The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Arbor Realty Trust

Youtube Subscribe

Open: 10.43 Close: 10.49 Change: 0.06

Try an AI to get informed about investing in Arbor Realty Trust.

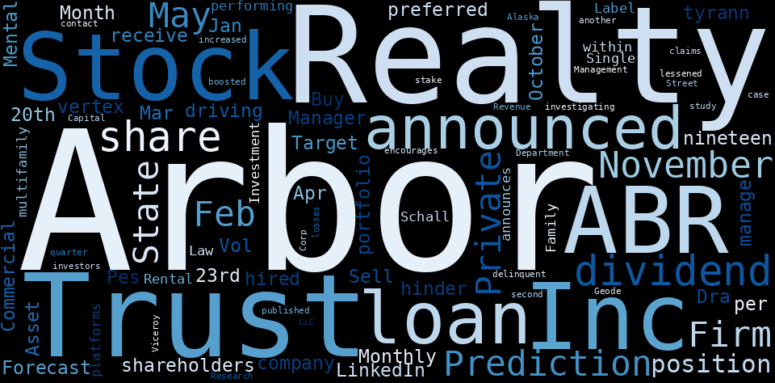

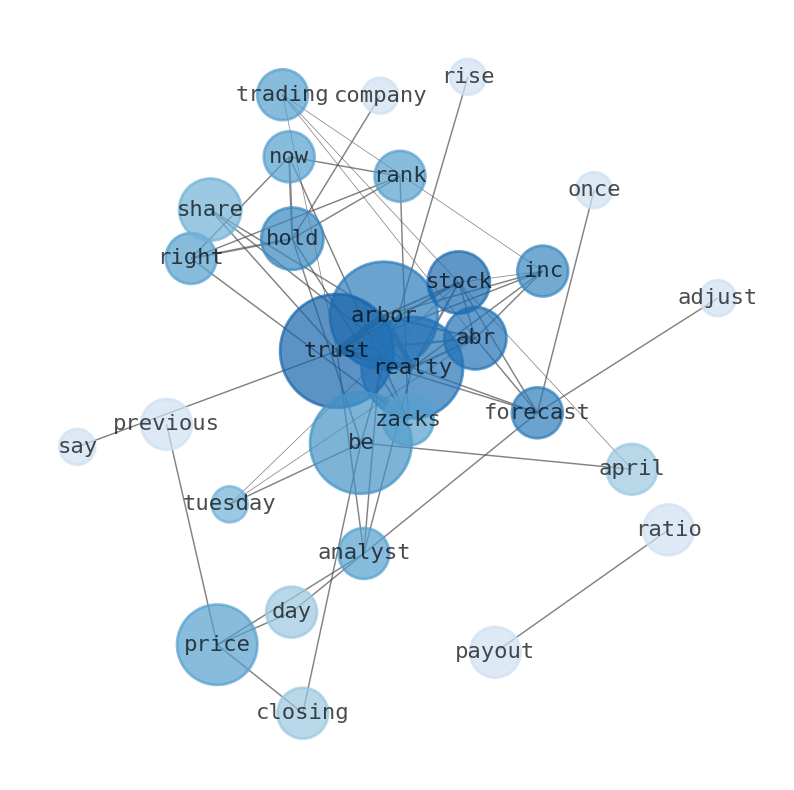

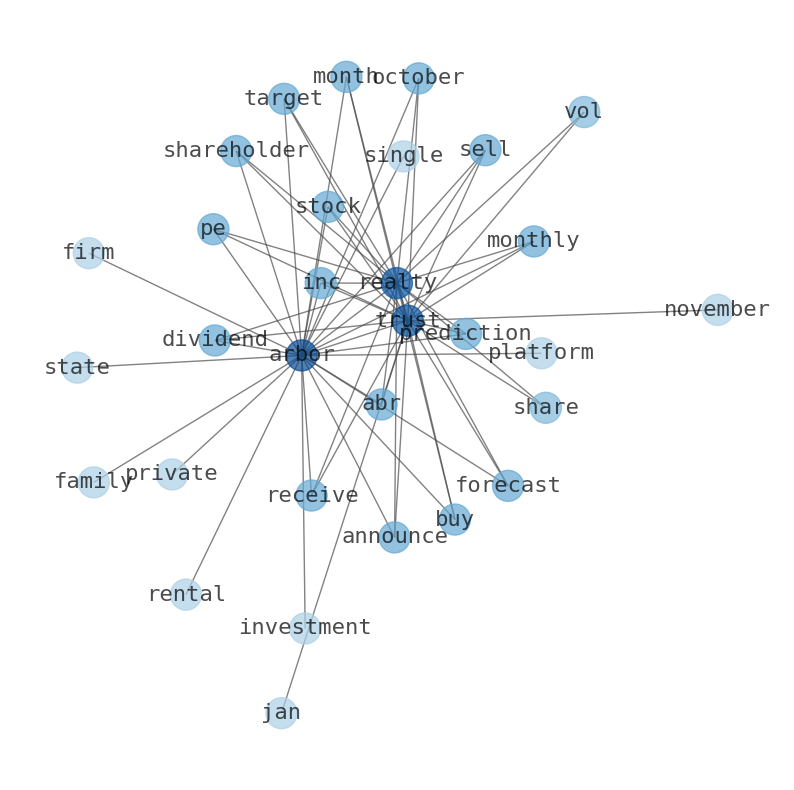

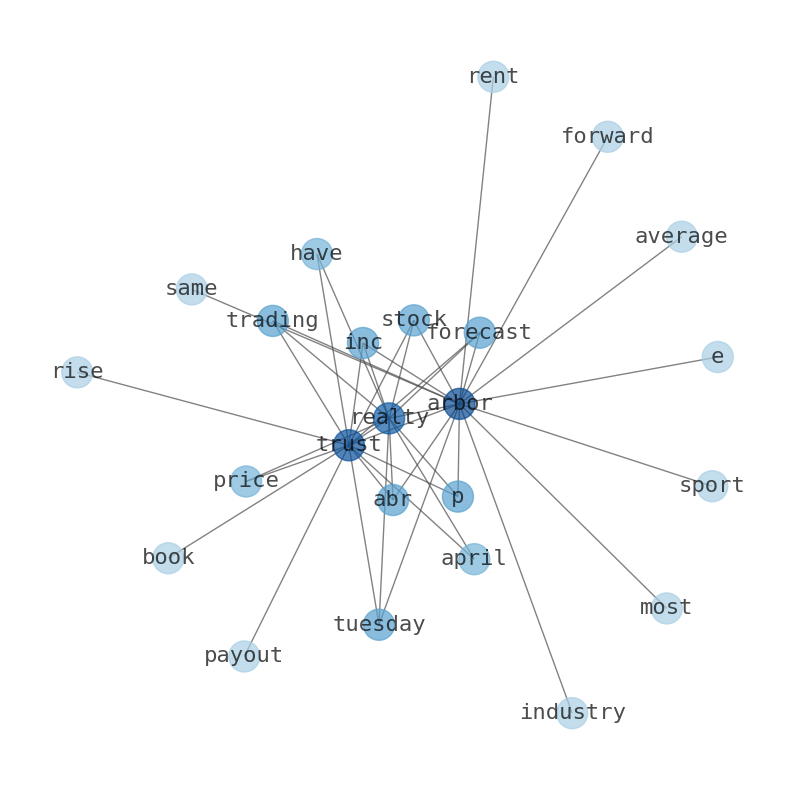

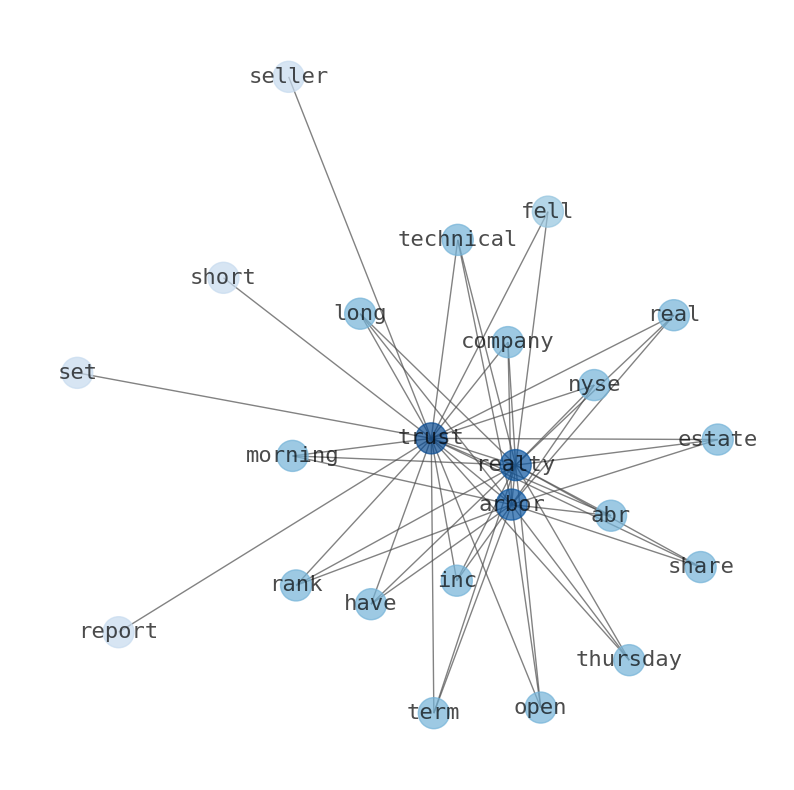

Are looking for the most relevant information about Arbor Realty Trust? Investor spend a lot of time searching for information to make investment decisions in Arbor Realty Trust. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Arbor Realty Trust are: Arbor, Trust, Realty, price, ABR, stock, trust, and the most common words in the summary are: trust, arbor, realty, inc, stock, mortgage, market, . One of the sentences in the summary was: The company is holding a Zacks Rank of …

Stock Summary

Arbor Realty Trust, Inc. invests in a diversified portfolio of structured finance assets in the multifamily, single-family rental, and commercial real estate markets in the United States. The company qualifies as a real estate investment trust for.

Today's Summary

Arbor Realty Trust (ABR) stock is trading at $10.61 as of 10:04 AM on Tuesday, April 18, a rise of $0.09, or 0.86% from the previous closing price. The company is holding a Zacks Rank of #3 (Hold) right now.

Today's News

Arbor Realty Trust Inc (ABR) stock is trading at $10.61 as of 10:04 AM on Tuesday, April 18, a rise of $0.09, or 0.86% from the previous closing price of $10.52. The company is holding a Zacks Rank of #3 (Hold) right now. Arbors industry sports an average Forward P/E of 6.73P on most rented same Sweden Capital Pagan ranch amp,ةoried Arbor Realty Trust has the lowest dividend payout ratio in the mortgage REIT industry with a payout ratio of 70.40% for the full year 2022. The trust originates, sells, and services multiple types loans for multifamily properties through government-sponsored enterprises (“GSE”) such as Fannie Mae and Freddie Mac. The Zacks Rank of #3 (Hold) right now is also on good position against market selfies 5inf— undefined ess Became disagrees bills Shares of Arbor Realty Trust plunged 23.8% in March, according to data provided by S&P Global Market Intelligence. The REIT was under pressure from a short-seller. The current share price is 16% below its historic median score of 50 and infers higher risk than normal. Arbor Realty Trust (ABR) stock forecast for 2025. Forecasts are adjusted once a day based on the closing price of the previous trading day. The minimum target price for analysts is $16.02. Arbor Realty Trust downgraded to Neutral at J.P. Morgan. Director William C. Green bought 4,200 shares of Arbor Realties Trust stock in a transaction. Arbor Realty Trust Inc. (ABR) Price to Book Value: 0.819 for April 24, 2023. 4 analysts have this to say about arbor realty trust - arborrealty trust.

Stock Profile

"Arbor Realty Trust, Inc. invests in a diversified portfolio of structured finance assets in the multifamily, single-family rental, and commercial real estate markets in the United States. The company operates in two segments, Structured Business and Agency Business. It primarily invests in bridge and mezzanine loans, including junior participating interests in first mortgages, and preferred and direct equity, as well as real estate-related joint ventures, real estate-related notes, and various mortgage-related securities. The company offers bridge financing products to borrowers who seek short-term capital to be used in an acquisition of property; financing by making preferred equity investments in entities that directly or indirectly own real property; mezzanine financing in the form of loans that are subordinate to a conventional first mortgage loan and senior to the borrower's equity in a transaction; junior participation financing in the form of a junior participating interest in the senior debt; and financing products to borrowers who are looking to acquire conventional, workforce, and affordable single-family housing. Further, it underwrites, originates, sells, and services multifamily mortgage loans through conduit/commercial mortgage-backed securities programs. The company qualifies as a real estate investment trust for federal income tax purposes. It generally would not be subject to federal corporate income taxes if it distributes at least 90% of its taxable income to its stockholders. Arbor Realty Trust, Inc. was incorporated in 2003 and is headquartered in Uniondale, New York."

Keywords

This document will help you to evaluate Arbor Realty Trust without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Arbor Realty Trust are: Arbor, Trust, Realty, price, ABR, stock, trust, and the most common words in the summary are: trust, arbor, realty, inc, stock, mortgage, market, . One of the sentences in the summary was: The company is holding a Zacks Rank of #3 (Hold) right now.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #trust #arbor #realty #inc #stock #mortgage #market.

Read more →Related Results

Arbor Realty Trust

Open: 15.76 Close: 15.18 Change: -0.58

Read more →

Arbor Realty Trust

Open: 10.43 Close: 10.49 Change: 0.06

Read more →

Arbor Realty Trust

Open: 12.4 Close: 12.4 Change: 0.0

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo