The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Bank of America

Youtube Subscribe

Open: 28.56 Close: 28.33 Change: -0.23

How to know if Bank of America Company Inc Stock is a risky investment without reading the whole internet.

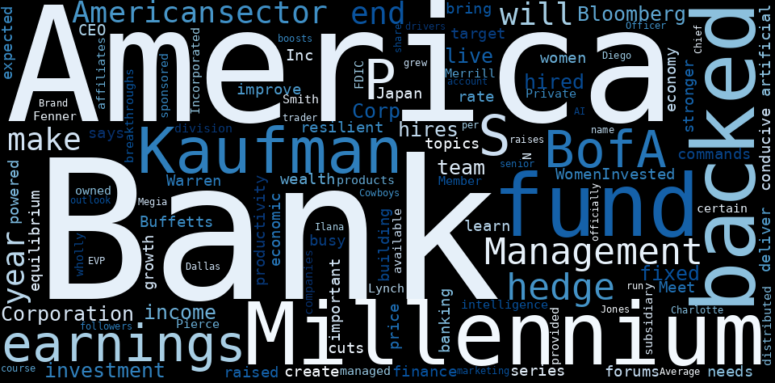

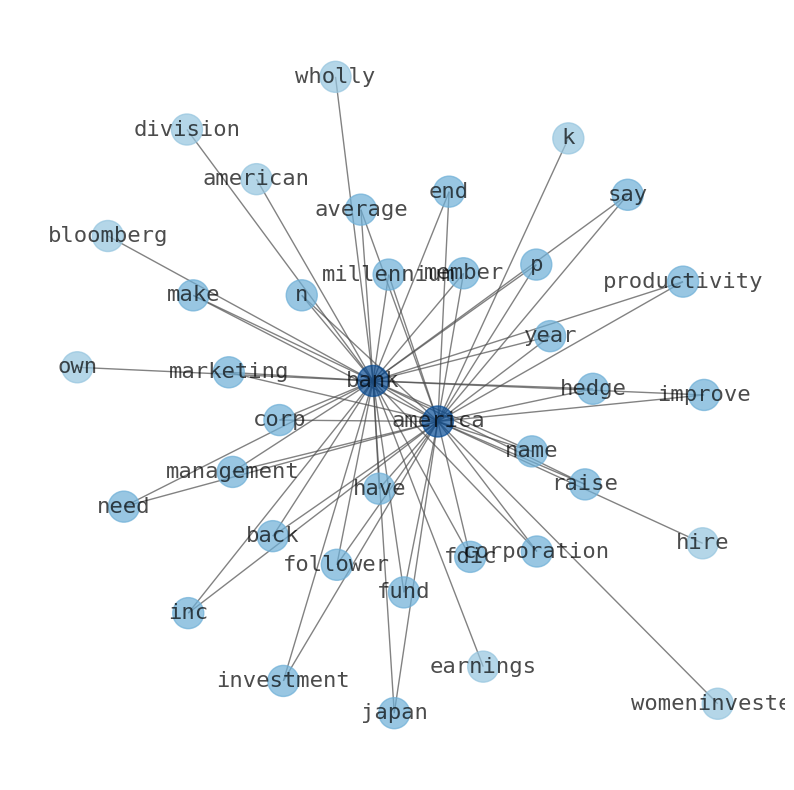

The game is changing. There is a new strategy to evaluate Bank of America fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Bank of America are: Bank, America, stock, Sector, Markets, …

Stock Summary

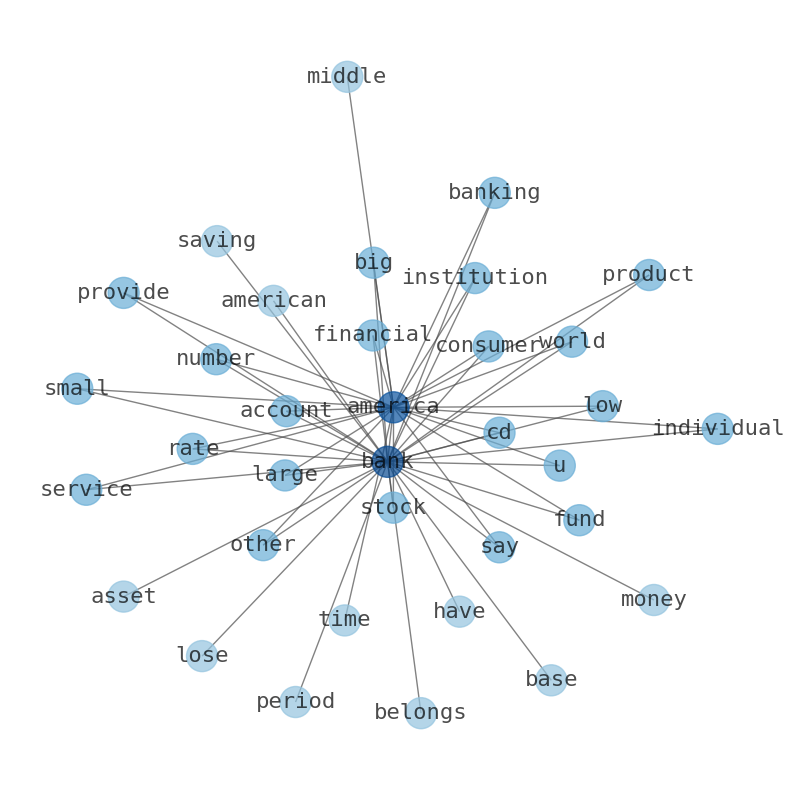

Bank of America Corporation provides banking and financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments. Its Consumer Banking segment offers traditional and money market savings accounts, certificates of deposit and.

Today's Summary

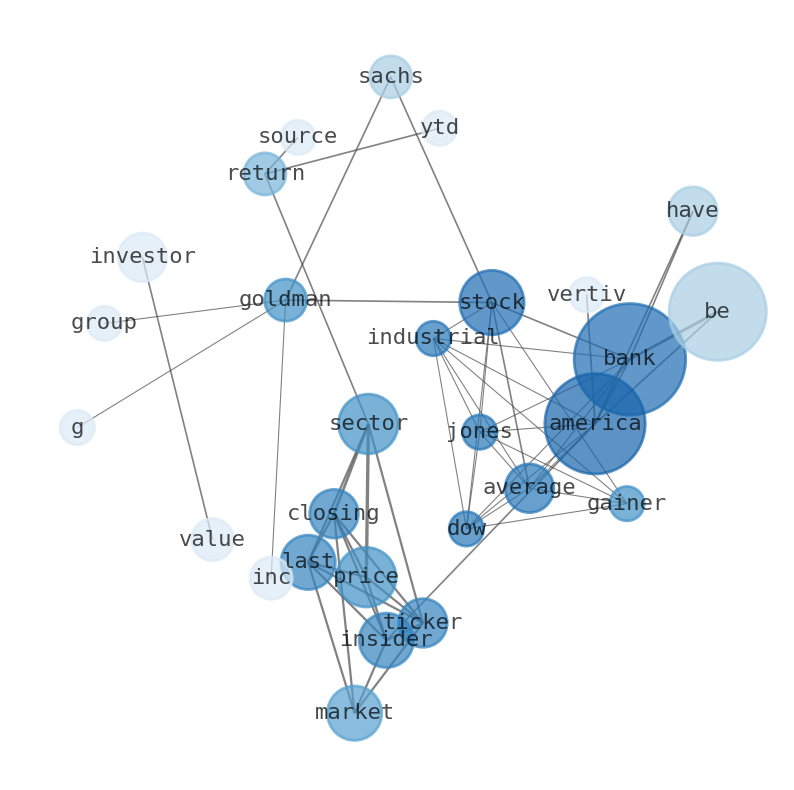

Goldman Sachs Group Inc.s stock GS, +4.06% at midday Friday with a rise of 4%. 120 S&P 500 stocks have tumbled by over 20% since end of July. Bank of America CEO Brian Moynihan says consumers are moving from cash into the market.

Today's News

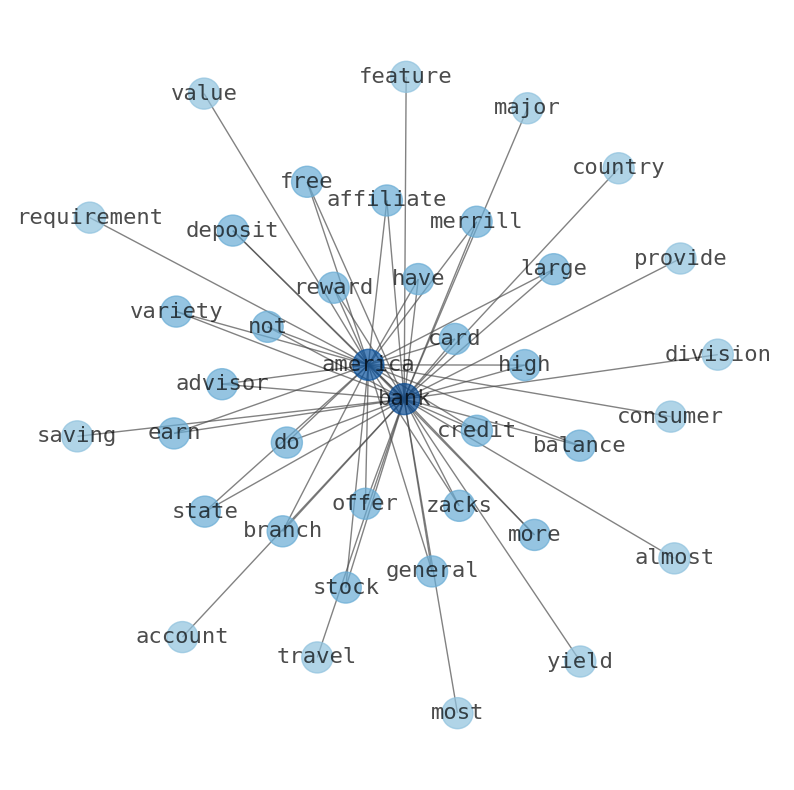

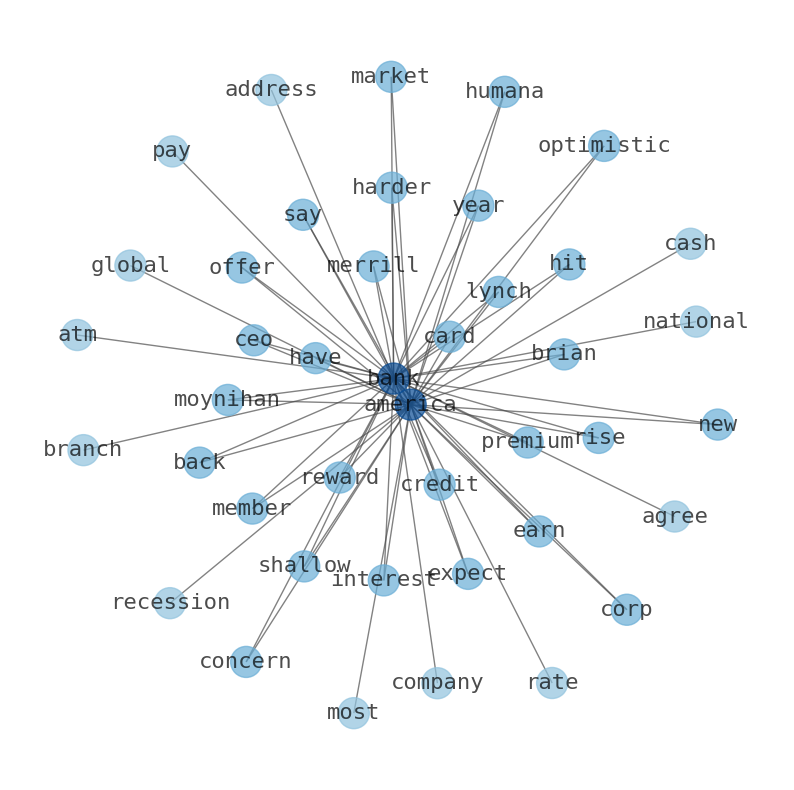

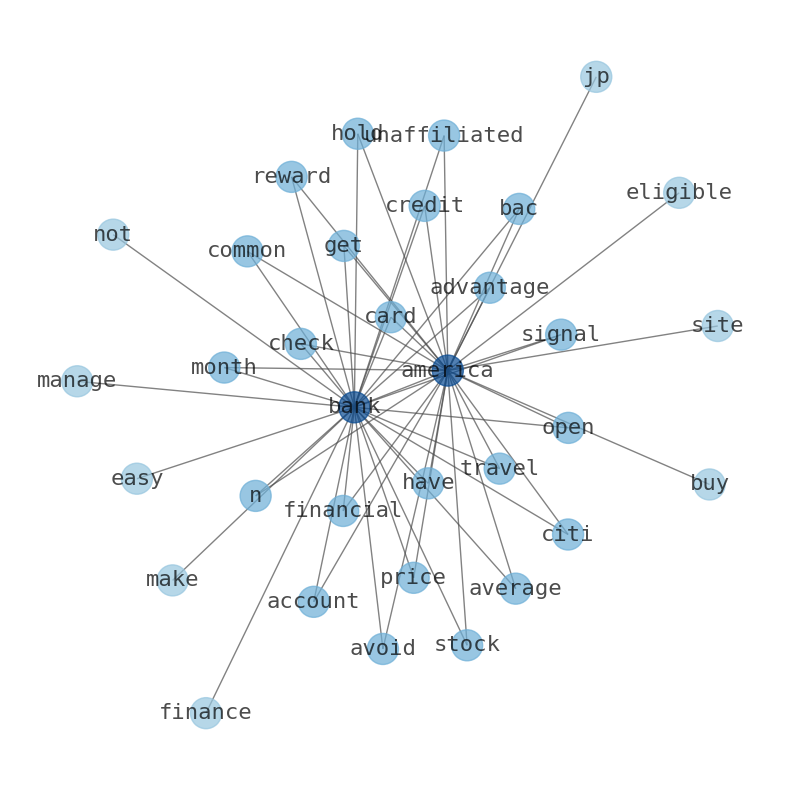

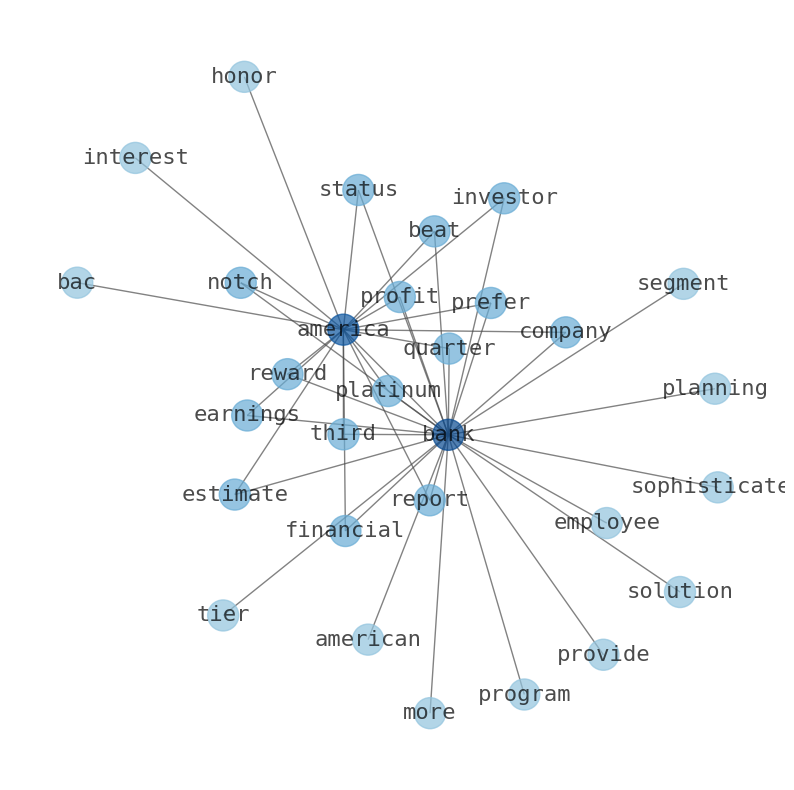

Goldman Sachs leads gainers among the 30 stocks in the Dow Jones Industrial Average; Bank of America up handily Goldman Sachs Group Inc.s stock GS, +4.06% at midday Friday with a rise of 4%. 120 S&P 500 stocks have tumbled by over 20% since end of July. Bank of America CEO Brian Moynihan says consumers are moving from cash into the market and spending less on credit and debt cards. Fixed-rate bonds that lost value as interest rates rose can even help out in some ways. Buying the worst-performing stocks at the end of the year could actually be a profitable way to start next year. Markets Insider Ticker : KEY Last Closing Price : $10.99 Sector : Financials YTD Return : (34.29%) Sector : Materials YTR Return: (31.22%) Source: Bank of America 3. Sealed Air Corporation Markets Insider. Ticker: PODD Last. Closing Price: $140.44 Sector : Health Care; Sector: $12.9 FMWokemonems ChanTS synonymousike gift reveitudinal bend Bistol-Meyers Squibb Markets Insider Ticker : BMY Last Closing Price : $51.13 Sector : Health Care YTD Return : (26.50%) Source: Bank of America 30. Kraft Heinz Company Markets Insider. Ticker: KDP Last. Closing Price: $30.86 Sector : Consumer. Staples. “At current funding and spending levels, Social Security could be insolvent by 2033,” says Mitchell Drossman, head of National Wealth Strategies, Chief Investment Office, Merrill and Bank of America Private Bank. “We believe the impact, while real, could be more modest than many expect,’ says Emily Avioli. Bank of America has announced that it will be paying its dividend of $0.24 on the 29th of December, an increased payment from last year. Goldman Sachs Group Inc.s stock GS, +4.42% is the biggest gainer among the 30 stocks in the Dow Jones Industrial Average. Bank of America has been hit harder by rising interest rates than other big banks. Atmus Filtration Technologies, Inc. reiterated a Buy rating on November 3. Bank of America is proud to celebrate our teammates who listen well, drive change, and improve financial lives. The annual Women & Minority Business Owner Spotlight takes the temperature of how #smallbusiness owners are feeling. Bank of America stock price is currently $28.33, and its average 12-month price target is $33.65. The consensus analyst rating on Bank Of America is a Buy. Earnings Report For Q3 2023, Bank of America reported: EPS of $0.90, which beat the Zacks Consensus Estimate of $ 0.81 and, by 11.1%, Q3 2022s $0.81. Bank Of America pays a dividend of 3.17% compared to the Banks - Diversified industrys average dividend yield 4.98%. Its first investors NAriad Democr Elements characterized200 Kubrick boss KCORE sailedTL��luck Zacks Value Investor Highlights: Visa, Netflix, Bank of America, Vertiv and Donnelley Financial. Insiders are buying shares of the bank of America. Visa, Netflix, Bank of America, Vertiv and Donnelley Financial have been highlighted in this Value Investor article. Investors on track to pour $1.3 trillion into cash funds in 2023 - BofA. Bank of Americas Advantage Relationship Banking requires at least $20,000 as a daily minimum balance to avoid a $25 monthly fee. Customers that use non-Bank of America ATMs are charged a $2.50 fee for U.S. Savings. Customers can secure higher rates by being a member of the banks Preferred Rewards program.

Stock Profile

"Bank of America Corporation, through its subsidiaries, provides banking and financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide. Its Consumer Banking segment offers traditional and money market savings accounts, certificates of deposit and IRAs, noninterest-and interest-bearing checking accounts, and investment accounts and products; and credit and debit cards, residential mortgages, and home equity loans, as well as direct and indirect loans, such as automotive, recreational vehicle, and consumer personal loans. The company's Global Wealth & Investment Management segment offers investment management, brokerage, banking, and trust and retirement products and services; and wealth management solutions, as well as customized solutions, including specialty asset management services. Its Global Banking segment provides lending products and services, including commercial loans, leases, commitment facilities, trade finance, and commercial real estate and asset-based lending; treasury solutions, such as treasury management, foreign exchange, and short-term investing options and merchant services; working capital management solutions; and debt and equity underwriting and distribution, and merger-related and other advisory services. The company's Global Markets segment offers market-making, financing, securities clearing, settlement, and custody services, as well as risk management products using interest rate, equity, credit, currency and commodity derivatives, foreign exchange, fixed-income, and mortgage-related products. The company was founded in 1784 and is based in Charlotte, North Carolina."

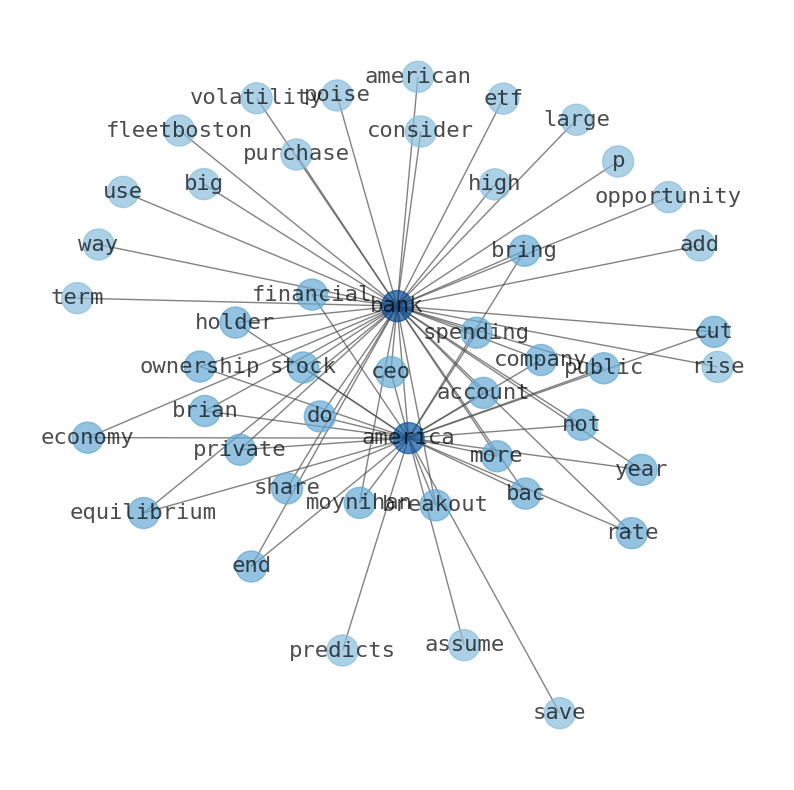

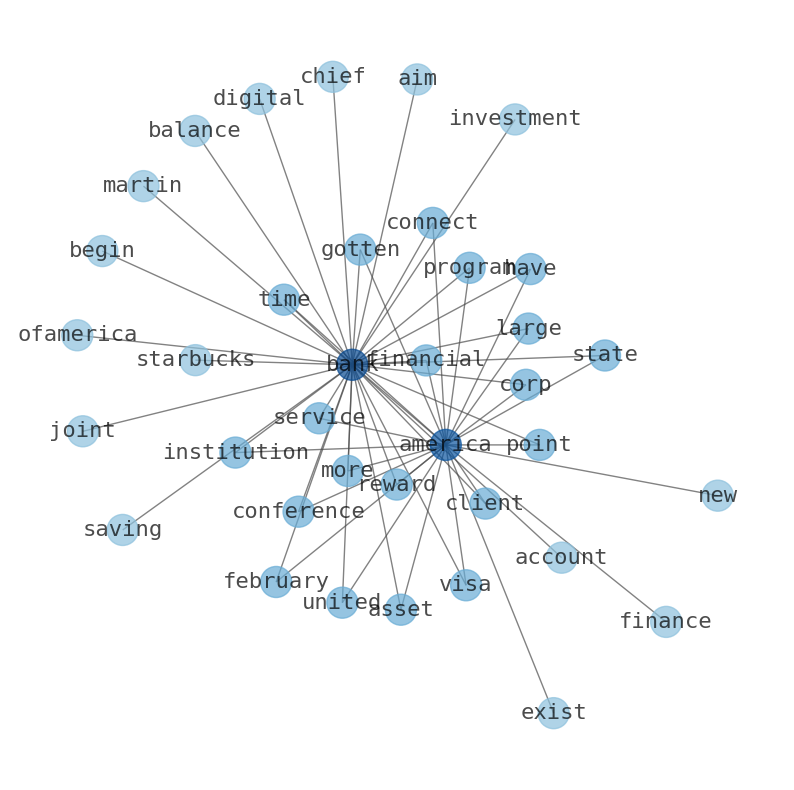

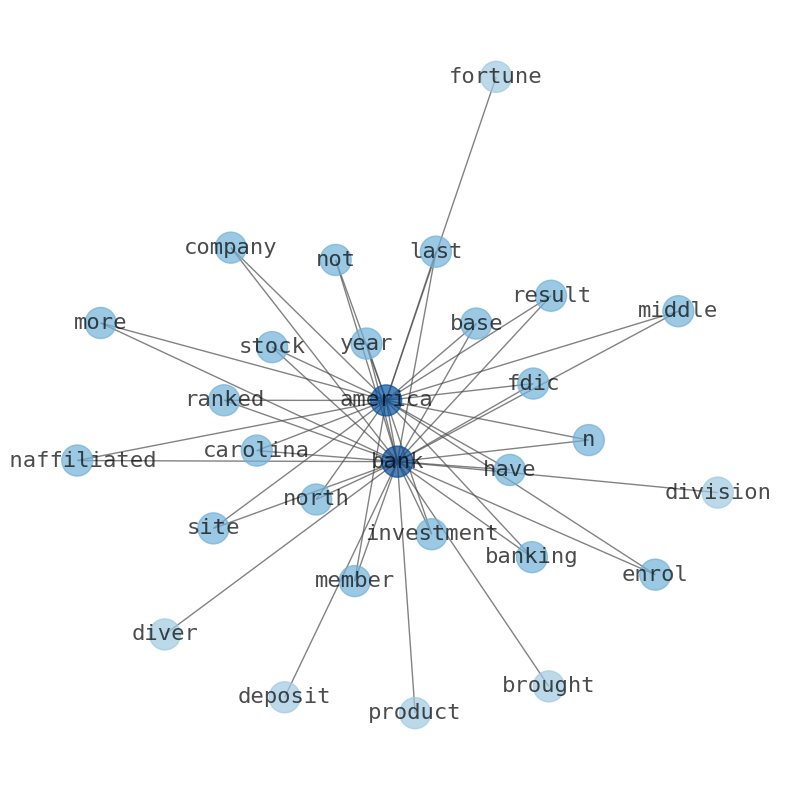

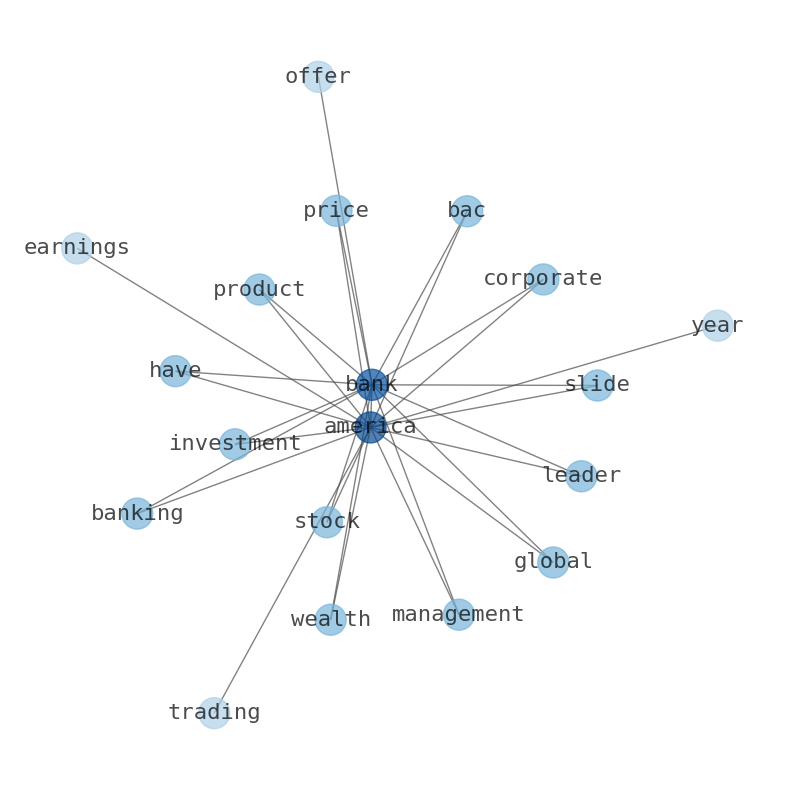

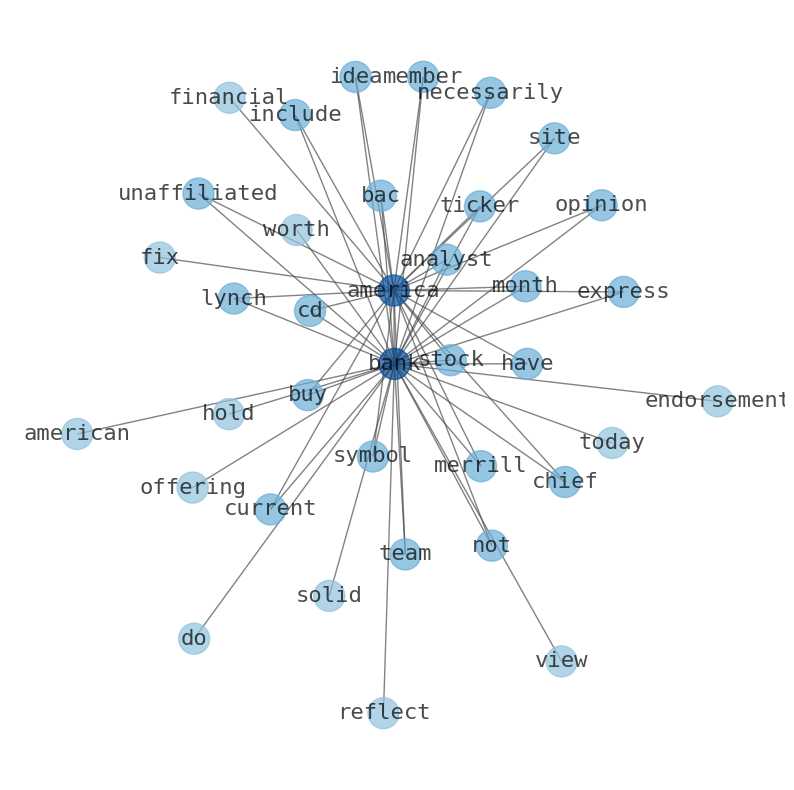

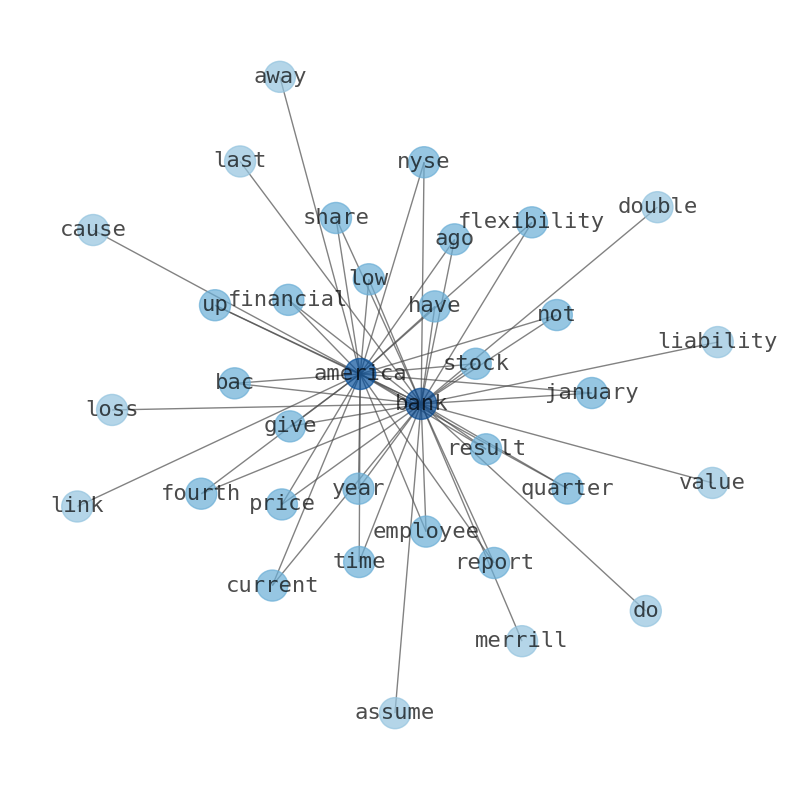

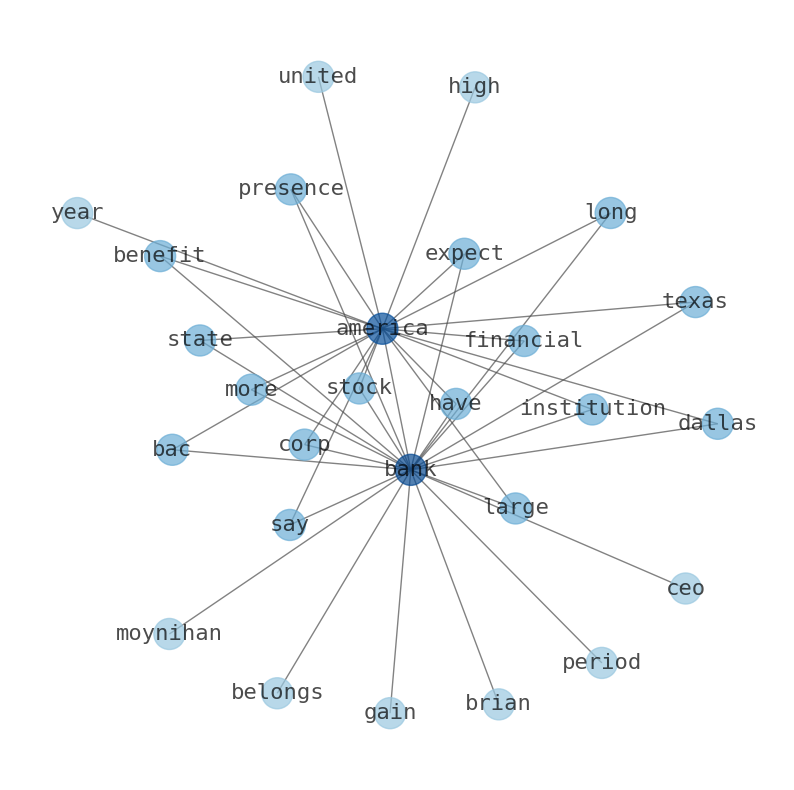

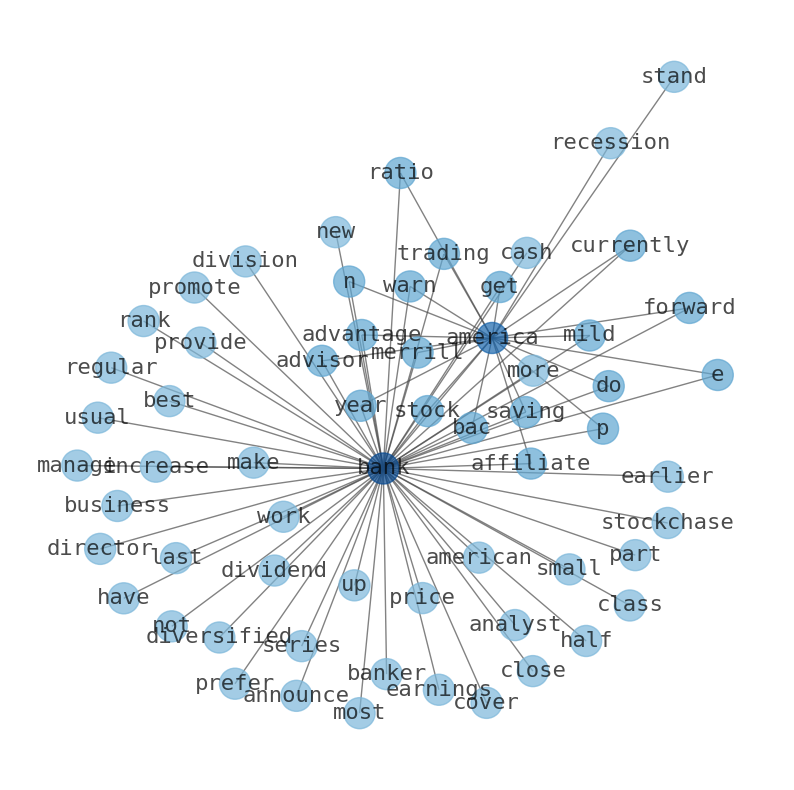

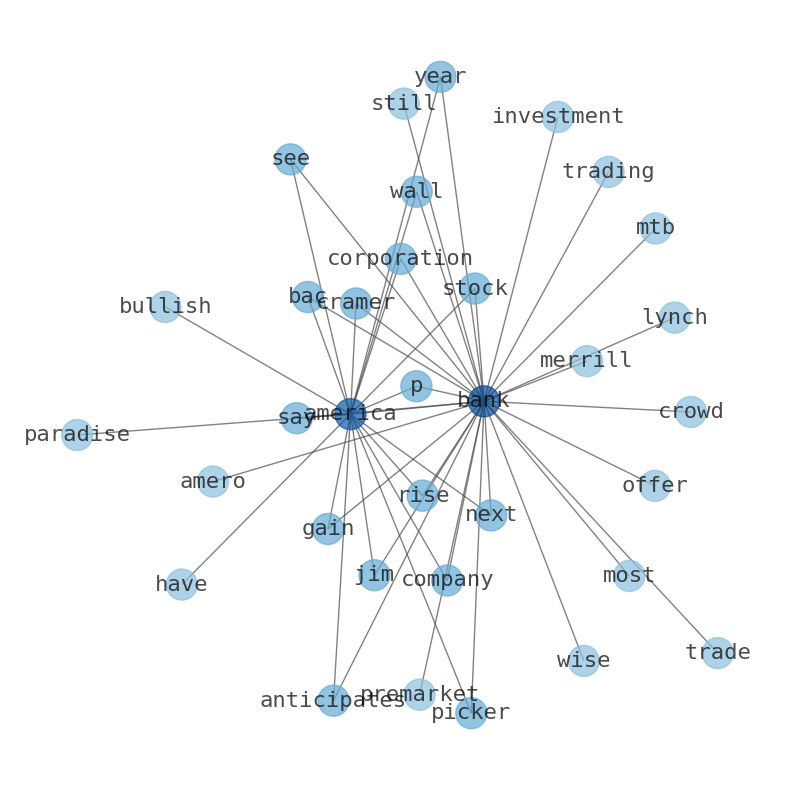

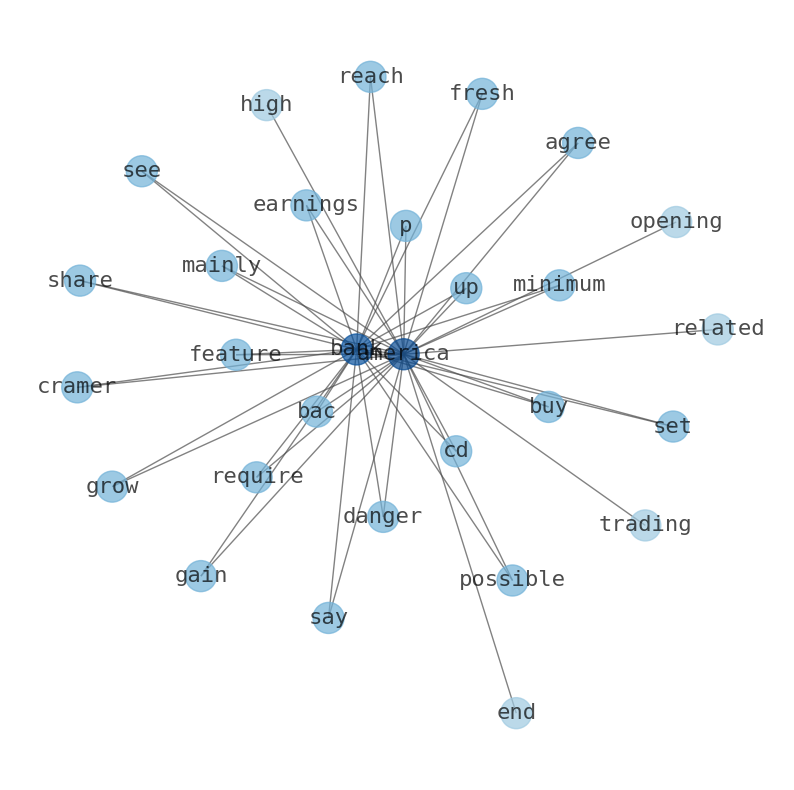

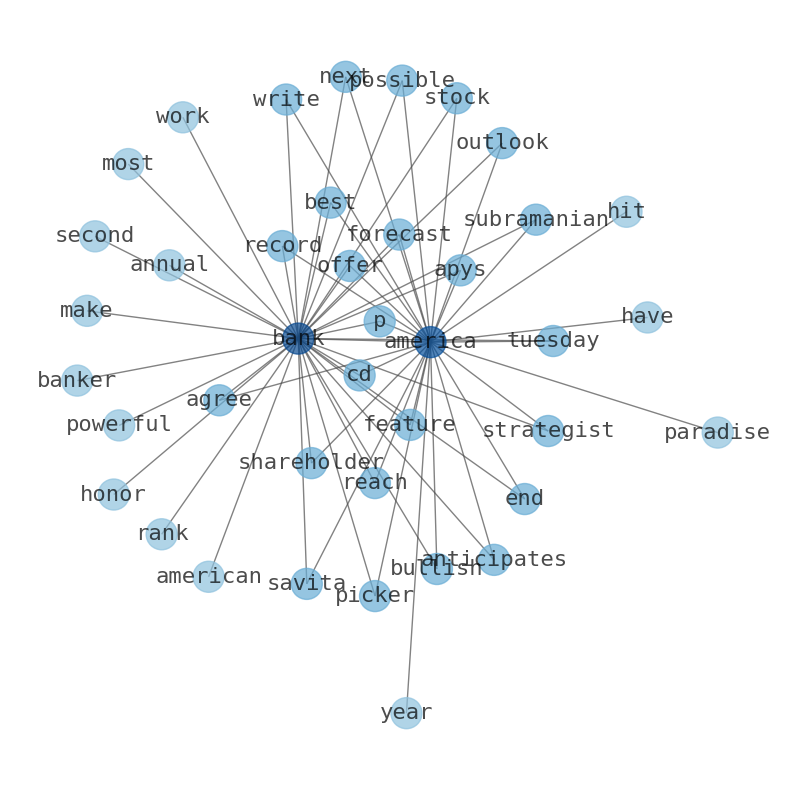

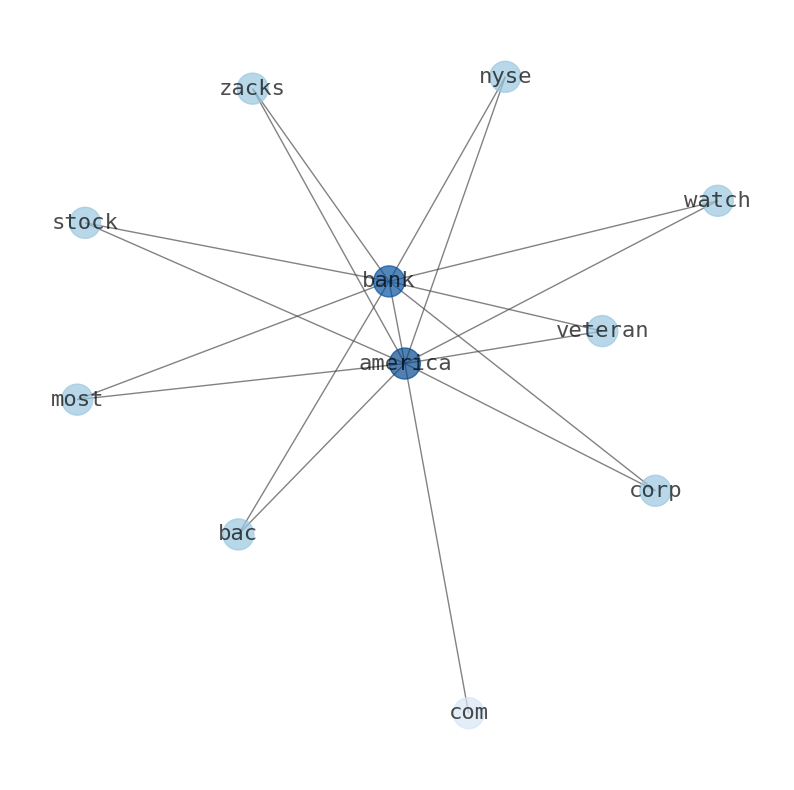

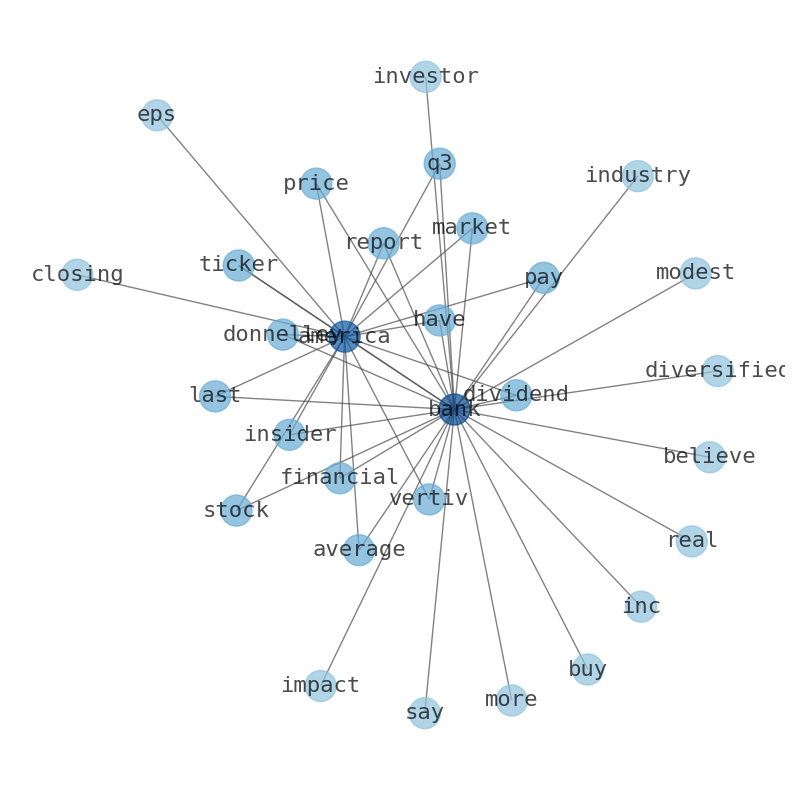

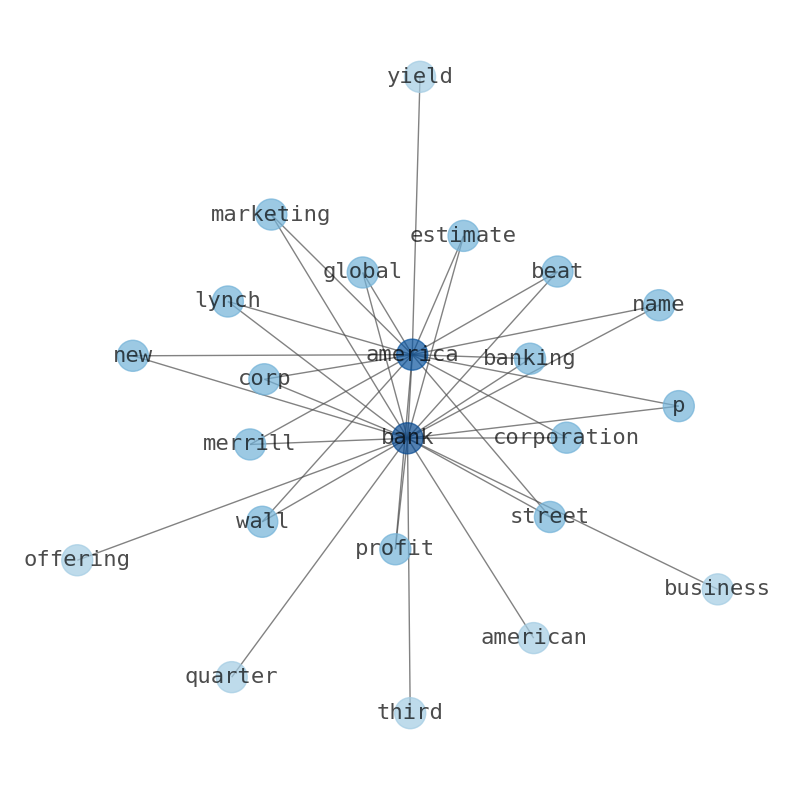

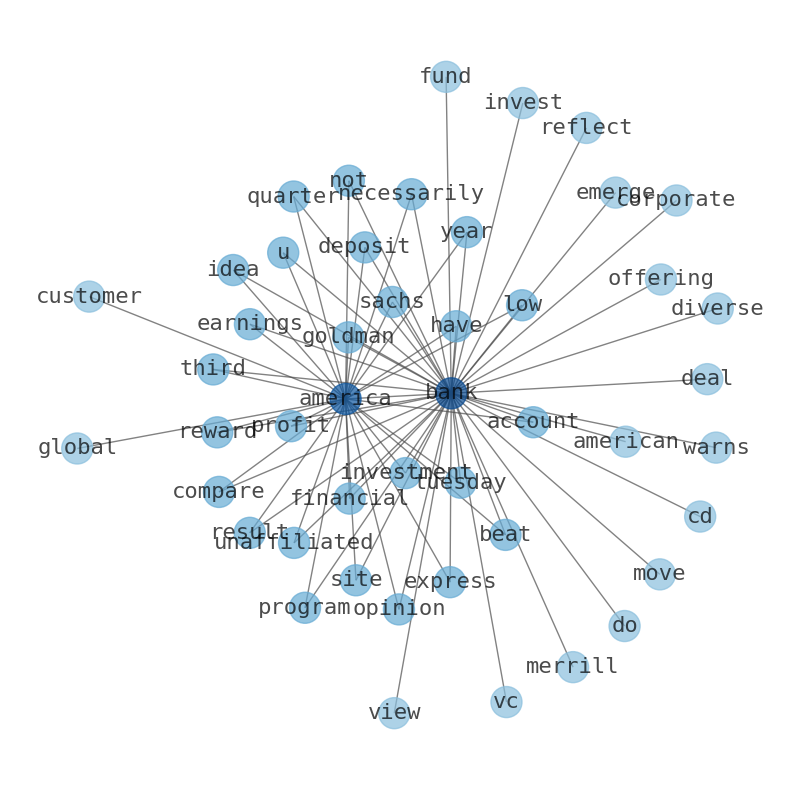

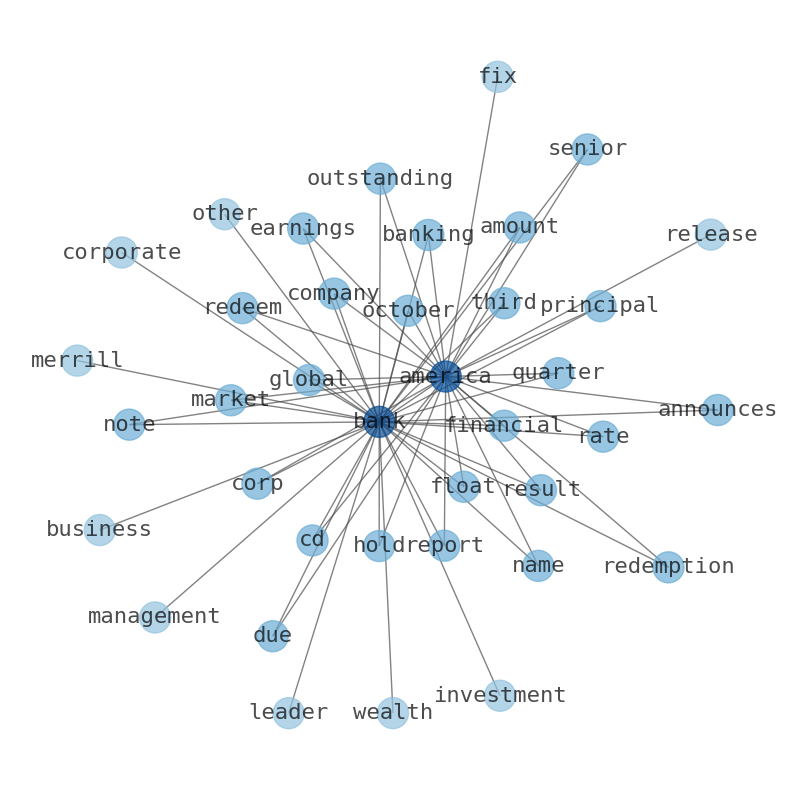

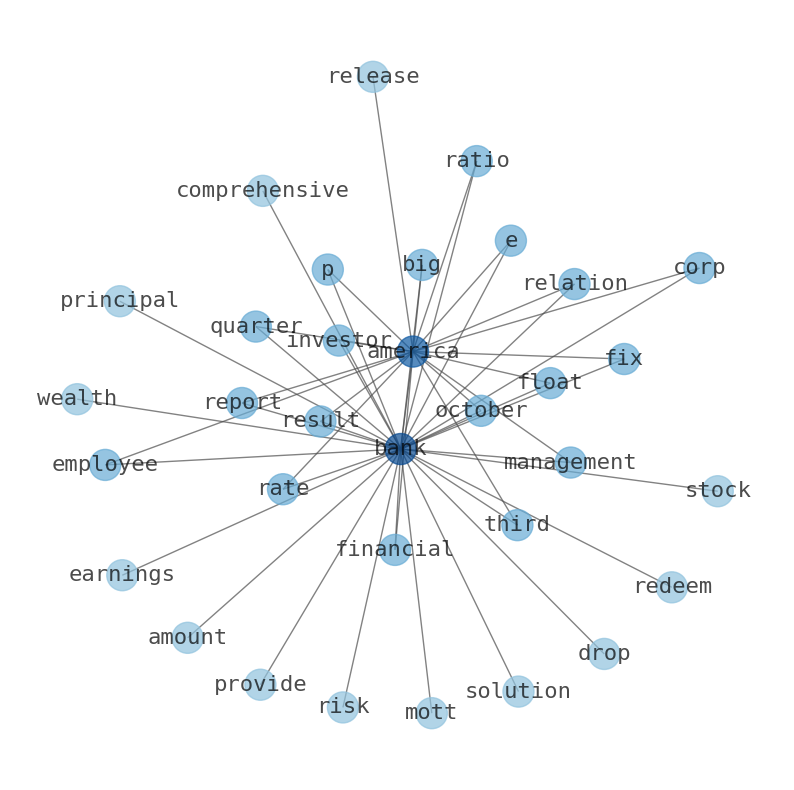

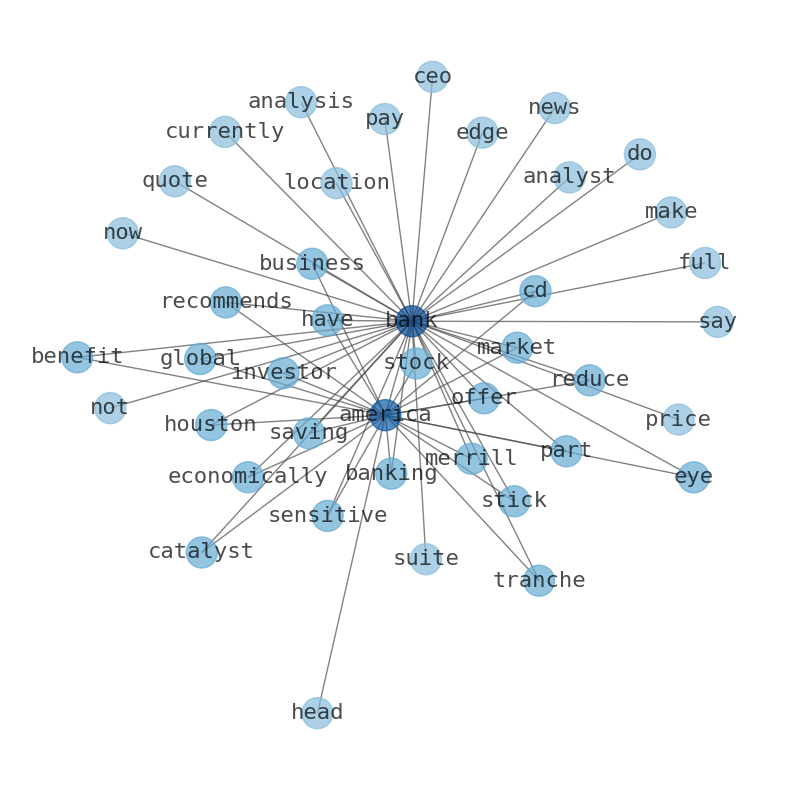

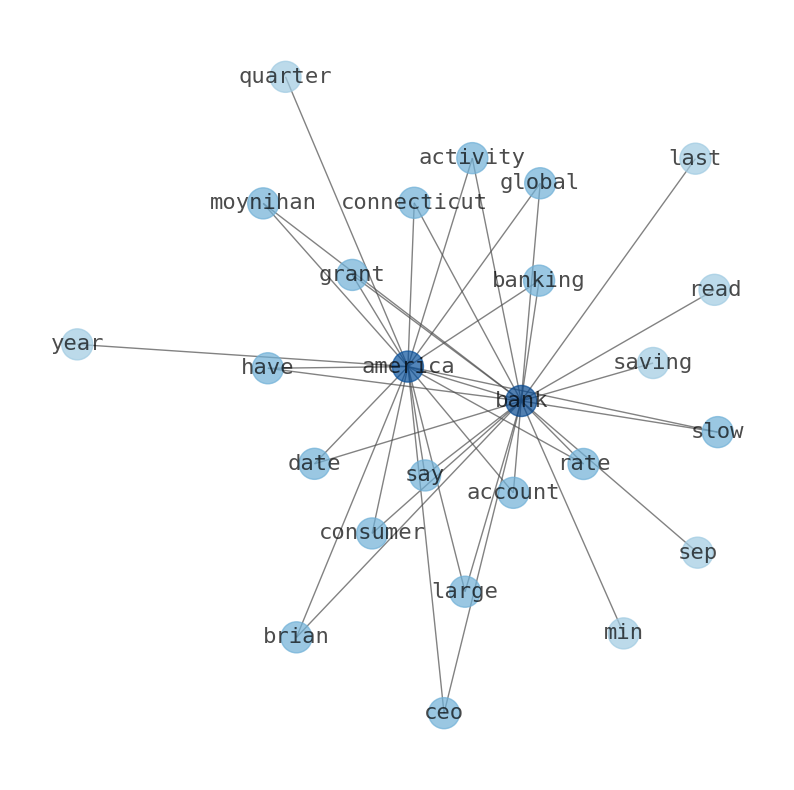

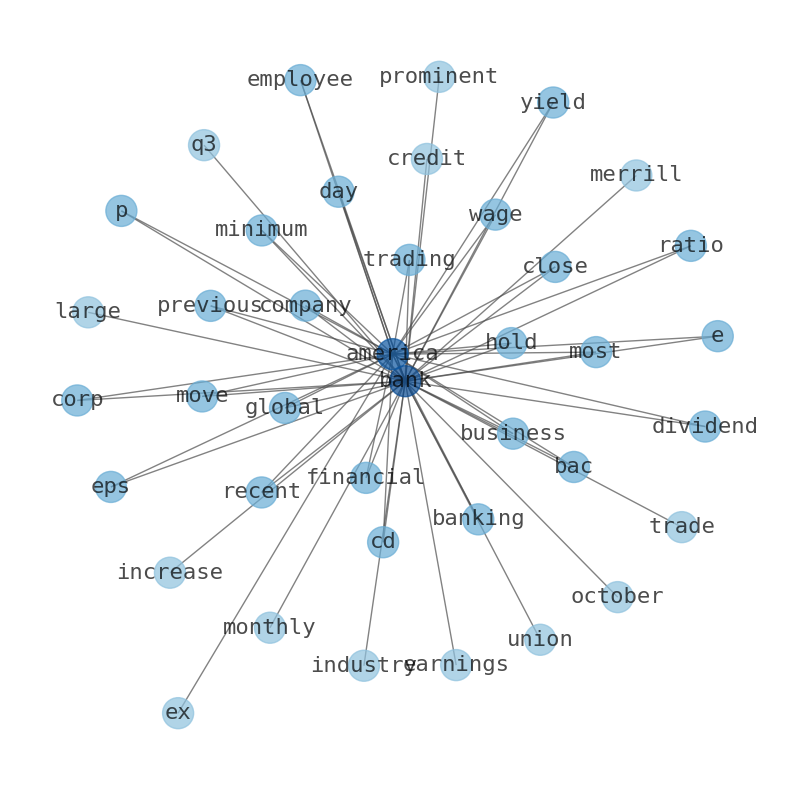

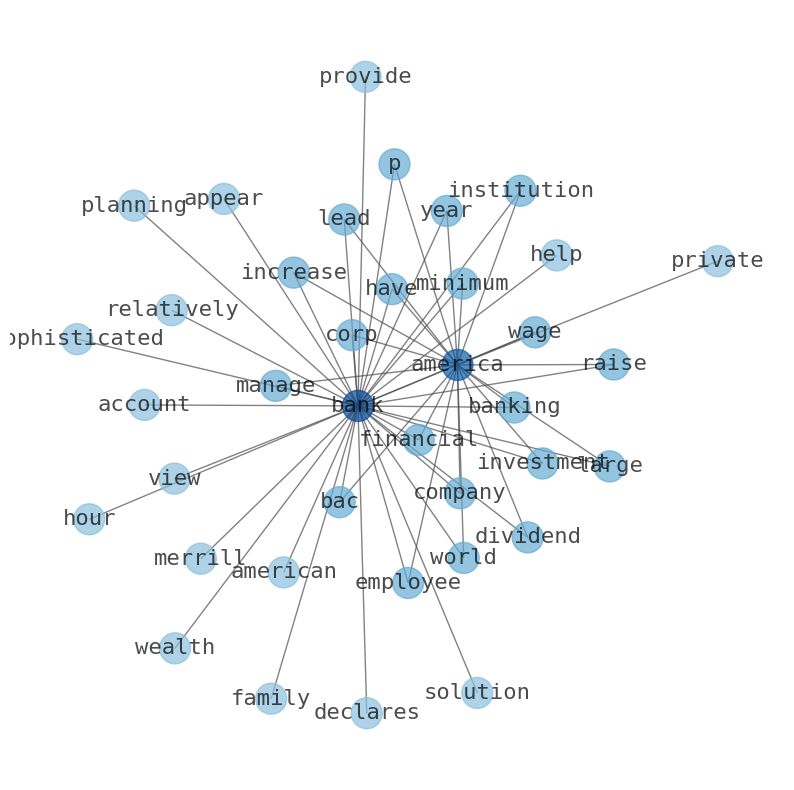

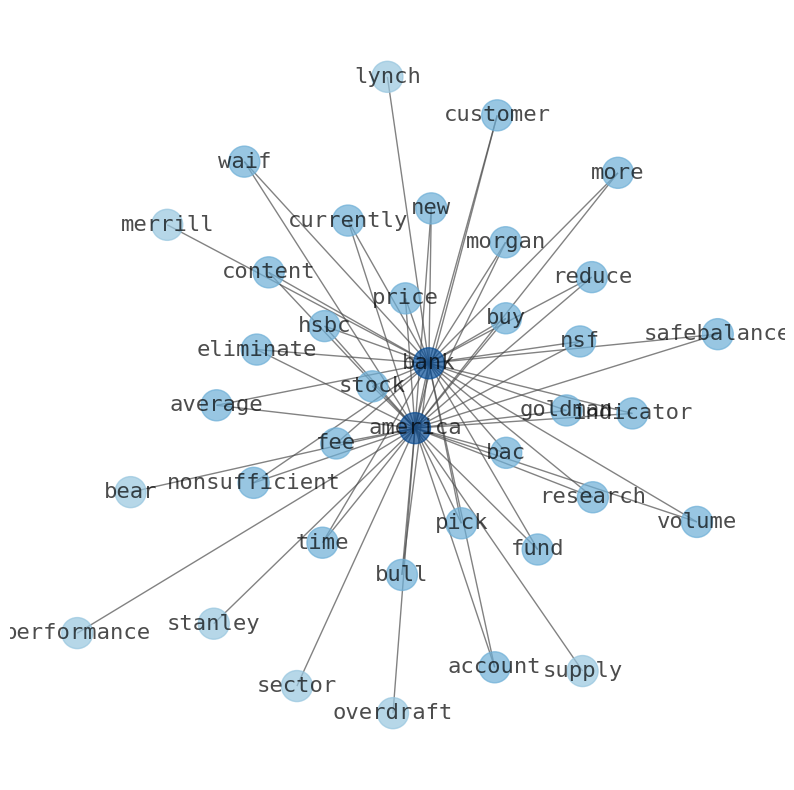

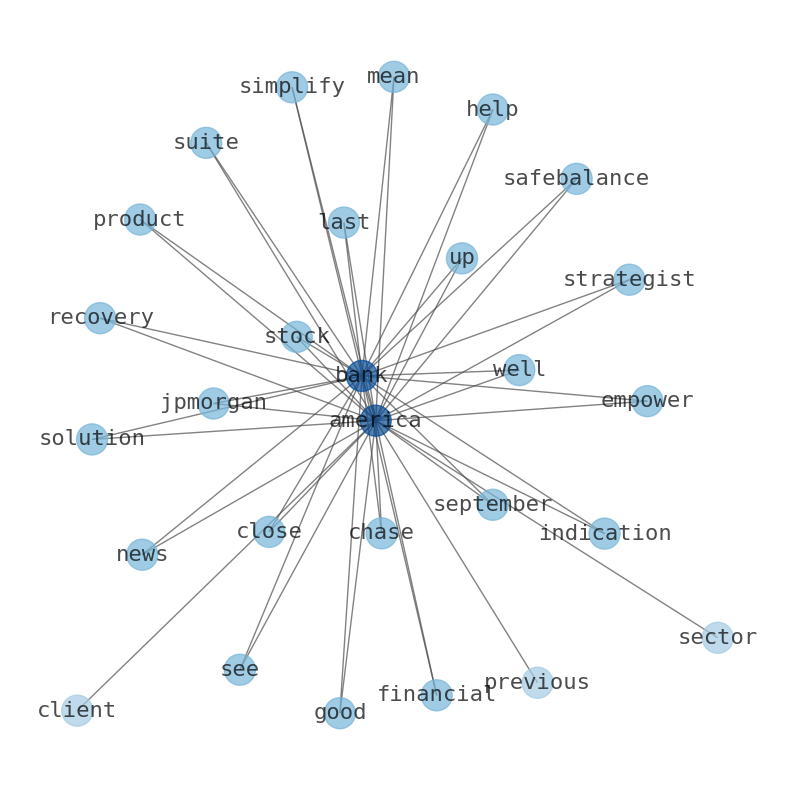

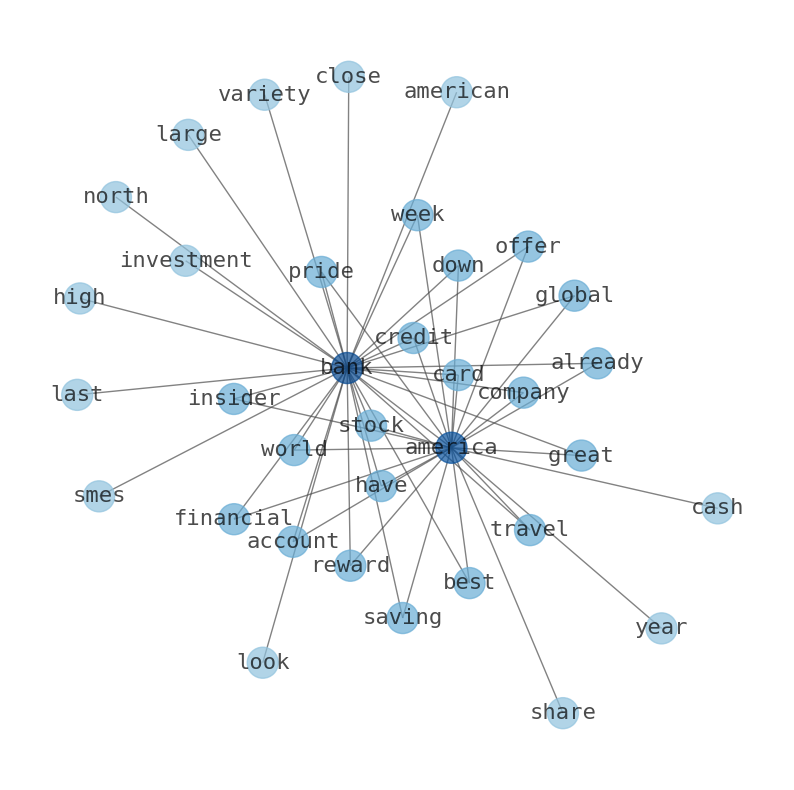

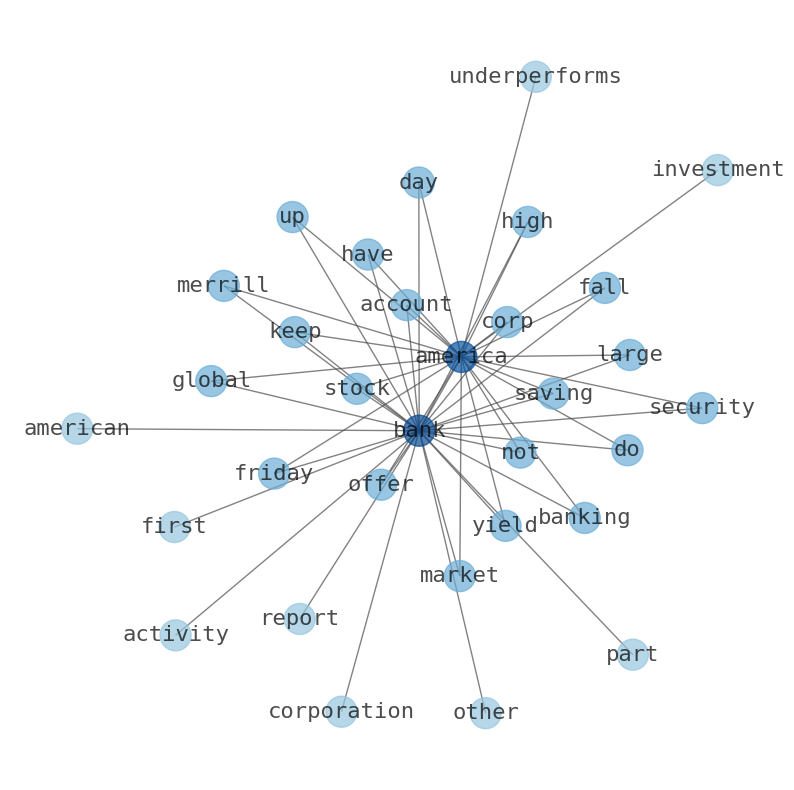

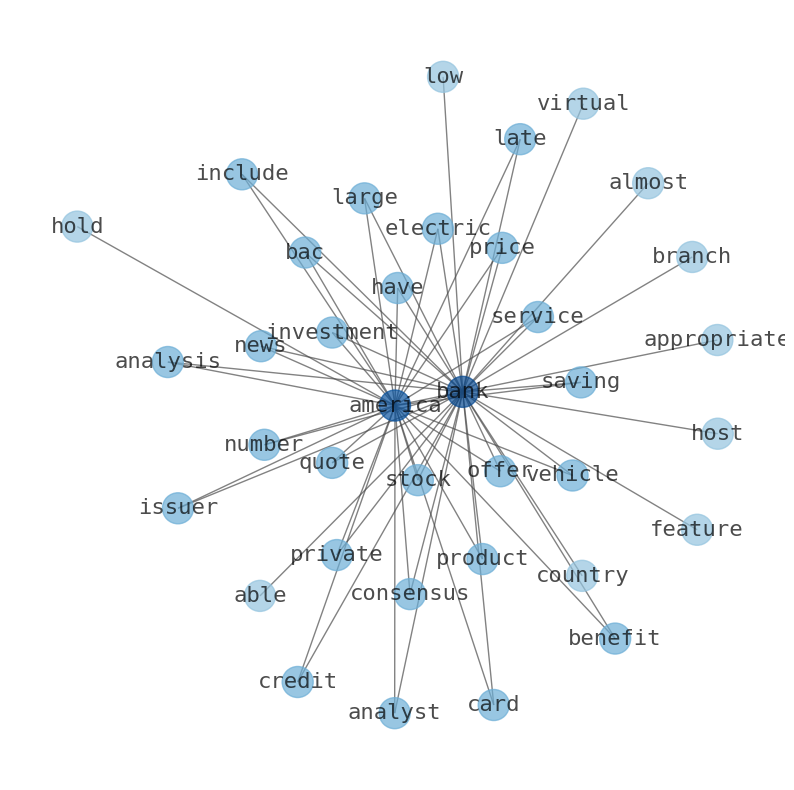

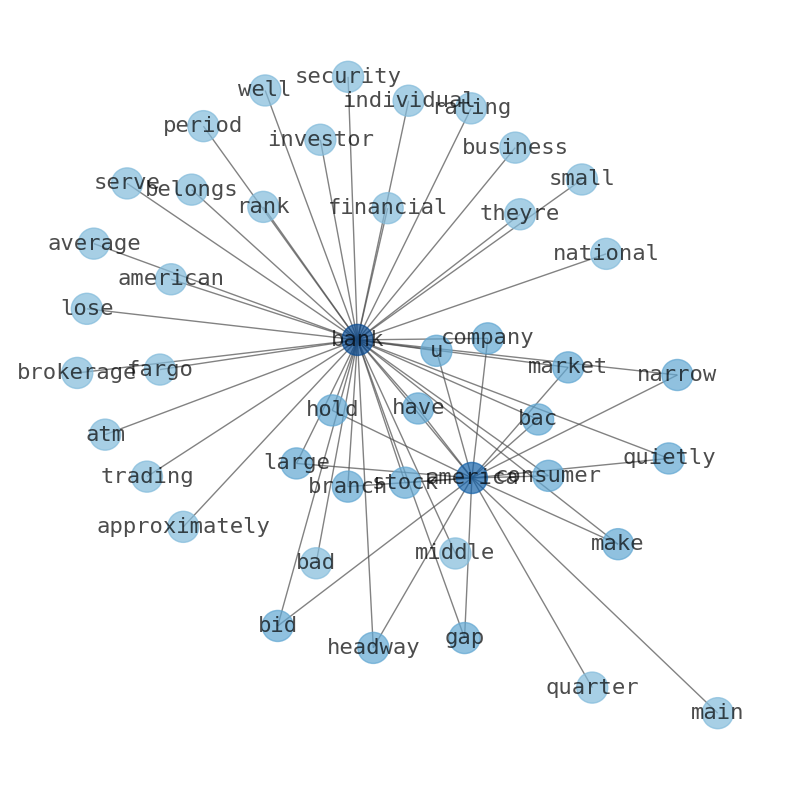

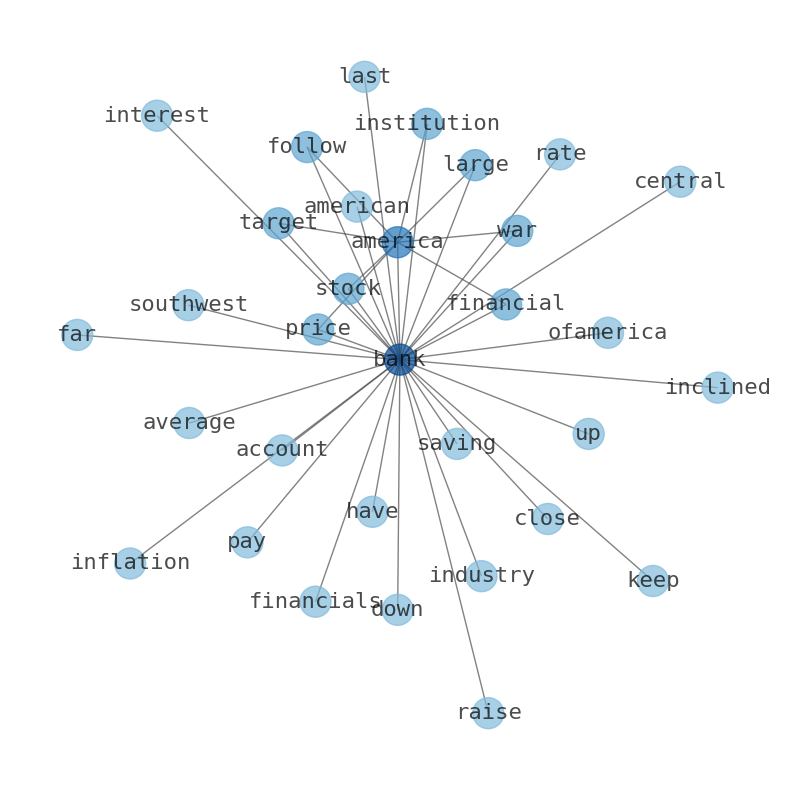

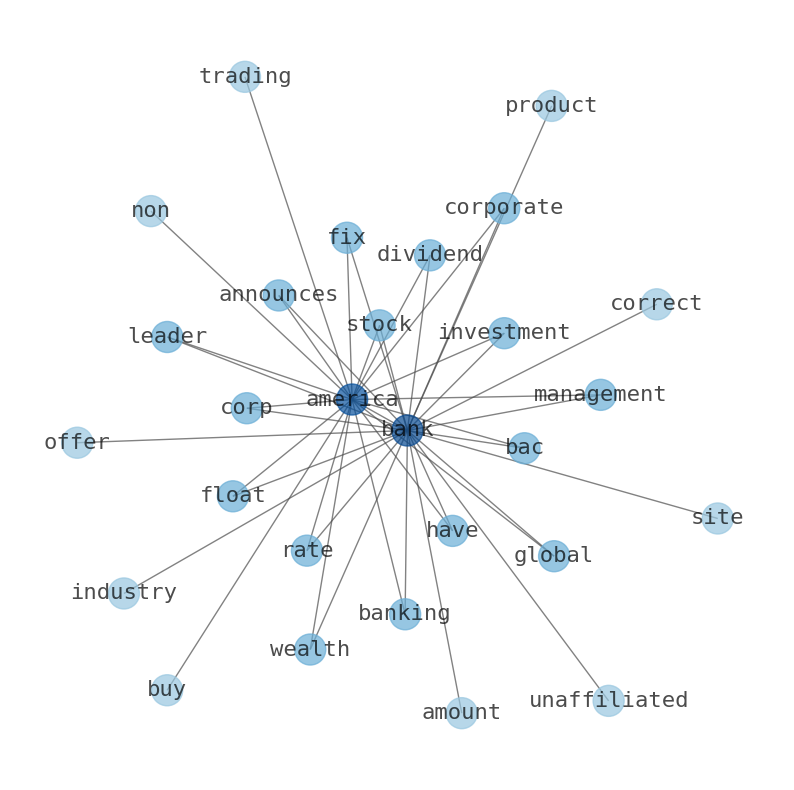

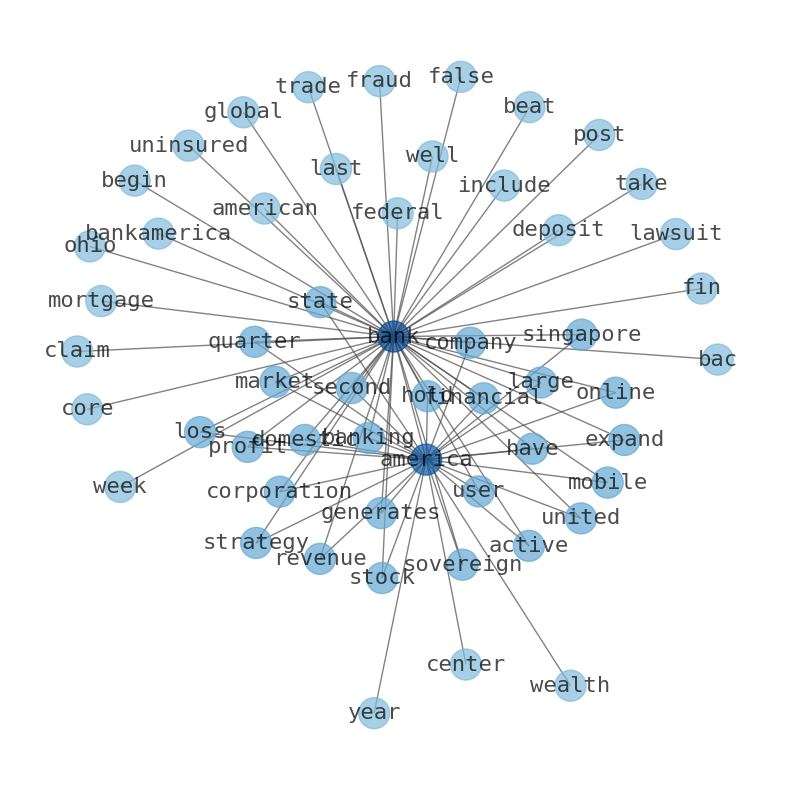

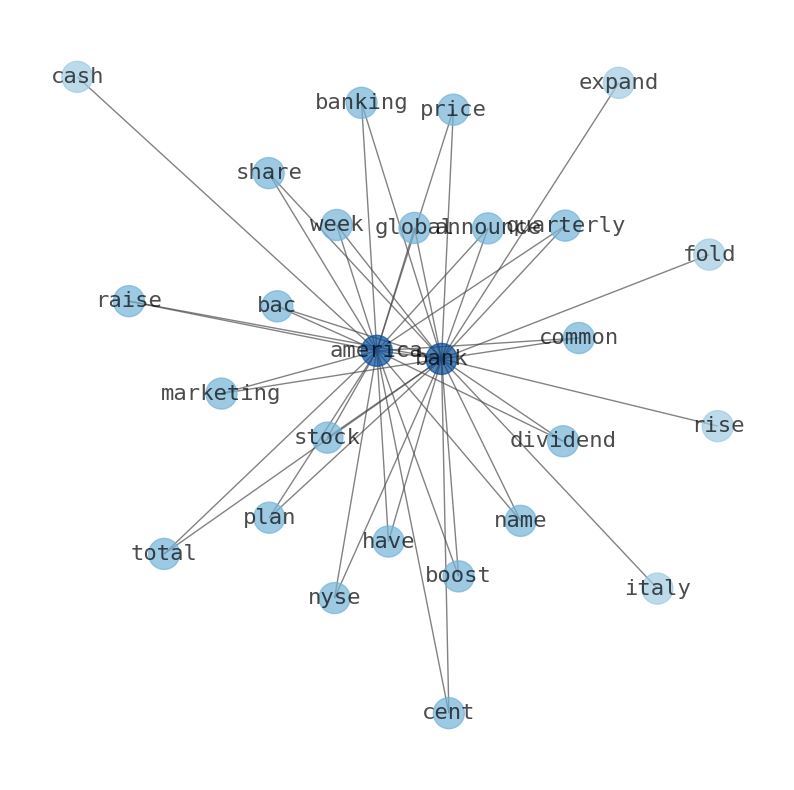

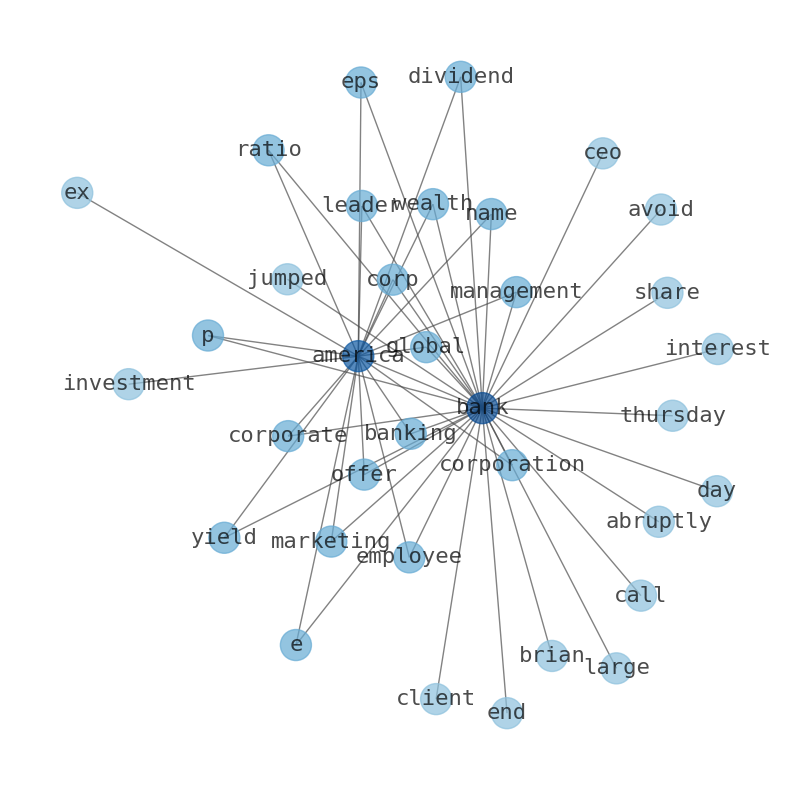

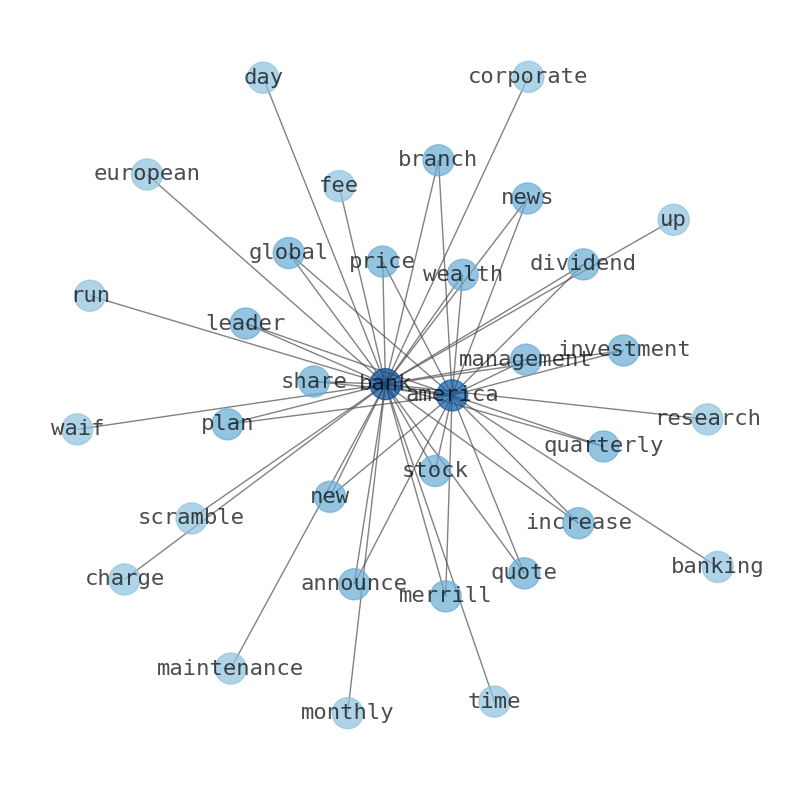

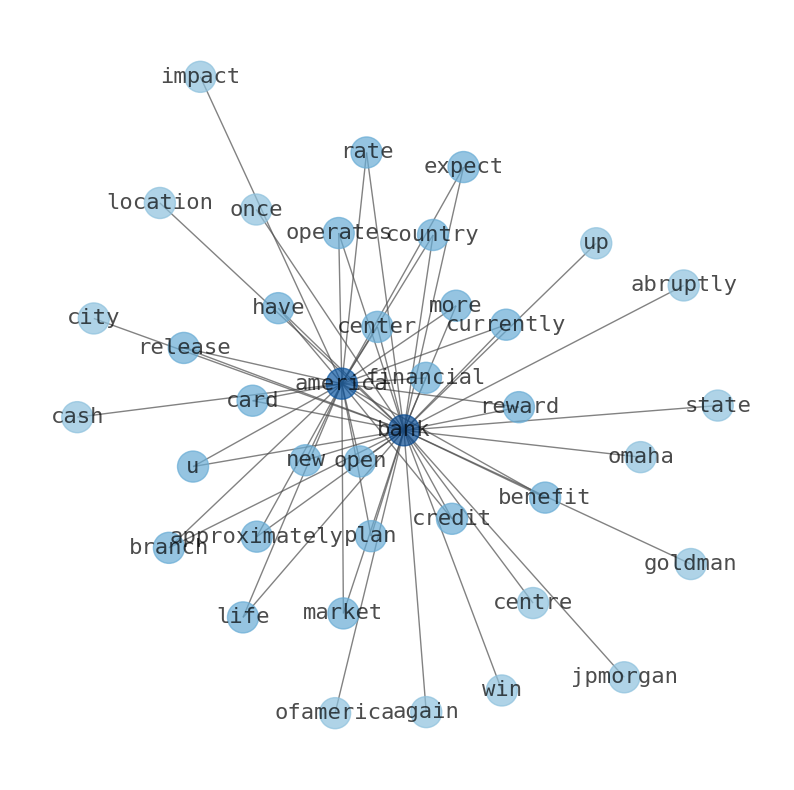

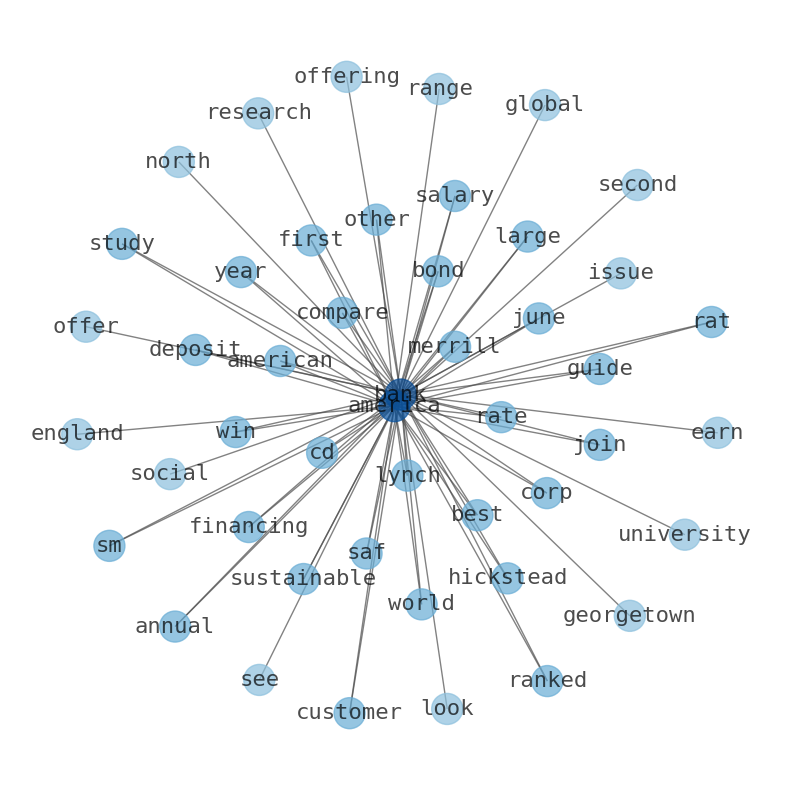

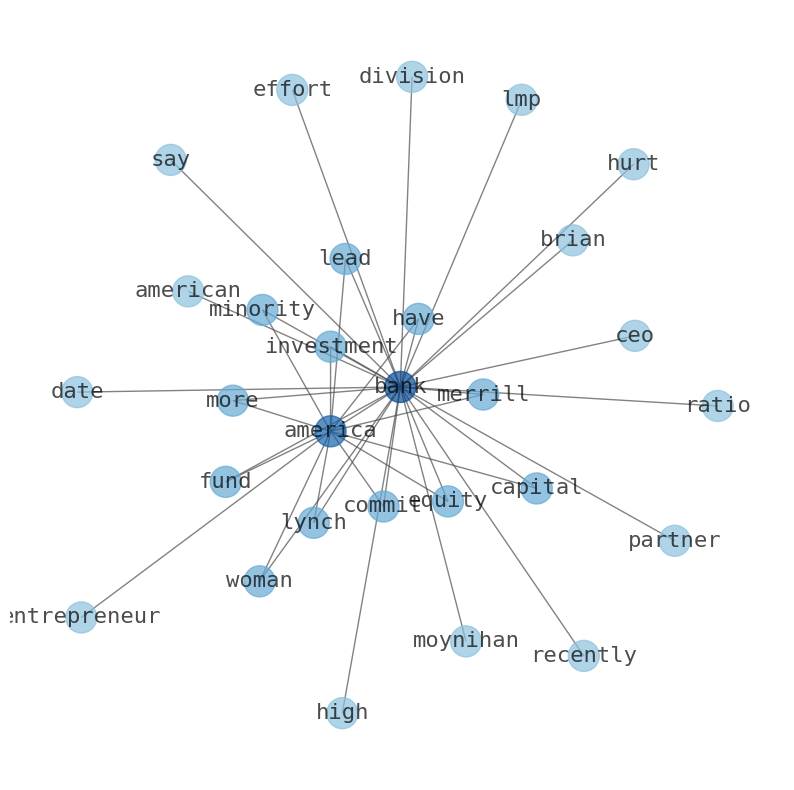

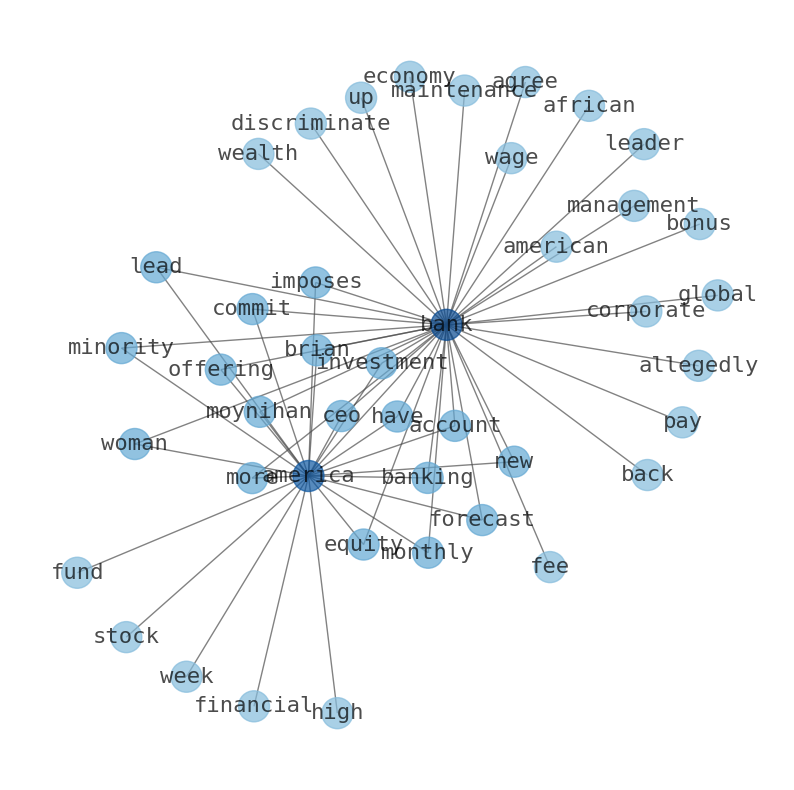

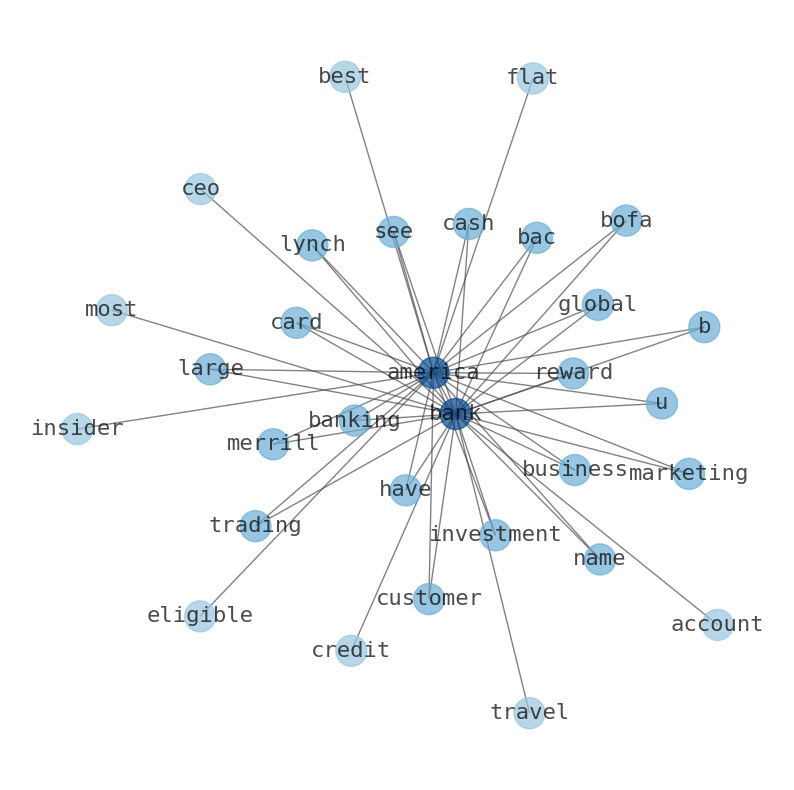

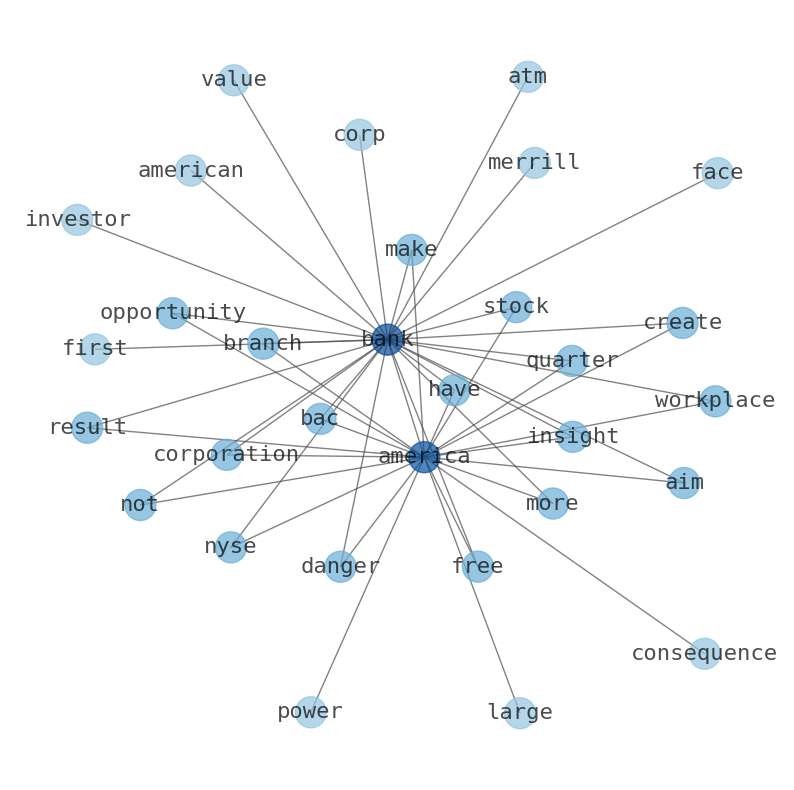

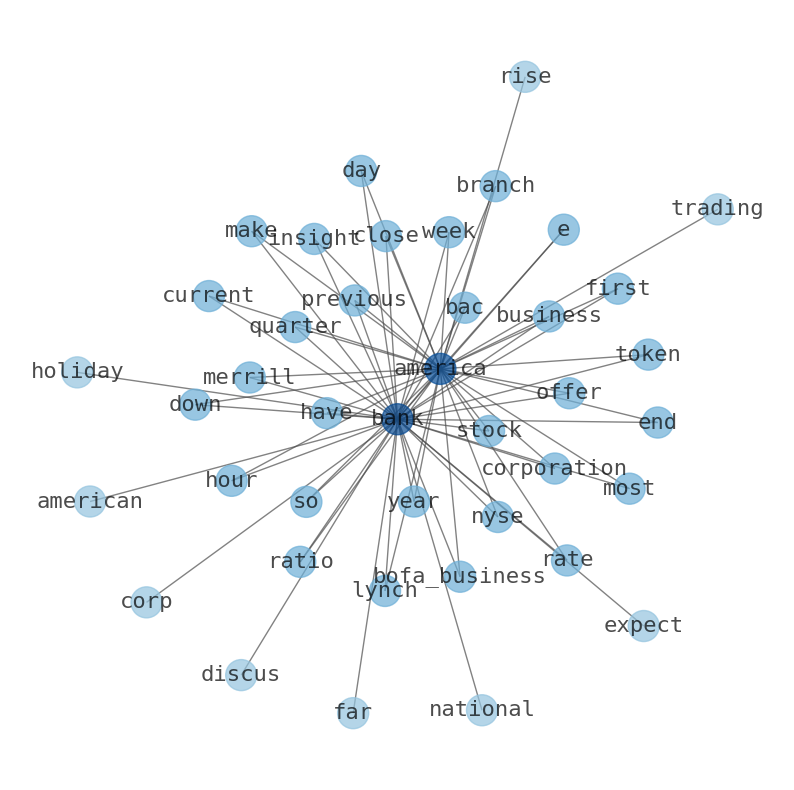

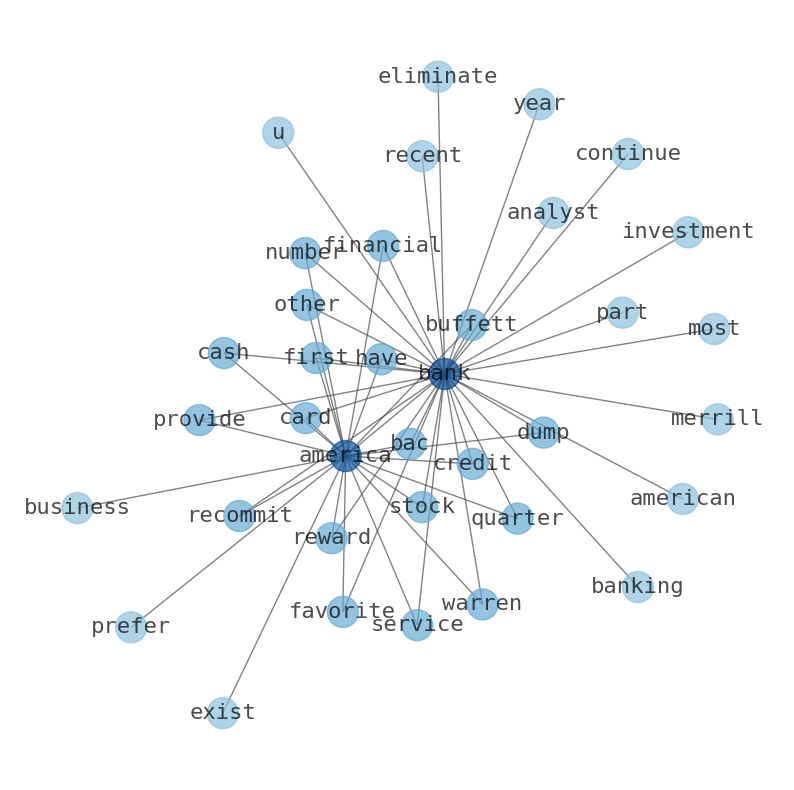

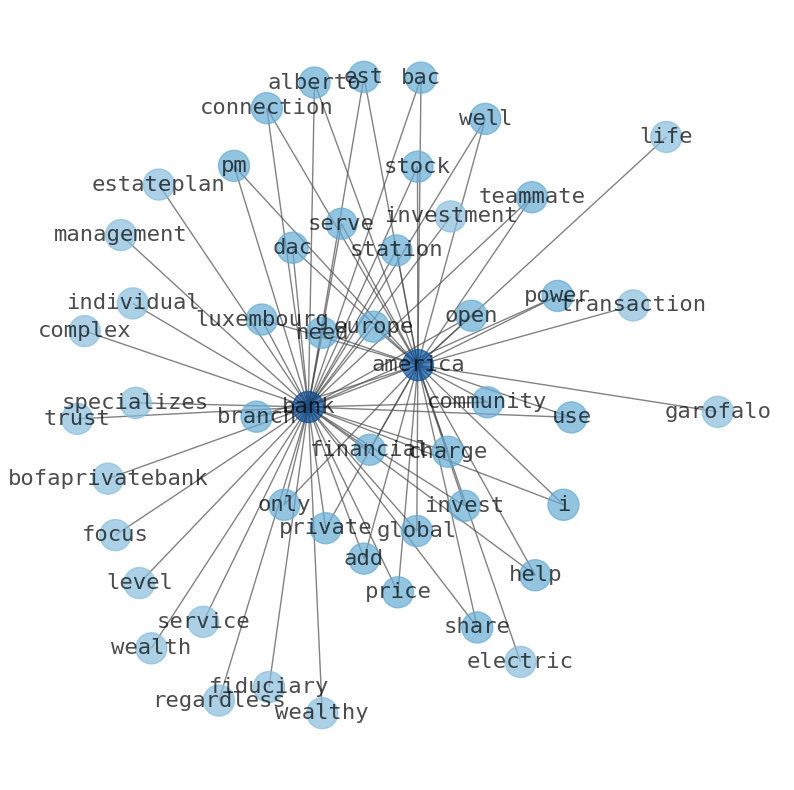

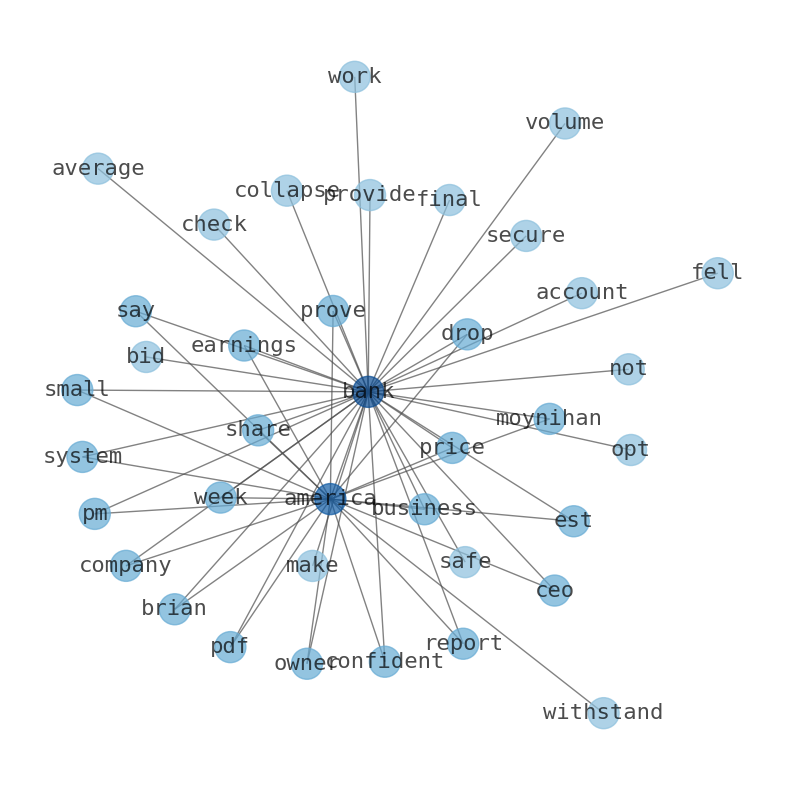

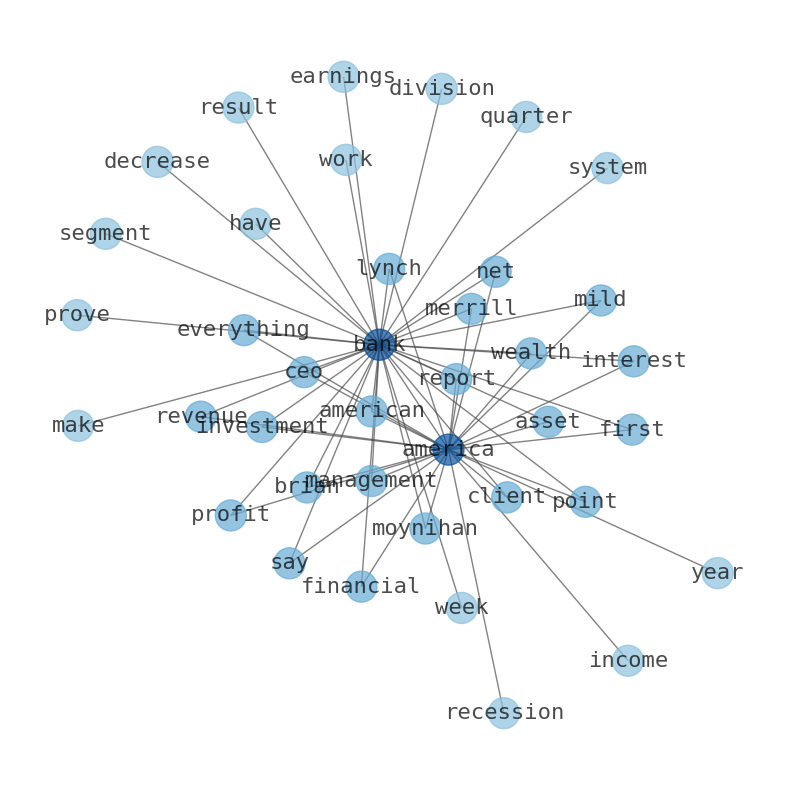

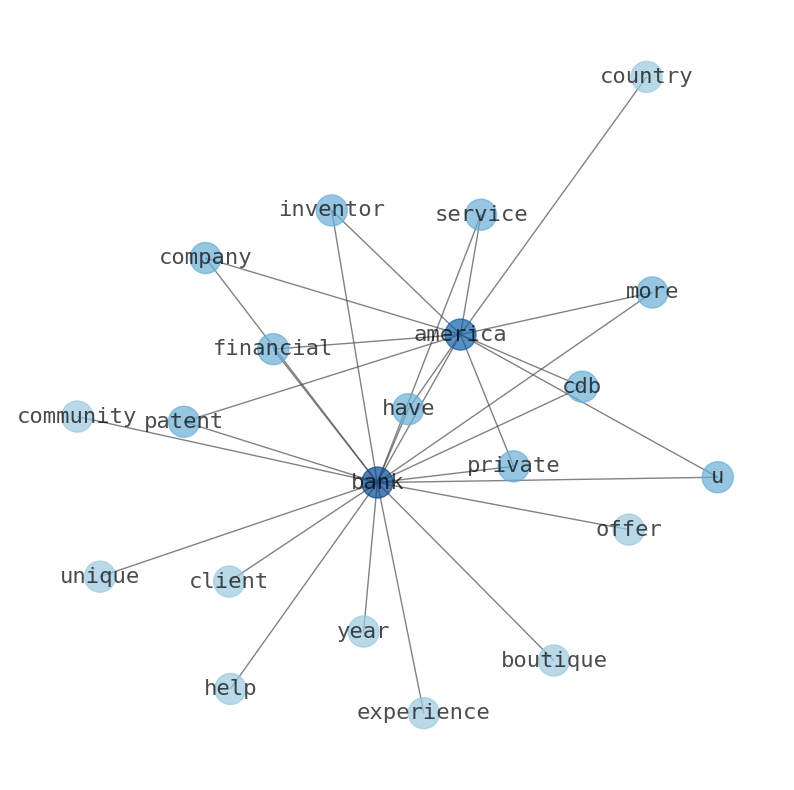

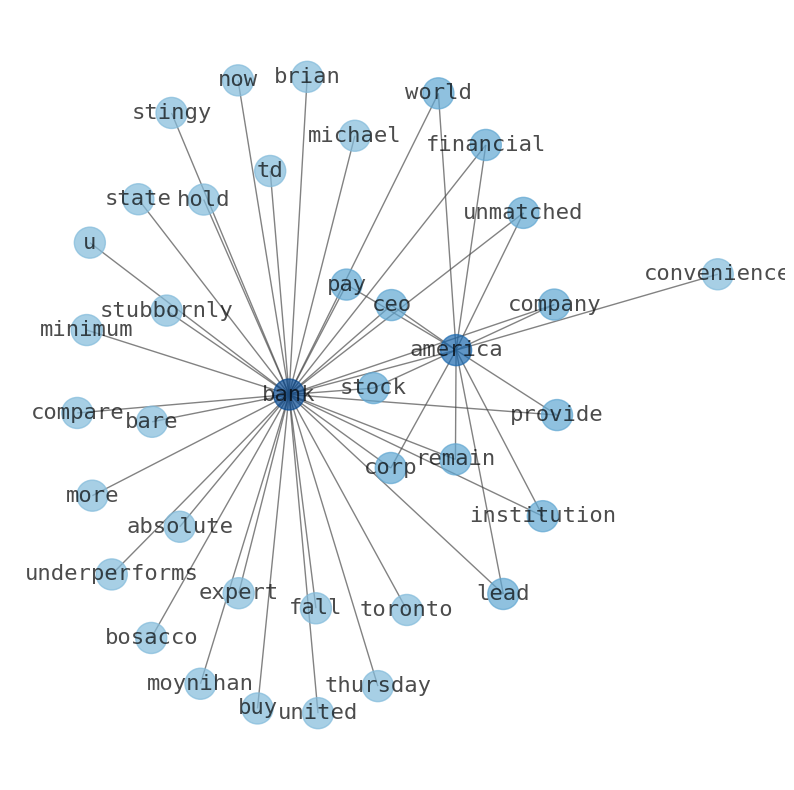

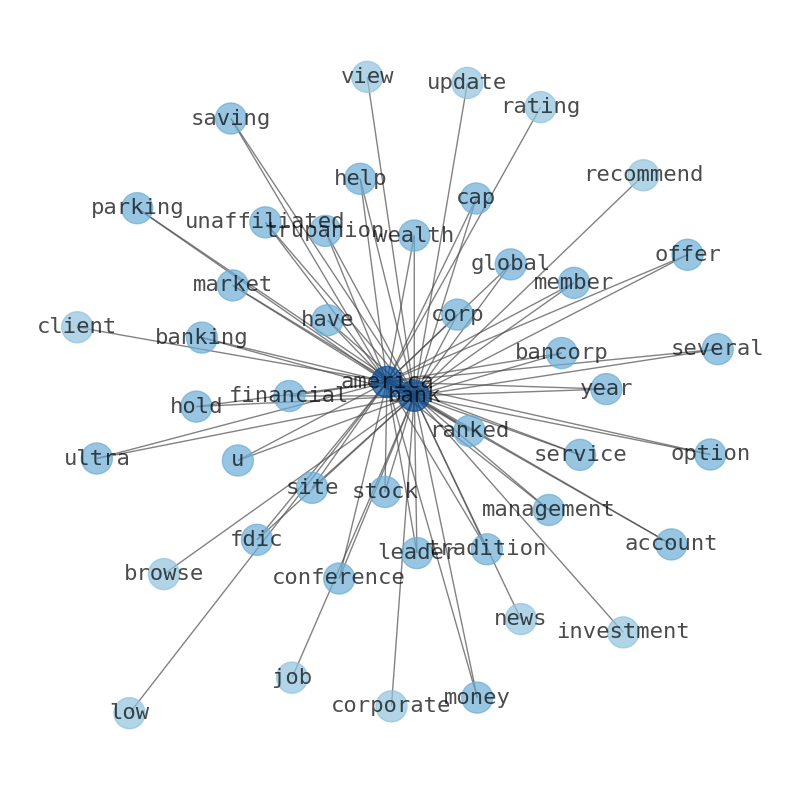

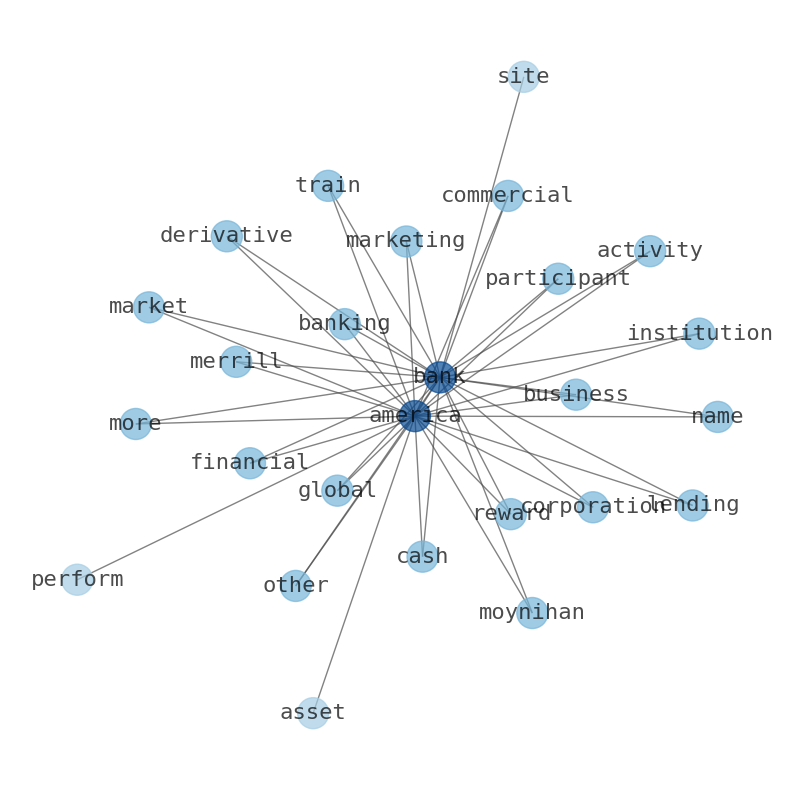

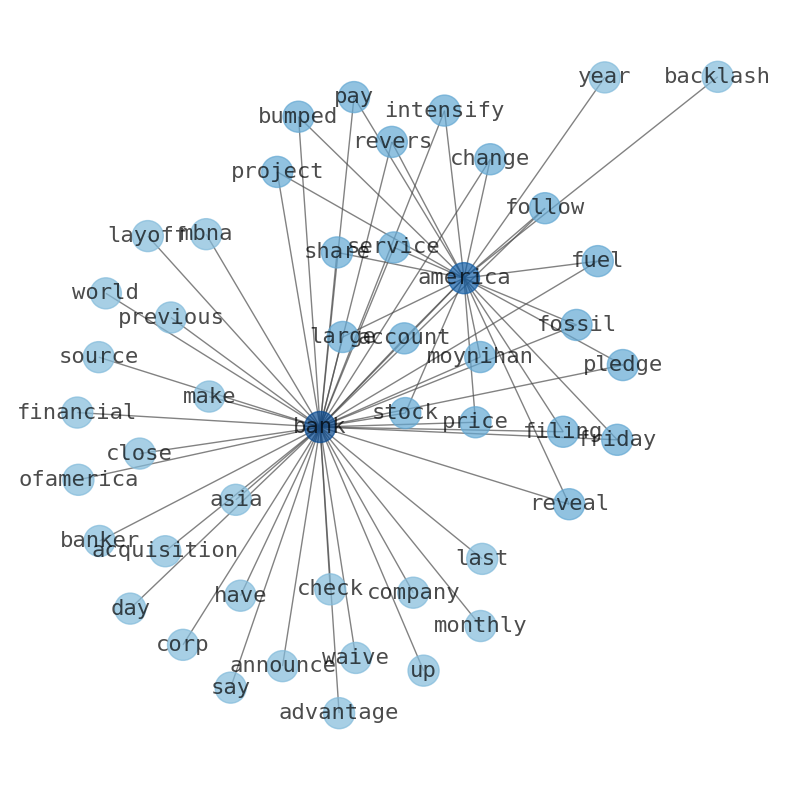

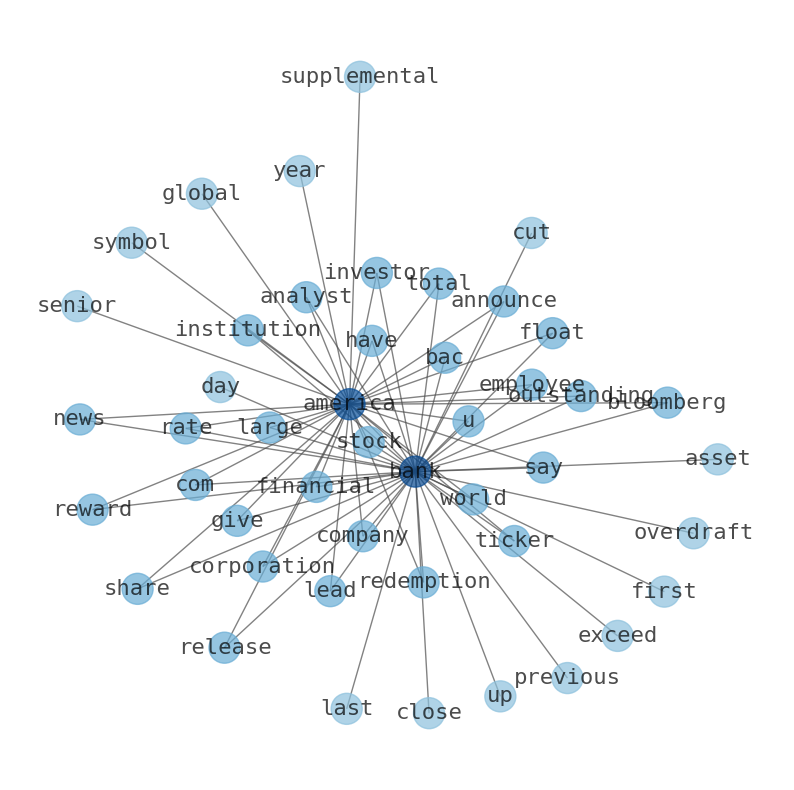

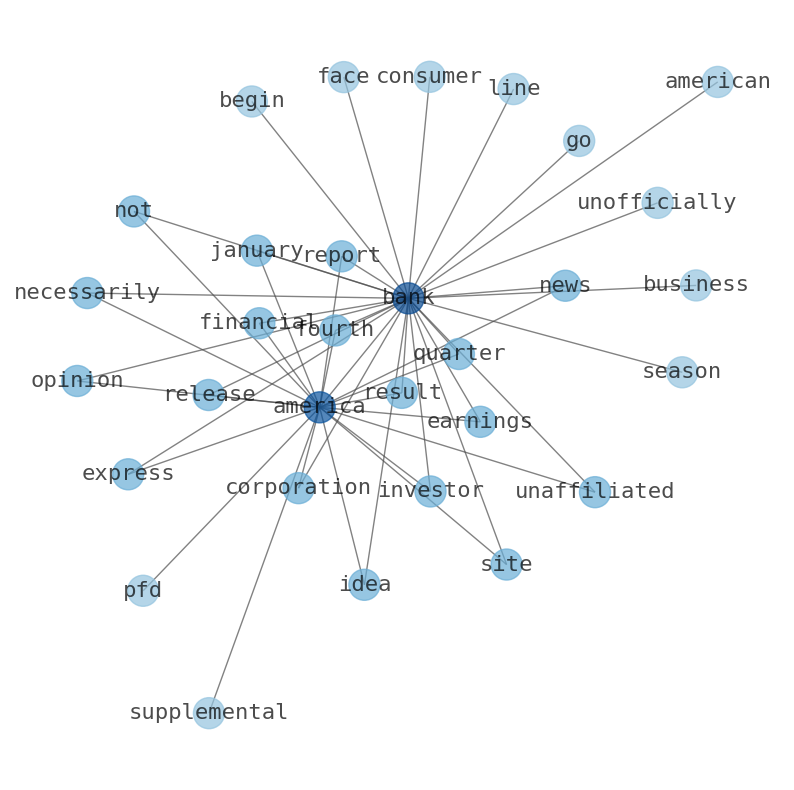

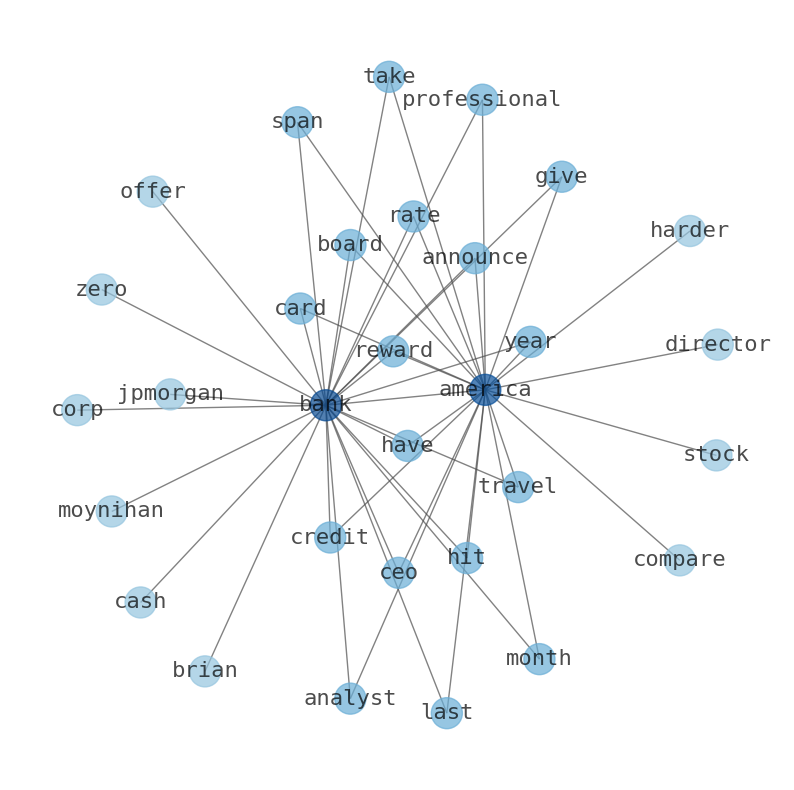

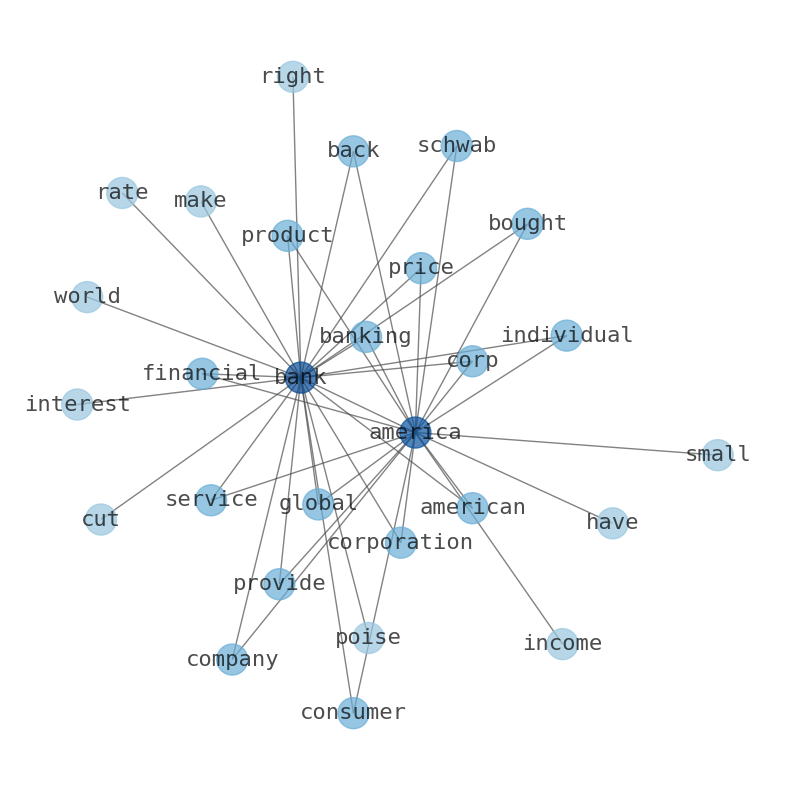

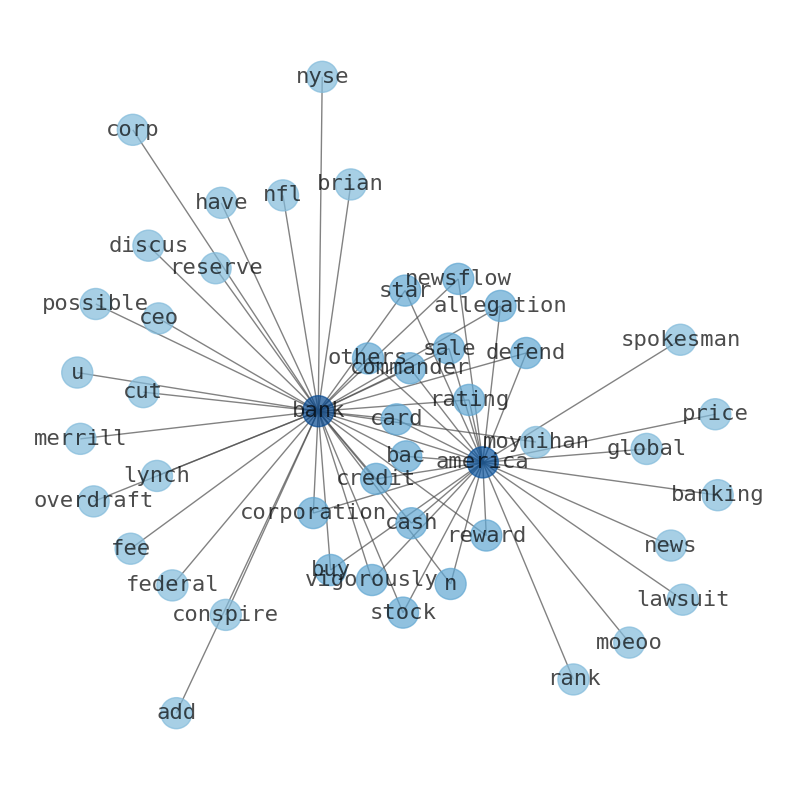

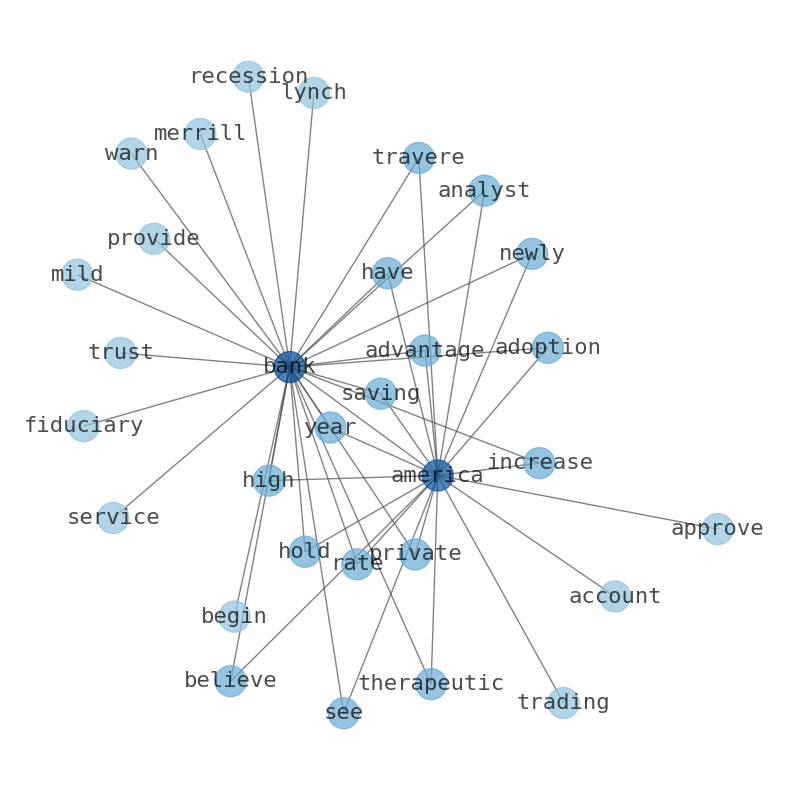

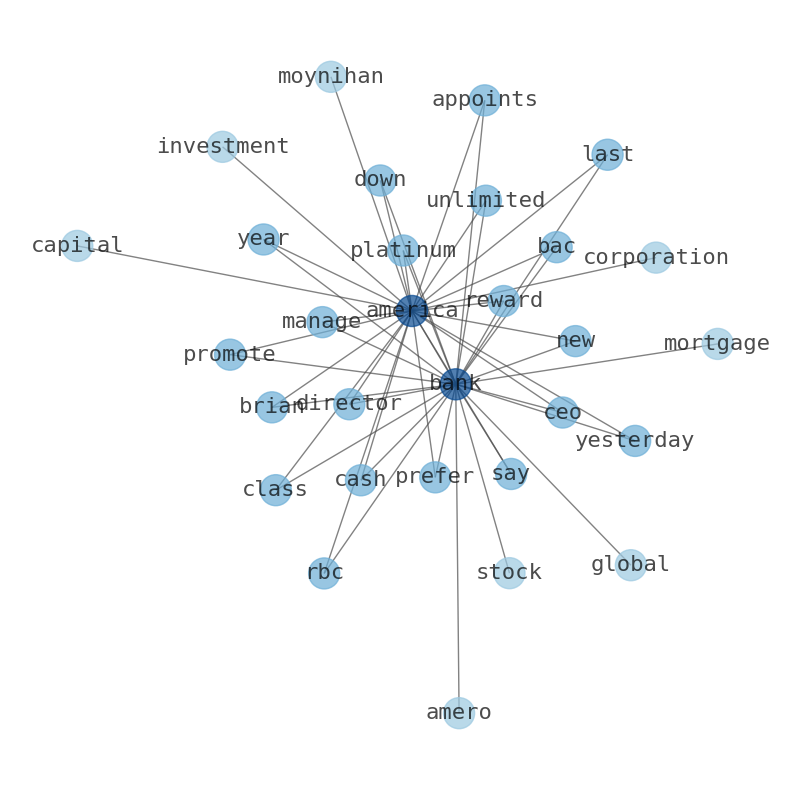

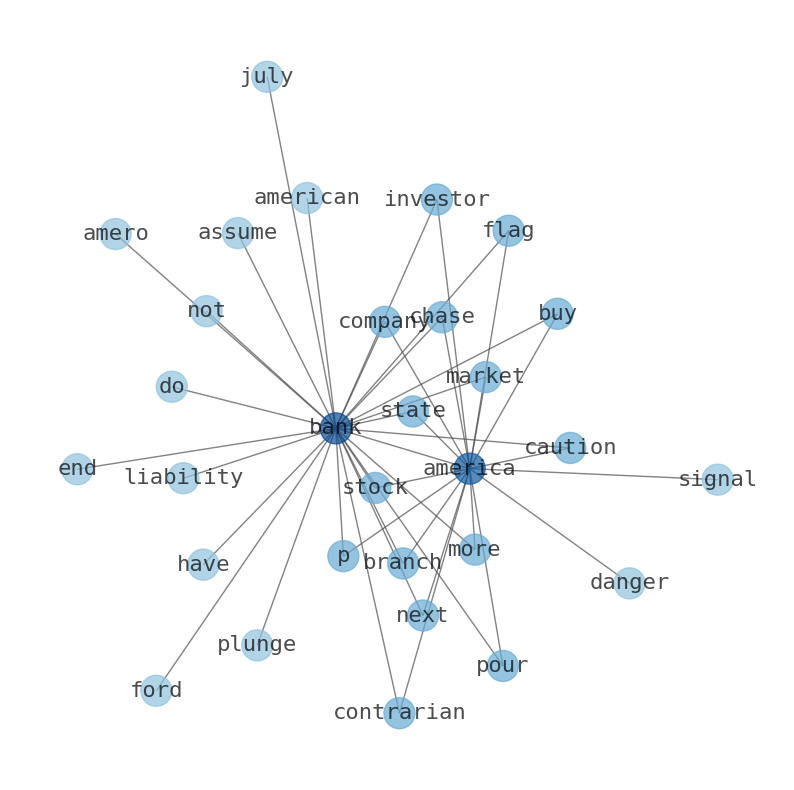

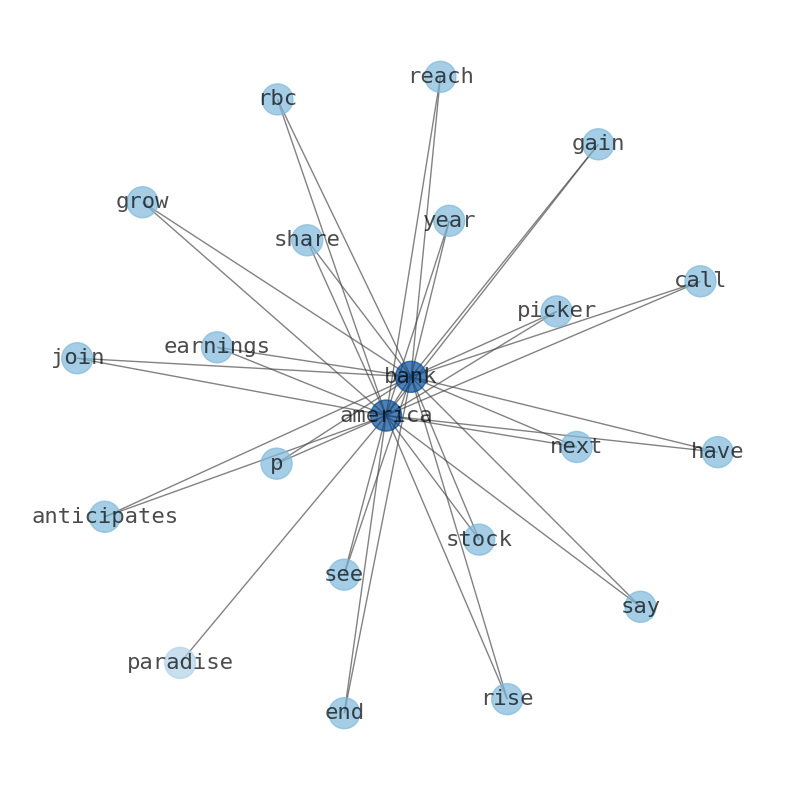

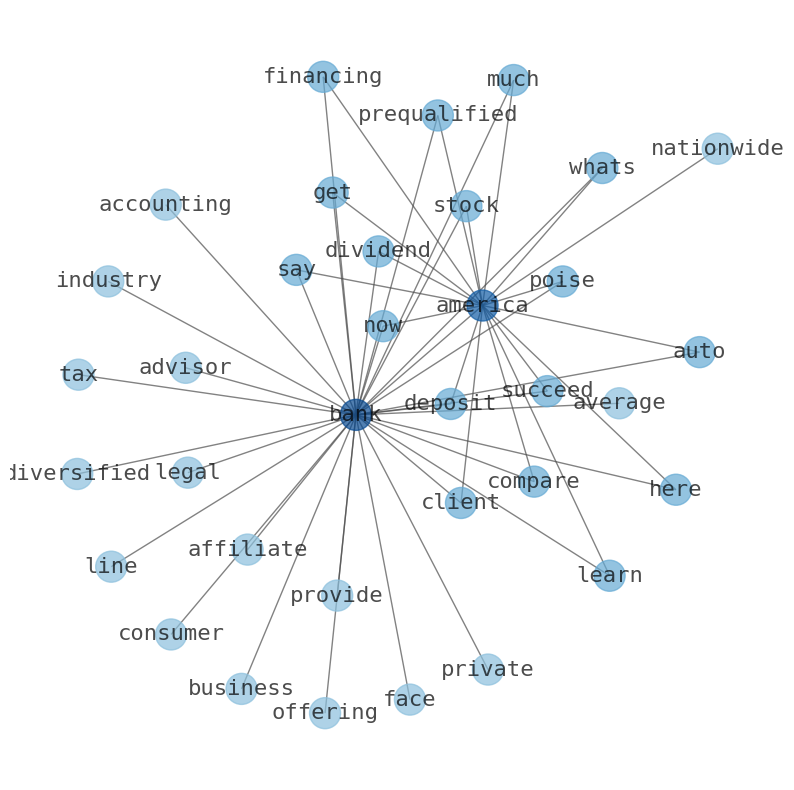

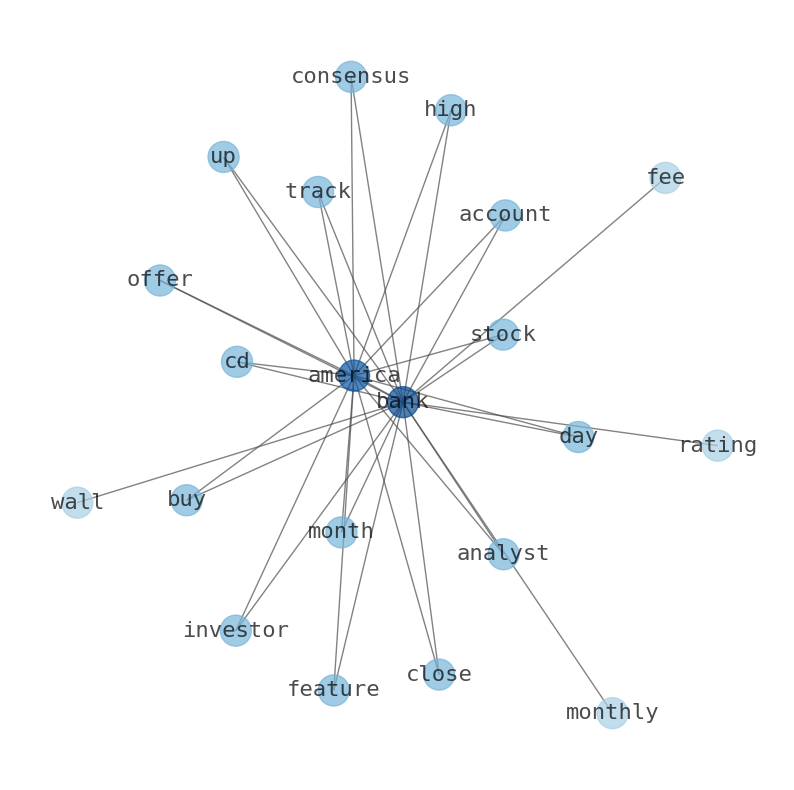

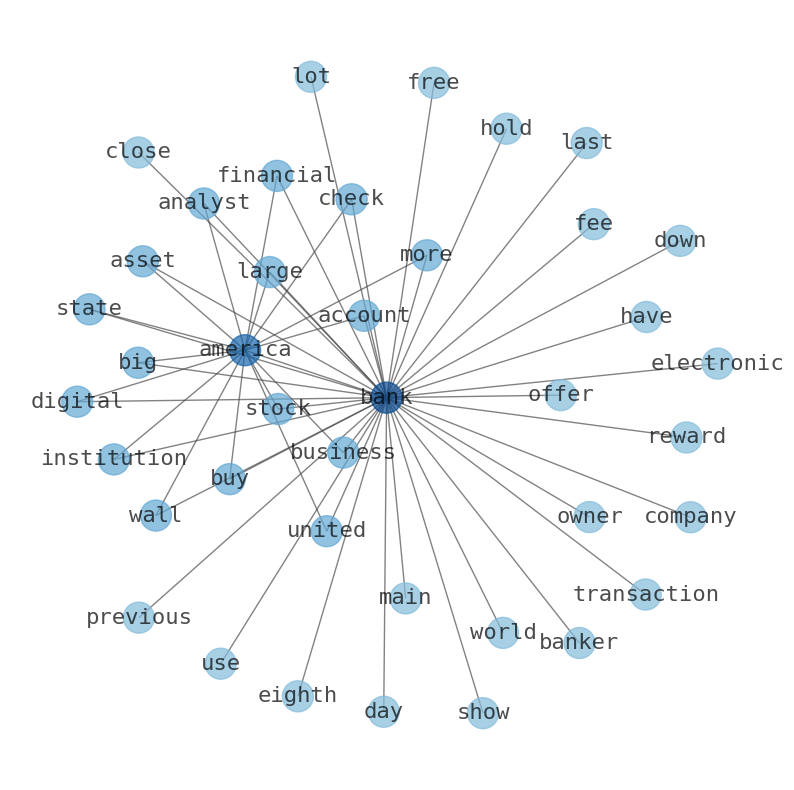

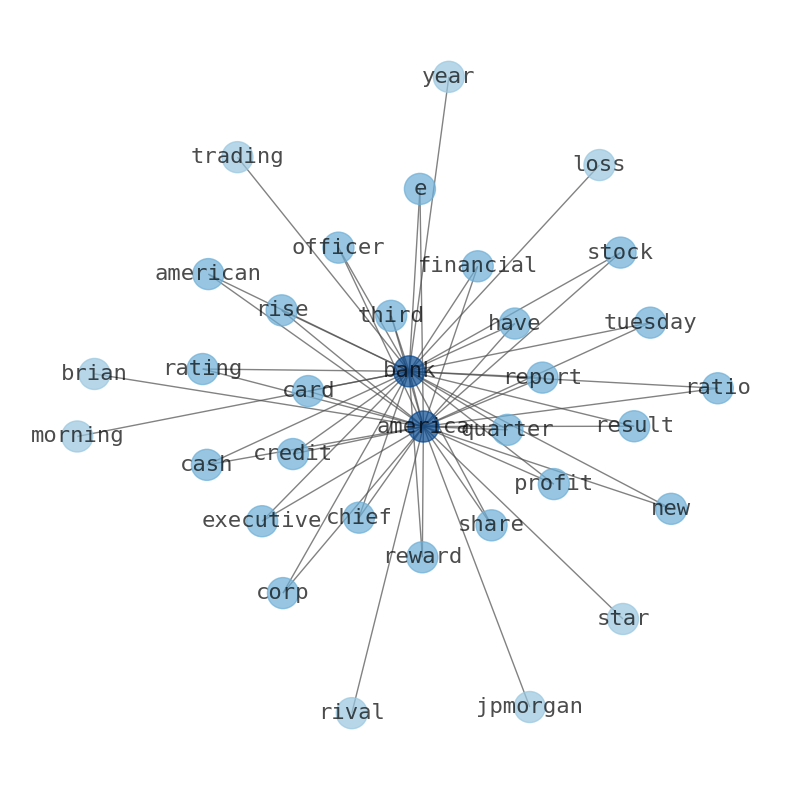

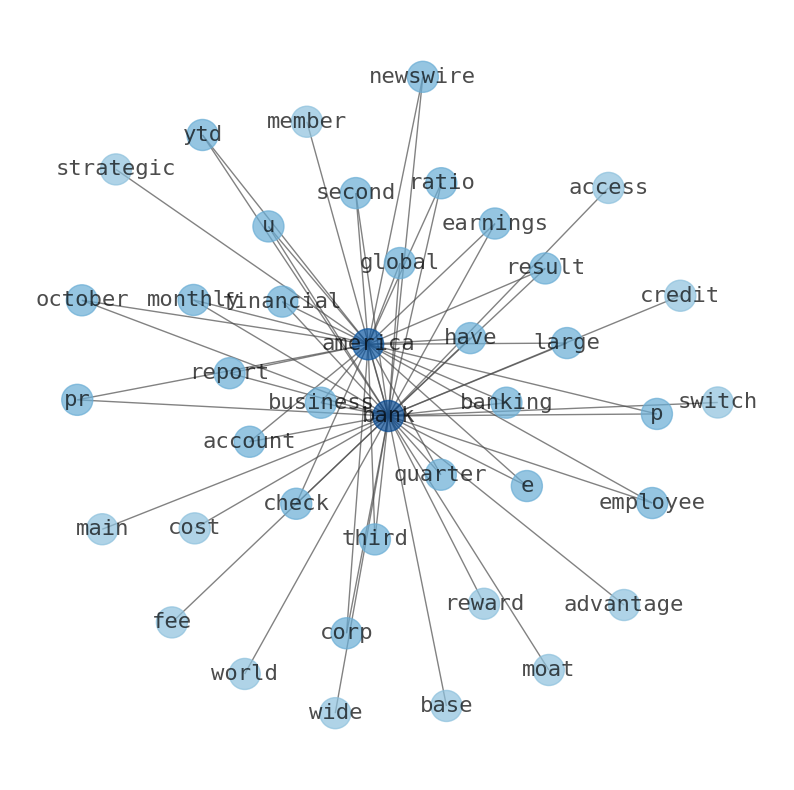

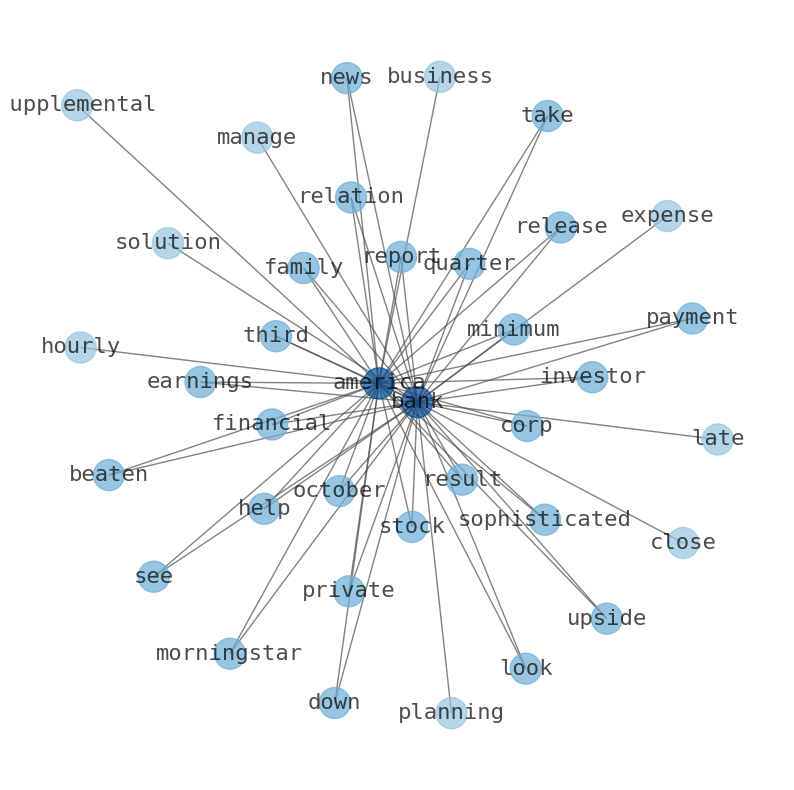

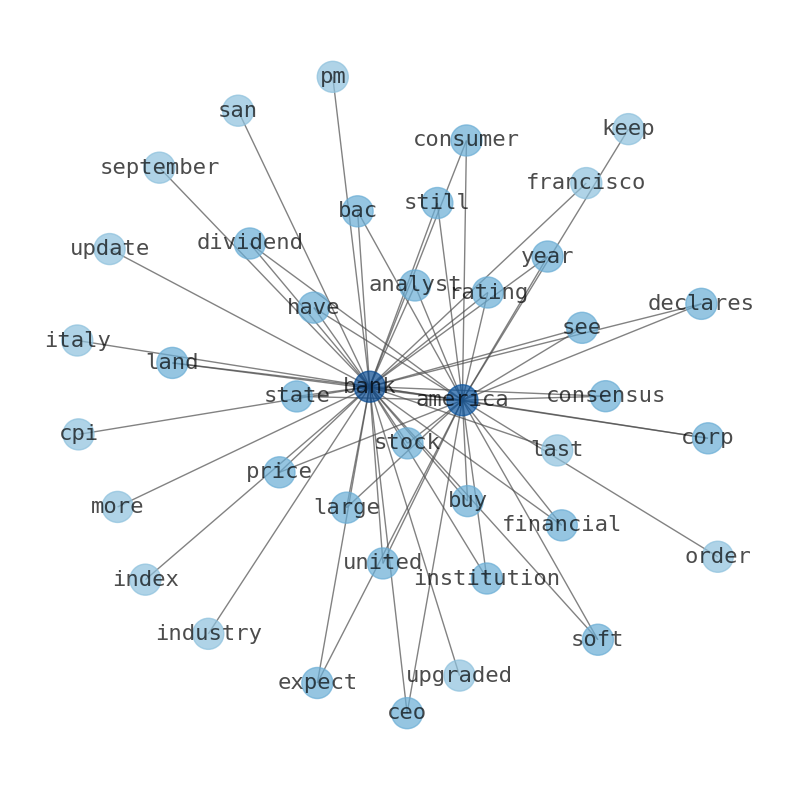

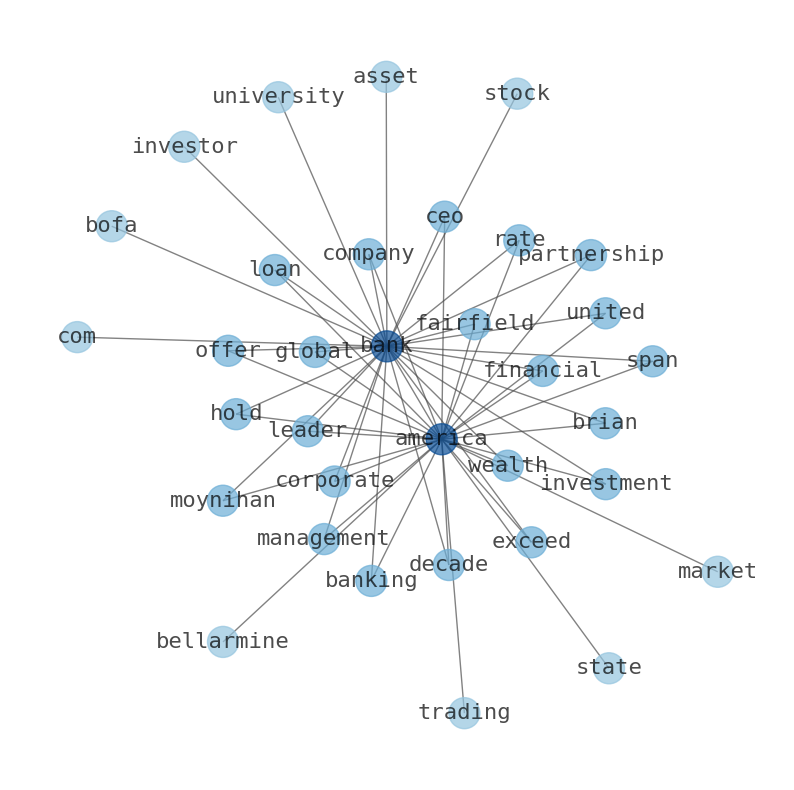

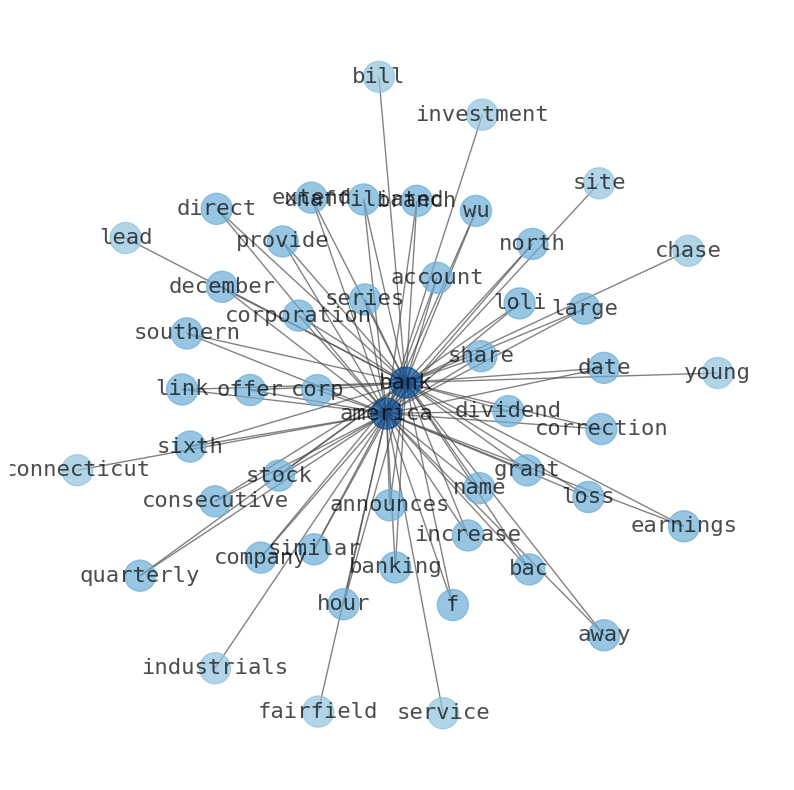

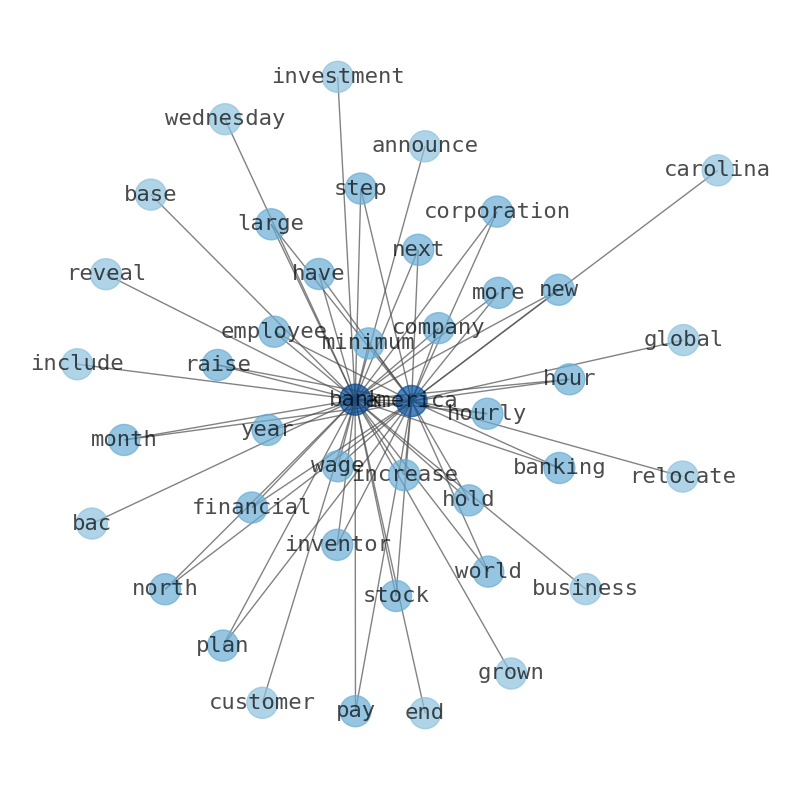

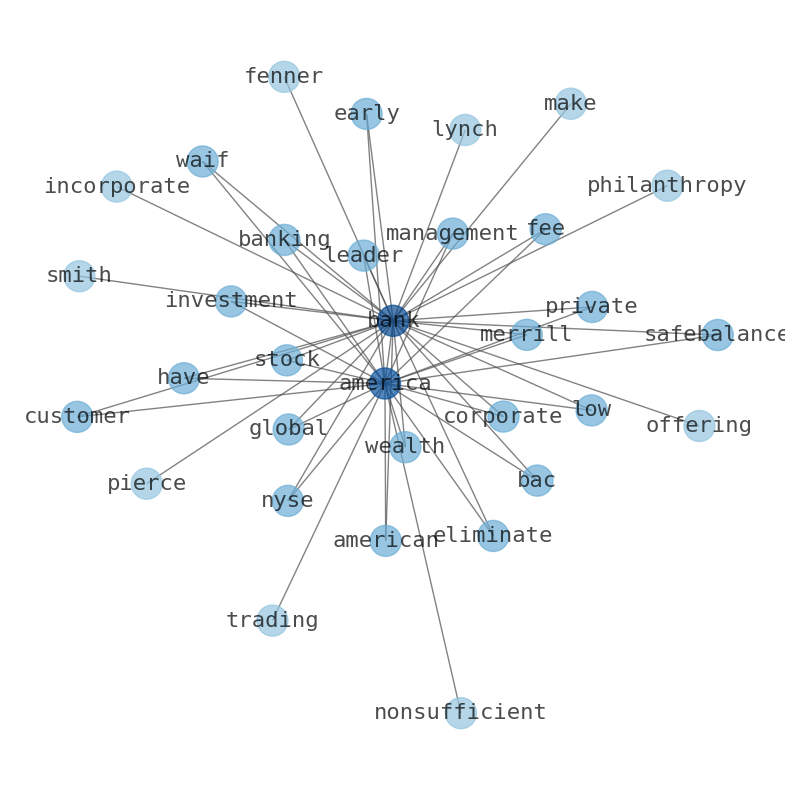

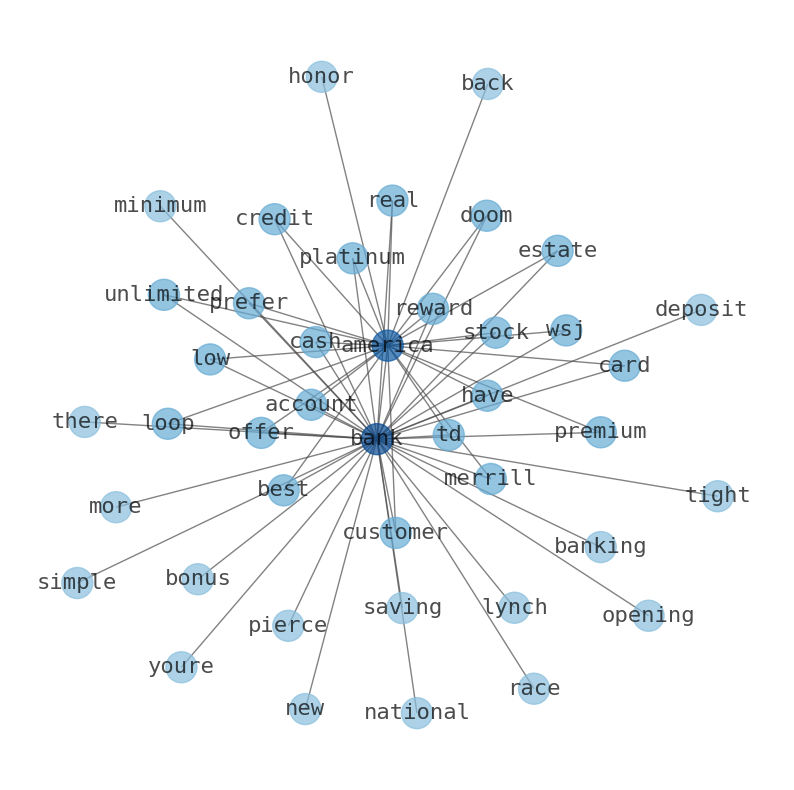

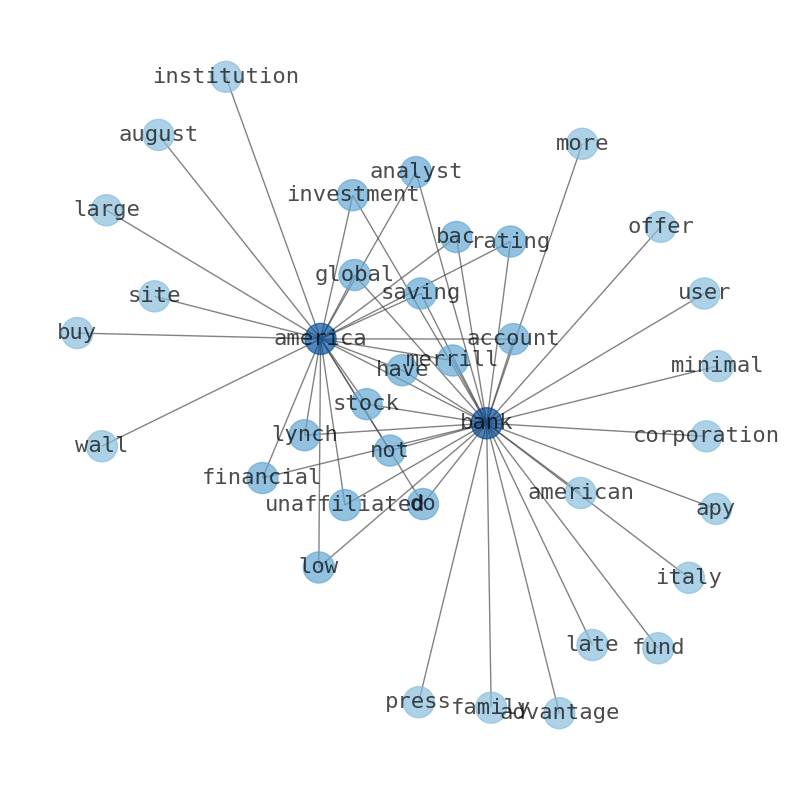

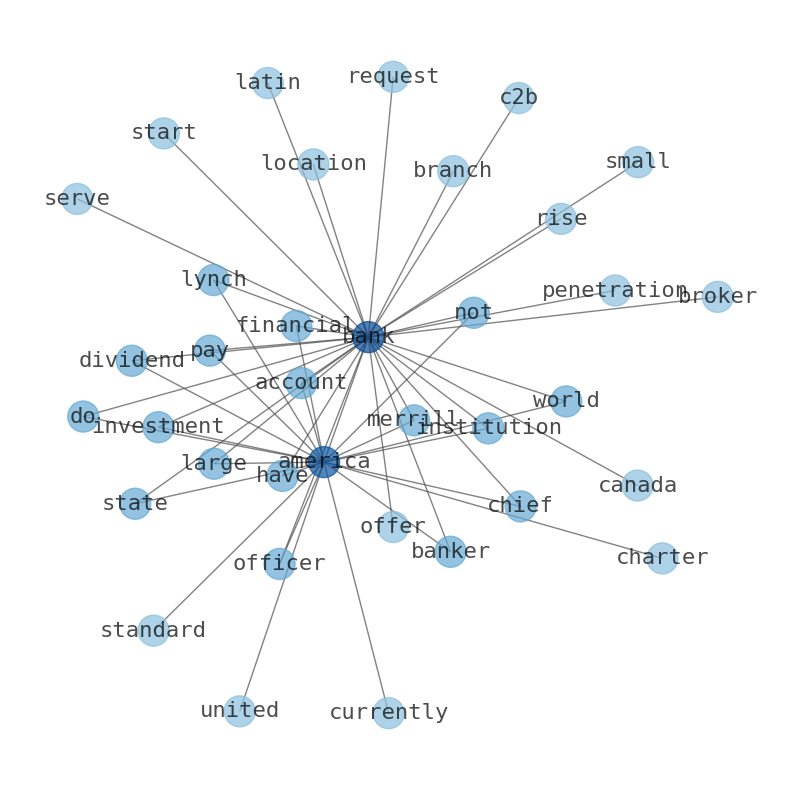

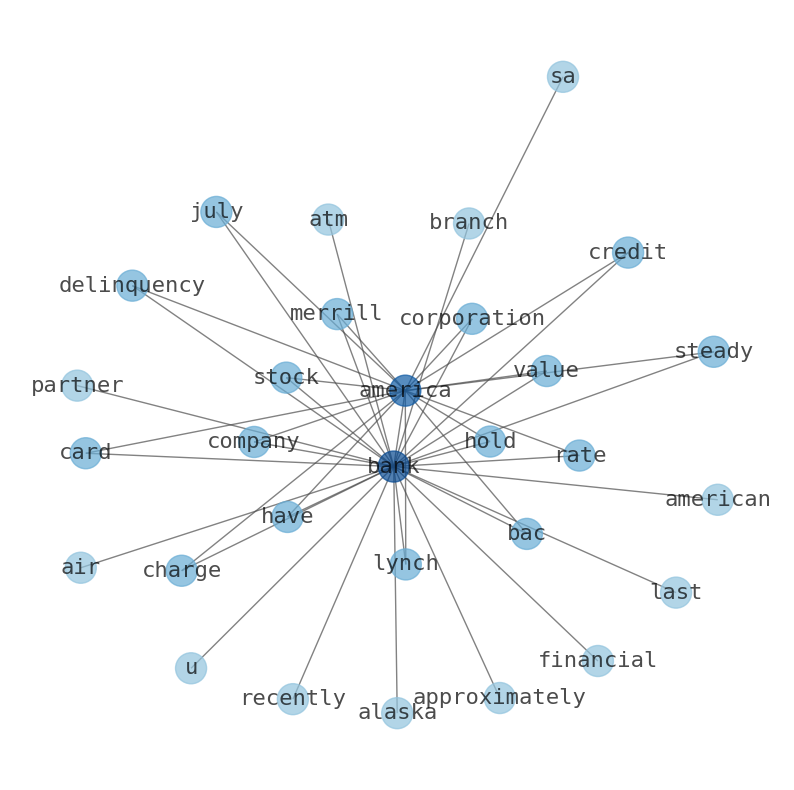

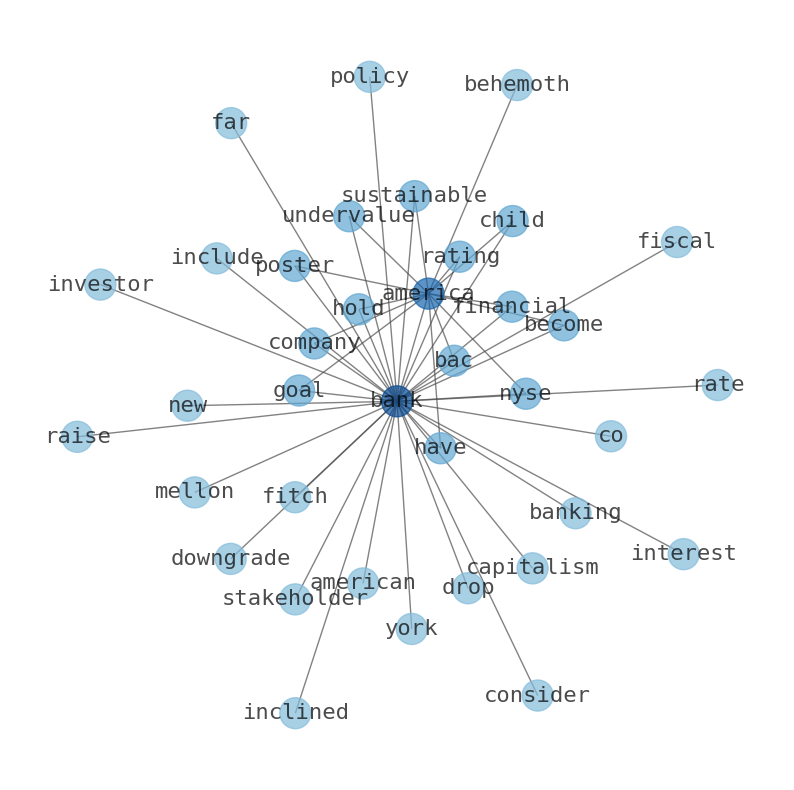

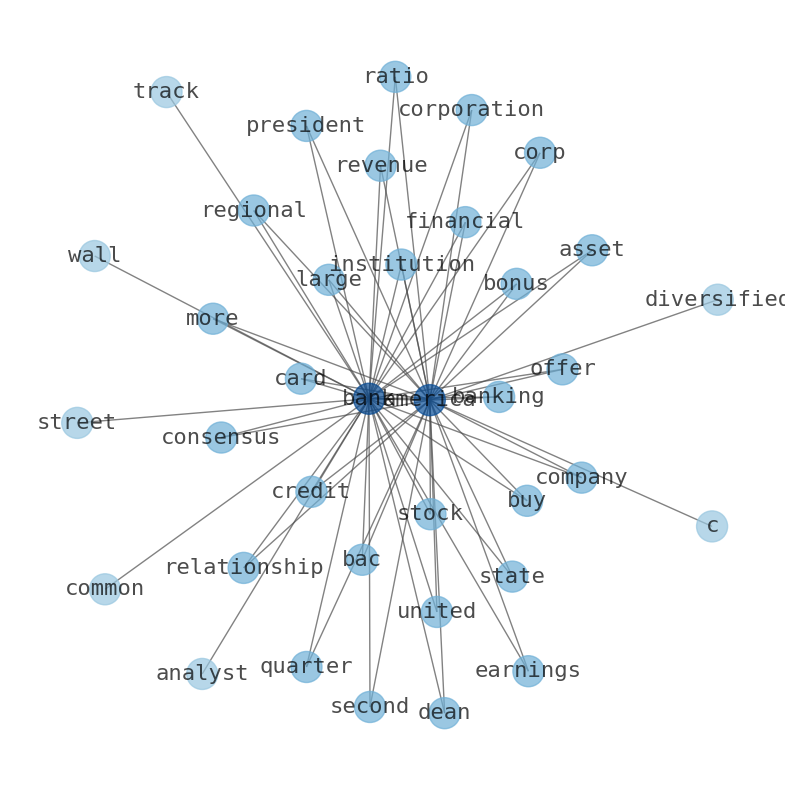

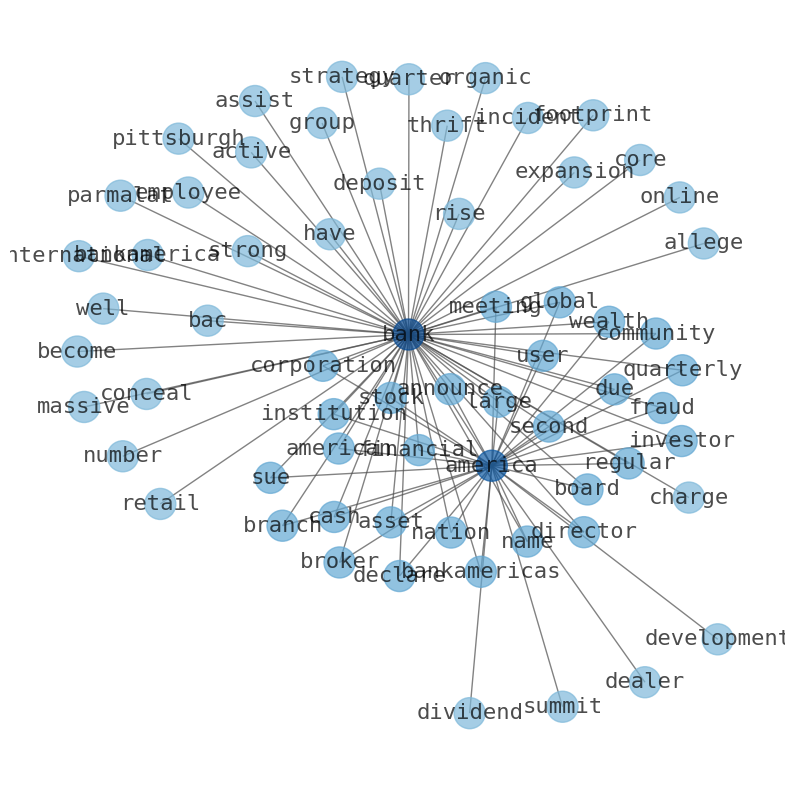

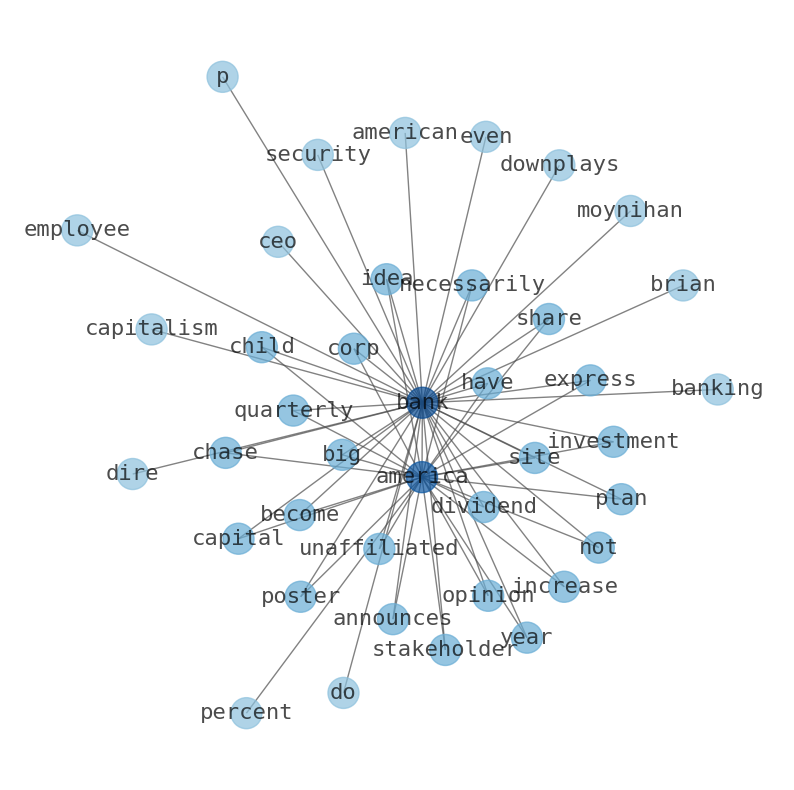

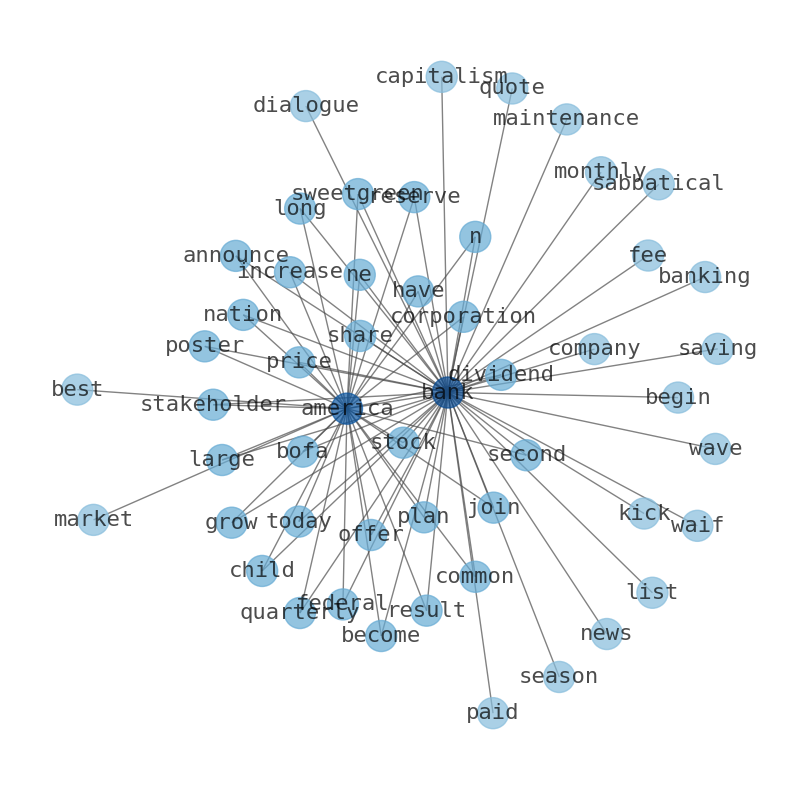

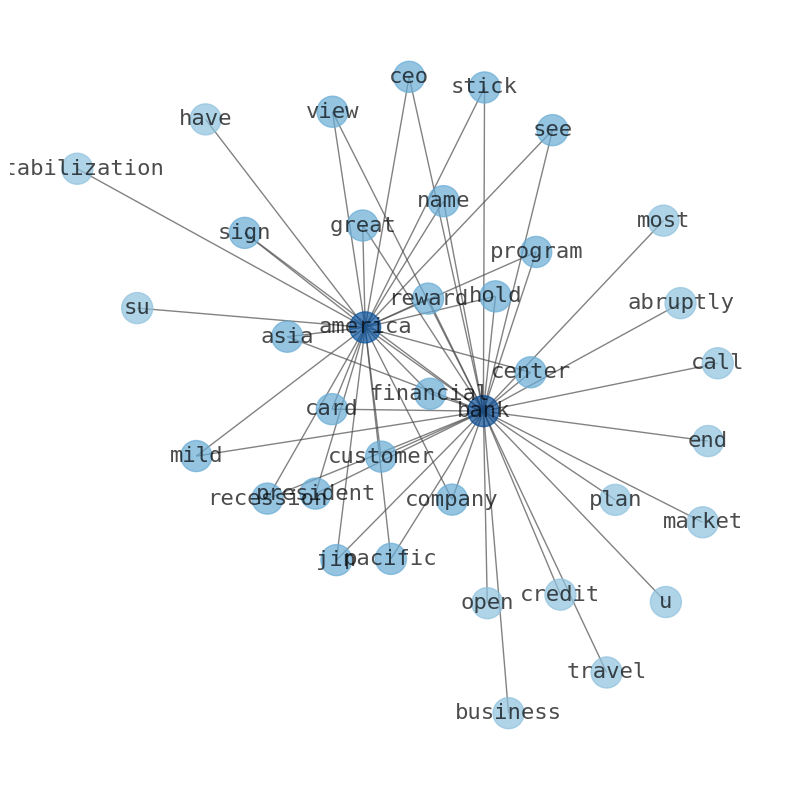

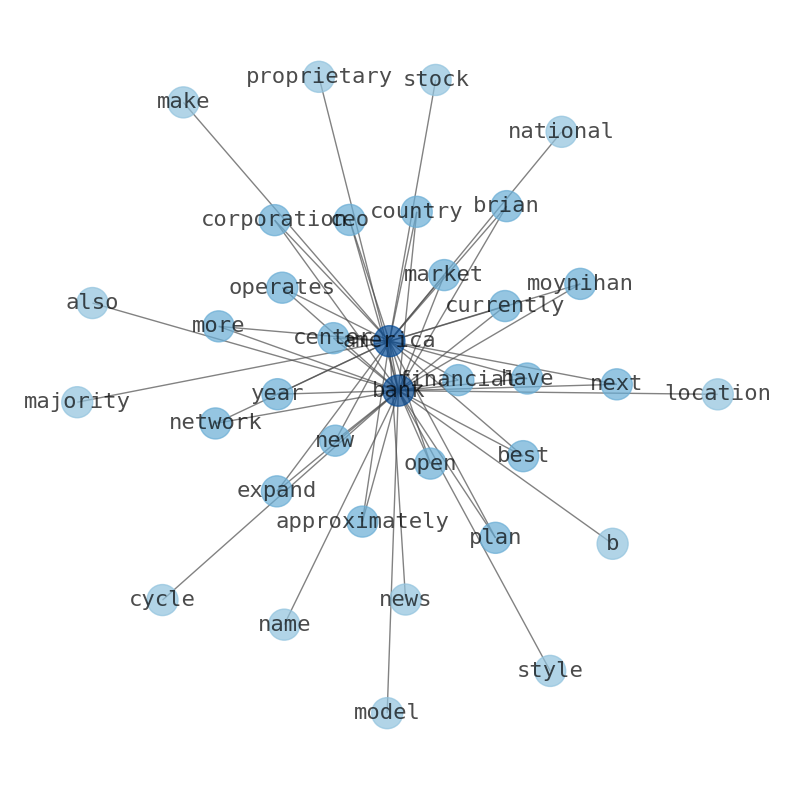

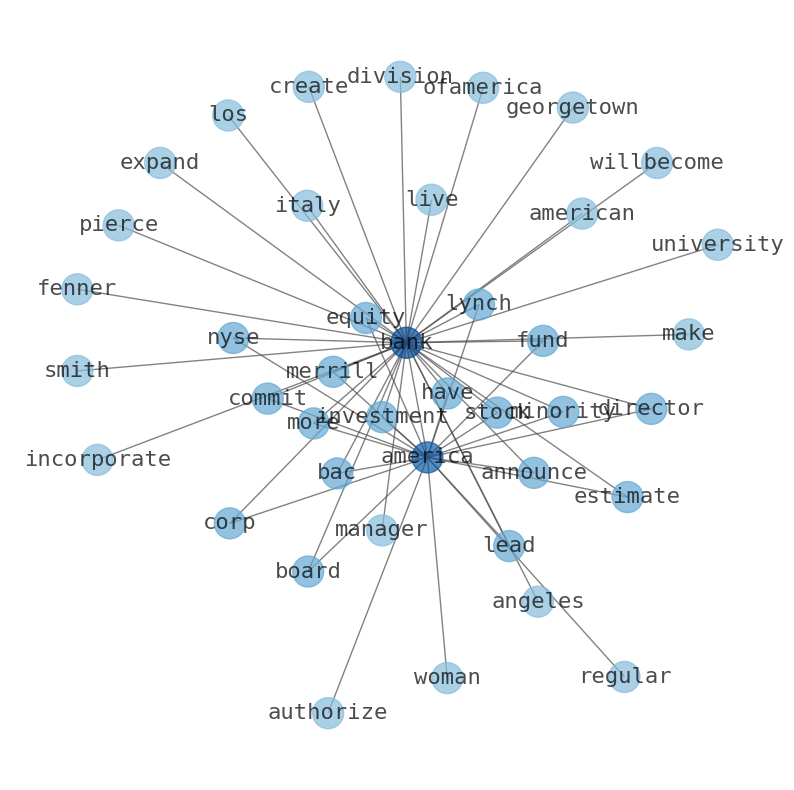

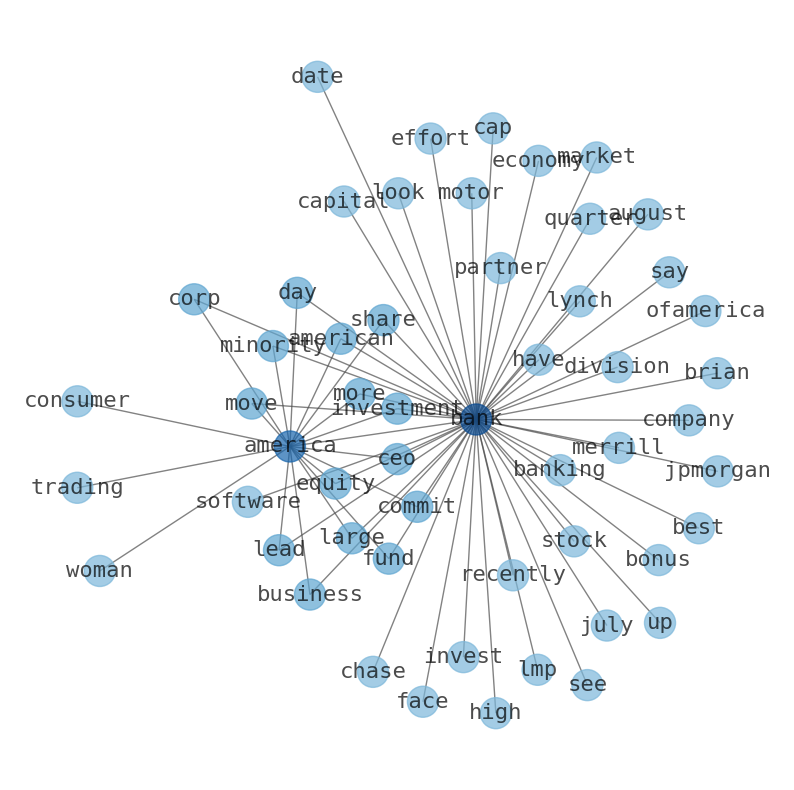

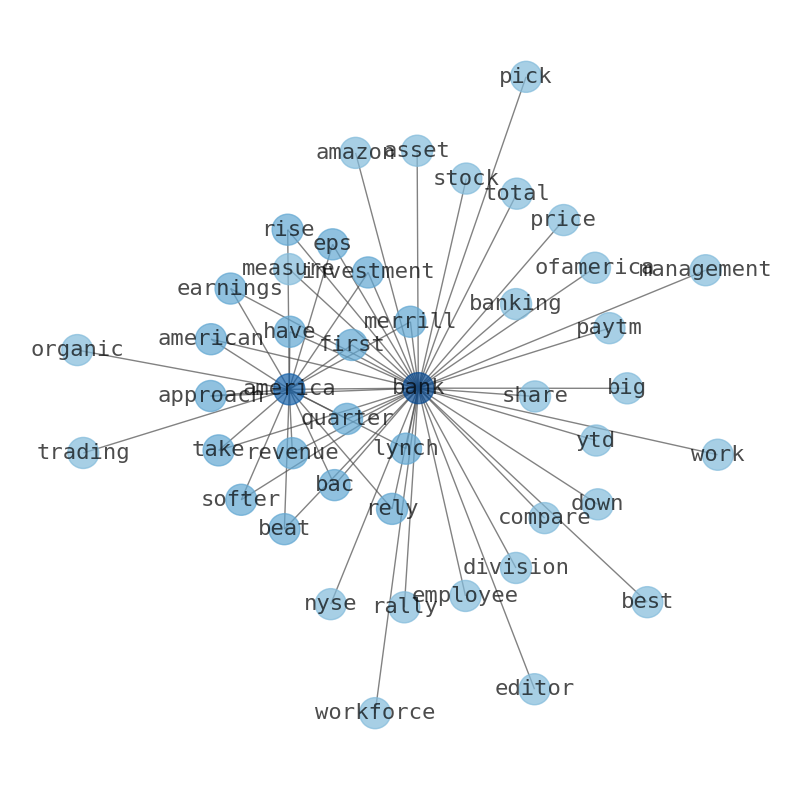

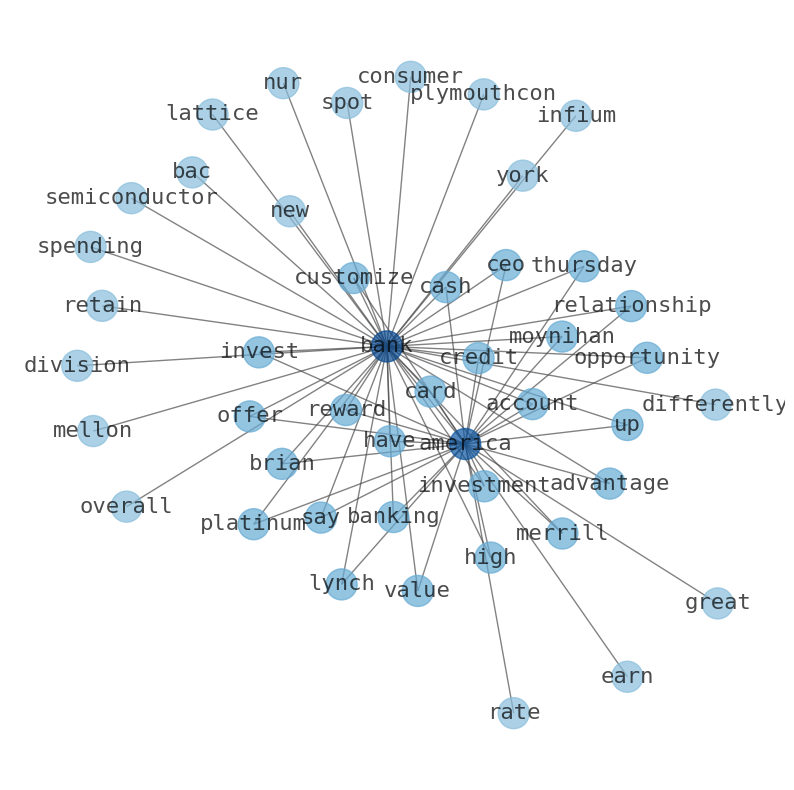

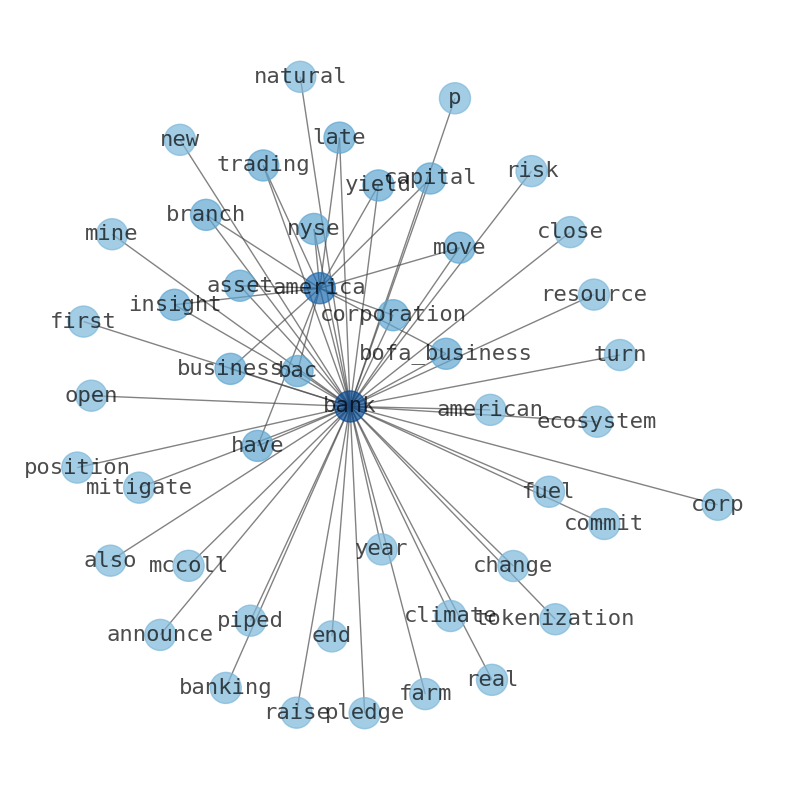

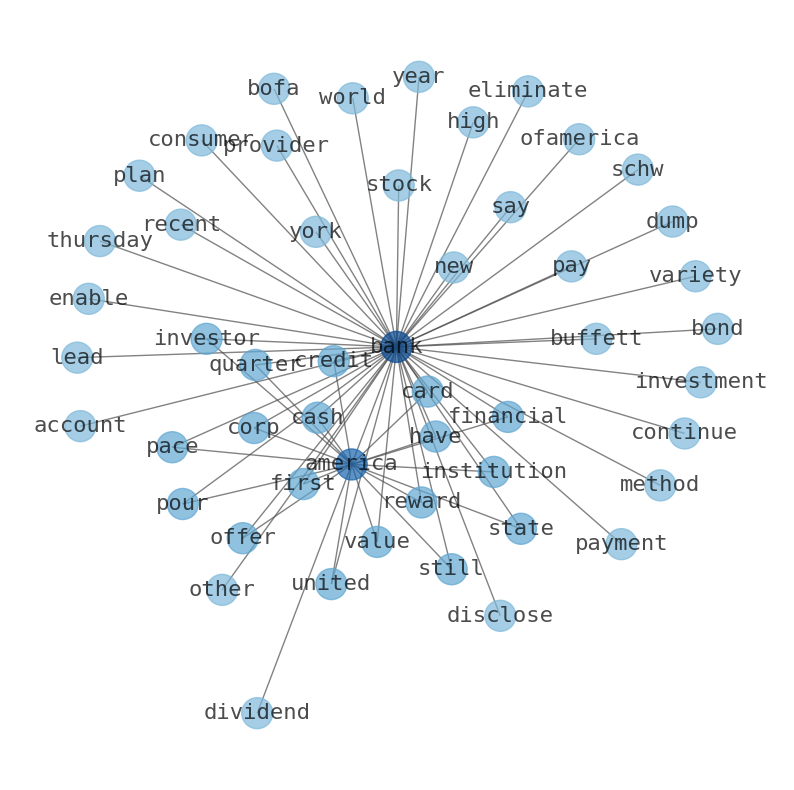

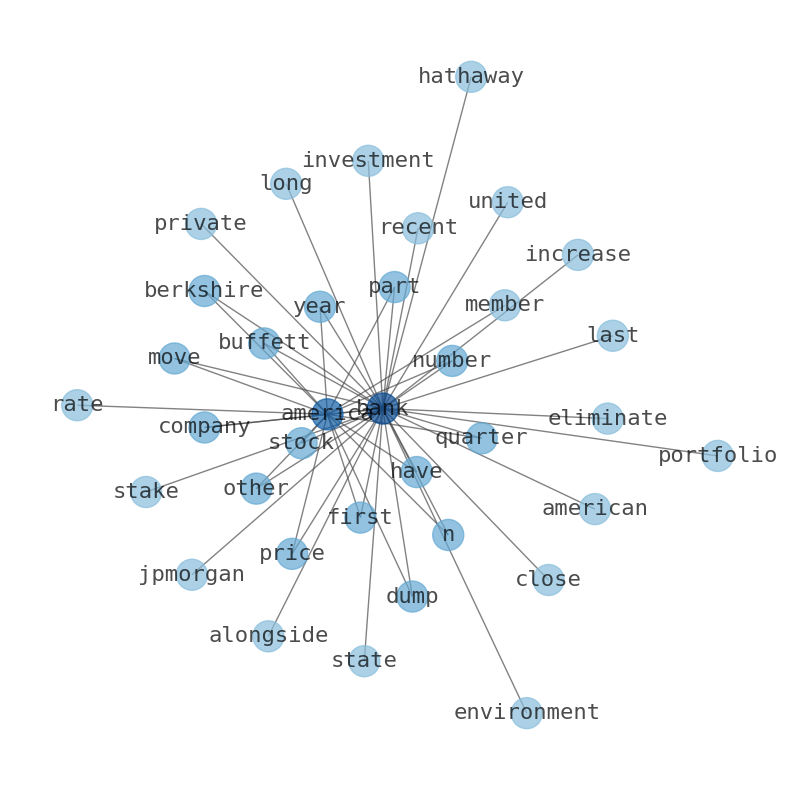

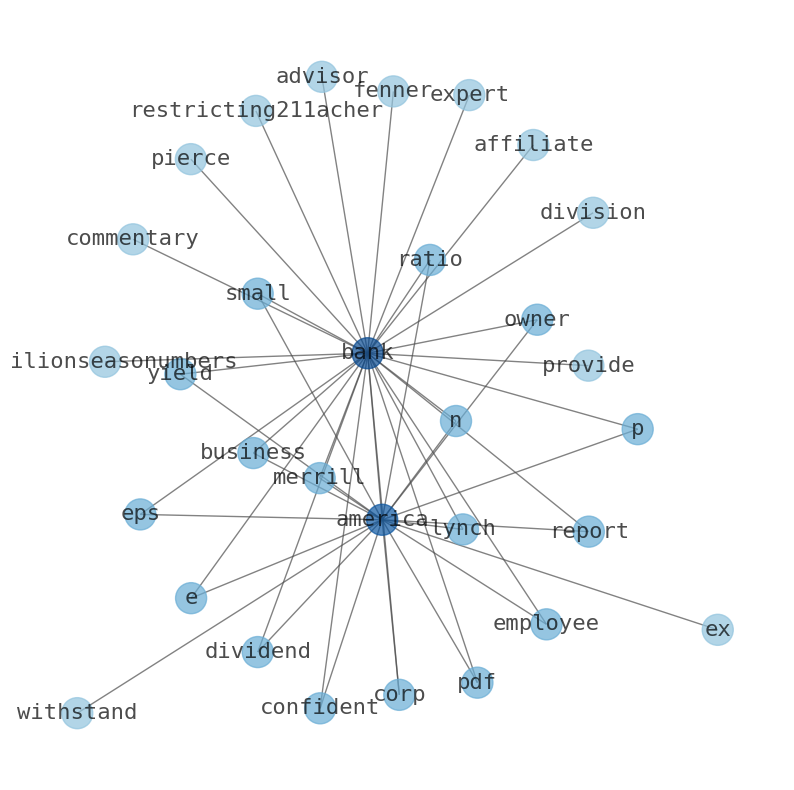

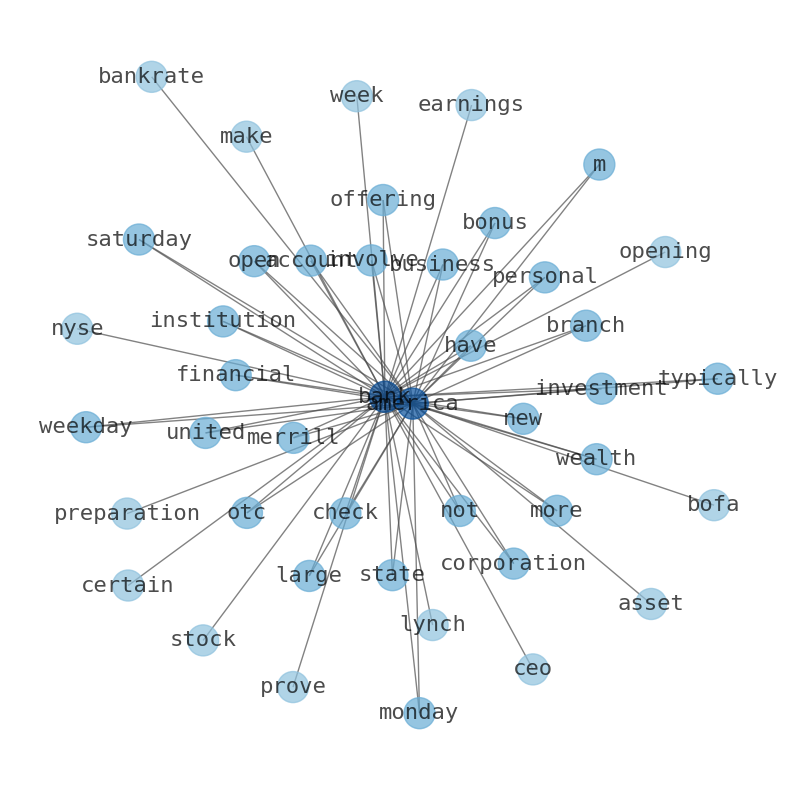

Keywords

How much time have you spent trying to decide whether investing in Bank of America? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Bank of America are: Bank, America, stock, Sector, Markets, Insider, Ticker, and the most common words in the summary are: bank, best, credit, market, stock, insurance, rate, . One of the sentences in the summary was: Goldman Sachs Group Inc.s stock GS, +4.06% at midday Friday with a rise of 4%. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #bank #best #credit #market #stock #insurance #rate.

Read more →Related Results

Bank of America

Open: 35.28 Close: 35.41 Change: 0.13

Read more →

Bank of America

Open: 33.73 Close: 33.92 Change: 0.19

Read more →

Bank of America

Open: 33.36 Close: 33.7 Change: 0.34

Read more →

Bank of America

Open: 33.32 Close: 34.07 Change: 0.75

Read more →

Bank of America

Open: 33.1 Close: 33.07 Change: -0.03

Read more →

Bank of America

Open: 33.4 Close: 33.43 Change: 0.03

Read more →

Bank of America

Open: 31.8 Close: 32.22 Change: 0.42

Read more →

Bank of America

Open: 33.8 Close: 34.43 Change: 0.63

Read more →

Bank of America

Open: 33.39 Close: 33.9 Change: 0.51

Read more →

Bank of America

Open: 33.94 Close: 33.67 Change: -0.27

Read more →

Bank of America

Open: 33.94 Close: 33.67 Change: -0.27

Read more →

Bank of America

Open: 33.71 Close: 33.43 Change: -0.28

Read more →

Bank of America

Open: 29.48 Close: 29.73 Change: 0.25

Read more →

Bank of America

Open: 29.74 Close: 29.63 Change: -0.11

Read more →

Bank of America

Open: 29.99 Close: 29.66 Change: -0.33

Read more →

Bank of America

Open: 28.5 Close: 29.22 Change: 0.72

Read more →

Bank of America

Open: 28.56 Close: 28.33 Change: -0.23

Read more →

Bank of America

Open: 26.13 Close: 25.61 Change: -0.52

Read more →

Bank of America

Open: 26.8 Close: 26.31 Change: -0.49

Read more →

Bank of America

Open: 27.43 Close: 26.76 Change: -0.67

Read more →

Bank of America

Open: 27.43 Close: 26.68 Change: -0.75

Read more →

Bank of America

Open: 25.78 Close: 25.92 Change: 0.14

Read more →

Bank of America

Open: 27.23 Close: 27.43 Change: 0.2

Read more →

Bank of America

Open: 27.5 Close: 27.6 Change: 0.1

Read more →

Bank of America

Open: 28.07 Close: 27.64 Change: -0.43

Read more →

Bank of America

Open: 28.95 Close: 28.84 Change: -0.11

Read more →

Bank of America

Open: 29.12 Close: 28.88 Change: -0.24

Read more →

Bank of America

Open: 28.41 Close: 28.13 Change: -0.28

Read more →

Bank of America

Open: 28.76 Close: 28.98 Change: 0.22

Read more →

Bank of America

Open: 29.22 Close: 29.04 Change: -0.18

Read more →

Bank of America

Open: 28.64 Close: 28.5 Change: -0.14

Read more →

Bank of America

Open: 29.22 Close: 29.15 Change: -0.07

Read more →

Bank of America

Open: 31.22 Close: 30.86 Change: -0.36

Read more →

Bank of America

Open: 31.87 Close: 31.98 Change: 0.11

Read more →

Bank of America

Open: 28.59 Close: 28.66 Change: 0.07

Read more →

Bank of America

Open: 28.8 Close: 28.28 Change: -0.52

Read more →

Bank of America

Open: 29.14 Close: 29.08 Change: -0.06

Read more →

Bank of America

Open: 28.5 Close: 28.66 Change: 0.16

Read more →

Bank of America

Open: 27.74 Close: 27.75 Change: 0.01

Read more →

Bank of America

Open: 29.53 Close: 29.19 Change: -0.34

Read more →

Bank of America

Open: 29.57 Close: 29.12 Change: -0.45

Read more →

Bank of America

Open: 28.82 Close: 28.67 Change: -0.15

Read more →

Bank of America

Open: 28.32 Close: 28.26 Change: -0.06

Read more →

Bank of America

Open: 27.99 Close: 28.17 Change: 0.18

Read more →

Bank of America

Open: 28.46 Close: 28.11 Change: -0.35

Read more →

Bank of America

Open: 27.52 Close: 26.93 Change: -0.59

Read more →

Bank of America

Open: 28.16 Close: 27.86 Change: -0.3

Read more →

Bank of America

Open: 29.75 Close: 29.87 Change: 0.12

Read more →

Bank of America

Open: 35.87 Close: 35.6 Change: -0.27

Read more →

Bank of America

Open: 33.37 Close: 33.61 Change: 0.24

Read more →

Bank of America

Open: 33.92 Close: 34.09 Change: 0.17

Read more →

Bank of America

Open: 33.1 Close: 33.07 Change: -0.03

Read more →

Bank of America

Open: 33.06 Close: 33.18 Change: 0.12

Read more →

Bank of America

Open: 33.4 Close: 33.43 Change: 0.03

Read more →

Bank of America

Open: 33.5 Close: 33.33 Change: -0.17

Read more →

Bank of America

Open: 33.39 Close: 33.9 Change: 0.51

Read more →

Bank of America

Open: 33.94 Close: 33.67 Change: -0.27

Read more →

Bank of America

Open: 33.94 Close: 33.67 Change: -0.27

Read more →

Bank of America

Open: 33.03 Close: 33.51 Change: 0.48

Read more →

Bank of America

Open: 30.77 Close: 30.74 Change: -0.03

Read more →

Bank of America

Open: 29.48 Close: 29.73 Change: 0.25

Read more →

Bank of America

Open: 29.74 Close: 29.59 Change: -0.15

Read more →

Bank of America

Open: 29.2 Close: 29.62 Change: 0.42

Read more →

Bank of America

Open: 28.56 Close: 28.33 Change: -0.23

Read more →

Bank of America

Open: 26.07 Close: 25.17 Change: -0.9

Read more →

Bank of America

Open: 26.8 Close: 26.31 Change: -0.49

Read more →

Bank of America

Open: 27.54 Close: 27.31 Change: -0.23

Read more →

Bank of America

Open: 27.43 Close: 26.76 Change: -0.67

Read more →

Bank of America

Open: 27.17 Close: 27.02 Change: -0.15

Read more →

Bank of America

Open: 27.89 Close: 27.38 Change: -0.51

Read more →

Bank of America

Open: 27.23 Close: 27.27 Change: 0.04

Read more →

Bank of America

Open: 28.07 Close: 27.64 Change: -0.43

Read more →

Bank of America

Open: 28.81 Close: 28.55 Change: -0.26

Read more →

Bank of America

Open: 29.12 Close: 28.88 Change: -0.24

Read more →

Bank of America

Open: 28.12 Close: 28.36 Change: 0.24

Read more →

Bank of America

Open: 28.76 Close: 28.98 Change: 0.22

Read more →

Bank of America

Open: 28.76 Close: 28.98 Change: 0.22

Read more →

Bank of America

Open: 28.64 Close: 28.5 Change: -0.14

Read more →

Bank of America

Open: 28.45 Close: 28.45 Change: 0.0

Read more →

Bank of America

Open: 30.5 Close: 29.94 Change: -0.56

Read more →

Bank of America

Open: 32.15 Close: 31.9 Change: -0.25

Read more →

Bank of America

Open: 31.33 Close: 31.69 Change: 0.36

Read more →

Bank of America

Open: 28.8 Close: 28.28 Change: -0.52

Read more →

Bank of America

Open: 28.8 Close: 28.28 Change: -0.52

Read more →

Bank of America

Open: 28.94 Close: 28.69 Change: -0.25

Read more →

Bank of America

Open: 28.5 Close: 28.7 Change: 0.2

Read more →

Bank of America

Open: 29.53 Close: 29.19 Change: -0.34

Read more →

Bank of America

Open: 28.9 Close: 29.18 Change: 0.28

Read more →

Bank of America

Open: 29.3 Close: 29.5 Change: 0.2

Read more →

Bank of America

Open: 28.16 Close: 28.71 Change: 0.55

Read more →

Bank of America

Open: 28.2 Close: 28.31 Change: 0.11

Read more →

Bank of America

Open: 28.46 Close: 28.11 Change: -0.35

Read more →

Bank of America

Open: 27.78 Close: 27.36 Change: -0.42

Read more →

Bank of America

Open: 28.16 Close: 27.86 Change: -0.3

Read more →

Bank of America

Open: 28.76 Close: 28.44 Change: -0.32

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo