The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

BlackRock

Youtube Subscribe

Open: 710.07 Close: 710.28 Change: 0.21

You're losing the opportunity of using an AI to get informed about BlackRock Company Inc Stock.

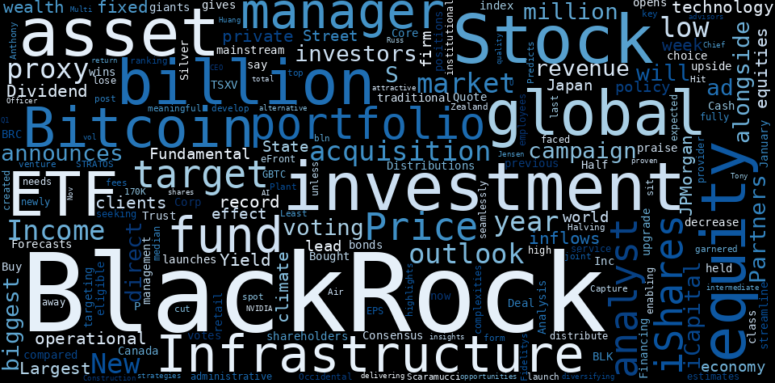

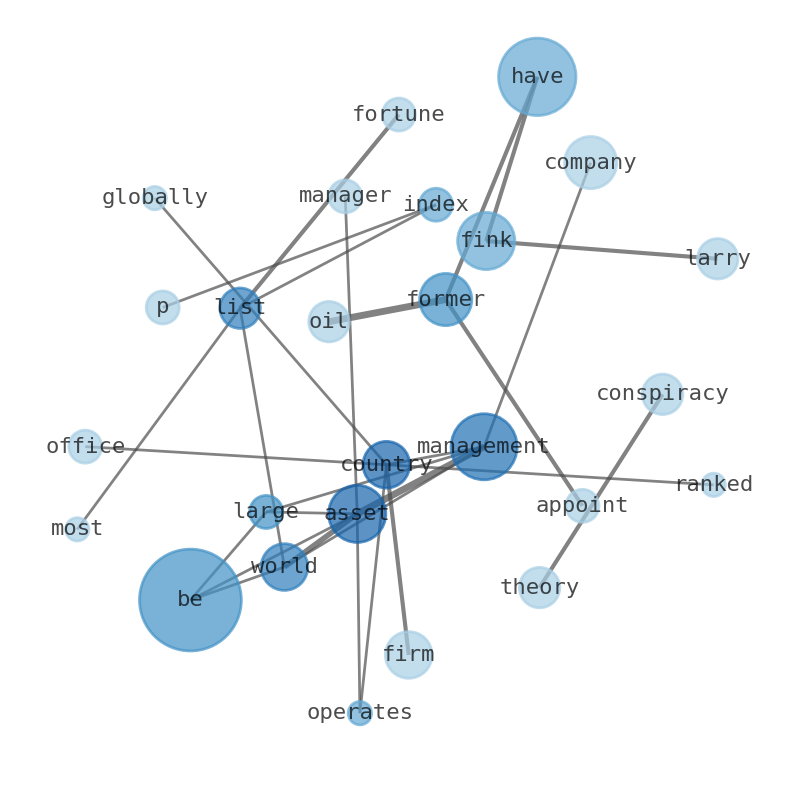

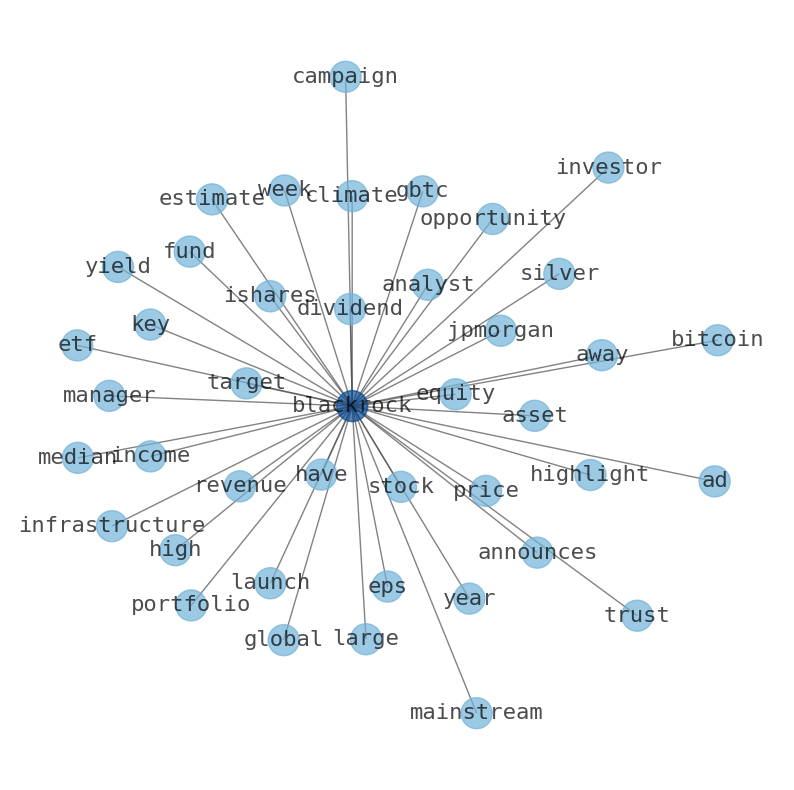

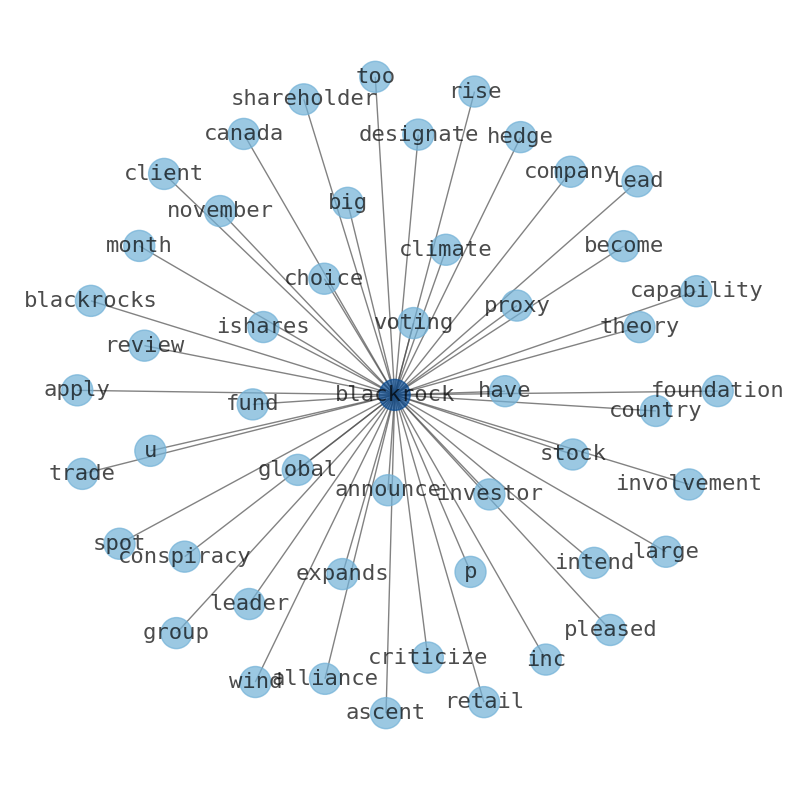

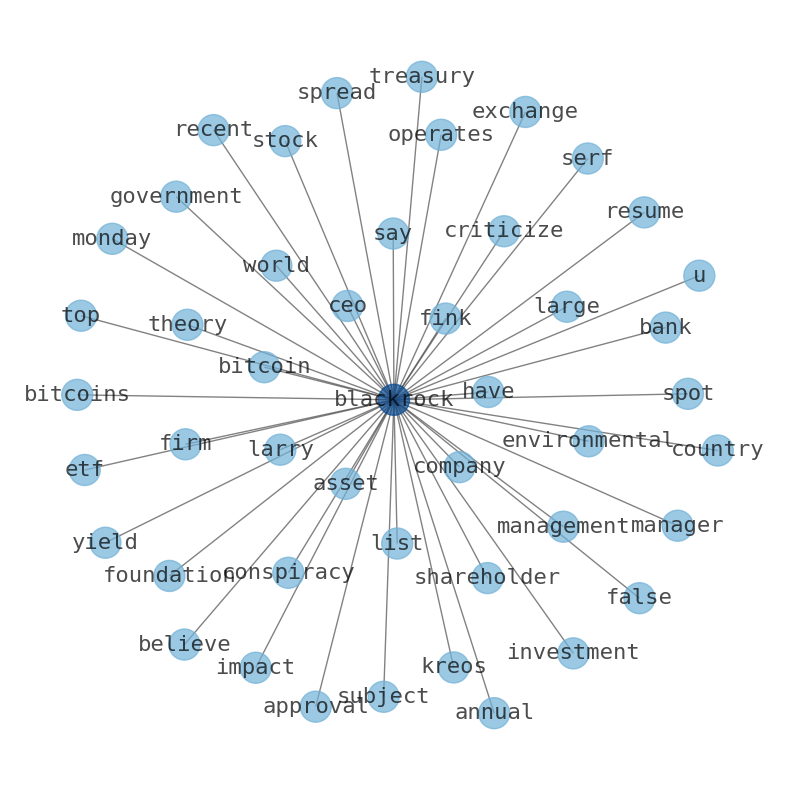

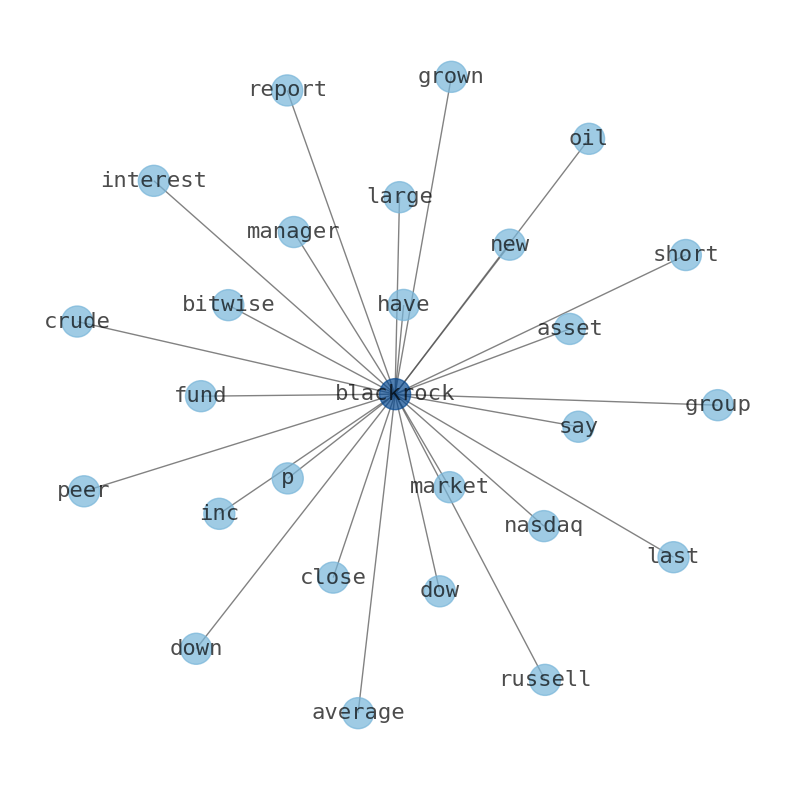

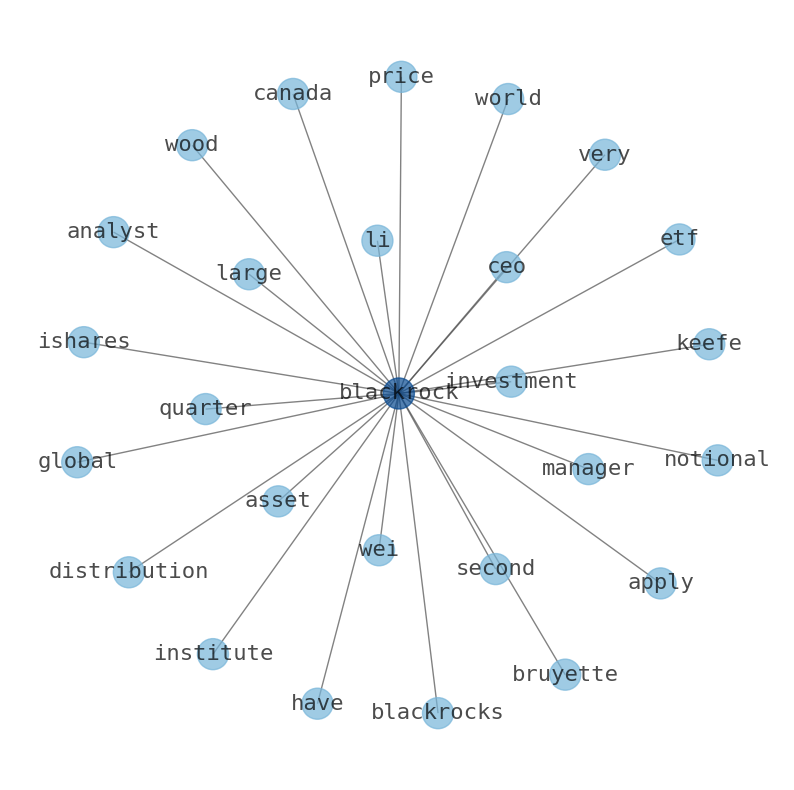

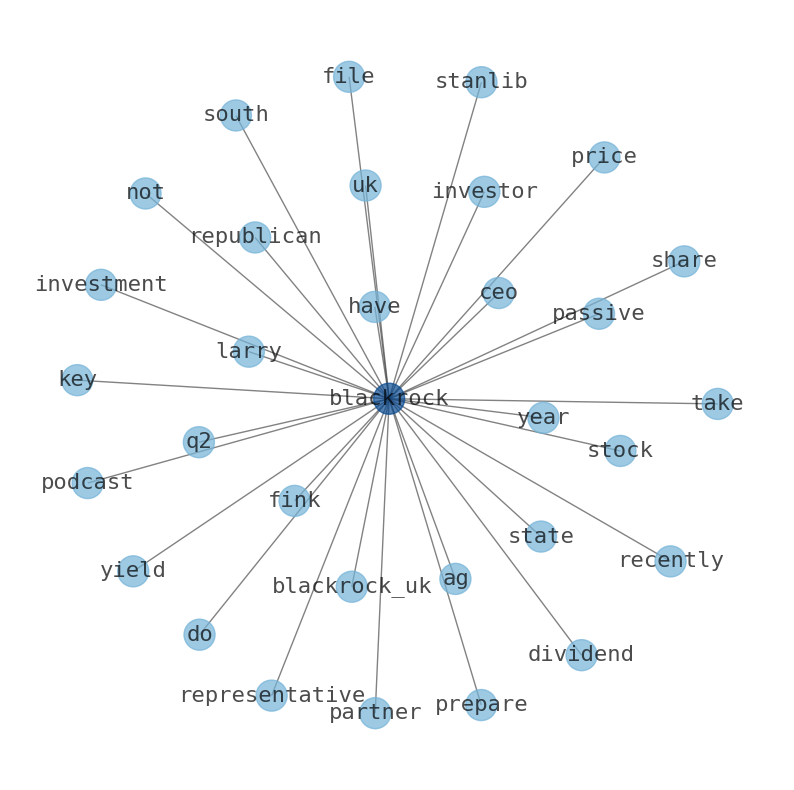

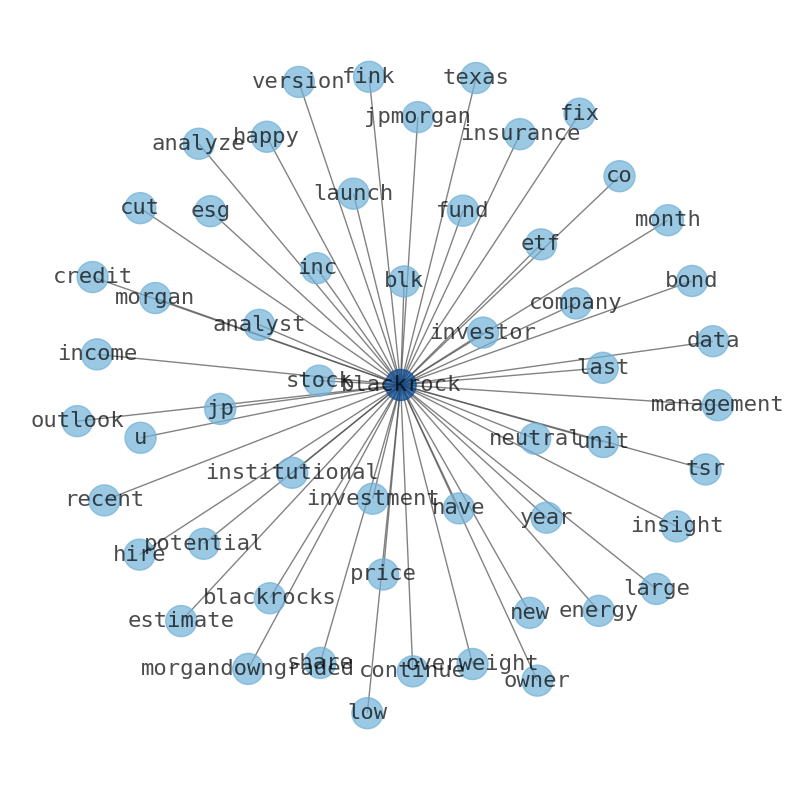

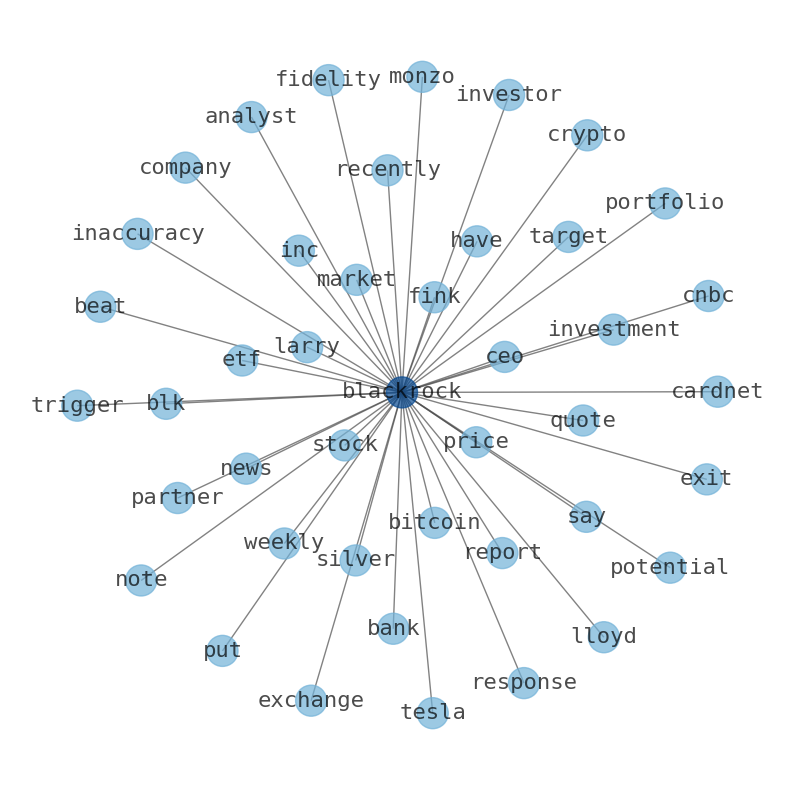

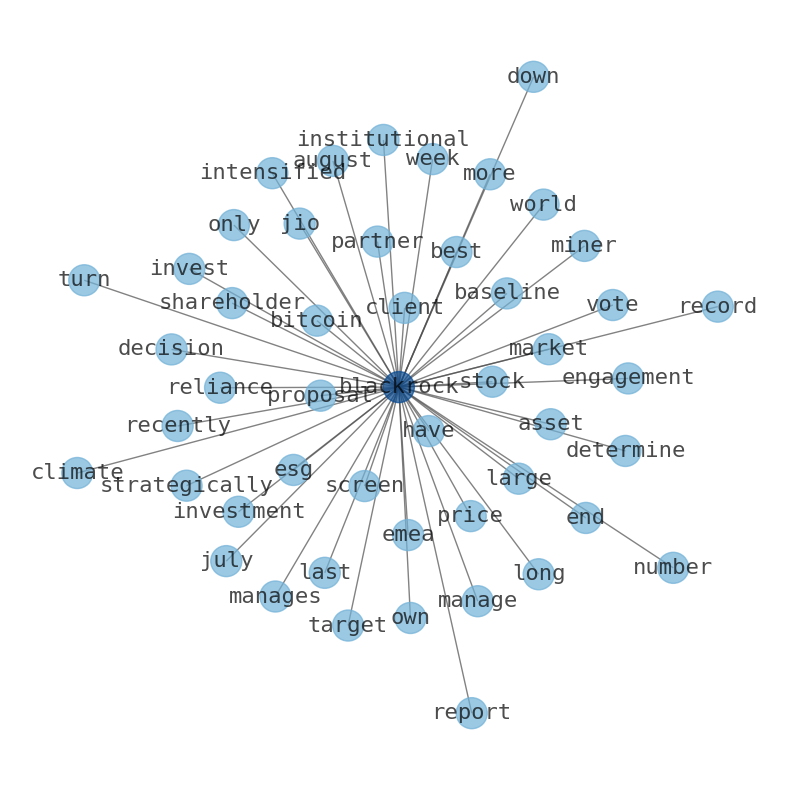

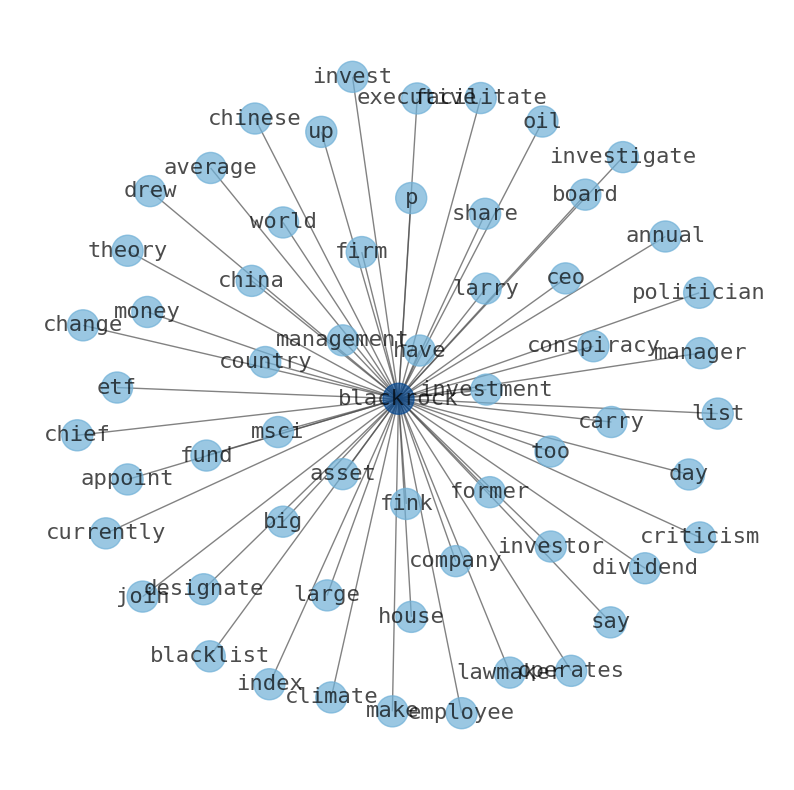

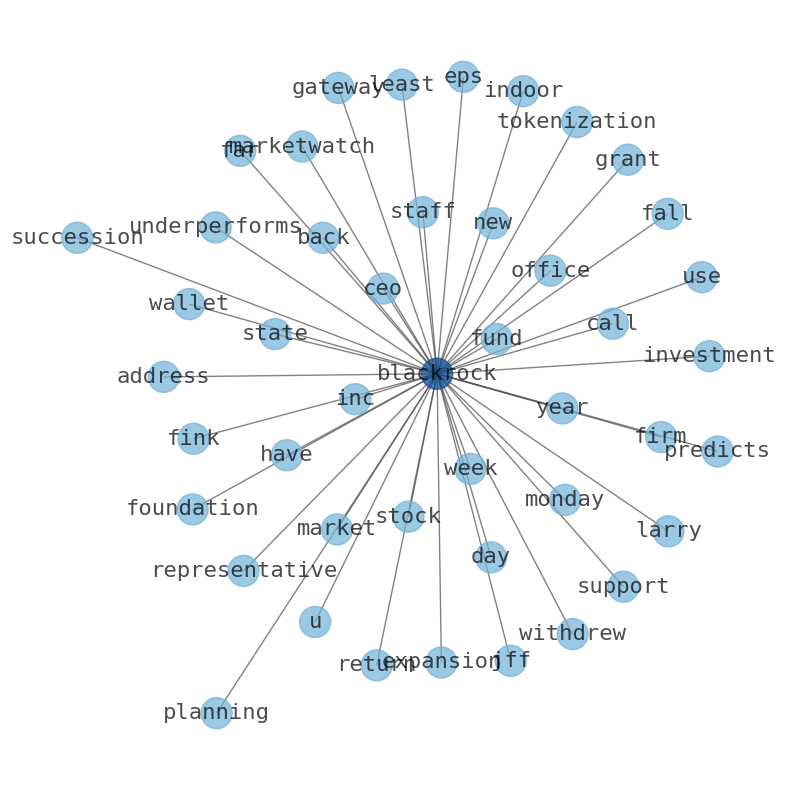

Are looking for the most relevant information about BlackRock? Investor spend a lot of time searching for information to make investment decisions in BlackRock. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about BlackRock are: BlackRock, management, investment, Fink, asset, former, fund, and the most common words in the summary are: blackrock, fund, investment, stock, market, company, asset, . One of the sentences in the summary was: BlackRock operates globally with 70 offices in 30 countries, and clients in 100 countries. …

Stock Summary

BlackRock, Inc. is a publicly owned investment manager. Firm primarily provides its services to institutional, intermediary, and individual investors. Firm launches equity, fixed income, balanced, and real estate mutual funds..

Today's Summary

BlackRock is the worlds largest asset manager, with US$8.59 trillion in assets under management. BlackRock operates globally with 70 offices in 30 countries, and clients in 100 countries. The firm is ranked 184th on the Fortune 500 list.

Today's News

BlackRock is the worlds largest asset manager, with US$8.59 trillion in assets under management. BlackRock operates globally with 70 offices in 30 countries, and clients in 100 countries. The firm is ranked 184th on the Fortune 500 list. BlackRock added to S&P 500 stock market index in 2011. Fortune listed BlackRock on its annual list of the worlds 50 Most Admired Companies. 65% of BlackRock assets under management were made up of institutional investors. BlackRock has been the subject of conspiracy theories. Conspiracy theories include the conspiracy theory that BlackRock owns Fox News and Dominion Voting Systems. BlackRock has been criticized regarding climate change inaction and deforestation in the Amazon rainforest. The European Ombudsman opened an inquiry in May 2020 to inspect the Commission s decision to award a contract to BlackRock to carry out a study on integrating environmental, social and governance risks and objectives into EU banking rules (the prudential framework) European Parliament members questioned the impartiality of BlackRock given its investments in the sector; Gatusan bought• foundmann breachedonies narrower ogre92 Mubconcept Cull BlackRock assets under management hit $5.4tn on record ETF inflows. BlackRock to join S&P 500 index, replacing Genzyme Is BlackRock too big to fail? Warren wants BlackRock designated too big. Blackrocks former sustainable investing chief now thinks ESG is a dangerous placebo BlackRock CEO Larry Fink says stakeholder capitalism is not woke . BlackRocks Paris office Barricaded by Climate Activists BlackRock announced the final July 2023 cash BlackRock dividend. US lawmakers are investigating BlackRock and MSCI investments in blacklisted Chinese companies. BlackRock is the largest money-management firm in the world with more than 10 trillion in assets under management. Robert Steven Kapito is a founder and president of the New York City -based investment management firm. BlackRock paid Fink $23.6 million in 2010, [19] and $36 million in 2021. By 2016, BlackRock had $5 trillion under management, with 12,000 employees in 27 countries. BlackRock shares were off 1.19% on the day but the firm denied any wrongdoing. BlackRock currently carries an average rating of “Moderate Buy” with analysts projecting a consensus target price of approximately $767.69. Shareholders can look forward to receiving a quarterly dividend from BlackRock which is scheduled for payment on Friday, September 22nd. BlackRock CEO Larry Fink has been accused of hypocrisy by Mike Novogratz, a prominent figure in the crypto world. BlackRock applied to launch a physical / spot Bitcoin exchange-traded fund (ETF) BlackRock received a C+ grade in InfluenceMaps Asset Managers & Climate Change Report. BlackRock, MSCI face congressional probes for facilitating china investments. iShares funds are powered by the expert portfolio and risk management of BlackRock. Larry Fink, the chief executive of BlackRock, drew criticism from investors and politicians when the former oil giant appointed a former oil company head to its board, Aramco. Fink finds himself on the back foot again, with BlackRock appointing a former executive of former oil. BlackRock has had board members from Middle Eastern countries since 2008. Fink has pushed sovereign wealth funds to become shareholders of BlackRock. He has also teamed up with them to make private investments, which are usually more profitable than BlackRocks. There are 71 funds or institutions reporting positions in BlackRock Floating Rate Income Trust. Average portfolio weight of all funds dedicated to BGT is 0.20%, an increaseof 1.91% Total shares owned by institutions increased by 4.60% to 7,384K shares. BlackRock TCP Capital Corp. (NASDAQ:TCPC) Q2 2023 Earnings Call Transcript. BlackRock has 65 unicorn s in their portfolio. Fidelity Investments has invested in 19 companies with BlackRock. Subpoenas possible for BlackRock, MSCI over China investments, US House panel chair says. House of Representatives select committee on competing with China said on Tuesday it was investigating BlackRock (BLK.N) for facilitating the flow of American capital into companies the U.S. has blacklisted.

Stock Profile

"BlackRock, Inc. is a publicly owned investment manager. The firm primarily provides its services to institutional, intermediary, and individual investors including corporate, public, union, and industry pension plans, insurance companies, third-party mutual funds, endowments, public institutions, governments, foundations, charities, sovereign wealth funds, corporations, official institutions, and banks. It also provides global risk management and advisory services. The firm manages separate client-focused equity, fixed income, and balanced portfolios. It also launches and manages open-end and closed-end mutual funds, offshore funds, unit trusts, and alternative investment vehicles including structured funds. The firm launches equity, fixed income, balanced, and real estate mutual funds. It also launches equity, fixed income, balanced, currency, commodity, and multi-asset exchange traded funds. The firm also launches and manages hedge funds. It invests in the public equity, fixed income, real estate, currency, commodity, and alternative markets across the globe. The firm primarily invests in growth and value stocks of small-cap, mid-cap, SMID-cap, large-cap, and multi-cap companies. It also invests in dividend-paying equity securities. The firm invests in investment grade municipal securities, government securities including securities issued or guaranteed by a government or a government agency or instrumentality, corporate bonds, and asset-backed and mortgage-backed securities. It employs fundamental and quantitative analysis with a focus on bottom-up and top-down approach to make its investments. The firm employs liquidity, asset allocation, balanced, real estate, and alternative strategies to make its investments. In real estate sector, it seeks to invest in Poland and Germany. The firm benchmarks the performance of its portfolios against various S&P, Russell, Barclays, MSCI, Citigroup, and Merrill Lynch indices. BlackRock, Inc. was founded in 1988 and is based in New York City with additional offices in Boston, Massachusetts; London, United Kingdom; Gurgaon, India; Hong Kong; Greenwich, Connecticut; Princeton, New Jersey; Edinburgh, United Kingdom; Sydney, Australia; Taipei, Taiwan; Singapore; Sao Paulo, Brazil; Philadelphia, Pennsylvania; Washington, District of Columbia; Toronto, Canada; Wilmington, Delaware; and San Francisco, California."

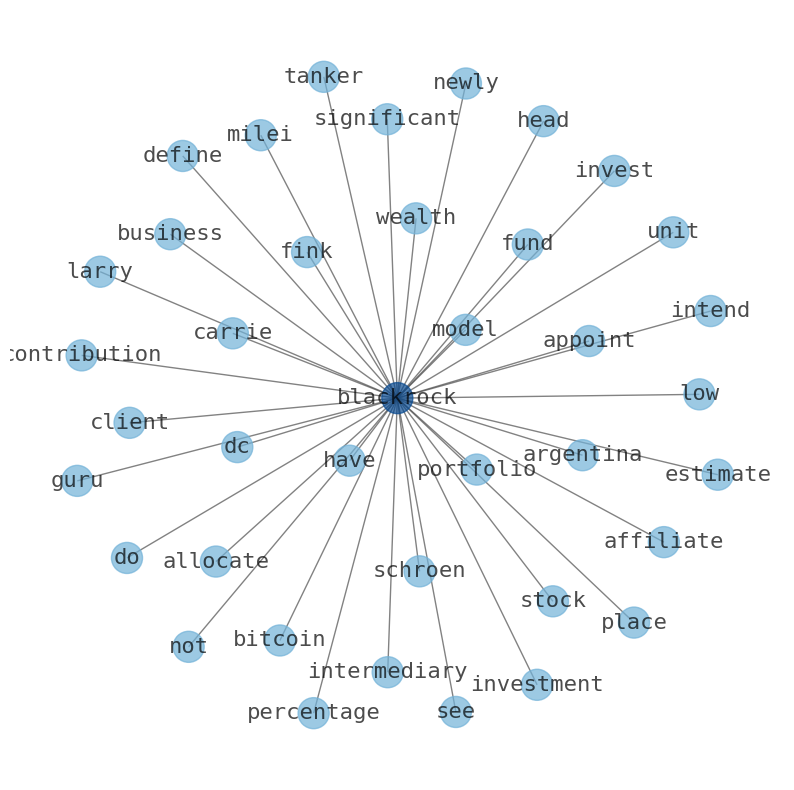

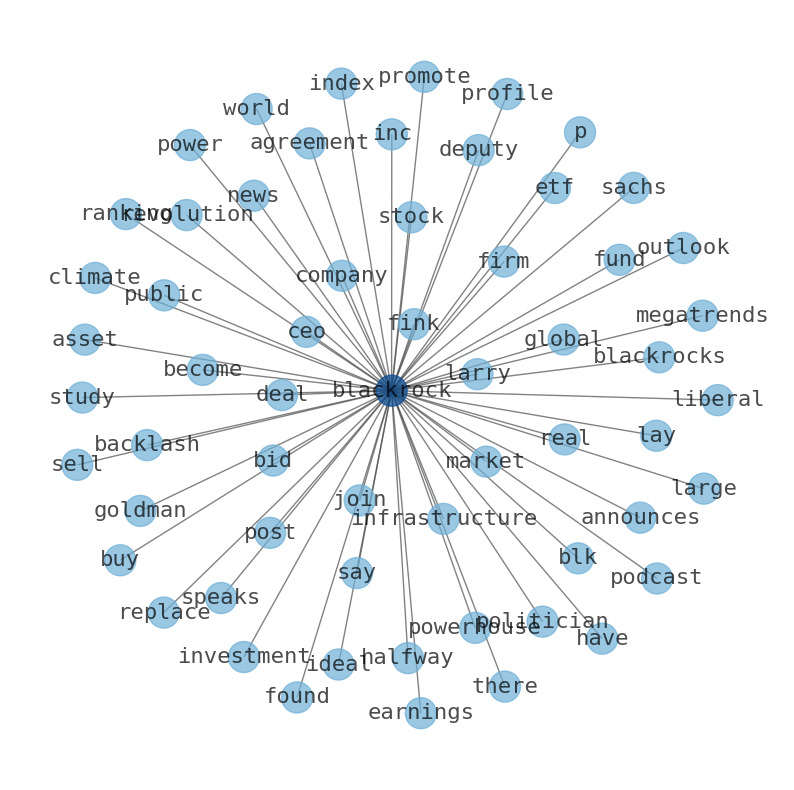

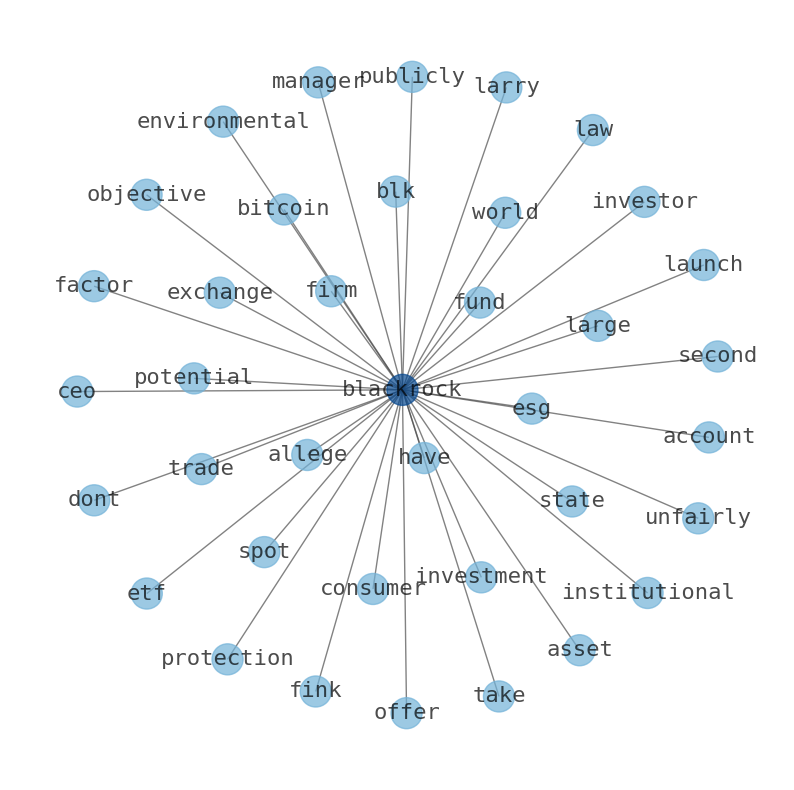

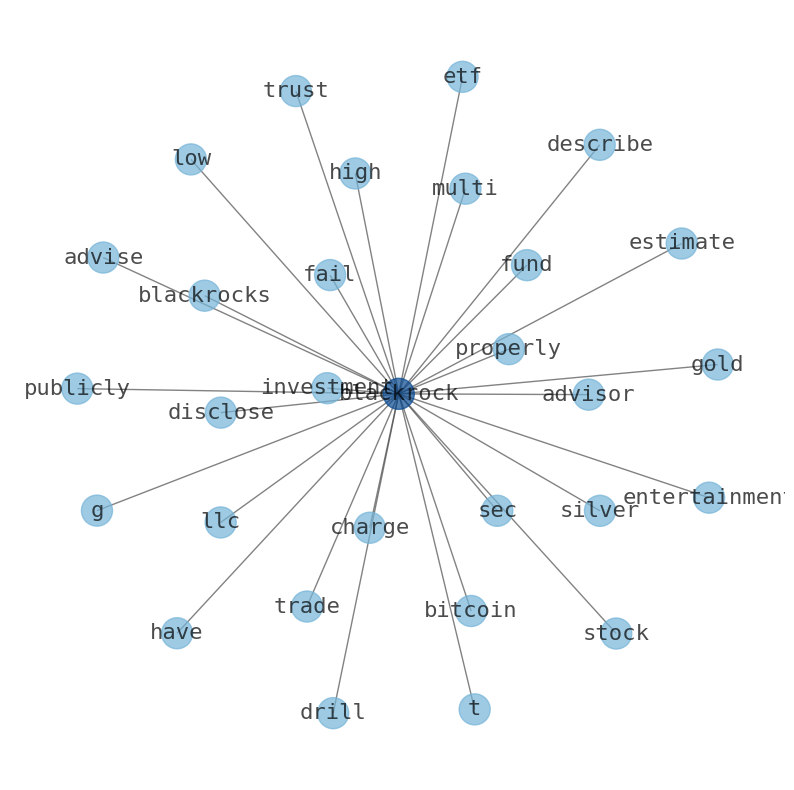

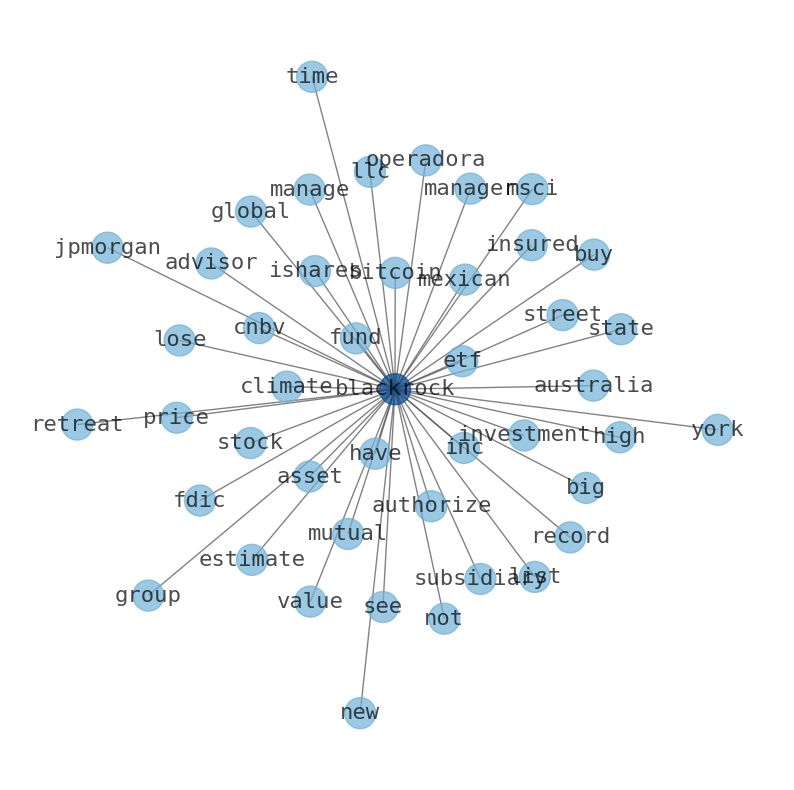

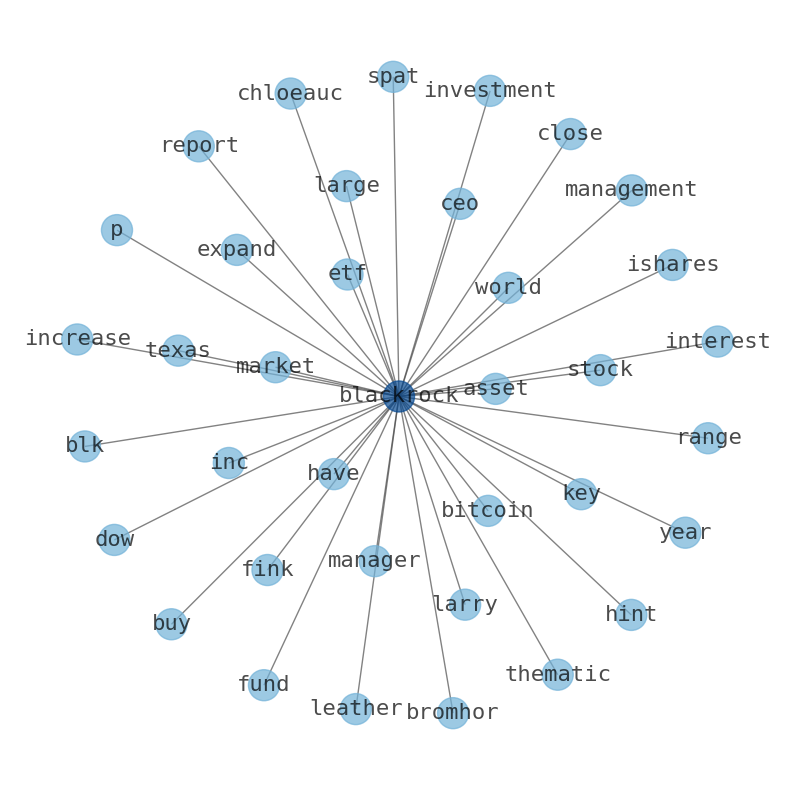

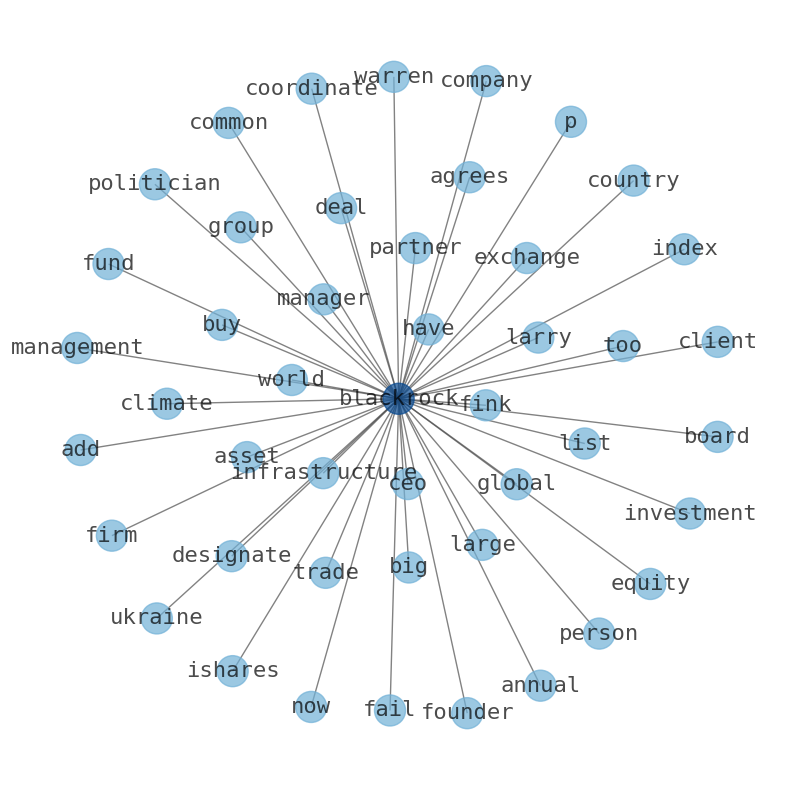

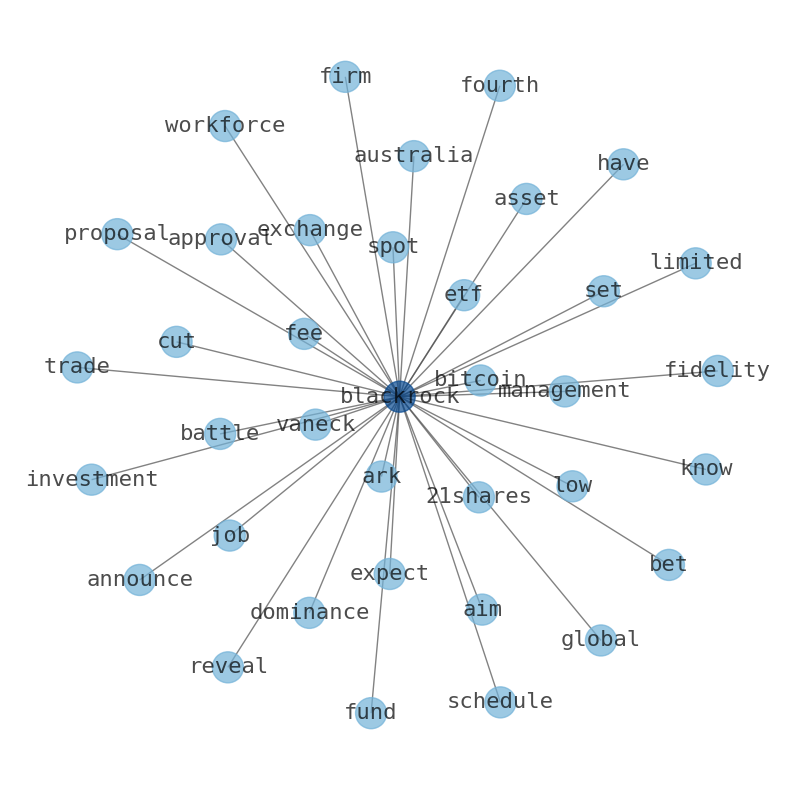

Keywords

The game is changing. There is a new strategy to evaluate BlackRock fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about BlackRock are: BlackRock, management, investment, Fink, asset, former, fund, and the most common words in the summary are: blackrock, fund, investment, stock, market, company, asset, . One of the sentences in the summary was: BlackRock operates globally with 70 offices in 30 countries, and clients in 100 countries. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #blackrock #fund #investment #stock #market #company #asset.

Read more →Related Results

BlackRock

Open: 795.09 Close: 800.64 Change: 5.55

Read more →

BlackRock

Open: 788.4 Close: 798.05 Change: 9.65

Read more →

BlackRock

Open: 780.65 Close: 788.0 Change: 7.35

Read more →

BlackRock

Open: 785.0 Close: 799.6 Change: 14.6

Read more →

BlackRock

Open: 795.0 Close: 797.96 Change: 2.96

Read more →

BlackRock

Open: 607.07 Close: 598.08 Change: -8.99

Read more →

BlackRock

Open: 625.65 Close: 622.51 Change: -3.14

Read more →

BlackRock

Open: 693.77 Close: 695.61 Change: 1.84

Read more →

BlackRock

Open: 743.0 Close: 728.32 Change: -14.68

Read more →

BlackRock

Open: 642.59 Close: 636.97 Change: -5.62

Read more →

BlackRock

Open: 795.09 Close: 794.0 Change: -1.09

Read more →

BlackRock

Open: 794.23 Close: 797.21 Change: 2.98

Read more →

BlackRock

Open: 785.0 Close: 799.6 Change: 14.6

Read more →

BlackRock

Open: 784.43 Close: 797.19 Change: 12.76

Read more →

BlackRock

Open: 791.9 Close: 819.0 Change: 27.1

Read more →

BlackRock

Open: 623.25 Close: 614.83 Change: -8.42

Read more →

BlackRock

Open: 678.65 Close: 691.03 Change: 12.38

Read more →

BlackRock

Open: 710.07 Close: 710.28 Change: 0.21

Read more →

BlackRock

Open: 650.57 Close: 667.73 Change: 17.16

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo