The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

WEC Energy Group

Youtube Subscribe

Open: 80.28 Close: 81.34 Change: 1.06

Don't invest in WEC Energy Group before reading this automated analysis produce by an AI.

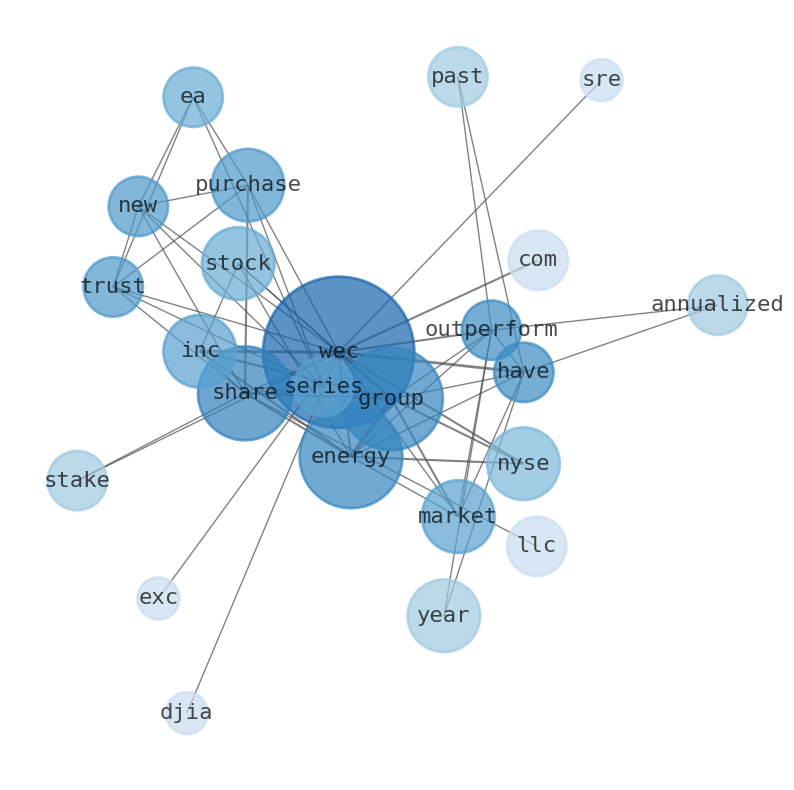

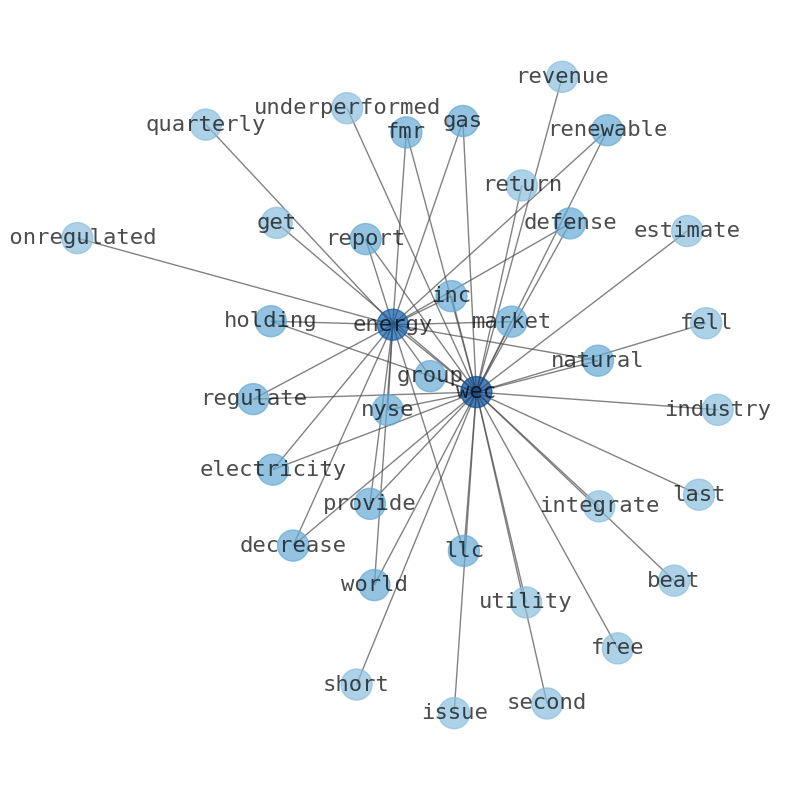

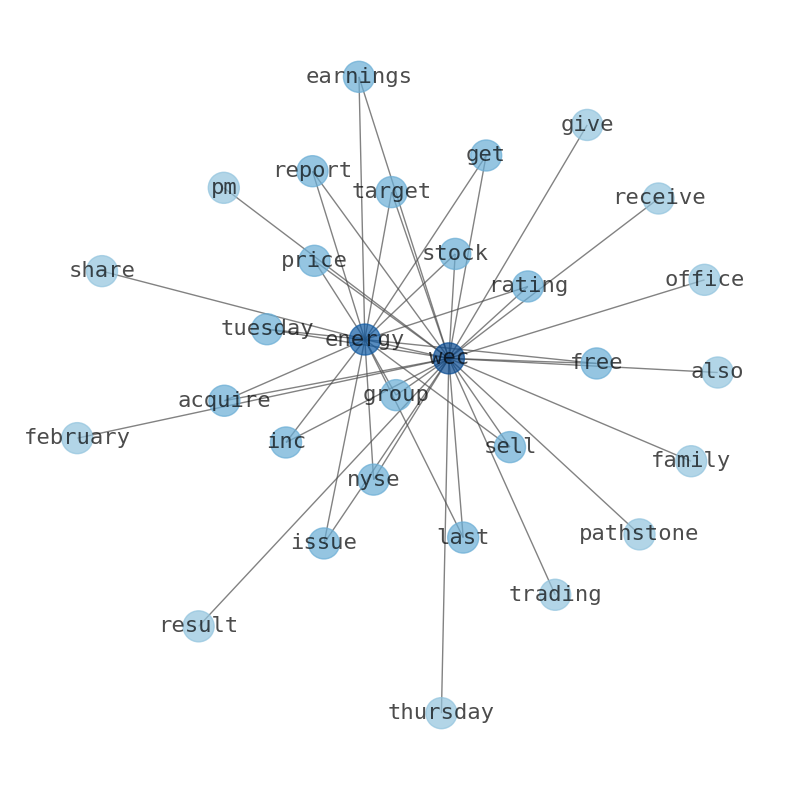

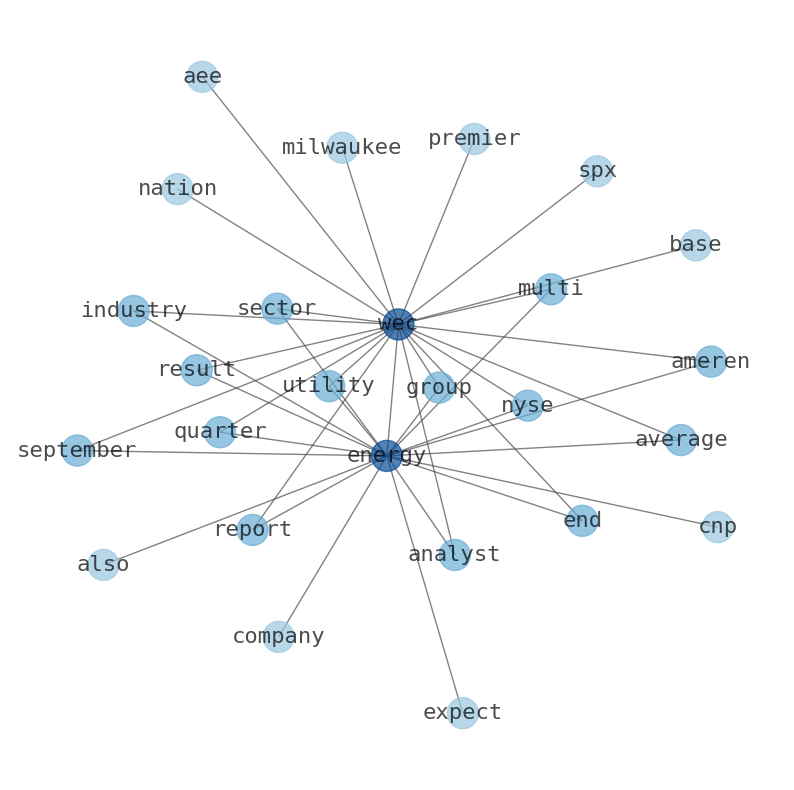

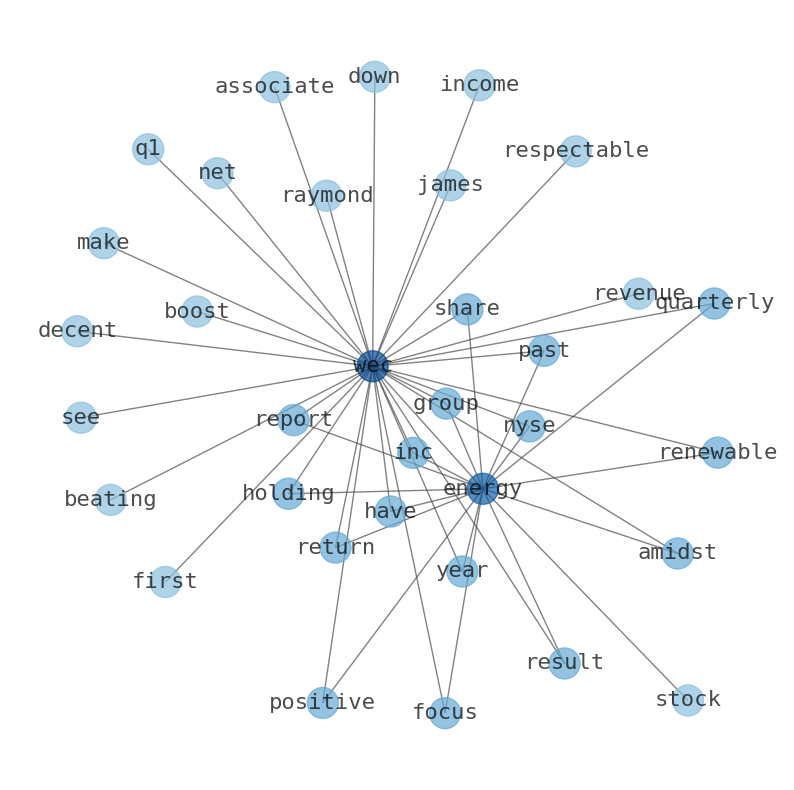

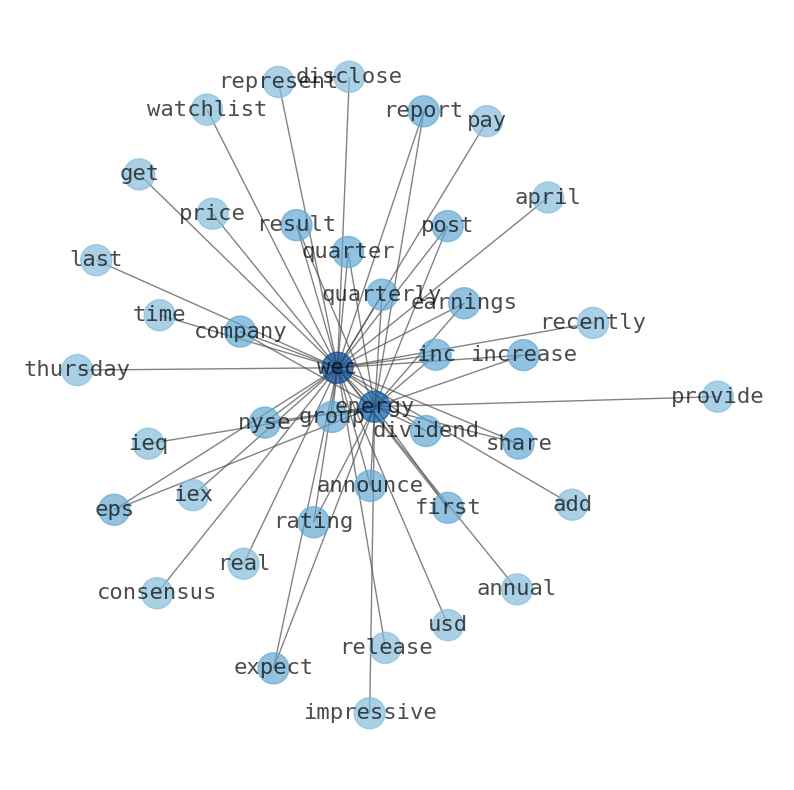

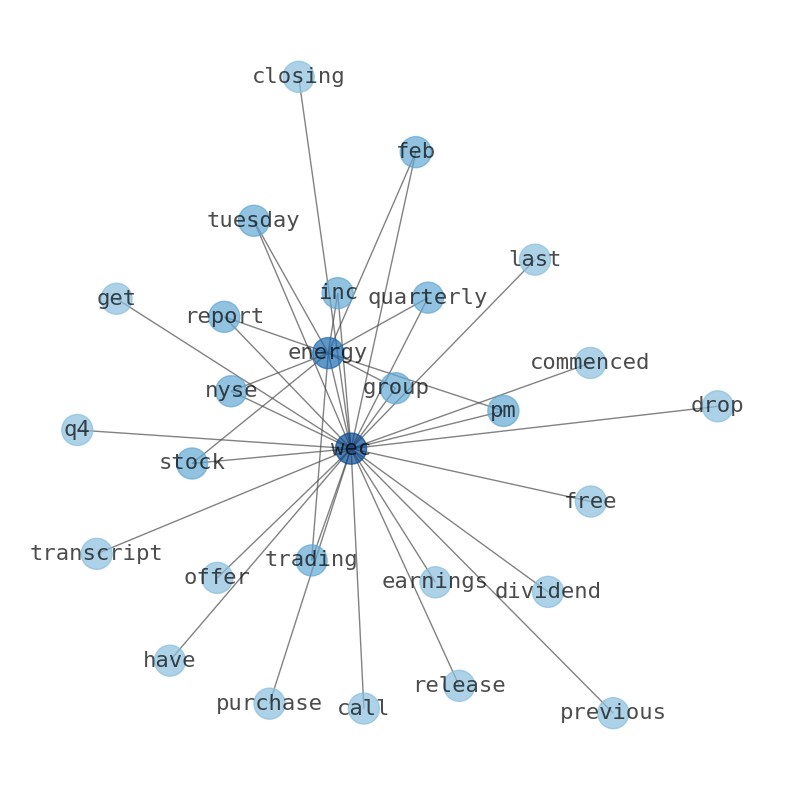

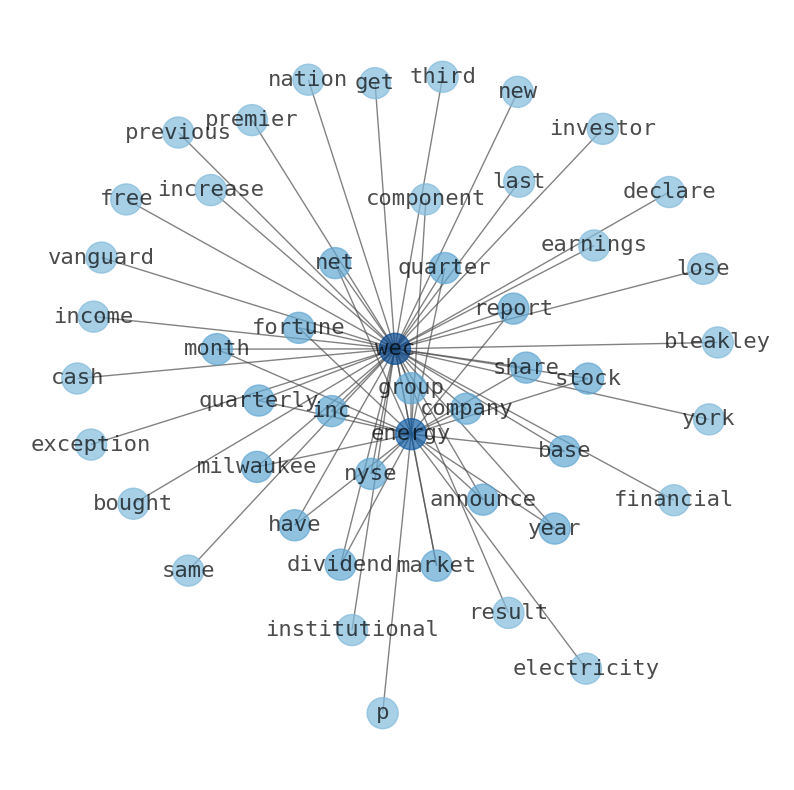

The game is changing. There is a new strategy to evaluate WEC Energy Group fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about WEC Energy Group are: WEC, Energy, Group, Inc, share, …

Stock Summary

WEC Energy Group, Inc. provides regulated natural gas and electricity, and renewable and nonregulated renewable energy services in the United States. The company operates through six segments: Wisconsin, Illinois, Other States, Electric Transmission, Electric Distribution,.

Today's Summary

EA Series trust purchased a new stake in shares of WEC. Graypoint LLC purchased a position in shares in the first quarter worth $229,000. $1000 invested in this stock 20 years ago would be worth $5,200 today - wec energy group (nyse:wec)

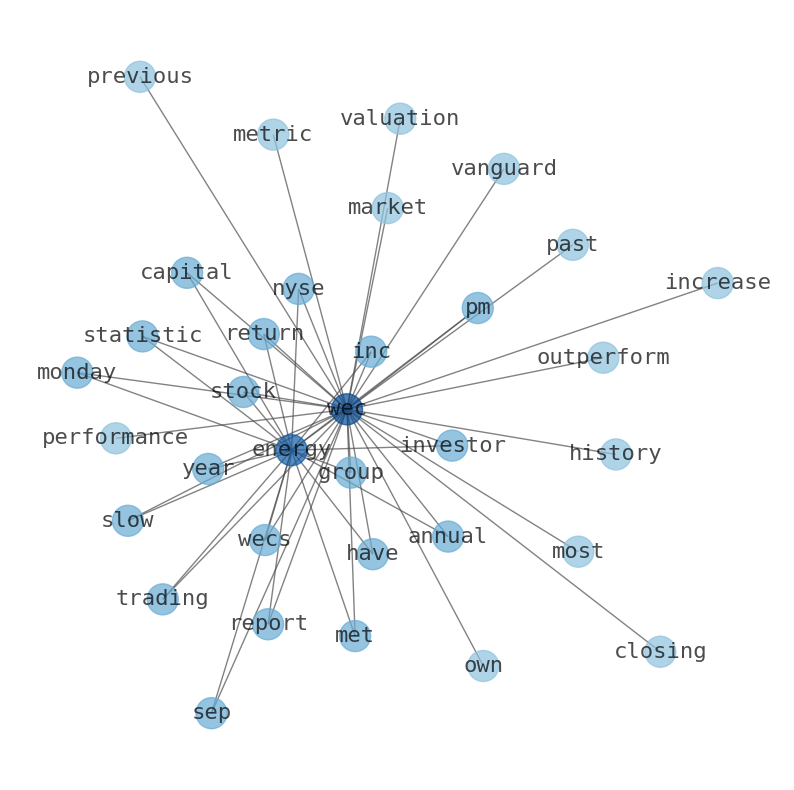

Today's News

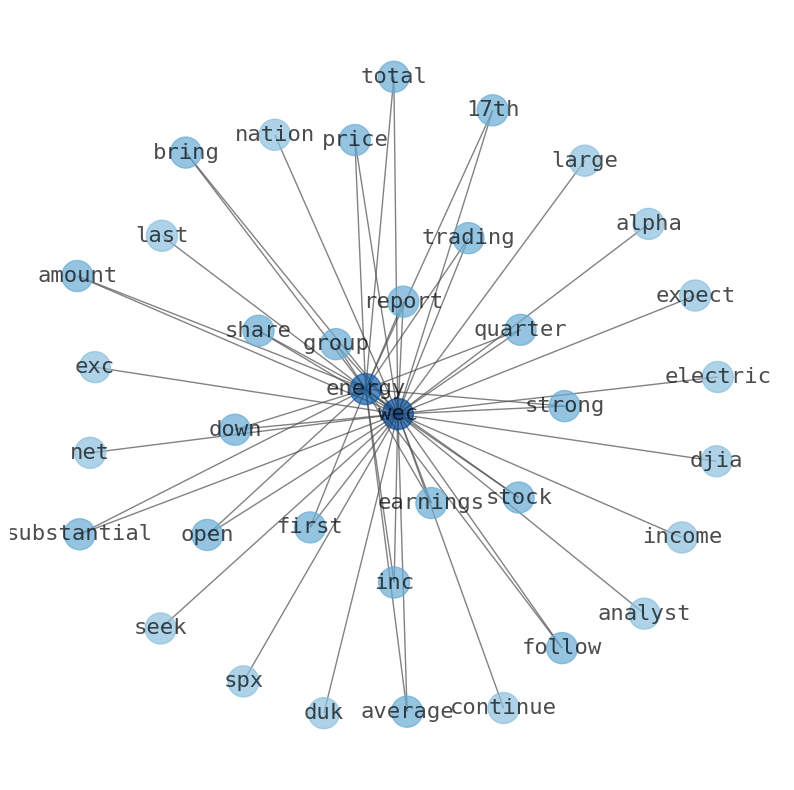

EA Series Trust Purchases New Shares in WEC Energy Group, Inc. (NYSE:WEC) EA Series trust purchased a new stake in shares of WEC. Graypoint LLC purchased a position in shares in the first quarter worth $229,000. Daymark Wealth Partners LLC raised its stake in. shares by 52.2%. WEC Energy Group Inc. stock outperforms market despite losses on the day - marketwatch.com. WEC +0.16% SPX + 0.53% DJIA +0.12% EXC -1.65% SRE +0 0.26% Shares of WEC. WEC Energy Group has outperformed the market over the past 20 years by 1.31% on an annualized basis producing an average annual return of 8.56%. $1000 invested in this stock 20 years ago would be worth $5,200 today - wec energy group (nyse:wec) - benzinga.com. WEC Energy Group (NYSE:WEC) has outperformed the market over the past 20 years by 1.31% on an annualized basis producing an average annual return of 8.56%. The investors seeking up-to-date and accurate forecasts for WEC. Minimize WEC Energy Group Inc monthly stock forecast for 2023, 2026, 2027, 8143 7643 7660, 1275 1275. Minimize is a robust metric offering a robust investment strategies.

Stock Profile

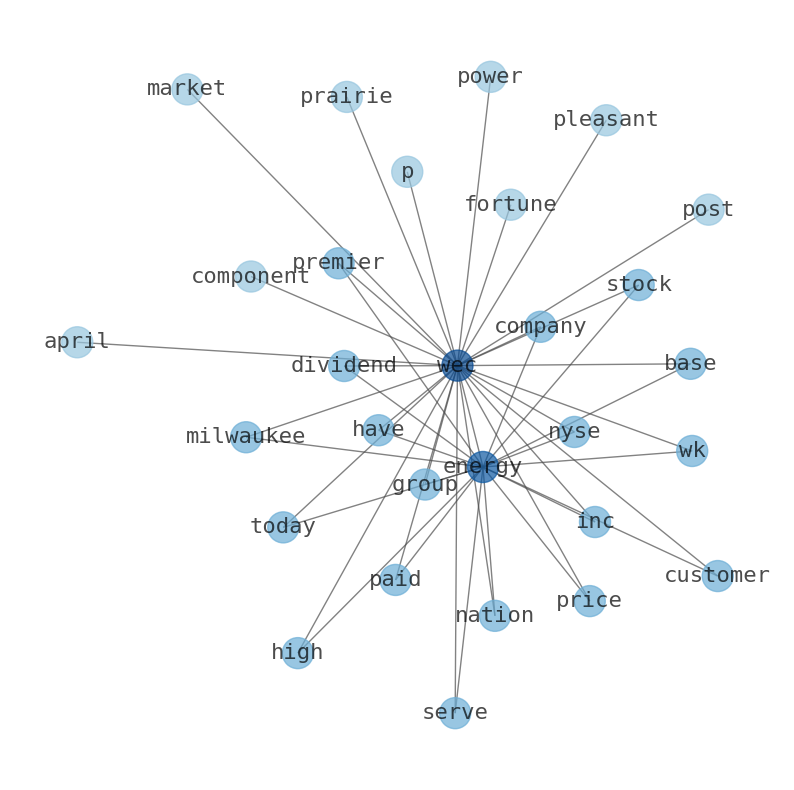

"WEC Energy Group, Inc., through its subsidiaries, provides regulated natural gas and electricity, and renewable and nonregulated renewable energy services in the United States. The company operates through six segments: Wisconsin, Illinois, Other States, Electric Transmission, Non-Utility Energy Infrastructure, and Corporate and Other. It generates and distributes electricity from coal, natural gas, and oil, as well as hydroelectric, wind, solar, and biomass sources; provides electric transmission services; offers retail natural gas distribution services; transports natural gas; and generates, distributes, and sells steam. As of December 31, 2022, it operated approximately 35,600 miles of overhead distribution lines and 36,100 miles of underground distribution cables, as well as 430 electric distribution substations and 514,800 line transformers; 52,000 miles of natural gas distribution mains; 1,100 miles of natural gas transmission mains; 2.4 million natural gas lateral services; 500 natural gas distribution and transmission gate stations; and 68.2 billion cubic feet of working gas capacities in underground natural gas storage fields. The company was formerly known as Wisconsin Energy Corporation and changed its name to WEC Energy Group, Inc. in June 2015. WEC Energy Group, Inc. was founded in 1896 and is headquartered in Milwaukee, Wisconsin."

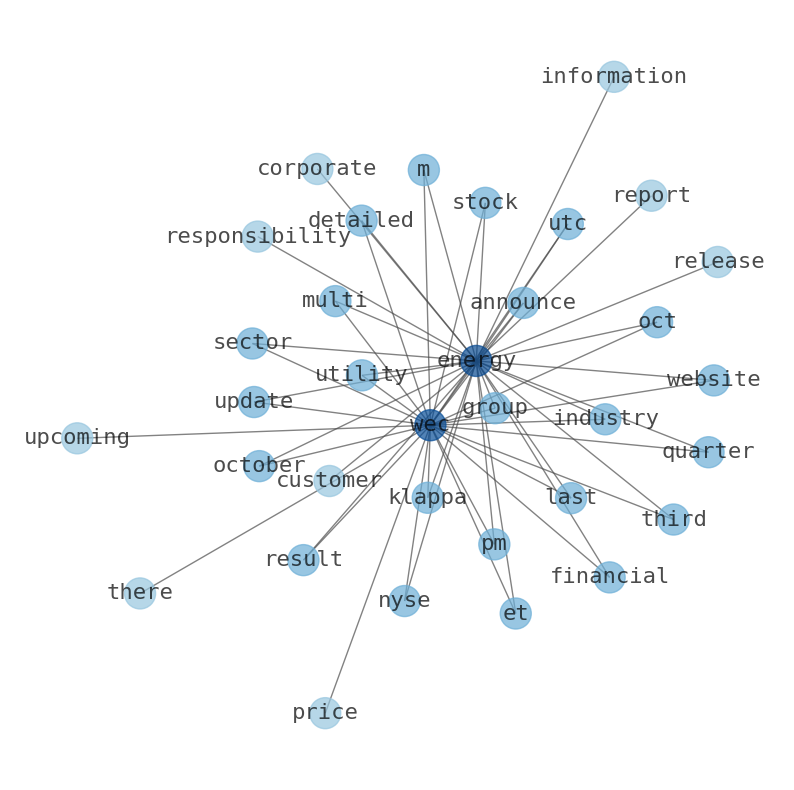

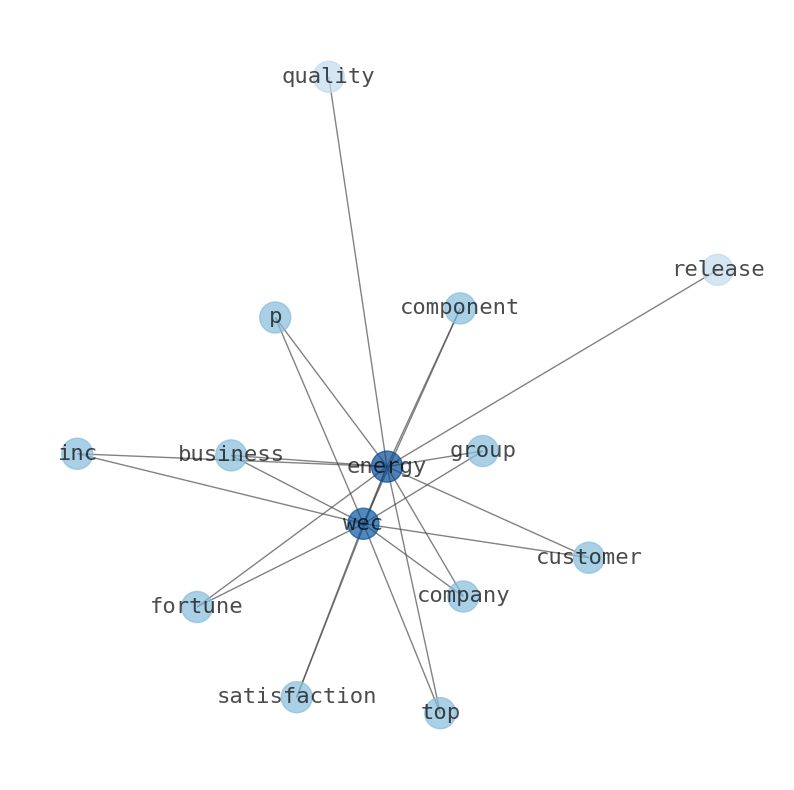

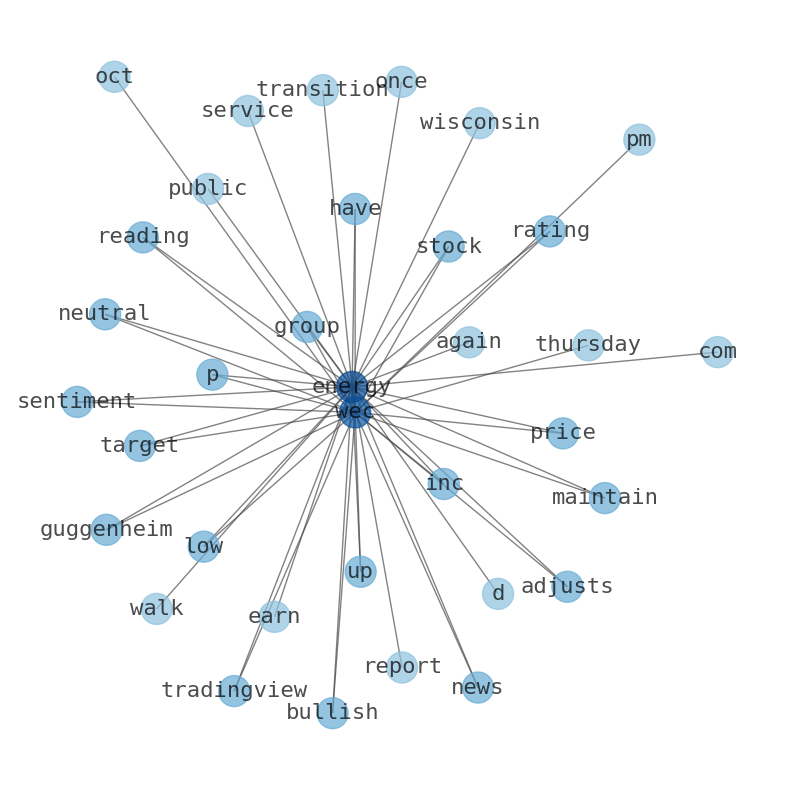

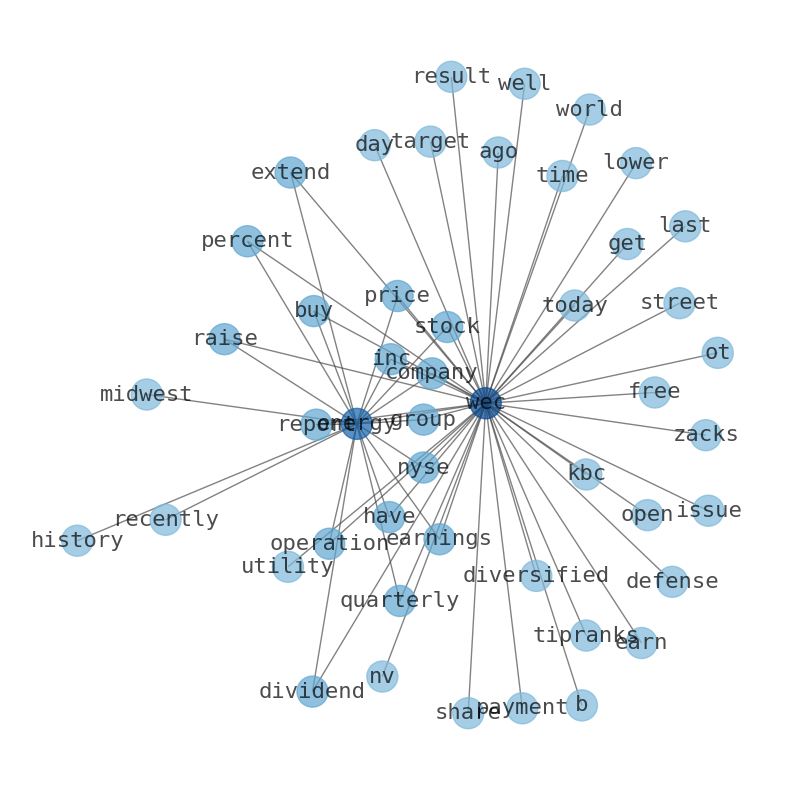

Keywords

How much time have you spent trying to decide whether investing in WEC Energy Group? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about WEC Energy Group are: WEC, Energy, Group, Inc, share, stock, market, and the most common words in the summary are: energy, wec, stock, group, market, inc, dividend, . One of the sentences in the summary was: $1000 invested in this stock 20 years ago would be worth $5,200 today - wec energy group (nyse:wec). Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #energy #wec #stock #group #market #inc #dividend.

Read more →Related Results

WEC Energy Group

Open: 76.86 Close: 77.46 Change: 0.6

Read more →

WEC Energy Group

Open: 76.36 Close: 76.65 Change: 0.29

Read more →

WEC Energy Group

Open: 82.71 Close: 81.73 Change: -0.98

Read more →

WEC Energy Group

Open: 82.71 Close: 81.73 Change: -0.98

Read more →

WEC Energy Group

Open: 80.28 Close: 81.34 Change: 1.06

Read more →

WEC Energy Group

Open: 85.88 Close: 85.44 Change: -0.44

Read more →

WEC Energy Group

Open: 85.31 Close: 84.12 Change: -1.19

Read more →

WEC Energy Group

Open: 88.26 Close: 88.92 Change: 0.66

Read more →

WEC Energy Group

Open: 96.41 Close: 96.17 Change: -0.24

Read more →

WEC Energy Group

Open: 77.0 Close: 77.81 Change: 0.81

Read more →

WEC Energy Group

Open: 84.96 Close: 84.07 Change: -0.89

Read more →

WEC Energy Group

Open: 82.71 Close: 81.73 Change: -0.98

Read more →

WEC Energy Group

Open: 81.36 Close: 82.32 Change: 0.96

Read more →

WEC Energy Group

Open: 81.68 Close: 82.24 Change: 0.56

Read more →

WEC Energy Group

Open: 86.57 Close: 86.74 Change: 0.17

Read more →

WEC Energy Group

Open: 87.5 Close: 87.69 Change: 0.19

Read more →

WEC Energy Group

Open: 89.81 Close: 89.92 Change: 0.11

Read more →

WEC Energy Group

Open: 97.36 Close: 95.79 Change: -1.57

Read more →- Apple

- Taiwan Semiconductor Manufacturing Company

- The Boeing Company

- Prosperity Bancshares

- Donaldson Company

- AutoNation

- HashiCorp

- Exelixis

- Matador Resources Company

- Halozyme Therapeutics

- MKS Instruments

- Brookfield Renewable

- Envista Holdings

- Automatic Data Processing

- Grupo Aeroportuario del Pacifico

- Murphy USA

- Gentex

- Bumble

- AGNC Investment

- National Fuel Gas Company

- Woori Financial Group

- The Western Union Company

- Tencent Music Entertainment Group

- The Estee Lauder Companies

- WESCO International

- Maravai LifeSciences Holdings

- Guidewire Software

- Unum Group

- PDC Energy

- Magnolia Oil & Gas

- SiteOne Landscape Supply

- Frontier Communications Parent

- Woodward

- Rio Tinto

- First Financial Bankshares

- SunRun

- Endeavor Group Holdings

- Kilroy Realty

- Stifel Financial

- South State

- Reynolds Consumer Products

- Starbucks

- Lumentum Holdings

- Sonoco Products Company

- FS KKR Capital

- Wyndham Hotels & Resorts

- United States Steel

- Vornado Realty Trust

- Dutch Bros

- Informatica

- Prologis

- AngloGold Ashanti

- Option Care Health

- CEMEX

- CCC Intelligent Solutions Holdings

- Huntsman

- Pinnacle Financial Partners

- Ingredion

- First American Financial

- Brunswick

- Voya Financial

- Flowers Foods

- Boyd Gaming

- Futu Holdings

- Stag Industrial

- Globus Medical

- BOK Financial

- ZIM Integrated Shipping Services

- British American Tobacco

- Valley National Bancorp

- Skechers USA

- nVent Electric

- Teladoc Health

- Popular

- BRP Inc.

- Acuity Brands

- MasTec

- Apellis Pharmaceuticals

- The Descartes Systems Group

- Applied Materials

- Agree Realty

- FirstService

- GXO Logistics

- MP Materials

- UWM Holdings

- Spirit Realty Capital

- Texas Roadhouse

- Southwest Gas Holdings

- Vipshop Holdings

- BP plc