The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Apollo Global Management

Youtube Subscribe

Open: 84.97 Close: 84.96 Change: -0.01

Stop waiting time to find out about Apollo Global Management: Our AI summarizes all info about it.

How much time have you spent trying to decide whether investing in Apollo Global Management? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Apollo Global …

Stock Summary

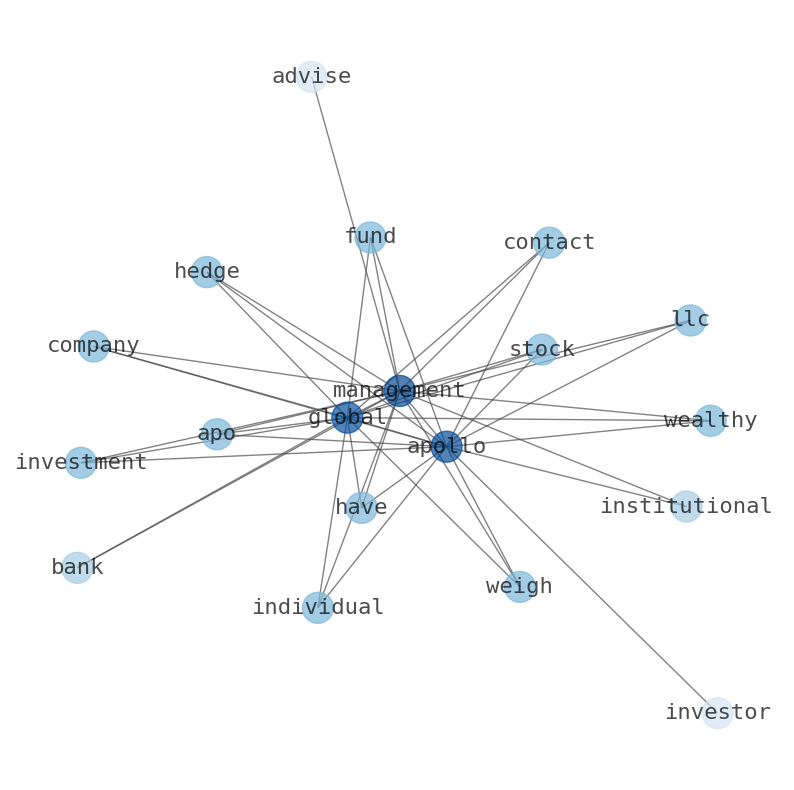

Apollo Global Management, Inc. is a private equity firm specializing in investments in credit, private equity and real estate markets. The firm provides its services to endowment and sovereign wealth funds, as well as other institutional and individual investors. The.

Today's Summary

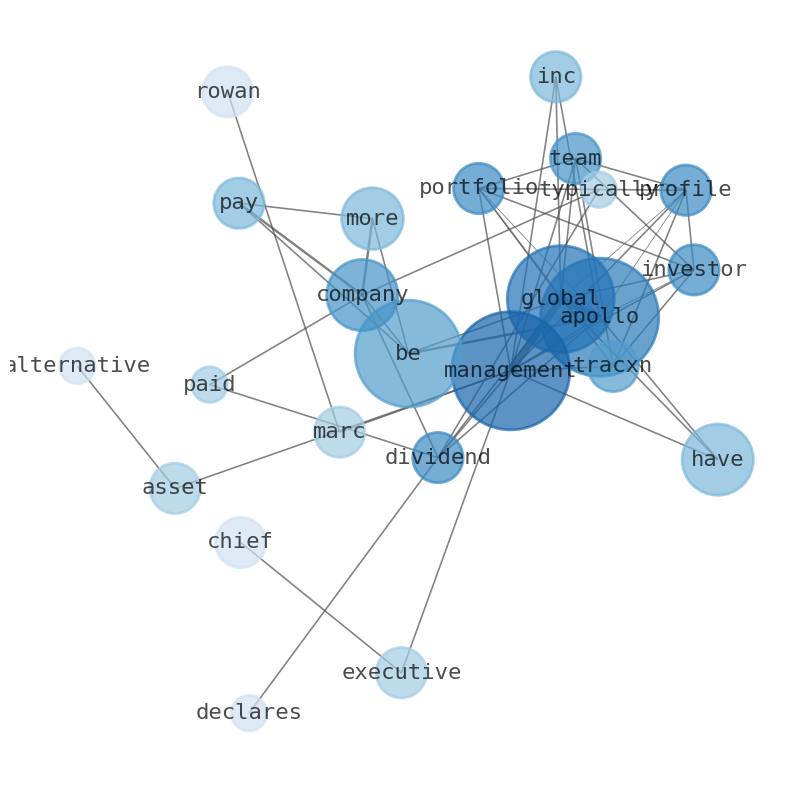

TracXn. analyzes 4 warning signs for Apollo Global Management that we strongly recommend you have a look at. Company is paying out more than half its profits to shareholders.

Today's News

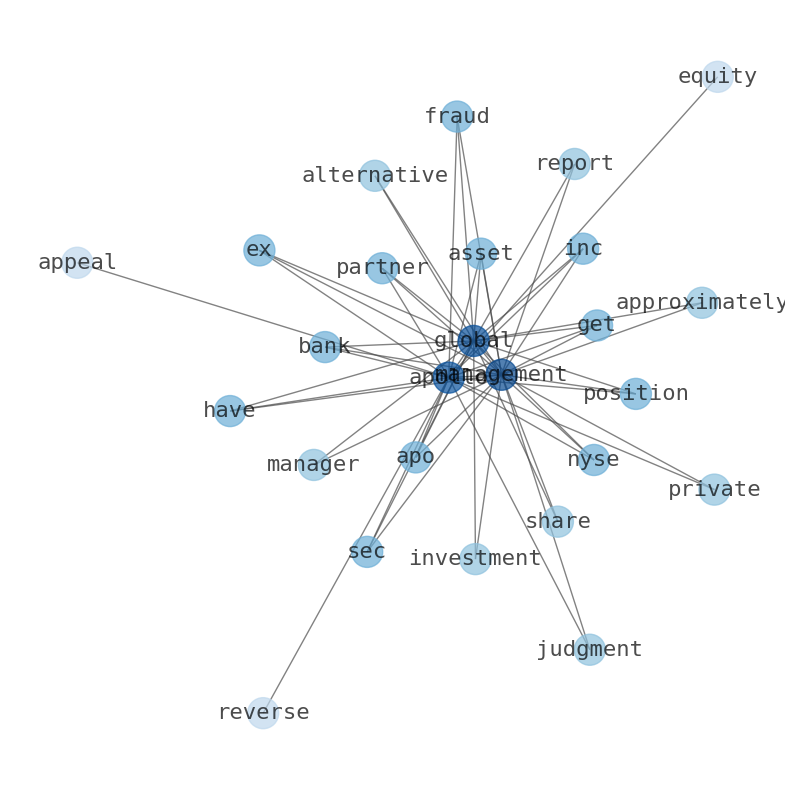

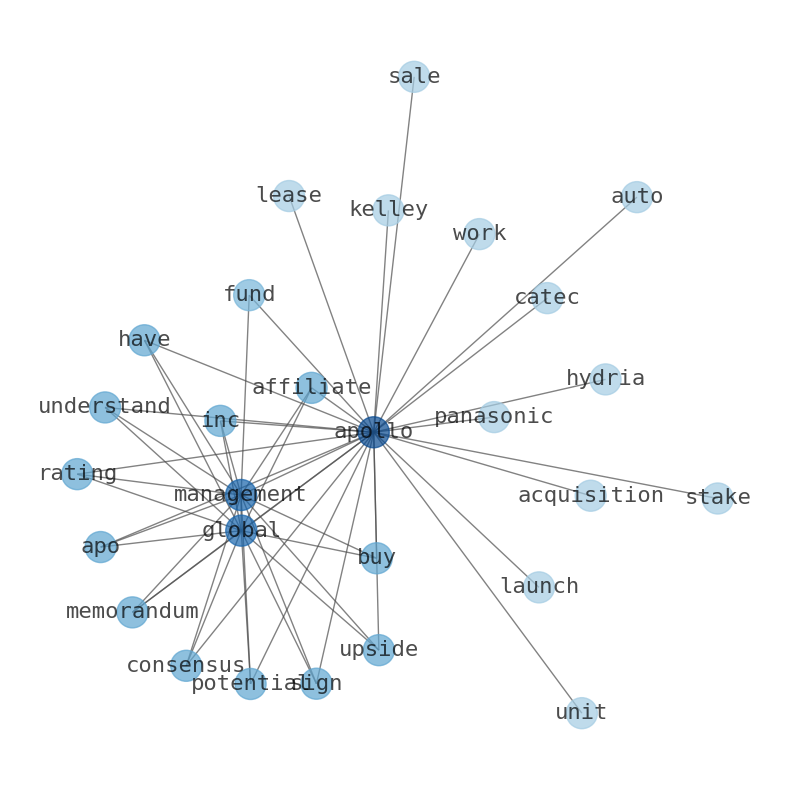

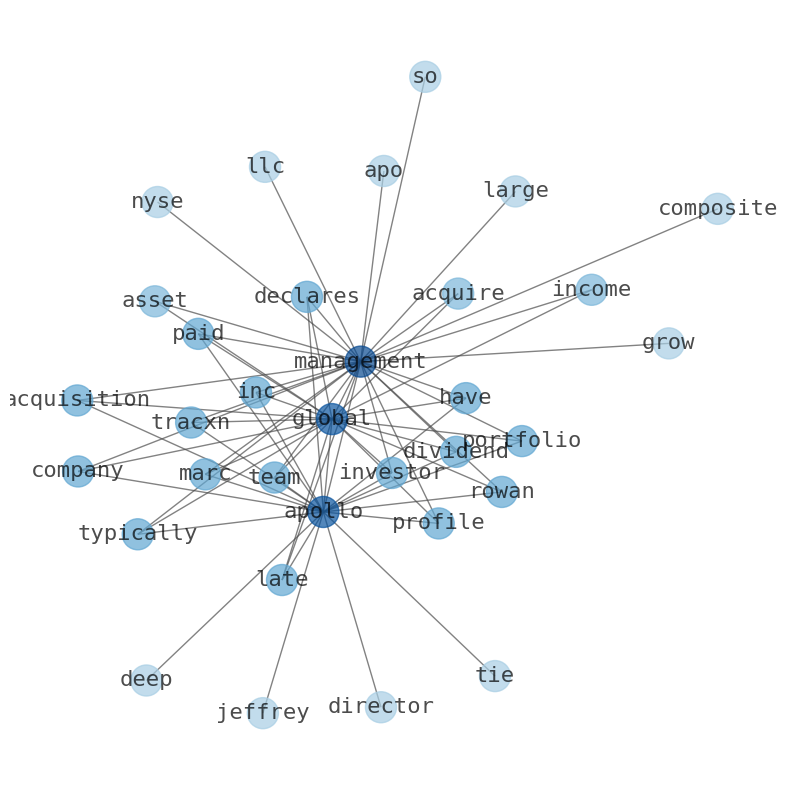

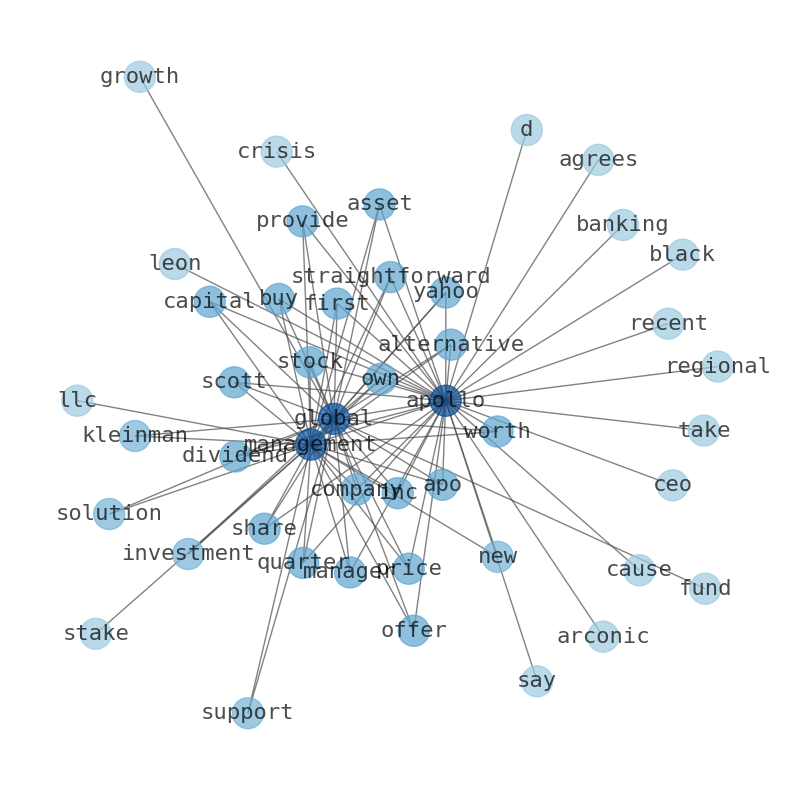

Apollo Global Management - investor profile, portfolio & team - tracxn. apollo global management - Investor Profile, Portfolio & Team - TracXn. Their latest acquisition was of Composite Advanced Technologies. Apollo Global Management declares $0.43 dividend. Dividends are typically paid out of company income, so if a company pays out more than earned, its usually at a higher risk of being cut. Clayton, Dubilier & Rice and CVC Capital Partners have accumulated more cash for their flagship buyout. Earnings per share have been declining and the company is paying out more than half its profits to shareholders. Our analysis shows 4 warning signs for Apollo Global Management that we strongly recommend you have a look at. Apollo Global Management is one of the largest alternative asset managers in the world, boasting about $631 billion in assets under management at the end of September. Rising interest rates will trigger a shift in the balance of value from equity to debt over the next few years, according to Apollo Global Management Chief Executive Marc Rowan. Yousif Capital Management LLC grew its holdings in Apollo Global Management, Inc. (NYSE:APO) Parkside Financial Bank & Trust increased its stake in shares by 7,183.3% in the first quarter. Jim Belardi is a member of Apollo Global Management, Inc.s (“AGM”) board of directors. Marc Rowan is a Co-Founder and the Chief Executive Officer of the company. Apollo Global Management has acquired Verizons media group for $5 billion. Michaels to be acquired by Apollo for $3.3 billion. Leon Black named independent directors to Apollo despite deep ties to Jeffrey Epstein.

Stock Profile

"Apollo Global Management, Inc. is a private equity firm specializing in investments in credit, private equity and real estate markets. The firm's private equity investments include traditional buyouts, recapitalization, distressed buyouts and debt investments in real estate, corporate partner buyouts, distressed asset, corporate carve-outs, middle market, growth capital, turnaround, bridge, corporate restructuring, special situation, acquisition, and industry consolidation transactions. The firm provides its services to endowment and sovereign wealth funds, as well as other institutional and individual investors. It manages client focused portfolios. The firm launches and manages hedge funds for its clients. It also manages real estate funds and private equity funds for its clients. The firm invests in the fixed income and alternative investment markets across the globe. Its fixed income investments include income-oriented senior loans, bonds, collateralized loan obligations, structured credit, opportunistic credit, non-performing loans, distressed debt, mezzanine debt, and value oriented fixed income securities. The firm seeks to invest in chemicals, commodities, consumer and retail, oil and gas, metals, mining, agriculture, commodities, distribution and transportation, financial and business services, manufacturing and industrial, media distribution, cable, entertainment and leisure, telecom, technology, natural resources, energy, packaging and materials, and satellite and wireless industries. It also focuses on clean energy, sustainable industry, climate solutions, energy transition, industrial decarbonization, sustainable mobility, sustainable resource use, and sustainable real estate. It seeks to invest in companies based in across Africa, North America with a focus on United States, and Europe. The firm also makes investments outside North America, primarily in Western Europe and Asia. It employs a combination of contrarian, value, and distressed strategies to make its investments. The firm seeks to make investments in the range of $10 million and $1500 million. The firm seeks to invest in companies with Enterprise value between $750 million to $2500 million. The firm conducts an in-house research to create its investment portfolio. It seeks to acquire minority and majority positions in its portfolio companies. Apollo Global Management, Inc. was founded in 1990 and is headquartered in New York, New York with additional offices in North America, Asia , India and Europe."

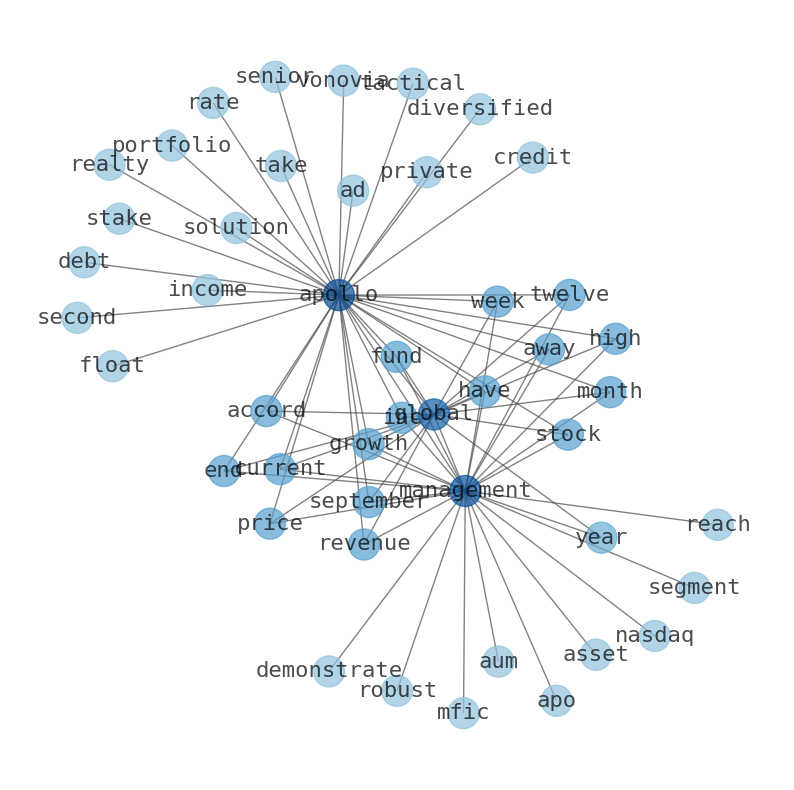

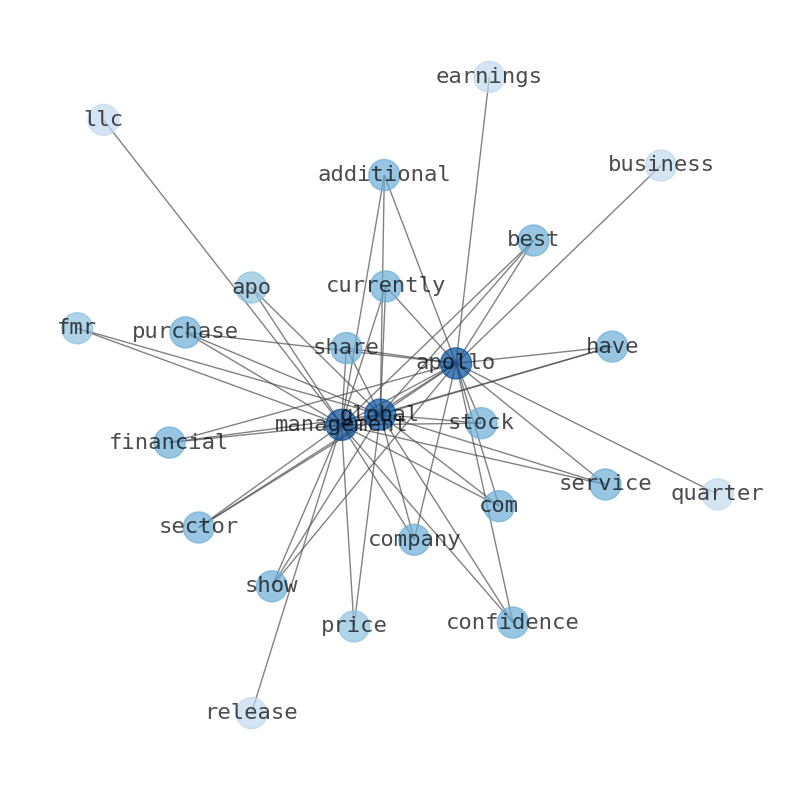

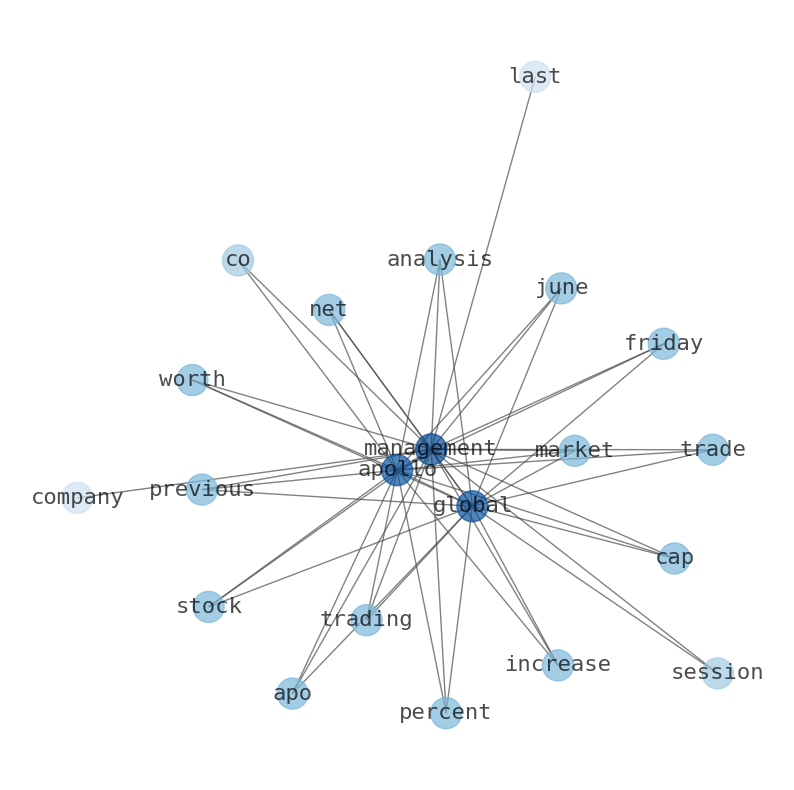

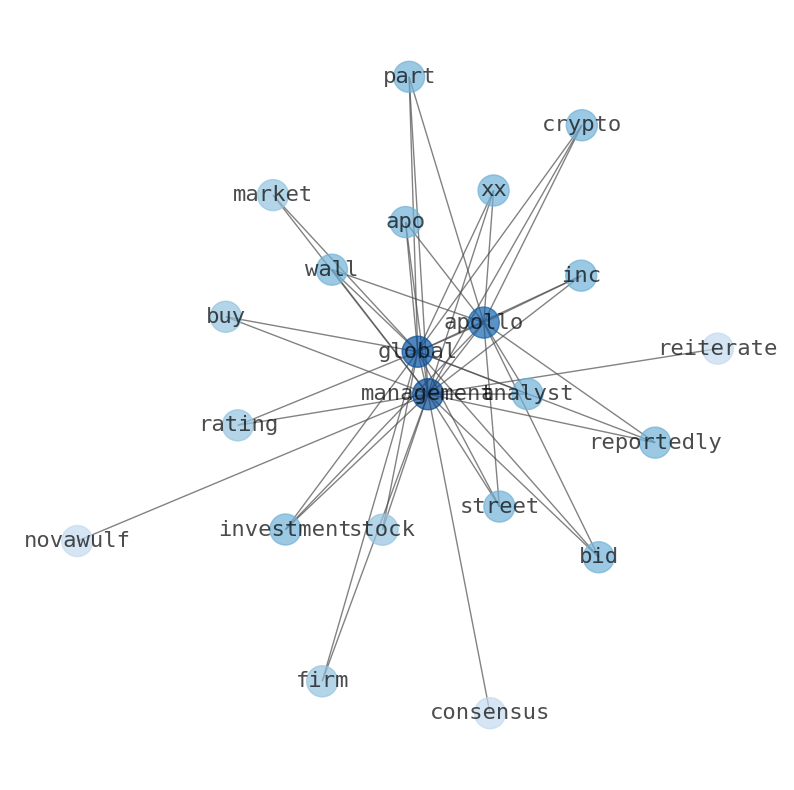

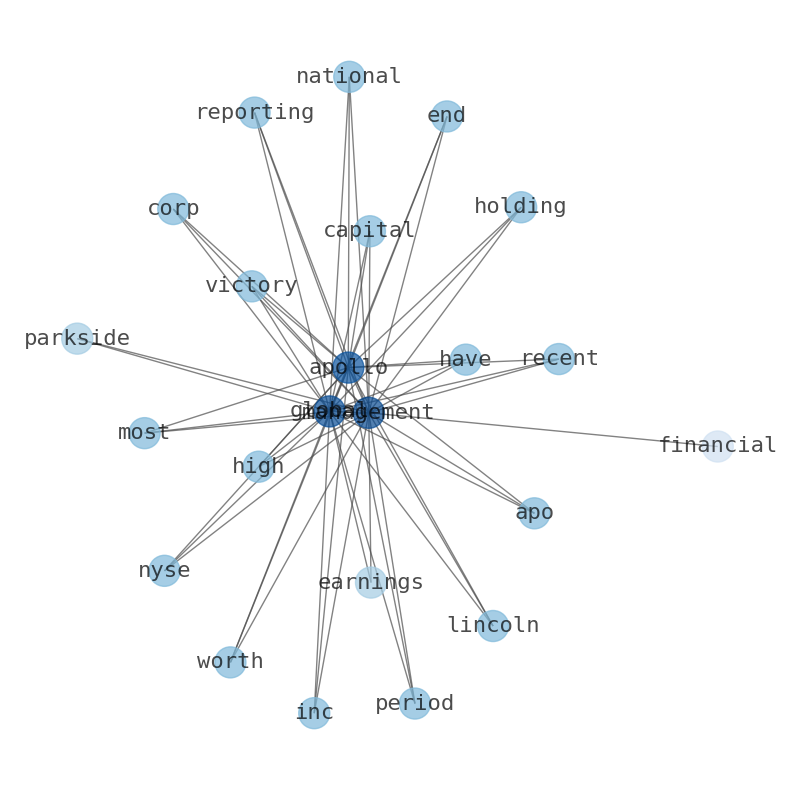

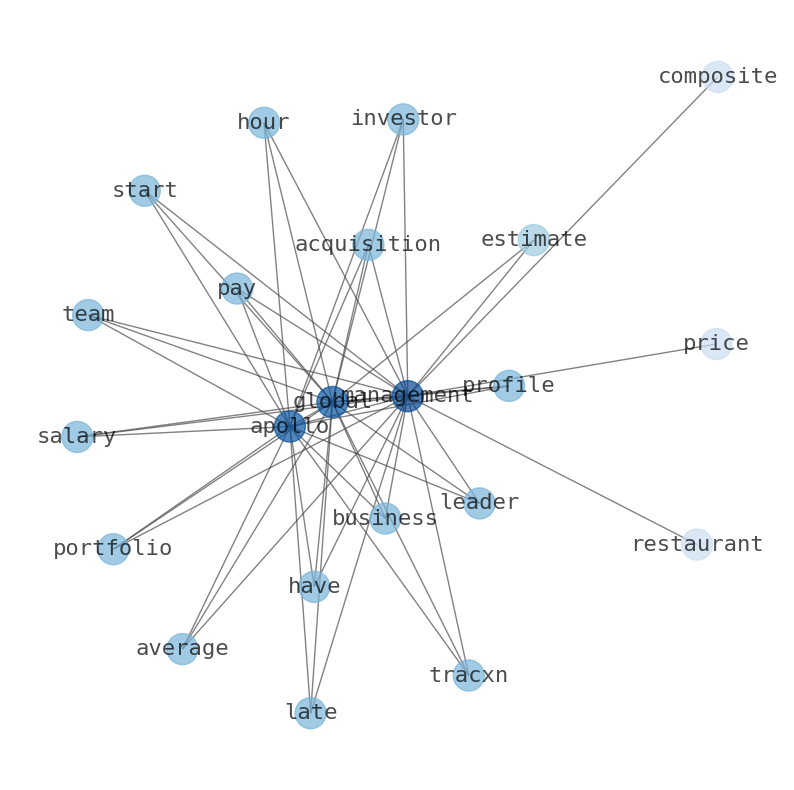

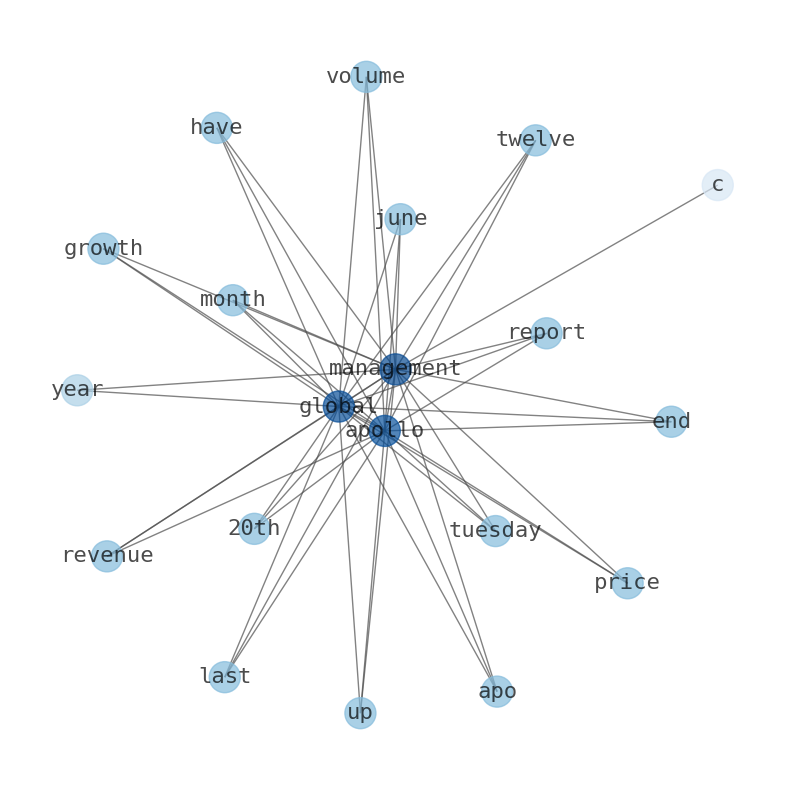

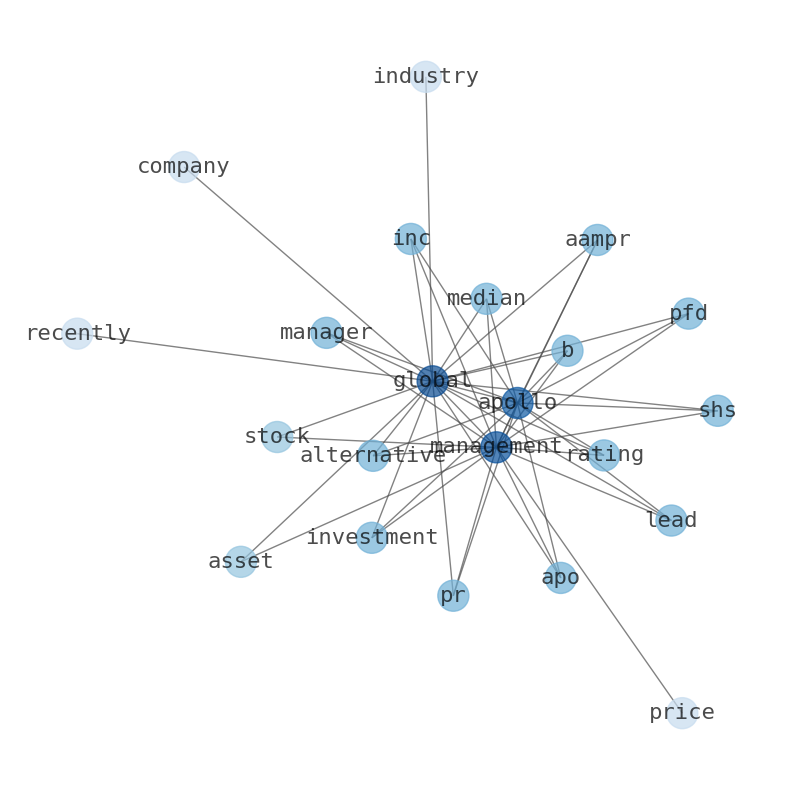

Keywords

Are looking for the most relevant information about Apollo Global Management? Investor spend a lot of time searching for information to make investment decisions in Apollo Global Management. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Apollo Global Management are: Apollo, Management, Global, company, pay, management, Capital, and the most common words in the summary are: apollo, management, global, inc, stock, market, job, . One of the sentences in the summary was: Company is paying out more than half its profits to shareholders.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #apollo #management #global #inc #stock #market #job.

Read more →Related Results

Apollo Global Management

Open: 109.22 Close: 110.41 Change: 1.19

Read more →

Apollo Global Management

Open: 99.33 Close: 98.01 Change: -1.32

Read more →

Apollo Global Management

Open: 86.84 Close: 88.32 Change: 1.48

Read more →

Apollo Global Management

Open: 85.15 Close: 85.36 Change: 0.21

Read more →

Apollo Global Management

Open: 84.0 Close: 83.64 Change: -0.36

Read more →

Apollo Global Management

Open: 72.72 Close: 72.98 Change: 0.26

Read more →

Apollo Global Management

Open: 63.65 Close: 64.04 Change: 0.39

Read more →

Apollo Global Management

Open: 100.78 Close: 99.57 Change: -1.21

Read more →

Apollo Global Management

Open: 91.9 Close: 91.45 Change: -0.45

Read more →

Apollo Global Management

Open: 84.97 Close: 84.96 Change: -0.01

Read more →

Apollo Global Management

Open: 83.23 Close: 82.36 Change: -0.87

Read more →

Apollo Global Management

Open: 78.42 Close: 81.16 Change: 2.74

Read more →

Apollo Global Management

Open: 63.52 Close: 63.19 Change: -0.33

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo