The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Ameriprise Financial

Youtube Subscribe

Open: 387.81 Close: 390.07 Change: 2.26

The 14 top things that an AI found about Ameriprise Financial and you do not know…

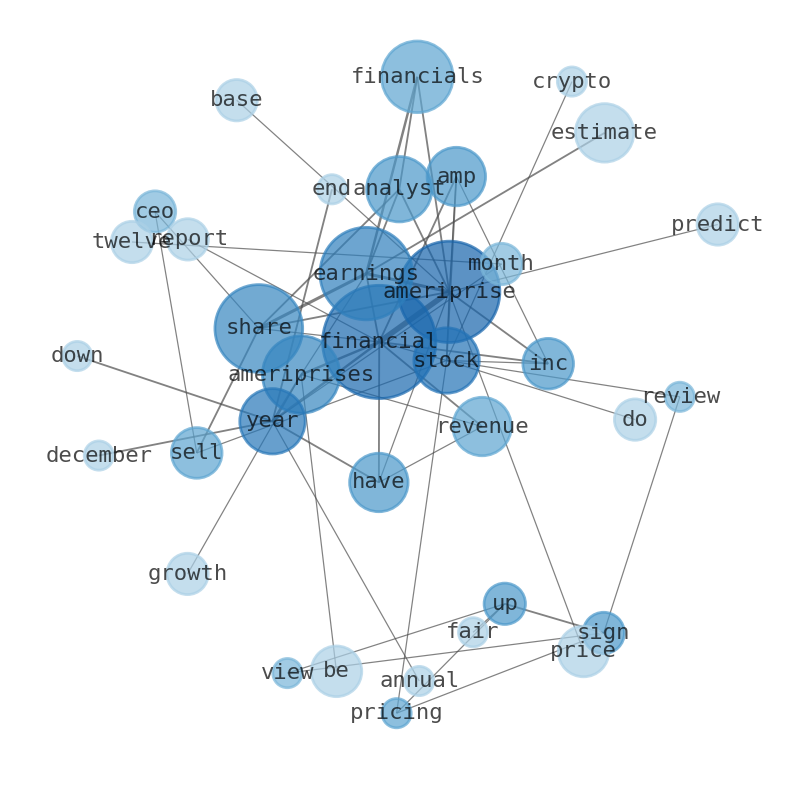

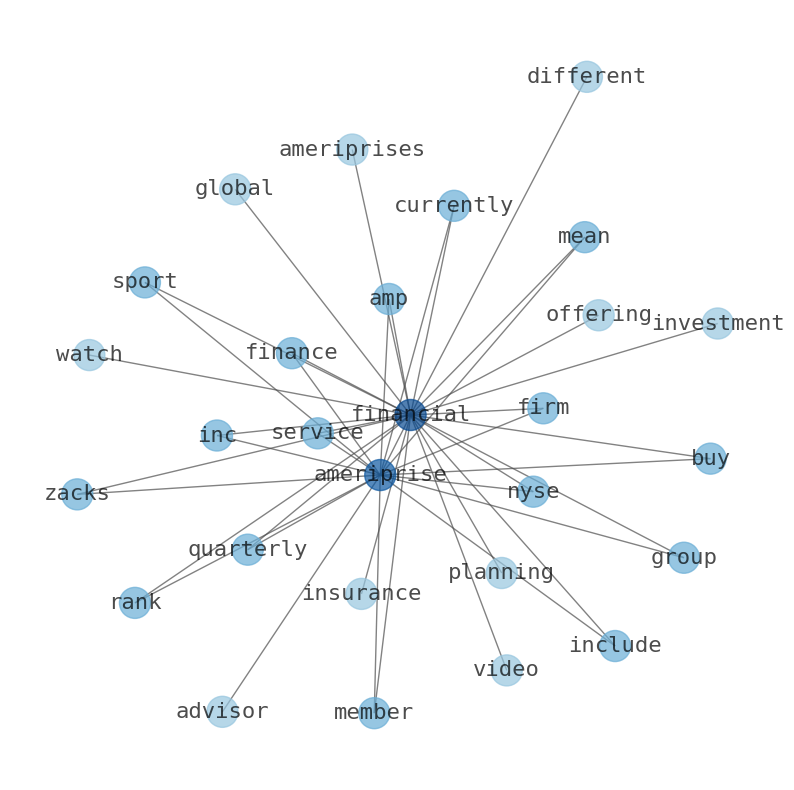

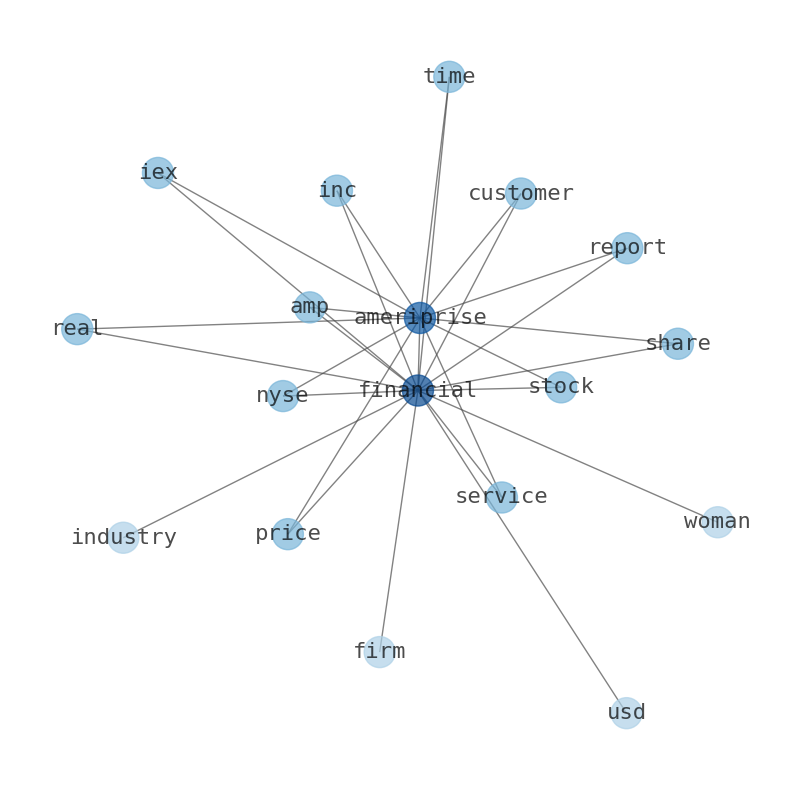

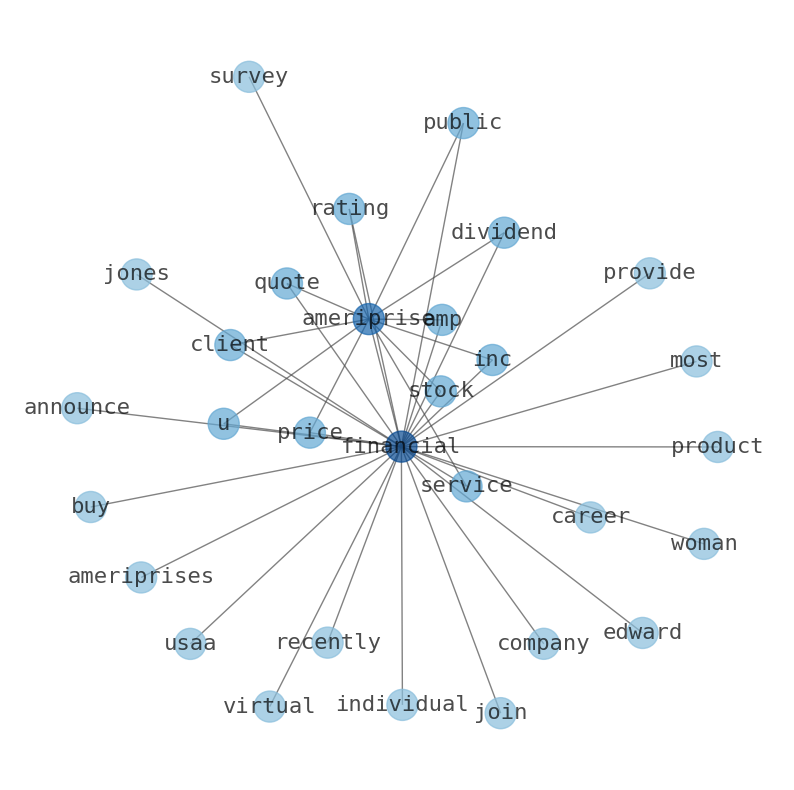

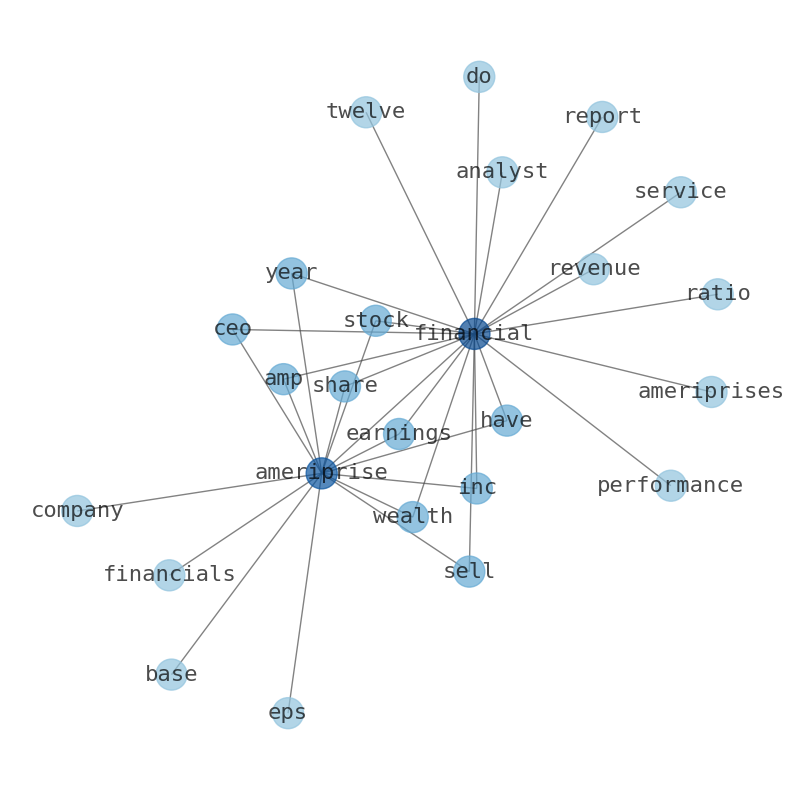

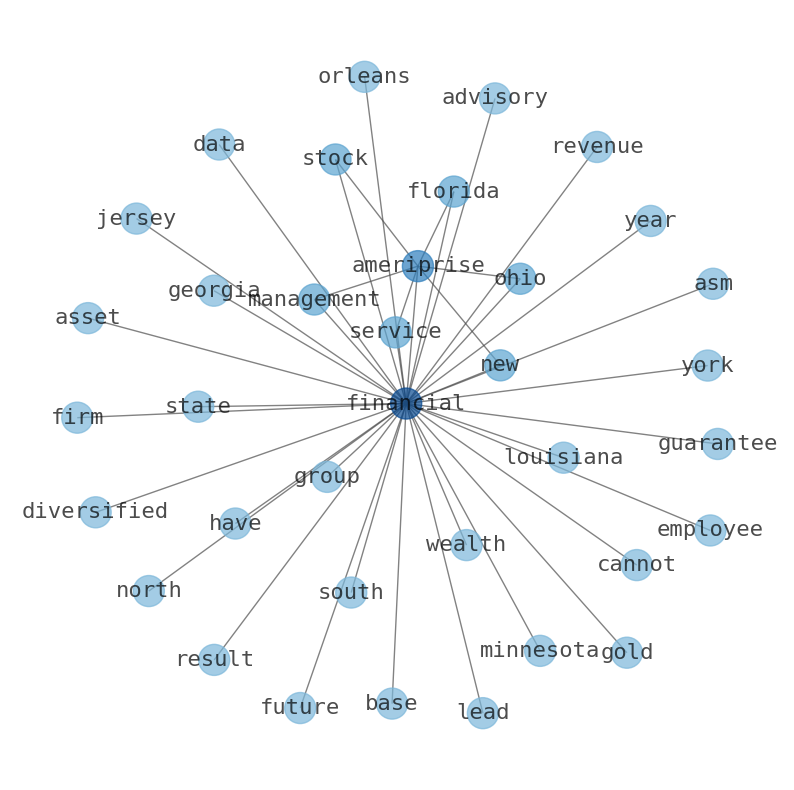

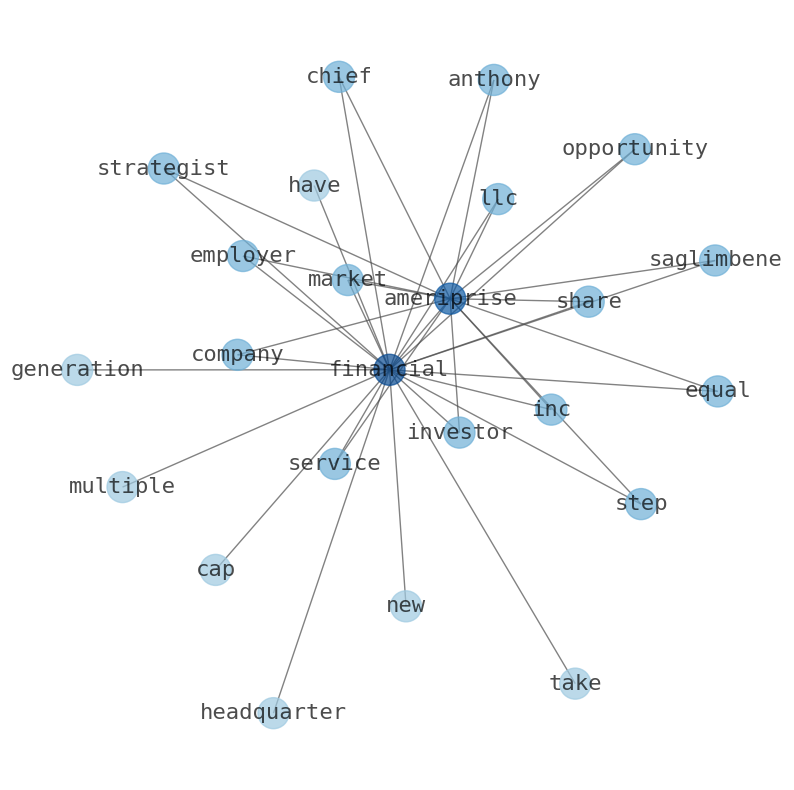

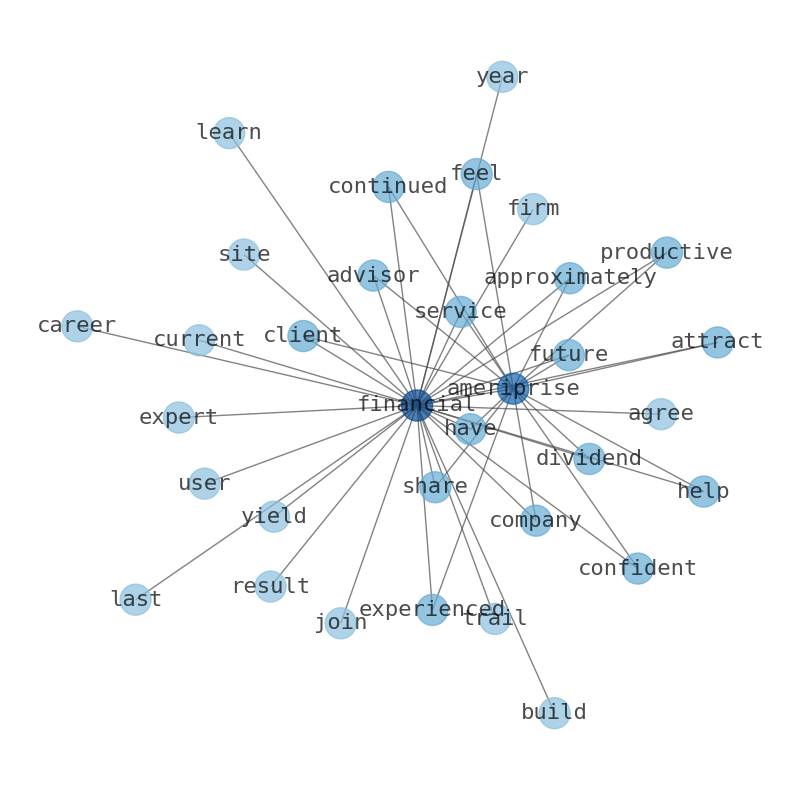

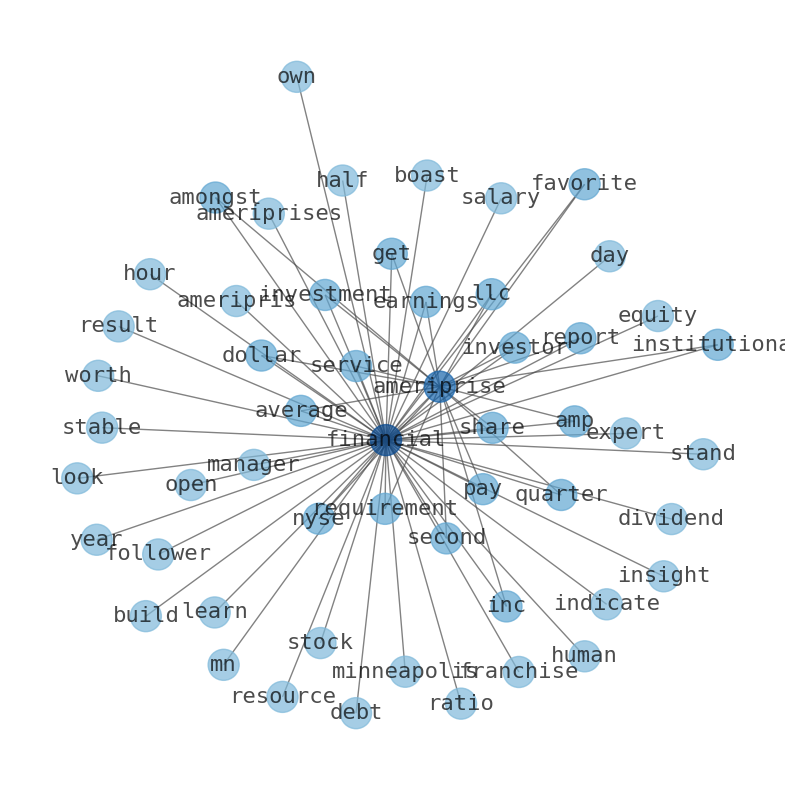

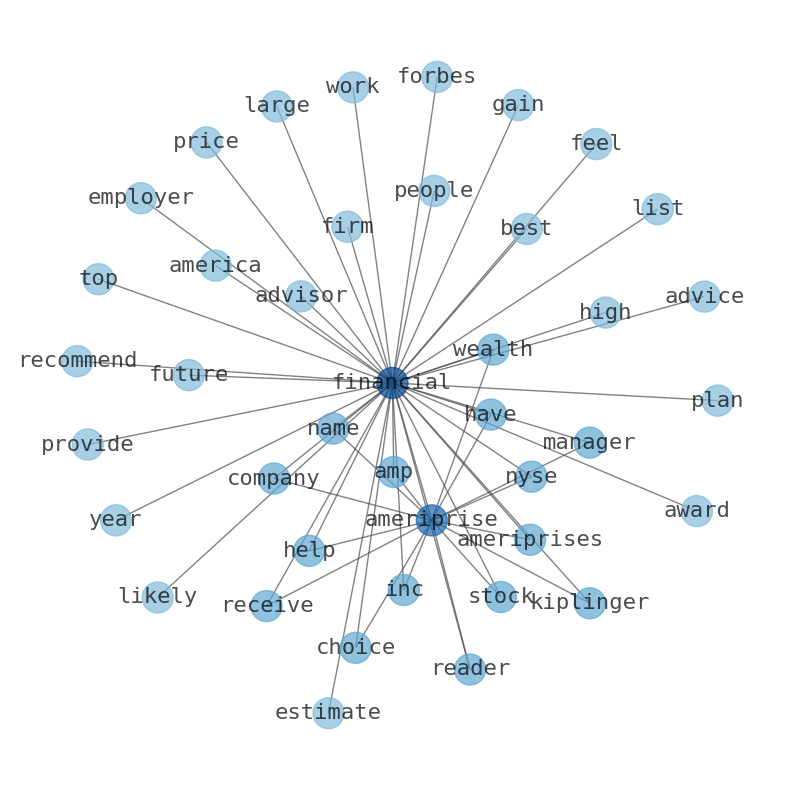

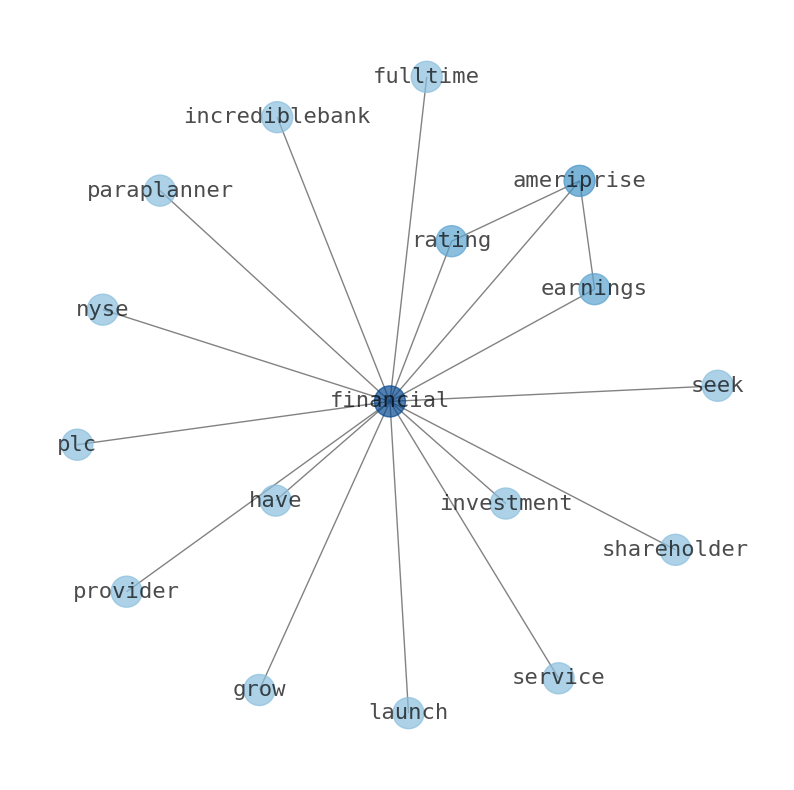

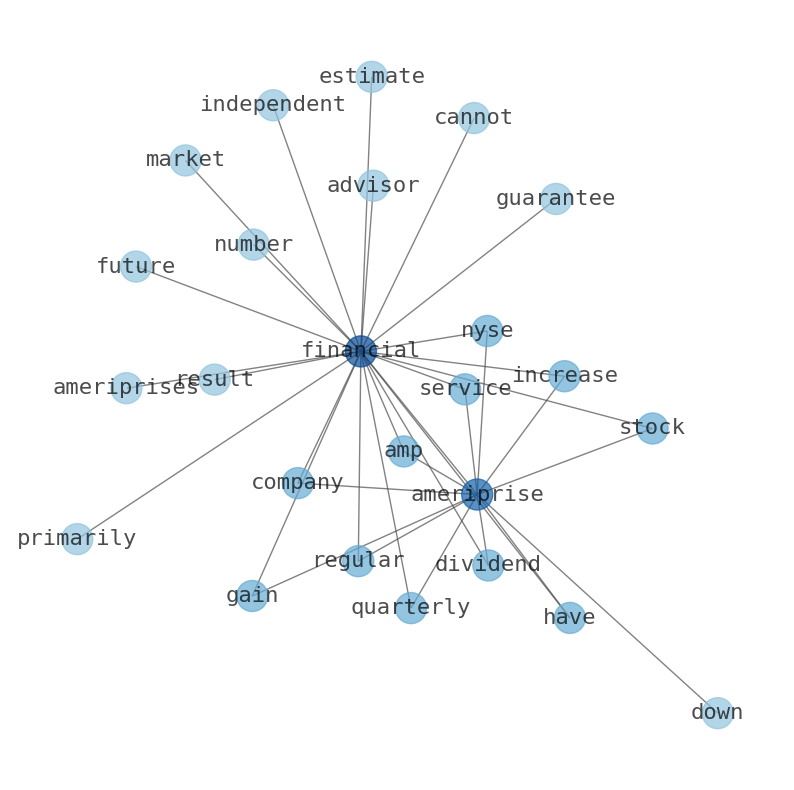

Are looking for the most relevant information about Ameriprise Financial? Investor spend a lot of time searching for information to make investment decisions in Ameriprise Financial. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Ameriprise Financial are: Financial, Ameriprise, share, earnings, Ameriprises, Financials, revenue, and the most common words in the summary are: financial, ameriprise, stock, market, earnings, advisor, job, . One of the sentences in the summary was: Ameripris Financial recently reported earnings of $7.75 per share, surpassing analyst …

Stock Summary

Ameriprise Financial, Inc. provides various financial products and services to individual and institutional clients in the United States and internationally. The Advice & Wealth Management segment provides financial planning and advice; brokerage products and brokerage products. The Retirement & Protection.

Today's Summary

CEO William F. Truscott sold 9,689 shares of Ameriprise Financial stock in a transaction on Friday, January 26. Ameripris Financial recently reported earnings of $7.75 per share, surpassing analyst expectations.

Today's News

Great Lakes Advisors LLC raised its stake in Ameriprise Financial, Inc. (NYSE:AMP) CEO William F. Truscott sold 9,689 shares of Ameriprises Financial stock in a transaction on Friday, January 26. Ameriprise Financial had revenue of $11.54B in the twelve months ending December 31, 2023, down -19.12% year-over-year. In the year 2022, Ameriprises Financial had annual revenue of. $14.27B with 5.80% growth. What do the Fundamentals predict for Ameriprise Financial, Inc. (AMP) Stock? Stocks Crypto What We Do Reviews About Us Pricing Sign Up Login Sign Up to view Fair Value for AMP. With the latest stock price at 390.07 USD, the upside of Ameriprise Financial Inc based on DCF is 5.3%. With the most recent earnings release, Ameriprises Financial (AMP) reported earnings of $7.75 per share. Analysts provide estimates for Ameriprise Financials earnings based on a variety of factors, including industry trends, company performance, and economic conditions. Ameriprises Financials revenue history demonstrates a consistent upward trend, indicating strong financial performance. Analysts consider the overall economic environment and macroeconomic factors that could affect Ameripris Financials financial performance. By tracking the revenue history, investors gain valuable insights. Ameriprise Financial has a trailing price-to-earnings ratio of 16.48 and a forward P/E ratio of 11.47. 321 Ameriprise Financial Advisor Teams named to Forbes list of Best-in-State Wealth Management Teams. Ameriprises Financial recognized by J.D. Power for its “Outstanding Customer Service Experience” for the fifth year in a row. Insiders At Ameriprise Financial sold US$28m in stock, alluding to potential weakness. Chairman & CEO, James Cracchiolo, sold US $14m worth of shares at a price of US$353 per share in the last twelve months. Ameriprise Financial Services, LLC is a private wealth advisory practice of Ameriprises Wealth Partners. Stay informed on the markets, economy, and investing landscape. Ameriprise Financial recently reported earnings of $7.75 per share, surpassing analyst expectations. The company has consistently exceeded the estimated earnings per share in the past four quarters. Analysts closely monitor Ameriprise Financials earnings per share (EPS) estimates as they play a crucial role in projecting the companys future profitability. The image above provides a visual representation of the earnings estimates and actuals for the past quarters. Analysts predict Ameriprise Financials earnings per share (EPS) for the next year will be $36.61 per share, representing a projected increase of 7.52%. Investors can use these forecasts to assess Ameriprises Financials potential for future earnings growth.

Stock Profile

"Ameriprise Financial, Inc., through its subsidiaries, provides various financial products and services to individual and institutional clients in the United States and internationally. It operates through four segments: Advice & Wealth Management, Asset Management, Retirement & Protection Solutions, and Corporate & Other. The Advice & Wealth Management segment provides financial planning and advice; brokerage products and services for retail and institutional clients; discretionary and non-discretionary investment advisory accounts; mutual funds; insurance and annuities products; cash management and banking products; and face-amount certificates. The Asset Management segment offers investment management and advice, and investment products to retail, high net worth, and institutional clients through unaffiliated third-party financial institutions and institutional sales force. This segment products also include U.S. mutual funds and their non-U.S. equivalents, exchange-traded funds, variable product funds underlying insurance, and annuity separate accounts; and institutional asset management products, such as traditional asset classes, separately managed accounts, individually managed accounts, collateralized loan obligations, hedge funds, collective funds, and property and infrastructure funds. The Retirement & Protection Solutions segment provides variable annuity products to individual clients, as well as life and DI insurance products to retail clients. The company was formerly known as American Express Financial Corporation and changed its name to Ameriprise Financial, Inc. in September 2005. The company was founded in 1894 and is headquartered in Minneapolis, Minnesota."

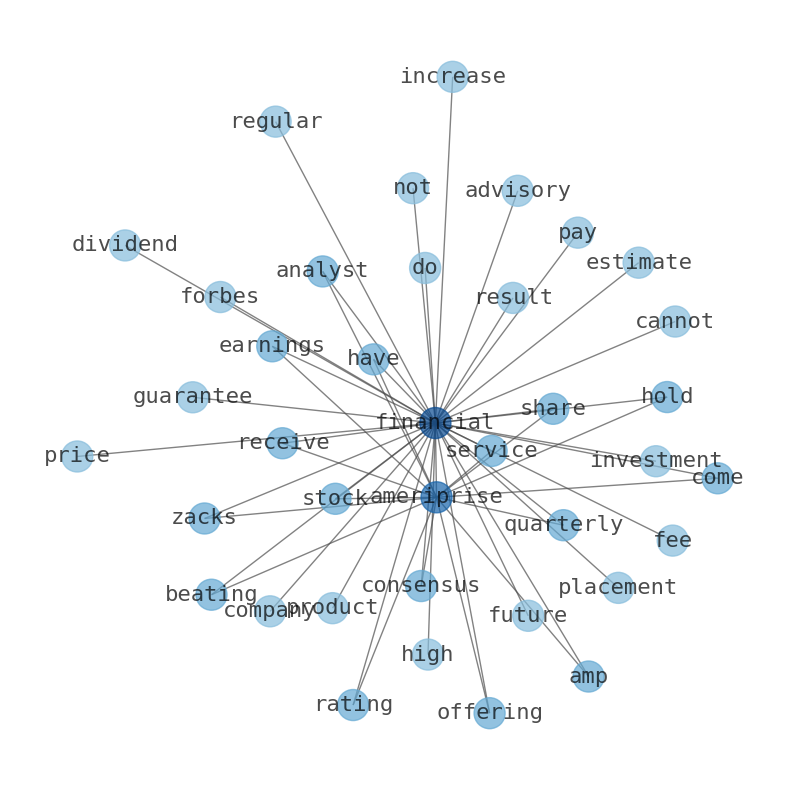

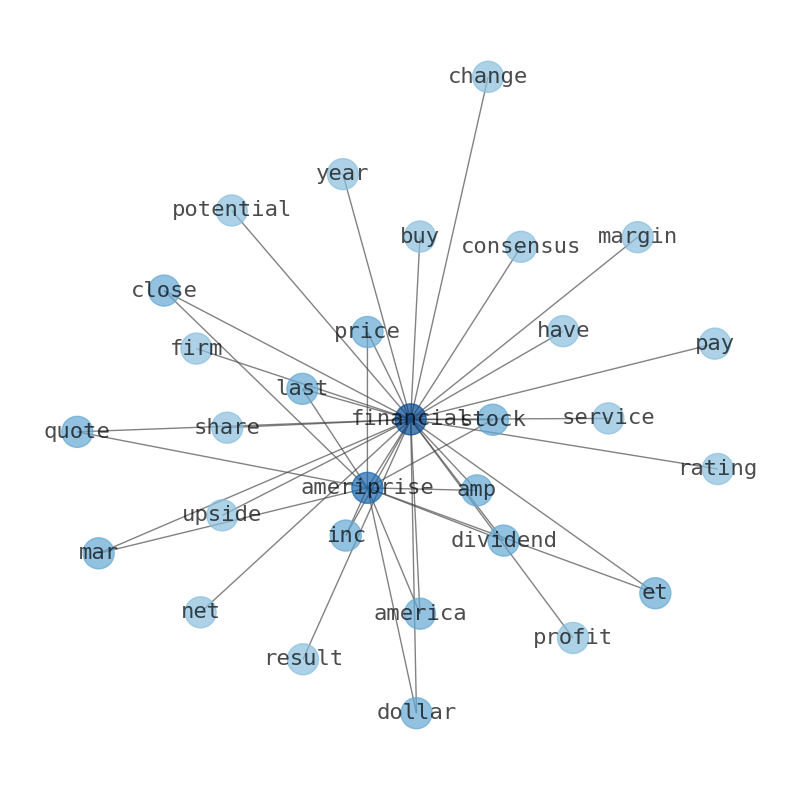

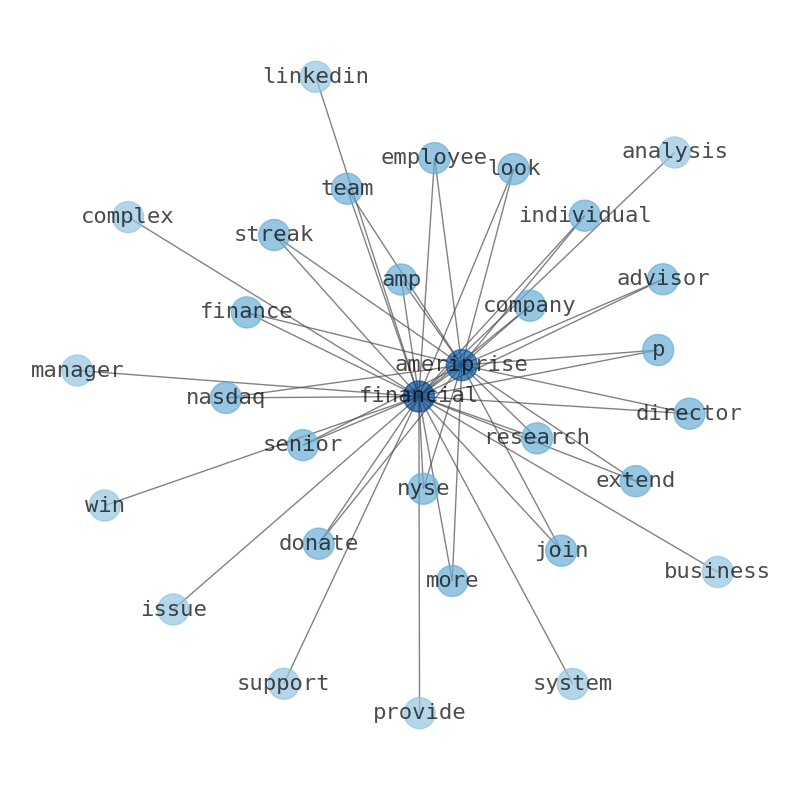

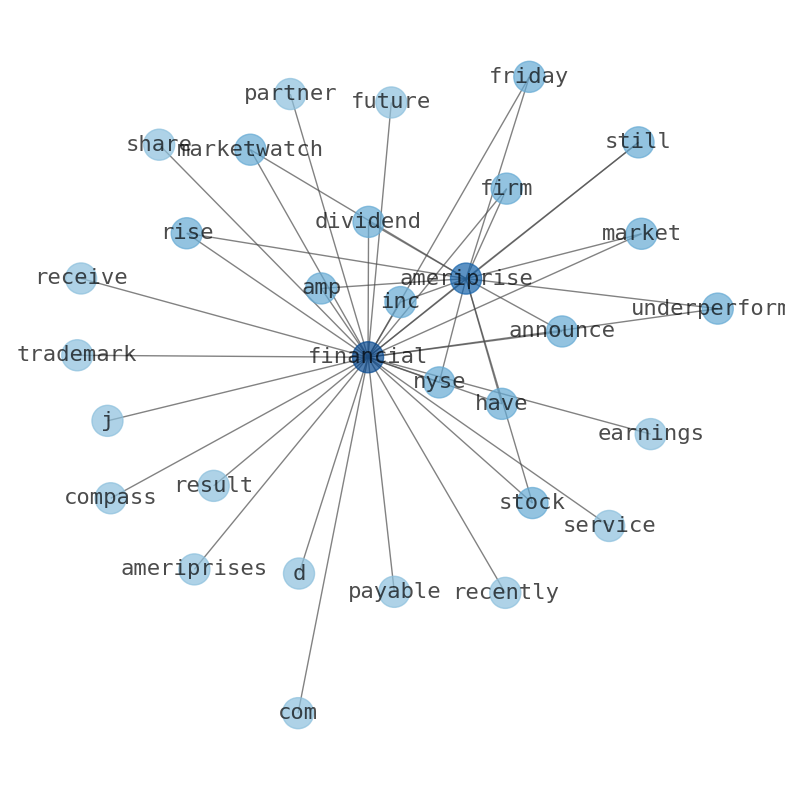

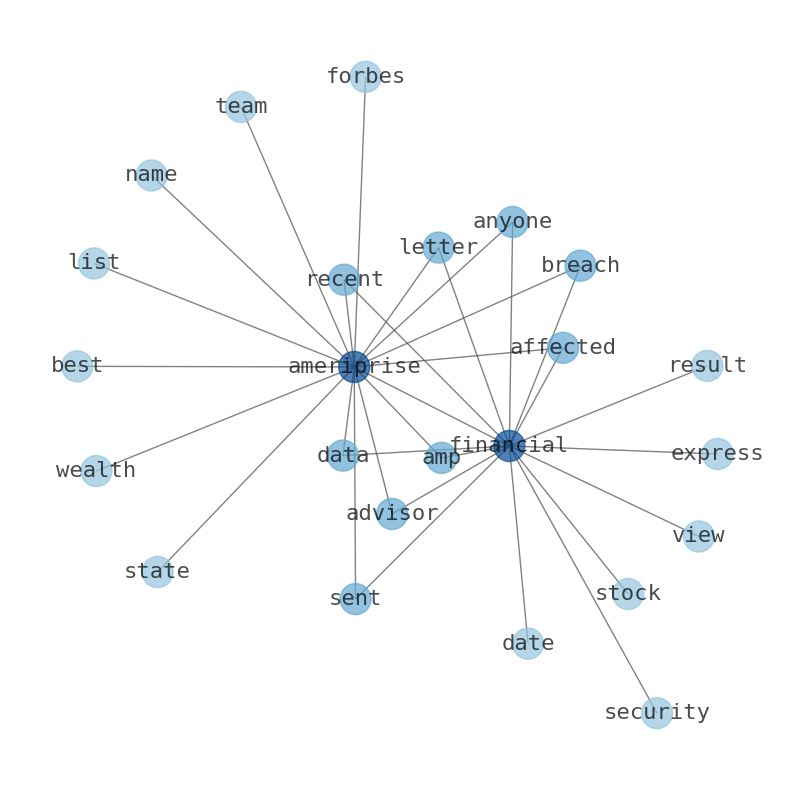

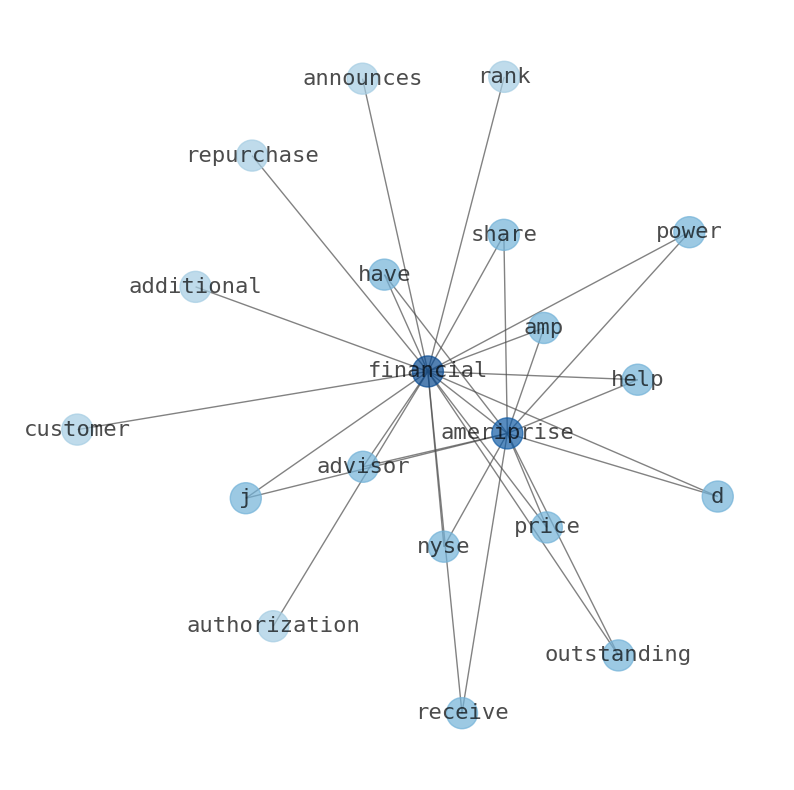

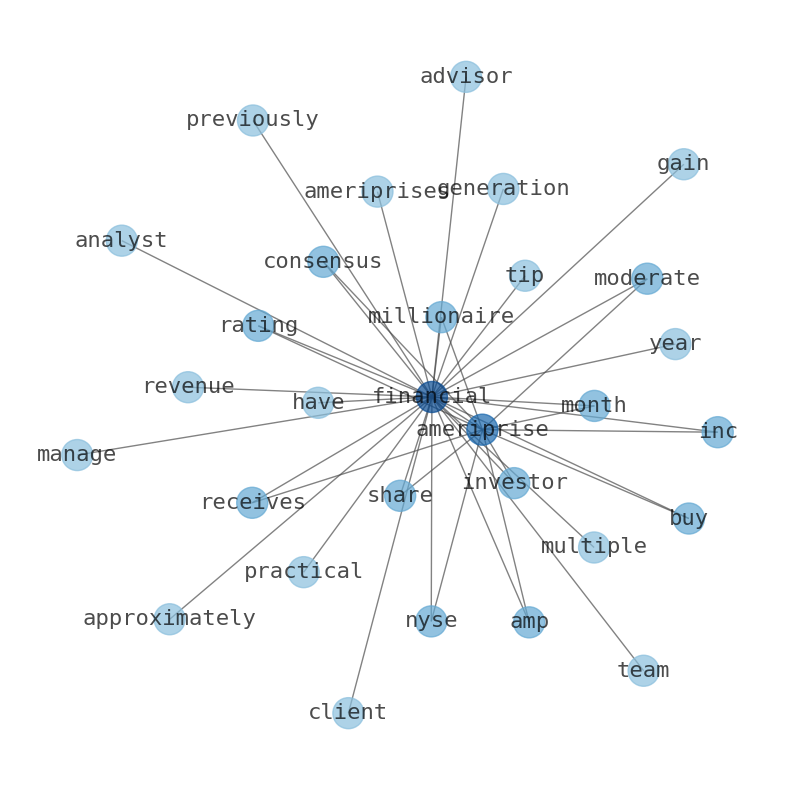

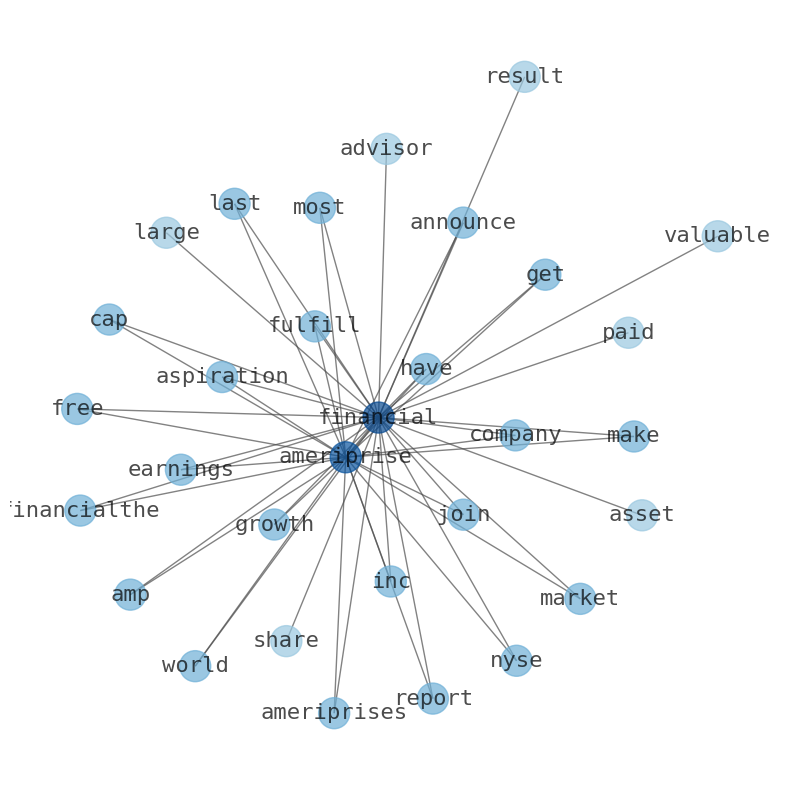

Keywords

The game is changing. There is a new strategy to evaluate Ameriprise Financial fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Ameriprise Financial are: Financial, Ameriprise, share, earnings, Ameriprises, Financials, revenue, and the most common words in the summary are: financial, ameriprise, stock, market, earnings, advisor, job, . One of the sentences in the summary was: Ameripris Financial recently reported earnings of $7.75 per share, surpassing analyst expectations.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #financial #ameriprise #stock #market #earnings #advisor #job.

Read more →Related Results

Ameriprise Financial

Open: 410.39 Close: 419.49 Change: 9.1

Read more →

Ameriprise Financial

Open: 394.2 Close: 396.78 Change: 2.58

Read more →

Ameriprise Financial

Open: 394.64 Close: 396.94 Change: 2.3

Read more →

Ameriprise Financial

Open: 387.81 Close: 390.07 Change: 2.26

Read more →

Ameriprise Financial

Open: 380.46 Close: 376.4 Change: -4.06

Read more →

Ameriprise Financial

Open: 333.51 Close: 336.36 Change: 2.85

Read more →

Ameriprise Financial

Open: 315.91 Close: 314.57 Change: -1.34

Read more →

Ameriprise Financial

Open: 332.43 Close: 327.93 Change: -4.5

Read more →

Ameriprise Financial

Open: 348.15 Close: 349.53 Change: 1.38

Read more →

Ameriprise Financial

Open: 316.61 Close: 317.02 Change: 0.41

Read more →

Ameriprise Financial

Open: 297.19 Close: 291.45 Change: -5.74

Read more →

Ameriprise Financial

Open: 288.64 Close: 294.11 Change: 5.46

Read more →

Ameriprise Financial

Open: 409.46 Close: 412.38 Change: 2.92

Read more →

Ameriprise Financial

Open: 392.43 Close: 391.36 Change: -1.07

Read more →

Ameriprise Financial

Open: 394.64 Close: 396.94 Change: 2.3

Read more →

Ameriprise Financial

Open: 377.63 Close: 381.67 Change: 4.04

Read more →

Ameriprise Financial

Open: 351.09 Close: 351.42 Change: 0.33

Read more →

Ameriprise Financial

Open: 336.22 Close: 333.17 Change: -3.05

Read more →

Ameriprise Financial

Open: 320.14 Close: 326.44 Change: 6.3

Read more →

Ameriprise Financial

Open: 326.98 Close: 332.37 Change: 5.39

Read more →

Ameriprise Financial

Open: 320.12 Close: 326.11 Change: 5.99

Read more →

Ameriprise Financial

Open: 296.52 Close: 294.42 Change: -2.1

Read more →

Ameriprise Financial

Open: 294.67 Close: 302.41 Change: 7.74

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo