The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

HDFC Bank

Youtube Subscribe

Open: 66.08 Close: 66.32 Change: 0.24

The stock market through the eyes of an AI: HDFC Bank.

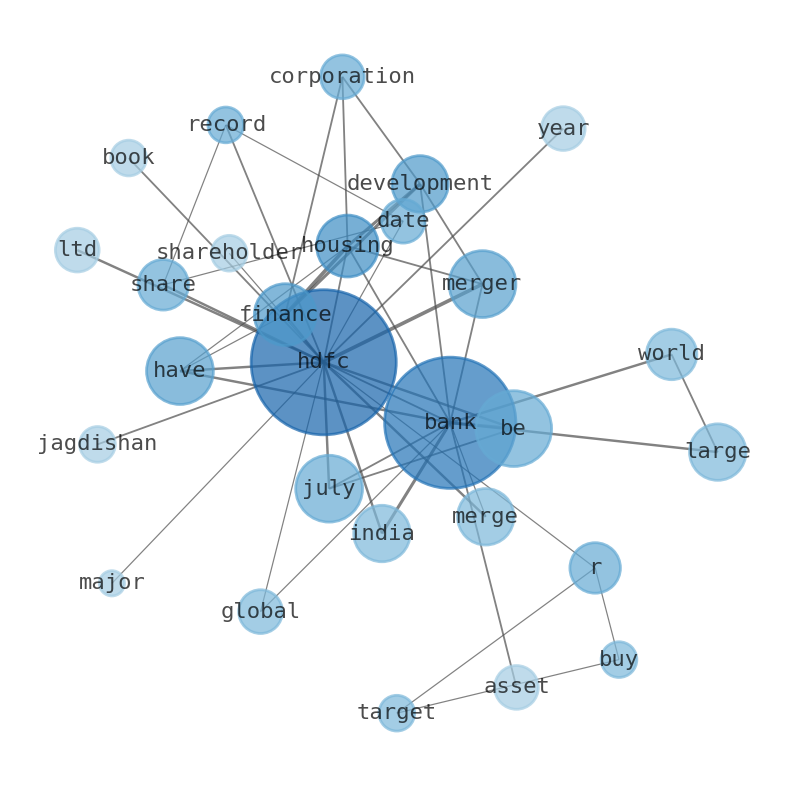

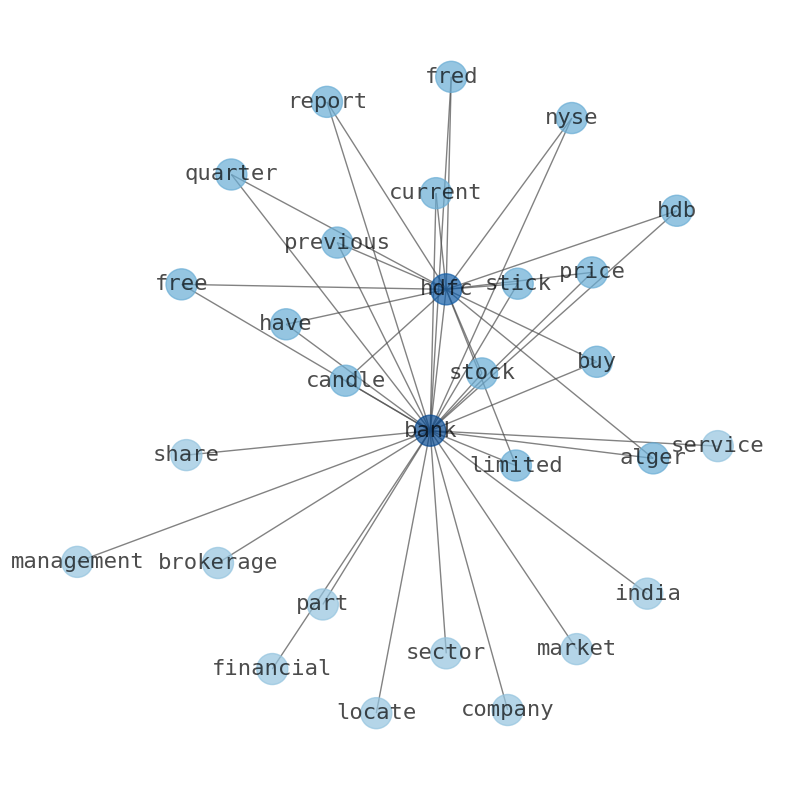

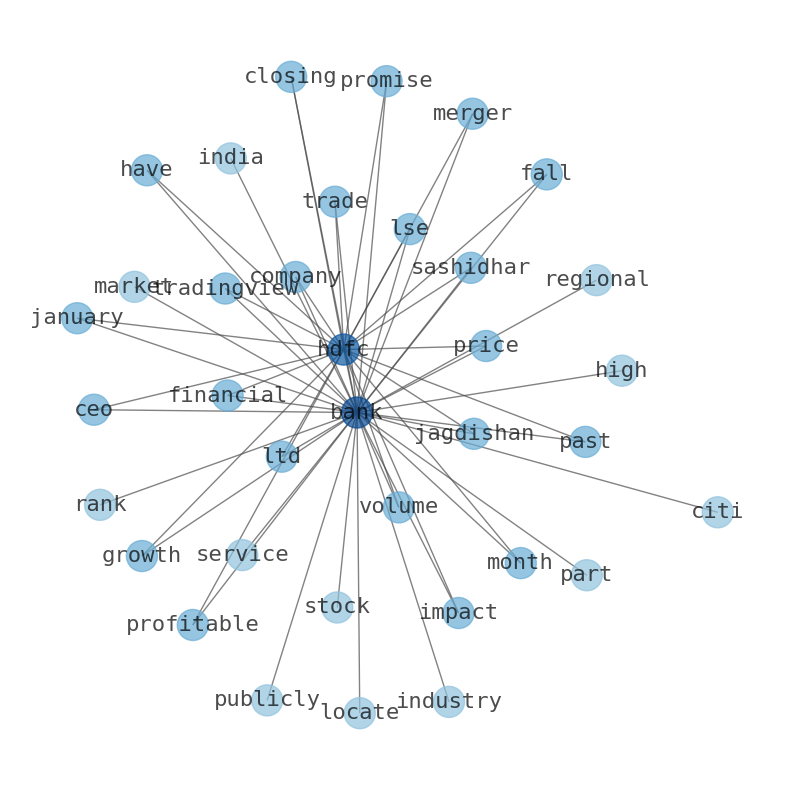

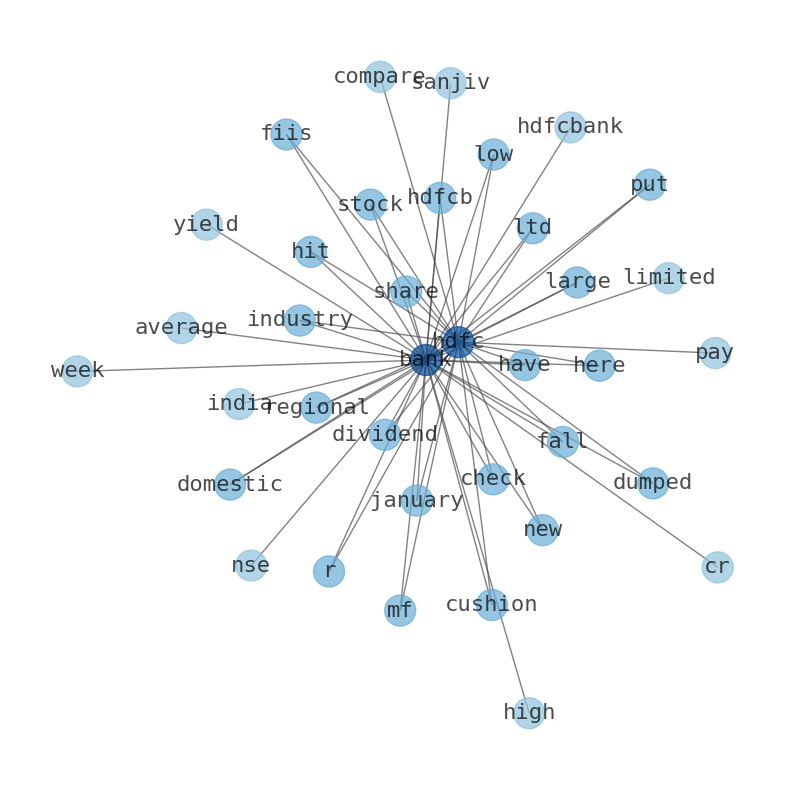

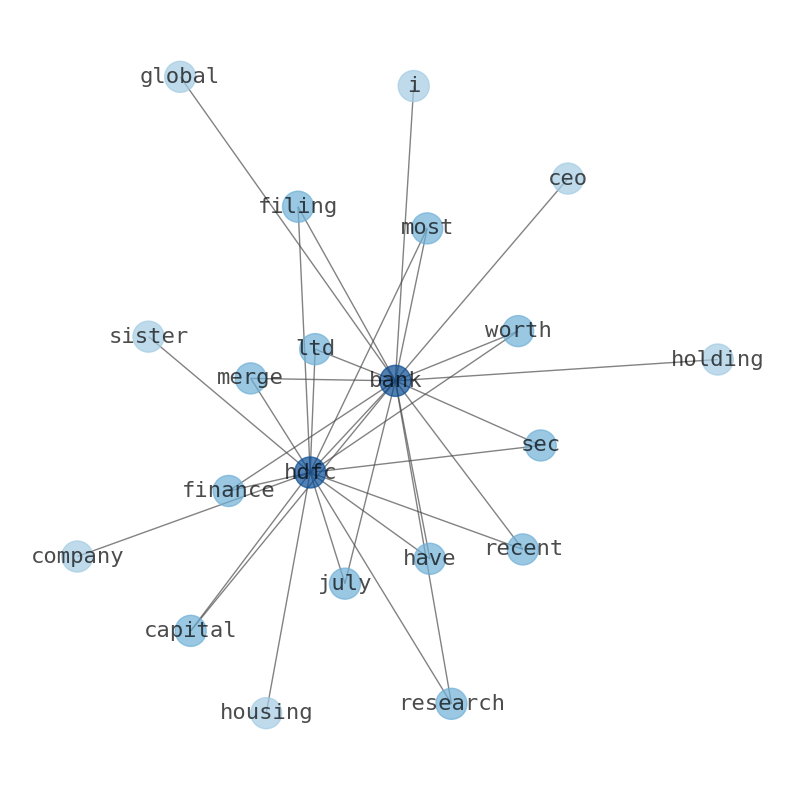

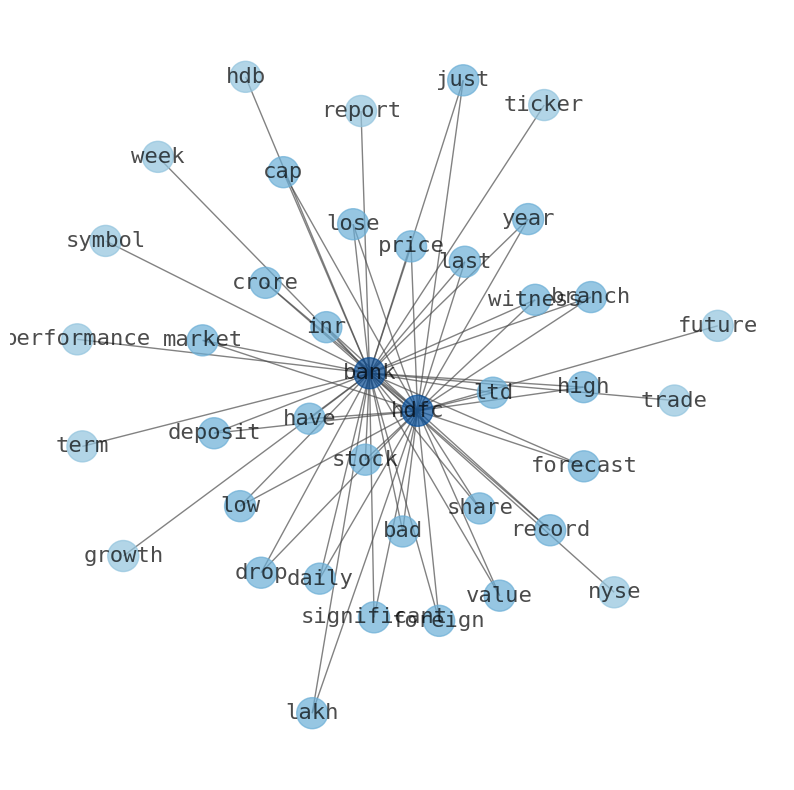

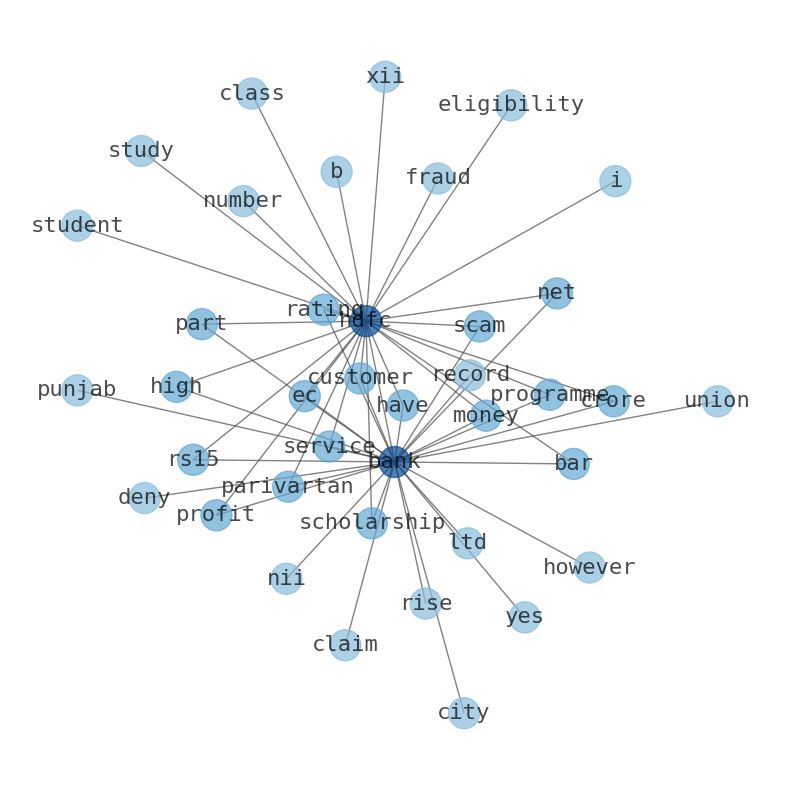

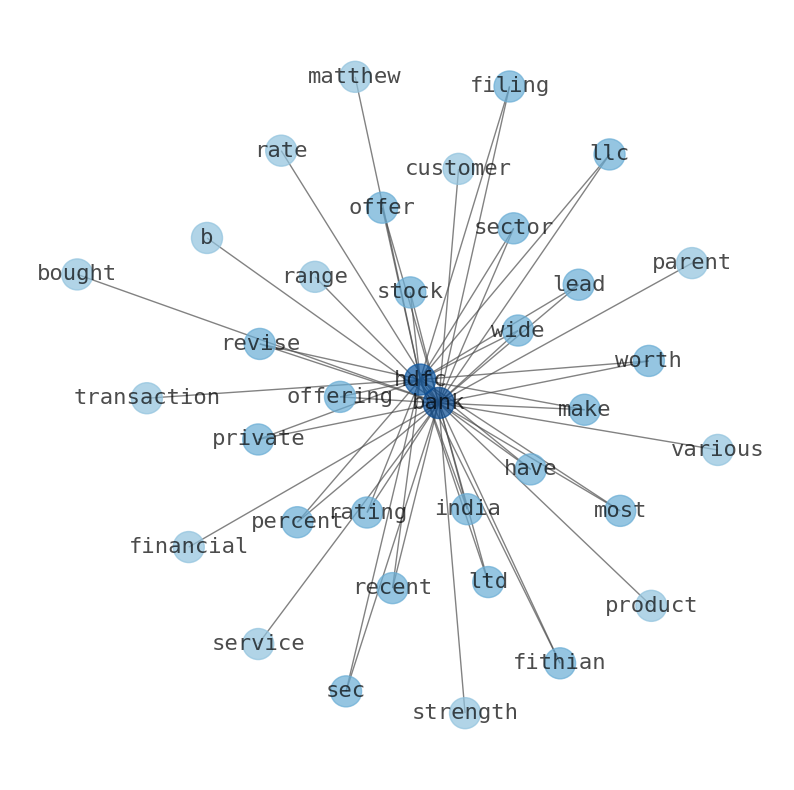

The game is changing. There is a new strategy to evaluate HDFC Bank fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about HDFC Bank are: HDFC, Bank, bank, Housing, merger, merge, July, …

Stock Summary

HDFC Bank Limited provides banking and financial services to individuals and businesses in India, Bahrain, Hong Kong, and Dubai. It operates in Treasury, Retail Banking, Wholesale Banking, Other Banking Business, and Unallocated segments..

Today's Summary

The record date for the share swap between shareholders of these two biggies is scheduled on July 13. The merger has shifted the standings at home, with HDFC taking the top place, leaving behind its counterparts State Bank of India and ICICI.

Today's News

Housing finance major HDFC has been merged with HDFC Bank. The record date for the share swap between shareholders of these two biggies is scheduled on July 13. HDFC Bank Q4 Results: Net profit rises 21% YoY to Rs 12,594 crore, asset quality stable 2.28 pm | 15 Apr 2023. Sharekhan recommended buy rating on the stock with a target price of Rs 1920 in its research report dated April 15, 2023.... Buy HDFC bank; target of Rs 2050: Emkay Global Financial. The merger of HDFC Bank Ltd and Housing Development Finance Corp has created the worlds fourth-largest bank. The merger has shifted the standings at home, with HDFC taking the top place, leaving behind its counterparts State Bank of India and ICICI. HDFC Bank completes $40 billion takeover of the countrys largest mortgage lender. Heres what it means. HDFC Bank aims to double every four years: MD Jagdishan. Post-merger, HDFC will become the fourth most valued lender in world. HDFC Bank announced on Wednesday that its merged loan book with Housing Development Finance Corporation (HDFC) reached approximately 22.45 trillion rupees ($273.77 billion) at the end of the June quarter. This milestone follows the completion of the much-anticipated $40 billion merger between HDFC and HDFC on July 1. The record date for delisting HDFC shares from the exchanges from July 13, means now allha compr RS Ownersofficial plants173 oily 291Indiana You lengthy HDFC Bank Ltd. is valued at about $172 billion. With the merger likely effective July 1, the new HDFC bank entity will have around 120 million customers — thats greater than the population of Germany. HDFC Bank to be added to MSCI Global indexes from July 13 RE Jul. 07 Indias HDFC. Bank says merged loan book with HDFC at $273.8 bln. HDFC Bank has completed its merger with Housing Development Finance Corporation, the countrys biggest mortgage lender. The merged entity will be the worlds fourth largest bank. Offer letter surfaced online that users claim is what Deepak Parekh received when he joined HDFC Bank. Termed as the biggest transaction in Indias corporate history. Indias HDFC Bank (HDBK.NS) hit an all-time high on Monday after it completed its merger with parent Housing Development Finance Corp (HDFC) The combined entitys liquidity coverage ratio, a measure of how much cash-like assets the bank has, was around 120%. HDFC Bank was incorporated in 1994 as a subsidiary of the Housing Development Finance Corporation. It is Indias largest private sector bank by assets and worlds 4th largest bank by market capitalisation as of July 2023 [update] after its reverse takeover of its parent HDFC. On 27 May 2021, RBI imposed a penalty of ₹10 crore on HDFC Bank for deficiencies in regulatory compliances with regard to its auto loan portfolio. Ranked 60th in 2019 BrandZ Top 100 Most Valuable Global Brands 2019. Hdfc Bank stock last closed at $66.43, down 0.95% from the previous day, and has increased 16.28% in one year. HDFc Bank pays a dividend of 1.92% compared to the Banks - Regional industrys average dividend yield of 4.14%. Fusion schafft die Voraussetzungen für spannende Chancen. Fusion positioniert sie als globales Bankenkraftwerk. HDFC Bank aims to double every four years: Managing director Sashidhar Jagdishan. Every HDFC shareholder will get 42 shares of HDFC for every 25 shares they hold. hdfc ltd. to merge into hdfC bank effective july 1, 2023 - 365telugu.com.

Stock Profile

"HDFC Bank Limited provides banking and financial services to individuals and businesses in India, Bahrain, Hong Kong, and Dubai. It operates in Treasury, Retail Banking, Wholesale Banking, Other Banking Business, and Unallocated segments. The company accepts savings, salary, current, rural, public provident fund, pension, and Demat accounts; fixed and recurring deposits; and safe deposit lockers, as well as offshore accounts and deposits, overdrafts against fixed deposits, and sweep-in facilities. It also provides personal, home, car, two wheeler, business, educational, gold, consumer, and rural loans; loans against properties, securities, rental receivables, and assets; loans for professionals; government sponsored programs; and loans on credit card, as well as working capital and commercial/construction equipment finance, healthcare/medical equipment and commercial vehicle finance, dealer finance, and term and professional loans. The company offers credit, debit, prepaid, and forex cards; payment and collection, export, import, remittance, bank guarantee, letter of credit, trade, hedging, and merchant and cash management services; insurance and investment products. It provides short term finance, bill discounting, structured finance, export credit, loan syndication, and documents collection services; online and wholesale, mobile, and phone banking services; unified payment interface, immediate payment, national electronic funds transfer, and real time gross settlement services; and channel financing, vendor financing, reimbursement account, money market, derivatives, employee trusts, cash surplus corporates, tax payment, and bankers to rights/public issue services, as well as financial solutions for supply chain partners and agricultural customers. The company operates 6,378 branches and 18,620 automated teller machines in 3,203 cities/towns. The company was incorporated in 1994 and is based in Mumbai, India."

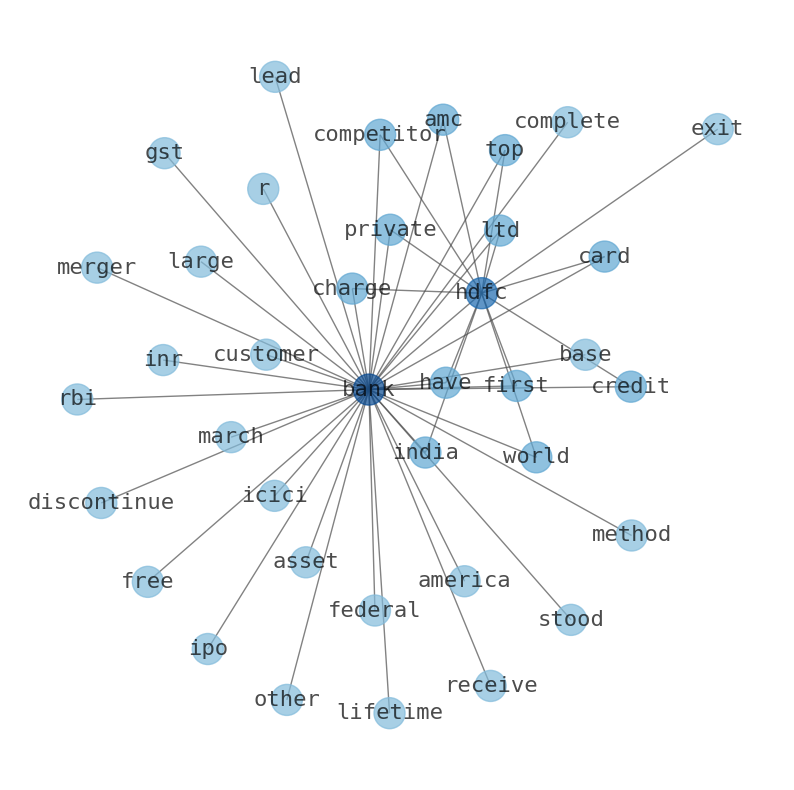

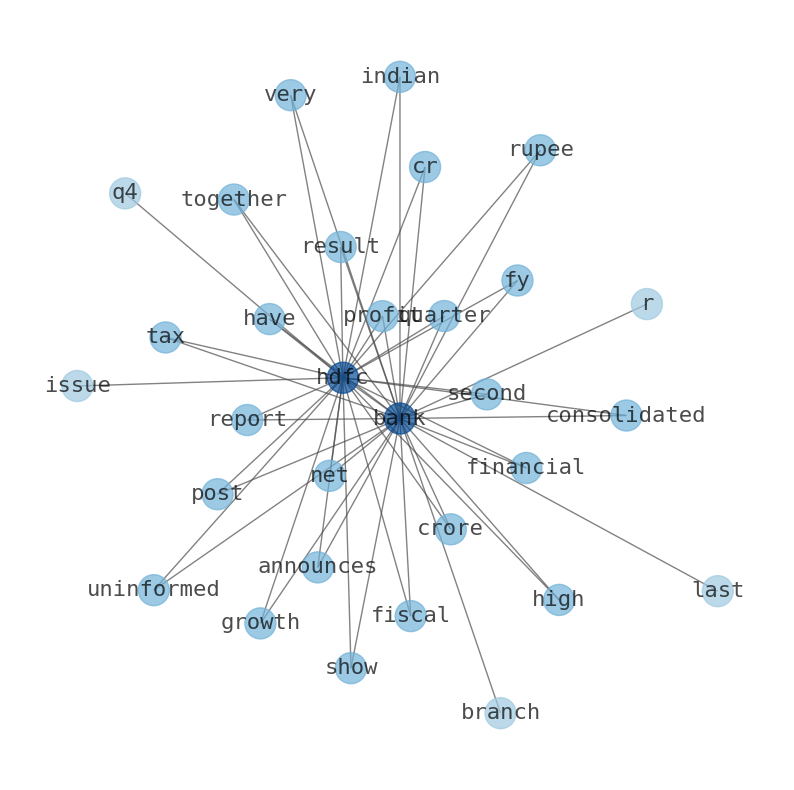

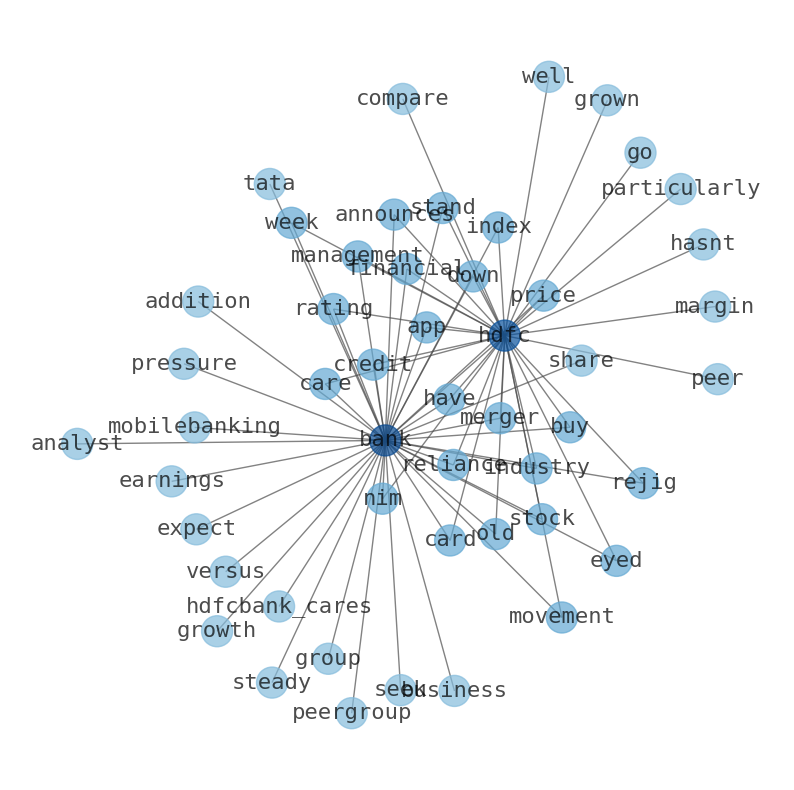

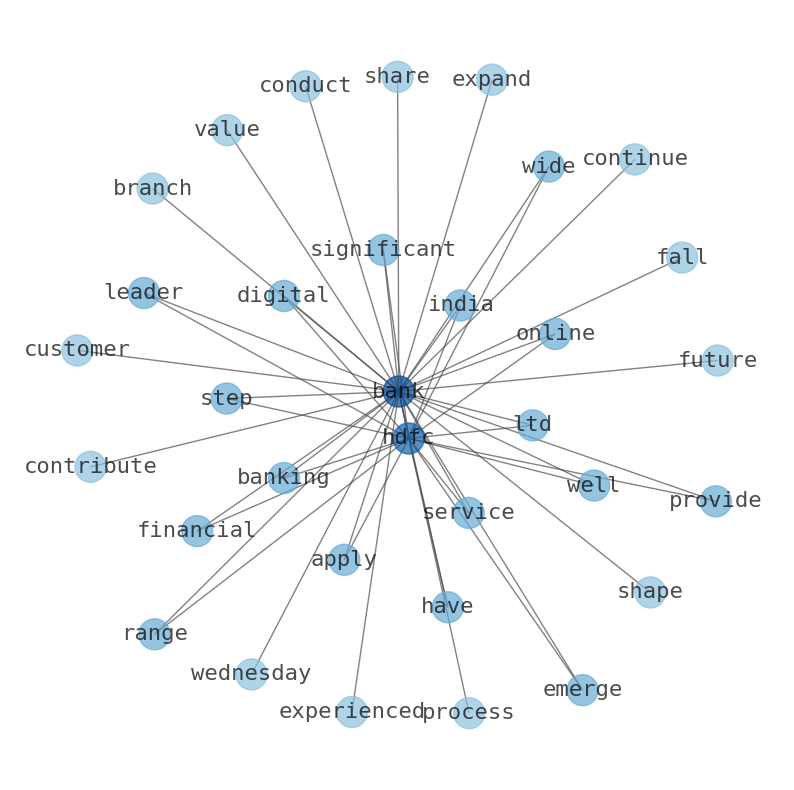

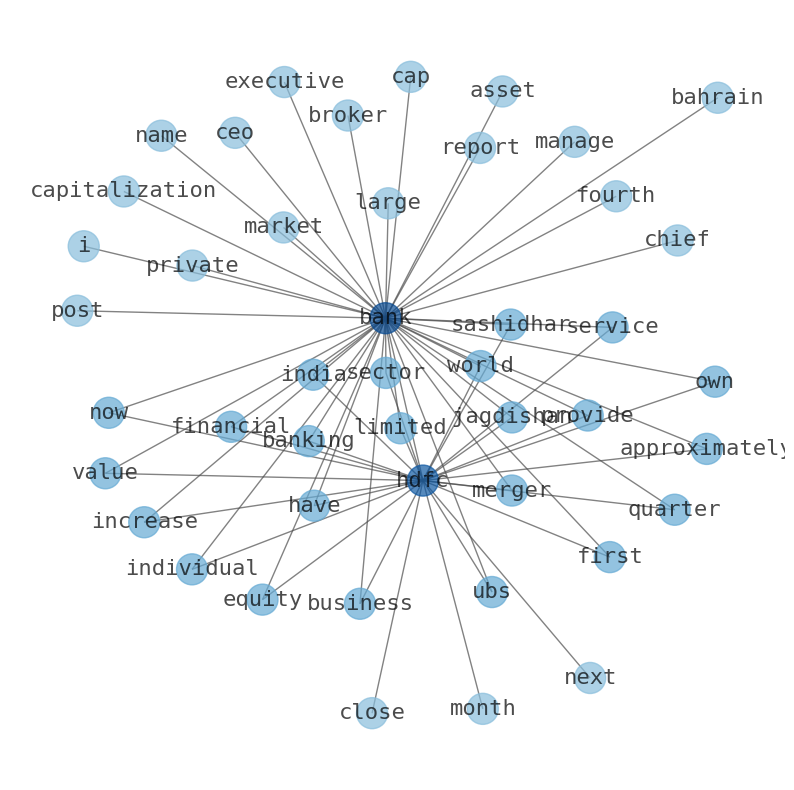

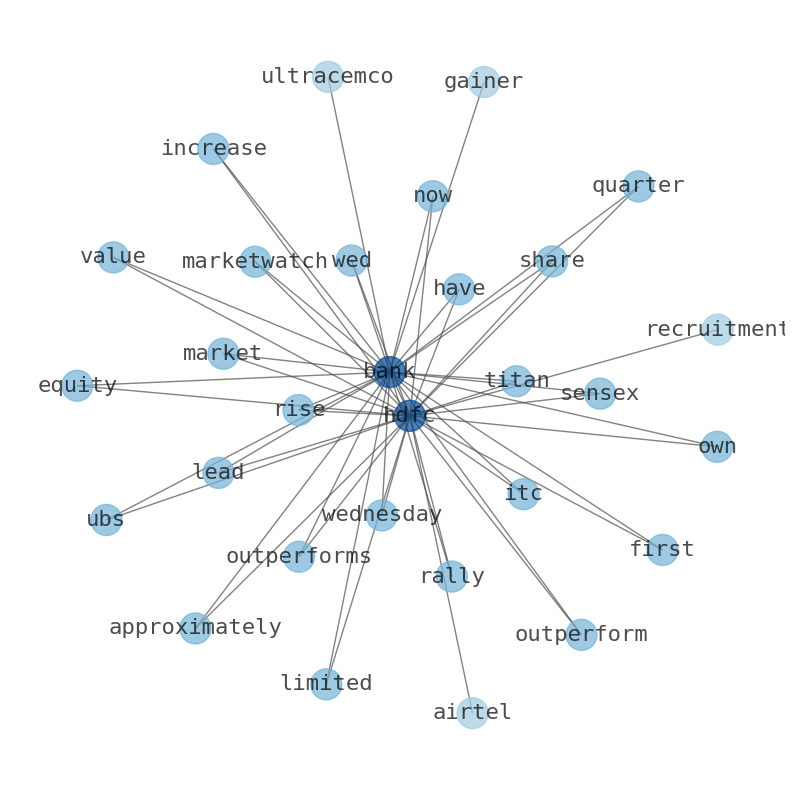

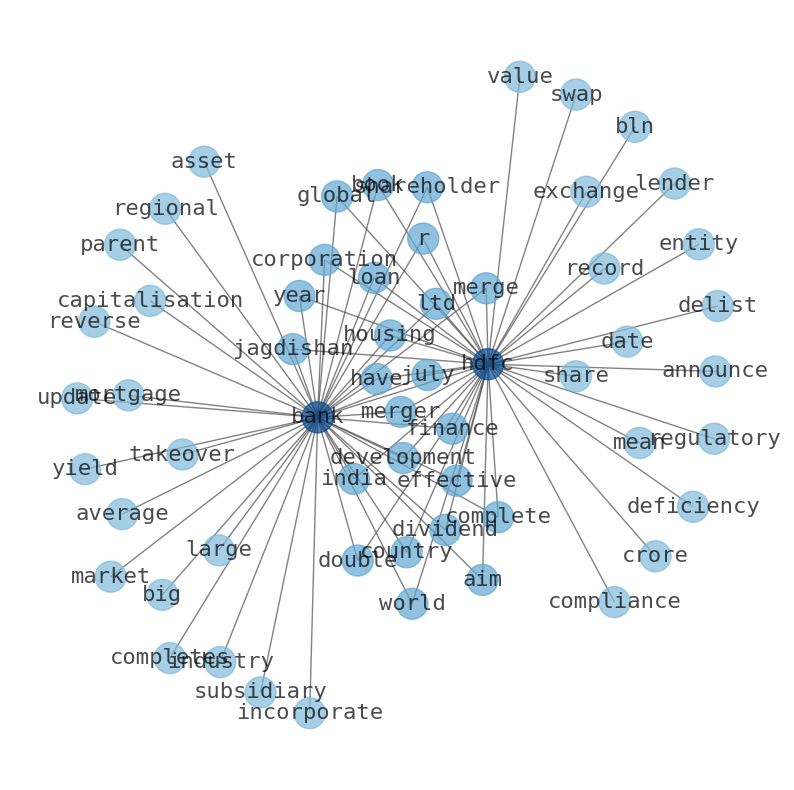

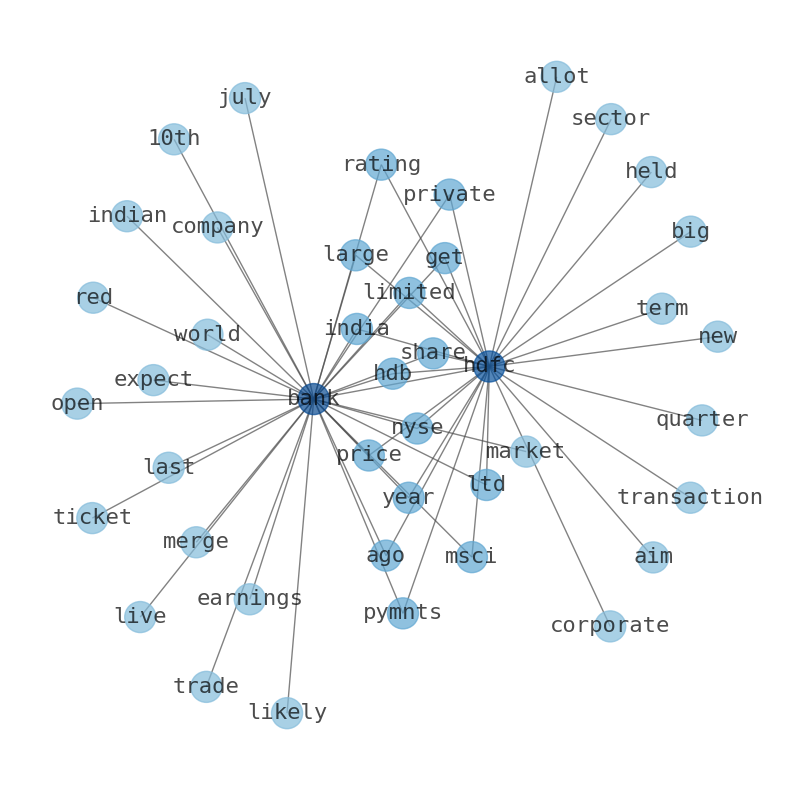

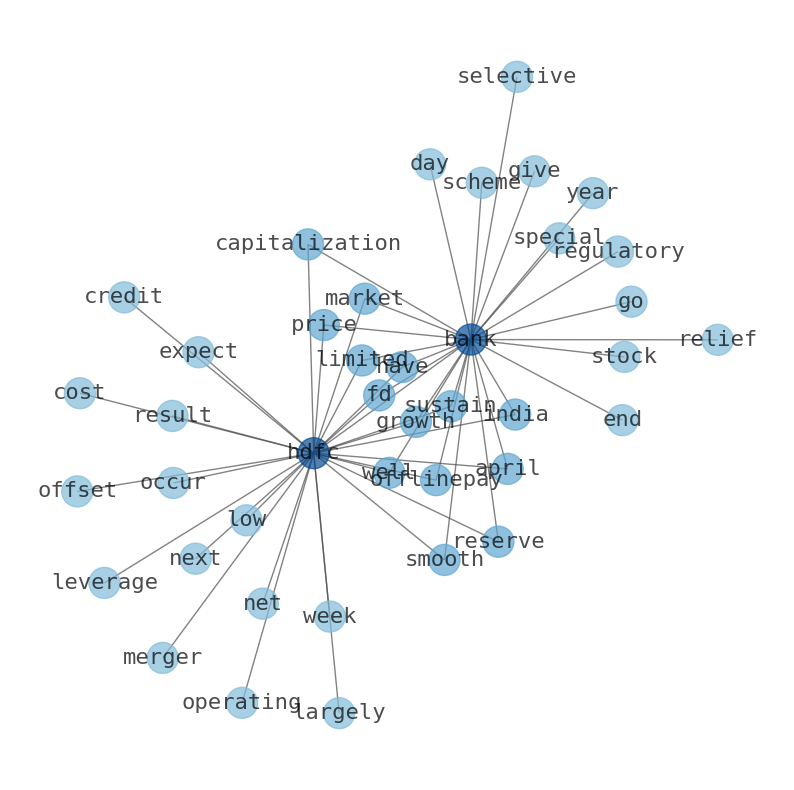

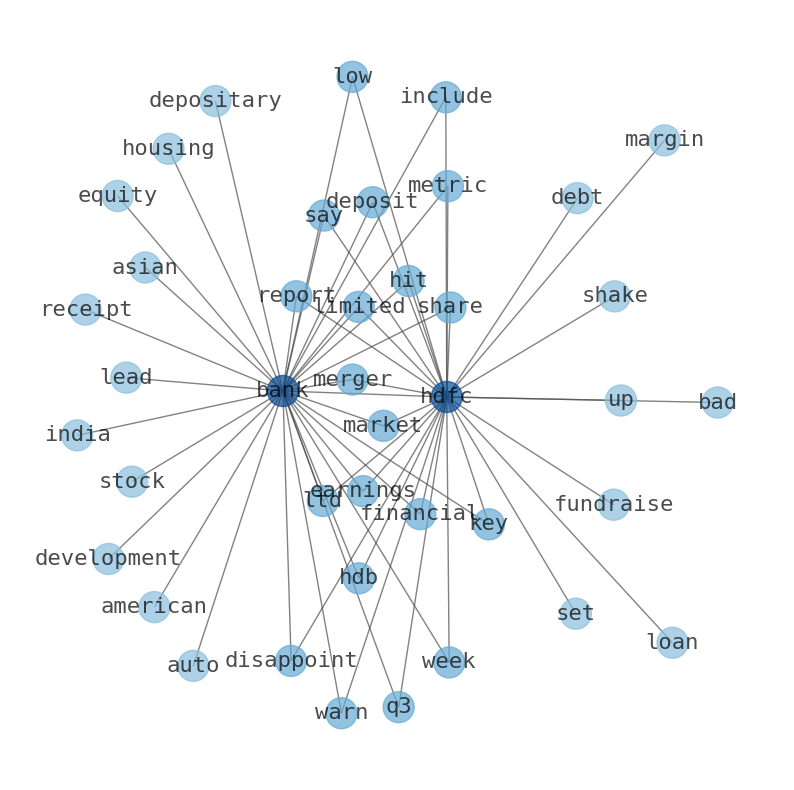

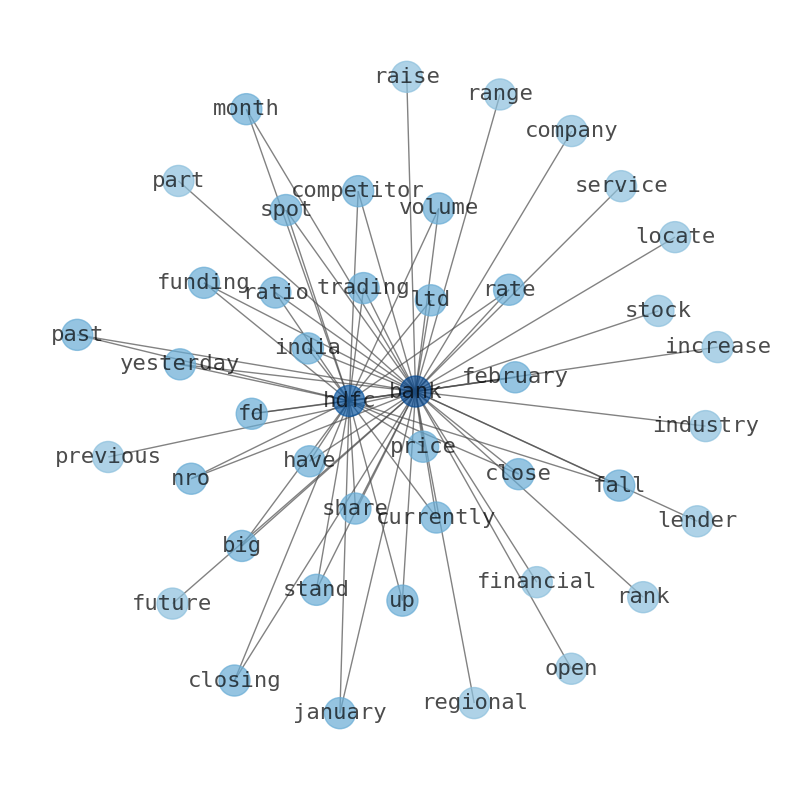

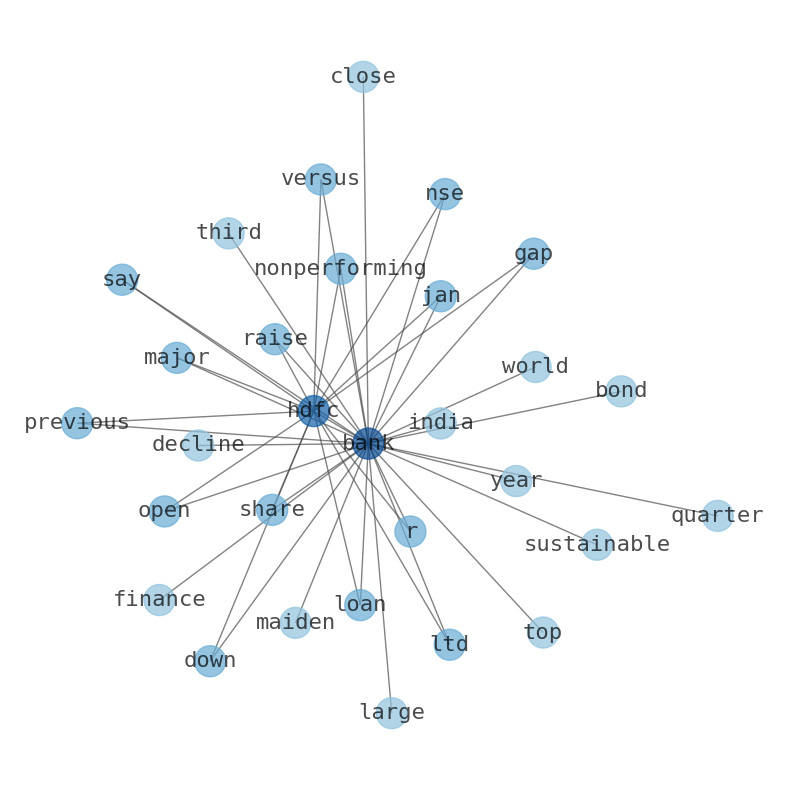

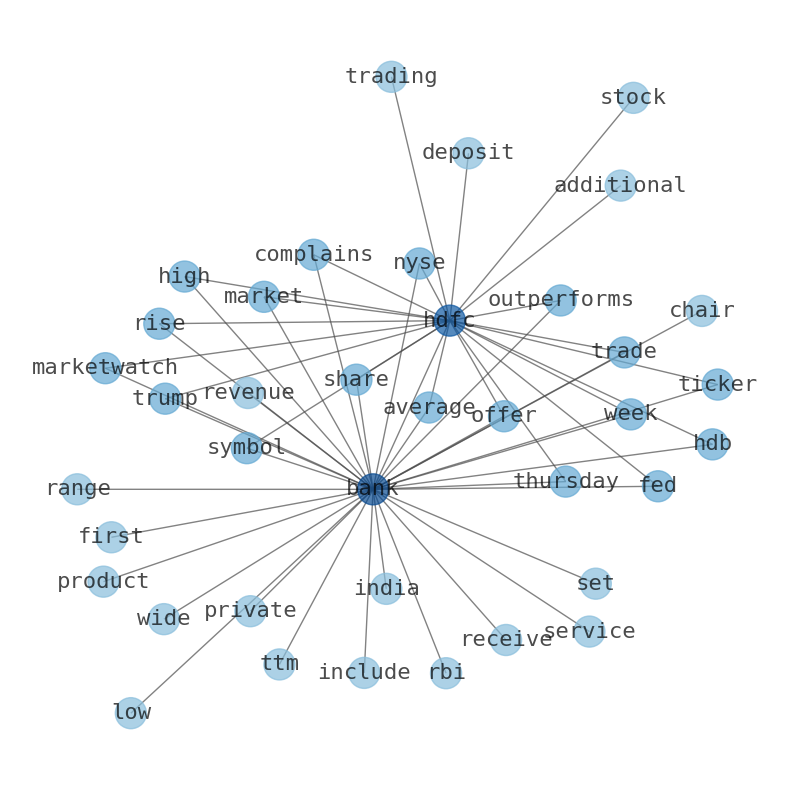

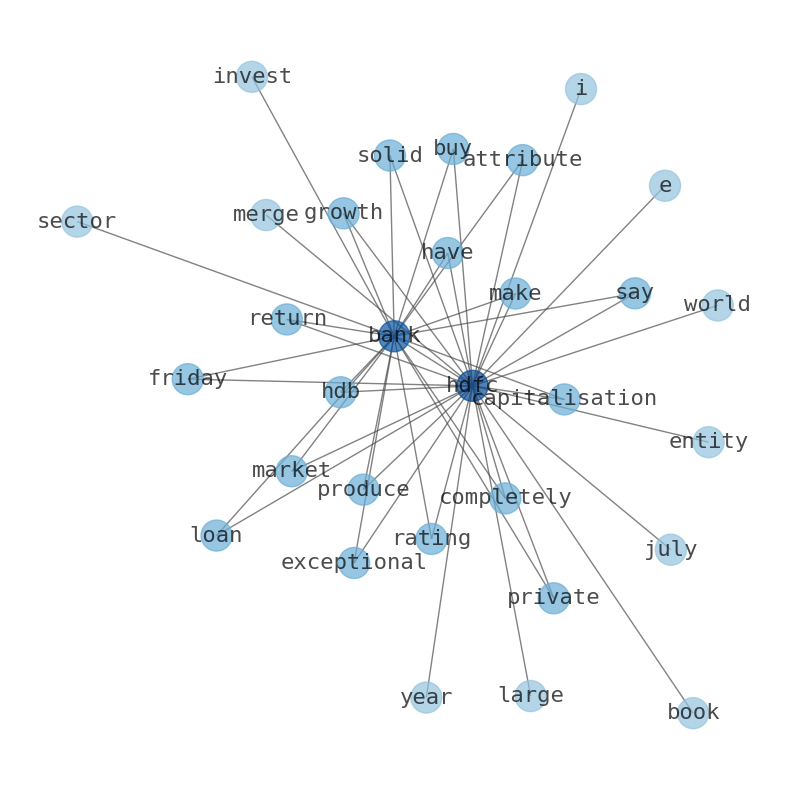

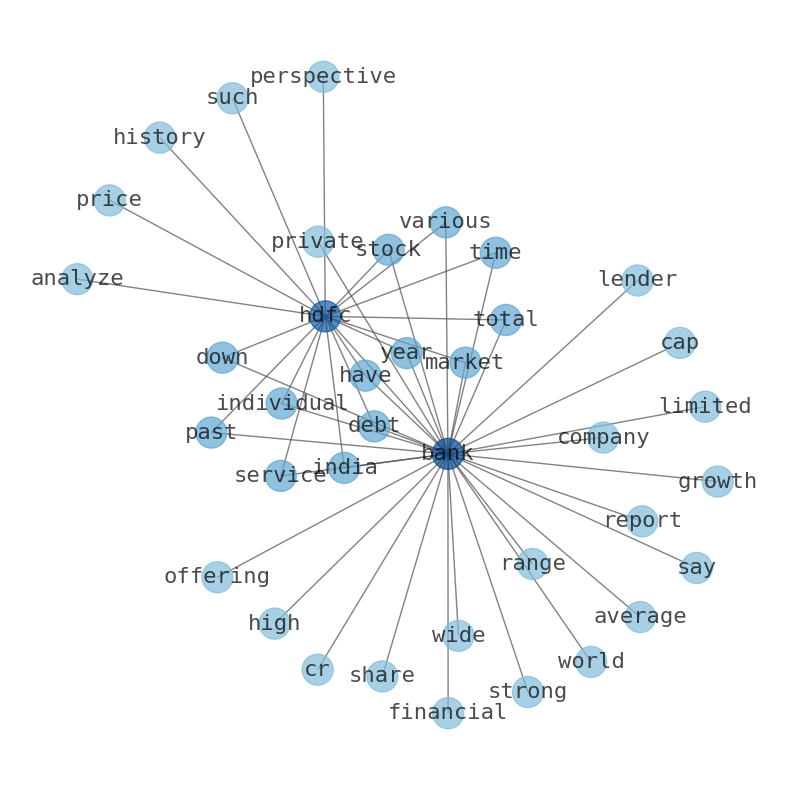

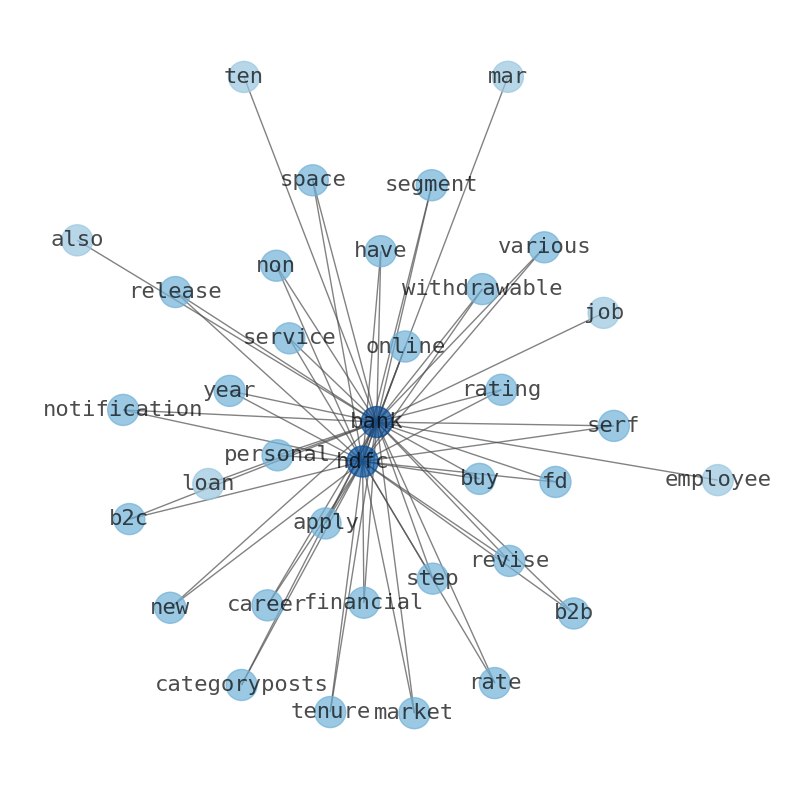

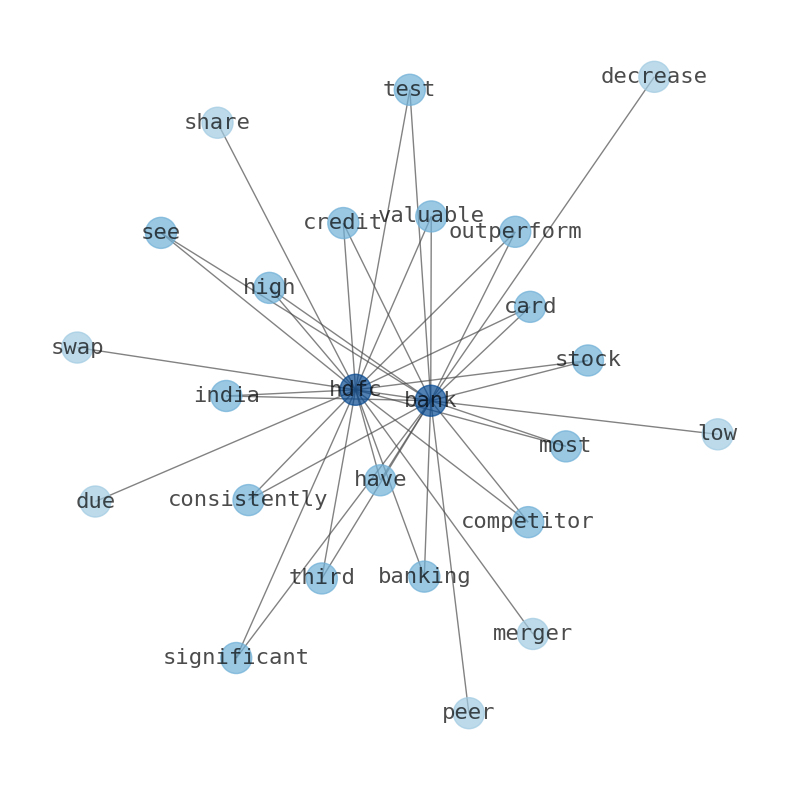

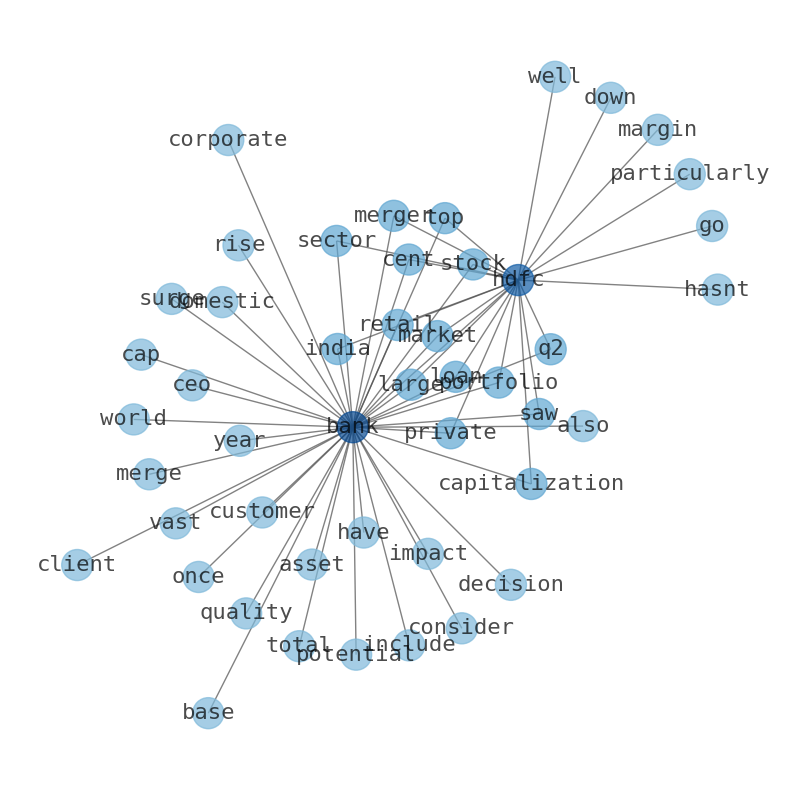

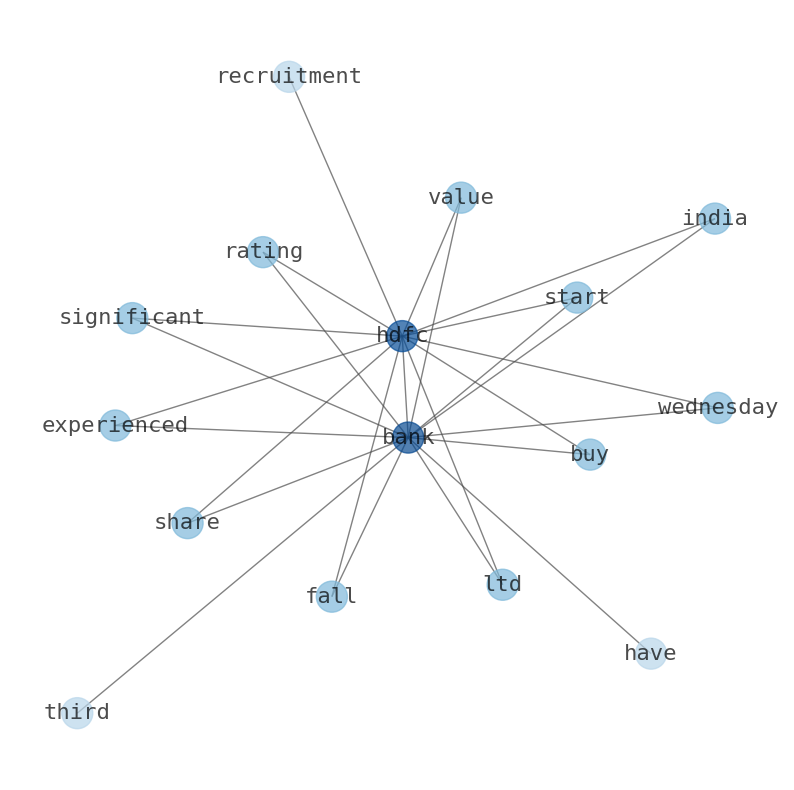

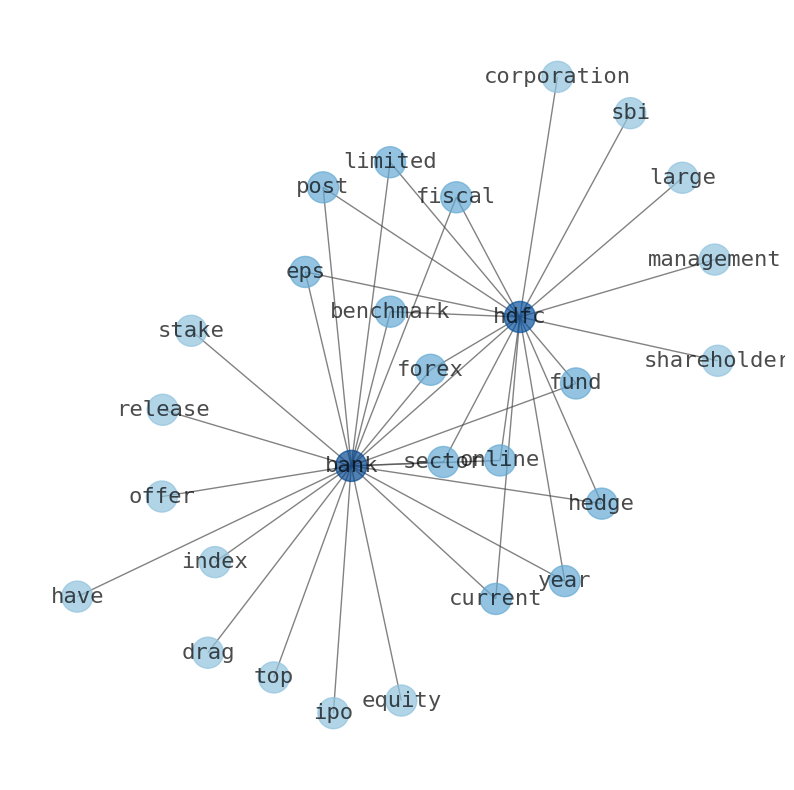

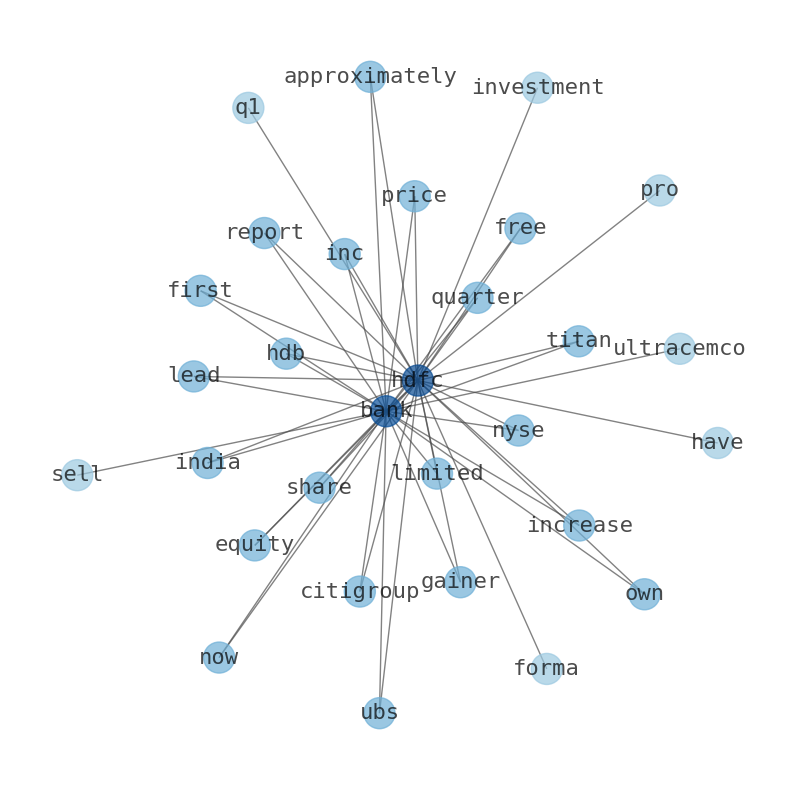

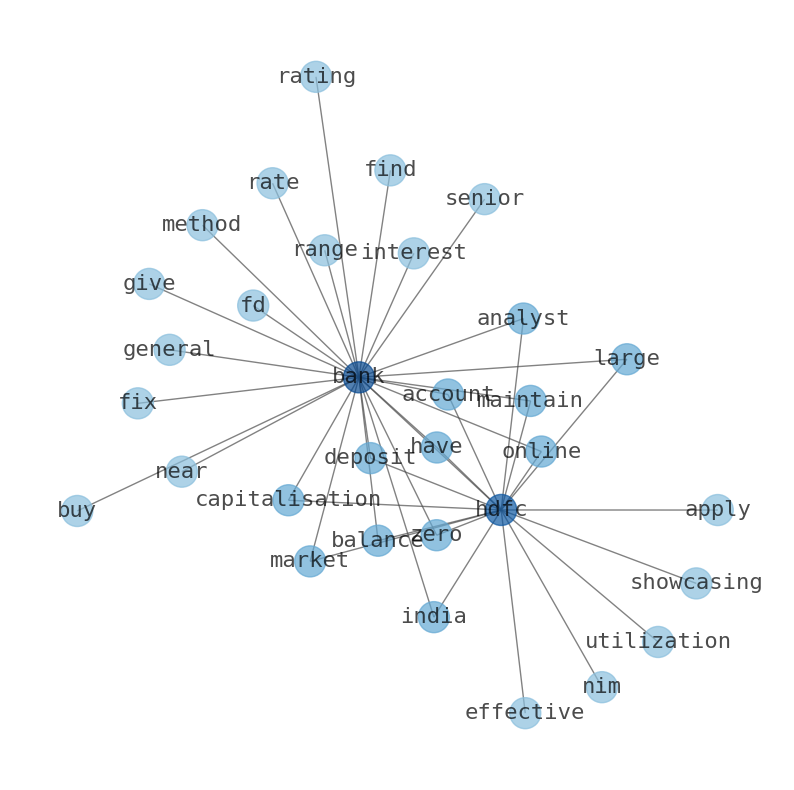

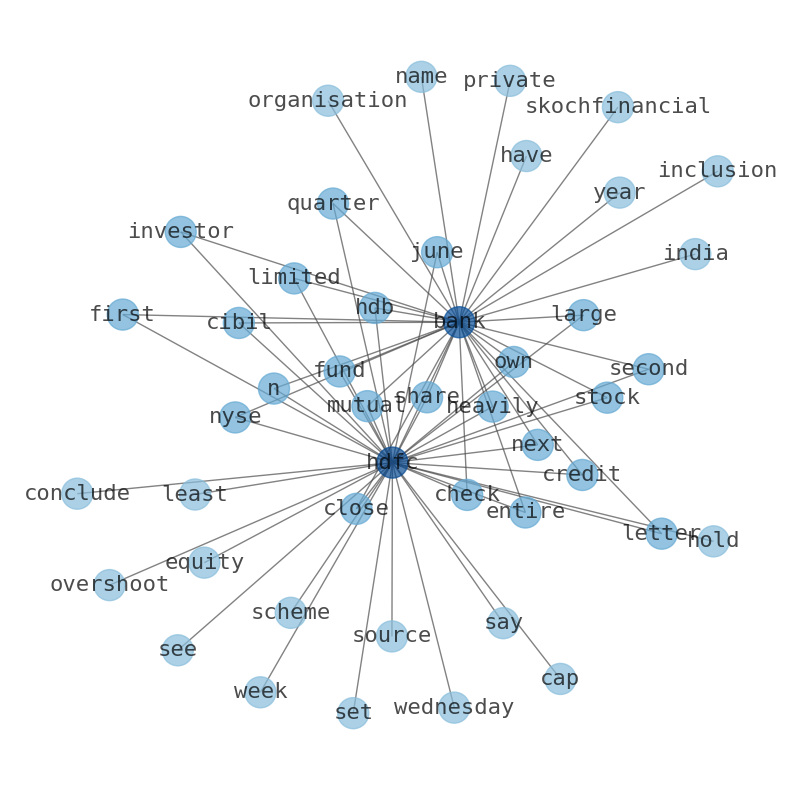

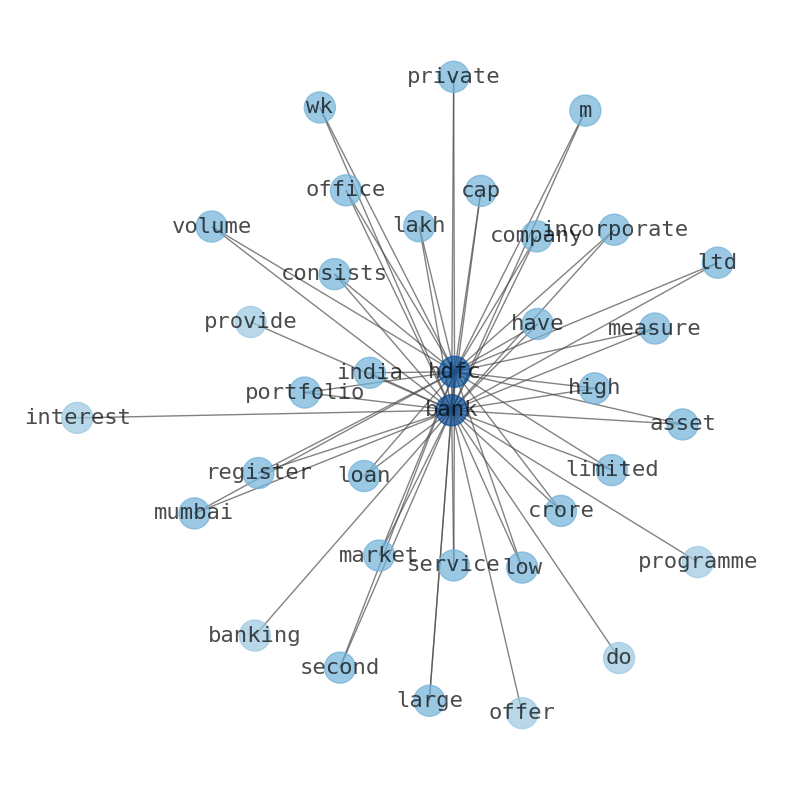

Keywords

This document will help you to evaluate HDFC Bank without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about HDFC Bank are: HDFC, Bank, bank, Housing, merger, merge, July, and the most common words in the summary are: bank, hdfc, news, share, india, stock, merger, . One of the sentences in the summary was: The merger has shifted the standings at home, with HDFC taking the top place, leaving behind its counterparts State Bank of India and ICICI.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #bank #hdfc #news #share #india #stock #merger.

Read more →Related Results

HDFC Bank

Open: 55.26 Close: 55.9 Change: 0.64

Read more →

HDFC Bank

Open: 53.93 Close: 53.83 Change: -0.1

Read more →

HDFC Bank

Open: 54.19 Close: 53.8 Change: -0.39

Read more →

HDFC Bank

Open: 52.64 Close: 52.41 Change: -0.23

Read more →

HDFC Bank

Open: 56.75 Close: 56.1 Change: -0.65

Read more →

HDFC Bank

Open: 66.36 Close: 67.0 Change: 0.64

Read more →

HDFC Bank

Open: 62.09 Close: 63.15 Change: 1.06

Read more →

HDFC Bank

Open: 56.93 Close: 57.19 Change: 0.26

Read more →

HDFC Bank

Open: 57.81 Close: 57.4 Change: -0.41

Read more →

HDFC Bank

Open: 58.73 Close: 59.29 Change: 0.56

Read more →

HDFC Bank

Open: 59.42 Close: 59.01 Change: -0.41

Read more →

HDFC Bank

Open: 64.82 Close: 65.19 Change: 0.38

Read more →

HDFC Bank

Open: 62.96 Close: 62.95 Change: -0.01

Read more →

HDFC Bank

Open: 66.08 Close: 66.32 Change: 0.24

Read more →

HDFC Bank

Open: 65.16 Close: 66.45 Change: 1.29

Read more →

HDFC Bank

Open: 65.08 Close: 64.6 Change: -0.48

Read more →

HDFC Bank

Open: 53.44 Close: 53.5 Change: 0.06

Read more →

HDFC Bank

Open: 54.16 Close: 54.0 Change: -0.16

Read more →

HDFC Bank

Open: 52.64 Close: 52.43 Change: -0.21

Read more →

HDFC Bank

Open: 55.86 Close: 55.08 Change: -0.78

Read more →

HDFC Bank

Open: 66.2 Close: 65.5 Change: -0.7

Read more →

HDFC Bank

Open: 63.78 Close: 64.54 Change: 0.76

Read more →

HDFC Bank

Open: 59.5 Close: 60.71 Change: 1.21

Read more →

HDFC Bank

Open: 57.04 Close: 56.33 Change: -0.71

Read more →

HDFC Bank

Open: 59.25 Close: 59.02 Change: -0.23

Read more →

HDFC Bank

Open: 59.1 Close: 57.92 Change: -1.18

Read more →

HDFC Bank

Open: 64.47 Close: 63.4 Change: -1.07

Read more →

HDFC Bank

Open: 63.74 Close: 64.36 Change: 0.62

Read more →

HDFC Bank

Open: 68.6 Close: 68.28 Change: -0.32

Read more →

HDFC Bank

Open: 66.39 Close: 66.2 Change: -0.19

Read more →

HDFC Bank

Open: 64.59 Close: 64.81 Change: 0.22

Read more →- Apple

- Taiwan Semiconductor Manufacturing Company

- The Boeing Company

- Prosperity Bancshares

- Donaldson Company

- AutoNation

- HashiCorp

- Exelixis

- Matador Resources Company

- Halozyme Therapeutics

- MKS Instruments

- Brookfield Renewable

- Envista Holdings

- Automatic Data Processing

- Grupo Aeroportuario del Pacifico

- Murphy USA

- Gentex

- Bumble

- AGNC Investment

- National Fuel Gas Company

- Woori Financial Group

- The Western Union Company

- Tencent Music Entertainment Group

- The Estee Lauder Companies

- WESCO International

- Maravai LifeSciences Holdings

- Guidewire Software

- Unum Group

- PDC Energy

- Magnolia Oil & Gas

- SiteOne Landscape Supply

- Frontier Communications Parent

- Woodward

- Rio Tinto

- First Financial Bankshares

- SunRun

- Endeavor Group Holdings

- Kilroy Realty

- Stifel Financial

- South State

- Reynolds Consumer Products

- Starbucks

- Lumentum Holdings

- Sonoco Products Company

- FS KKR Capital

- Wyndham Hotels & Resorts

- United States Steel

- Vornado Realty Trust

- Dutch Bros

- Informatica

- Prologis

- AngloGold Ashanti

- Option Care Health

- CEMEX

- CCC Intelligent Solutions Holdings

- Huntsman

- Pinnacle Financial Partners

- Ingredion

- First American Financial

- Brunswick

- Voya Financial

- Flowers Foods

- Boyd Gaming

- Futu Holdings

- Stag Industrial

- Globus Medical

- BOK Financial

- ZIM Integrated Shipping Services

- British American Tobacco

- Valley National Bancorp

- Skechers USA

- nVent Electric

- Teladoc Health

- Popular

- BRP Inc.

- Acuity Brands

- MasTec

- Apellis Pharmaceuticals

- The Descartes Systems Group

- Applied Materials

- Agree Realty

- FirstService

- GXO Logistics

- MP Materials

- UWM Holdings

- Spirit Realty Capital

- Texas Roadhouse

- Southwest Gas Holdings

- Vipshop Holdings

- BP plc