The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Hanesbrands

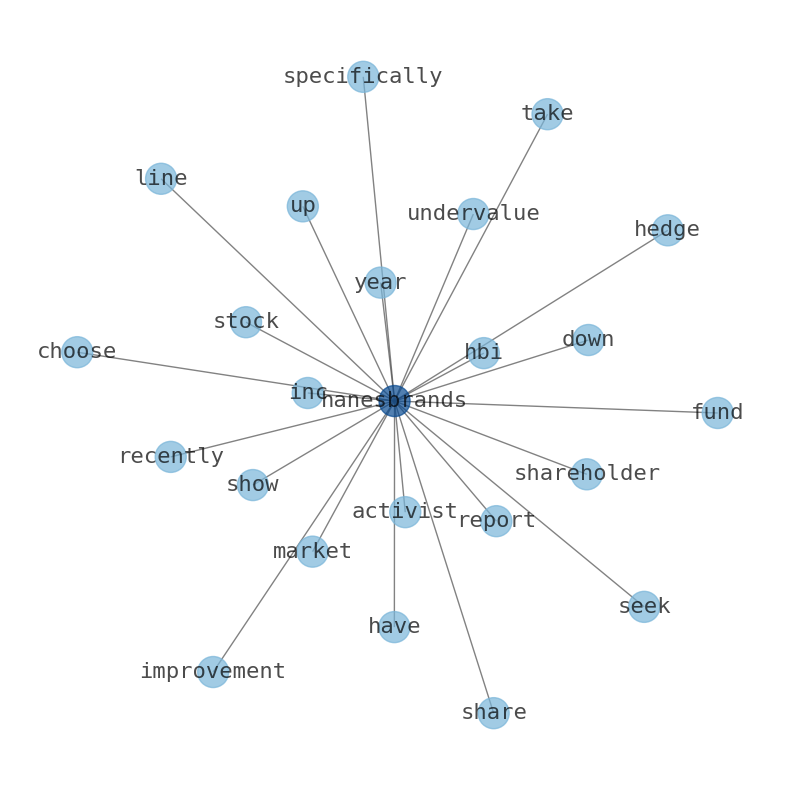

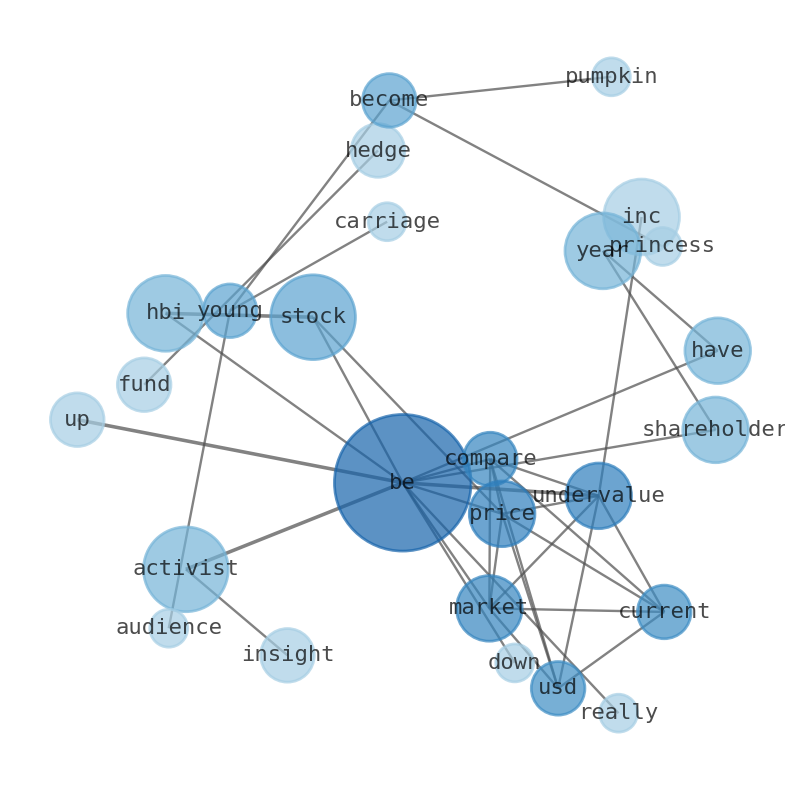

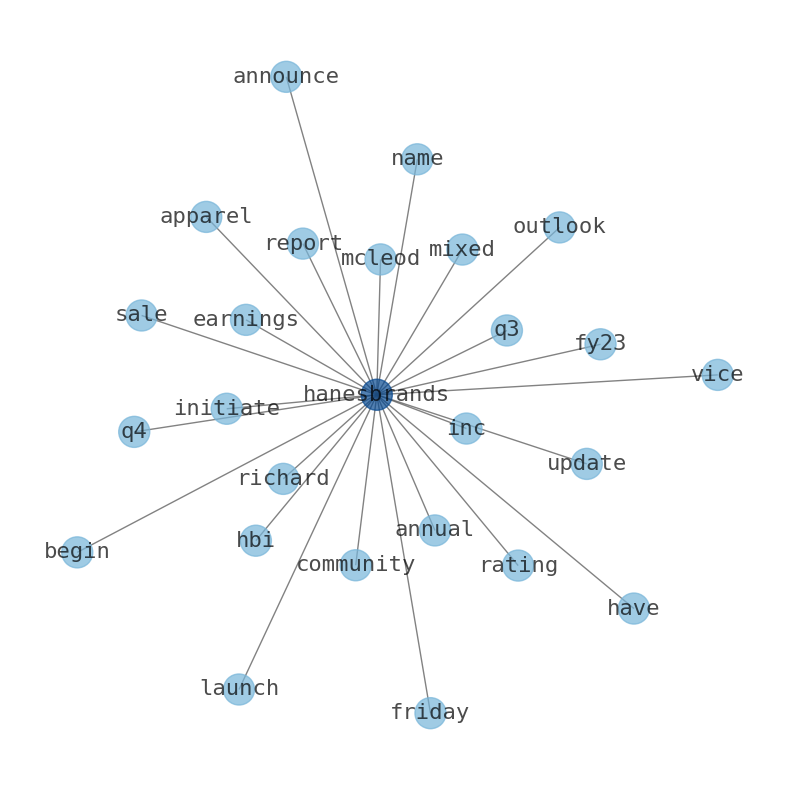

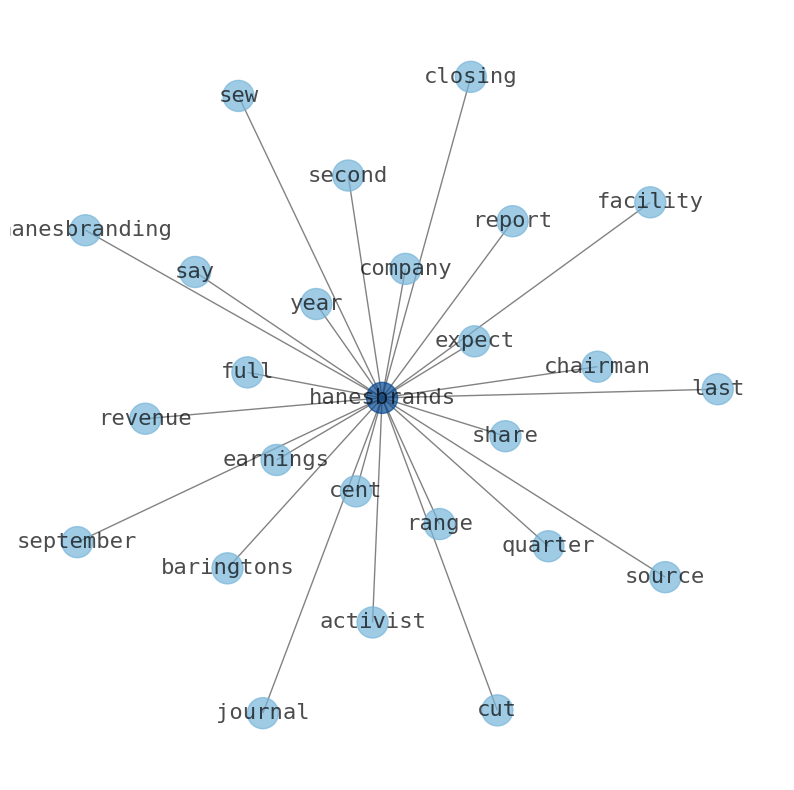

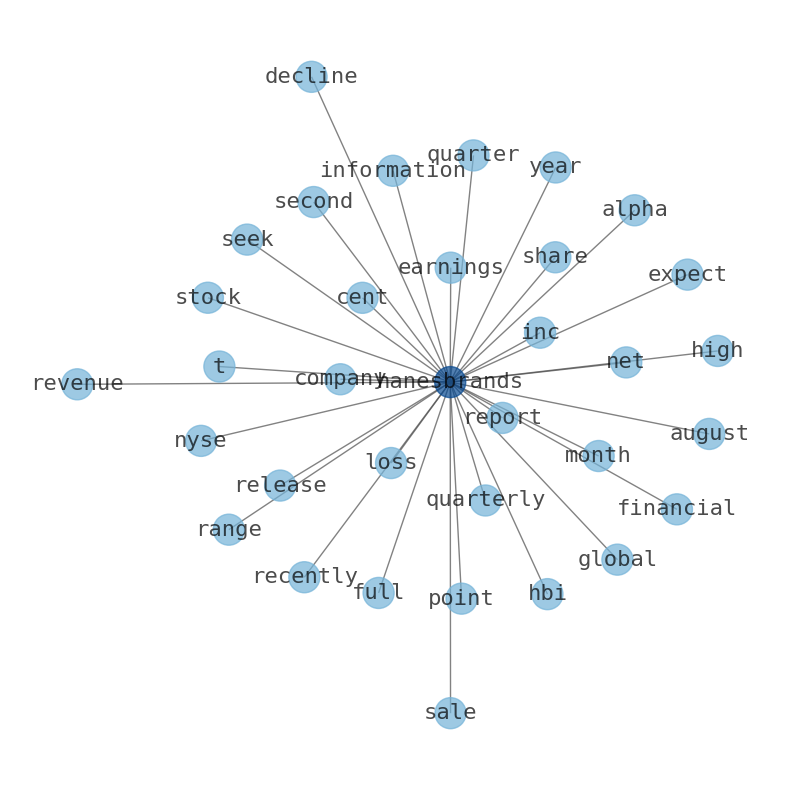

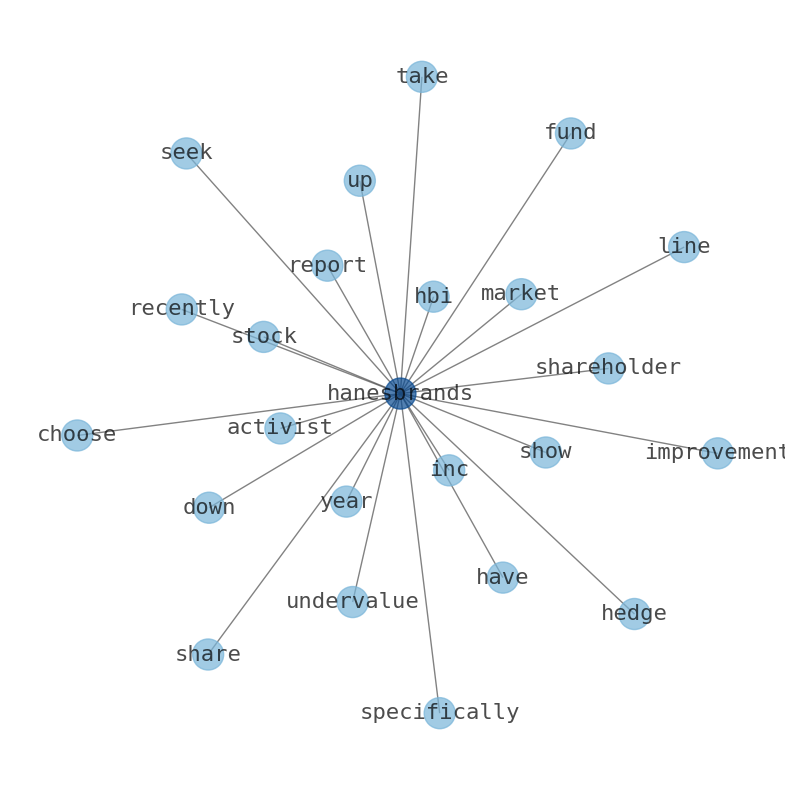

Activist Insight suggests that Hanesbrands may be in line for an activist to show up and take over. Hedge funds are very much in support of HanesBrands. An activist might specifically choose to seek improvements. Shares of Hanesbrands ( HBI) showed a 6.52% gain on Wednesday at 11:02 a.m. ET. A report from Activist Insight being circulated by traders highlights that HanesBrands could be a top target for an activist play. Hanesbrands Inc. recently reported its quarterly earnings data for the quarter ending May 3rd this year. Hedge funds and other institutional investors currently own a substantial portion — specifically around 88.35% —of Hanesbands total stock. This weekend at HanesBrands Theatre, mice will turn to horses, pumpkins will become carriages, and a young maiden will become a princess as young audiences enjoy the classic Rodgers and Hammerstein musical. Hanesbrands Inc. is Undervalued by 69% compared to the current market price of 5.18 USD. Is HBI stock undervalued or overvalued? Compared to the. current market. price of $4.00 USD, HanesBrands Inc is undervalued. Hanesbrands shareholders are down 59% for the year, but the market is up 12%. Dividends have been really beneficial for shareholders, and that cash payout explains why its total shareholder loss of 76%, over the last 5 years, isnt as bad. Hanesbrands trades on the NYSE under the ticker symbol HBI. Hanesbrandss stock was originally listed at a price of $5.28 in Sep 6, 2006. If you had invested in HanesBrands stock at $5.28, your return over the last 16 years would have been -1.84%. Hanesbrands Inc. (HBI) stock is higher by 5.54% this week: buy, hold, or sell? Find out what this means to you.

Related Results

Hanesbrands

Open: 3.63 Close: 3.95 Change: 0.32

Read more →

Hanesbrands

Open: 4.92 Close: 5.27 Change: 0.35

Read more →

Hanesbrands

Open: 5.48 Close: 5.39 Change: -0.09

Read more →

Hanesbrands

Open: 5.19 Close: 5.18 Change: -0.01

Read more →- Apple

- Taiwan Semiconductor Manufacturing Company

- The Boeing Company

- Prosperity Bancshares

- Donaldson Company

- AutoNation

- HashiCorp

- Exelixis

- Matador Resources Company

- Halozyme Therapeutics

- MKS Instruments

- Brookfield Renewable

- Envista Holdings

- Automatic Data Processing

- Grupo Aeroportuario del Pacifico

- Murphy USA

- Gentex

- Bumble

- AGNC Investment

- National Fuel Gas Company

- Woori Financial Group

- The Western Union Company

- Tencent Music Entertainment Group

- The Estee Lauder Companies

- WESCO International

- Maravai LifeSciences Holdings

- Guidewire Software

- Unum Group

- PDC Energy

- Magnolia Oil & Gas

- SiteOne Landscape Supply

- Frontier Communications Parent

- Woodward

- Rio Tinto

- First Financial Bankshares

- SunRun

- Endeavor Group Holdings

- Kilroy Realty

- Stifel Financial

- South State

- Reynolds Consumer Products

- Starbucks

- Lumentum Holdings

- Sonoco Products Company

- FS KKR Capital

- Wyndham Hotels & Resorts

- United States Steel

- Vornado Realty Trust

- Dutch Bros

- Informatica

- Prologis

- AngloGold Ashanti

- Option Care Health

- CEMEX

- CCC Intelligent Solutions Holdings

- Huntsman

- Pinnacle Financial Partners

- Ingredion

- First American Financial

- Brunswick

- Voya Financial

- Flowers Foods

- Boyd Gaming

- Futu Holdings

- Stag Industrial

- Globus Medical

- BOK Financial

- ZIM Integrated Shipping Services

- British American Tobacco

- Valley National Bancorp

- Skechers USA

- nVent Electric

- Teladoc Health

- Popular

- BRP Inc.

- Acuity Brands

- MasTec

- Apellis Pharmaceuticals

- The Descartes Systems Group

- Applied Materials

- Agree Realty

- FirstService

- GXO Logistics

- MP Materials

- UWM Holdings

- Spirit Realty Capital

- Texas Roadhouse

- Southwest Gas Holdings

- Vipshop Holdings

- BP plc

- Synovus Financial

- Houlihan Lokey

- Valmont Industries

- EMCOR Group

- UFP Industries

- Marriott Vacations Worldwide

- Inspire Medical Systems

- Penn National Gaming

- Endava

- Visa Inc.

- Petroleo Brasileiro

- MDU Resources Group

- Grupo Aeroportuario del Sureste

- Perrigo Company

- Alaska Air Group

- CRISPR Therapeutics AG

- Rayonier

- Toll Brothers

- Iridium Communications

- Landstar System

- JD

- IDACORP

- Glacier Bancorp

- Valvoline

- IPG Photonics

- Kinsale Capital Group

- FTI Consulting

- Axalta Coating Systems

- Harley-Davidson

- Harley-Davidson

- ExlService Holdings

- Anheuser-Busch InBev

- Oshkosh

- RenaissanceRe Holdings

- Ashland Global Holdings

- Curtiss-Wright

- Universal Display

- Marqeta

- The Chemours Company

- Novanta

- ServiceNow

- Stantec

- Gildan Activewear

- Sotera Health Company

- Chord Energy

- Science Applications International

- Post Holdings

- Murphy Oil

- DT Midstream

- Enbridge

- ASGN Incorporated

- Braskem

- Colliers International Group

- Wayfair

- Clean Harbors

- Ionis Pharmaceuticals

- Penumbra

- Louisiana-Pacific

- Analog Devices

- CyberArk Software

- United Bankshares

- Blackstone Mortgage Trust

- Leggett & Platt

- Wintrust Financial

- The New York Times Company

- Driven Brands Holdings

- Hexcel

- Medpace Holdings

- Mondelez International

- Playtika Holding

- Lantheus Holdings

- BWX Technologies

- AMN Healthcare Services

- Tower Semiconductor

- TriNet Group

- Ginkgo Bioworks Holdings

- National Instruments

- Cigna

- Silicon Laboratories

- SoFi Technologies

- Old National Bancorp

- Azenta

- Encompass Health

- Exponent

- Canadian National Railway Company

- Zurn Water Solutions

- Bausch + Lomb

- Rogers

- MSA Safety

- Norwegian Cruise Line Holdings

- RLI Corp.

- Amkor Technology

- Affiliated Managers Group

- GSK plc

- Hilton Grand Vacations

- Brookfield Infrastructure

- Viper Energy Partners LP

- ChargePoint Holdings

- New York Community Bancorp

- Primerica

- Black Hills

- Guardant Health

- Element Solutions

- Independence Realty Trust

- Meta Platforms

- Zoetis

- Commercial Metals Company

- Omnicell

- Civitas Resources

- Thoughtworks Holding

- Silgan Holdings

- Nuvei

- Ormat Technologies

- Tempur Sealy International

- Coca-Cola Consolidated

- Bank OZK

- Duke Energy

- The Scotts Miracle-Gro Company

- Ryman Hospitality Properties

- Intra-Cellular Therapies

- Home Bancshares

- Blue Owl Capital

- Euronet Worldwide

- SM Energy Company

- OneMain Holdings

- Douglas Emmett

- Power Integrations

- General Electric Company

- Evotec SE

- Qualys

- Allegro MicroSystems

- HealthEquity

- Macys

- Antero Midstream

- Cadence Bank

- Paycor HCM

- Ascendis Pharma

- Infosys

- The Hanover Insurance Group

- Helmerich & Payne

- Intellia Therapeutics

- Integra LifeSciences Holdings

- Eagle Materials

- Terreno Realty

- Altair Engineering

- The Timken Company

- iRhythm Technologies

- 3M Company

- Avnet

- Seaboard

- ServisFirst Bancshares

- Grupo Simec

- Cirrus Logic

- The Boston Beer Company

- EnLink Midstream LLC

- Watts Water Technologies

- Portland General Electric Company

- Intuitive Surgical

- Tegna

- Cousins Properties

- Hawaiian Electric Industries

- monday

- Columbia Sportswear Company

- RingCentral

- MSC Industrial Direct Company

- Qurate Retail

- The Southern Company

- Natera

- Thor Industries

- Daqo New Energy

- Enviva

- ONE Gas

- The Wendys Company

- The Ensign Group

- Brookfield Asset Management

- Essent Group

- Parsons

- NCR Corporation

- 10X Genomics

- SPS Commerce

- Premier

- Kinross Gold

- New Oriental Education & Technology Group

- QuantumScape

- Crocs

- YETI Holdings

- Stericycle

- Arrowhead Pharmaceuticals

- Schneider National

- New Jersey Resources

- Janus Henderson Group

- Flowserve

- First Interstate BancSystem

- Stryker

- Altice USA

- UMB Financial

- MGIC Investment

- Crescent Point Energy

- Livent

- Kite Realty Group Trust

- Phillips Edison & Company

- Exxon Mobil

- Altria Group

- Atkore

- DigitalOcean Holdings

- Pan American Silver

- Tenable Holdings

- Casella Waste Systems

- Insperity

- Beacon Roofing Supply

- ICU Medical

- Franklin Electric Co.

- Crown Castle International

- Autohome

- Hancock Whitney

- Inari Medical

- Physicians Realty Trust

- Novavax

- Cabot

- Booking Holdings

- ChampionX

- Tandem Diabetes Care

- Vontier

- TFS Financial

- Amedisys

- Braze

- APi Group

- Grupo Aval Acciones y Valores

- Chubb

- Ardagh Metal Packaging

- Armstrong World Industries

- ManpowerGroup

- PNM Resources

- Beam Therapeutics

- Alkermes

- Alight

- Vermilion Energy

- Maximus

- AXIS Capital Holdings

- Target

- Air Lease

- Balchem

- Cerevel Therapeutics Holdings

- Under Armour

- Grocery Outlet Holding

- EPR Properties

- Onto Innovation

- New Relic

- Gilead Sciences

- MACOM Technology Solutions Holdings

- Atlantica Sustainable Infrastructure

- Dillards

- Core & Main

- Sendas Distribuidora

- Denali Therapeutics

- Hamilton Lane

- Triton International

- Evercore

- Allison Transmission Holdings

- Northrop Grumman

- Fox Factory Holding

- Teradata

- Virtu Financial

- Asbury Automotive Group

- Privia Health Group

- SLM Corporation

- Ziff Davis

- Applied Industrial Technologies

- PBF Energy

- The TJX Companies

- Ryder System

- Spire

- SiTime

- Smartsheet

- Avient

- Highwoods Properties

- STAAR Surgical Company

- Independent Bank

- Canadian Pacific Railway

- Hanesbrands

- Select Medical Holdings

- Radian Group

- Zai Lab

- Ollies Bargain Outlet Holdings

- Freshworks

- Kirby

- Rapid7

- The Bank of Nova Scotia

- Nordstrom

- Mueller Industries

- Global-E Online

- International Game Technology

- Kohls

- Broadstone Net Lease

- Enact Holdings

- Apple Hospitality REIT

- Cushman & Wakefield

- Comfort Systems USA

- Walmart

- ICICI Bank

- Madison Square Garden Sports

- White Mountains Insurance Group

- BlackLine

- CVB Financial

- Companhia Siderurgica Nacional

- Perficient

- Assured Guaranty

- Academy Sports and Outdoors

- Charter Communications

- Lancaster Colony

- Petco Health And Wellness Company

- Clear Secure

- Hagerty

- Eastern Bankshares

- Asana

- Semtech

- Lazard

- Matson

- Mitsubishi UFJ Financial Group

- Karuna Therapeutics

- DoubleVerify Holdings

- Duolingo

- Travel + Leisure Co.

- UniFirst

- B2Gold

- Certara

- Spirit AeroSystems Holdings

- TechnipFMC

- Fomento Economico Mexicano

- Comstock Resources

- Community Bank System

- Park Hotels & Resorts

- Mirati Therapeutics

- Sensient Technologies

- Diodes

- Skyline Champion

- Clearwater Analytics Holdings

- Herc Holdings

- Vir Biotechnology

- Airbnb

- United Community Banks

- The Howard Hughes Corporation

- Valaris

- Sabra Health Care REIT

- Nelnet

- AppFolio

- BancFirst

- The Gap

- nCino

- Mister Car Wash

- Appian

- Easterly Government Properties

- Fluor

- John Bean Technologies

- Gates Industrial

- Patterson-UTI Energy

- Ultragenyx Pharmaceutical

- Wingstop

- GATX Corporation

- CME Group

- Enstar Group

- ALLETE

- Haemonetics

- BlackBerry

- Alarm Holdings

- Shift4 Payments

- PagSeguro Digital

- Cytokinetics

- TTEC Holdings

- Vertex Pharmaceuticals

- Fabrinet

- Sunoco LP

- Visteon

- Denbury

- Workiva

- American Equity Investment Life Holding Company

- SSR Mining

- Wix

- DigitalBridge Group

- CSX Corporation

- Korn Ferry

- Bellring Brands

- The Goodyear Tire & Rubber Company

- SeaWorld Entertainment

- Instructure Holdings

- FirstCash Holdings

- SunPower

- PotlatchDeltic

- Advanced Energy Industries