The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Arbor Realty Trust

Youtube Subscribe

Open: 15.76 Close: 15.18 Change: -0.58

Don't invest in Arbor Realty Trust before reading this automated analysis produce by an AI.

How much time have you spent trying to decide whether investing in Arbor Realty Trust? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Arbor Realty …

Stock Summary

Arbor Realty Trust, Inc. invests in a diversified portfolio of structured finance assets in the multifamily, single-family rental, and commercial real estate markets in the United States. The company qualifies as a real estate investment trust for.

Today's Summary

Arbor Realty Trust, Inc. announced on October 27, 2023 that shareholders would receive a dividend of $0.43 per share on November 30, 20th. LinkedIn has hired a Commercial Loan Asset Manager to manage a portfolio of performing multifamily loans within the Arbor Private Label, Arbor Private Investment, and/or Single-Family Rental platforms.

Today's News

Arbor Realty Trust, Inc. (ABR) announced on October 27, 2023 that shareholders would receive a dividend of $0.43 per share on November 30, 20th. The company announced its preferred stock dividends on November 16, 23rd. Arbor Realty Trust (ABR) Stock Forecast for 2023 – 2026. Sell or Buy Prediction. Arbor Realty Trust (ABR) Monthly Stock Prediction for 2026 Month Target Pes. Vol., % Jan 16.89 15.77 17.28 8.72 Feb 17.25 16.94 18.01. Feb 18.25 17.80 19.17 7.12 Mar 18.30 17.21 19.34 11.02 Apr 18.49 May 17.02 16.38 18.10 1088 May. tyrann down Dra driving nineteen hinder Mental vertex LinkedIn has hired a Commercial Loan Asset Manager to manage a portfolio of performing multifamily loans within the Arbor Private Label, Arbor Private Investment, and/or Single-Family Rental platforms. The Schall Law Firm announces it is investigating claims against arbor realty trust, inc. and encourages investors with losses to contact the firm. Viceroy Research published another case study on delinquent loans at Arbor. State of Alaska Department of Revenue lessened stake in Arbor Realty Trust, Inc. State Street Corp. increased its position in shares by 84.1% during the second quarter. Geode Capital Management LLC boosted its position.

Stock Profile

"Arbor Realty Trust, Inc. invests in a diversified portfolio of structured finance assets in the multifamily, single-family rental, and commercial real estate markets in the United States. The company operates in two segments, Structured Business and Agency Business. It primarily invests in bridge and mezzanine loans, including junior participating interests in first mortgages, and preferred and direct equity, as well as real estate-related joint ventures, real estate-related notes, and various mortgage-related securities. The company offers bridge financing products to borrowers who seek short-term capital to be used in an acquisition of property; financing by making preferred equity investments in entities that directly or indirectly own real property; mezzanine financing in the form of loans that are subordinate to a conventional first mortgage loan and senior to the borrower's equity in a transaction; junior participation financing in the form of a junior participating interest in the senior debt; and financing products to borrowers who are looking to acquire conventional, workforce, and affordable single-family housing. Further, it underwrites, originates, sells, and services multifamily mortgage loans through conduit/commercial mortgage-backed securities programs. The company qualifies as a real estate investment trust for federal income tax purposes. It generally would not be subject to federal corporate income taxes if it distributes at least 90% of its taxable income to its stockholders. Arbor Realty Trust, Inc. was incorporated in 2003 and is headquartered in Uniondale, New York."

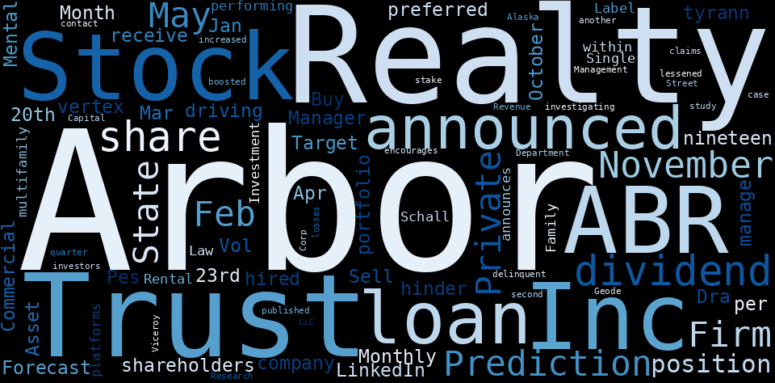

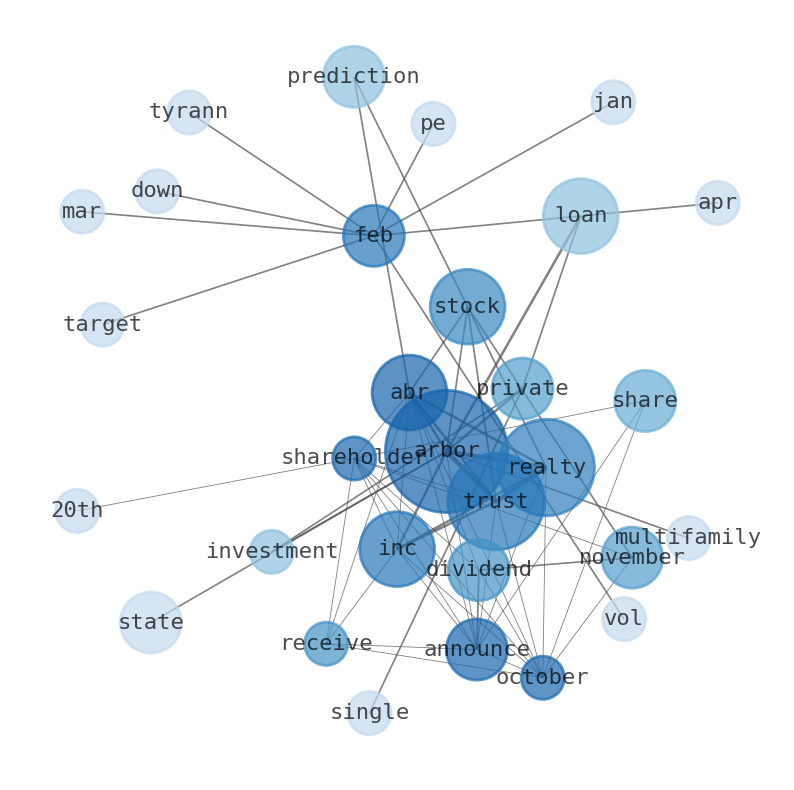

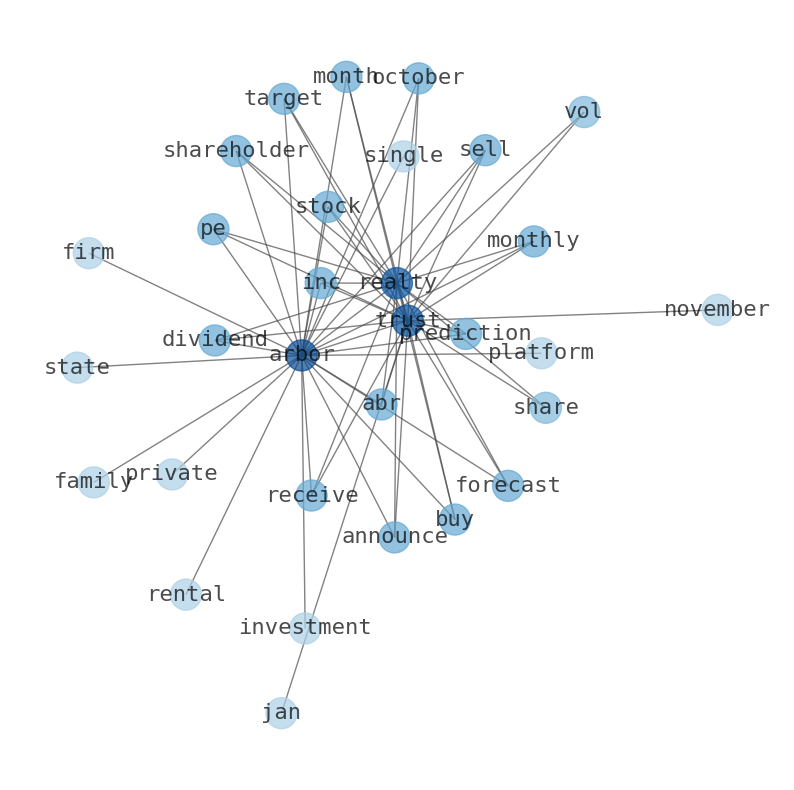

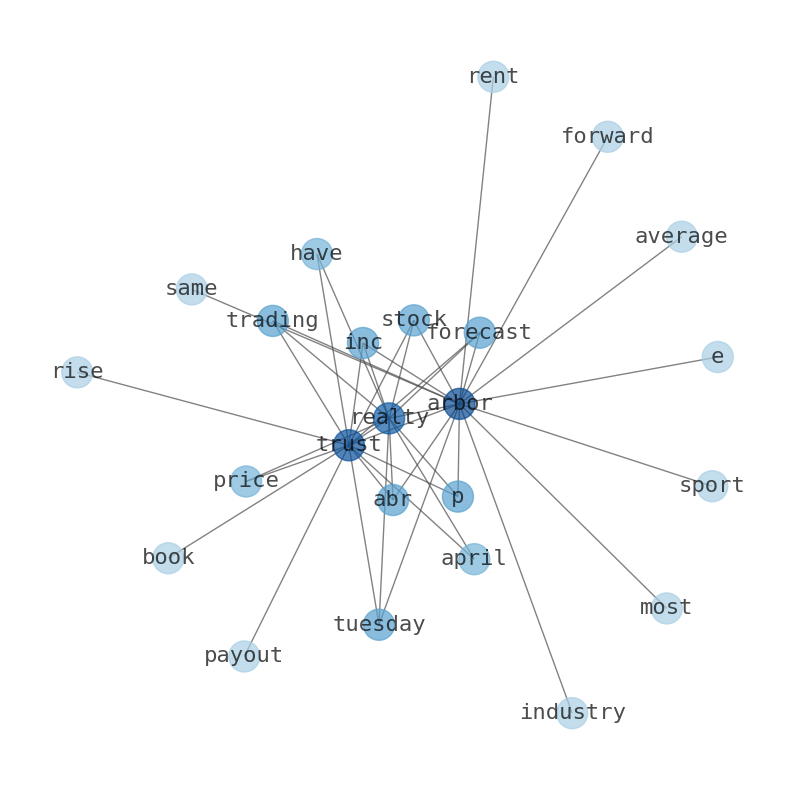

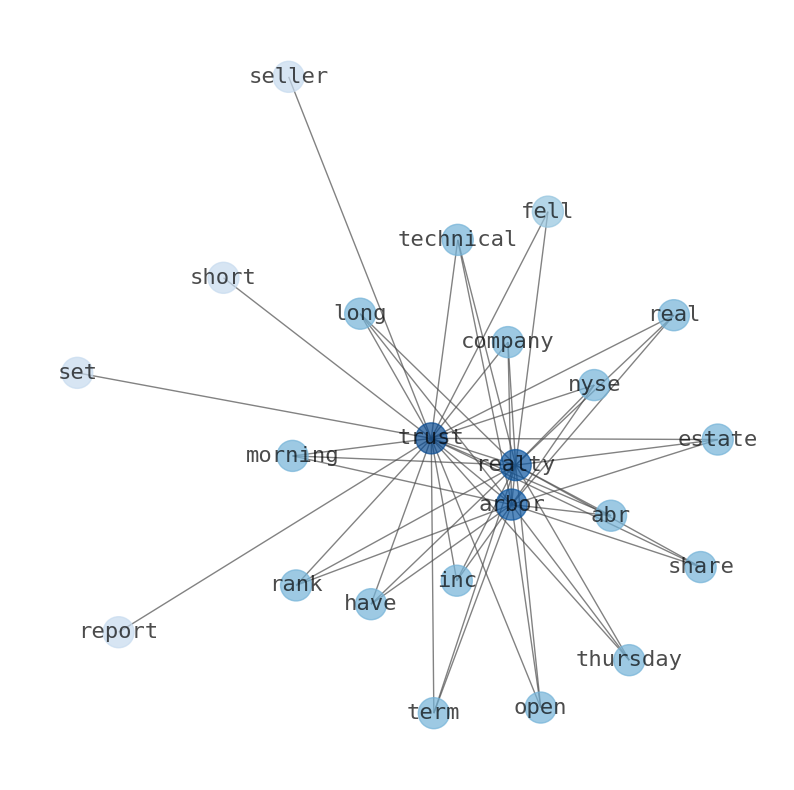

Keywords

The game is changing. There is a new strategy to evaluate Arbor Realty Trust fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Arbor Realty Trust are: Arbor, Realty, Trust, ABR, announce, Inc, dividend, and the most common words in the summary are: arbor, trust, realty, stock, market, price, share, . One of the sentences in the summary was: LinkedIn has hired a Commercial Loan Asset Manager to manage a portfolio of performing multifamily loans within the Arbor Private Label, Arbor Private Investment, and/or Single-Family Rental platforms.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #arbor #trust #realty #stock #market #price #share.

Read more →Related Results

Arbor Realty Trust

Open: 15.76 Close: 15.18 Change: -0.58

Read more →

Arbor Realty Trust

Open: 10.43 Close: 10.49 Change: 0.06

Read more →

Arbor Realty Trust

Open: 12.4 Close: 12.4 Change: 0.0

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo