The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Apollo Global Management

Youtube Subscribe

Open: 84.0 Close: 83.64 Change: -0.36

Don't invest before reading what an AI found about Apollo Global Management.

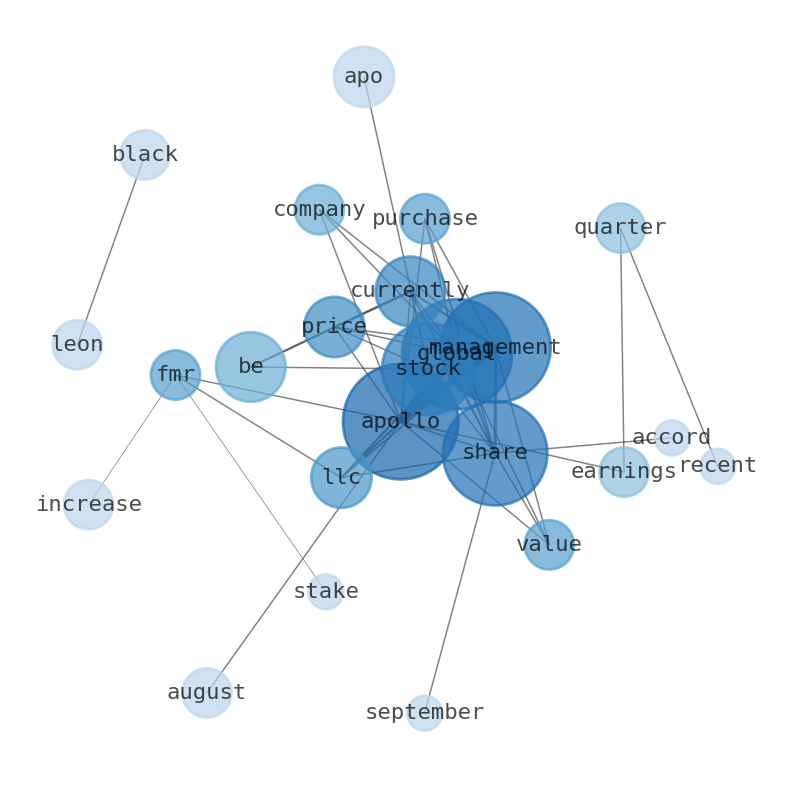

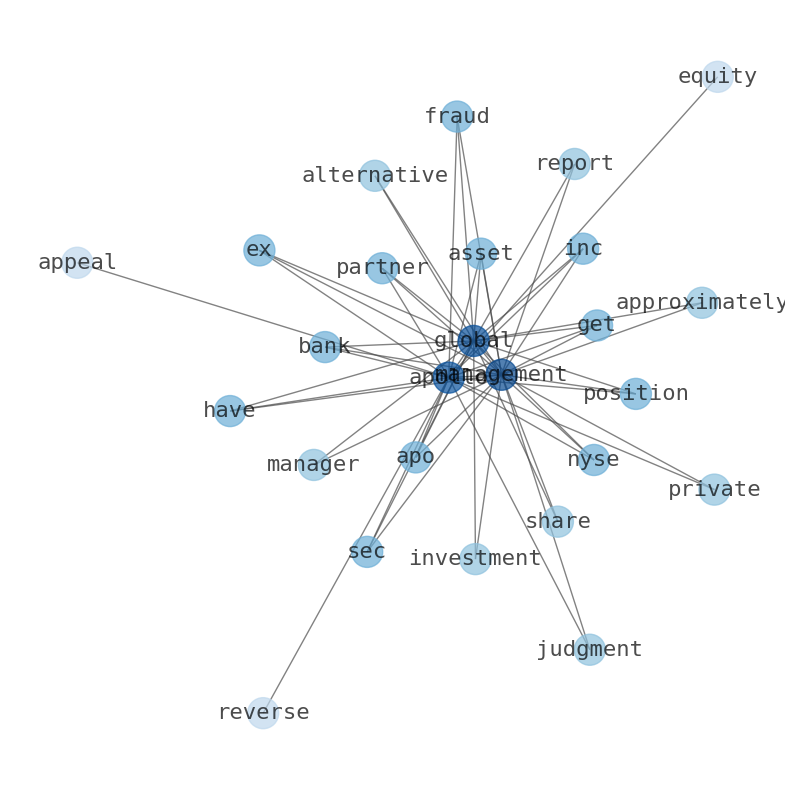

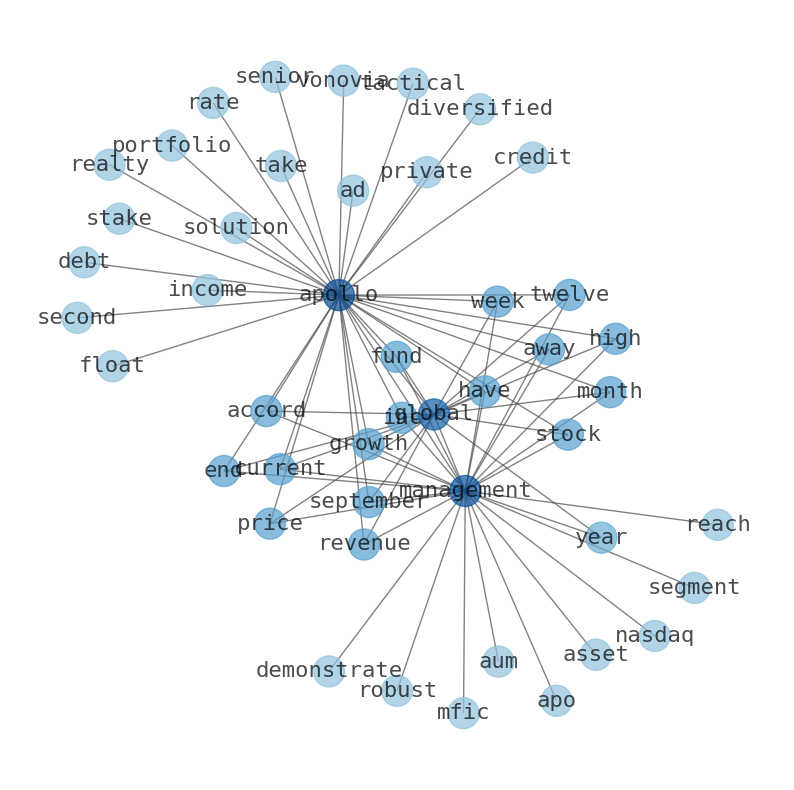

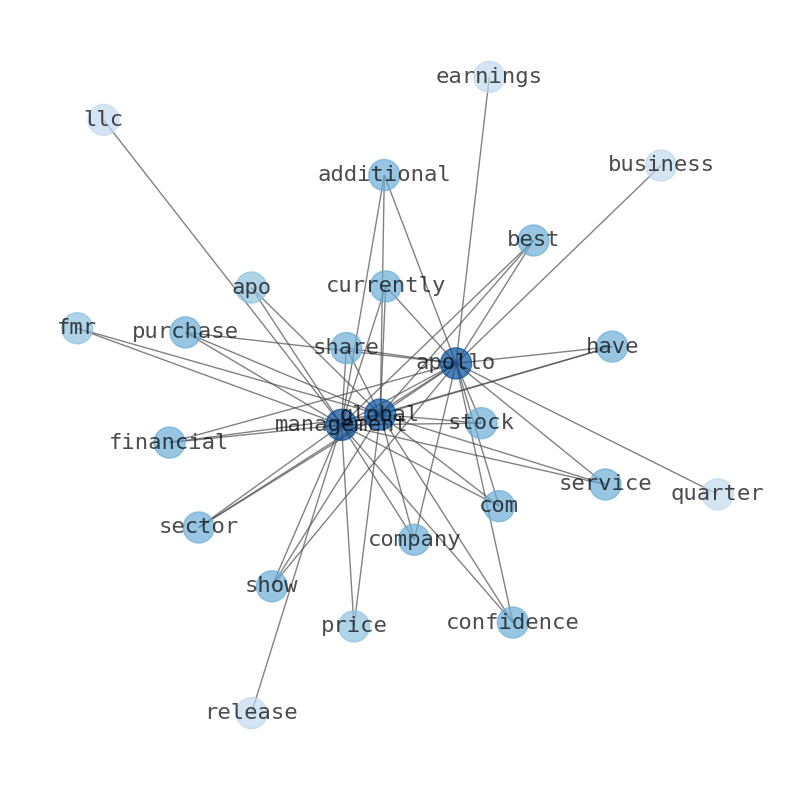

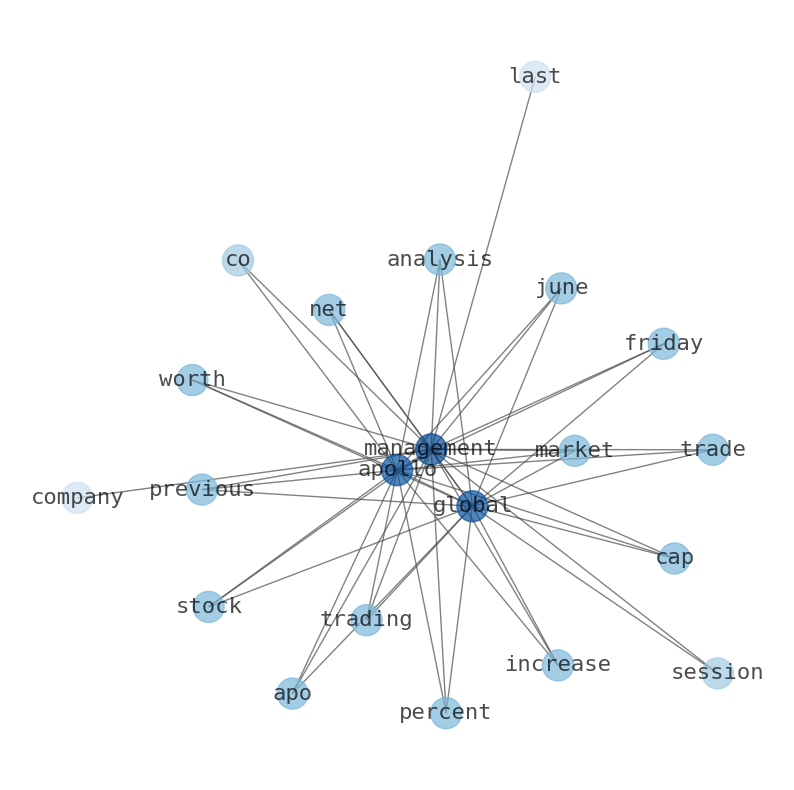

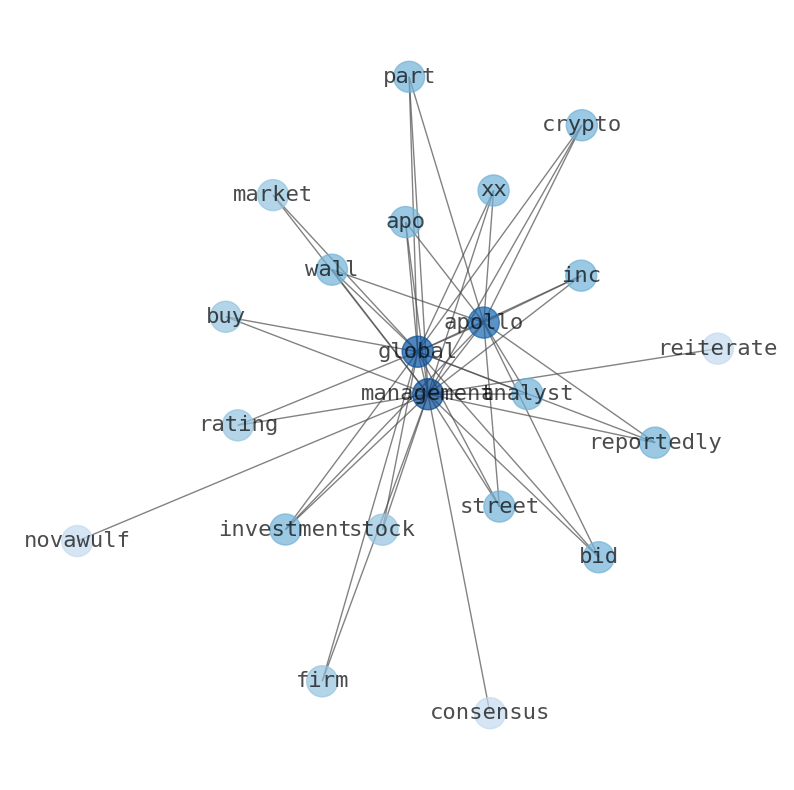

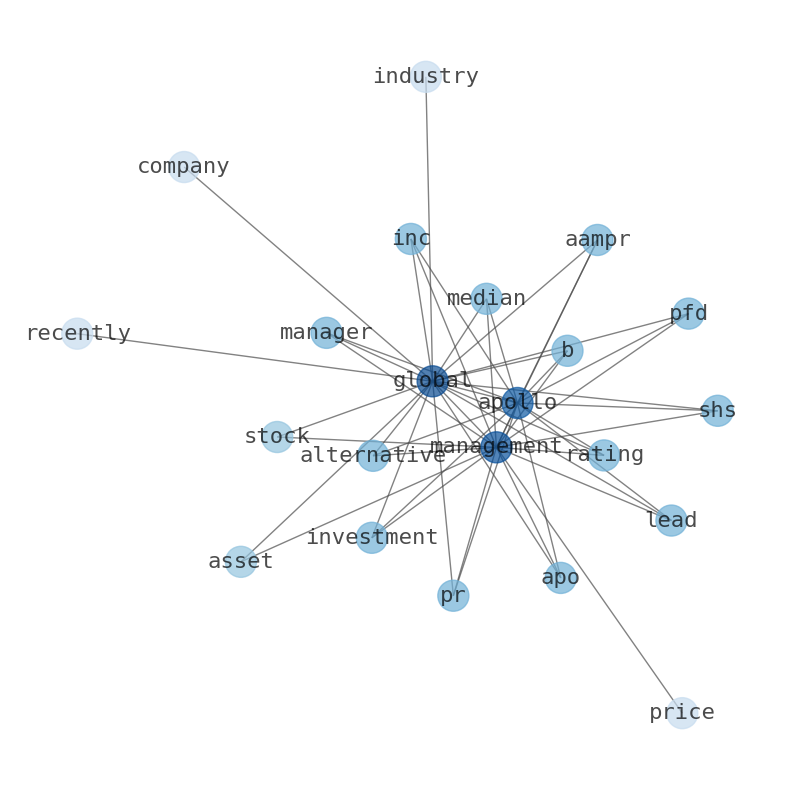

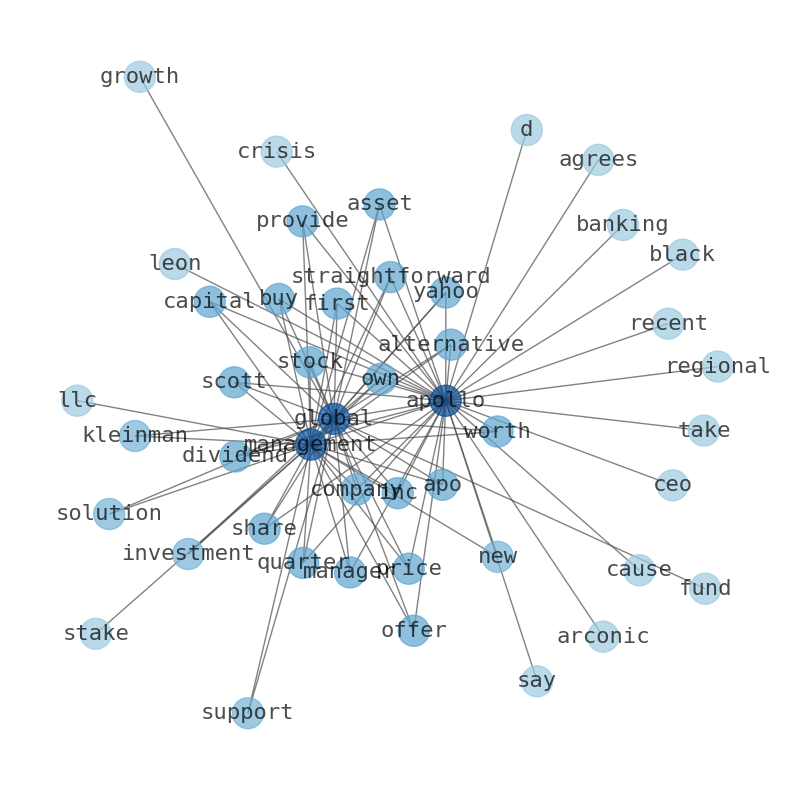

Are looking for the most relevant information about Apollo Global Management? Investor spend a lot of time searching for information to make investment decisions in Apollo Global Management. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Apollo Global Management are: share, Apollo, Global, stock, Management, currently, price, and the most common words in the summary are: apollo, management, global, stock, market, price, job, . One of the sentences in the summary was: Leon Black stepped down as CEO and chairman …

Stock Summary

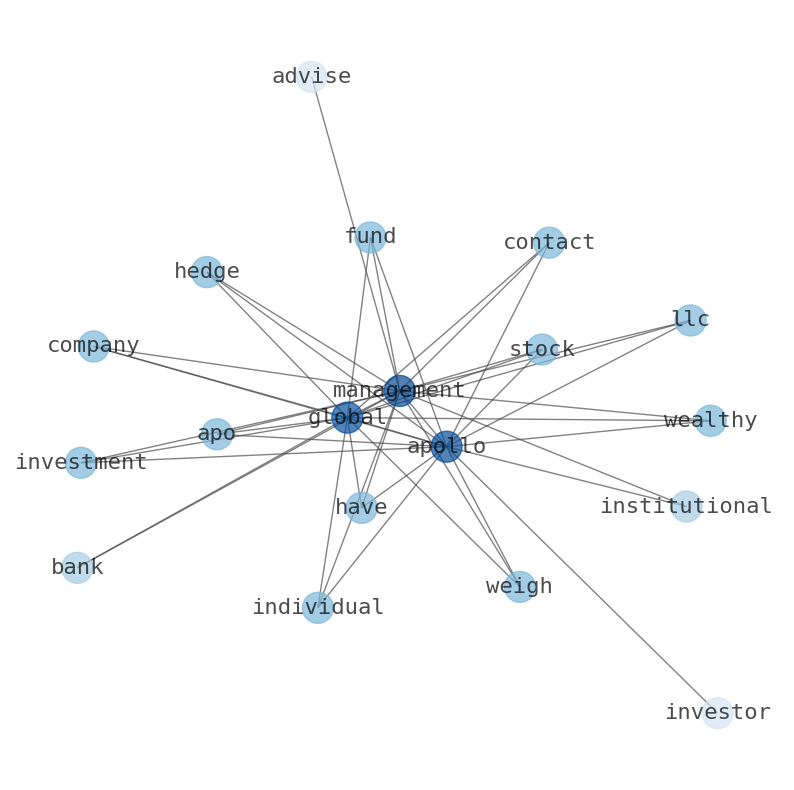

Apollo Global Management, Inc. is a private equity firm specializing in investments in credit, private equity and real estate markets. The firm provides its services to endowment and sovereign wealth funds, as well as other institutional and individual investors. The.

Today's Summary

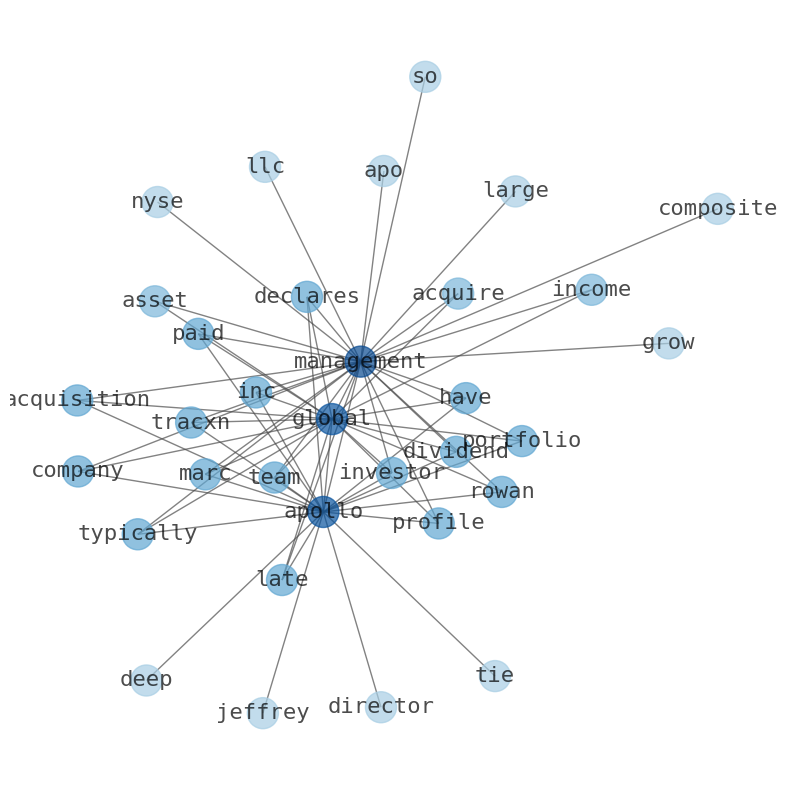

Fmr LLC now owns 8,830,094 shares of Apollo Global Managements stock, having purchased an additional 3,872,458 shares. Leon Black stepped down as CEO and chairman after a company investigation exposed $158 million in fees he paid to Jeffrey Epstein.

Today's News

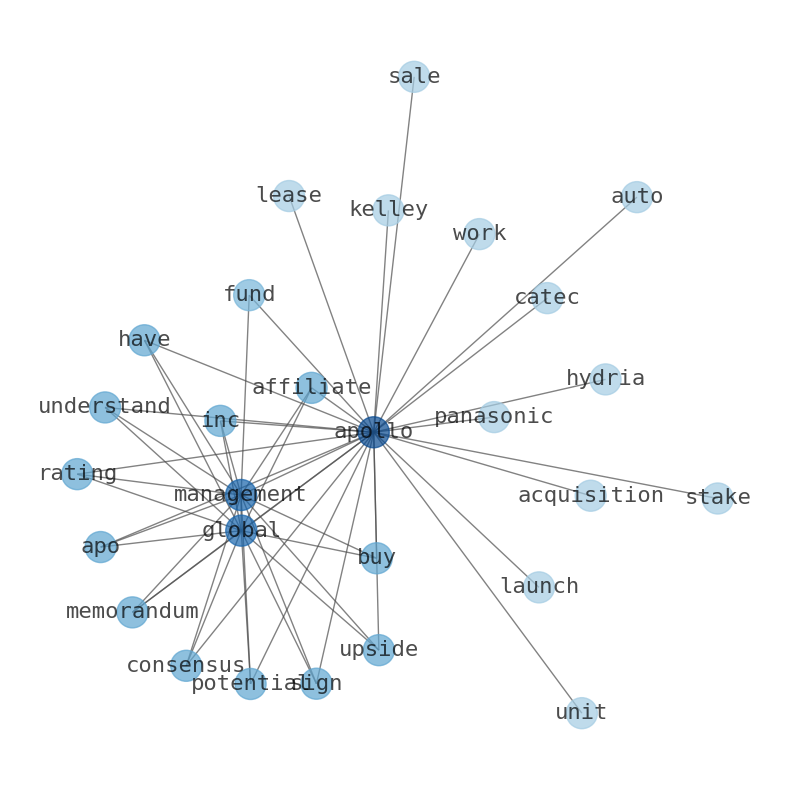

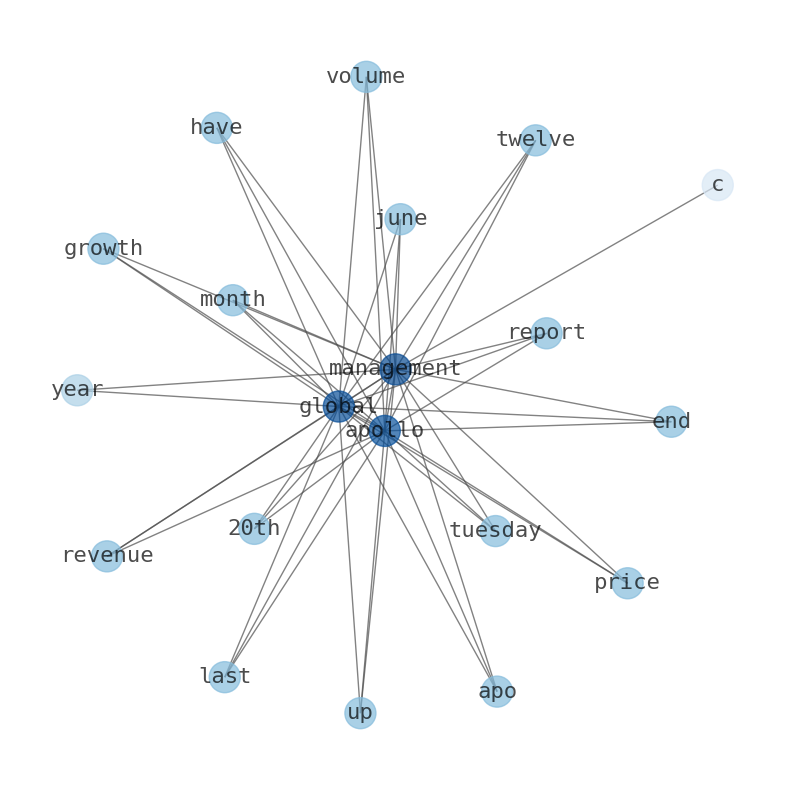

fmr llc increases stake in apollo global management, showing confidence in financial services sector - best stocks. Fmr LLC now owns 8,830,094 shares of Apollo Global Managements stock, having purchased an additional 3,872,458 shares. Apollo Global Management released its earnings results for the most recent quarter on August 3rd. Apollos second-quarter earnings surge 75% on upbeat annuities business. US regulator targets private equity and hedge funds The US Securities and Exchange Commission wants more transparency for investors. LPL Financial LLC purchases 3,708 shares of Apollo Global Management, Inc. (nyse:apo) - defense world.com. BMO Capital Markets lifted their price target on shares of Apollo Global Management from $89.00 to $96.00 and gave the company an “outperform” rating. StockNews.com began coverage on shares on Thursday, August 17th. In other Apollo Global management news, insider Joshua Harris sold 300,000 shares of the business. Investors should exercise caution in stocks during market corrections, making it an attractive investment option for long-term portfolios. Leon Black stepped down as CEO and chairman of Apollo Global Management in 2021 following a company investigation that exposed $158 million in fees he paid to Jeffrey Epstein. Leon Black Struck $62.5 million settlement Allowing him To Evade Potential Epstein-Related Litigation. The value of Apollo Global Management shares will drop by -4.18% and reach $ 80.14 per share by September 3, 2023. According to our current APO stock forecast, the value of. Apollo Global. Management shares currently. currently. are currently $83.63. The price of Apollo Global Management stock is expected to increase by -5.45% in the next year. This is because the price of APO stock is currently not a good stock to buy.

Stock Profile

"Apollo Global Management, Inc. is a private equity firm specializing in investments in credit, private equity and real estate markets. The firm's private equity investments include traditional buyouts, recapitalization, distressed buyouts and debt investments in real estate, corporate partner buyouts, distressed asset, corporate carve-outs, middle market, growth capital, turnaround, bridge, corporate restructuring, special situation, acquisition, and industry consolidation transactions. The firm provides its services to endowment and sovereign wealth funds, as well as other institutional and individual investors. It manages client focused portfolios. The firm launches and manages hedge funds for its clients. It also manages real estate funds and private equity funds for its clients. The firm invests in the fixed income and alternative investment markets across the globe. Its fixed income investments include income-oriented senior loans, bonds, collateralized loan obligations, structured credit, opportunistic credit, non-performing loans, distressed debt, mezzanine debt, and value oriented fixed income securities. The firm seeks to invest in chemicals, commodities, consumer and retail, oil and gas, metals, mining, agriculture, commodities, distribution and transportation, financial and business services, manufacturing and industrial, media distribution, cable, entertainment and leisure, telecom, technology, natural resources, energy, packaging and materials, and satellite and wireless industries. It also focuses on clean energy, sustainable industry, climate solutions, energy transition, industrial decarbonization, sustainable mobility, sustainable resource use, and sustainable real estate. It seeks to invest in companies based in across Africa, North America with a focus on United States, and Europe. The firm also makes investments outside North America, primarily in Western Europe and Asia. It employs a combination of contrarian, value, and distressed strategies to make its investments. The firm seeks to make investments in the range of $10 million and $1500 million. The firm seeks to invest in companies with Enterprise value between $750 million to $2500 million. The firm conducts an in-house research to create its investment portfolio. It seeks to acquire minority and majority positions in its portfolio companies. Apollo Global Management, Inc. was founded in 1990 and is headquartered in New York, New York with additional offices in North America, Asia , India and Europe."

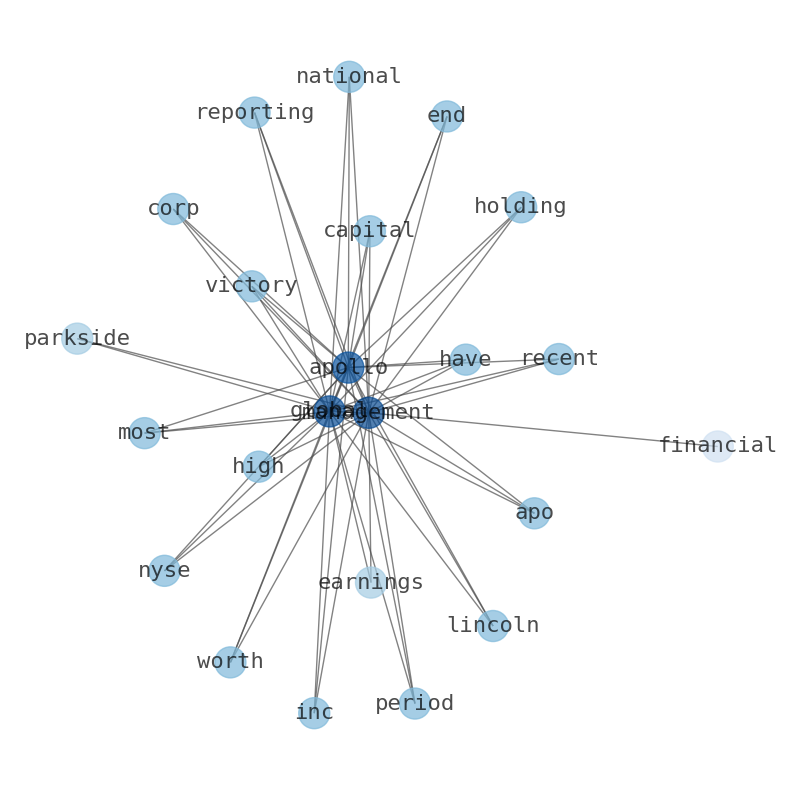

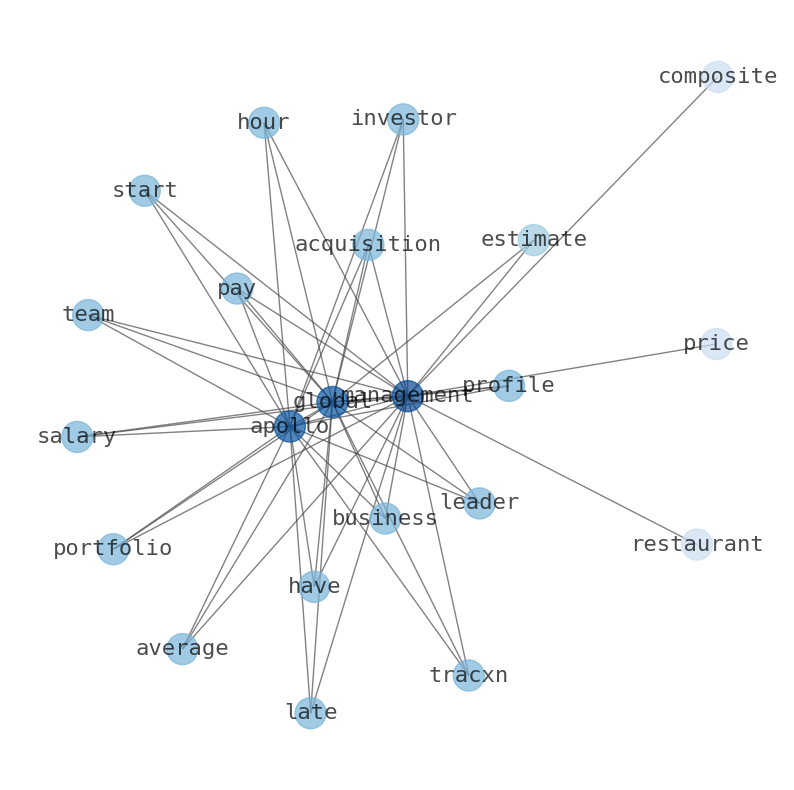

Keywords

This document will help you to evaluate Apollo Global Management without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Apollo Global Management are: share, Apollo, Global, stock, Management, currently, price, and the most common words in the summary are: apollo, management, global, stock, market, price, job, . One of the sentences in the summary was: Leon Black stepped down as CEO and chairman after a company investigation exposed $158 million in fees he paid to Jeffrey Epstein.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #apollo #management #global #stock #market #price #job.

Read more →Related Results

Apollo Global Management

Open: 109.22 Close: 110.41 Change: 1.19

Read more →

Apollo Global Management

Open: 99.33 Close: 98.01 Change: -1.32

Read more →

Apollo Global Management

Open: 86.84 Close: 88.32 Change: 1.48

Read more →

Apollo Global Management

Open: 85.15 Close: 85.36 Change: 0.21

Read more →

Apollo Global Management

Open: 84.0 Close: 83.64 Change: -0.36

Read more →

Apollo Global Management

Open: 72.72 Close: 72.98 Change: 0.26

Read more →

Apollo Global Management

Open: 63.65 Close: 64.04 Change: 0.39

Read more →

Apollo Global Management

Open: 100.78 Close: 99.57 Change: -1.21

Read more →

Apollo Global Management

Open: 91.9 Close: 91.45 Change: -0.45

Read more →

Apollo Global Management

Open: 84.97 Close: 84.96 Change: -0.01

Read more →

Apollo Global Management

Open: 83.23 Close: 82.36 Change: -0.87

Read more →

Apollo Global Management

Open: 78.42 Close: 81.16 Change: 2.74

Read more →

Apollo Global Management

Open: 63.52 Close: 63.19 Change: -0.33

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo