The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Bank of America

Youtube Subscribe

Open: 27.43 Close: 26.76 Change: -0.67

The 11 top things that an AI found about Bank of America... they will surprise you

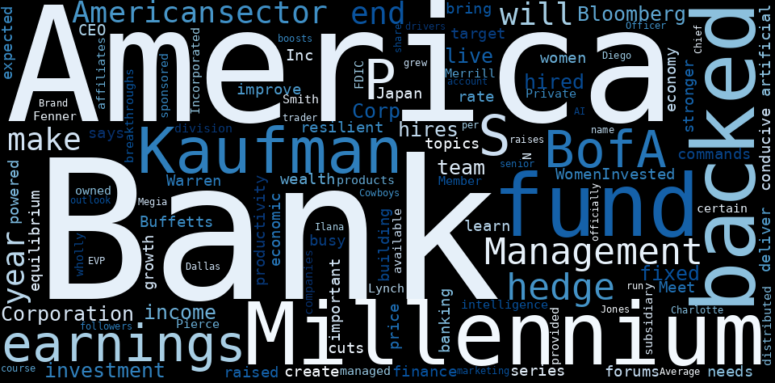

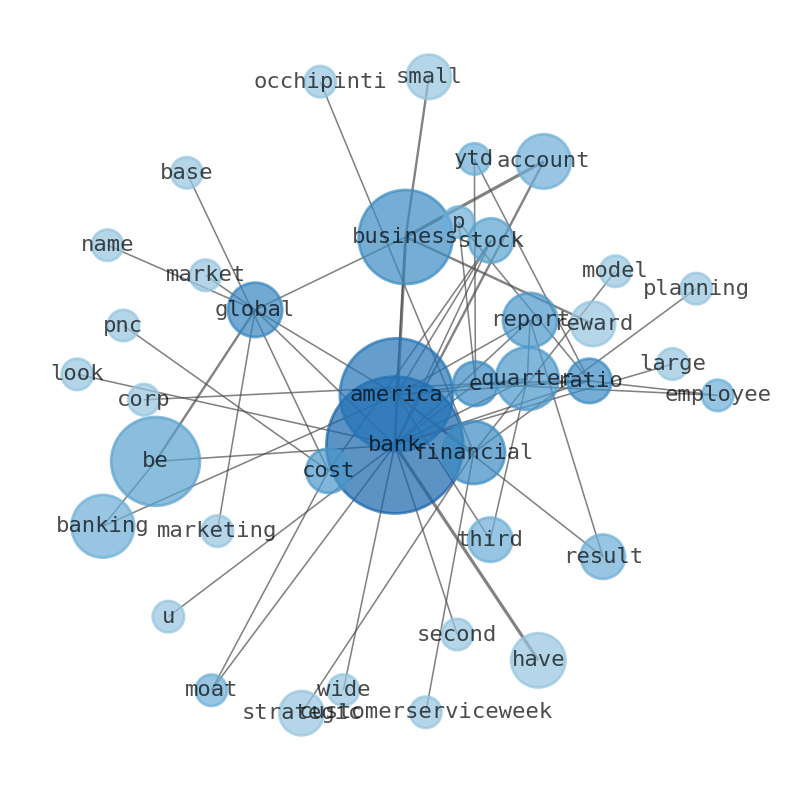

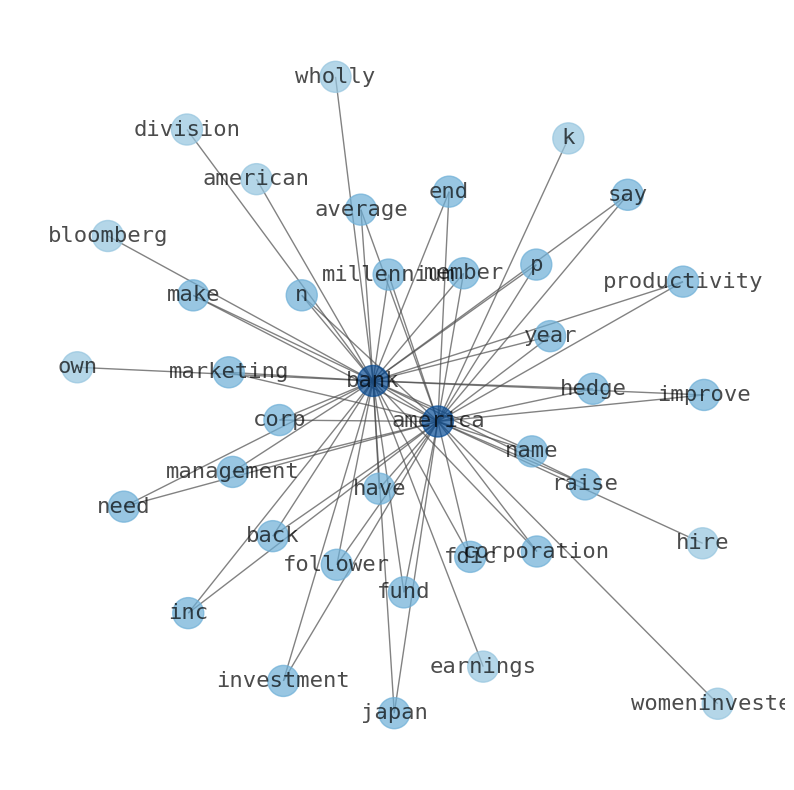

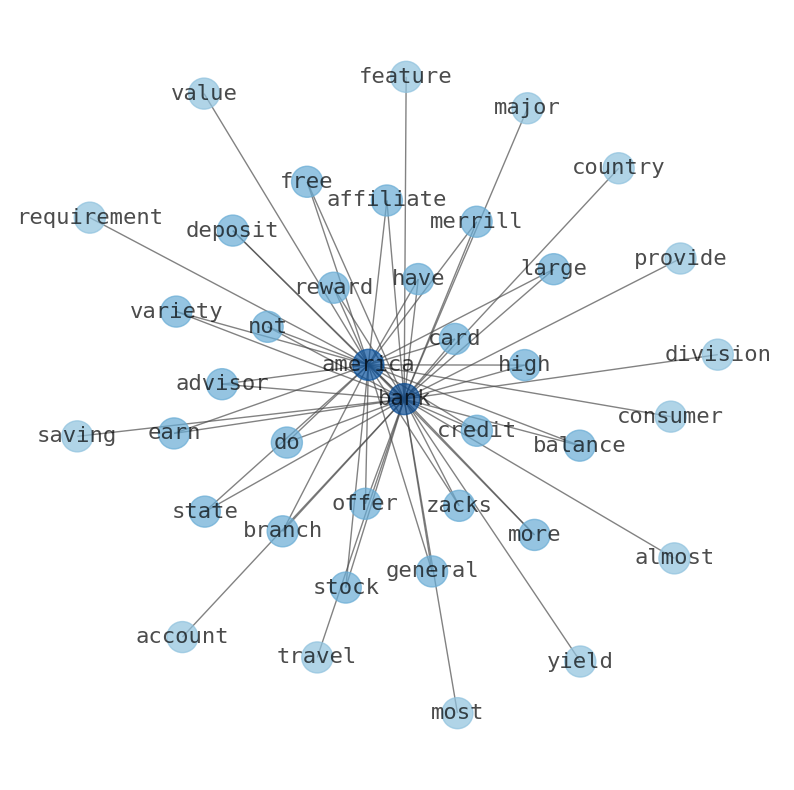

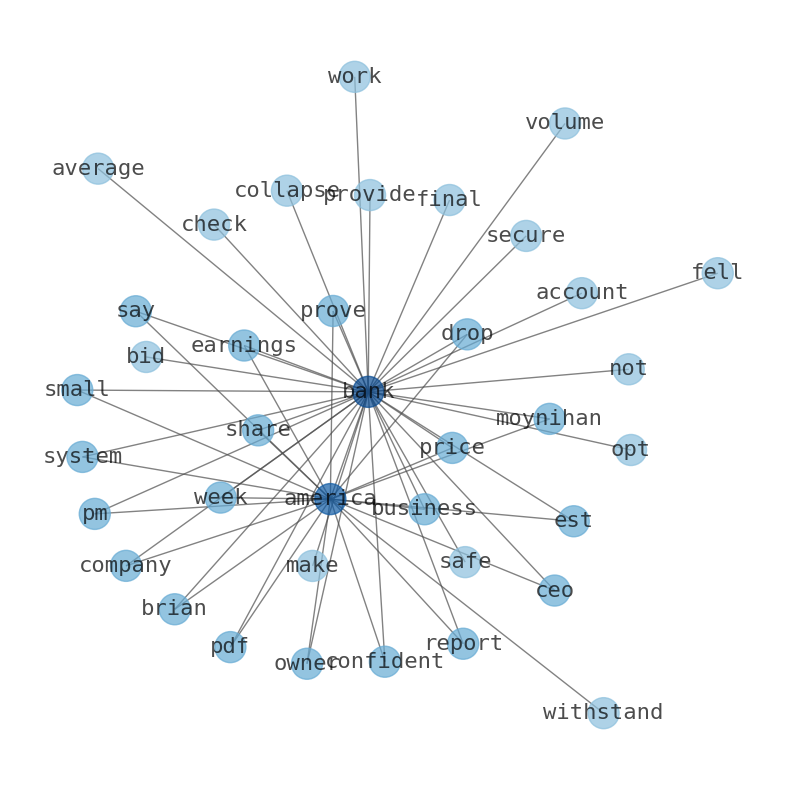

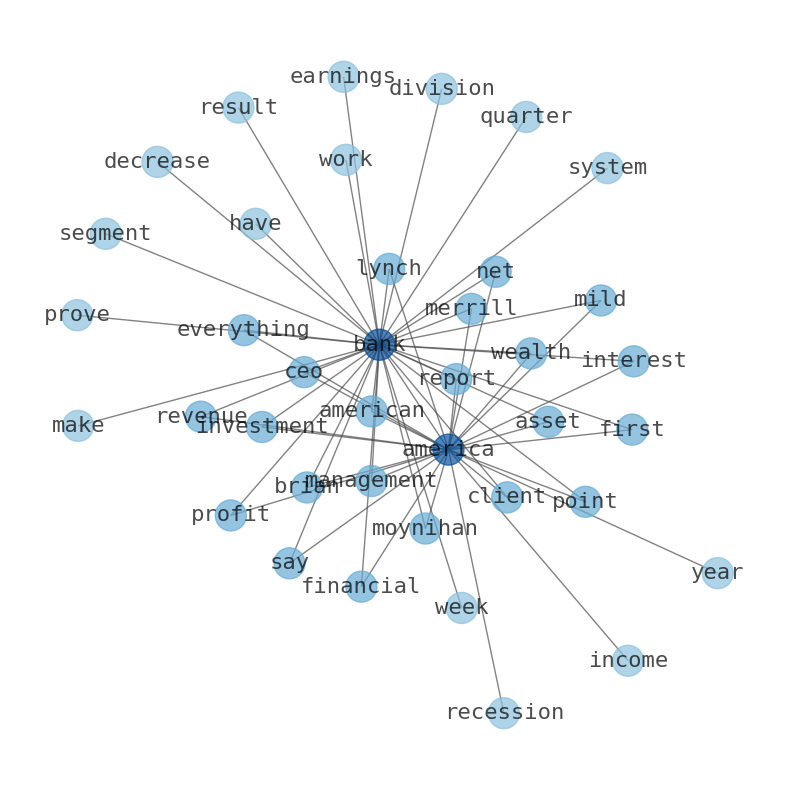

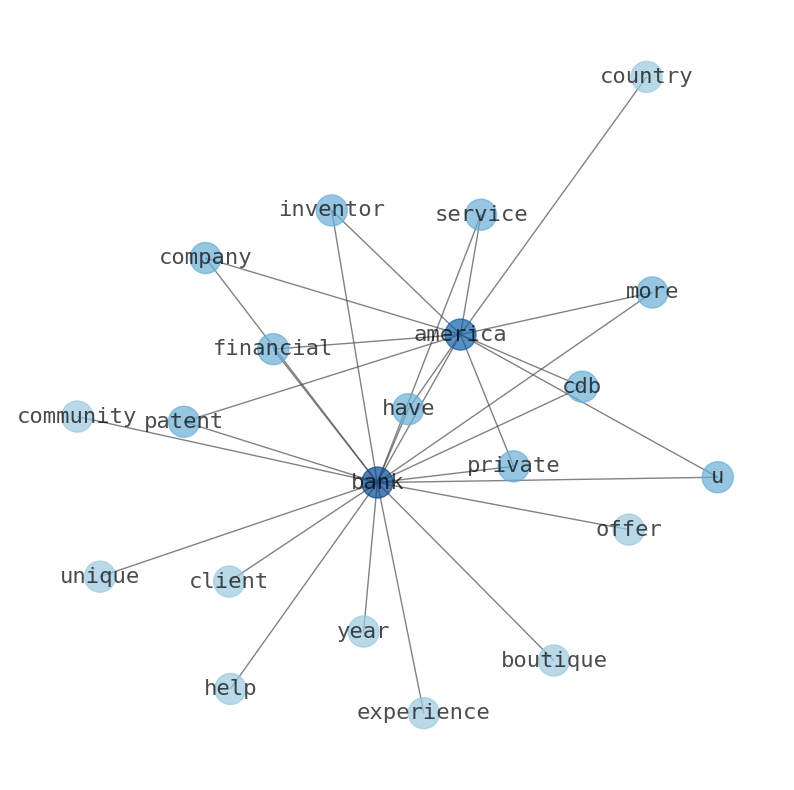

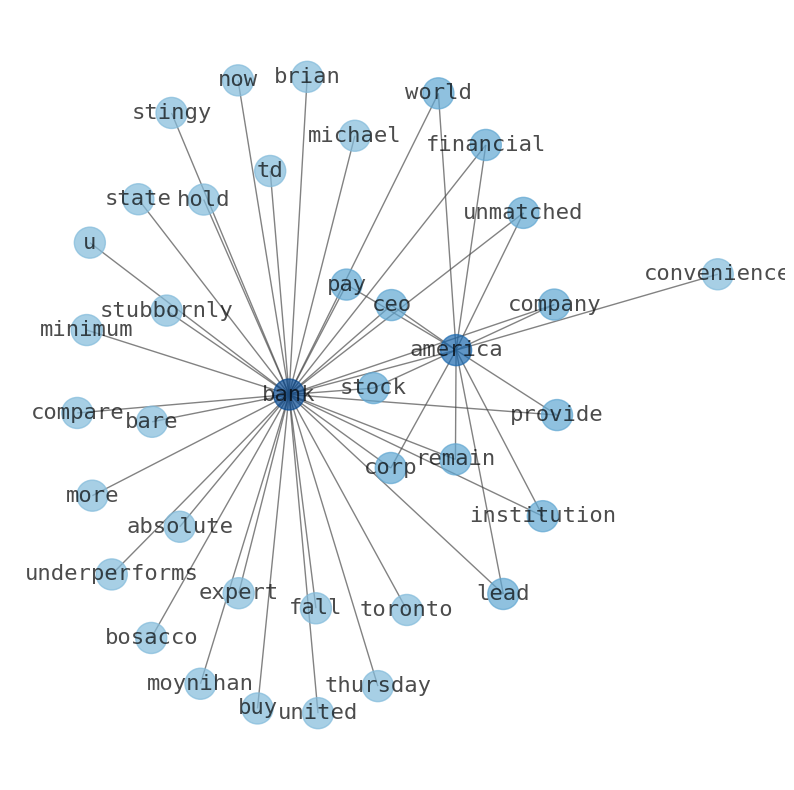

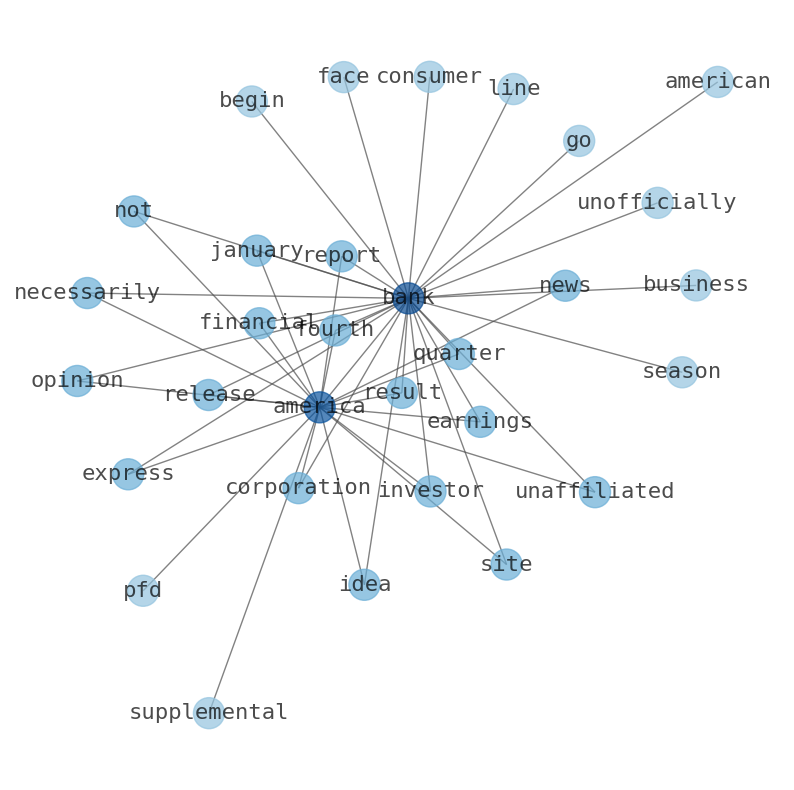

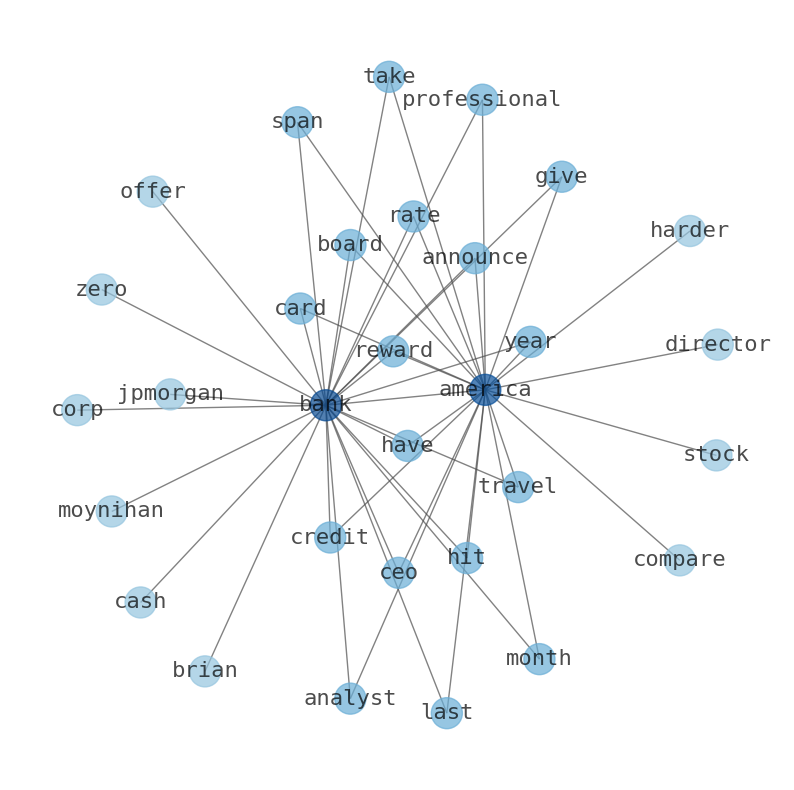

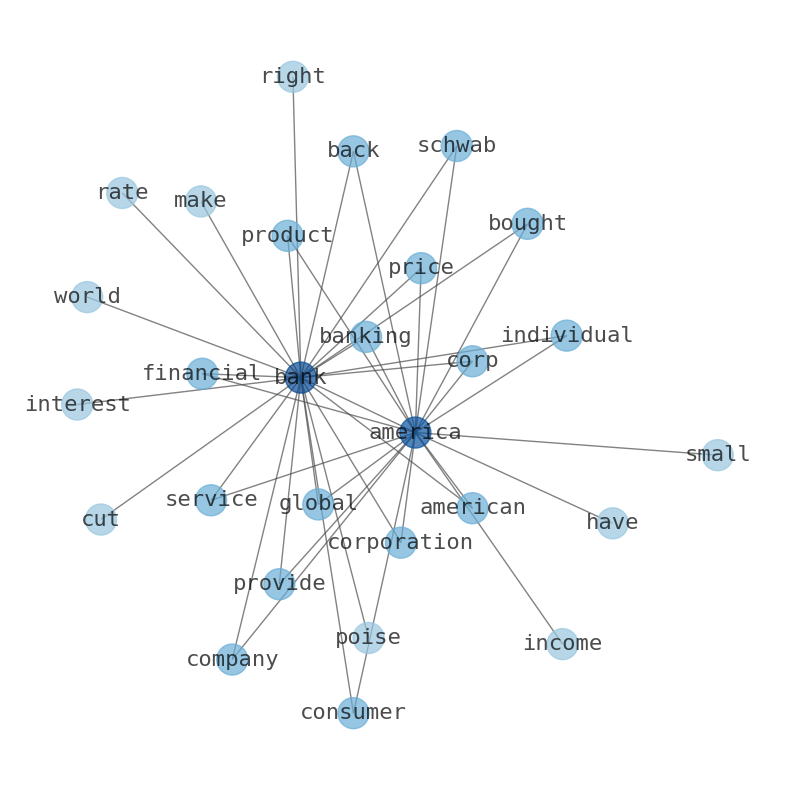

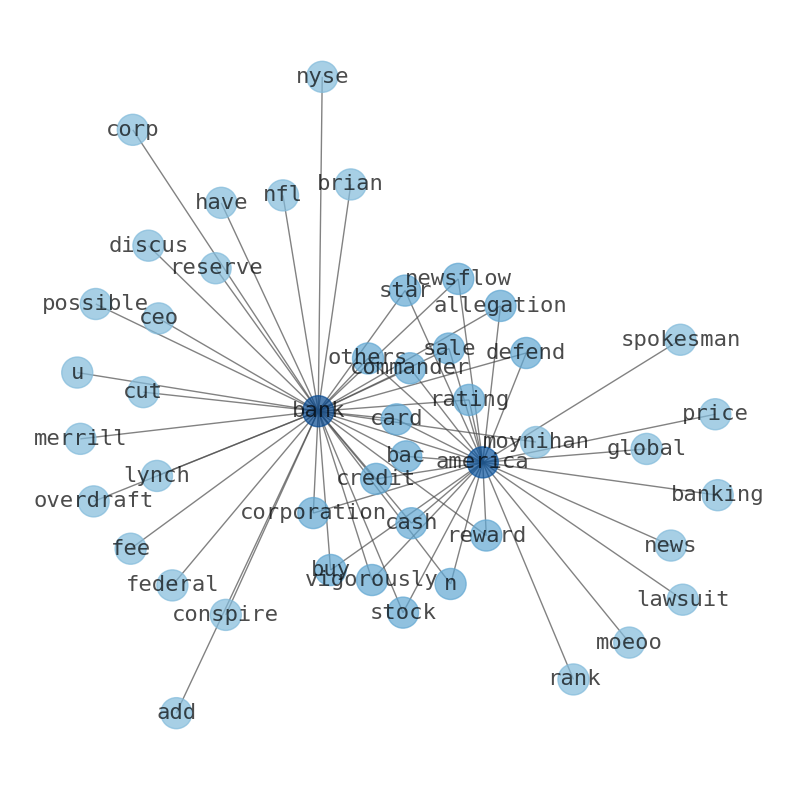

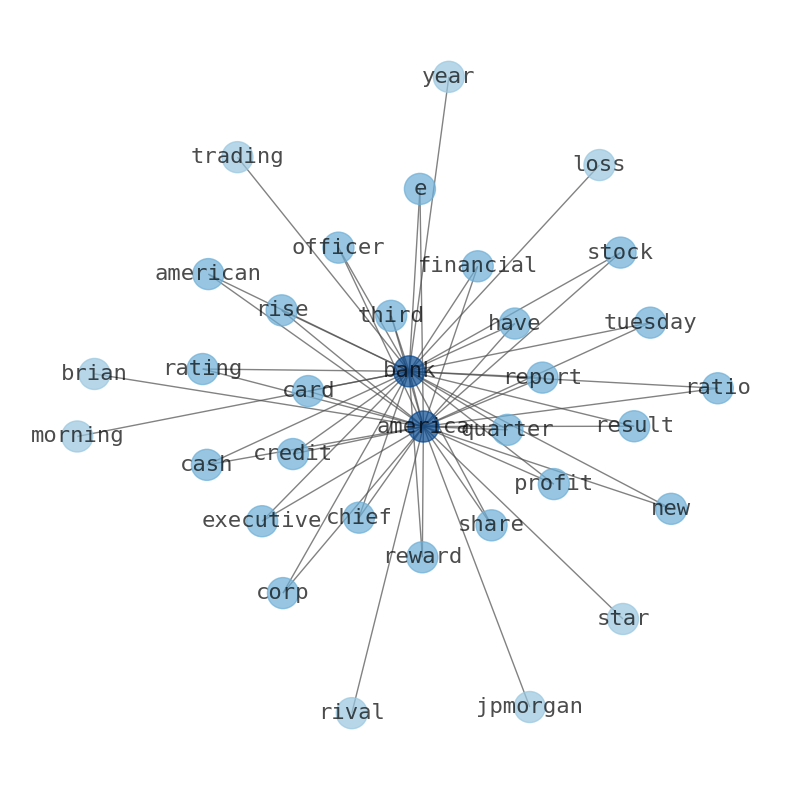

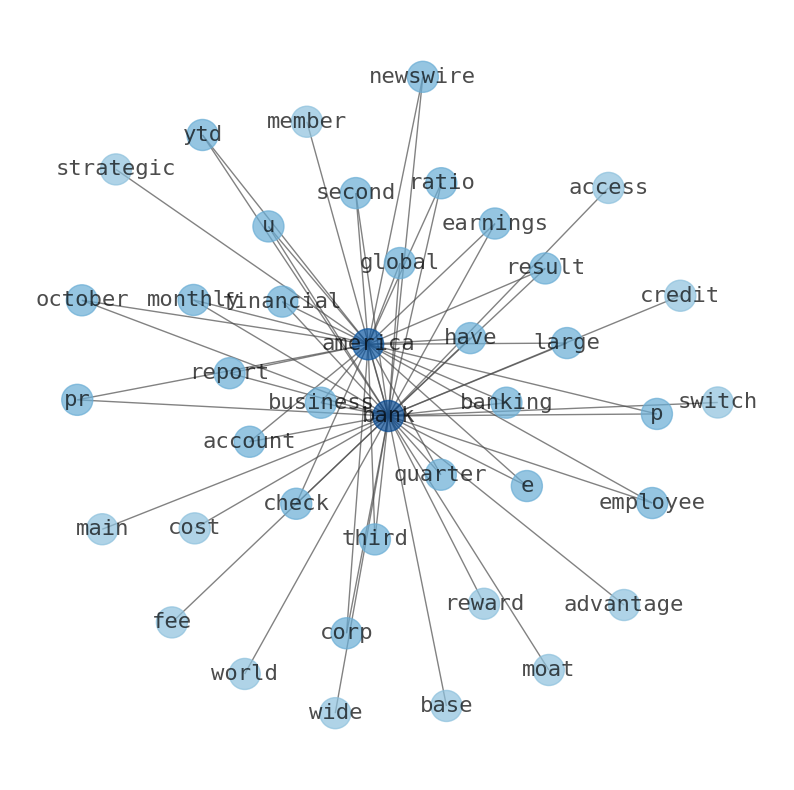

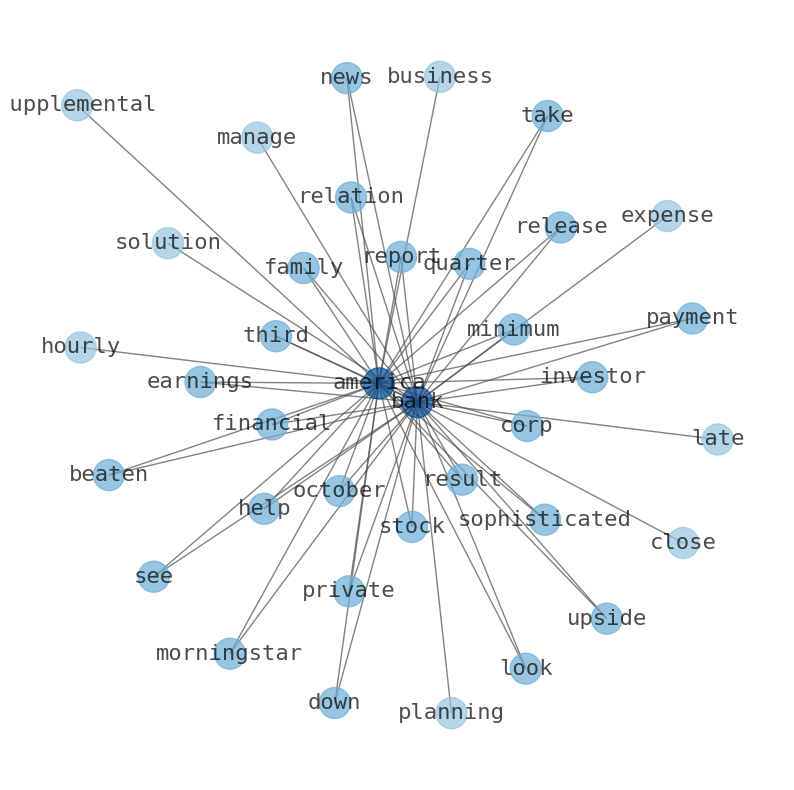

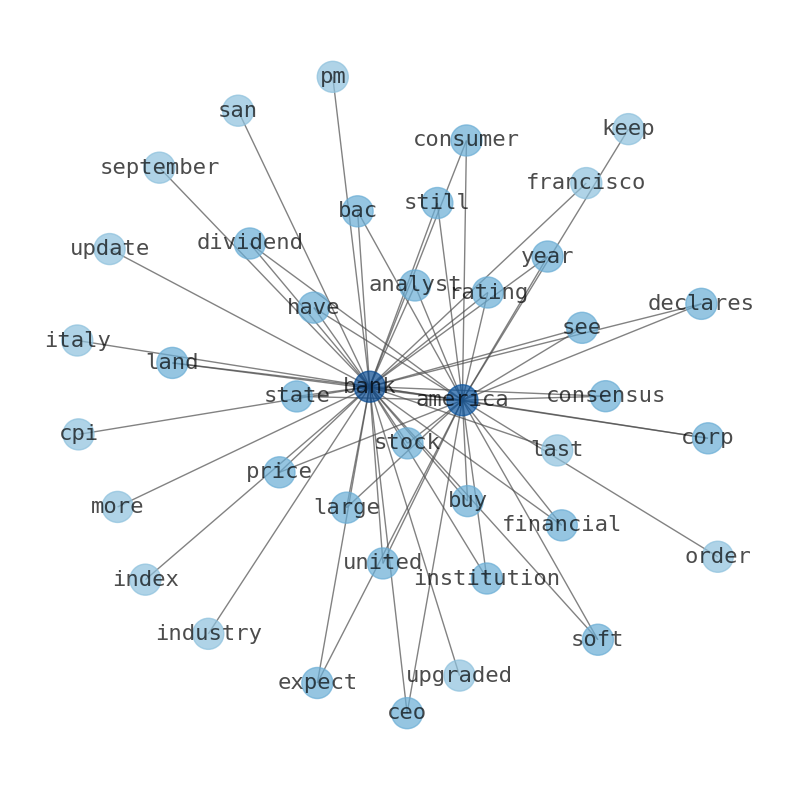

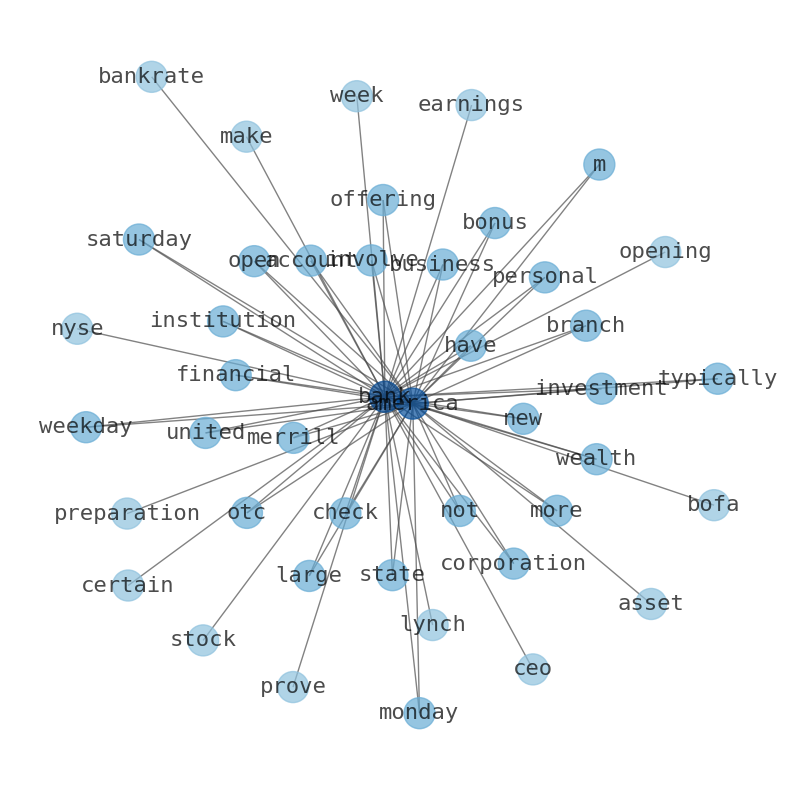

Are looking for the most relevant information about Bank of America? Investor spend a lot of time searching for information to make investment decisions in Bank of America. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Bank of America are: Bank, America, business, bank, Financial, earnings, global, and the most common words in the summary are: r, bank, objk, rpg, enusp, rp, obja, . One of the sentences in the summary was: Wall Street expects flat earnings compared to the …

Stock Summary

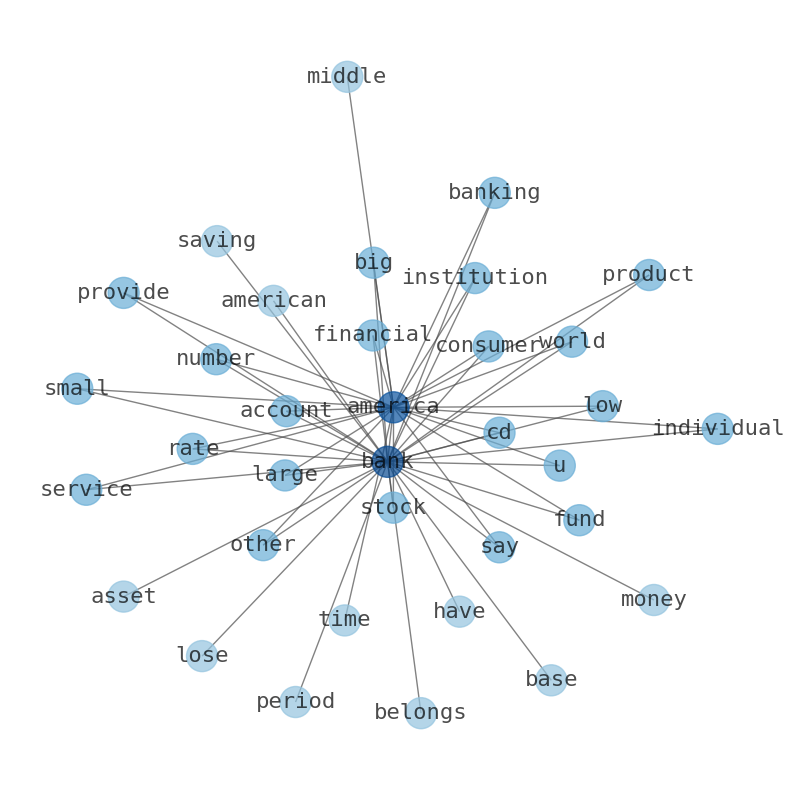

Bank of America Corporation provides banking and financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments. Its Consumer Banking segment offers traditional and money market savings accounts, certificates of deposit and.

Today's Summary

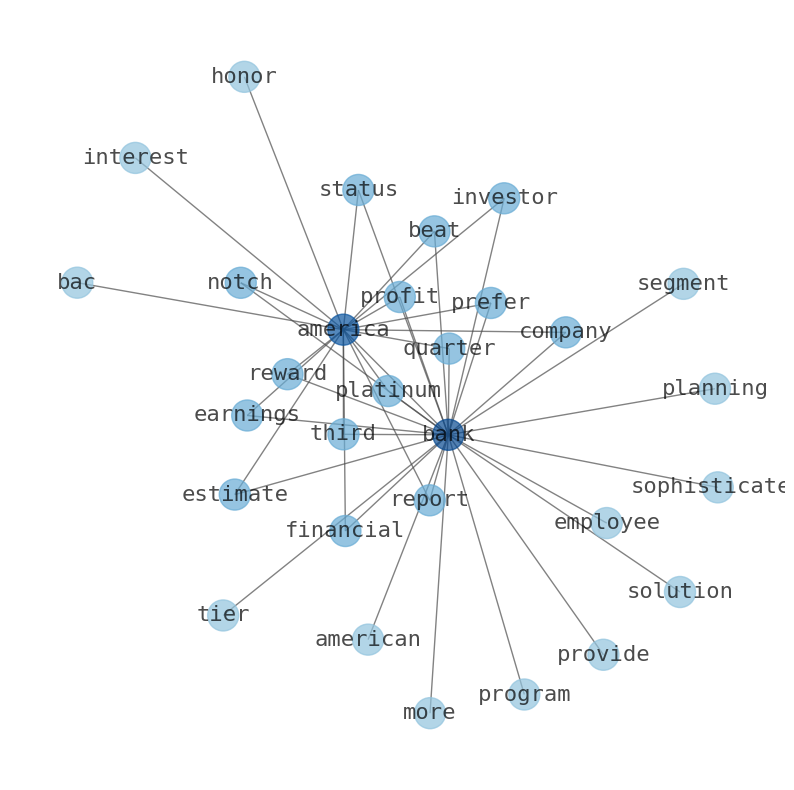

Bank of America BAC is set to release its third-quarter earnings report on Oct. 11, 2023. Wall Street expects flat earnings compared to the year-ago quarter on higher revenues. Morningstars take on what to look for in Bank of Americas earnings.

Today's News

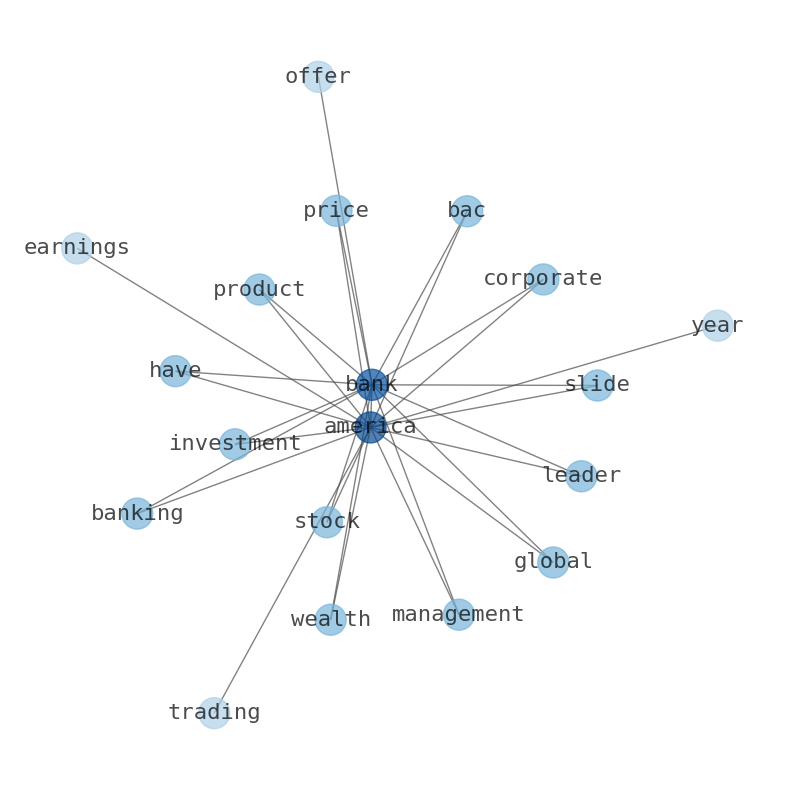

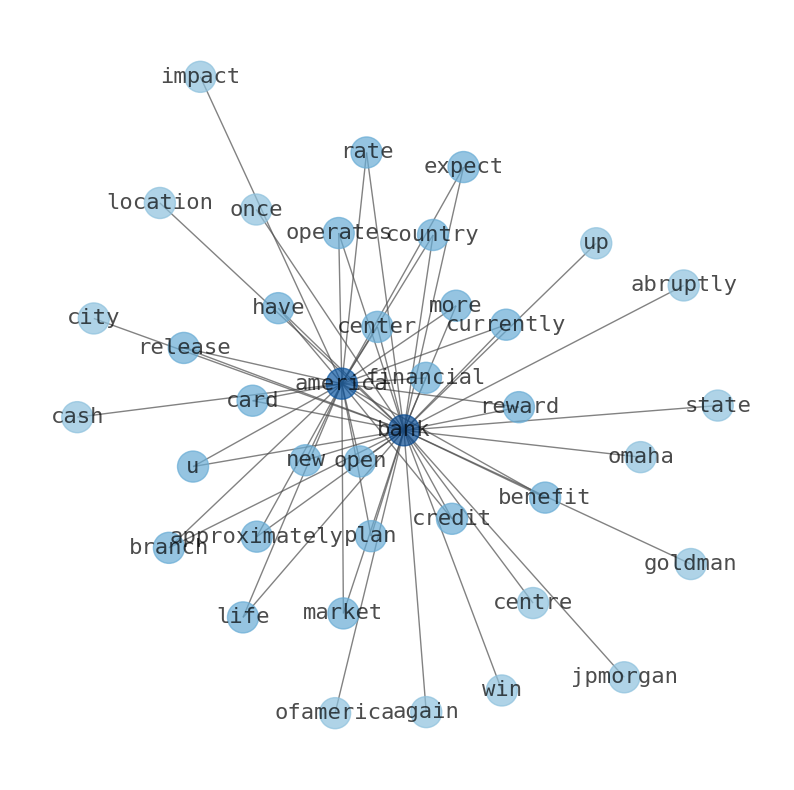

Bank of America Corp. per Employee $698.50K P/E ratio 7.70P/E Ratio 7.69% YTD -19.20% Bank of America to Report Third-Quarter 2023 Financial Results on October 17 PR Newswire. Bank of America BAC is set to release its third-quarter earnings report on Oct. 11, 2023. Morningstars take on what to look for in Bank of Americas earnings and stock. Bank of America is the second-largest U.S. bank in the world. The bank has a wide moat based on its cost advantages and switching costs. PNC stock remains undervalued. Bank of America is the marketing name for the global banking and global markets business of Bank of America. Lending, derivatives, and other commercial banking activities are performed globally by banking affiliates. Investment products offered through MLPF&S and insurance and annuity products are not FDIC insured. Bank of America celebrates #CustomerServiceWeek. Occhipinti Strategic Financial Analyst | Financial Modeling, Strategic Planning, Data Analytics | I Help Companies Utilize Data to Achieve Growth Targets. Bank of America business checking accounts are digital-friendly options for small-business owners. The banks two main business accounts offer fee-free electronic transactions and high cash deposit allowances. The bank has about 3,900 branch locations and 16,000 ATMs. Bank of America business checking accounts have monthly fees. The bank rewards business owners who use it as their main business bank. Members can access a 25% rewards bonus on eligible business credit cards. With Bank of Americas Featured CDs, youll see your interest compounded and credited on a monthly basis. Wall Street expects flat earnings compared to the year-ago quarter on higher revenues when Bank of America reports results for the quarter ended September. Efforts to lure disillusioned investors back to Turkey are making slow progress, according to leaked BofA document. Bank of America is a global leader in wealth management, corporate and investment banking and trading. The company provides unmatched convenience in the United States, serving approximately 68 million consumer and small business clients with approximately 3,900 retail financial centers.

Stock Profile

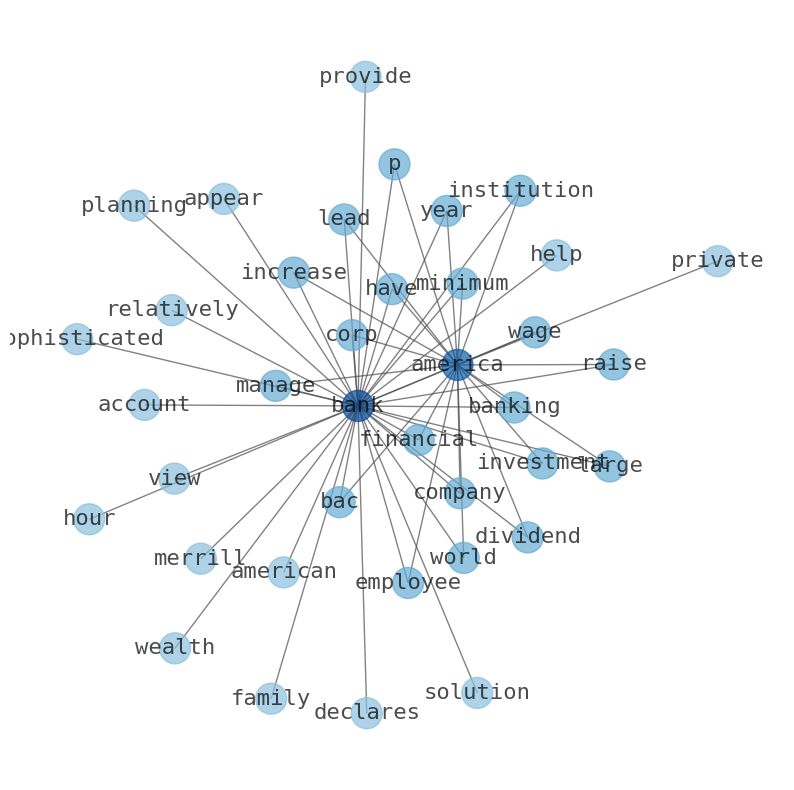

"Bank of America Corporation, through its subsidiaries, provides banking and financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide. Its Consumer Banking segment offers traditional and money market savings accounts, certificates of deposit and IRAs, noninterest-and interest-bearing checking accounts, and investment accounts and products; and credit and debit cards, residential mortgages, and home equity loans, as well as direct and indirect loans, such as automotive, recreational vehicle, and consumer personal loans. The company's Global Wealth & Investment Management segment offers investment management, brokerage, banking, and trust and retirement products and services; and wealth management solutions, as well as customized solutions, including specialty asset management services. Its Global Banking segment provides lending products and services, including commercial loans, leases, commitment facilities, trade finance, and commercial real estate and asset-based lending; treasury solutions, such as treasury management, foreign exchange, and short-term investing options and merchant services; working capital management solutions; and debt and equity underwriting and distribution, and merger-related and other advisory services. The company's Global Markets segment offers market-making, financing, securities clearing, settlement, and custody services, as well as risk management products using interest rate, equity, credit, currency and commodity derivatives, foreign exchange, fixed-income, and mortgage-related products. The company was founded in 1784 and is based in Charlotte, North Carolina."

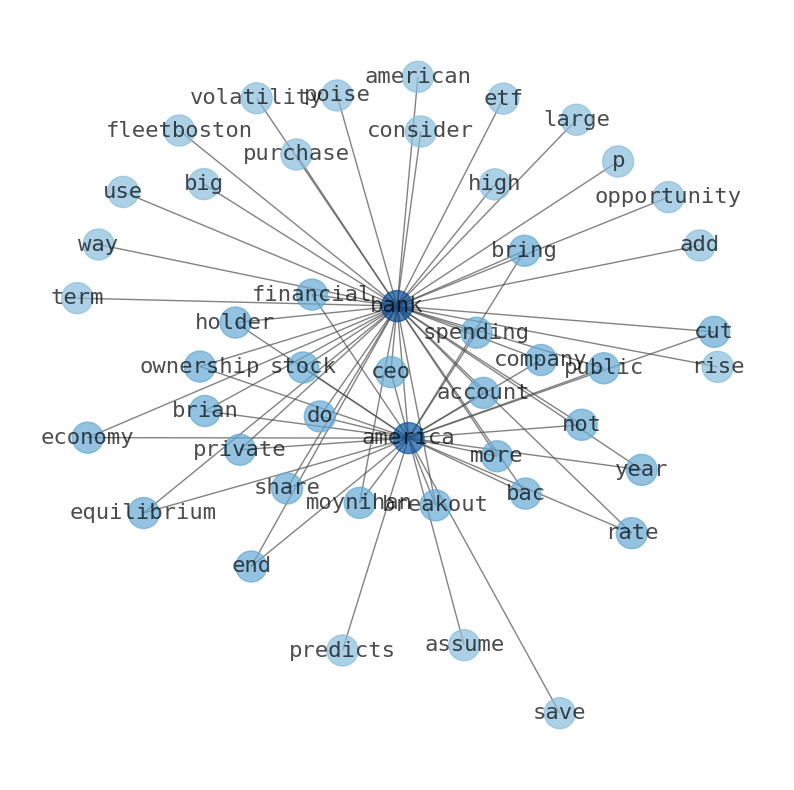

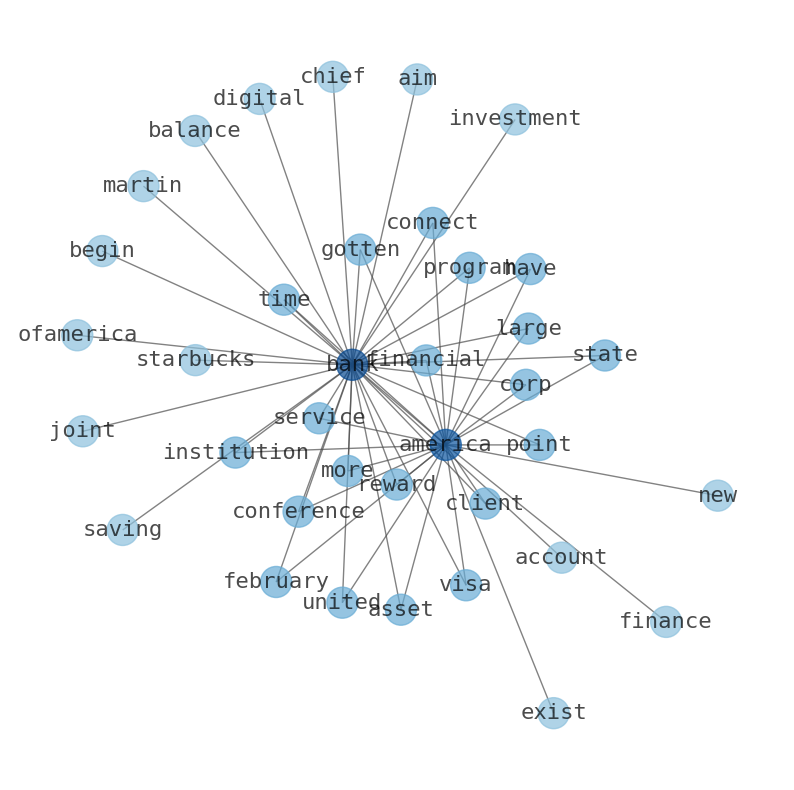

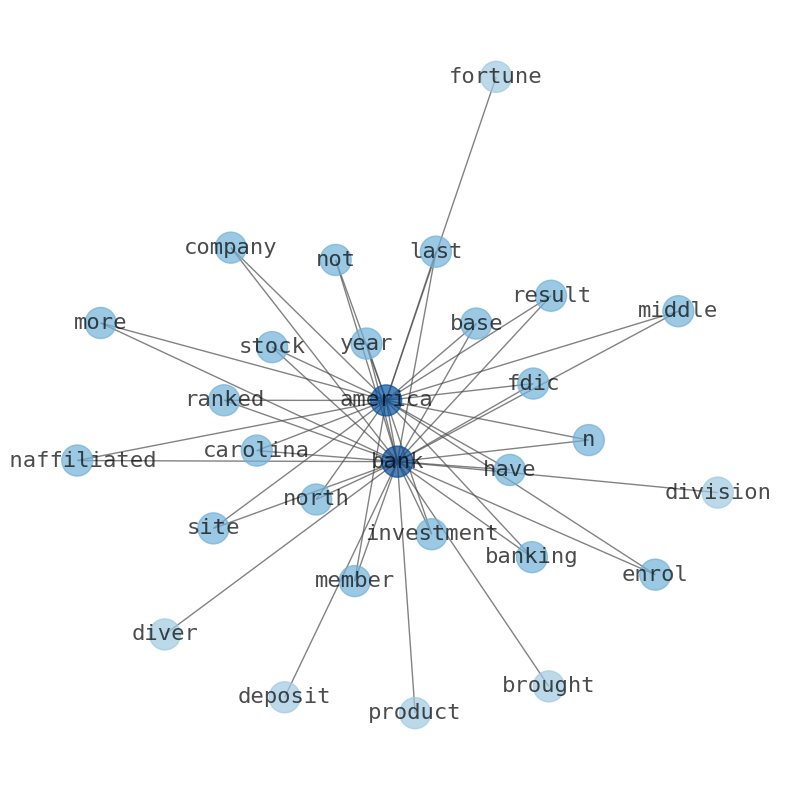

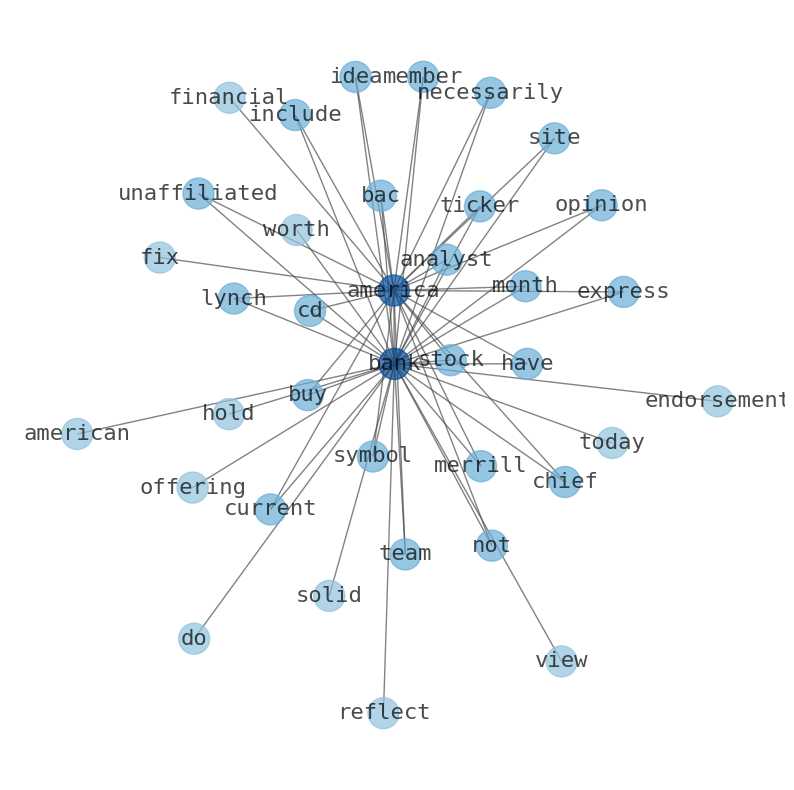

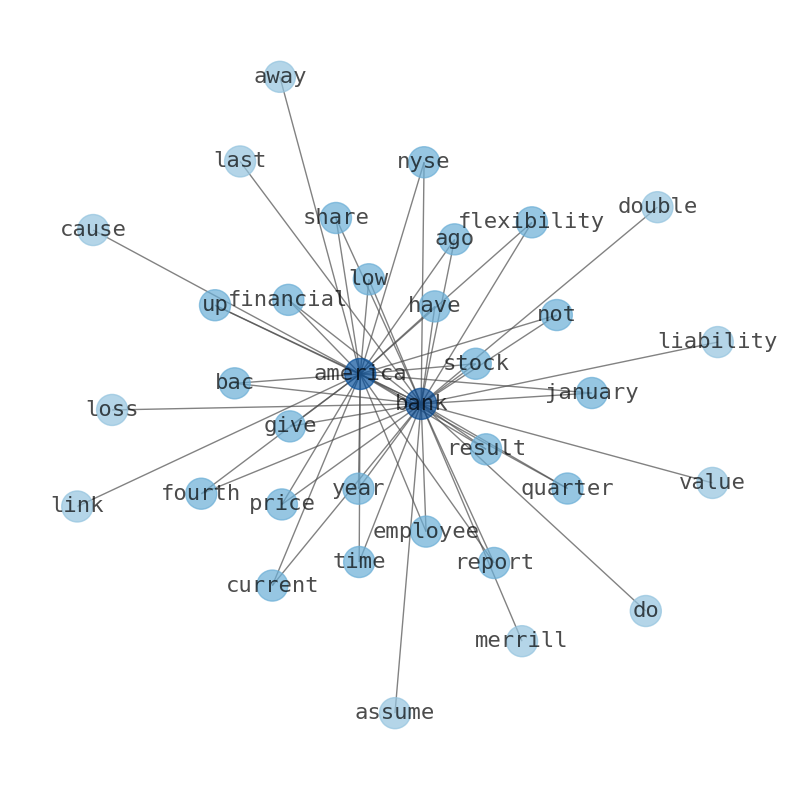

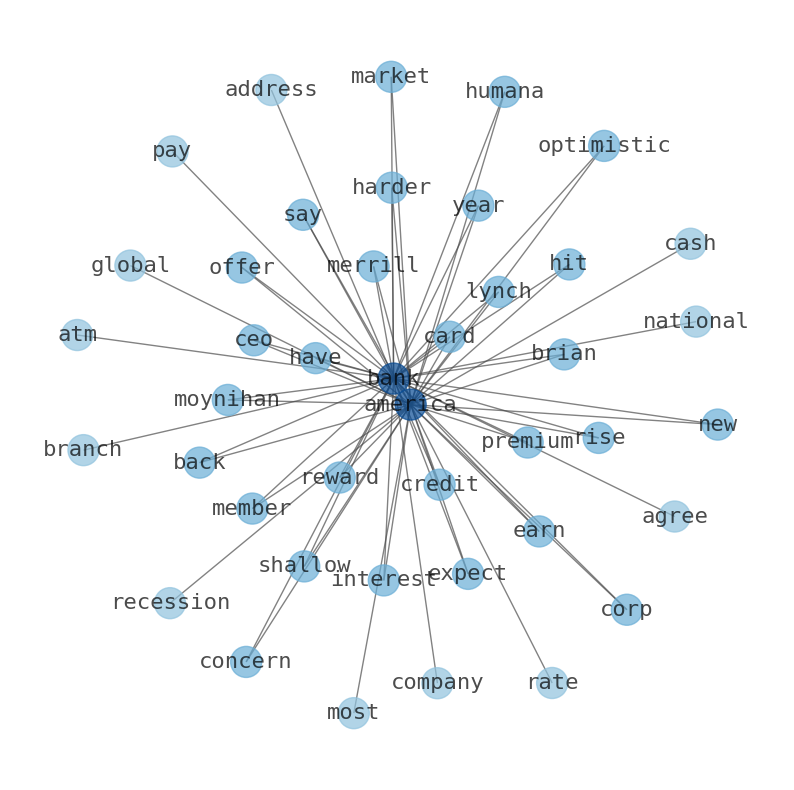

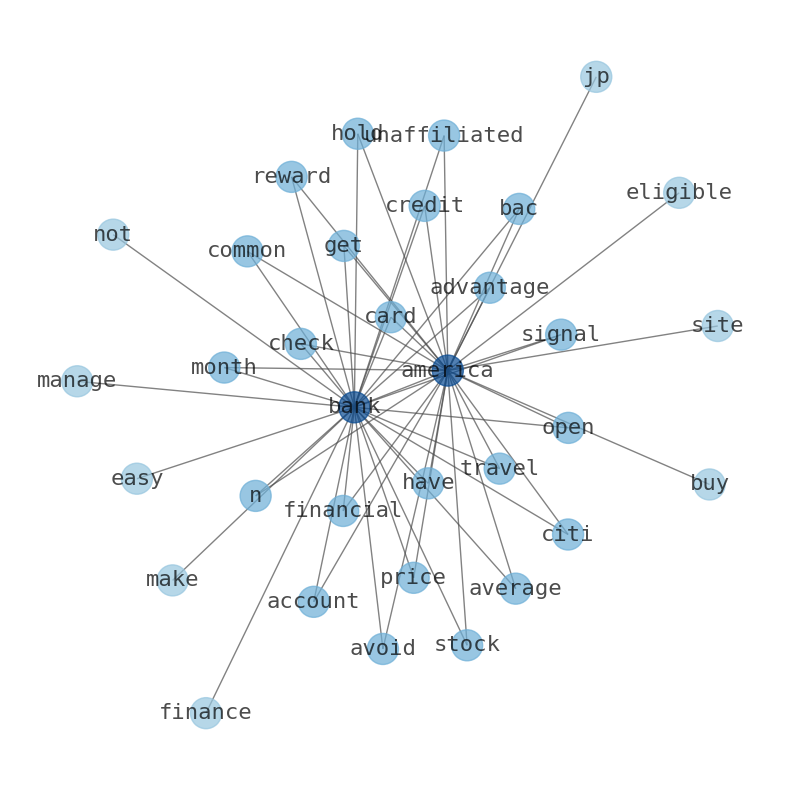

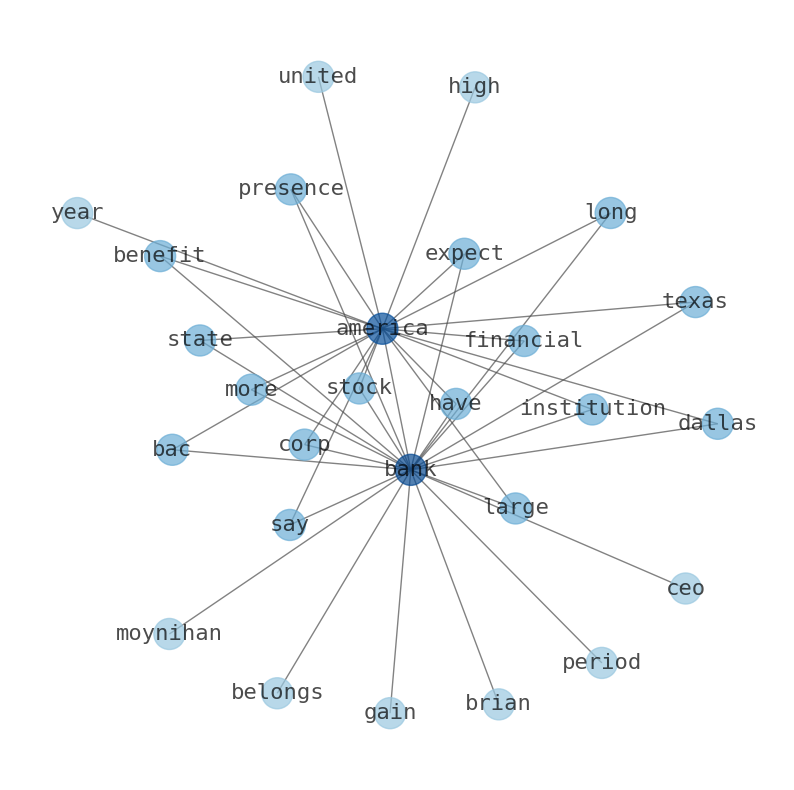

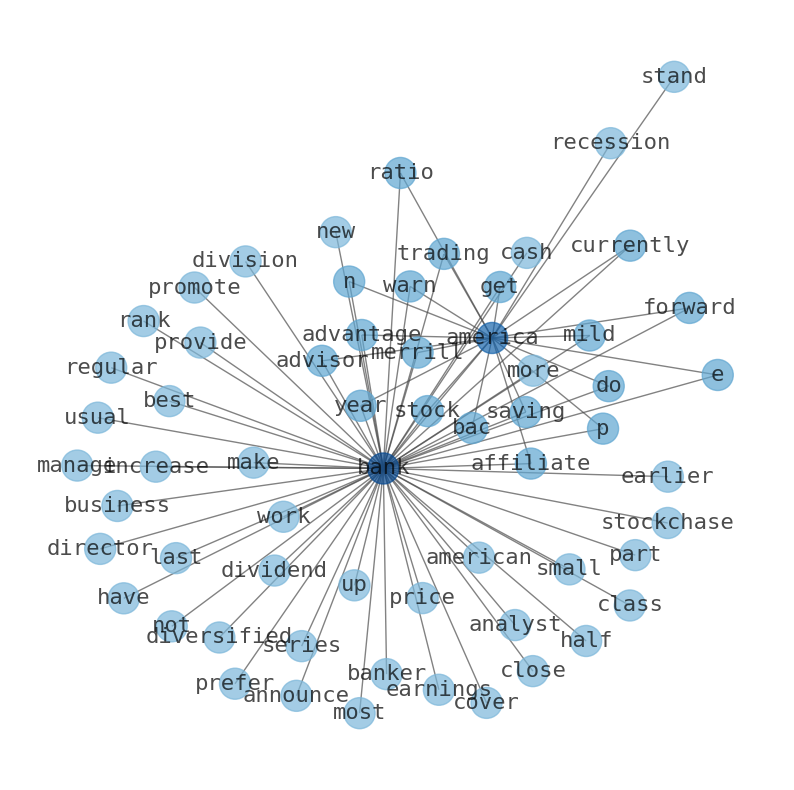

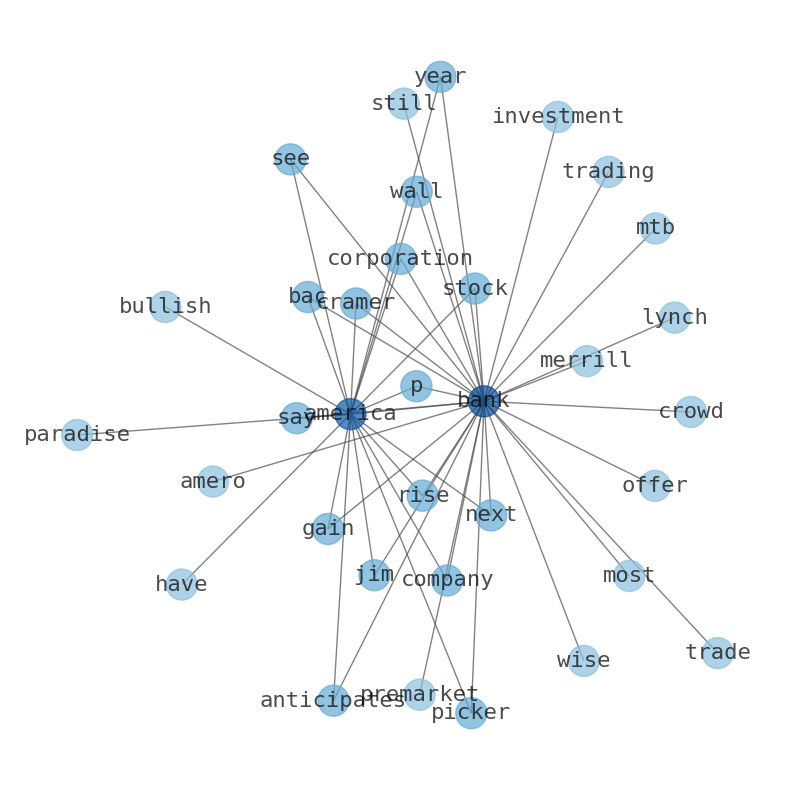

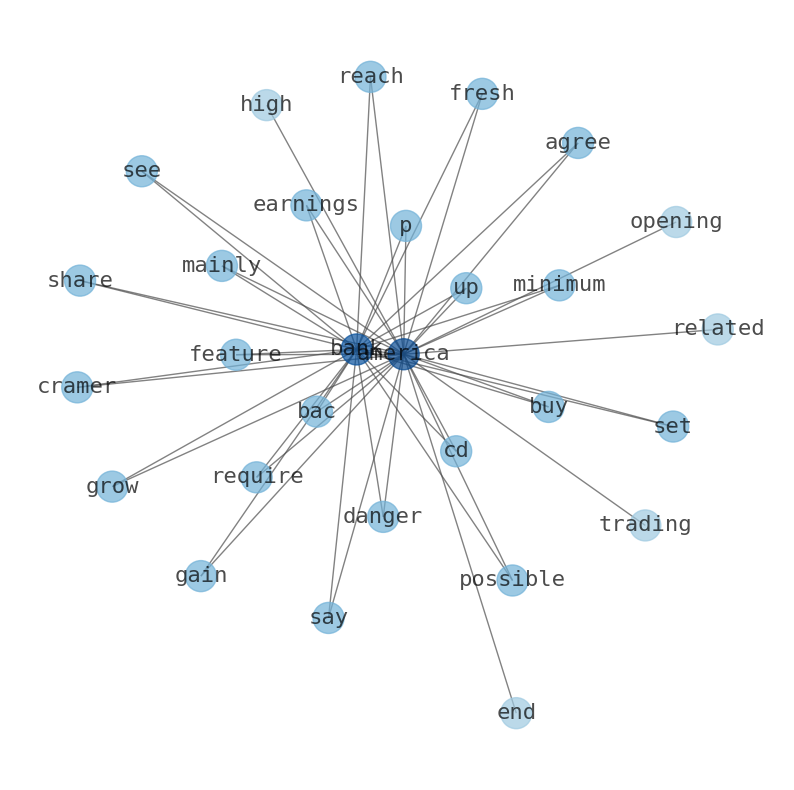

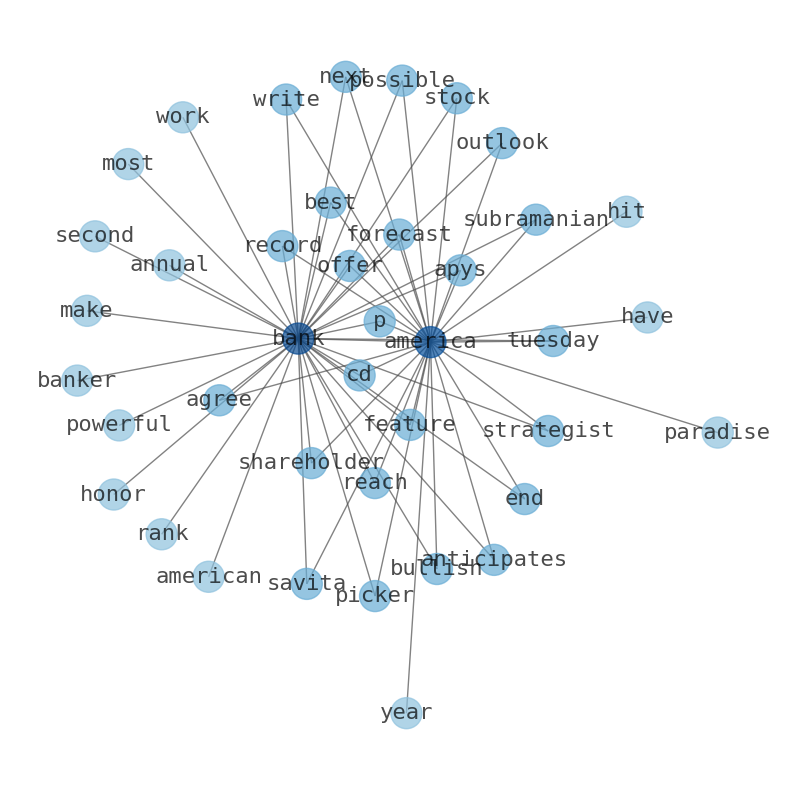

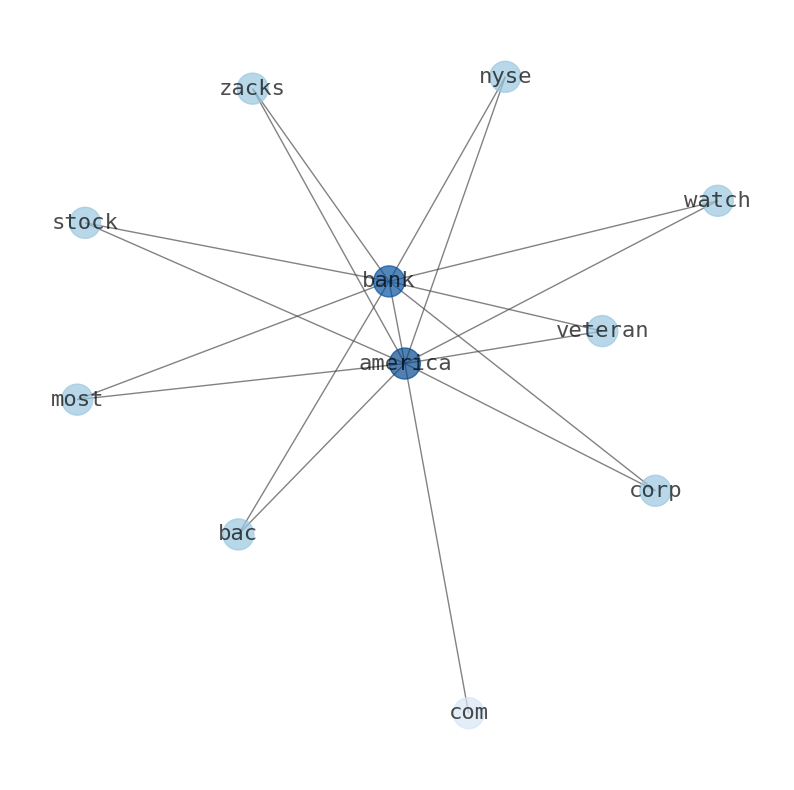

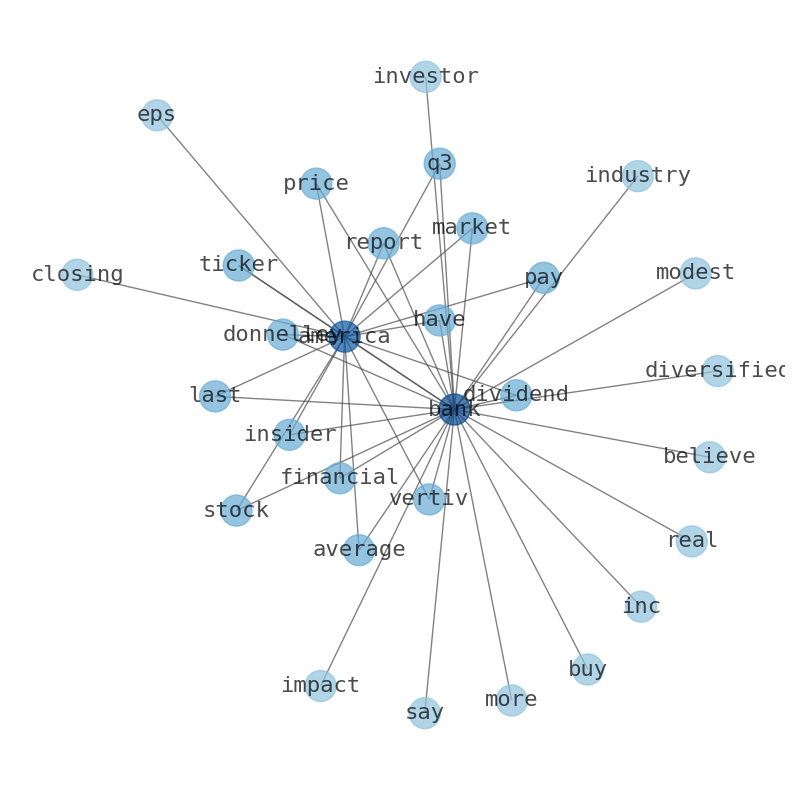

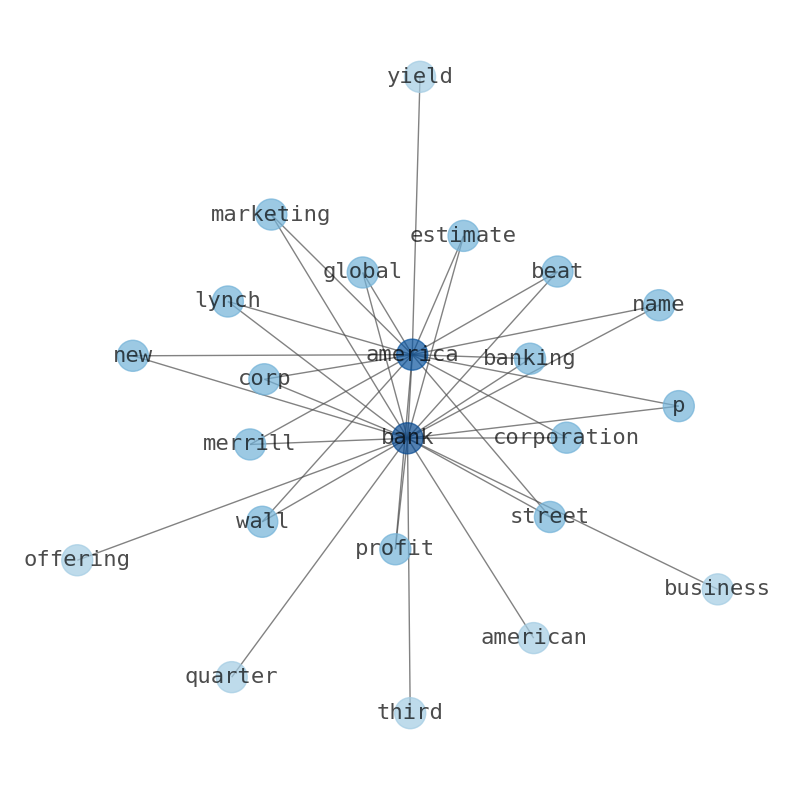

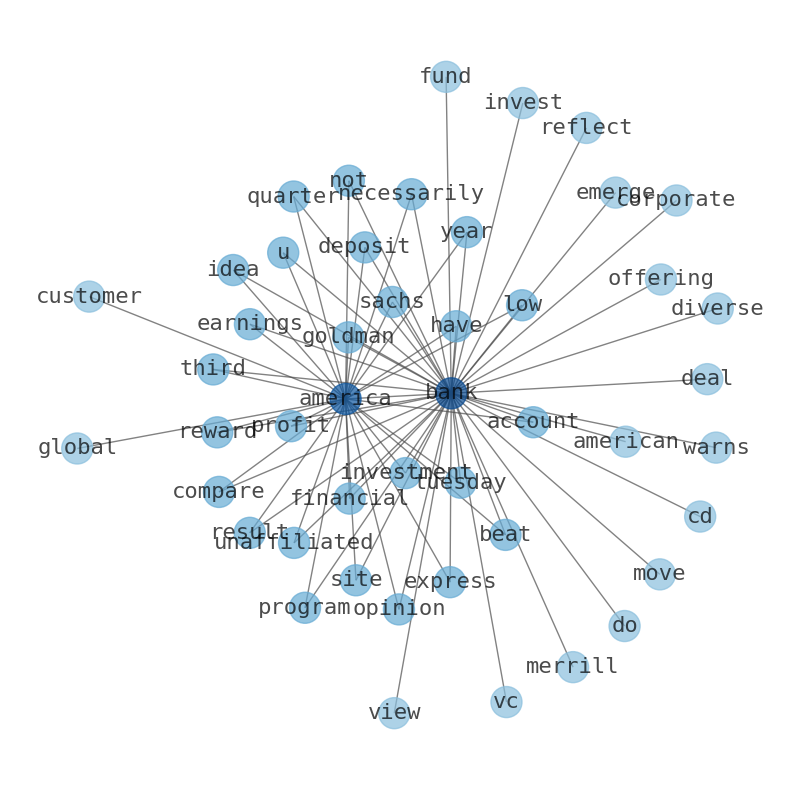

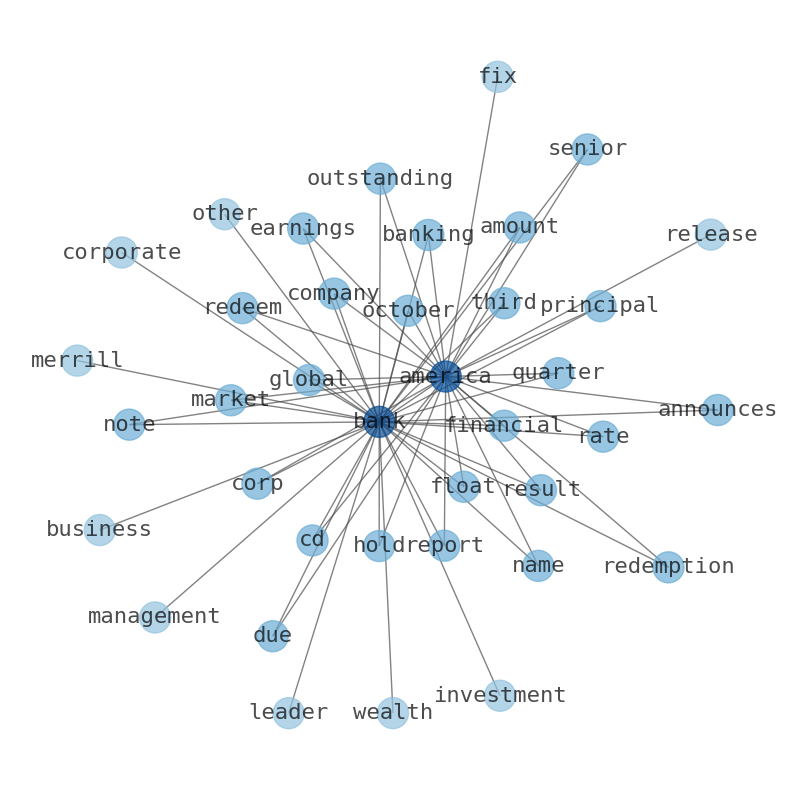

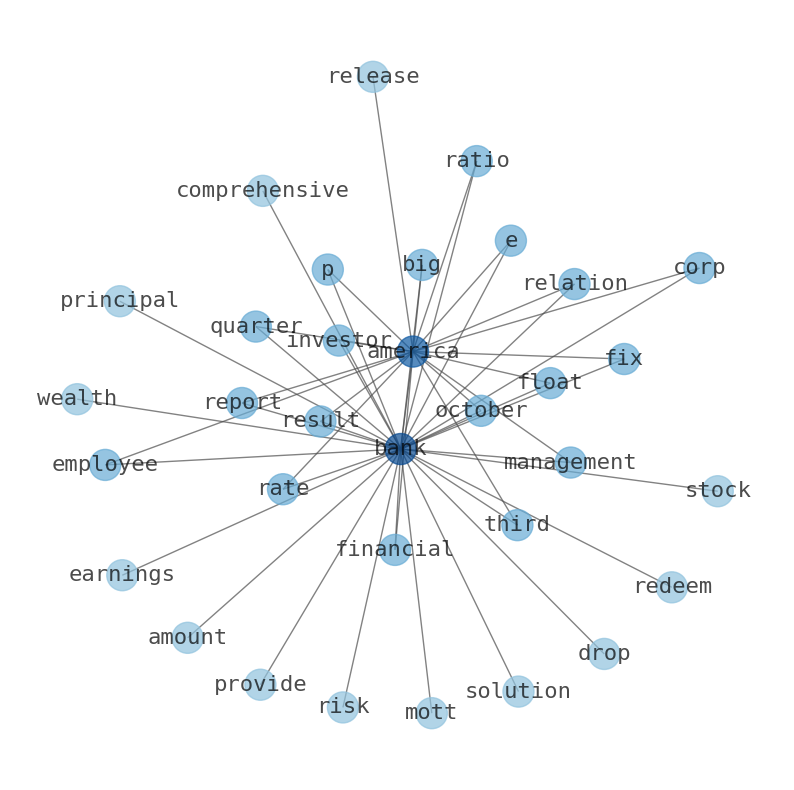

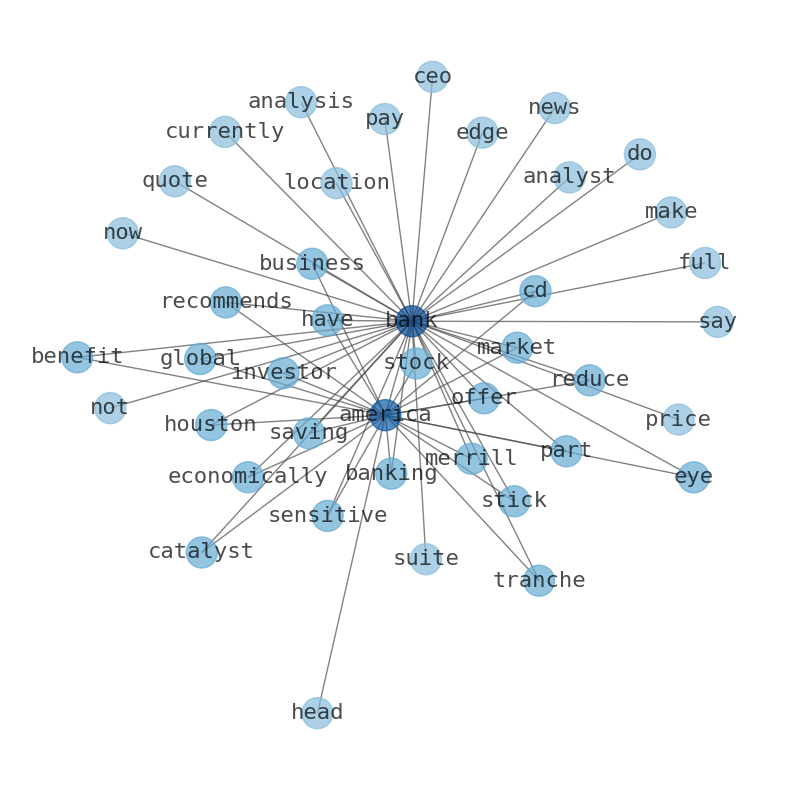

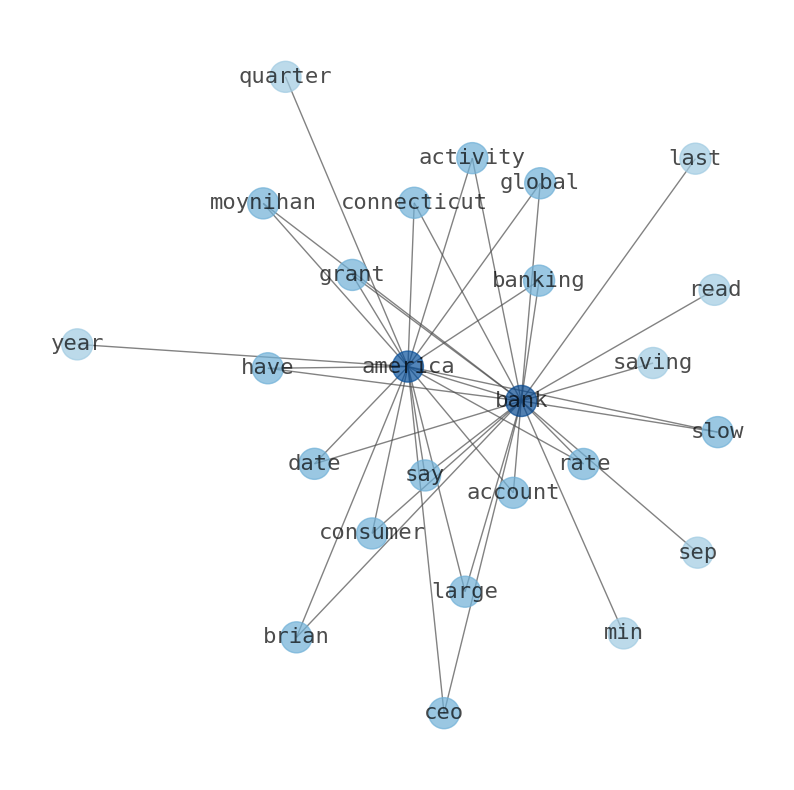

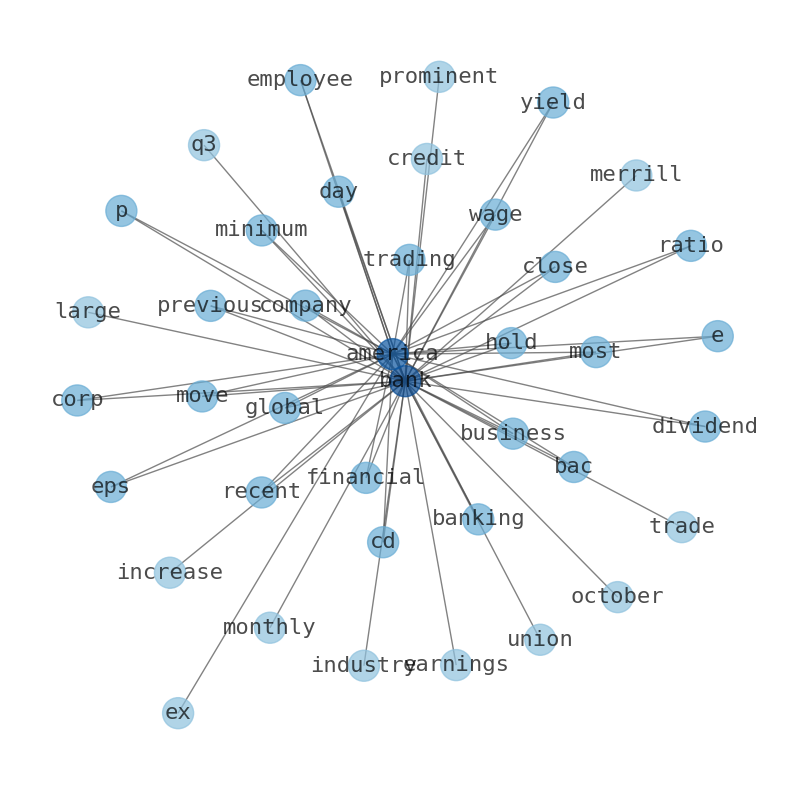

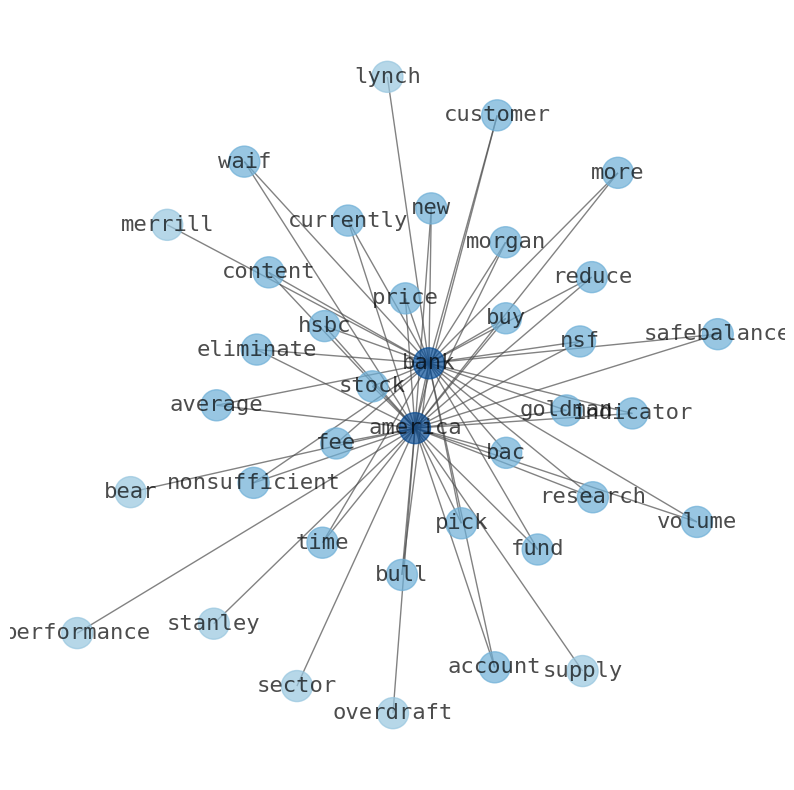

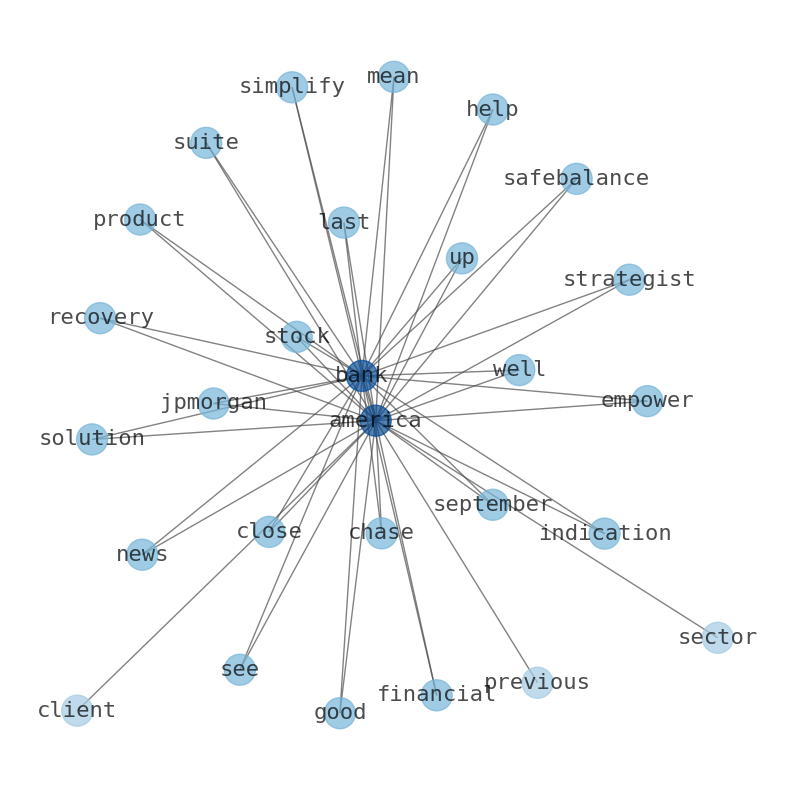

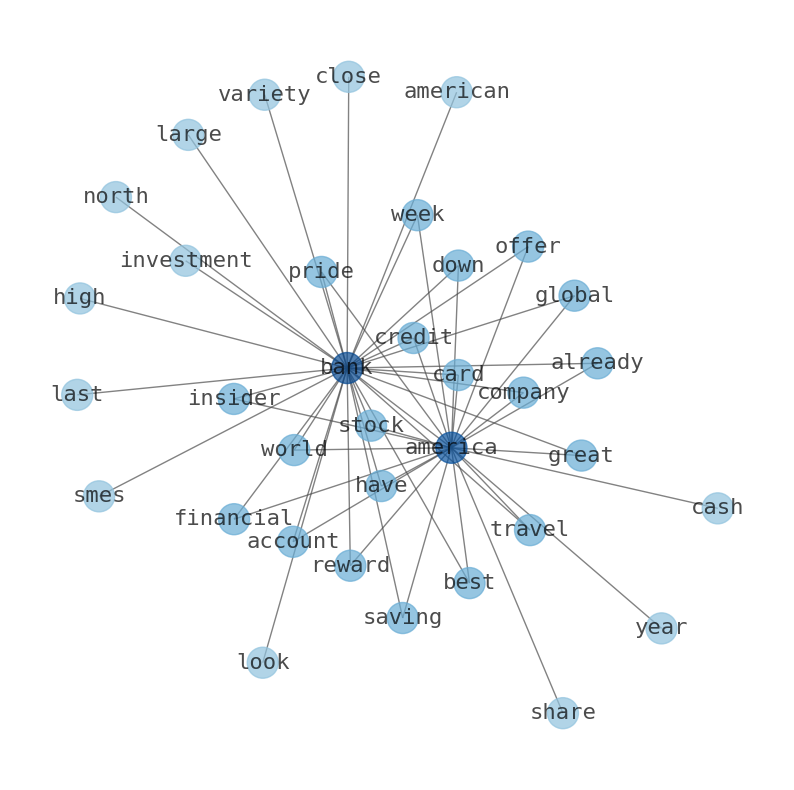

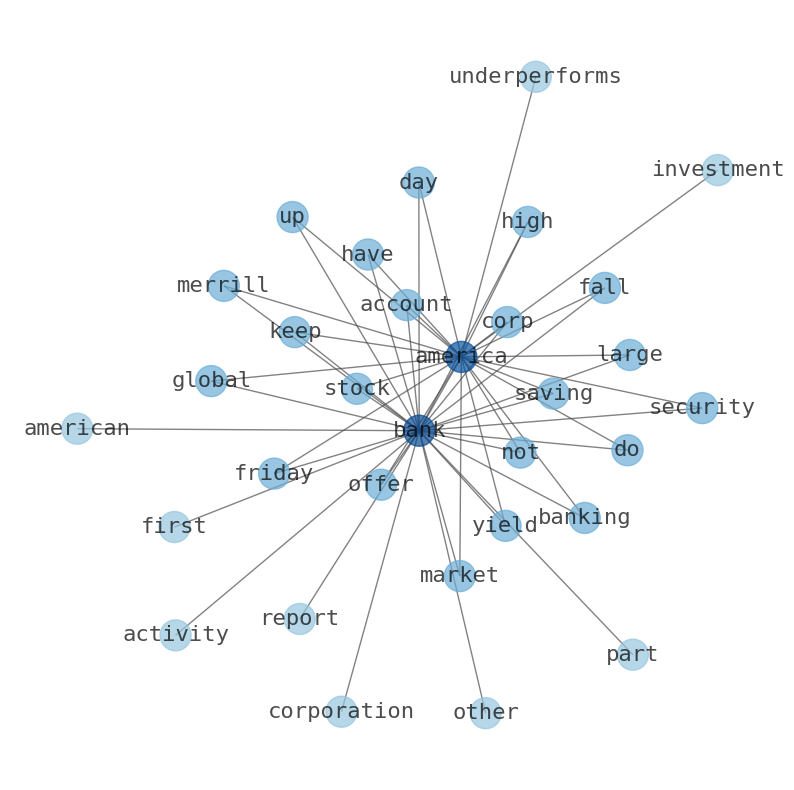

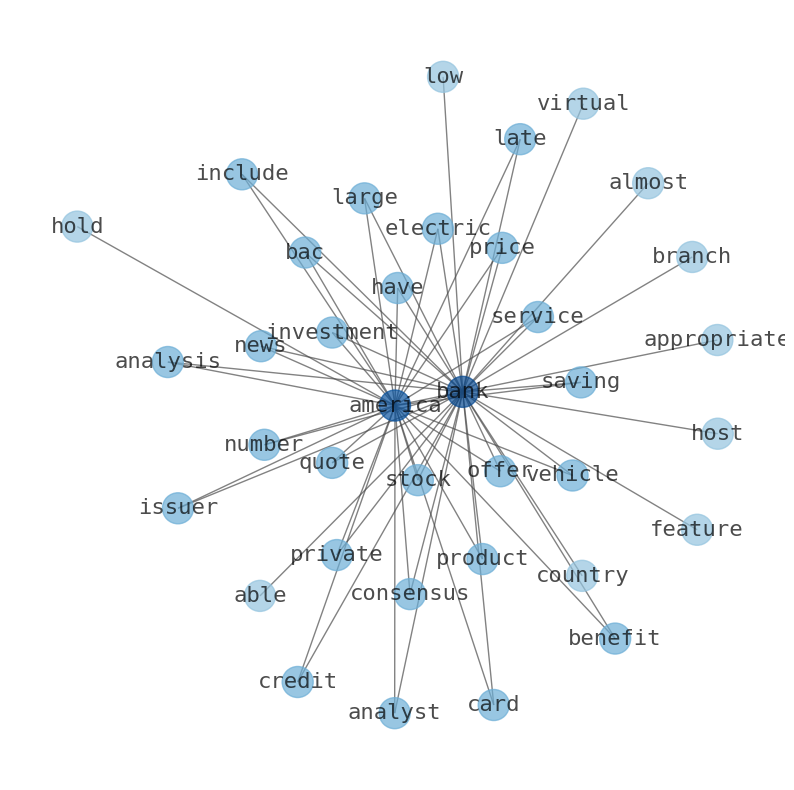

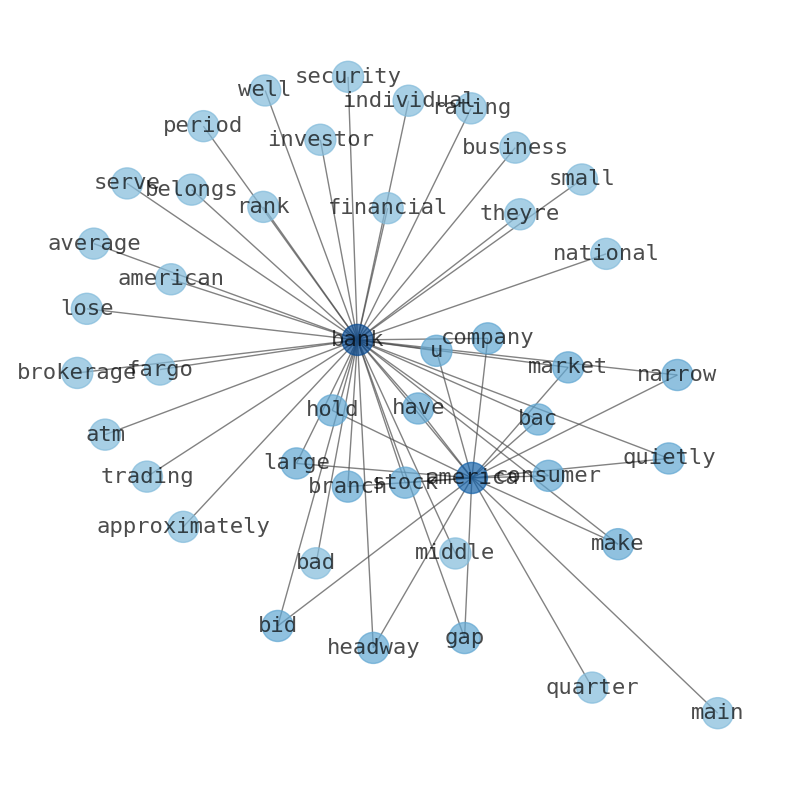

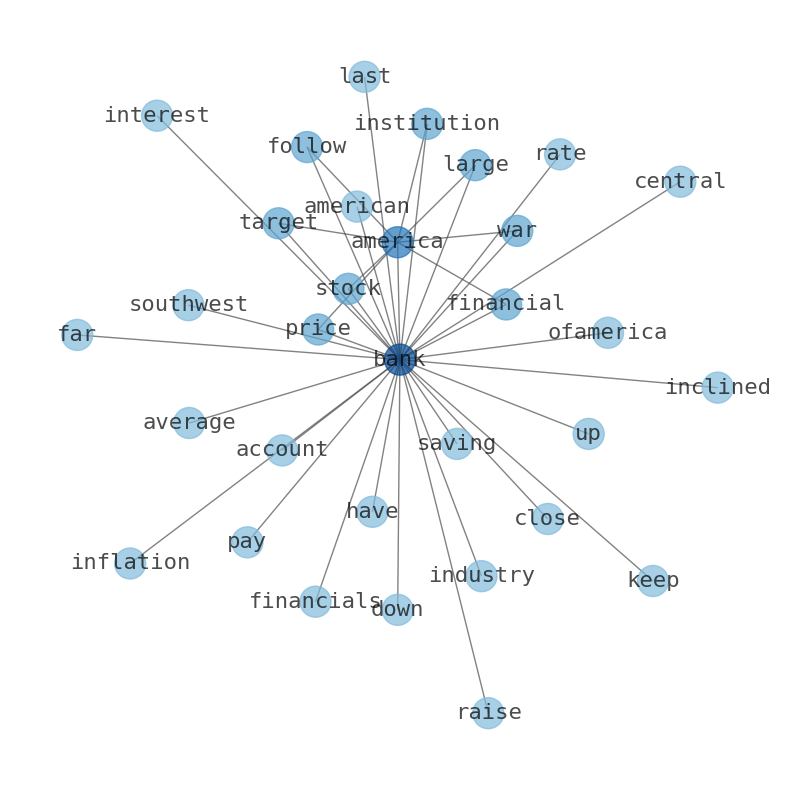

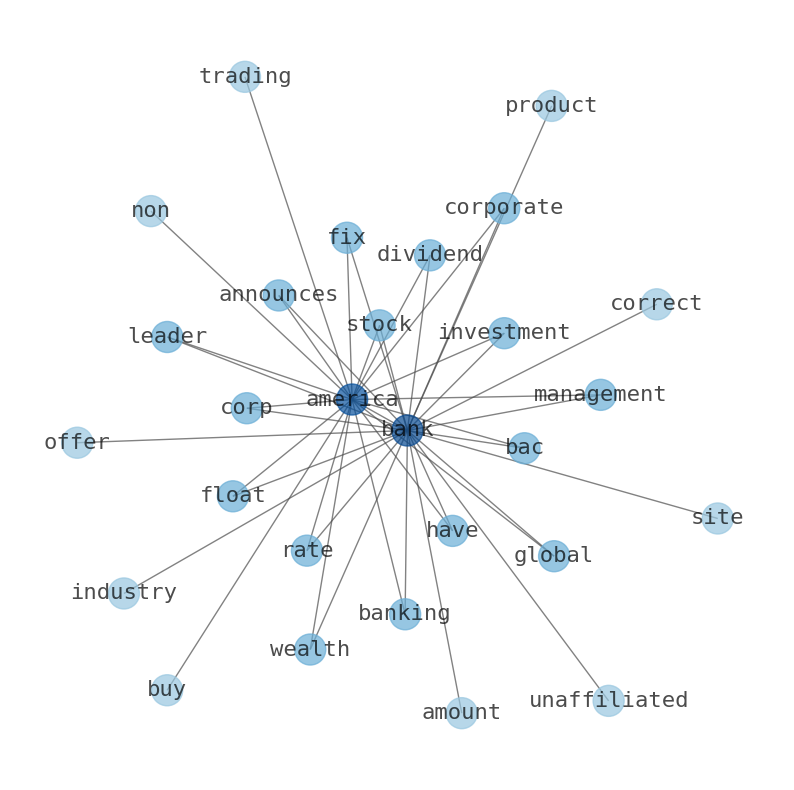

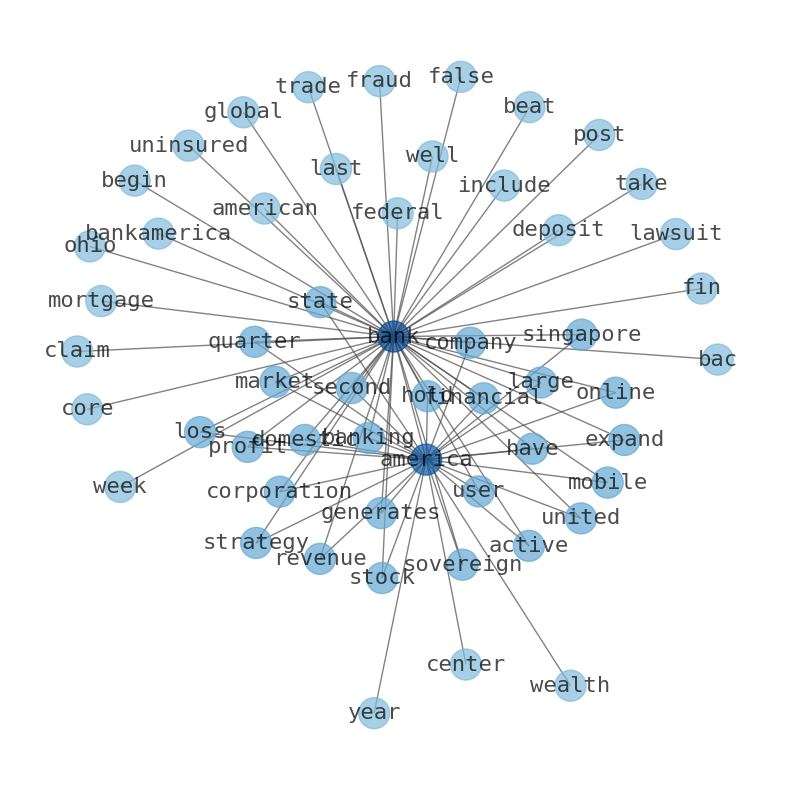

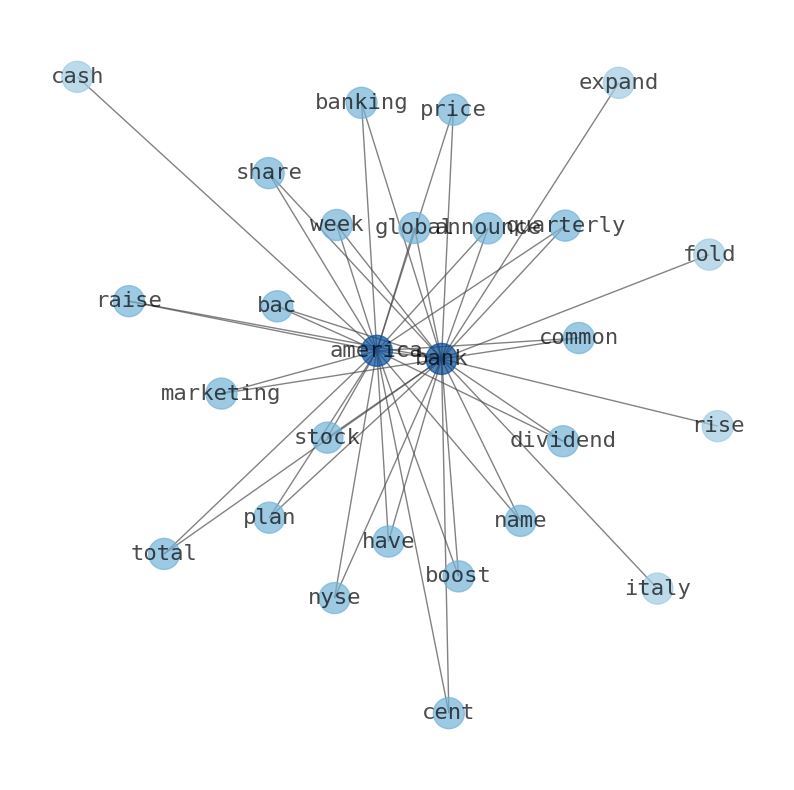

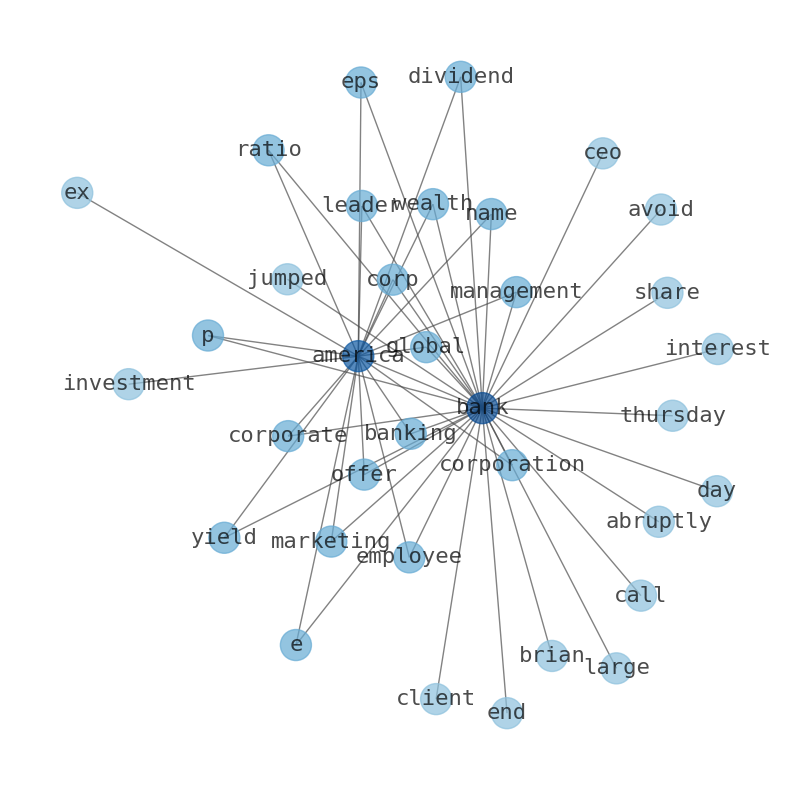

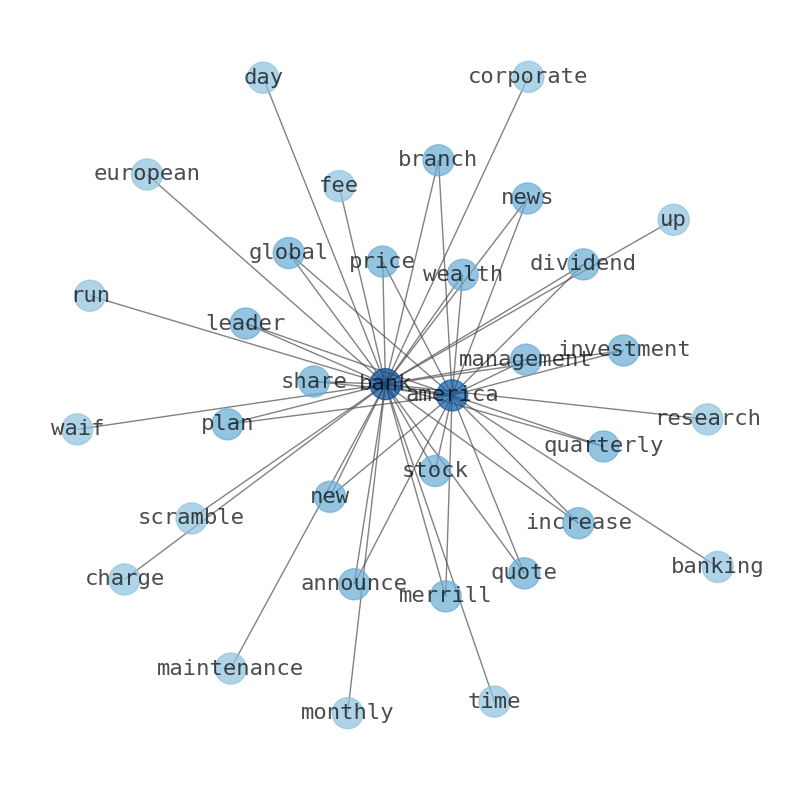

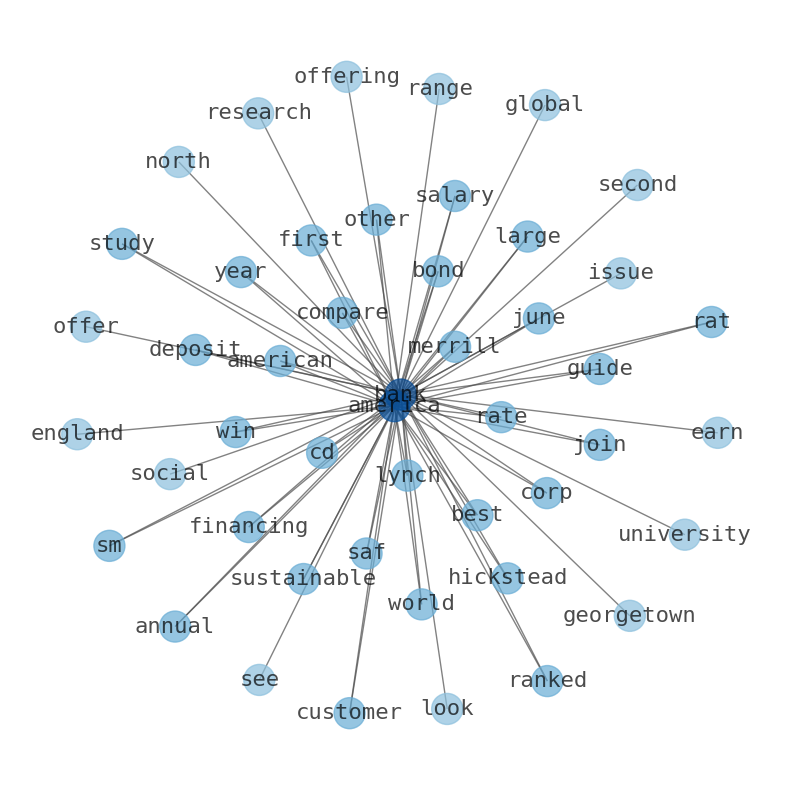

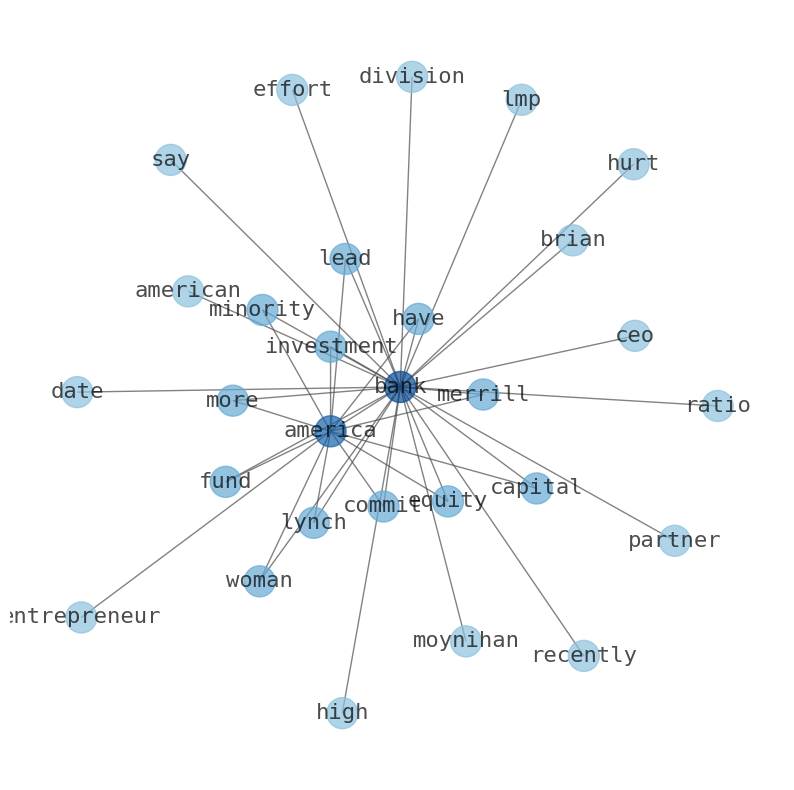

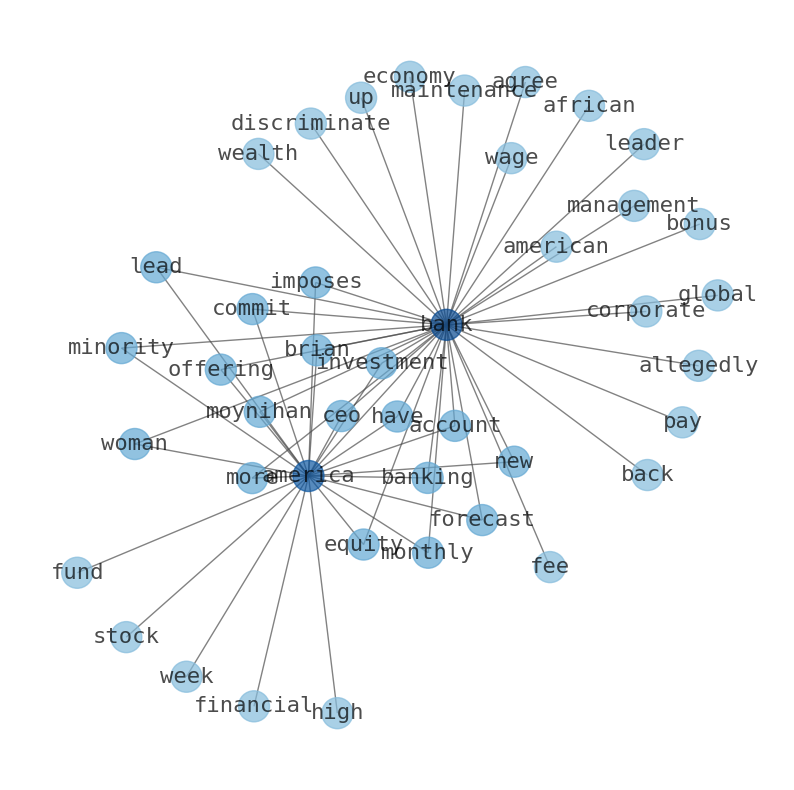

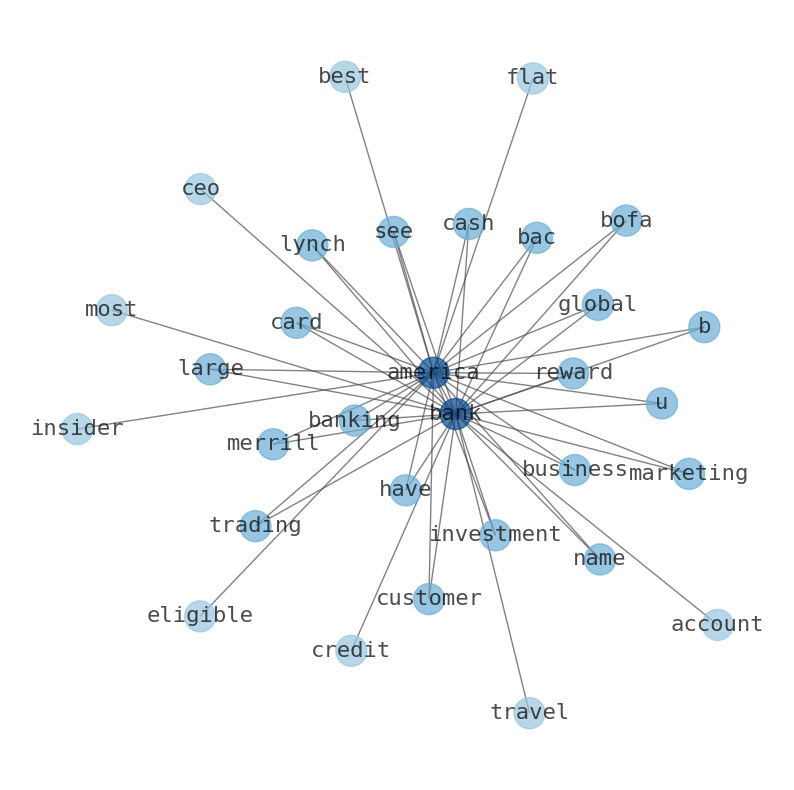

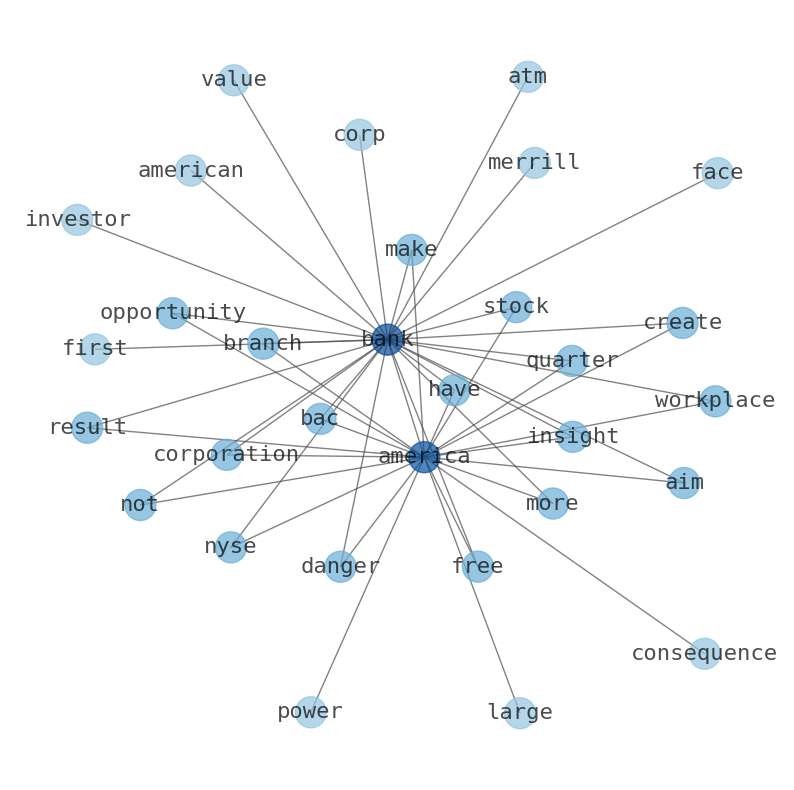

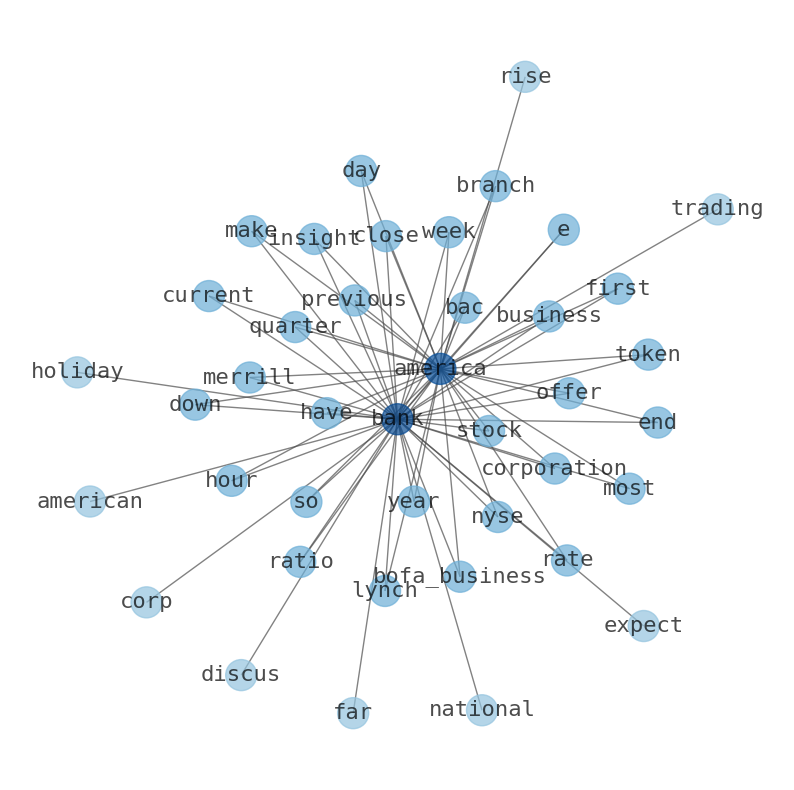

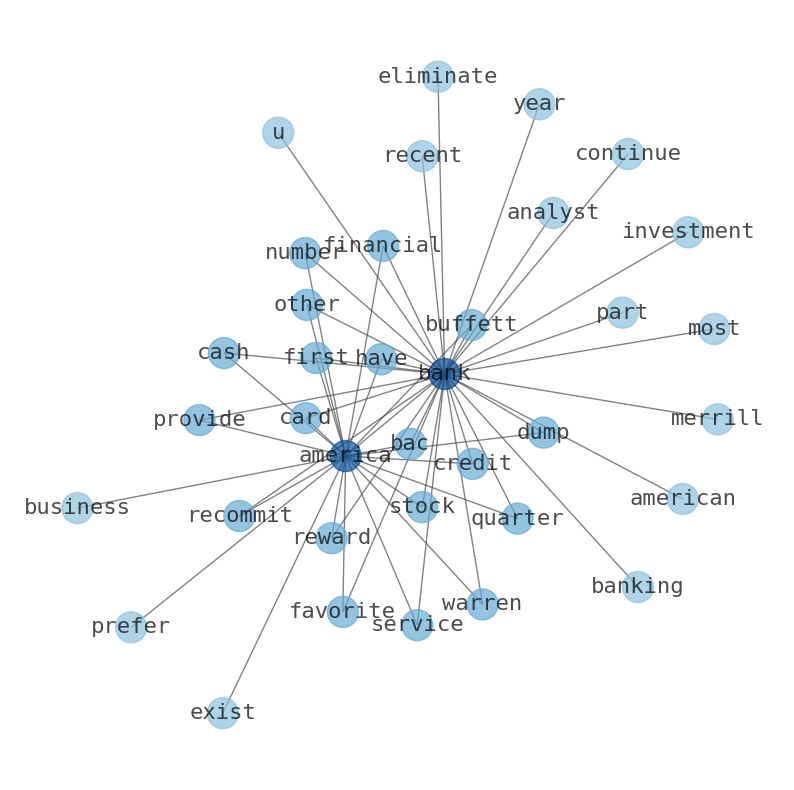

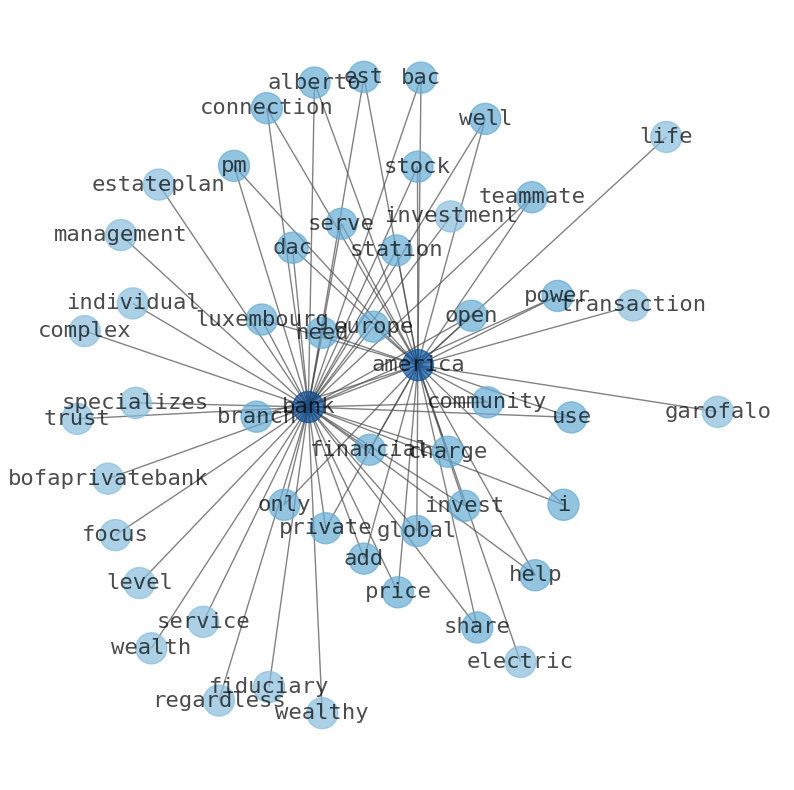

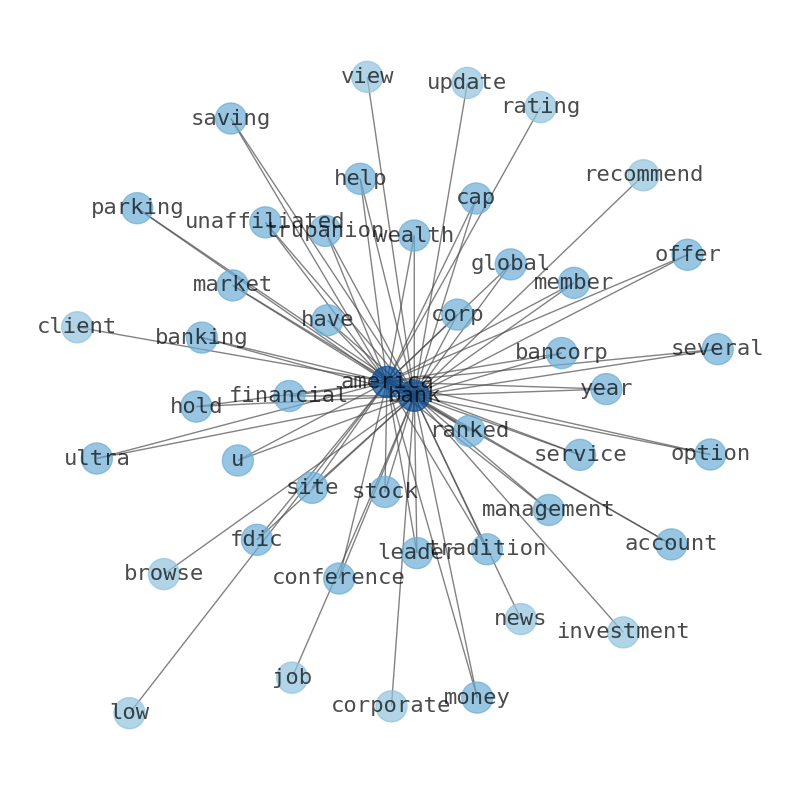

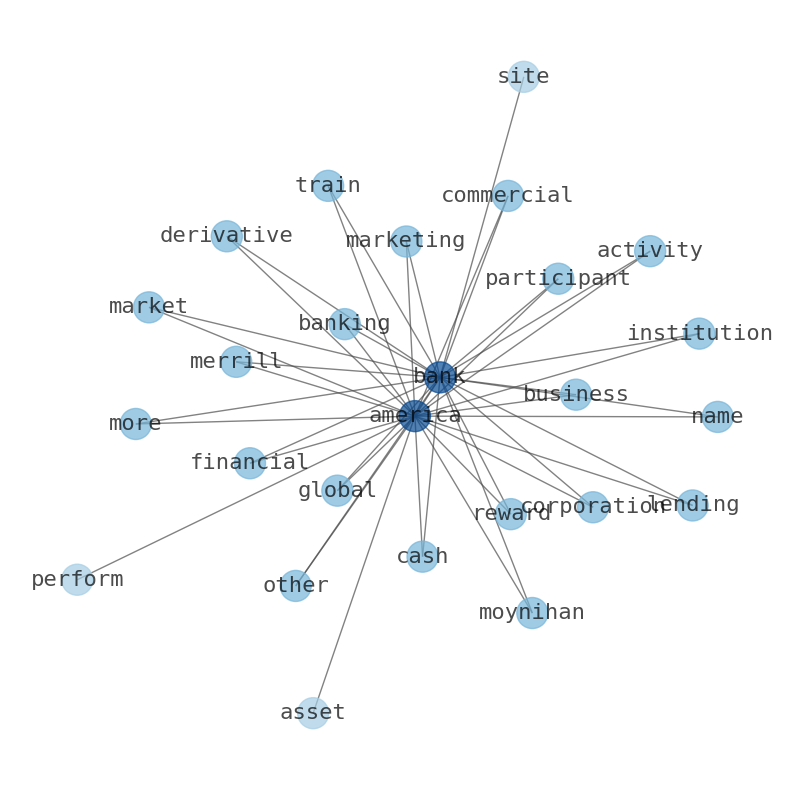

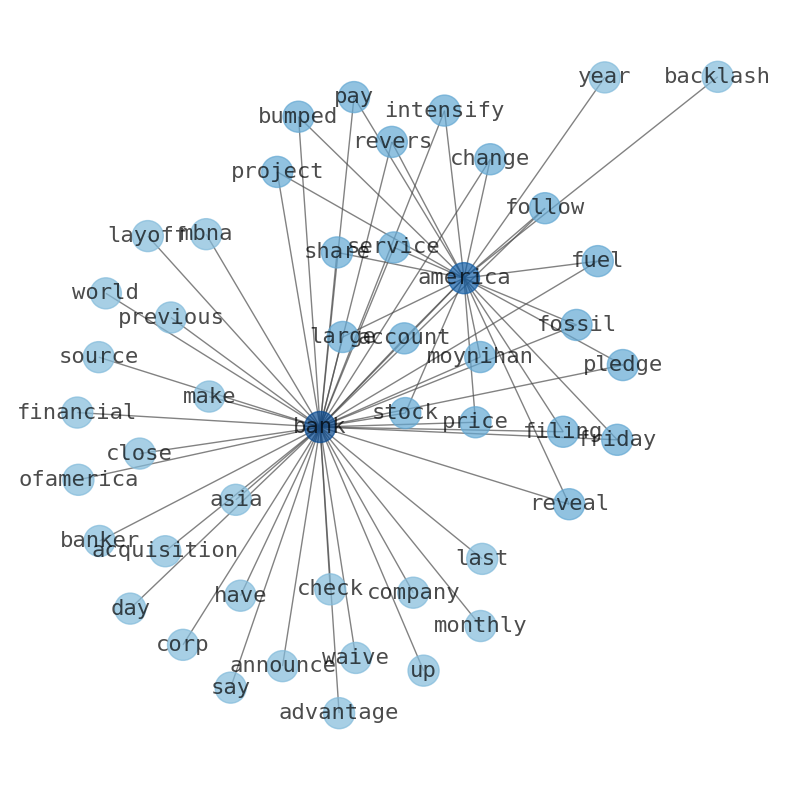

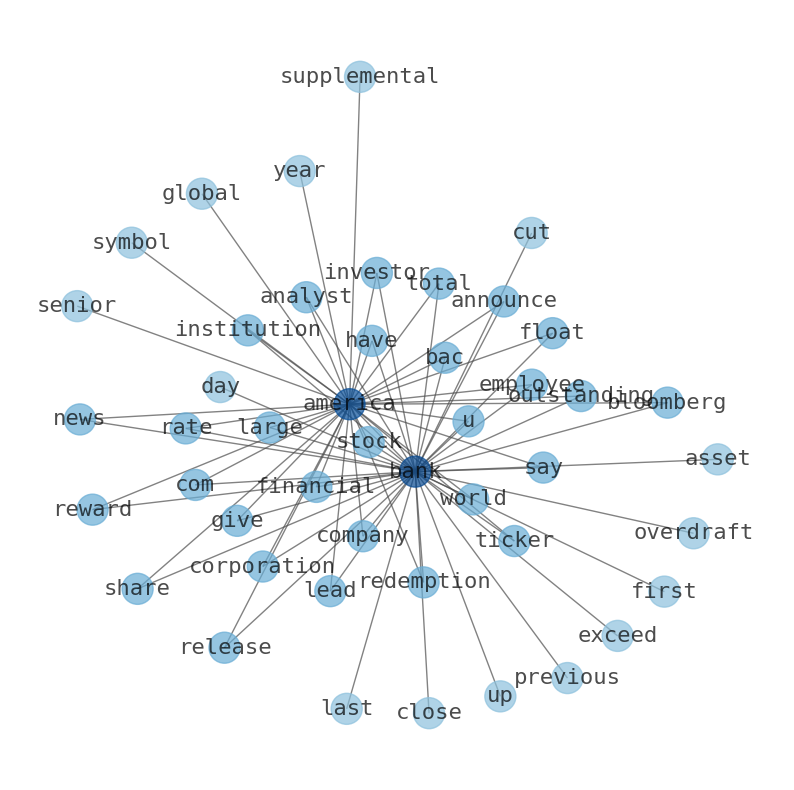

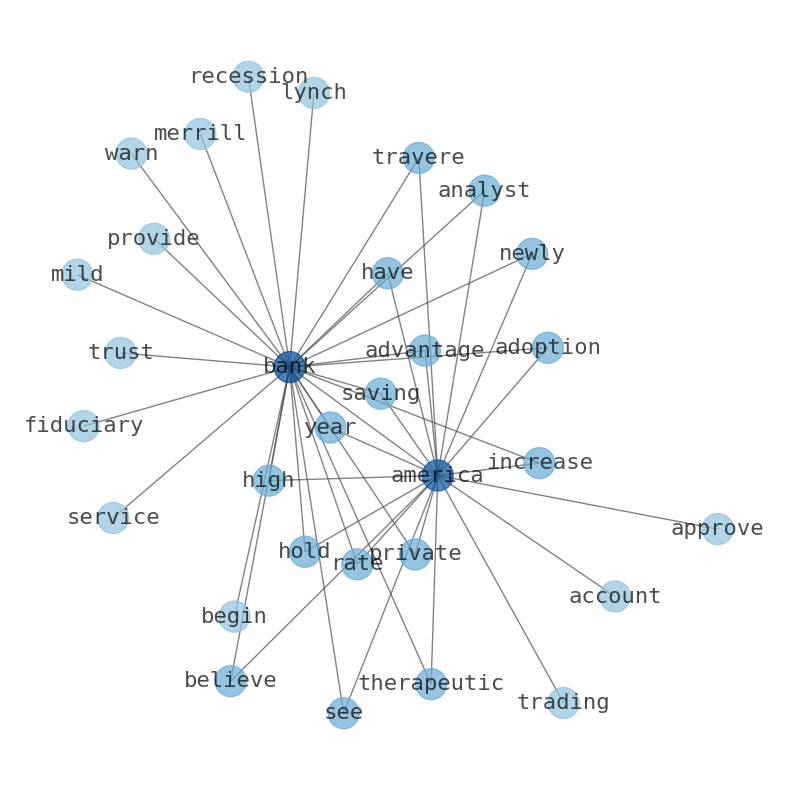

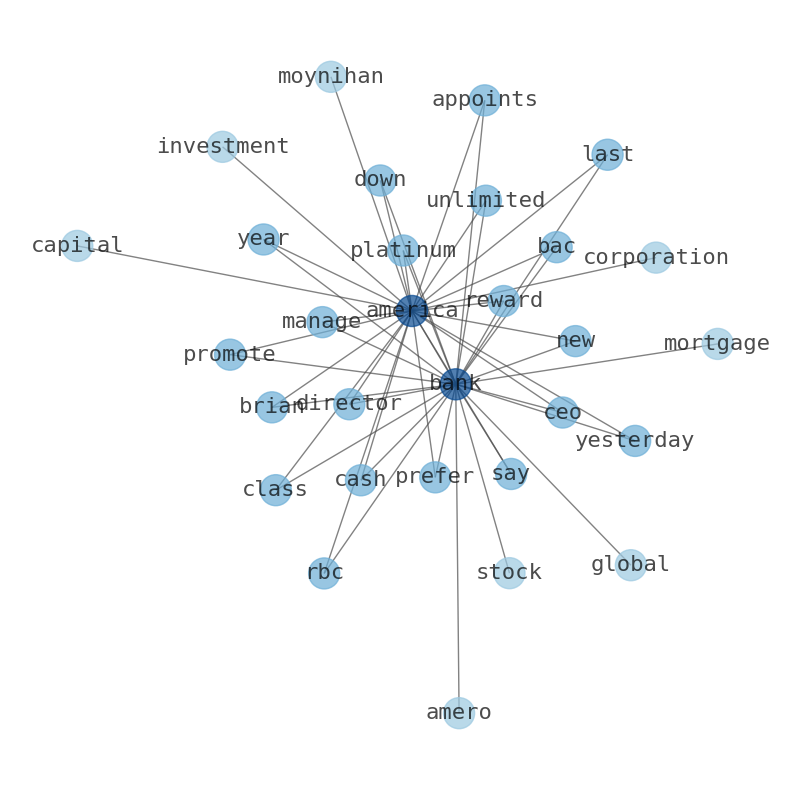

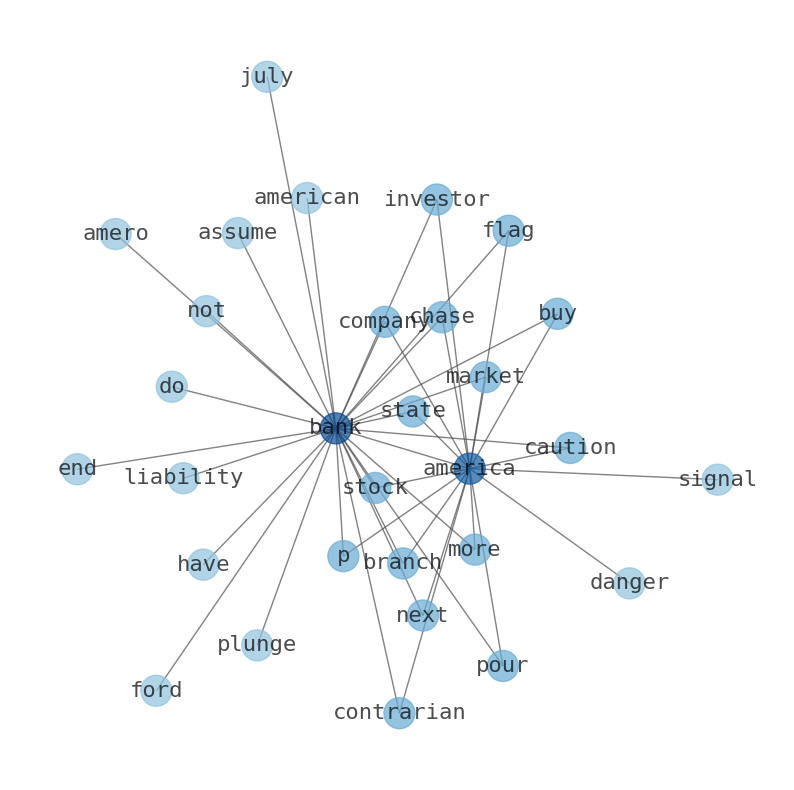

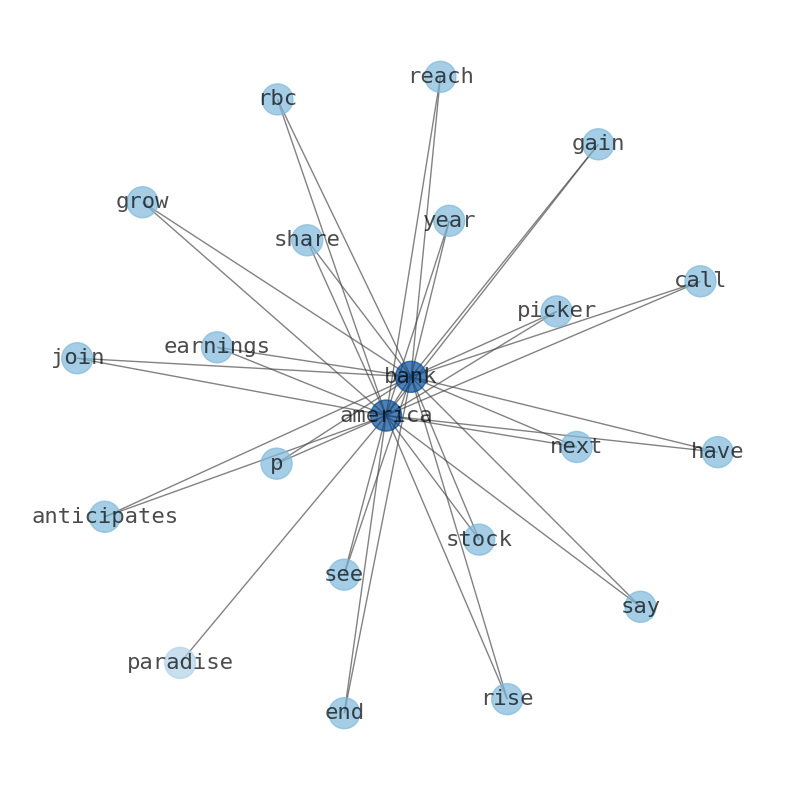

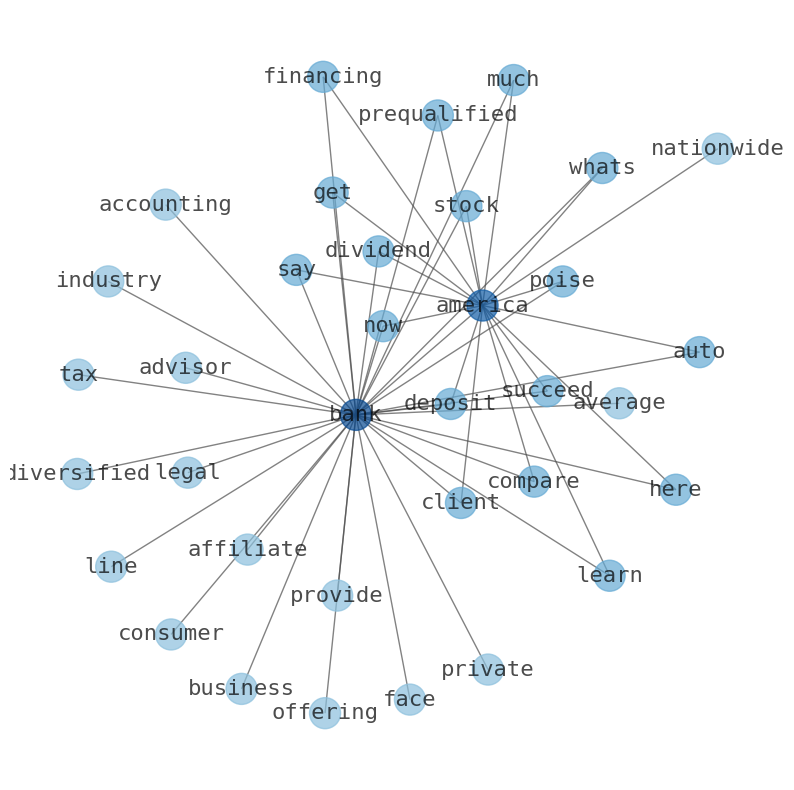

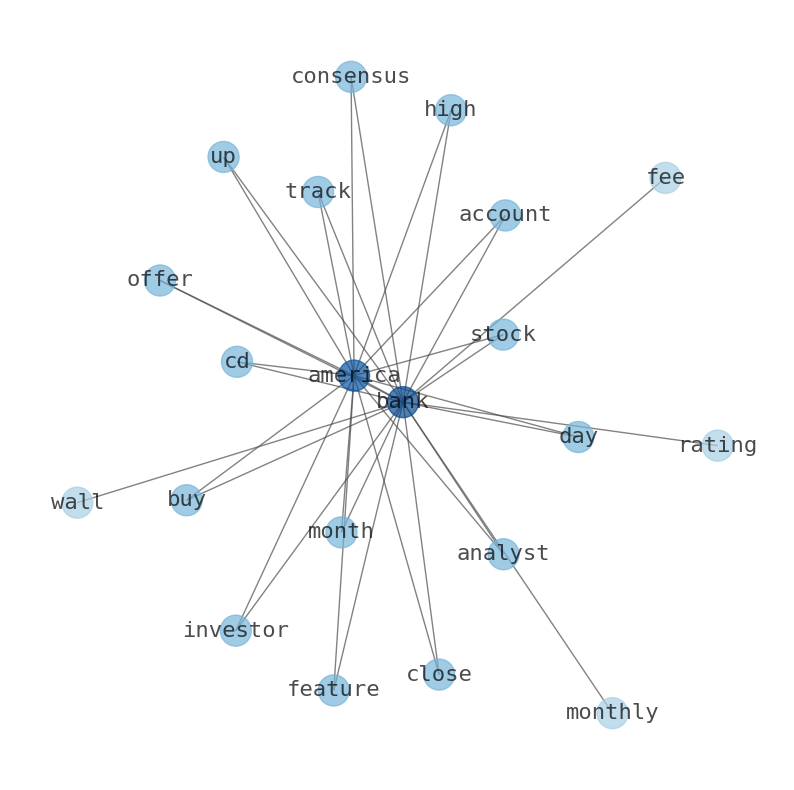

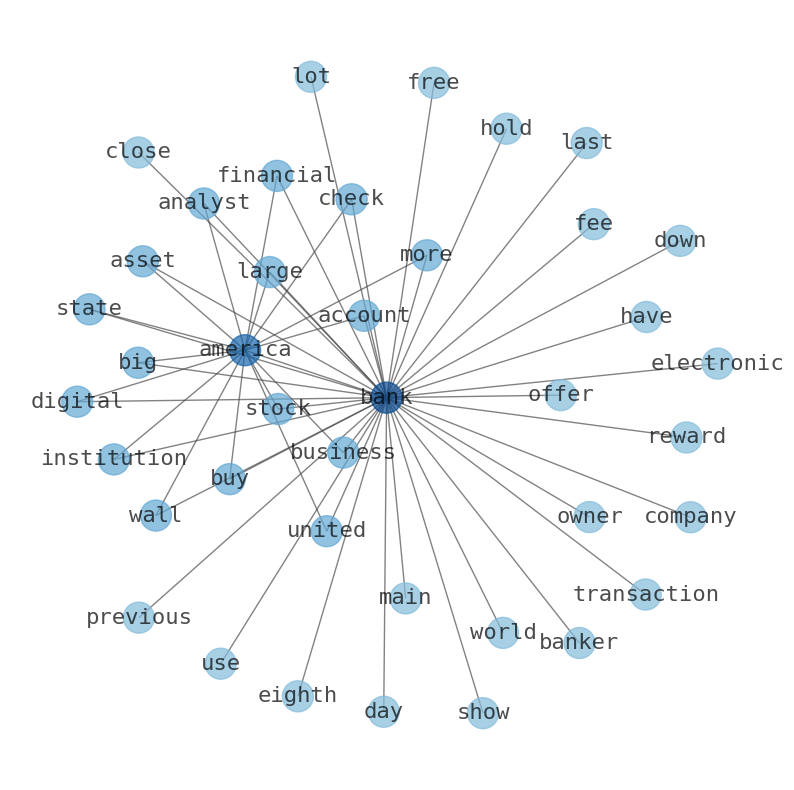

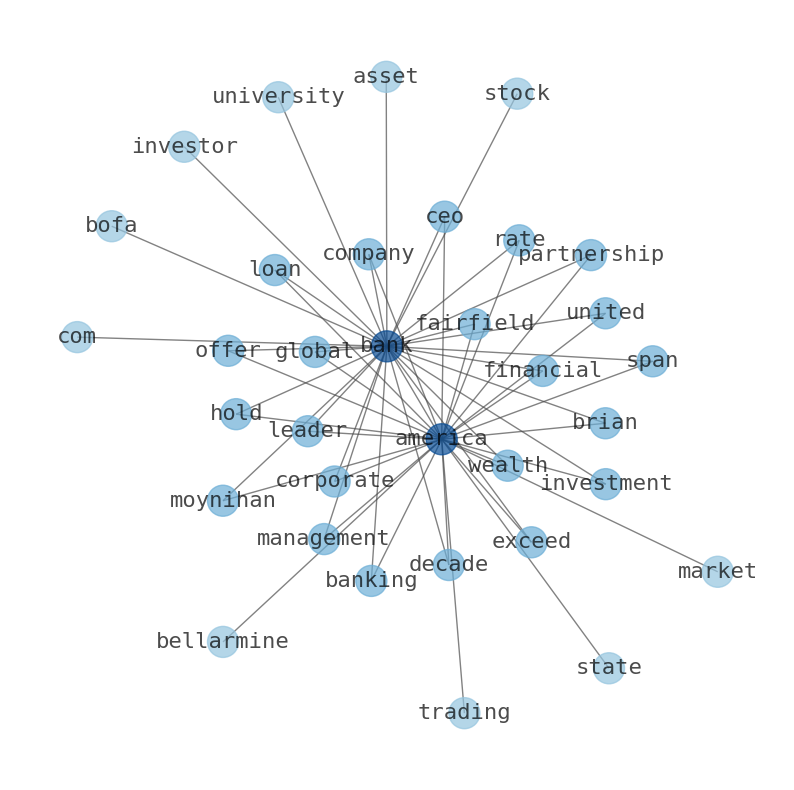

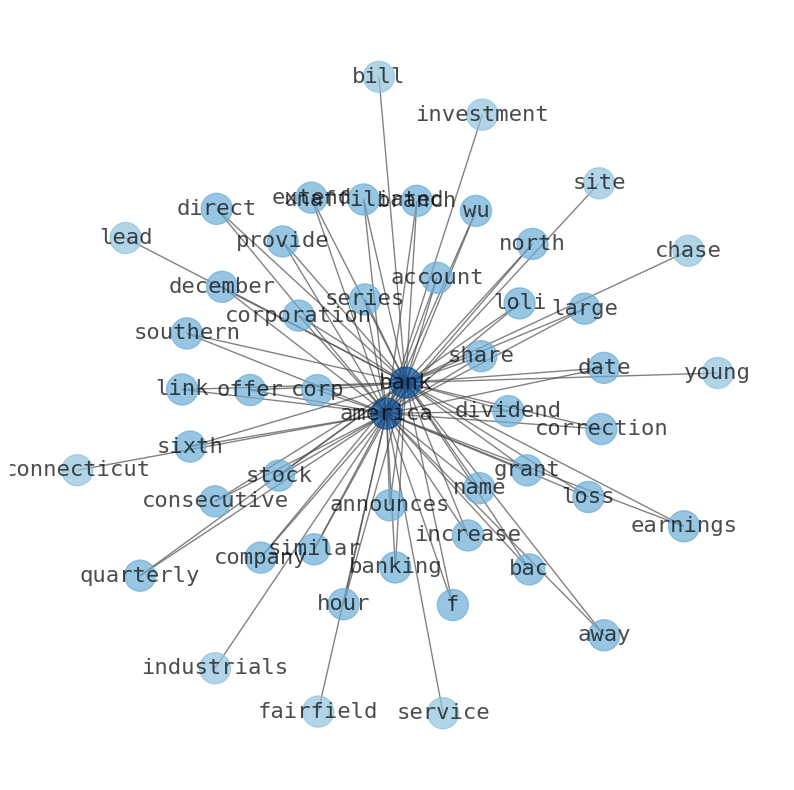

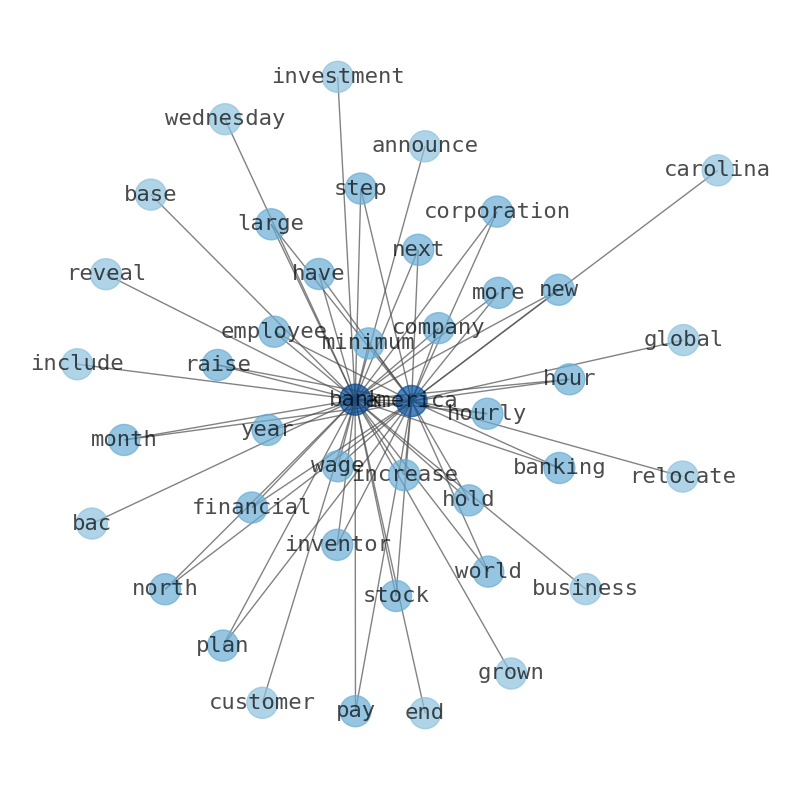

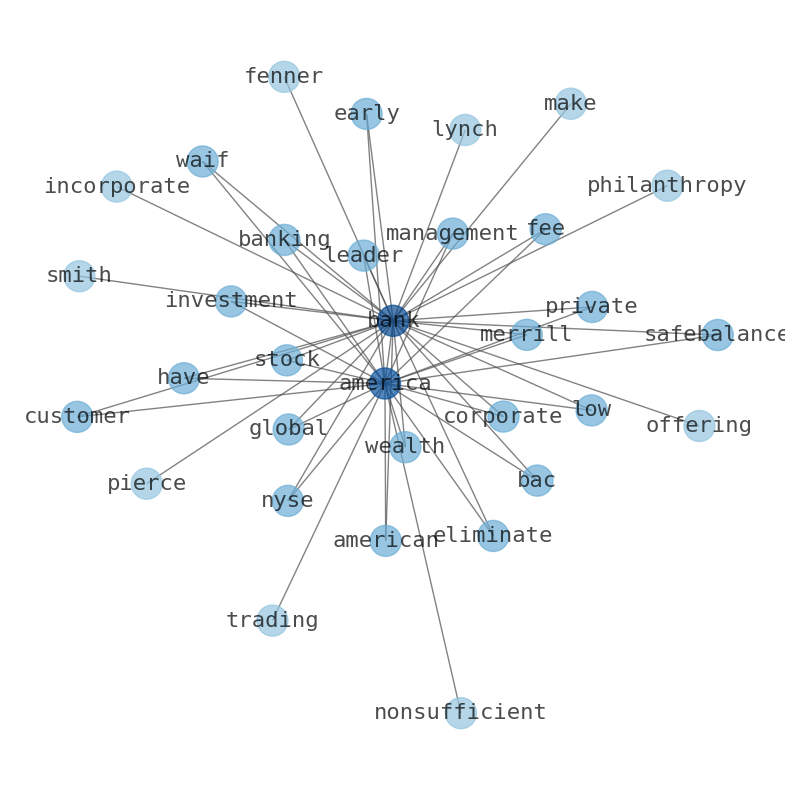

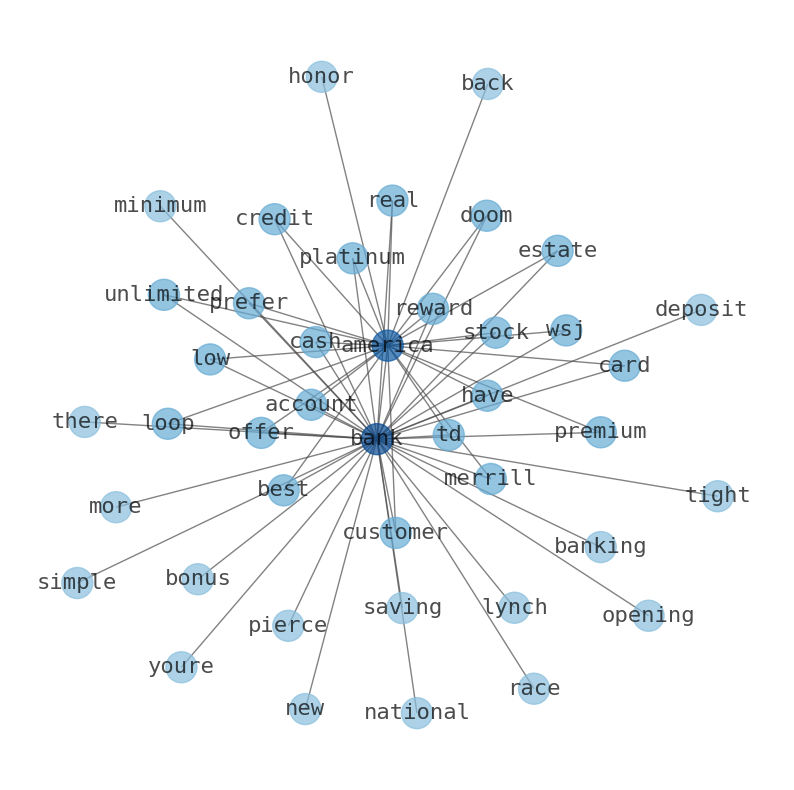

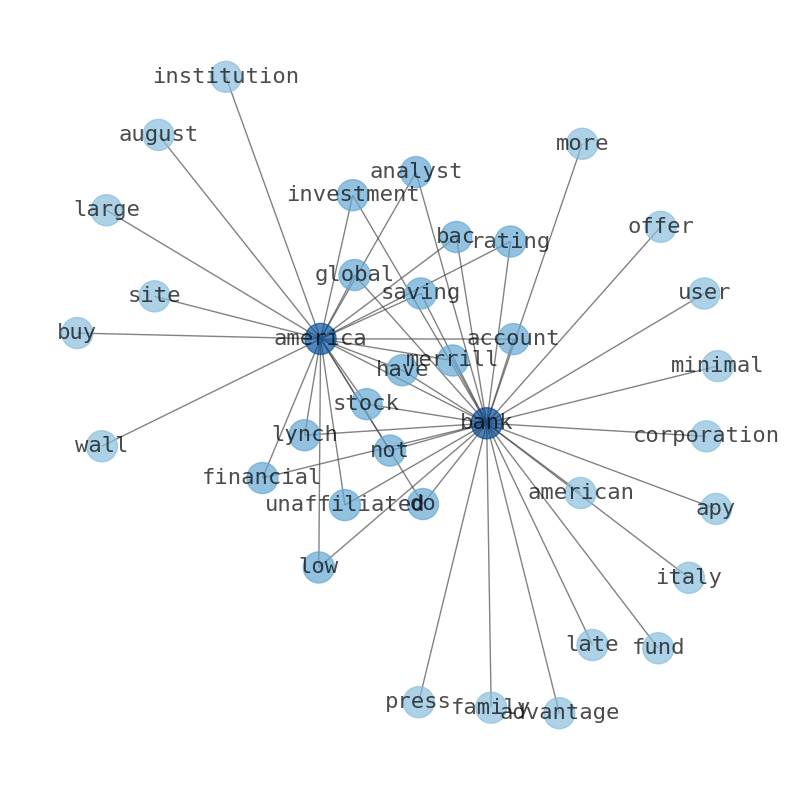

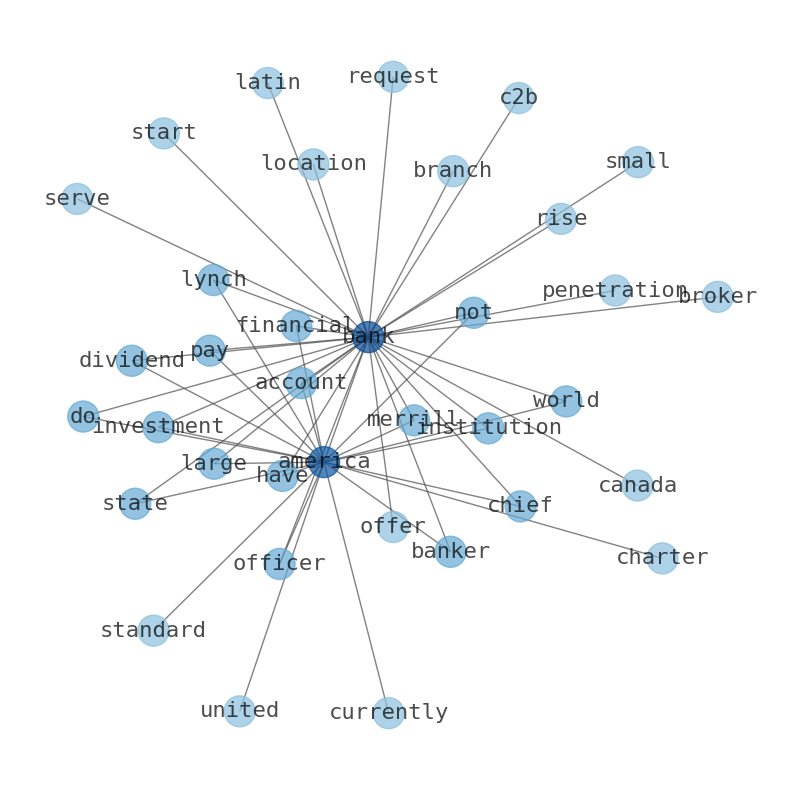

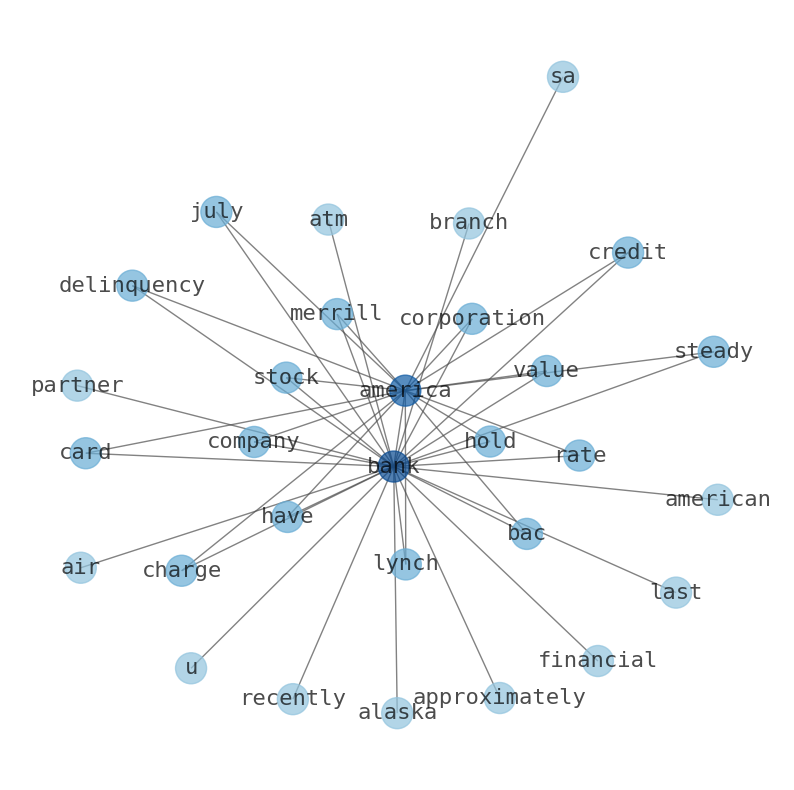

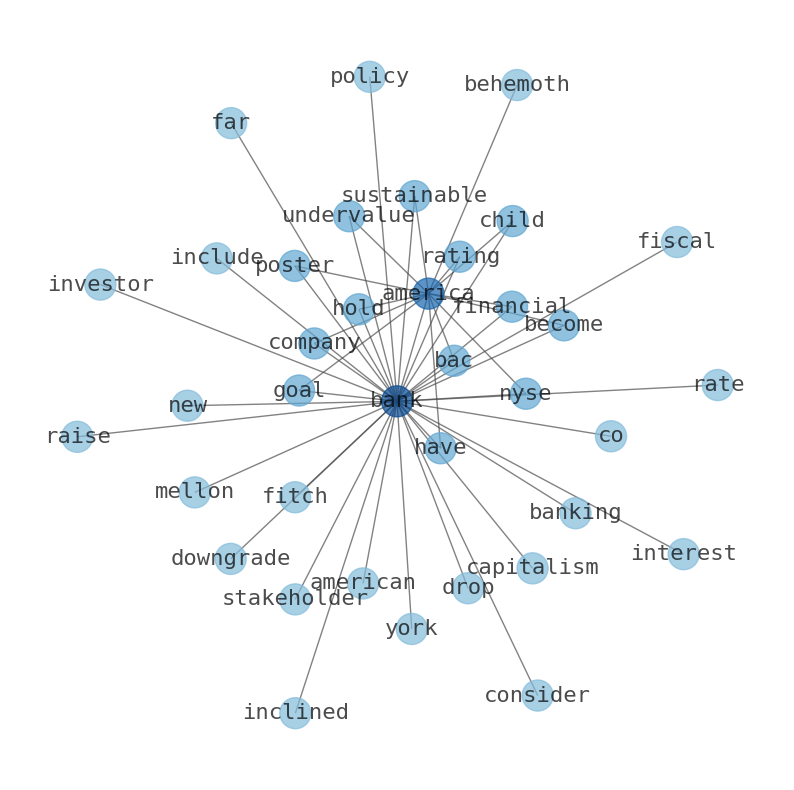

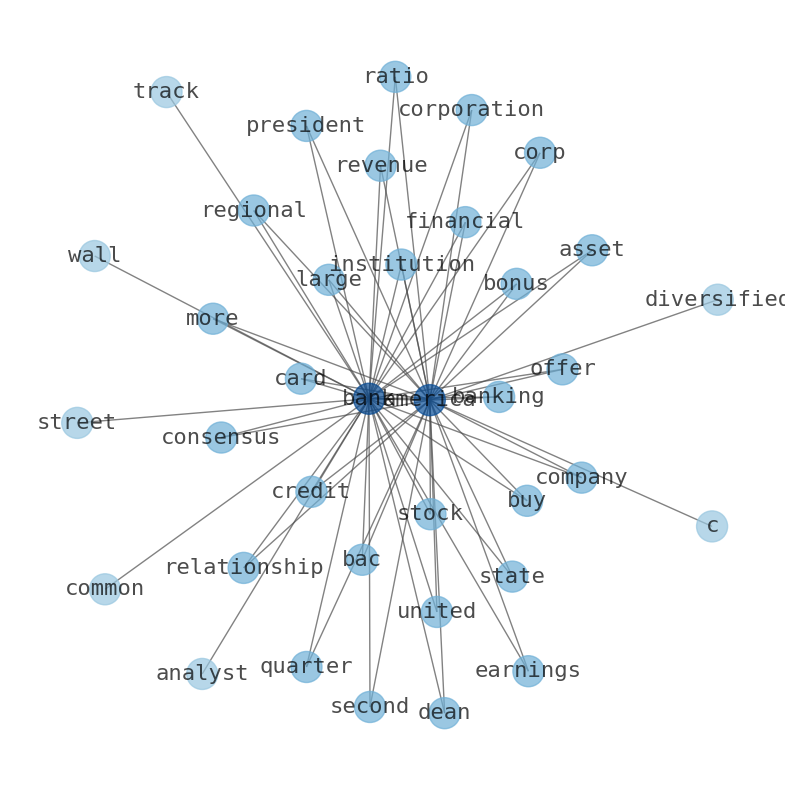

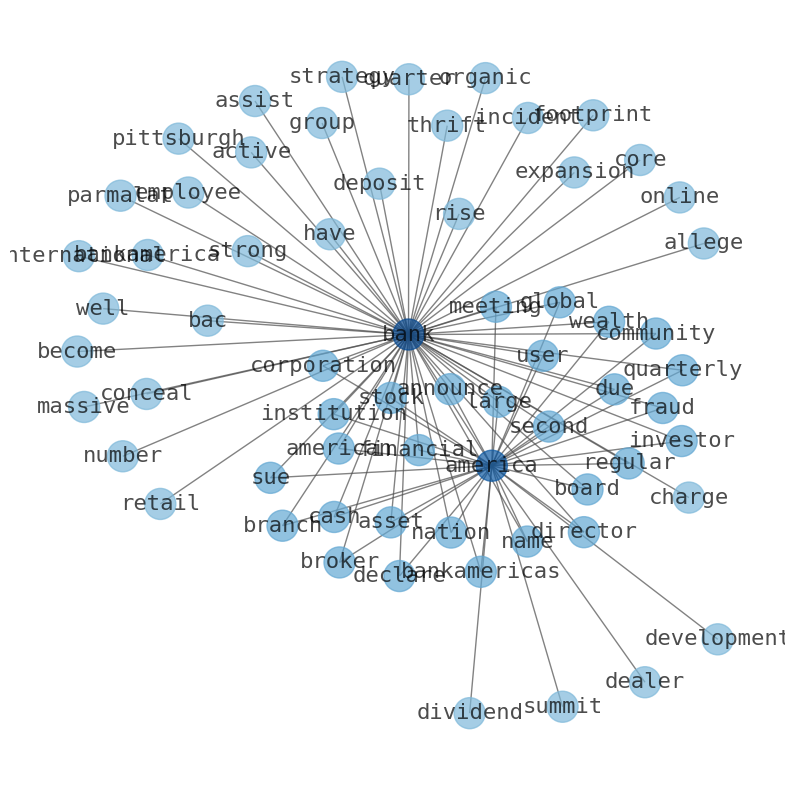

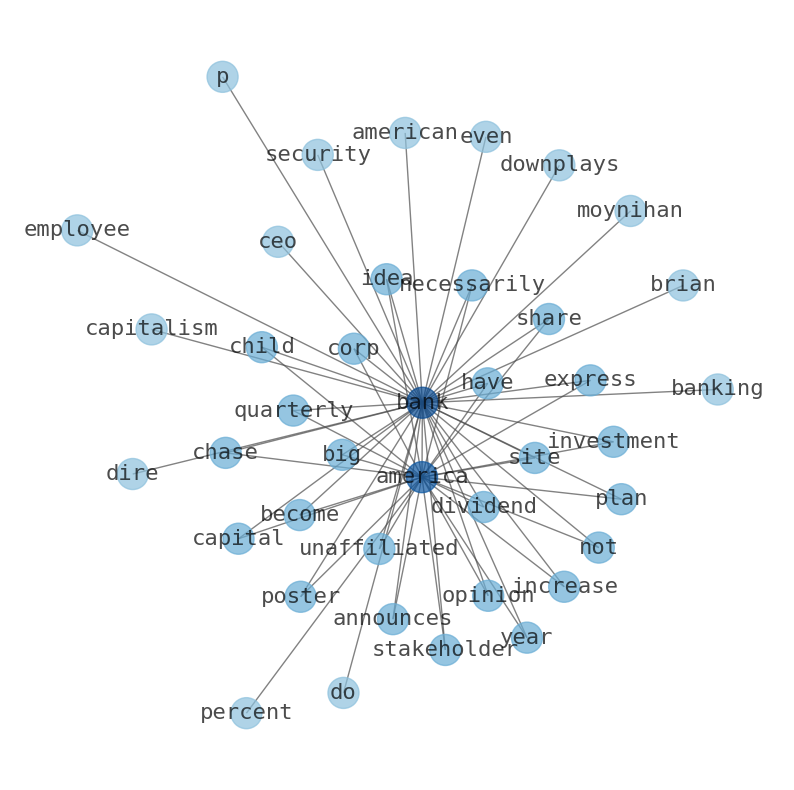

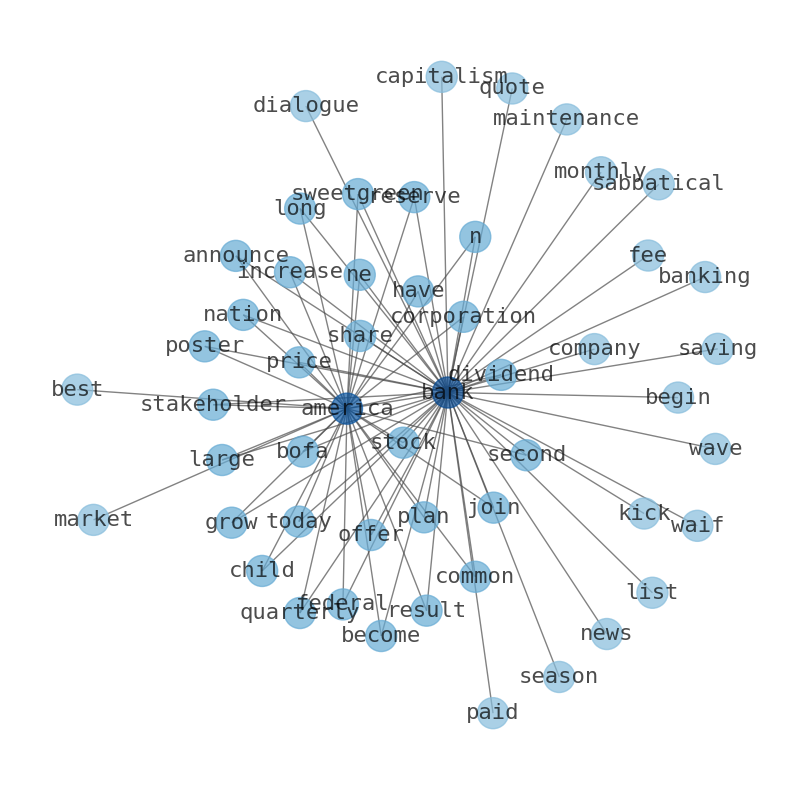

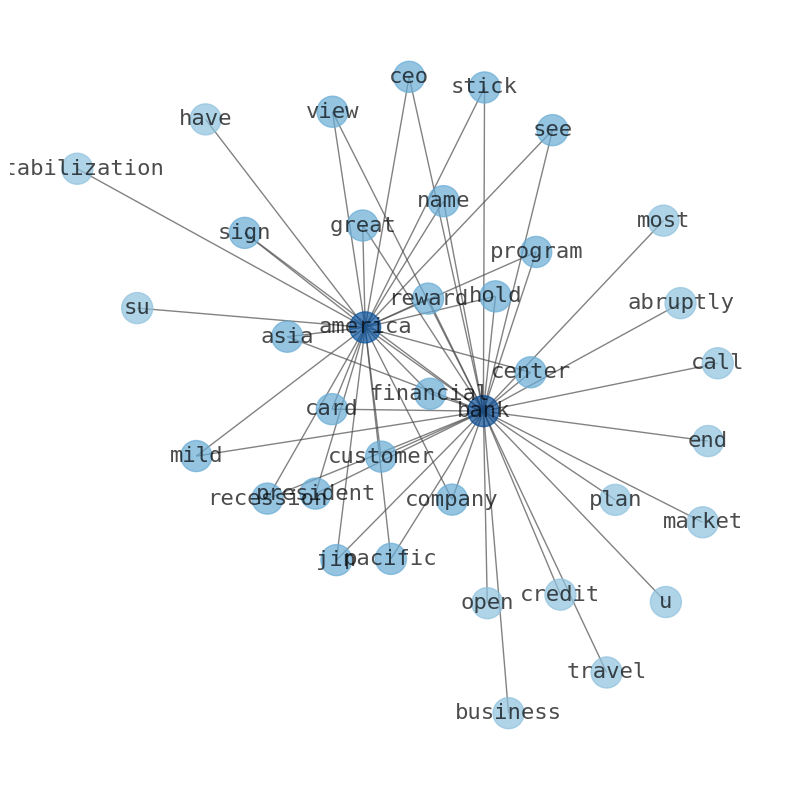

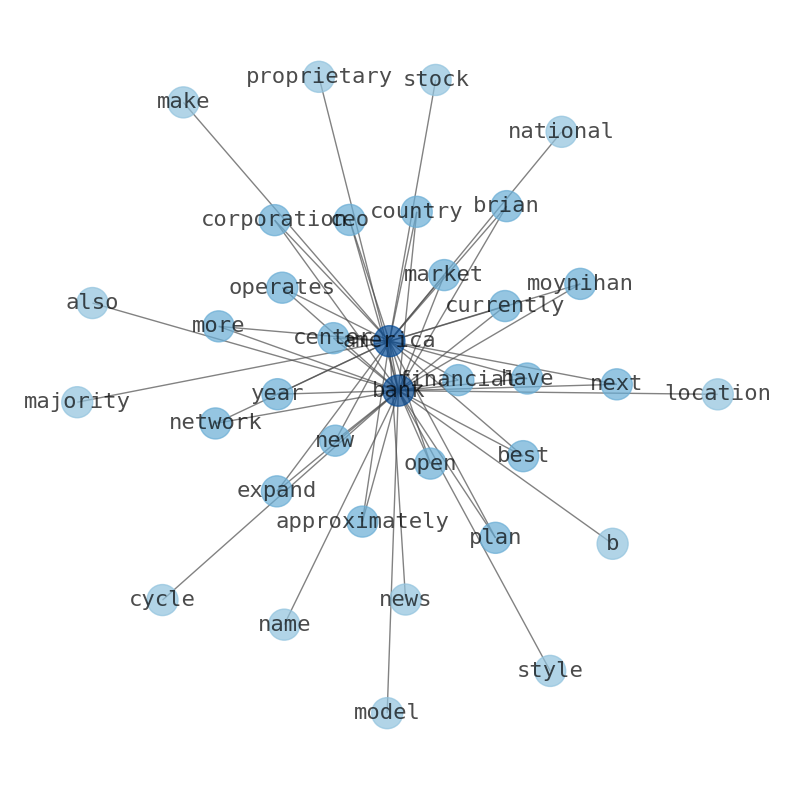

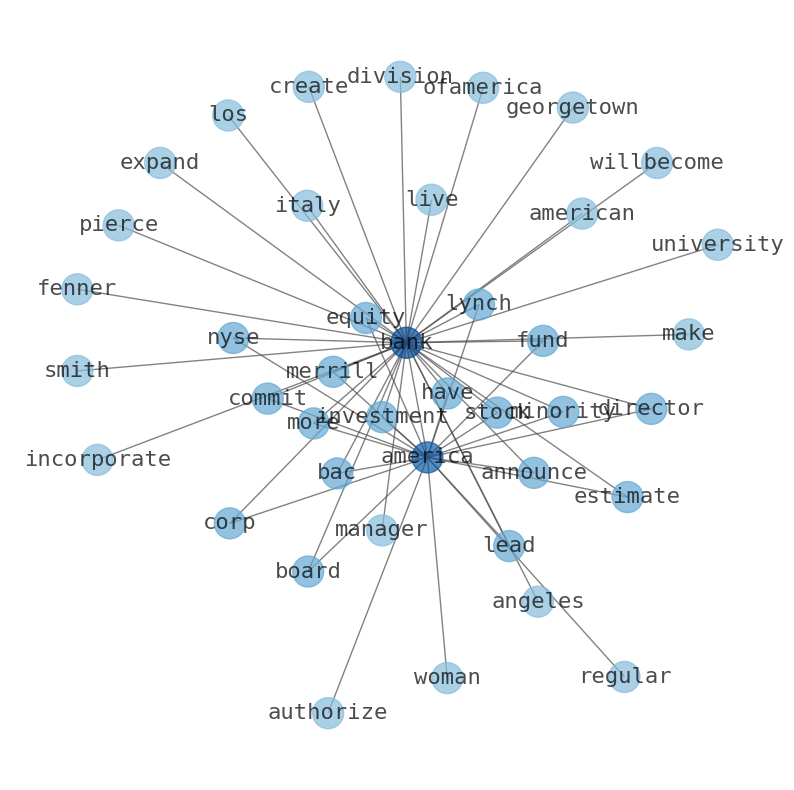

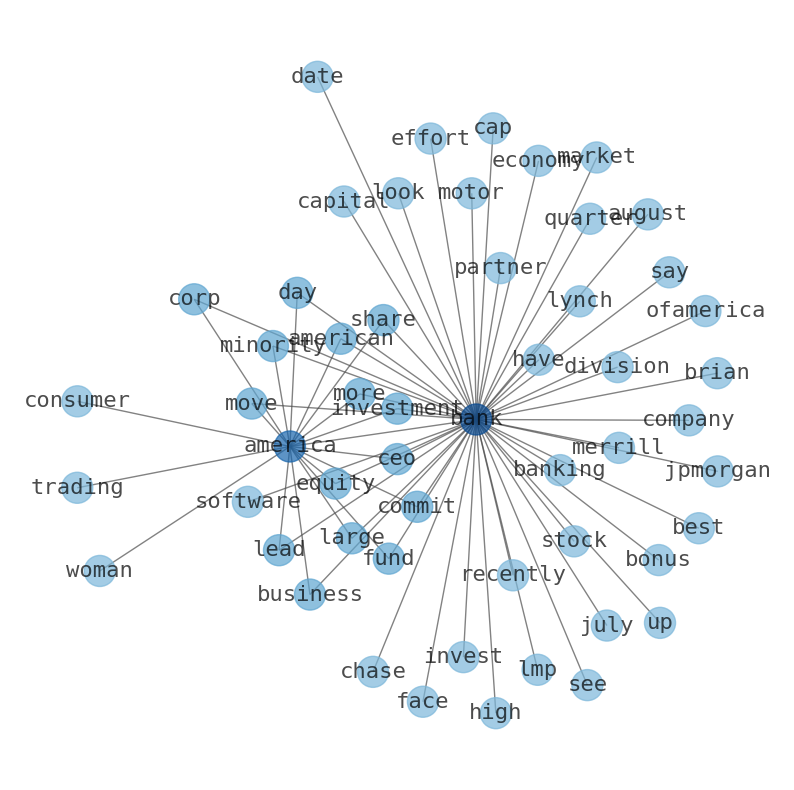

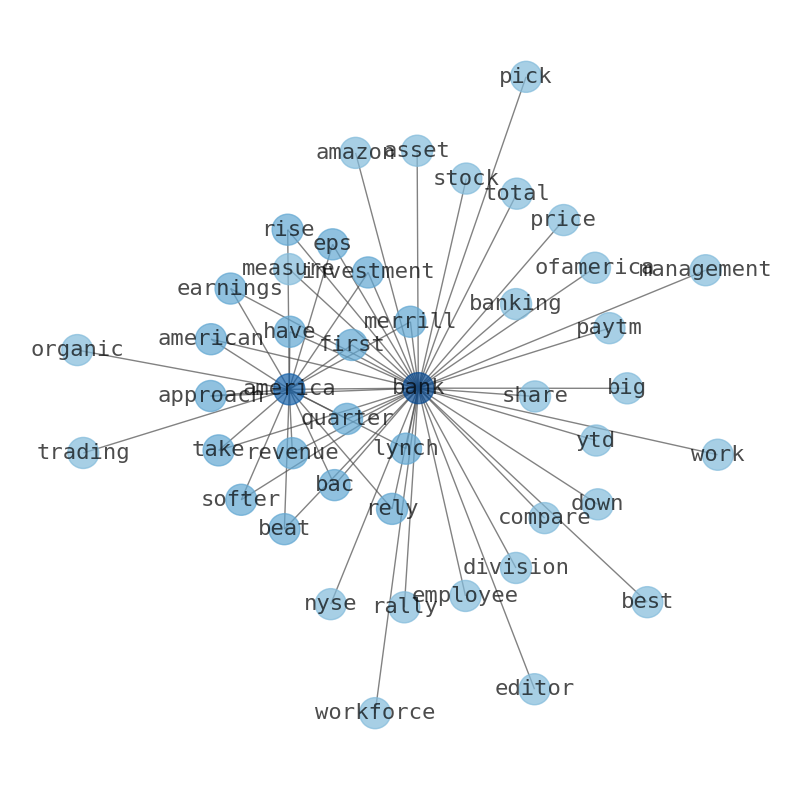

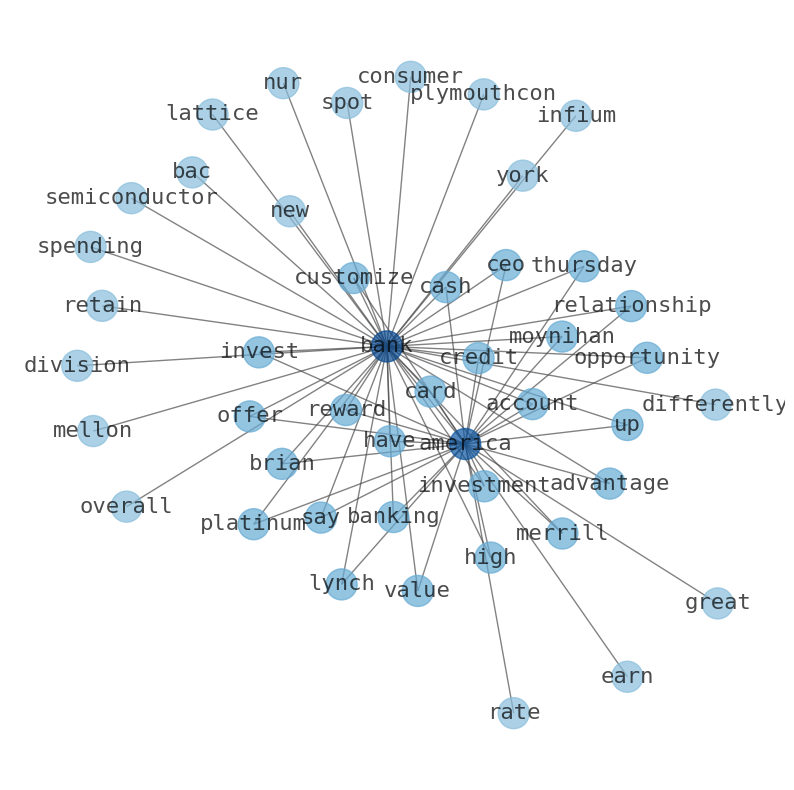

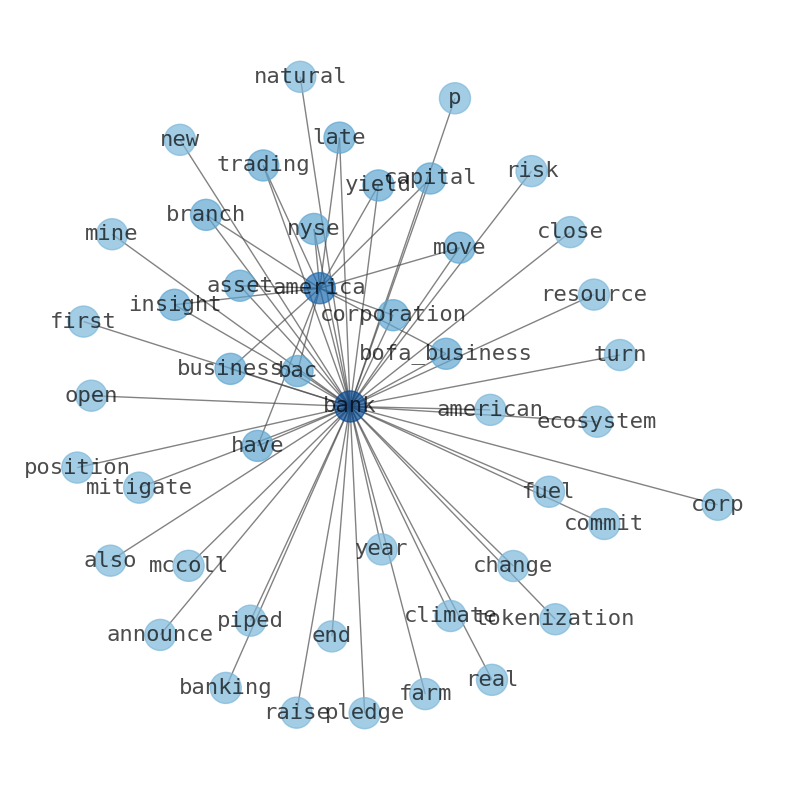

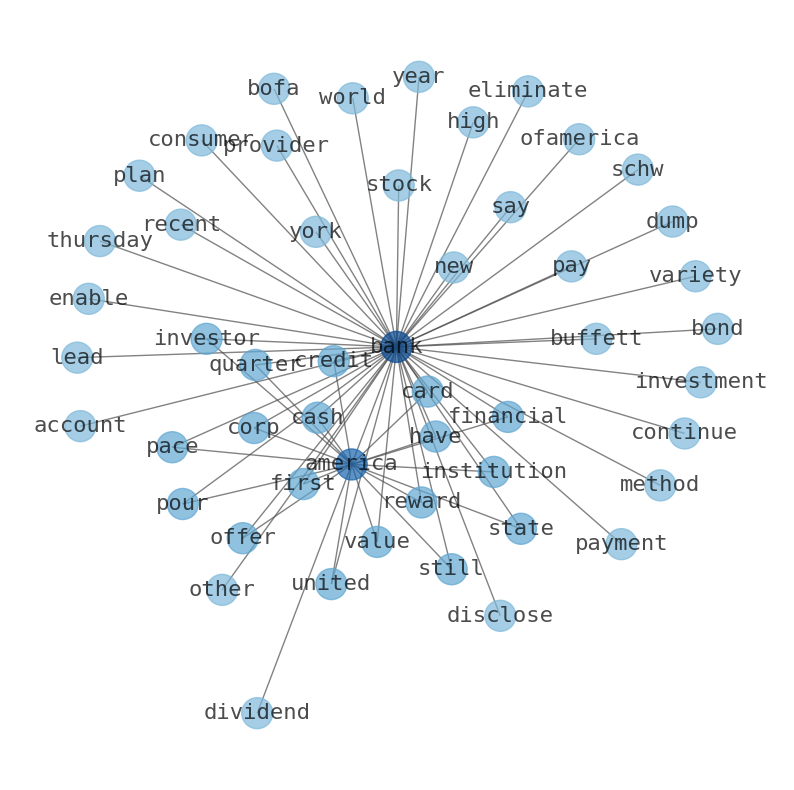

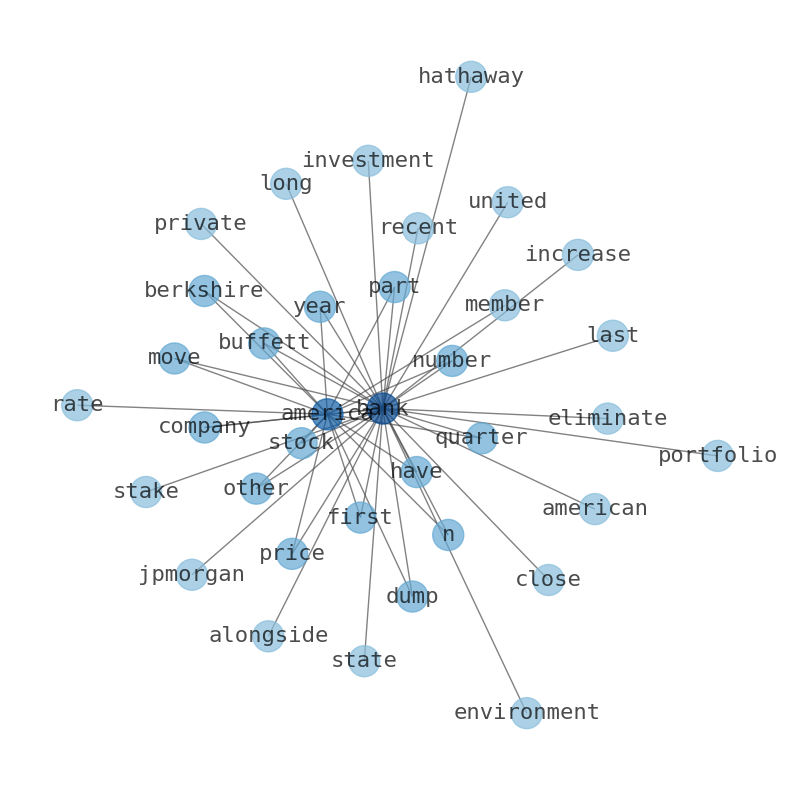

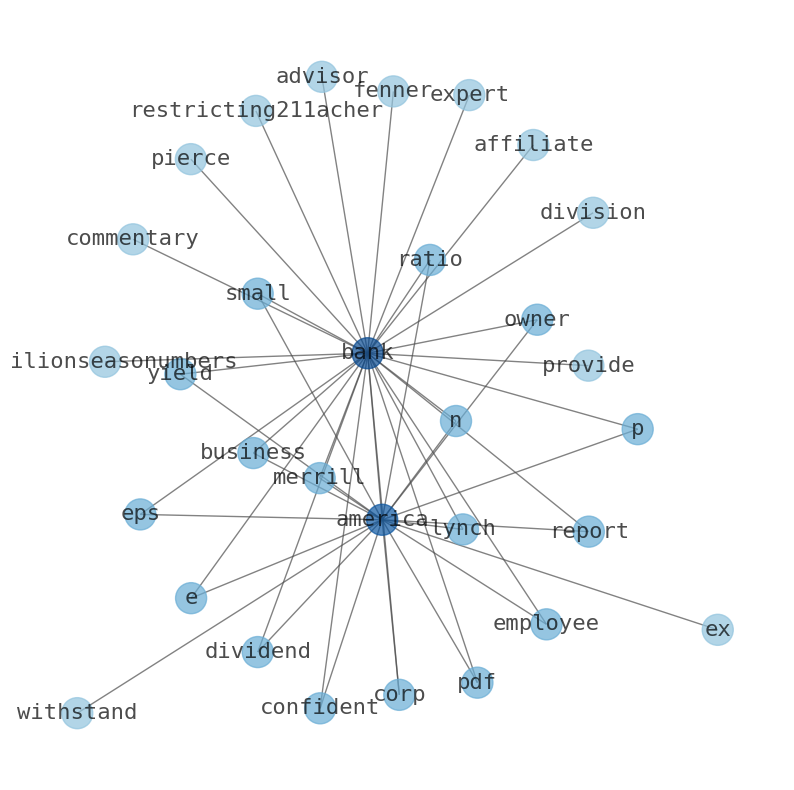

Keywords

The game is changing. There is a new strategy to evaluate Bank of America fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Bank of America are: Bank, America, business, bank, Financial, earnings, global, and the most common words in the summary are: r, bank, objk, rpg, enusp, rp, obja, . One of the sentences in the summary was: Wall Street expects flat earnings compared to the year-ago quarter on higher revenues. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #r #bank #objk #rpg #enusp #rp #obja.

Read more →Related Results

Bank of America

Open: 35.28 Close: 35.41 Change: 0.13

Read more →

Bank of America

Open: 33.73 Close: 33.92 Change: 0.19

Read more →

Bank of America

Open: 33.36 Close: 33.7 Change: 0.34

Read more →

Bank of America

Open: 33.32 Close: 34.07 Change: 0.75

Read more →

Bank of America

Open: 33.1 Close: 33.07 Change: -0.03

Read more →

Bank of America

Open: 33.4 Close: 33.43 Change: 0.03

Read more →

Bank of America

Open: 31.8 Close: 32.22 Change: 0.42

Read more →

Bank of America

Open: 33.8 Close: 34.43 Change: 0.63

Read more →

Bank of America

Open: 33.39 Close: 33.9 Change: 0.51

Read more →

Bank of America

Open: 33.94 Close: 33.67 Change: -0.27

Read more →

Bank of America

Open: 33.94 Close: 33.67 Change: -0.27

Read more →

Bank of America

Open: 33.71 Close: 33.43 Change: -0.28

Read more →

Bank of America

Open: 29.48 Close: 29.73 Change: 0.25

Read more →

Bank of America

Open: 29.74 Close: 29.63 Change: -0.11

Read more →

Bank of America

Open: 29.99 Close: 29.66 Change: -0.33

Read more →

Bank of America

Open: 28.5 Close: 29.22 Change: 0.72

Read more →

Bank of America

Open: 28.56 Close: 28.33 Change: -0.23

Read more →

Bank of America

Open: 26.13 Close: 25.61 Change: -0.52

Read more →

Bank of America

Open: 26.8 Close: 26.31 Change: -0.49

Read more →

Bank of America

Open: 27.43 Close: 26.76 Change: -0.67

Read more →

Bank of America

Open: 27.43 Close: 26.68 Change: -0.75

Read more →

Bank of America

Open: 25.78 Close: 25.92 Change: 0.14

Read more →

Bank of America

Open: 27.23 Close: 27.43 Change: 0.2

Read more →

Bank of America

Open: 27.5 Close: 27.6 Change: 0.1

Read more →

Bank of America

Open: 28.07 Close: 27.64 Change: -0.43

Read more →

Bank of America

Open: 28.95 Close: 28.84 Change: -0.11

Read more →

Bank of America

Open: 29.12 Close: 28.88 Change: -0.24

Read more →

Bank of America

Open: 28.41 Close: 28.13 Change: -0.28

Read more →

Bank of America

Open: 28.76 Close: 28.98 Change: 0.22

Read more →

Bank of America

Open: 29.22 Close: 29.04 Change: -0.18

Read more →

Bank of America

Open: 28.64 Close: 28.5 Change: -0.14

Read more →

Bank of America

Open: 29.22 Close: 29.15 Change: -0.07

Read more →

Bank of America

Open: 31.22 Close: 30.86 Change: -0.36

Read more →

Bank of America

Open: 31.87 Close: 31.98 Change: 0.11

Read more →

Bank of America

Open: 28.59 Close: 28.66 Change: 0.07

Read more →

Bank of America

Open: 28.8 Close: 28.28 Change: -0.52

Read more →

Bank of America

Open: 29.14 Close: 29.08 Change: -0.06

Read more →

Bank of America

Open: 28.5 Close: 28.66 Change: 0.16

Read more →

Bank of America

Open: 27.74 Close: 27.75 Change: 0.01

Read more →

Bank of America

Open: 29.53 Close: 29.19 Change: -0.34

Read more →

Bank of America

Open: 29.57 Close: 29.12 Change: -0.45

Read more →

Bank of America

Open: 28.82 Close: 28.67 Change: -0.15

Read more →

Bank of America

Open: 28.32 Close: 28.26 Change: -0.06

Read more →

Bank of America

Open: 27.99 Close: 28.17 Change: 0.18

Read more →

Bank of America

Open: 28.46 Close: 28.11 Change: -0.35

Read more →

Bank of America

Open: 27.52 Close: 26.93 Change: -0.59

Read more →

Bank of America

Open: 28.16 Close: 27.86 Change: -0.3

Read more →

Bank of America

Open: 29.75 Close: 29.87 Change: 0.12

Read more →

Bank of America

Open: 35.87 Close: 35.6 Change: -0.27

Read more →

Bank of America

Open: 33.37 Close: 33.61 Change: 0.24

Read more →

Bank of America

Open: 33.92 Close: 34.09 Change: 0.17

Read more →

Bank of America

Open: 33.1 Close: 33.07 Change: -0.03

Read more →

Bank of America

Open: 33.06 Close: 33.18 Change: 0.12

Read more →

Bank of America

Open: 33.4 Close: 33.43 Change: 0.03

Read more →

Bank of America

Open: 33.5 Close: 33.33 Change: -0.17

Read more →

Bank of America

Open: 33.39 Close: 33.9 Change: 0.51

Read more →

Bank of America

Open: 33.94 Close: 33.67 Change: -0.27

Read more →

Bank of America

Open: 33.94 Close: 33.67 Change: -0.27

Read more →

Bank of America

Open: 33.03 Close: 33.51 Change: 0.48

Read more →

Bank of America

Open: 30.77 Close: 30.74 Change: -0.03

Read more →

Bank of America

Open: 29.48 Close: 29.73 Change: 0.25

Read more →

Bank of America

Open: 29.74 Close: 29.59 Change: -0.15

Read more →

Bank of America

Open: 29.2 Close: 29.62 Change: 0.42

Read more →

Bank of America

Open: 28.56 Close: 28.33 Change: -0.23

Read more →

Bank of America

Open: 26.07 Close: 25.17 Change: -0.9

Read more →

Bank of America

Open: 26.8 Close: 26.31 Change: -0.49

Read more →

Bank of America

Open: 27.54 Close: 27.31 Change: -0.23

Read more →

Bank of America

Open: 27.43 Close: 26.76 Change: -0.67

Read more →

Bank of America

Open: 27.17 Close: 27.02 Change: -0.15

Read more →

Bank of America

Open: 27.89 Close: 27.38 Change: -0.51

Read more →

Bank of America

Open: 27.23 Close: 27.27 Change: 0.04

Read more →

Bank of America

Open: 28.07 Close: 27.64 Change: -0.43

Read more →

Bank of America

Open: 28.81 Close: 28.55 Change: -0.26

Read more →

Bank of America

Open: 29.12 Close: 28.88 Change: -0.24

Read more →

Bank of America

Open: 28.12 Close: 28.36 Change: 0.24

Read more →

Bank of America

Open: 28.76 Close: 28.98 Change: 0.22

Read more →

Bank of America

Open: 28.76 Close: 28.98 Change: 0.22

Read more →

Bank of America

Open: 28.64 Close: 28.5 Change: -0.14

Read more →

Bank of America

Open: 28.45 Close: 28.45 Change: 0.0

Read more →

Bank of America

Open: 30.5 Close: 29.94 Change: -0.56

Read more →

Bank of America

Open: 32.15 Close: 31.9 Change: -0.25

Read more →

Bank of America

Open: 31.33 Close: 31.69 Change: 0.36

Read more →

Bank of America

Open: 28.8 Close: 28.28 Change: -0.52

Read more →

Bank of America

Open: 28.8 Close: 28.28 Change: -0.52

Read more →

Bank of America

Open: 28.94 Close: 28.69 Change: -0.25

Read more →

Bank of America

Open: 28.5 Close: 28.7 Change: 0.2

Read more →

Bank of America

Open: 29.53 Close: 29.19 Change: -0.34

Read more →

Bank of America

Open: 28.9 Close: 29.18 Change: 0.28

Read more →

Bank of America

Open: 29.3 Close: 29.5 Change: 0.2

Read more →

Bank of America

Open: 28.16 Close: 28.71 Change: 0.55

Read more →

Bank of America

Open: 28.2 Close: 28.31 Change: 0.11

Read more →

Bank of America

Open: 28.46 Close: 28.11 Change: -0.35

Read more →

Bank of America

Open: 27.78 Close: 27.36 Change: -0.42

Read more →

Bank of America

Open: 28.16 Close: 27.86 Change: -0.3

Read more →

Bank of America

Open: 28.76 Close: 28.44 Change: -0.32

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo