The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Ambev

Youtube Subscribe

Open: 2.5 Close: 2.48 Change: -0.02

The unbelievably easy way to evaluate Ambev Company Inc Stock: Use an AI.

This document will help you to evaluate Ambev without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Ambev are: Ambev, earnings, JPMorgan, share, Ambevs, SA, analyst, and the …

Stock Summary

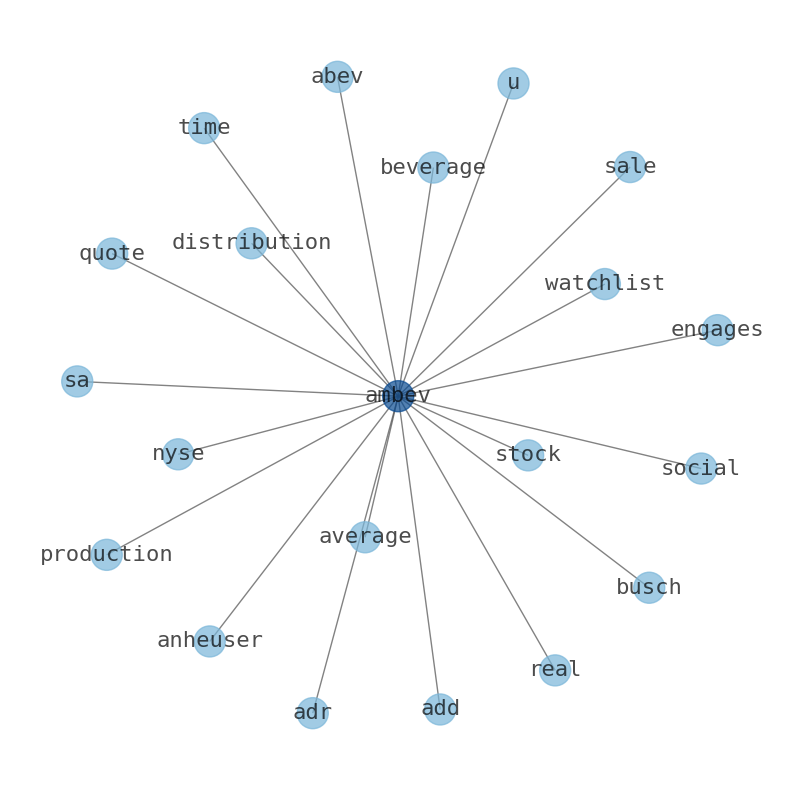

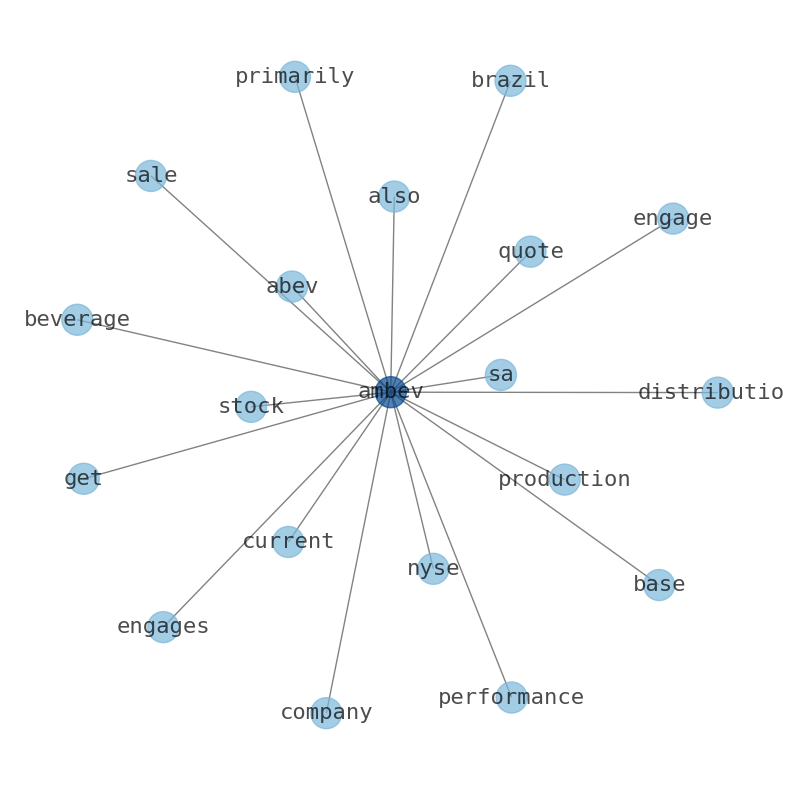

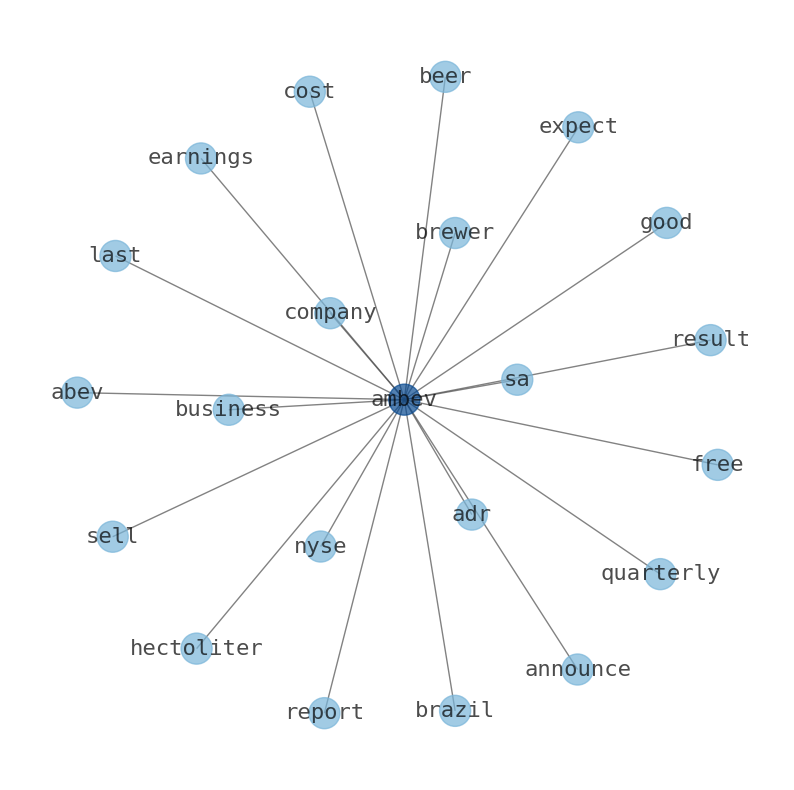

Ambev S.A. engages in the production, distribution, and sale of beer, draft beer, carbonated soft drinks, other non-alcoholic beverages, malt, and food products. It offers beer primarily under the Sk.

Today's Summary

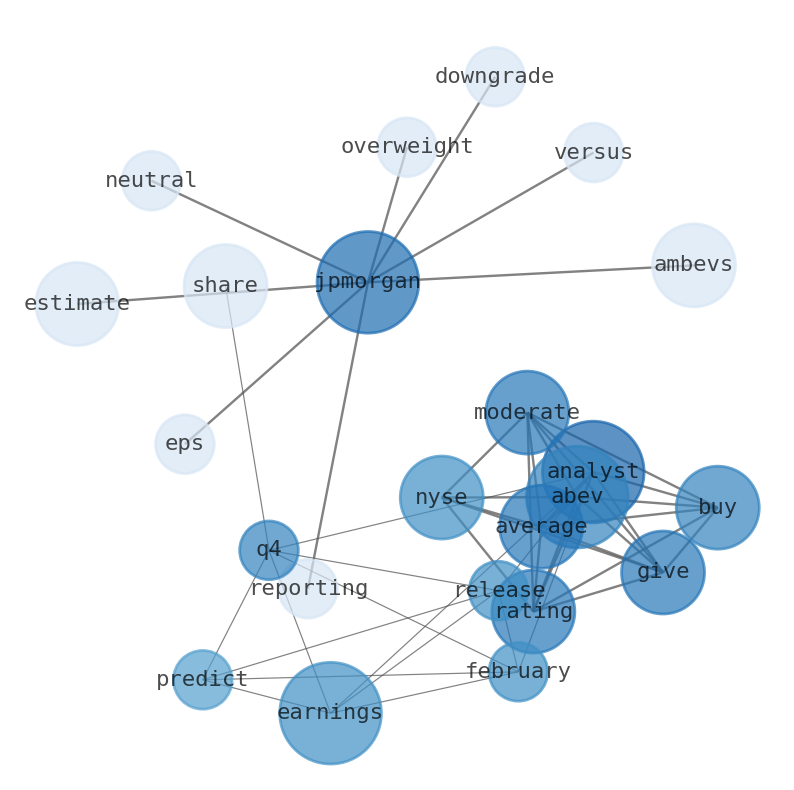

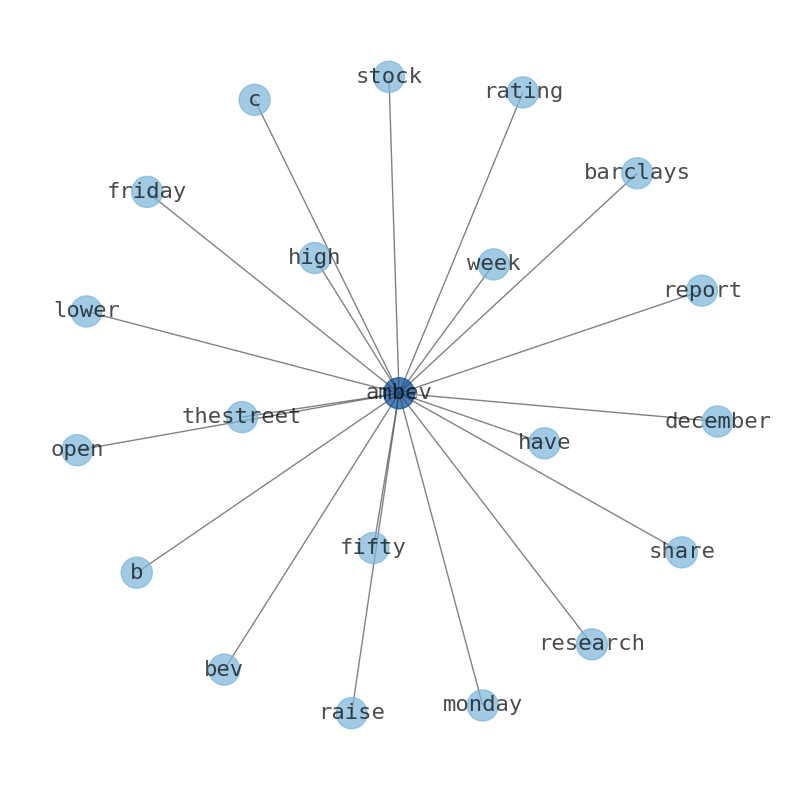

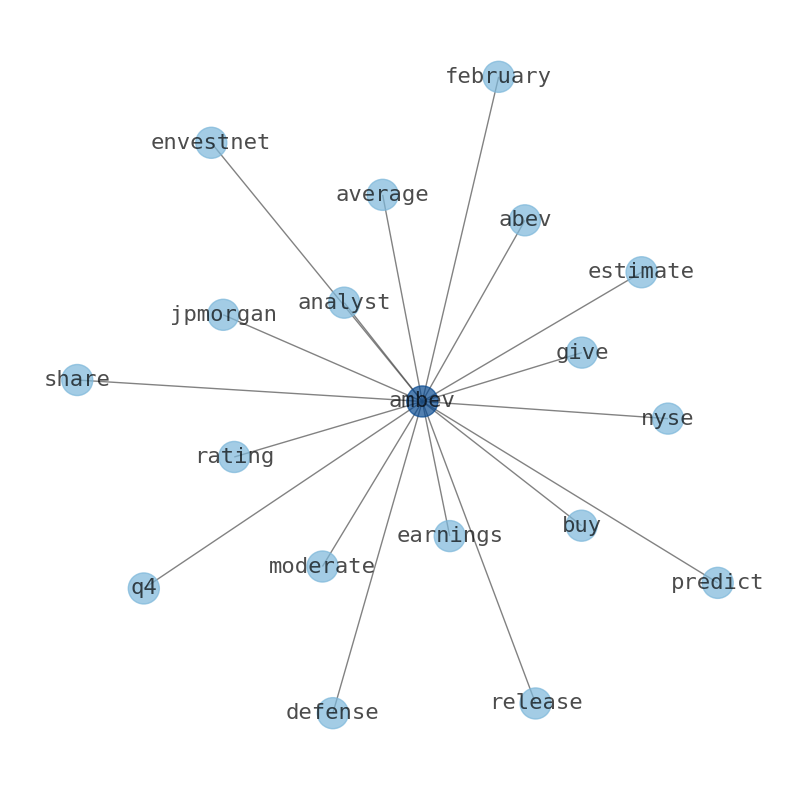

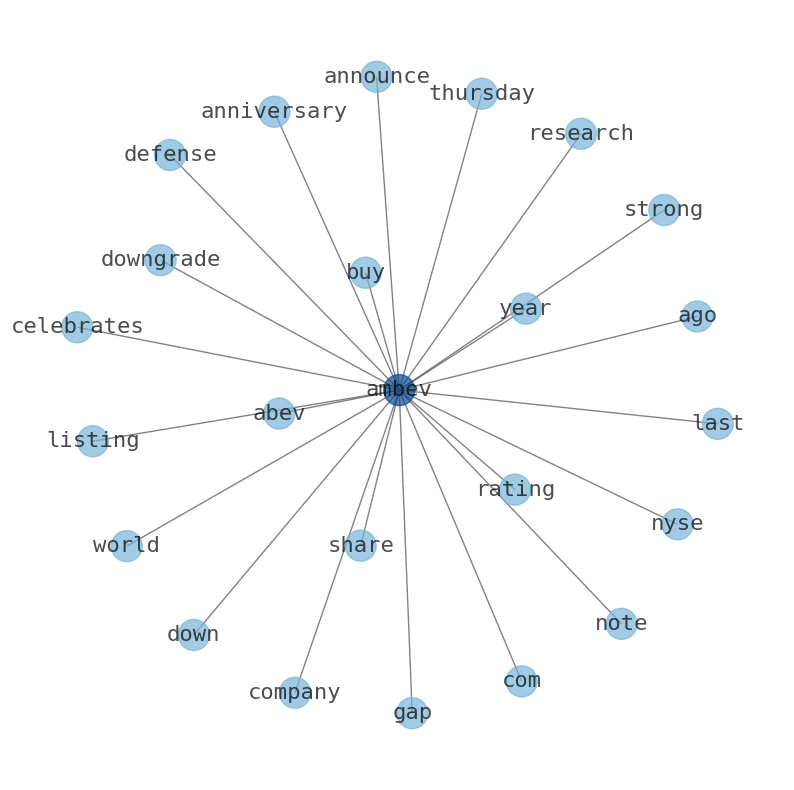

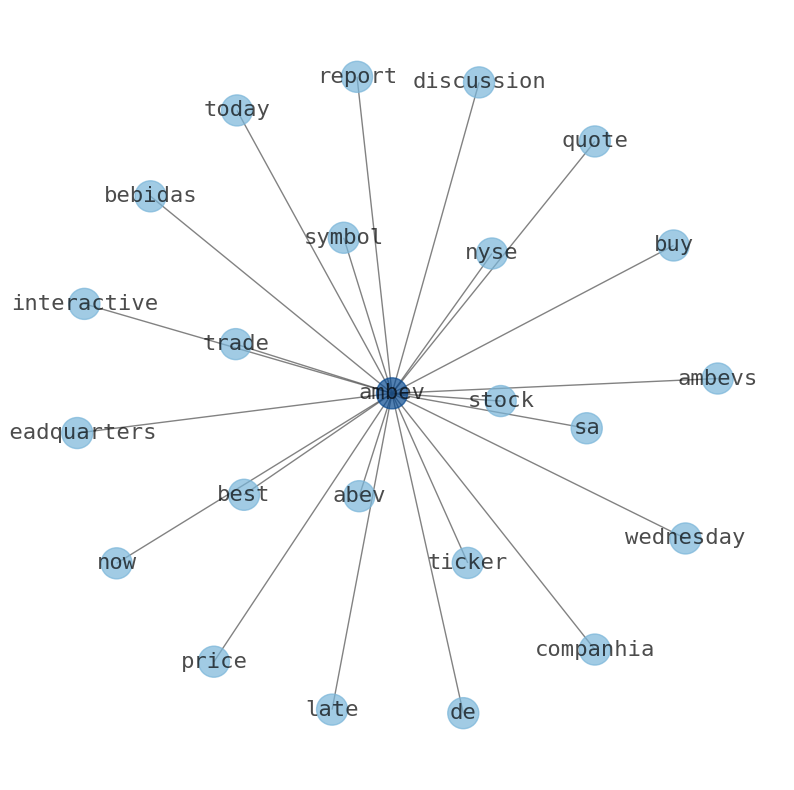

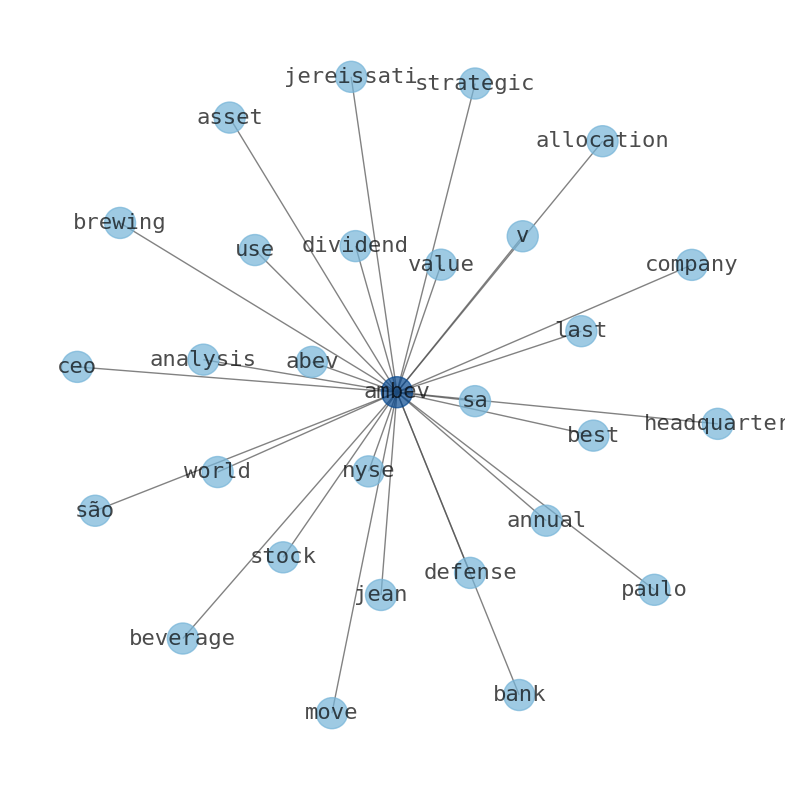

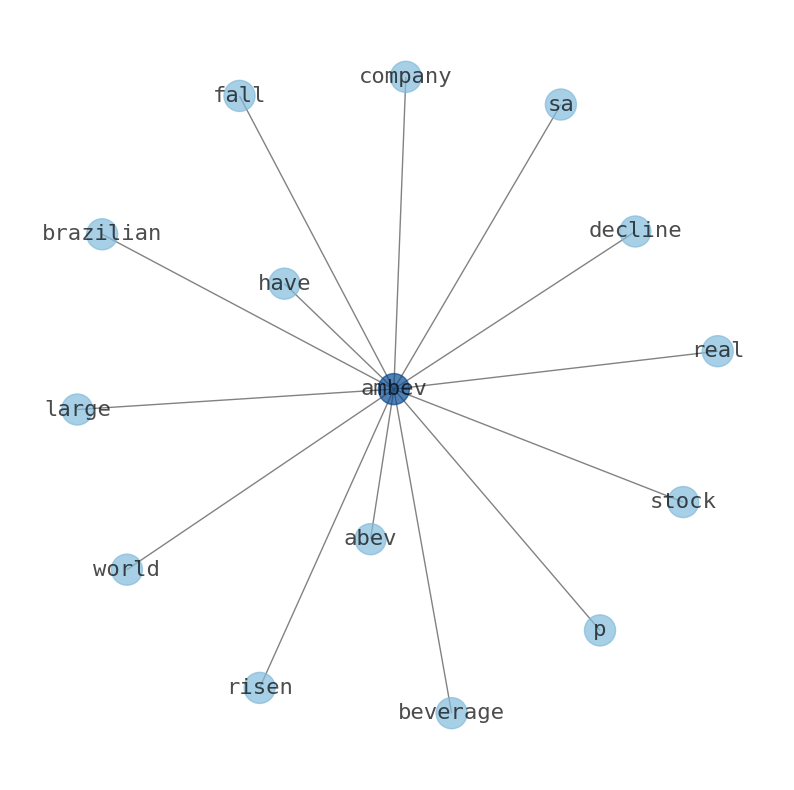

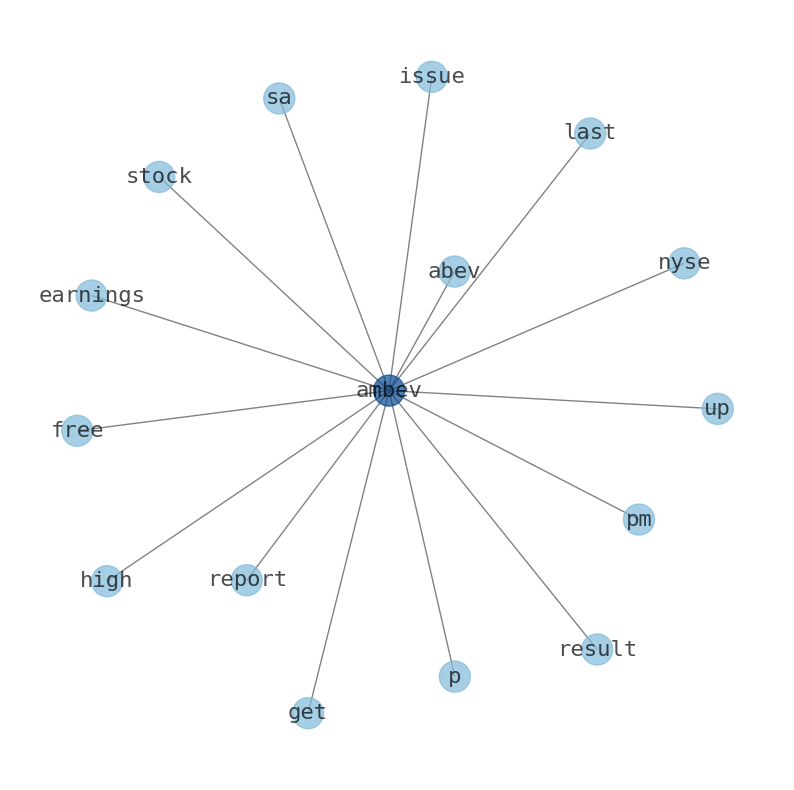

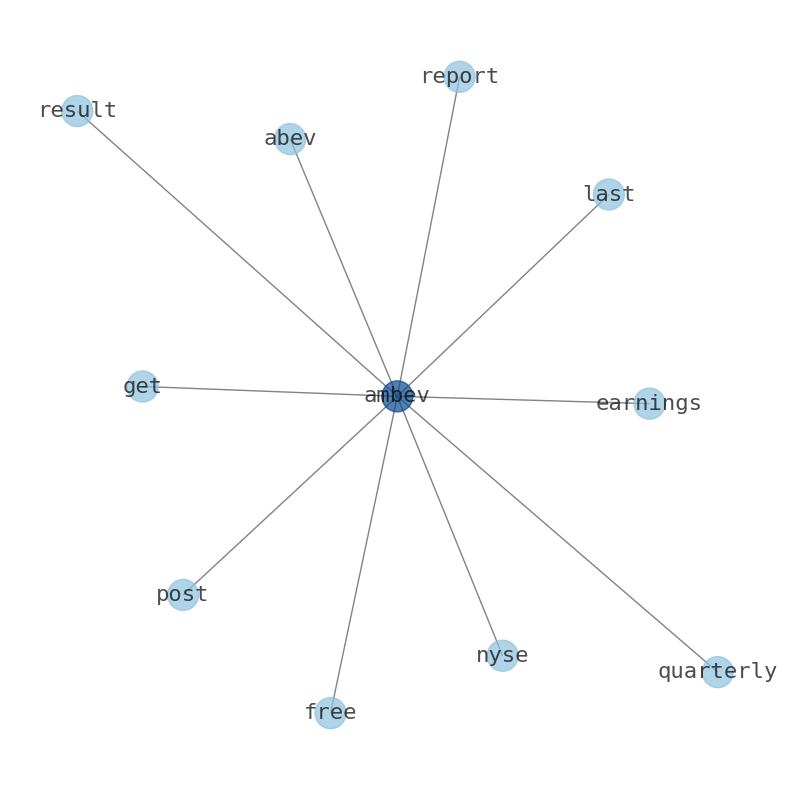

Ambev releases earnings for Q4 on February 29. Analysts predict earnings per share of $0.055. Envestnet Asset Management Inc. grew its stake in shares of Ambevs S.A. (ABEV) in the past quarter. Ambev S.A. (NYSE:ABEV) Given Average Rating of “Moderate Buy” by analysts - defense world. ambev s.a. (nyse:abev) given average rating of ‘moderate buy’ by analysts. Ambev beat estimated earnings by 40.0%, reporting an EPS of $0.07 versus an estimate of $ 0.05. JPMorgan JPMorgan downgraded Ambevs to Neutral from Overweight at JPMorgan. Brazils economy down 0.5%, FX flat.

Today's News

Ambev releases earnings for Q4 on February 29. Analysts predict earnings per share of $0.055. Envestnet Asset Management Inc. grew its stake in shares of Ambevs S.A. (ABEV) in the past quarter. Ambev S.A. (NYSE:ABEV) Given Average Rating of “Moderate Buy” by analysts - defense world. ambev s.a. (nyse:abev) given average rating of ‘moderate buy’ by analysts. Ambev beat estimated earnings by 40.0%, reporting an EPS of $0.07 versus an estimate of $ 0.05. JPMorgan JPMorgan downgraded Ambevs to Neutral from Overweight at JPMorgan. Brazils economy down 0.5%, FX flat.

Stock Profile

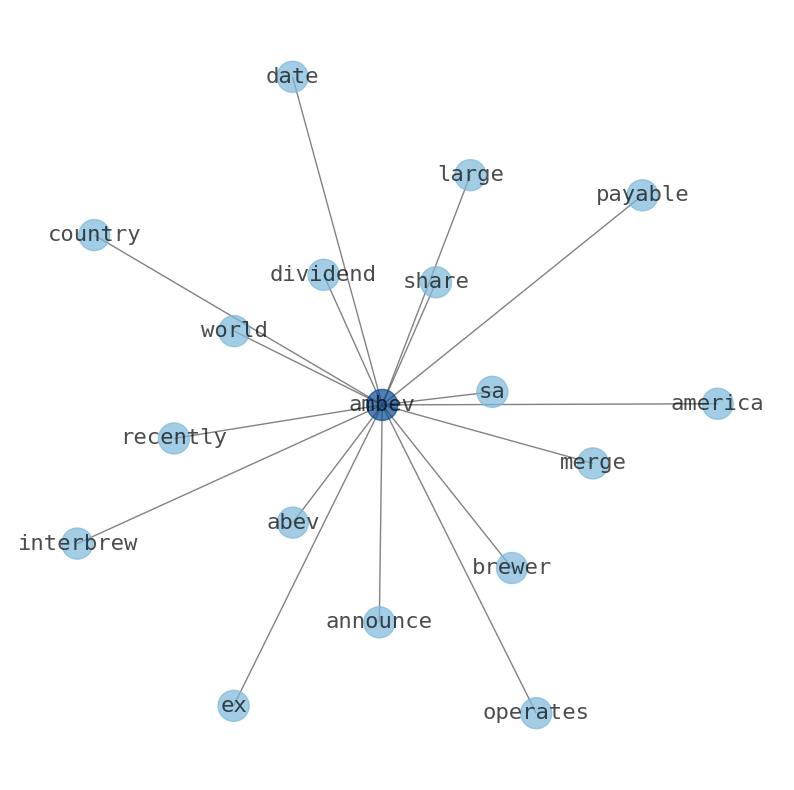

"Ambev S.A., through its subsidiaries, engages in the production, distribution, and sale of beer, draft beer, carbonated soft drinks, other non-alcoholic beverages, malt, and food products. It offers beer primarily under the Skol, Brahma, Antarctica, Brahva, Budweiser, Bud Light, Beck, Leffe and Hoegaarden, Bucanero, Cristal, Mayabe, Presidente, Presidente Light, Brahma Light, Bohemia, The One, Corona, Modelo Especial, Stella Artois, Quilmes Clásica, Paceña, Taquiña, Huari, Becker, Cusqueña, Michelob Ultra, Busch, Pilsen, Ouro Fino, Banks, Deputy, Patricia, Labatt Blue, Alexander Keith's, and Kokanee brands. The company also provides carbonated soft drinks, bottled water, isotonic beverages, energy drinks, coconut water, powdered and natural juices, and ready-to-drink teas under the Guaraná Antarctica, Gatorade, H2OH!, Lipton Iced Tea, Fusion, Do Bem, Pepsi-Cola, Canada Dry, Squirt, Red Rock, Red Bull, Seven Up, Nutrl, Bud Light Seltzer, Palm Bay, and Mike's brands. It offers its products through a network of third-party distributors and a direct distribution system. The company was founded in 1885 and is headquartered in São Paulo, Brazil. Ambev S.A. operates as a subsidiary of Interbrew International B.V."

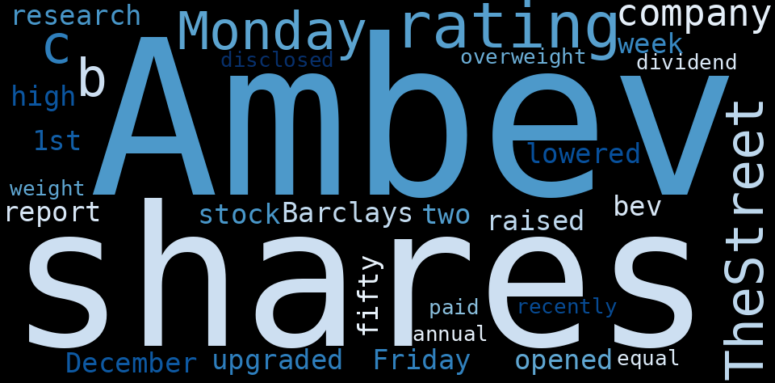

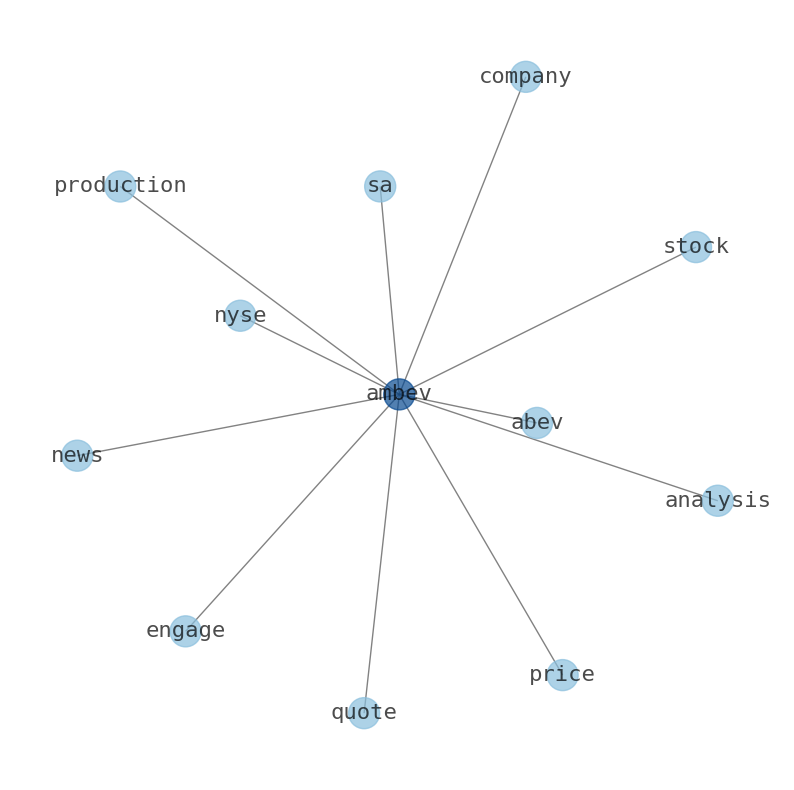

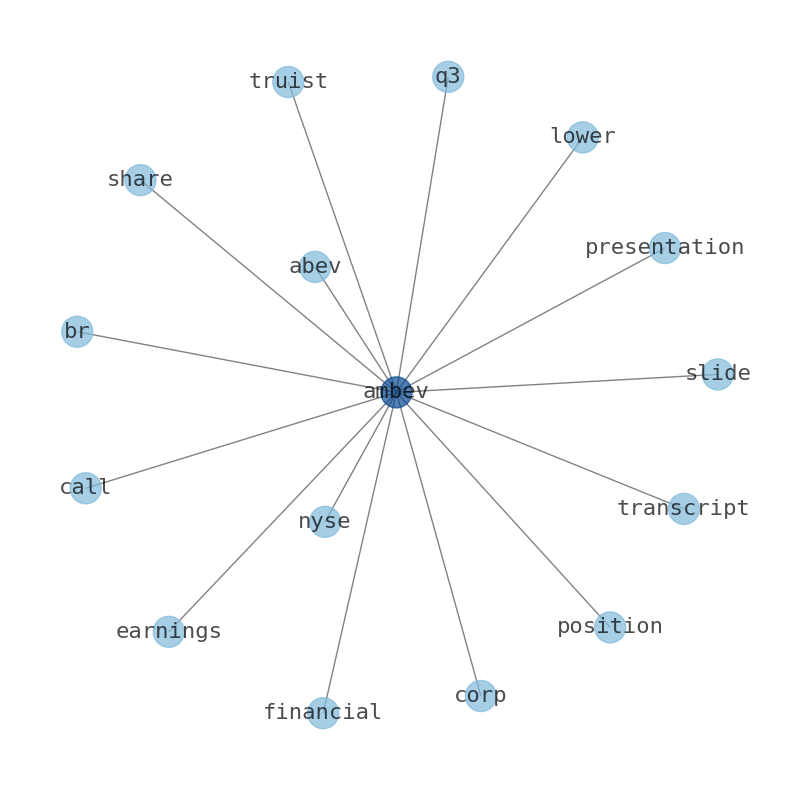

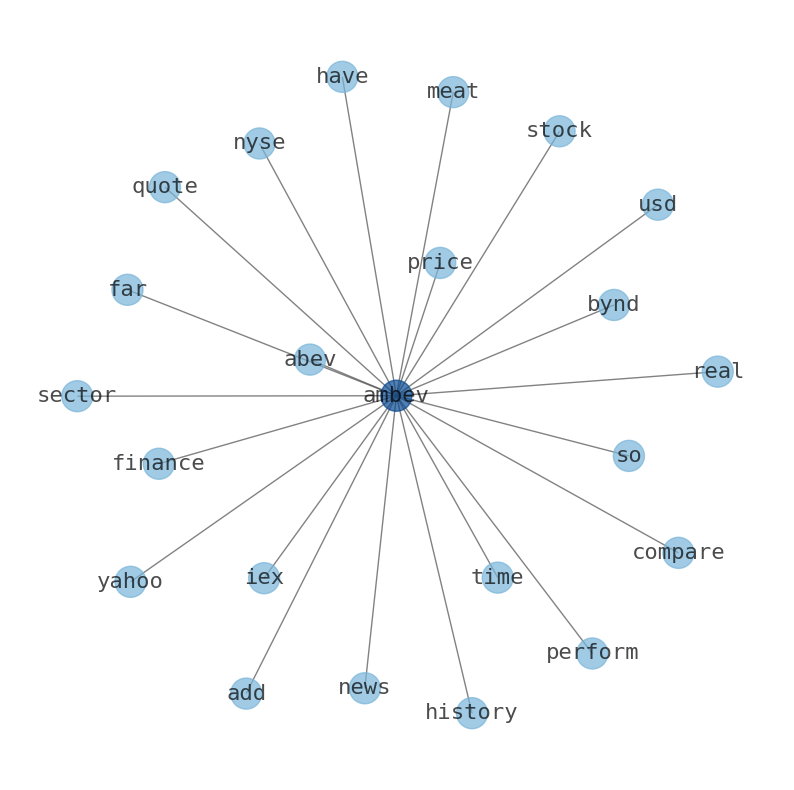

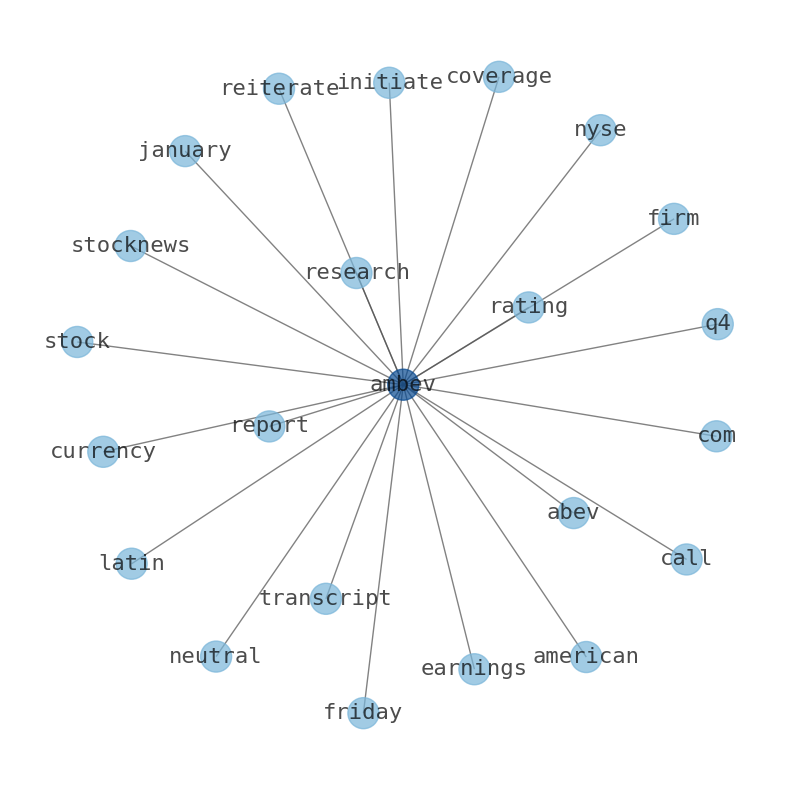

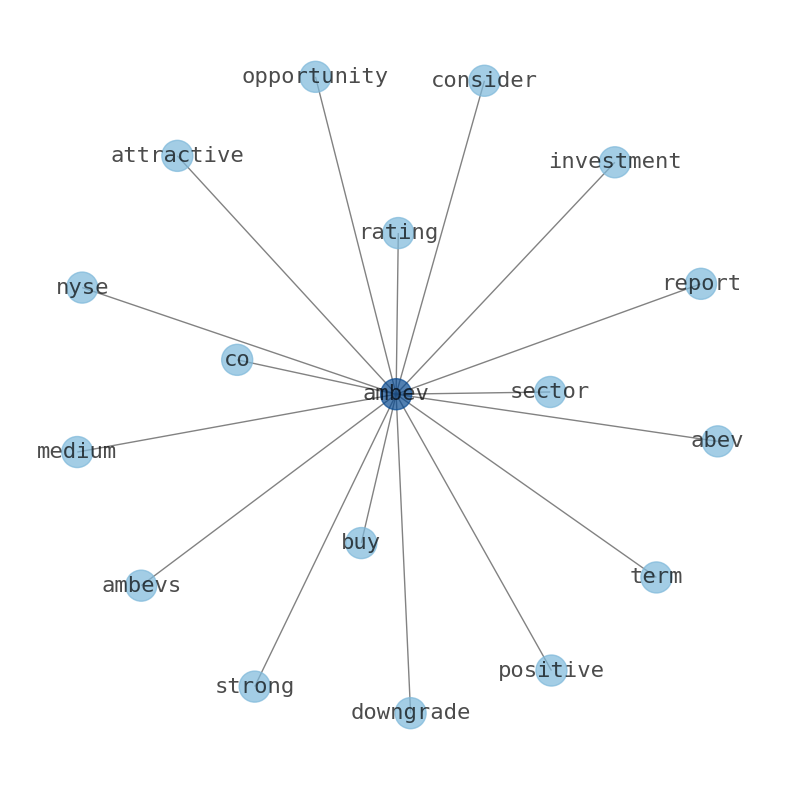

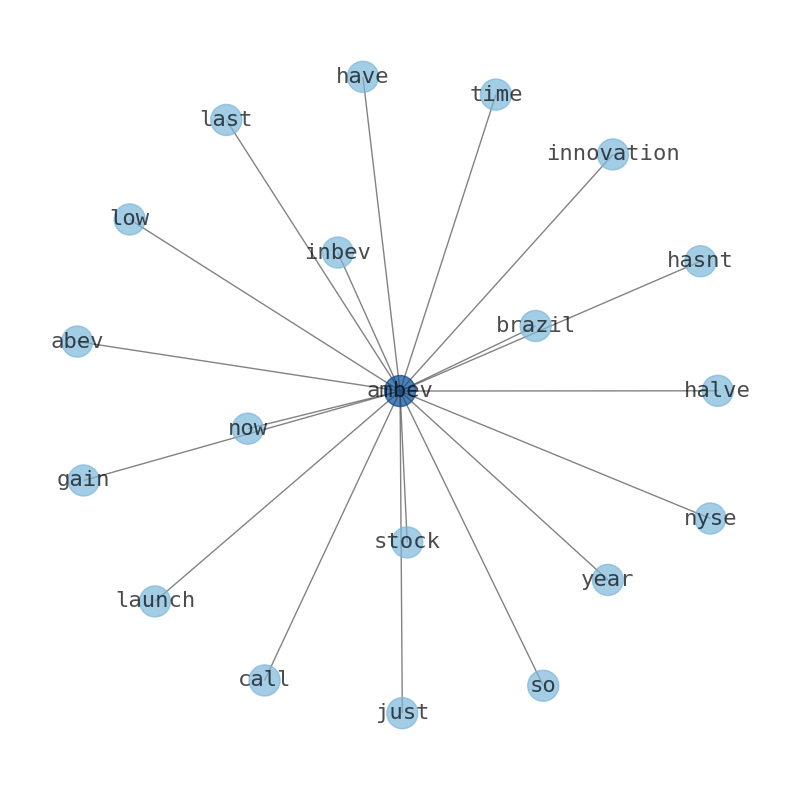

Keywords

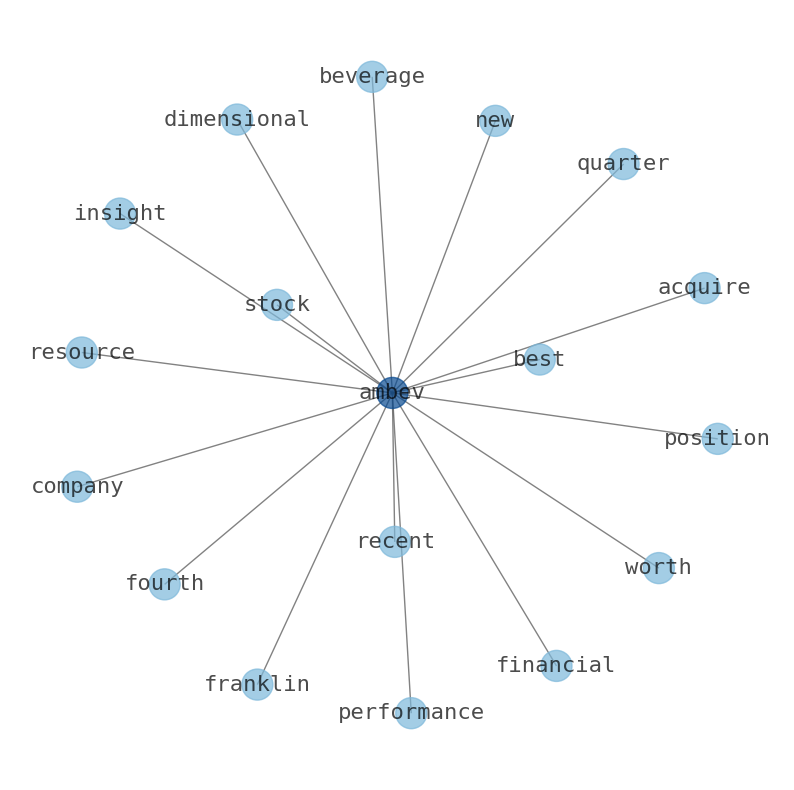

The game is changing. There is a new strategy to evaluate Ambev fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Ambev are: Ambev, earnings, JPMorgan, share, Ambevs, SA, analyst, and the most common words in the summary are: ambev, stock, job, market, best, earnings, sa, . One of the sentences in the summary was: (nyse:abev) given average rating of ‘moderate buy’ by analysts. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #ambev #stock #job #market #best #earnings #sa.

Read more →Related Results

Ambev

Open: 2.56 Close: 2.55 Change: -0.01

Read more →

Ambev

Open: 2.5 Close: 2.48 Change: -0.02

Read more →

Ambev

Open: 2.79 Close: 2.81 Change: 0.02

Read more →

Ambev

Open: 2.76 Close: 2.78 Change: 0.02

Read more →

Ambev

Open: 2.76 Close: 2.74 Change: -0.02

Read more →

Ambev

Open: 3.18 Close: 3.15 Change: -0.03

Read more →

Ambev

Open: 3.04 Close: 3.03 Change: -0.01

Read more →

Ambev

Open: 3.09 Close: 3.1 Change: 0.01

Read more →

Ambev

Open: 2.94 Close: 2.91 Change: -0.03

Read more →

Ambev

Open: 2.8 Close: 2.8 Change: 0.0

Read more →

Ambev

Open: 2.55 Close: 2.55 Change: 0.0

Read more →

Ambev

Open: 2.67 Close: 2.67 Change: 0.0

Read more →

Ambev

Open: 2.86 Close: 2.89 Change: 0.03

Read more →

Ambev

Open: 2.46 Close: 2.54 Change: 0.08

Read more →

Ambev

Open: 2.86 Close: 2.82 Change: -0.04

Read more →

Ambev

Open: 3.13 Close: 3.16 Change: 0.03

Read more →

Ambev

Open: 3.07 Close: 3.0 Change: -0.07

Read more →

Ambev

Open: 3.02 Close: 3.1 Change: 0.08

Read more →

Ambev

Open: 2.91 Close: 2.88 Change: -0.03

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo