The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the whole internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Amarin

Youtube Subscribe

Open: 0.75 Close: 0.7 Change: -0.05

Our AI found 14 flaws in Amarin.

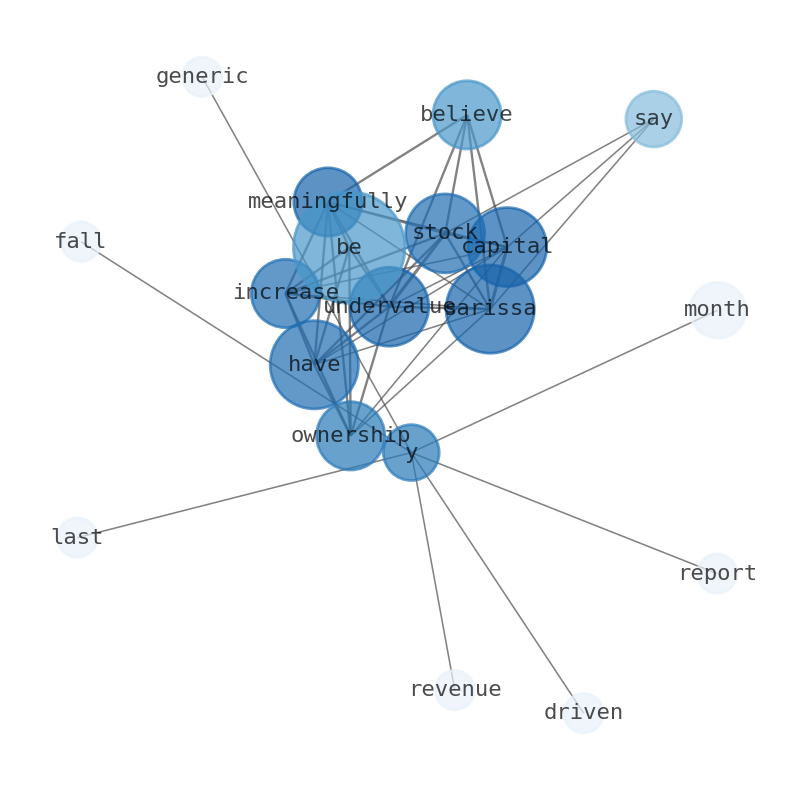

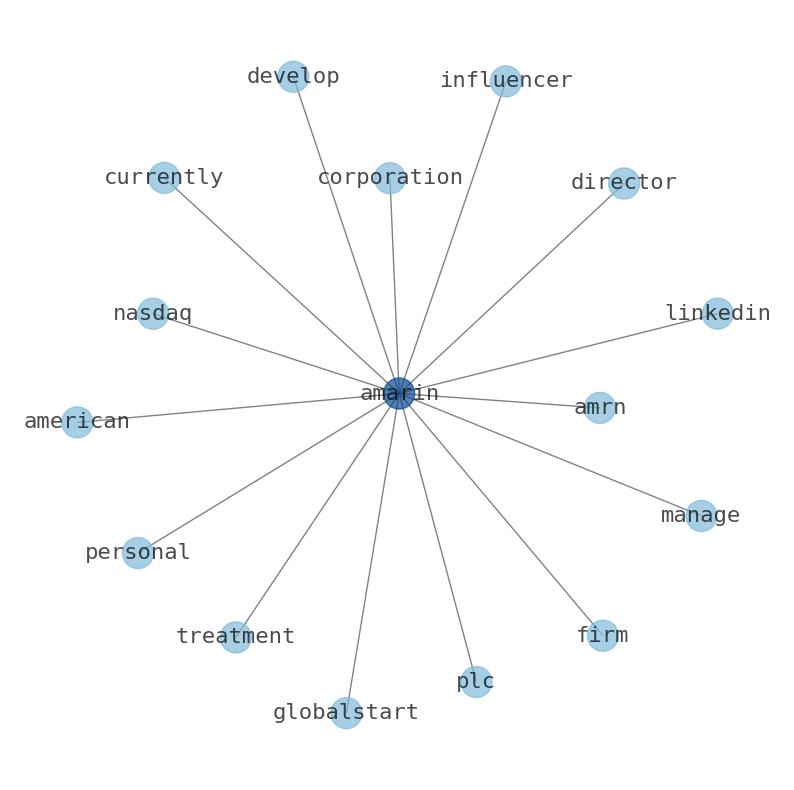

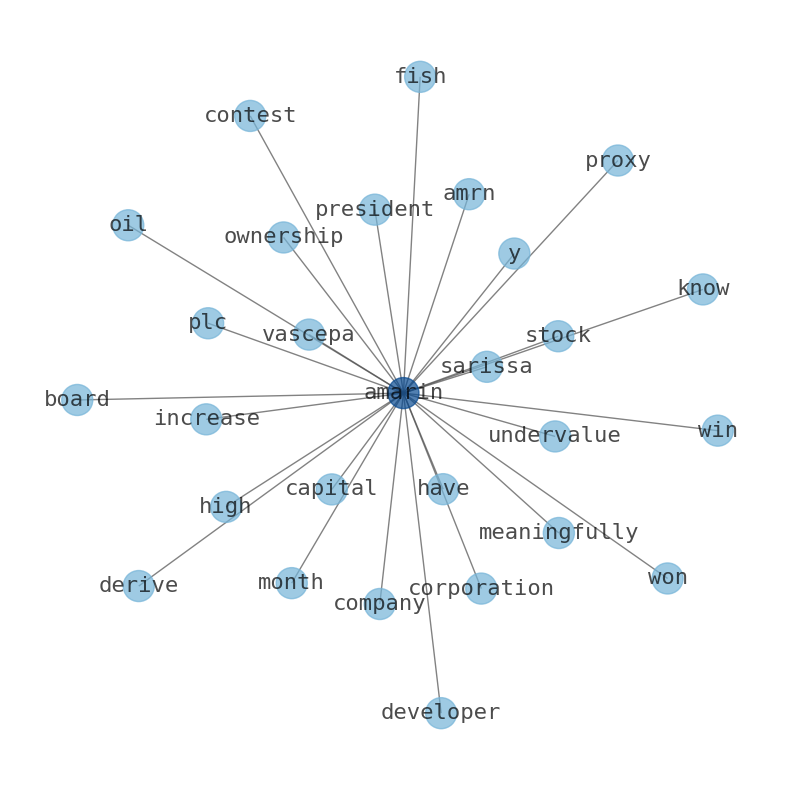

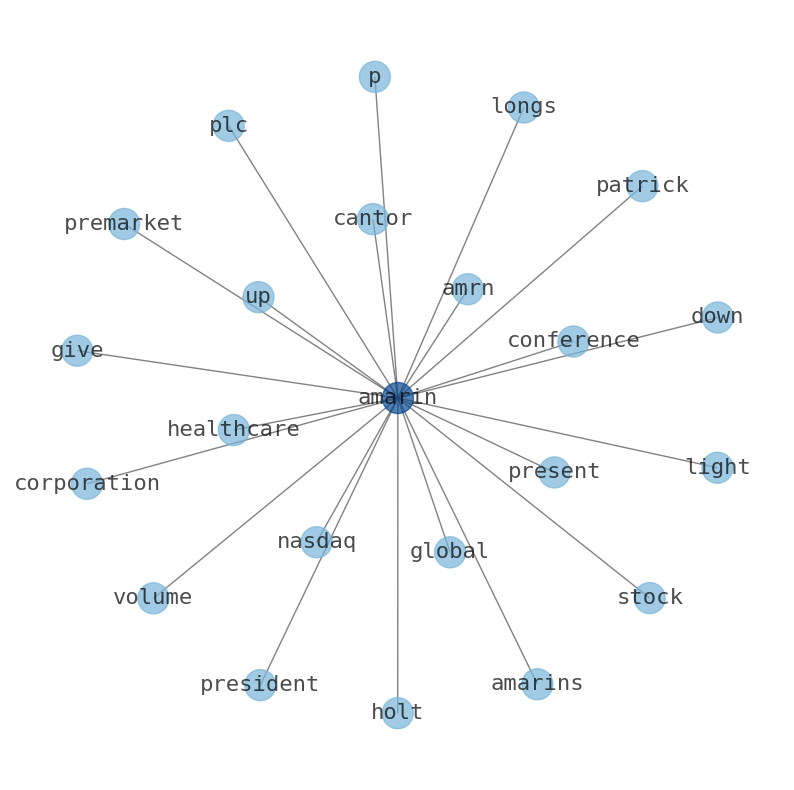

How much time have you spent trying to decide whether investing in Amarin? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Amarin are: Amarin, Sarissa, …

Stock Summary

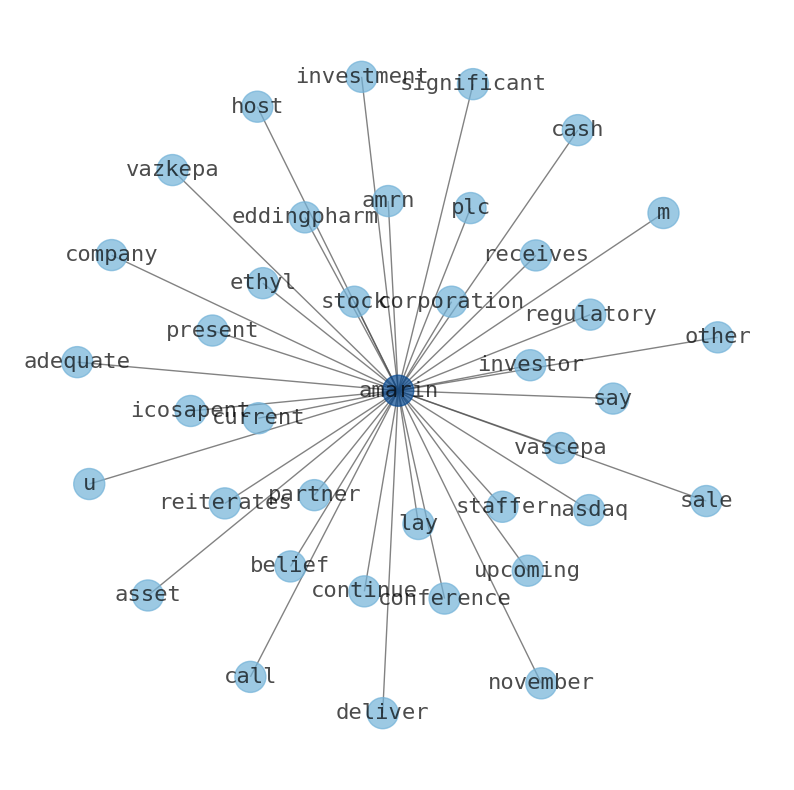

Amarin Corporation plc engages in the development and commercialization of therapeutics for the treatment of cardiovascular diseases. It offers VASCEPA, a prescription-only omega-3 fatty acid product, used as an adjunct to diet for.

Today's Summary

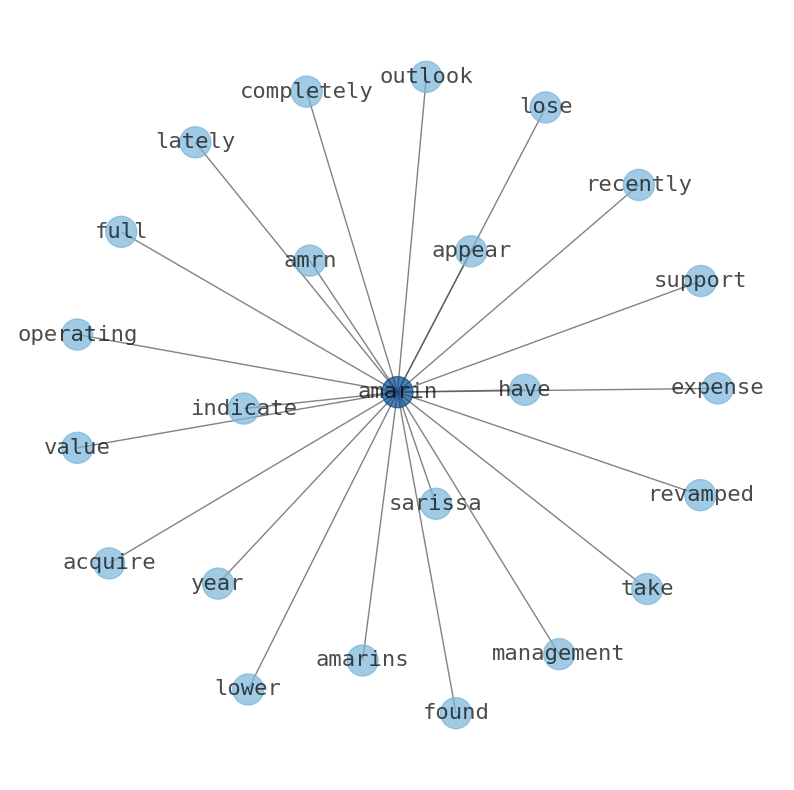

Sarissa Capital Management says Amarin stock undervalued. Sarissa won seven board seats at Amarin (AMRN ) - known as the developer of fish-oil derived heart drug Vascepa.

Today's News

Sarissa Capital Believes Amarin Stock Is Meaningfully Undervalued and Has Increased Its Ownership. Sarissa capital believes amarin stock is meaningfully undervalued and has increased its ownership. Sarissa Capital Management says Amarin stock undervalued, months after winning proxy contest. Sarissa won seven board seats at Amarin (AMRN ) - known as the developer of fish-oil derived heart drug Vascepa. Amarin last month reported a 27% Y/Y fall in revenue, driven by generic competition. Amarin Corporation plc is recognized as one of the leading companies in the pharmaceutical industry, particularly in the cardiovascular health sector. Amarin has experienced significant growth in sales of Vascepa, with the medication gaining traction in the market and being prescribed by healthcare providers. Amarin Printing And and President Bakery Public are 1.34 times less risky than President Bakary. Pair trading strategies can diversify away market risk if combined in same portfolio. Amarin Corporation plc (AMRN) is a biopharmaceutical company that focuses on the commercialization and development of therapeutics for cardiovascular health. Amarin has implemented a premium pricing strategy for Vascepa, positioning it as a high-value product in the market. Amarin shares are trading higher after Sarissa Capital Issued a Statement saying it Believes Amarins Stock Is Meaningfully Undervalued and That It Has Increased Its Ownership.

Stock Profile

"Amarin Corporation plc, a pharmaceutical company, engages in the development and commercialization of therapeutics for the treatment of cardiovascular diseases in the United States, European countries, Canada, Lebanon, and the United Arab Emirates. It offers VASCEPA, a prescription-only omega-3 fatty acid product, used as an adjunct to diet for reducing triglyceride levels in adult patients with severe hypertriglyceridemia. The company sells its products principally to wholesalers and specialty pharmacy providers. It has a collaboration with Mochida Pharmaceutical Co., Ltd. to develop and commercialize drug products and indications based on the active pharmaceutical ingredient in Vascepa. The company was formerly known as Ethical Holdings plc and changed its name to Amarin Corporation plc in 1999. Amarin Corporation plc was incorporated in 1989 and is headquartered in Dublin, Ireland."

Keywords

The game is changing. There is a new strategy to evaluate Amarin fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Amarin are: Amarin, Sarissa, Capital, Vascepa, market, Believes, Stock, and the most common words in the summary are: amarin, corporation, plc, name, amrn, bloomberg, e, . One of the sentences in the summary was: Sarissa Capital Management says Amarin stock undervalued. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #amarin #corporation #plc #name #amrn #bloomberg #e.

Read more →Related Results

Amarin

Open: 0.89 Close: 0.9 Change: 0.01

Read more →

Amarin

Open: 0.68 Close: 0.68 Change: 0.0

Read more →

Amarin

Open: 1.14 Close: 1.19 Change: 0.05

Read more →

Amarin

Open: 0.75 Close: 0.7 Change: -0.05

Read more →

Amarin

Open: 1.0 Close: 1.02 Change: 0.02

Read more →- Apple

- Microsoft

- Alphabet

- Amazon

- Tesla

- Berkshire Hathaway

- UnitedHealth Group

- NVIDIA

- Johnson & Johnson

- Taiwan Semiconductor Manufacturing Company

- Visa Inc.

- Meta Platforms

- Exxon Mobil

- Walmart

- The Procter & Gamble Company

- Mastercard

- JPMorgan Chase & Co.

- Chevron

- The Home Depot

- Eli Lilly and Company

- Pfizer

- The Coca-Cola Company

- Bank of America

- Novo Nordisk

- Alibaba Group Holding

- AbbVie

- PepsiCo

- Costco Wholesale

- Thermo Fisher Scientific

- ASML Holding

- Toyota Motor

- Merck & Co.

- Broadcom

- Danaher

- Oracle

- AstraZeneca

- McDonalds

- Verizon Communications

- The Walt Disney Company

- Accenture

- Shell

- Adobe

- Abbott Laboratories

- BHP Group

- Cisco Systems

- Novartis AG

- Salesforce

- T-Mobile US

- Nike, Inc.

- NextEra Energy

- United Parcel Service

- Qualcomm

- Comcast

- Wells Fargo & Company

- Texas Instruments

- Bristol-Myers Squibb Company

- Advanced Micro Devices

- Philip Morris International

- Intel

- Linde

- AMTD Digital

- Morgan Stanley

- Union Pacific

- Raytheon Technologies

- Royal Bank of Canada

- HSBC Holdings

- Amgen

- TotalEnergies SE

- Honeywell International

- The Charles Schwab Corporation

- S&P Global

- Intuit

- CVS Health

- American Tower

- Blackstone

- Unilever

- Lowes Companies

- Medtronic plc.

- ConocoPhillips

- Sanofi

- Equinor ASA

- International Business Machines

- HDFC Bank

- The Toronto-Dominion Bank

- American Express Company

- The Goldman Sachs Group

- Elevance Health

- Lockheed Martin

- SAP SE

- Diageo