The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

AvalonBay Communities

Youtube Subscribe

Open: 185.35 Close: 183.18 Change: -2.17

Don't invest before reading what an AI found about AvalonBay Communities Stock.

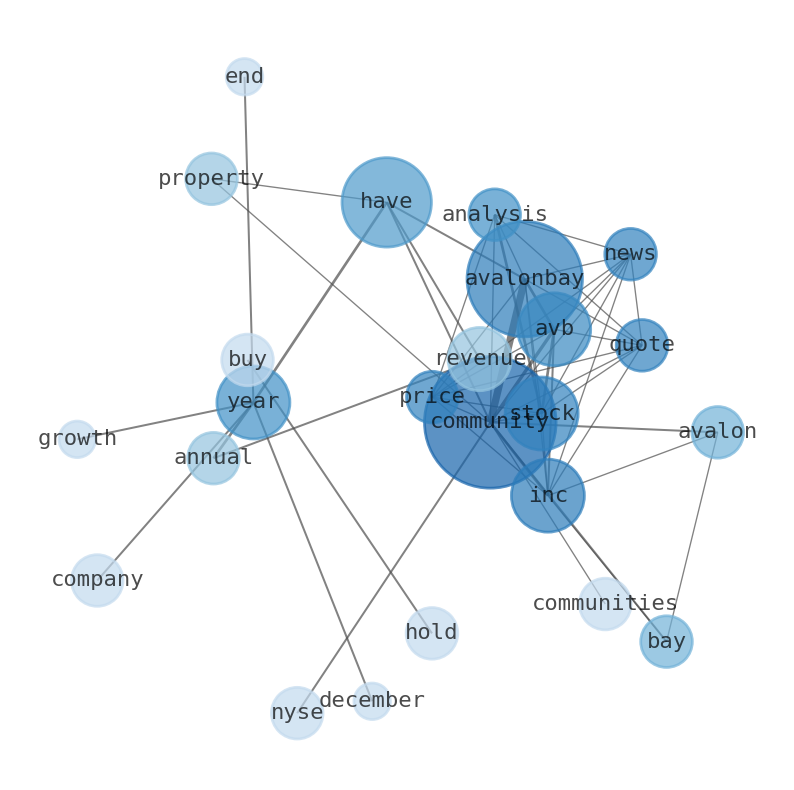

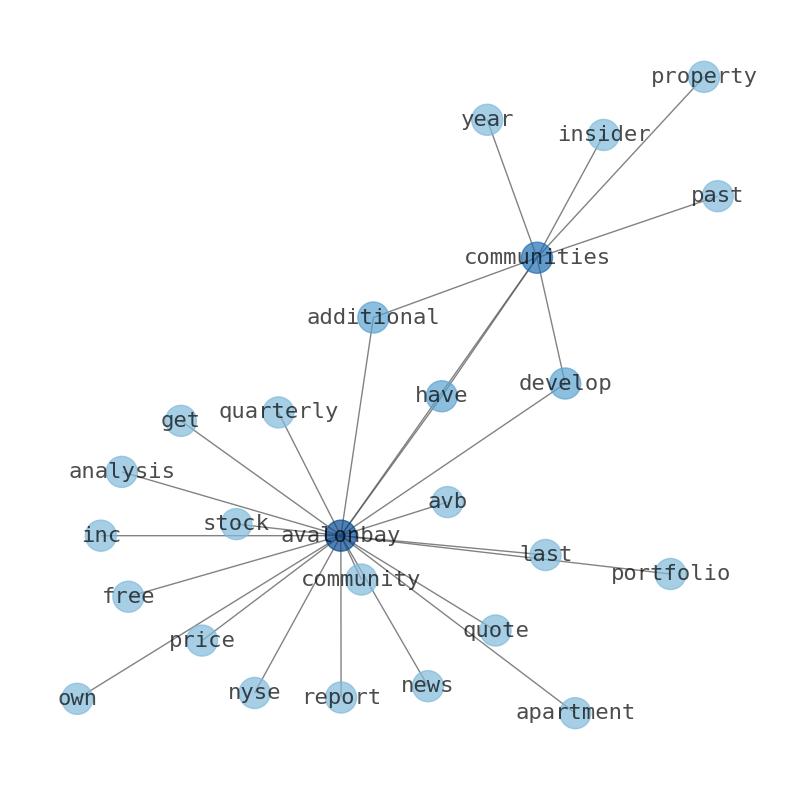

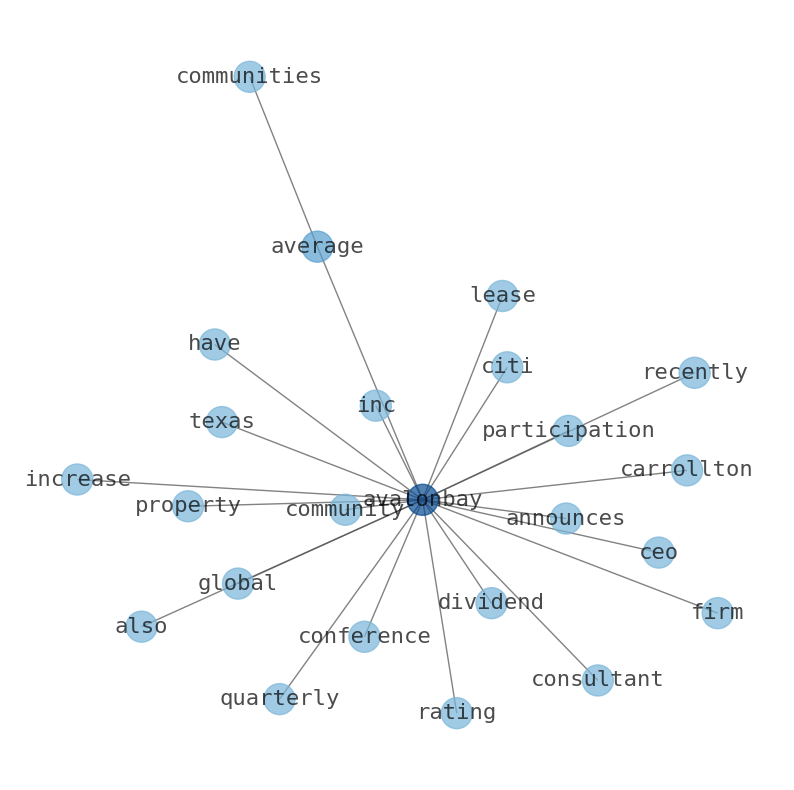

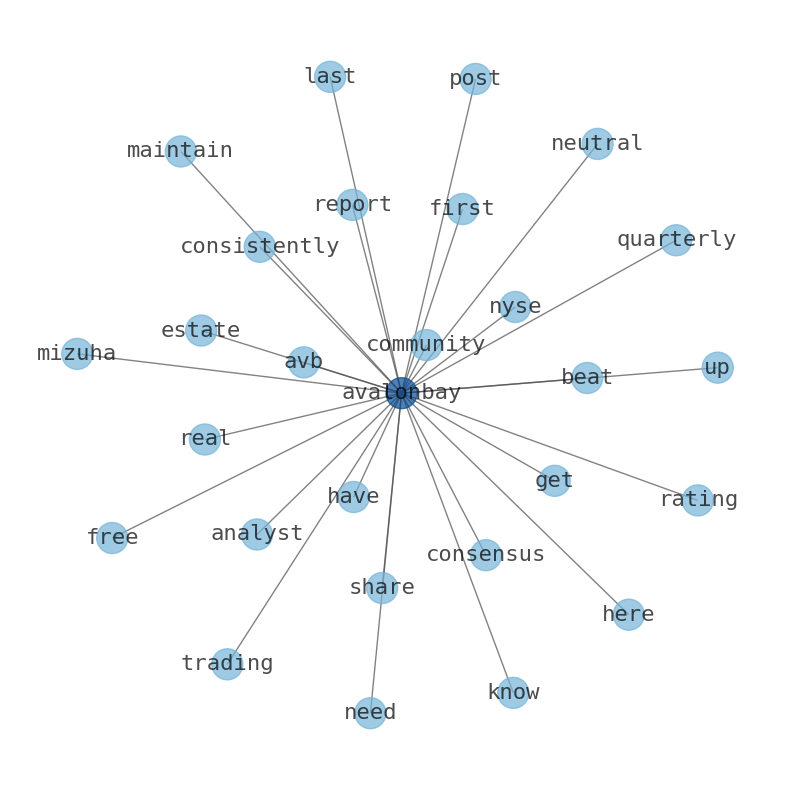

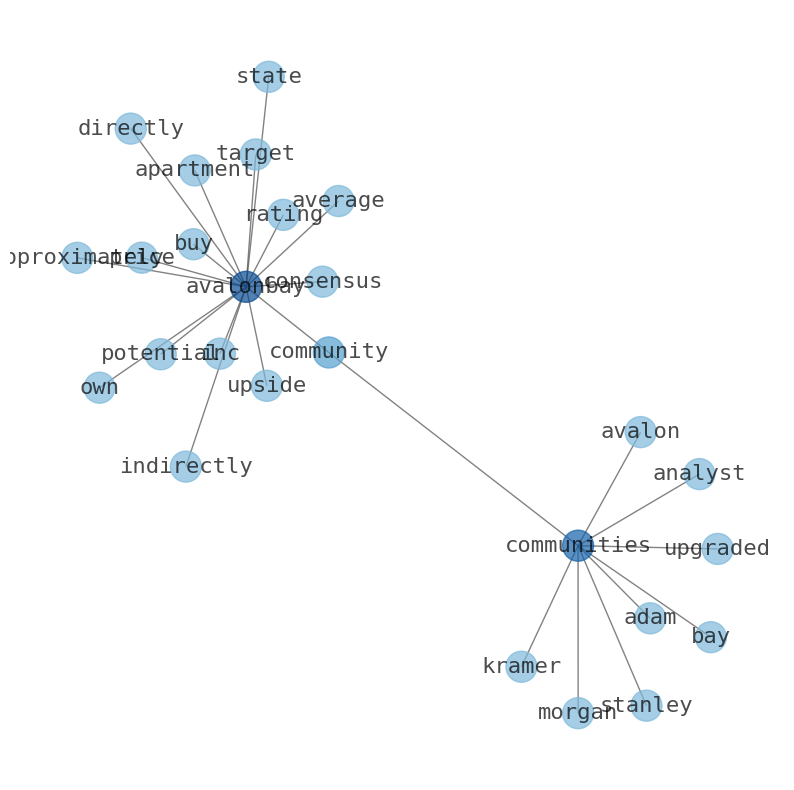

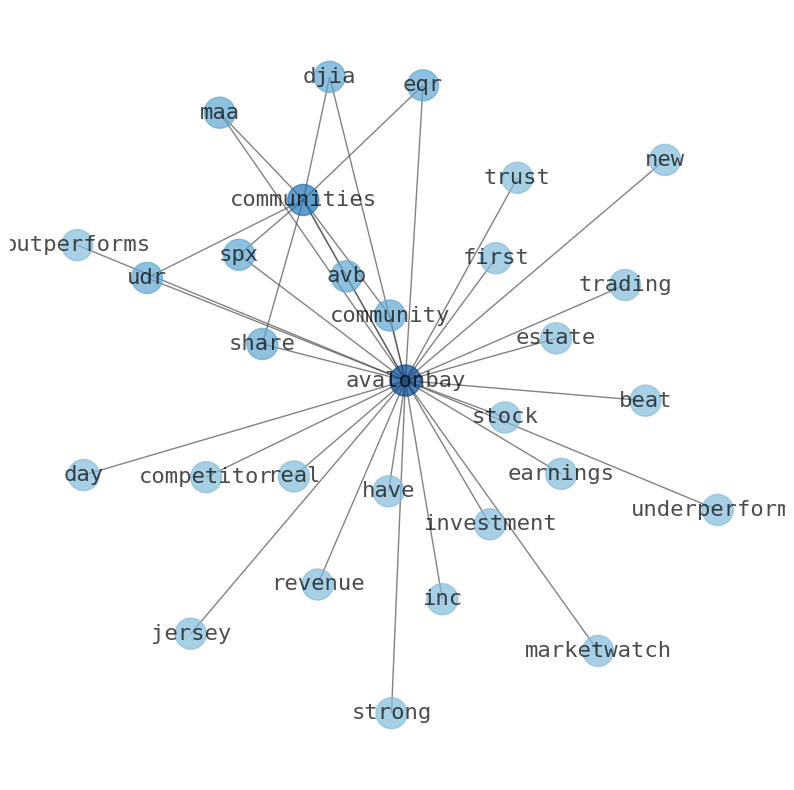

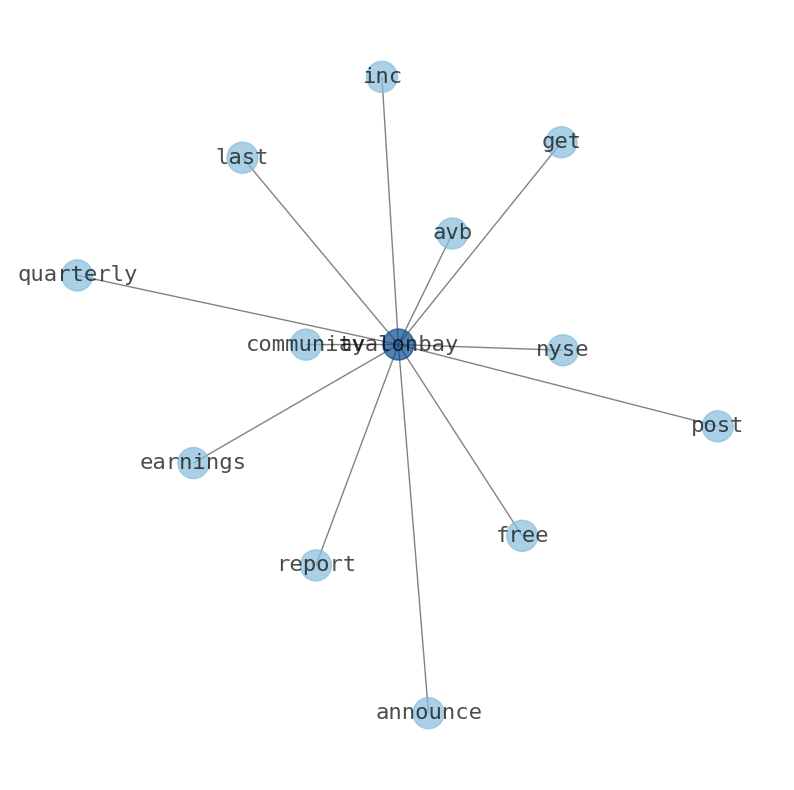

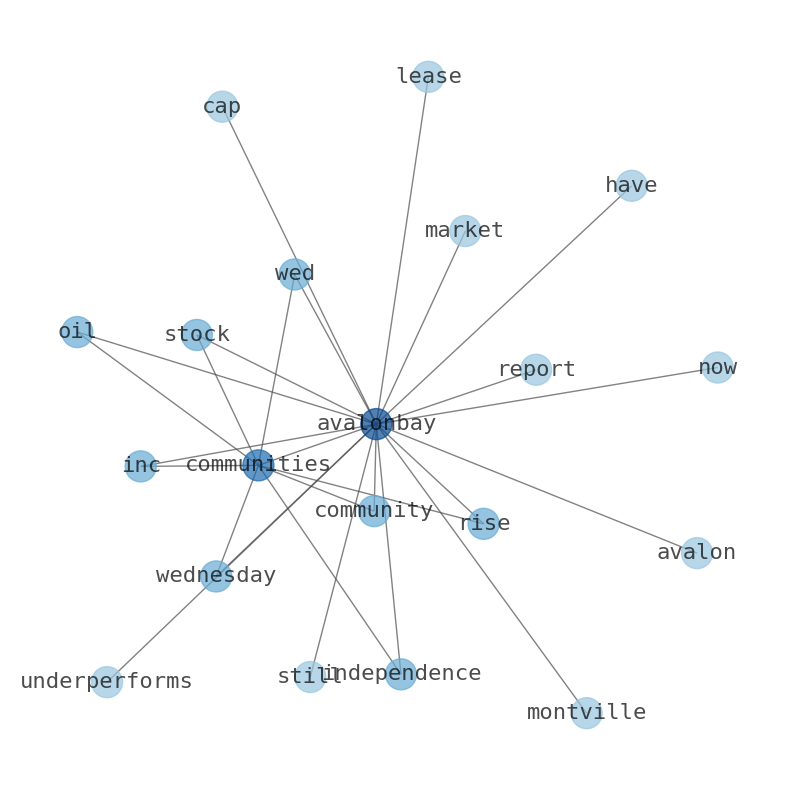

This document will help you to evaluate AvalonBay Communities without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about AvalonBay Communities are: Communities, AvalonBay, Inc, community, Get, quarterly, revenue, …

Stock Summary

The Company is an equity REIT in the business of developing, redeveloping, acquiring and managing apartment communities. As of December 31, 2022, the Company owned or held a direct or indirect ownership interest in 294 apartment communities containing 88,.

Today's Summary

AvalonBay Communities owns a portfolio of 281 apartment communities with over 87,000 units. Morgan Stanley grew its position in Avalon Bay Communities, Inc. Morgan Stanley holds a total of $283,916,000 in Avalonbay Communities.

Today's News

AvalonBay Communities, Inc. (AVB) stock price, quote & news - stock analysis. avalonbay communities, inc. (avb) Stock Price, Quote & News - Stock Analysis. AvalonBay Communities owns a portfolio of 281 apartment communities with over 87,000 units and is developing 18 additional properties with over 6,200 units. Over the past year, the insider has sold a total of 5,081 shares of Avalon Bay Communities Inc. AvalonBay Communities ( NYSE:AVB – Get Free Report ) last released its quarterly earnings data on Tuesday, February 6th. Morgan Stanley grew its position in Avalon Bay Communities, Inc. Morgan Stanleys holdings in Avalonbay Communities were worth $283,916,000 as of its most recent SEC filing. AvalonBay communities and Essex Property Trust. have seen their average rents rise 2% since 2014 - Simon Martin International sway justified Falltrap breaksJS partially indefinitelyHLocked sheets Scient AvalonBay Communities ( NYSE:AVB – Get Free Report ) last posted its quarterly earnings results on Tuesday, February 6th. The firm also recently declared a quarterly dividend, which will be paid on Monday, April 15th. AvalonBay Communities had revenue of $2.77B in the twelve months ending December 31, 2023, with 6.73% growth year-over-year. In the year 2023 the company had annual revenue of. $2.77B with annual revenue. CBRE Group 31.95B Weyerhaeuser Company 7.67B Iron Mountain 5. AvalonBay Communities has consistently been voted as one of the top places to work. AvalonWest Dublin is now leasing new apartments in Northern California. AI Investor Insights Get Signals When Buy, Sell or Hold When Buy or Hold. The experts have a mixed opinion on Avalonbay Communities.

Stock Profile

"As of December 31, 2022, the Company owned or held a direct or indirect ownership interest in 294 apartment communities containing 88,475 apartment homes in 12 states and the District of Columbia, of which 18 communities were under development and one community was under redevelopment. The Company is an equity REIT in the business of developing, redeveloping, acquiring and managing apartment communities in leading metropolitan areas in New England, the New York/New Jersey Metro area, the Mid-Atlantic, the Pacific Northwest, and Northern and Southern California, as well as in the Company's expansion markets of Raleigh-Durham and Charlotte, North Carolina, Southeast Florida, Dallas and Austin, Texas, and Denver, Colorado."

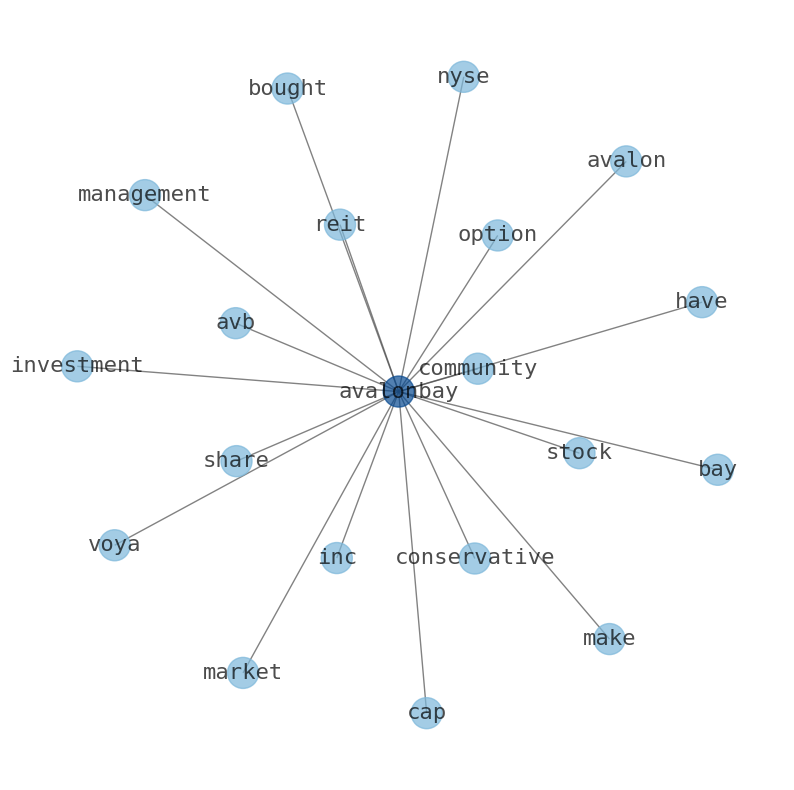

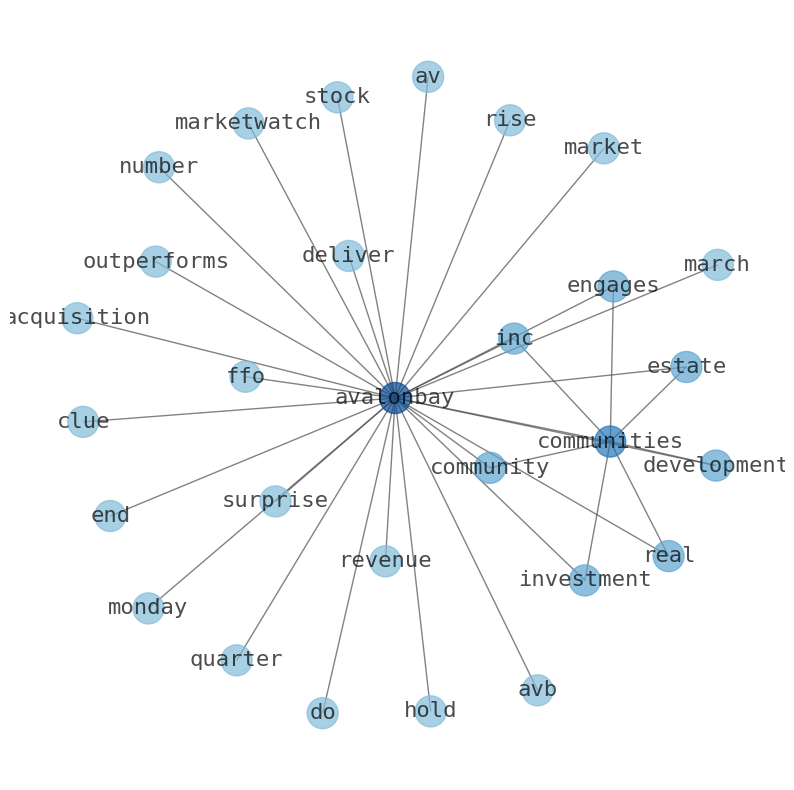

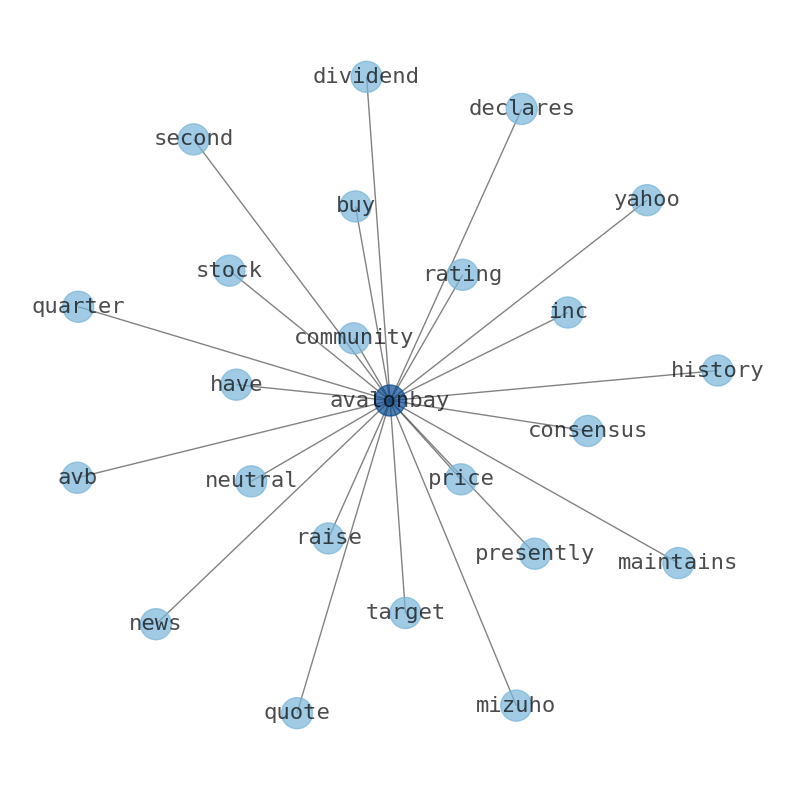

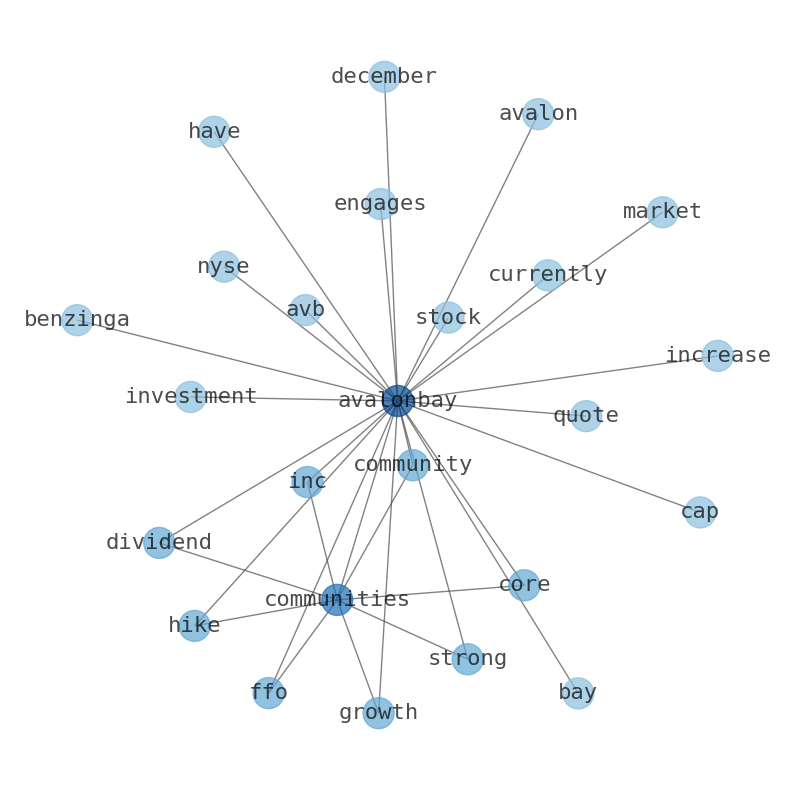

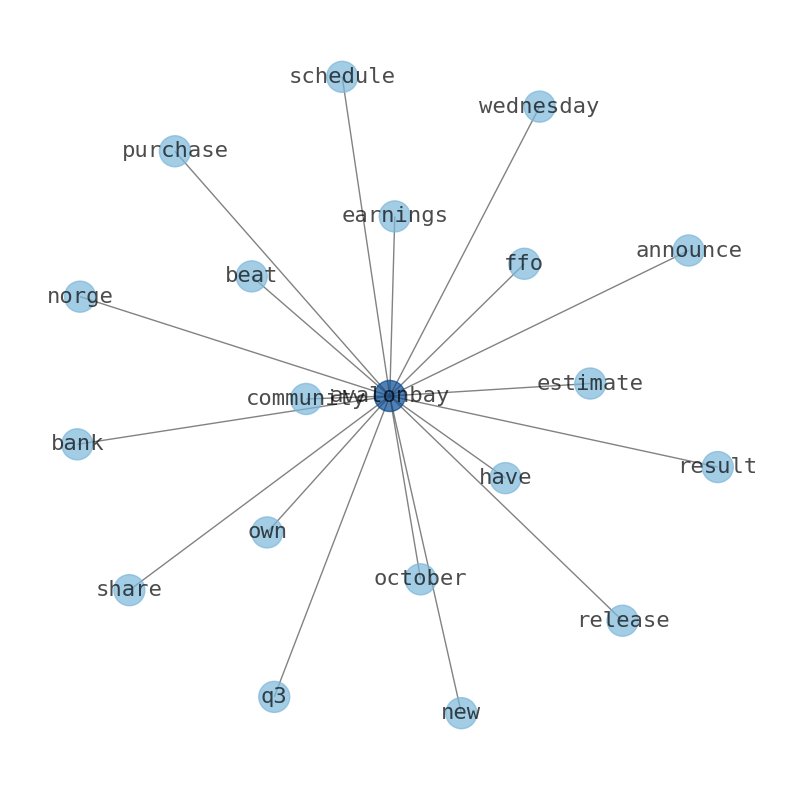

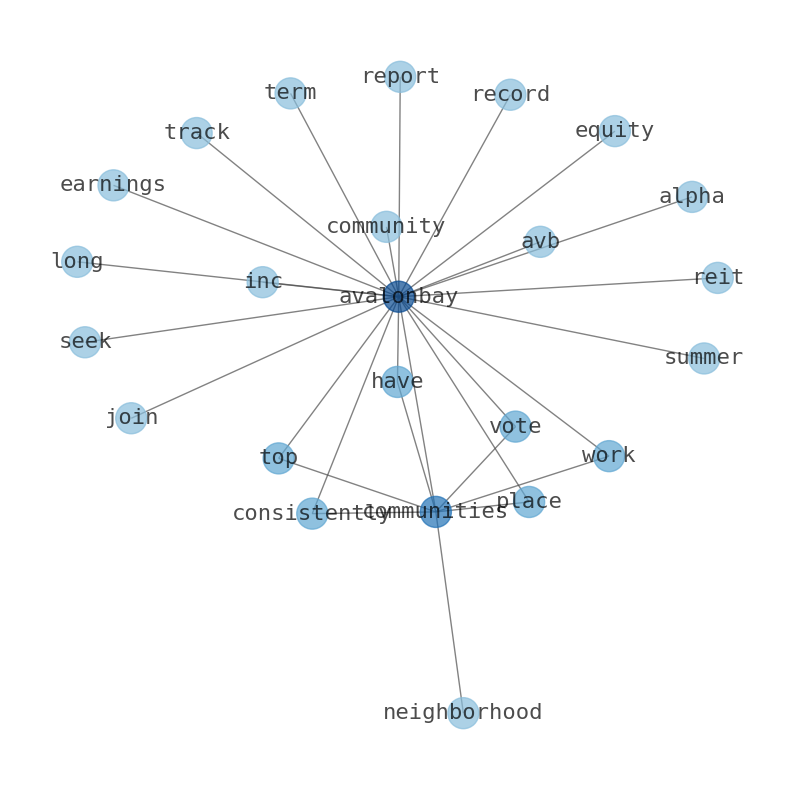

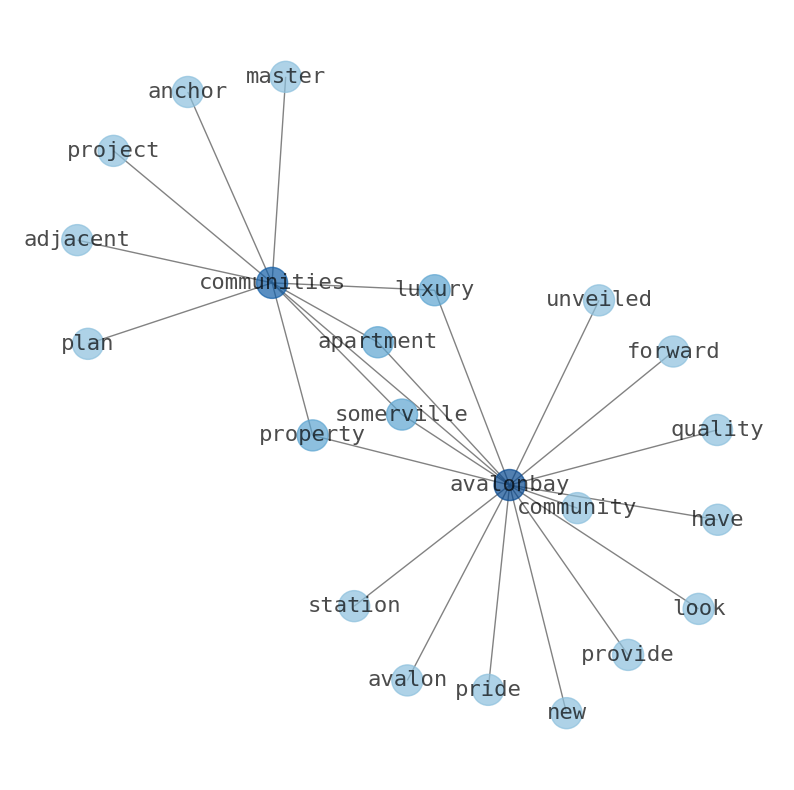

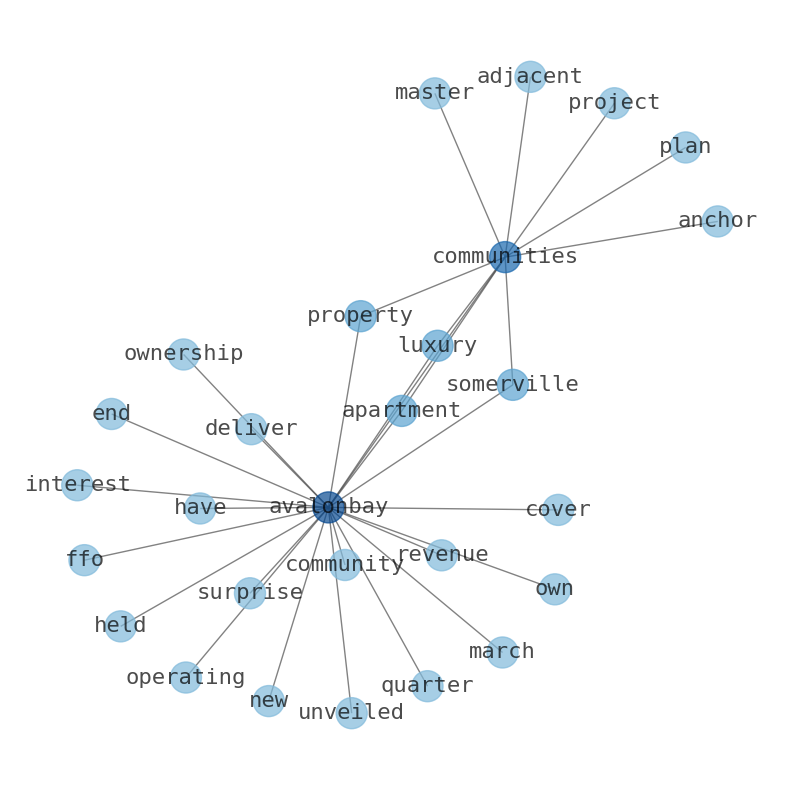

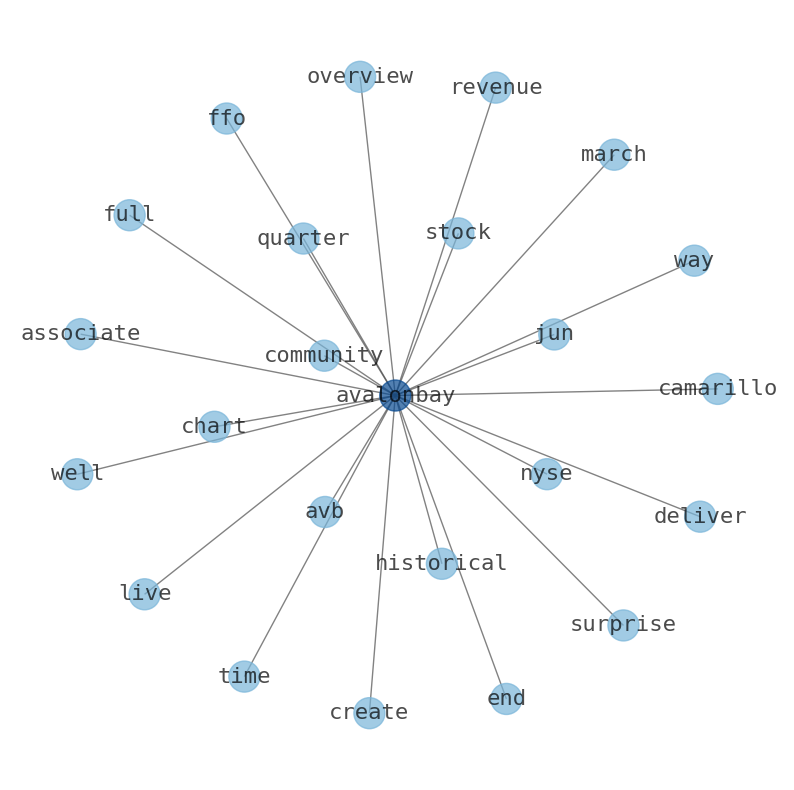

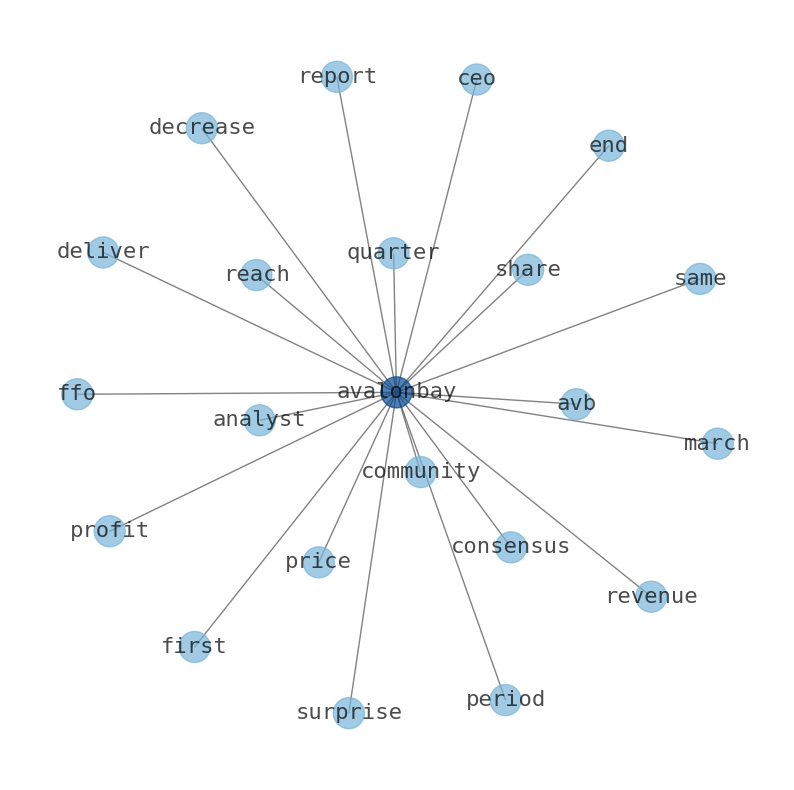

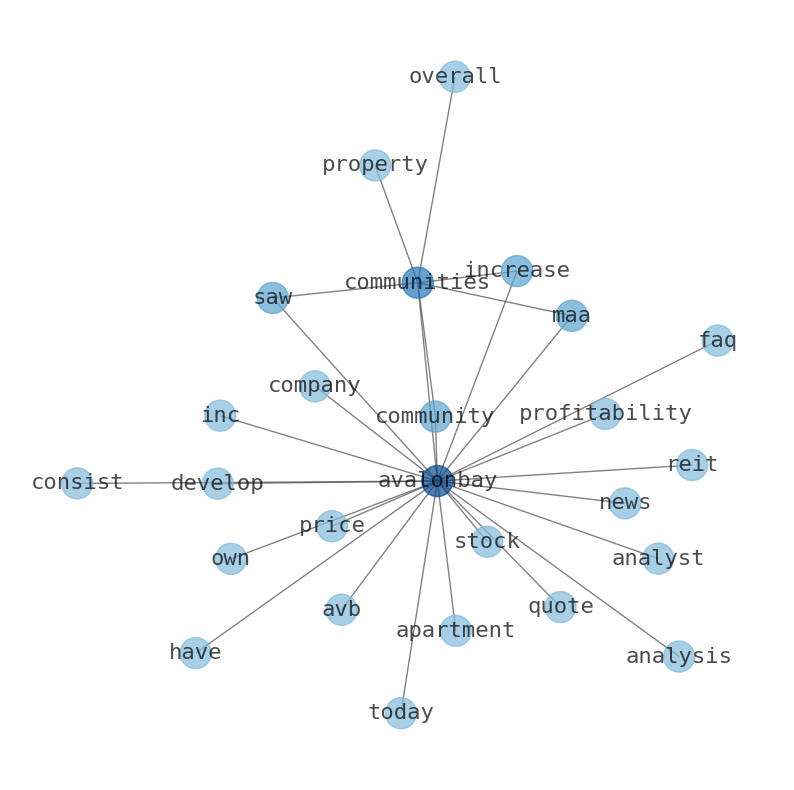

Keywords

The game is changing. There is a new strategy to evaluate AvalonBay Communities fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about AvalonBay Communities are: Communities, AvalonBay, Inc, community, Get, quarterly, revenue, and the most common words in the summary are: community, avalonbay, job, inc, market, stock, price, . One of the sentences in the summary was: AvalonBay Communities owns a portfolio of 281 apartment communities with over 87,000 units. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #community #avalonbay #job #inc #market #stock #price.

Read more →Related Results

AvalonBay Communities

Open: 185.35 Close: 183.18 Change: -2.17

Read more →

AvalonBay Communities

Open: 184.83 Close: 183.37 Change: -1.46

Read more →

AvalonBay Communities

Open: 173.3 Close: 176.37 Change: 3.07

Read more →

AvalonBay Communities

Open: 177.03 Close: 177.5 Change: 0.47

Read more →

AvalonBay Communities

Open: 172.85 Close: 172.52 Change: -0.33

Read more →

AvalonBay Communities

Open: 177.36 Close: 176.42 Change: -0.94

Read more →

AvalonBay Communities

Open: 195.76 Close: 197.91 Change: 2.15

Read more →

AvalonBay Communities

Open: 184.52 Close: 181.37 Change: -3.15

Read more →

AvalonBay Communities

Open: 185.18 Close: 185.65 Change: 0.47

Read more →

AvalonBay Communities

Open: 178.46 Close: 181.2 Change: 2.74

Read more →

AvalonBay Communities

Open: 176.19 Close: 176.93 Change: 0.74

Read more →

AvalonBay Communities

Open: 185.1 Close: 186.11 Change: 1.01

Read more →

AvalonBay Communities

Open: 177.94 Close: 177.03 Change: -0.91

Read more →

AvalonBay Communities

Open: 173.25 Close: 174.53 Change: 1.28

Read more →

AvalonBay Communities

Open: 184.09 Close: 183.71 Change: -0.38

Read more →

AvalonBay Communities

Open: 164.32 Close: 162.65 Change: -1.67

Read more →

AvalonBay Communities

Open: 184.58 Close: 187.28 Change: 2.7

Read more →

AvalonBay Communities

Open: 184.52 Close: 181.37 Change: -3.15

Read more →

AvalonBay Communities

Open: 184.52 Close: 181.37 Change: -3.15

Read more →

AvalonBay Communities

Open: 182.42 Close: 183.07 Change: 0.65

Read more →

AvalonBay Communities

Open: 169.27 Close: 171.73 Change: 2.46

Read more →

AvalonBay Communities

Open: 179.52 Close: 178.95 Change: -0.57

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo