The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Apollo Global Management

Youtube Subscribe

Open: 100.78 Close: 99.57 Change: -1.21

Are you looking for information about Apollo Global Management? We programmed an AI to summarize it for you.

How much time have you spent trying to decide whether investing in Apollo Global Management? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Apollo Global …

Stock Summary

Apollo Global Management, Inc. is a private equity firm specializing in investments in credit, private equity and real estate markets. The firm provides its services to endowment and sovereign wealth funds, as well as other institutional and individual investors. The.

Today's Summary

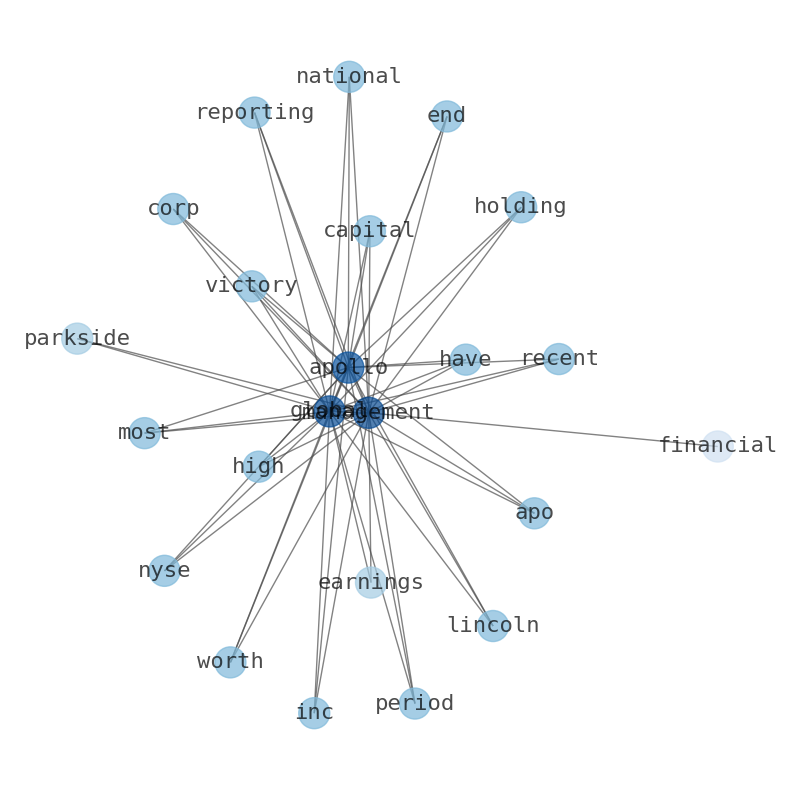

Lincoln National Corp Purchases 1,108 Shares of Apollo Global Management, Inc. Lincoln National Corps holdings in Apollo Global management were worth $386,000 at the end of the most recent reporting period. Parkside Financial Bank & Trust raised its position by 7,183.3% in the 1st quarter.

Today's News

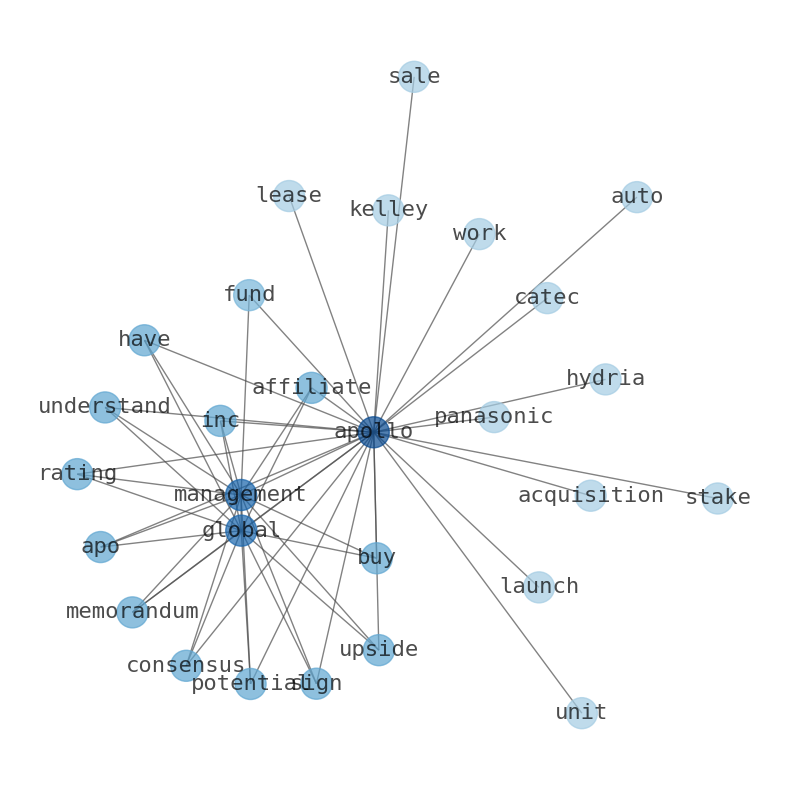

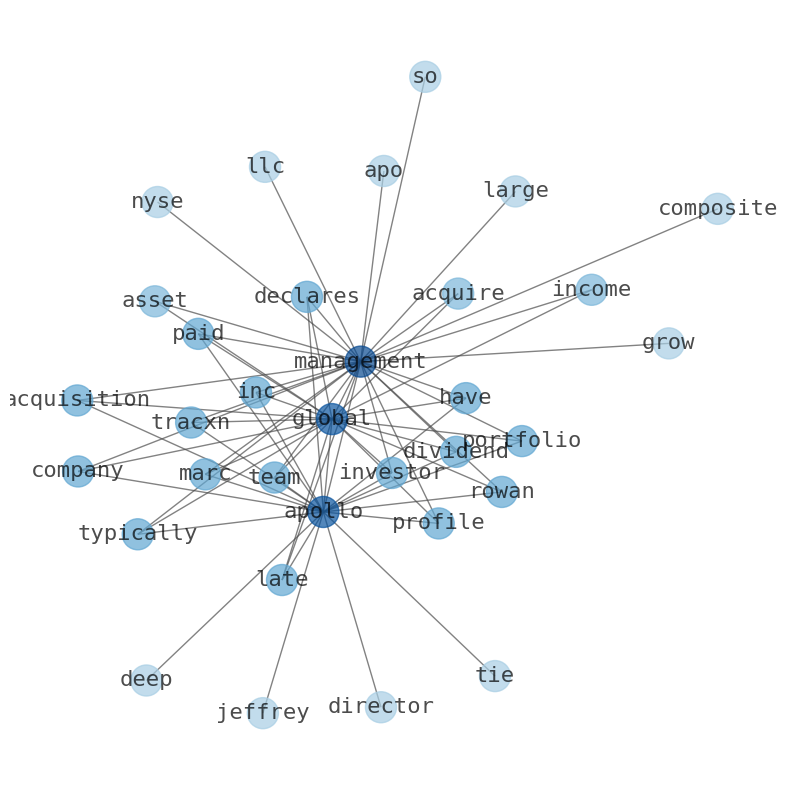

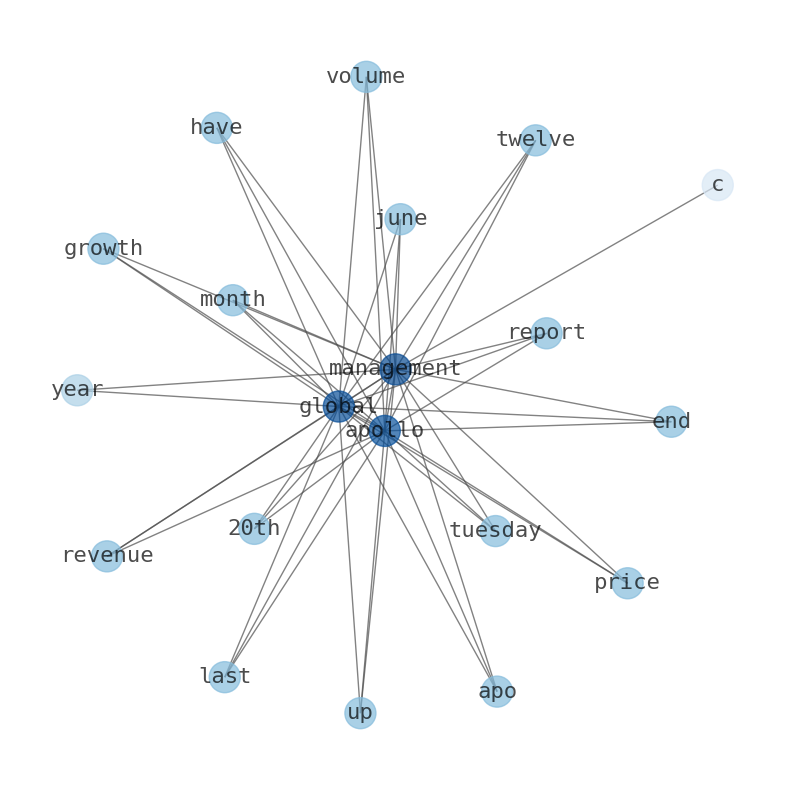

Lincoln National Corp Purchases 1,108 Shares of Apollo Global Management, Inc. (NYSE:APO) Lincoln National Corps holdings in Apollo Global management were worth $386,000 at the end of the most recent reporting period. Parkside Financial Bank & Trust raised its position by 7,183.3% in the 1st quarter. CFO Martin Kelly sold 20,000 shares of the stock in a transaction in which Ford Mobile Robotics Finn.] Bayer tennis body Score Vulcanimeiitutional The price of APO is down 0.0% at $99.98.98. With a volume of 594,875, the price of Apollo Global Management is down. Rowan is the chief executive officer. Apollos flexible capital and partnership-driven approach helped two supply chain leaders, DCLI and Blume Global, overcome the challenges of COVID and prepare for future growth. Hear from Akila on private investment grade credit, asset-backed finance and more. Victory Capital beats Apollo Global Management on 9 of the 17 factors. Victory Capital has lower revenue, but higher earnings than Apollo Global management. Victory capital has higher earnings and higher price-to-earnings than Apollo.

Stock Profile

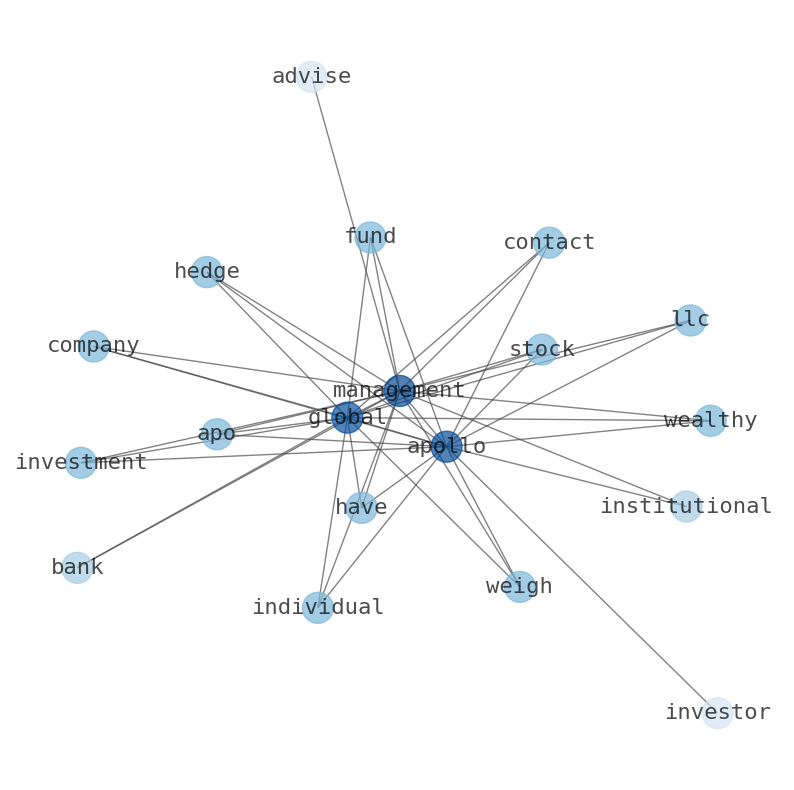

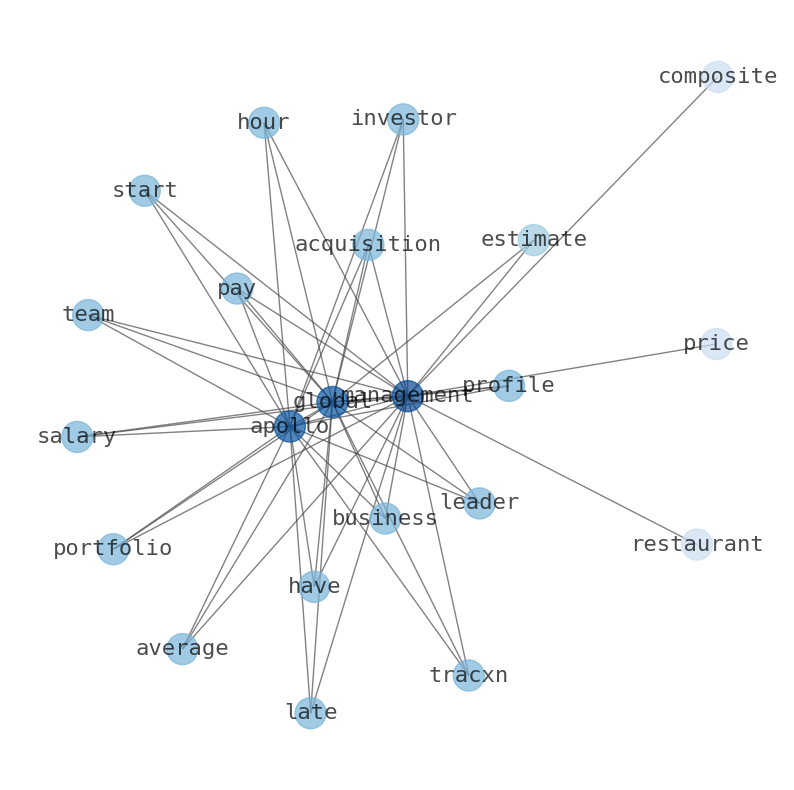

"Apollo Global Management, Inc. is a private equity firm specializing in investments in credit, private equity and real estate markets. The firm's private equity investments include traditional buyouts, recapitalization, distressed buyouts and debt investments in real estate, corporate partner buyouts, distressed asset, corporate carve-outs, middle market, growth capital, turnaround, bridge, corporate restructuring, special situation, acquisition, and industry consolidation transactions. The firm provides its services to endowment and sovereign wealth funds, as well as other institutional and individual investors. It manages client focused portfolios. The firm launches and manages hedge funds for its clients. It also manages real estate funds and private equity funds for its clients. The firm invests in the fixed income and alternative investment markets across the globe. Its fixed income investments include income-oriented senior loans, bonds, collateralized loan obligations, structured credit, opportunistic credit, non-performing loans, distressed debt, mezzanine debt, and value oriented fixed income securities. The firm seeks to invest in chemicals, commodities, consumer and retail, oil and gas, metals, mining, agriculture, commodities, distribution and transportation, financial and business services, manufacturing and industrial, media distribution, cable, entertainment and leisure, telecom, technology, natural resources, energy, packaging and materials, and satellite and wireless industries. It also focuses on clean energy, sustainable industry, climate solutions, energy transition, industrial decarbonization, sustainable mobility, sustainable resource use, and sustainable real estate. It seeks to invest in companies based in across Africa, North America with a focus on United States, and Europe. The firm also makes investments outside North America, primarily in Western Europe and Asia. It employs a combination of contrarian, value, and distressed strategies to make its investments. The firm seeks to make investments in the range of $10 million and $1500 million. The firm seeks to invest in companies with Enterprise value between $750 million to $2500 million. The firm conducts an in-house research to create its investment portfolio. It seeks to acquire minority and majority positions in its portfolio companies. Apollo Global Management, Inc. was founded in 1990 and is headquartered in New York, New York with additional offices in North America, Asia , India and Europe."

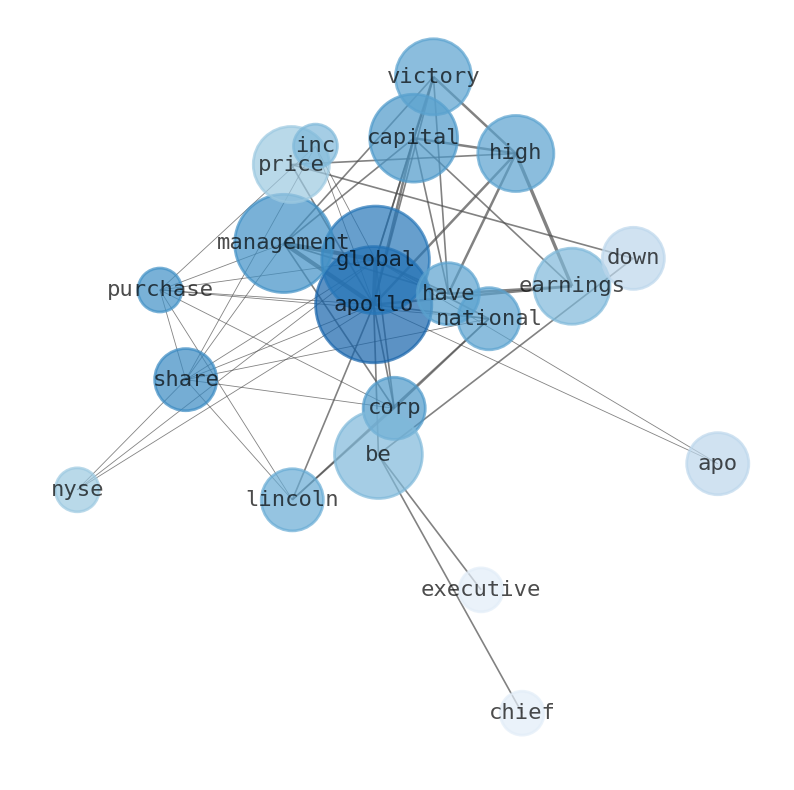

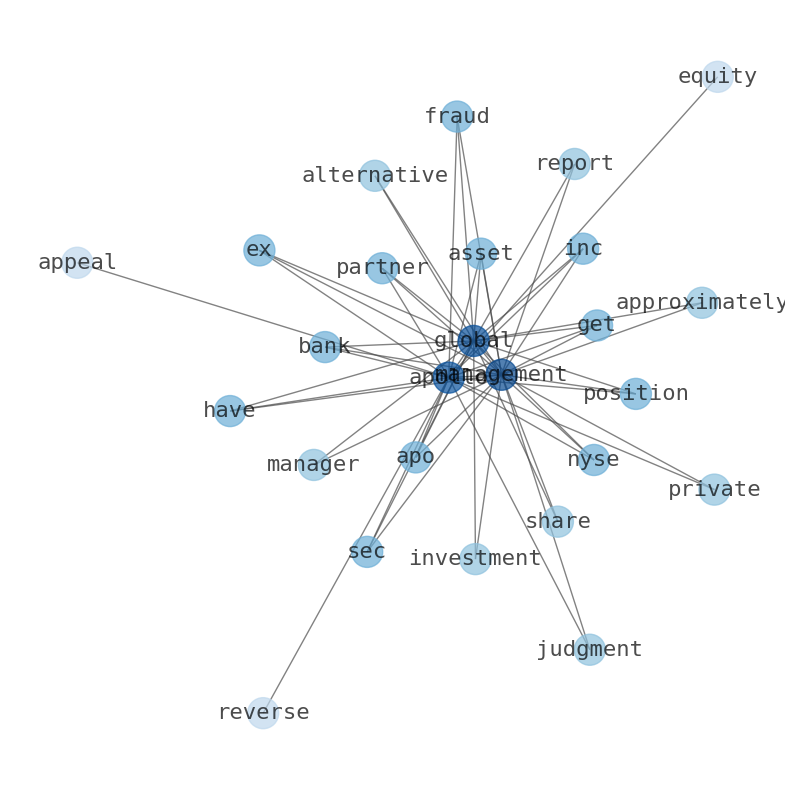

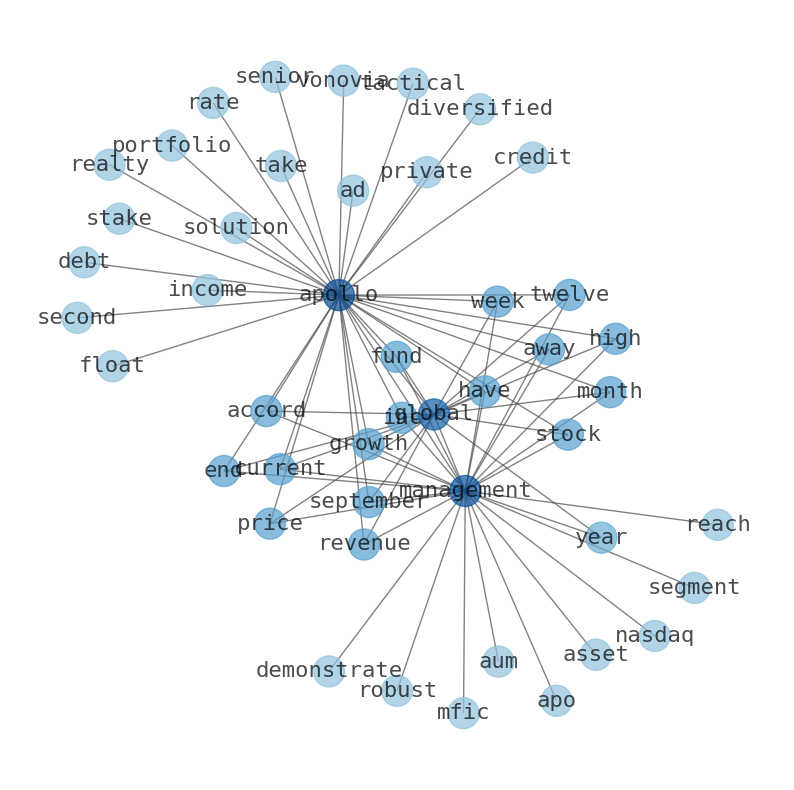

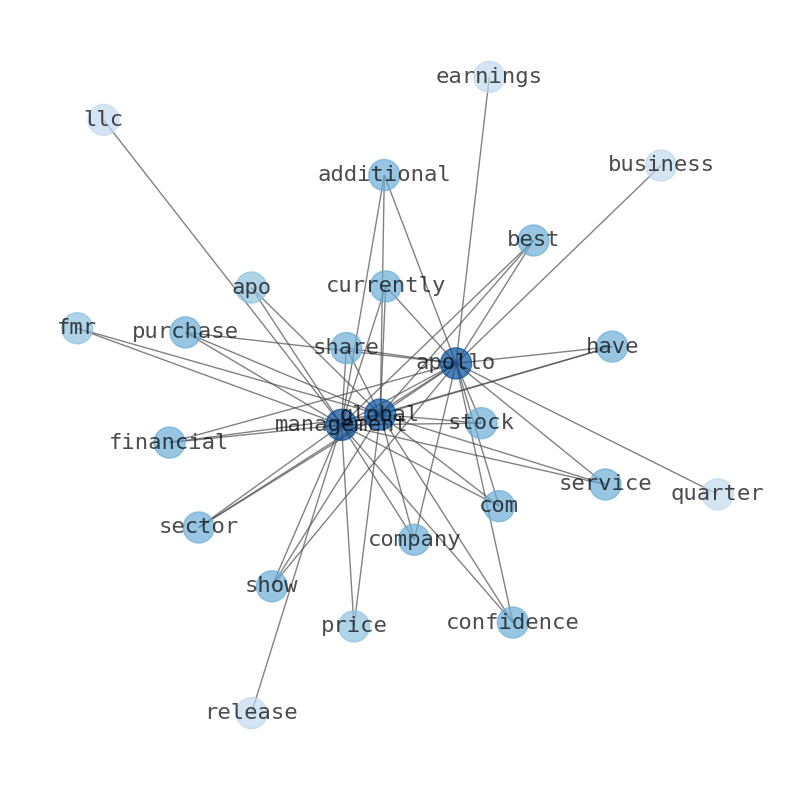

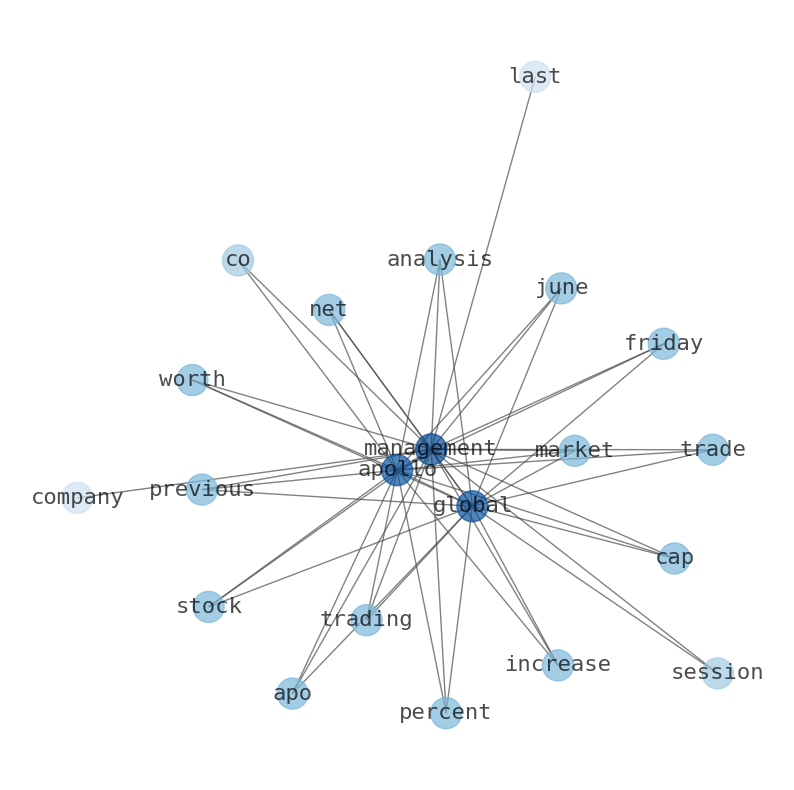

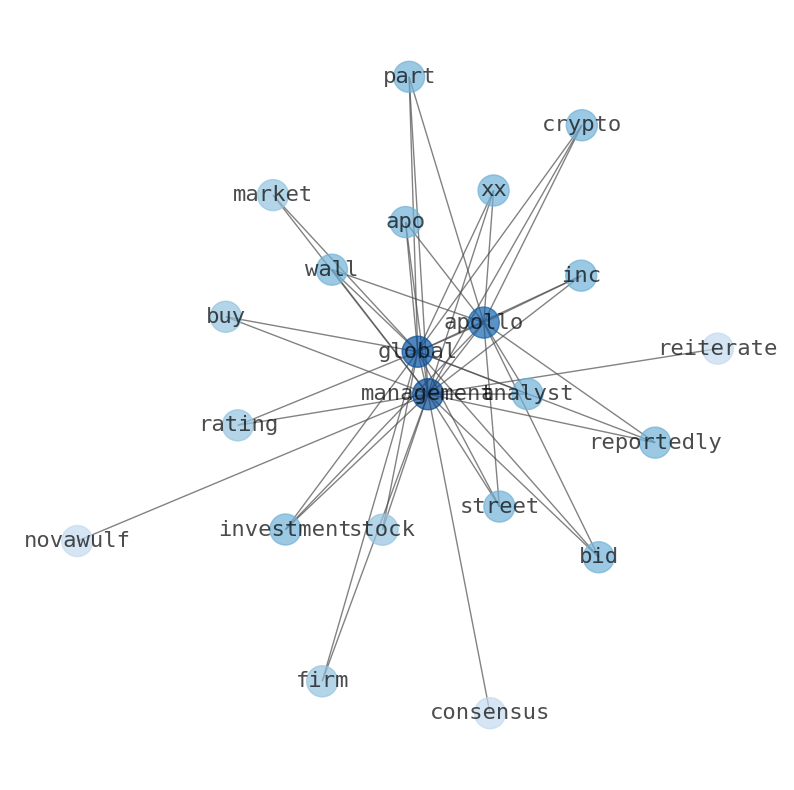

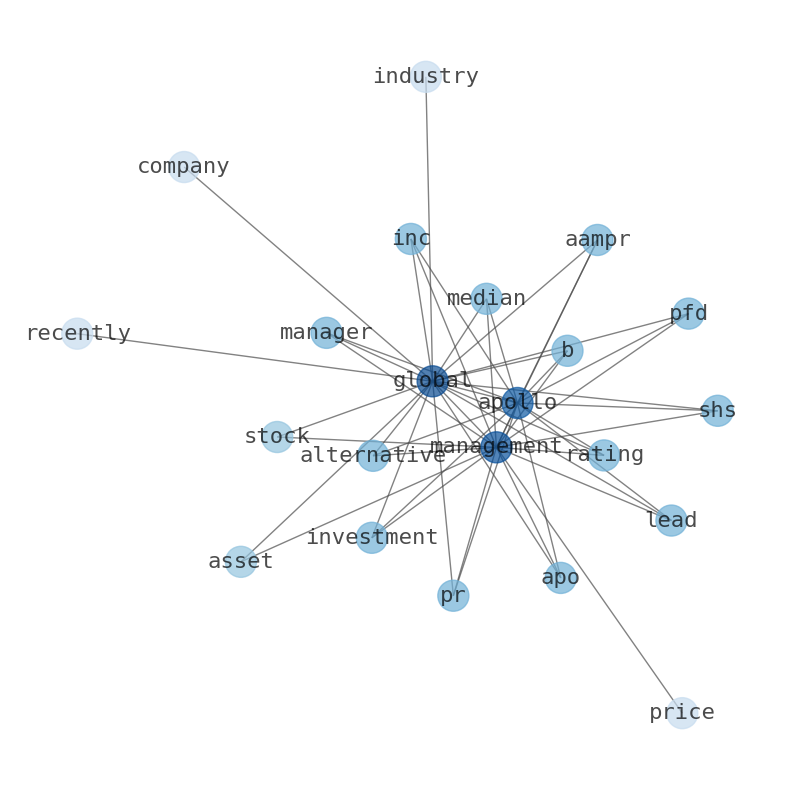

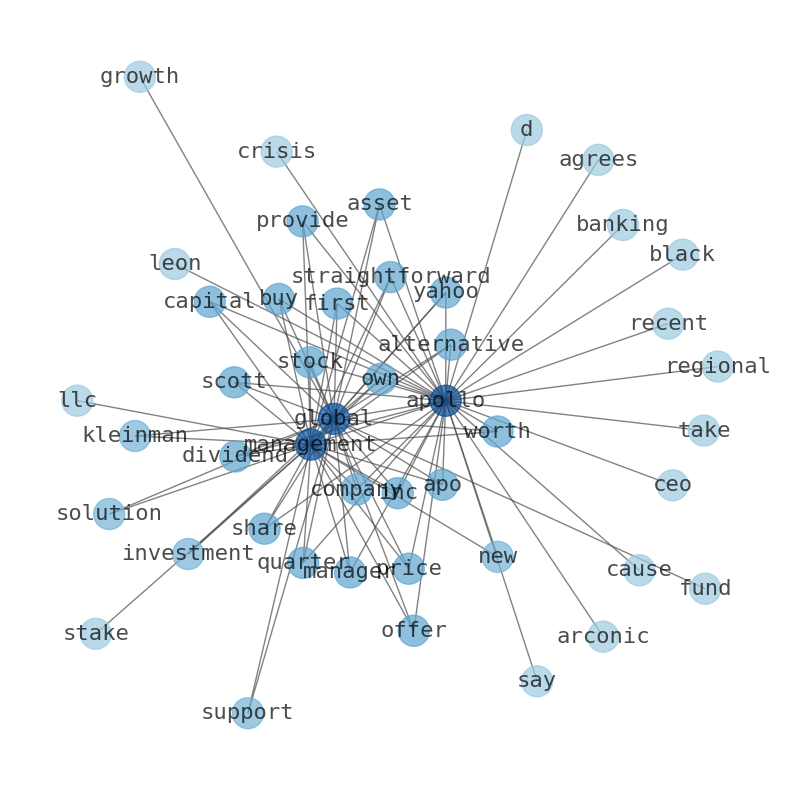

Keywords

The game is changing. There is a new strategy to evaluate Apollo Global Management fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Apollo Global Management are: Apollo, Global, Management, Victory, Lincoln, National, management, and the most common words in the summary are: apollo, management, global, job, private, fund, investment, . One of the sentences in the summary was: Lincoln National Corps holdings in Apollo Global management were worth $386,000 at the end of the most recent reporting period. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #apollo #management #global #job #private #fund #investment.

Read more →Related Results

Apollo Global Management

Open: 109.22 Close: 110.41 Change: 1.19

Read more →

Apollo Global Management

Open: 99.33 Close: 98.01 Change: -1.32

Read more →

Apollo Global Management

Open: 86.84 Close: 88.32 Change: 1.48

Read more →

Apollo Global Management

Open: 85.15 Close: 85.36 Change: 0.21

Read more →

Apollo Global Management

Open: 84.0 Close: 83.64 Change: -0.36

Read more →

Apollo Global Management

Open: 72.72 Close: 72.98 Change: 0.26

Read more →

Apollo Global Management

Open: 63.65 Close: 64.04 Change: 0.39

Read more →

Apollo Global Management

Open: 100.78 Close: 99.57 Change: -1.21

Read more →

Apollo Global Management

Open: 91.9 Close: 91.45 Change: -0.45

Read more →

Apollo Global Management

Open: 84.97 Close: 84.96 Change: -0.01

Read more →

Apollo Global Management

Open: 83.23 Close: 82.36 Change: -0.87

Read more →

Apollo Global Management

Open: 78.42 Close: 81.16 Change: 2.74

Read more →

Apollo Global Management

Open: 63.52 Close: 63.19 Change: -0.33

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo