The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

Kinder Morgan

Youtube Subscribe

Open: 16.38 Close: 16.32 Change: -0.06

Stop reading the whole internet to decide if you want to invest in Kinder Morgan.

This document will help you to evaluate Kinder Morgan without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Kinder Morgan are: Kinder, Morgan, CEO, KMI, company, natural, gas, …

Stock Summary

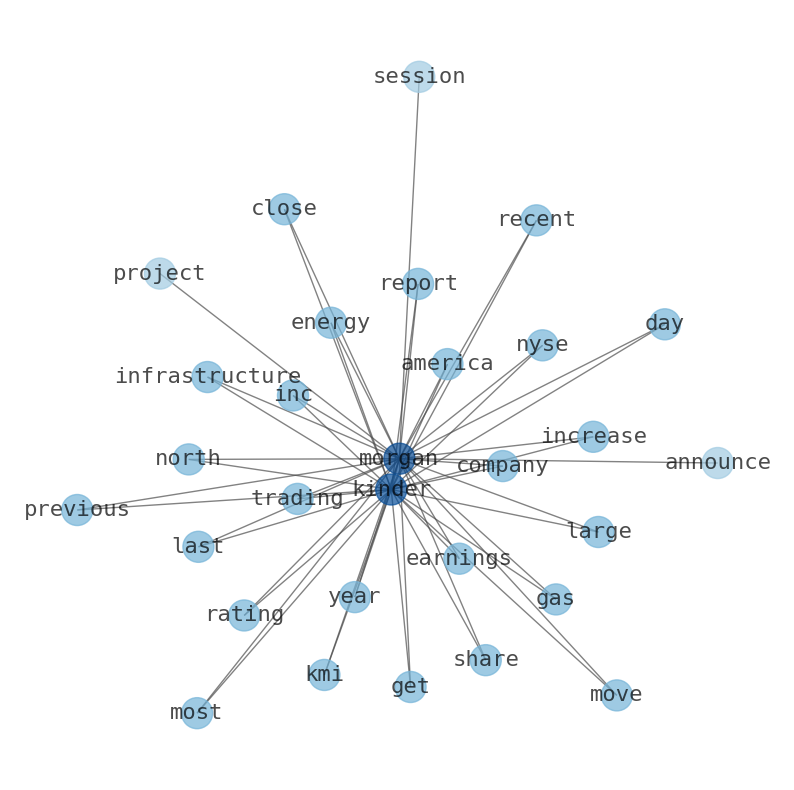

Kinder Morgan, Inc. operates as an energy infrastructure company in North America. The company owns and operates approximately 83,000 miles of pipelines and 140 terminals. The CO2 segment produces, transports, and markets CO2 to recovery and production.

Today's Summary

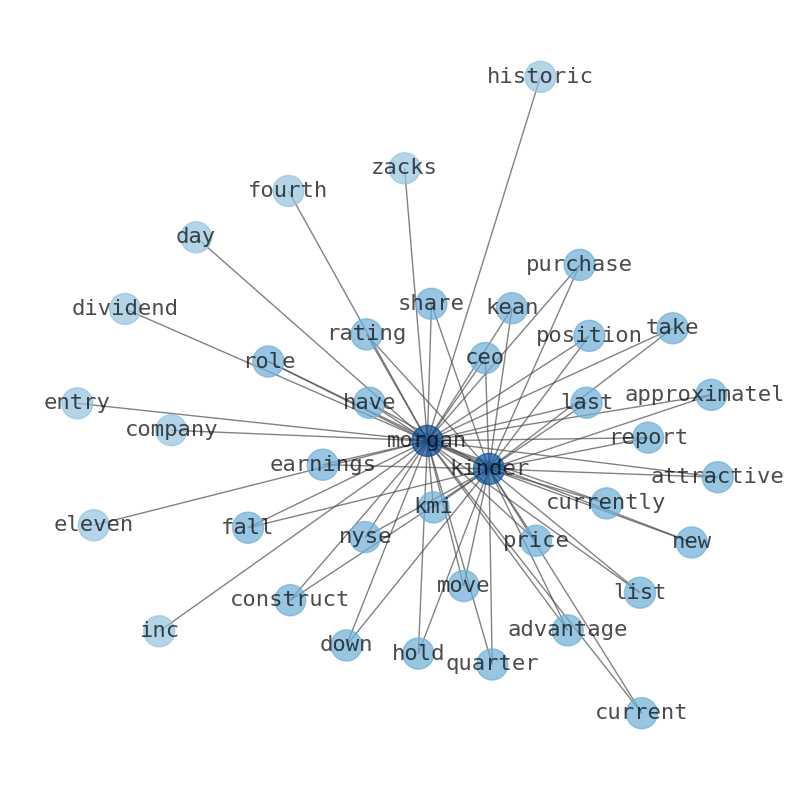

Kinder Morgan ( NYSE:KMI – Get Rating ) last posted its quarterly earnings results on April 19th. Citi reiterated a Hold rating on Kinder Morgan with a price target of $19.49.

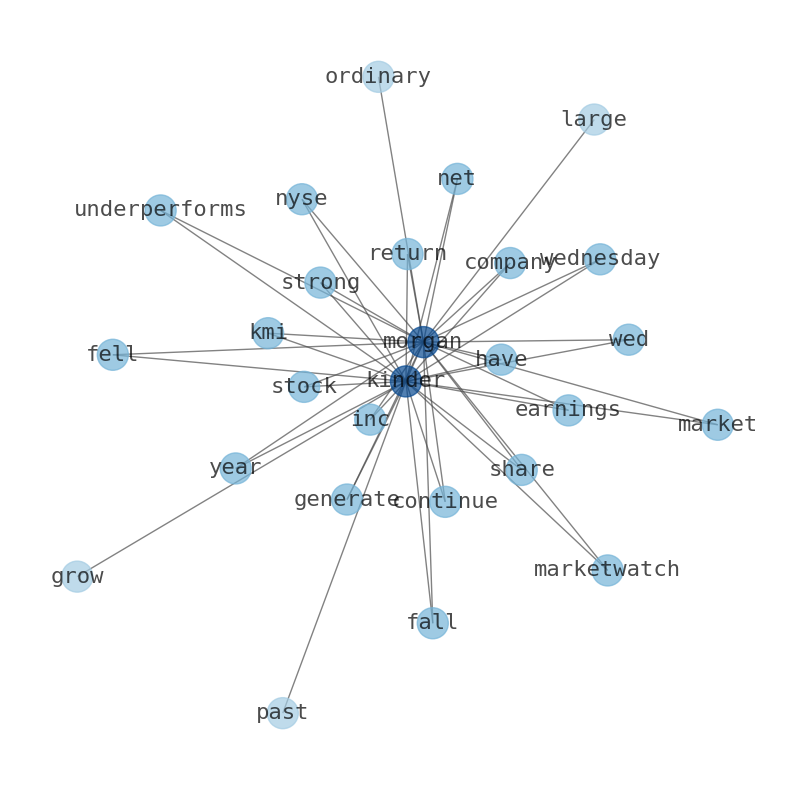

Today's News

The current Kinder Morgan [ KMI ] share price is $16.49. The current rating is 59, which is 18% above its historic median score of 50 and infers lower risk than normal. Over the next 52 weeks, Kinder Morgan has on average historically fallen by 1.6%. Kinder Morgan shares (KMI) are listed on the NYSE and all prices are listed in US Dollars. Kinder Morgan employs 10,525 staff and has a trailing 12-month revenue of around $18.8 billion. The most recent dividend payout was on May 20. Kinder Morgan (NYSE:KMI) is one of my larger holdings. The company offers a lower-risk income stream. Kinder Morgan (KMI) closed at $16.64 in the latest trading session, marking a -0.12% move from the prior day. Investors will be hoping for strength from Kinder Morgan as it approaches its next earnings release. Kinder Morgan currently has a Zacks Rank of #3 (Hold) Kinder Morgan is positioned to benefit from increased natural gas production and future energy landscape. The company is well-positioned to take advantage of the numerous opportunities available in the LNG market. Kinder Morgan continues to grow the dividend and reward shareholders. Kinder Morgan: An Attractive Entry Price And Forward Growth Potential (NYSE:KMI) The company has the largest natural gas pipeline network in the United States and transports more liquid resources than any other country in the nation. The demand for natural gas in the U.S. will grow by 15% between now and 2050: Kinder Morgan. Kinder Morgan is moving to take advantage of this by constructing approximately eleven billion cubic feet per day of new natural gas capacity by 2030. This will provide a potential growth engine that contributes to the companys growth during the second half of this decade. Kinder Morgan CEO Steven J. Kean is currently the CEO of Kinder Morgan, a role he plans to leave in August. Kean announced in January his intention to step down as CEO and will be succeeded by Kinder Morgan President Kim Dang. Kinder Morgan (KMI) down 4.8% Since Last Earnings Report: Can It Rebound? Kinder Morgan reported earnings 30 days ago. Citi reiterated a Hold rating on Kinder Morgan with a price target of $19. Steve Kean, the outgoing CEO of Kinder Morgan Inc., will have a new role this fall following his departure from the midstream company. Kean was tapped as the CEO of the Greater Houston Partnership. Kinder Morgan ( NYSE:KMI – Get Rating ) last posted its quarterly earnings results on Wednesday, April 19th. Moneta Group Investment Advisors LLC lifted its stake in shares of Kinder Morgan by 102,208.0% in the 4th quarter. Norges Bank purchased a new position in Kinder Morgan during the fourth quarter worth about $256,613,000. Renaissance Technologies LLC purchased a

Stock Profile

"Kinder Morgan, Inc. operates as an energy infrastructure company in North America. The company operates through four segments: Natural Gas Pipelines, Products Pipelines, Terminals, and CO2. The Natural Gas Pipelines segment owns and operates interstate and intrastate natural gas pipeline, and underground storage systems; natural gas gathering systems and natural gas processing and treating facilities; natural gas liquids fractionation facilities and transportation systems; and liquefied natural gas gasification, liquefaction, and storage facilities. The Products Pipelines segment owns and operates refined petroleum products, and crude oil and condensate pipelines; and associated product terminals and petroleum pipeline transmix facilities. The Terminals segment owns and/or operates liquids and bulk terminals that stores and handles various commodities, including gasoline, diesel fuel, renewable fuel stock, chemicals, ethanol, metals, and petroleum coke; and owns tankers. The CO2 segment produces, transports, and markets CO2 to recovery and production crude oil from mature oil fields; owns interests in/or operates oil fields and gasoline processing plants; and operates a crude oil pipeline system in West Texas, as well as owns and operates RNG and LNG facilities. It owns and operates approximately 83,000 miles of pipelines and 140 terminals. The company was formerly known as Kinder Morgan Holdco LLC and changed its name to Kinder Morgan, Inc. in February 2011. Kinder Morgan, Inc. was founded in 1936 and is headquartered in Houston, Texas."

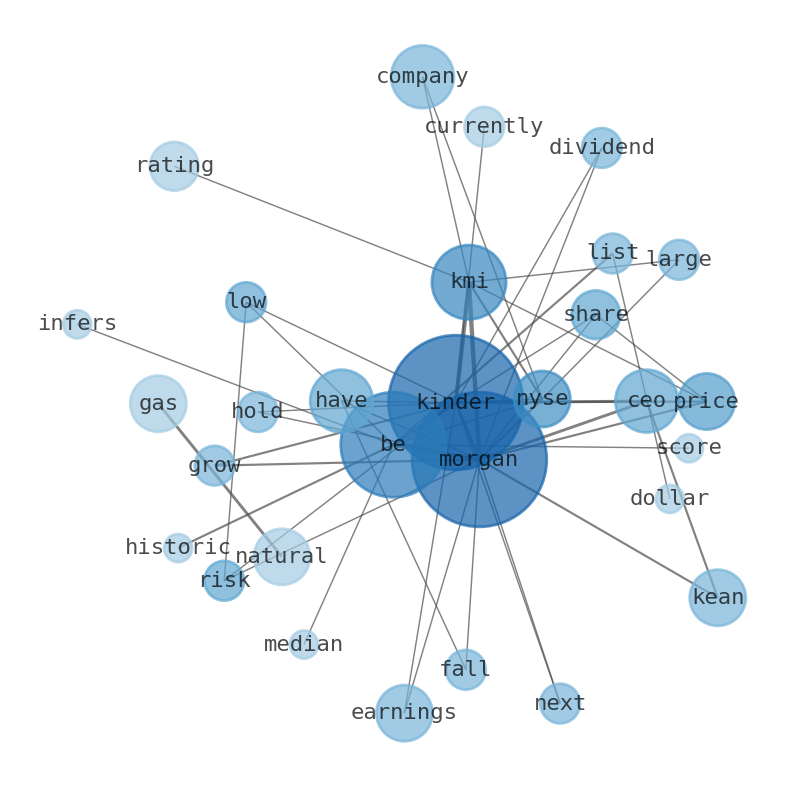

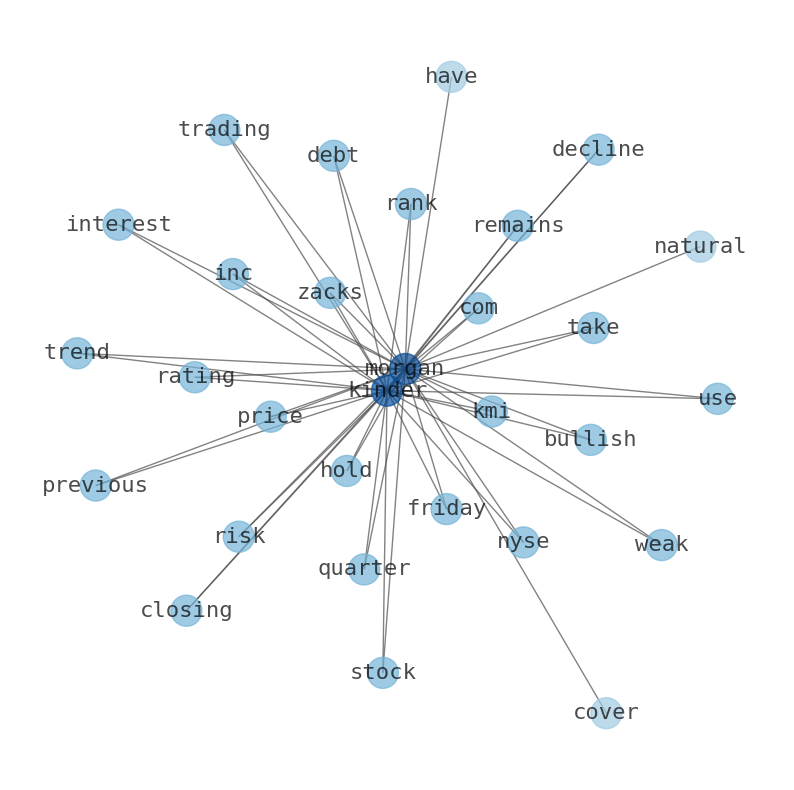

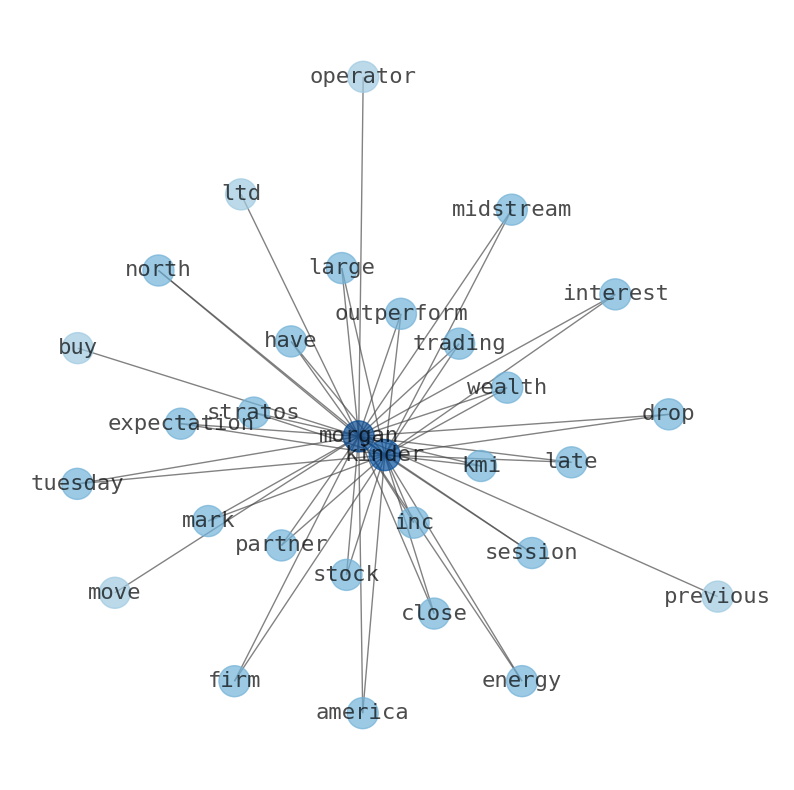

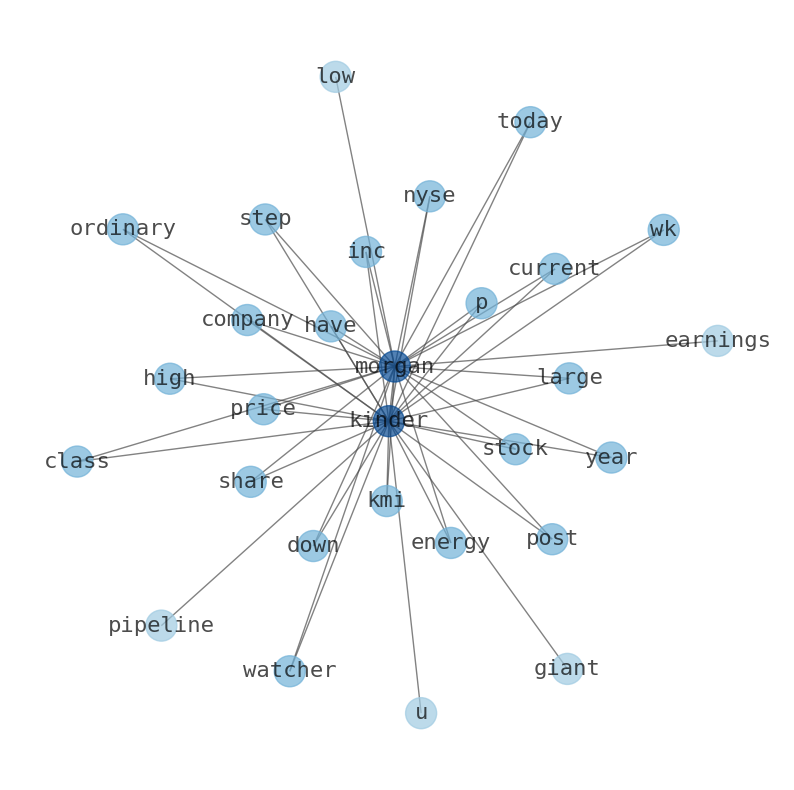

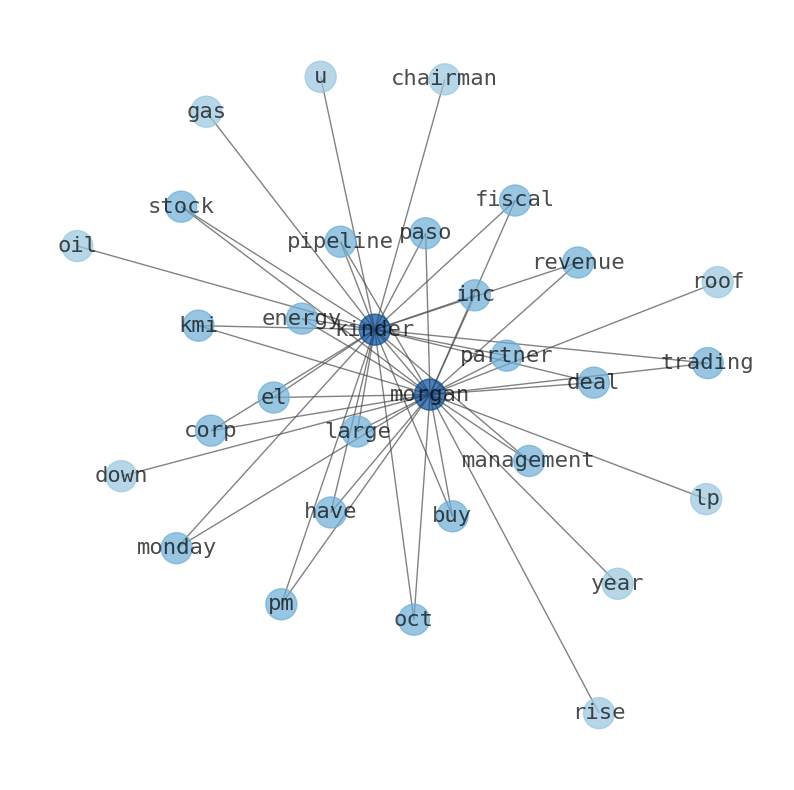

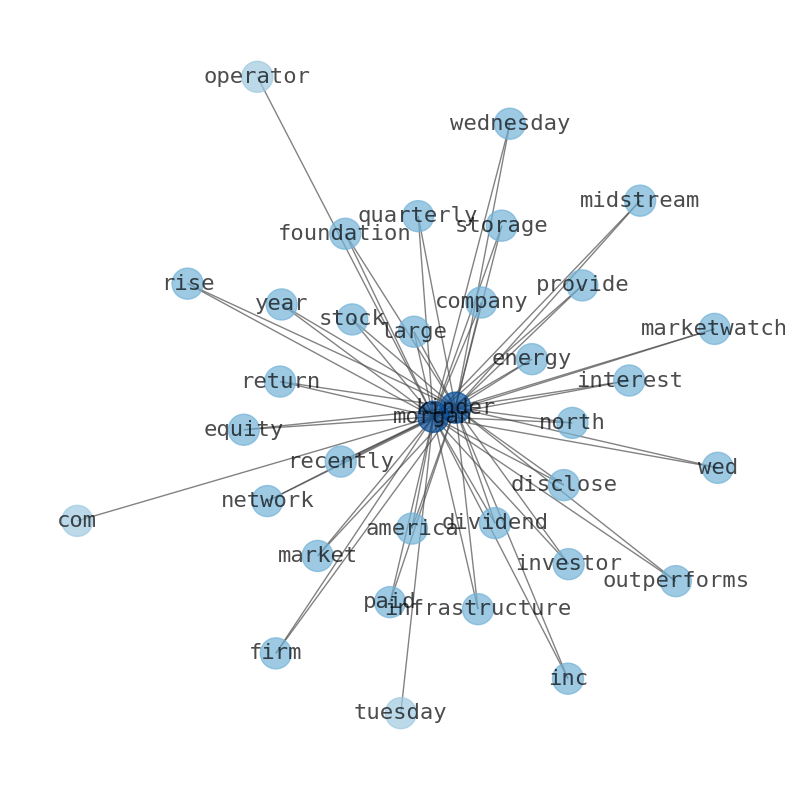

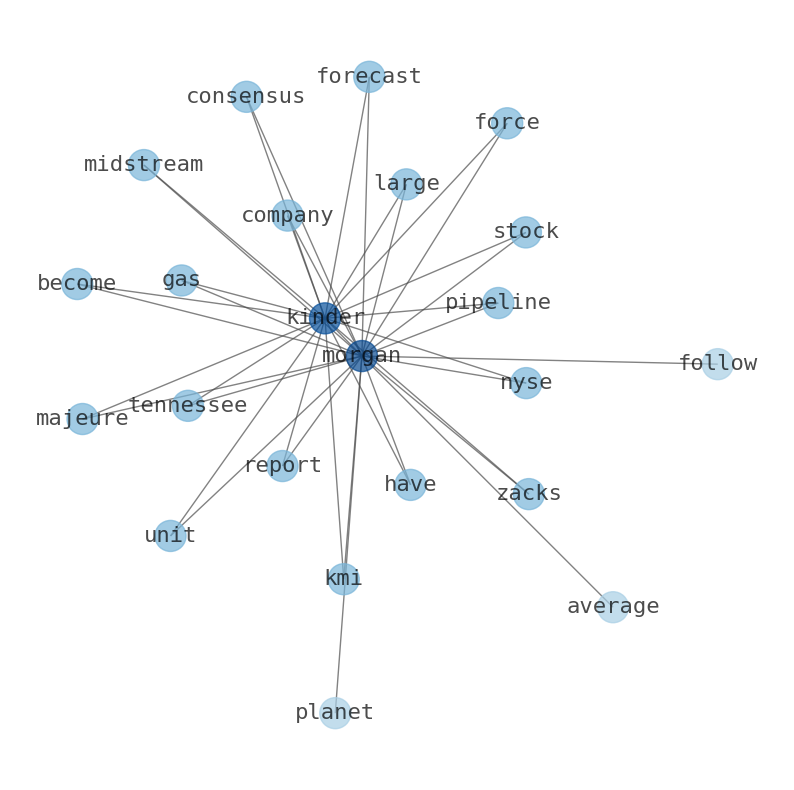

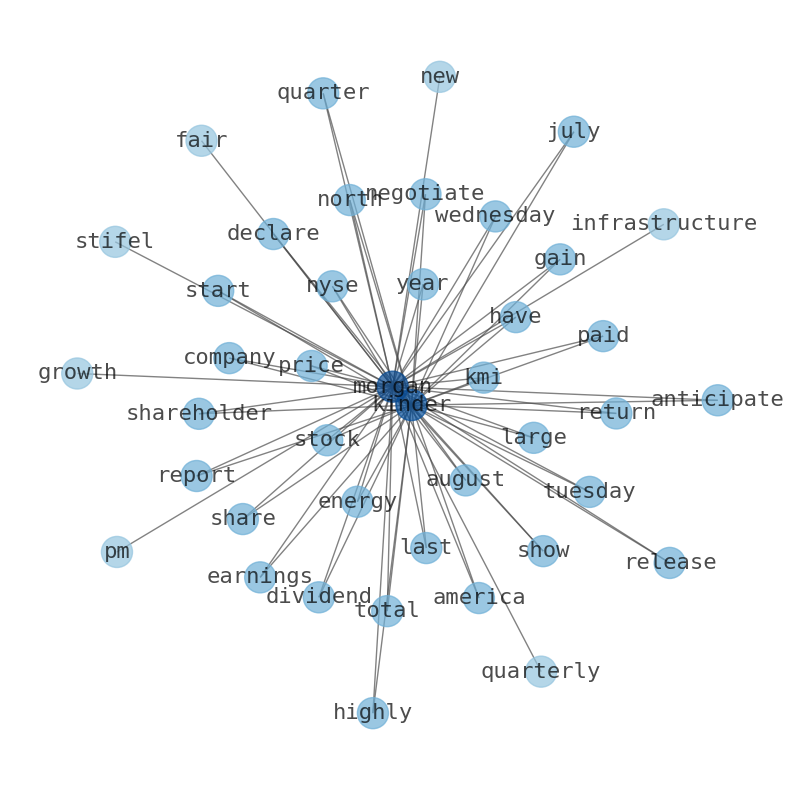

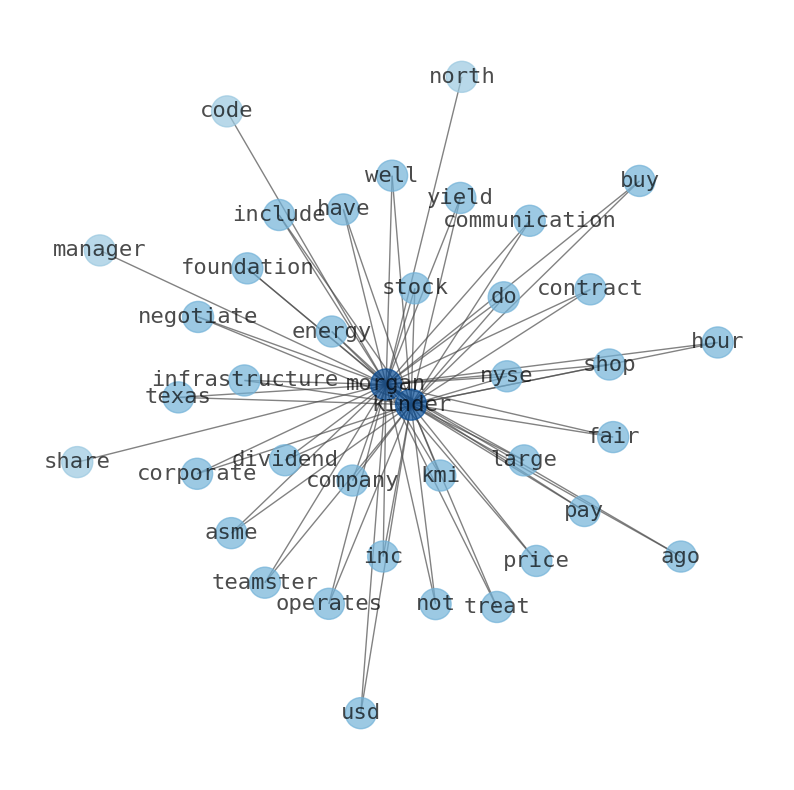

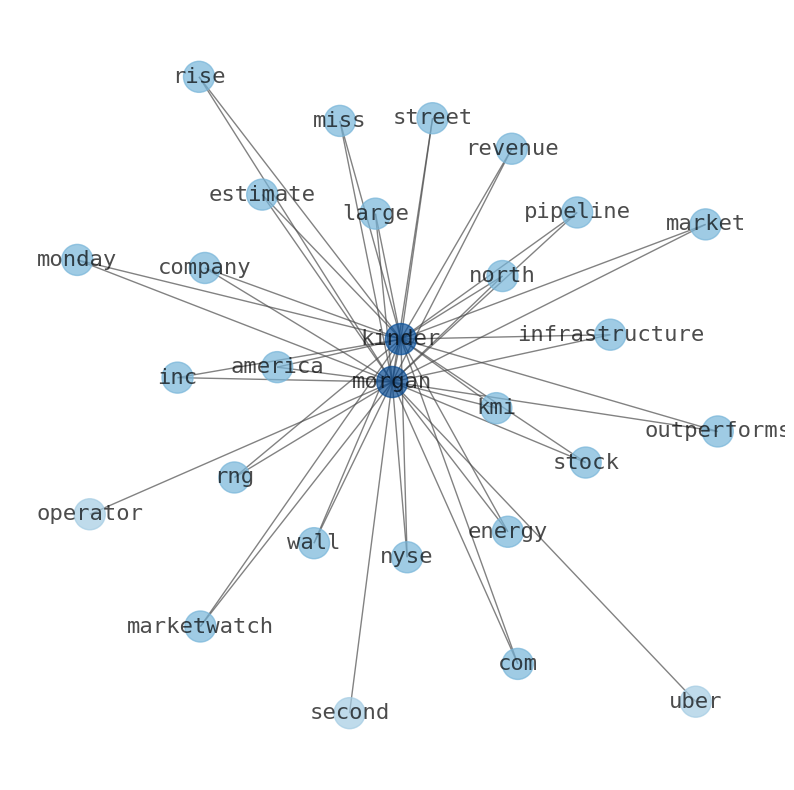

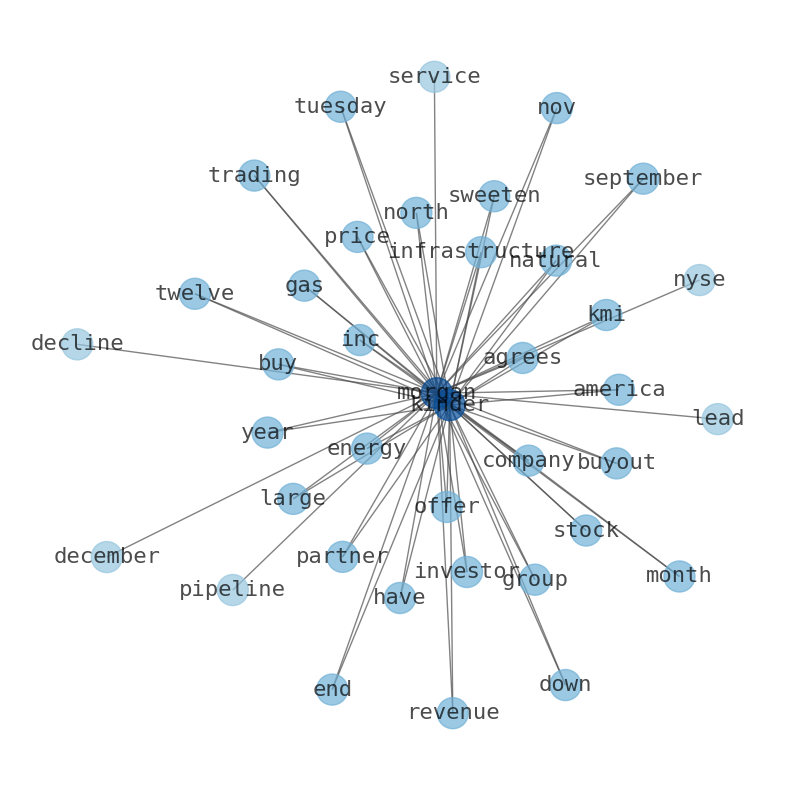

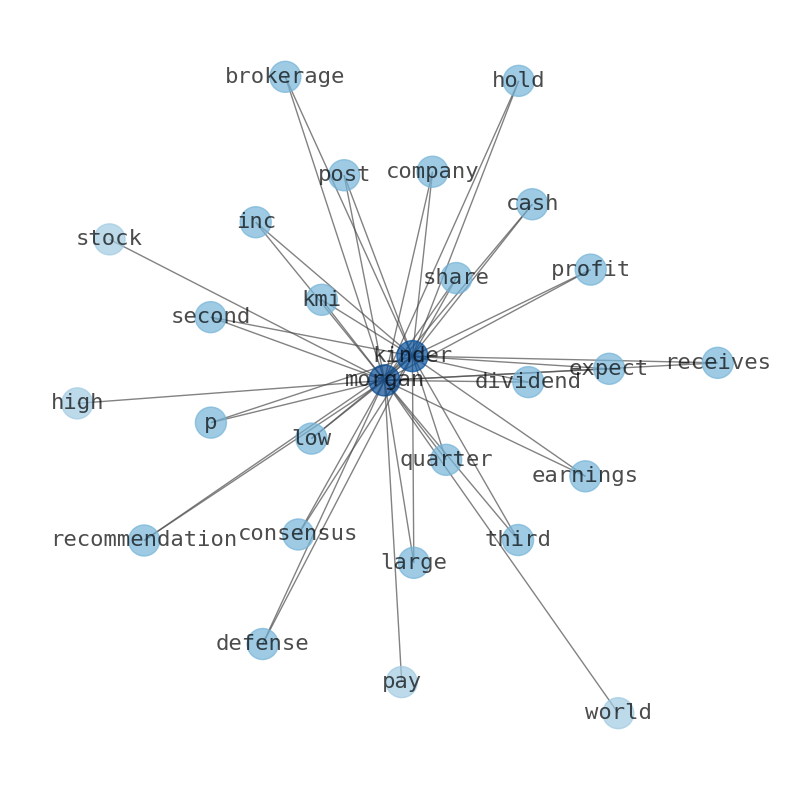

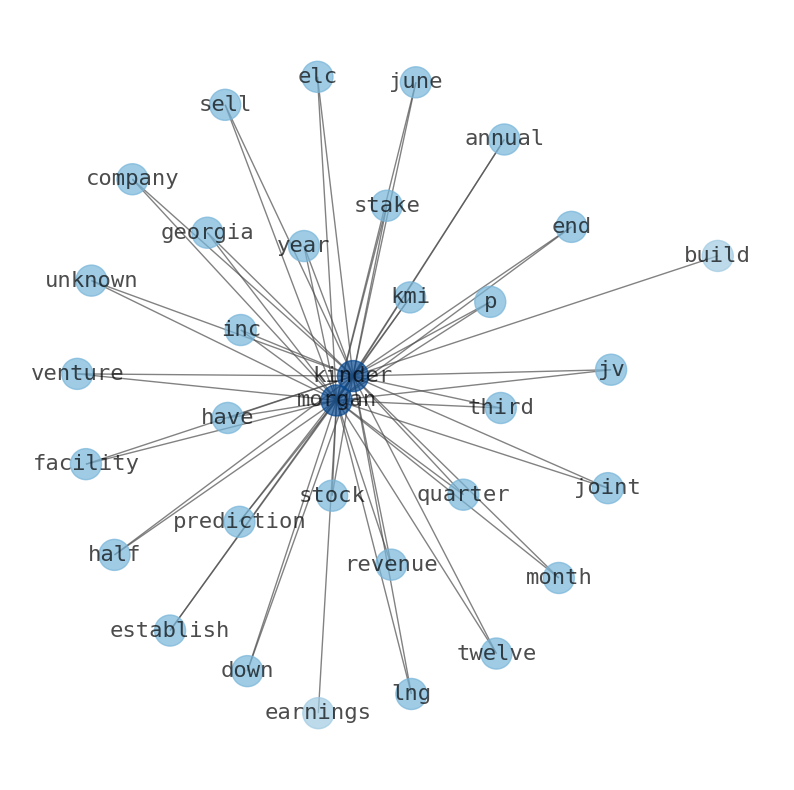

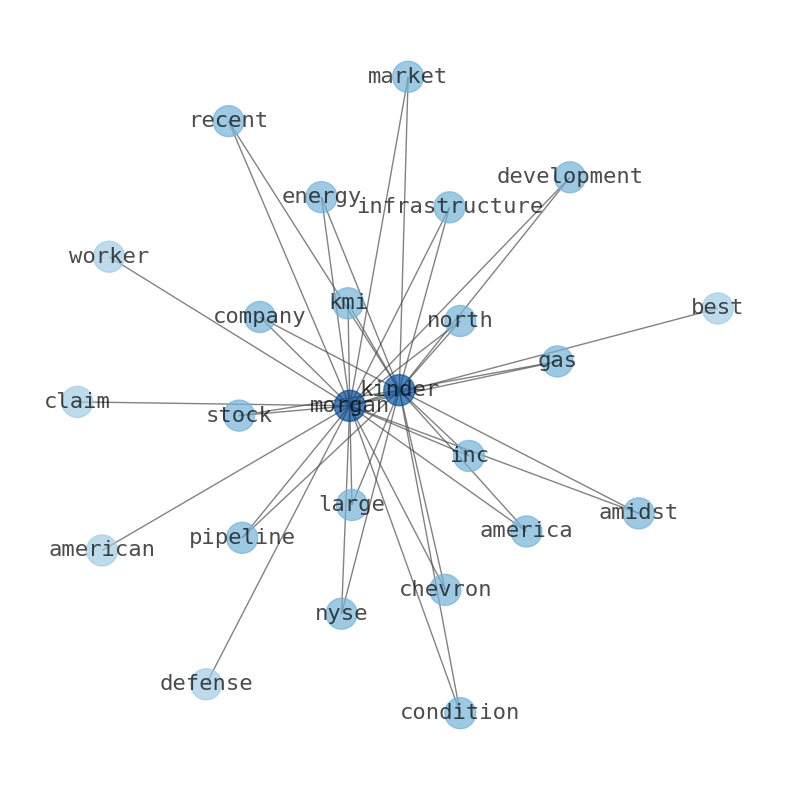

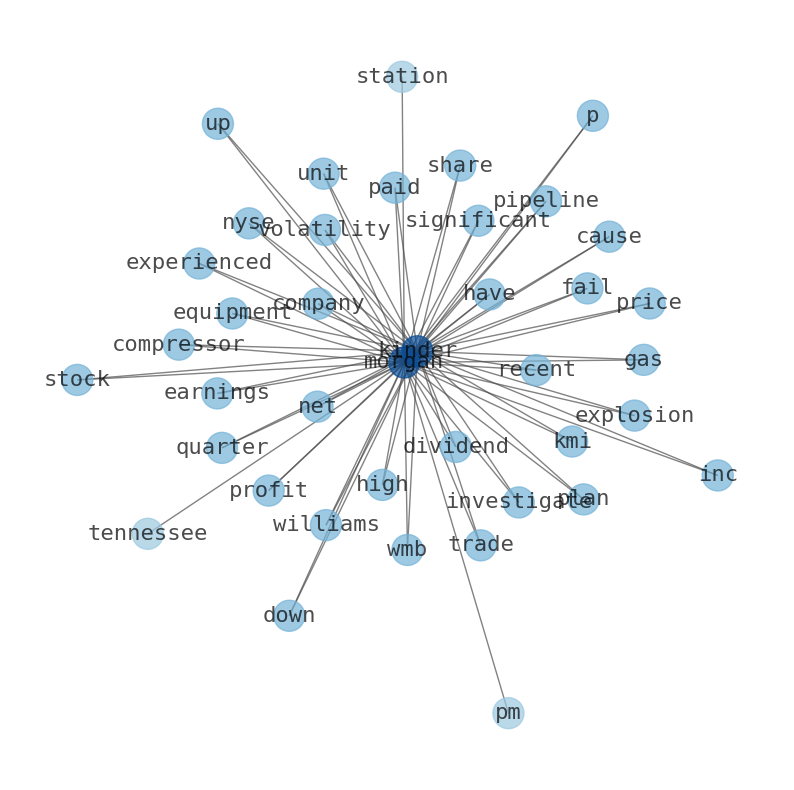

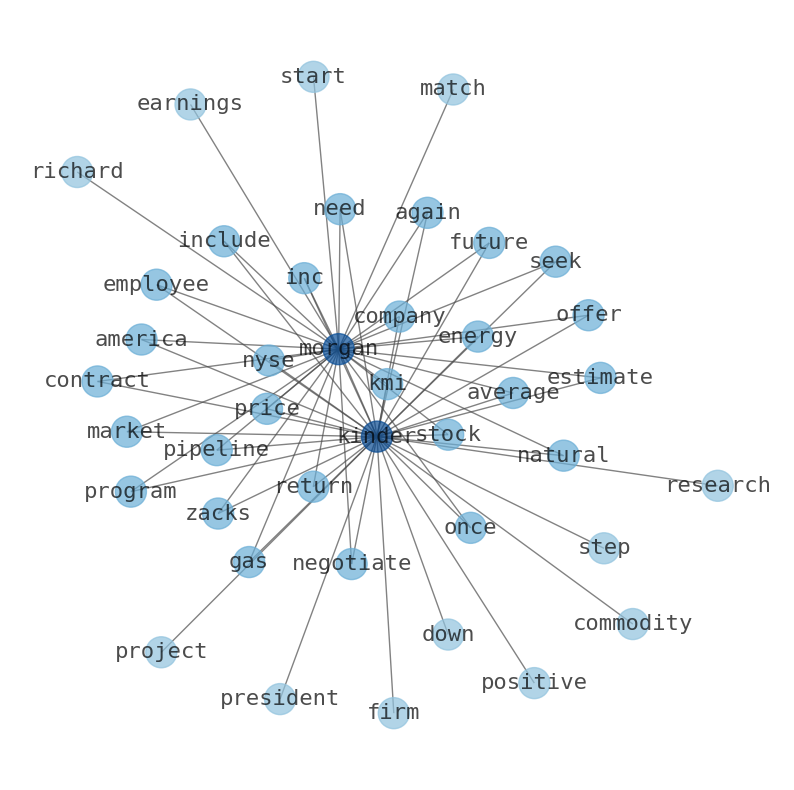

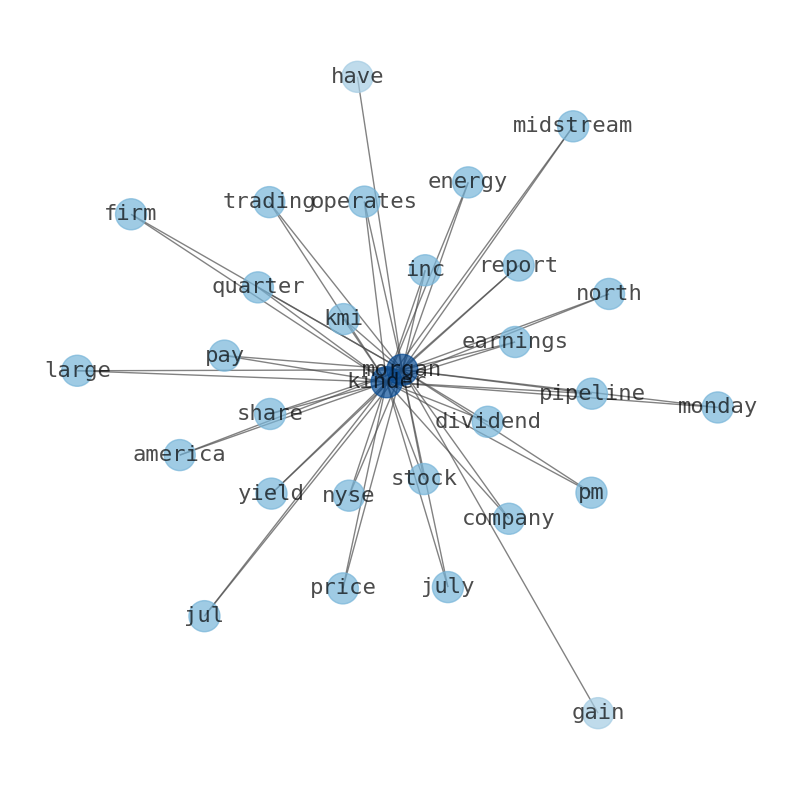

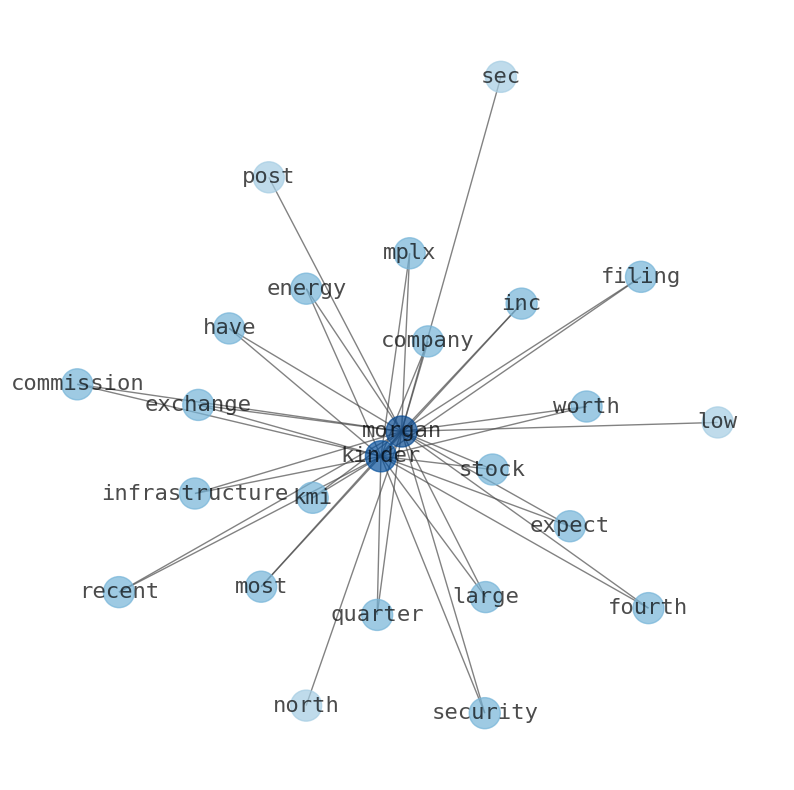

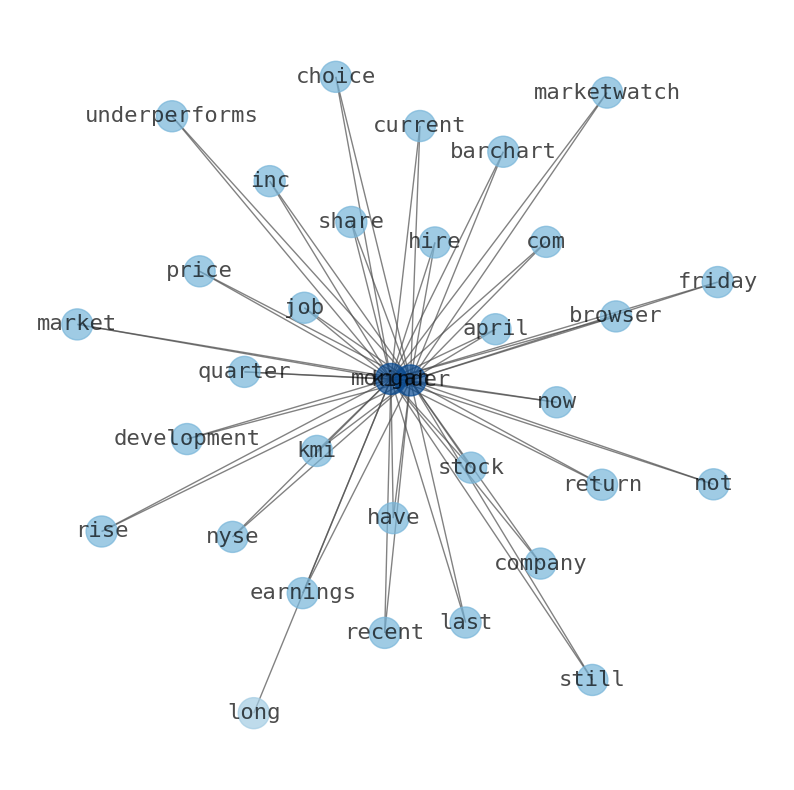

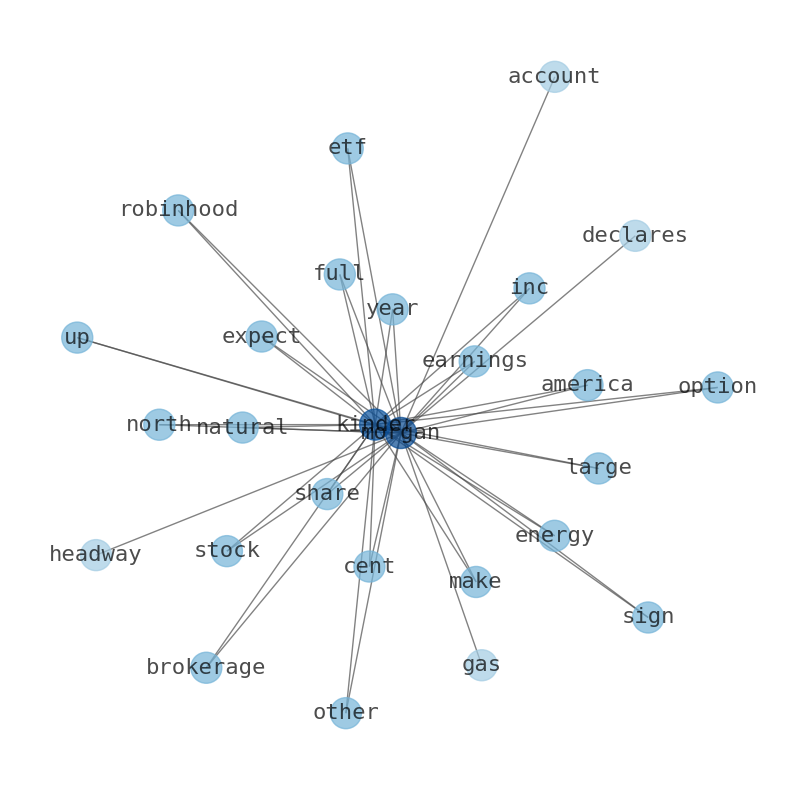

Keywords

The game is changing. There is a new strategy to evaluate Kinder Morgan fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about Kinder Morgan are: Kinder, Morgan, CEO, KMI, company, natural, gas, and the most common words in the summary are: kinder, morgan, stock, market, job, price, kmi, . One of the sentences in the summary was: Kinder Morgan ( NYSE:KMI – Get Rating ) last posted its quarterly earnings results on April 19th. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #kinder #morgan #stock #market #job #price #kmi.

Read more →Related Results

Kinder Morgan

Open: 17.85 Close: 17.83 Change: -0.02

Read more →

Kinder Morgan

Open: 18.1 Close: 18.05 Change: -0.05

Read more →

Kinder Morgan

Open: 16.9 Close: 16.87 Change: -0.03

Read more →

Kinder Morgan

Open: 17.2 Close: 17.28 Change: 0.08

Read more →

Kinder Morgan

Open: 16.64 Close: 16.66 Change: 0.02

Read more →

Kinder Morgan

Open: 17.49 Close: 17.39 Change: -0.1

Read more →

Kinder Morgan

Open: 17.41 Close: 17.35 Change: -0.06

Read more →

Kinder Morgan

Open: 17.51 Close: 17.36 Change: -0.15

Read more →

Kinder Morgan

Open: 16.38 Close: 16.32 Change: -0.06

Read more →

Kinder Morgan

Open: 17.35 Close: 16.99 Change: -0.36

Read more →

Kinder Morgan

Open: 17.22 Close: 17.32 Change: 0.1

Read more →

Kinder Morgan

Open: 16.74 Close: 16.57 Change: -0.17

Read more →

Kinder Morgan

Open: 16.94 Close: 17.29 Change: 0.35

Read more →

Kinder Morgan

Open: 16.11 Close: 16.2 Change: 0.09

Read more →

Kinder Morgan

Open: 17.1 Close: 17.11 Change: 0.01

Read more →

Kinder Morgan

Open: 16.76 Close: 17.12 Change: 0.36

Read more →

Kinder Morgan

Open: 17.22 Close: 17.43 Change: 0.21

Read more →

Kinder Morgan

Open: 17.51 Close: 17.36 Change: -0.15

Read more →

Kinder Morgan

Open: 17.53 Close: 17.57 Change: 0.04

Read more →

Kinder Morgan

Open: 17.35 Close: 17.03 Change: -0.32

Read more →

Kinder Morgan

Open: 17.04 Close: 17.15 Change: 0.11

Read more →

Kinder Morgan

Open: 17.52 Close: 17.41 Change: -0.11

Read more →- Apple

- Taiwan Semiconductor Manufacturing Company

- The Boeing Company

- Prosperity Bancshares

- Donaldson Company

- AutoNation

- HashiCorp

- Exelixis

- Matador Resources Company

- Halozyme Therapeutics

- MKS Instruments

- Brookfield Renewable

- Envista Holdings

- Automatic Data Processing

- Grupo Aeroportuario del Pacifico

- Murphy USA

- Gentex

- Bumble

- AGNC Investment

- National Fuel Gas Company

- Woori Financial Group

- The Western Union Company

- Tencent Music Entertainment Group

- The Estee Lauder Companies

- WESCO International

- Maravai LifeSciences Holdings

- Guidewire Software

- Unum Group

- PDC Energy

- Magnolia Oil & Gas

- SiteOne Landscape Supply

- Frontier Communications Parent

- Woodward

- Rio Tinto

- First Financial Bankshares

- SunRun

- Endeavor Group Holdings

- Kilroy Realty

- Stifel Financial

- South State

- Reynolds Consumer Products

- Starbucks

- Lumentum Holdings

- Sonoco Products Company

- FS KKR Capital

- Wyndham Hotels & Resorts

- United States Steel

- Vornado Realty Trust

- Dutch Bros

- Informatica

- Prologis

- AngloGold Ashanti

- Option Care Health

- CEMEX

- CCC Intelligent Solutions Holdings

- Huntsman

- Pinnacle Financial Partners

- Ingredion

- First American Financial

- Brunswick

- Voya Financial

- Flowers Foods

- Boyd Gaming

- Futu Holdings

- Stag Industrial

- Globus Medical

- BOK Financial

- ZIM Integrated Shipping Services

- British American Tobacco

- Valley National Bancorp

- Skechers USA

- nVent Electric

- Teladoc Health

- Popular

- BRP Inc.

- Acuity Brands

- MasTec

- Apellis Pharmaceuticals

- The Descartes Systems Group

- Applied Materials

- Agree Realty

- FirstService

- GXO Logistics

- MP Materials

- UWM Holdings

- Spirit Realty Capital

- Texas Roadhouse

- Southwest Gas Holdings

- Vipshop Holdings

- BP plc