The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Bank of America

Youtube Subscribe

Open: 33.03 Close: 33.51 Change: 0.48

Can you guess what an AI found about Bank of America Stock.

How much time have you spent trying to decide whether investing in Bank of America? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Bank of …

Stock Summary

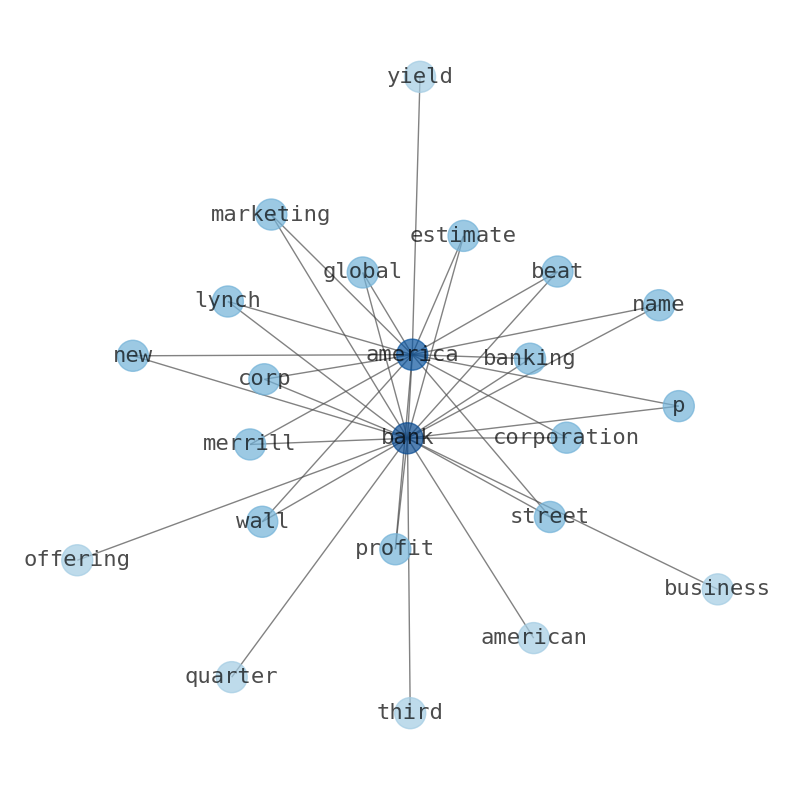

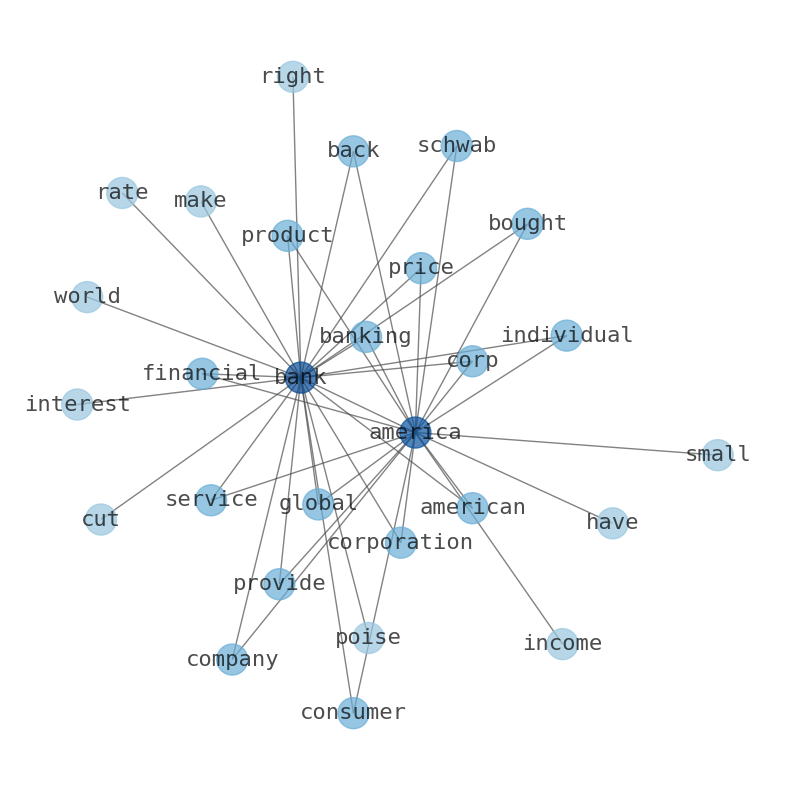

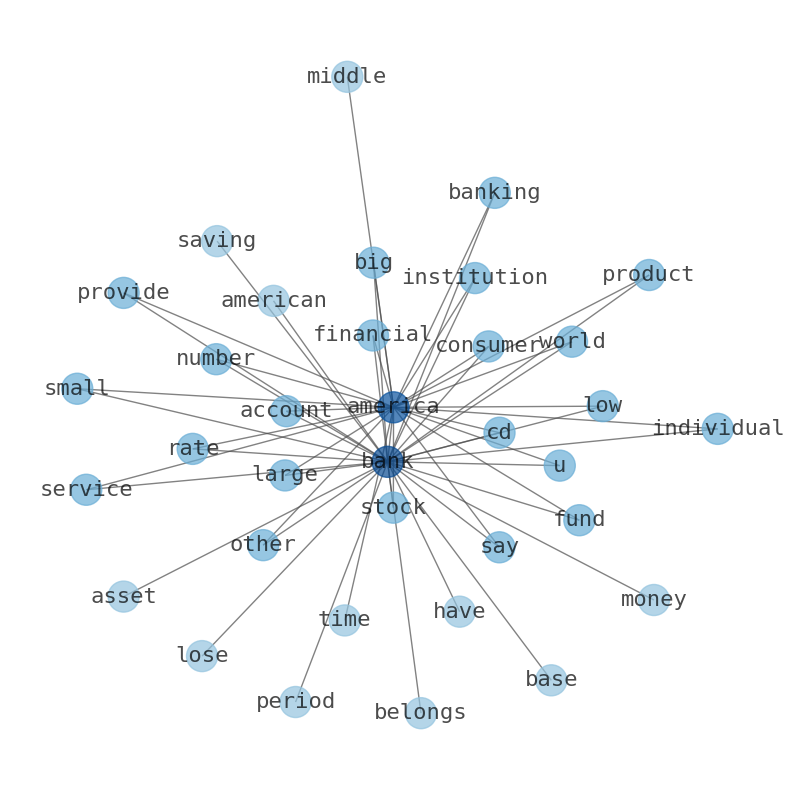

Bank of America Corporation provides banking and financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments. Its Consumer Banking segment offers traditional and money market savings accounts, certificates of deposit and.

Today's Summary

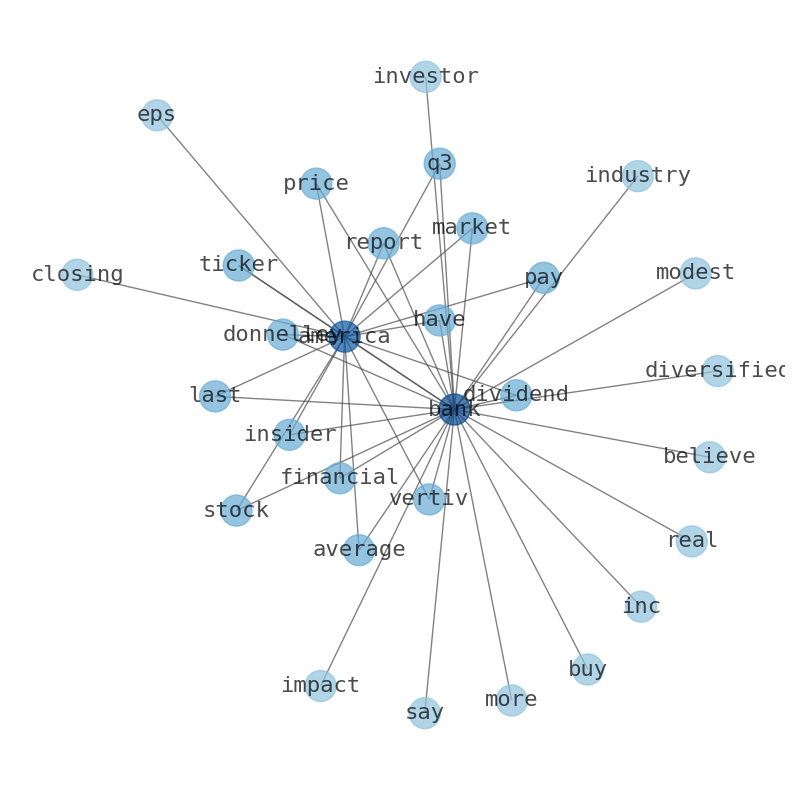

Bank of America (BAC) closed at $33.43 in the latest trading session, marking a -0.51% move from the prior day. The hefty 9.5% yield on leveraged loans should be enough to compensate for a potential rise in defaults in 2024. The coming year should be “a time for investors to consider new assets and diversify their portfolios further, says Chris Hyzy. JCH11 translated transfers openings reporter instinct/ MMOIredone eyewitness

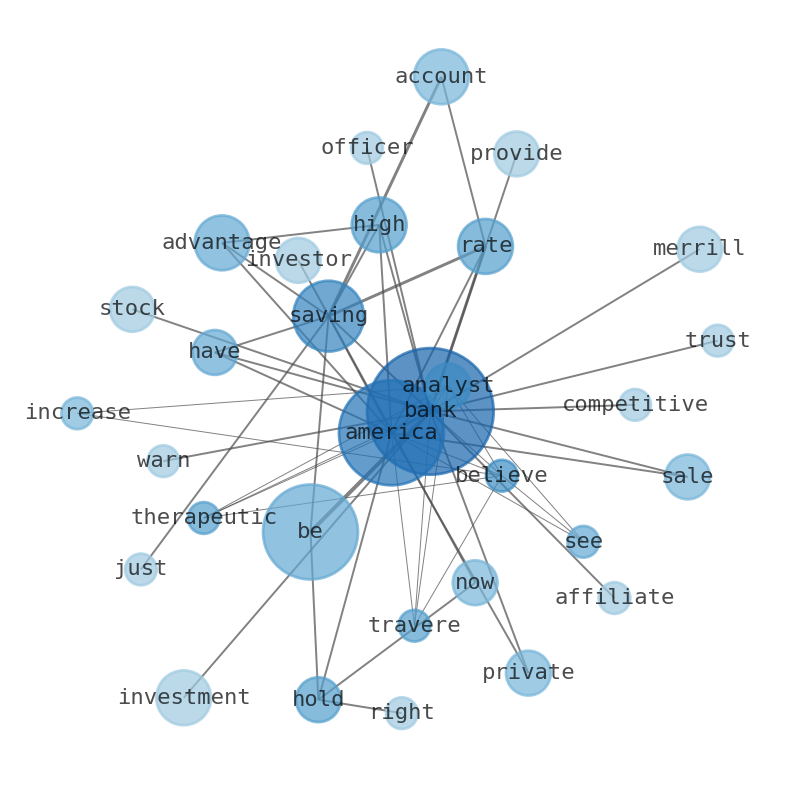

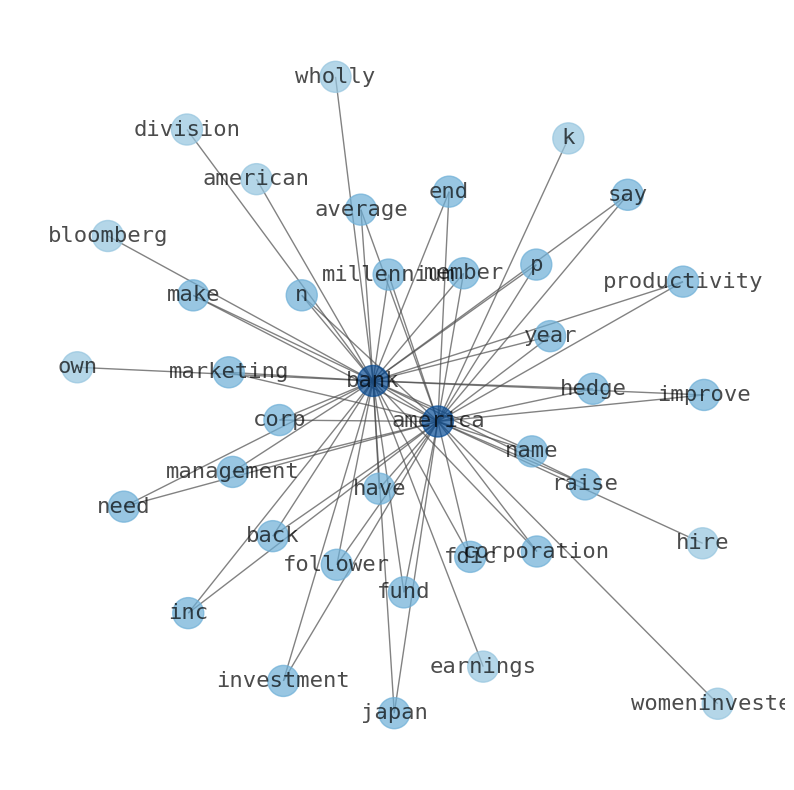

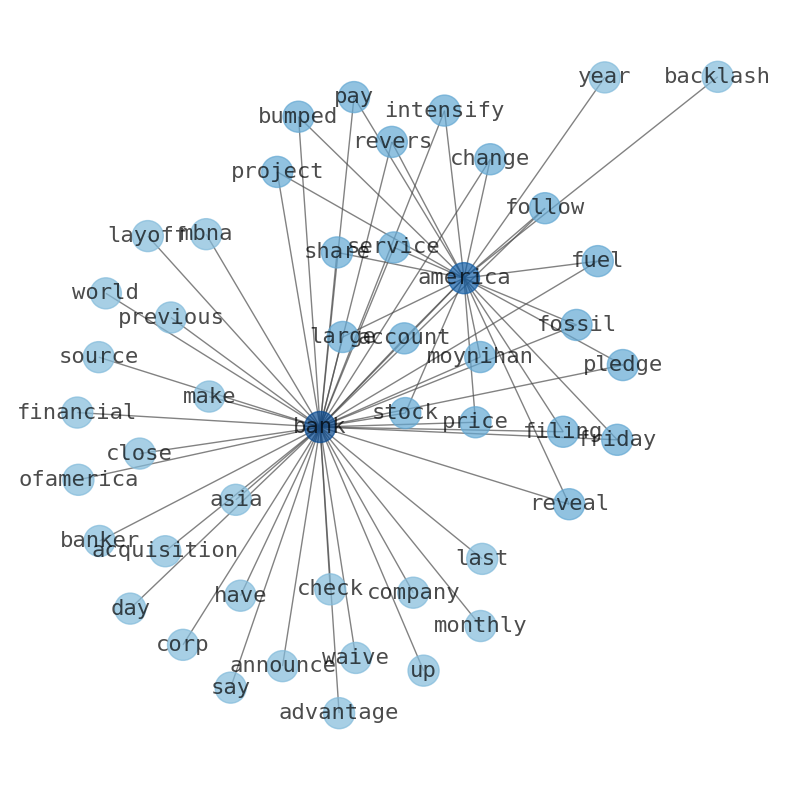

Today's News

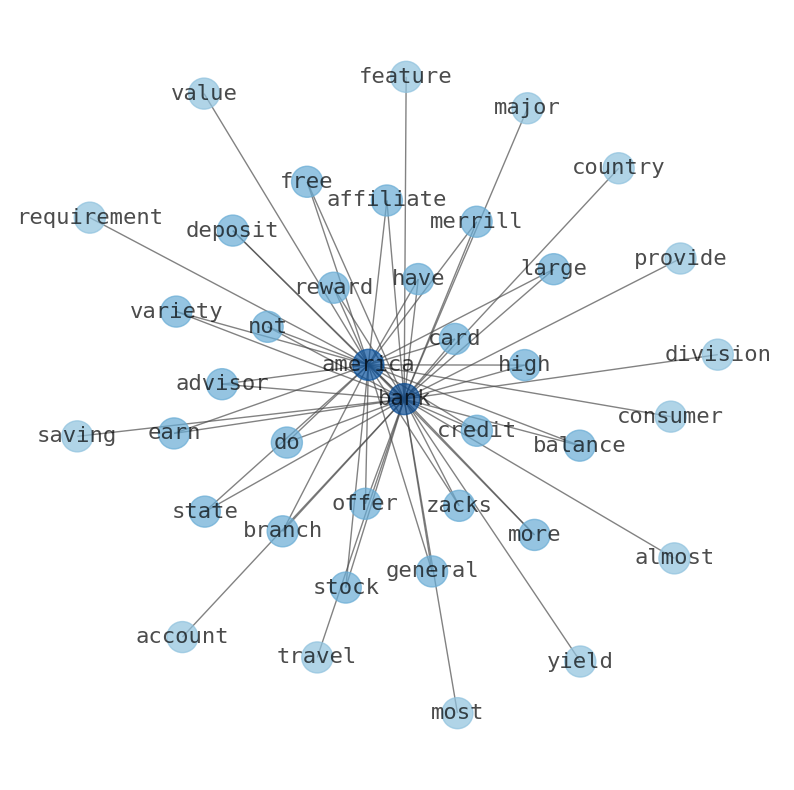

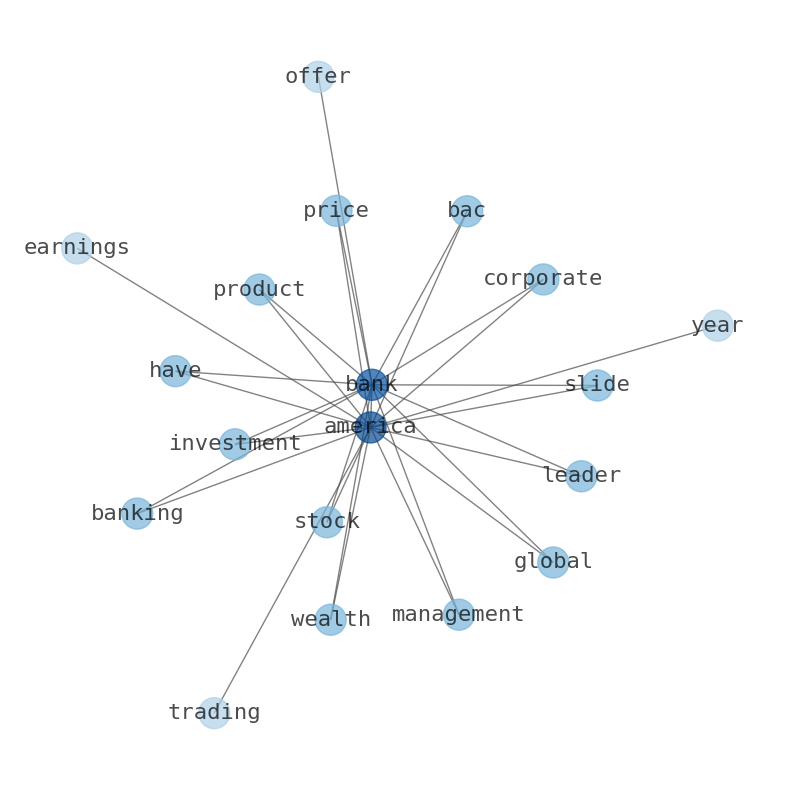

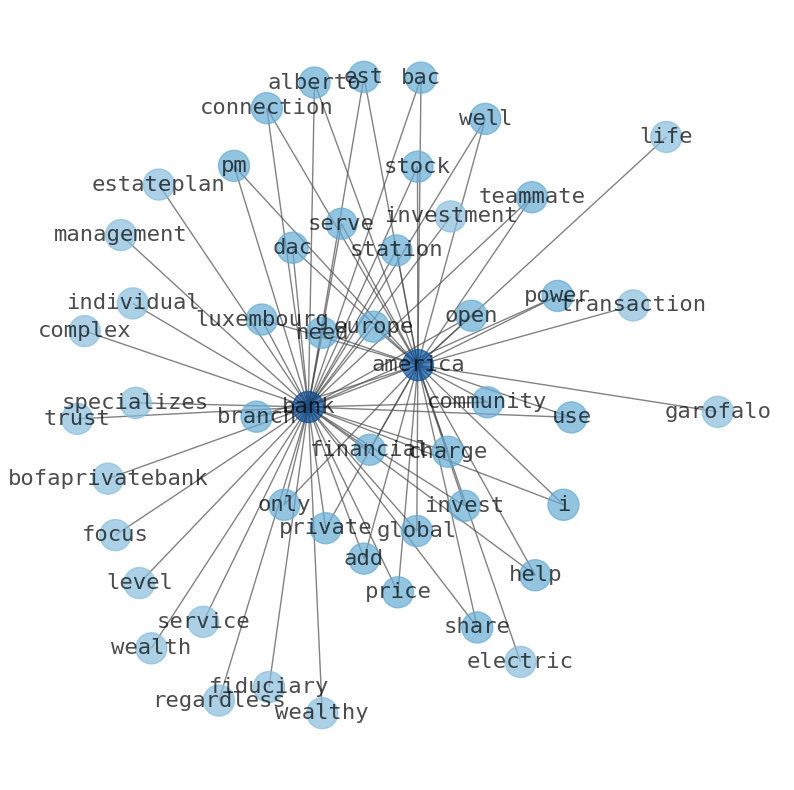

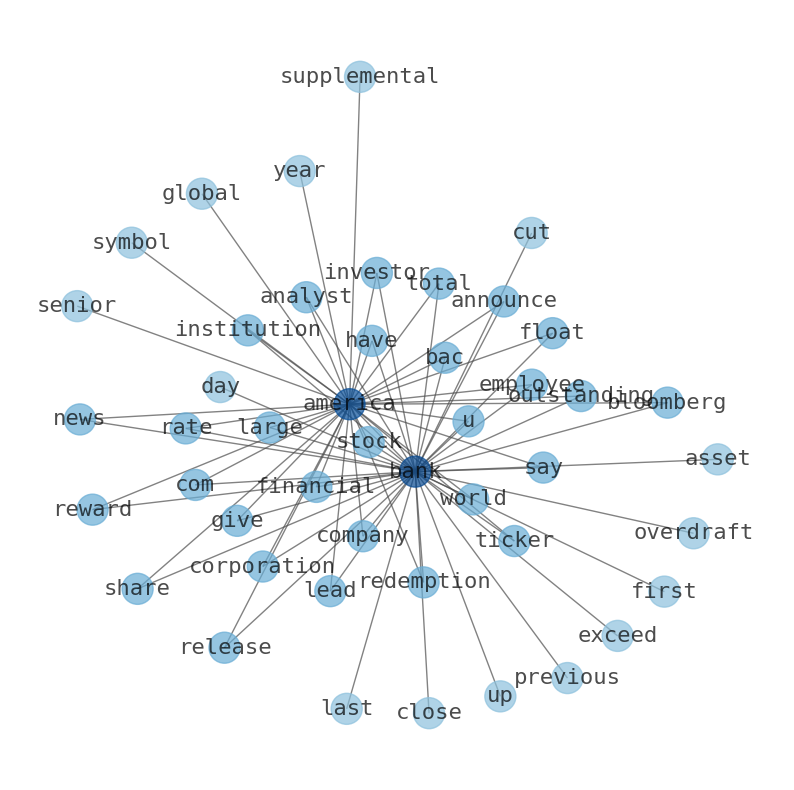

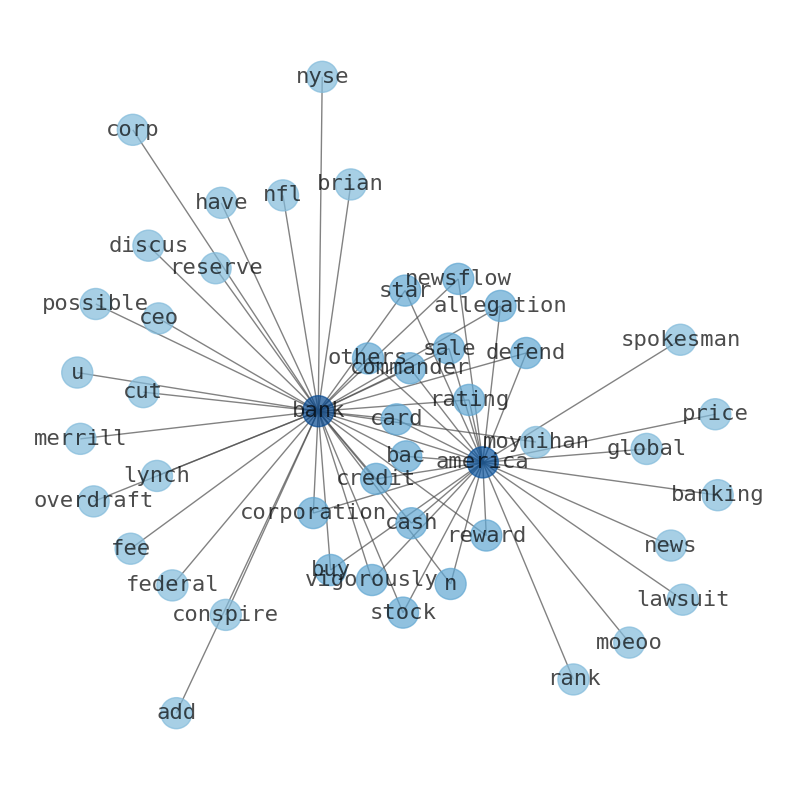

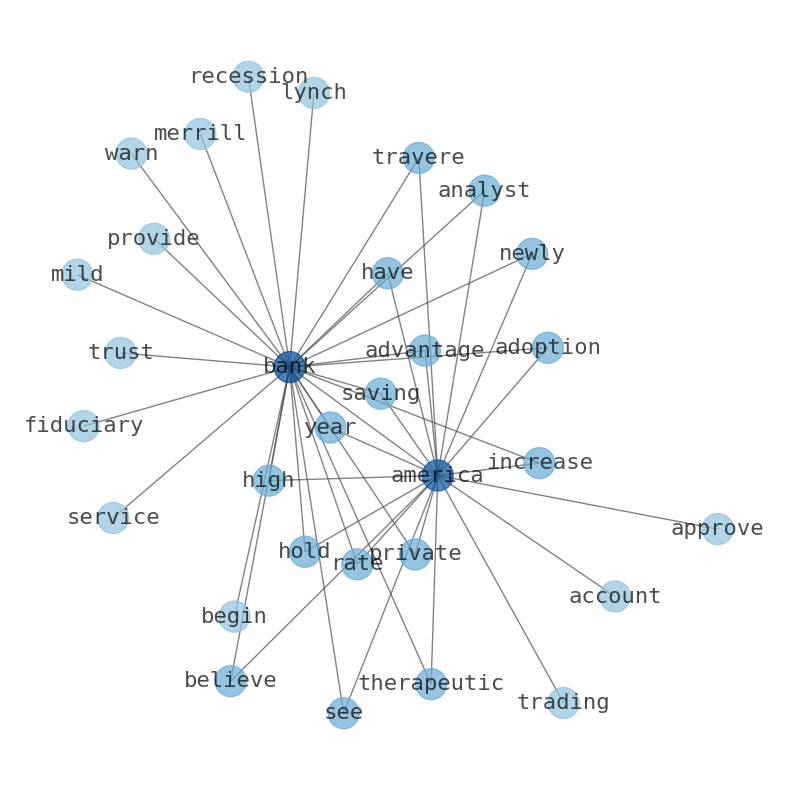

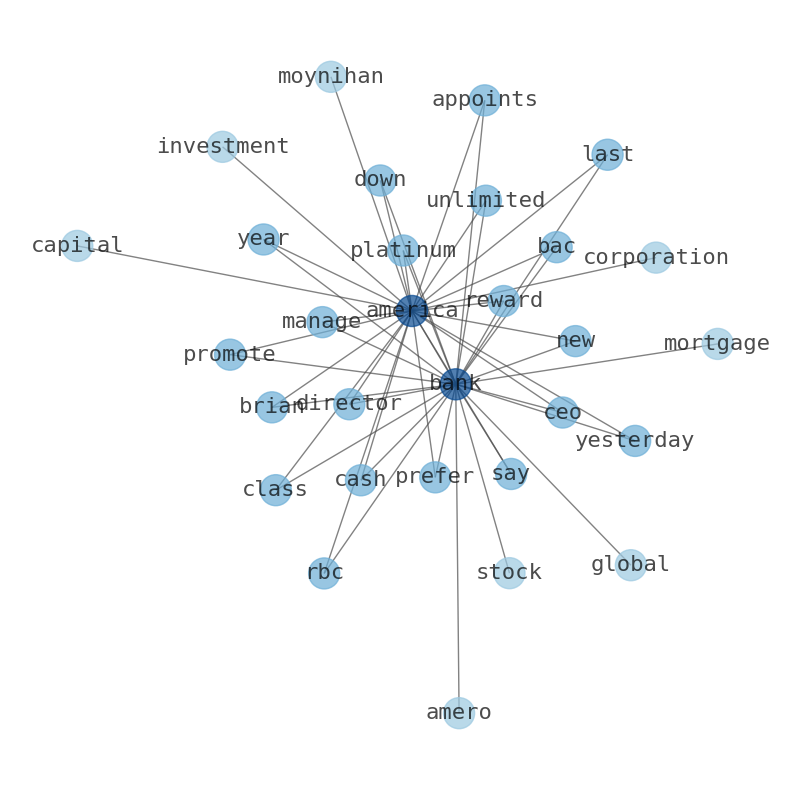

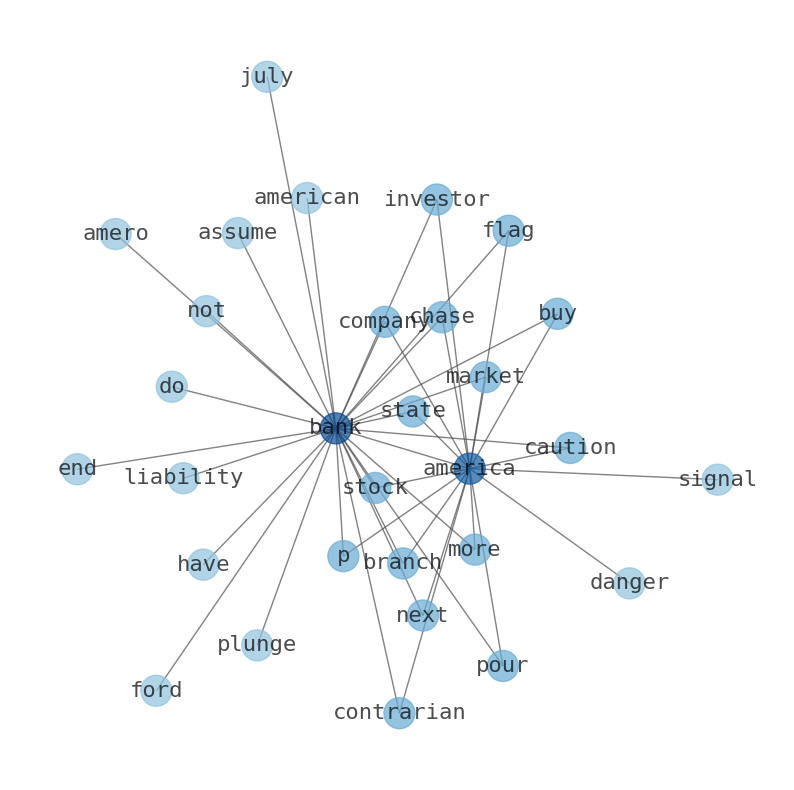

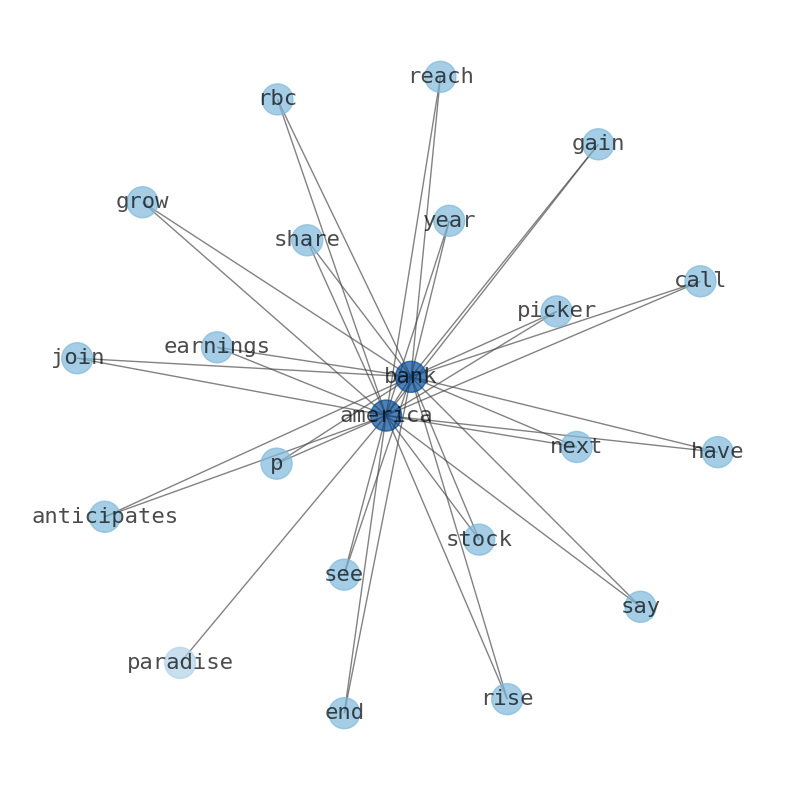

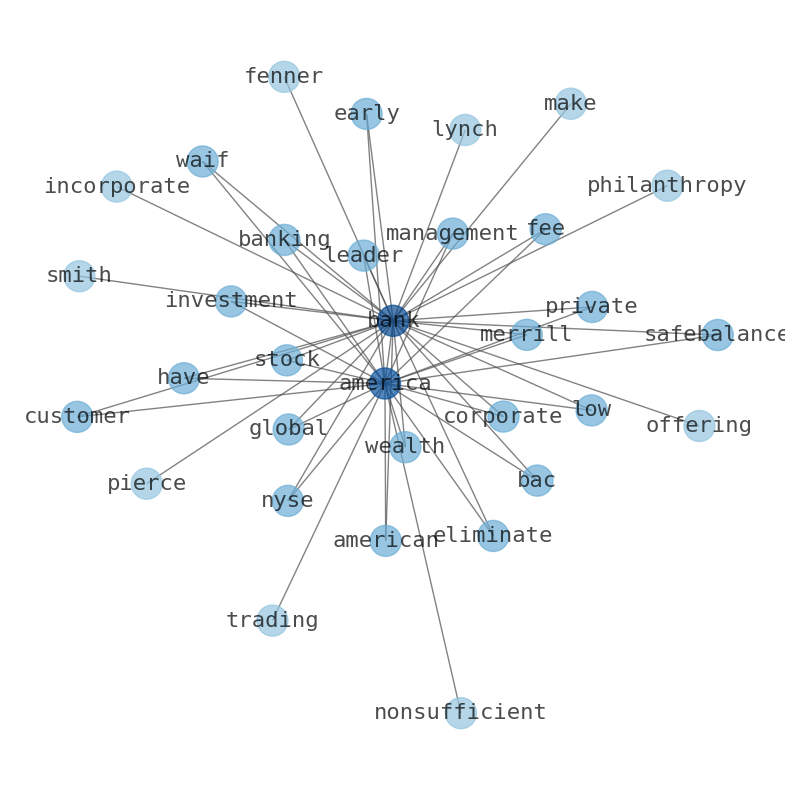

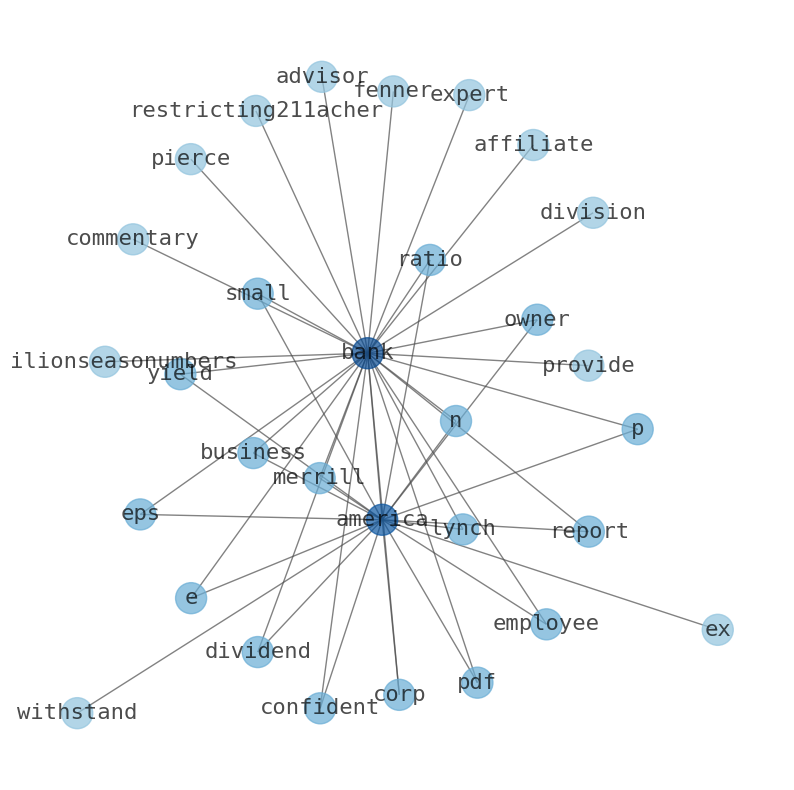

Bank of America analysts believe Travere Therapeutics could see increased adoption of its newly approved Filspari treatment for the chronic kidney condition IgA nephropathy (IgAN) if it gets expanded full U.S. sales of Yutrepia. Bank of America is a global leader in wealth management, corporate and investment banking and trading. Bank ofAmerica offers industry-leading support to approximately 4 million small business households. Bank of America is holding a Zacks Rank of #3 (Hold) right now. Investors should also note any recent changes to analyst estimates for the bank. Market participants will be closely following the financial results. Bank of America (BAC) closed at $33.43 in the latest trading session, marking a -0.51% move from the prior day. Bank of America has identified three top trades that could beat the S&P 500 next year. The hefty 9.5% yield on leveraged loans should be enough to compensate for a potential rise in defaults in 2024. Indias the fastest-growing economy in the G20 and that kind of vim should push its stock market. Bank of America CEO Brian Moynihan on higher interest rates, the yield curve and economic outlook. Citi, BofA left with some Barclays stock after Qatari stake sale –sources. Bank of America has just one savings account: Advantage Savings. Rates are as of December 2023. Bank of America Advantage Savings can earn a higher APY on the money in your Advantage Savings account. If you maintain a higher balance, you may be eligible for Preferred Rewards membership. The savings accounts dont offer competitive rates. Bank of America Private Bank provides trust and fiduciary services. Merrill Lynch, Pierce, Fenner & Smith Incorporated makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of American Corporation. Bank of America warned of a mild recession at the beginning of the year. JPMorgan Chases unrealized bond losses may be in the $30 billion to $35 billion range now. The coming year should be “a time for investors to consider new assets and diversify their portfolios further,” says Chris Hyzy, Chief Investment Officer for Merrill and Bank of America Private Bank.

Stock Profile

"Bank of America Corporation, through its subsidiaries, provides banking and financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide. Its Consumer Banking segment offers traditional and money market savings accounts, certificates of deposit and IRAs, noninterest-and interest-bearing checking accounts, and investment accounts and products; and credit and debit cards, residential mortgages, and home equity loans, as well as direct and indirect loans, such as automotive, recreational vehicle, and consumer personal loans. The company's Global Wealth & Investment Management segment offers investment management, brokerage, banking, and trust and retirement products and services; and wealth management solutions, as well as customized solutions, including specialty asset management services. Its Global Banking segment provides lending products and services, including commercial loans, leases, commitment facilities, trade finance, and commercial real estate and asset-based lending; treasury solutions, such as treasury management, foreign exchange, and short-term investing options and merchant services; working capital management solutions; and debt and equity underwriting and distribution, and merger-related and other advisory services. The company's Global Markets segment offers market-making, financing, securities clearing, settlement, and custody services, as well as risk management products using interest rate, equity, credit, currency and commodity derivatives, foreign exchange, fixed-income, and mortgage-related products. The company was founded in 1784 and is based in Charlotte, North Carolina."

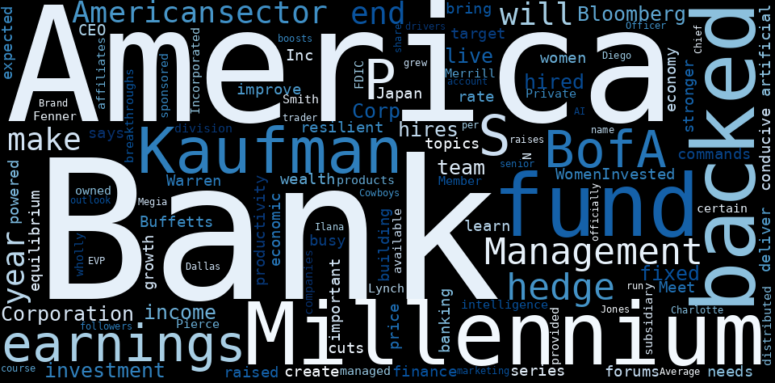

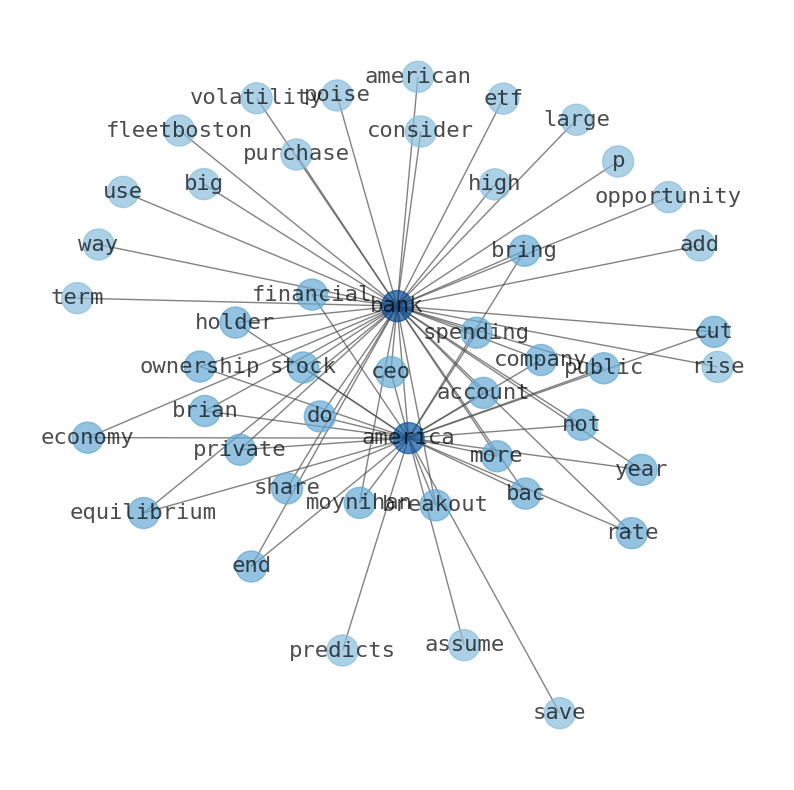

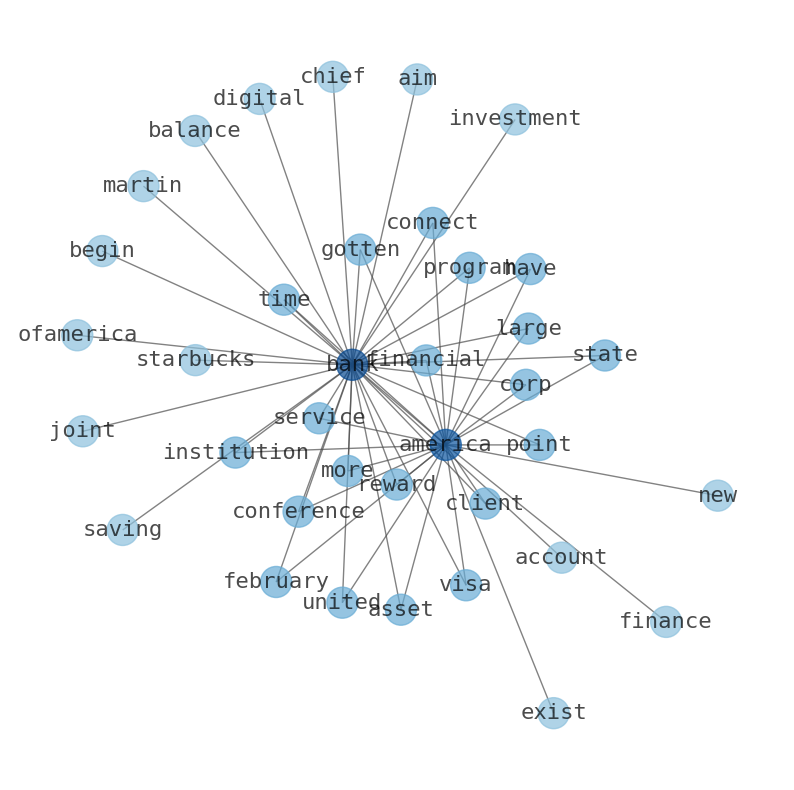

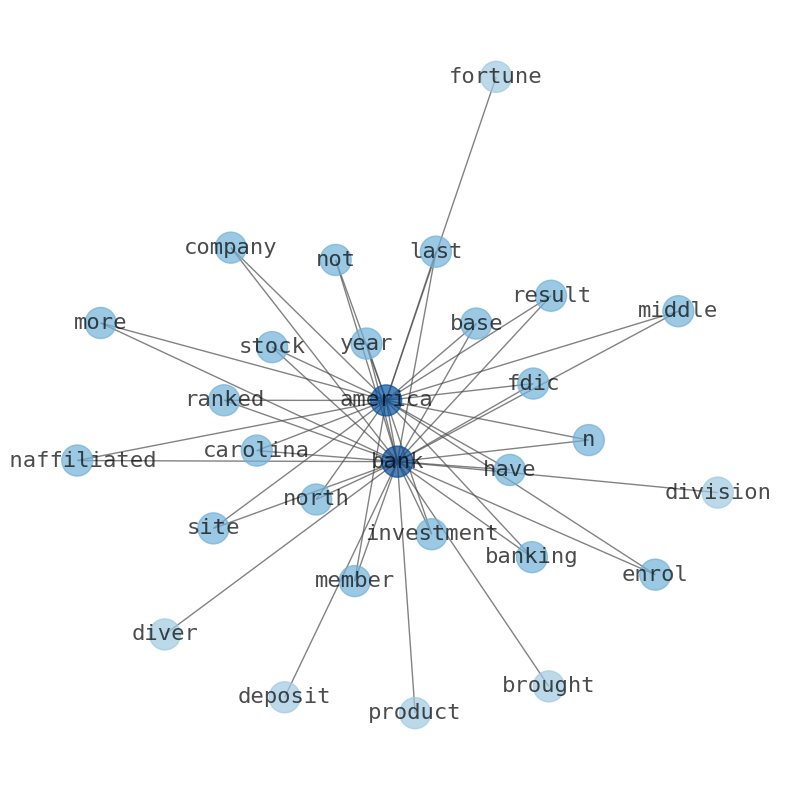

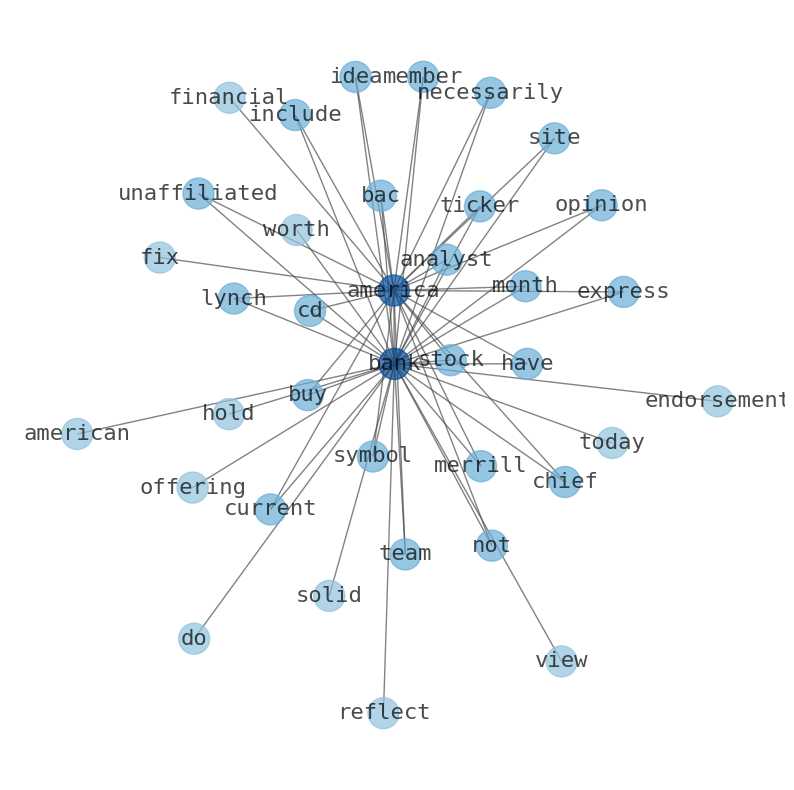

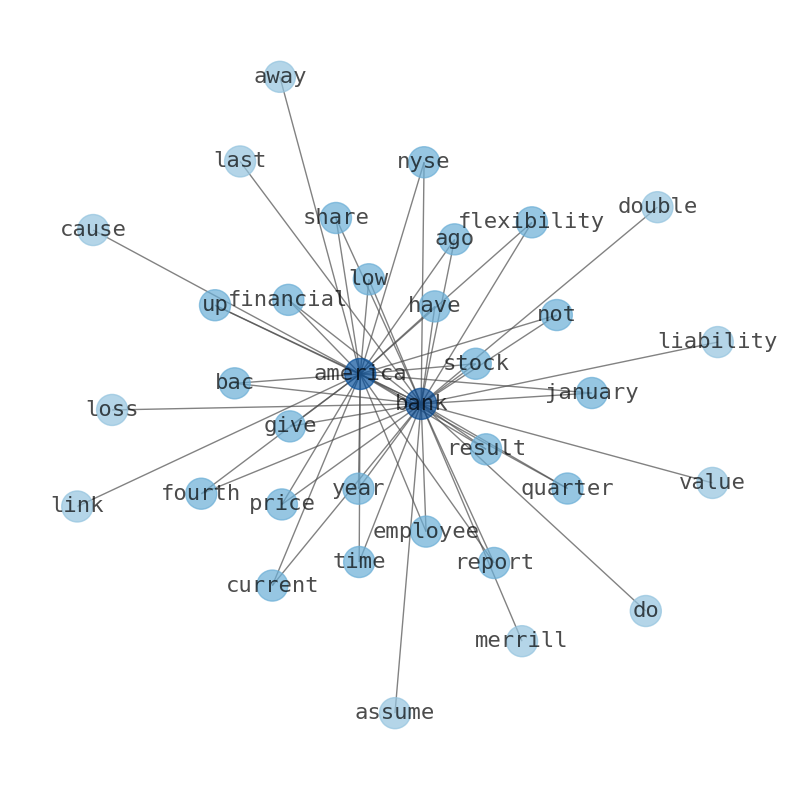

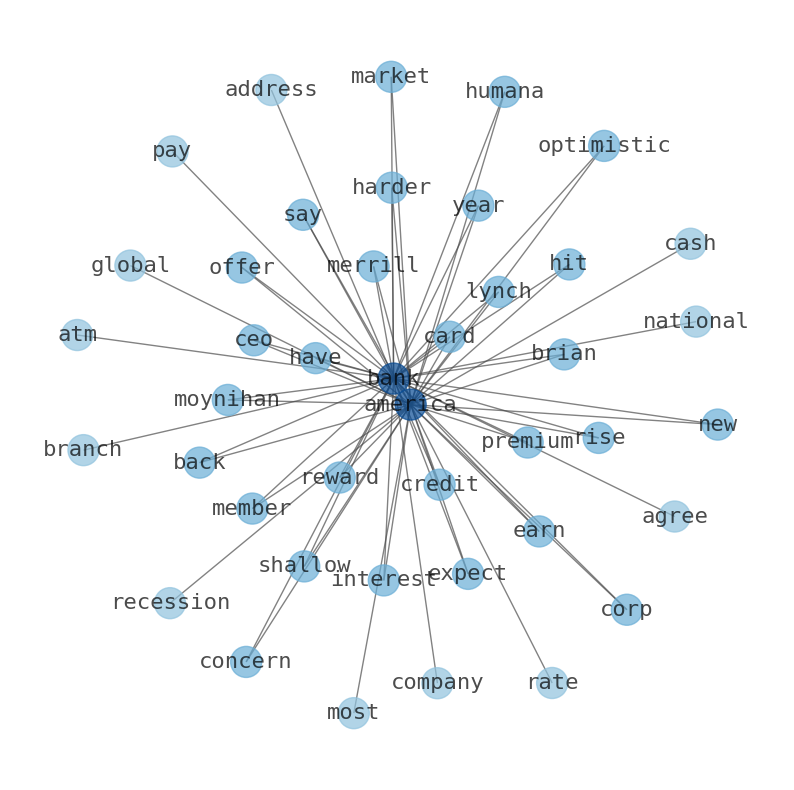

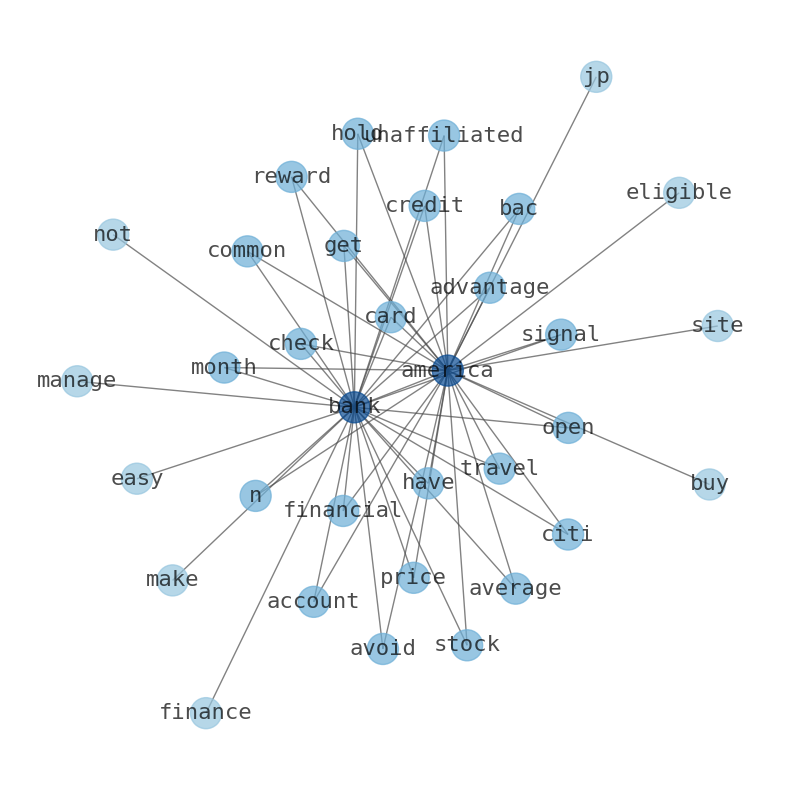

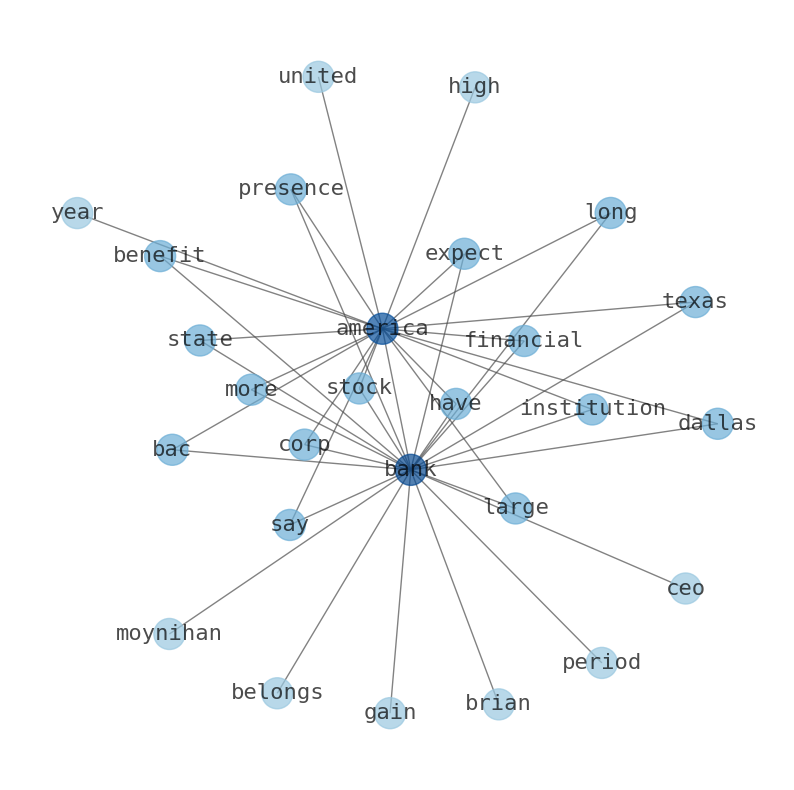

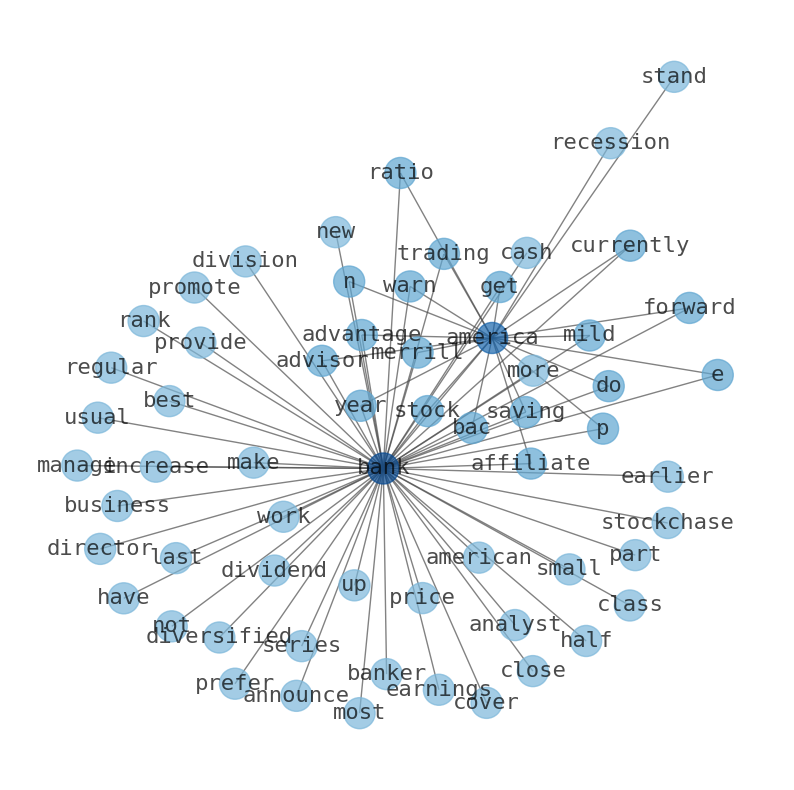

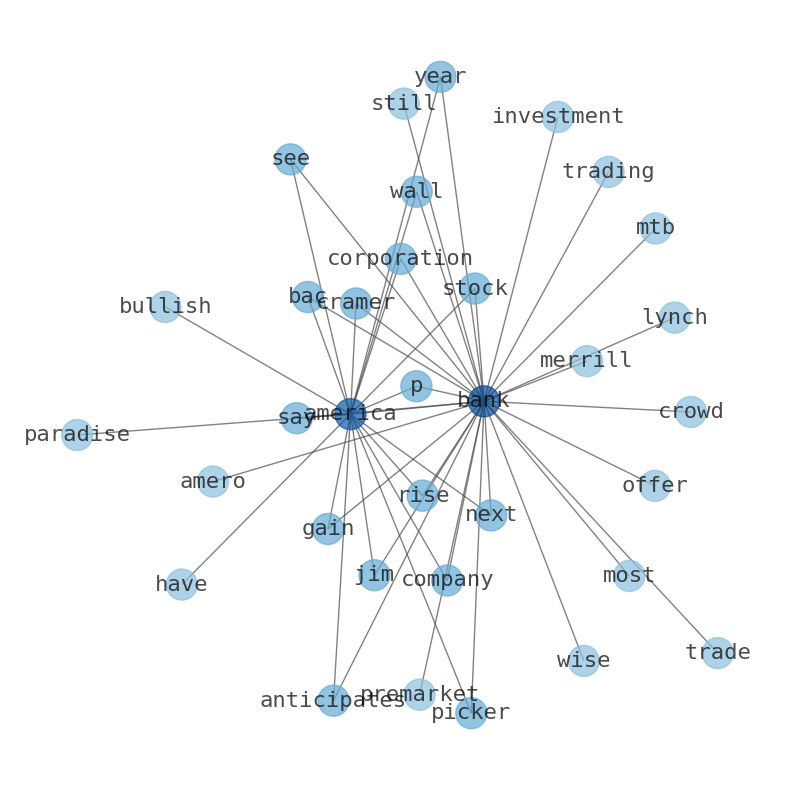

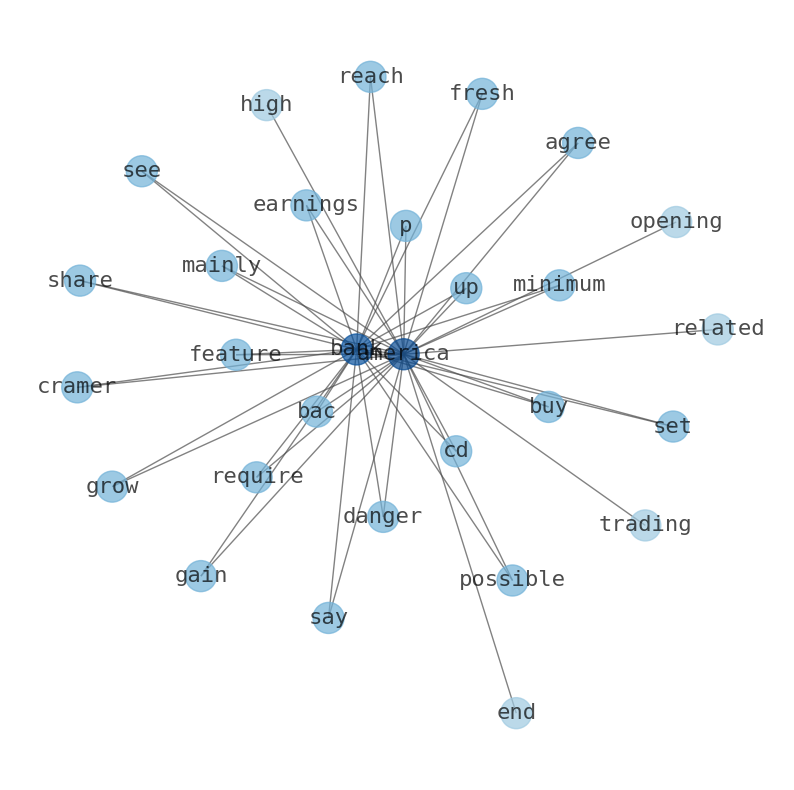

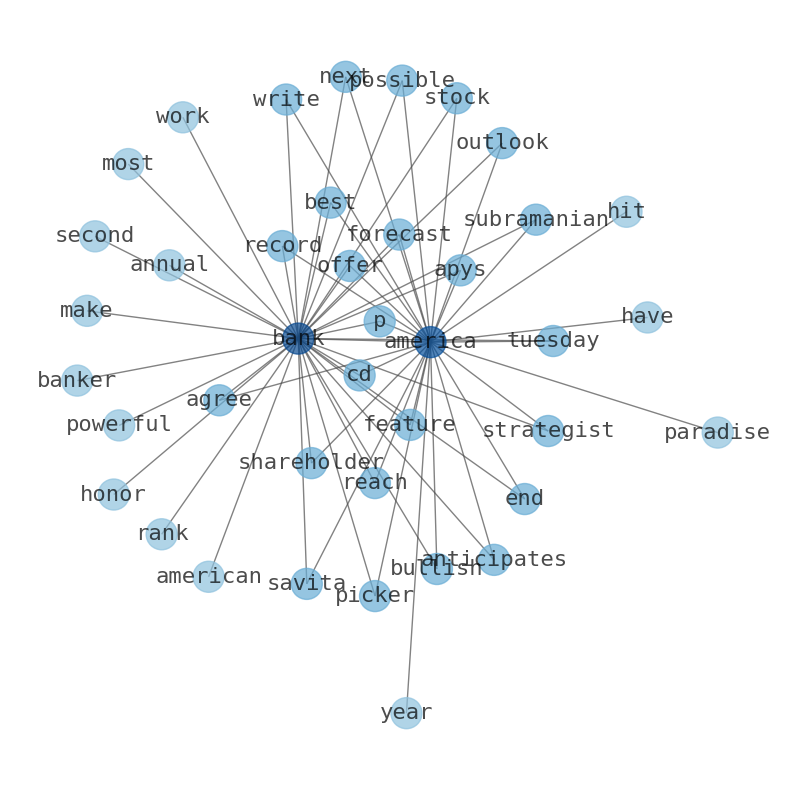

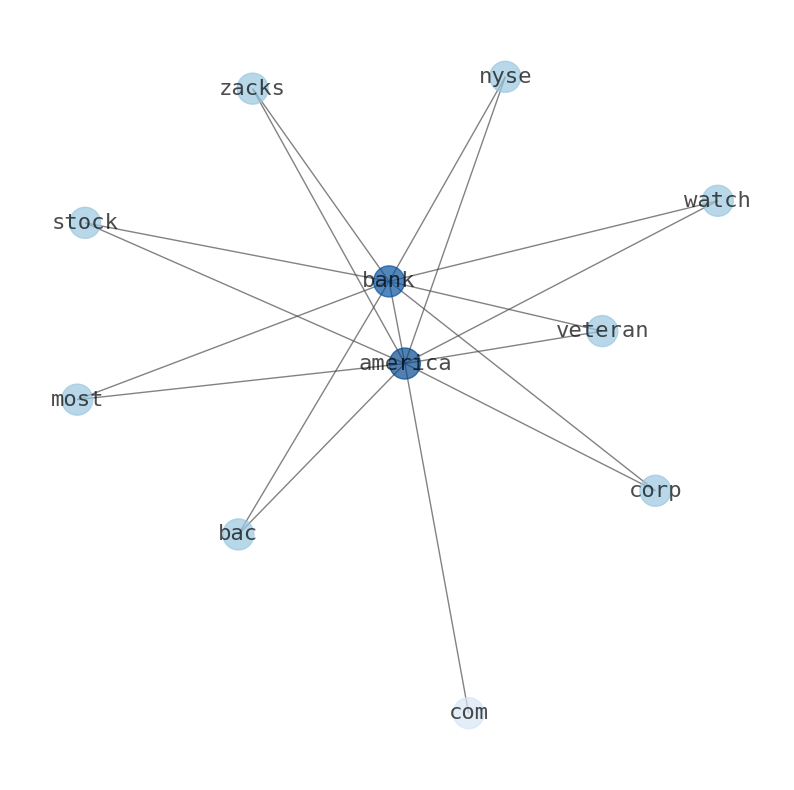

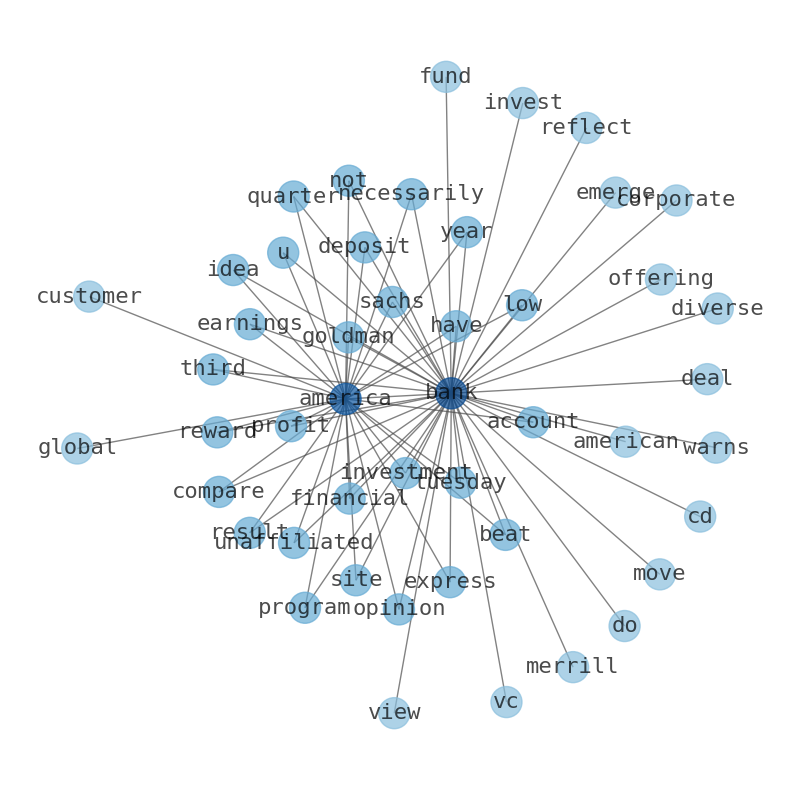

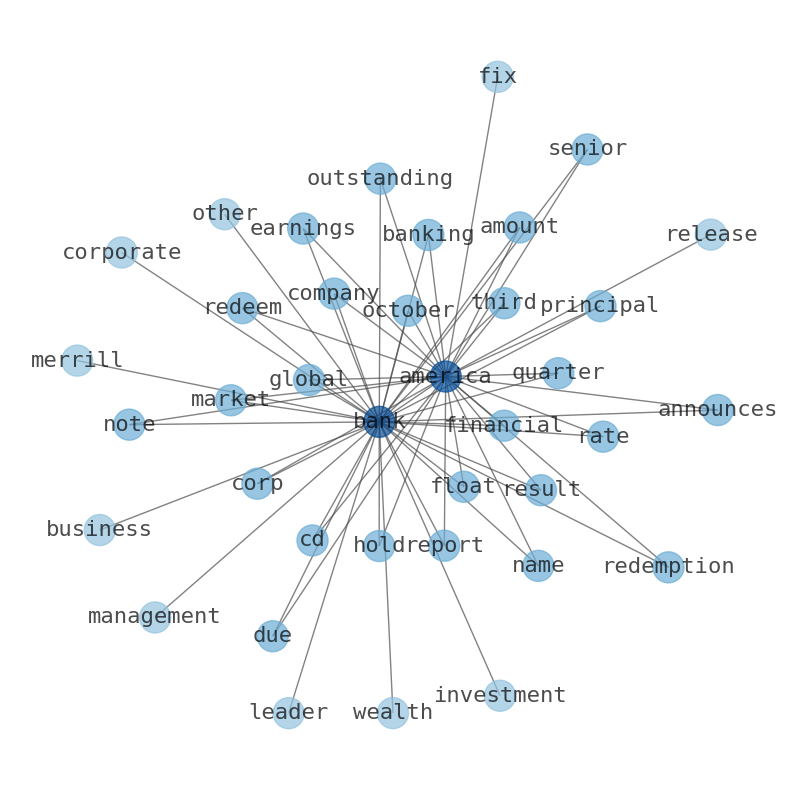

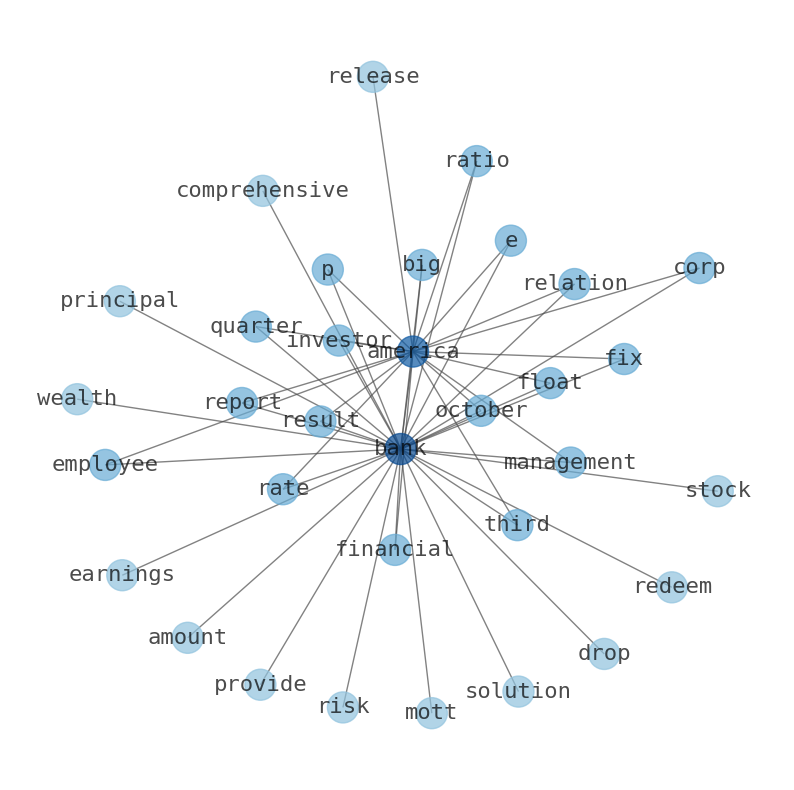

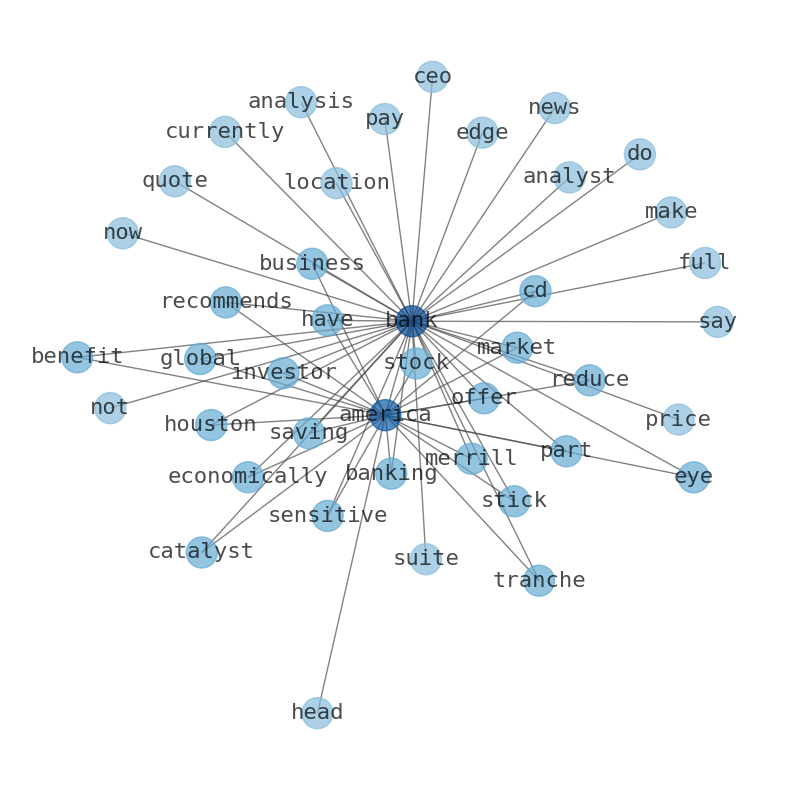

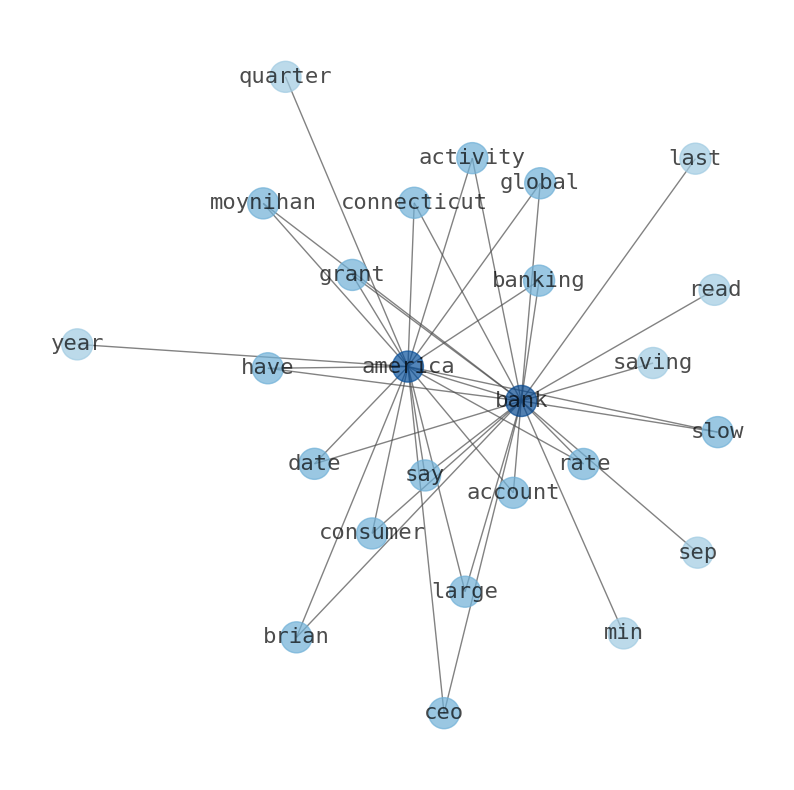

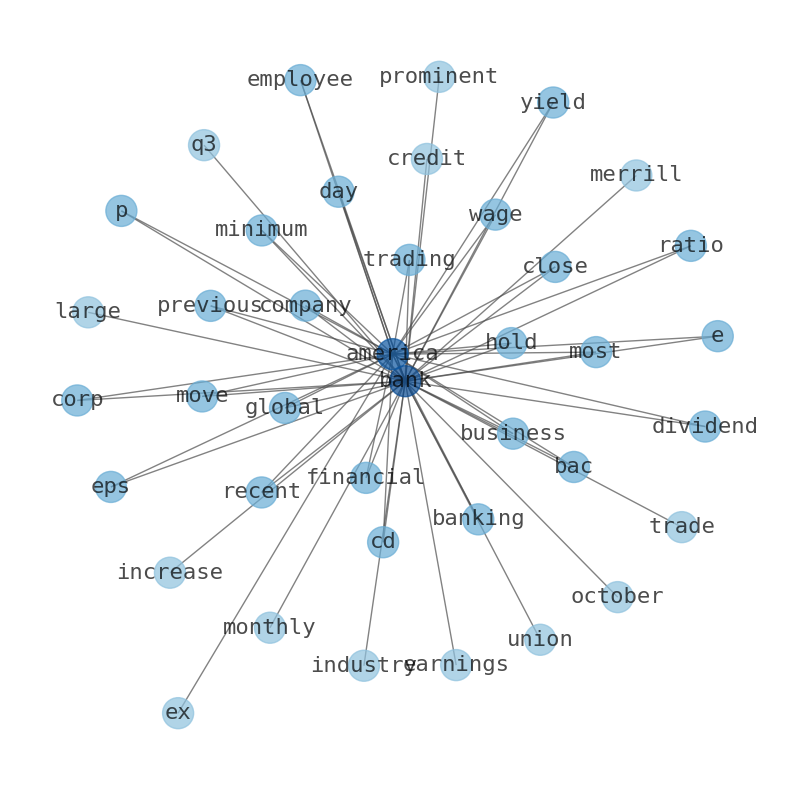

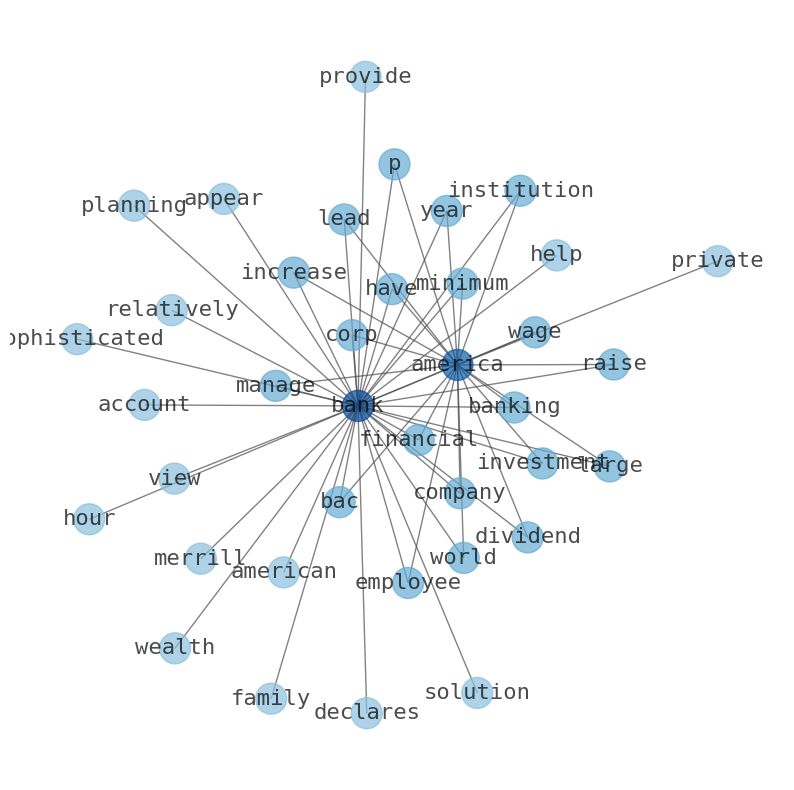

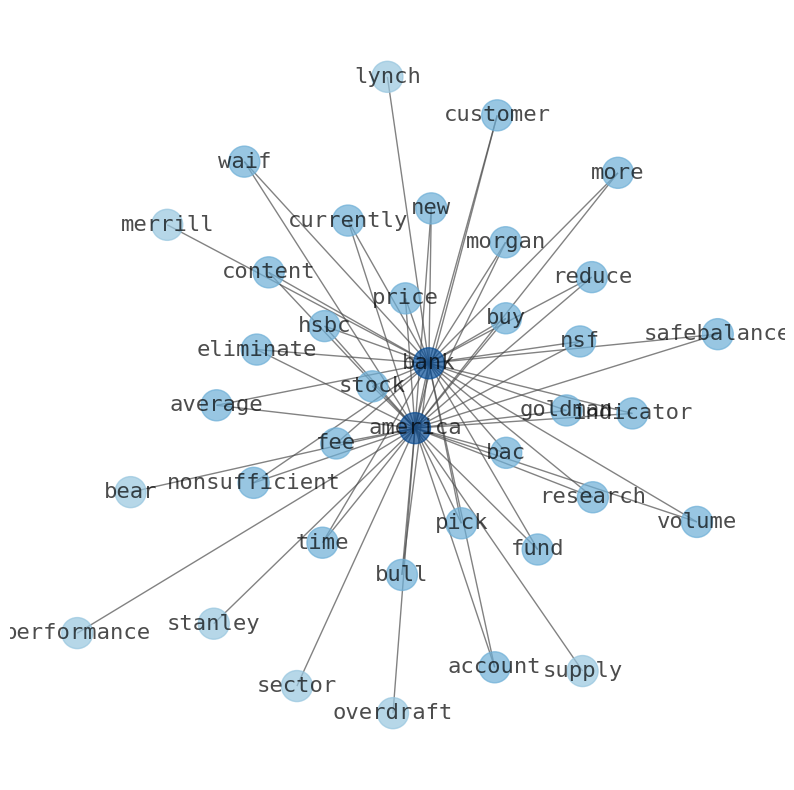

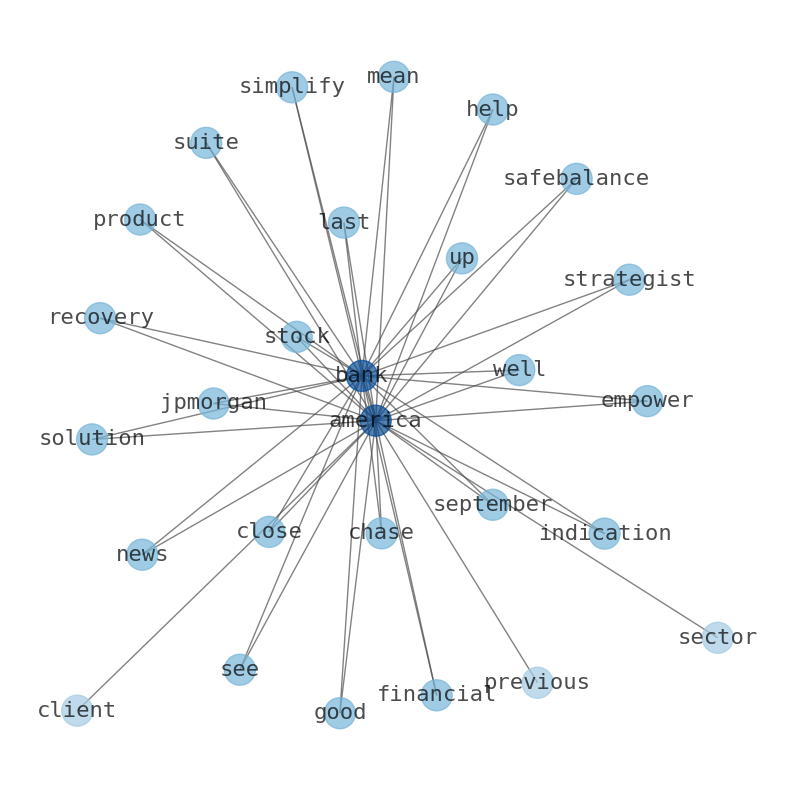

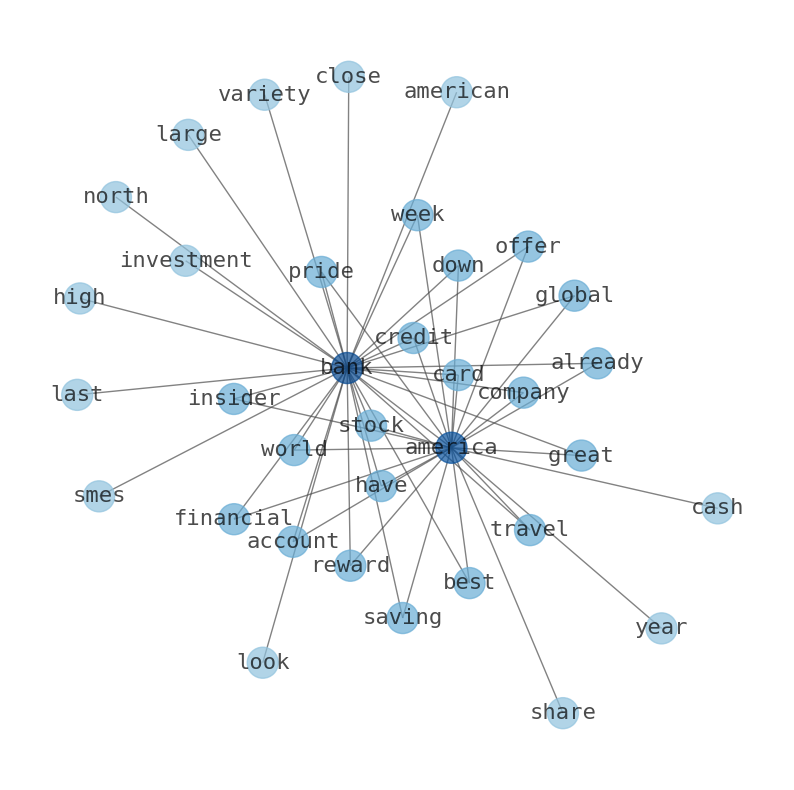

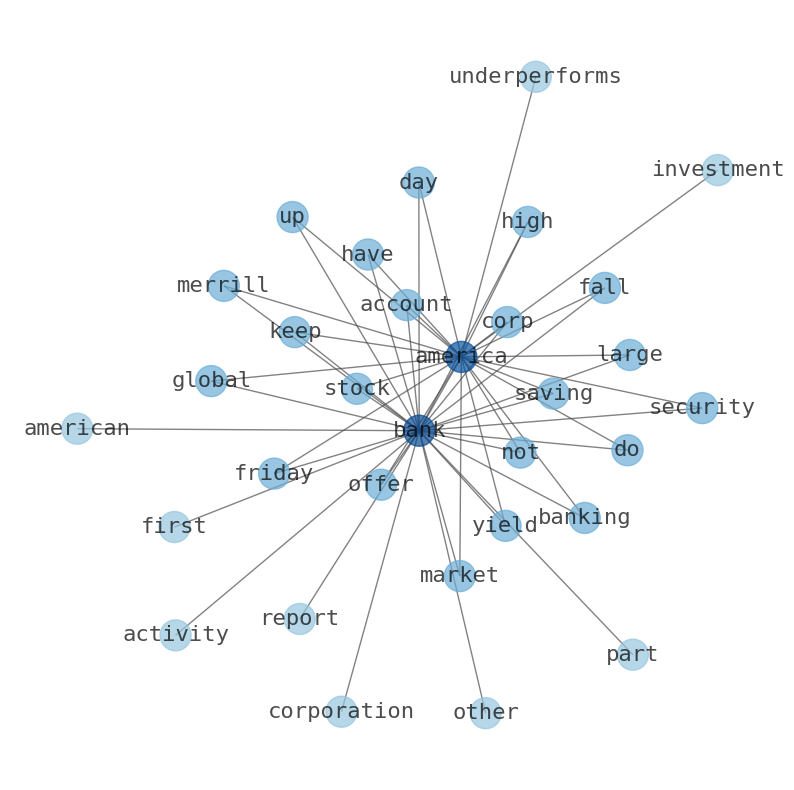

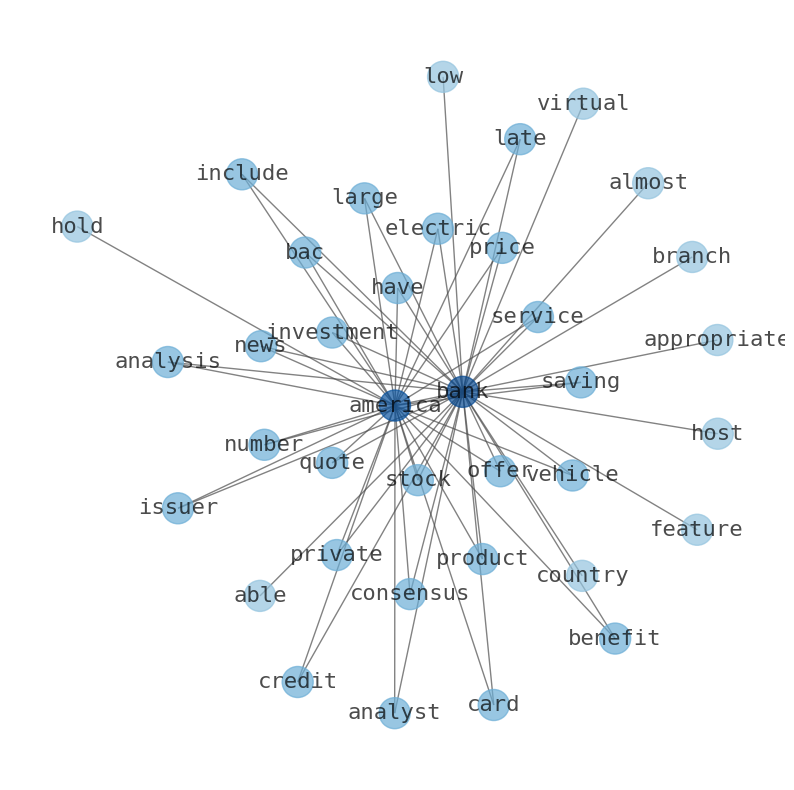

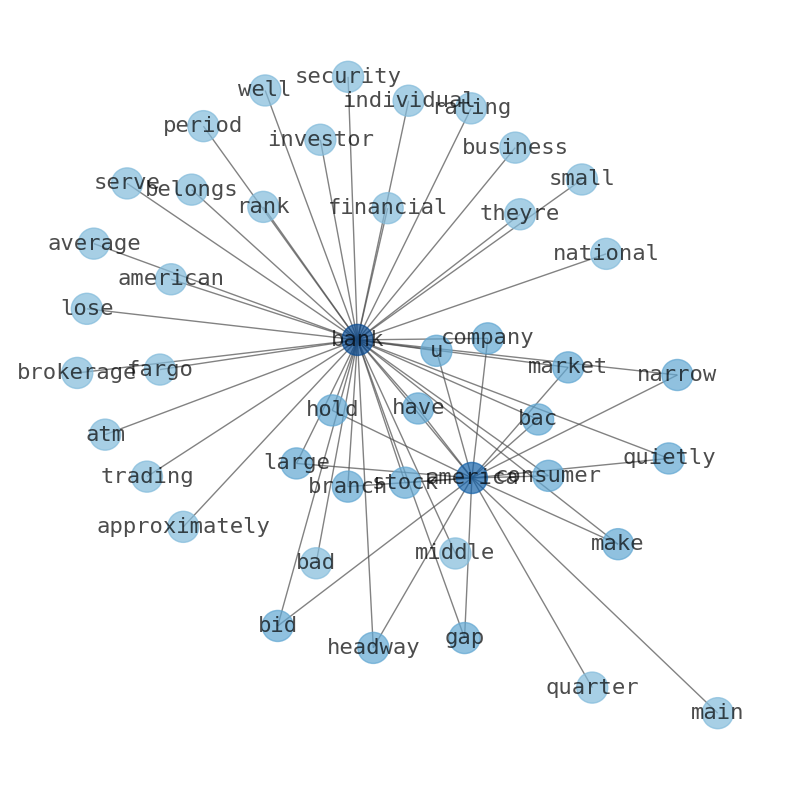

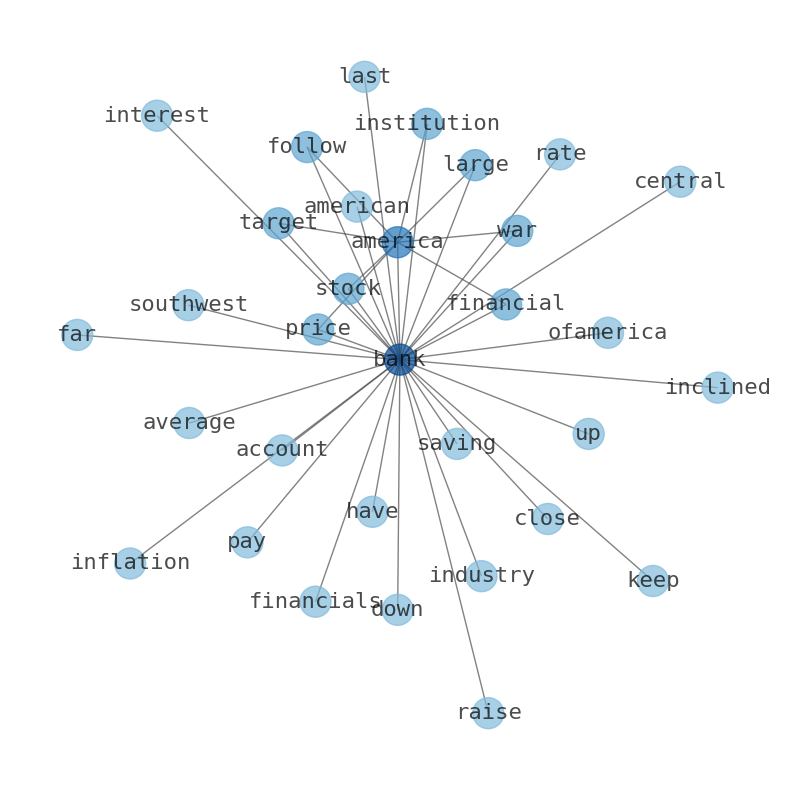

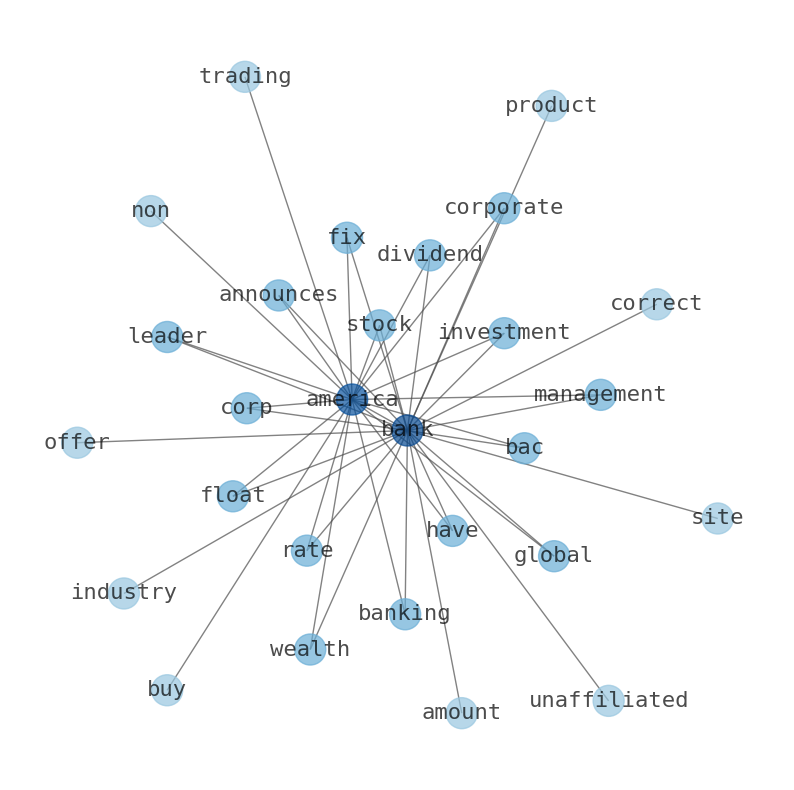

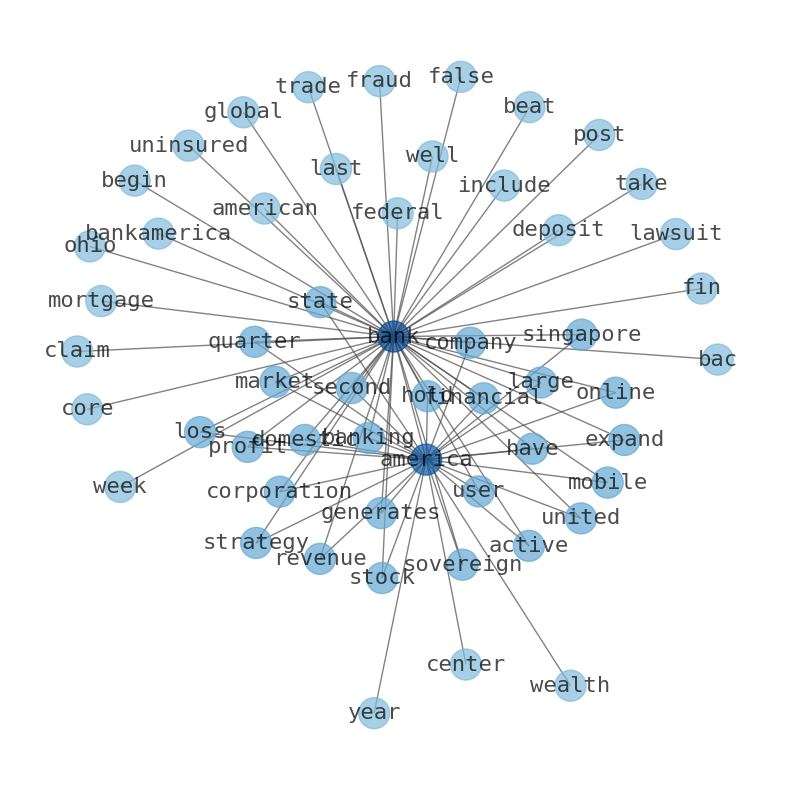

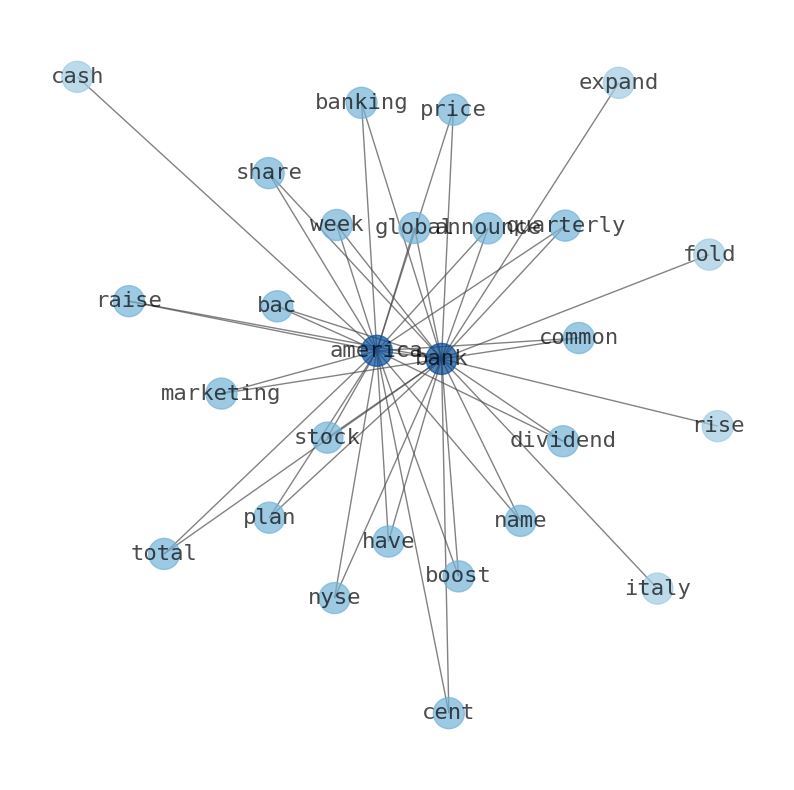

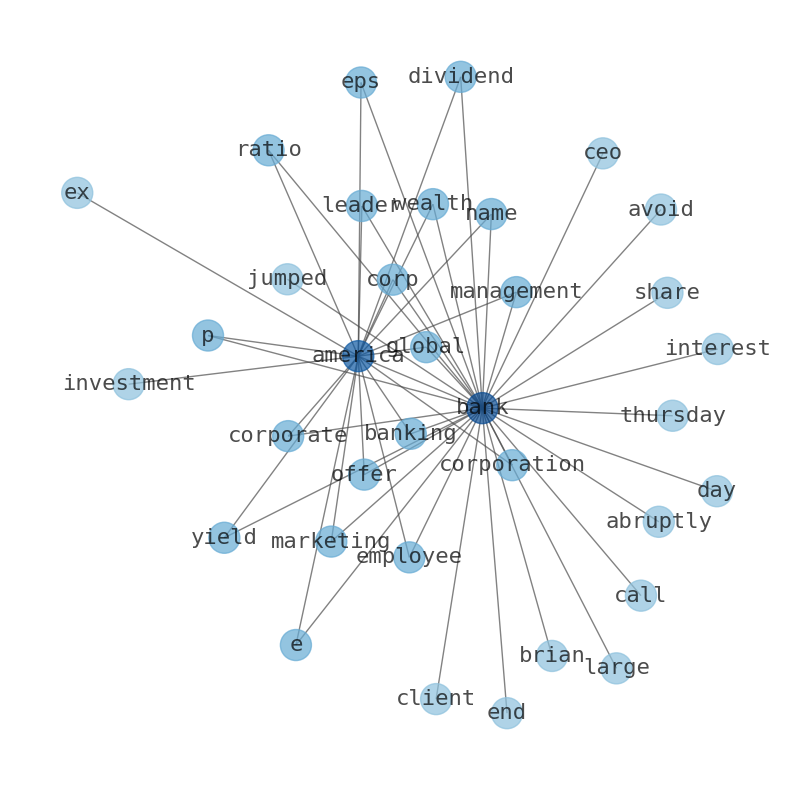

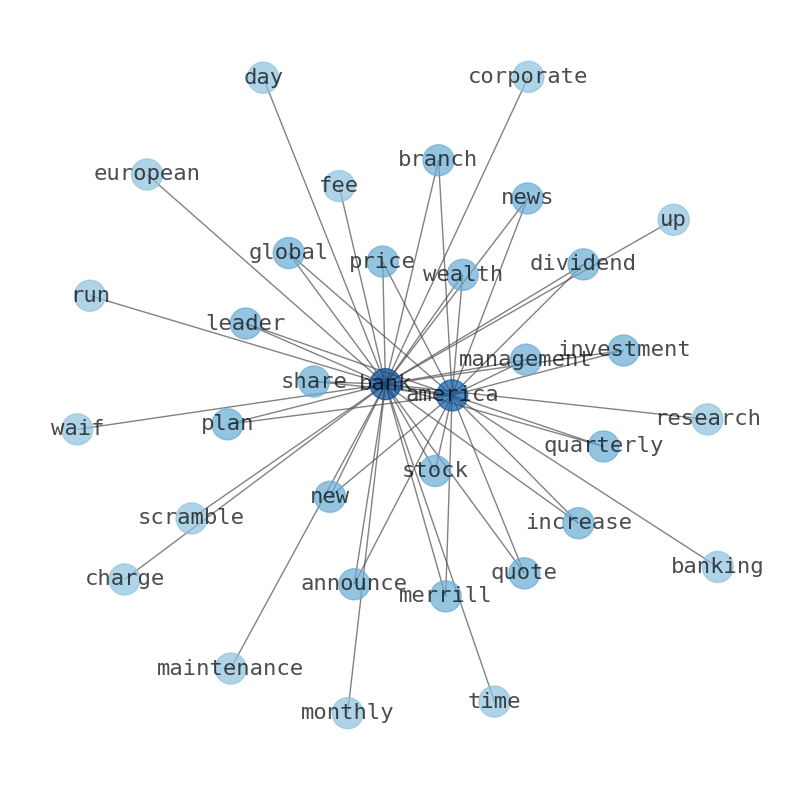

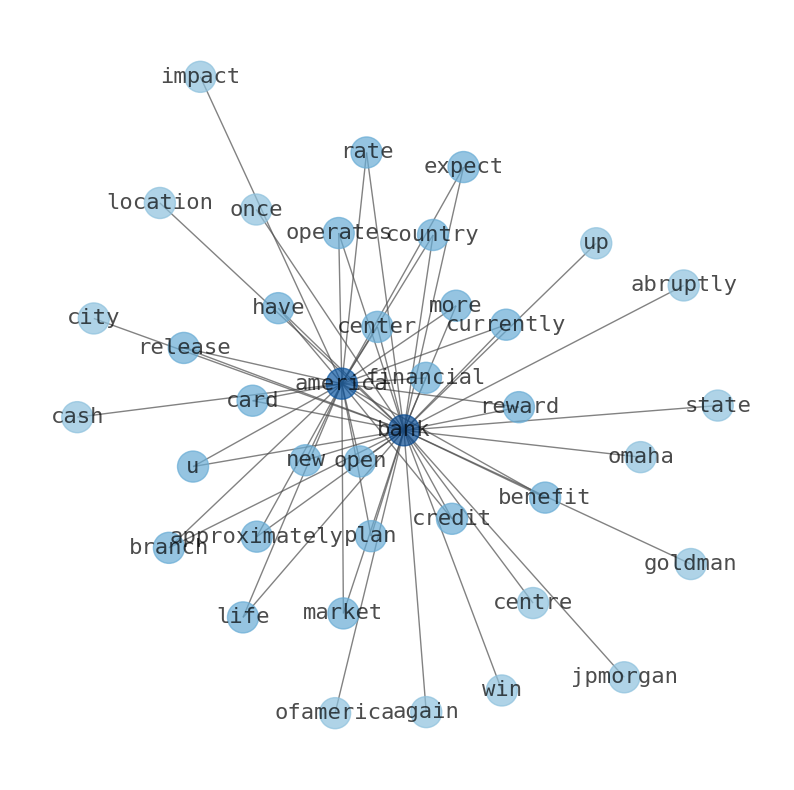

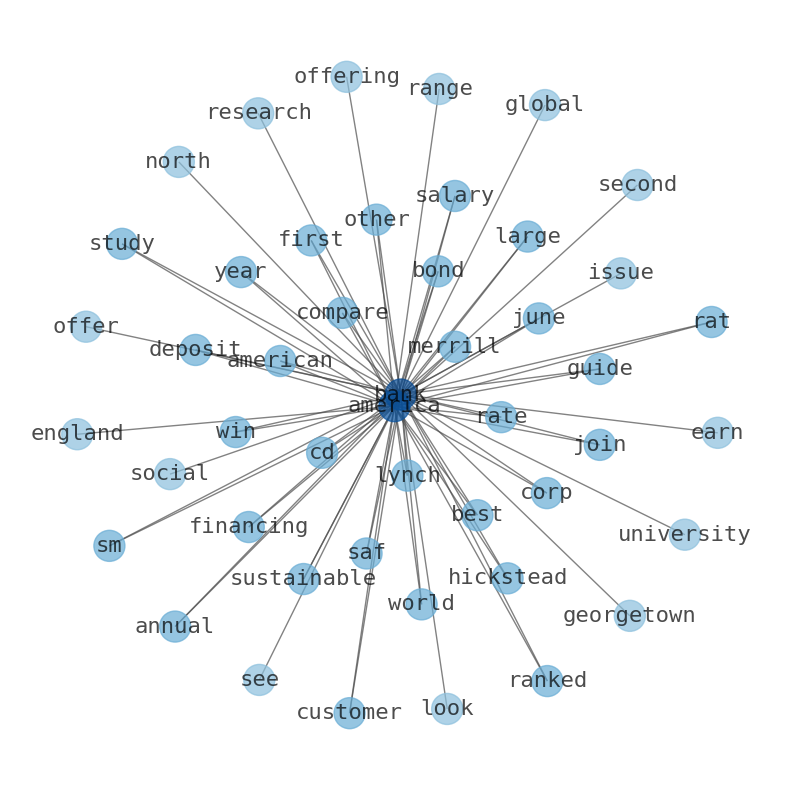

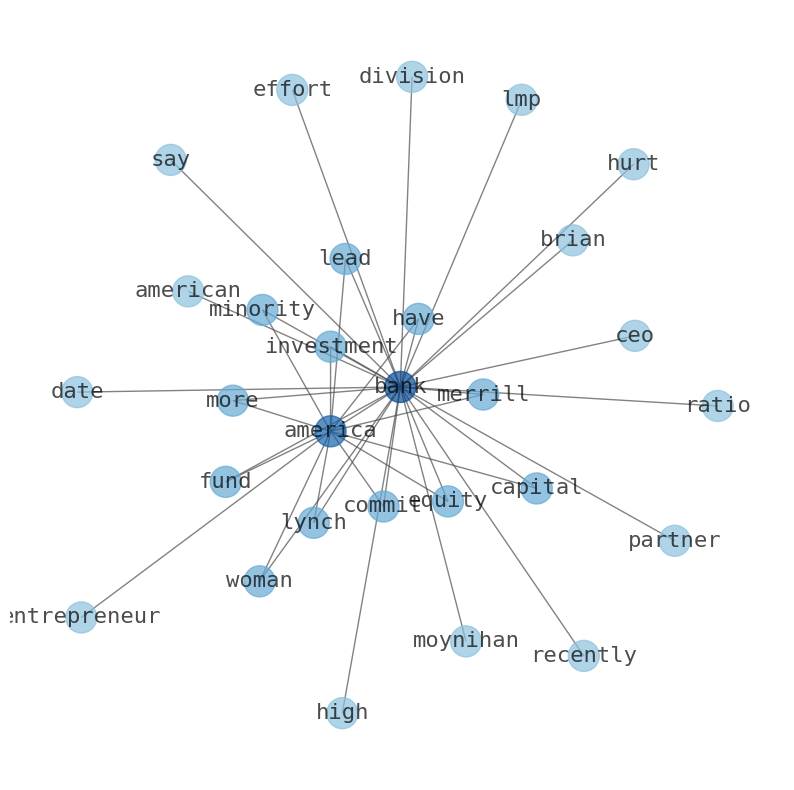

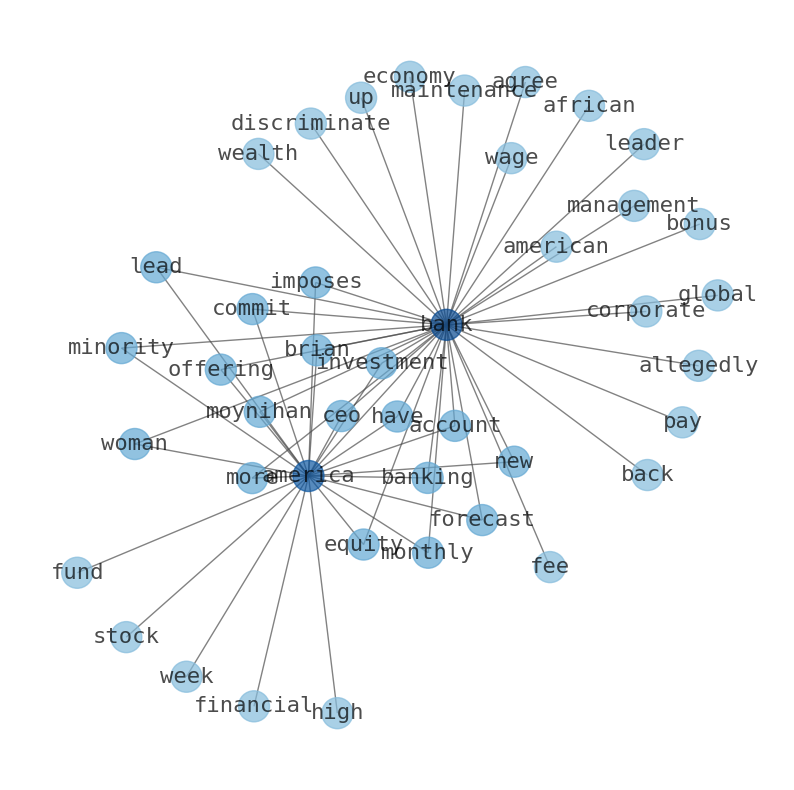

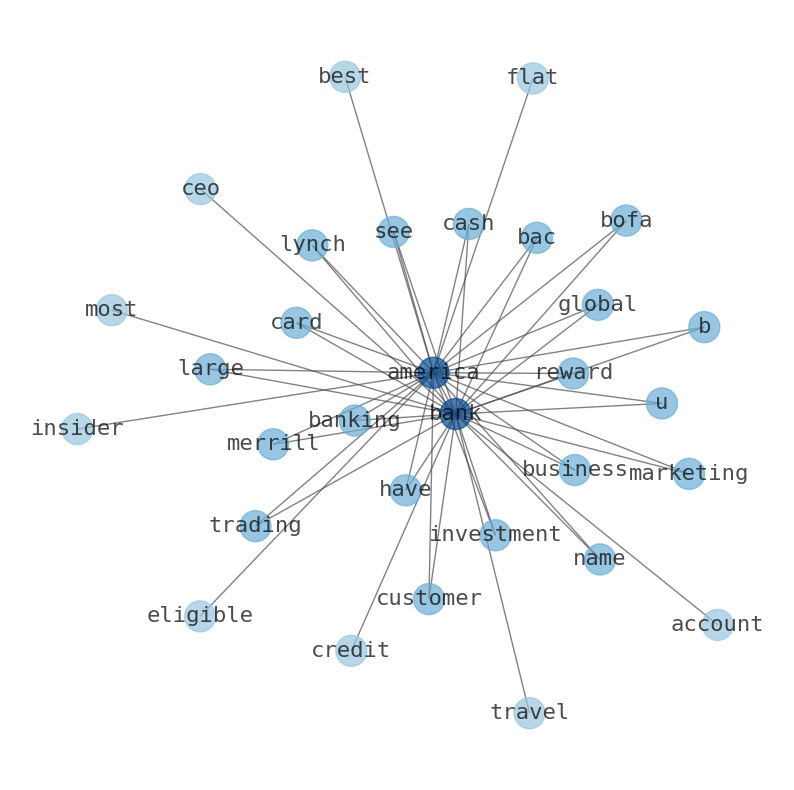

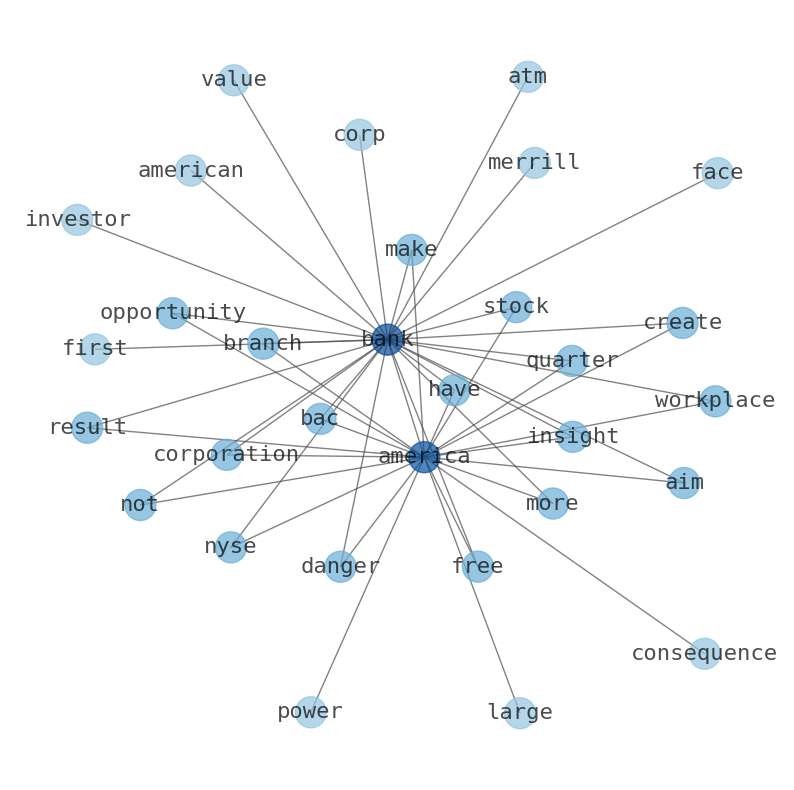

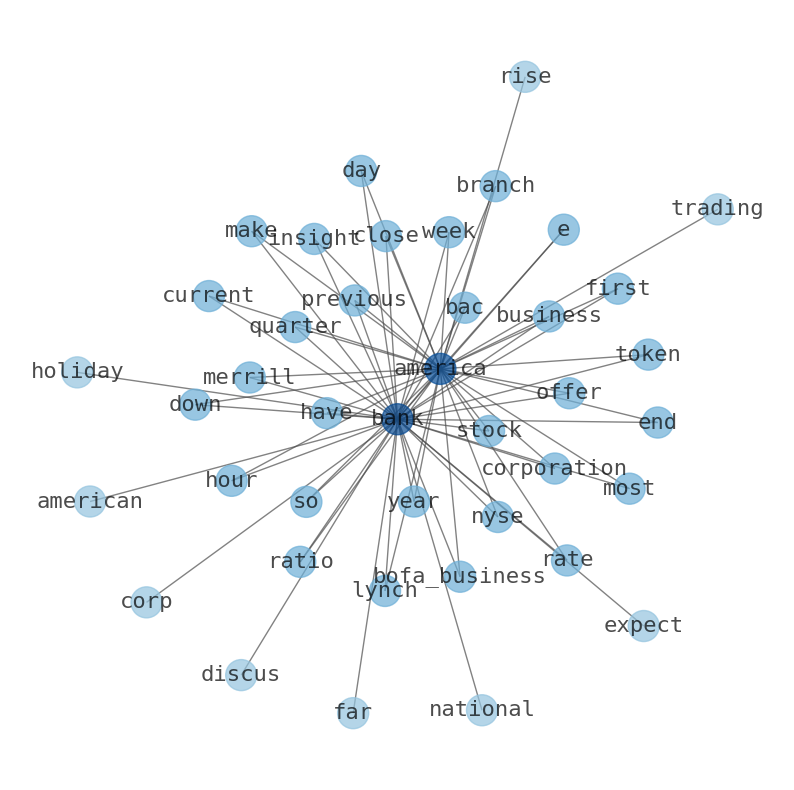

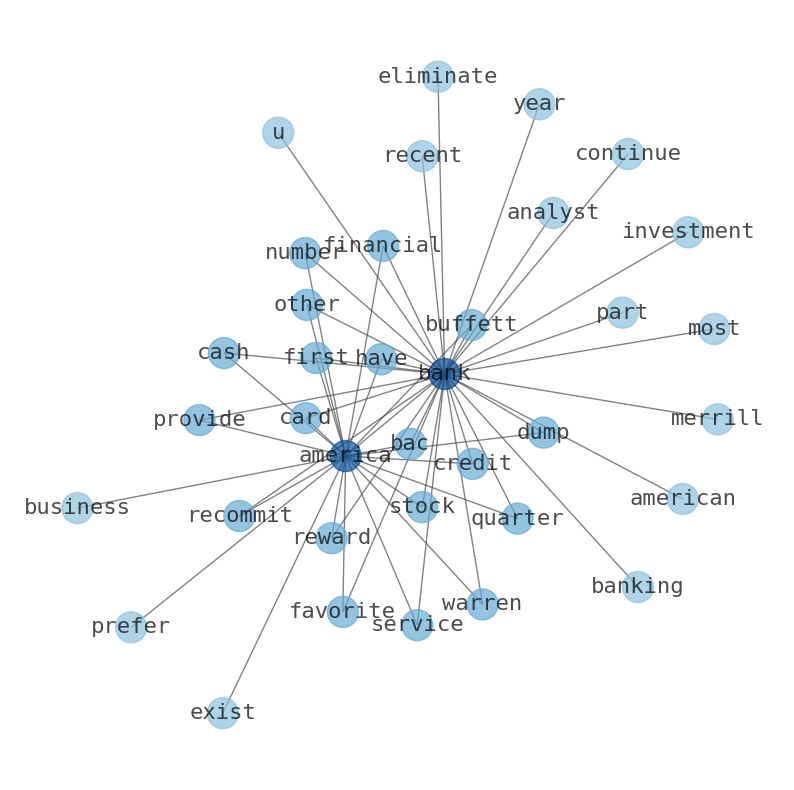

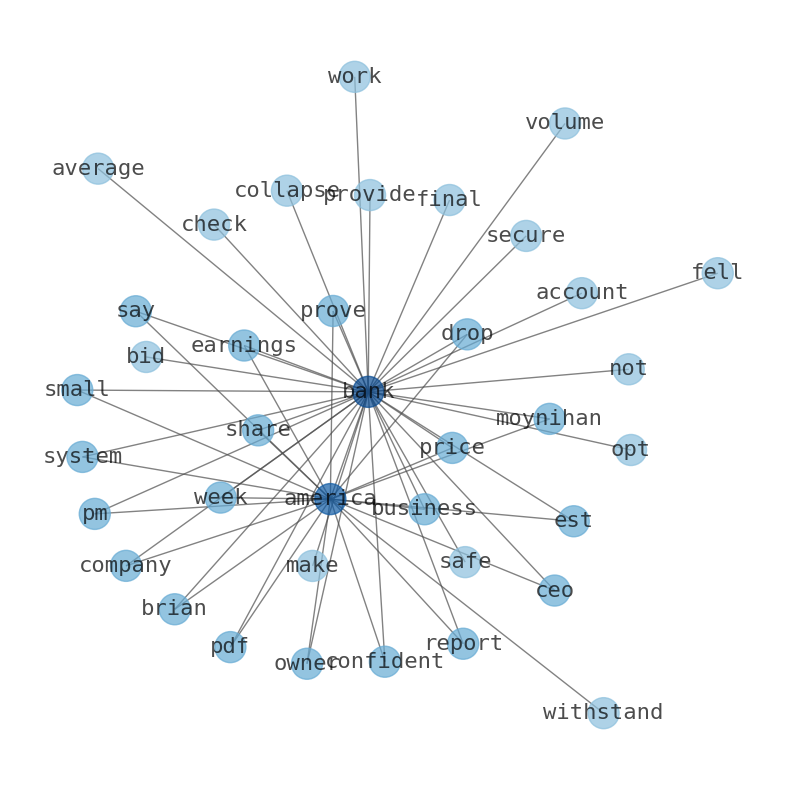

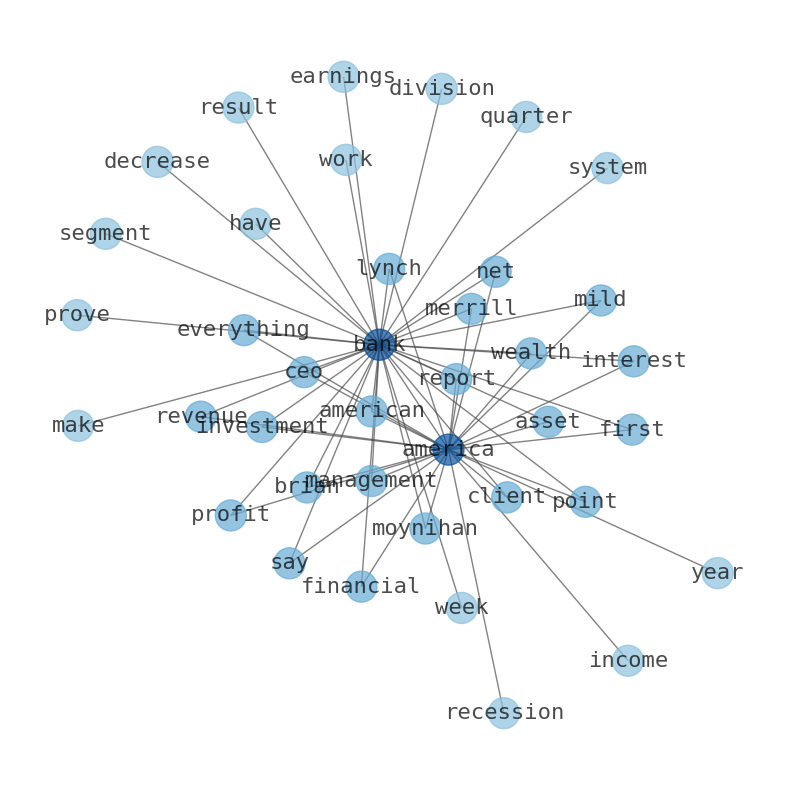

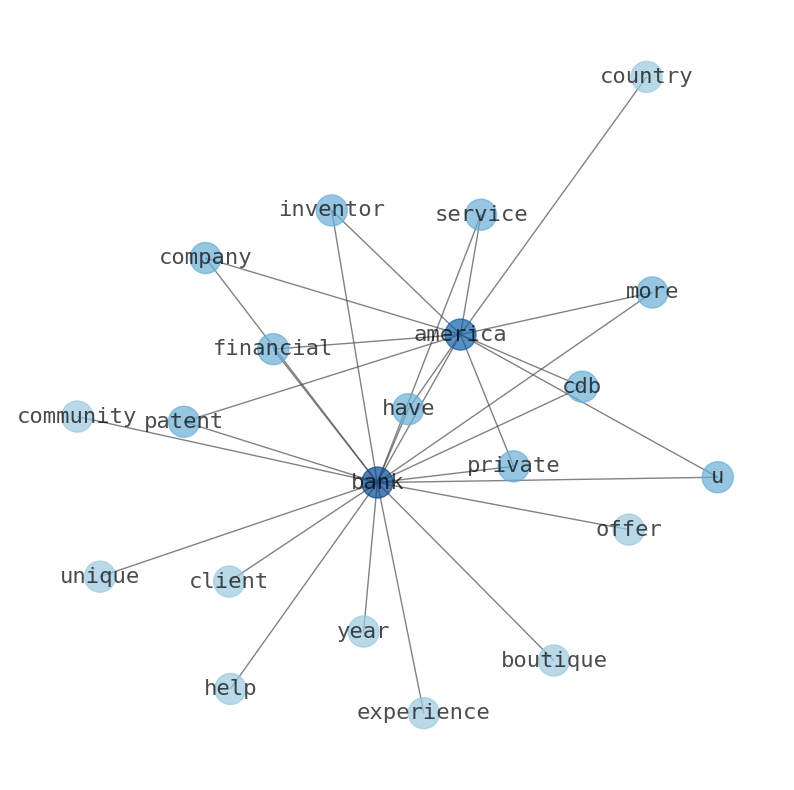

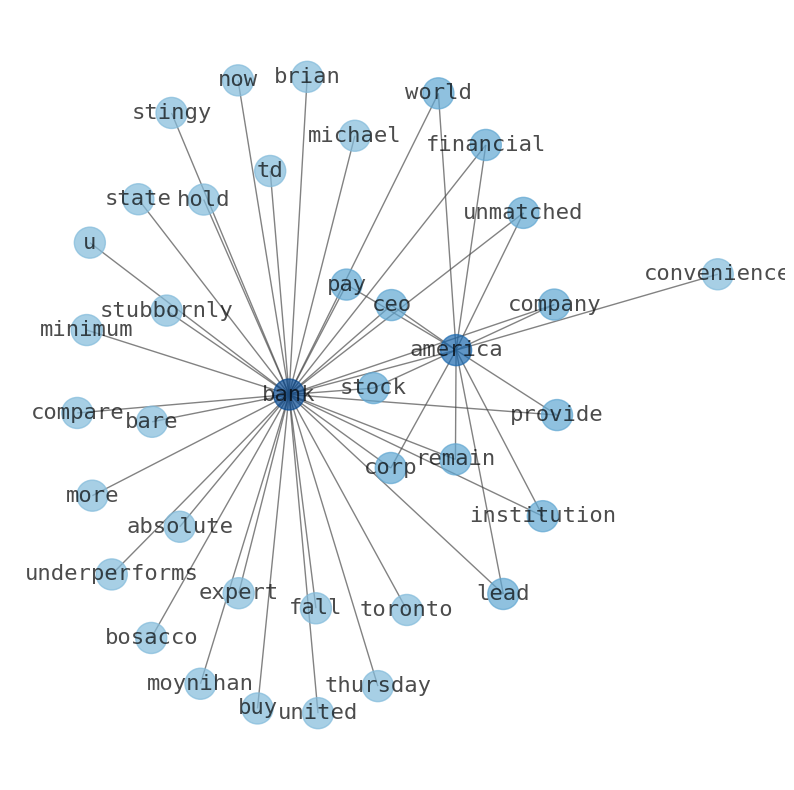

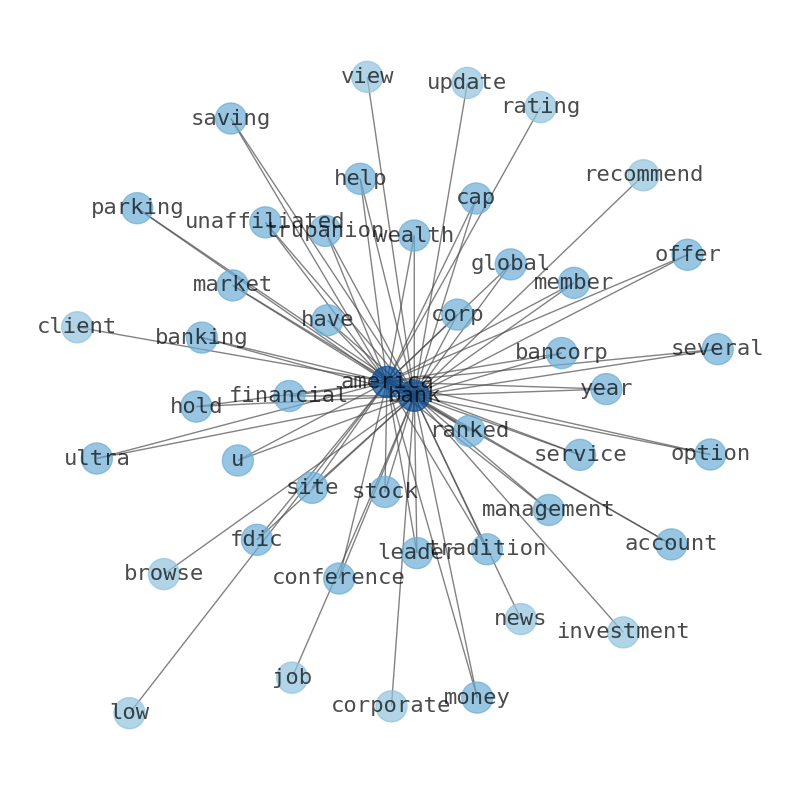

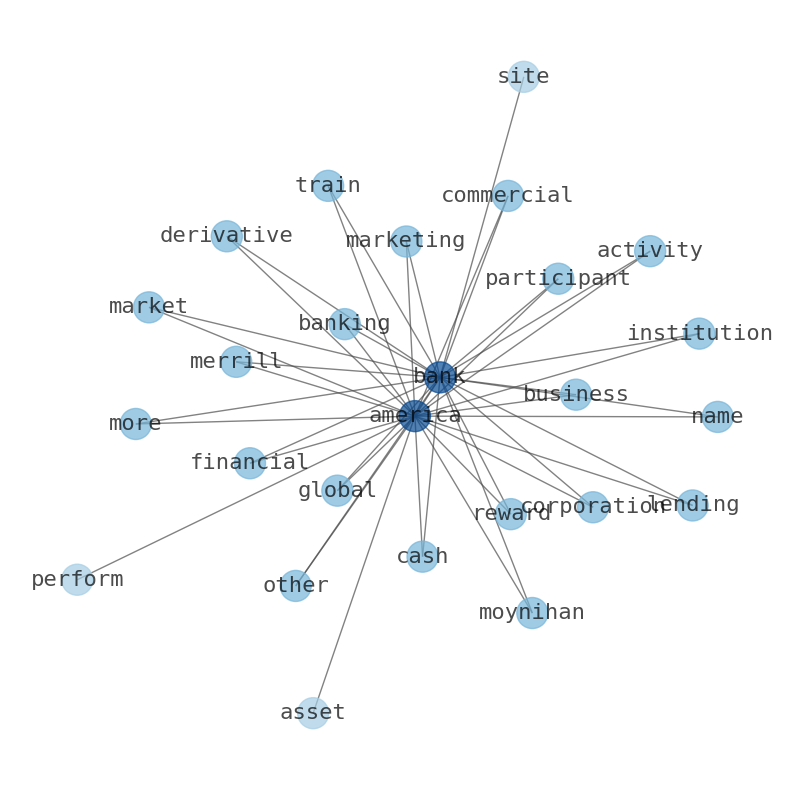

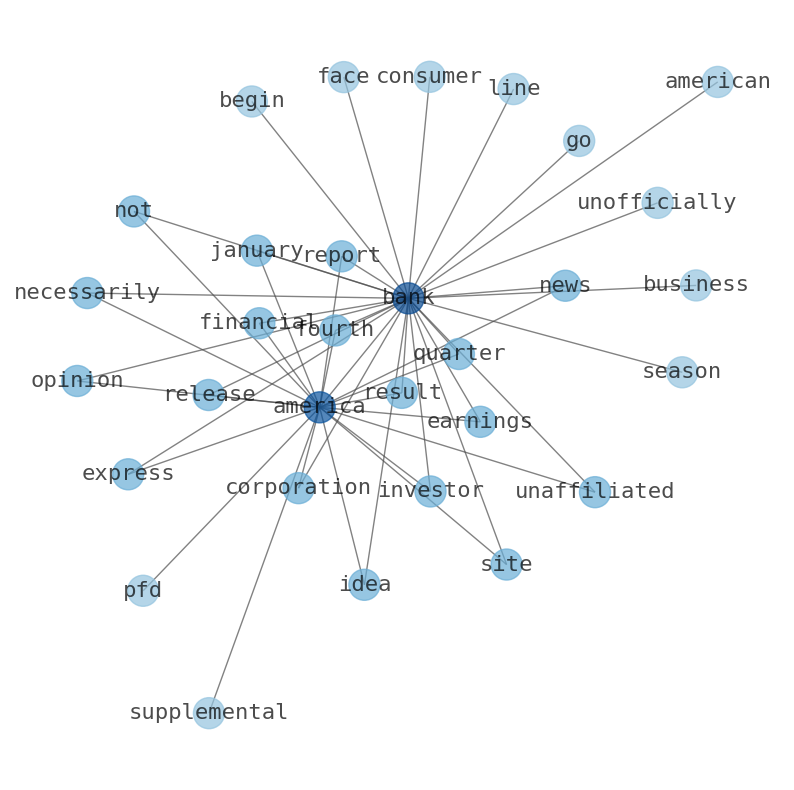

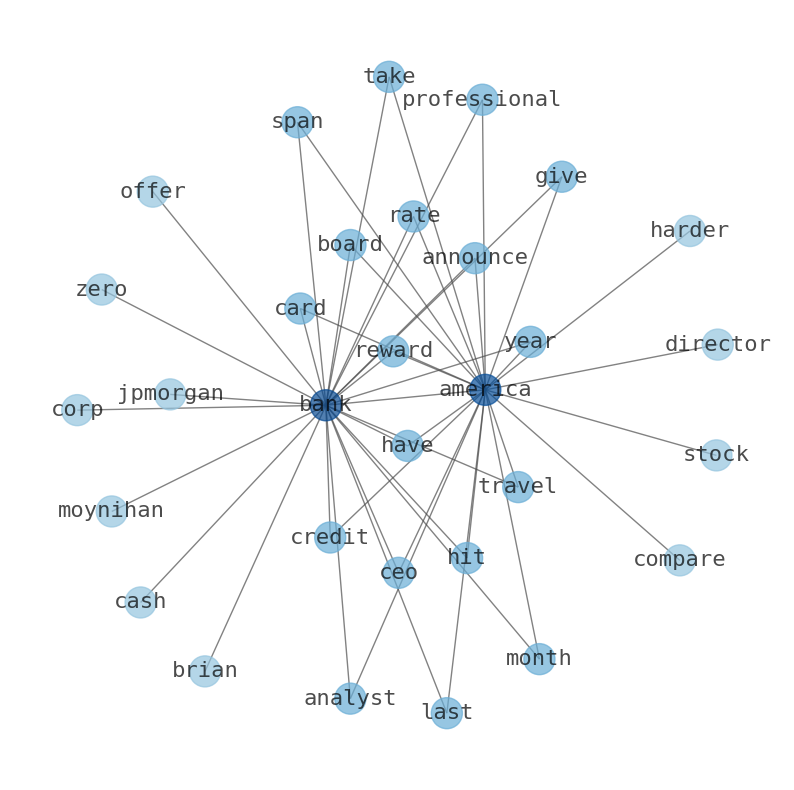

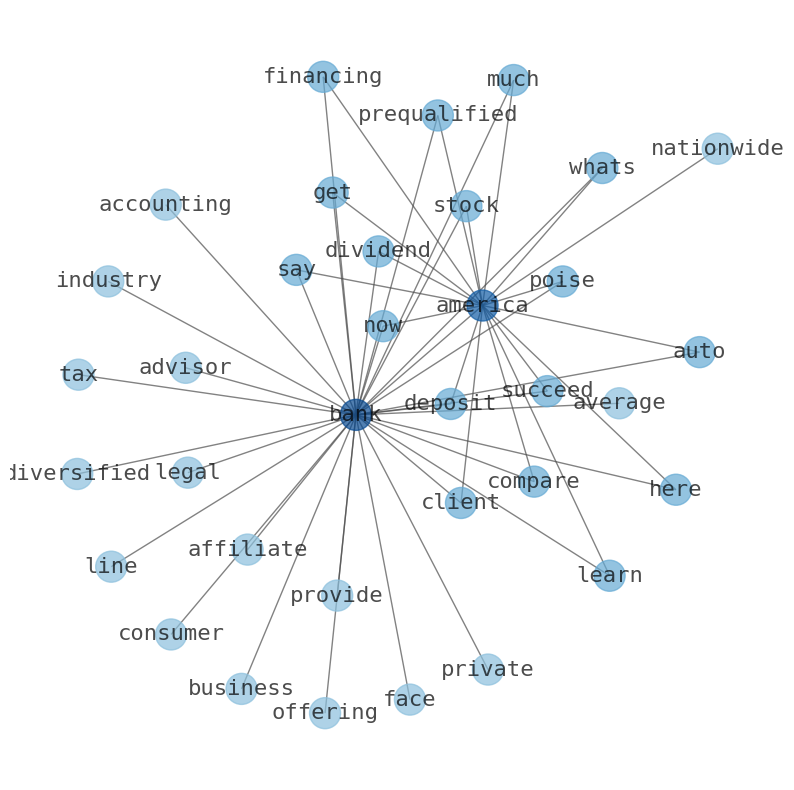

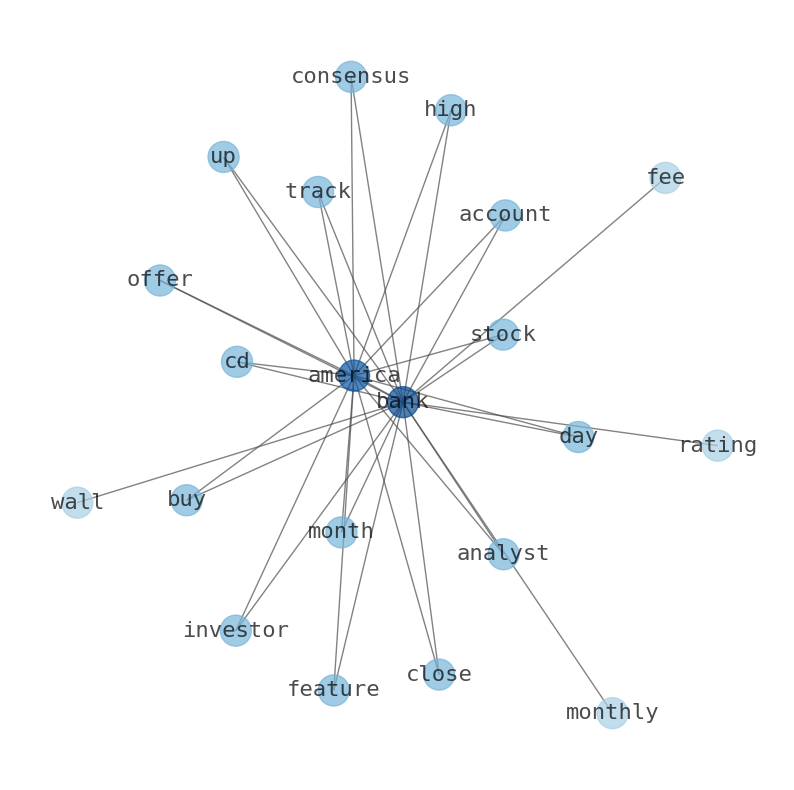

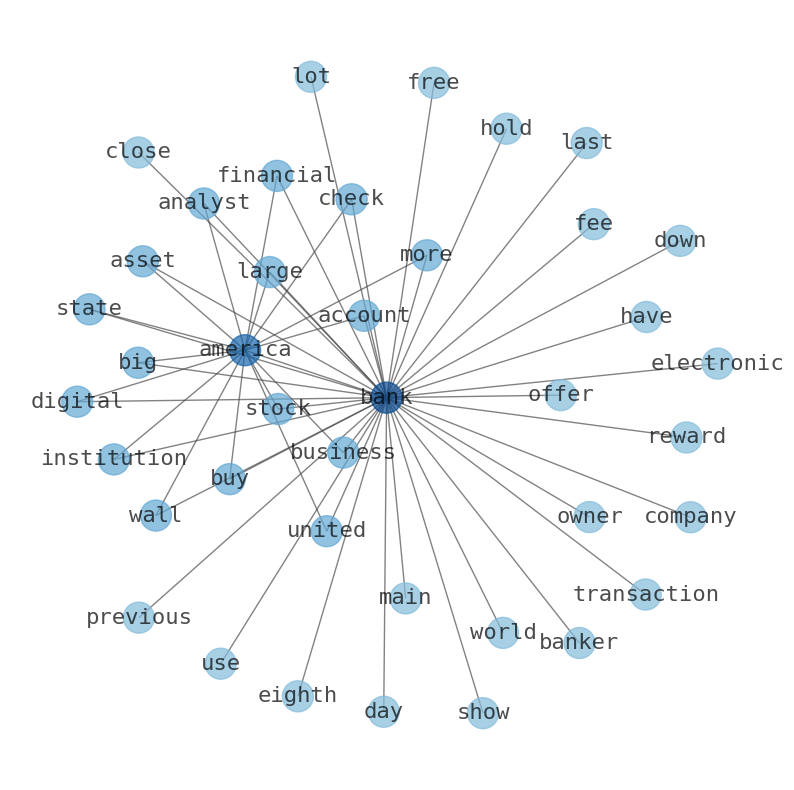

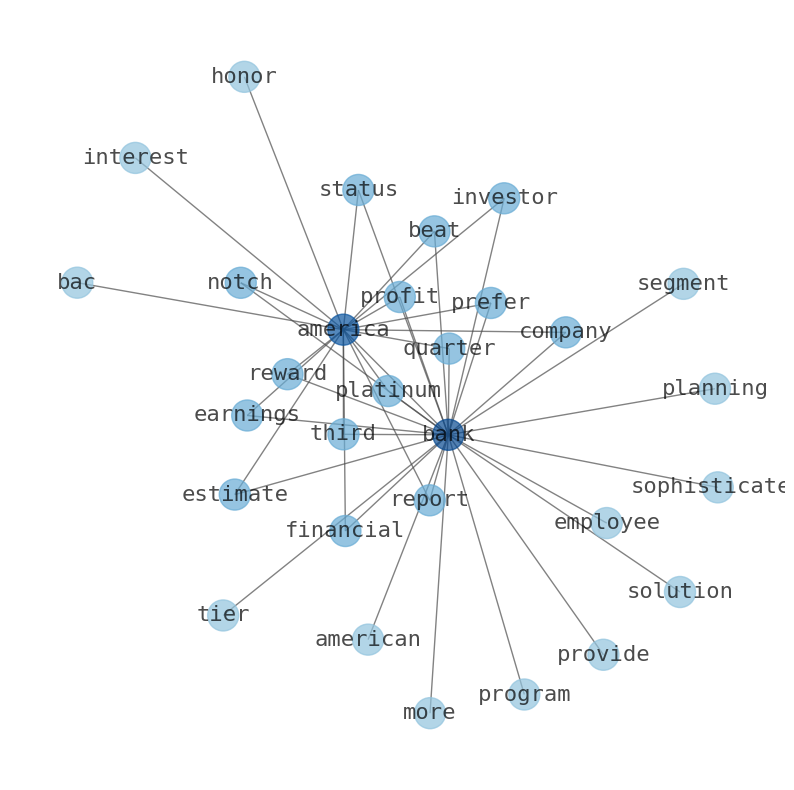

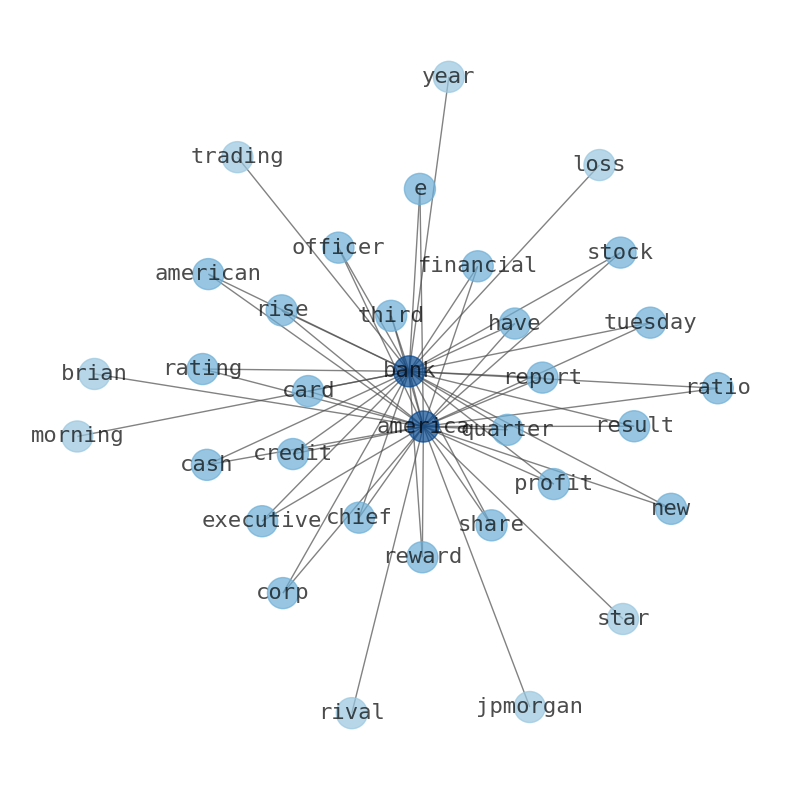

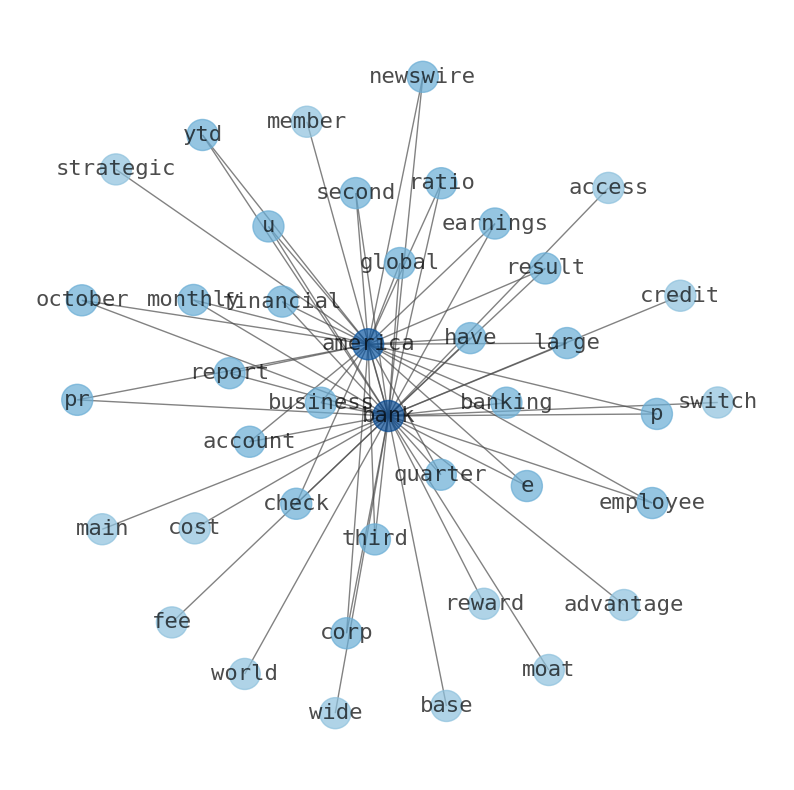

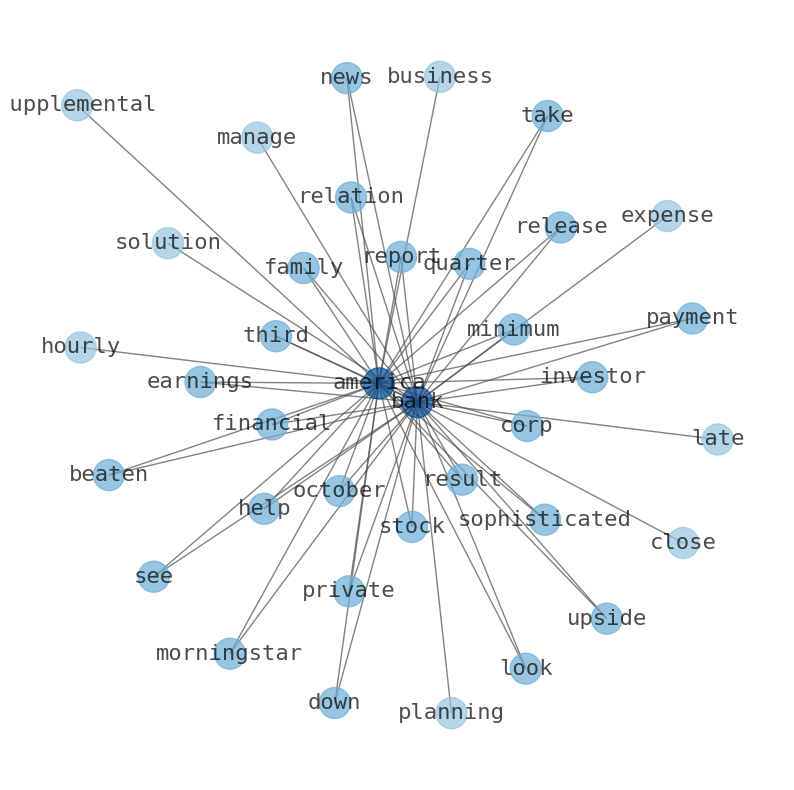

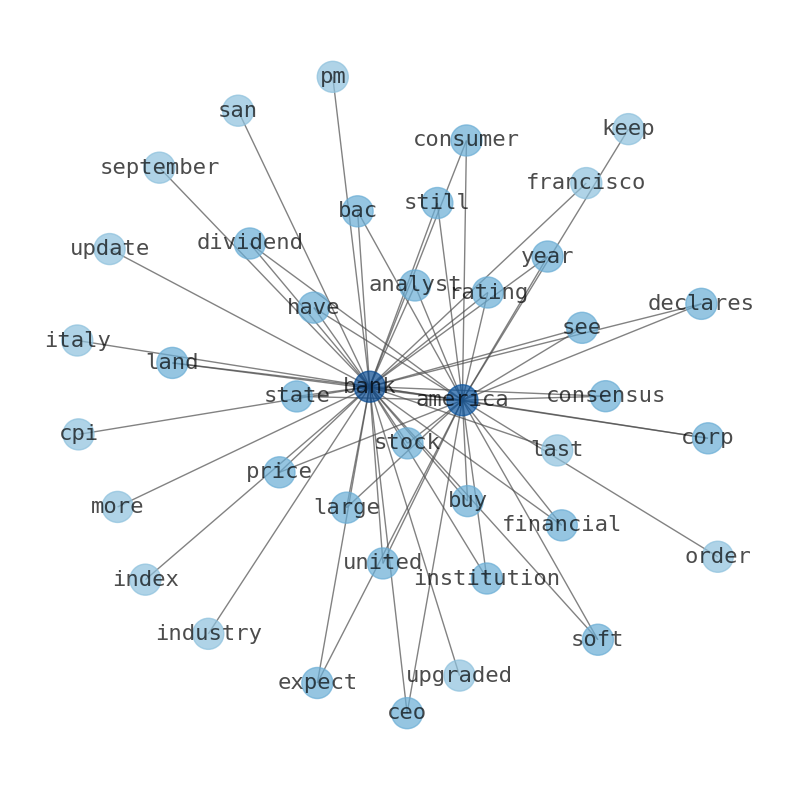

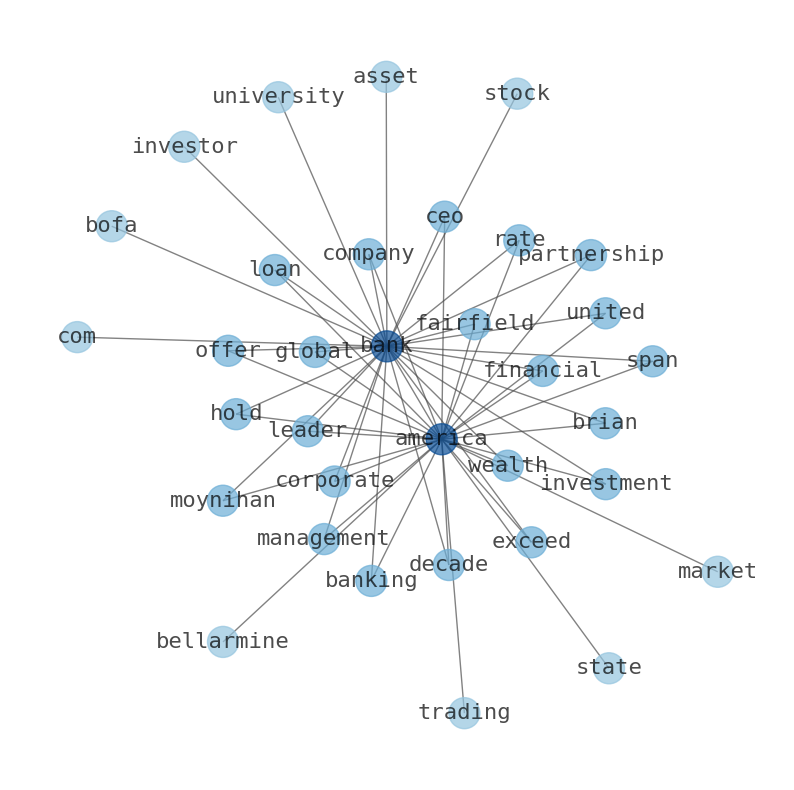

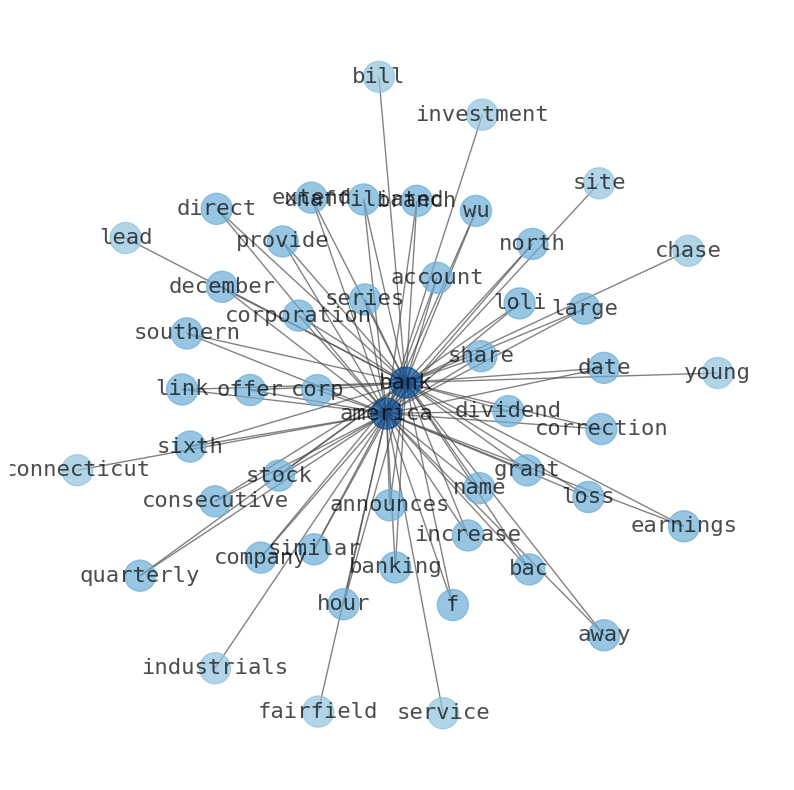

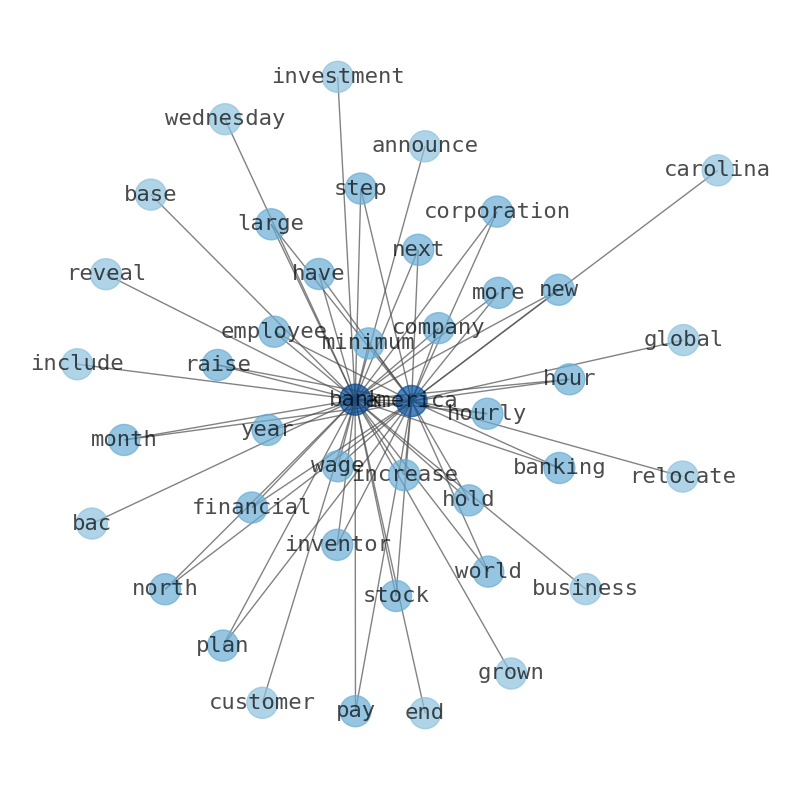

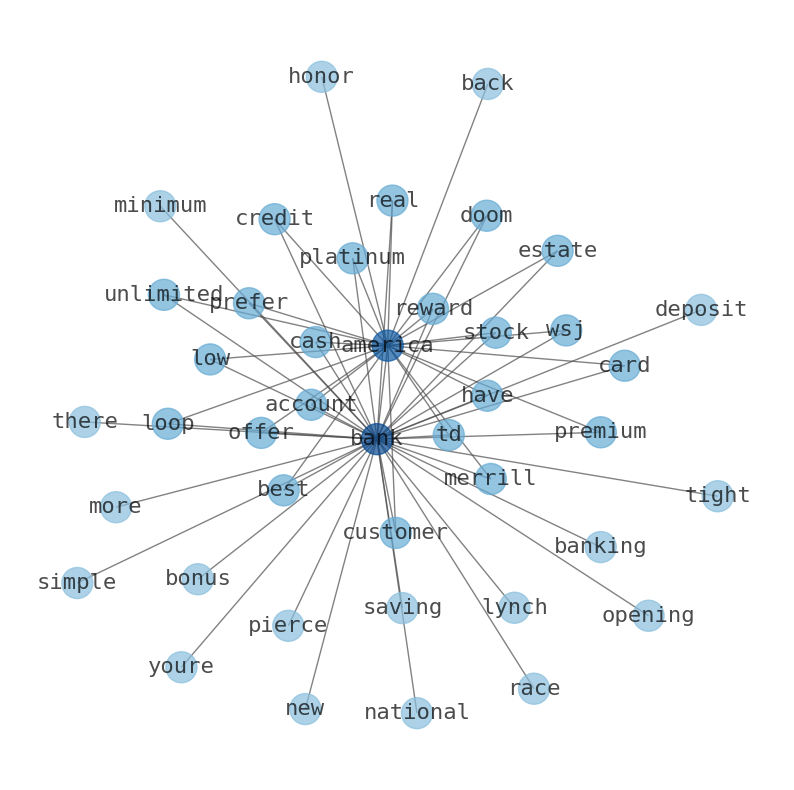

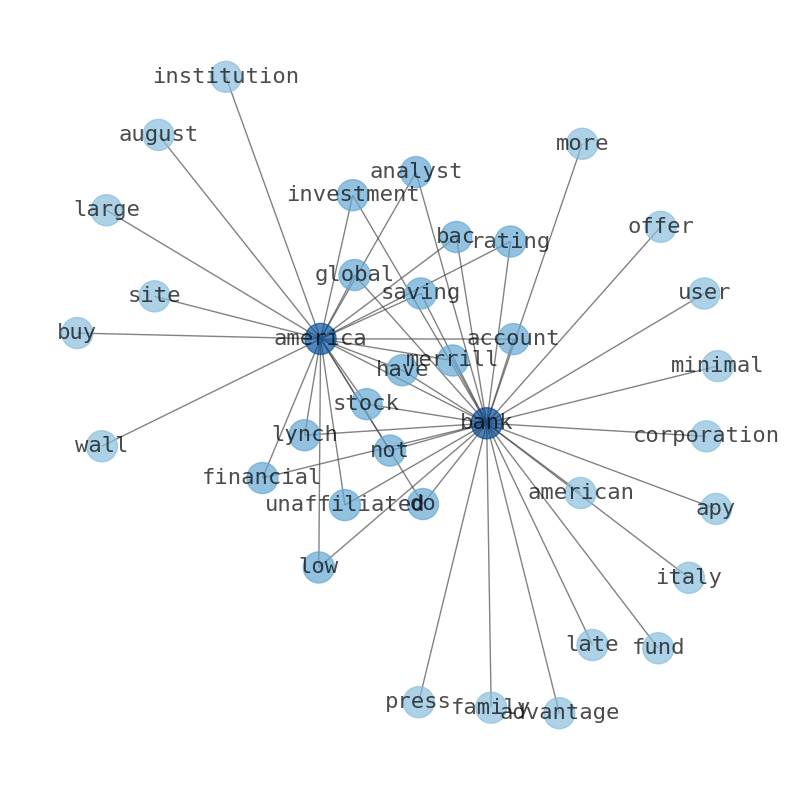

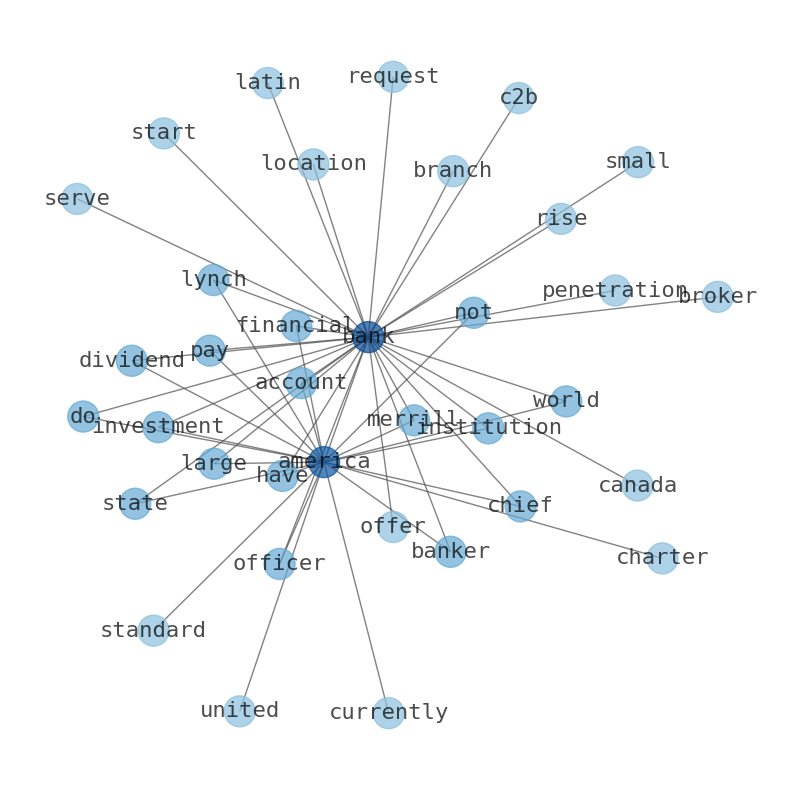

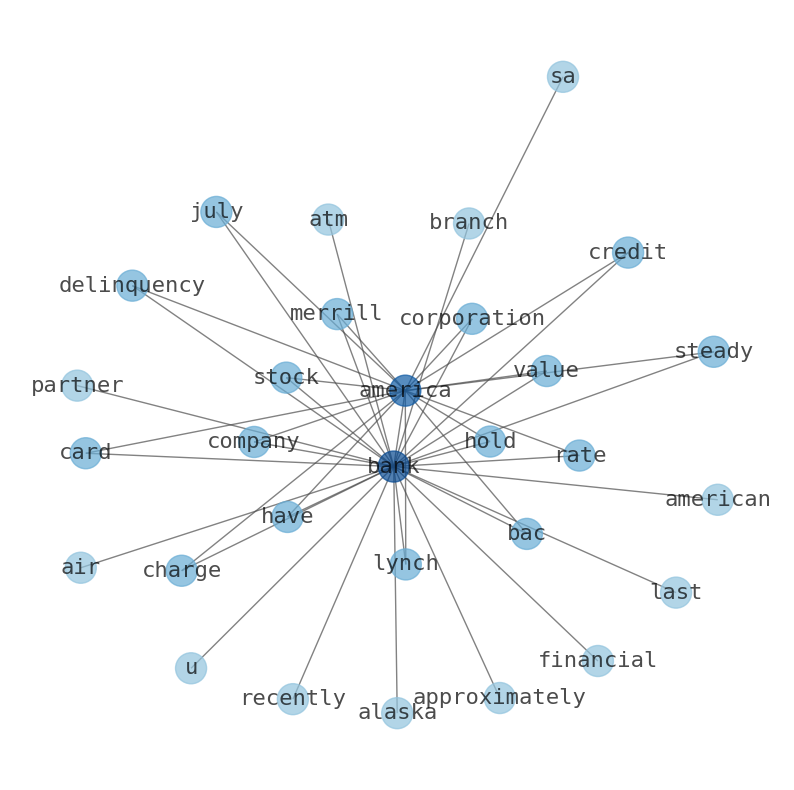

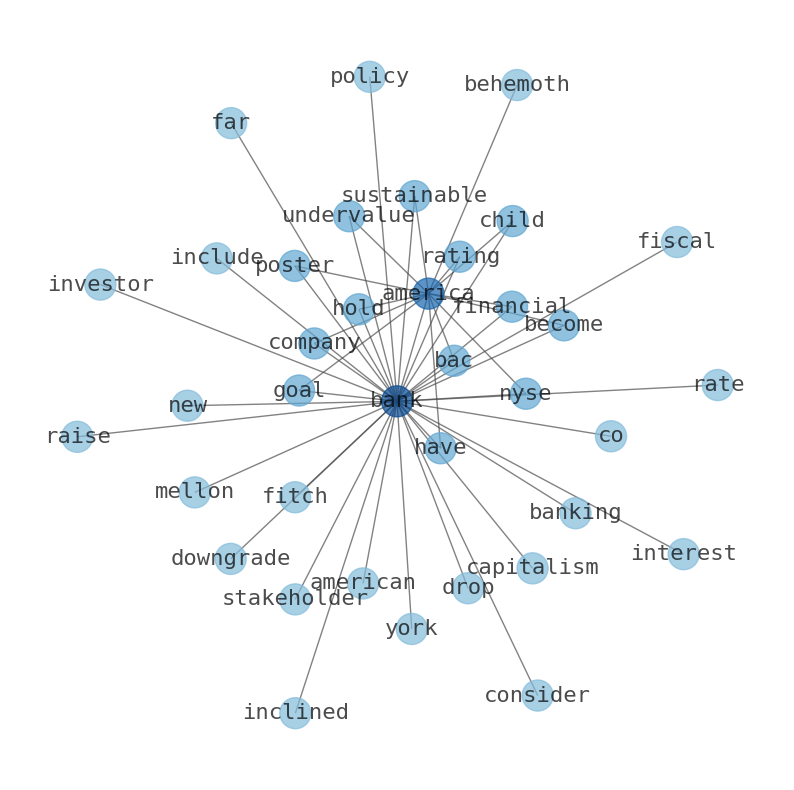

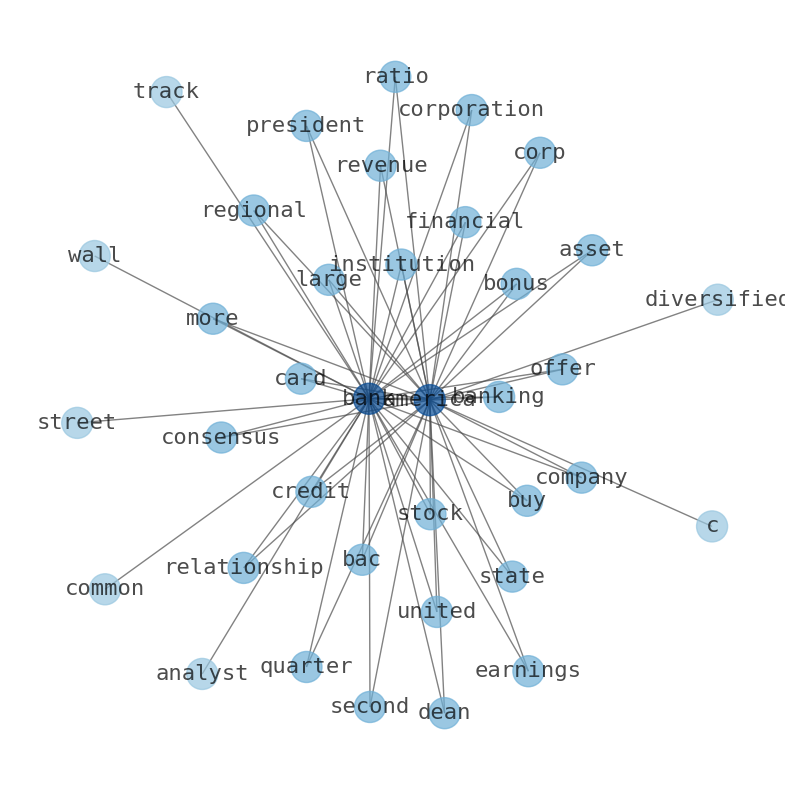

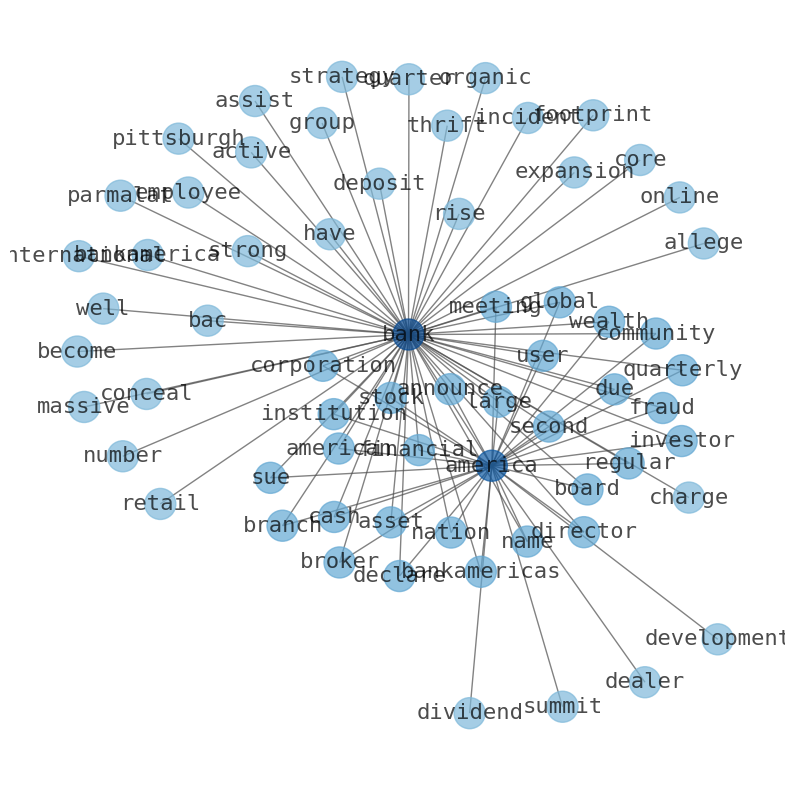

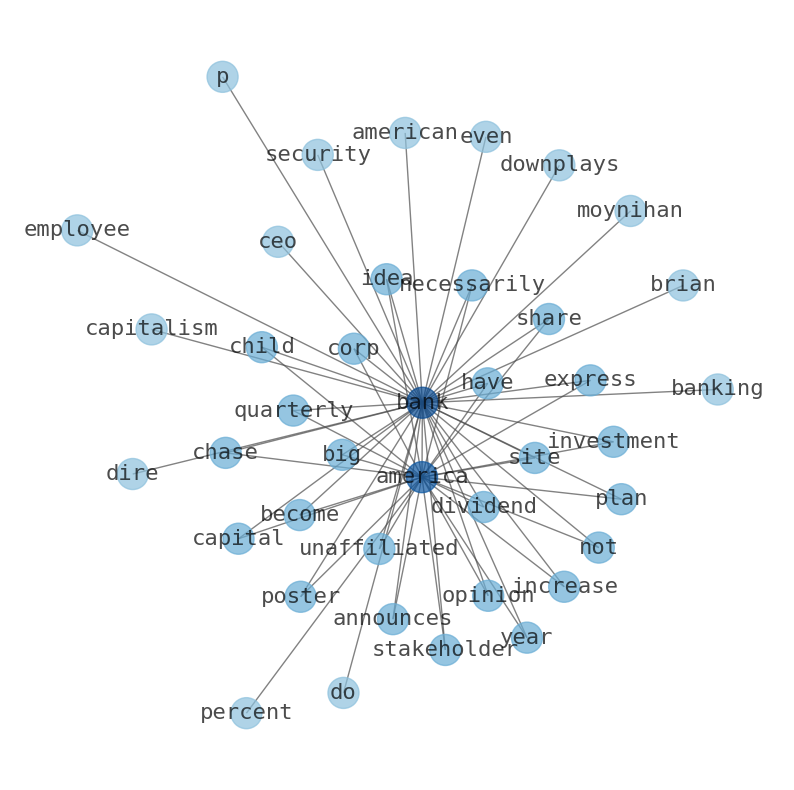

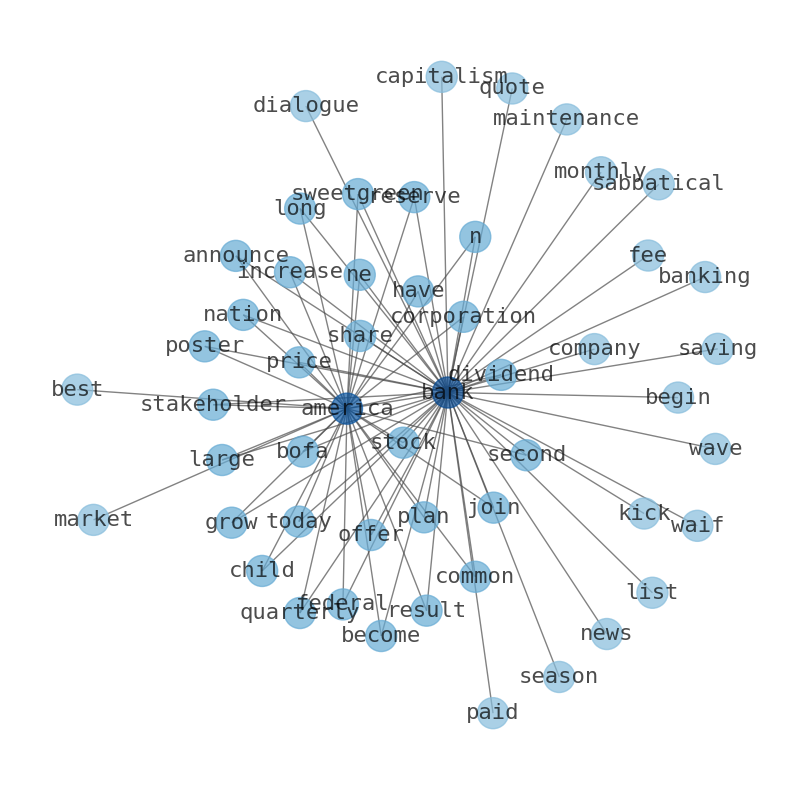

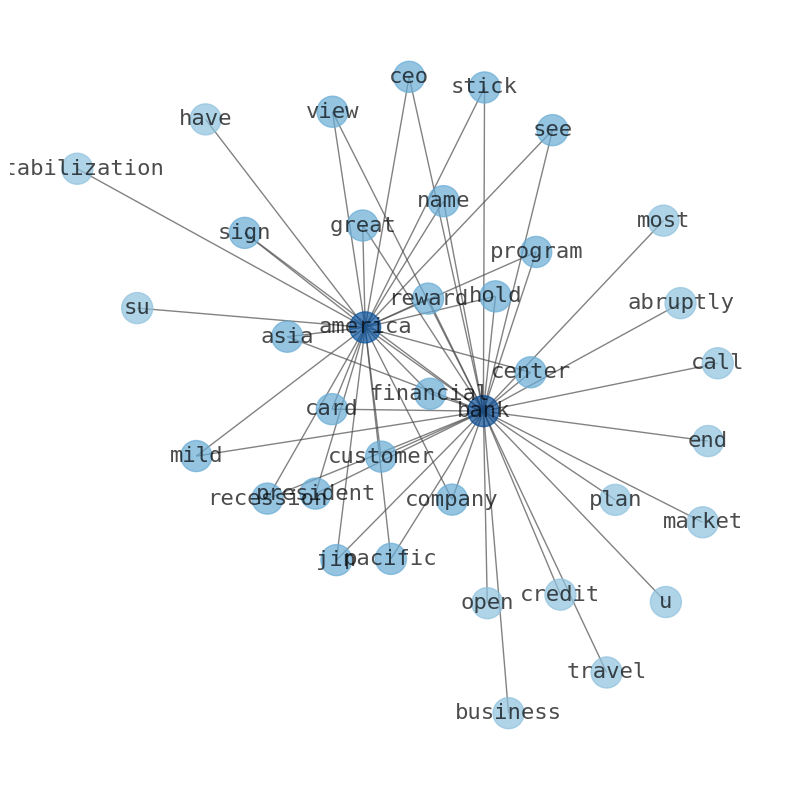

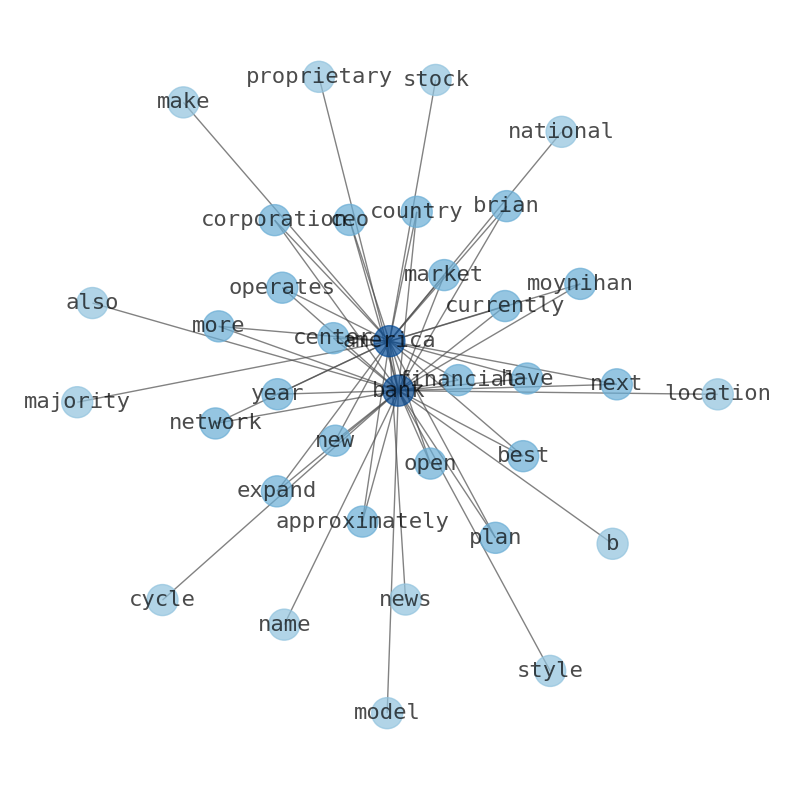

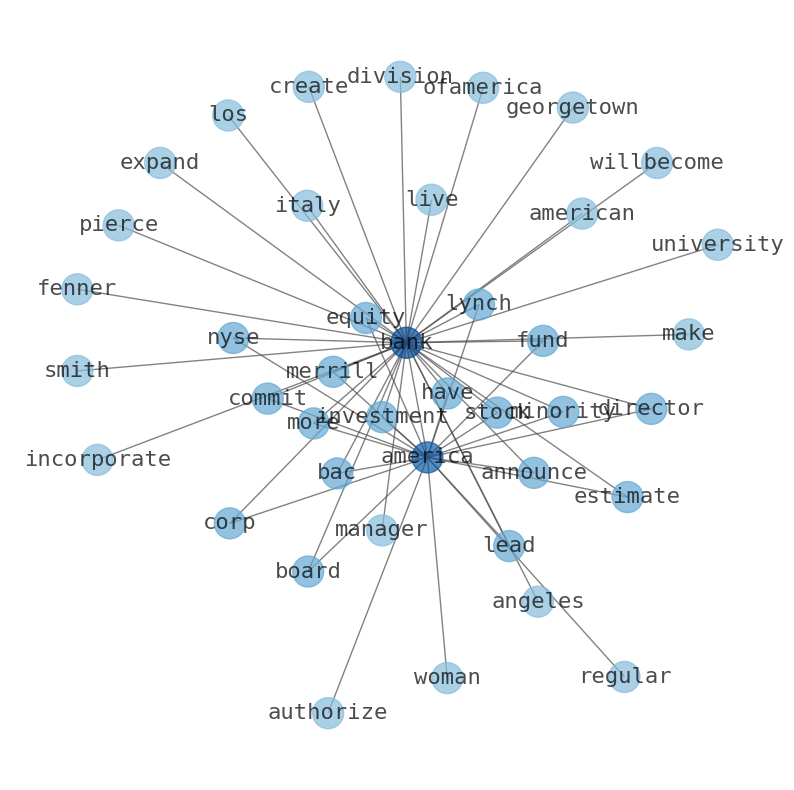

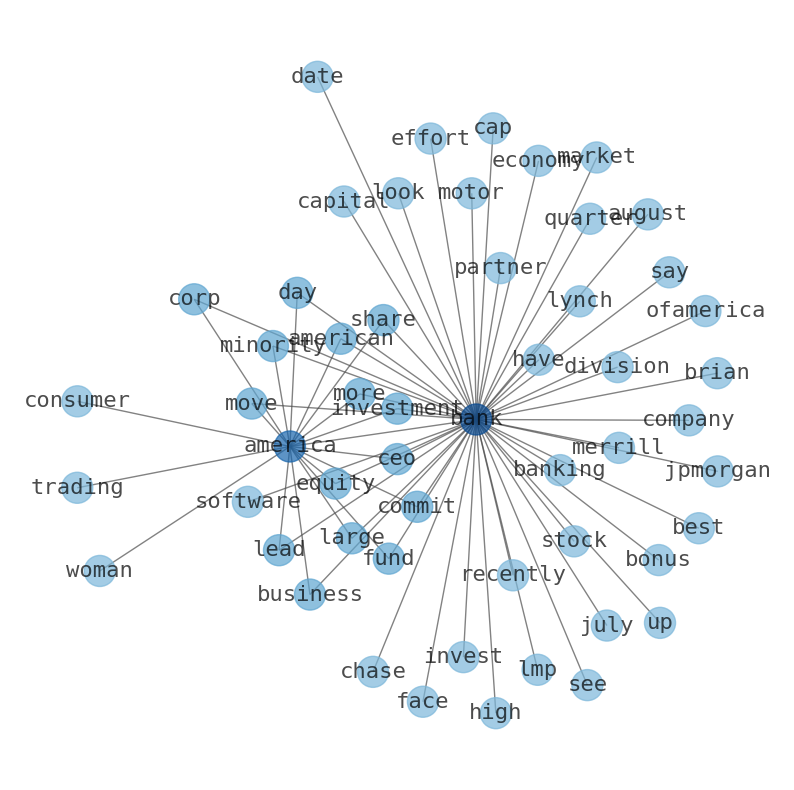

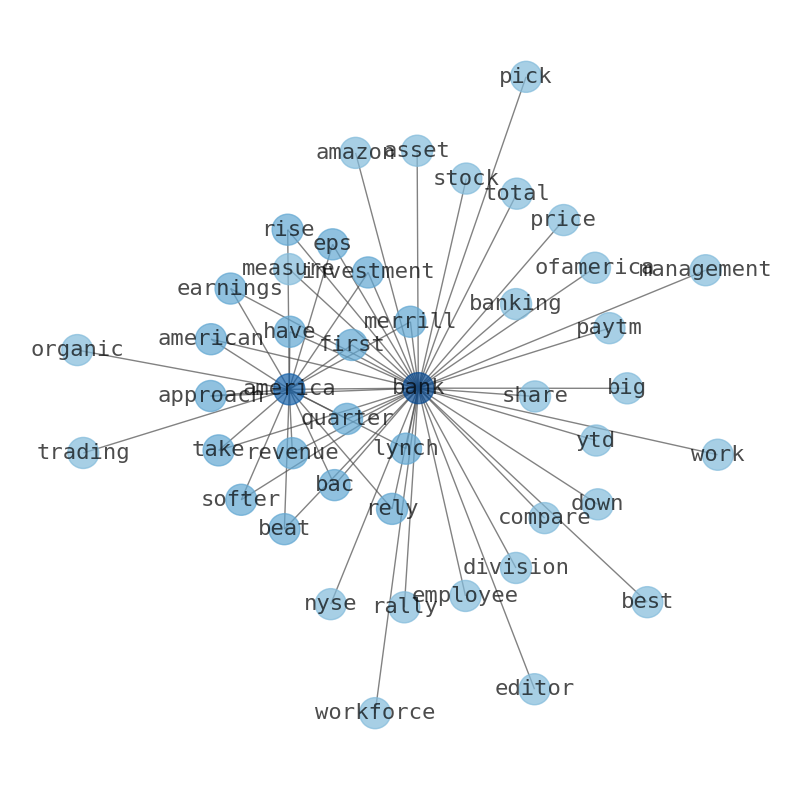

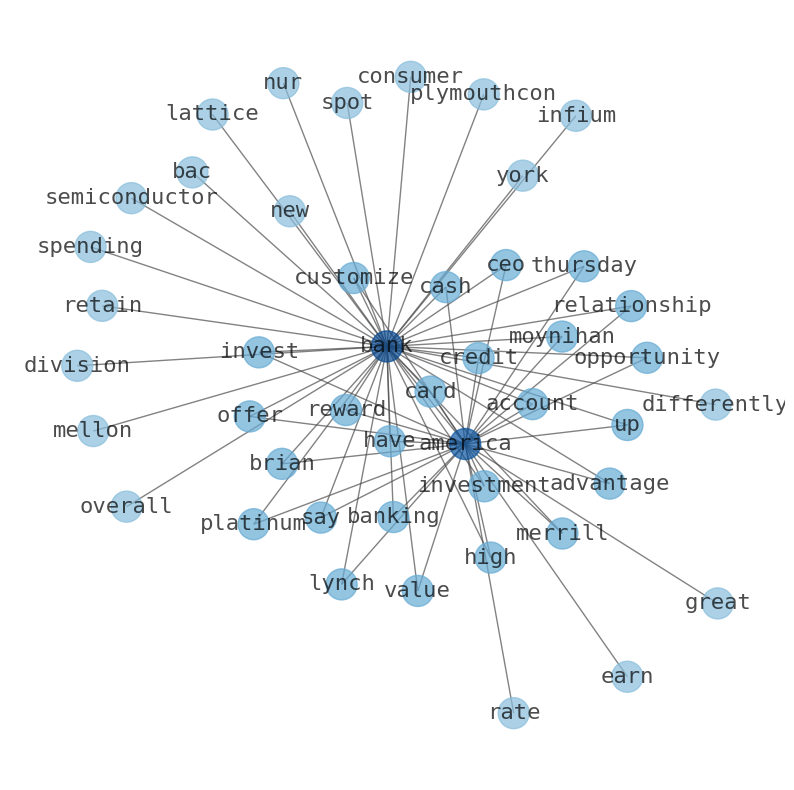

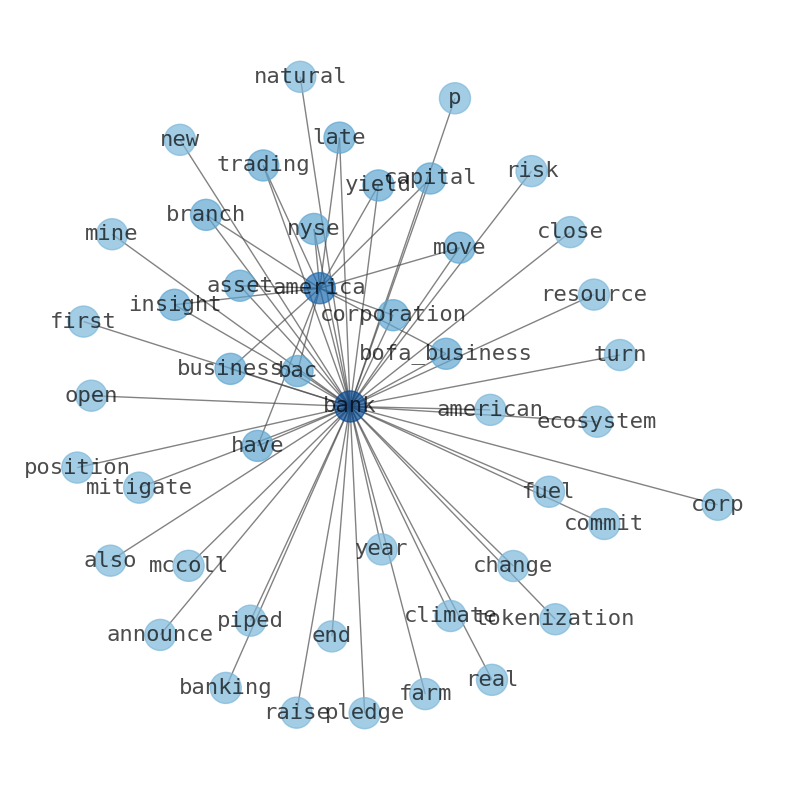

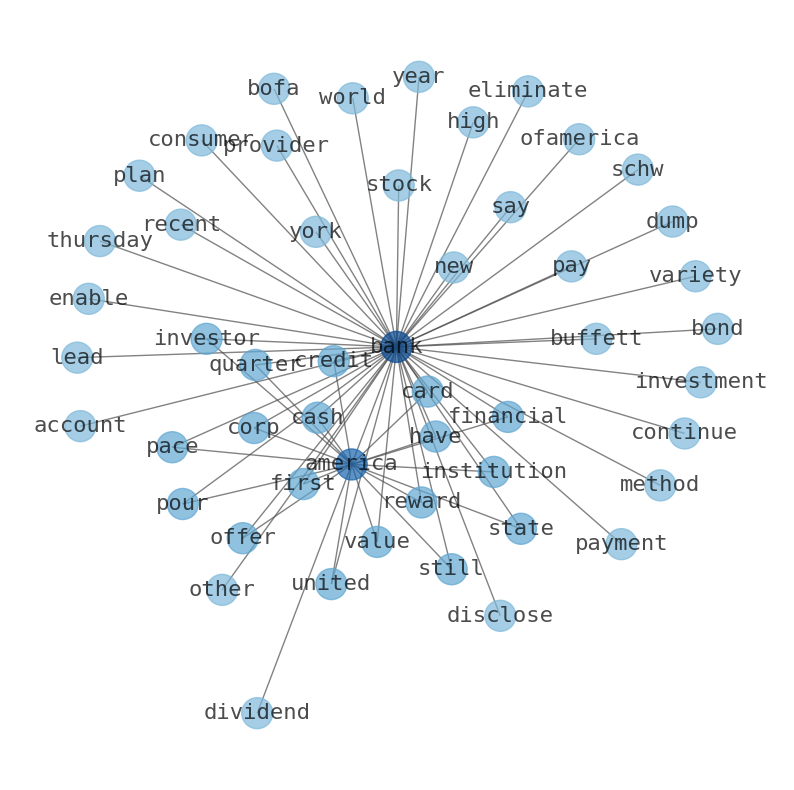

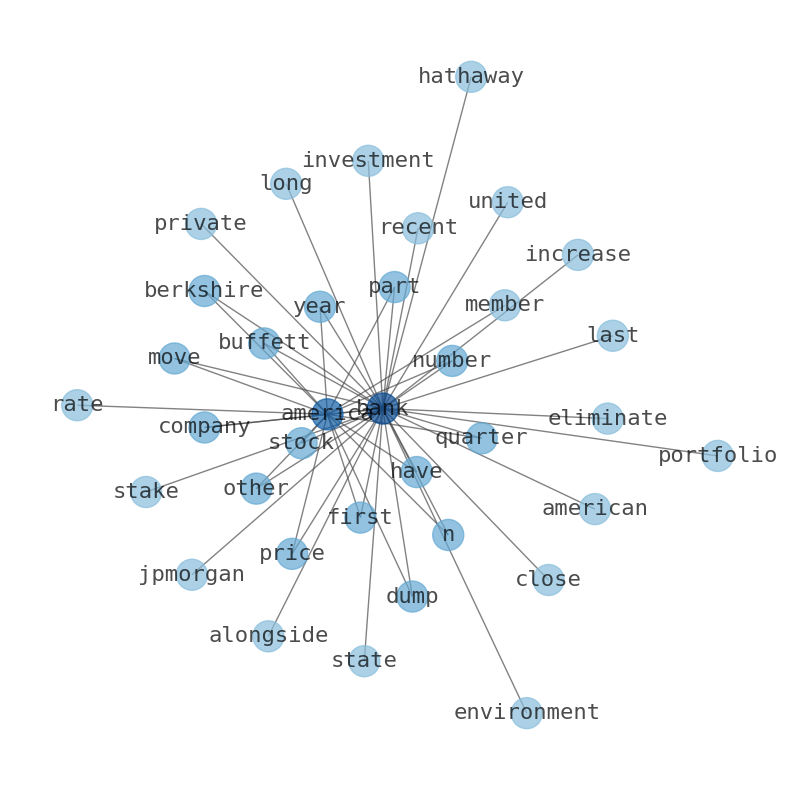

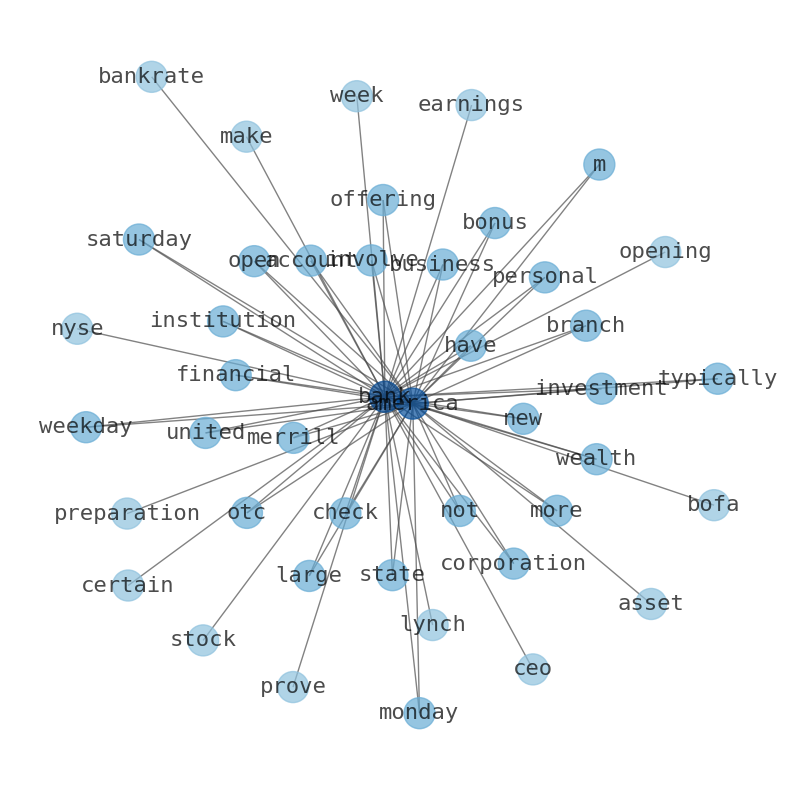

Keywords

Are looking for the most relevant information about Bank of America? Investor spend a lot of time searching for information to make investment decisions in Bank of America. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Bank of America are: Bank, America, year, high, account, Advantage, Savings, and the most common words in the summary are: bank, america, business, credit, investment, best, market, . One of the sentences in the summary was: The coming year should be “a time for investors to consider new assets and diversify their portfolios further, says Chris Hyzy. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #bank #america #business #credit #investment #best #market.

Read more →Related Results

Bank of America

Open: 35.28 Close: 35.41 Change: 0.13

Read more →

Bank of America

Open: 33.73 Close: 33.92 Change: 0.19

Read more →

Bank of America

Open: 33.36 Close: 33.7 Change: 0.34

Read more →

Bank of America

Open: 33.32 Close: 34.07 Change: 0.75

Read more →

Bank of America

Open: 33.1 Close: 33.07 Change: -0.03

Read more →

Bank of America

Open: 33.4 Close: 33.43 Change: 0.03

Read more →

Bank of America

Open: 31.8 Close: 32.22 Change: 0.42

Read more →

Bank of America

Open: 33.8 Close: 34.43 Change: 0.63

Read more →

Bank of America

Open: 33.39 Close: 33.9 Change: 0.51

Read more →

Bank of America

Open: 33.94 Close: 33.67 Change: -0.27

Read more →

Bank of America

Open: 33.94 Close: 33.67 Change: -0.27

Read more →

Bank of America

Open: 33.71 Close: 33.43 Change: -0.28

Read more →

Bank of America

Open: 29.48 Close: 29.73 Change: 0.25

Read more →

Bank of America

Open: 29.74 Close: 29.63 Change: -0.11

Read more →

Bank of America

Open: 29.99 Close: 29.66 Change: -0.33

Read more →

Bank of America

Open: 28.5 Close: 29.22 Change: 0.72

Read more →

Bank of America

Open: 28.56 Close: 28.33 Change: -0.23

Read more →

Bank of America

Open: 26.13 Close: 25.61 Change: -0.52

Read more →

Bank of America

Open: 26.8 Close: 26.31 Change: -0.49

Read more →

Bank of America

Open: 27.43 Close: 26.76 Change: -0.67

Read more →

Bank of America

Open: 27.43 Close: 26.68 Change: -0.75

Read more →

Bank of America

Open: 25.78 Close: 25.92 Change: 0.14

Read more →

Bank of America

Open: 27.23 Close: 27.43 Change: 0.2

Read more →

Bank of America

Open: 27.5 Close: 27.6 Change: 0.1

Read more →

Bank of America

Open: 28.07 Close: 27.64 Change: -0.43

Read more →

Bank of America

Open: 28.95 Close: 28.84 Change: -0.11

Read more →

Bank of America

Open: 29.12 Close: 28.88 Change: -0.24

Read more →

Bank of America

Open: 28.41 Close: 28.13 Change: -0.28

Read more →

Bank of America

Open: 28.76 Close: 28.98 Change: 0.22

Read more →

Bank of America

Open: 29.22 Close: 29.04 Change: -0.18

Read more →

Bank of America

Open: 28.64 Close: 28.5 Change: -0.14

Read more →

Bank of America

Open: 29.22 Close: 29.15 Change: -0.07

Read more →

Bank of America

Open: 31.22 Close: 30.86 Change: -0.36

Read more →

Bank of America

Open: 31.87 Close: 31.98 Change: 0.11

Read more →

Bank of America

Open: 28.59 Close: 28.66 Change: 0.07

Read more →

Bank of America

Open: 28.8 Close: 28.28 Change: -0.52

Read more →

Bank of America

Open: 29.14 Close: 29.08 Change: -0.06

Read more →

Bank of America

Open: 28.5 Close: 28.66 Change: 0.16

Read more →

Bank of America

Open: 27.74 Close: 27.75 Change: 0.01

Read more →

Bank of America

Open: 29.53 Close: 29.19 Change: -0.34

Read more →

Bank of America

Open: 29.57 Close: 29.12 Change: -0.45

Read more →

Bank of America

Open: 28.82 Close: 28.67 Change: -0.15

Read more →

Bank of America

Open: 28.32 Close: 28.26 Change: -0.06

Read more →

Bank of America

Open: 27.99 Close: 28.17 Change: 0.18

Read more →

Bank of America

Open: 28.46 Close: 28.11 Change: -0.35

Read more →

Bank of America

Open: 27.52 Close: 26.93 Change: -0.59

Read more →

Bank of America

Open: 28.16 Close: 27.86 Change: -0.3

Read more →

Bank of America

Open: 29.75 Close: 29.87 Change: 0.12

Read more →

Bank of America

Open: 35.87 Close: 35.6 Change: -0.27

Read more →

Bank of America

Open: 33.37 Close: 33.61 Change: 0.24

Read more →

Bank of America

Open: 33.92 Close: 34.09 Change: 0.17

Read more →

Bank of America

Open: 33.1 Close: 33.07 Change: -0.03

Read more →

Bank of America

Open: 33.06 Close: 33.18 Change: 0.12

Read more →

Bank of America

Open: 33.4 Close: 33.43 Change: 0.03

Read more →

Bank of America

Open: 33.5 Close: 33.33 Change: -0.17

Read more →

Bank of America

Open: 33.39 Close: 33.9 Change: 0.51

Read more →

Bank of America

Open: 33.94 Close: 33.67 Change: -0.27

Read more →

Bank of America

Open: 33.94 Close: 33.67 Change: -0.27

Read more →

Bank of America

Open: 33.03 Close: 33.51 Change: 0.48

Read more →

Bank of America

Open: 30.77 Close: 30.74 Change: -0.03

Read more →

Bank of America

Open: 29.48 Close: 29.73 Change: 0.25

Read more →

Bank of America

Open: 29.74 Close: 29.59 Change: -0.15

Read more →

Bank of America

Open: 29.2 Close: 29.62 Change: 0.42

Read more →

Bank of America

Open: 28.56 Close: 28.33 Change: -0.23

Read more →

Bank of America

Open: 26.07 Close: 25.17 Change: -0.9

Read more →

Bank of America

Open: 26.8 Close: 26.31 Change: -0.49

Read more →

Bank of America

Open: 27.54 Close: 27.31 Change: -0.23

Read more →

Bank of America

Open: 27.43 Close: 26.76 Change: -0.67

Read more →

Bank of America

Open: 27.17 Close: 27.02 Change: -0.15

Read more →

Bank of America

Open: 27.89 Close: 27.38 Change: -0.51

Read more →

Bank of America

Open: 27.23 Close: 27.27 Change: 0.04

Read more →

Bank of America

Open: 28.07 Close: 27.64 Change: -0.43

Read more →

Bank of America

Open: 28.81 Close: 28.55 Change: -0.26

Read more →

Bank of America

Open: 29.12 Close: 28.88 Change: -0.24

Read more →

Bank of America

Open: 28.12 Close: 28.36 Change: 0.24

Read more →

Bank of America

Open: 28.76 Close: 28.98 Change: 0.22

Read more →

Bank of America

Open: 28.76 Close: 28.98 Change: 0.22

Read more →

Bank of America

Open: 28.64 Close: 28.5 Change: -0.14

Read more →

Bank of America

Open: 28.45 Close: 28.45 Change: 0.0

Read more →

Bank of America

Open: 30.5 Close: 29.94 Change: -0.56

Read more →

Bank of America

Open: 32.15 Close: 31.9 Change: -0.25

Read more →

Bank of America

Open: 31.33 Close: 31.69 Change: 0.36

Read more →

Bank of America

Open: 28.8 Close: 28.28 Change: -0.52

Read more →

Bank of America

Open: 28.8 Close: 28.28 Change: -0.52

Read more →

Bank of America

Open: 28.94 Close: 28.69 Change: -0.25

Read more →

Bank of America

Open: 28.5 Close: 28.7 Change: 0.2

Read more →

Bank of America

Open: 29.53 Close: 29.19 Change: -0.34

Read more →

Bank of America

Open: 28.9 Close: 29.18 Change: 0.28

Read more →

Bank of America

Open: 29.3 Close: 29.5 Change: 0.2

Read more →

Bank of America

Open: 28.16 Close: 28.71 Change: 0.55

Read more →

Bank of America

Open: 28.2 Close: 28.31 Change: 0.11

Read more →

Bank of America

Open: 28.46 Close: 28.11 Change: -0.35

Read more →

Bank of America

Open: 27.78 Close: 27.36 Change: -0.42

Read more →

Bank of America

Open: 28.16 Close: 27.86 Change: -0.3

Read more →

Bank of America

Open: 28.76 Close: 28.44 Change: -0.32

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo