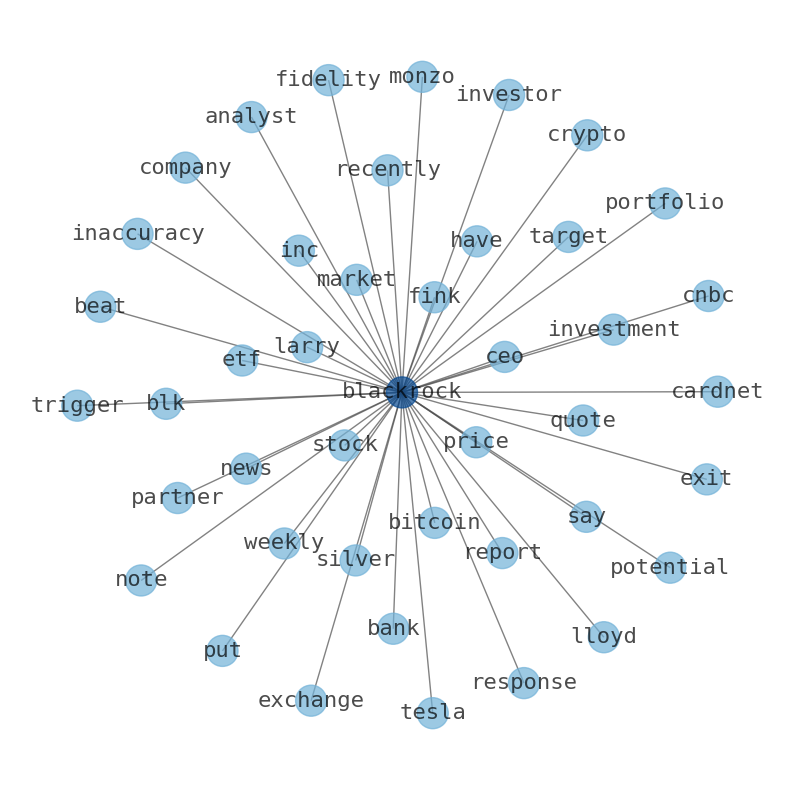

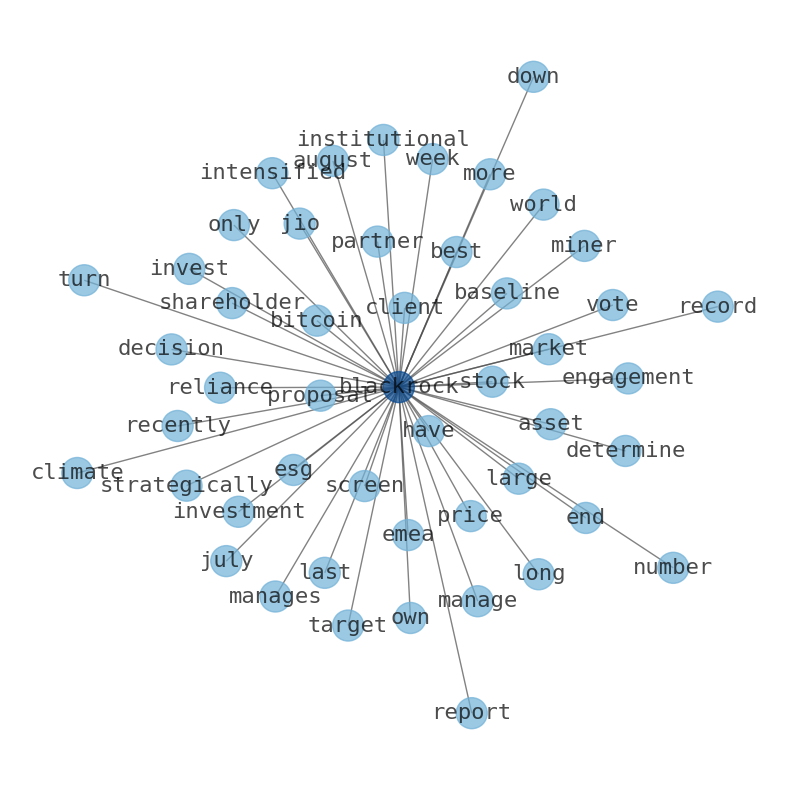

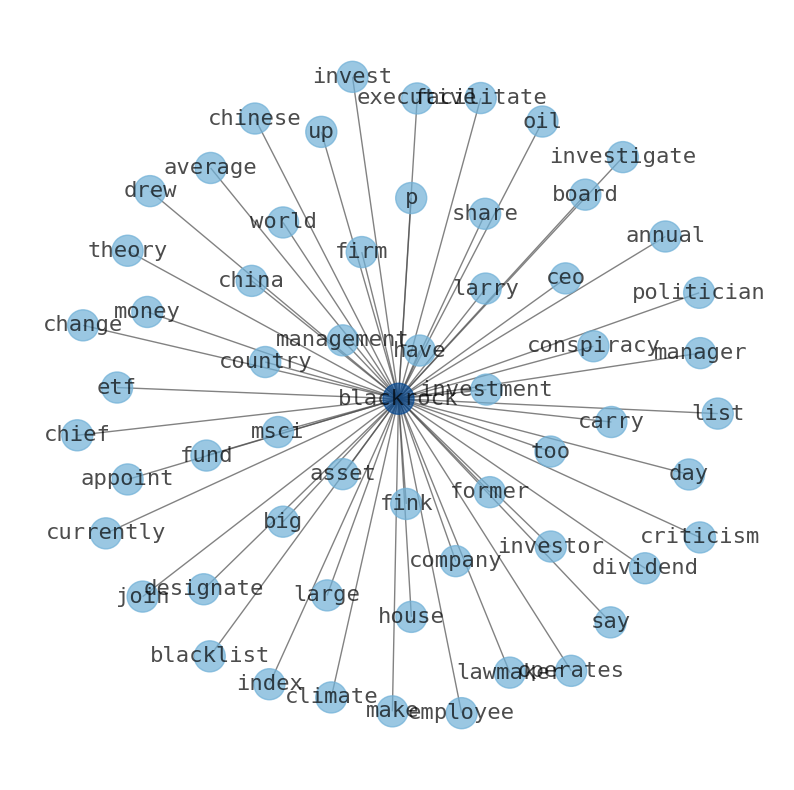

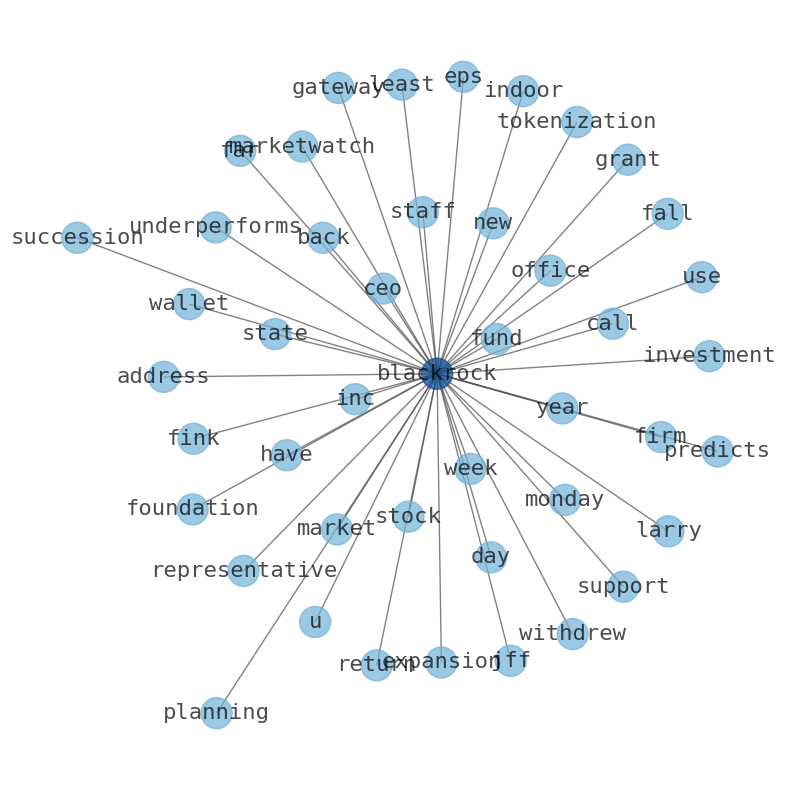

Keywords

The game is changing. There is a new strategy to evaluate BlackRock fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about BlackRock are: BlackRock, asset, manager, Fink, CEO, large, deal, and the most common words in the summary are: blackrock, fund, best, market, investment, etf, news, . One of the sentences in the summary was: The acquisition would be BlackRocks largest since it bought Barclays s asset management business in 2009. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #blackrock #fund #best #market #investment #etf #news.

Read more →Related Results

BlackRock

Open: 795.09 Close: 800.64 Change: 5.55

Read more →

BlackRock

Open: 788.4 Close: 798.05 Change: 9.65

Read more →

BlackRock

Open: 780.65 Close: 788.0 Change: 7.35

Read more →

BlackRock

Open: 785.0 Close: 799.6 Change: 14.6

Read more →

BlackRock

Open: 795.0 Close: 797.96 Change: 2.96

Read more →

BlackRock

Open: 607.07 Close: 598.08 Change: -8.99

Read more →

BlackRock

Open: 625.65 Close: 622.51 Change: -3.14

Read more →

BlackRock

Open: 693.77 Close: 695.61 Change: 1.84

Read more →

BlackRock

Open: 743.0 Close: 728.32 Change: -14.68

Read more →

BlackRock

Open: 642.59 Close: 636.97 Change: -5.62

Read more →

BlackRock

Open: 795.09 Close: 794.0 Change: -1.09

Read more →

BlackRock

Open: 794.23 Close: 797.21 Change: 2.98

Read more →

BlackRock

Open: 785.0 Close: 799.6 Change: 14.6

Read more →

BlackRock

Open: 784.43 Close: 797.19 Change: 12.76

Read more →

BlackRock

Open: 791.9 Close: 819.0 Change: 27.1

Read more →

BlackRock

Open: 623.25 Close: 614.83 Change: -8.42

Read more →

BlackRock

Open: 678.65 Close: 691.03 Change: 12.38

Read more →

BlackRock

Open: 710.07 Close: 710.28 Change: 0.21

Read more →

BlackRock

Open: 650.57 Close: 667.73 Change: 17.16

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo