The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Bank of America

Youtube Subscribe

Open: 33.36 Close: 33.7 Change: 0.34

Don't invest in Bank of America before reading this automated analysis produce by an AI.

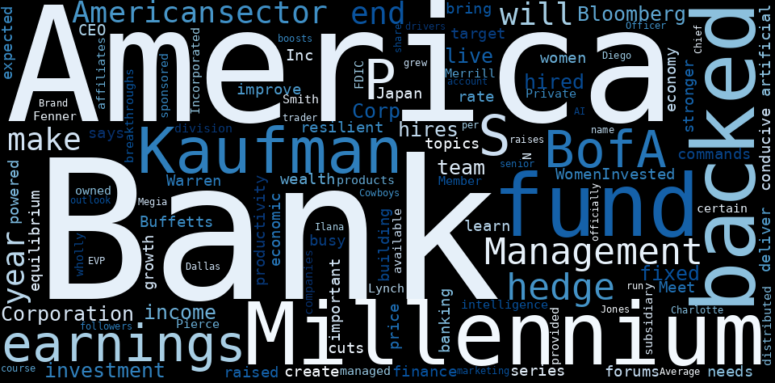

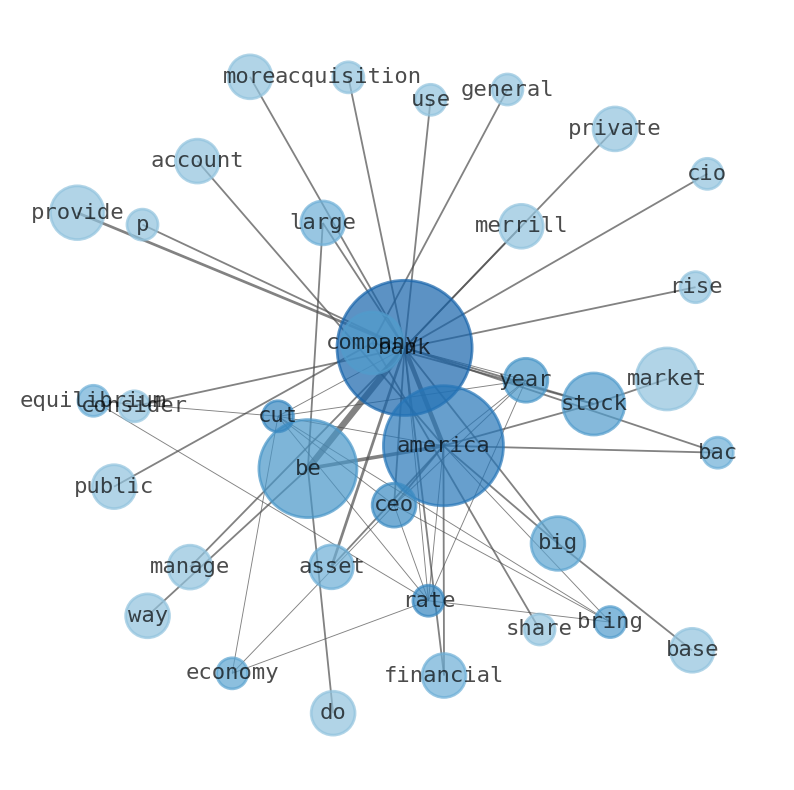

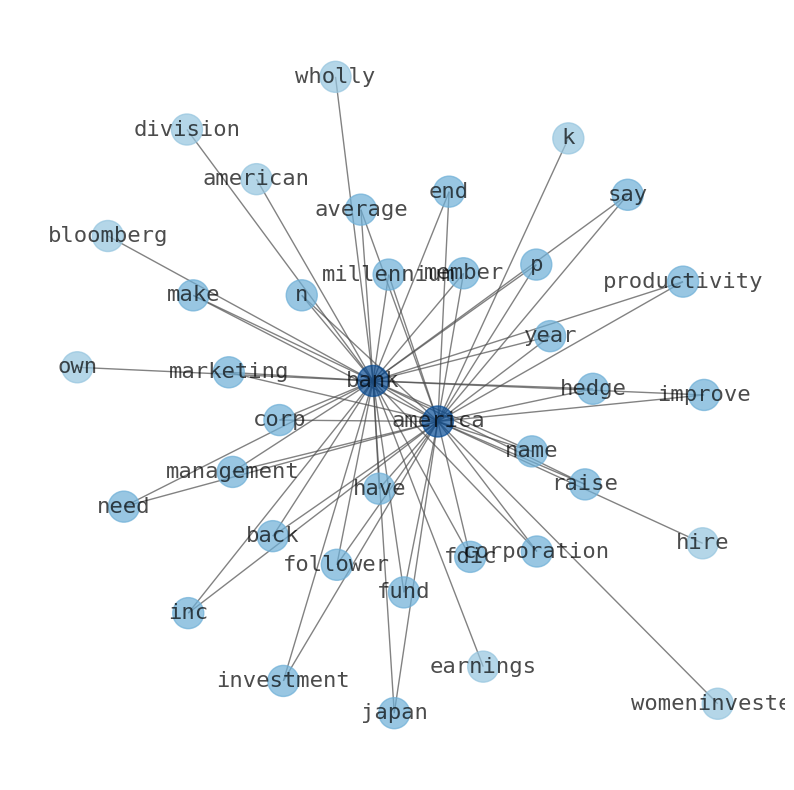

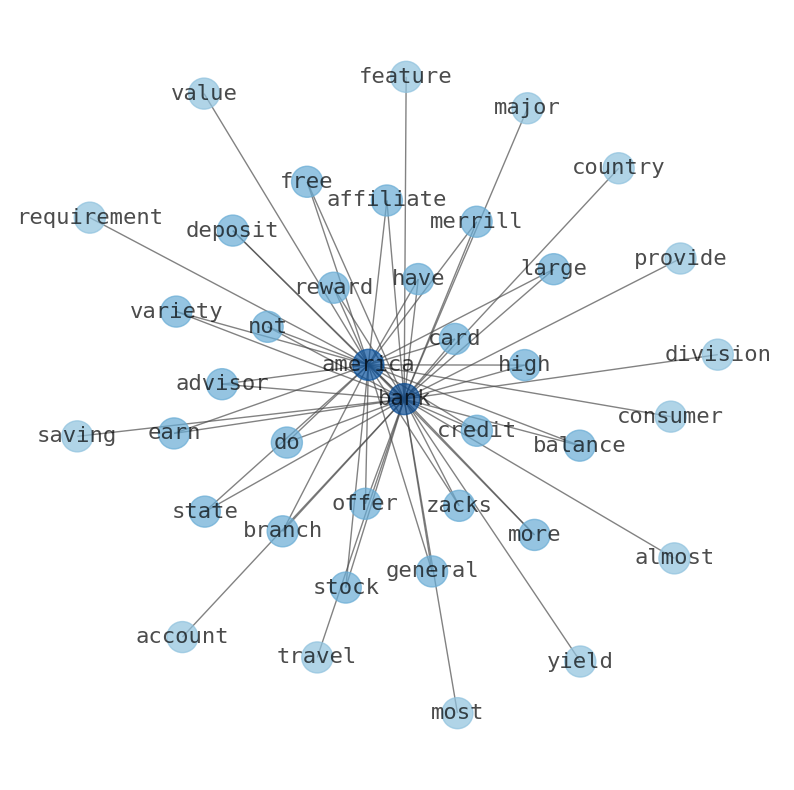

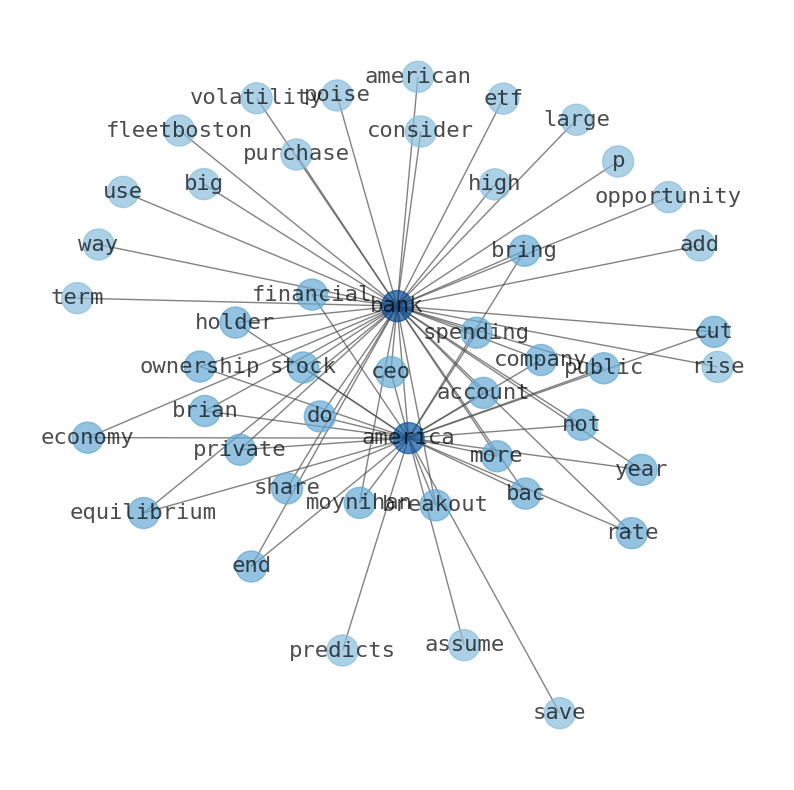

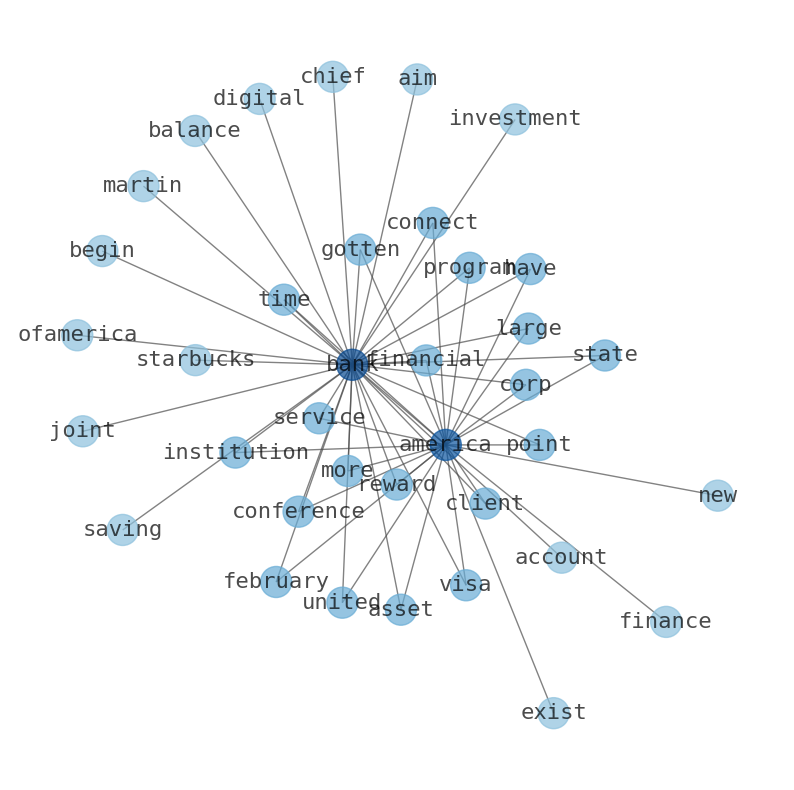

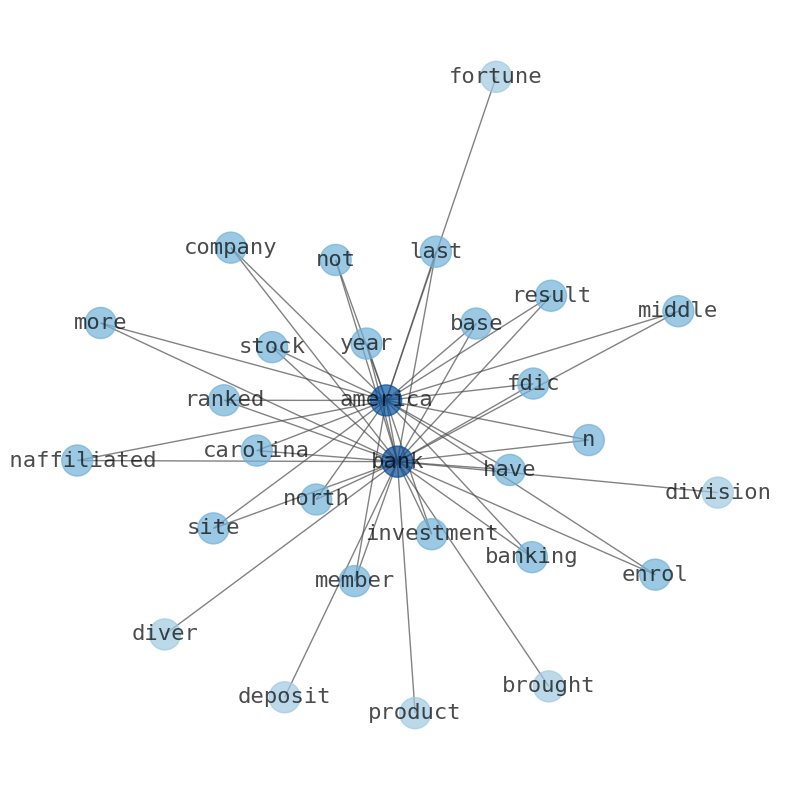

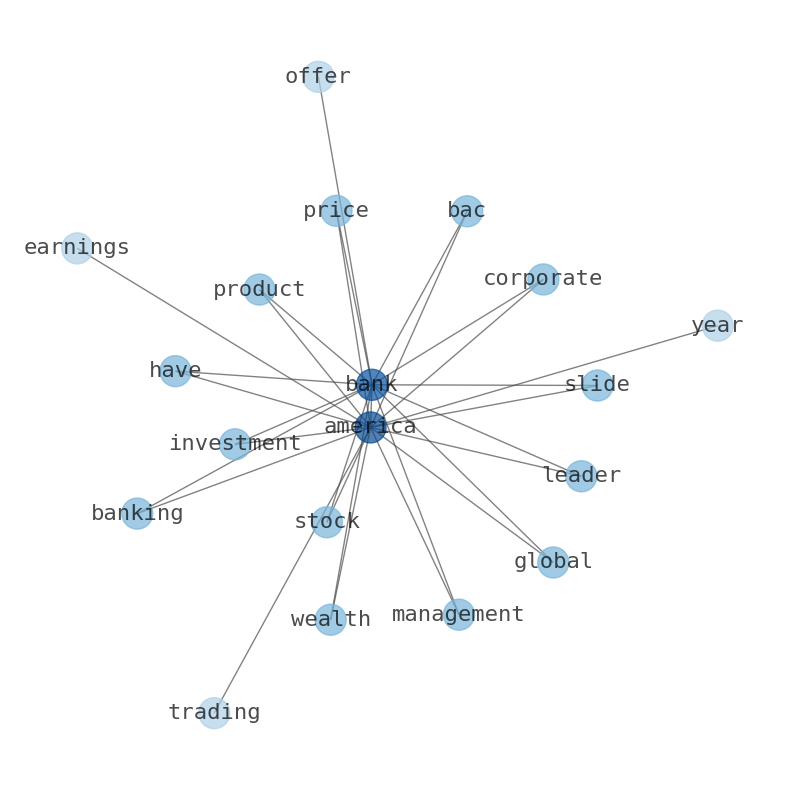

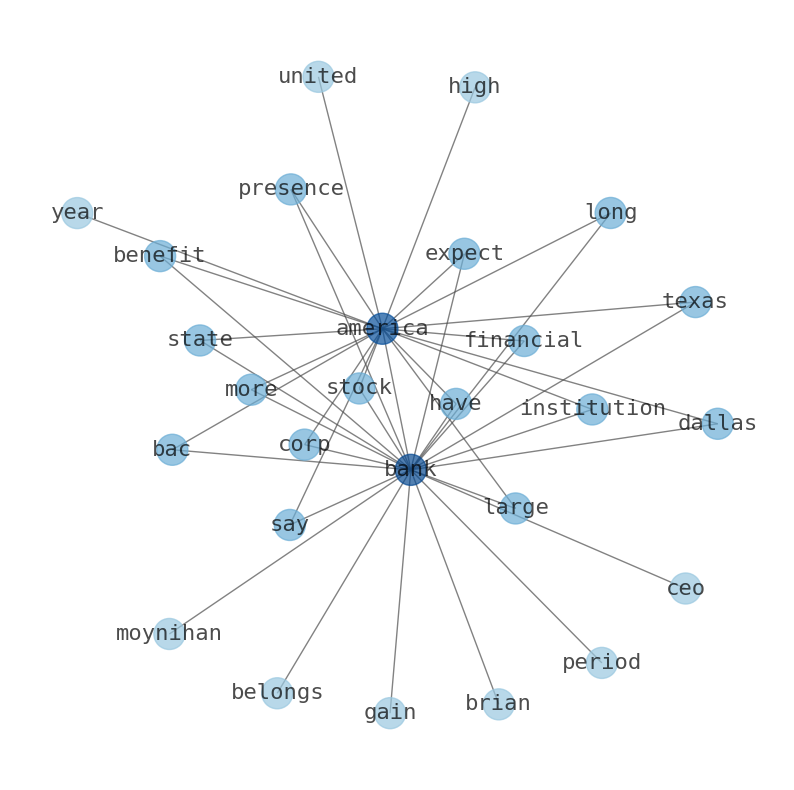

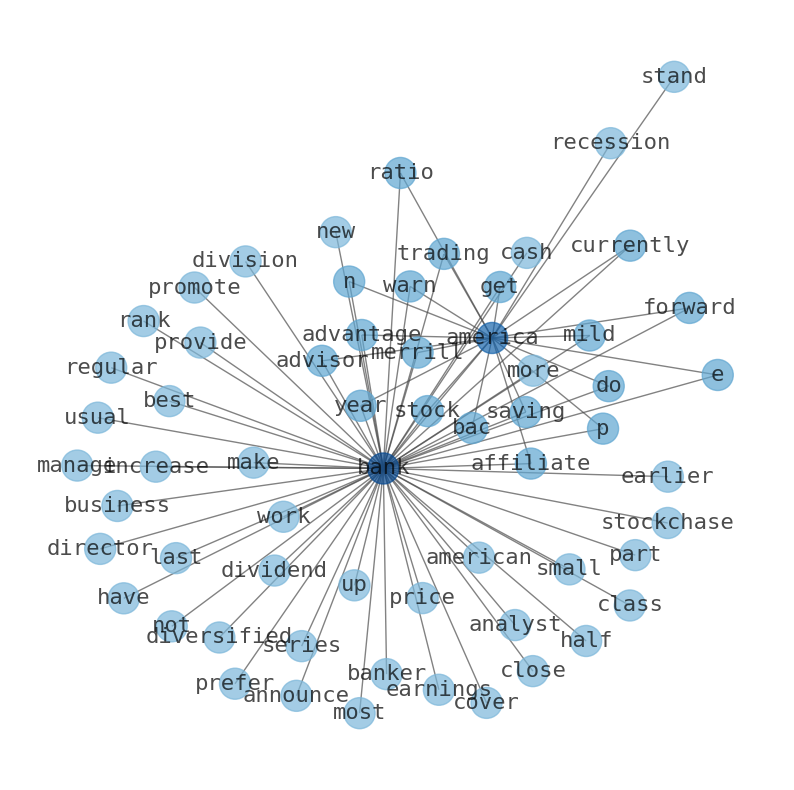

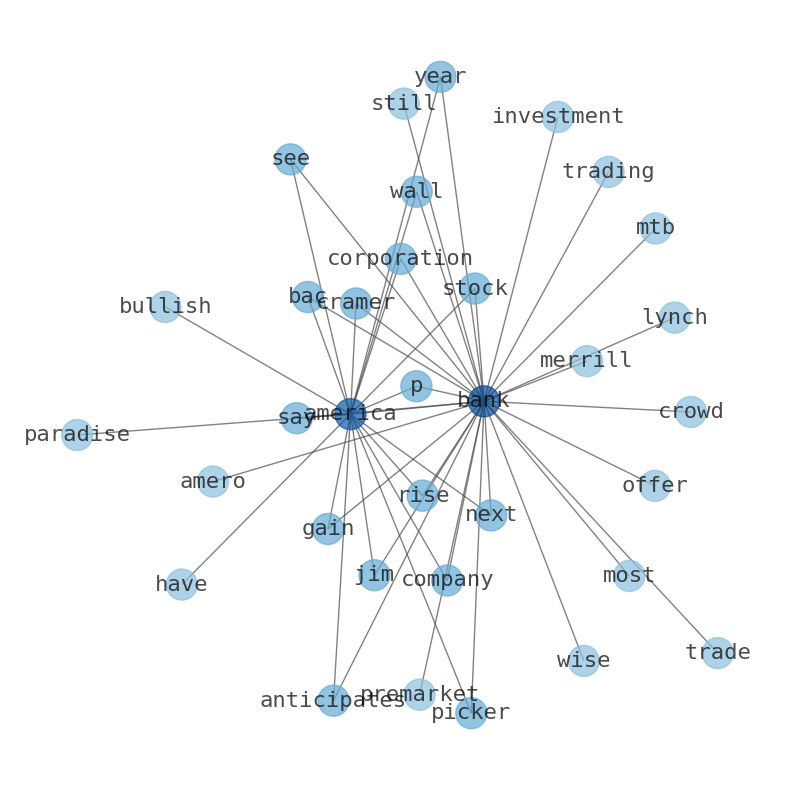

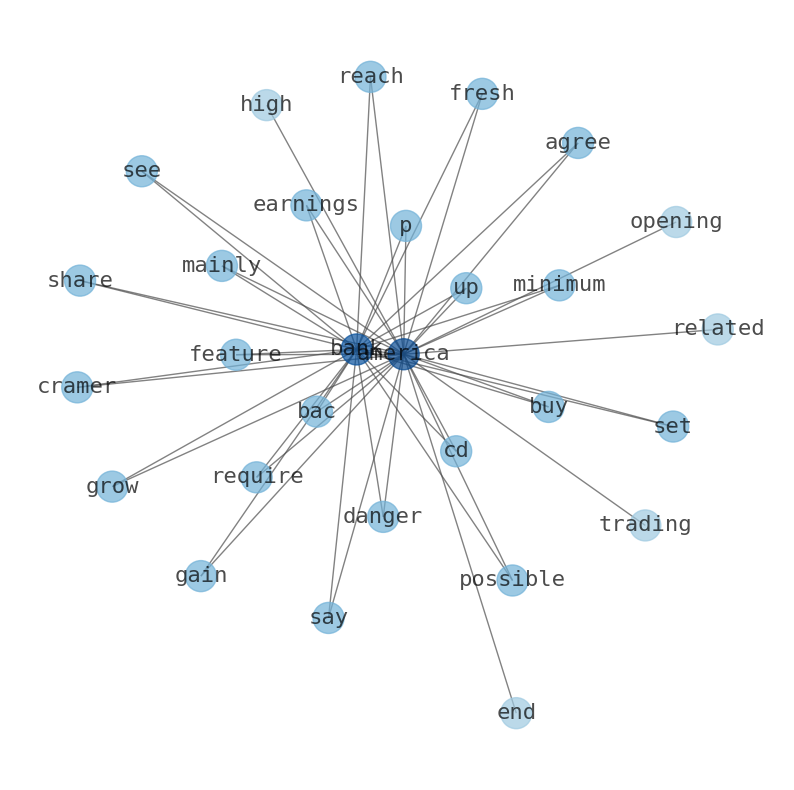

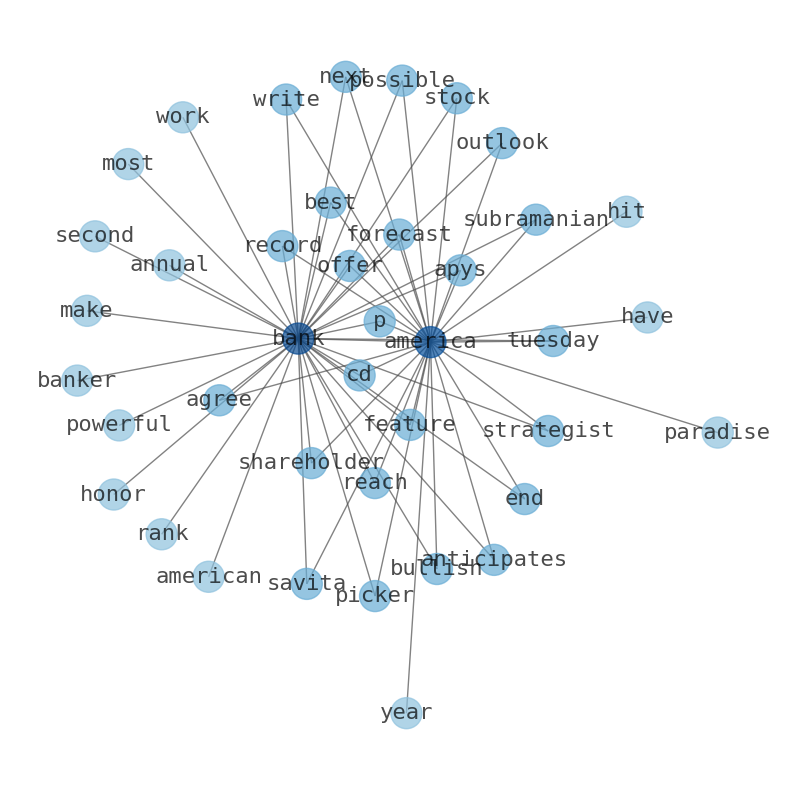

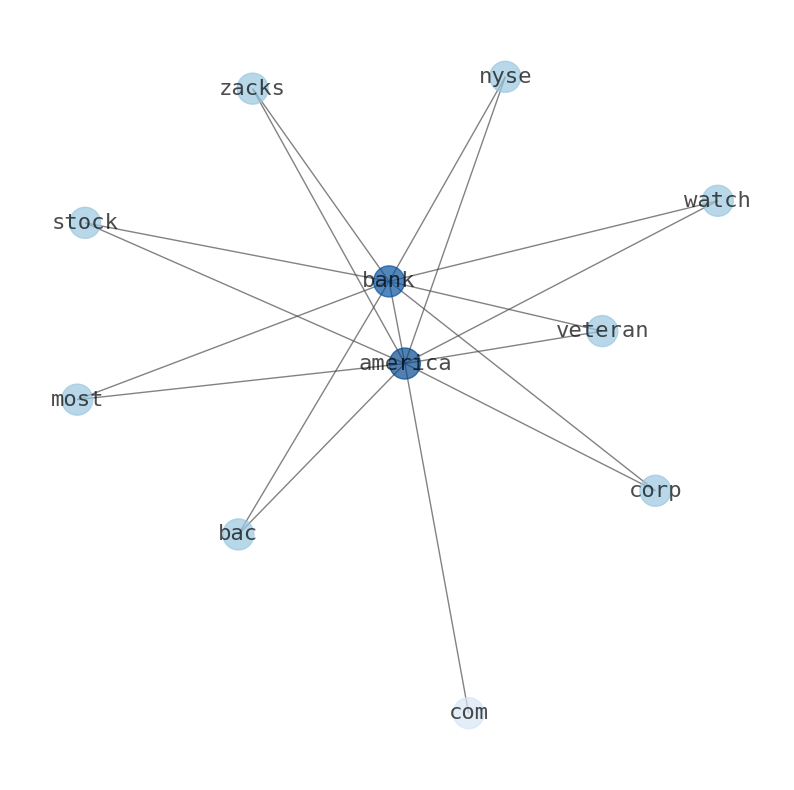

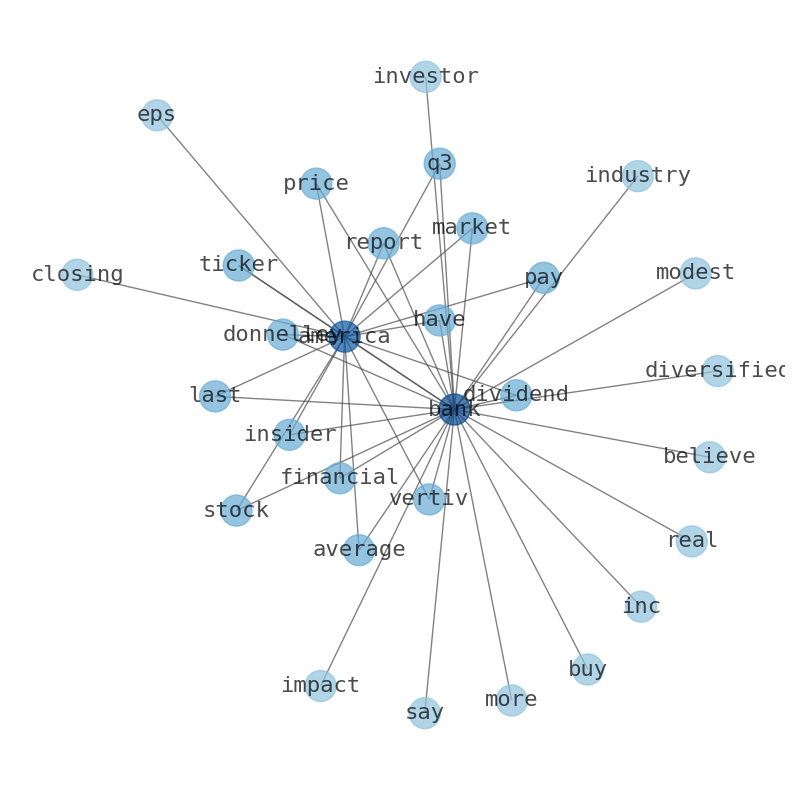

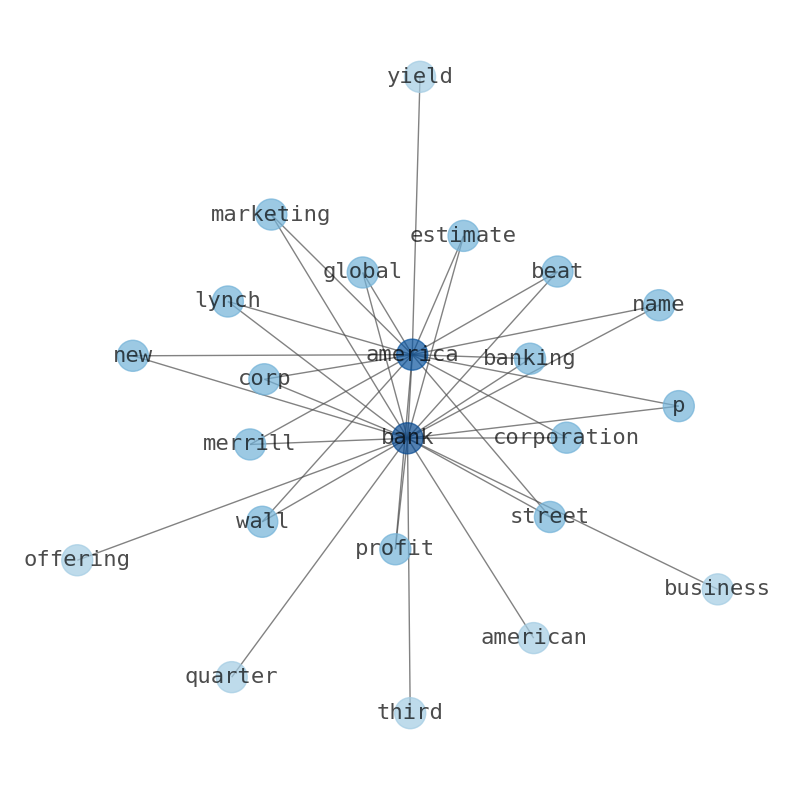

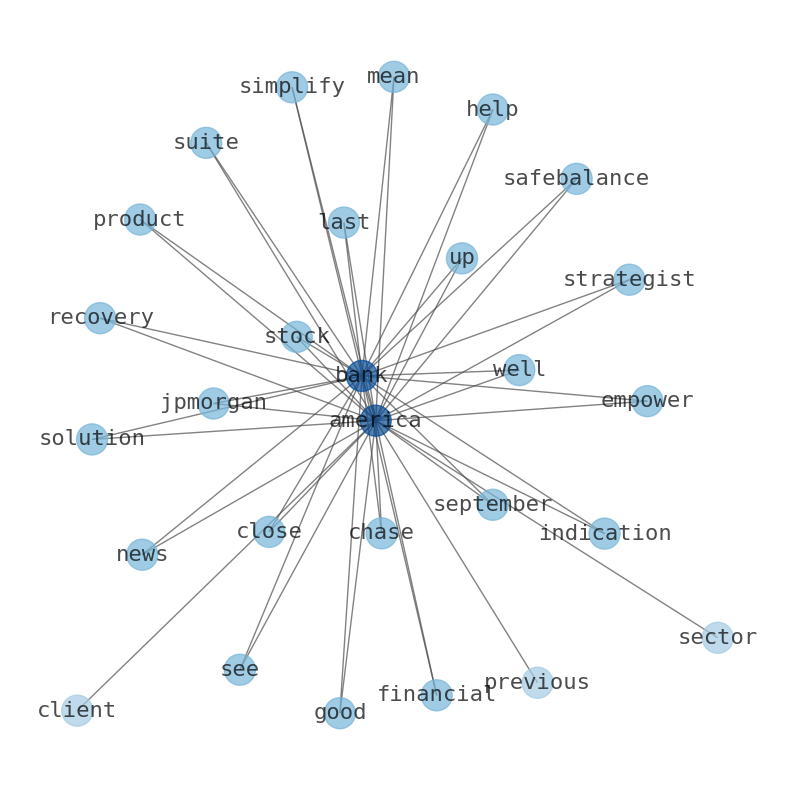

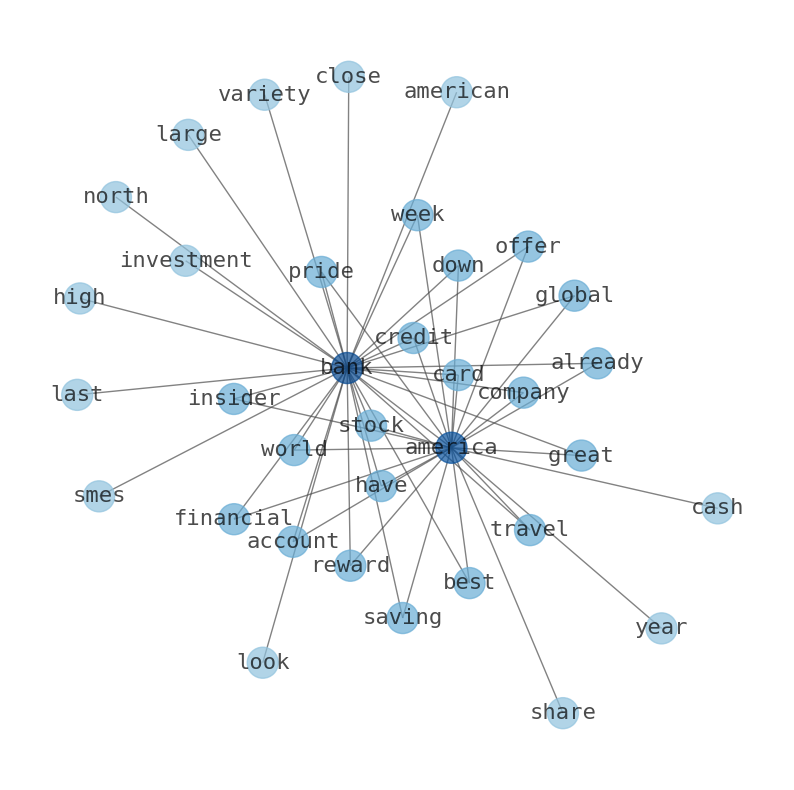

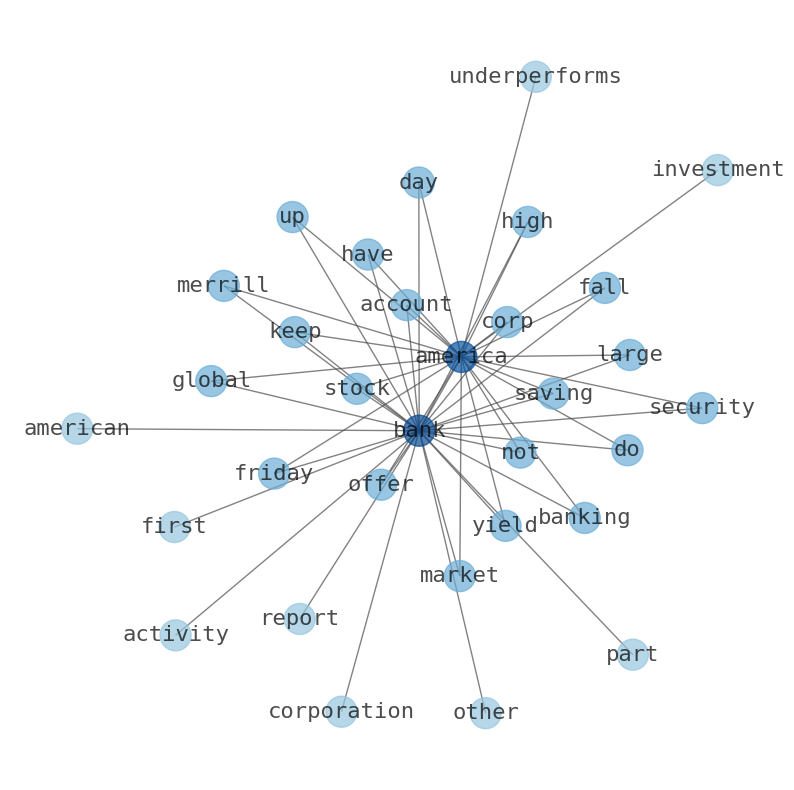

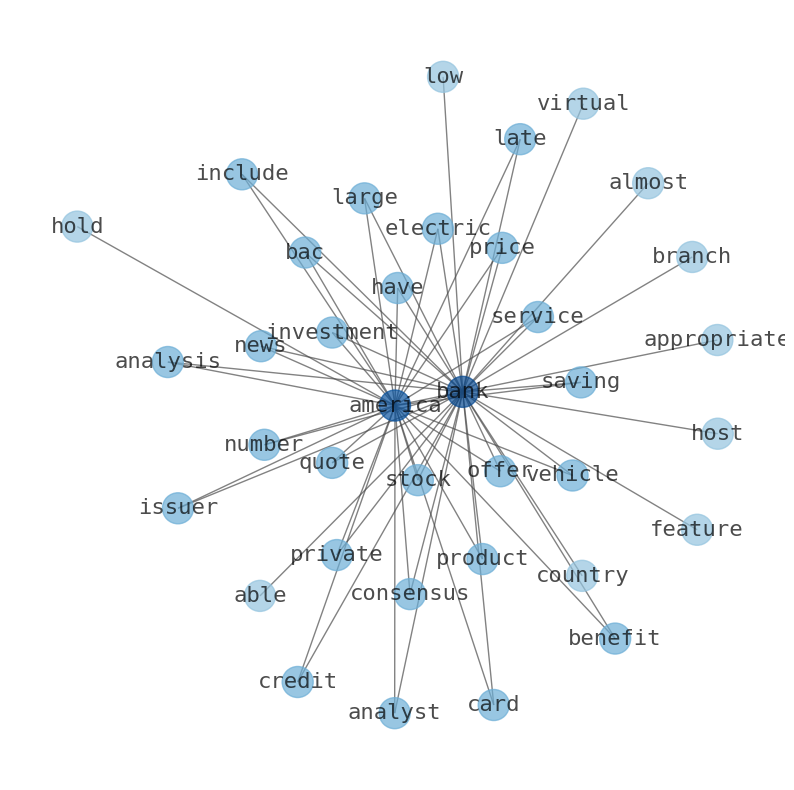

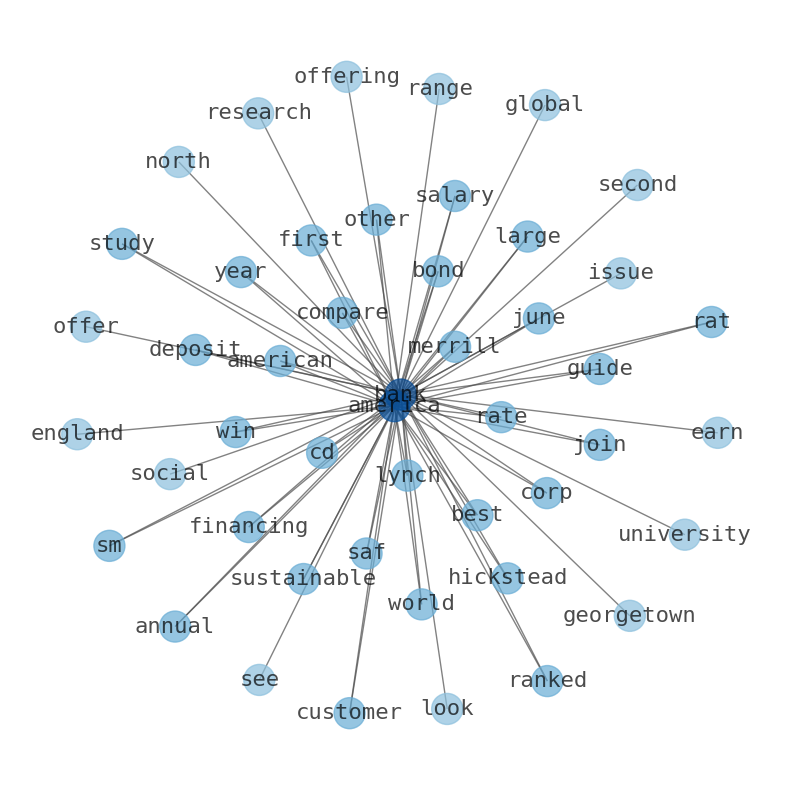

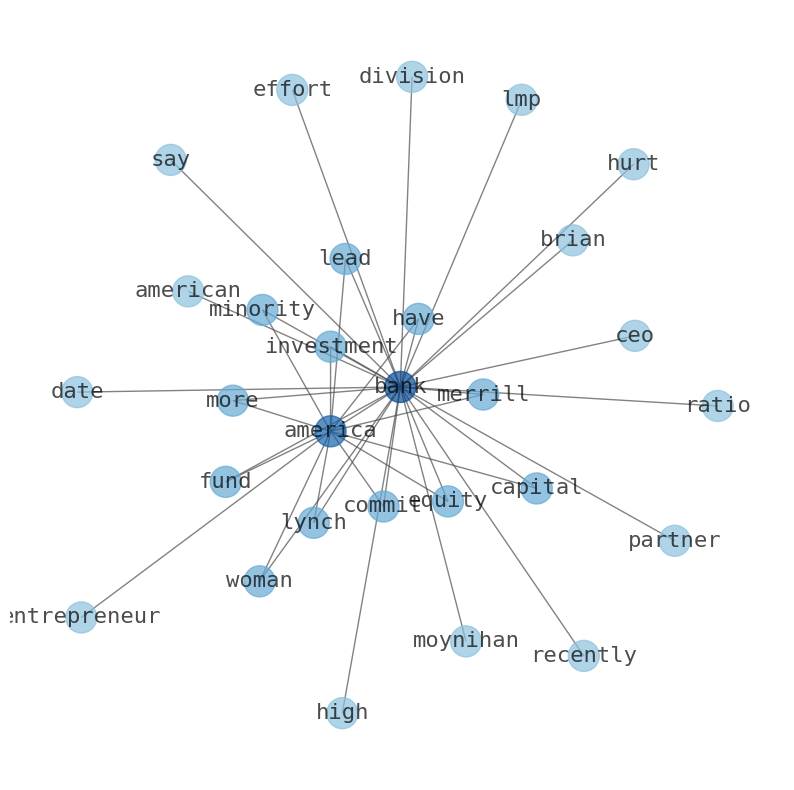

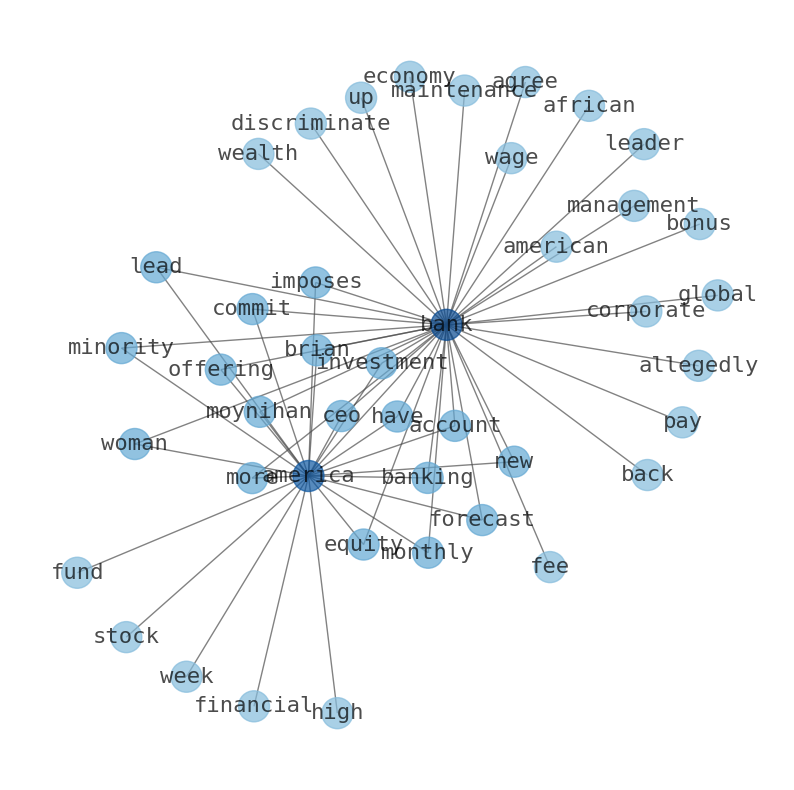

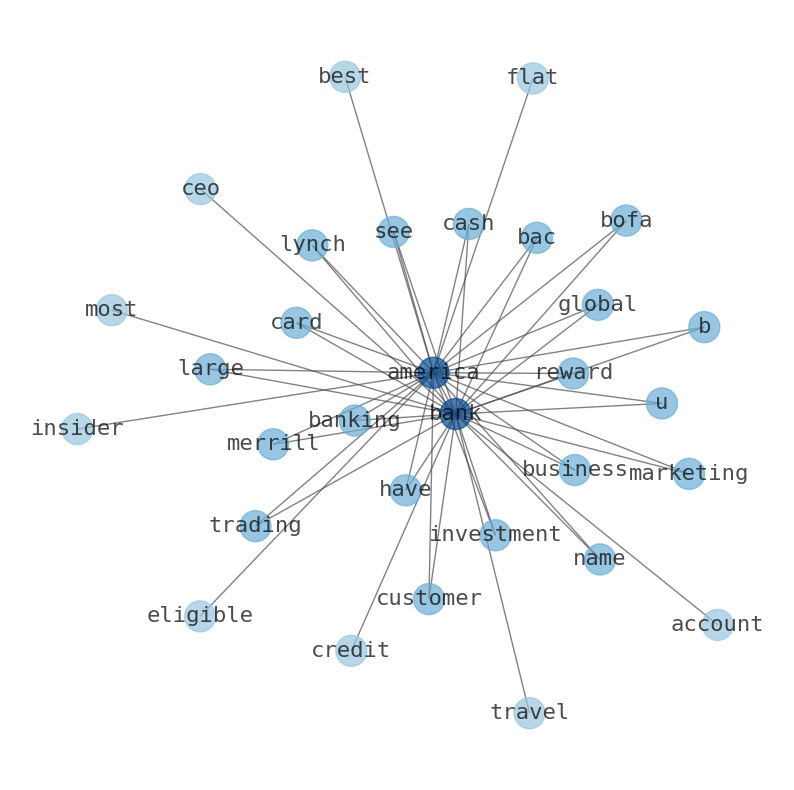

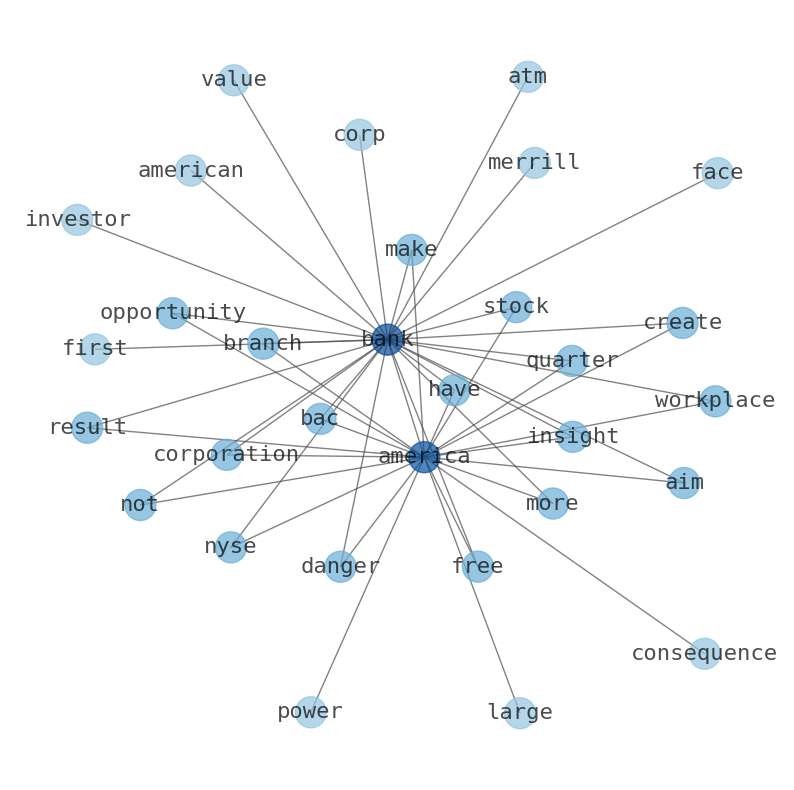

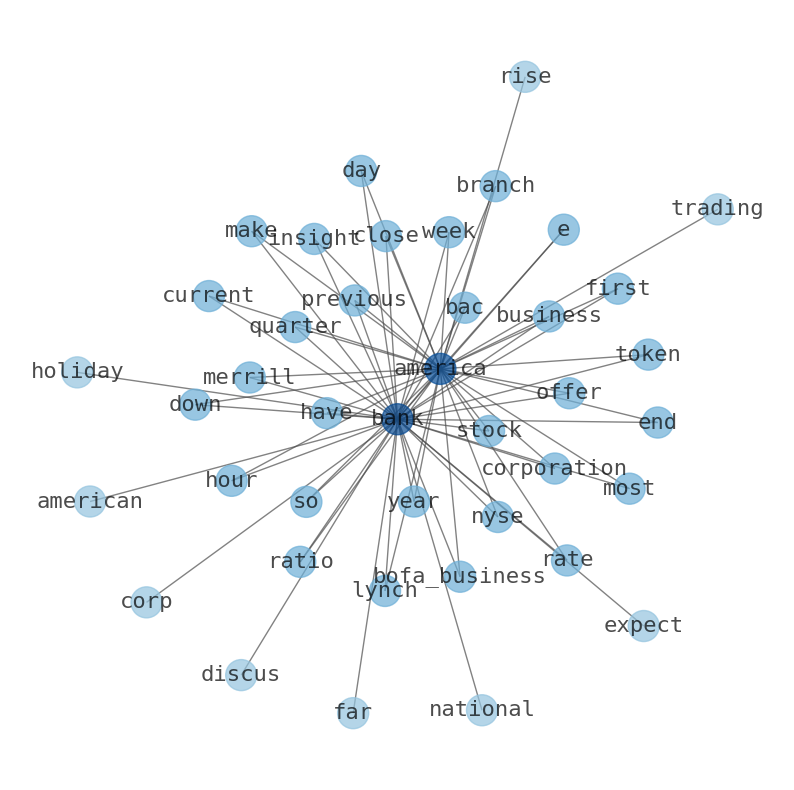

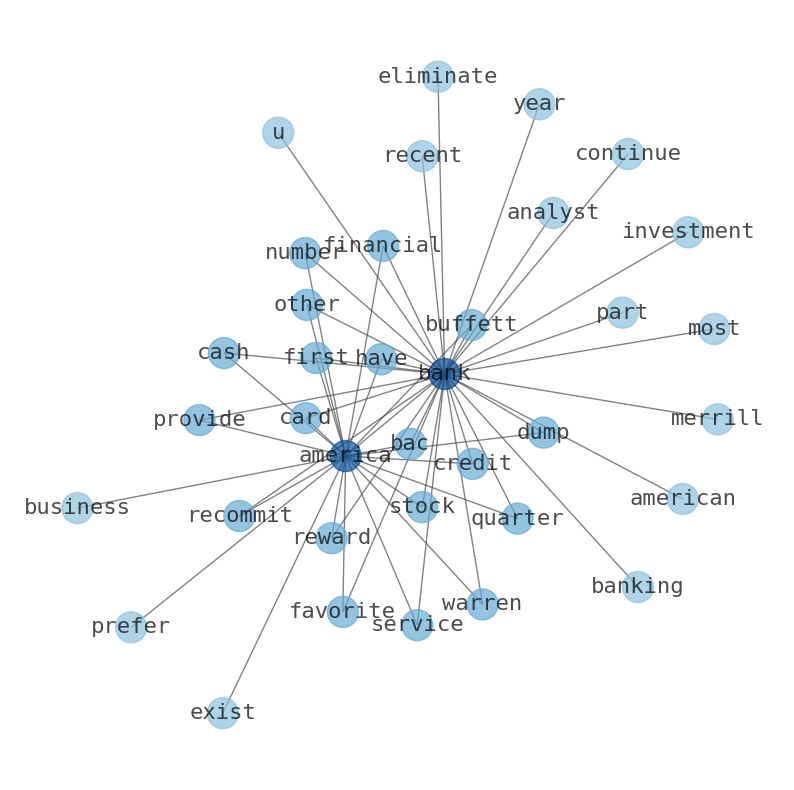

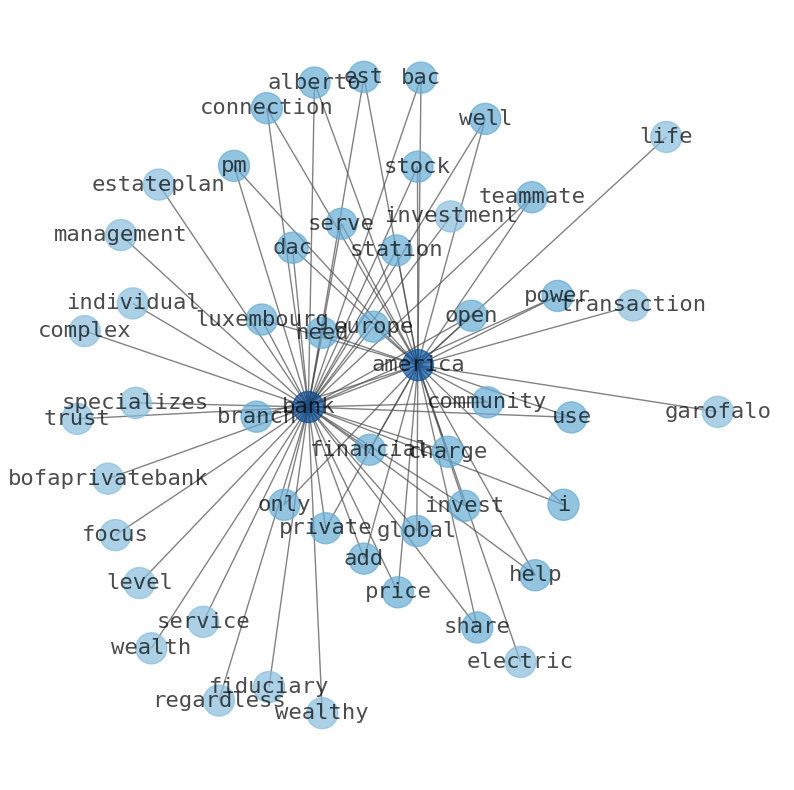

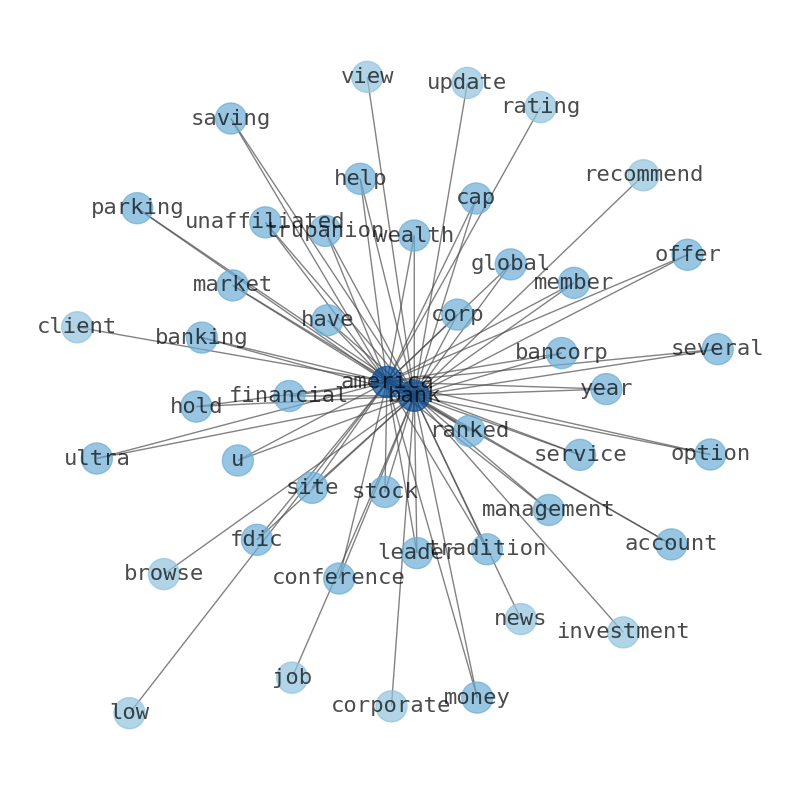

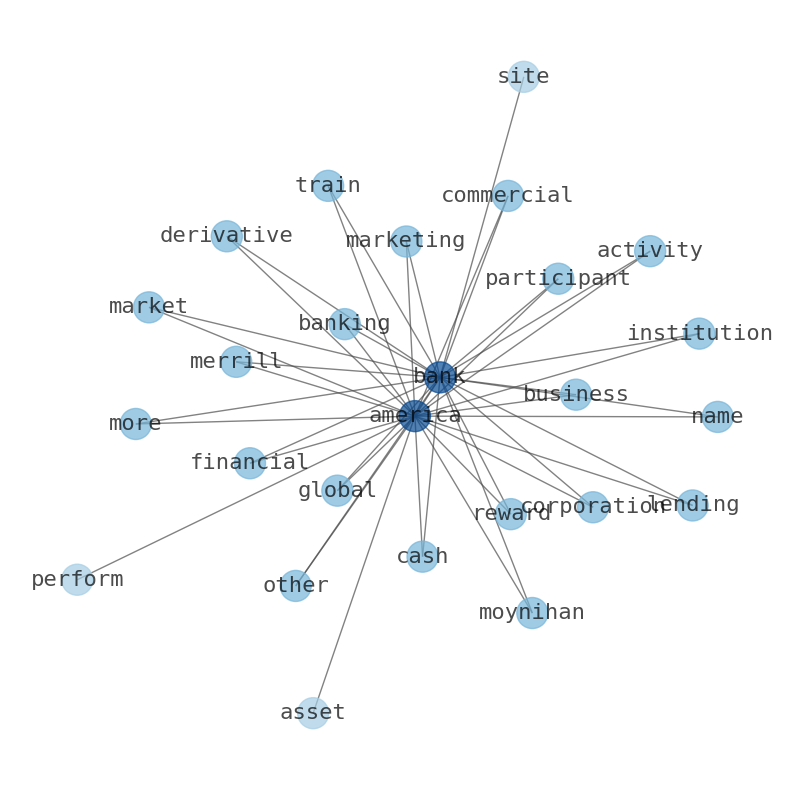

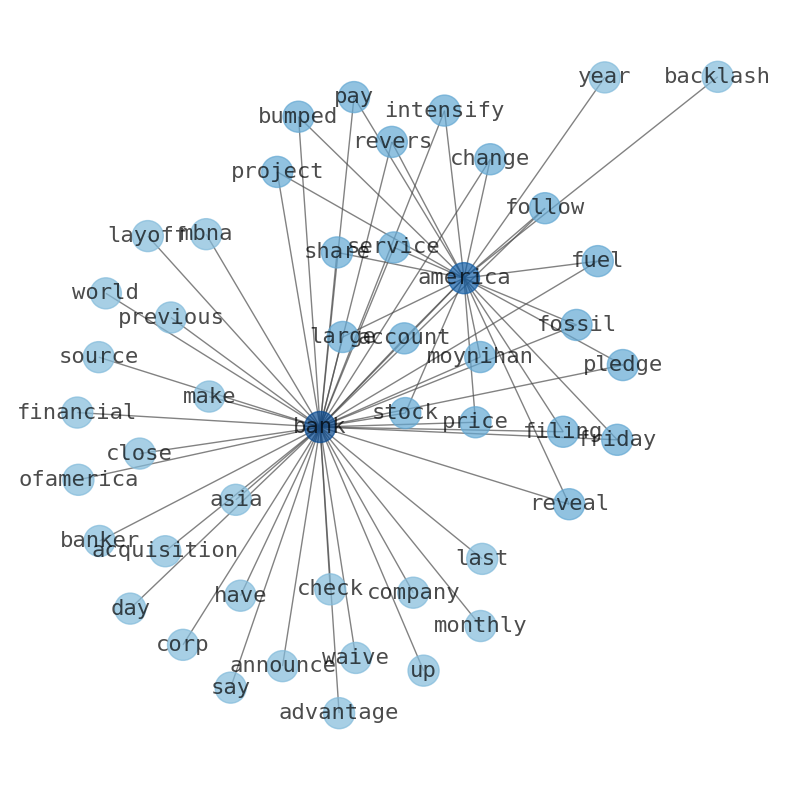

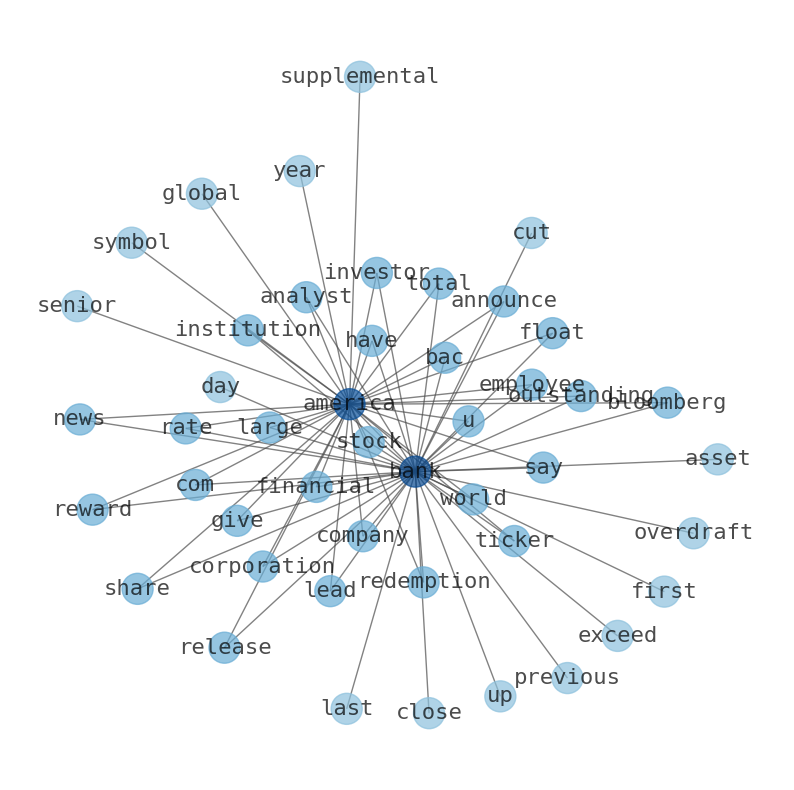

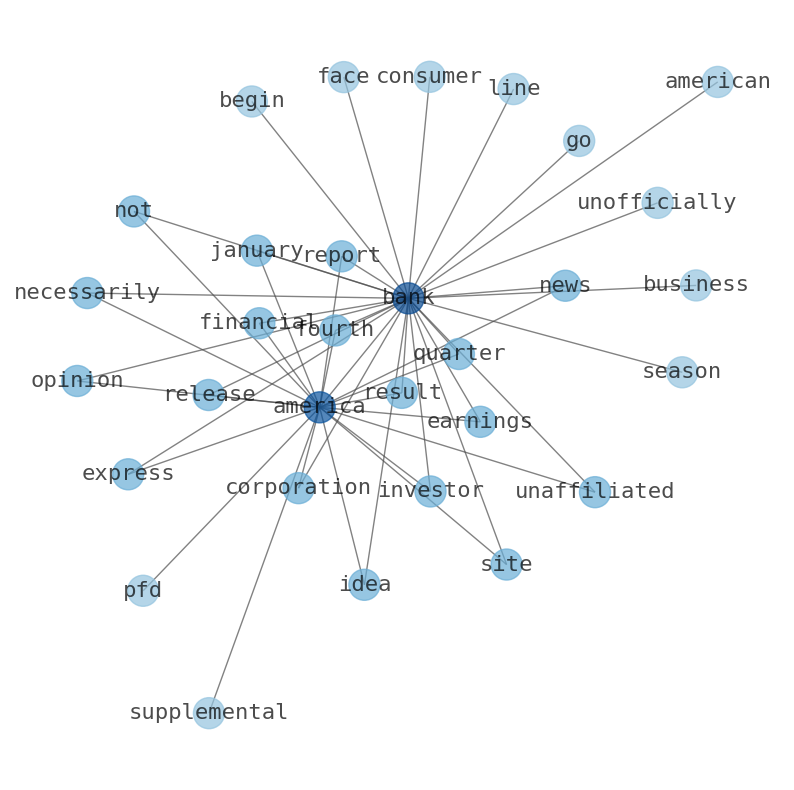

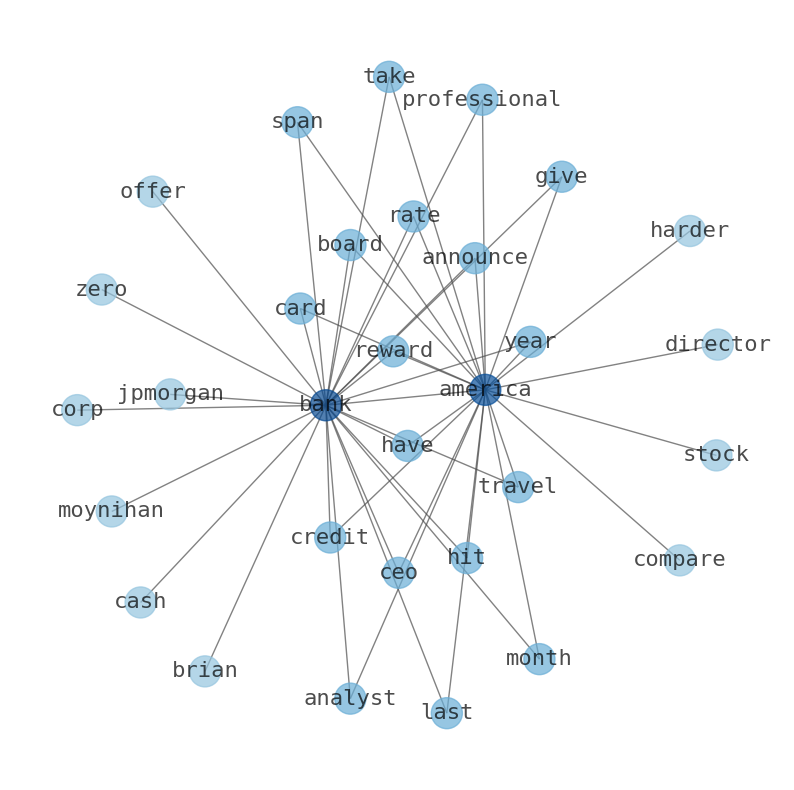

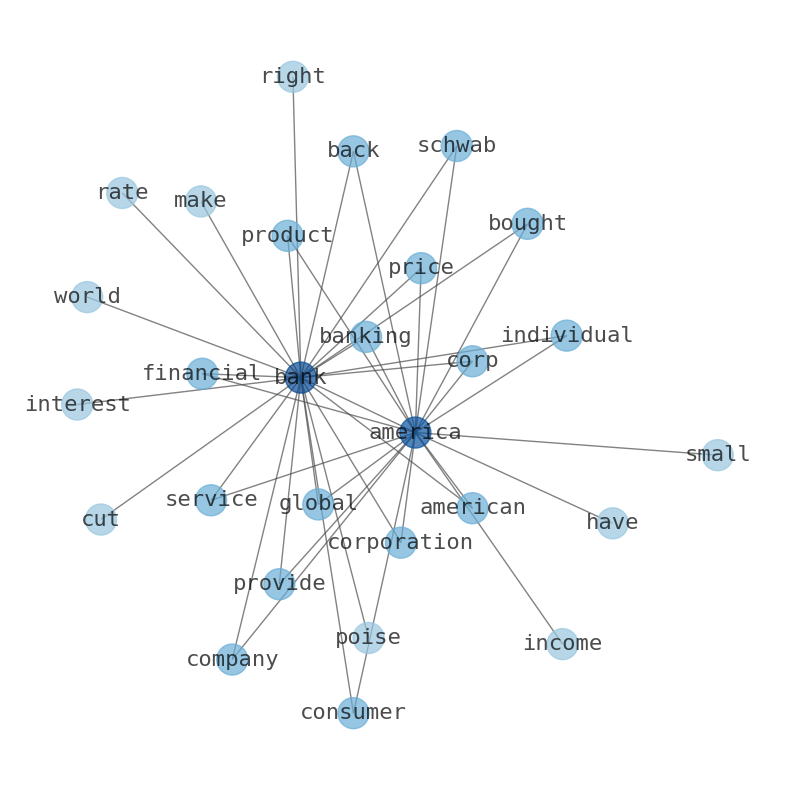

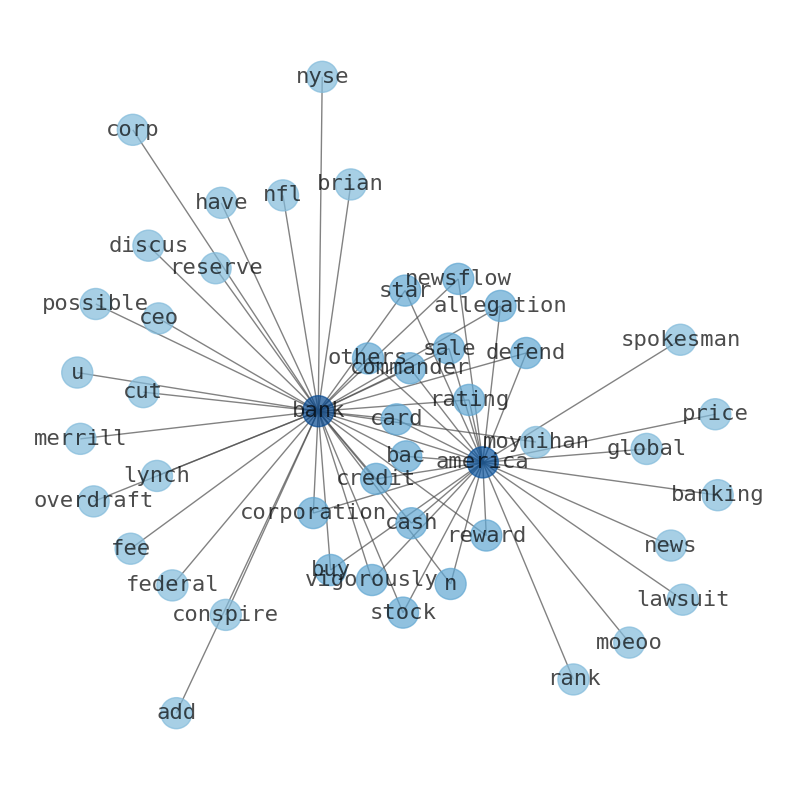

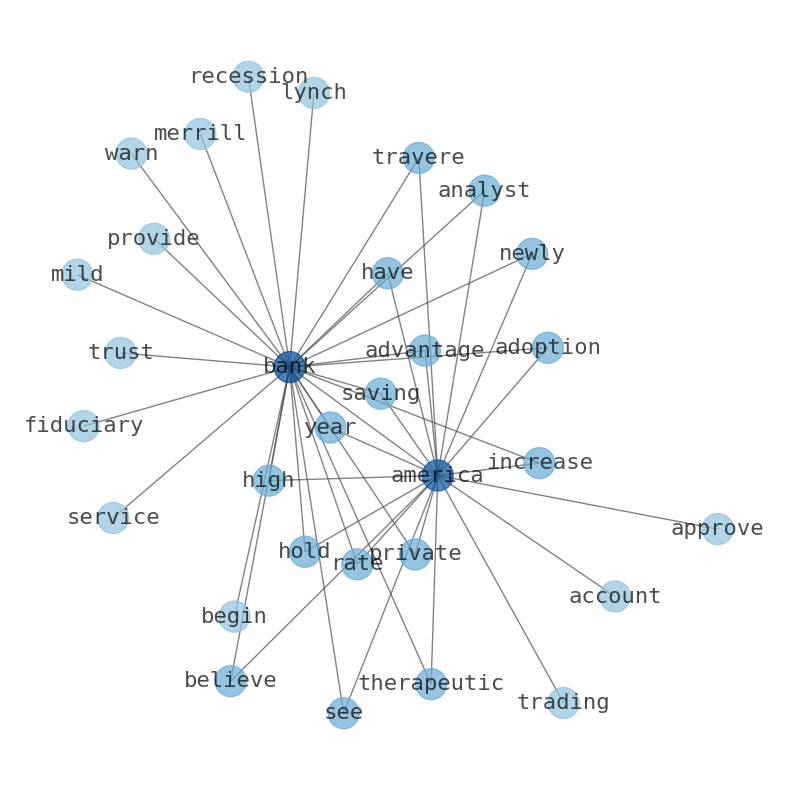

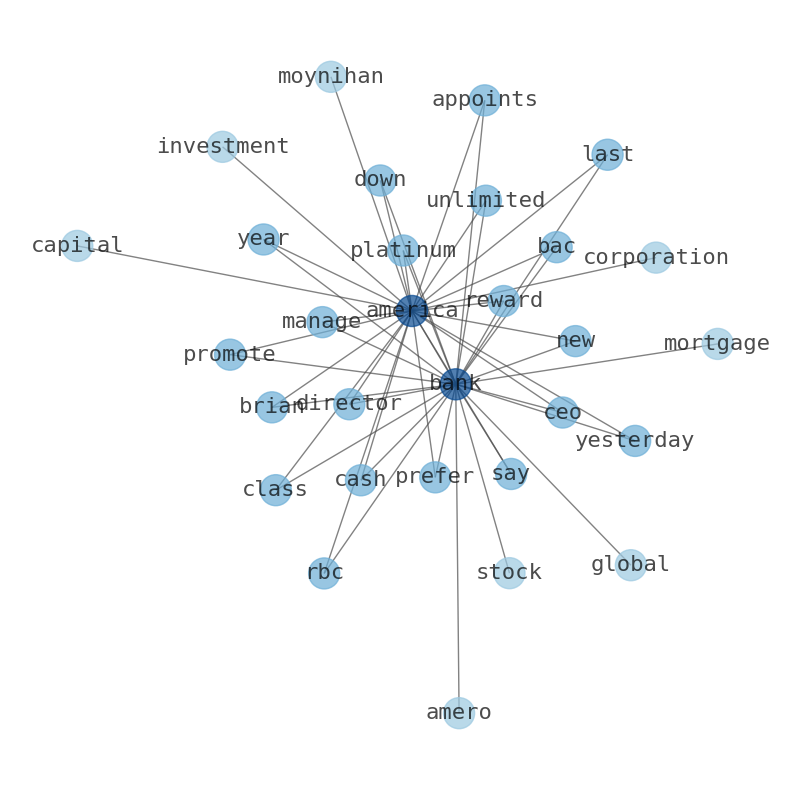

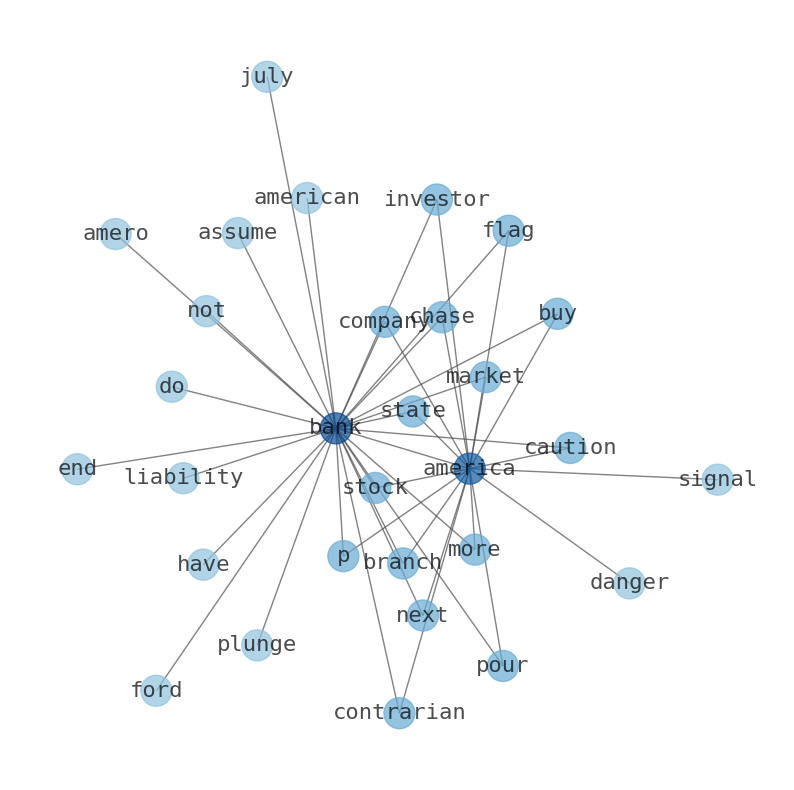

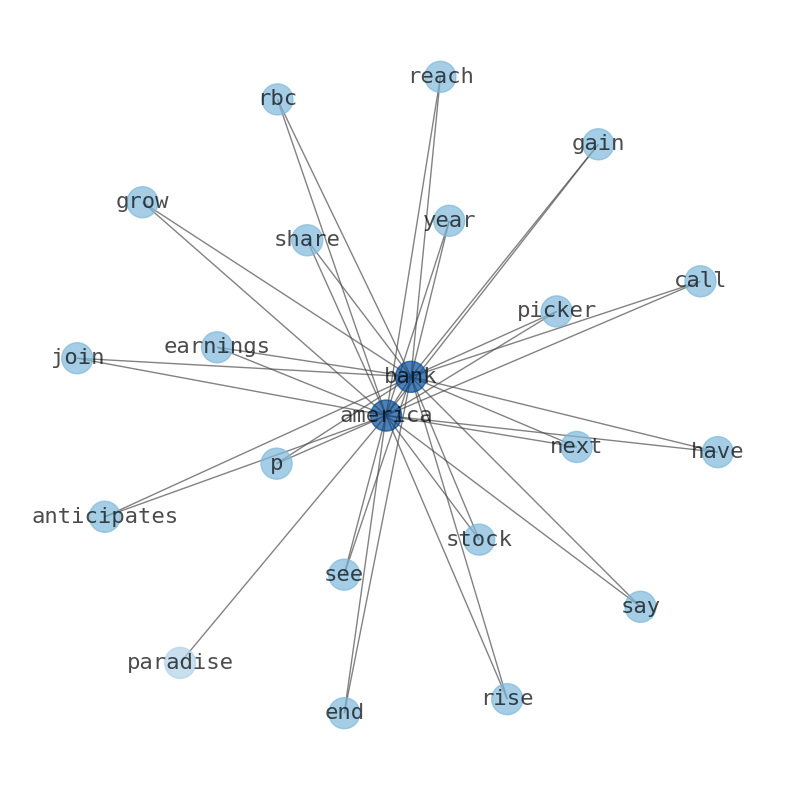

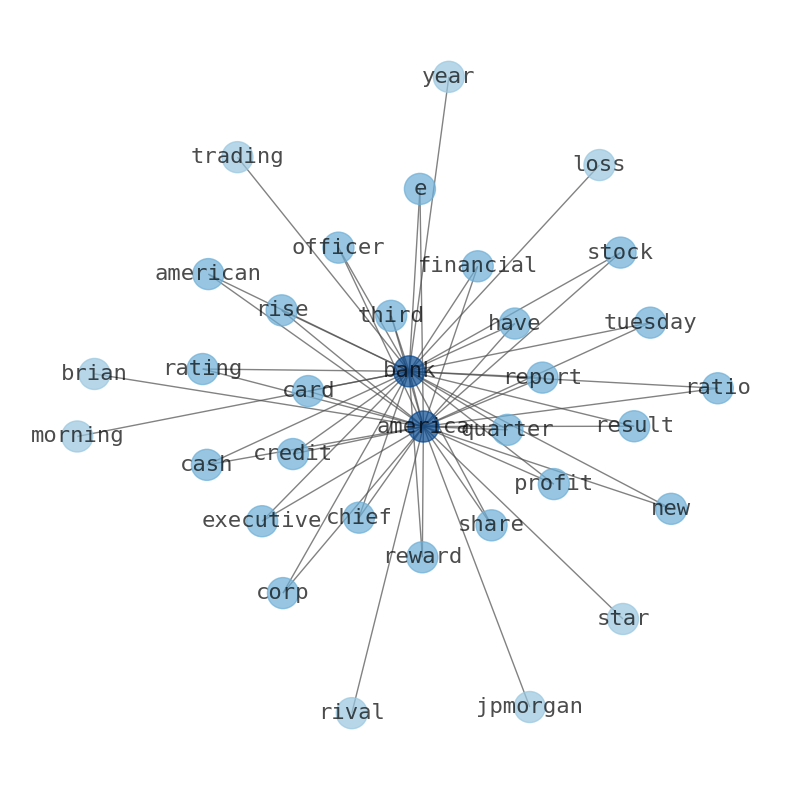

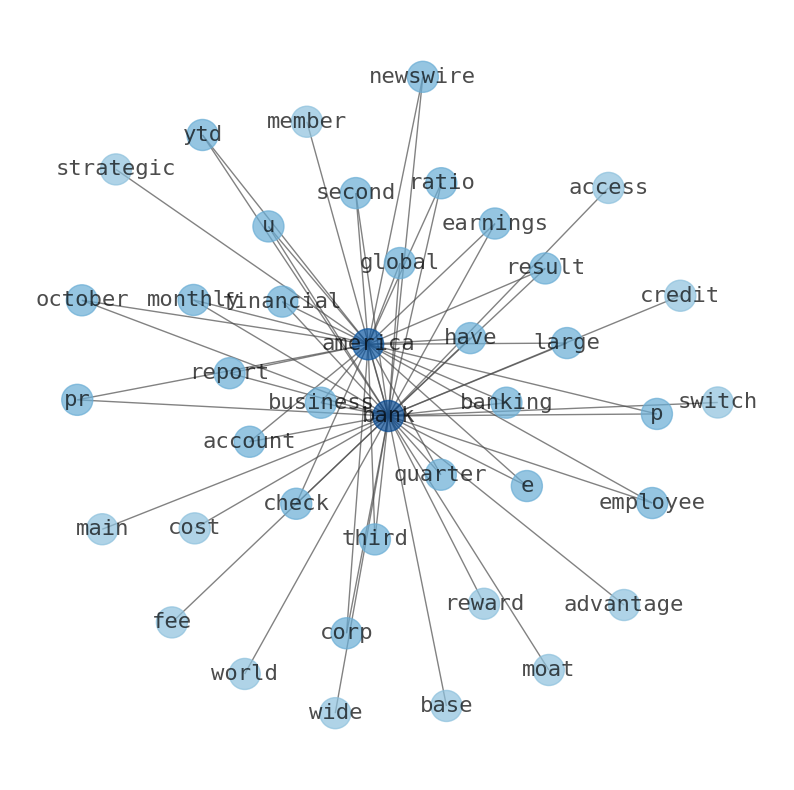

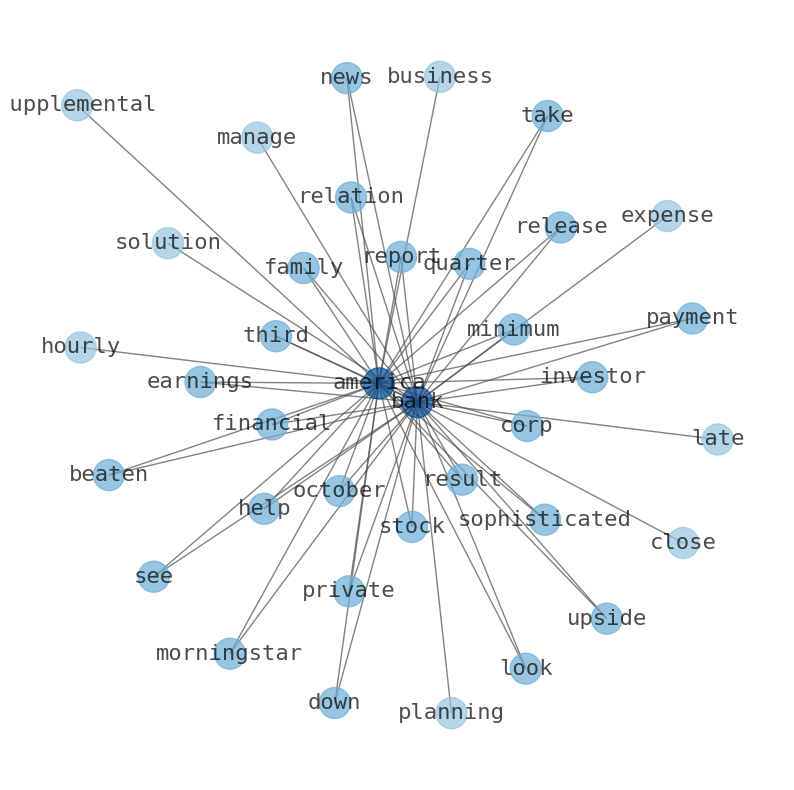

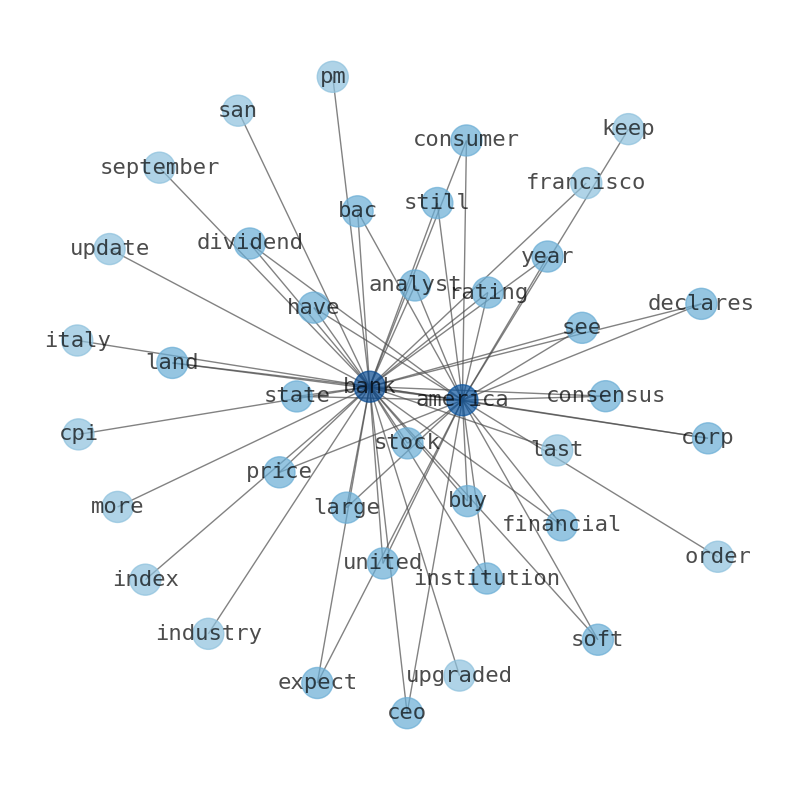

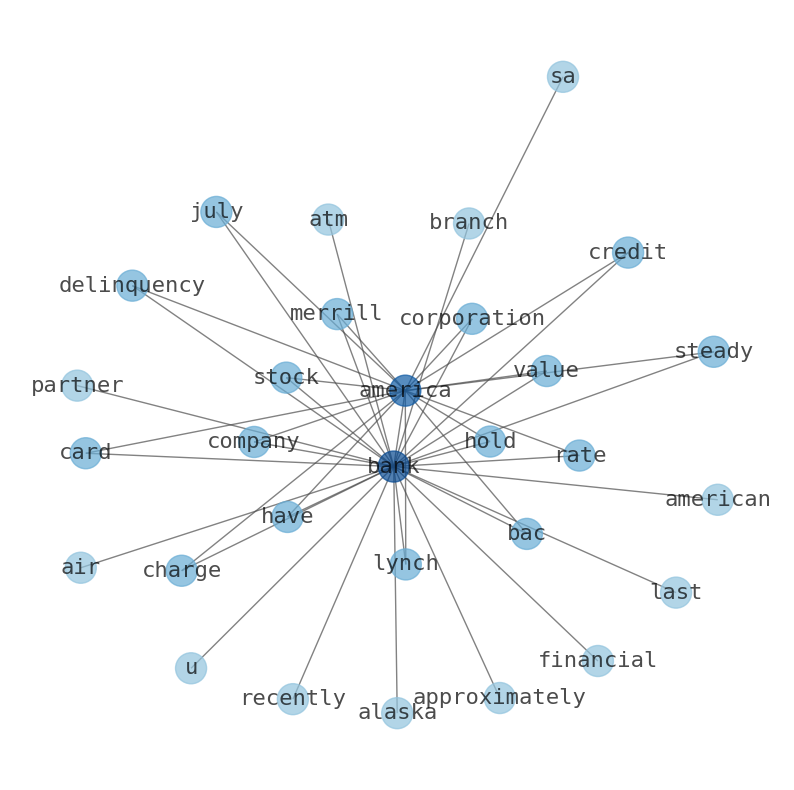

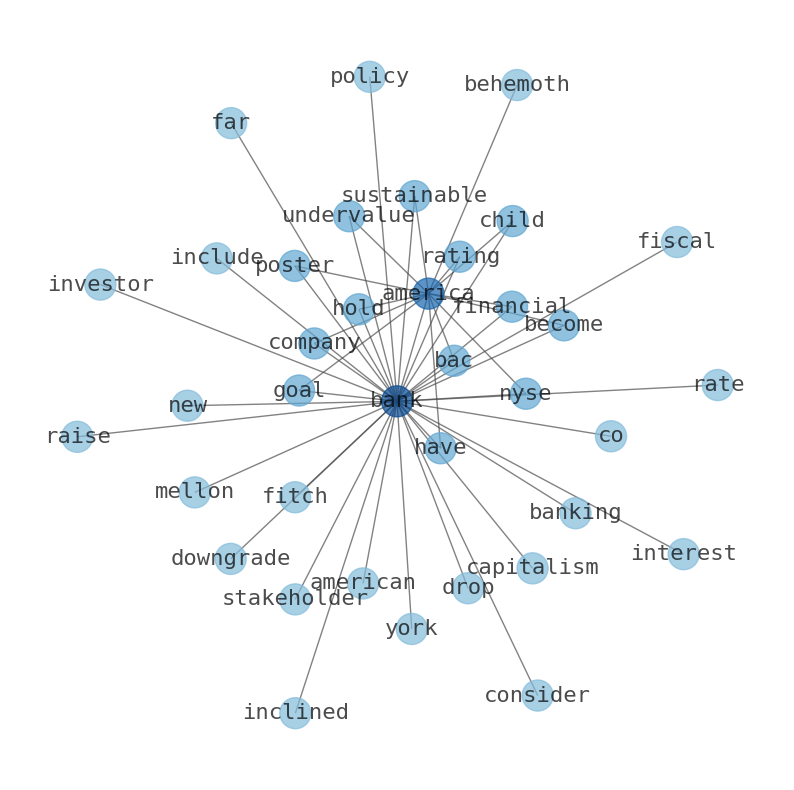

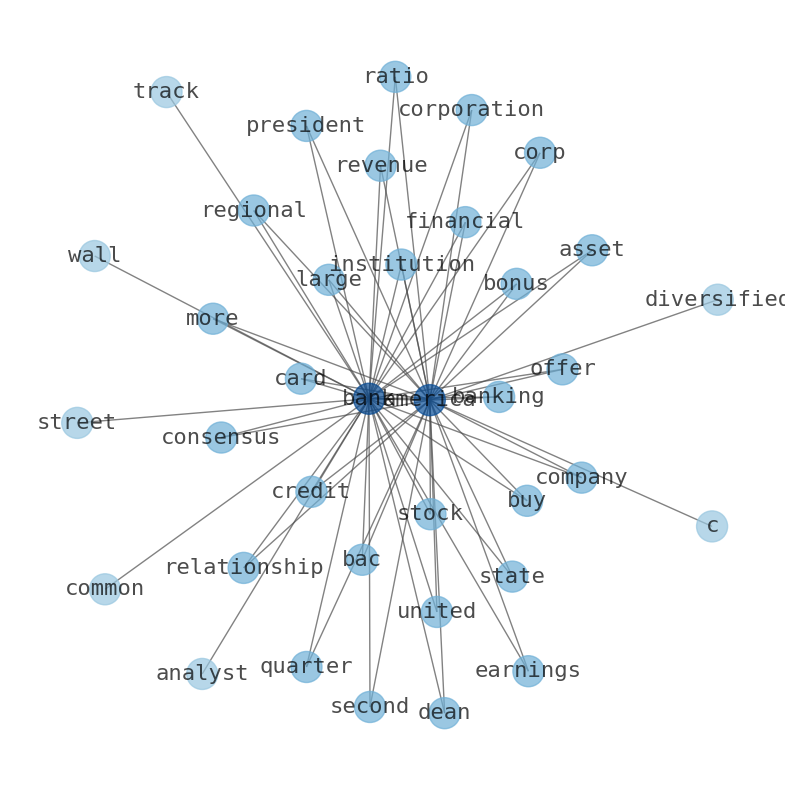

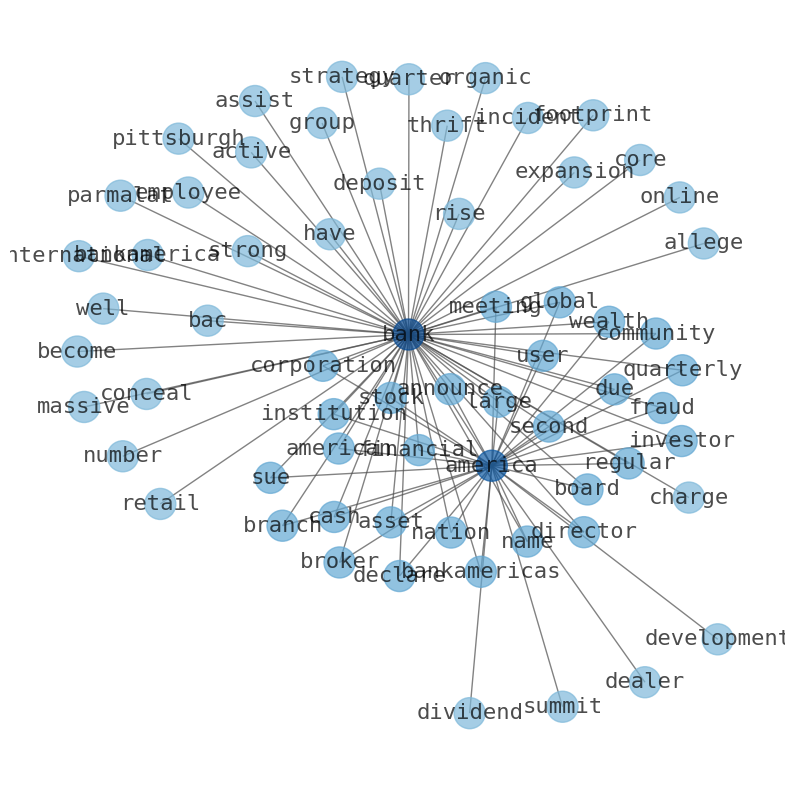

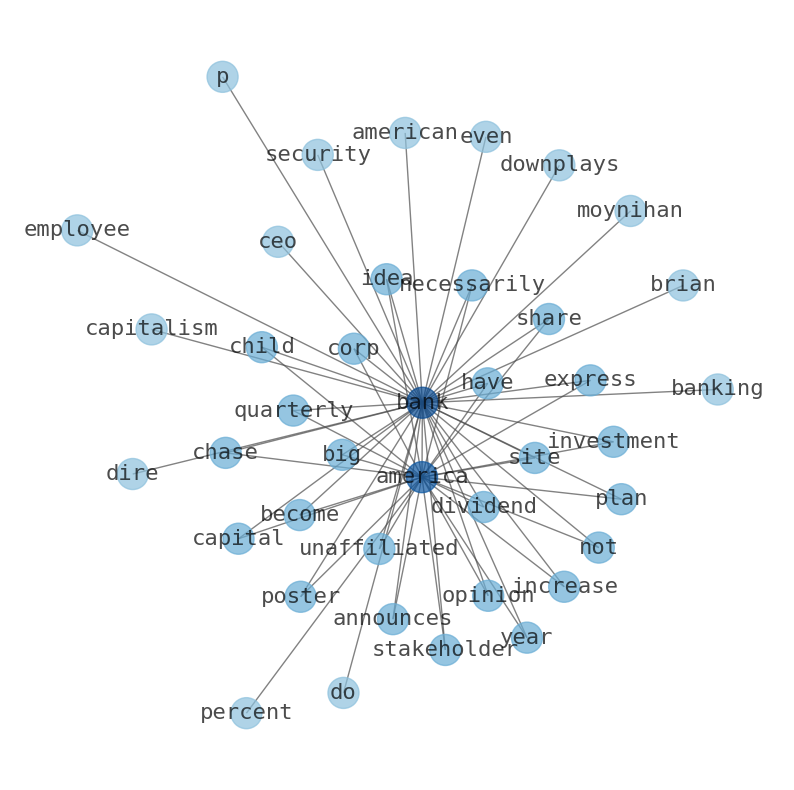

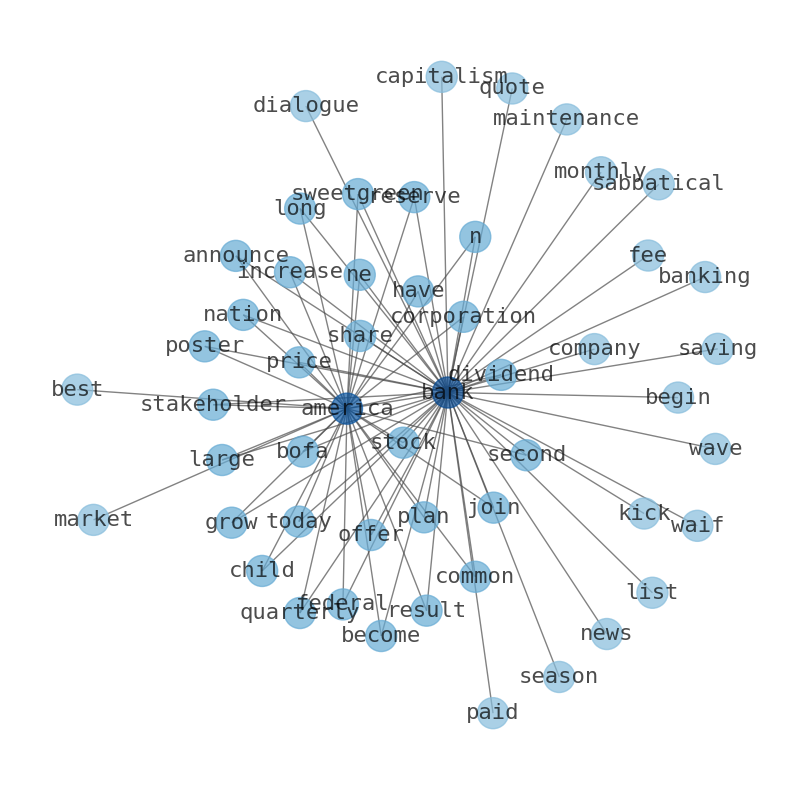

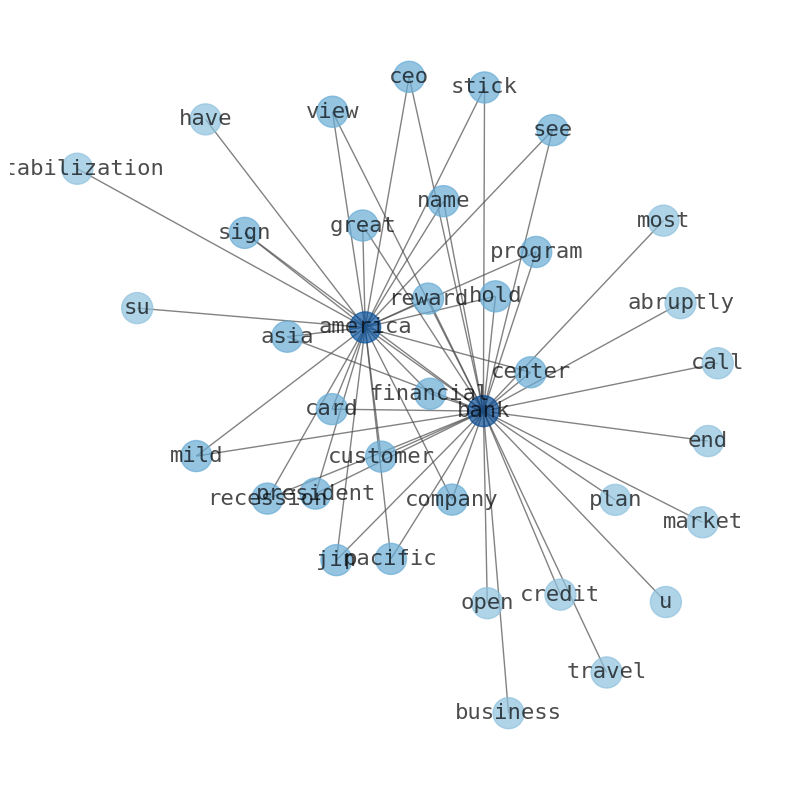

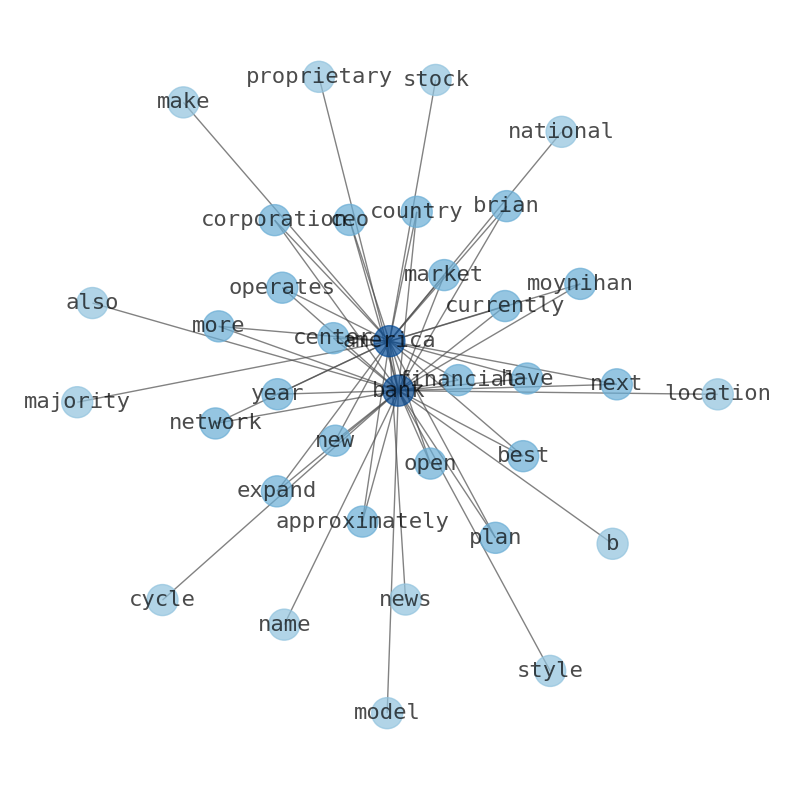

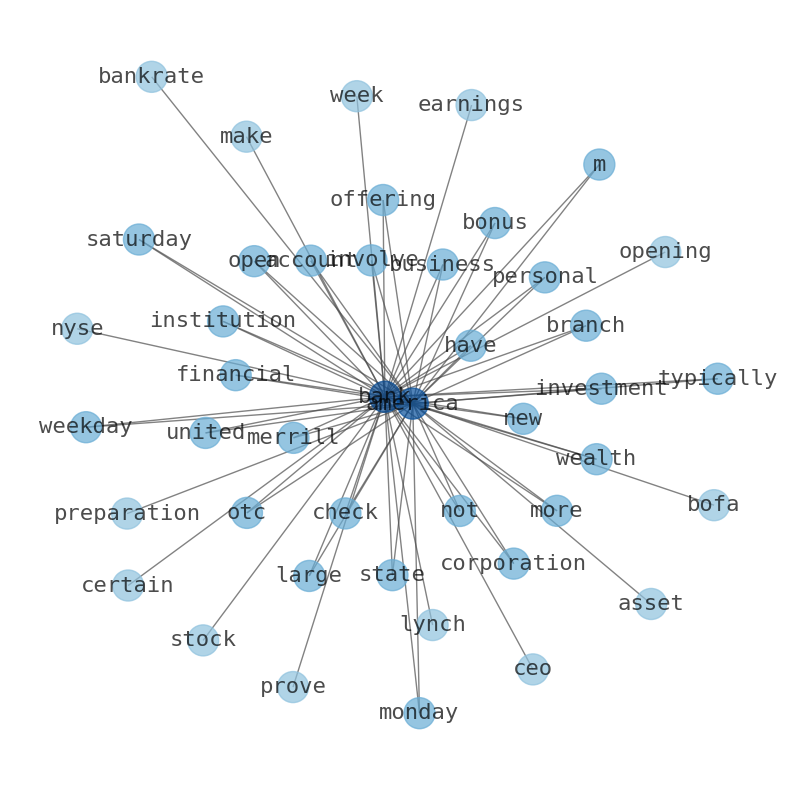

Are looking for the most relevant information about Bank of America? Investor spend a lot of time searching for information to make investment decisions in Bank of America. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Bank of America are: Bank, America, stock, company, market, CEO, year, and the most common words in the summary are: bank, best, business, market, america, credit, job, . One of the sentences in the summary was: S&P 500 could rise as high as 5600, …

Stock Summary

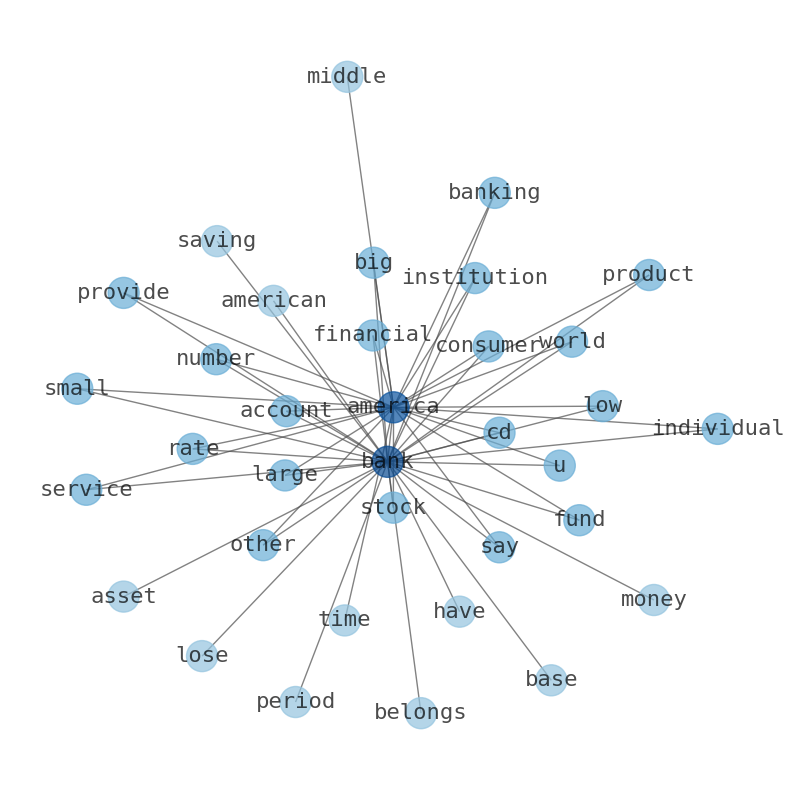

Bank of America Corporation provides banking and financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments. Its Consumer Banking segment offers traditional and money market savings accounts, certificates of deposit and.

Today's Summary

S&P 500 could rise as high as 5600, and these 8 ETFs are poised for big upside along the way. Bank of America is one of the largest financial institutions in the United States, with more than $2.5 trillion in assets.

Today's News

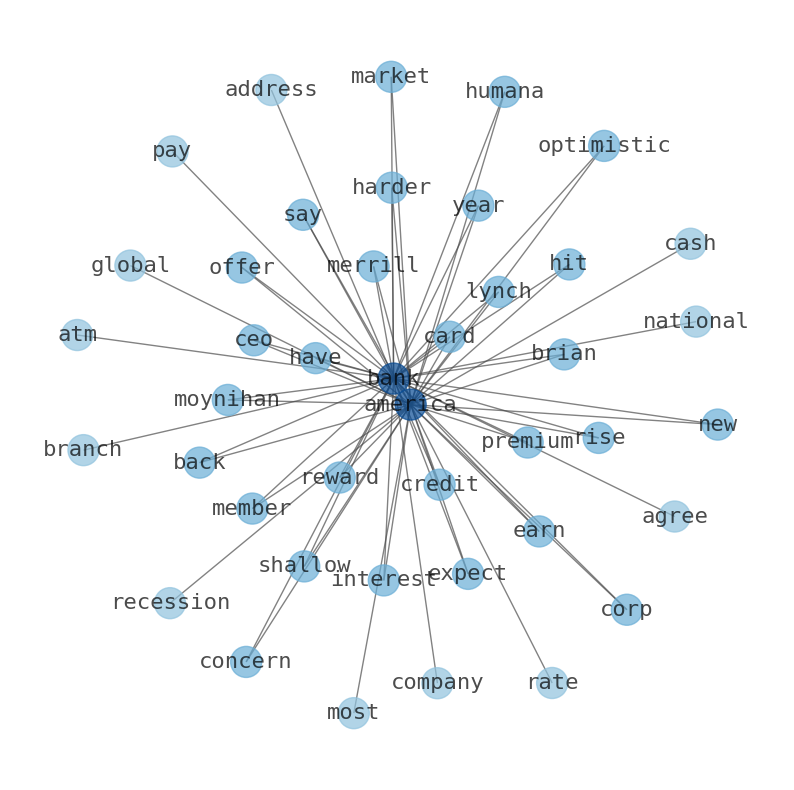

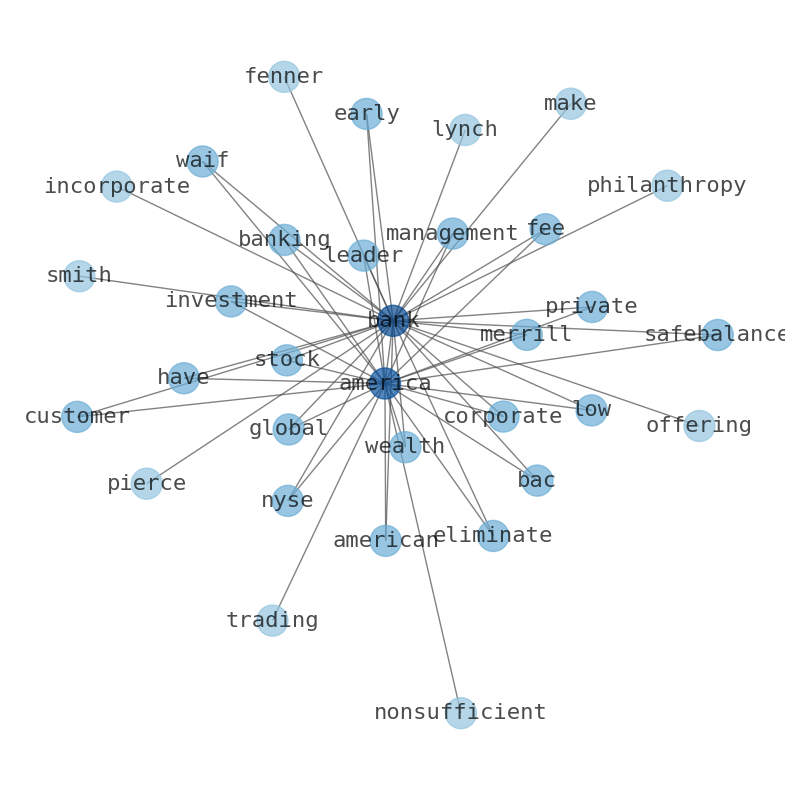

Bank of America CEO: 3 rate cuts this year will bring economy into equilibrium by the end of 2025. You can save $1,650 over the next decade by making this change to your coffee order. Bank of America: These 25 stocks with sustainable dividends trading at a 50% discount to the market should outperform during this recovery. Value stocks and high-yielding companies may lead the market. Merrill Lynch, Pierce, Fenner & Smith Incorporated makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation. Trust and fiduciary services are provided by Bank of American Private Bank. S&P 500 could rise as high as 5600, and these 8 ETFs are poised for big upside along the way: Bank of America. The index is on its way to new highs of up to 5600. XBI: 2022-2023 bottom breakout watch Bank of America. XLV attempts breakout above 141 to target 150 to 164. IYT: Big base breakout looks bullish for 320 and 340. IWM: Holding 190-187 keeps potential big base alive. Bank of America is one of the largest financial institutions in the United States, with more than $2.5 trillion in assets. JPMorgan Chase acquisition of Bank One in 2004 was the largest to date at $56.88 billion. Bank of Americas purchase of FleetBoston Financial in 2004. Bank of America CEO Brian Moynihan predicts consumer spending tug-of-war between inflation and wages will end in 2025. BlackRock agrees to manage $87 billion in assets for bank of America Corp. Bank of America (BAC) account holders are spending about 4% to 5% more out of their accounts than they did a year ago. Bank of Americas stock was down by 1.3% on Wednesday. Bank of America does not assume liability for any loss or damage resulting from anyones reliance on the information provided. Opinions or ideas expressed are not necessarily those of Bank of. America. Institutional investors dominate Bank of America, with 58% ownership of the shares. Public companies currently own 13% of the companys stock. General public has 28% ownership. “Trying to predict the markets is never wise — and thats particularly true in such an unpredictable investment landscape,” says Joe Quinlan, head of Market Strategy for the Chief Investment Office (CIO) at Merrill and Bank of America Private Bank. “Consider using any near-term volatility as an opportunity to add to equities,’ suggests Chris Hyzy.

Stock Profile

"Bank of America Corporation, through its subsidiaries, provides banking and financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide. Its Consumer Banking segment offers traditional and money market savings accounts, certificates of deposit and IRAs, noninterest-and interest-bearing checking accounts, and investment accounts and products; and credit and debit cards, residential mortgages, and home equity loans, as well as direct and indirect loans, such as automotive, recreational vehicle, and consumer personal loans. The company's Global Wealth & Investment Management segment offers investment management, brokerage, banking, and trust and retirement products and services; and wealth management solutions, as well as customized solutions, including specialty asset management services. Its Global Banking segment provides lending products and services, including commercial loans, leases, commitment facilities, trade finance, and commercial real estate and asset-based lending; treasury solutions, such as treasury management, foreign exchange, and short-term investing options and merchant services; working capital management solutions; and debt and equity underwriting and distribution, and merger-related and other advisory services. The company's Global Markets segment offers market-making, financing, securities clearing, settlement, and custody services, as well as risk management products using interest rate, equity, credit, currency and commodity derivatives, foreign exchange, fixed-income, and mortgage-related products. The company was founded in 1784 and is based in Charlotte, North Carolina."

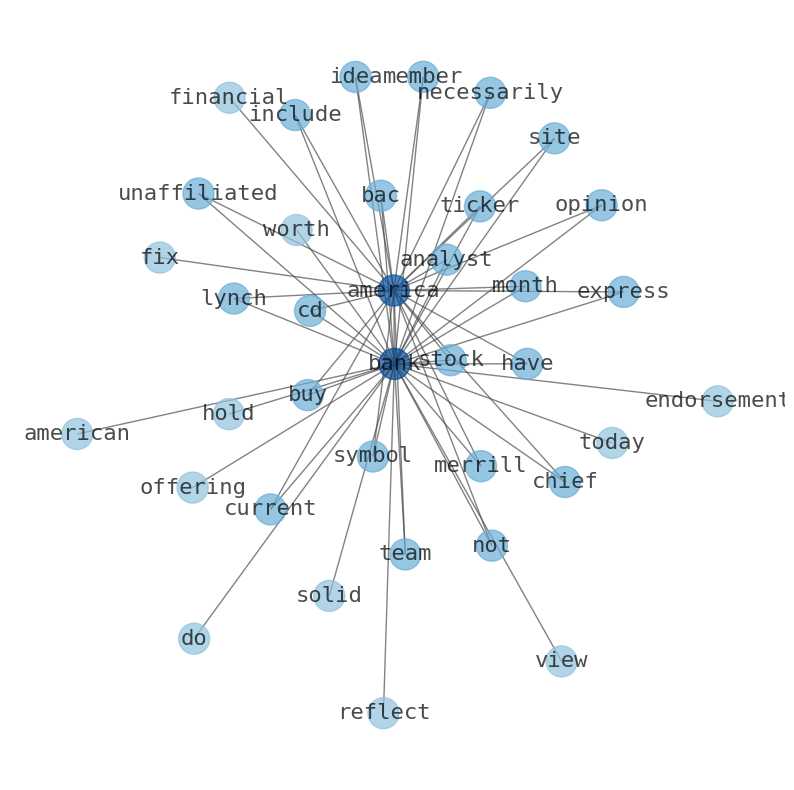

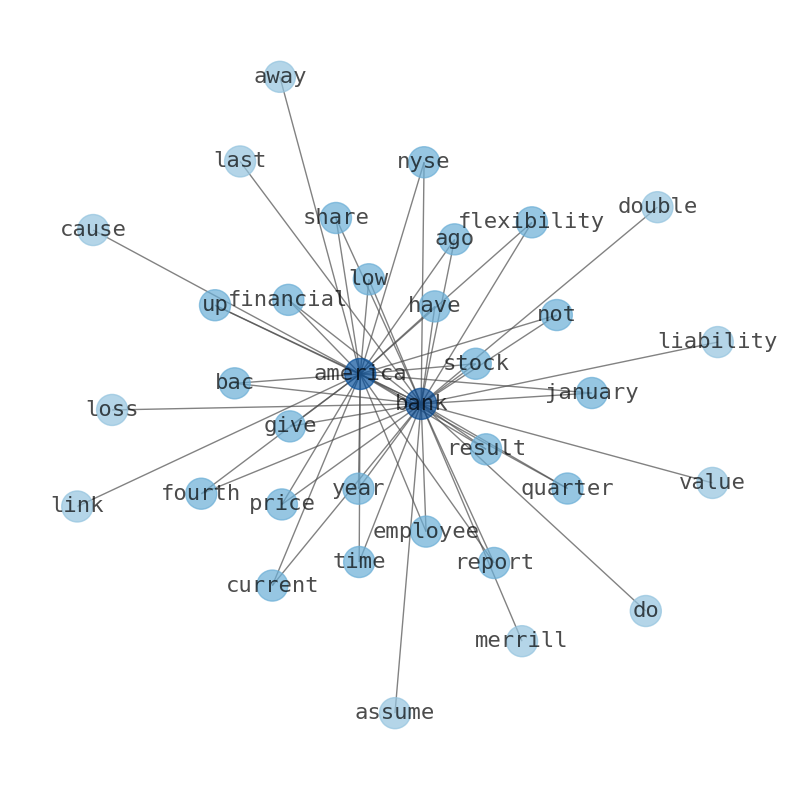

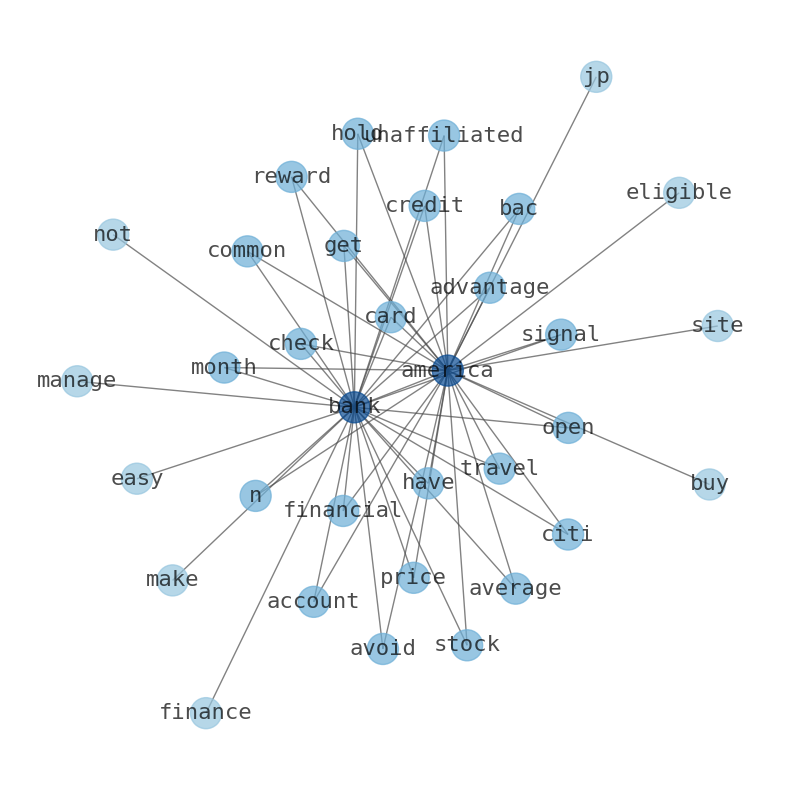

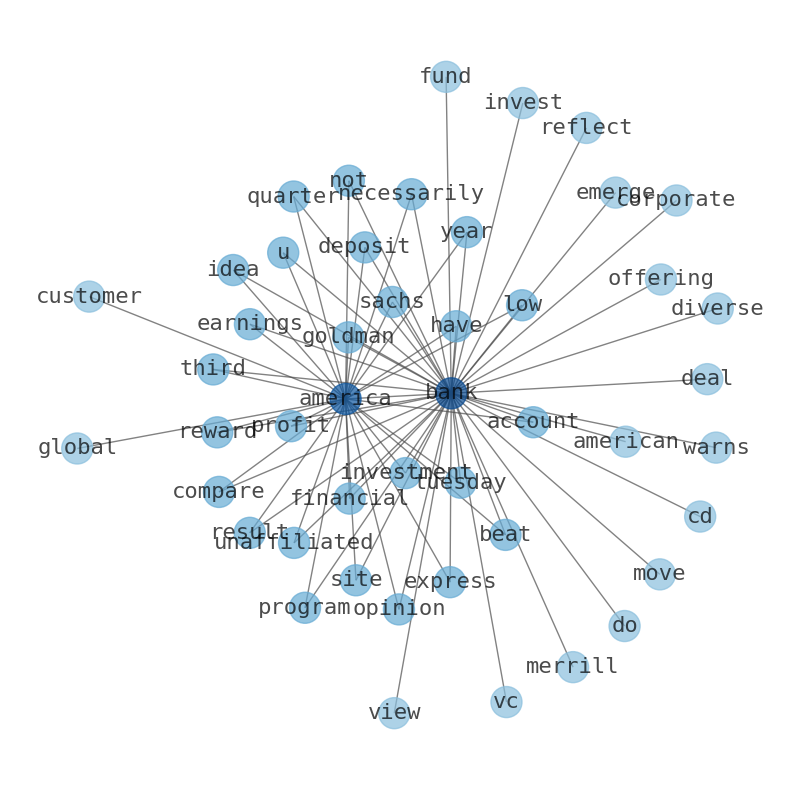

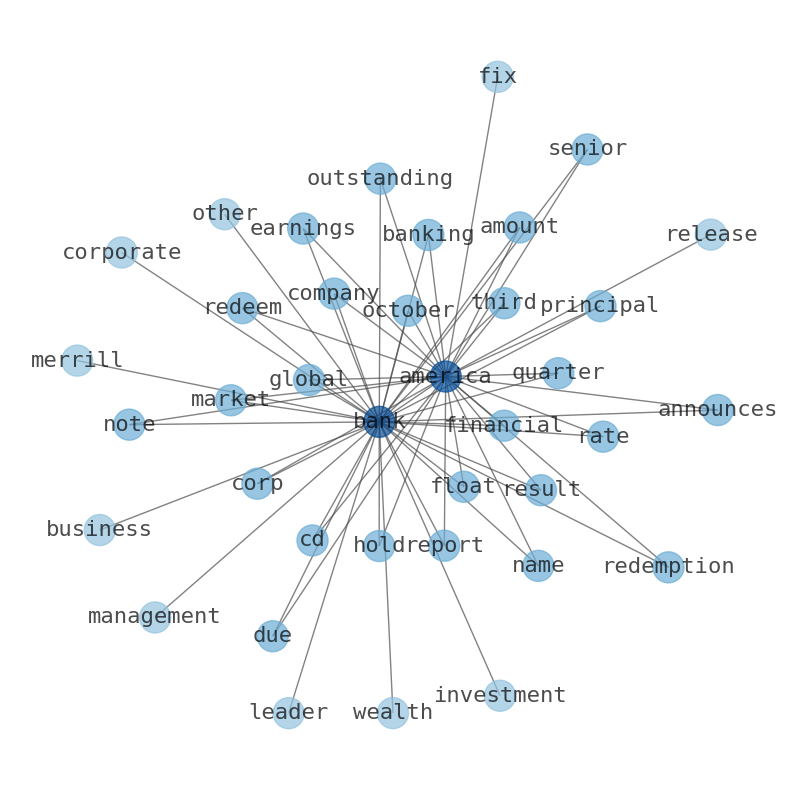

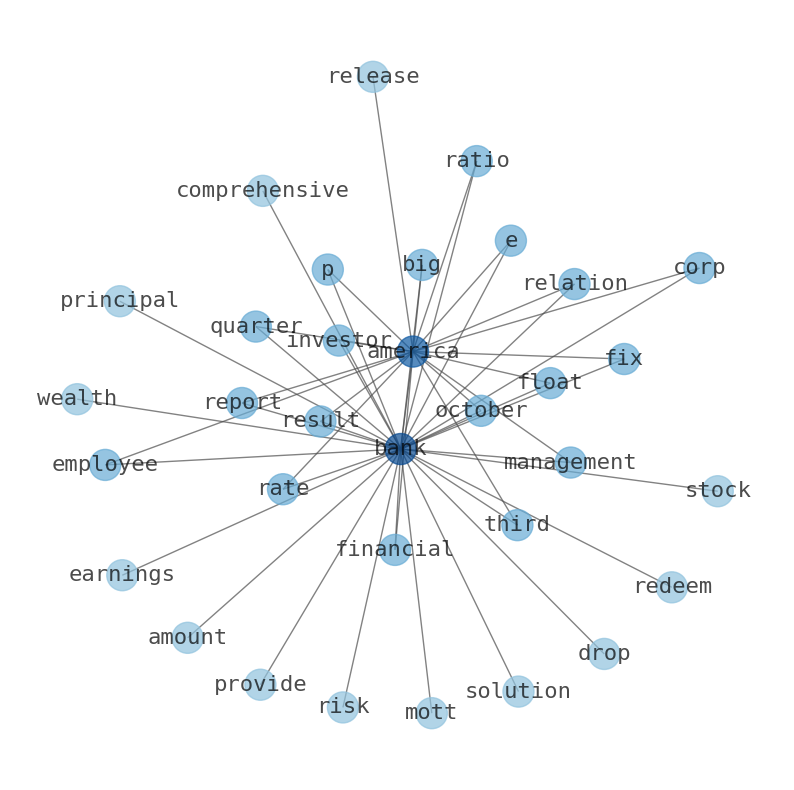

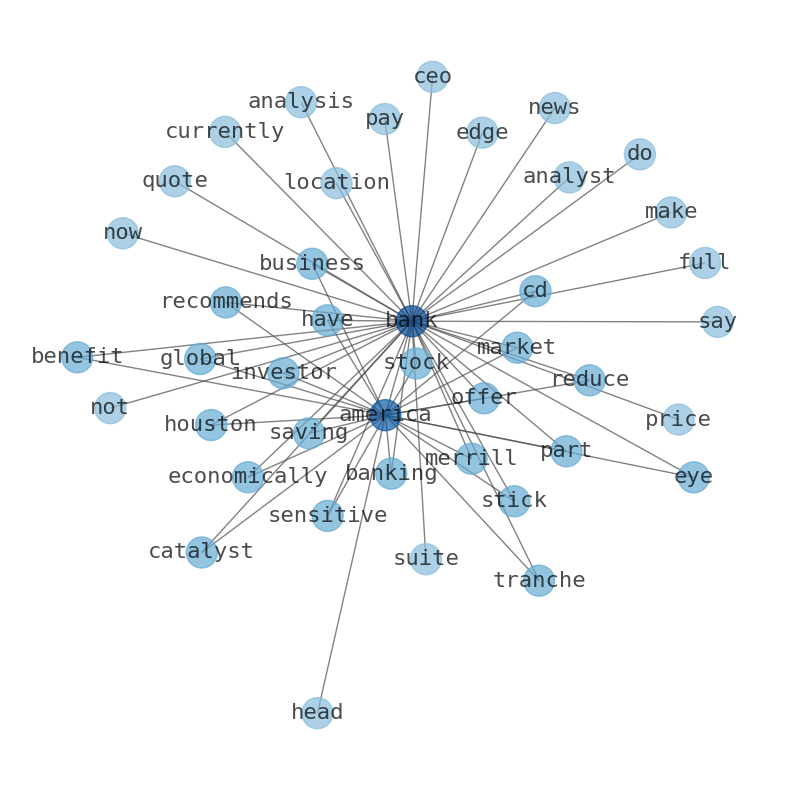

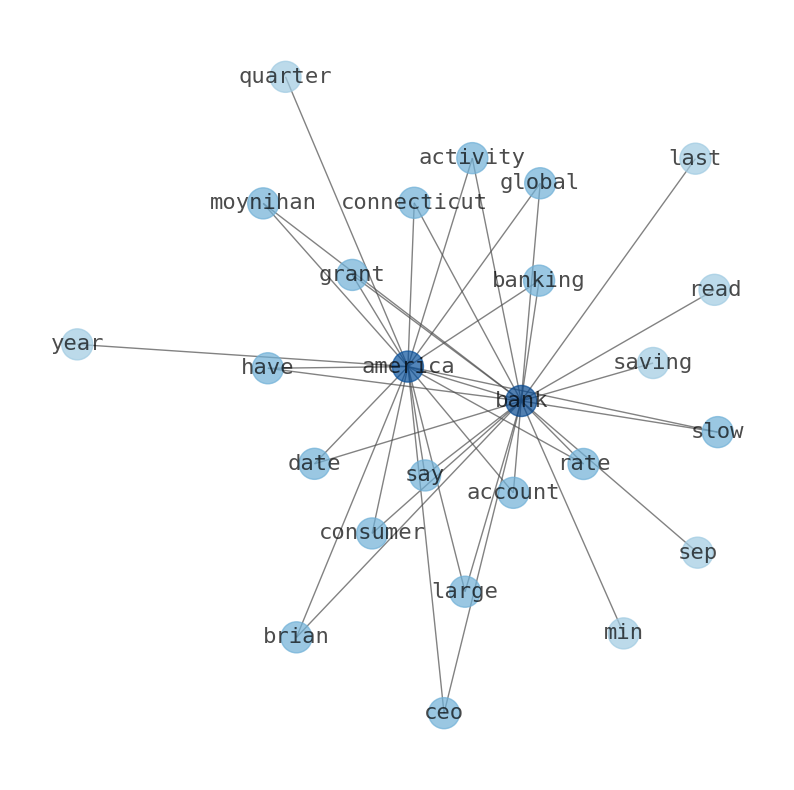

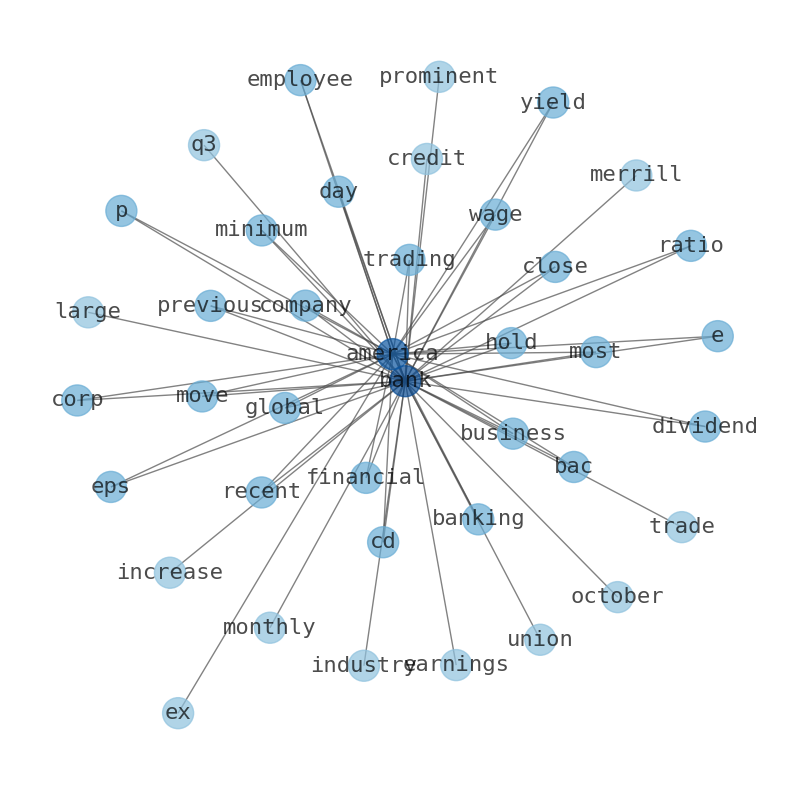

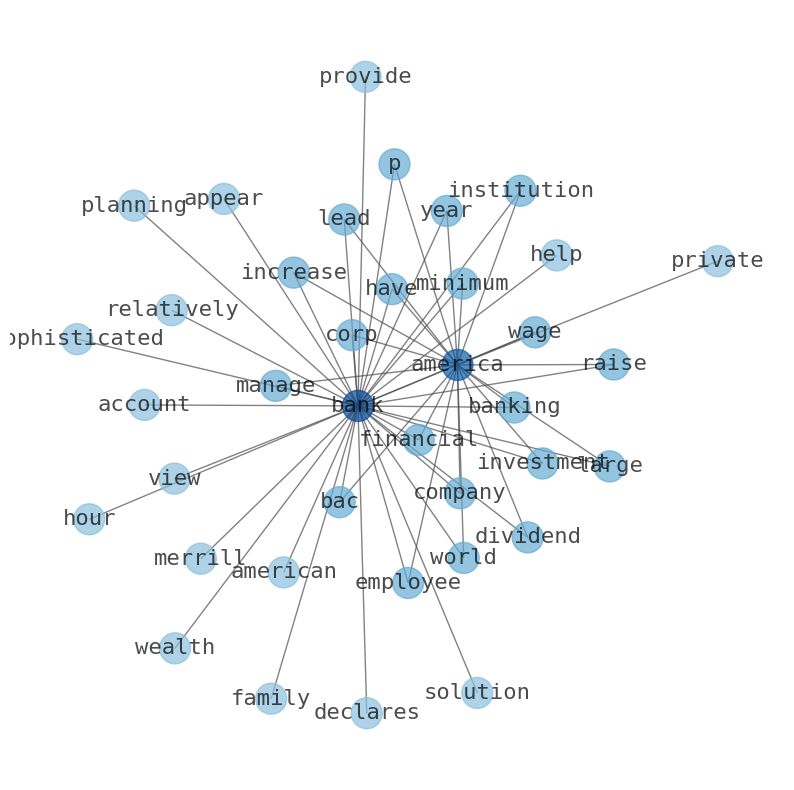

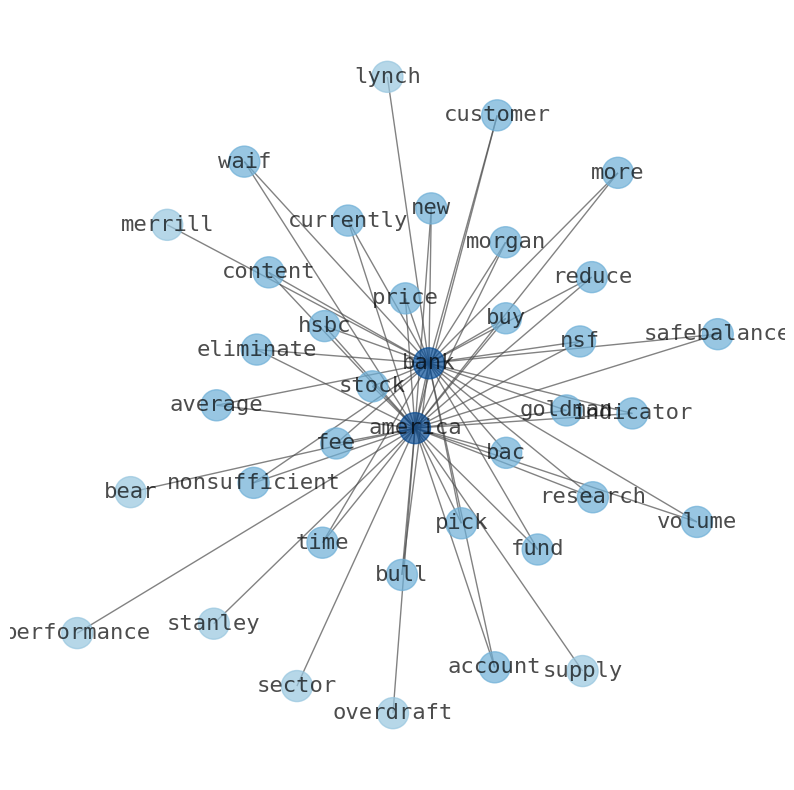

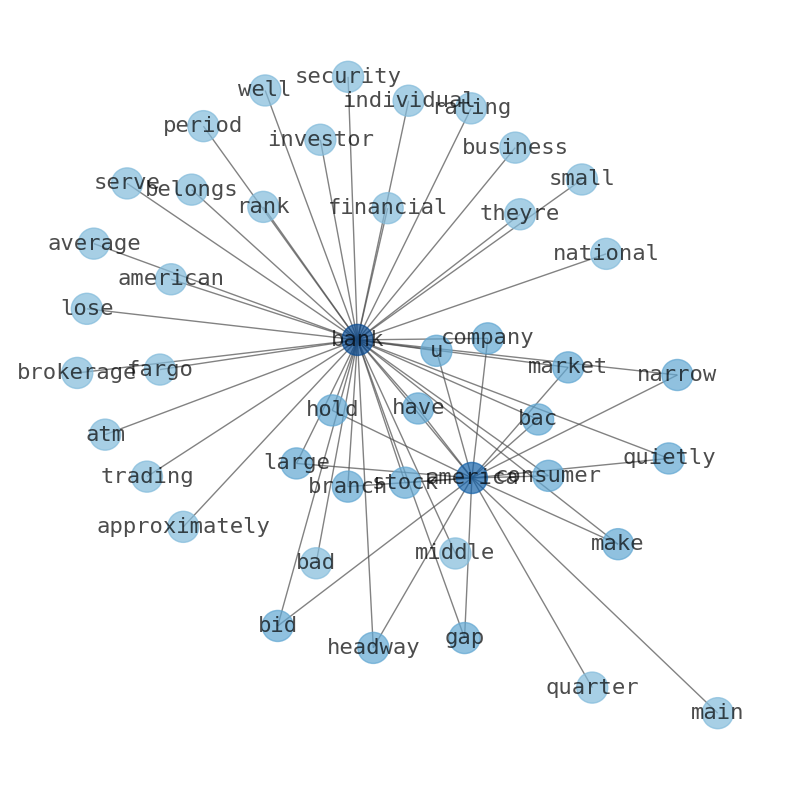

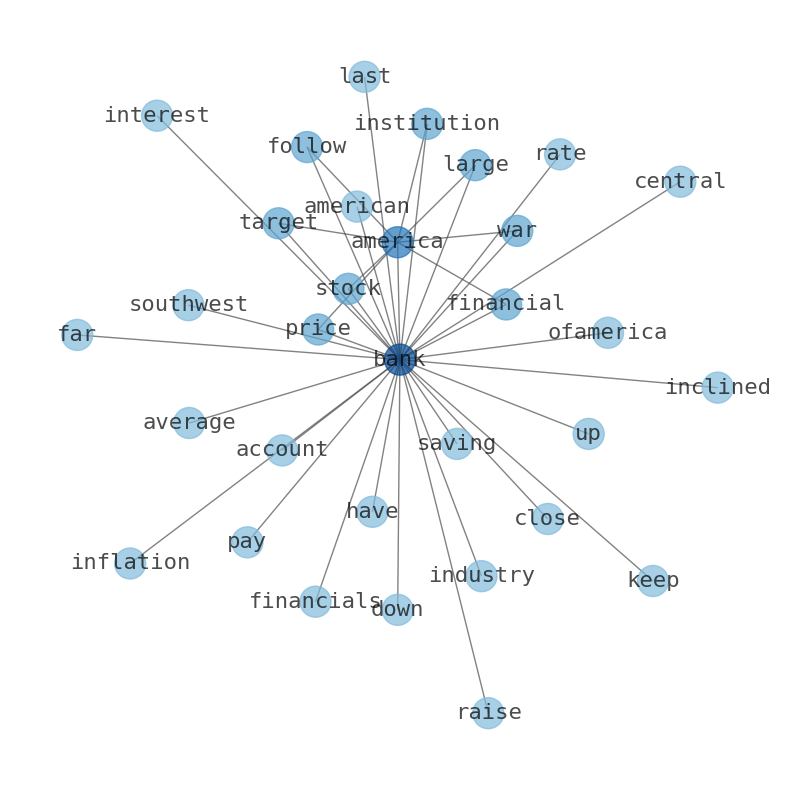

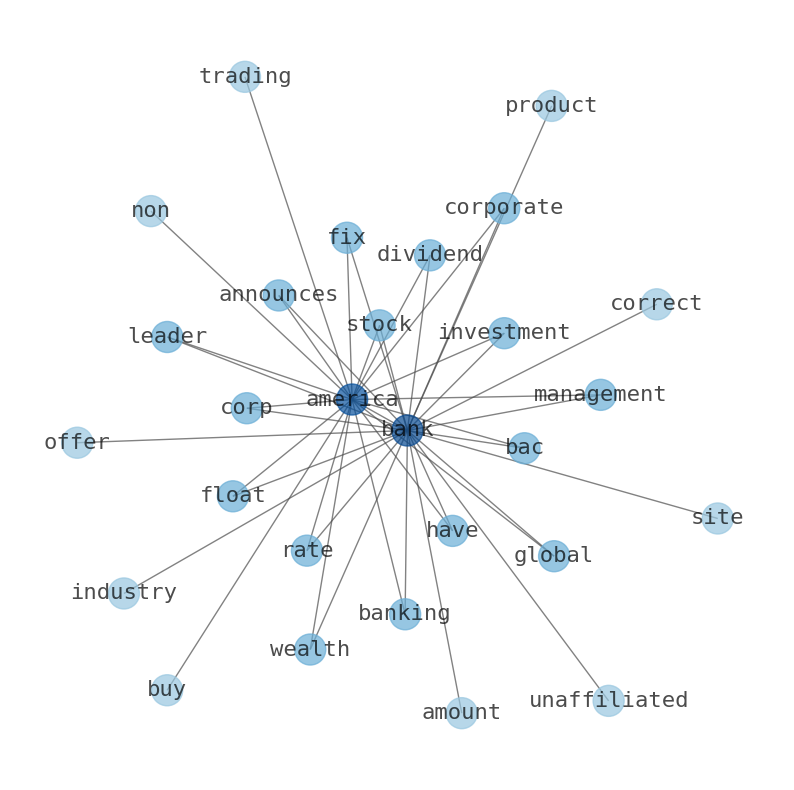

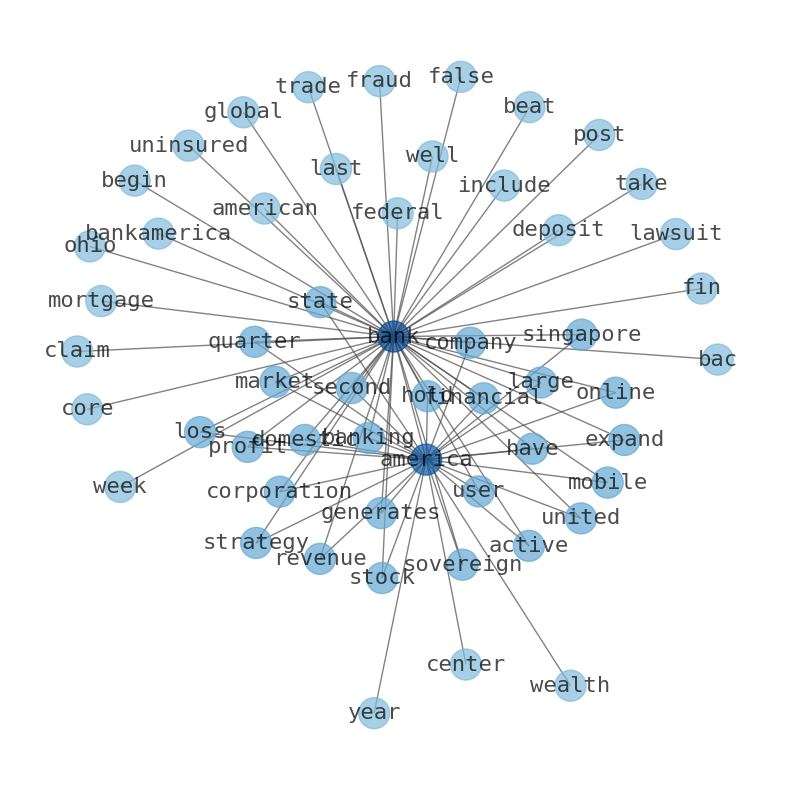

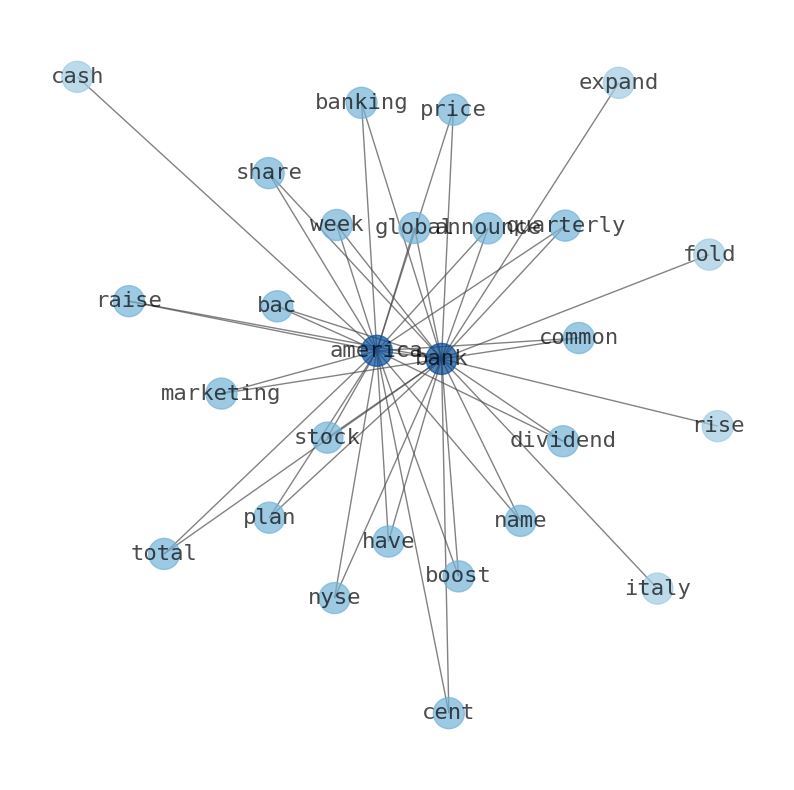

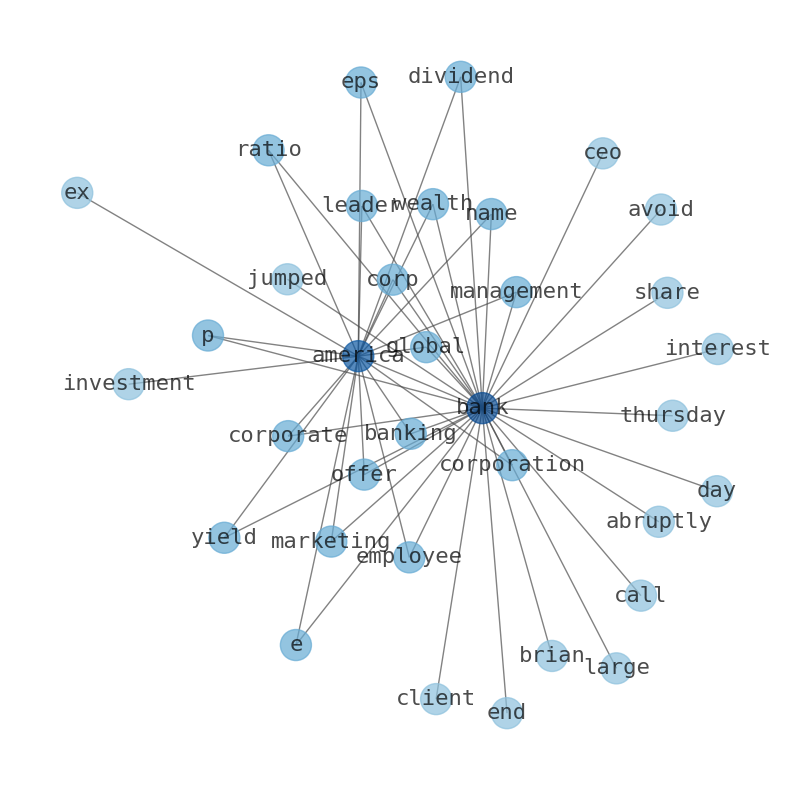

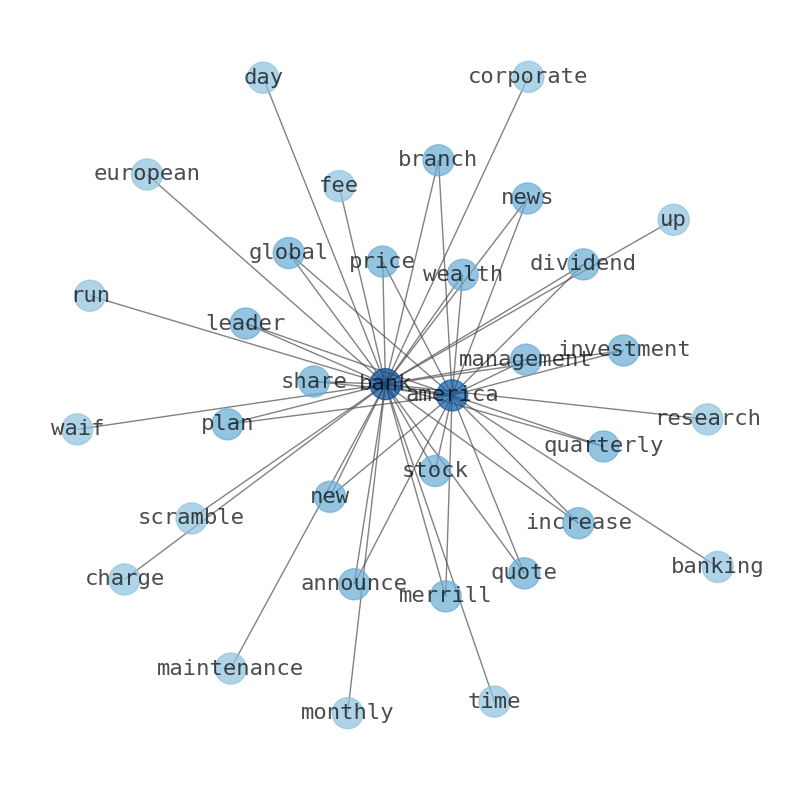

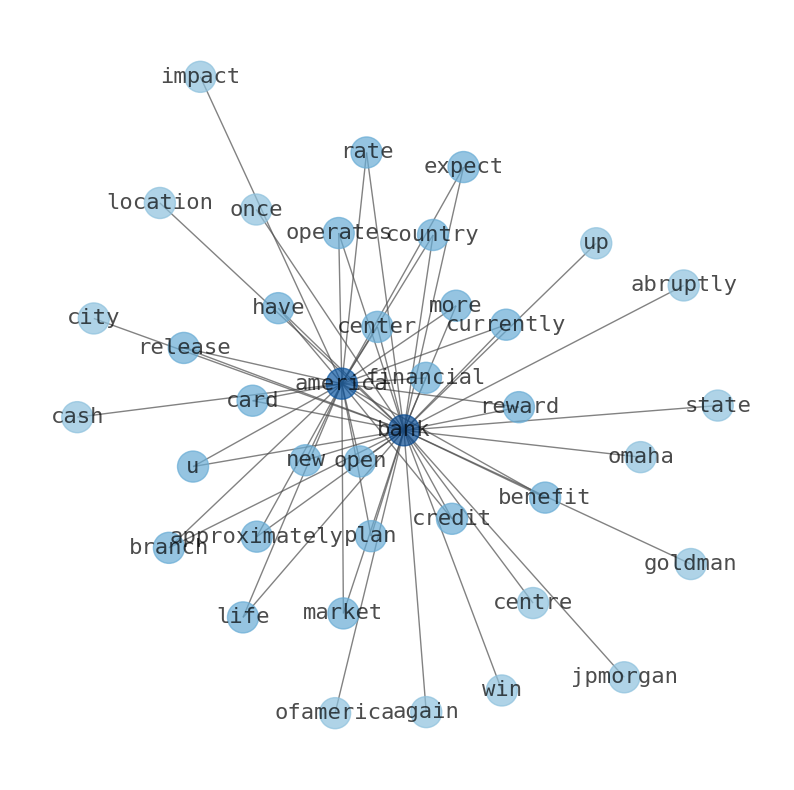

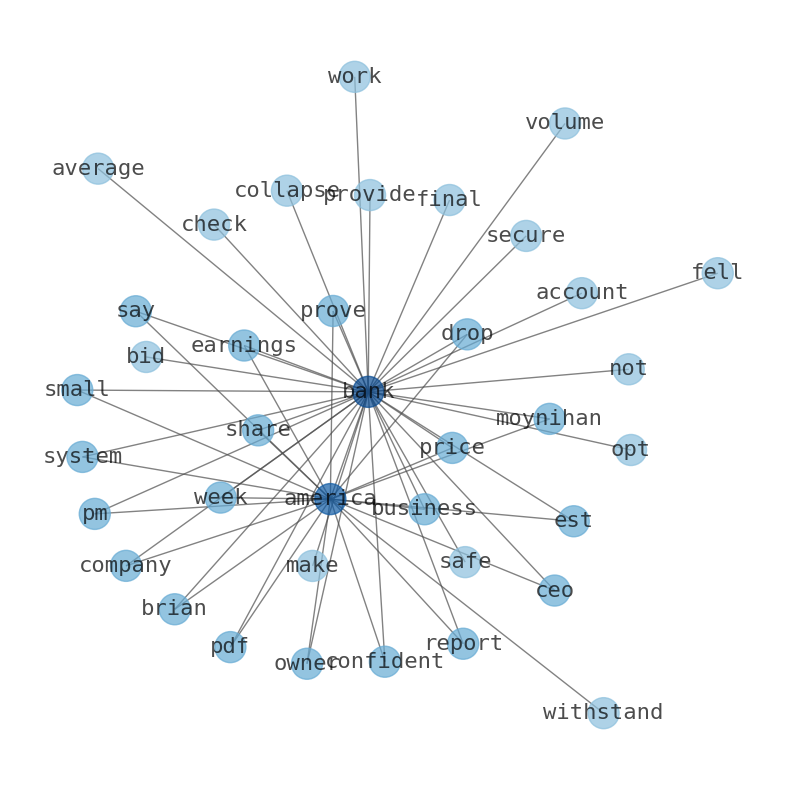

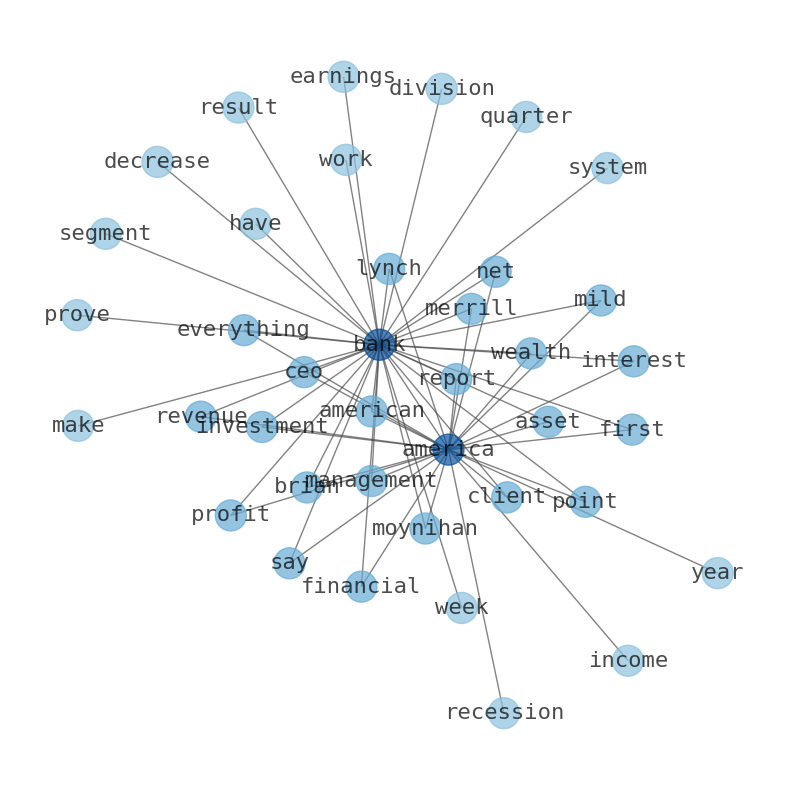

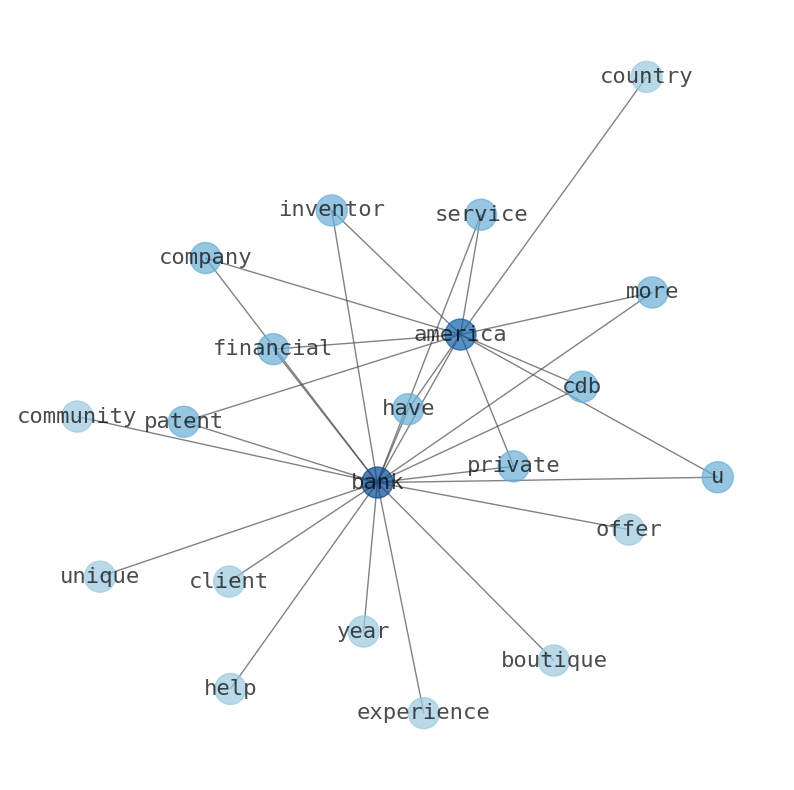

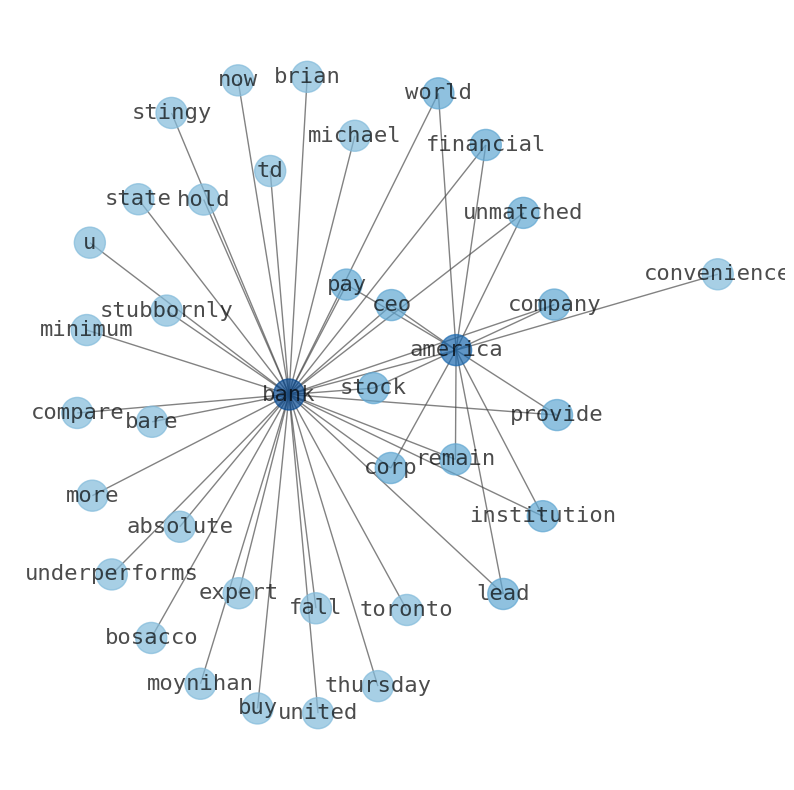

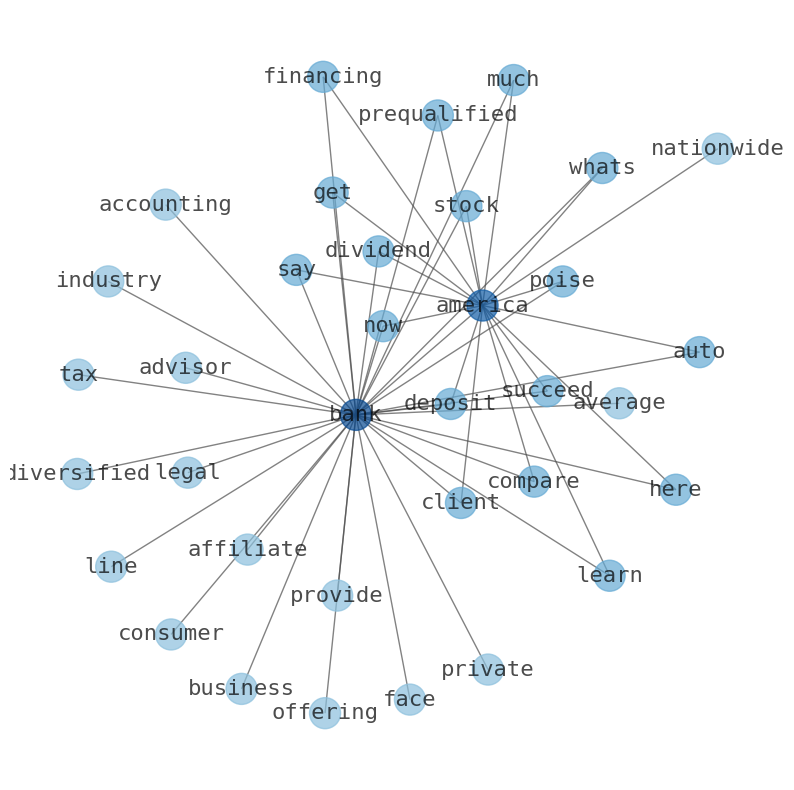

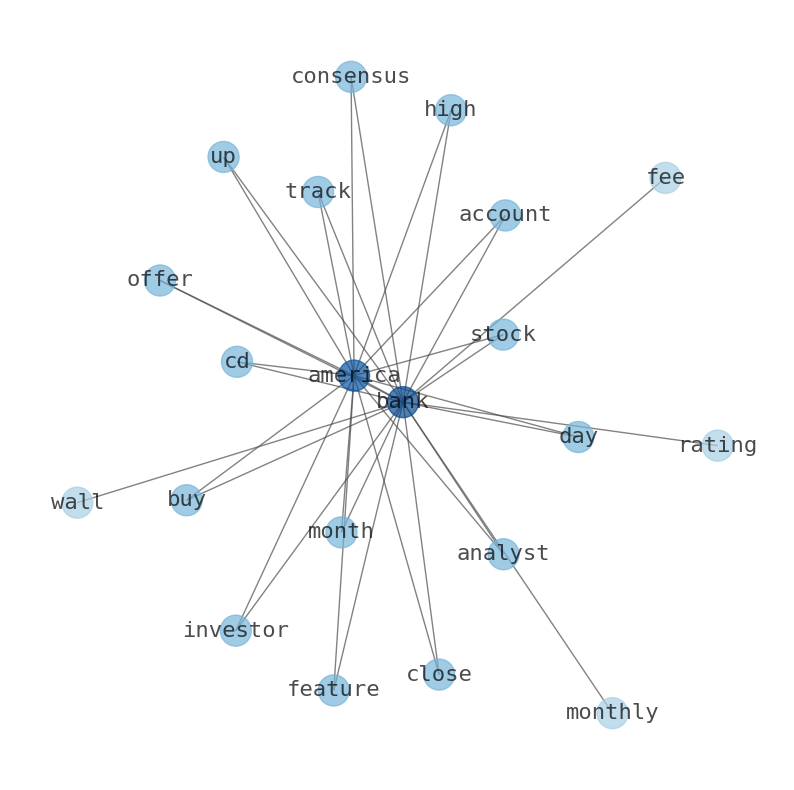

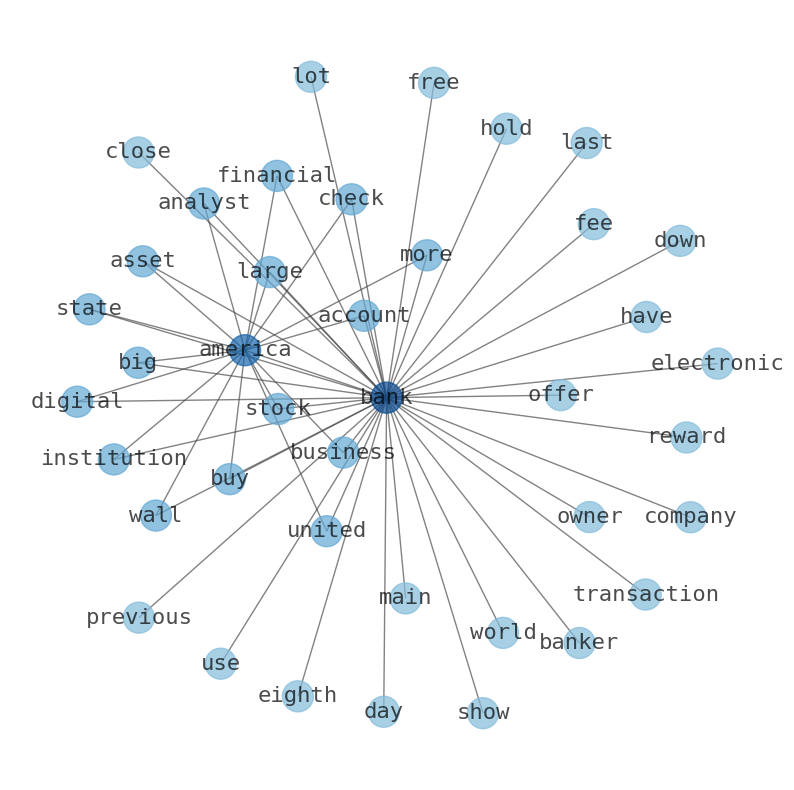

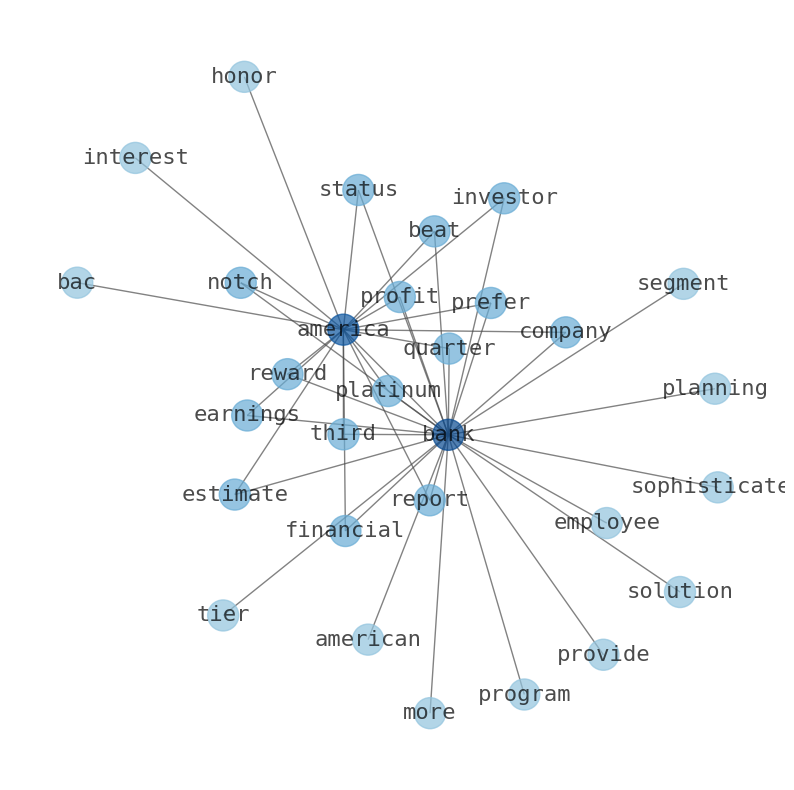

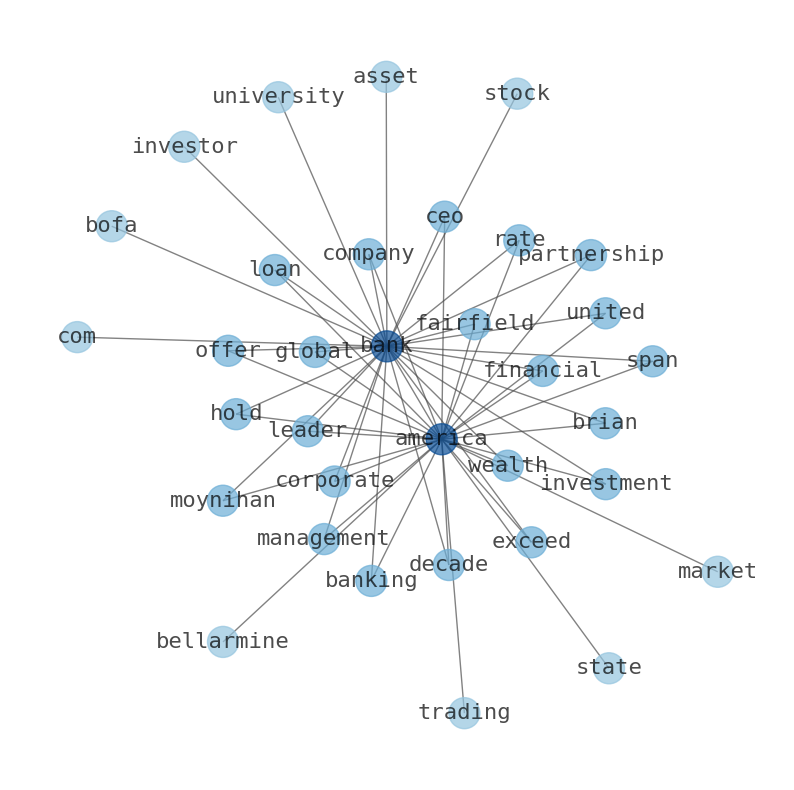

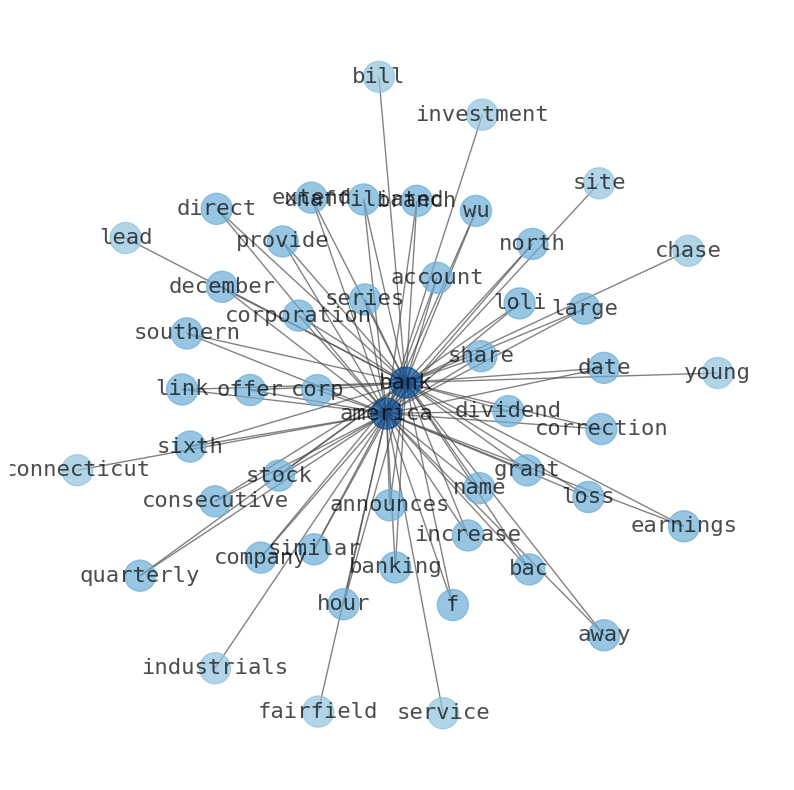

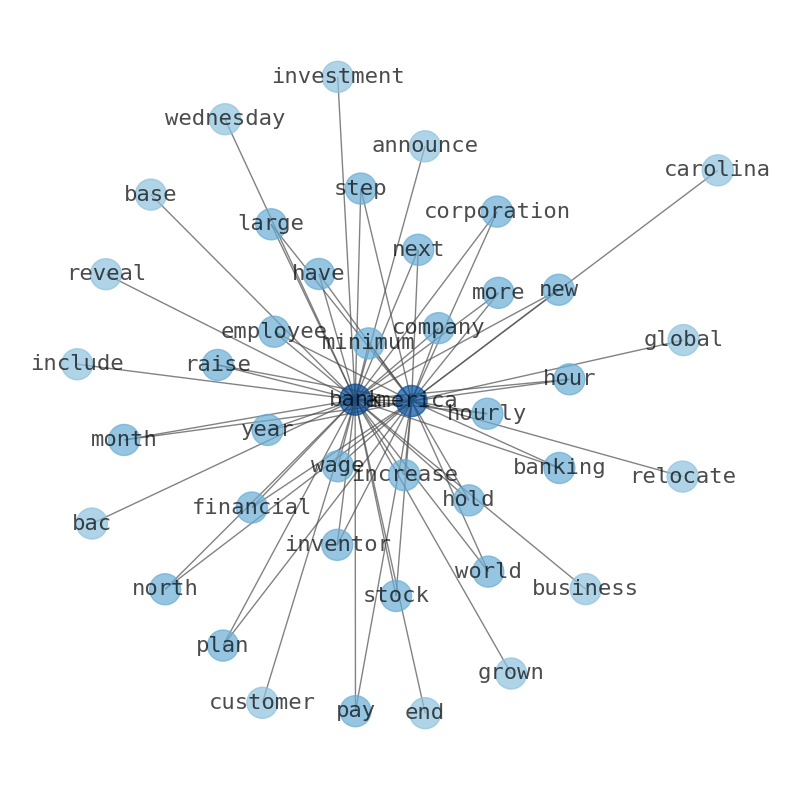

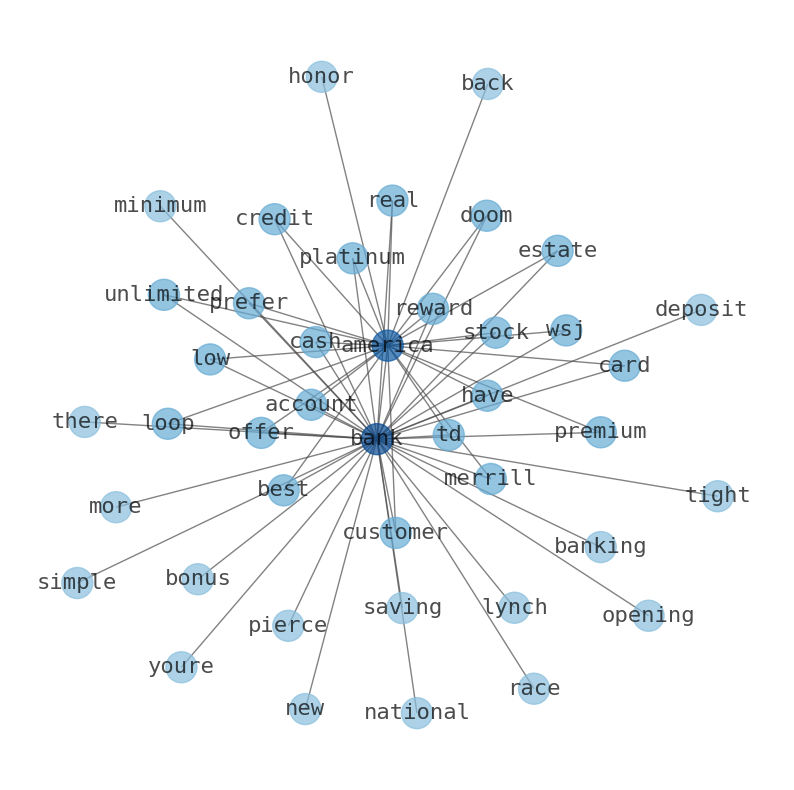

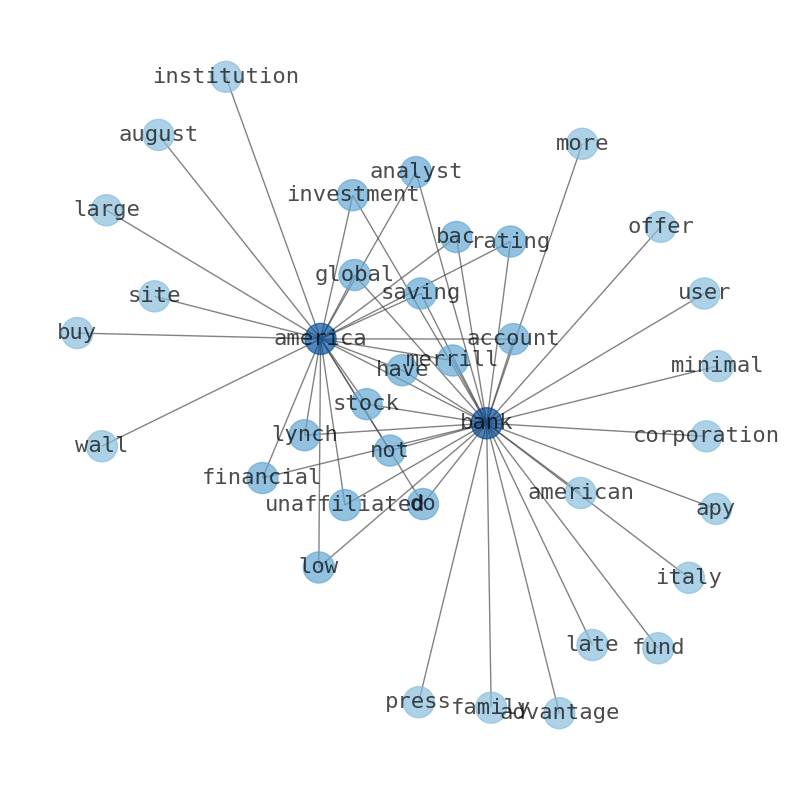

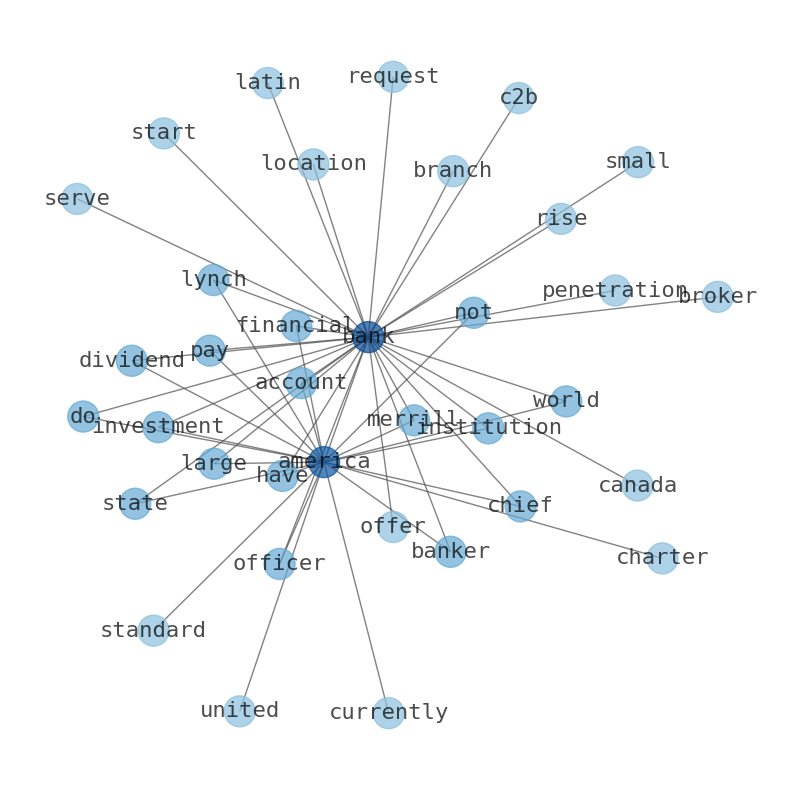

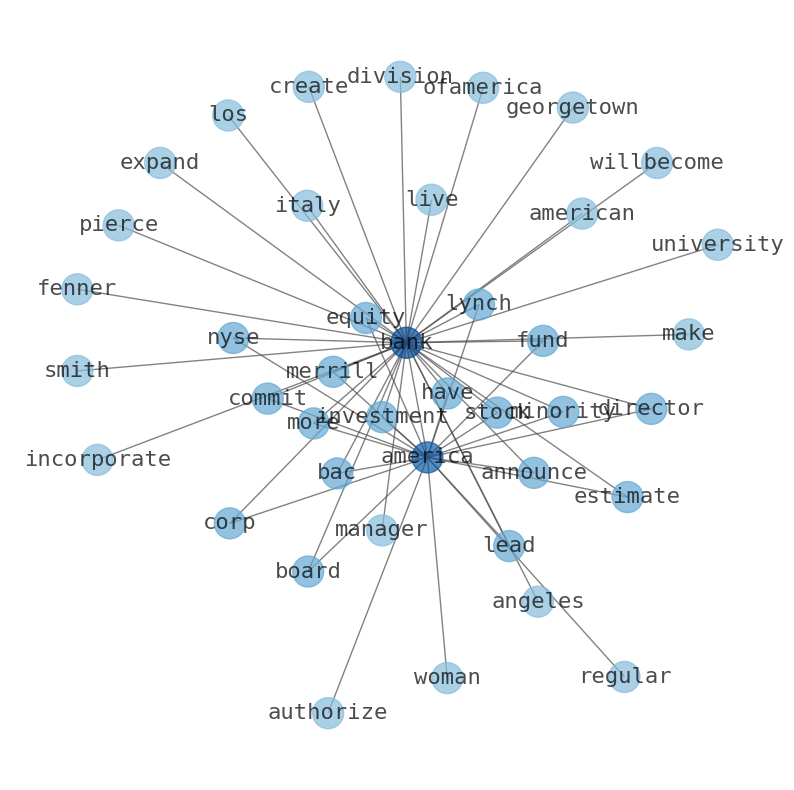

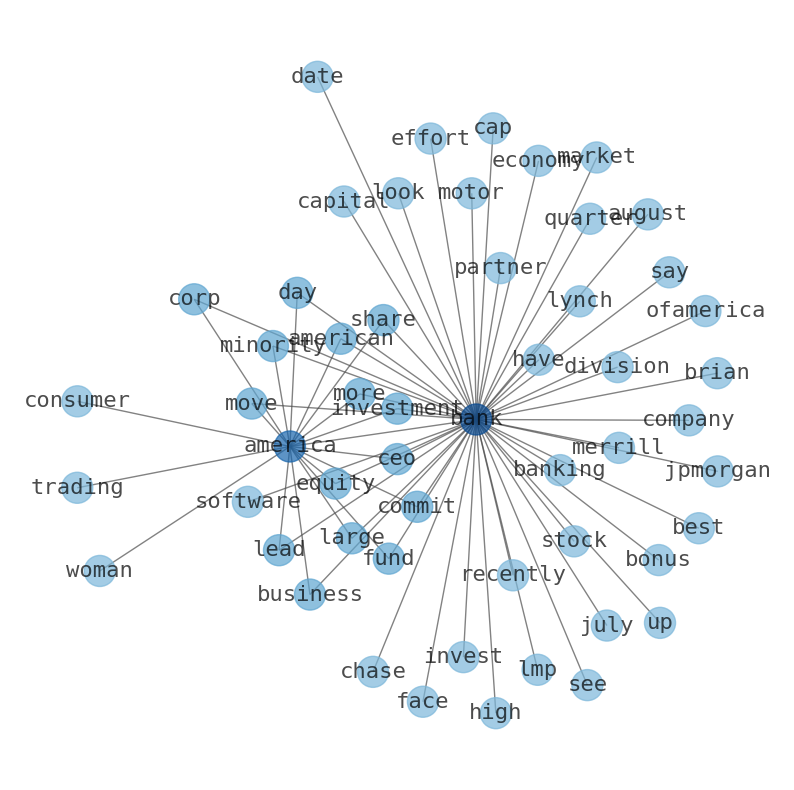

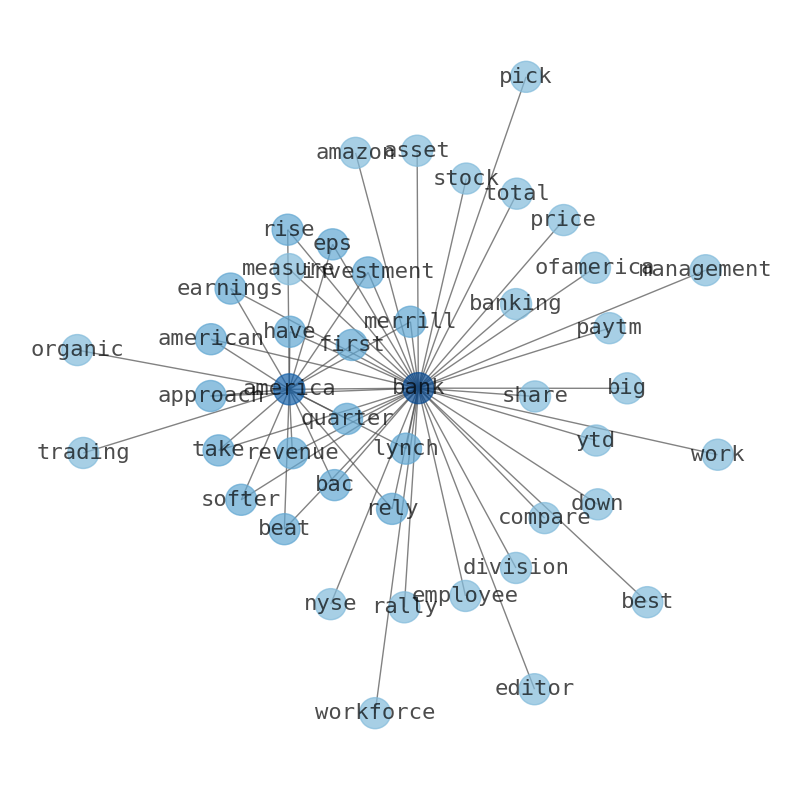

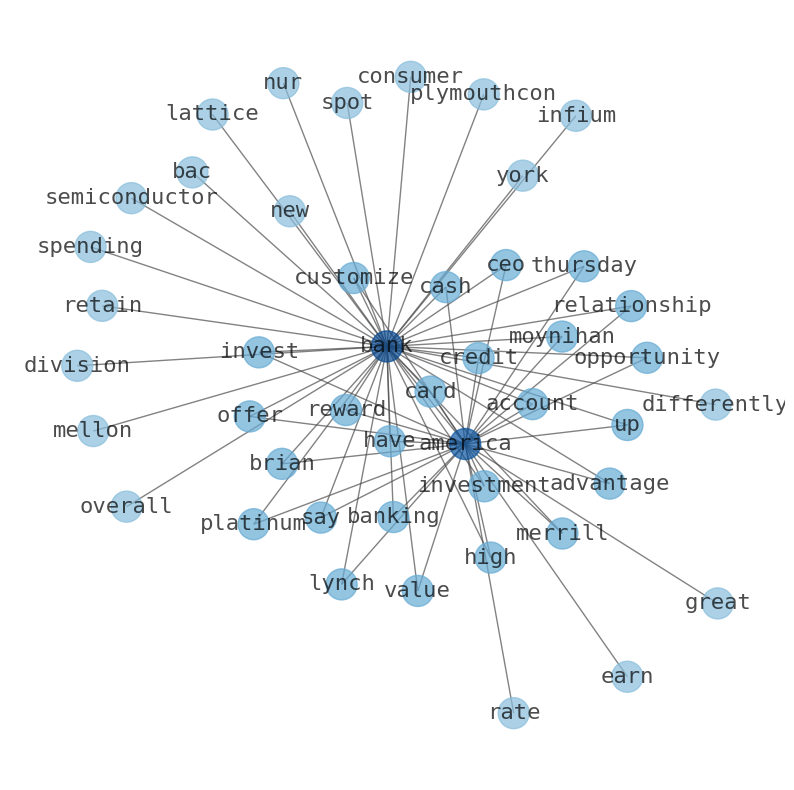

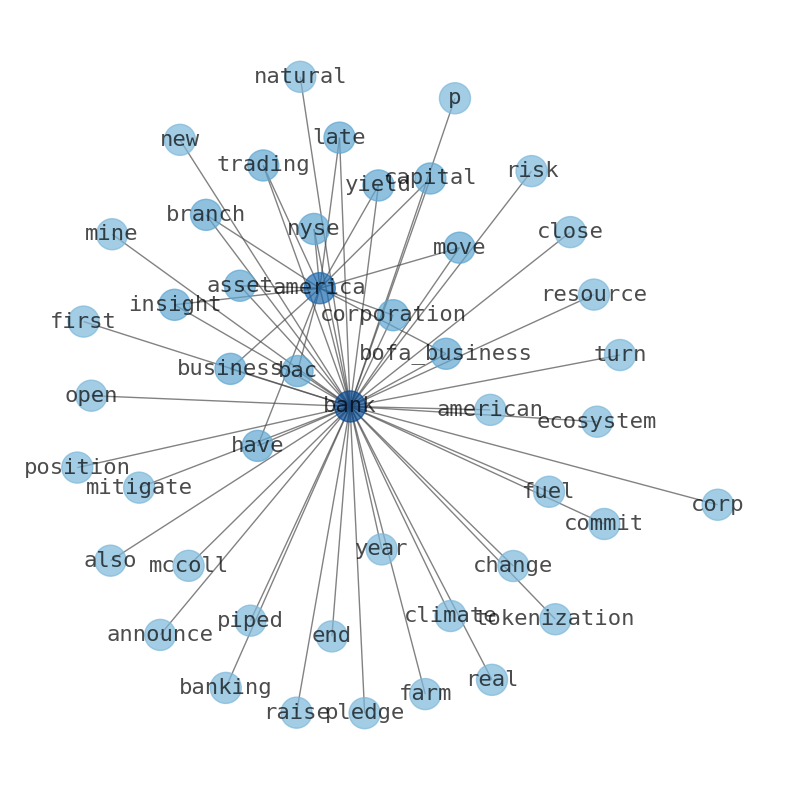

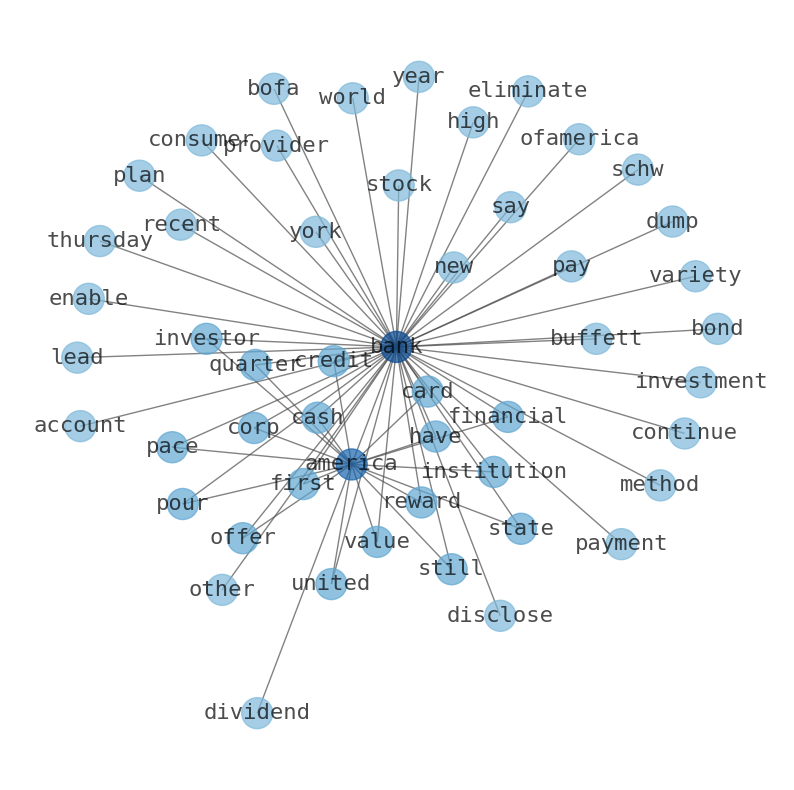

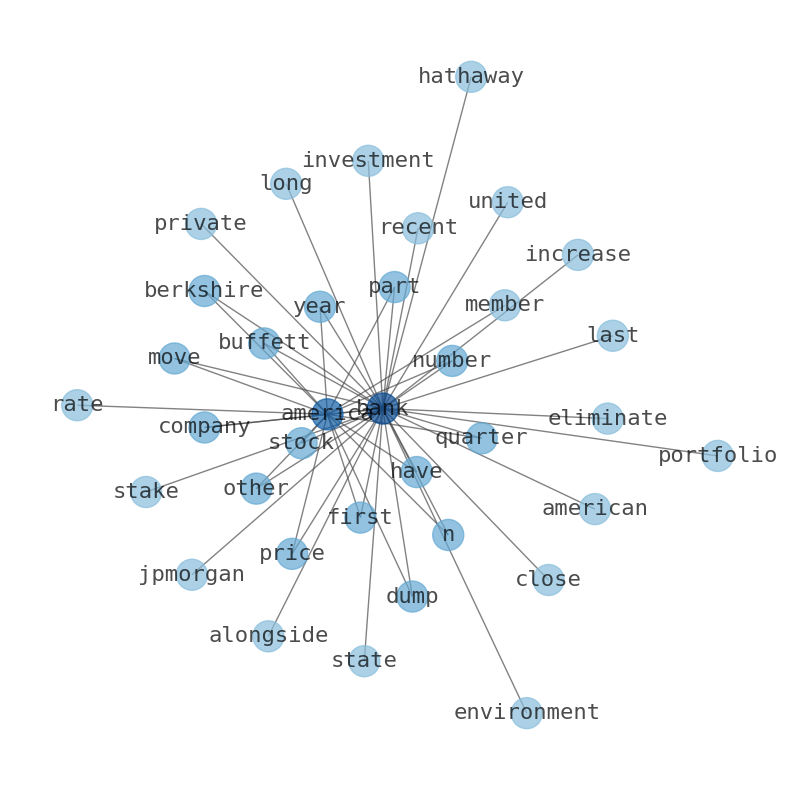

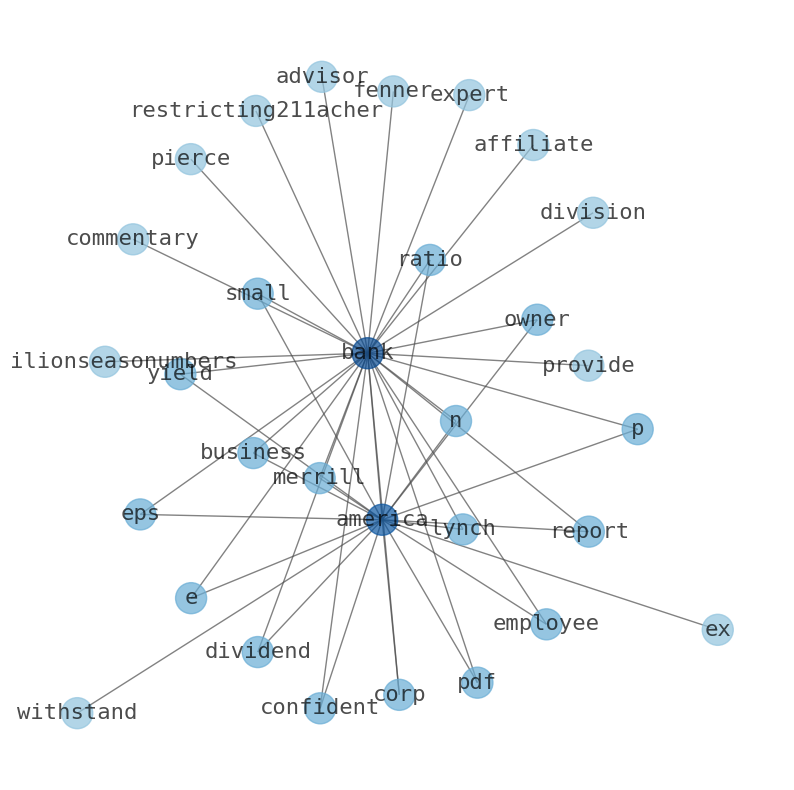

Keywords

The game is changing. There is a new strategy to evaluate Bank of America fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Bank of America are: Bank, America, stock, company, market, CEO, year, and the most common words in the summary are: bank, best, business, market, america, credit, job, . One of the sentences in the summary was: S&P 500 could rise as high as 5600, and these 8 ETFs are poised for big upside along the way. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #bank #best #business #market #america #credit #job.

Read more →Related Results

Bank of America

Open: 35.28 Close: 35.41 Change: 0.13

Read more →

Bank of America

Open: 33.73 Close: 33.92 Change: 0.19

Read more →

Bank of America

Open: 33.36 Close: 33.7 Change: 0.34

Read more →

Bank of America

Open: 33.32 Close: 34.07 Change: 0.75

Read more →

Bank of America

Open: 33.1 Close: 33.07 Change: -0.03

Read more →

Bank of America

Open: 33.4 Close: 33.43 Change: 0.03

Read more →

Bank of America

Open: 31.8 Close: 32.22 Change: 0.42

Read more →

Bank of America

Open: 33.8 Close: 34.43 Change: 0.63

Read more →

Bank of America

Open: 33.39 Close: 33.9 Change: 0.51

Read more →

Bank of America

Open: 33.94 Close: 33.67 Change: -0.27

Read more →

Bank of America

Open: 33.94 Close: 33.67 Change: -0.27

Read more →

Bank of America

Open: 33.71 Close: 33.43 Change: -0.28

Read more →

Bank of America

Open: 29.48 Close: 29.73 Change: 0.25

Read more →

Bank of America

Open: 29.74 Close: 29.63 Change: -0.11

Read more →

Bank of America

Open: 29.99 Close: 29.66 Change: -0.33

Read more →

Bank of America

Open: 28.5 Close: 29.22 Change: 0.72

Read more →

Bank of America

Open: 28.56 Close: 28.33 Change: -0.23

Read more →

Bank of America

Open: 26.13 Close: 25.61 Change: -0.52

Read more →

Bank of America

Open: 26.8 Close: 26.31 Change: -0.49

Read more →

Bank of America

Open: 27.43 Close: 26.76 Change: -0.67

Read more →

Bank of America

Open: 27.43 Close: 26.68 Change: -0.75

Read more →

Bank of America

Open: 25.78 Close: 25.92 Change: 0.14

Read more →

Bank of America

Open: 27.23 Close: 27.43 Change: 0.2

Read more →

Bank of America

Open: 27.5 Close: 27.6 Change: 0.1

Read more →

Bank of America

Open: 28.07 Close: 27.64 Change: -0.43

Read more →

Bank of America

Open: 28.95 Close: 28.84 Change: -0.11

Read more →

Bank of America

Open: 29.12 Close: 28.88 Change: -0.24

Read more →

Bank of America

Open: 28.41 Close: 28.13 Change: -0.28

Read more →

Bank of America

Open: 28.76 Close: 28.98 Change: 0.22

Read more →

Bank of America

Open: 29.22 Close: 29.04 Change: -0.18

Read more →

Bank of America

Open: 28.64 Close: 28.5 Change: -0.14

Read more →

Bank of America

Open: 29.22 Close: 29.15 Change: -0.07

Read more →

Bank of America

Open: 31.22 Close: 30.86 Change: -0.36

Read more →

Bank of America

Open: 31.87 Close: 31.98 Change: 0.11

Read more →

Bank of America

Open: 28.59 Close: 28.66 Change: 0.07

Read more →

Bank of America

Open: 28.8 Close: 28.28 Change: -0.52

Read more →

Bank of America

Open: 29.14 Close: 29.08 Change: -0.06

Read more →

Bank of America

Open: 28.5 Close: 28.66 Change: 0.16

Read more →

Bank of America

Open: 27.74 Close: 27.75 Change: 0.01

Read more →

Bank of America

Open: 29.53 Close: 29.19 Change: -0.34

Read more →

Bank of America

Open: 29.57 Close: 29.12 Change: -0.45

Read more →

Bank of America

Open: 28.82 Close: 28.67 Change: -0.15

Read more →

Bank of America

Open: 28.32 Close: 28.26 Change: -0.06

Read more →

Bank of America

Open: 27.99 Close: 28.17 Change: 0.18

Read more →

Bank of America

Open: 28.46 Close: 28.11 Change: -0.35

Read more →

Bank of America

Open: 27.52 Close: 26.93 Change: -0.59

Read more →

Bank of America

Open: 28.16 Close: 27.86 Change: -0.3

Read more →

Bank of America

Open: 29.75 Close: 29.87 Change: 0.12

Read more →

Bank of America

Open: 35.87 Close: 35.6 Change: -0.27

Read more →

Bank of America

Open: 33.37 Close: 33.61 Change: 0.24

Read more →

Bank of America

Open: 33.92 Close: 34.09 Change: 0.17

Read more →

Bank of America

Open: 33.1 Close: 33.07 Change: -0.03

Read more →

Bank of America

Open: 33.06 Close: 33.18 Change: 0.12

Read more →

Bank of America

Open: 33.4 Close: 33.43 Change: 0.03

Read more →

Bank of America

Open: 33.5 Close: 33.33 Change: -0.17

Read more →

Bank of America

Open: 33.39 Close: 33.9 Change: 0.51

Read more →

Bank of America

Open: 33.94 Close: 33.67 Change: -0.27

Read more →

Bank of America

Open: 33.94 Close: 33.67 Change: -0.27

Read more →

Bank of America

Open: 33.03 Close: 33.51 Change: 0.48

Read more →

Bank of America

Open: 30.77 Close: 30.74 Change: -0.03

Read more →

Bank of America

Open: 29.48 Close: 29.73 Change: 0.25

Read more →

Bank of America

Open: 29.74 Close: 29.59 Change: -0.15

Read more →

Bank of America

Open: 29.2 Close: 29.62 Change: 0.42

Read more →

Bank of America

Open: 28.56 Close: 28.33 Change: -0.23

Read more →

Bank of America

Open: 26.07 Close: 25.17 Change: -0.9

Read more →

Bank of America

Open: 26.8 Close: 26.31 Change: -0.49

Read more →

Bank of America

Open: 27.54 Close: 27.31 Change: -0.23

Read more →

Bank of America

Open: 27.43 Close: 26.76 Change: -0.67

Read more →

Bank of America

Open: 27.17 Close: 27.02 Change: -0.15

Read more →

Bank of America

Open: 27.89 Close: 27.38 Change: -0.51

Read more →

Bank of America

Open: 27.23 Close: 27.27 Change: 0.04

Read more →

Bank of America

Open: 28.07 Close: 27.64 Change: -0.43

Read more →

Bank of America

Open: 28.81 Close: 28.55 Change: -0.26

Read more →

Bank of America

Open: 29.12 Close: 28.88 Change: -0.24

Read more →

Bank of America

Open: 28.12 Close: 28.36 Change: 0.24

Read more →

Bank of America

Open: 28.76 Close: 28.98 Change: 0.22

Read more →

Bank of America

Open: 28.76 Close: 28.98 Change: 0.22

Read more →

Bank of America

Open: 28.64 Close: 28.5 Change: -0.14

Read more →

Bank of America

Open: 28.45 Close: 28.45 Change: 0.0

Read more →

Bank of America

Open: 30.5 Close: 29.94 Change: -0.56

Read more →

Bank of America

Open: 32.15 Close: 31.9 Change: -0.25

Read more →

Bank of America

Open: 31.33 Close: 31.69 Change: 0.36

Read more →

Bank of America

Open: 28.8 Close: 28.28 Change: -0.52

Read more →

Bank of America

Open: 28.8 Close: 28.28 Change: -0.52

Read more →

Bank of America

Open: 28.94 Close: 28.69 Change: -0.25

Read more →

Bank of America

Open: 28.5 Close: 28.7 Change: 0.2

Read more →

Bank of America

Open: 29.53 Close: 29.19 Change: -0.34

Read more →

Bank of America

Open: 28.9 Close: 29.18 Change: 0.28

Read more →

Bank of America

Open: 29.3 Close: 29.5 Change: 0.2

Read more →

Bank of America

Open: 28.16 Close: 28.71 Change: 0.55

Read more →

Bank of America

Open: 28.2 Close: 28.31 Change: 0.11

Read more →

Bank of America

Open: 28.46 Close: 28.11 Change: -0.35

Read more →

Bank of America

Open: 27.78 Close: 27.36 Change: -0.42

Read more →

Bank of America

Open: 28.16 Close: 27.86 Change: -0.3

Read more →

Bank of America

Open: 28.76 Close: 28.44 Change: -0.32

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo