The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Analog Devices

Youtube Subscribe

Open: 166.51 Close: 172.39 Change: 5.88

9 lessons that an AI found about Analog Devices after reading internet.

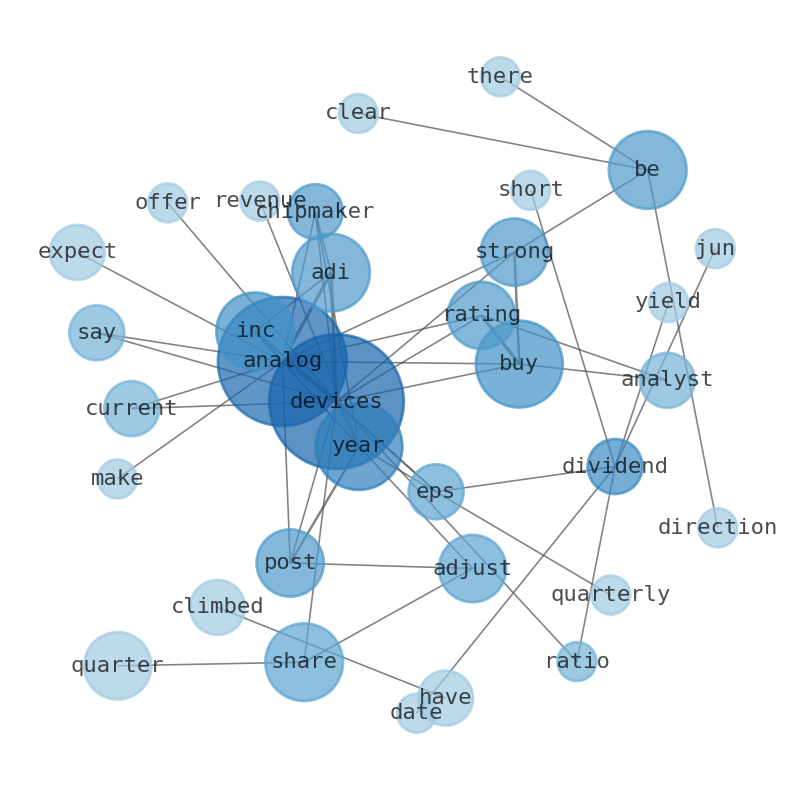

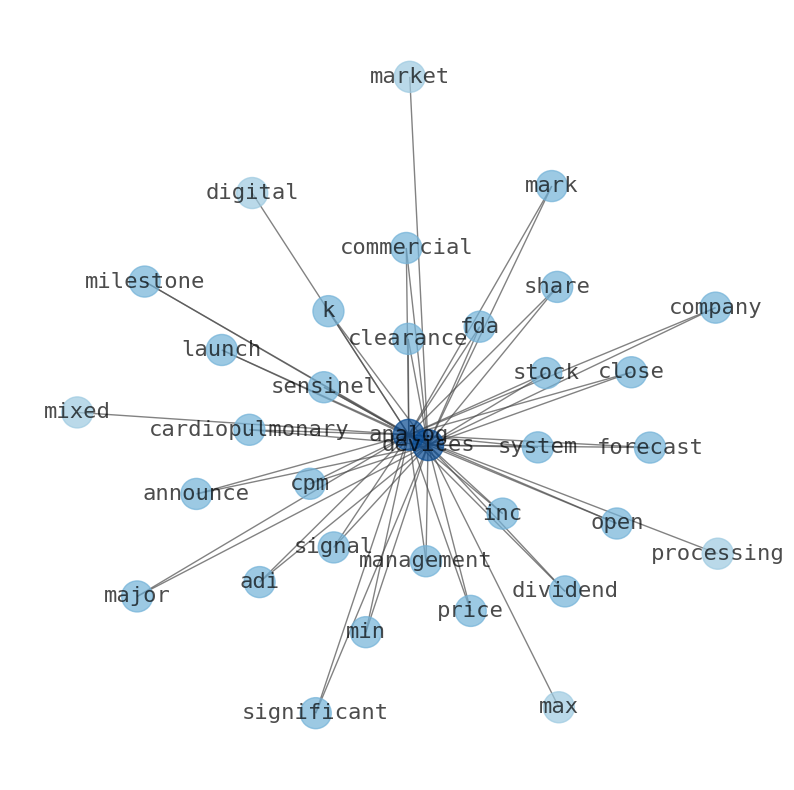

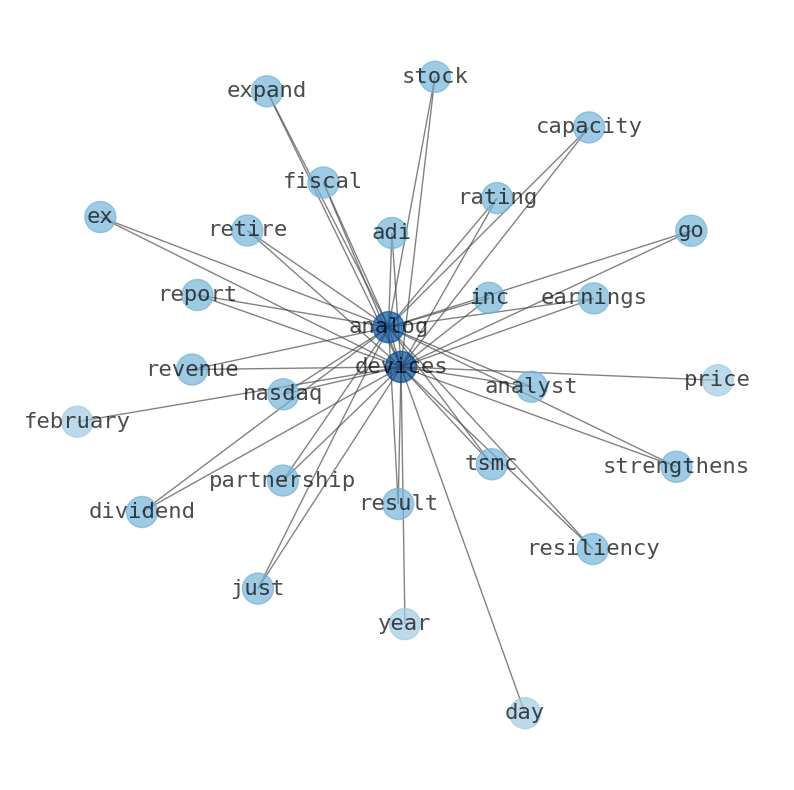

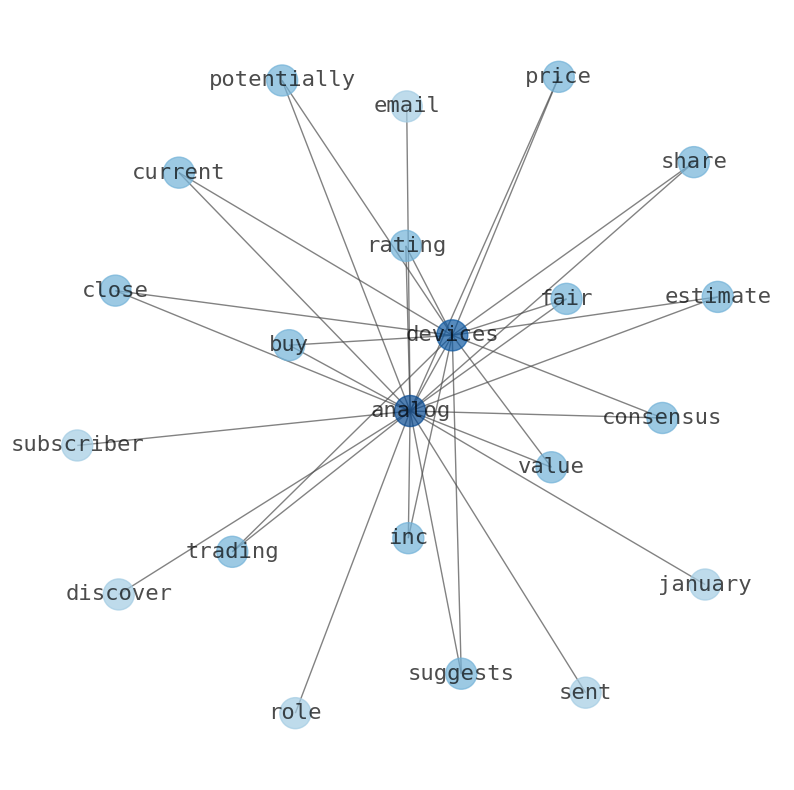

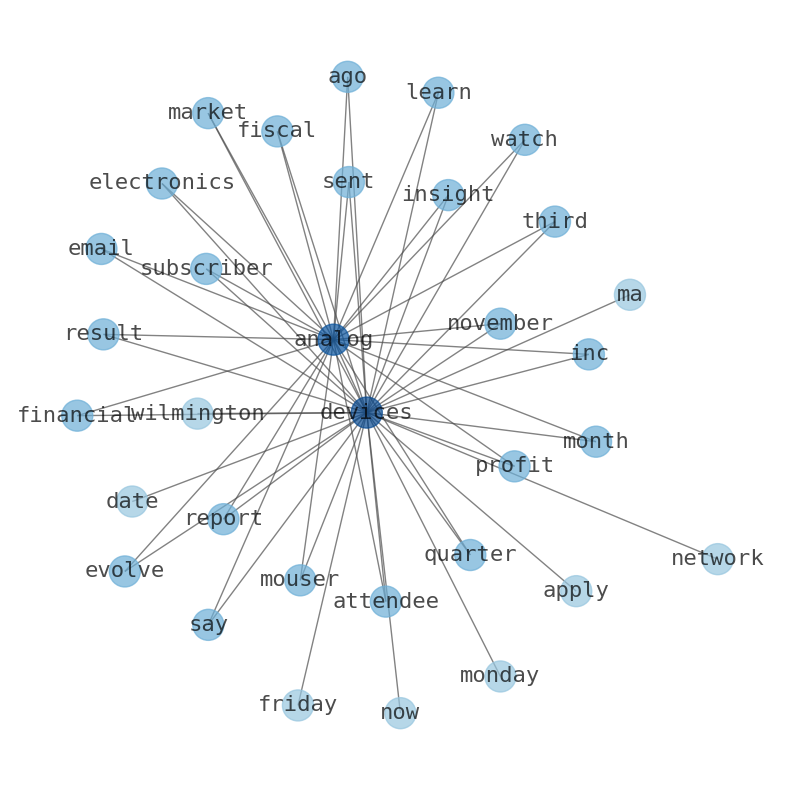

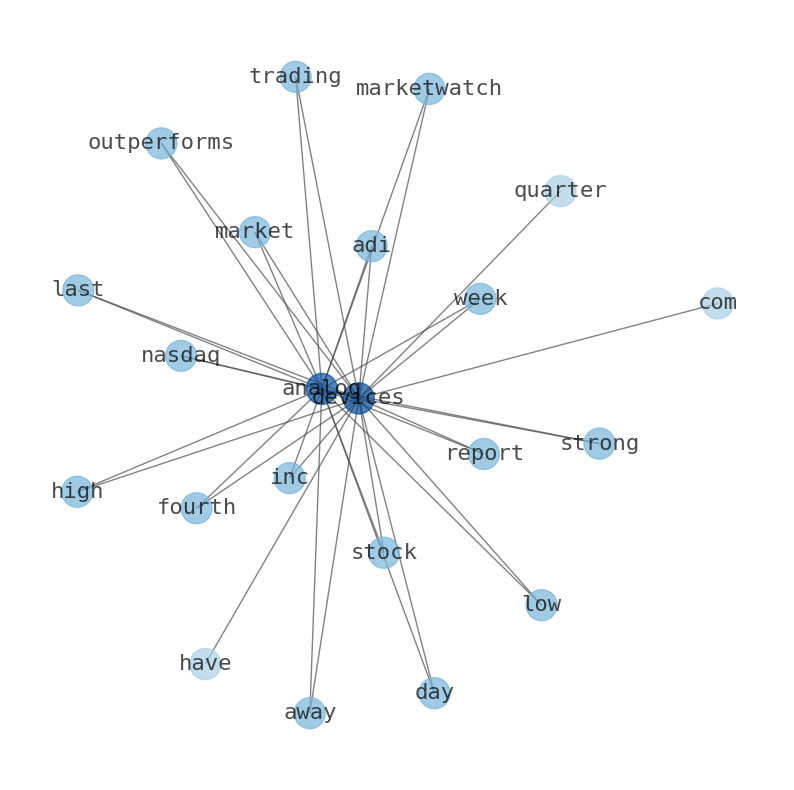

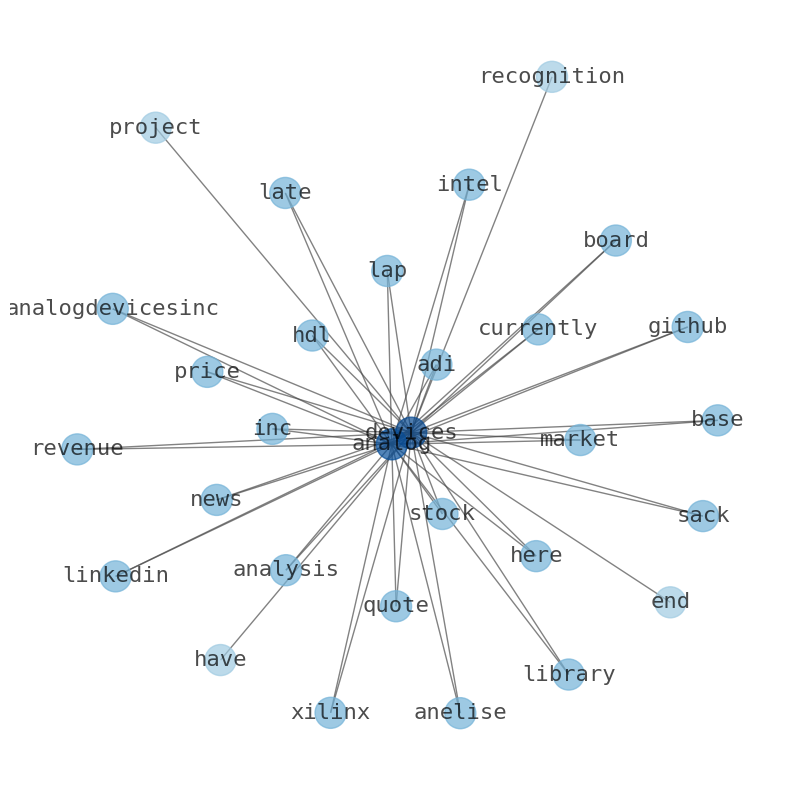

This document will help you to evaluate Analog Devices without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Analog Devices are: Analog, Devices, Buy, Inc, share, rating, ADI, …

Stock Summary

Analog Devices, Inc. designs, manufactures, tests, and markets integrated circuits. Company provides data converter products, which translate real-world analog signals into digital data. Also provides power ICs that include performance, integration, and software design.

Today's Summary

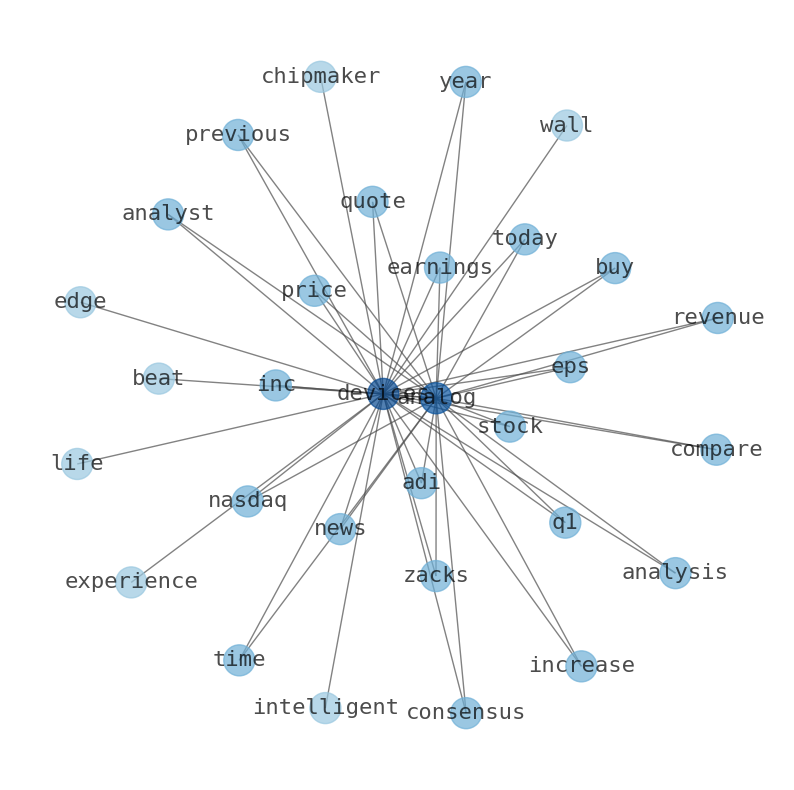

Chipmaker Analog Devices posted adjusted quarterly revenue of $3.26 billion year-on-year. Wall Street expects Analog Devices, Inc. to post 10.65 EPS for the current fiscal year.

Today's News

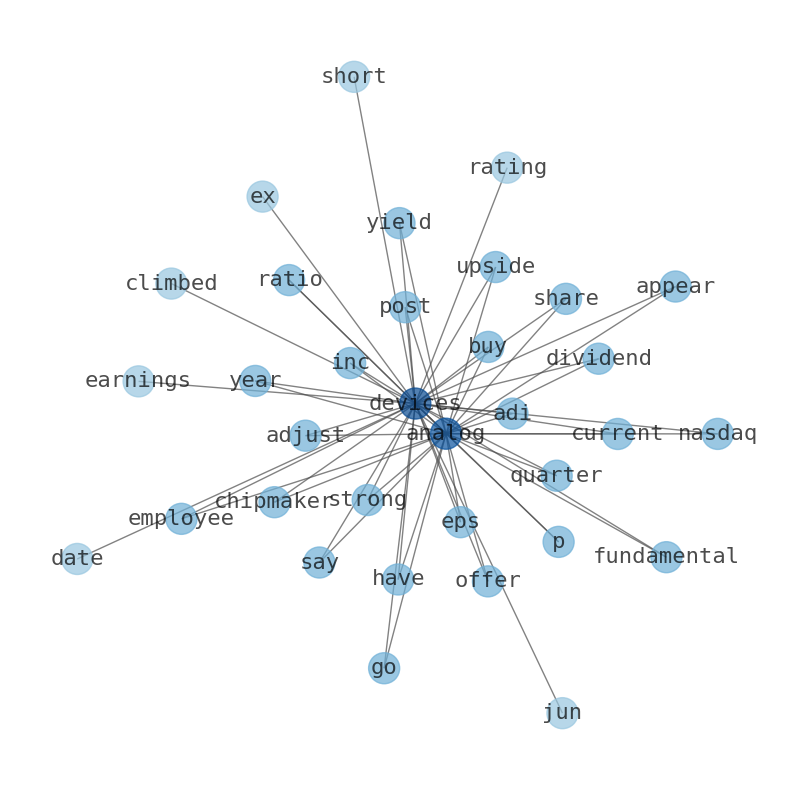

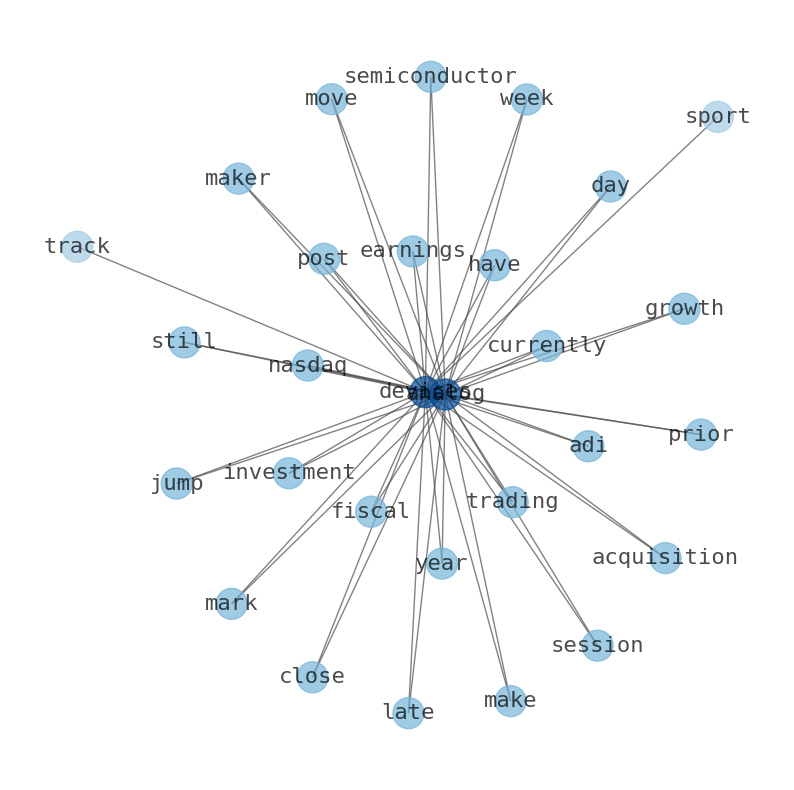

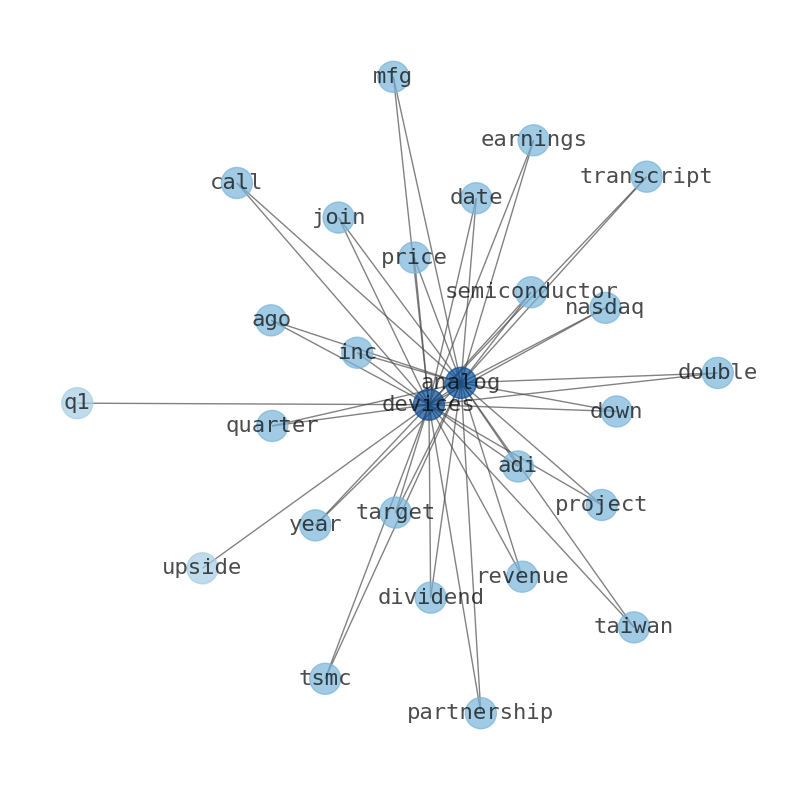

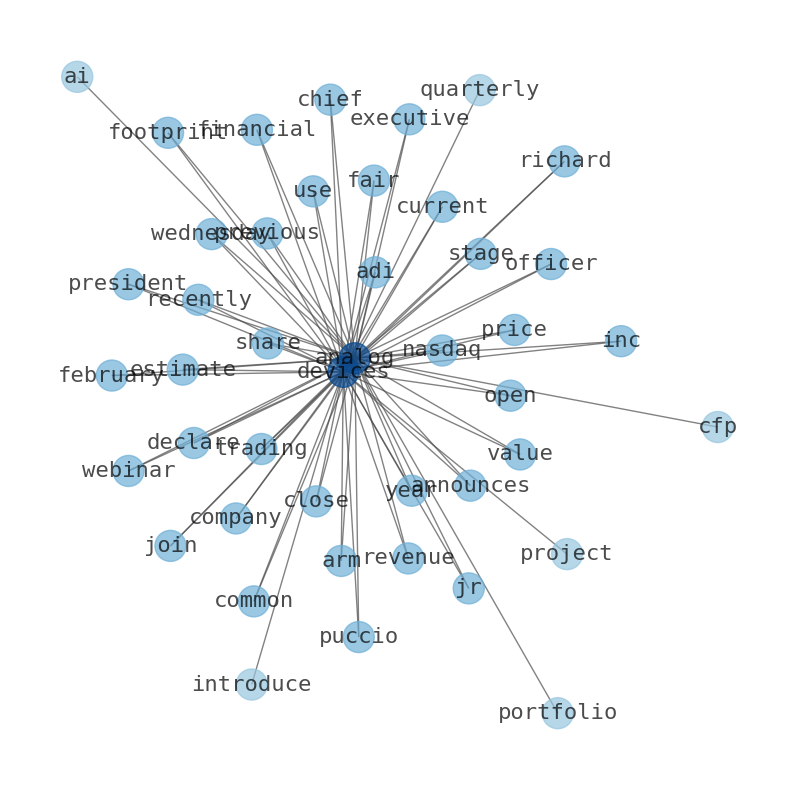

Analog Devices, Inc. (NASDAQ:ADI) Is going Strong But Fundamentals Appear To Be Mixed : Is There A Clear Direction For The Stock? Analog Devices Inc. per Employee $491.37K P/E Ratio 24.43 EPS $7.06 Yield 2.00% Dividend $0.86 Ex-Dividend date Jun 2, 2023 short interest 5.86M 05/15/23. Analog Devices is a unanimous Strong Buy according to analyst consensus. Seven Buy ratings make Analog Devices a strong Buy. Analog Devices offers a 33.44% upside. Chipmaker Analog Devices (ADI) posted adjusted earnings of $2.83 a share for the April quarter, up 18% from the same period a year earlier. The maker of semiconductors posted adjusted quarterly revenue of $3.26 billion year-on-year. Chipmaker Analog Devices Inc (ADI) said on Wednesday that a turbulent economy would weigh on its third-quarter results, sending the chipmakers shares down nearly 8%. Analog Devices also said it expects current-quarter adjusted profit of $2.52. Analog Devices shares have climbed 15% since the beginning of the year, while the S&Ps 500 index has climbed 8%. Wall Street expects Analog Devices, Inc. to post 10.65 EPS for the current fiscal year. Director James Champy sold 1,495 shares of the businesss stock in a transaction that occurred on Tuesday, March 14th. Goldman Sachs analyst Toshiya Hari maintained a Buy rating on Analog Devices (ADI – Research Report) Goldman Sachs maintained a. Buy rating today and set a price target of $204.00.

Stock Profile

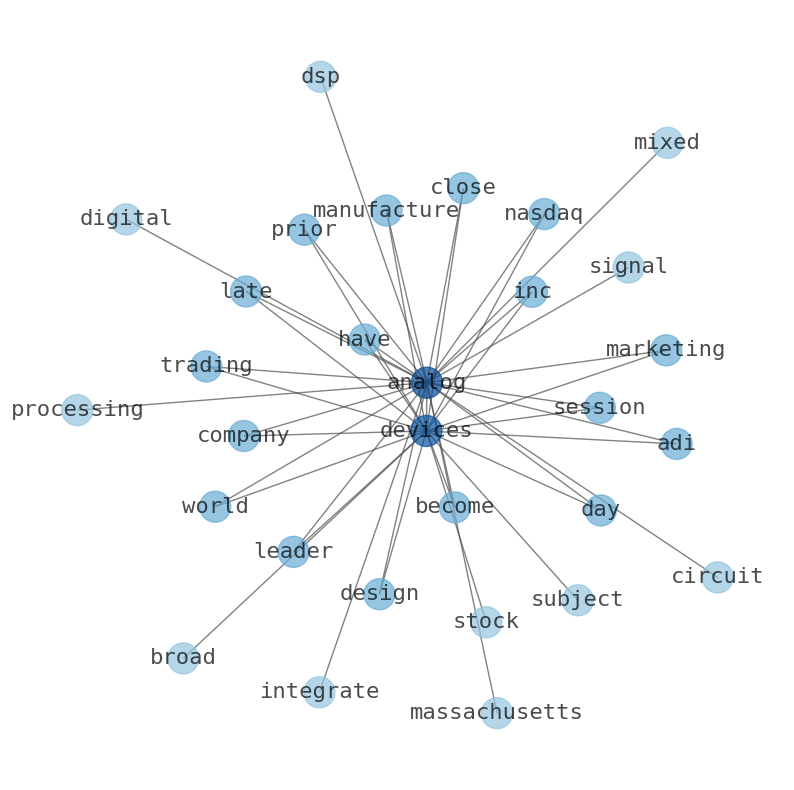

"Analog Devices, Inc. designs, manufactures, tests, and markets integrated circuits (ICs), software, and subsystems that leverage analog, mixed-signal, and digital signal processing technologies. The company provides data converter products, which translate real-world analog signals into digital data, as well as translates digital data into analog signals; power management and reference products for power conversion, driver monitoring, sequencing, and energy management applications in the automotive, communications, industrial, and high-end consumer markets; and power ICs that include performance, integration, and software design simulation tools for accurate power supply designs. It also offers high-performance amplifiers to condition analog signals; and radio frequency and microwave ICs to support cellular infrastructure; and micro-electro-mechanical systems technology solutions, including accelerometers used to sense acceleration, gyroscopes for sense rotation, inertial measurement units to sense multiple degrees of freedom, and broadband switches for radio and instrument systems, as well as isolators. In addition, the company provides digital signal processing and system products for high-speed numeric calculations. It serves clients in the industrial, automotive, consumer, instrumentation, aerospace, and communications markets through a direct sales force, third-party distributors, and independent sales representatives in the United States, rest of North and South America, Europe, Japan, China, and rest of Asia, as well as through its Website. Analog Devices, Inc. was incorporated in 1965 and is headquartered in Wilmington, Massachusetts."

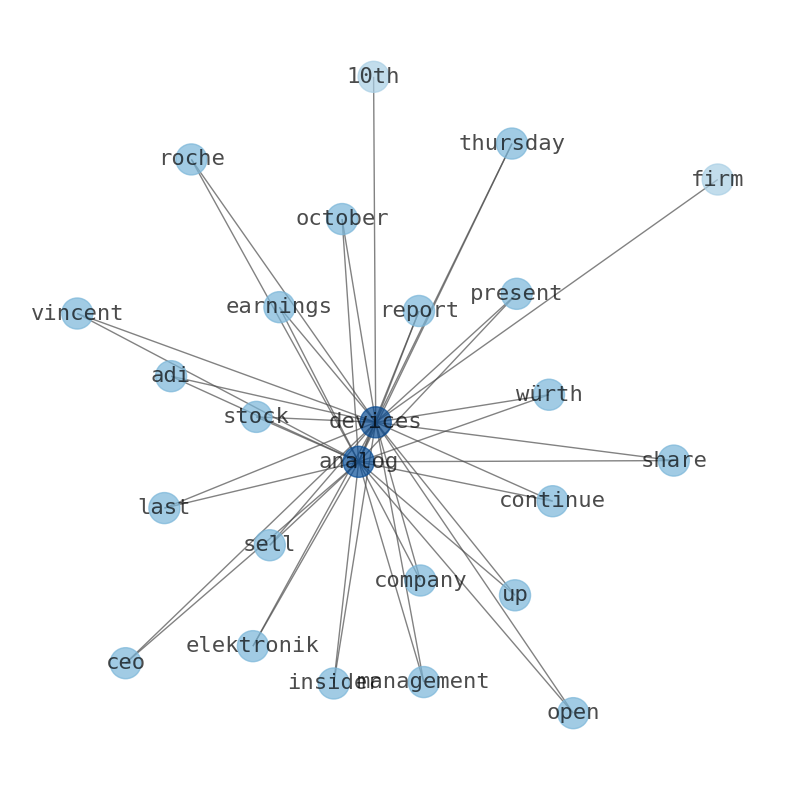

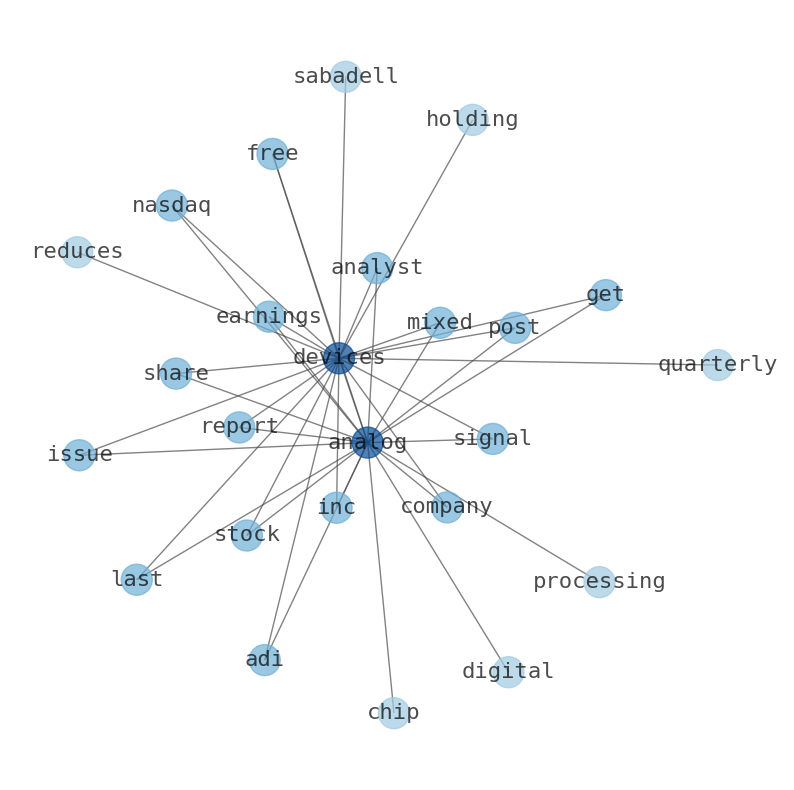

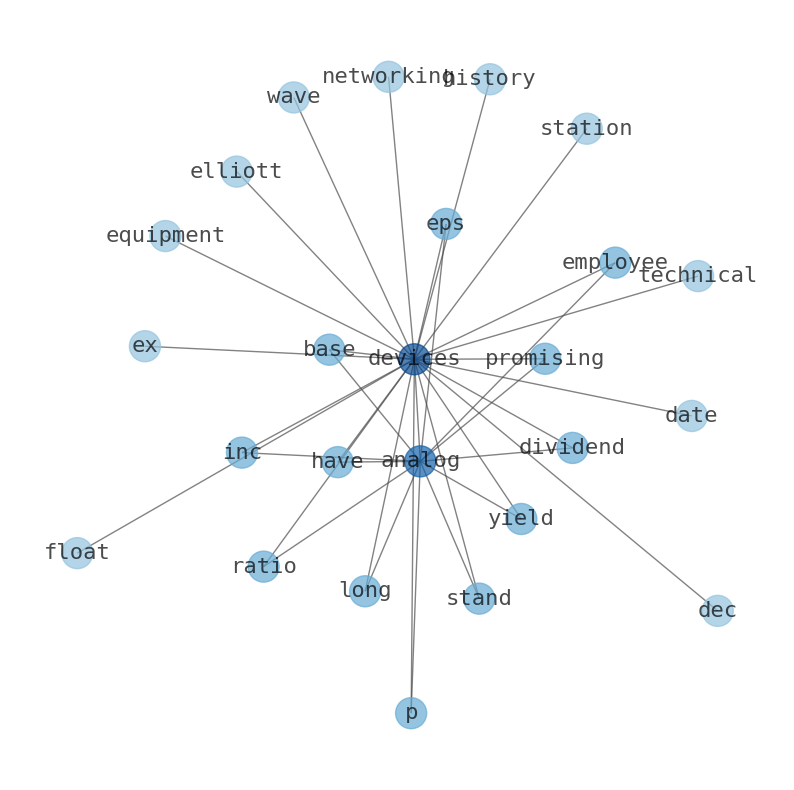

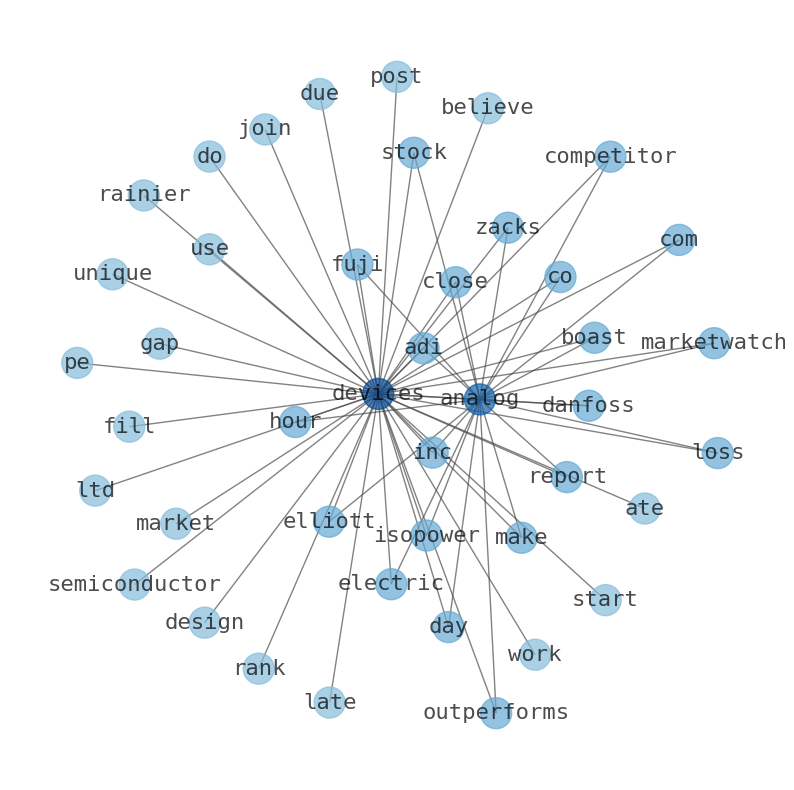

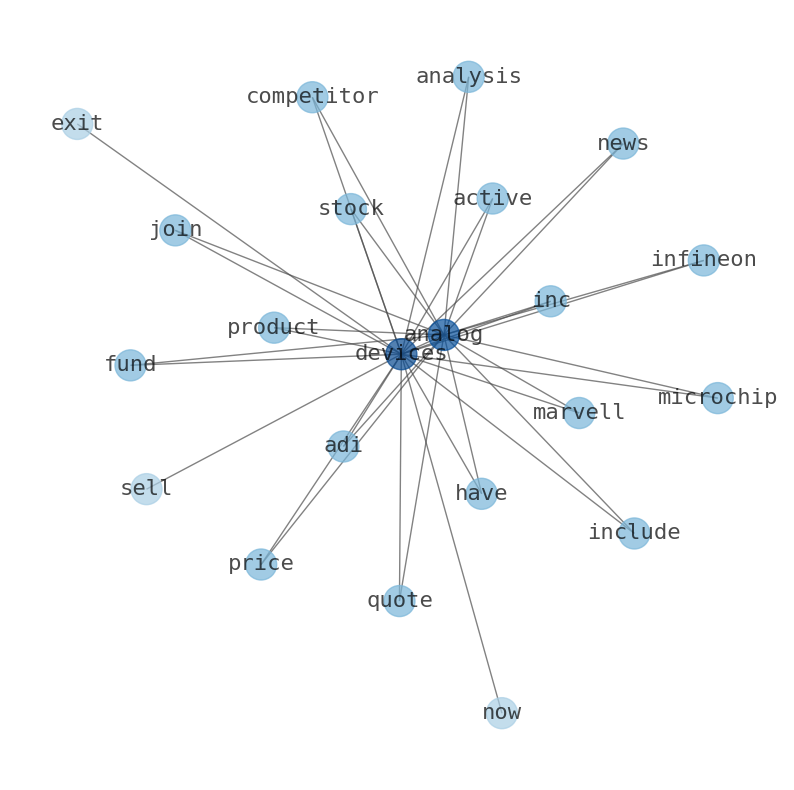

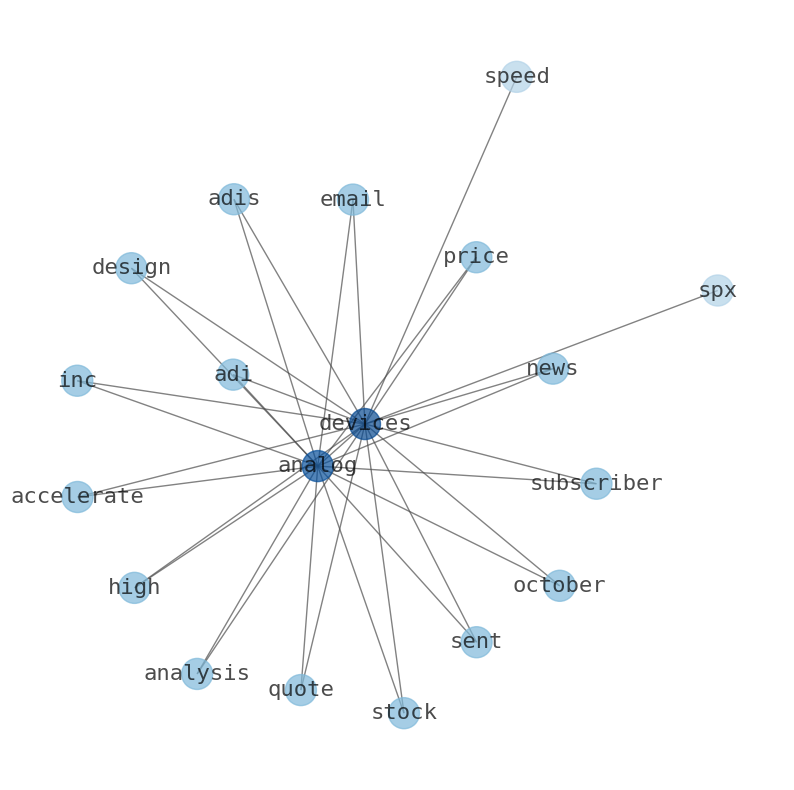

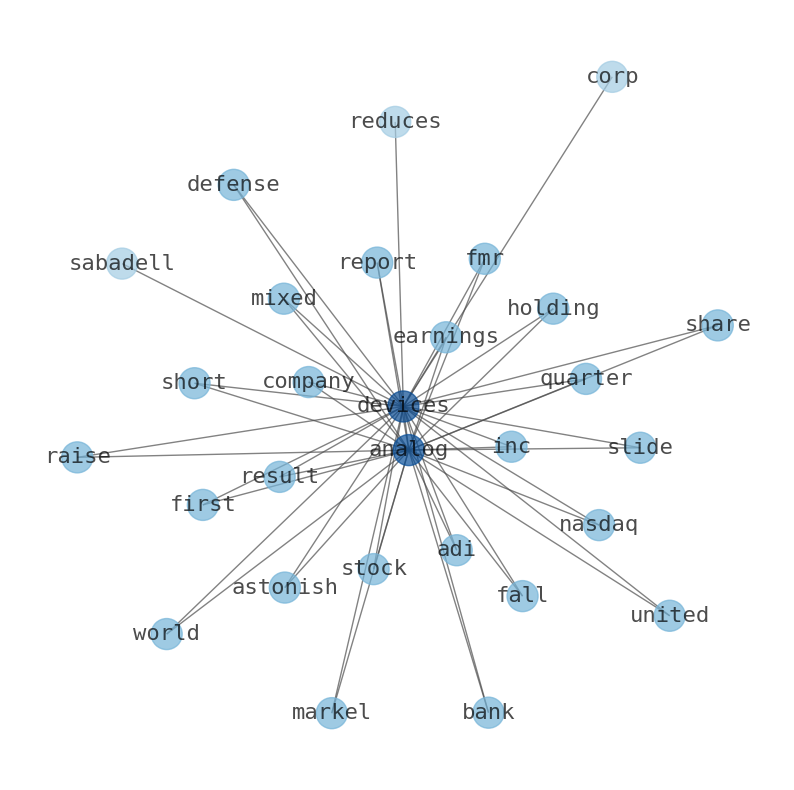

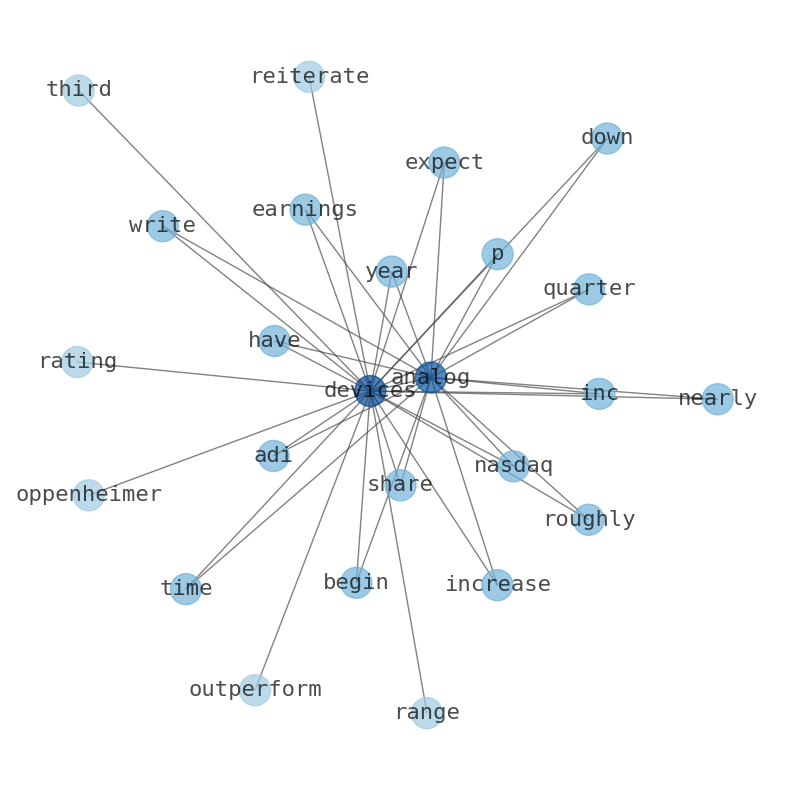

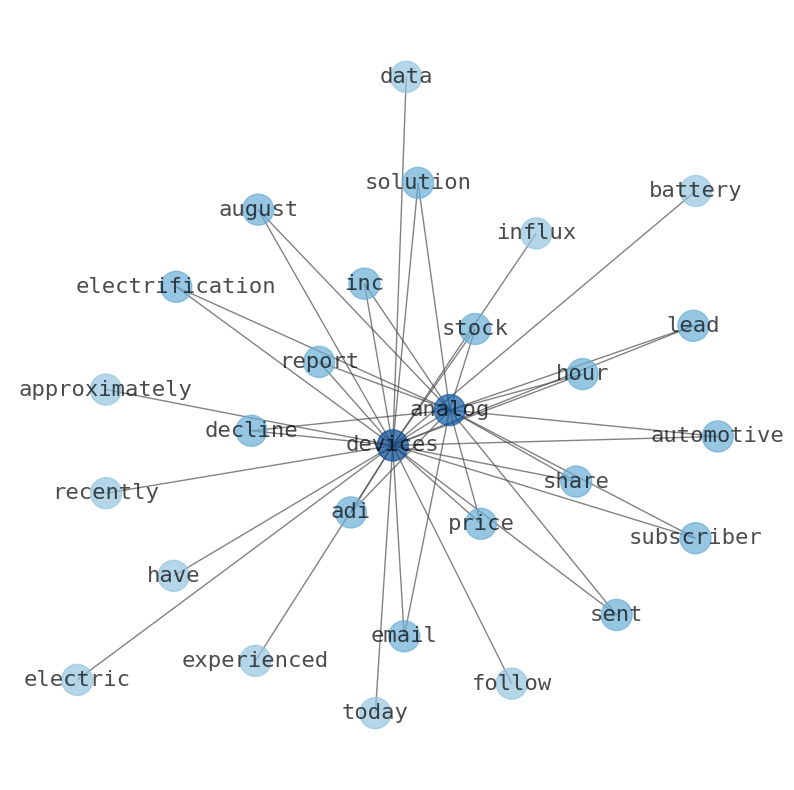

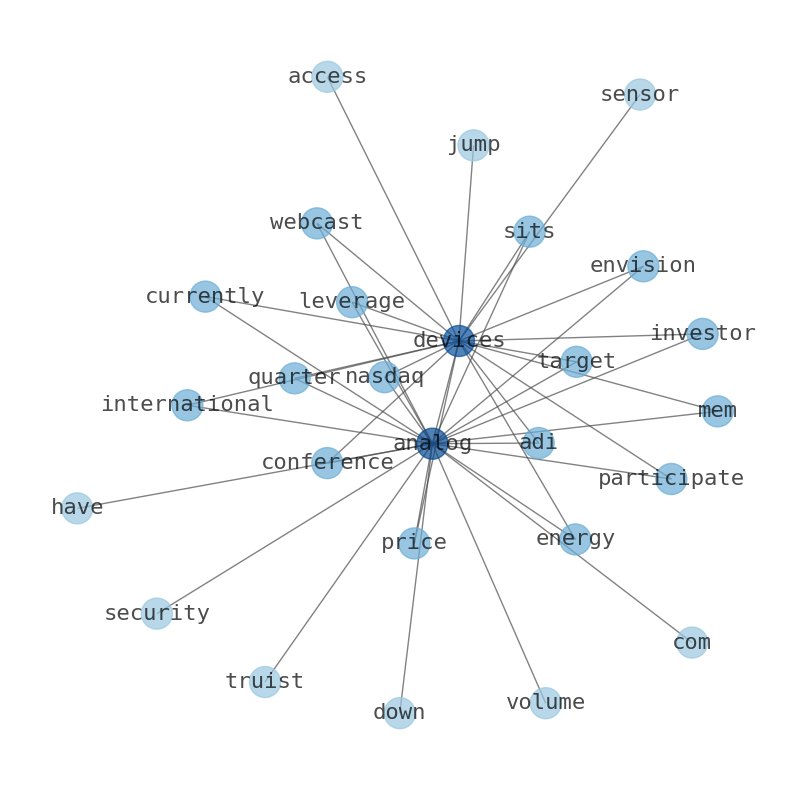

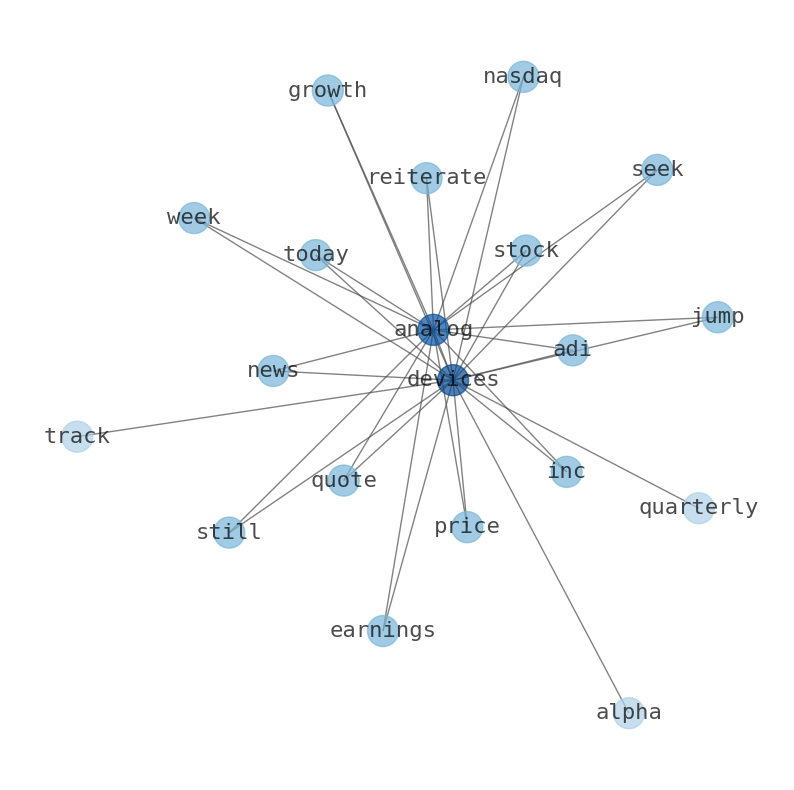

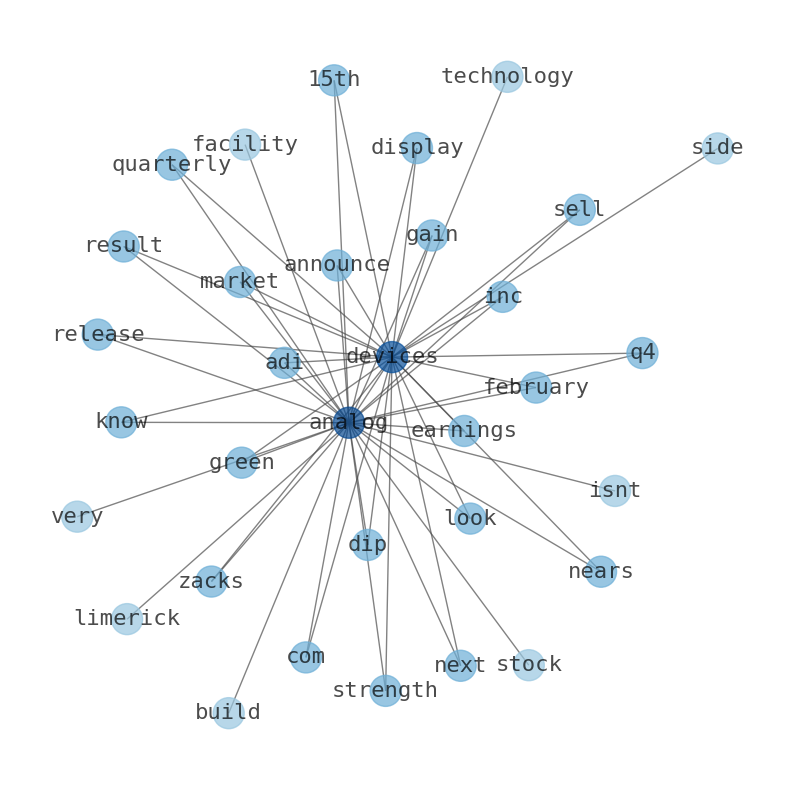

Keywords

How much time have you spent trying to decide whether investing in Analog Devices? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Analog Devices are: Analog, Devices, Buy, Inc, share, rating, ADI, and the most common words in the summary are: analog, device, stock, news, best, earnings, adi, . One of the sentences in the summary was: to post 10.65 EPS for the current fiscal year.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #analog #device #stock #news #best #earnings #adi.

Read more →Related Results

Analog Devices

Open: 199.0 Close: 195.94 Change: -3.06

Read more →

Analog Devices

Open: 187.2 Close: 187.76 Change: 0.56

Read more →

Analog Devices

Open: 196.0 Close: 197.31 Change: 1.31

Read more →

Analog Devices

Open: 169.28 Close: 172.32 Change: 3.04

Read more →

Analog Devices

Open: 167.44 Close: 167.57 Change: 0.13

Read more →

Analog Devices

Open: 170.71 Close: 173.97 Change: 3.26

Read more →

Analog Devices

Open: 173.36 Close: 172.79 Change: -0.57

Read more →

Analog Devices

Open: 178.4 Close: 177.47 Change: -0.93

Read more →

Analog Devices

Open: 180.39 Close: 177.17 Change: -3.22

Read more →

Analog Devices

Open: 183.27 Close: 182.46 Change: -0.81

Read more →

Analog Devices

Open: 166.51 Close: 172.39 Change: 5.88

Read more →

Analog Devices

Open: 188.95 Close: 192.26 Change: 3.31

Read more →

Analog Devices

Open: 192.55 Close: 196.16 Change: 3.61

Read more →

Analog Devices

Open: 195.32 Close: 193.93 Change: -1.39

Read more →

Analog Devices

Open: 183.18 Close: 181.77 Change: -1.41

Read more →

Analog Devices

Open: 167.44 Close: 167.57 Change: 0.13

Read more →

Analog Devices

Open: 173.98 Close: 171.07 Change: -2.91

Read more →

Analog Devices

Open: 170.71 Close: 173.97 Change: 3.26

Read more →

Analog Devices

Open: 179.54 Close: 177.65 Change: -1.89

Read more →

Analog Devices

Open: 178.72 Close: 181.69 Change: 2.97

Read more →

Analog Devices

Open: 187.0 Close: 186.61 Change: -0.39

Read more →

Analog Devices

Open: 183.27 Close: 182.46 Change: -0.81

Read more →

Analog Devices

Open: 192.26 Close: 190.53 Change: -1.73

Read more →

Analog Devices

Open: 183.63 Close: 182.79 Change: -0.84

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo