The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Terreno Realty

Youtube Subscribe

Open: 61.17 Close: 60.65 Change: -0.52

The stock market through the eyes of an AI: Terreno Realty.

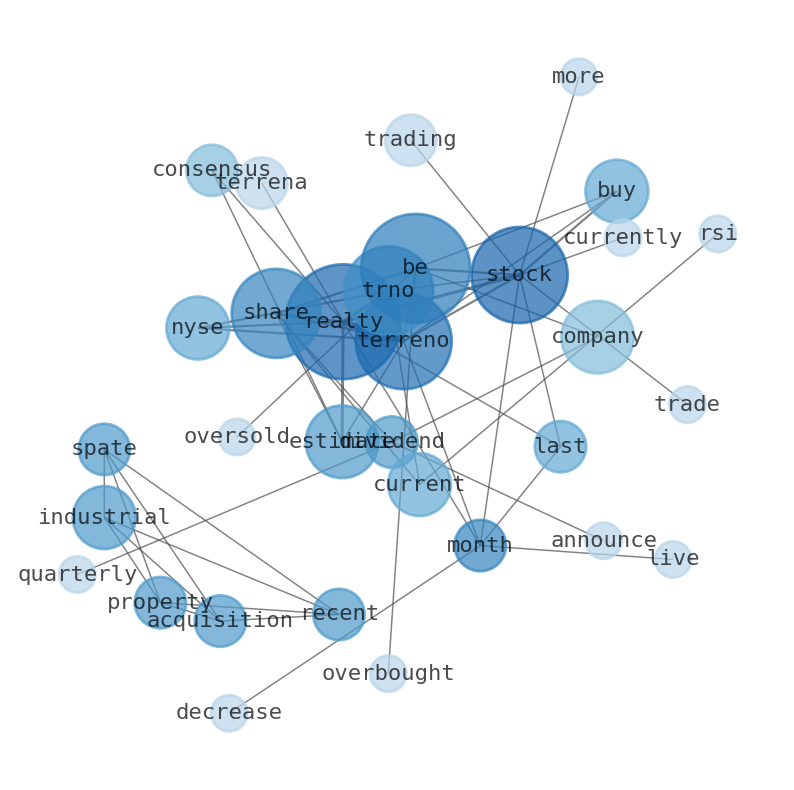

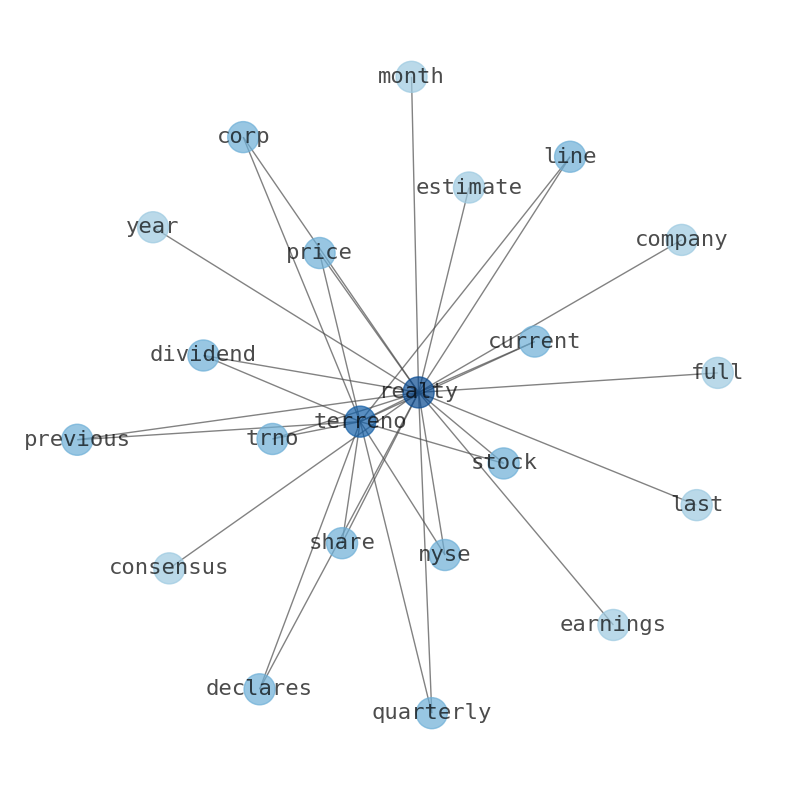

Are looking for the most relevant information about Terreno Realty? Investor spend a lot of time searching for information to make investment decisions in Terreno Realty. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Terreno Realty are: Realty, Terreno, stock, share, estimate, TRNO, company, and the most common words in the summary are: realty, real, estate, terreno, serhant, new, stock, . One of the sentences in the summary was: The company announced they will pay out of $4.0 per share …

Stock Summary

Terreno Realty Corporation acquires, owns and operates industrial real estate in six major coastal U.S. markets. As of September 30, 2020, the Company owned 219 buildings aggregating approximately 13.1 million square feet..

Today's Summary

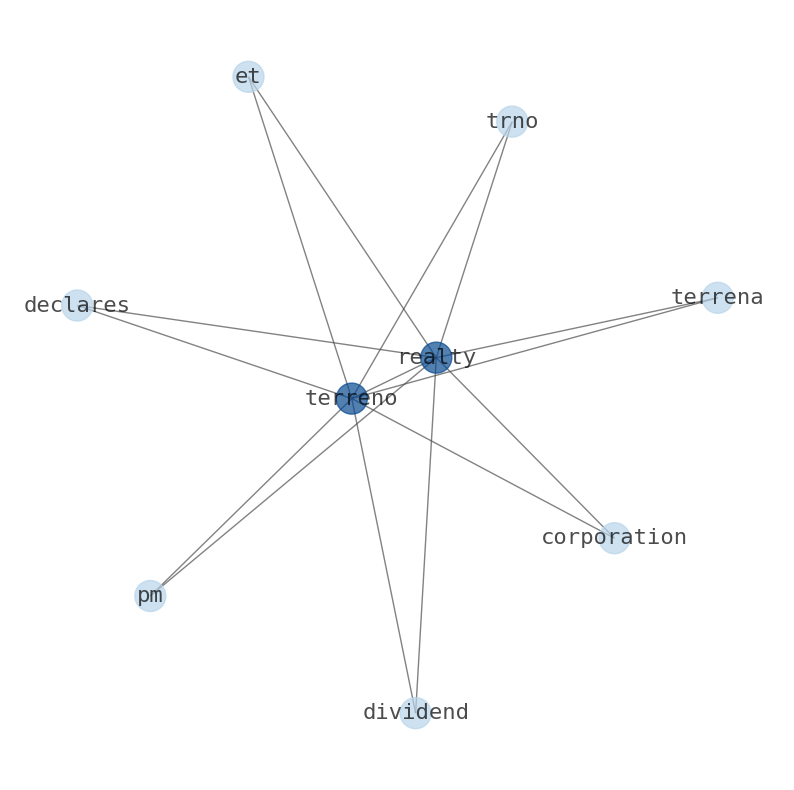

The company announced they will pay out of $4.0 per share for stockholders on Friday, July 14th. PGGM Investments recently acquired a new stake in Terreno.

Today's News

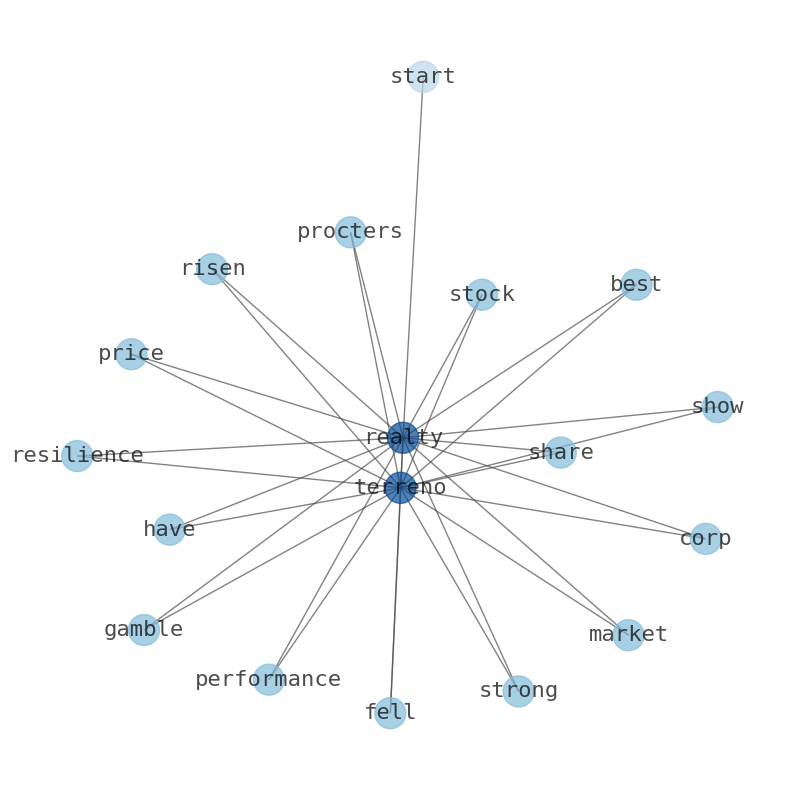

Terreno Realty Corp. declares $0.40/share quarterly dividend, in line with previous dividend. The company announced they will pay out of $4.0 per share for stockholders on Friday, July 14th. Terreno Realty Co. ( NYSE:TRNO – Get Rating ) – Equities research analysts at KeyCorp dropped their Q2 2023 EPS estimates for shares of Terrena Realty in a report issued on Monday, May 15th. The consensus estimate is $0.54 per share. Buy Terreno Realty stock (NYSE: TRNO) allows you to gain exposure to the growth potential of the company. One of the most convenient ways to invest in TRNO is to buy the companys stock on eToro, a leading online trading platform where users can buy, sell, and trade more than 3,000 stocks. Terreno Realty stock is currently trading at $ 60.65, down -0.49% over the last 24 hours. The price of Terrena Realty stocks decreased by -3.23% in the last month and -4.37% in three months. The live Terreno Realty stock price today is $ 60.65 per TRNO share with a current market cap of $5.05B. The current TRNO RSI is 56.6989, suggesting that the stock is overbought or oversold. PGGM Investments recently acquired a new stake in Terreno Realty valued at $96,080,000. The consensus estimate for Terreni Realtys current full-year earnings is $2.18 per share. Despite the lowered estimates, Terren Terreno Realty Corporation (NYSE:TRNO) recent spate of acquisitions of industrial properties is likely to aid it in riding robust industrial real estate market tailwinds. Recent spate of. acquisitions of. industrial properties in New York, Florida, California and Florida are likely to help the company.

Stock Profile

"Terreno Realty Corporation and together with its subsidiaries, the Company) acquires, owns and operates industrial real estate in six major coastal U.S. markets: Los Angeles, Northern New Jersey/New York City, San Francisco Bay Area, Seattle, Miami, and Washington, D.C. All square feet, acres, occupancy and number of properties disclosed in these condensed notes to the consolidated financial statements are unaudited. As of September 30, 2020, the Company owned 219 buildings aggregating approximately 13.1 million square feet, 22 improved land parcels consisting of approximately 85.0 acres and one property under redevelopment expected to contain approximately 0.2 million square feet upon completion. The Company is an internally managed Maryland corporation and elected to be taxed as a real estate investment trust (REIT) under Sections 856 through 860 of the Internal Revenue Code of 1986, as amended (the Code), commencing with its taxable year ended December 31, 2010."

Keywords

How much time have you spent trying to decide whether investing in Terreno Realty? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Terreno Realty are: Realty, Terreno, stock, share, estimate, TRNO, company, and the most common words in the summary are: realty, real, estate, terreno, serhant, new, stock, . One of the sentences in the summary was: The company announced they will pay out of $4.0 per share for stockholders on Friday, July 14th. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #realty #real #estate #terreno #serhant #new #stock.

Read more →Related Results

Terreno Realty

Open: 61.17 Close: 60.65 Change: -0.52

Read more →

Terreno Realty

Open: 61.9 Close: 61.92 Change: 0.02

Read more →

Terreno Realty

Open: 61.48 Close: 61.56 Change: 0.08

Read more →- Apple

- Taiwan Semiconductor Manufacturing Company

- The Boeing Company

- Prosperity Bancshares

- Donaldson Company

- AutoNation

- HashiCorp

- Exelixis

- Matador Resources Company

- Halozyme Therapeutics

- MKS Instruments

- Brookfield Renewable

- Envista Holdings

- Automatic Data Processing

- Grupo Aeroportuario del Pacifico

- Murphy USA

- Gentex

- Bumble

- AGNC Investment

- National Fuel Gas Company

- Woori Financial Group

- The Western Union Company

- Tencent Music Entertainment Group

- The Estee Lauder Companies

- WESCO International

- Maravai LifeSciences Holdings

- Guidewire Software

- Unum Group

- PDC Energy

- Magnolia Oil & Gas

- SiteOne Landscape Supply

- Frontier Communications Parent

- Woodward

- Rio Tinto

- First Financial Bankshares

- SunRun

- Endeavor Group Holdings

- Kilroy Realty

- Stifel Financial

- South State

- Reynolds Consumer Products

- Starbucks

- Lumentum Holdings

- Sonoco Products Company

- FS KKR Capital

- Wyndham Hotels & Resorts

- United States Steel

- Vornado Realty Trust

- Dutch Bros

- Informatica

- Prologis

- AngloGold Ashanti

- Option Care Health

- CEMEX

- CCC Intelligent Solutions Holdings

- Huntsman

- Pinnacle Financial Partners

- Ingredion

- First American Financial

- Brunswick

- Voya Financial

- Flowers Foods

- Boyd Gaming

- Futu Holdings

- Stag Industrial

- Globus Medical

- BOK Financial

- ZIM Integrated Shipping Services

- British American Tobacco

- Valley National Bancorp

- Skechers USA

- nVent Electric

- Teladoc Health

- Popular

- BRP Inc.

- Acuity Brands

- MasTec

- Apellis Pharmaceuticals

- The Descartes Systems Group

- Applied Materials

- Agree Realty

- FirstService

- GXO Logistics

- MP Materials

- UWM Holdings

- Spirit Realty Capital

- Texas Roadhouse

- Southwest Gas Holdings

- Vipshop Holdings

- BP plc