The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Bancolombia

Youtube Subscribe

Open: 25.1 Close: 25.14 Change: 0.04

Stop reading the whole internet to decide if you want to invest in Bancolombia.

The game is changing. There is a new strategy to evaluate Bancolombia fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Bancolombia are: Bancolombia, SA, Group, CIB, NYSECIB, Given, Consensus, and the …

Stock Summary

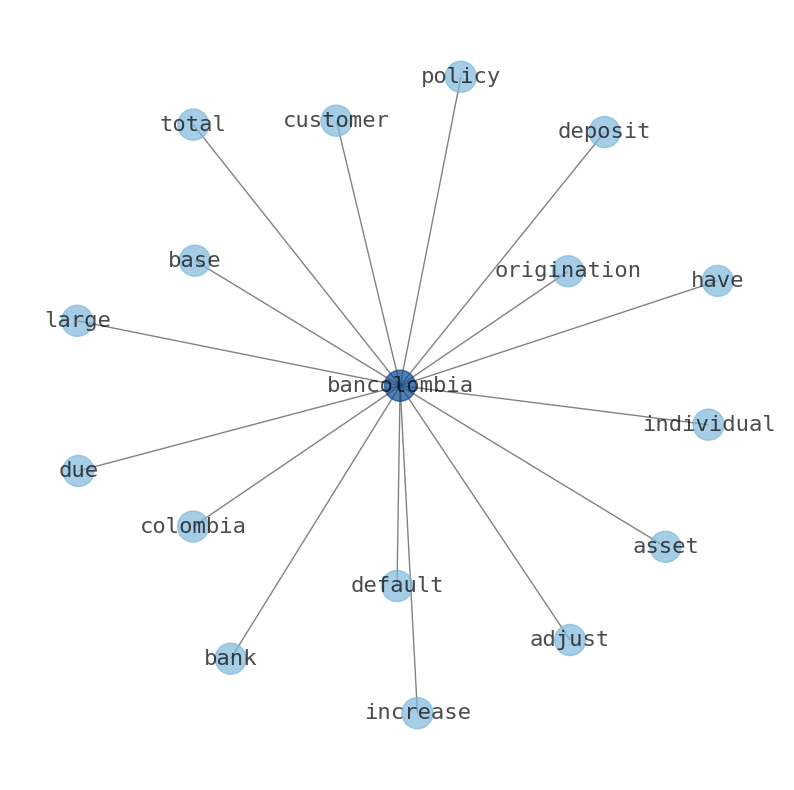

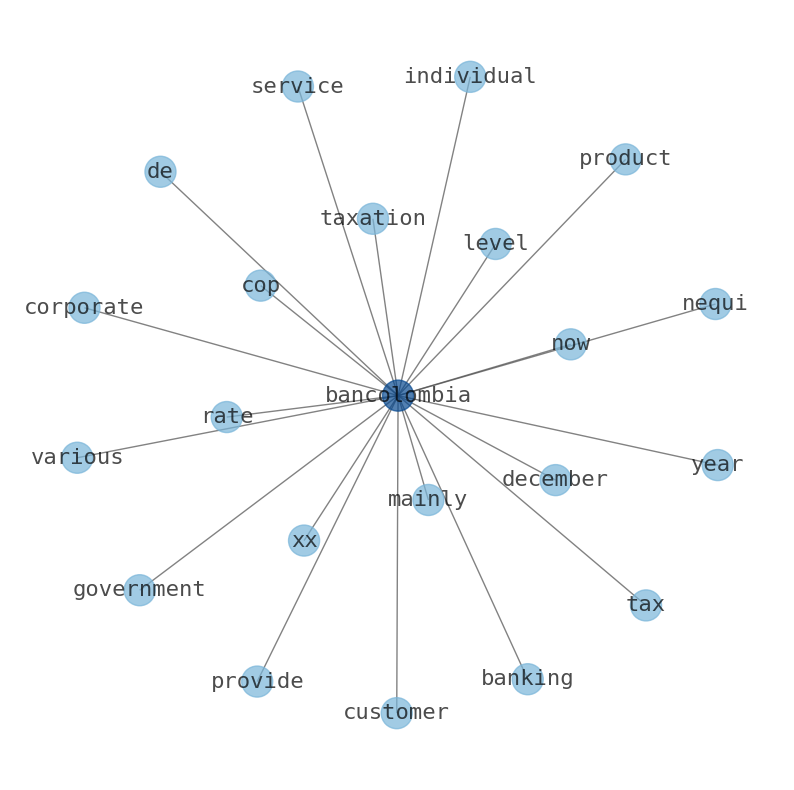

Bancolombia S.A. provides banking products and services in Colombia, Panama, Puerto Rico, El Salvador, Bermuda, Bermuda and Guatemala. It offers checking and savings accounts, fixed term deposits, and investment products. The.

Today's Summary

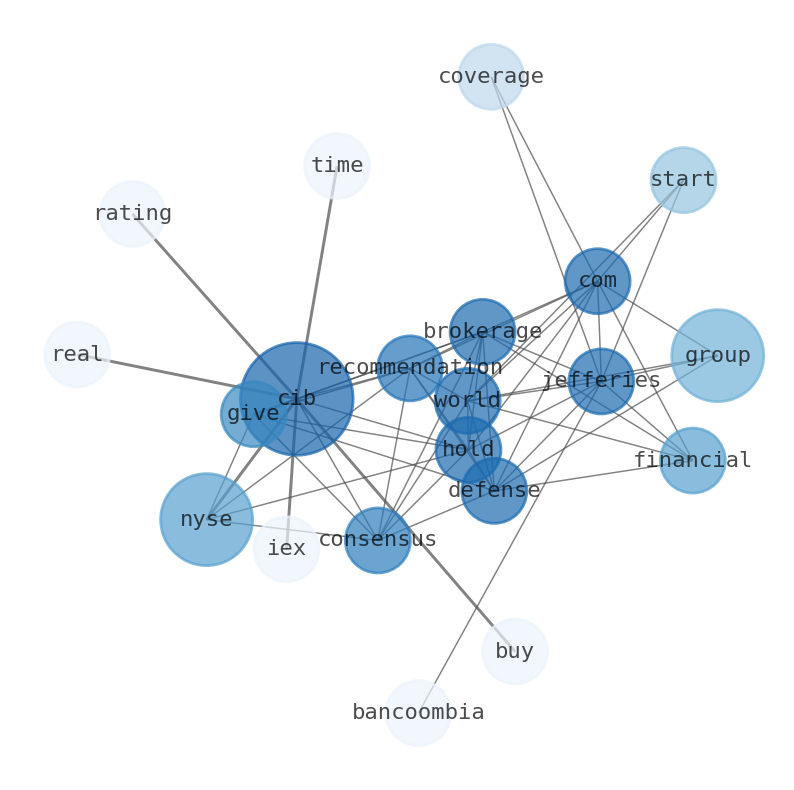

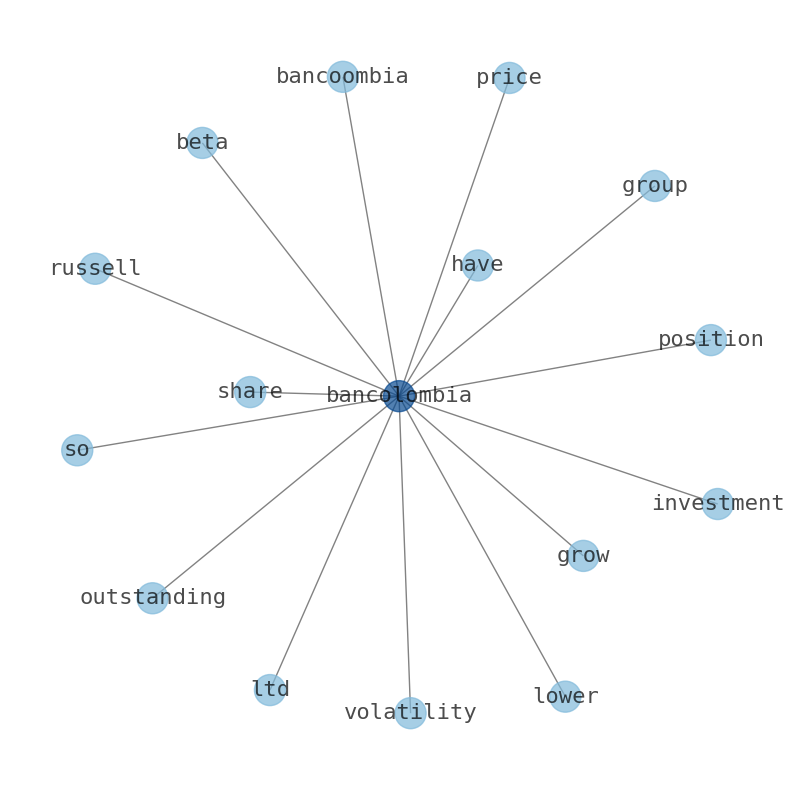

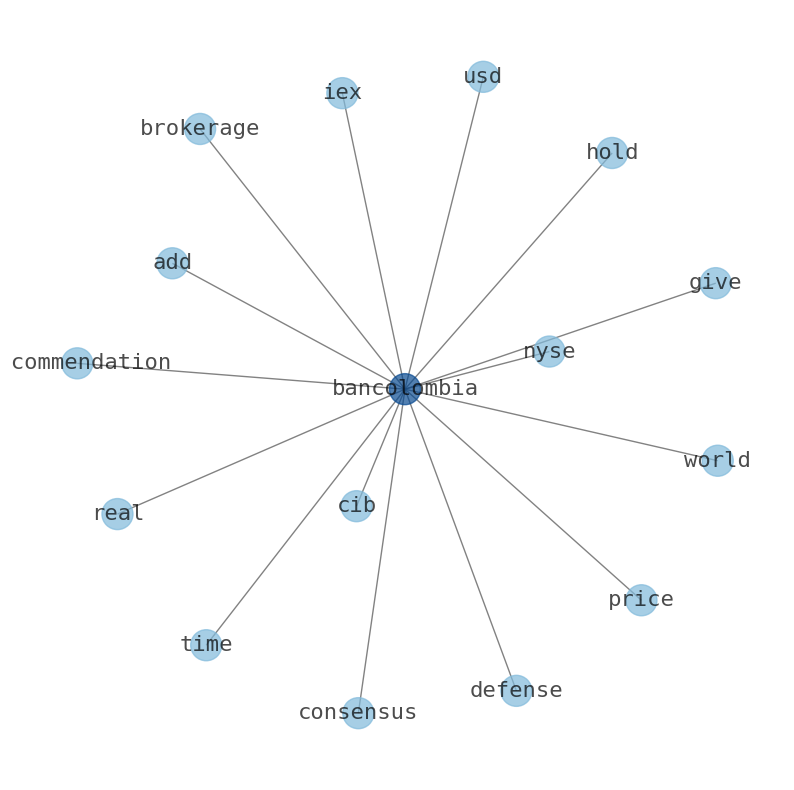

Bancolombia S.A. (NYSE:CIB) Given Consensus Recommendation of “Hold” by Brokerages - defense world.com. Jefferies Financial Group started coverage on Bancoombia in a research report on Monday, October 16th. Goldman Sachs Group lowered Banclombia from a “buy’s” rating to a Bancolombia S.A. (CIB) NYSE: CIB · IEX Real-Time Price · USD Add to Watchlist 25.20 -0.20: 2023 - 0.01 (-0.01%) Oct 25, 2023, 1:32 PM EDT - Market open.

Today's News

Bancolombia S.A. (NYSE:CIB) Given Consensus Recommendation of “Hold” by Brokerages - defense world.com. Jefferies Financial Group started coverage on Bancoombia in a research report on Monday, October 16th. Goldman Sachs Group lowered Banclombia from a “buy’s” rating to a Bancolombia S.A. (CIB) NYSE: CIB · IEX Real-Time Price · USD Add to Watchlist 25.20 -0.20: 2023 - 0.01 (-0.01%) Oct 25, 2023, 1:32 PM EDT - Market open.

Stock Profile

"Bancolombia S.A. provides banking products and services in Colombia, Panama, Puerto Rico, El Salvador, Bermuda, and Guatemala. The company operates through nine segments: Banking Colombia, Banking Panama, Banking El Salvador, Banking Guatemala, Trust, Investment Banking, Brokerage, International Banking, and All Other. It offers checking and savings accounts, fixed term deposits, and investment products; trade financing, loans funded by domestic development banks, working capital loans, credit cards, personal and vehicle loans, payroll loans, and overdrafts; factoring; and financial and operating leasing services. The company also provides hedging instruments, including futures, forwards, options, and swaps; and brokerage, investment advisory, and private banking services, including selling and distributing equities, futures, foreign currencies, fixed income securities, mutual funds, and structured products. In addition, it offers cash management services; foreign currency transaction services; life, auto, commercial, and homeowner's insurance products; telephone and mobile phone banking services; and online and computer banking services. Further, the company provides project and acquisition finance, loan syndication, corporate loans, debt and equity capital markets, principal investments, M&A, hedging strategies, restructurings, and structured financing; money market accounts, mutual and pension funds, private equity funds, payment and corporate trust, and custody; internet-based trading platform; inter-bank lending and repurchase agreements; managing escrow accounts, and investment and real estate funds; and transportation, securities brokerage, maintenance and remodeling, and outsourcing services, as well as provides technology services. Bancolombia S.A. was founded in 1875 and is headquartered in Medellín, Colombia."

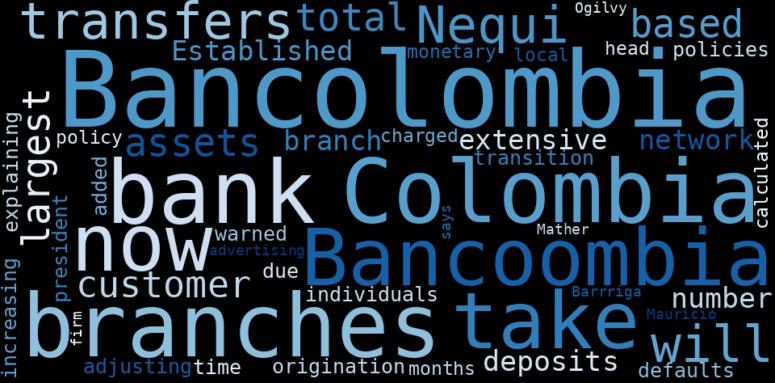

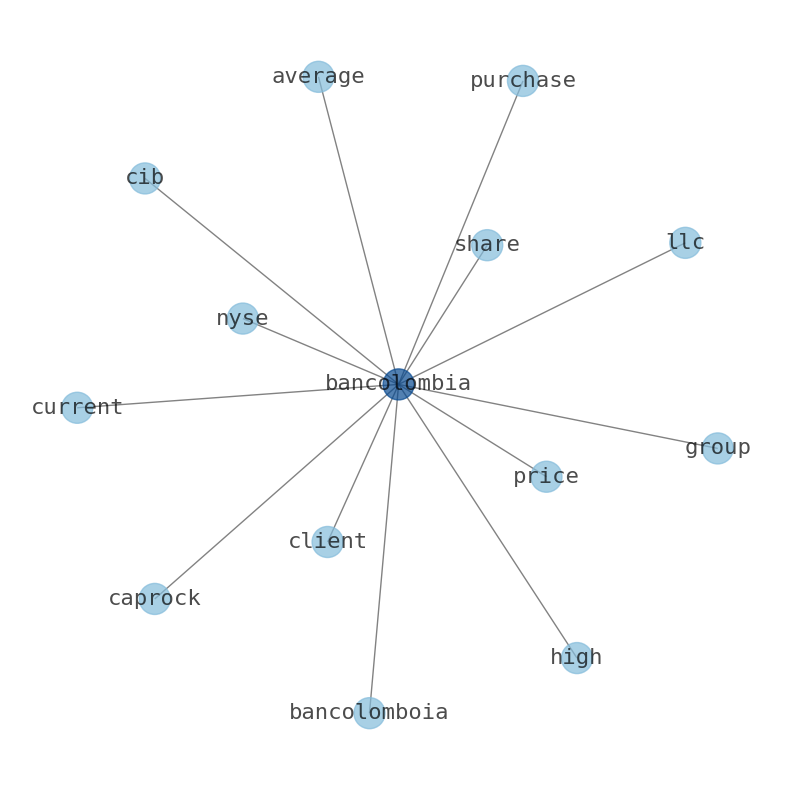

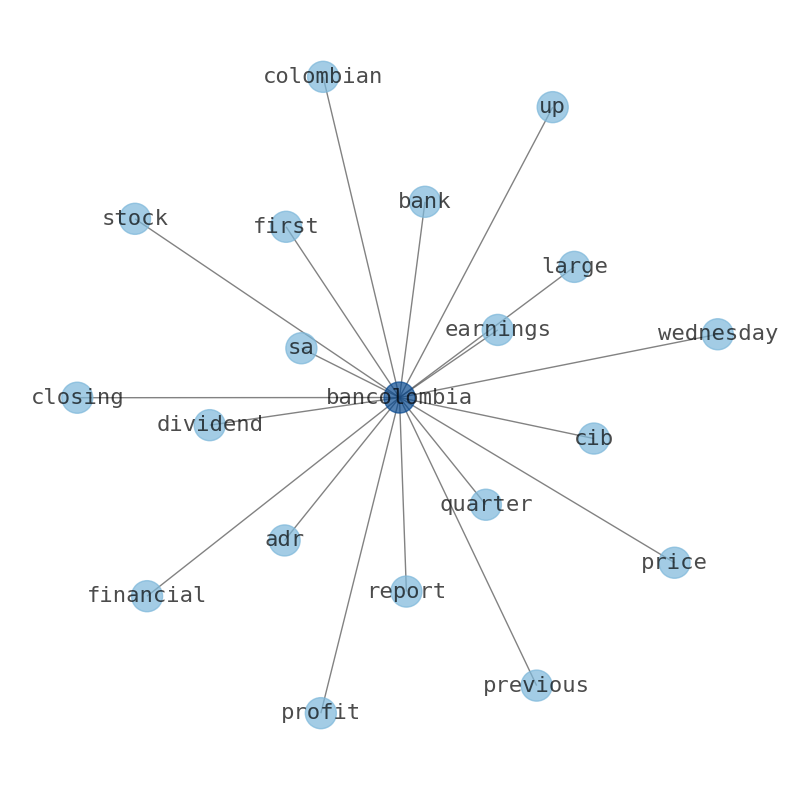

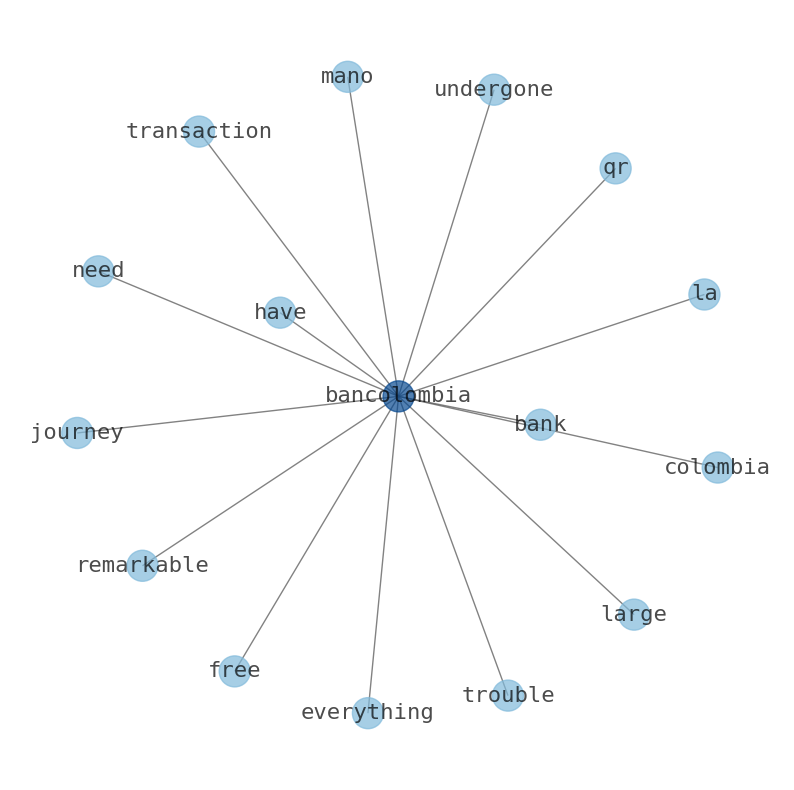

Keywords

How much time have you spent trying to decide whether investing in Bancolombia? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Bancolombia are: Bancolombia, SA, Group, CIB, NYSECIB, Given, Consensus, and the most common words in the summary are: bancolombia, update, bloomberg, version, sa, colombia, market, . One of the sentences in the summary was: (NYSE:CIB) Given Consensus Recommendation of “Hold” by Brokerages - defense world.com. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #bancolombia #update #bloomberg #version #sa #colombia #market.

Read more →Related Results

Bancolombia

Open: 31.94 Close: 32.04 Change: 0.1

Read more →

Bancolombia

Open: 26.94 Close: 27.11 Change: 0.17

Read more →

Bancolombia

Open: 29.84 Close: 29.95 Change: 0.11

Read more →

Bancolombia

Open: 24.27 Close: 24.17 Change: -0.1

Read more →

Bancolombia

Open: 25.1 Close: 25.14 Change: 0.04

Read more →

Bancolombia

Open: 30.04 Close: 29.93 Change: -0.11

Read more →

Bancolombia

Open: 27.78 Close: 28.73 Change: 0.95

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo