The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Bank of America

Youtube Subscribe

Open: 29.74 Close: 29.59 Change: -0.15

The unbelievably easy way to evaluate Bank of America Company Inc Stock: Use an AI.

How much time have you spent trying to decide whether investing in Bank of America? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Bank of …

Stock Summary

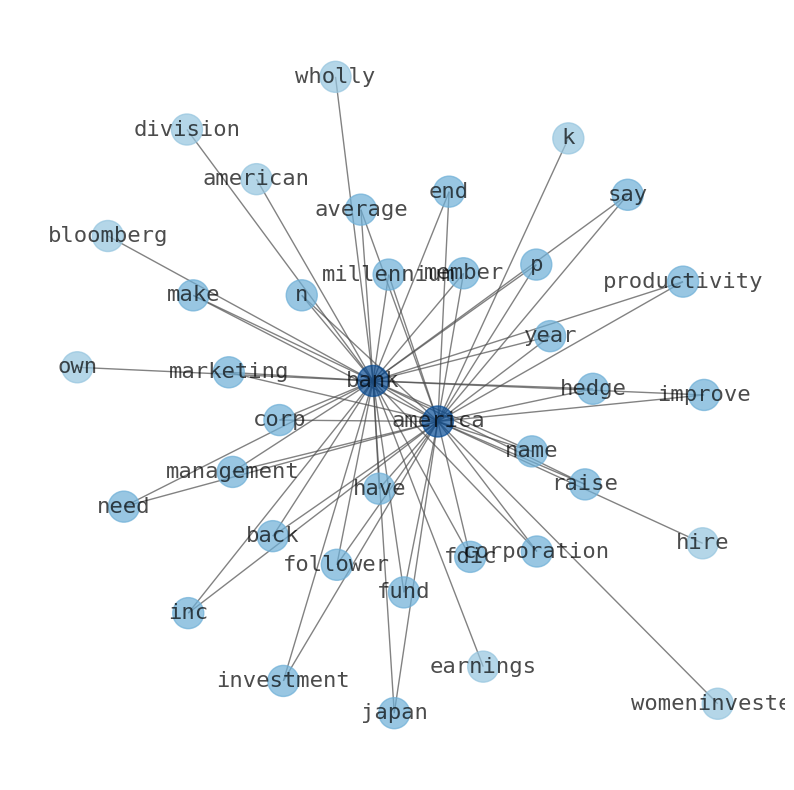

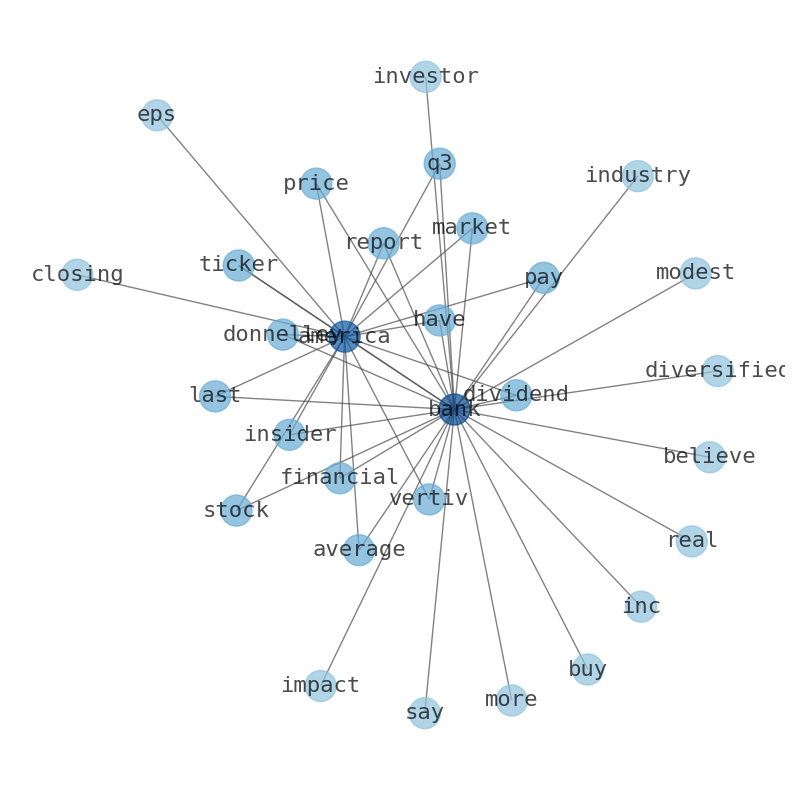

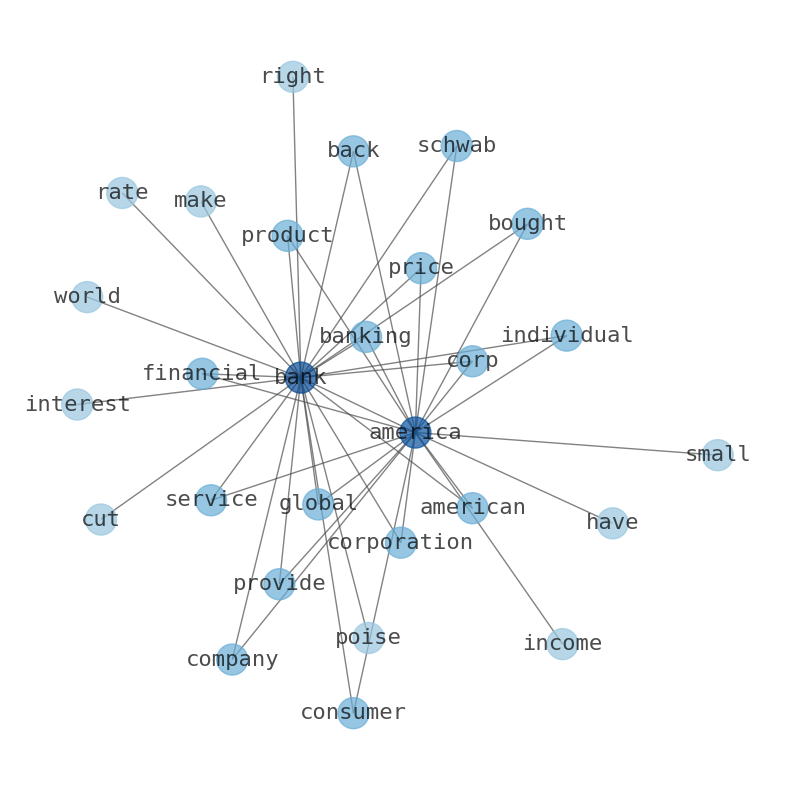

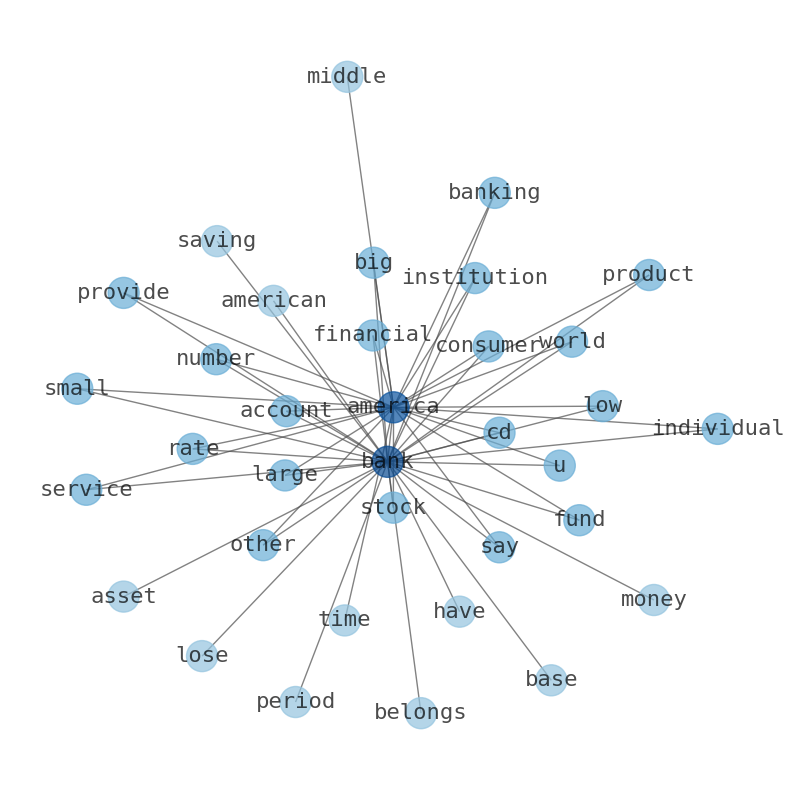

Bank of America Corporation provides banking and financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments. Its Consumer Banking segment offers traditional and money market savings accounts, certificates of deposit and.

Today's Summary

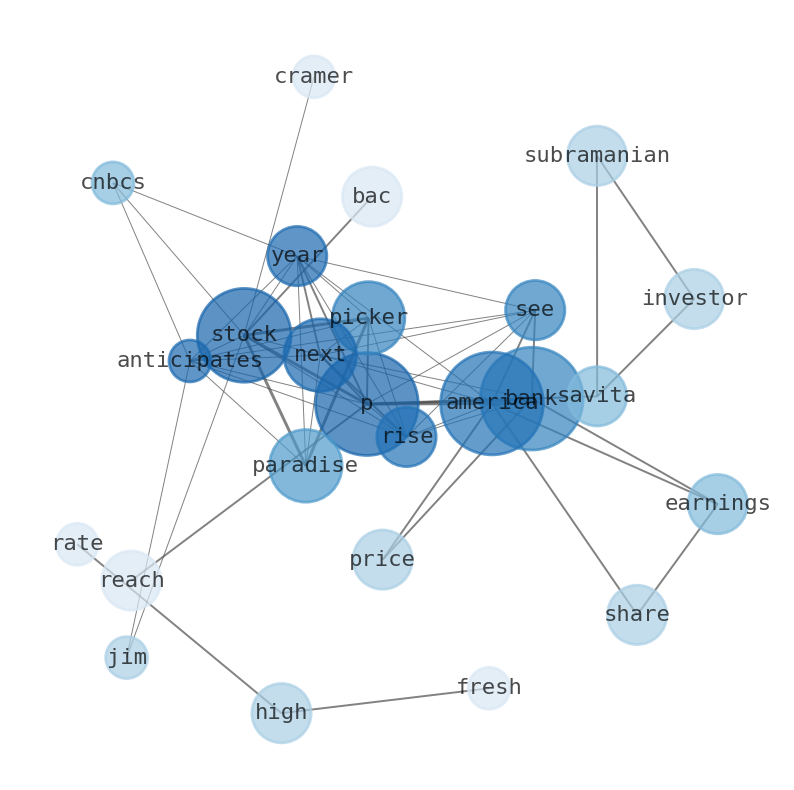

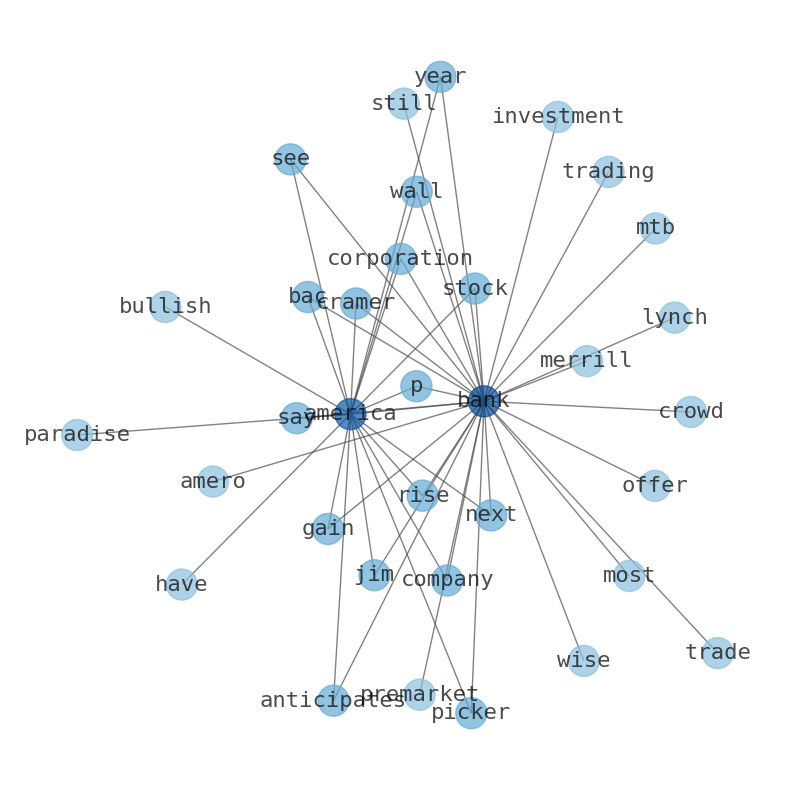

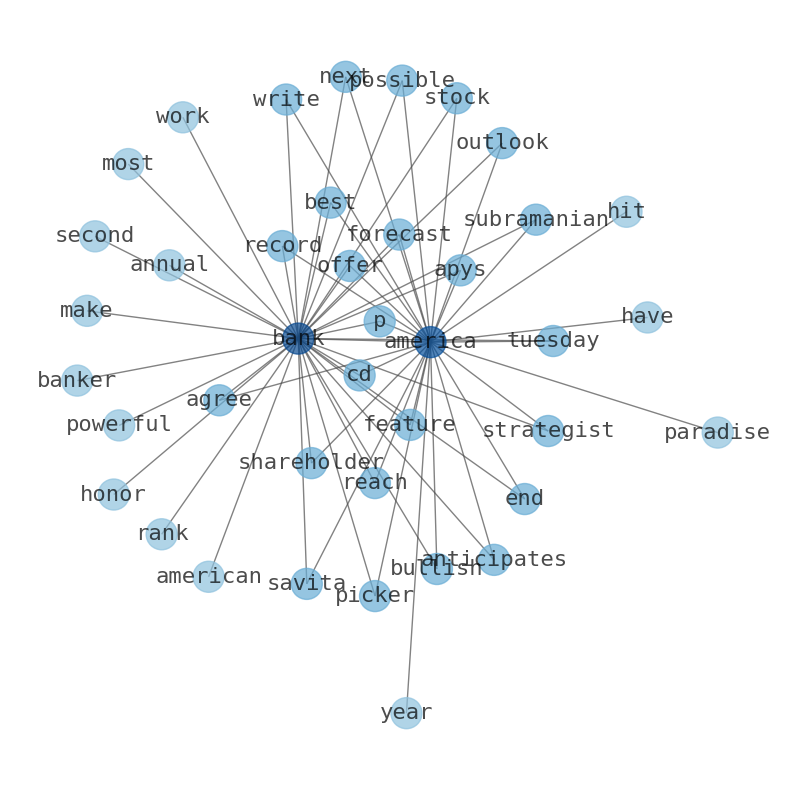

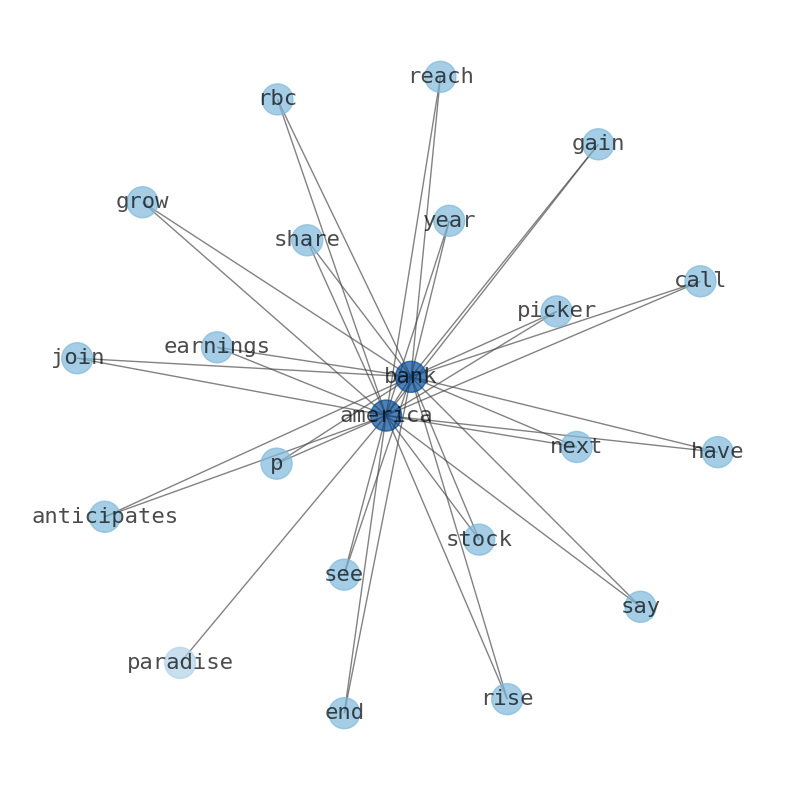

Bank of America sees the S&P 500 rising to 5,000 next year, anticipates a stock pickers paradise. Head of US equity strategy Savita Subramanian is urging investors not to worry so much.

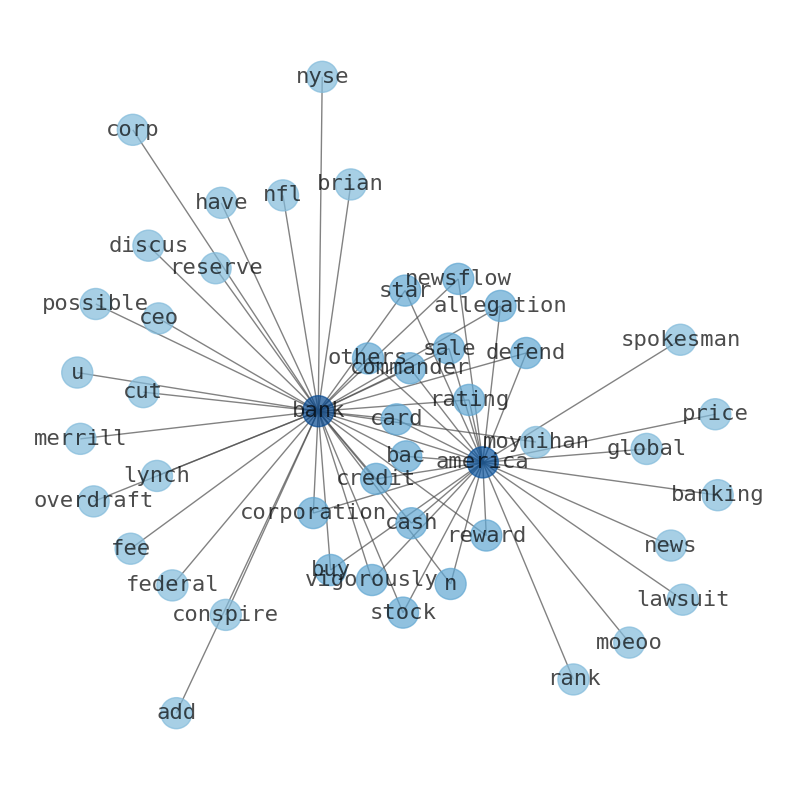

Today's News

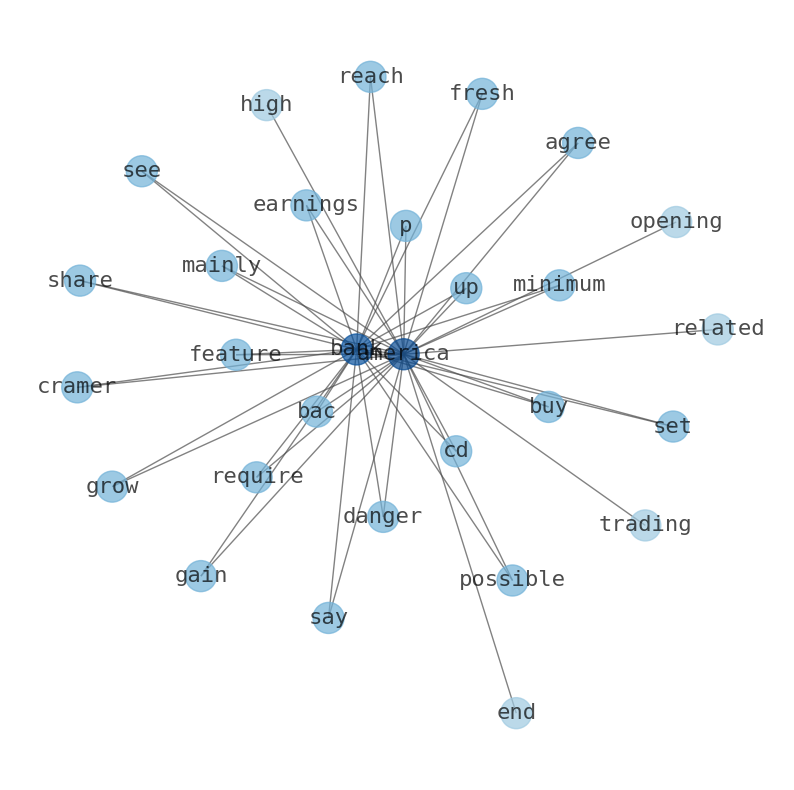

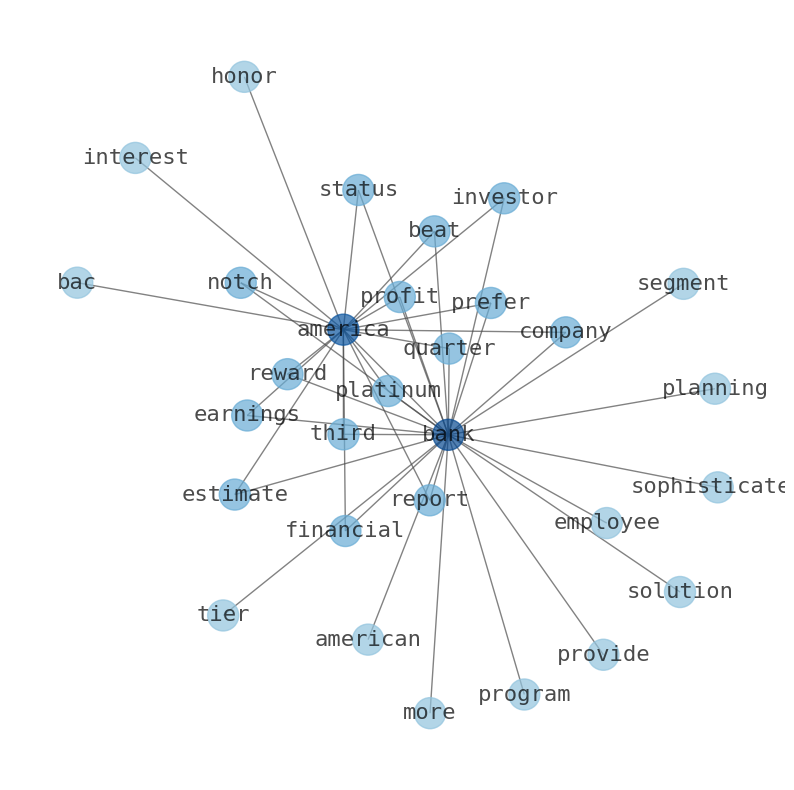

Bank of America sees the S&P 500 rising to 5,000 next year, anticipates a stock pickers paradise. CNBCs Jim Cramer agrees with bank of America, says 2024 gains for the s&p 500 could reach 5000 by the end of next year. Bank of America sees earnings growing 6% in 2024 to $235 per share. RBC has joined in calling for S&P 500 to reach 5,000 in 2024. Head of US equity strategy Savita Subramanian is urging investors not to worry so much about that narrow focus. S&P 500 is set for a fresh high in 2024 because US companies have adapted to higher rates. Bank of America strategist charts S&P 500s path to 5,000 for 2024 in a stock pickers paradise Savita Subramanian says investors are now past the maximum macro uncertainty and plenty of big geopolitical shocks. The intrinsic value of one BAC stock under the Base Case scenario is 43.03 USD. Compared to the current market price of 29.6 USD , Bank of America Corp is Undervalued by 31%. Wall Street analysts forecast BAC. stock price to rise over the next 12 months. Bank of Americas third-quarter 2023 earnings of 90 cents per share handily outpaced the Zacks Consensus Estimate of 80 cents. The S&P 500 SPX will hit a record 5,000 for 2024 in a “stock pickers paradise”

Stock Profile

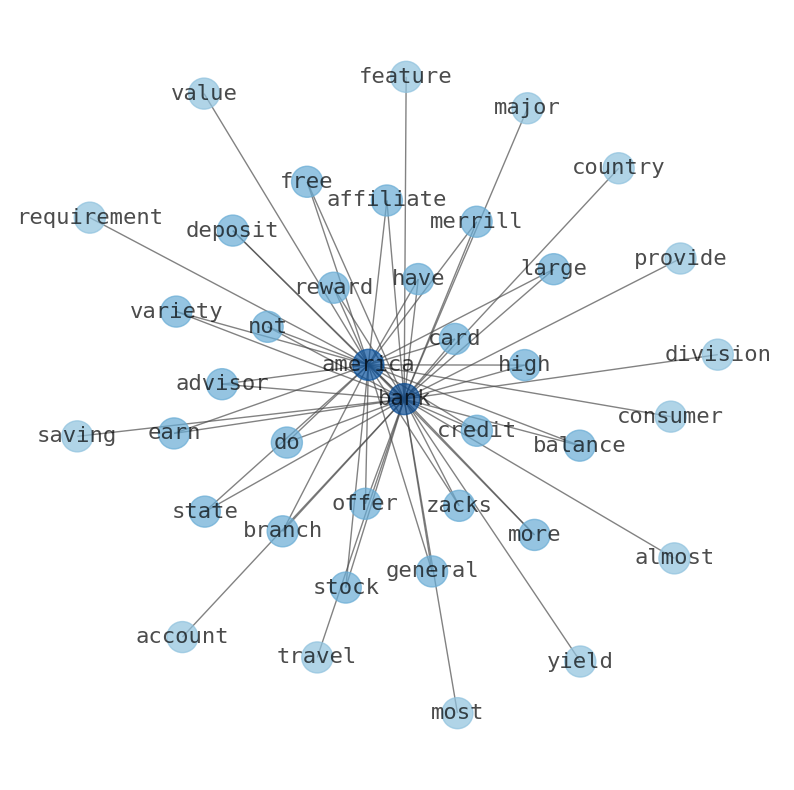

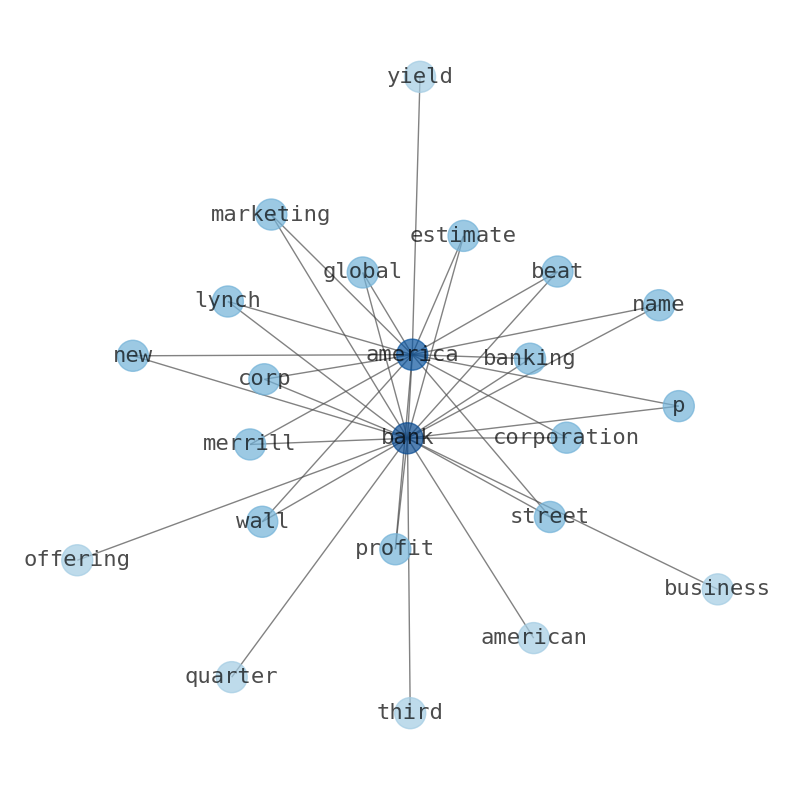

"Bank of America Corporation, through its subsidiaries, provides banking and financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide. Its Consumer Banking segment offers traditional and money market savings accounts, certificates of deposit and IRAs, noninterest-and interest-bearing checking accounts, and investment accounts and products; and credit and debit cards, residential mortgages, and home equity loans, as well as direct and indirect loans, such as automotive, recreational vehicle, and consumer personal loans. The company's Global Wealth & Investment Management segment offers investment management, brokerage, banking, and trust and retirement products and services; and wealth management solutions, as well as customized solutions, including specialty asset management services. Its Global Banking segment provides lending products and services, including commercial loans, leases, commitment facilities, trade finance, and commercial real estate and asset-based lending; treasury solutions, such as treasury management, foreign exchange, and short-term investing options and merchant services; working capital management solutions; and debt and equity underwriting and distribution, and merger-related and other advisory services. The company's Global Markets segment offers market-making, financing, securities clearing, settlement, and custody services, as well as risk management products using interest rate, equity, credit, currency and commodity derivatives, foreign exchange, fixed-income, and mortgage-related products. The company was founded in 1784 and is based in Charlotte, North Carolina."

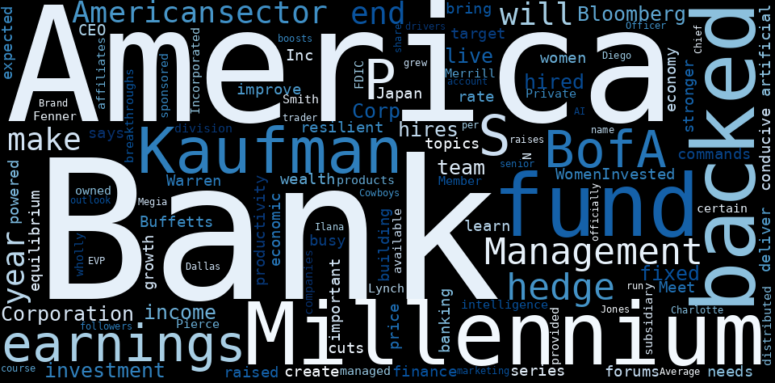

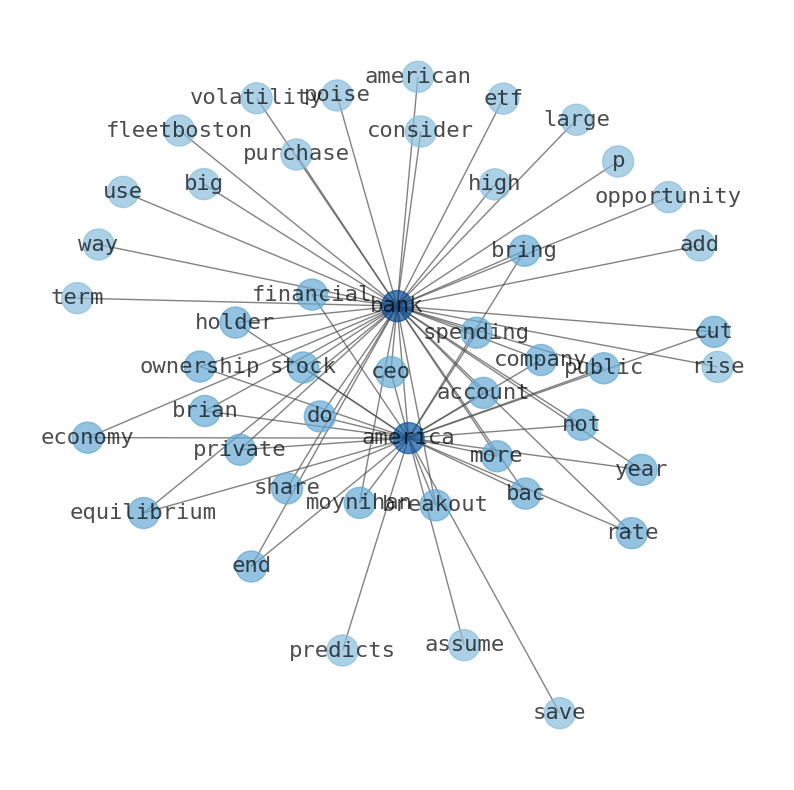

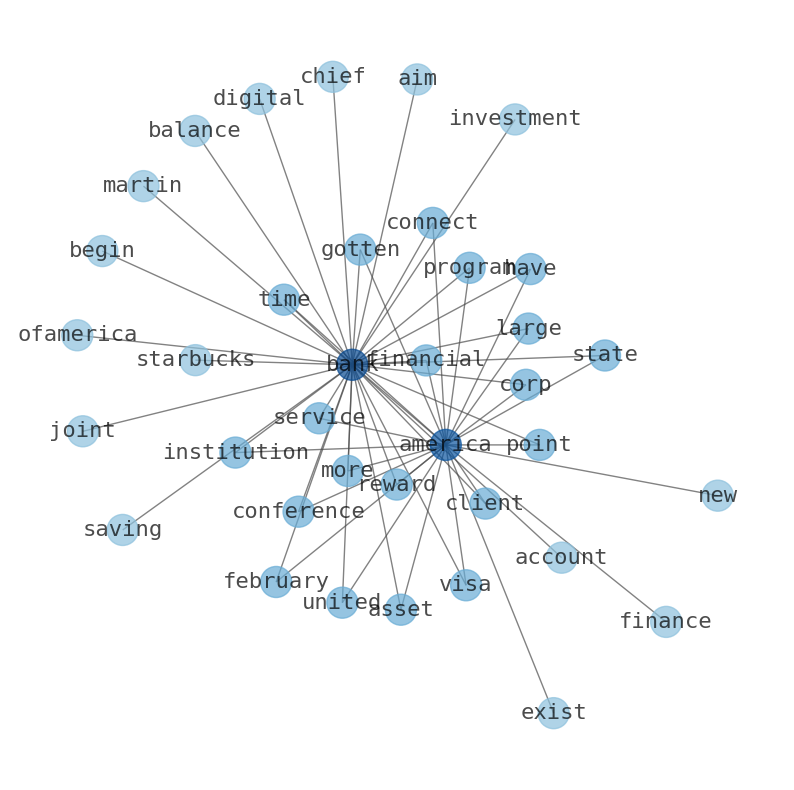

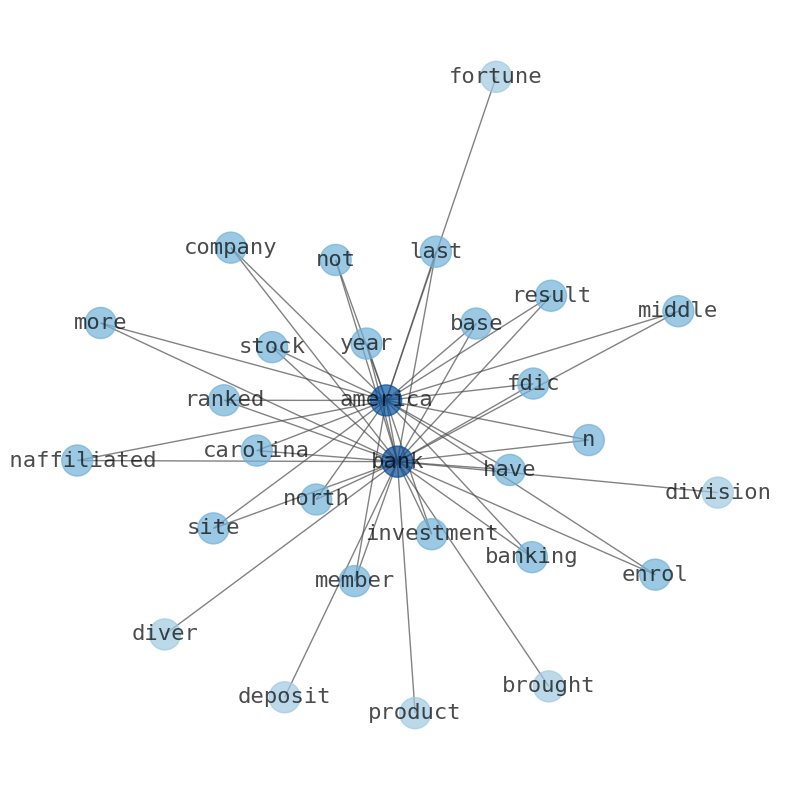

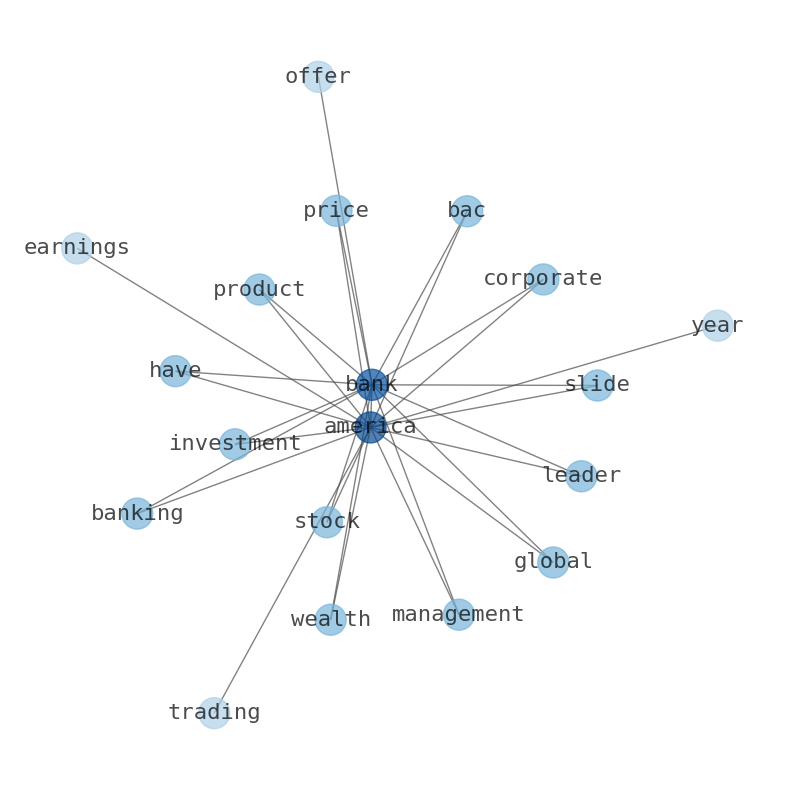

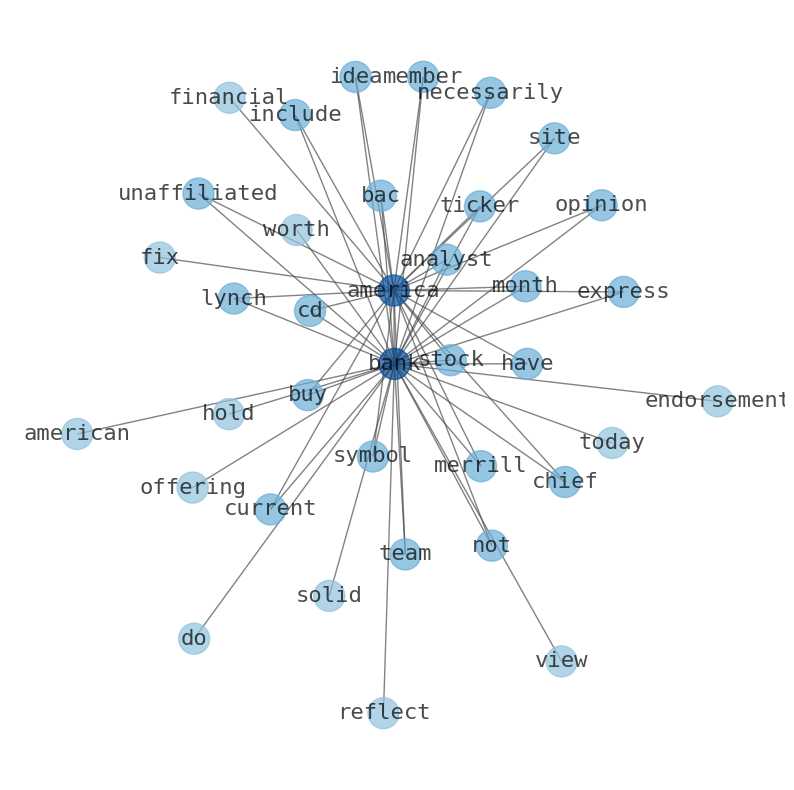

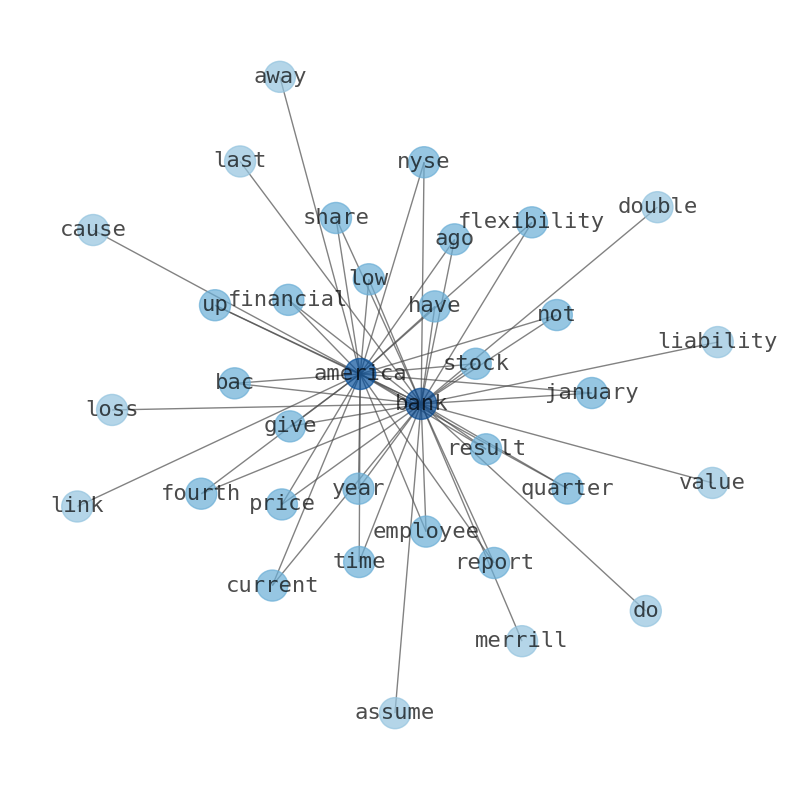

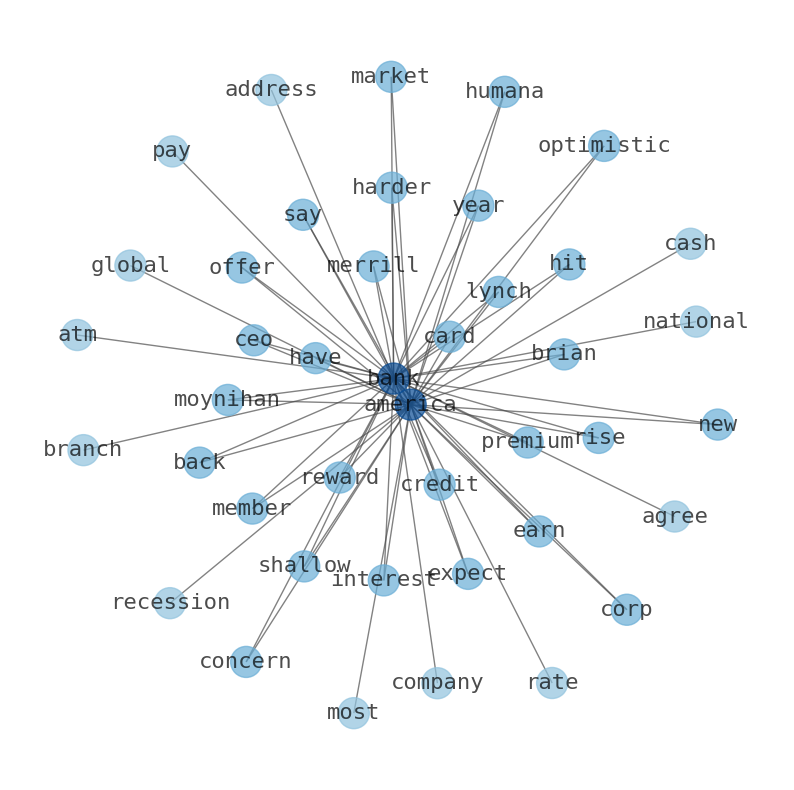

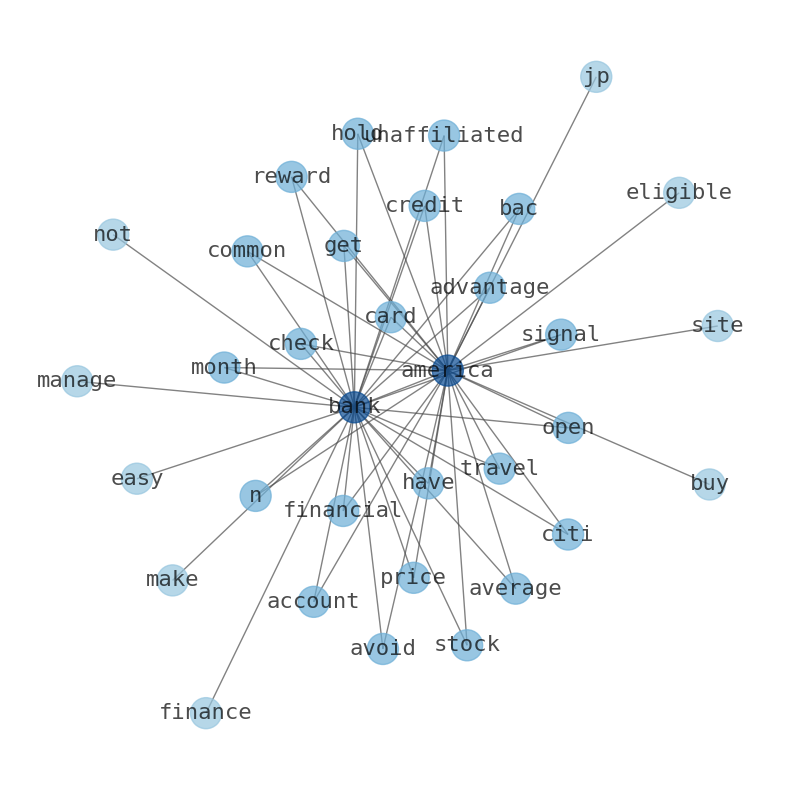

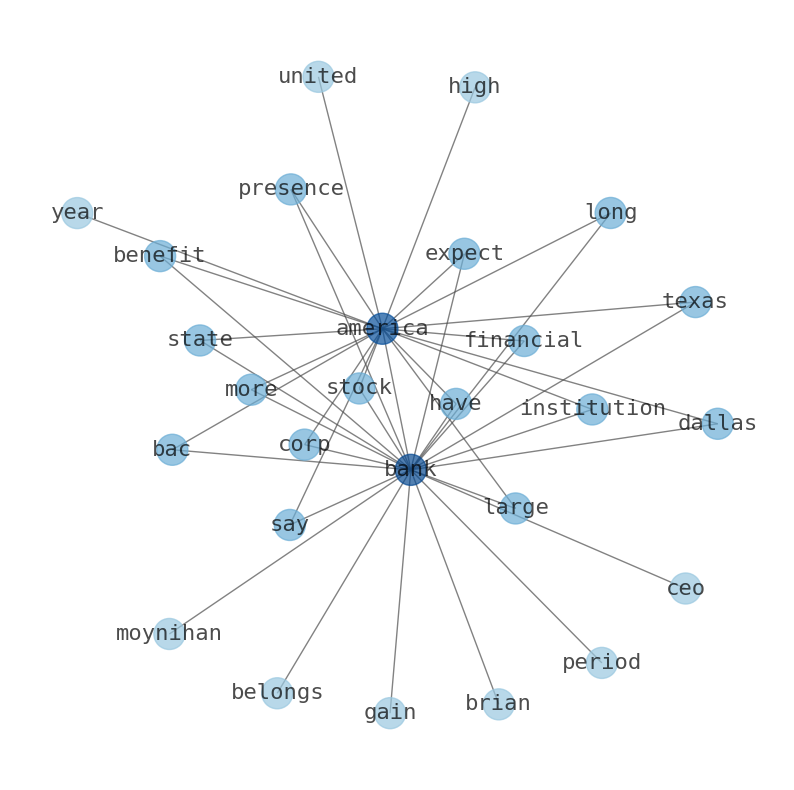

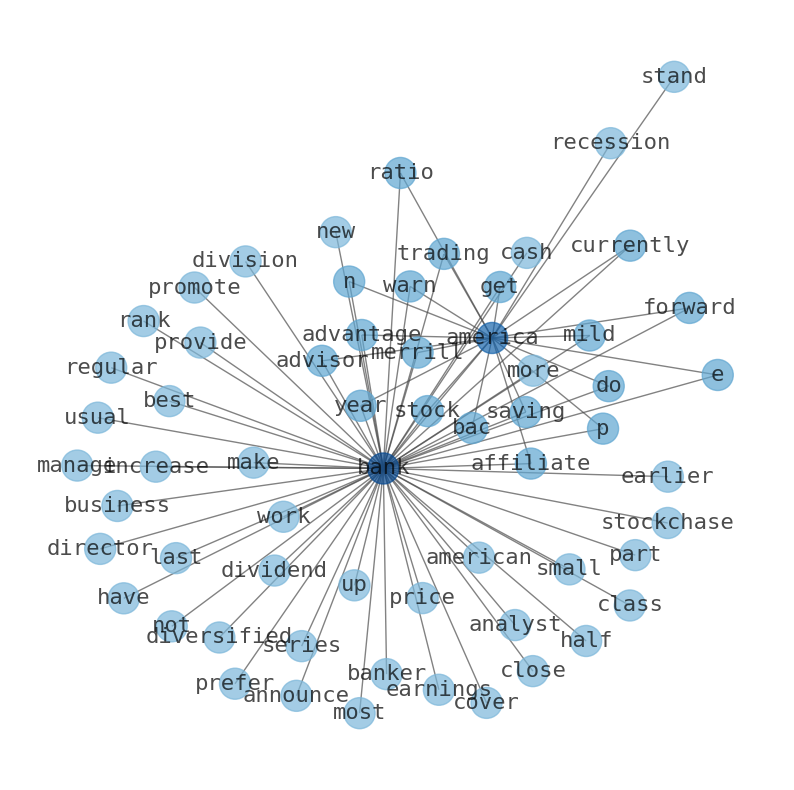

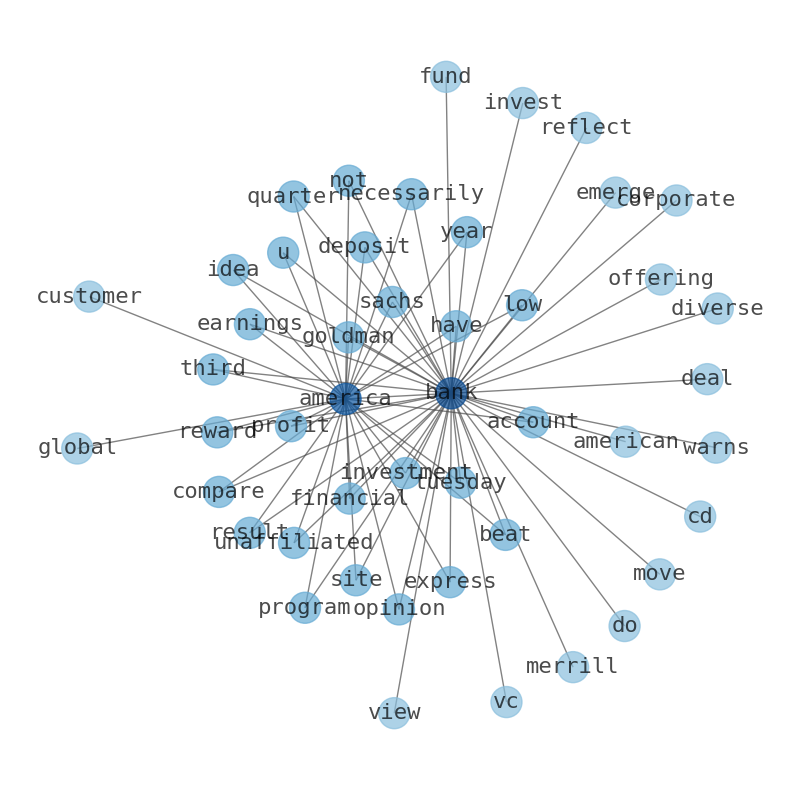

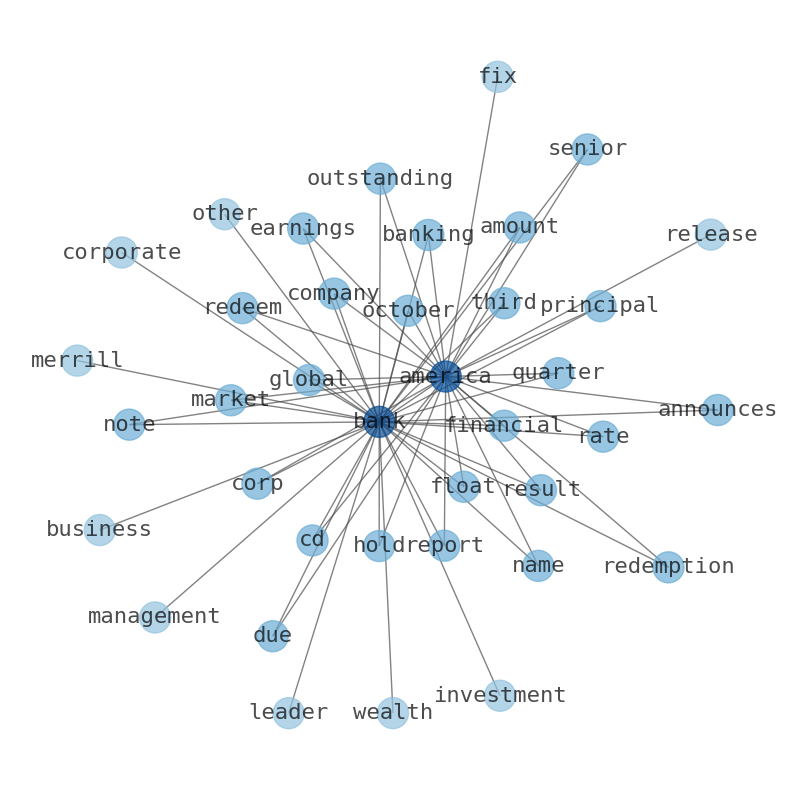

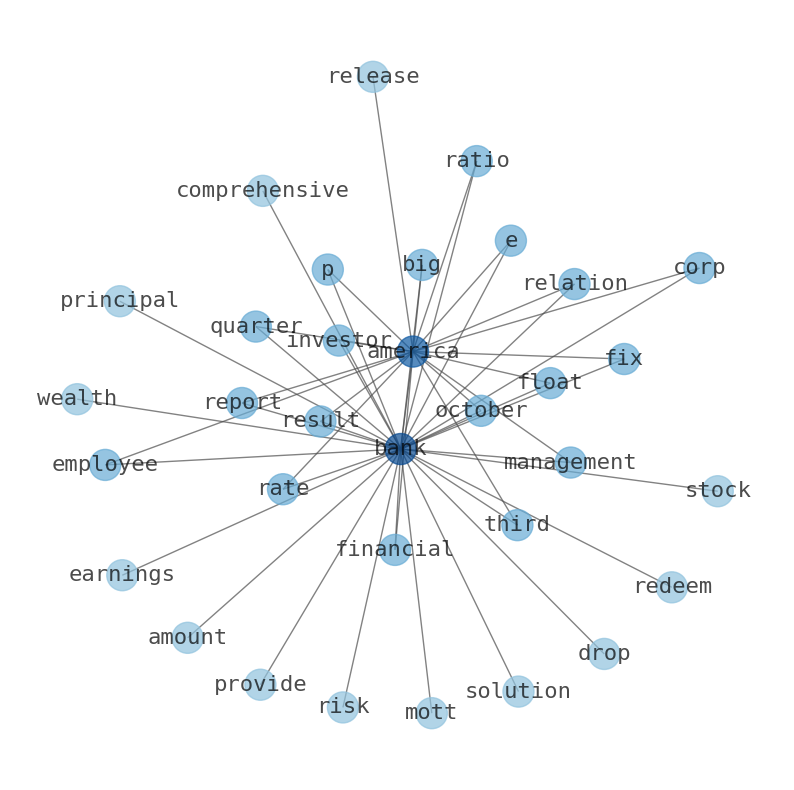

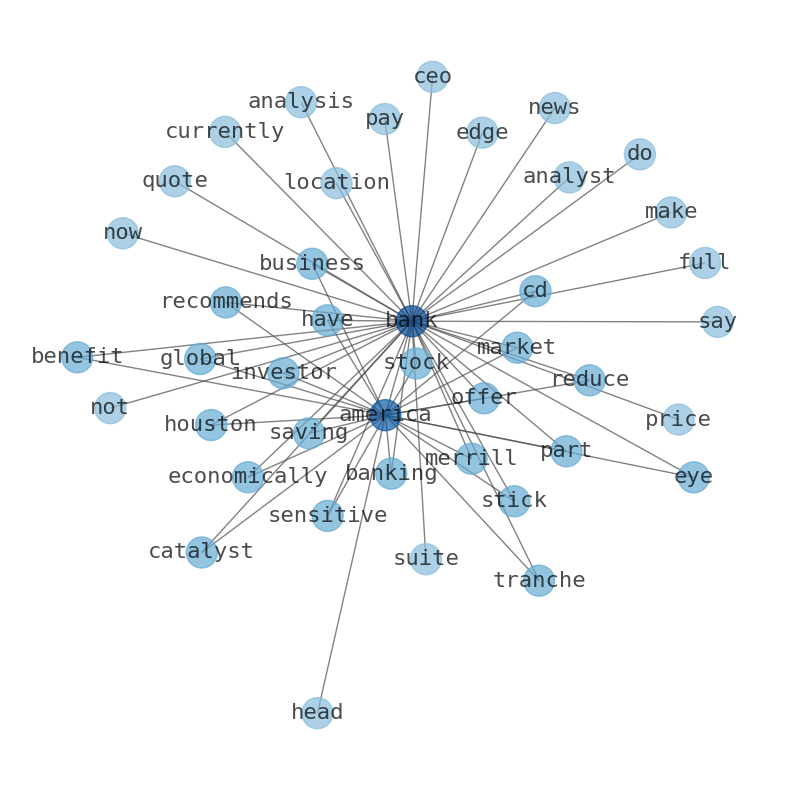

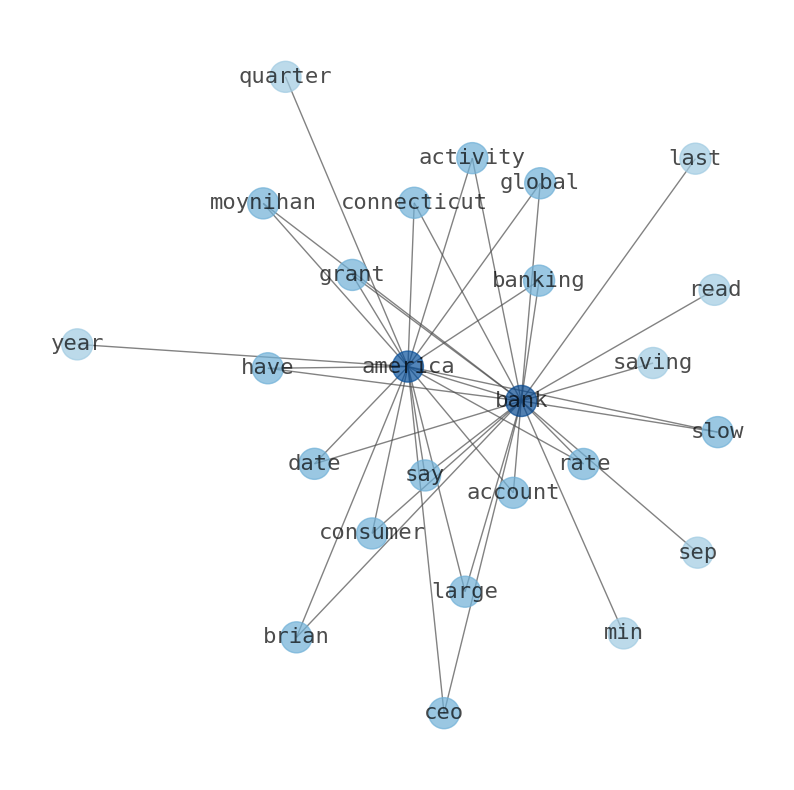

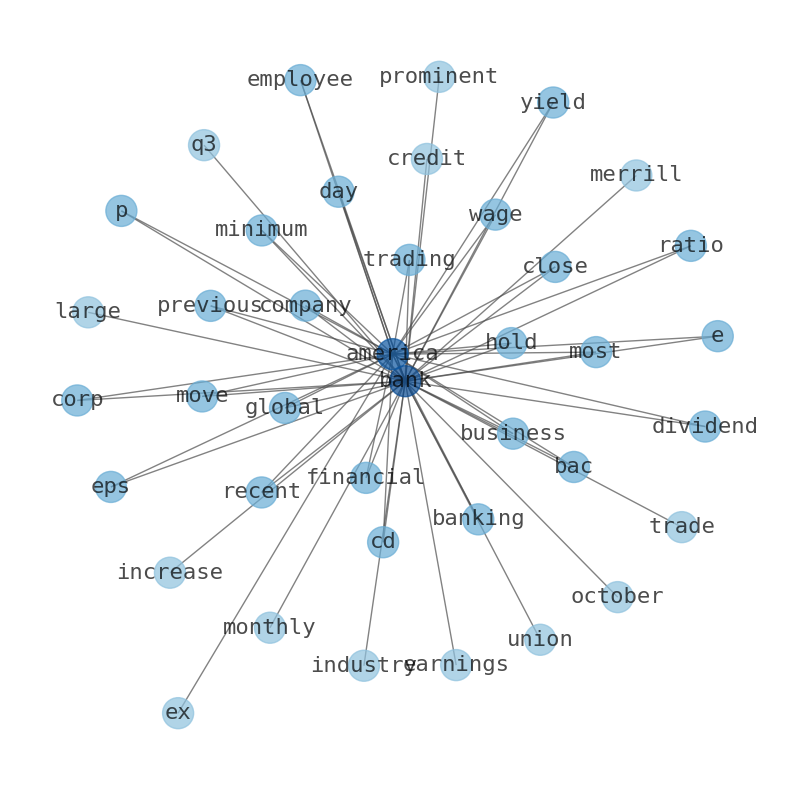

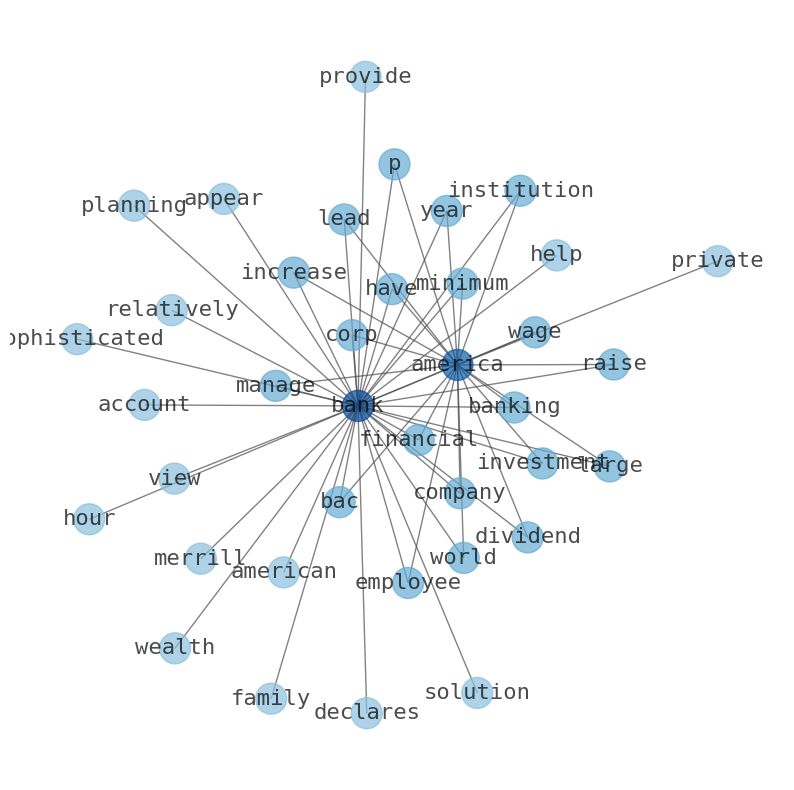

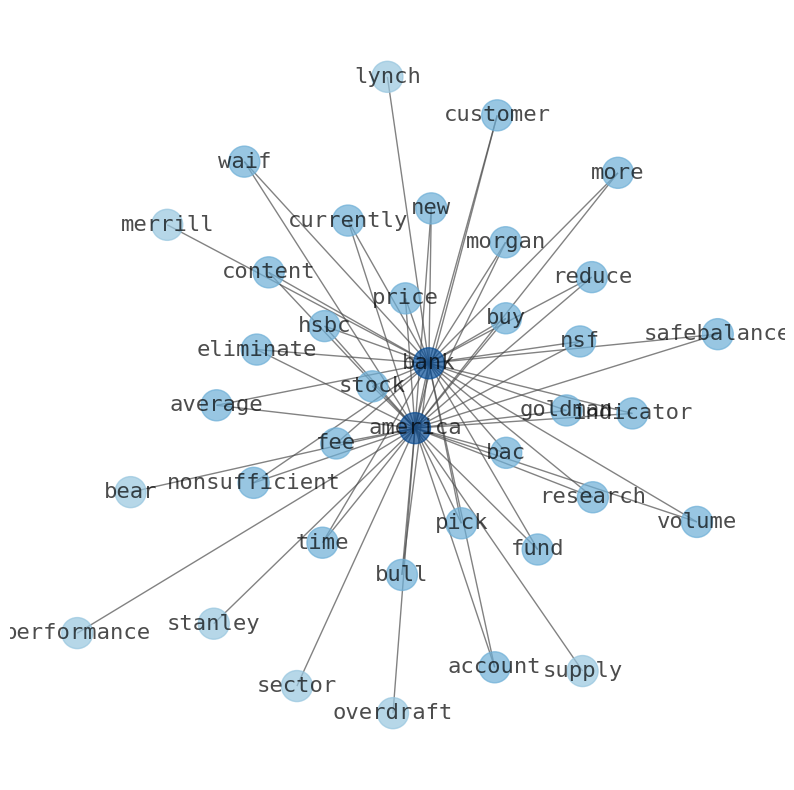

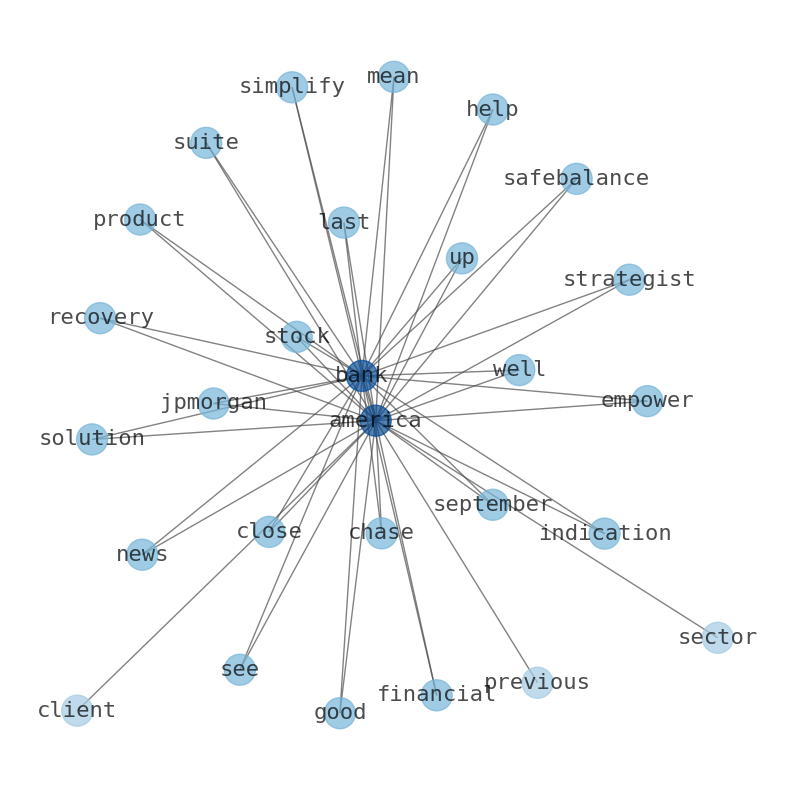

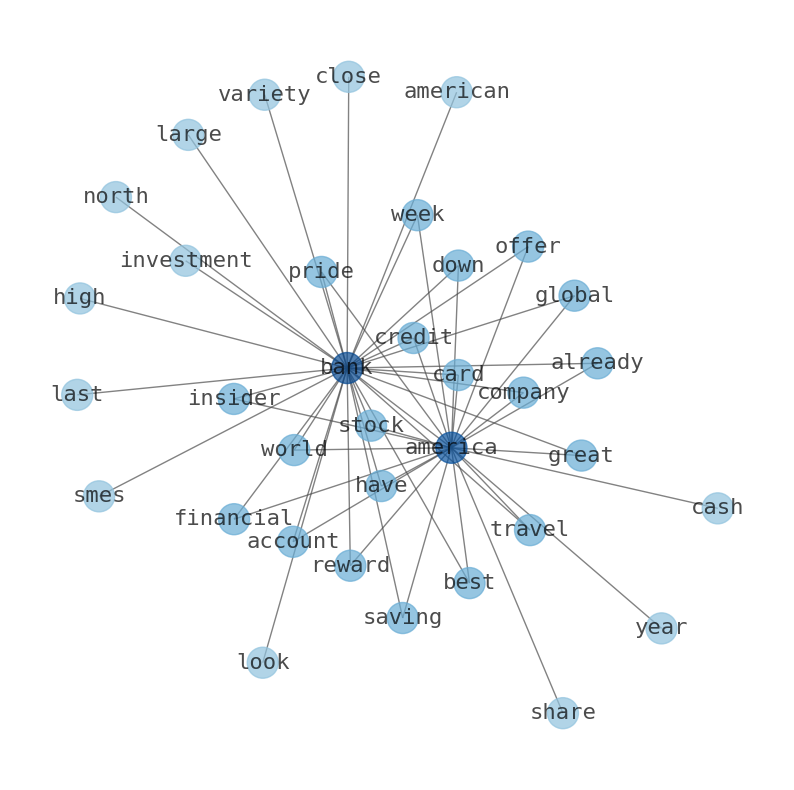

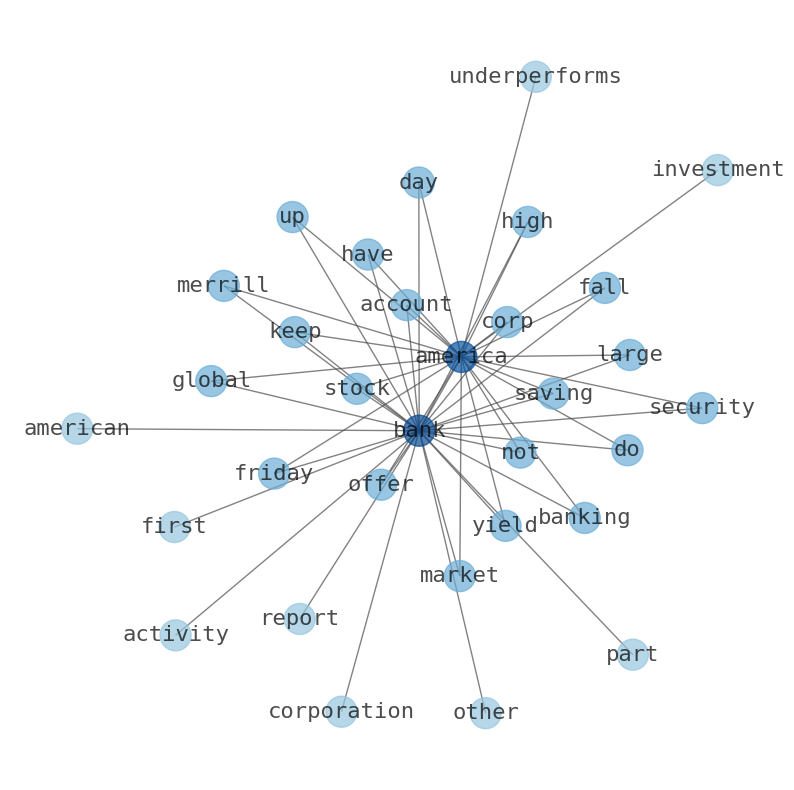

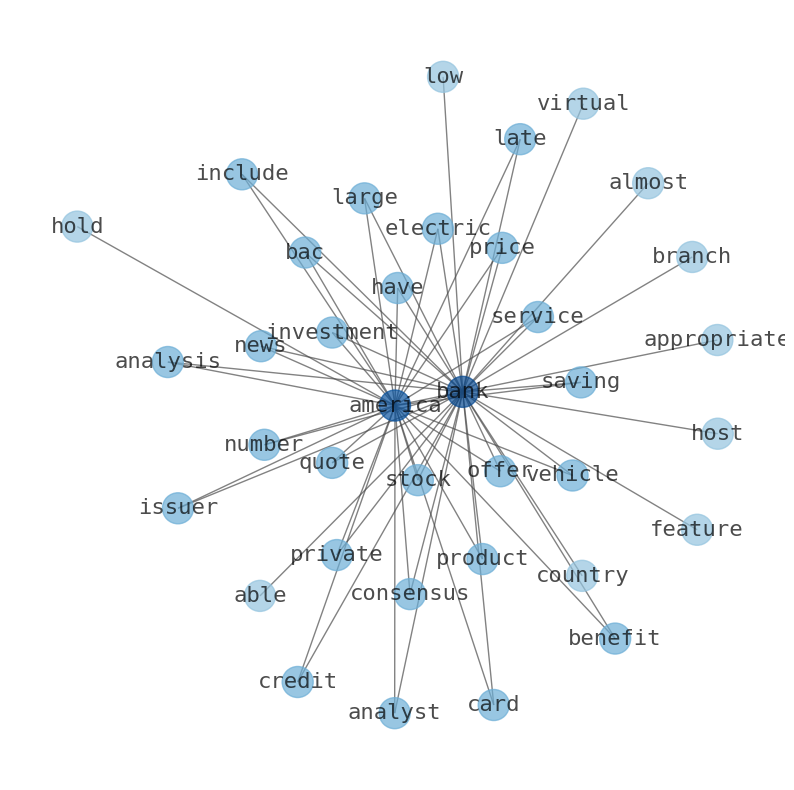

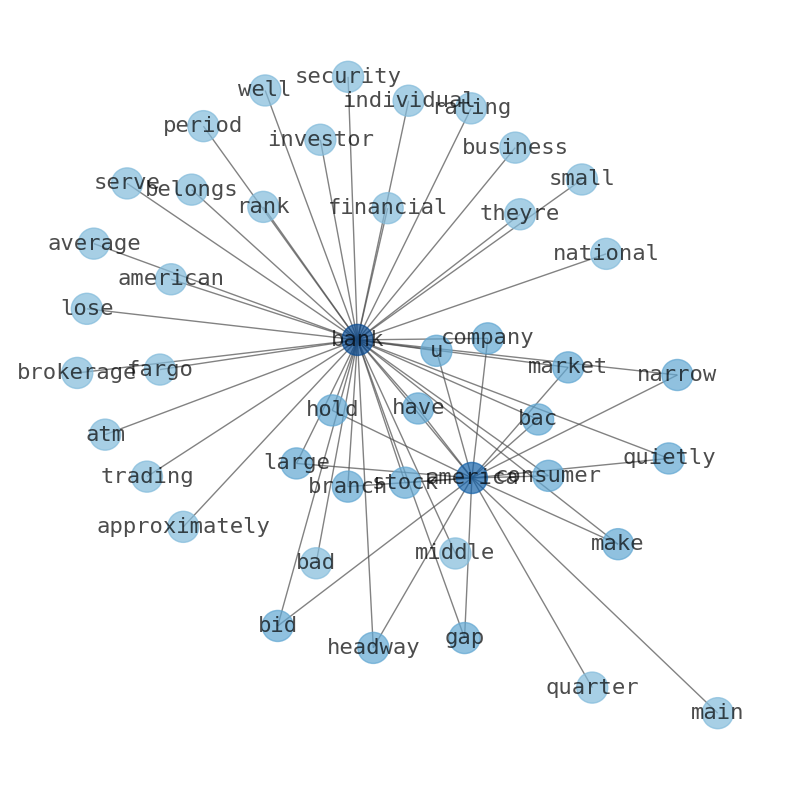

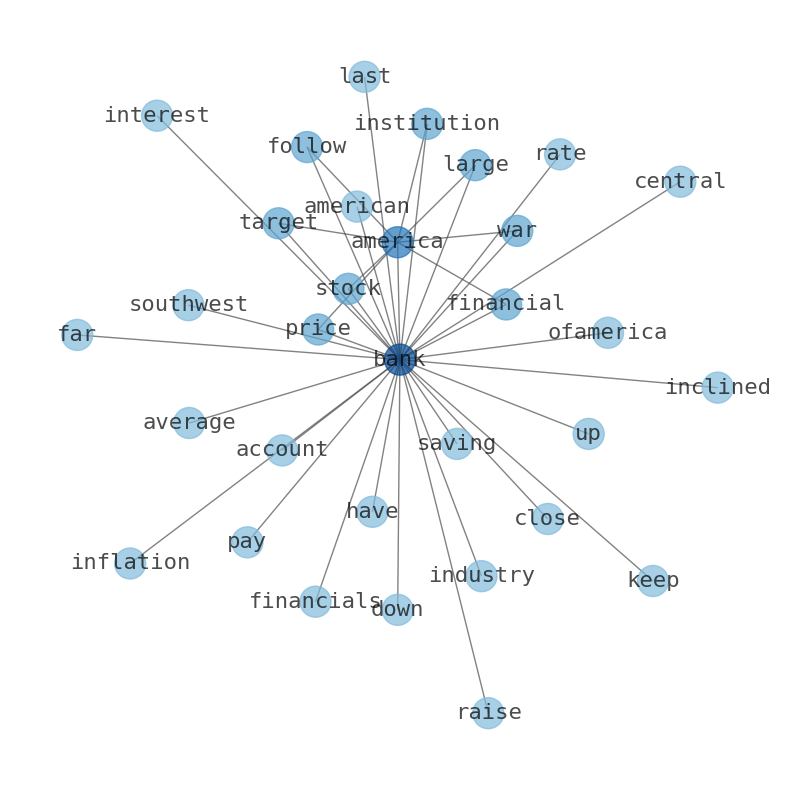

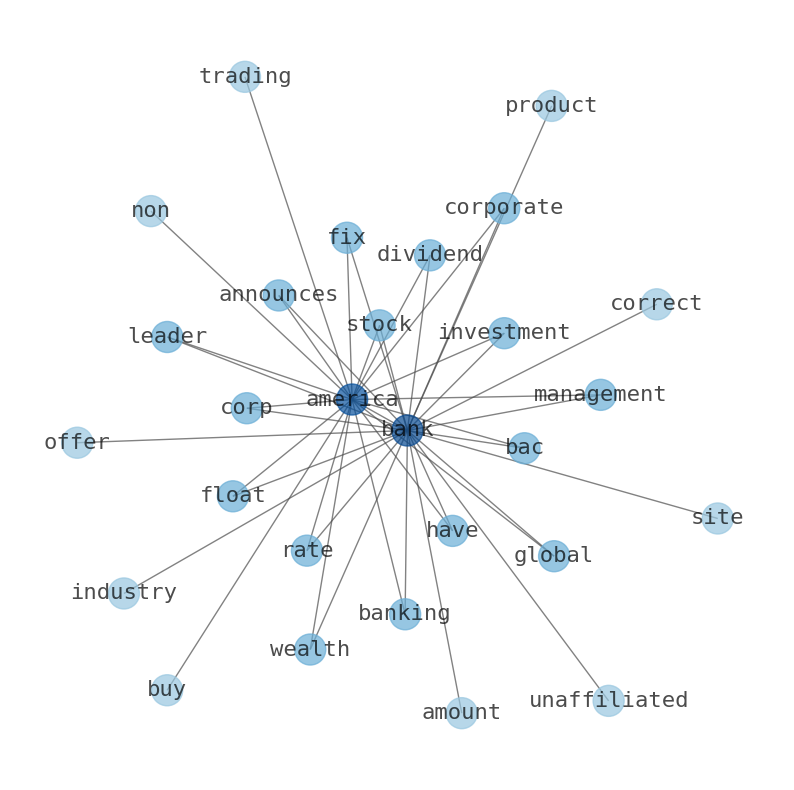

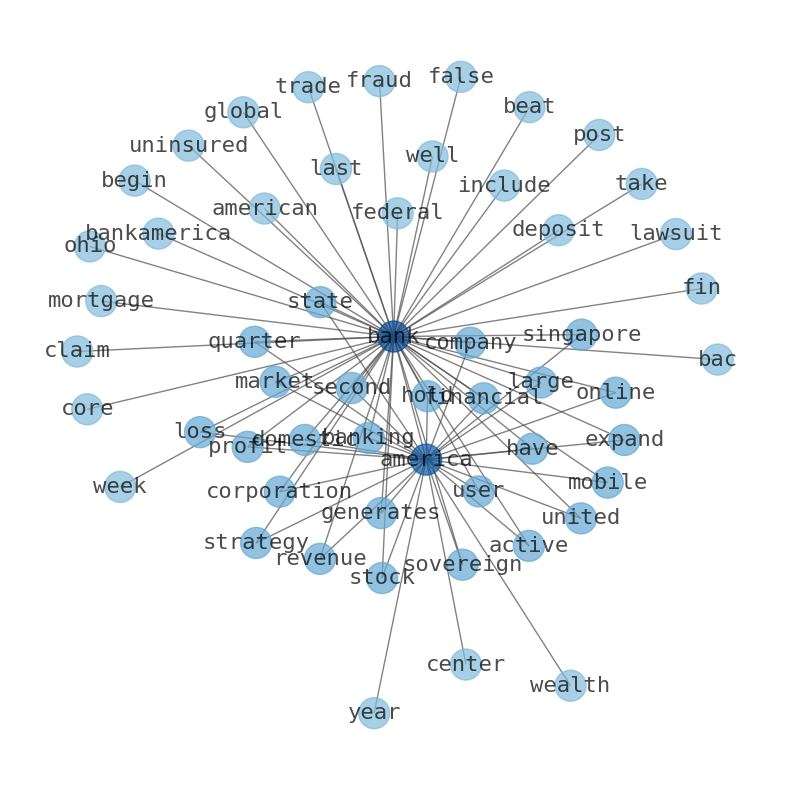

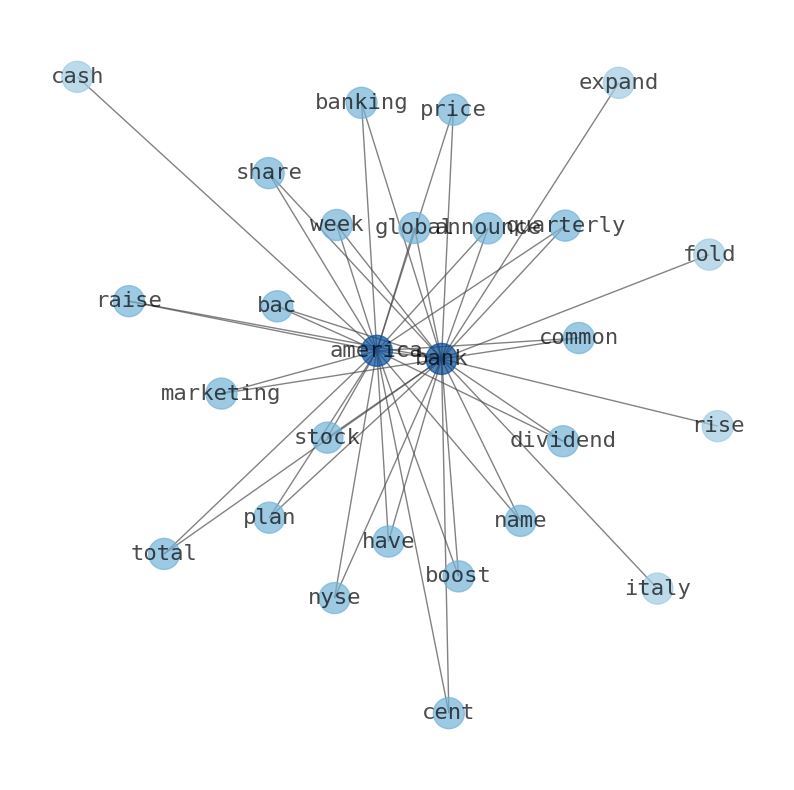

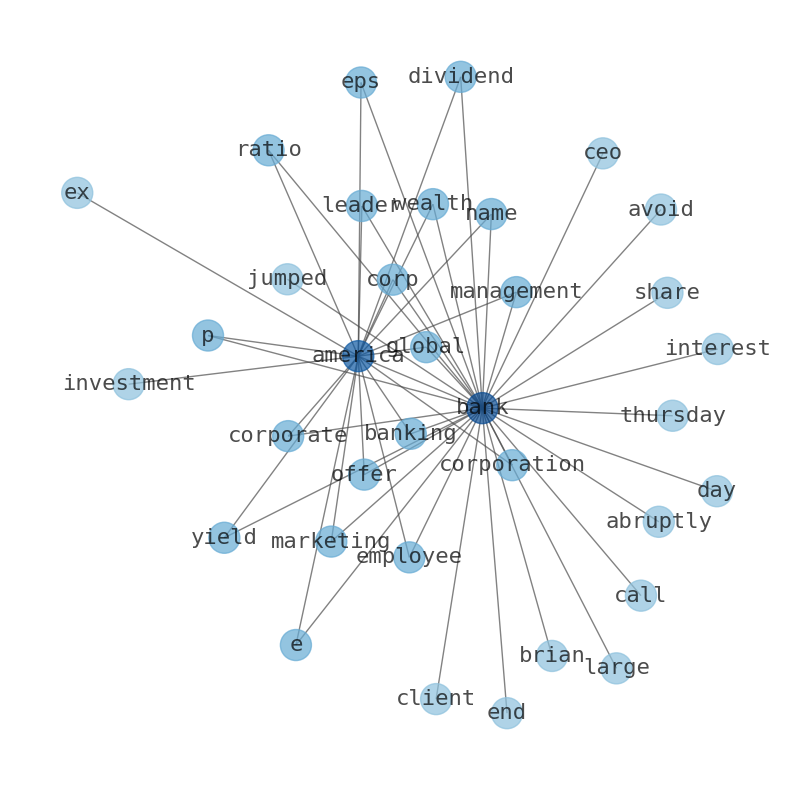

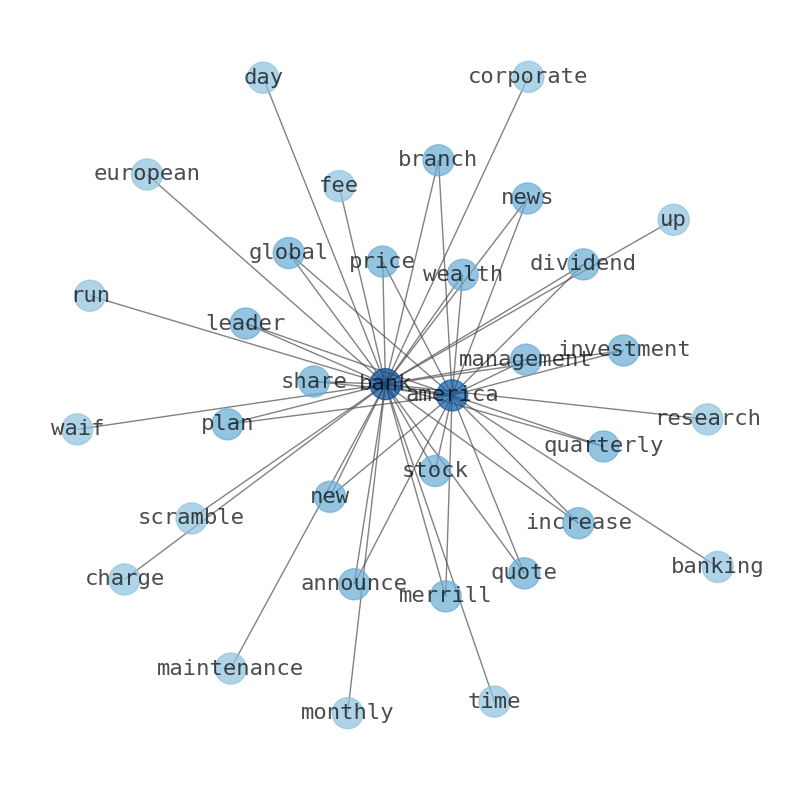

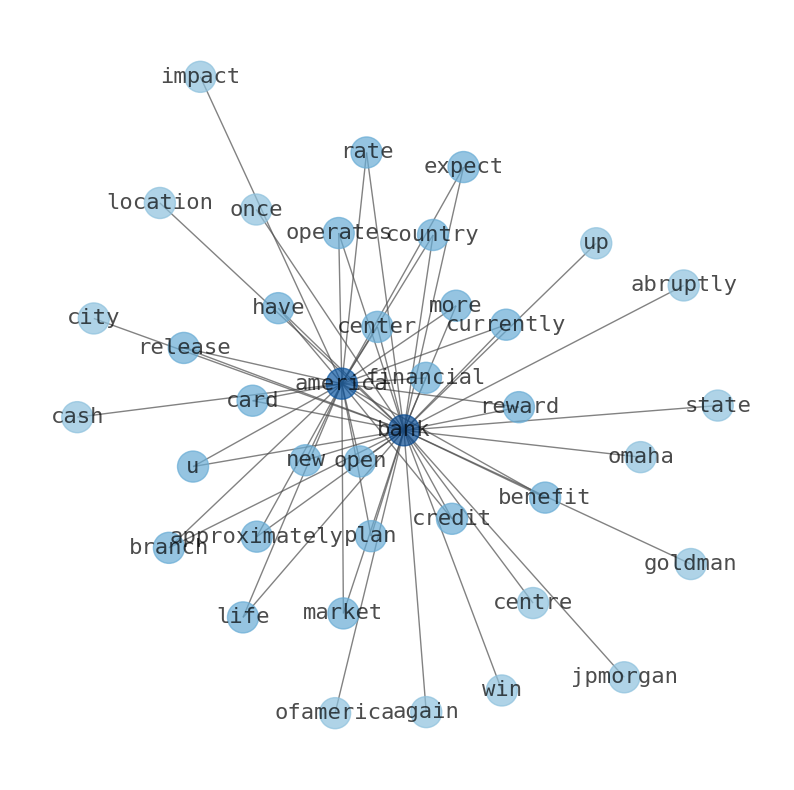

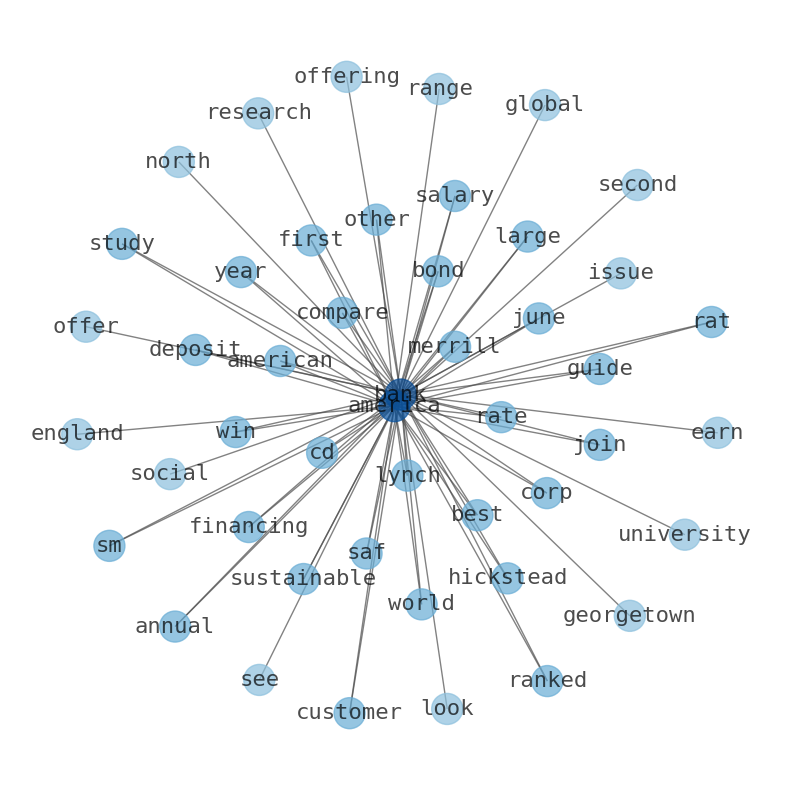

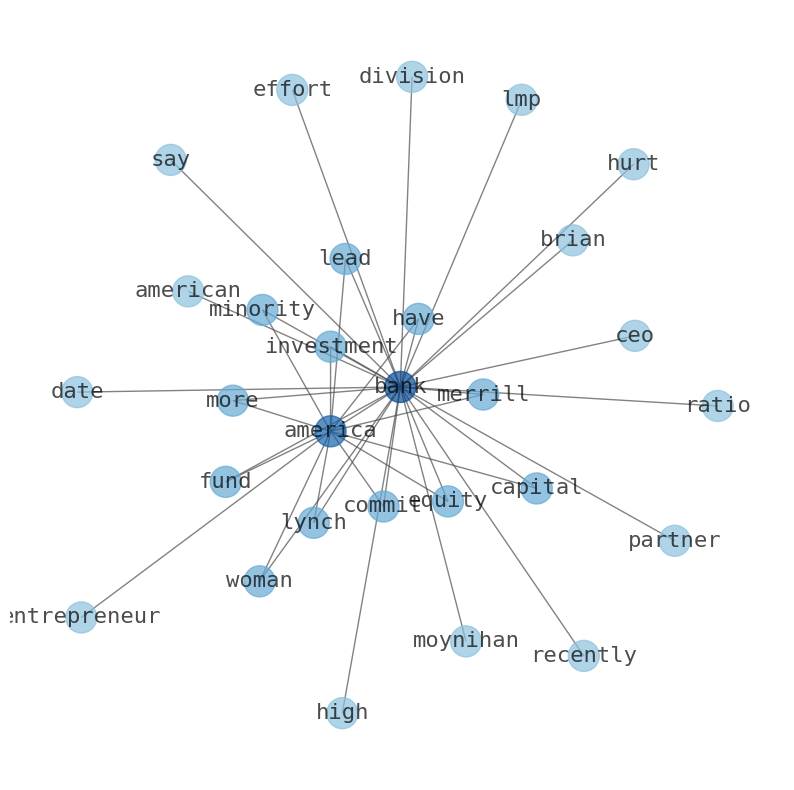

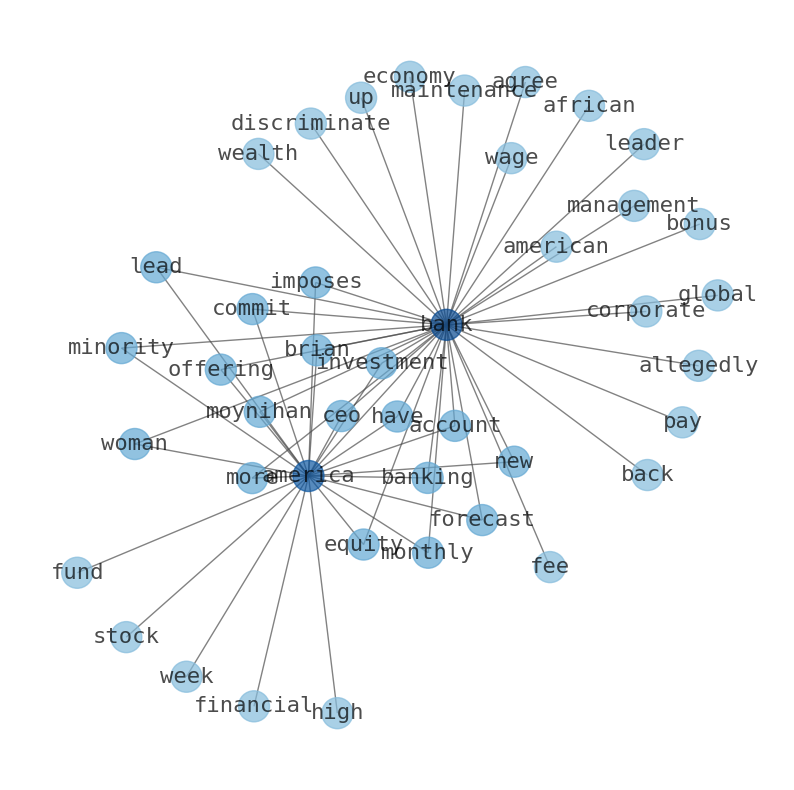

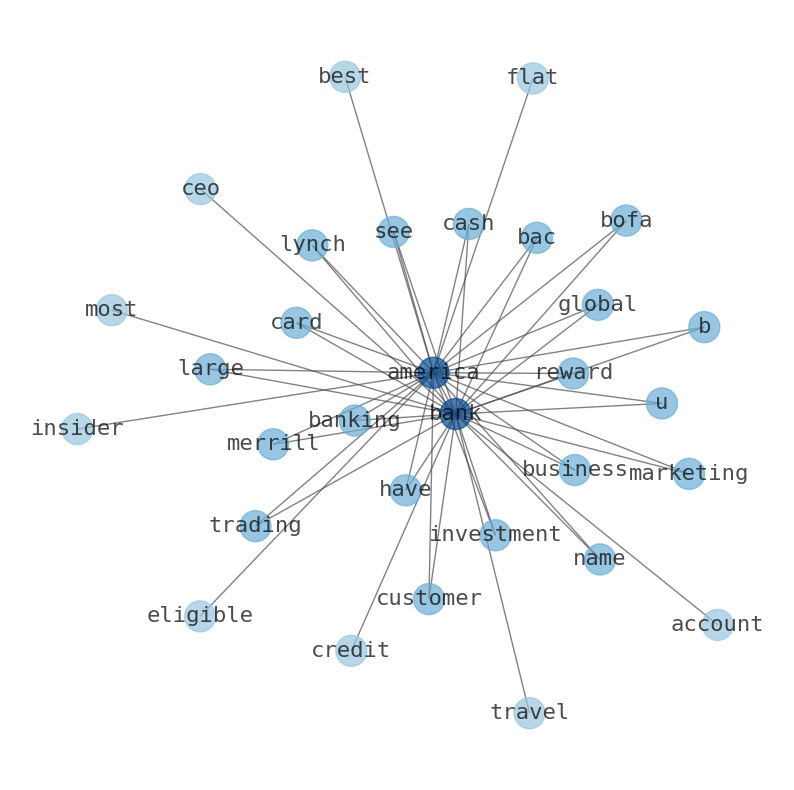

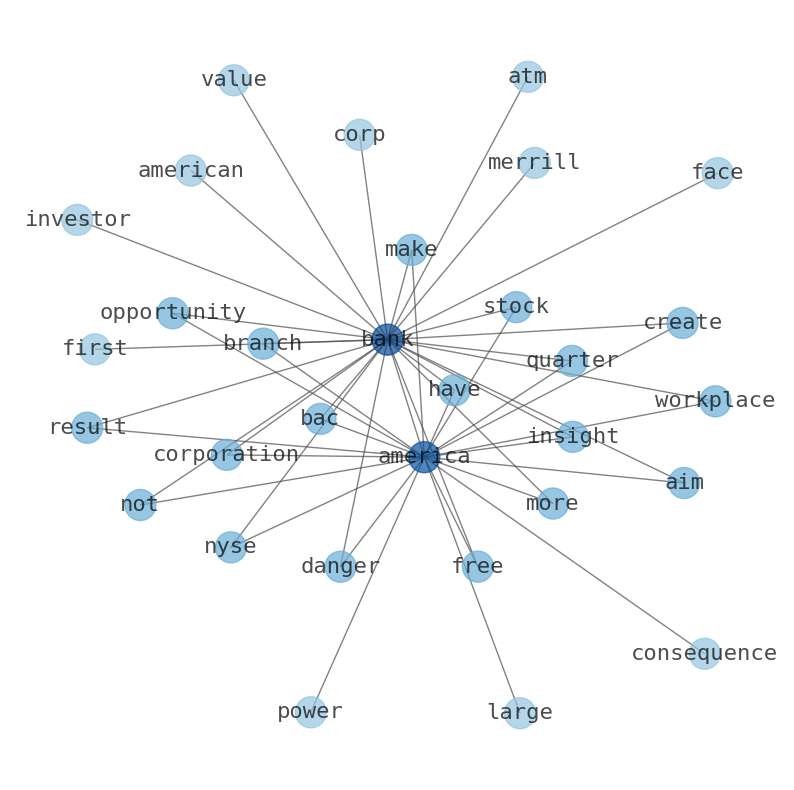

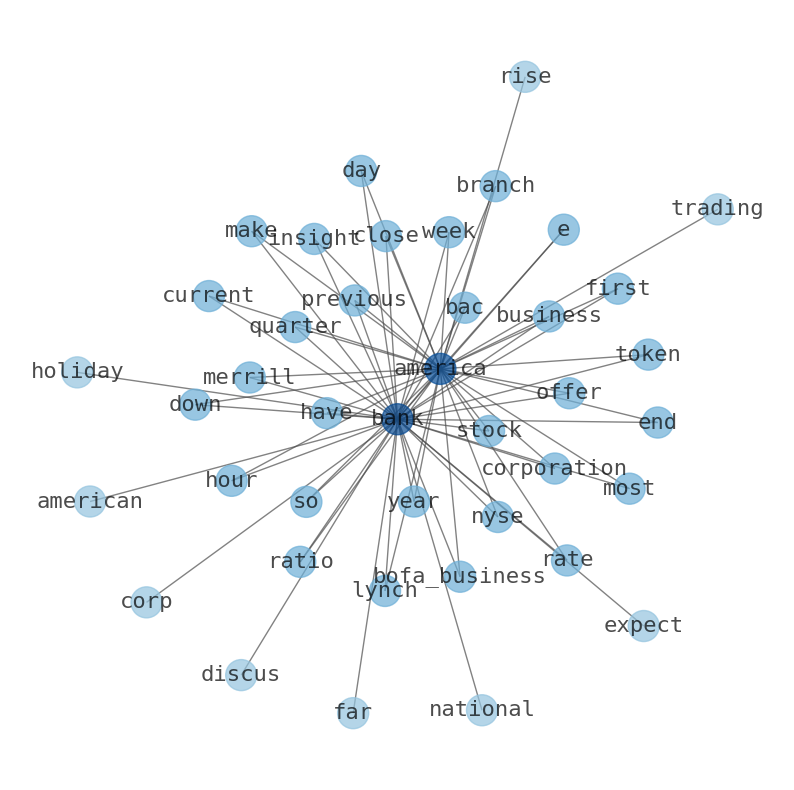

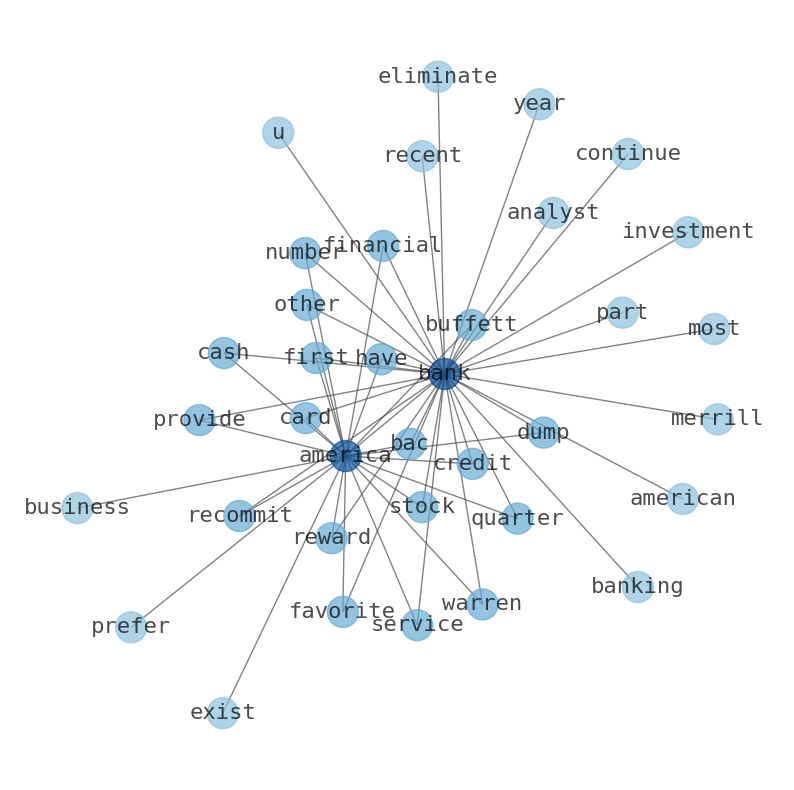

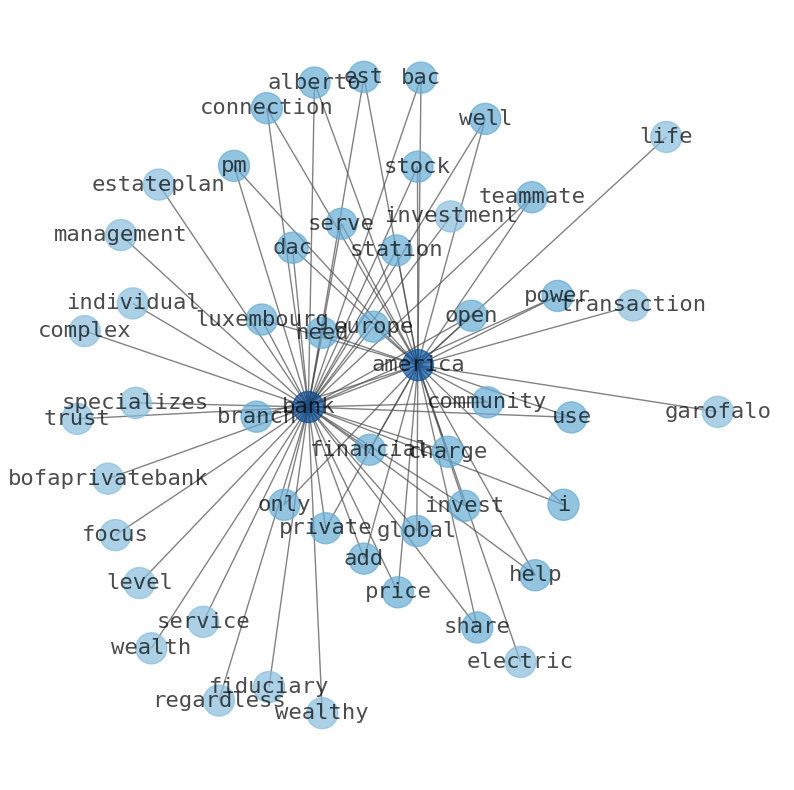

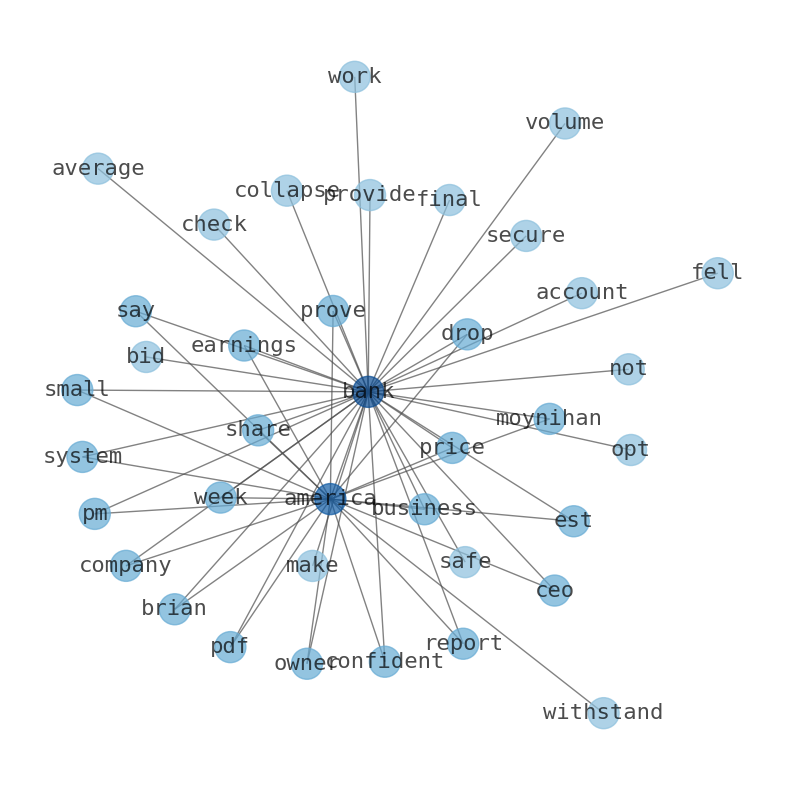

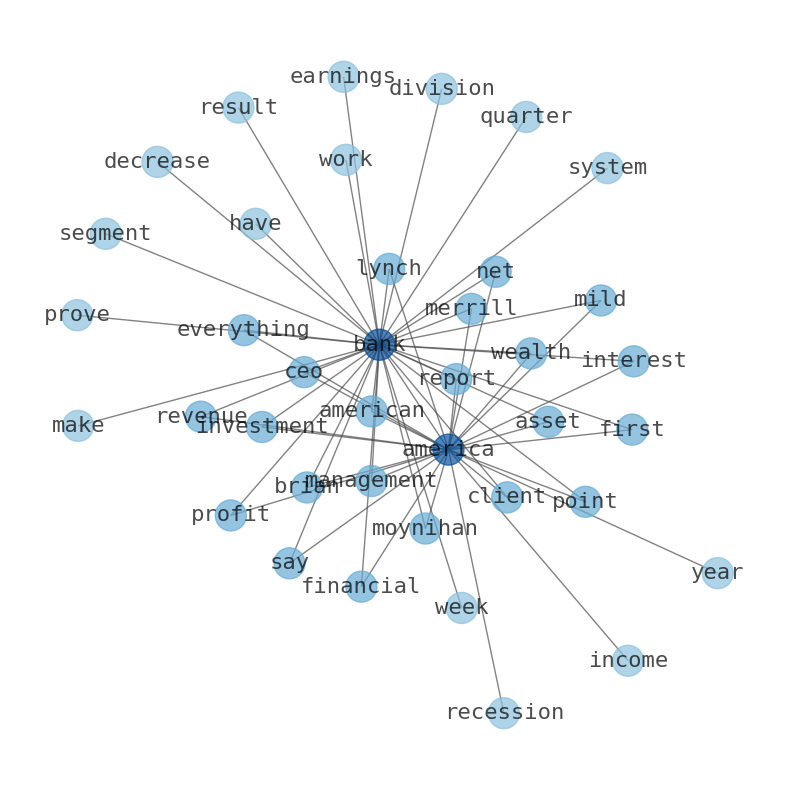

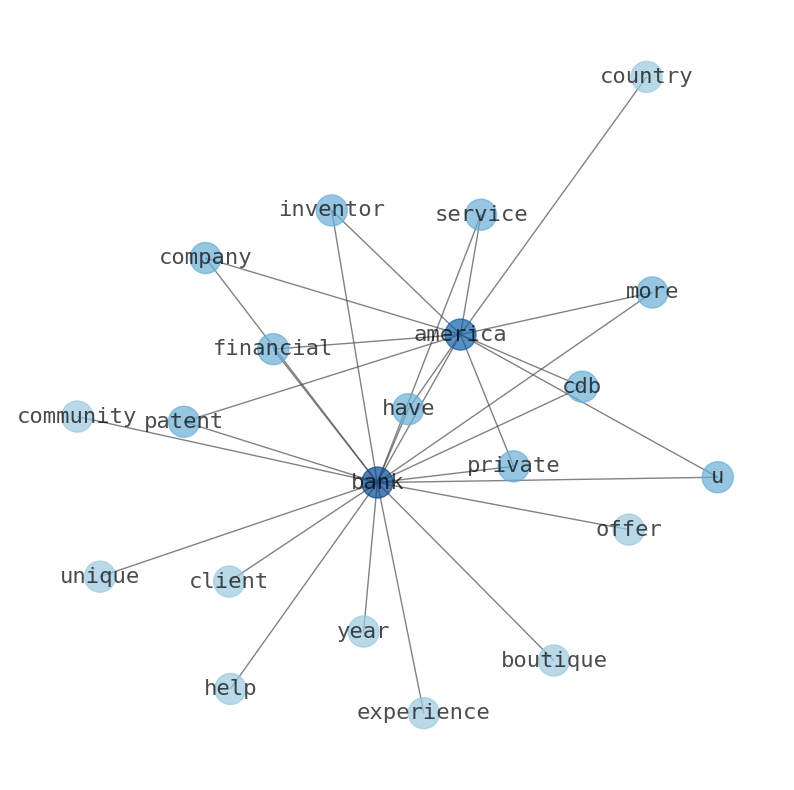

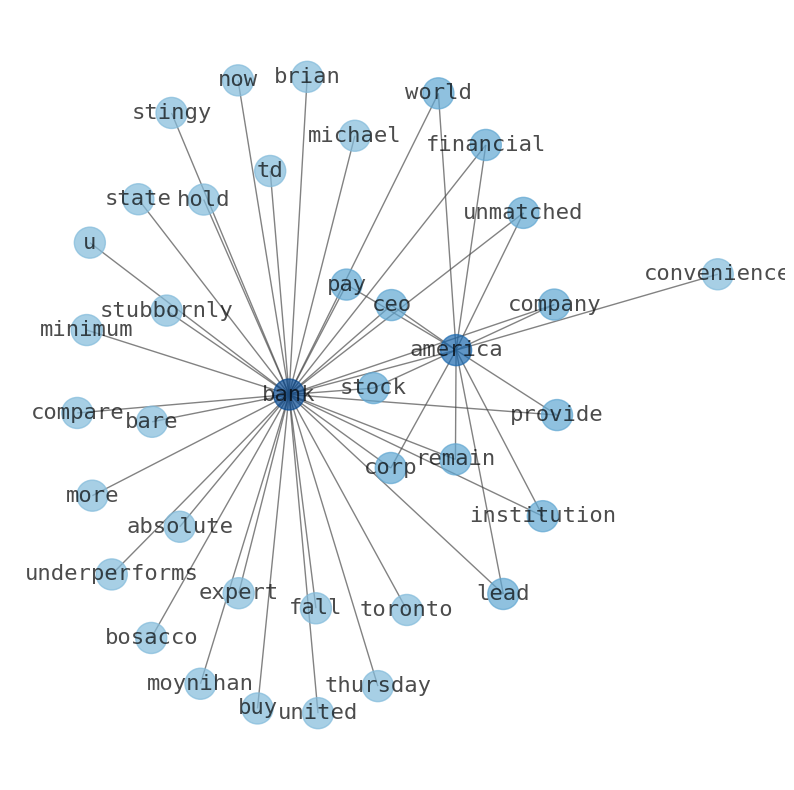

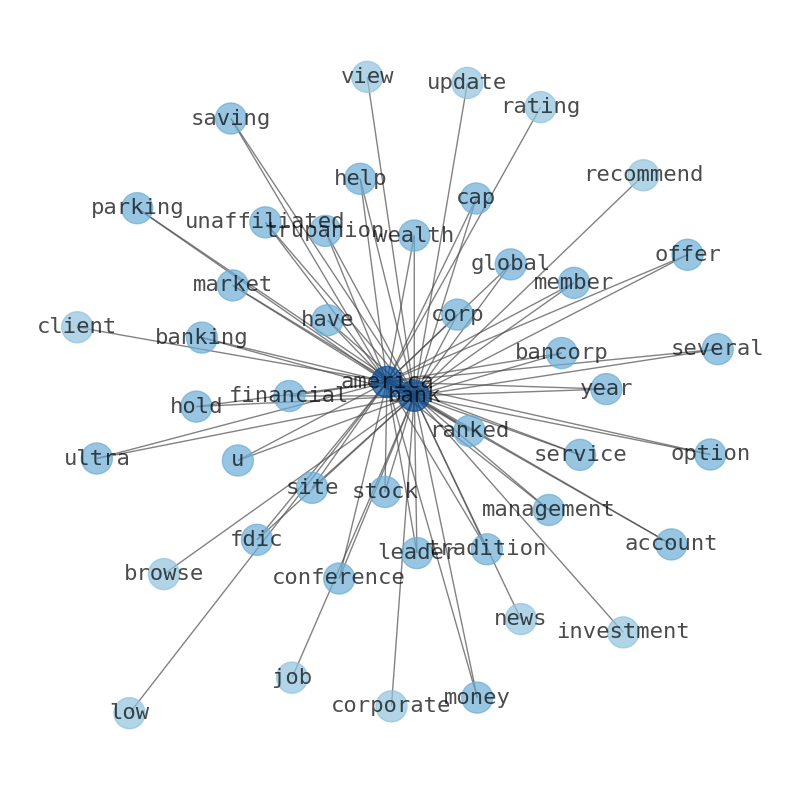

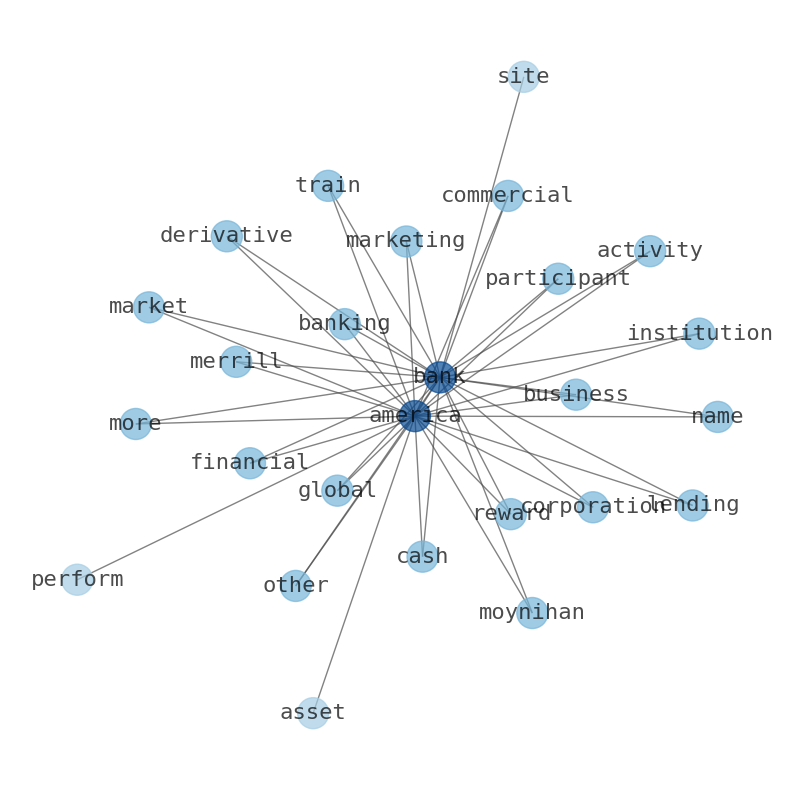

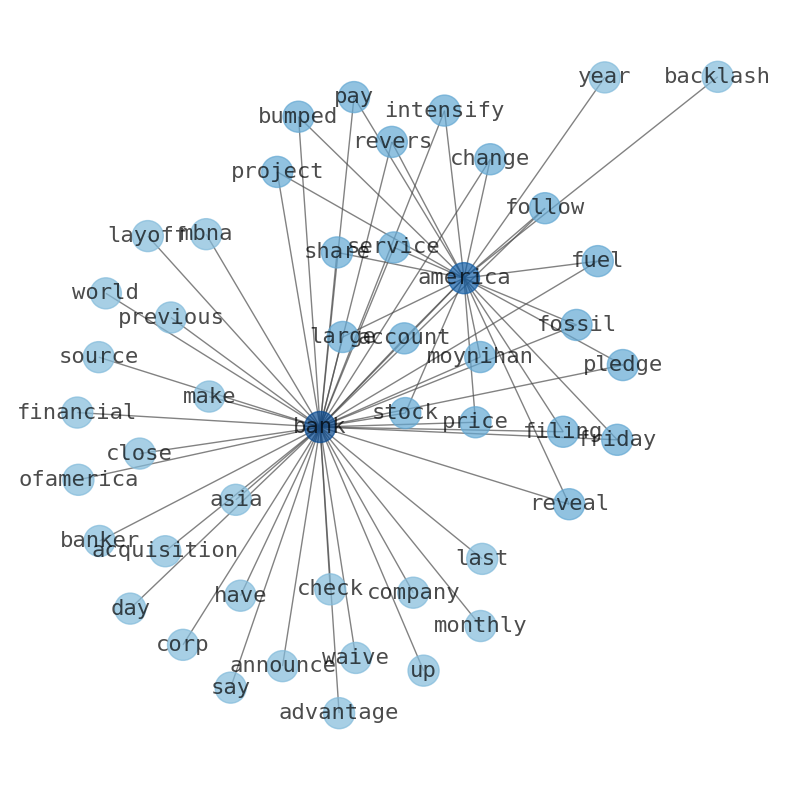

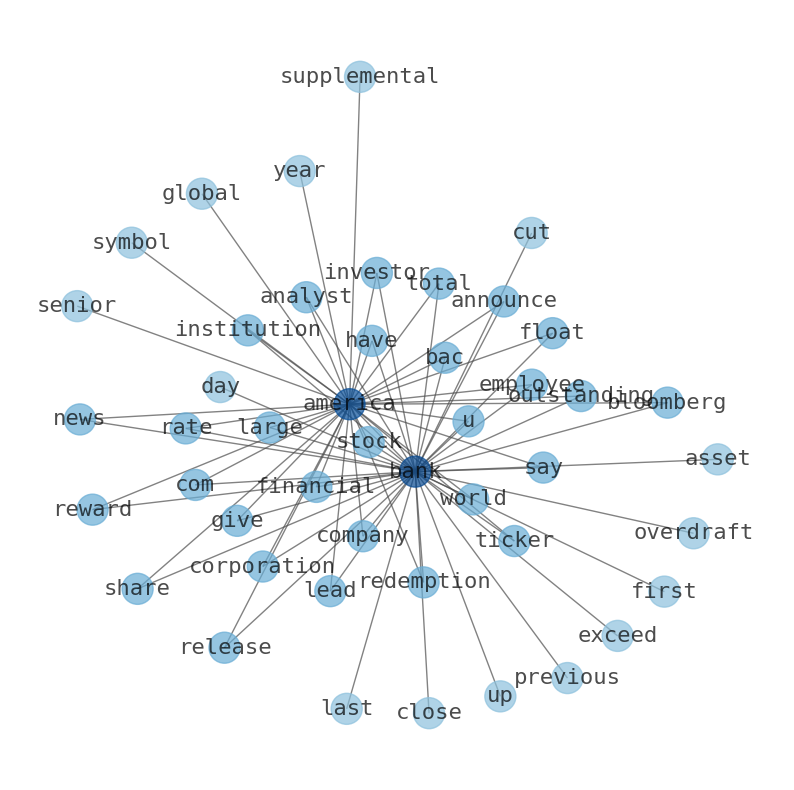

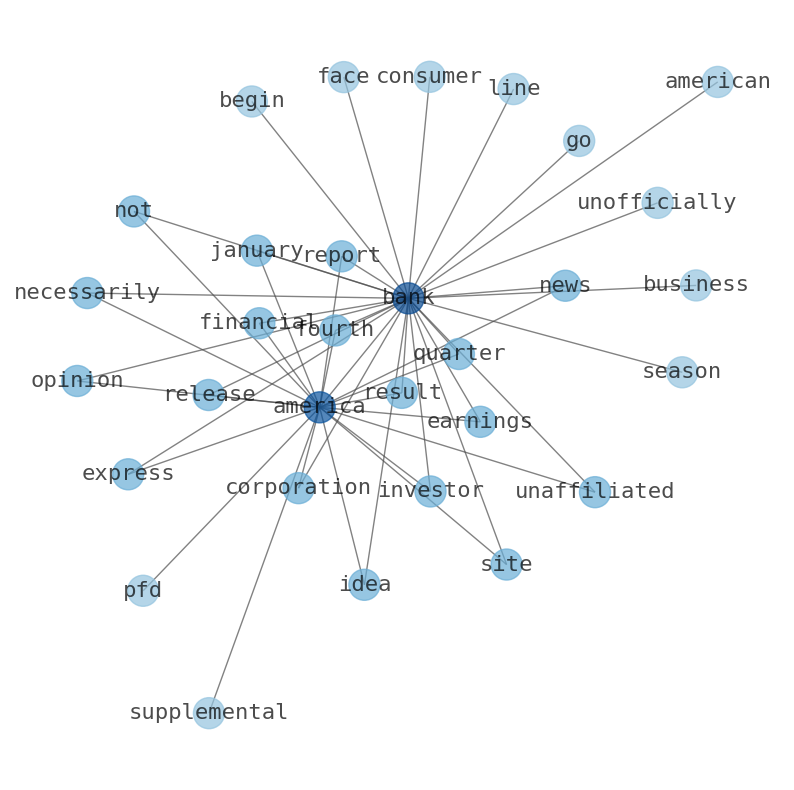

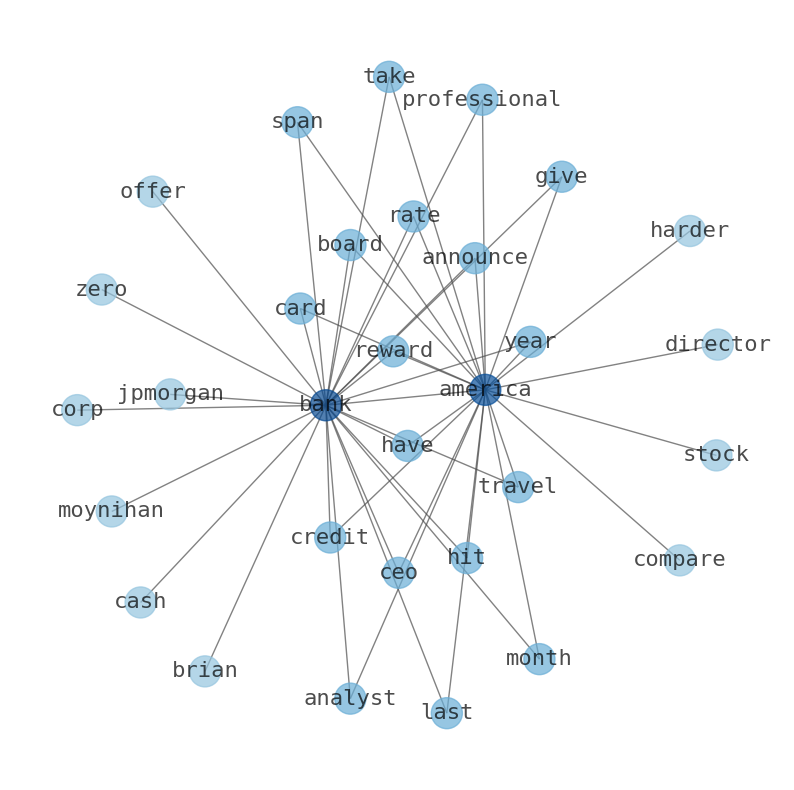

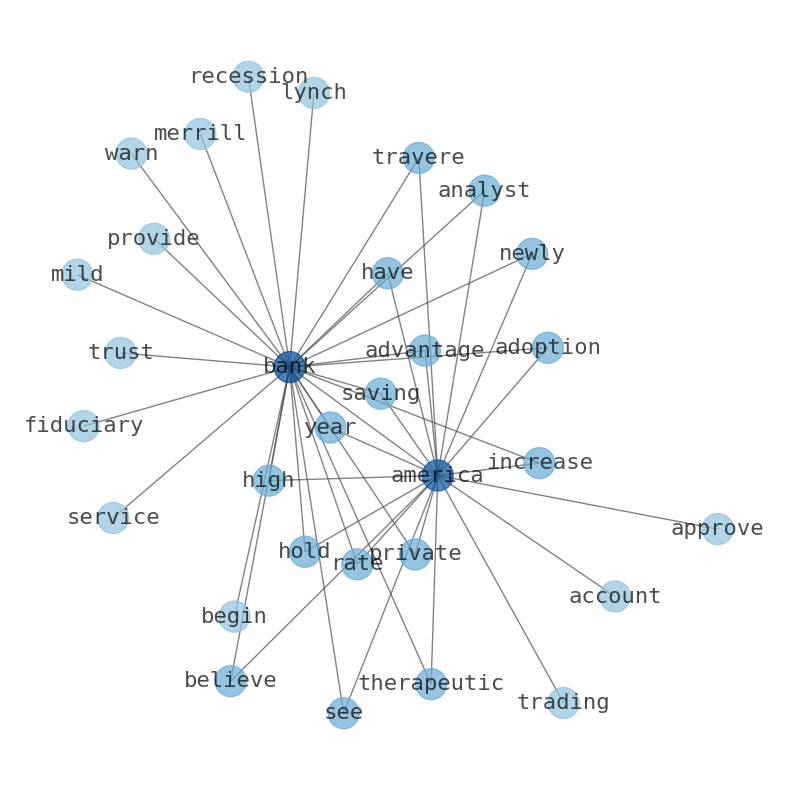

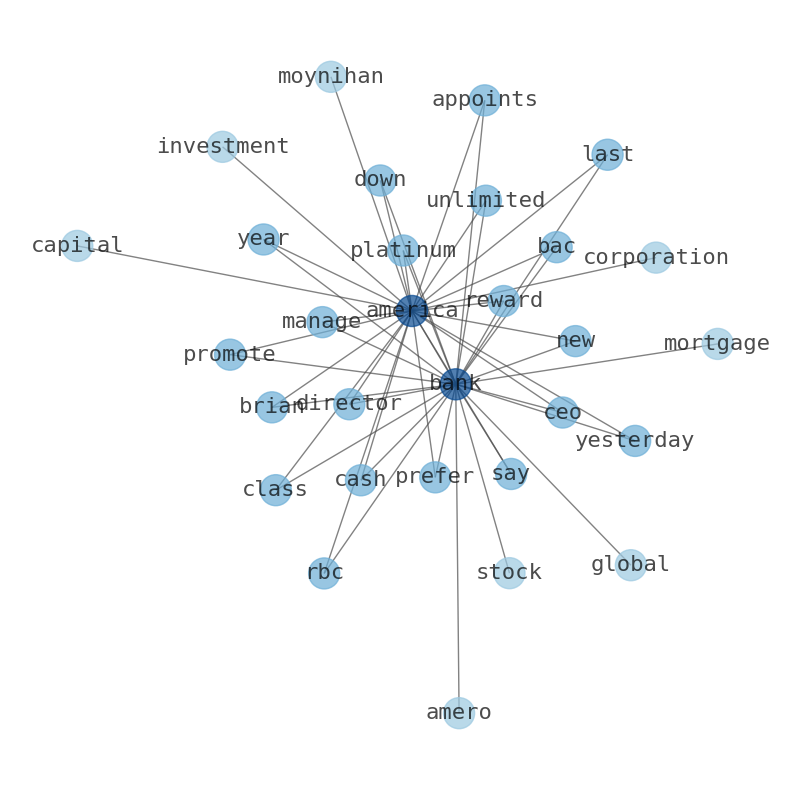

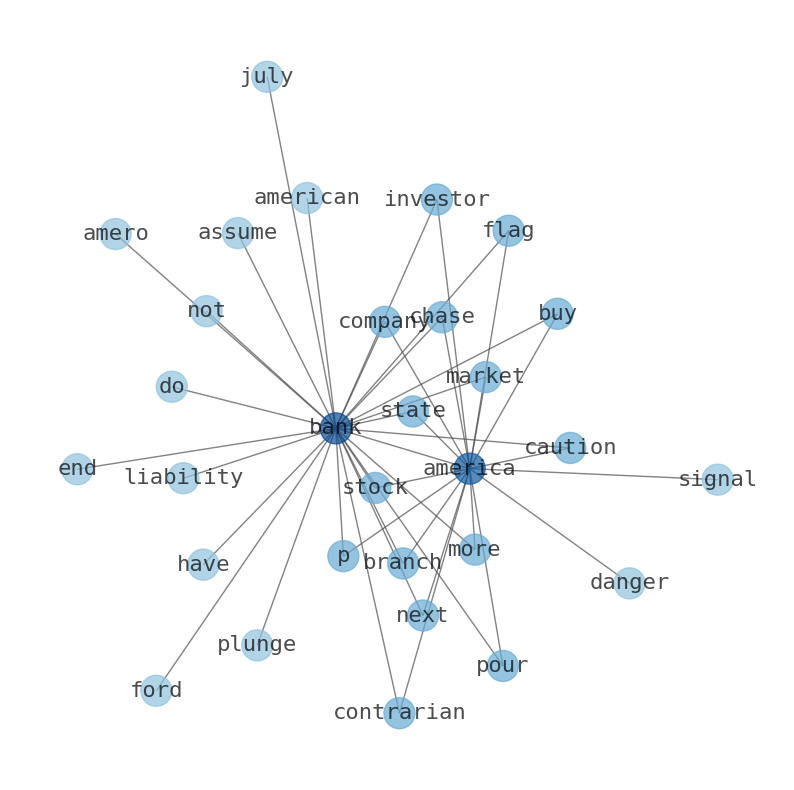

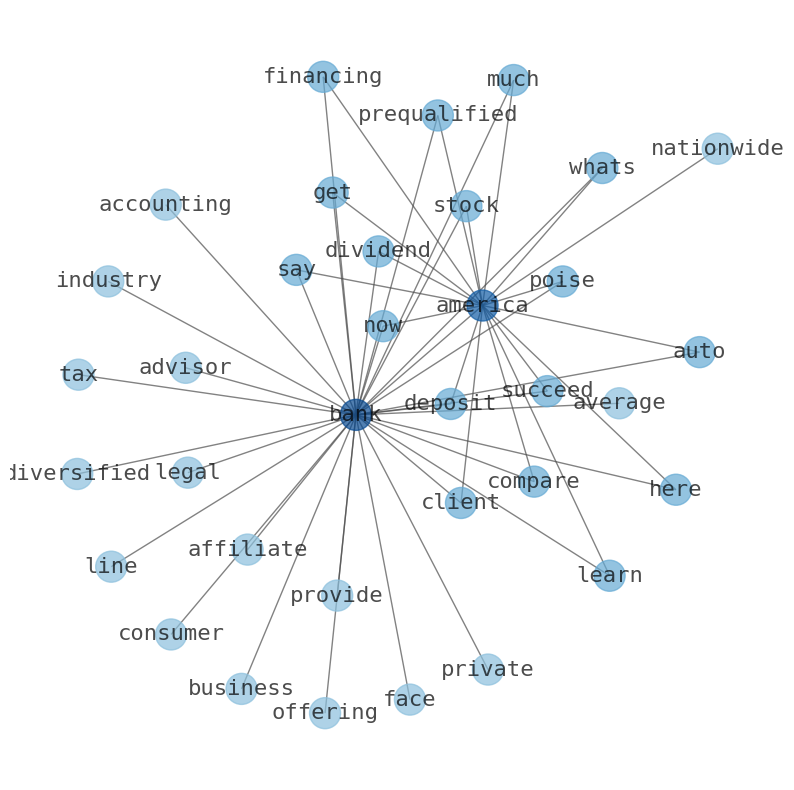

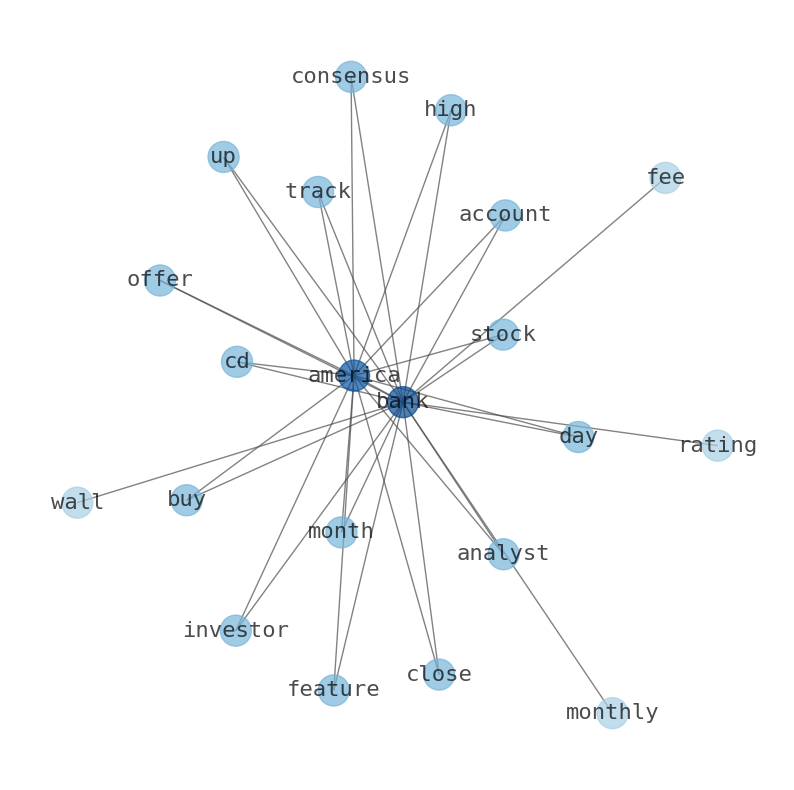

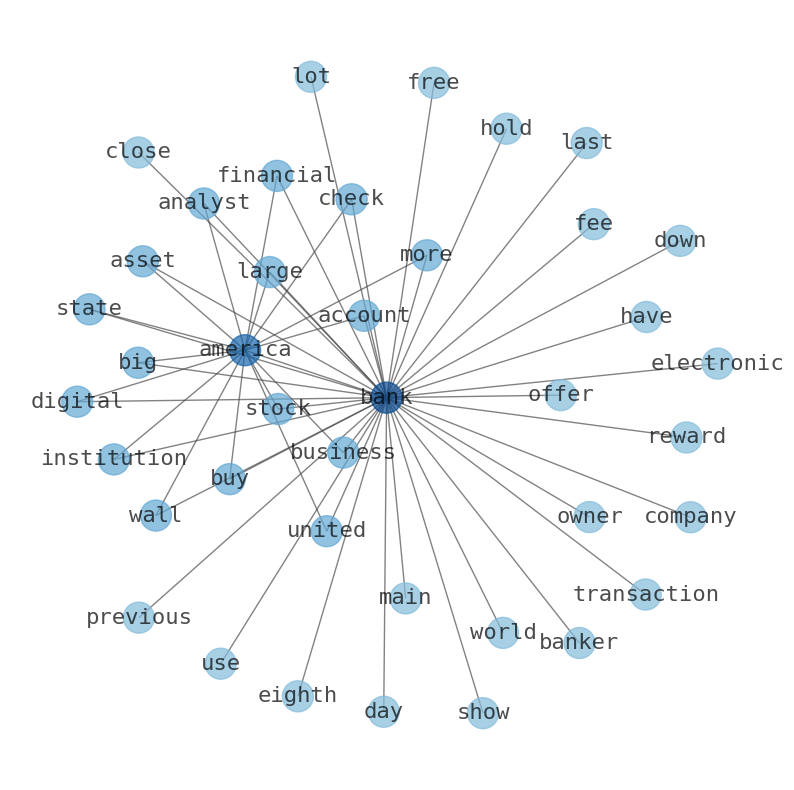

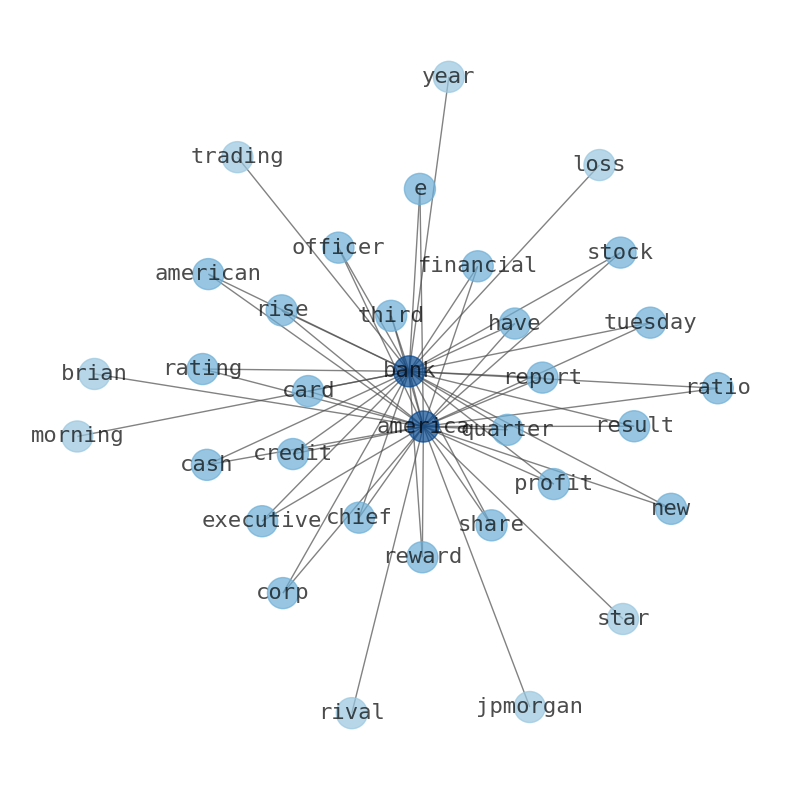

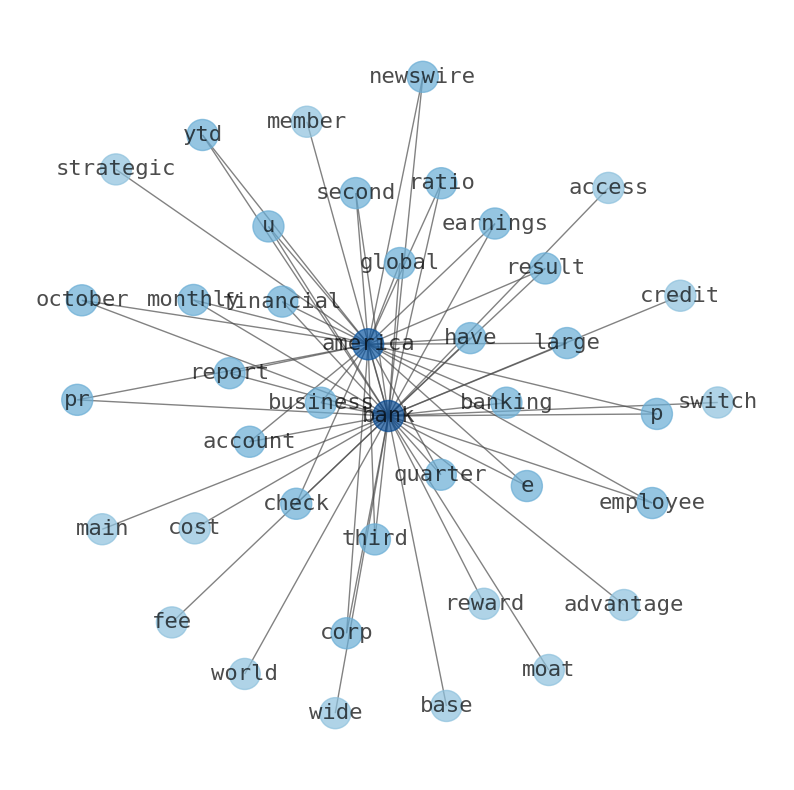

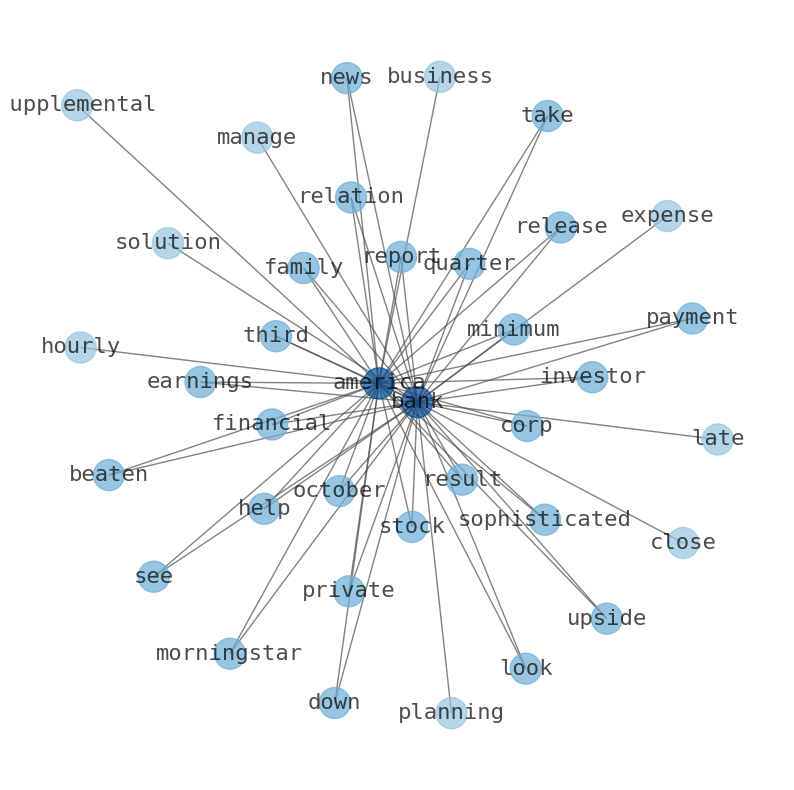

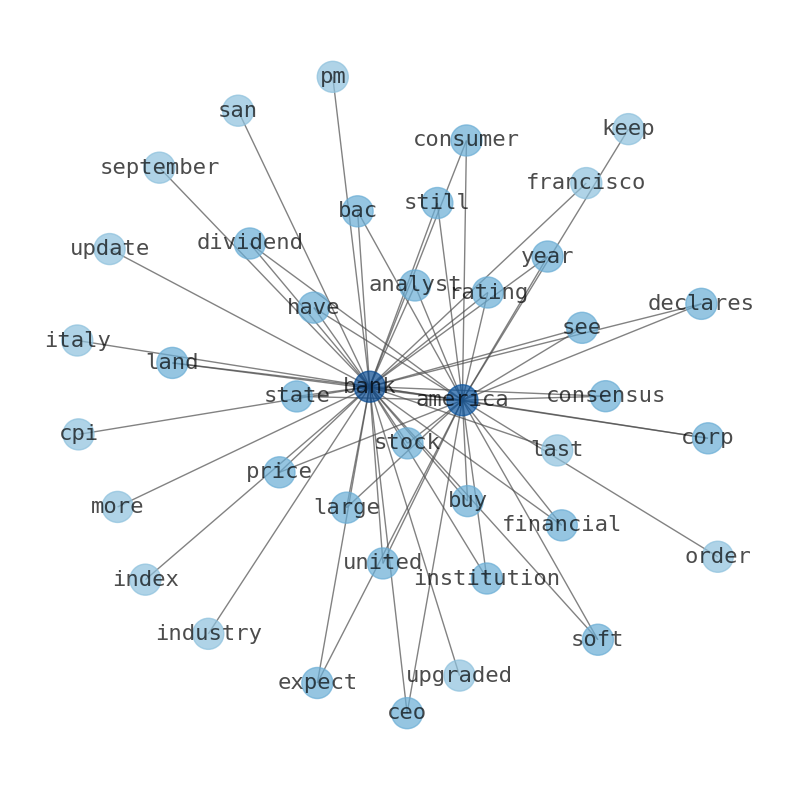

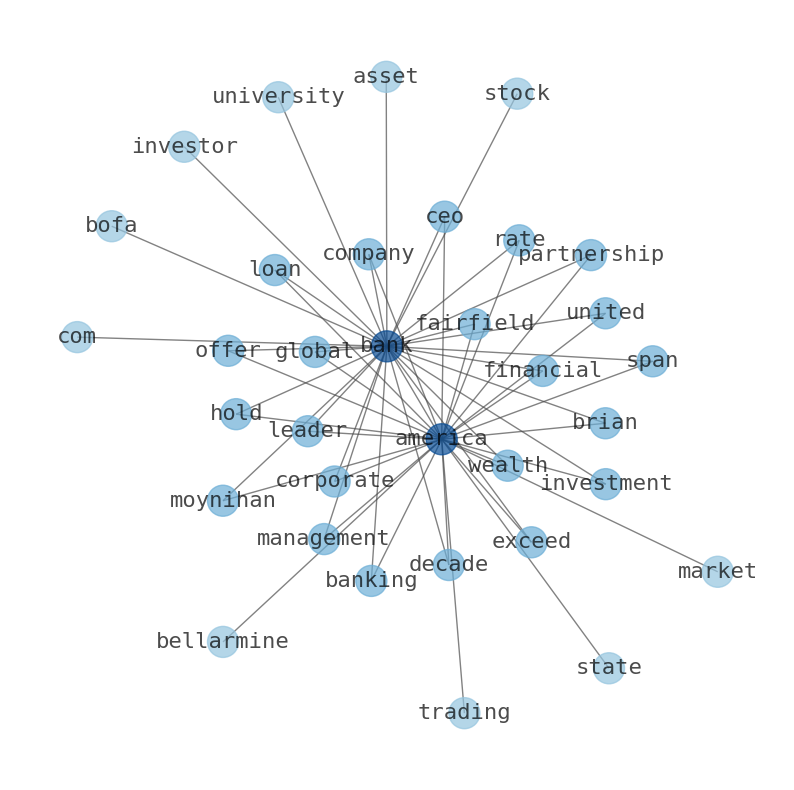

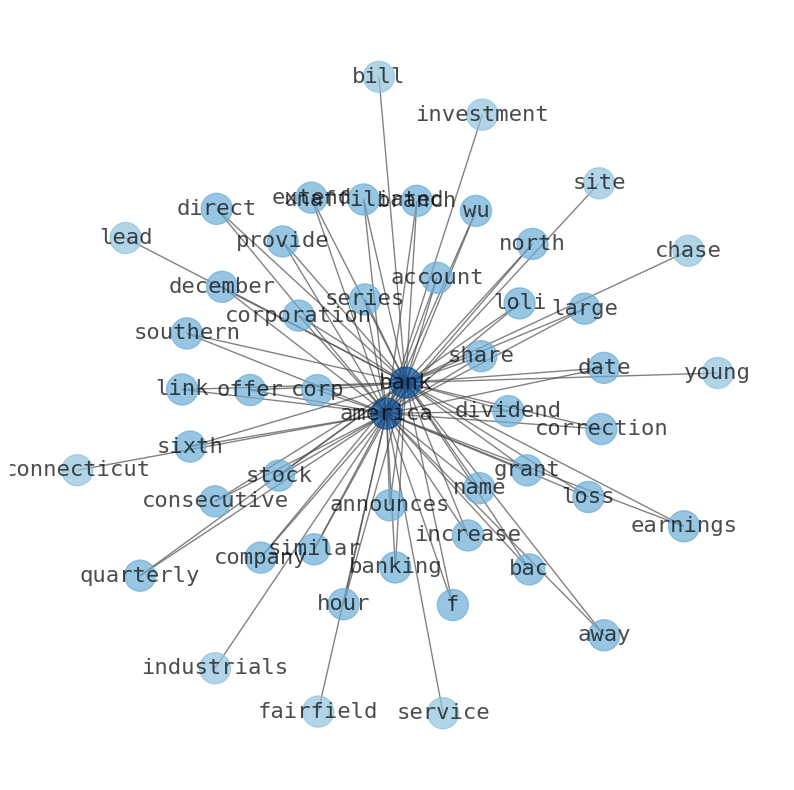

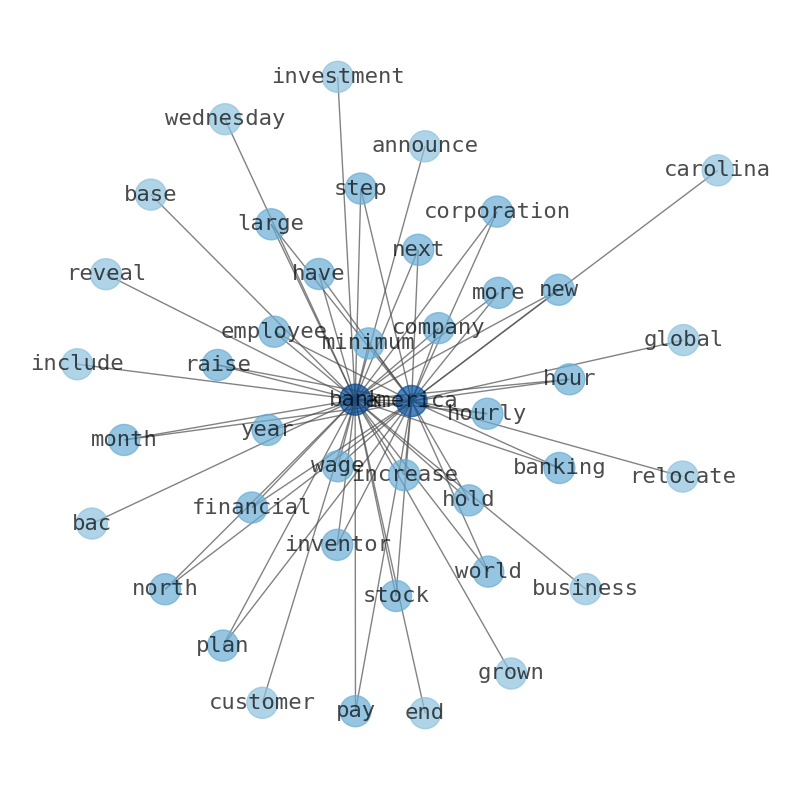

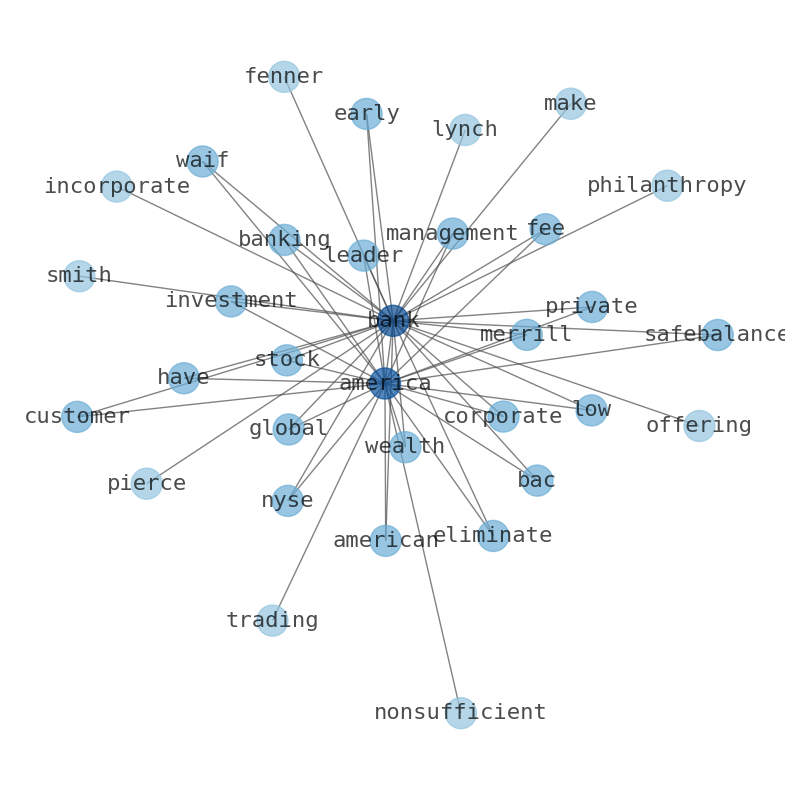

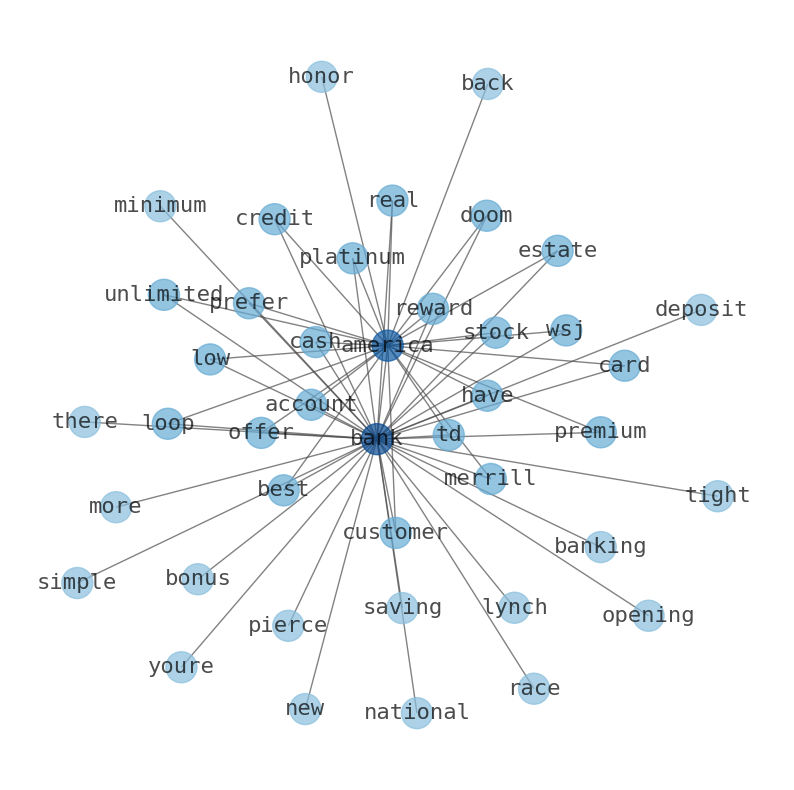

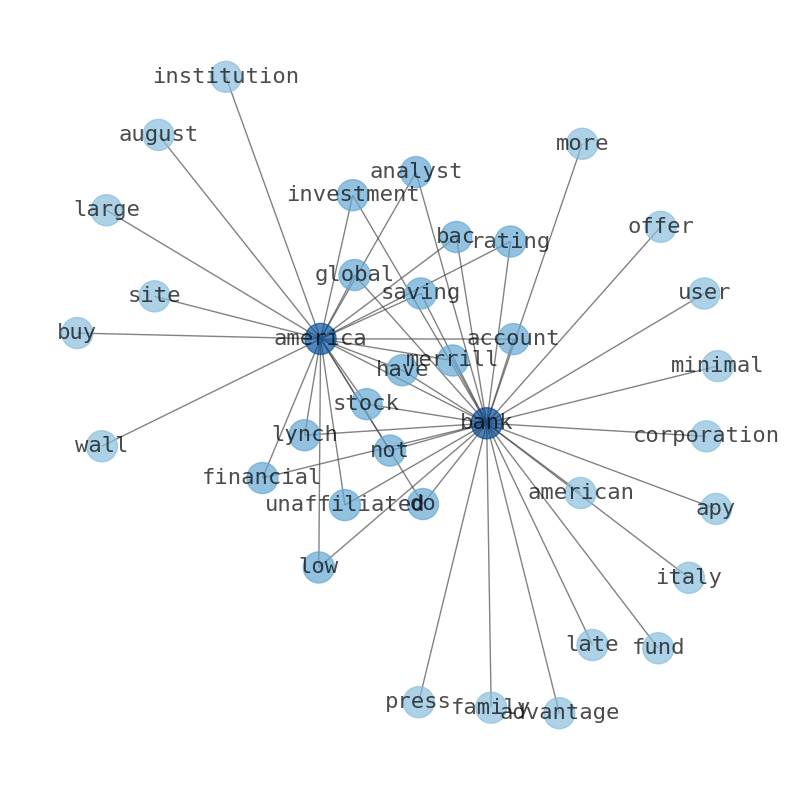

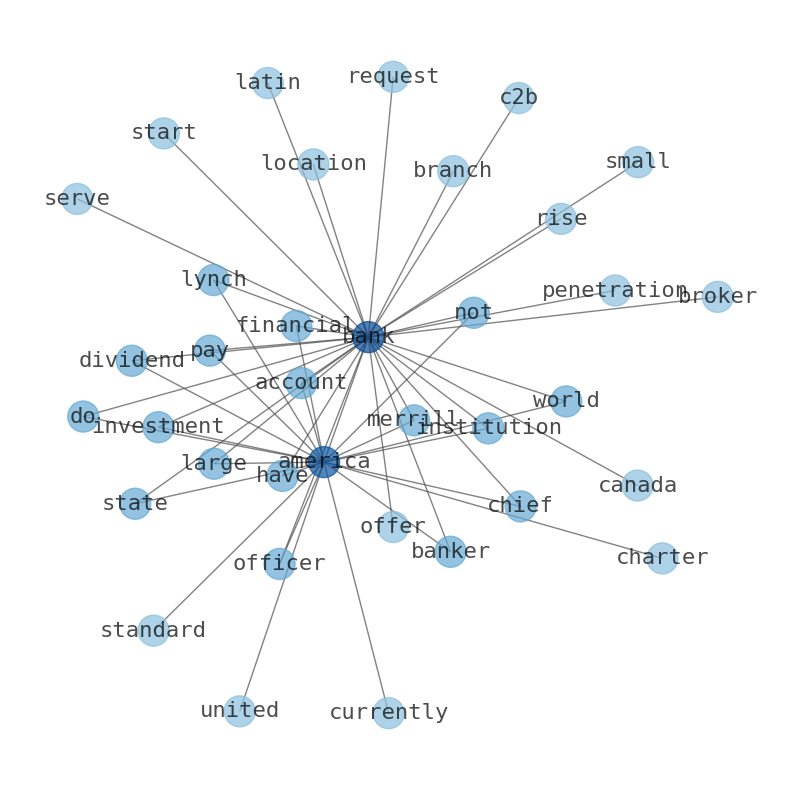

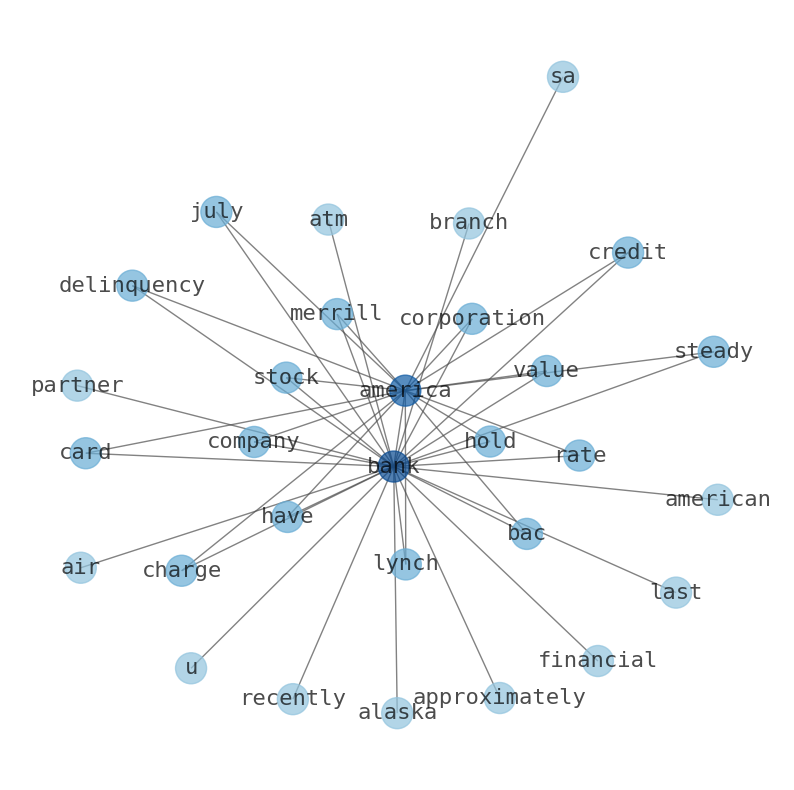

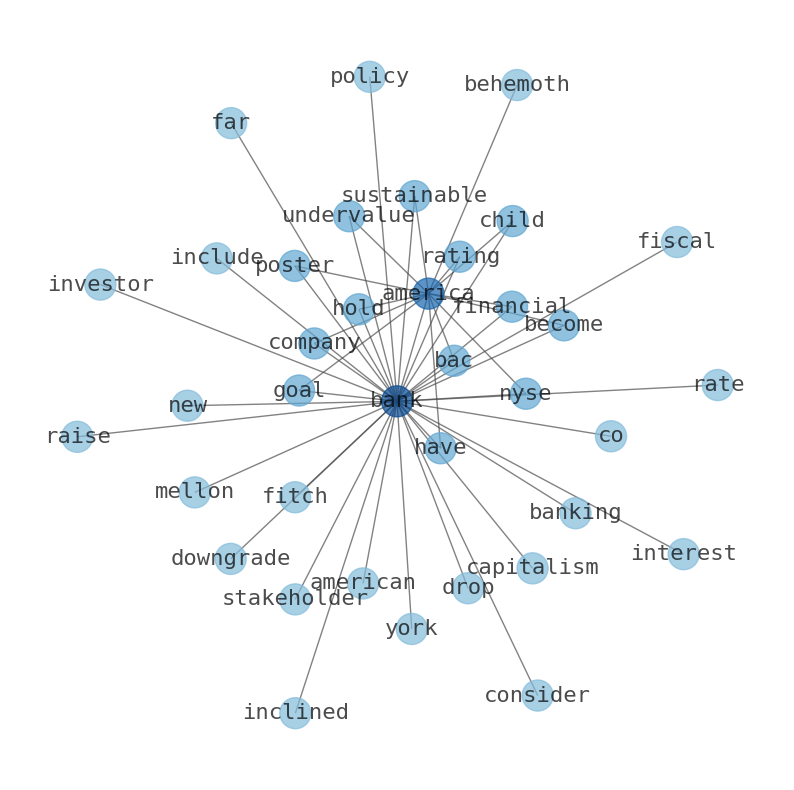

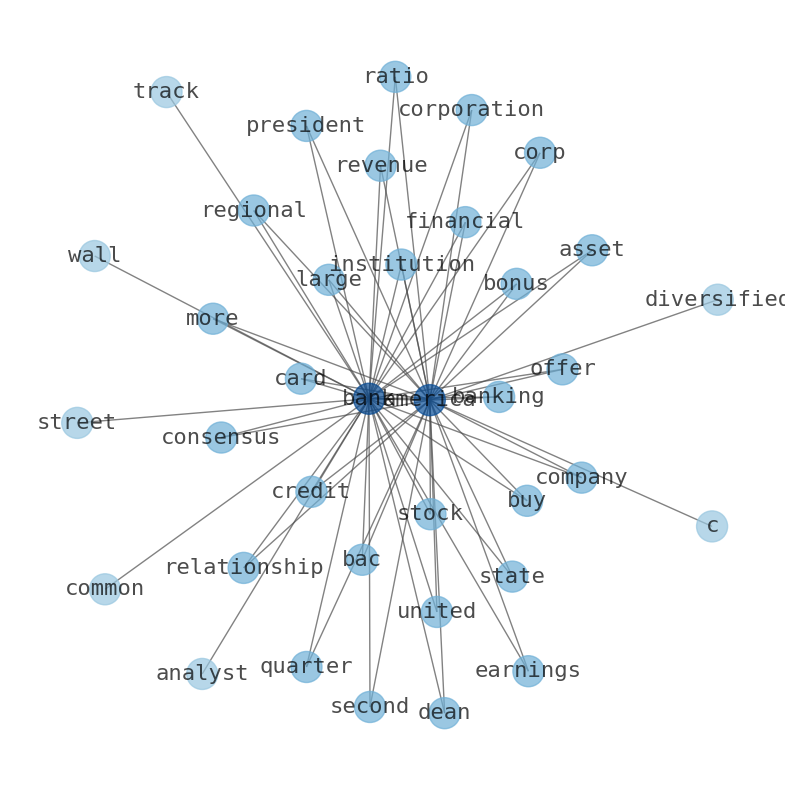

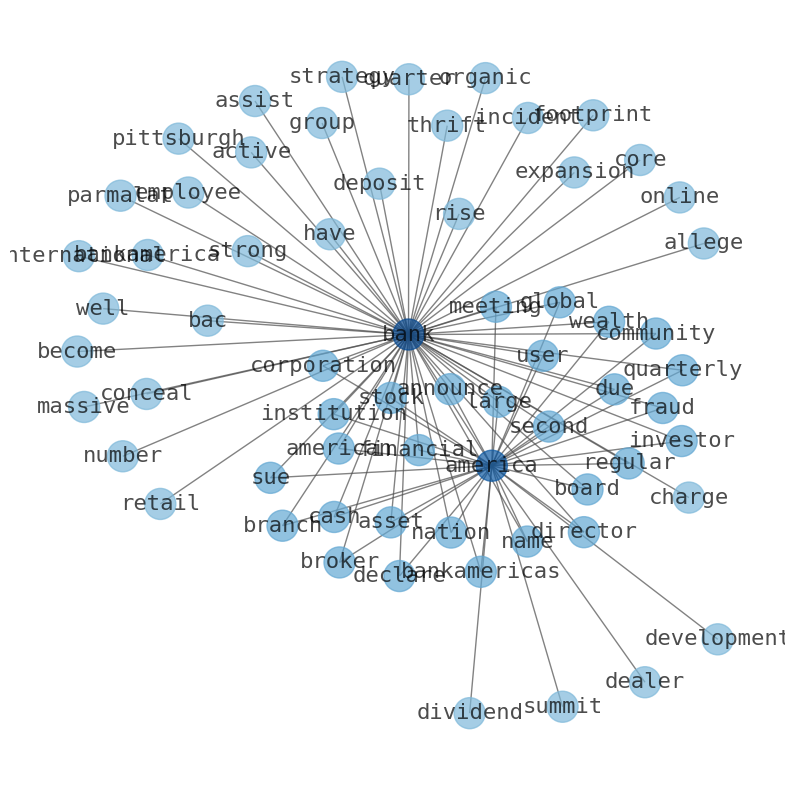

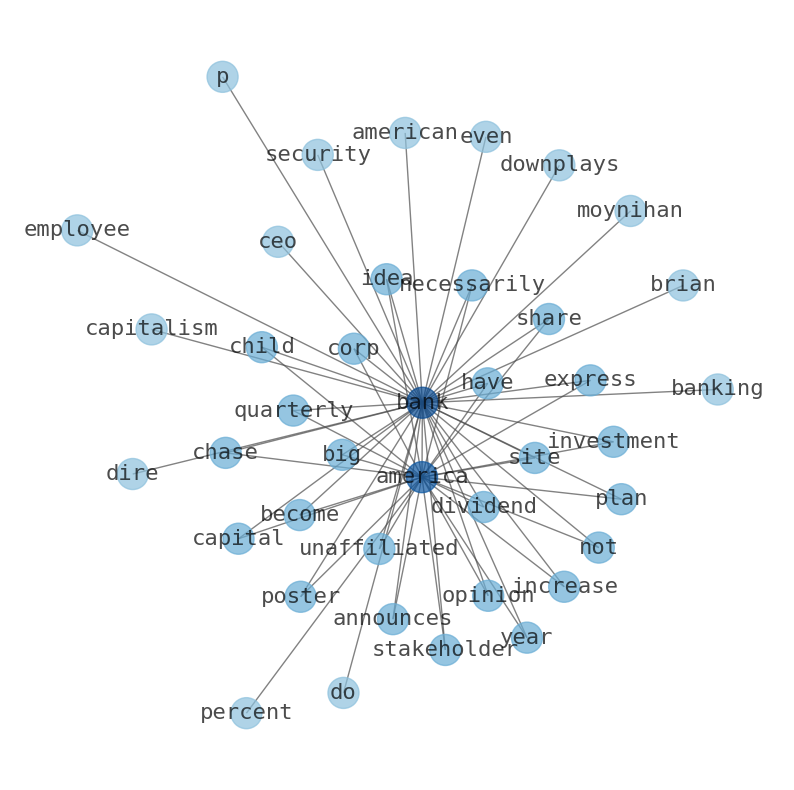

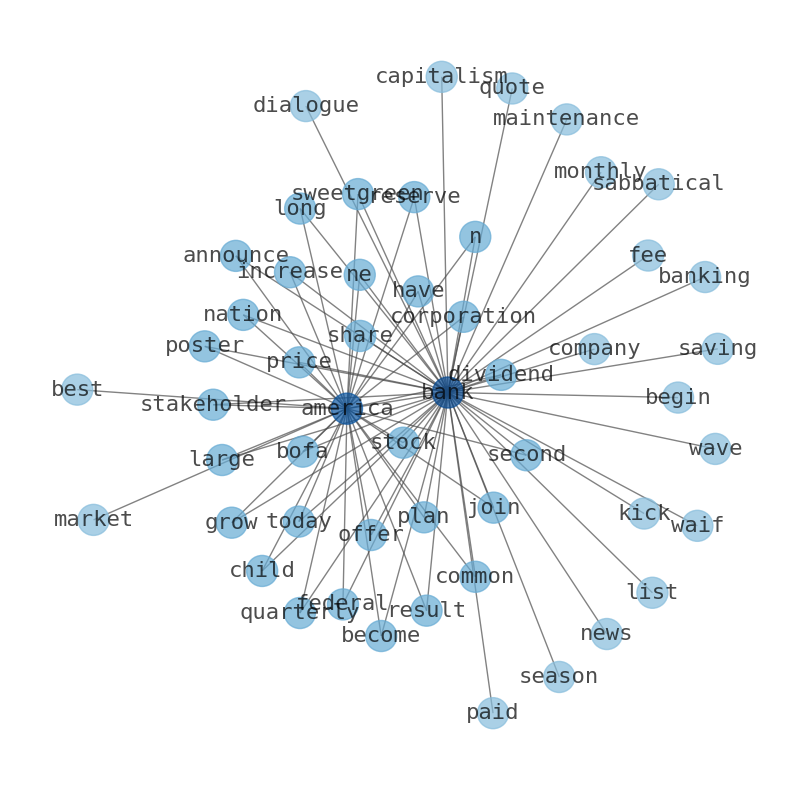

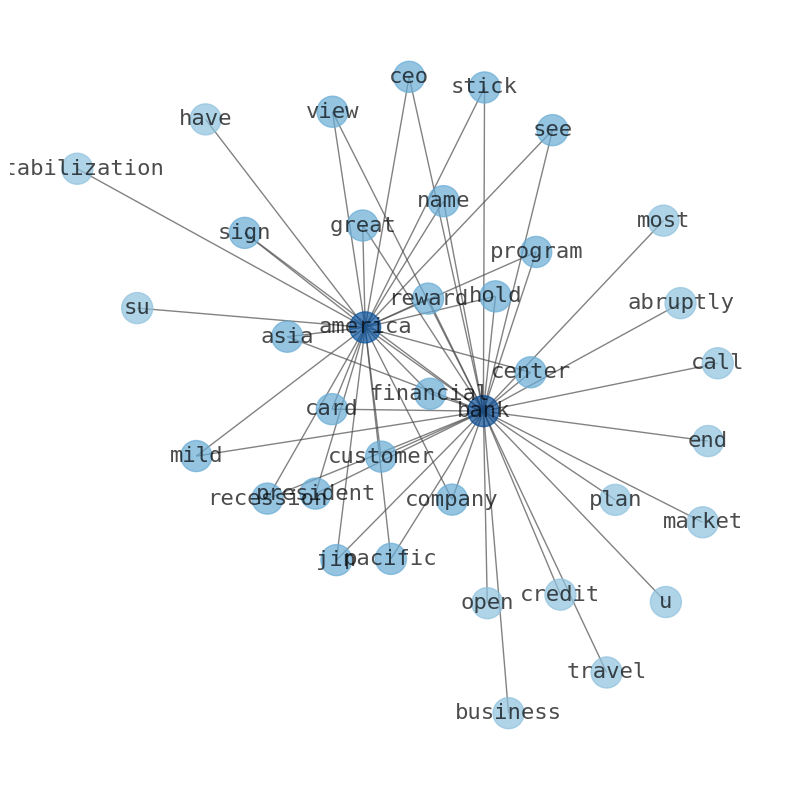

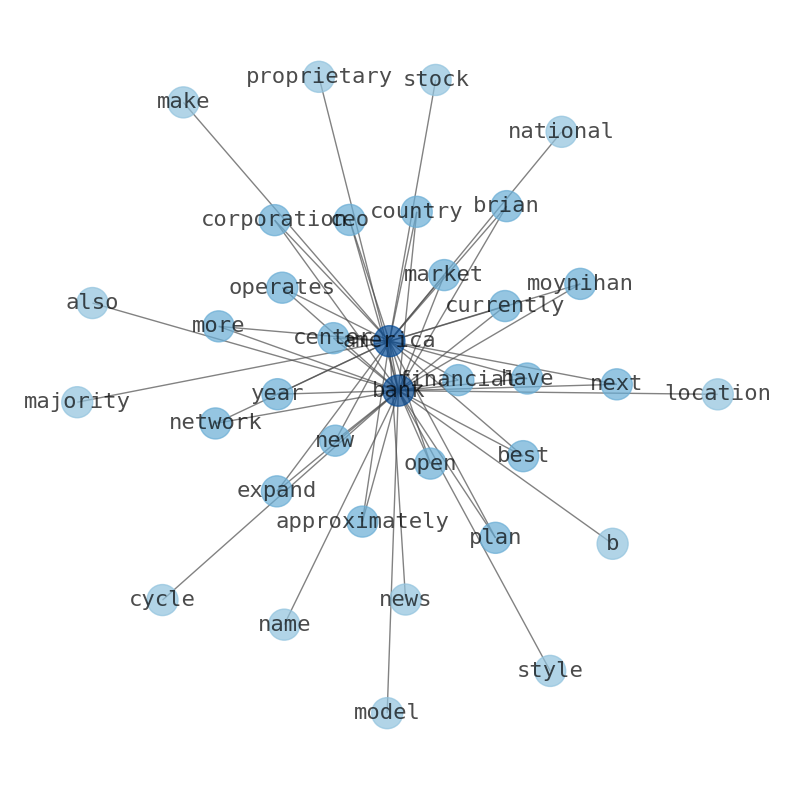

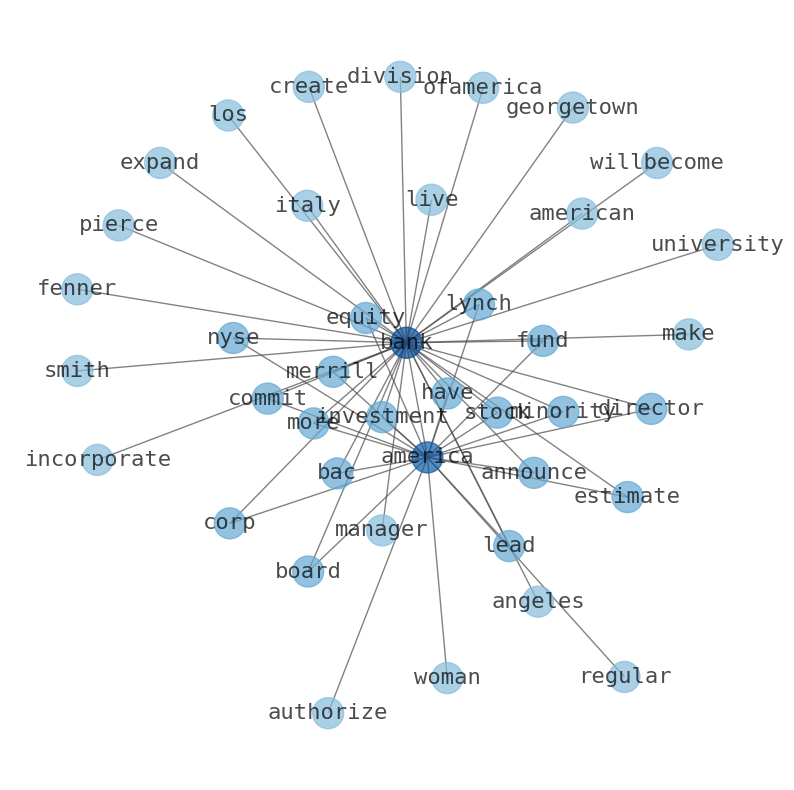

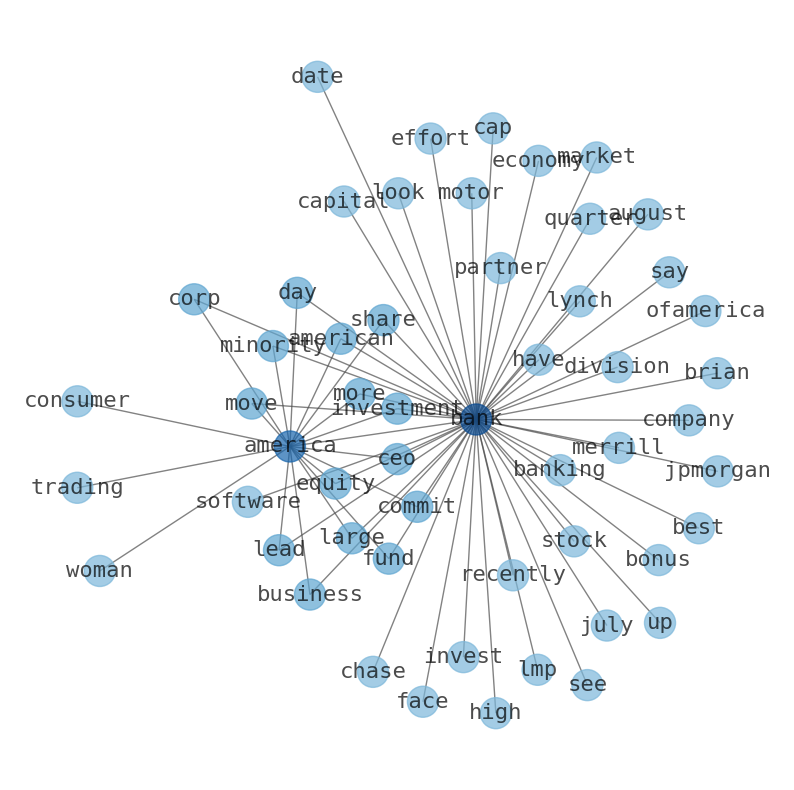

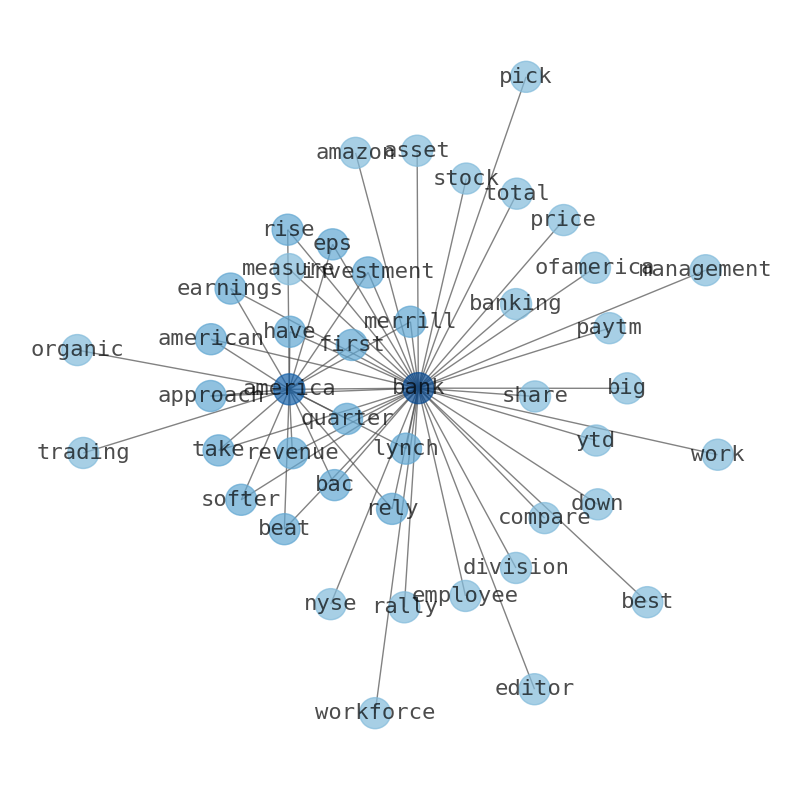

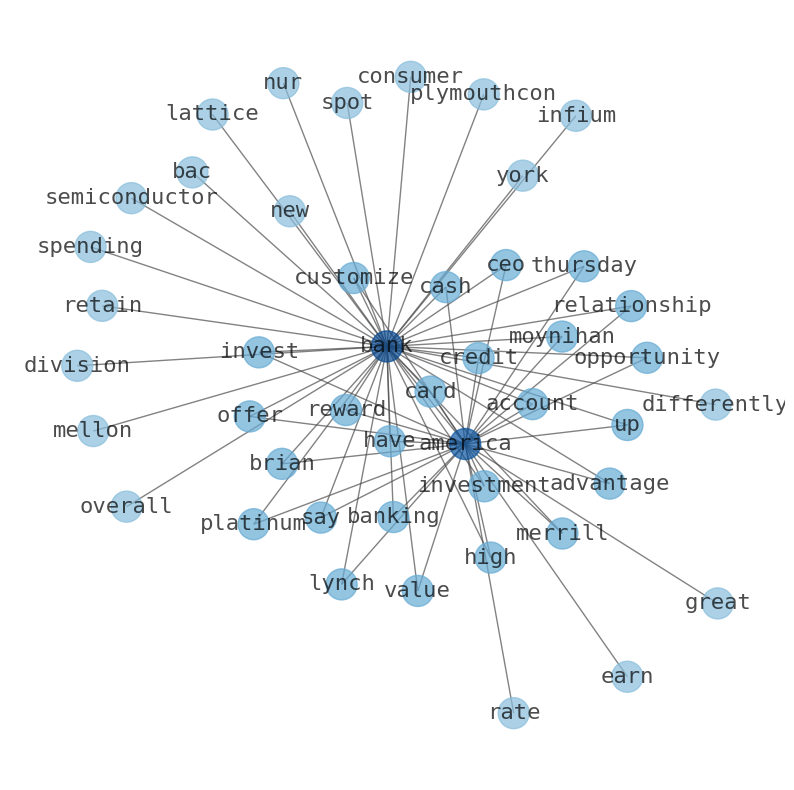

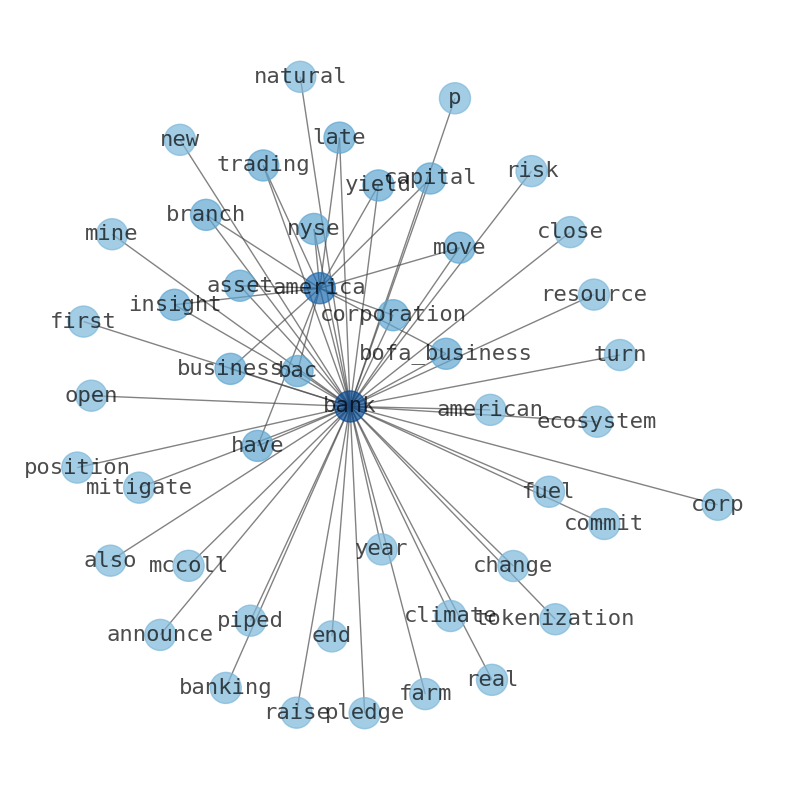

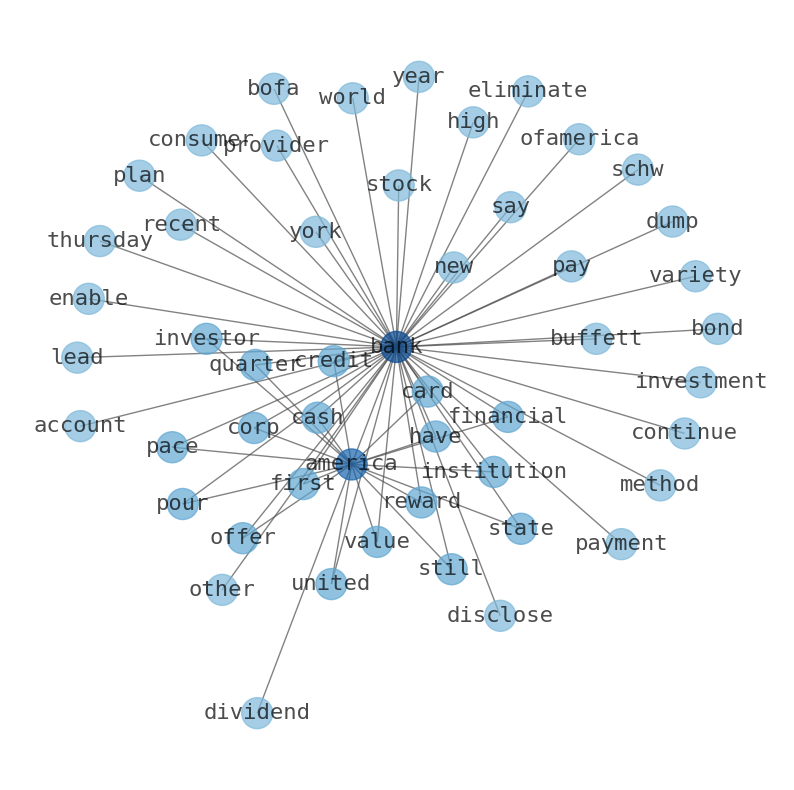

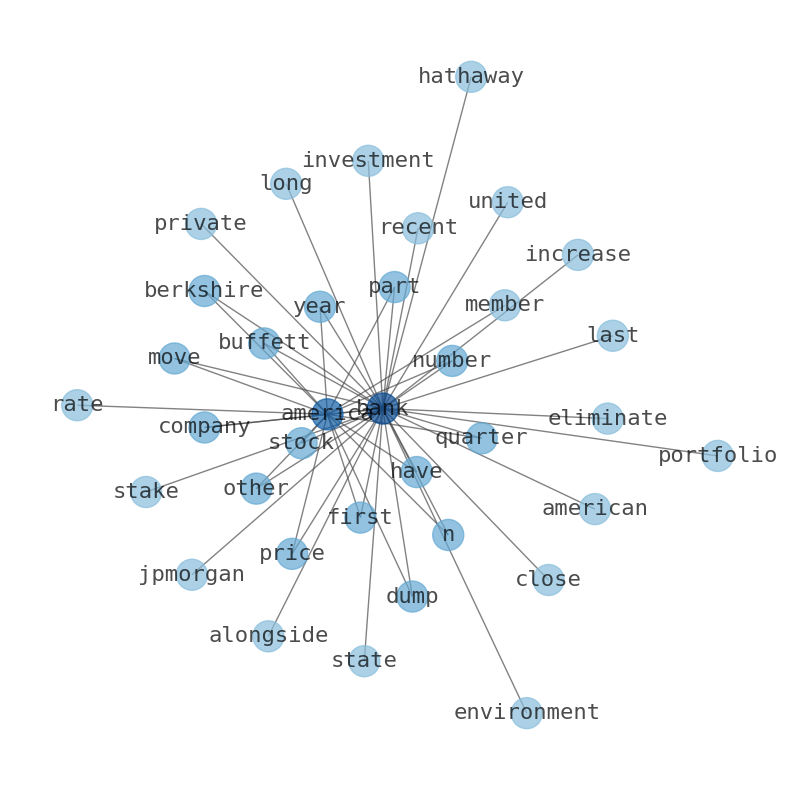

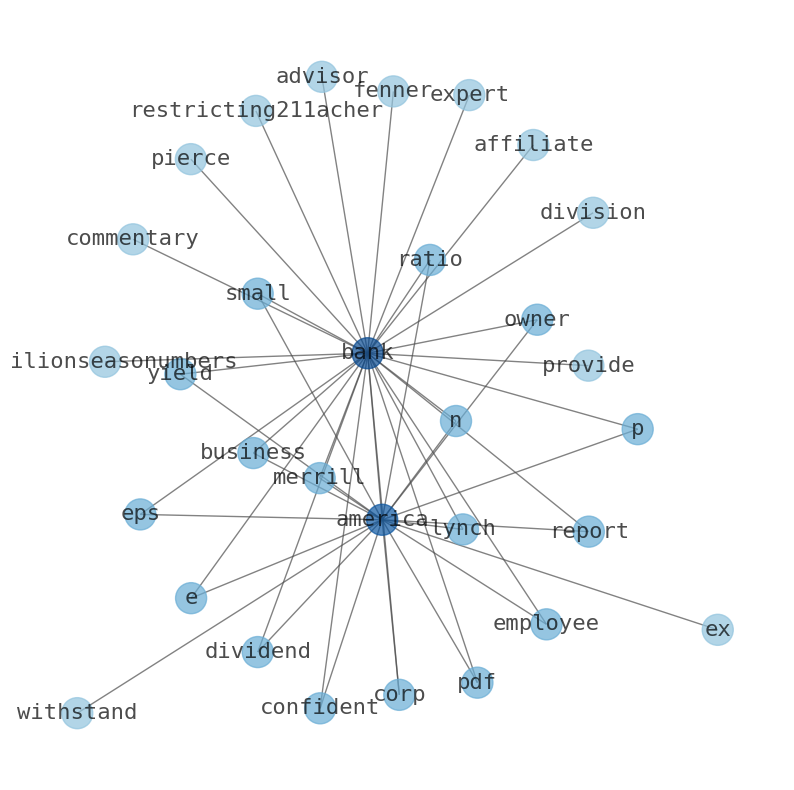

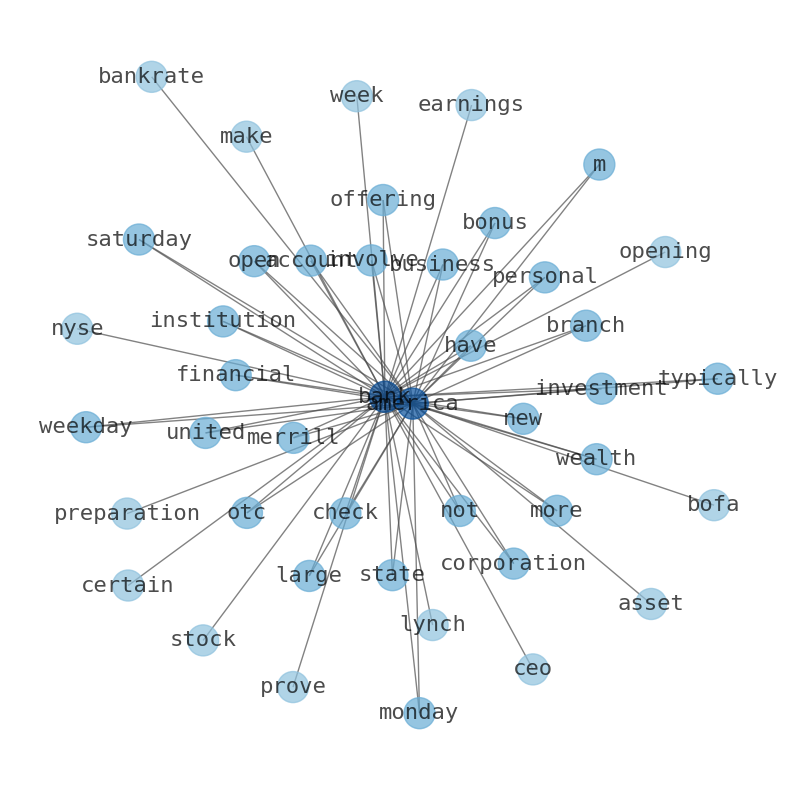

Keywords

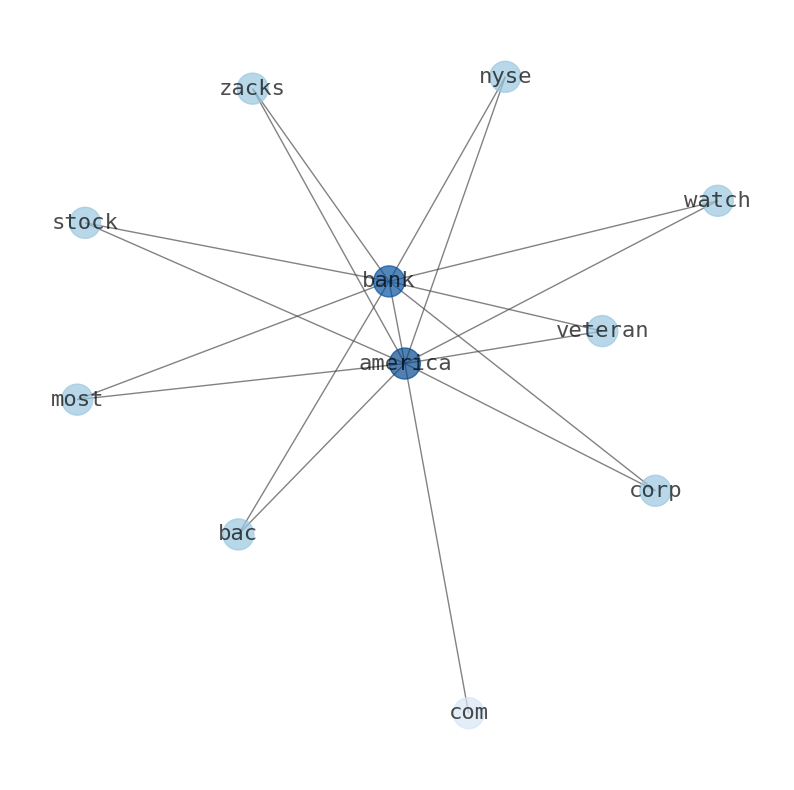

This document will help you to evaluate Bank of America without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Bank of America are: Bank, America, SP, stock, picker, paradise, see, and the most common words in the summary are: bank, market, banking, account, business, credit, best, . One of the sentences in the summary was: Head of US equity strategy Savita Subramanian is urging investors not to worry so much.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #bank #market #banking #account #business #credit #best.

Read more →Related Results

Bank of America

Open: 35.28 Close: 35.41 Change: 0.13

Read more →

Bank of America

Open: 33.73 Close: 33.92 Change: 0.19

Read more →

Bank of America

Open: 33.36 Close: 33.7 Change: 0.34

Read more →

Bank of America

Open: 33.32 Close: 34.07 Change: 0.75

Read more →

Bank of America

Open: 33.1 Close: 33.07 Change: -0.03

Read more →

Bank of America

Open: 33.4 Close: 33.43 Change: 0.03

Read more →

Bank of America

Open: 31.8 Close: 32.22 Change: 0.42

Read more →

Bank of America

Open: 33.8 Close: 34.43 Change: 0.63

Read more →

Bank of America

Open: 33.39 Close: 33.9 Change: 0.51

Read more →

Bank of America

Open: 33.94 Close: 33.67 Change: -0.27

Read more →

Bank of America

Open: 33.94 Close: 33.67 Change: -0.27

Read more →

Bank of America

Open: 33.71 Close: 33.43 Change: -0.28

Read more →

Bank of America

Open: 29.48 Close: 29.73 Change: 0.25

Read more →

Bank of America

Open: 29.74 Close: 29.63 Change: -0.11

Read more →

Bank of America

Open: 29.99 Close: 29.66 Change: -0.33

Read more →

Bank of America

Open: 28.5 Close: 29.22 Change: 0.72

Read more →

Bank of America

Open: 28.56 Close: 28.33 Change: -0.23

Read more →

Bank of America

Open: 26.13 Close: 25.61 Change: -0.52

Read more →

Bank of America

Open: 26.8 Close: 26.31 Change: -0.49

Read more →

Bank of America

Open: 27.43 Close: 26.76 Change: -0.67

Read more →

Bank of America

Open: 27.43 Close: 26.68 Change: -0.75

Read more →

Bank of America

Open: 25.78 Close: 25.92 Change: 0.14

Read more →

Bank of America

Open: 27.23 Close: 27.43 Change: 0.2

Read more →

Bank of America

Open: 27.5 Close: 27.6 Change: 0.1

Read more →

Bank of America

Open: 28.07 Close: 27.64 Change: -0.43

Read more →

Bank of America

Open: 28.95 Close: 28.84 Change: -0.11

Read more →

Bank of America

Open: 29.12 Close: 28.88 Change: -0.24

Read more →

Bank of America

Open: 28.41 Close: 28.13 Change: -0.28

Read more →

Bank of America

Open: 28.76 Close: 28.98 Change: 0.22

Read more →

Bank of America

Open: 29.22 Close: 29.04 Change: -0.18

Read more →

Bank of America

Open: 28.64 Close: 28.5 Change: -0.14

Read more →

Bank of America

Open: 29.22 Close: 29.15 Change: -0.07

Read more →

Bank of America

Open: 31.22 Close: 30.86 Change: -0.36

Read more →

Bank of America

Open: 31.87 Close: 31.98 Change: 0.11

Read more →

Bank of America

Open: 28.59 Close: 28.66 Change: 0.07

Read more →

Bank of America

Open: 28.8 Close: 28.28 Change: -0.52

Read more →

Bank of America

Open: 29.14 Close: 29.08 Change: -0.06

Read more →

Bank of America

Open: 28.5 Close: 28.66 Change: 0.16

Read more →

Bank of America

Open: 27.74 Close: 27.75 Change: 0.01

Read more →

Bank of America

Open: 29.53 Close: 29.19 Change: -0.34

Read more →

Bank of America

Open: 29.57 Close: 29.12 Change: -0.45

Read more →

Bank of America

Open: 28.82 Close: 28.67 Change: -0.15

Read more →

Bank of America

Open: 28.32 Close: 28.26 Change: -0.06

Read more →

Bank of America

Open: 27.99 Close: 28.17 Change: 0.18

Read more →

Bank of America

Open: 28.46 Close: 28.11 Change: -0.35

Read more →

Bank of America

Open: 27.52 Close: 26.93 Change: -0.59

Read more →

Bank of America

Open: 28.16 Close: 27.86 Change: -0.3

Read more →

Bank of America

Open: 29.75 Close: 29.87 Change: 0.12

Read more →

Bank of America

Open: 35.87 Close: 35.6 Change: -0.27

Read more →

Bank of America

Open: 33.37 Close: 33.61 Change: 0.24

Read more →

Bank of America

Open: 33.92 Close: 34.09 Change: 0.17

Read more →

Bank of America

Open: 33.1 Close: 33.07 Change: -0.03

Read more →

Bank of America

Open: 33.06 Close: 33.18 Change: 0.12

Read more →

Bank of America

Open: 33.4 Close: 33.43 Change: 0.03

Read more →

Bank of America

Open: 33.5 Close: 33.33 Change: -0.17

Read more →

Bank of America

Open: 33.39 Close: 33.9 Change: 0.51

Read more →

Bank of America

Open: 33.94 Close: 33.67 Change: -0.27

Read more →

Bank of America

Open: 33.94 Close: 33.67 Change: -0.27

Read more →

Bank of America

Open: 33.03 Close: 33.51 Change: 0.48

Read more →

Bank of America

Open: 30.77 Close: 30.74 Change: -0.03

Read more →

Bank of America

Open: 29.48 Close: 29.73 Change: 0.25

Read more →

Bank of America

Open: 29.74 Close: 29.59 Change: -0.15

Read more →

Bank of America

Open: 29.2 Close: 29.62 Change: 0.42

Read more →

Bank of America

Open: 28.56 Close: 28.33 Change: -0.23

Read more →

Bank of America

Open: 26.07 Close: 25.17 Change: -0.9

Read more →

Bank of America

Open: 26.8 Close: 26.31 Change: -0.49

Read more →

Bank of America

Open: 27.54 Close: 27.31 Change: -0.23

Read more →

Bank of America

Open: 27.43 Close: 26.76 Change: -0.67

Read more →

Bank of America

Open: 27.17 Close: 27.02 Change: -0.15

Read more →

Bank of America

Open: 27.89 Close: 27.38 Change: -0.51

Read more →

Bank of America

Open: 27.23 Close: 27.27 Change: 0.04

Read more →

Bank of America

Open: 28.07 Close: 27.64 Change: -0.43

Read more →

Bank of America

Open: 28.81 Close: 28.55 Change: -0.26

Read more →

Bank of America

Open: 29.12 Close: 28.88 Change: -0.24

Read more →

Bank of America

Open: 28.12 Close: 28.36 Change: 0.24

Read more →

Bank of America

Open: 28.76 Close: 28.98 Change: 0.22

Read more →

Bank of America

Open: 28.76 Close: 28.98 Change: 0.22

Read more →

Bank of America

Open: 28.64 Close: 28.5 Change: -0.14

Read more →

Bank of America

Open: 28.45 Close: 28.45 Change: 0.0

Read more →

Bank of America

Open: 30.5 Close: 29.94 Change: -0.56

Read more →

Bank of America

Open: 32.15 Close: 31.9 Change: -0.25

Read more →

Bank of America

Open: 31.33 Close: 31.69 Change: 0.36

Read more →

Bank of America

Open: 28.8 Close: 28.28 Change: -0.52

Read more →

Bank of America

Open: 28.8 Close: 28.28 Change: -0.52

Read more →

Bank of America

Open: 28.94 Close: 28.69 Change: -0.25

Read more →

Bank of America

Open: 28.5 Close: 28.7 Change: 0.2

Read more →

Bank of America

Open: 29.53 Close: 29.19 Change: -0.34

Read more →

Bank of America

Open: 28.9 Close: 29.18 Change: 0.28

Read more →

Bank of America

Open: 29.3 Close: 29.5 Change: 0.2

Read more →

Bank of America

Open: 28.16 Close: 28.71 Change: 0.55

Read more →

Bank of America

Open: 28.2 Close: 28.31 Change: 0.11

Read more →

Bank of America

Open: 28.46 Close: 28.11 Change: -0.35

Read more →

Bank of America

Open: 27.78 Close: 27.36 Change: -0.42

Read more →

Bank of America

Open: 28.16 Close: 27.86 Change: -0.3

Read more →

Bank of America

Open: 28.76 Close: 28.44 Change: -0.32

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo