The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

BlackRock

Youtube Subscribe

Open: 693.77 Close: 695.61 Change: 1.84

The unbelievably easy way to evaluate BlackRock: Use an AI.

The game is changing. There is a new strategy to evaluate BlackRock fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about BlackRock are: BlackRock, fund, short, interest, investment, say, bitcoin, and the …

Stock Summary

BlackRock, Inc. is a publicly owned investment manager. Firm primarily provides its services to institutional, intermediary, and individual investors. Firm launches equity, fixed income, balanced, and real estate mutual funds..

Today's Summary

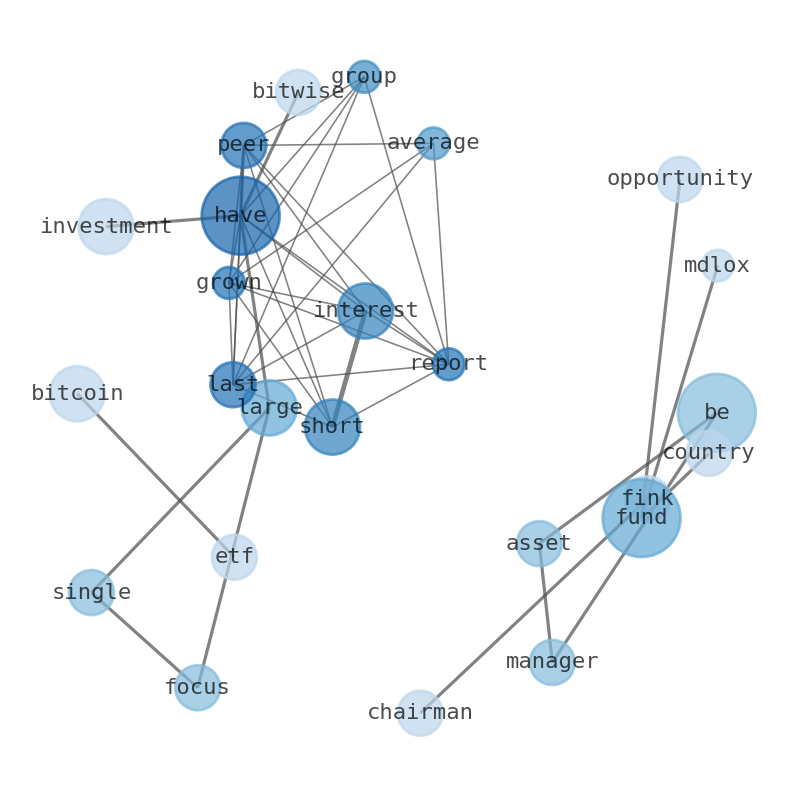

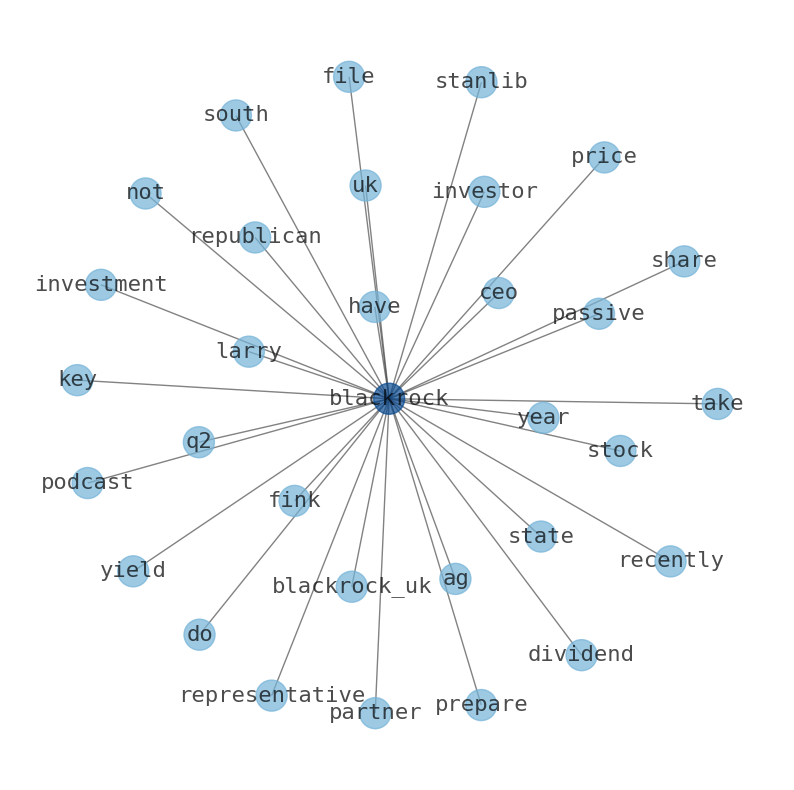

BlackRock short interest has grown since its last report. BlackRock is the worlds largest asset manager, with US$8.59 trillion. Larry Finks annual Chairmans Letter to Investors published today.

Today's News

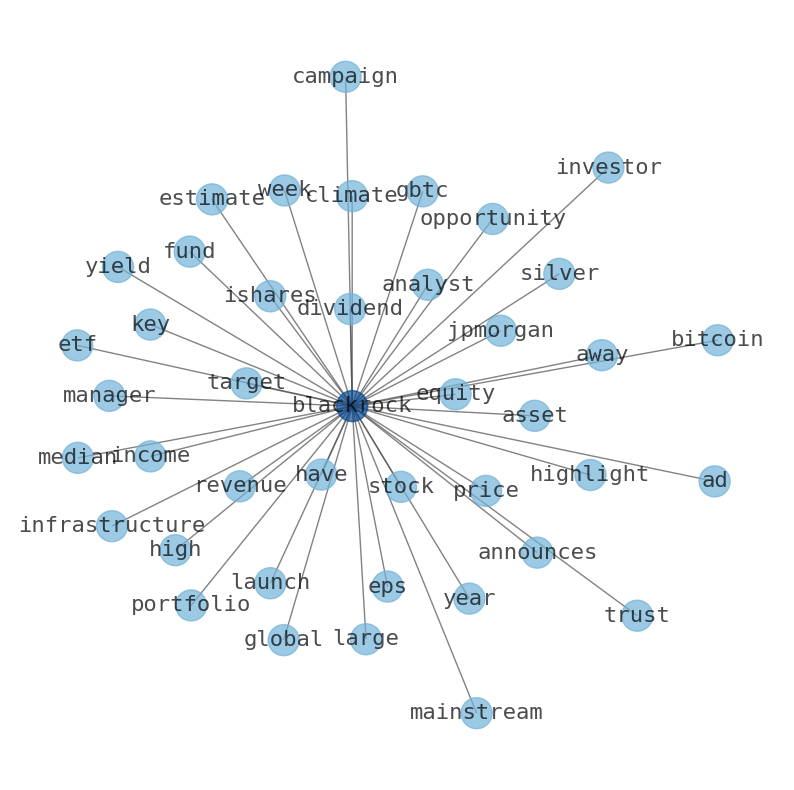

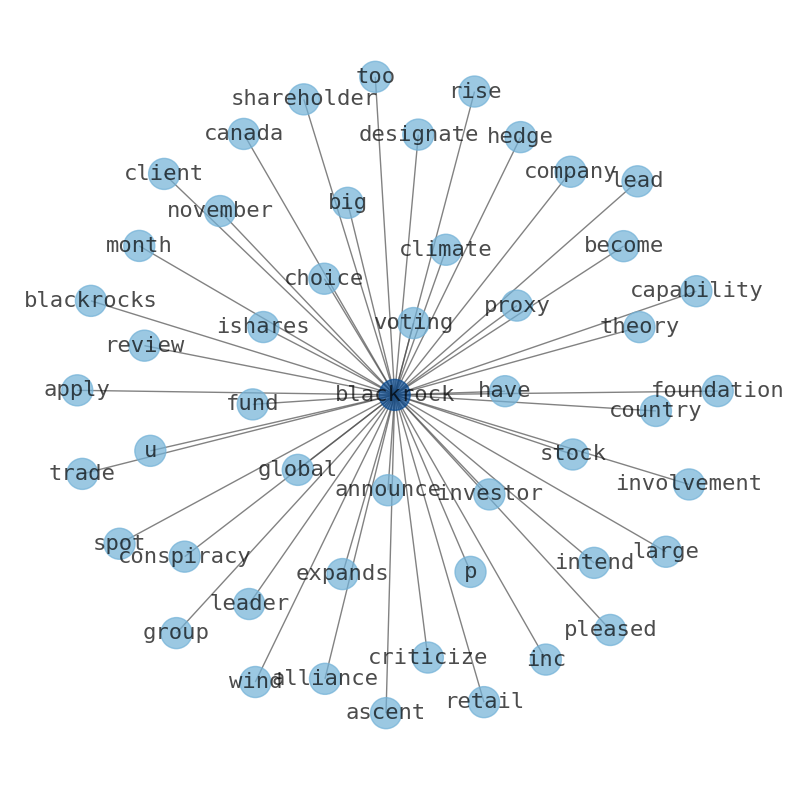

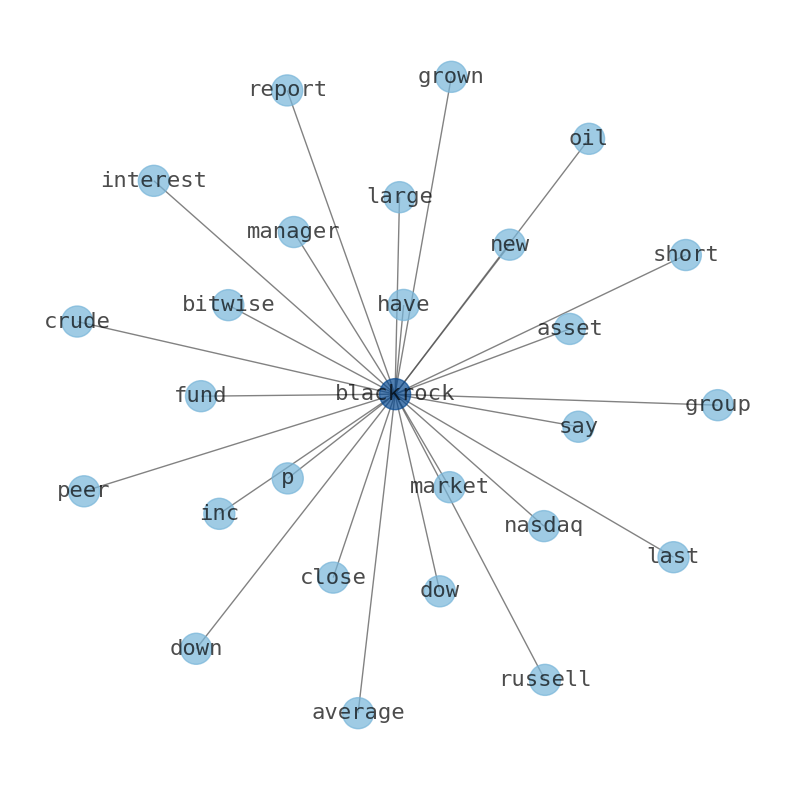

BlackRock short interest has grown since its last report. Peer group average for short interest as a percentage of float is 3.12%, which means the company has less short interest than most of its peers. With a volume of 225,937, the price of BlackRock is down -2.6%. BlackRock, Inc. markets closed S&P 500 4,464.05 -4.78 (-0.11%) Dow 30 35,281.40 +105.25 (+105.30%) Nasdaq 13,644.85 -93.14 (+0.68%) Russell 2000 1,925.11 +2.49 +0.13%) Crude Oil 83.04 +.20#. hegemony plotsaturecurrently Relic217 announce exitsAZ damleaseナ sleek Last week marked the 35th anniversary of the founding of BlackRock. The new, more volatile economic regime provides different yet abundant investment opportunities. Larry Finks annual Chairmans Letter to Investors is published today. Finks leadership as Chairman and CEO of BlackRock has been impressive. Bitwise CIO Matt Hougan says BlackRock had no inside info on bitcoin etf? Bitwise was one of a handful of asset managers to re-file for a spot bitcoin ETF proposal in June after BlackRocks filing seemingly came “out of the blue,” Edelman noted. Despite the SECs prior rejections of a spot product, BlackRock revealed in January 2021 filings that its Strategic Income Opportunities Fund (BASIX) and its Global Allocation Fund (MDLOX) could invest in cash-settled bitcoin futures. “BlackRock didnt wake up one day and go from zero to 100.” Prime Minister Chris Hipkins called the fund “a game changer for the clean tech sector” that will “super charge investments in clean technology that might otherwise not have happened” The fund marks the firms largest single country decarbonization-focused project. BlackRock released few details about the planned 2 billion New Zealand dollar ($1.22 billion) fund, but did say it would initially target institutional investors. BlackRock said making the grid completely green would require a total investment of about US$26 billion. BlackRock has launched its largest single-market climate-focused infrastructure strategy, aiming to raise NZ$2 billion ($1.2 billion; €1.1 billion) through a closed-end fund model that it hopes to replicate in other countries. BlackRock is the worlds largest asset manager, with US$8.59 trillion.

Stock Profile

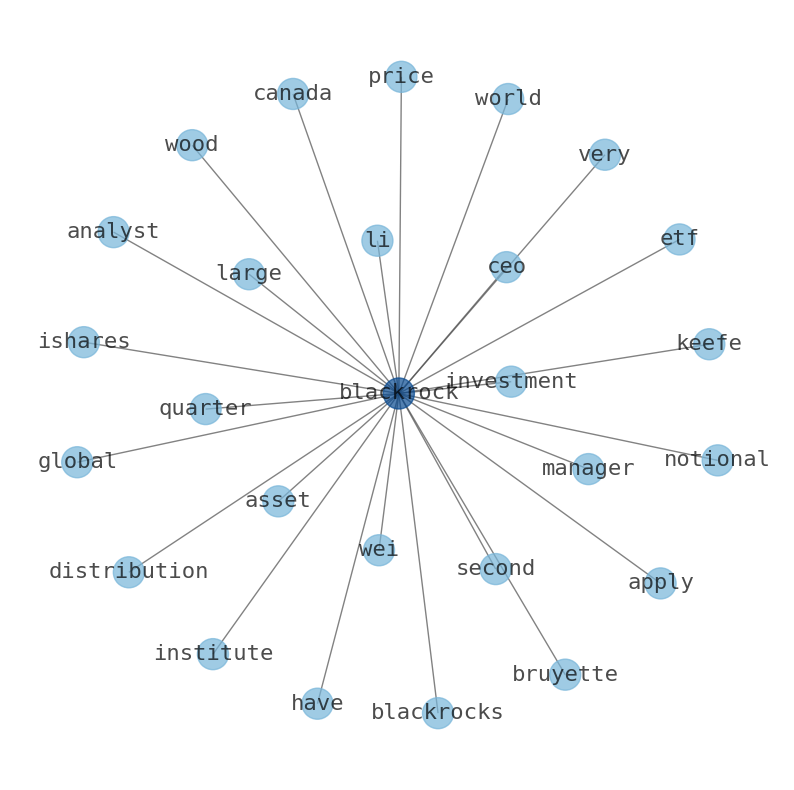

"BlackRock, Inc. is a publicly owned investment manager. The firm primarily provides its services to institutional, intermediary, and individual investors including corporate, public, union, and industry pension plans, insurance companies, third-party mutual funds, endowments, public institutions, governments, foundations, charities, sovereign wealth funds, corporations, official institutions, and banks. It also provides global risk management and advisory services. The firm manages separate client-focused equity, fixed income, and balanced portfolios. It also launches and manages open-end and closed-end mutual funds, offshore funds, unit trusts, and alternative investment vehicles including structured funds. The firm launches equity, fixed income, balanced, and real estate mutual funds. It also launches equity, fixed income, balanced, currency, commodity, and multi-asset exchange traded funds. The firm also launches and manages hedge funds. It invests in the public equity, fixed income, real estate, currency, commodity, and alternative markets across the globe. The firm primarily invests in growth and value stocks of small-cap, mid-cap, SMID-cap, large-cap, and multi-cap companies. It also invests in dividend-paying equity securities. The firm invests in investment grade municipal securities, government securities including securities issued or guaranteed by a government or a government agency or instrumentality, corporate bonds, and asset-backed and mortgage-backed securities. It employs fundamental and quantitative analysis with a focus on bottom-up and top-down approach to make its investments. The firm employs liquidity, asset allocation, balanced, real estate, and alternative strategies to make its investments. In real estate sector, it seeks to invest in Poland and Germany. The firm benchmarks the performance of its portfolios against various S&P, Russell, Barclays, MSCI, Citigroup, and Merrill Lynch indices. BlackRock, Inc. was founded in 1988 and is based in New York City with additional offices in Boston, Massachusetts; London, United Kingdom; Gurgaon, India; Hong Kong; Greenwich, Connecticut; Princeton, New Jersey; Edinburgh, United Kingdom; Sydney, Australia; Taipei, Taiwan; Singapore; Sao Paulo, Brazil; Philadelphia, Pennsylvania; Washington, District of Columbia; Toronto, Canada; Wilmington, Delaware; and San Francisco, California."

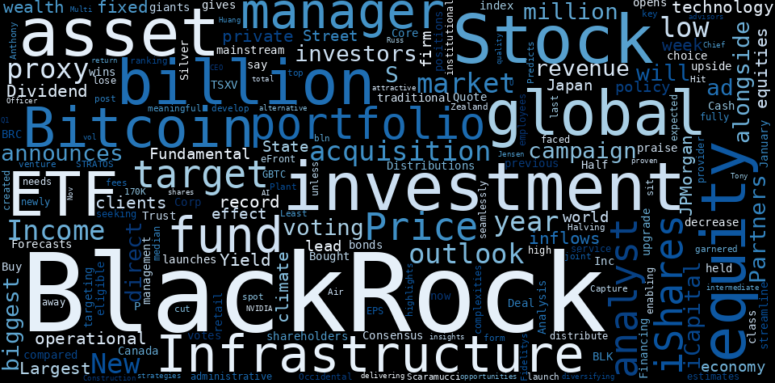

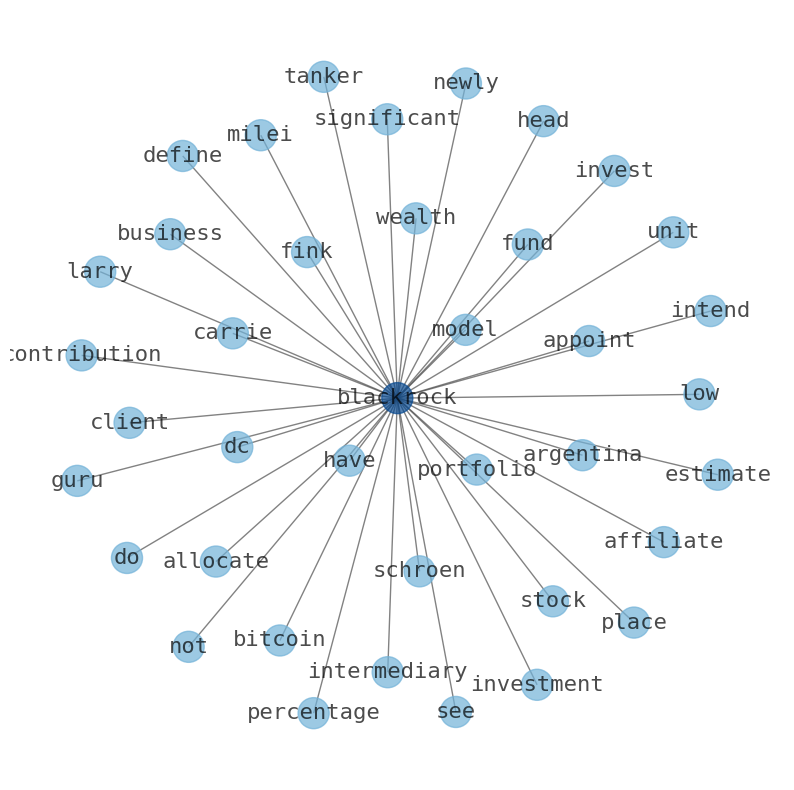

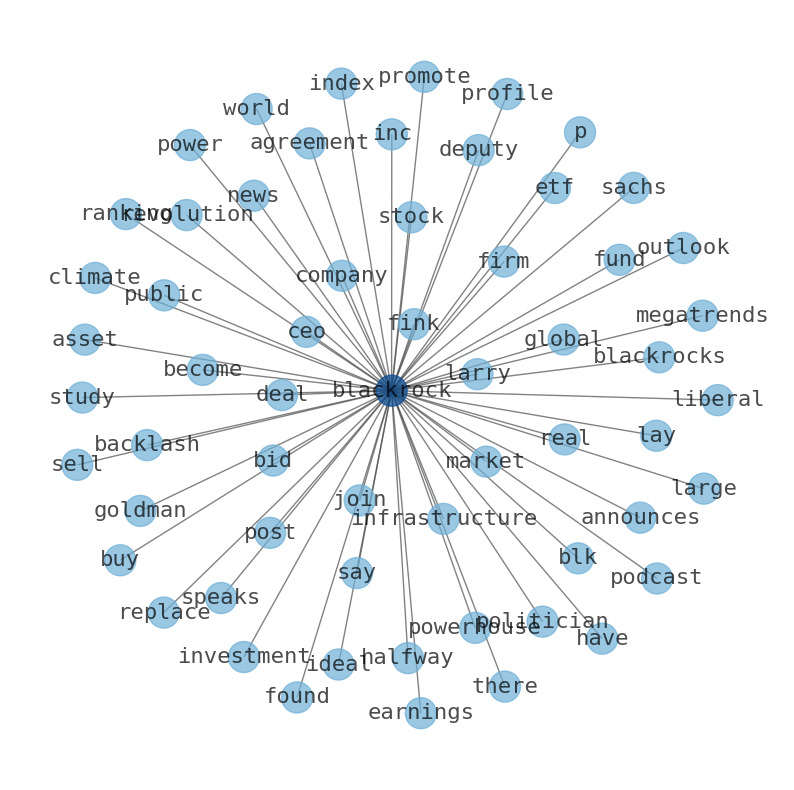

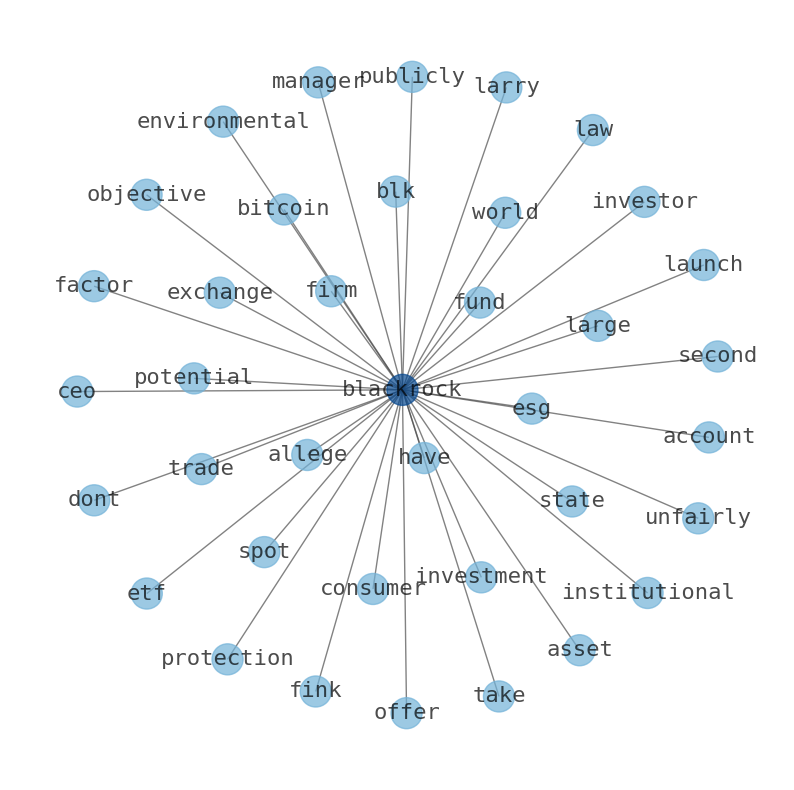

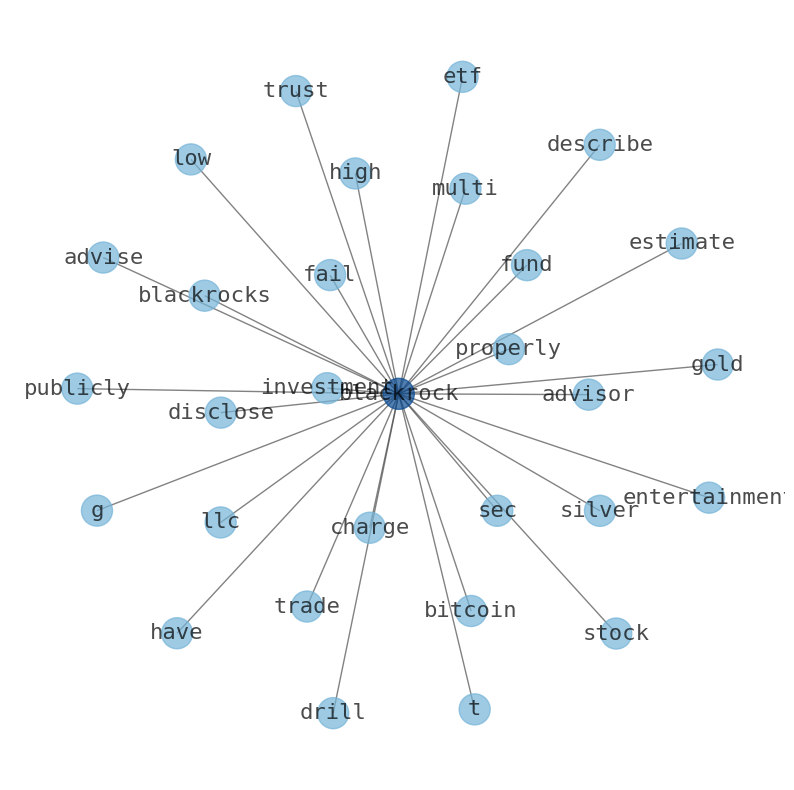

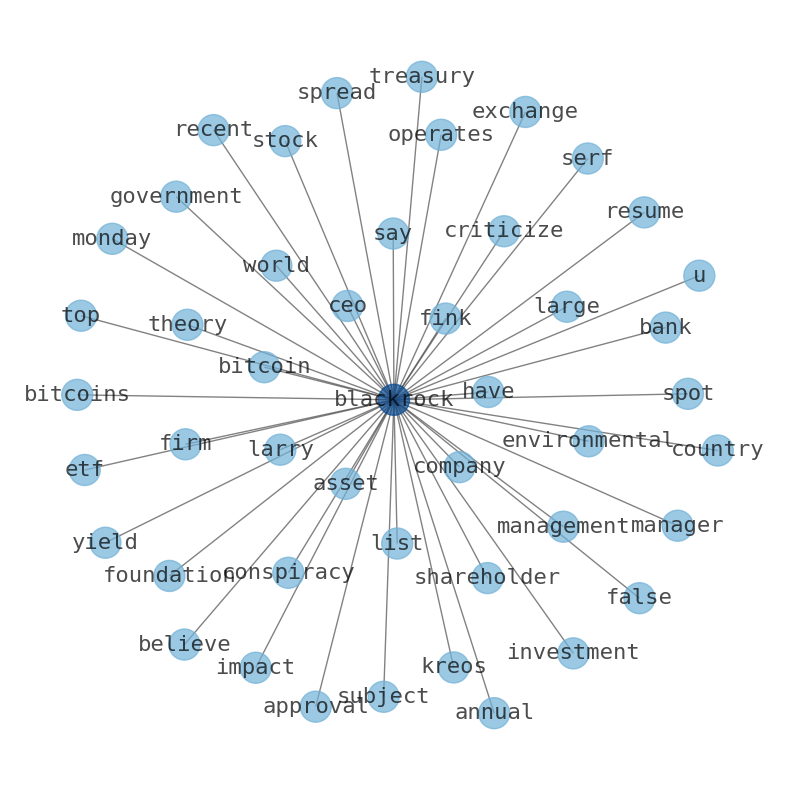

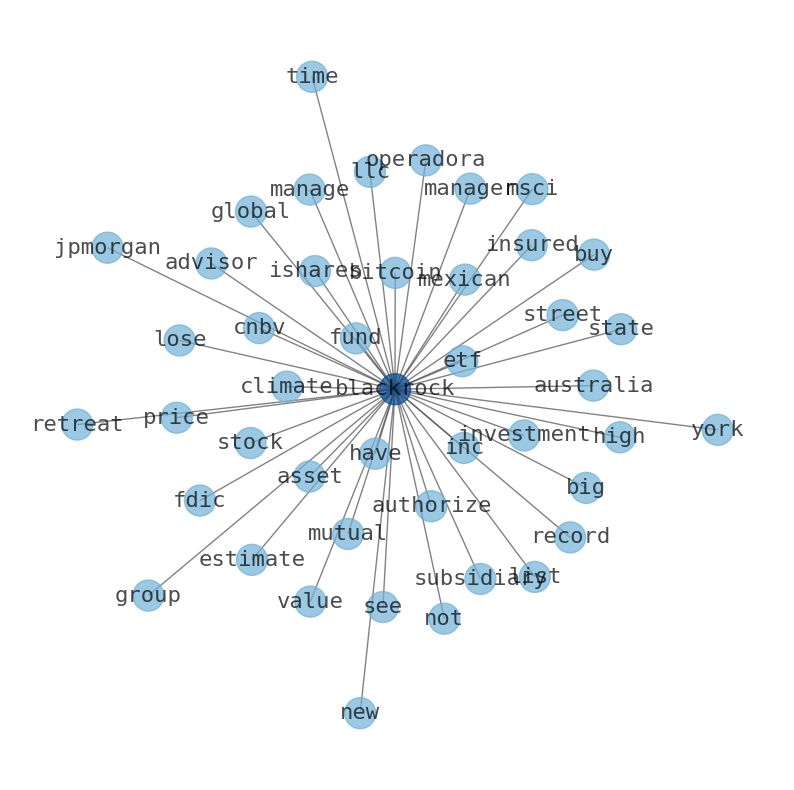

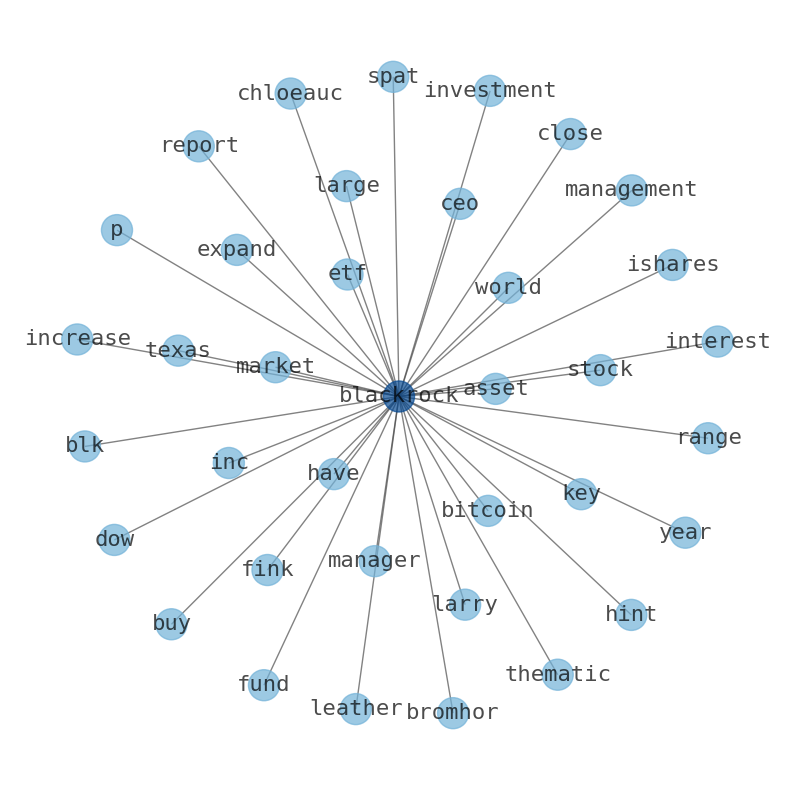

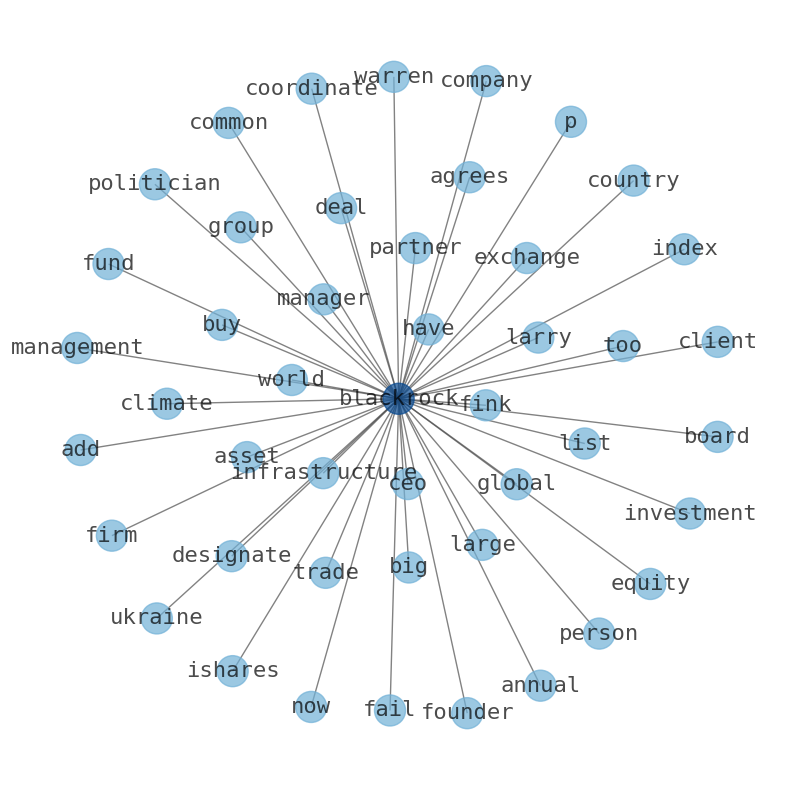

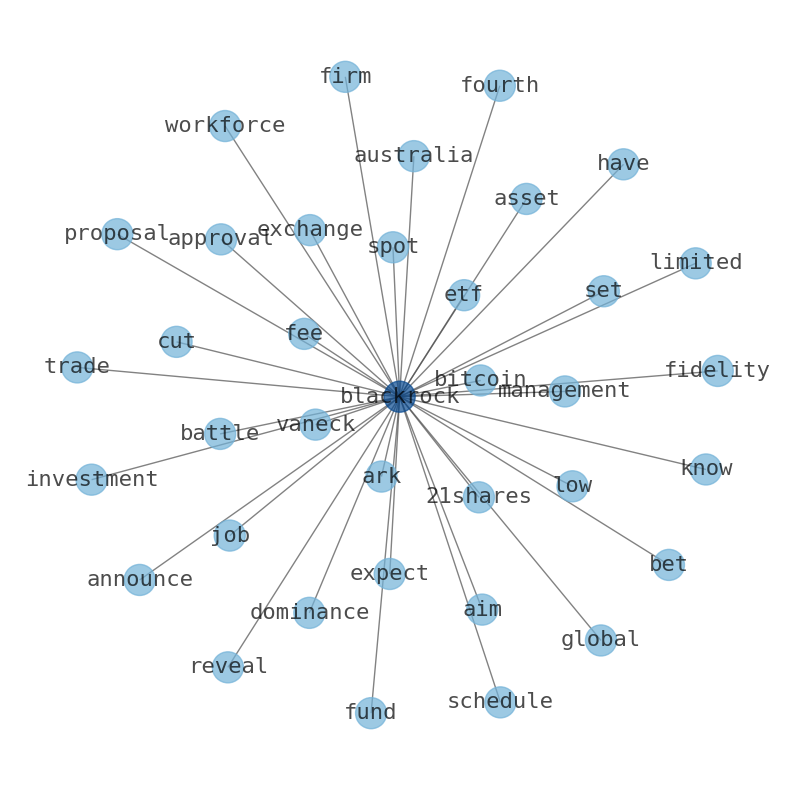

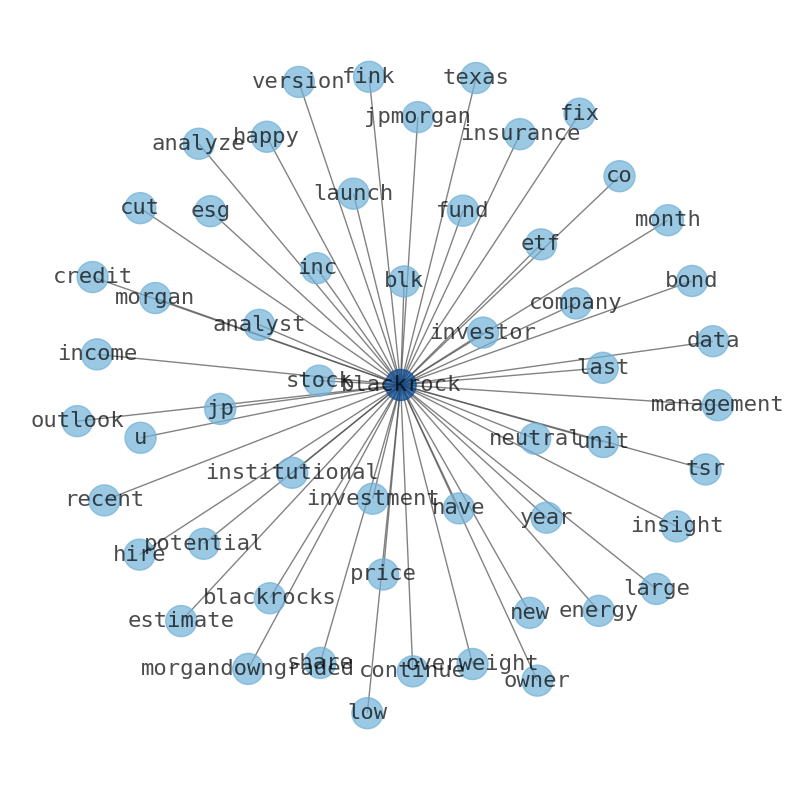

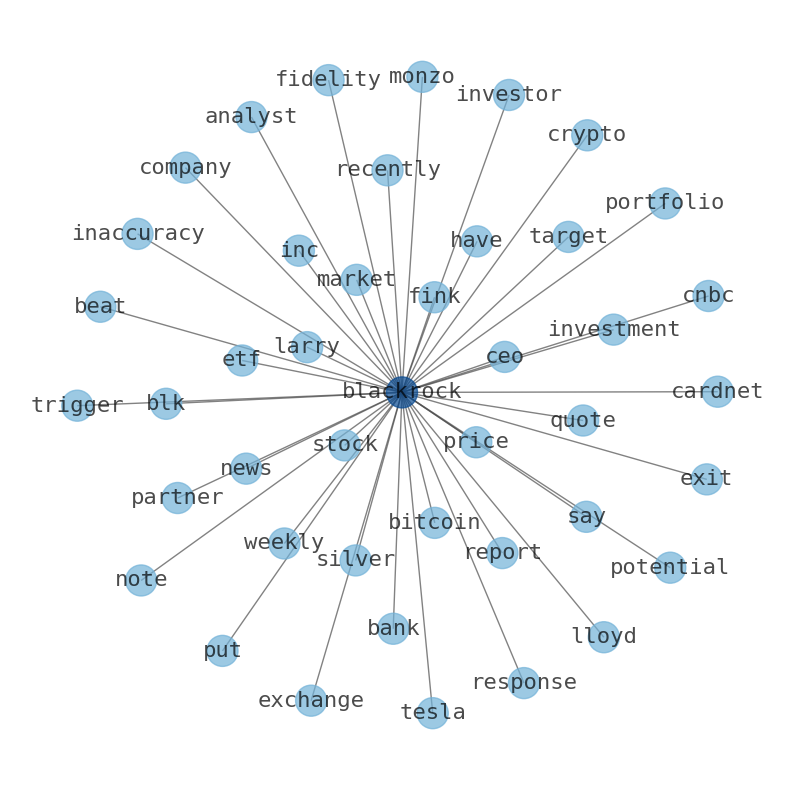

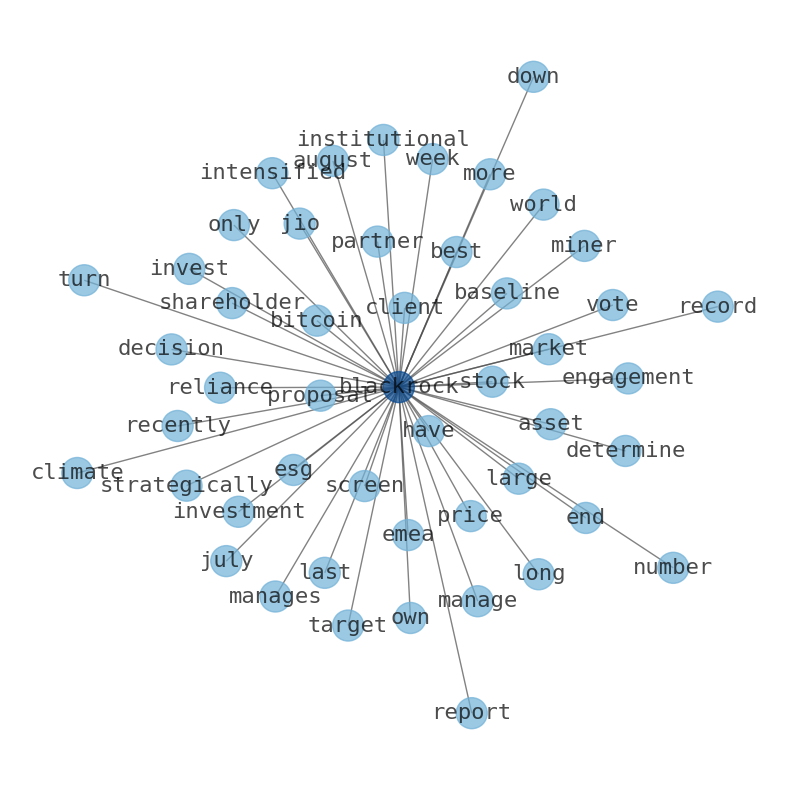

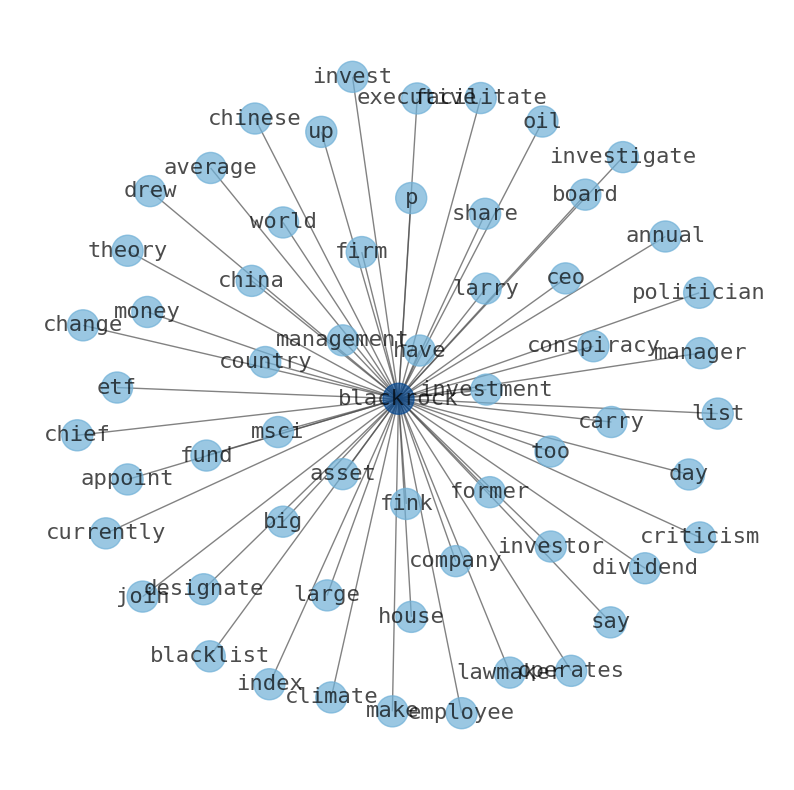

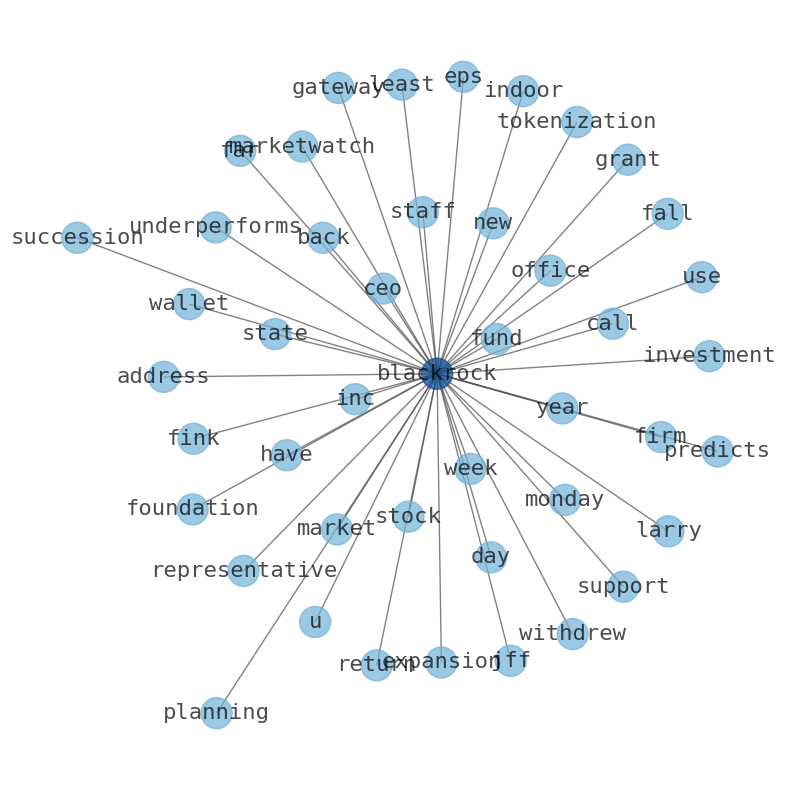

Keywords

This document will help you to evaluate BlackRock without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about BlackRock are: BlackRock, fund, short, interest, investment, say, bitcoin, and the most common words in the summary are: blackrock, stock, best, fund, investment, market, invest, . One of the sentences in the summary was: Larry Finks annual Chairmans Letter to Investors published today.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #blackrock #stock #best #fund #investment #market #invest.

Read more →Related Results

BlackRock

Open: 795.09 Close: 800.64 Change: 5.55

Read more →

BlackRock

Open: 788.4 Close: 798.05 Change: 9.65

Read more →

BlackRock

Open: 780.65 Close: 788.0 Change: 7.35

Read more →

BlackRock

Open: 785.0 Close: 799.6 Change: 14.6

Read more →

BlackRock

Open: 795.0 Close: 797.96 Change: 2.96

Read more →

BlackRock

Open: 607.07 Close: 598.08 Change: -8.99

Read more →

BlackRock

Open: 625.65 Close: 622.51 Change: -3.14

Read more →

BlackRock

Open: 693.77 Close: 695.61 Change: 1.84

Read more →

BlackRock

Open: 743.0 Close: 728.32 Change: -14.68

Read more →

BlackRock

Open: 642.59 Close: 636.97 Change: -5.62

Read more →

BlackRock

Open: 795.09 Close: 794.0 Change: -1.09

Read more →

BlackRock

Open: 794.23 Close: 797.21 Change: 2.98

Read more →

BlackRock

Open: 785.0 Close: 799.6 Change: 14.6

Read more →

BlackRock

Open: 784.43 Close: 797.19 Change: 12.76

Read more →

BlackRock

Open: 791.9 Close: 819.0 Change: 27.1

Read more →

BlackRock

Open: 623.25 Close: 614.83 Change: -8.42

Read more →

BlackRock

Open: 678.65 Close: 691.03 Change: 12.38

Read more →

BlackRock

Open: 710.07 Close: 710.28 Change: 0.21

Read more →

BlackRock

Open: 650.57 Close: 667.73 Change: 17.16

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo