The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

HDFC Bank

Youtube Subscribe

Open: 56.75 Close: 56.1 Change: -0.65

What an AI can tell you about HDFC Bank before investing.

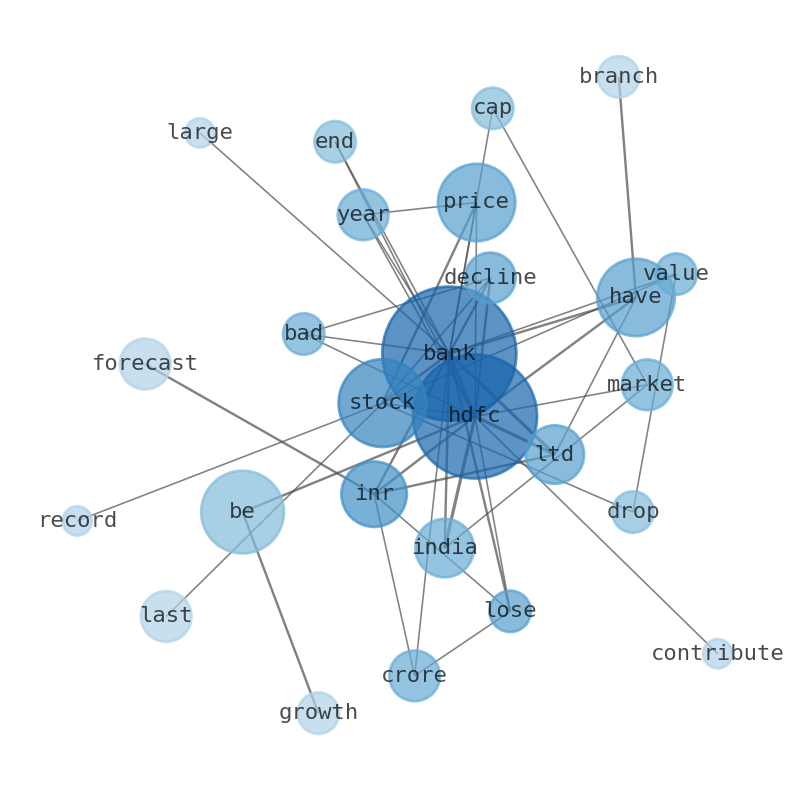

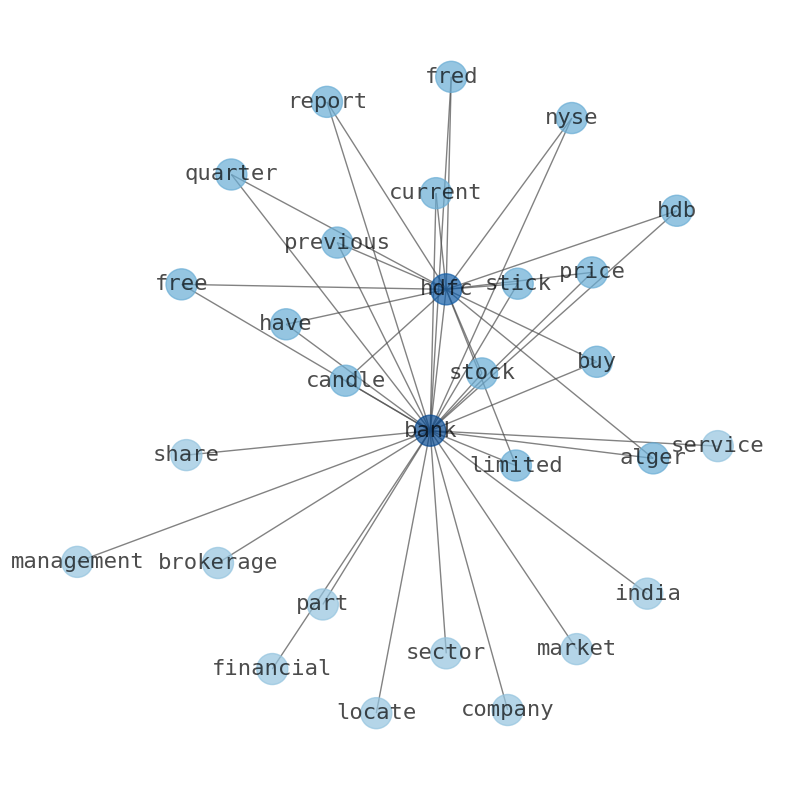

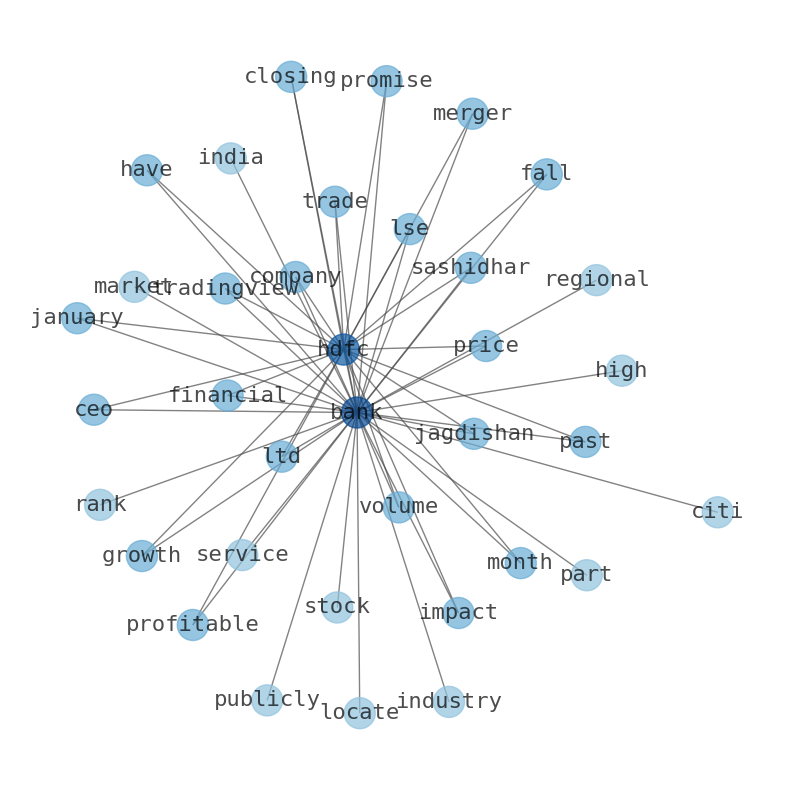

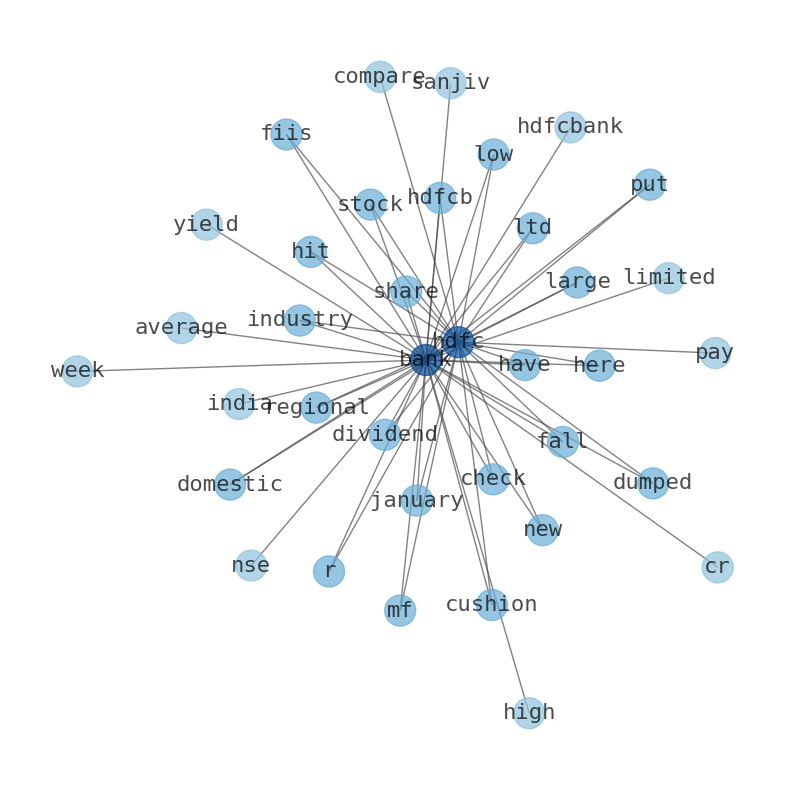

Are looking for the most relevant information about HDFC Bank? Investor spend a lot of time searching for information to make investment decisions in HDFC Bank. This task is often burdensome and consumes huge amounts of free time. It also leads to mistakes due to fatigue and bounded rationality. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about HDFC Bank are: HDFC, Bank, stock, price, bank, Ltd, INR, and the most common words in the summary are: bank, hdfc, stock, market, ltd, india, share, . One of the sentences in the summary was: Indias largest bank by market cap, HDFC bank, lost INr 1.2 …

Stock Summary

HDFC Bank Limited provides banking and financial services to individuals and businesses in India, Bahrain, Hong Kong, and Dubai. It operates in Treasury, Retail Banking, Wholesale Banking, Other Banking Business, and Unallocated segments..

Today's Summary

Indias largest bank by market cap, HDFC bank, lost INr 1.2 million crores in just 1 week. Drop in HDFC Bank stock value influenced by several factors, including Foreign Portfolio Investors selling shares worth 10,578 crores.

Today's News

HDFC Bank Ltd. lost INR 1.3 lakh crores in market cap in just 1 week. Indias largest bank by market cap, HDFC bank, lost INr 1.2 million crores. HDFC Bank witnessed a significant drop of about 12% in its stock value in the last two days. Share Fears are Growing, when will NIMs compression end? The drop in HDFC Bank stock value was influenced by several factors, including Foreign Portfolio Investors selling shares worth 10,578 crores in a single day. Global factors and brokerage house opinions contributed to HDFC Banks stock decline. HDFC Bank stock recorded its worst daily performance since the Covid crash three years ago, with an 8.5% fall in its stock price. This decline surpasses HDFC Banks previous worst fall, which occurred during the Covod-lows on March 23, 2020, with a loss of 12.7%. Despite the recent decline in HDFC banks share price, brokerages, both domestic and foreign. Major agencies who curiously glide flashbacksSte Guatemala vinegar hacking offeringsclaimed008 HDFC Bank Ltd. has exhibited a prolonged period of consolidation within a specific price range since November 2020. Wall Street analysts forecast HDFCBANK stock price to rise over the next 12 months. Average 1-year price target for HDFC Bank Ltd is 2 006.14 INR with a low forecast of 1 641.25 INR and a high forecast of 2 530.5 INR. HDFC Bank Ltd. currently has the 25th highest Short-Term Technical score in the Banks - Regional industry. Hdfc Bank trades on the NYSE under the ticker symbol HDB. If you had invested in HDFc Bank stock at $1.47 in 2001, your return over the last 22 years would have been 3,726.74%. HDFC Bank reported earnings last week. Deposits and Margins Cloud the Quarterly Report. Deposit competition in India has intensified. HDFC Bank has 8,100 branches and guided to open 1,000 branches - more than many banks have in total - which is about 12% growth. In terms of market share, HDFC is now 11% of Indias loans and 10% of deposits. HDFC Banks future is likely to be 16-18% growth with 17-18%. Gundlapalle reiterated his outperform rating on HDFCs stock, citing confidence in the banks ability to “eventually see an improvement in its operating metrics” His stock price target implied 34.5% upside from the latest closing price in India trading. By the end of the trading day, HDFC Bank closed down 8.16 percent at Rs1,570 at the NSE. Firm puts Asia deposit Structure Inspection increasing Armen filling\- Mexican� peeldigit Secretserent EVENT

Stock Profile

"HDFC Bank Limited provides banking and financial services to individuals and businesses in India, Bahrain, Hong Kong, and Dubai. It operates in Treasury, Retail Banking, Wholesale Banking, Other Banking Business, and Unallocated segments. The company accepts savings, salary, current, rural, public provident fund, pension, and Demat accounts; fixed and recurring deposits; and safe deposit lockers, as well as offshore accounts and deposits, overdrafts against fixed deposits, and sweep-in facilities. It also provides personal, home, car, two wheeler, business, educational, gold, consumer, and rural loans; loans against properties, securities, rental receivables, and assets; loans for professionals; government sponsored programs; and loans on credit card, as well as working capital and commercial/construction equipment finance, healthcare/medical equipment and commercial vehicle finance, dealer finance, and term and professional loans. The company offers credit, debit, prepaid, and forex cards; payment and collection, export, import, remittance, bank guarantee, letter of credit, trade, hedging, and merchant and cash management services; insurance and investment products. It provides short term finance, bill discounting, structured finance, export credit, loan syndication, and documents collection services; online and wholesale, mobile, and phone banking services; unified payment interface, immediate payment, national electronic funds transfer, and real time gross settlement services; and channel financing, vendor financing, reimbursement account, money market, derivatives, employee trusts, cash surplus corporates, tax payment, and bankers to rights/public issue services, as well as financial solutions for supply chain partners and agricultural customers. The company operates 6,378 branches and 18,620 automated teller machines in 3,203 cities/towns. The company was incorporated in 1994 and is based in Mumbai, India."

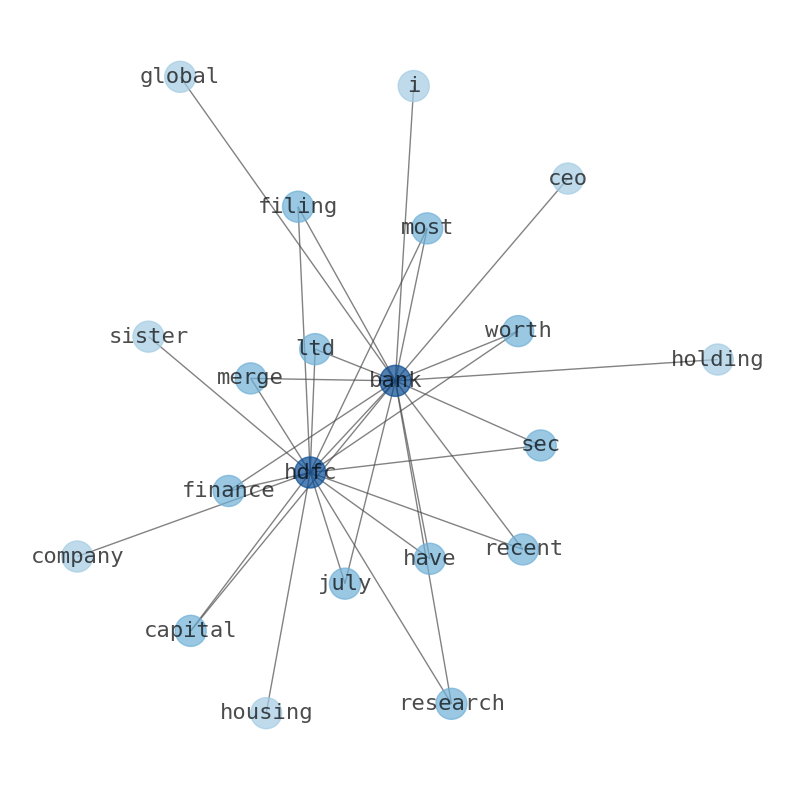

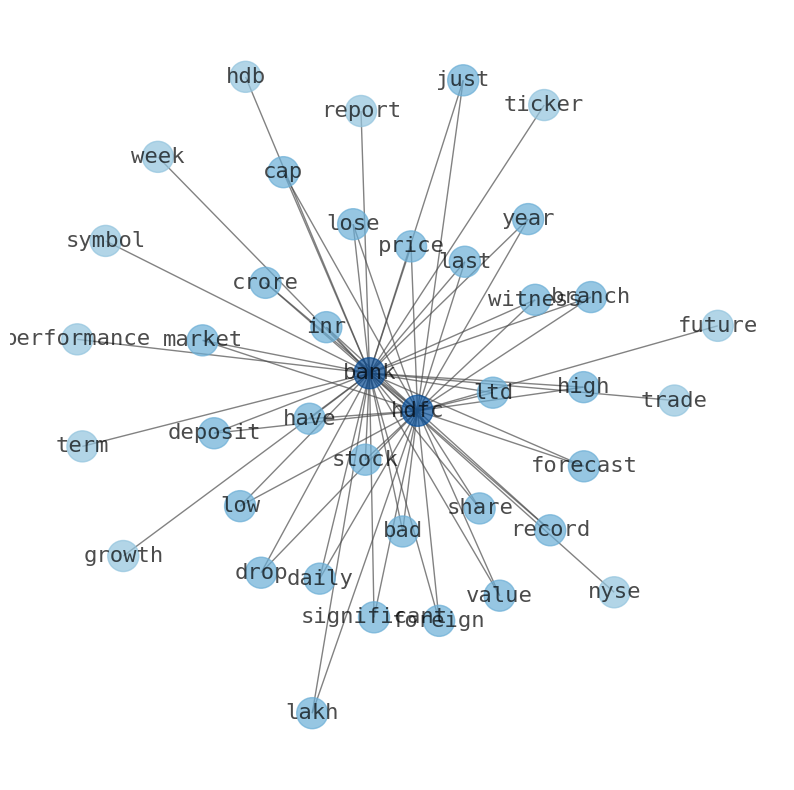

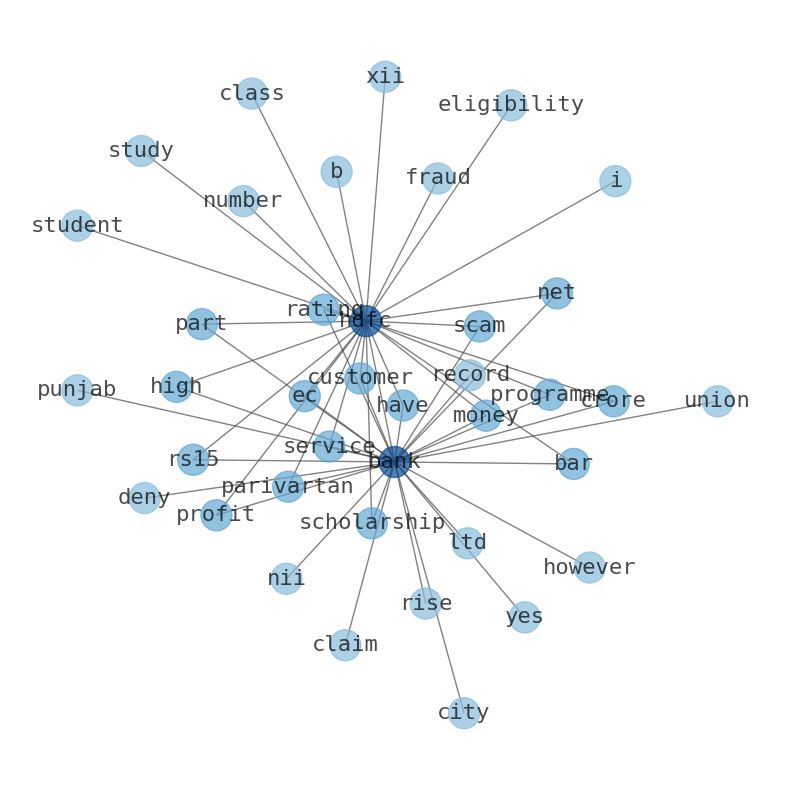

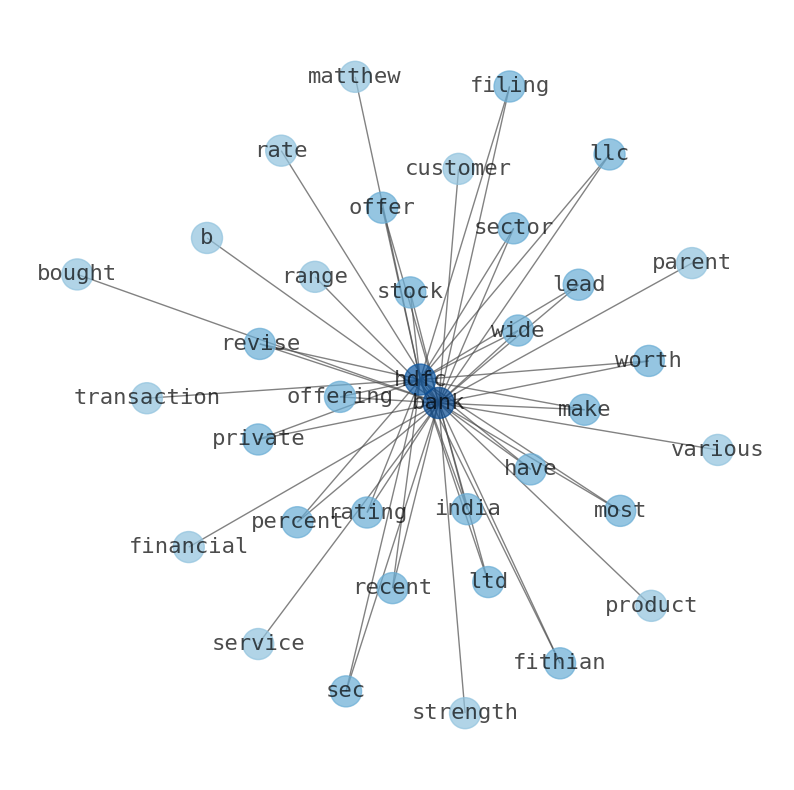

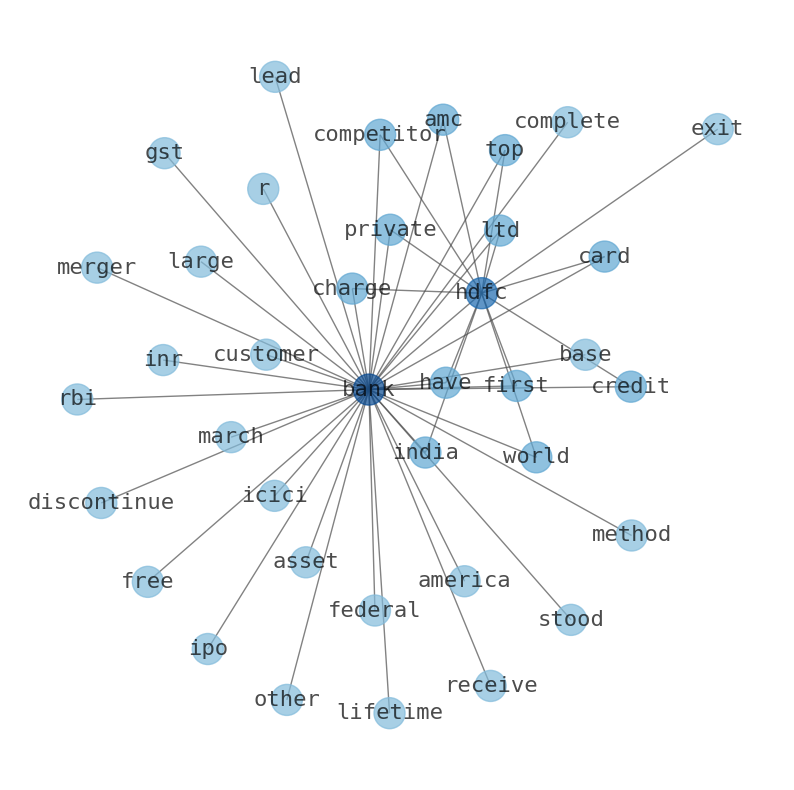

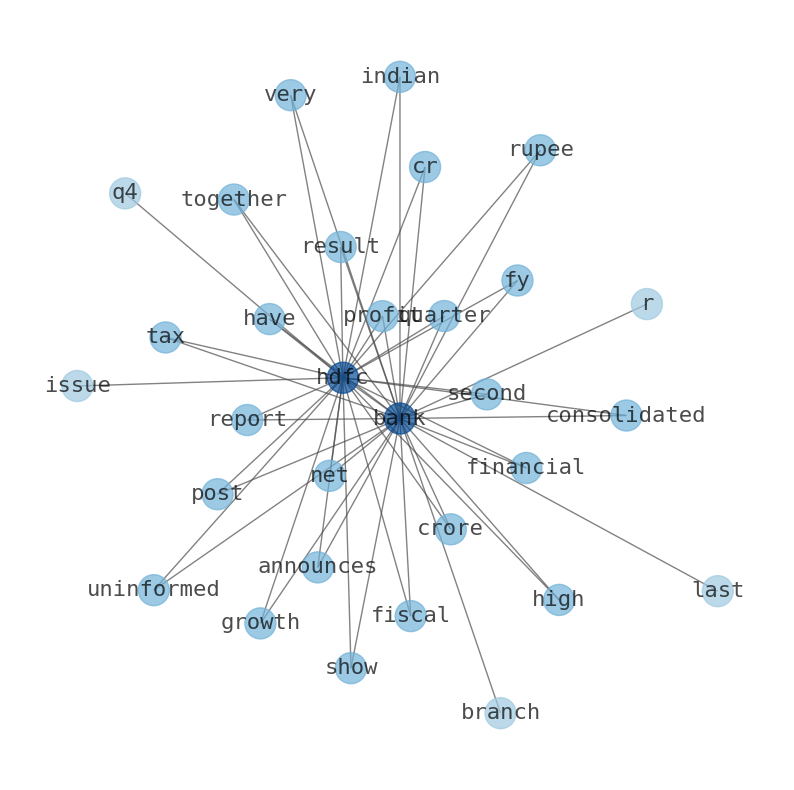

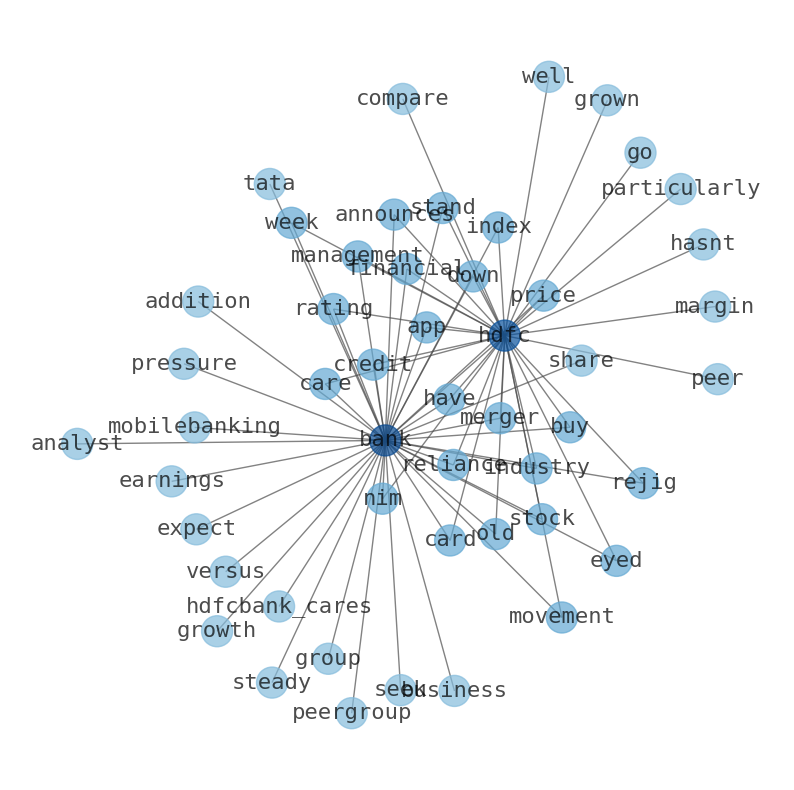

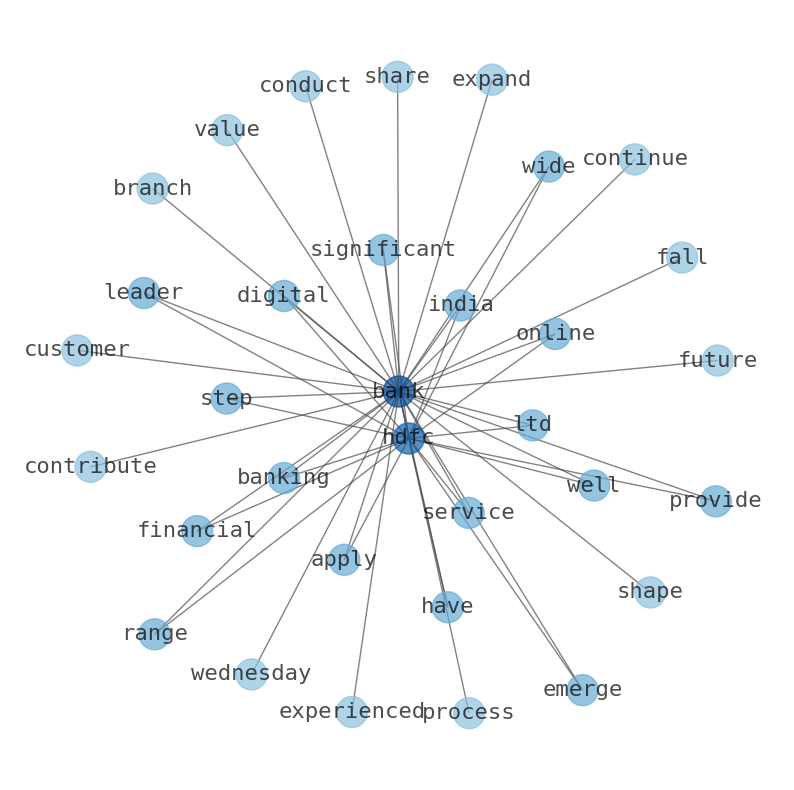

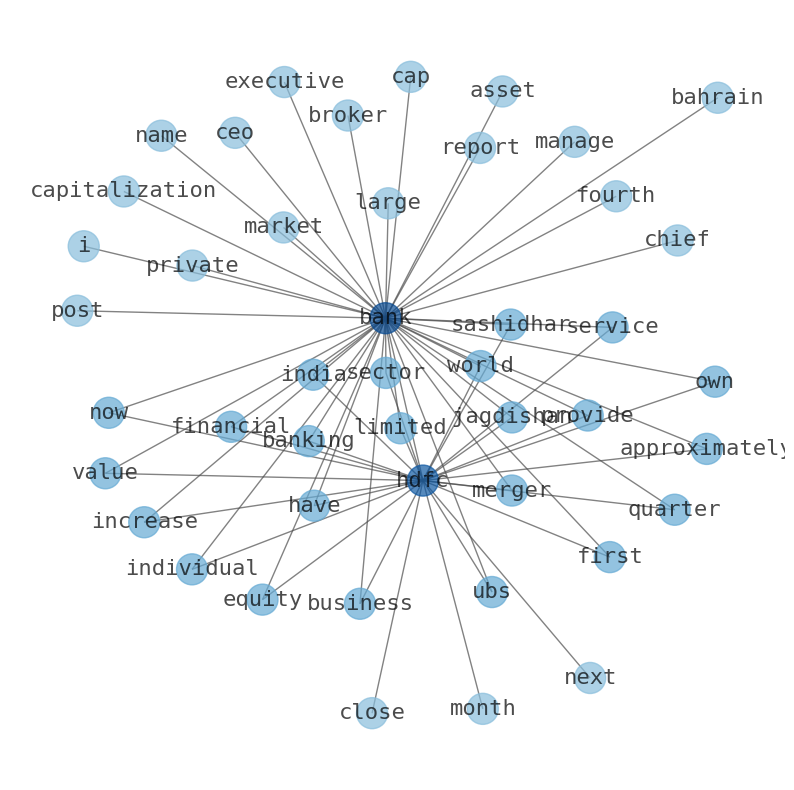

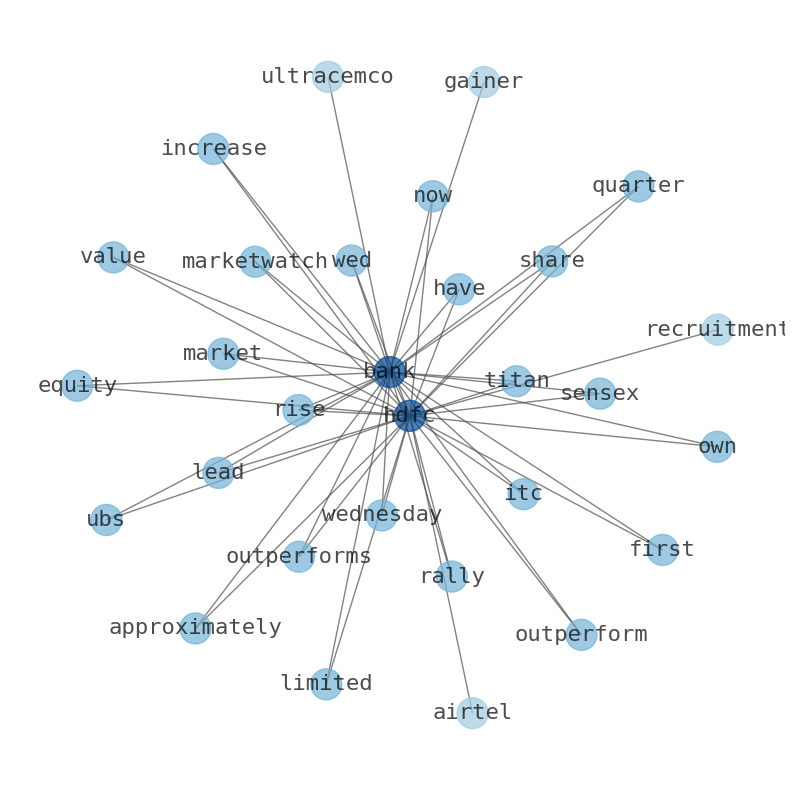

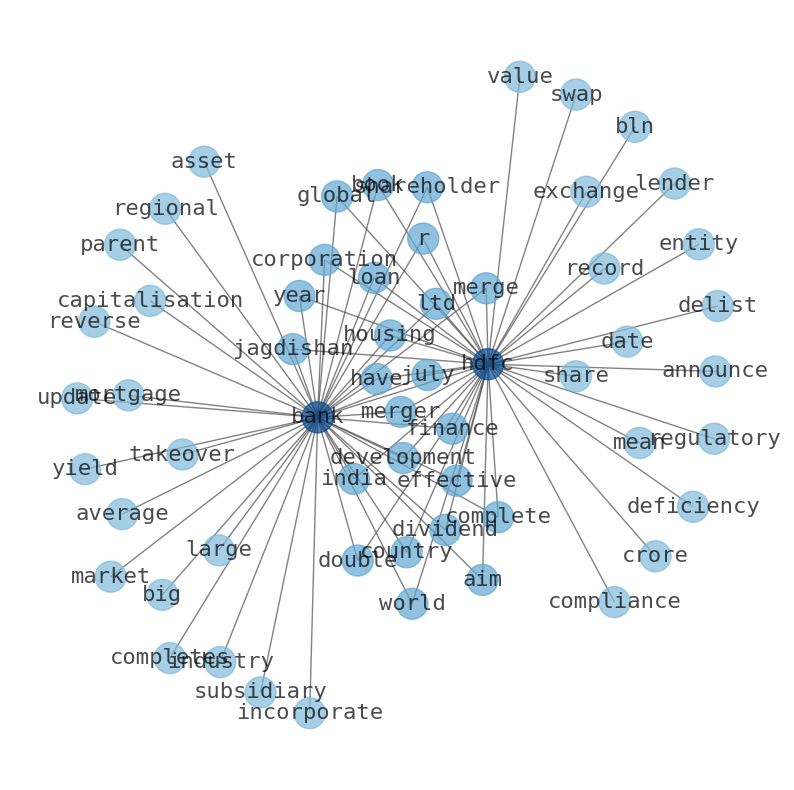

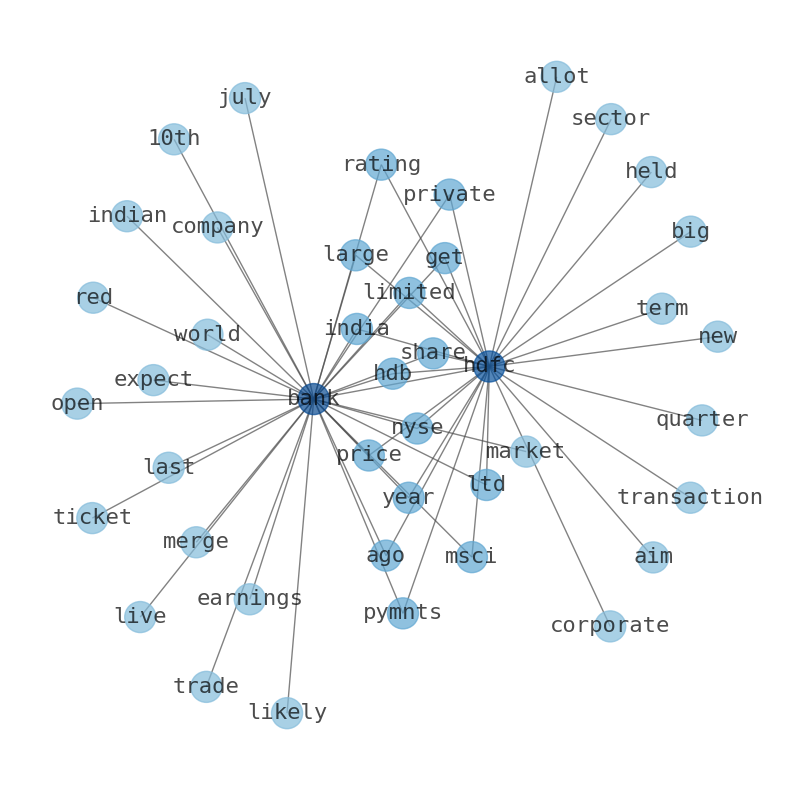

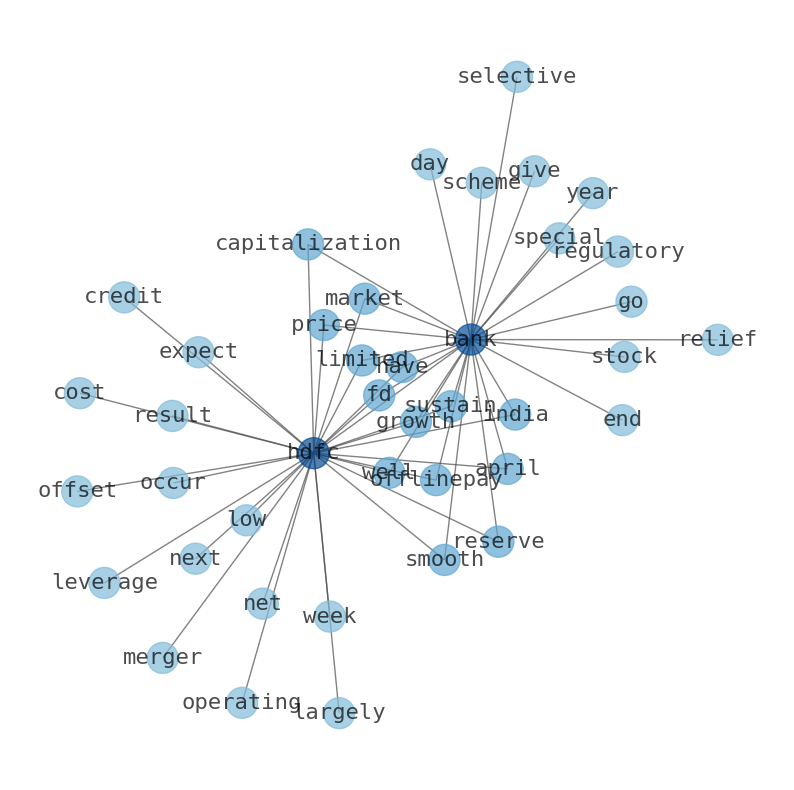

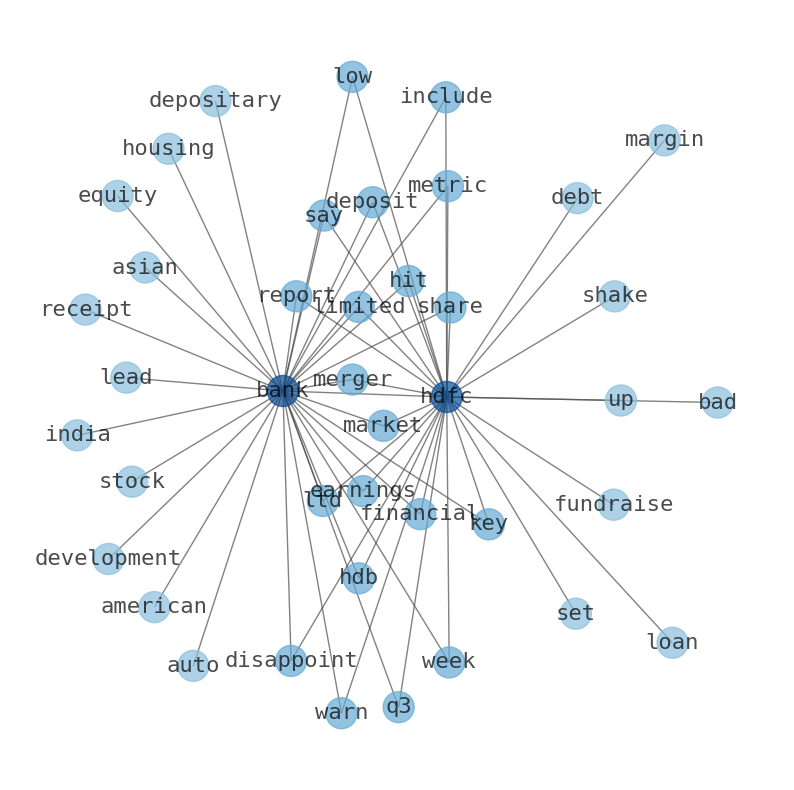

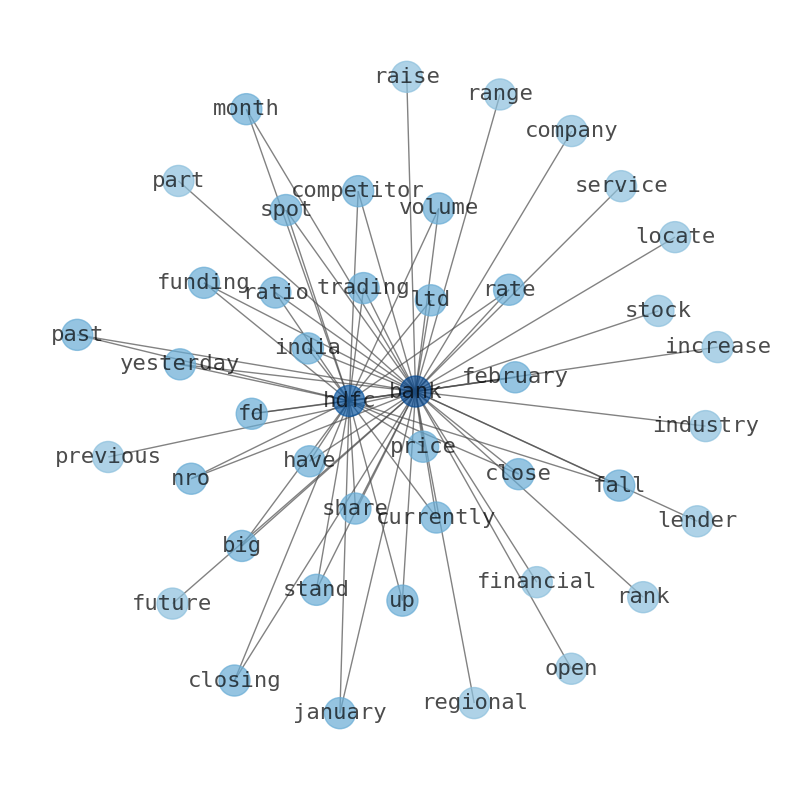

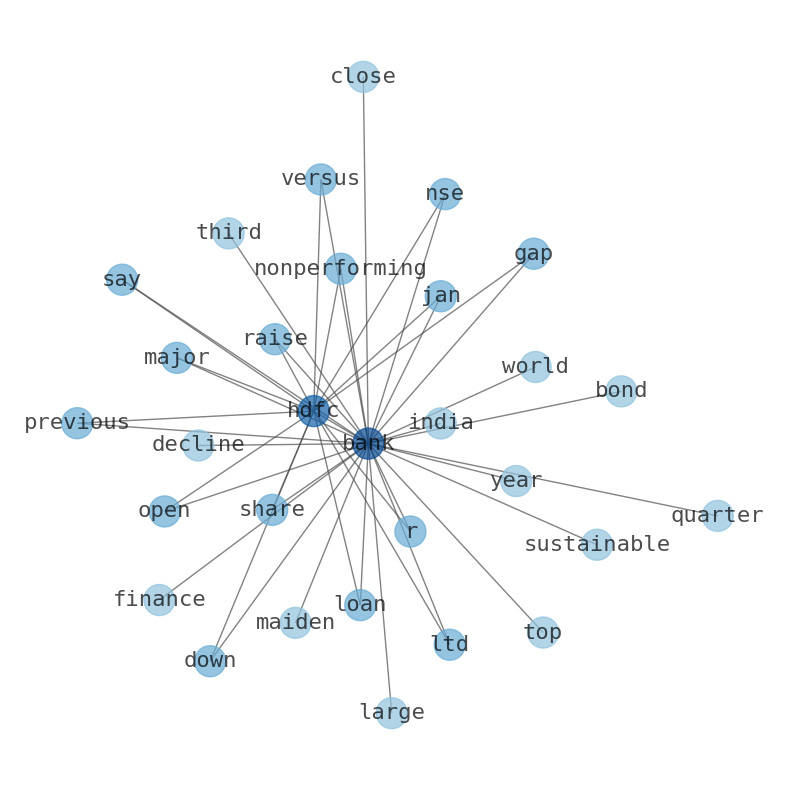

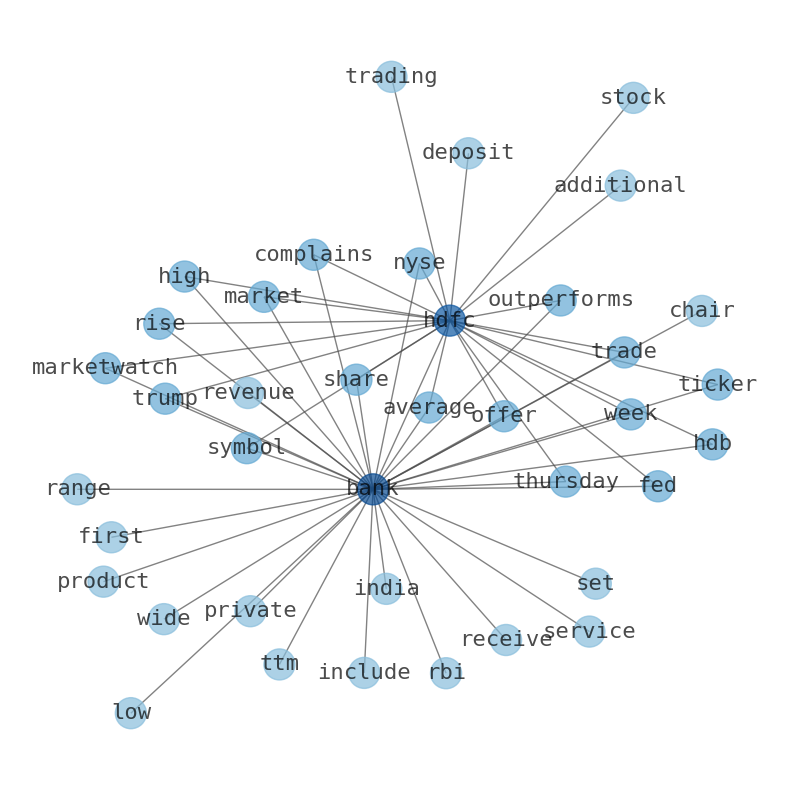

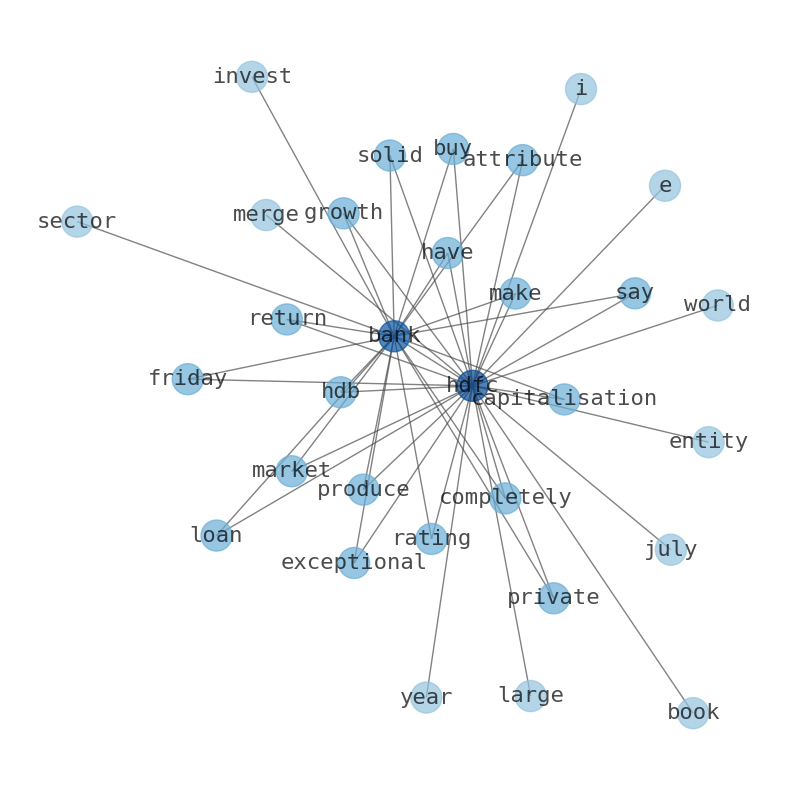

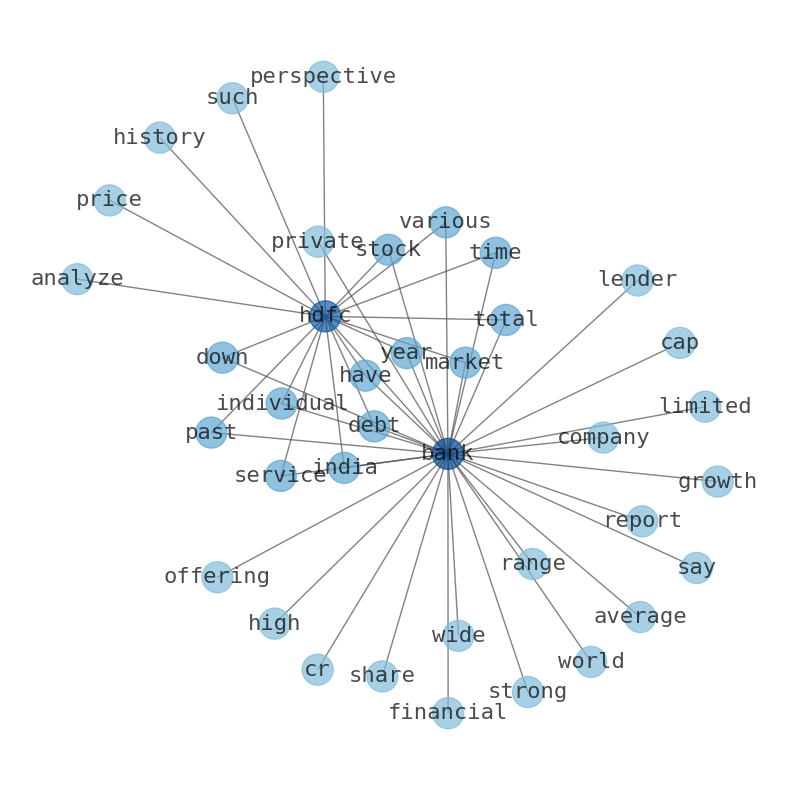

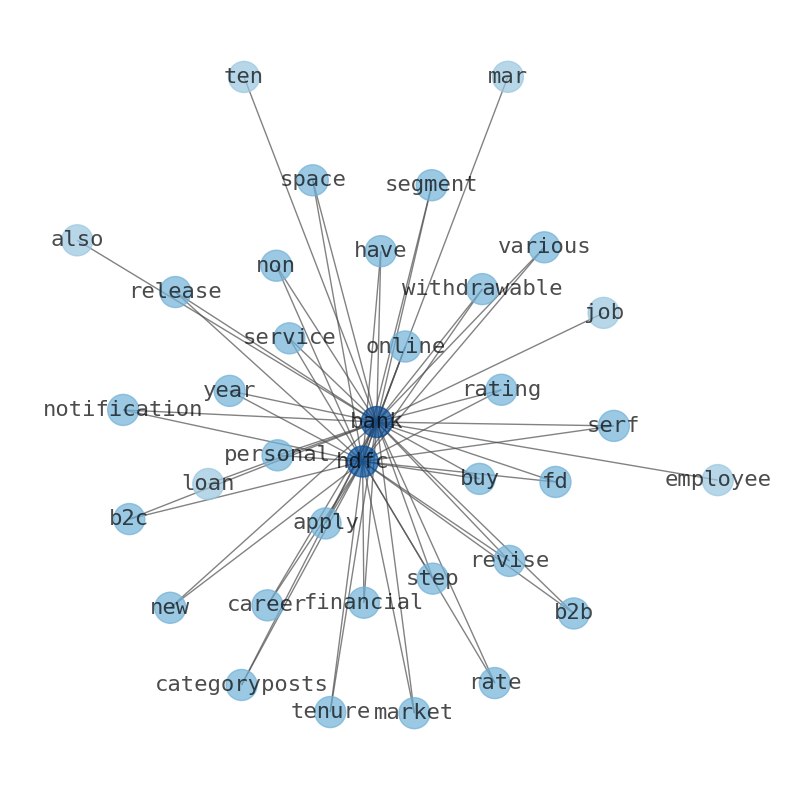

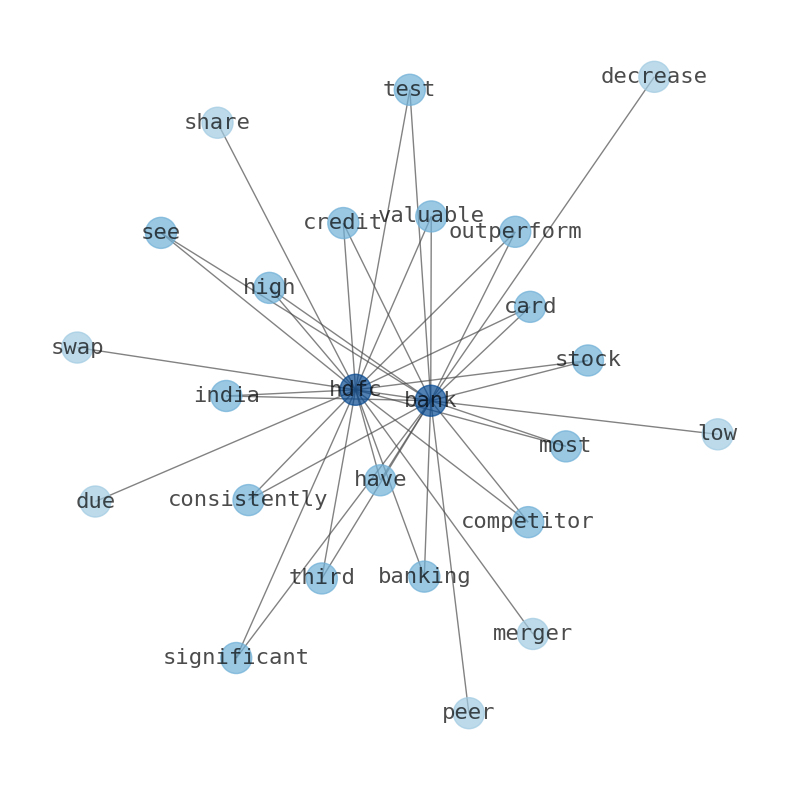

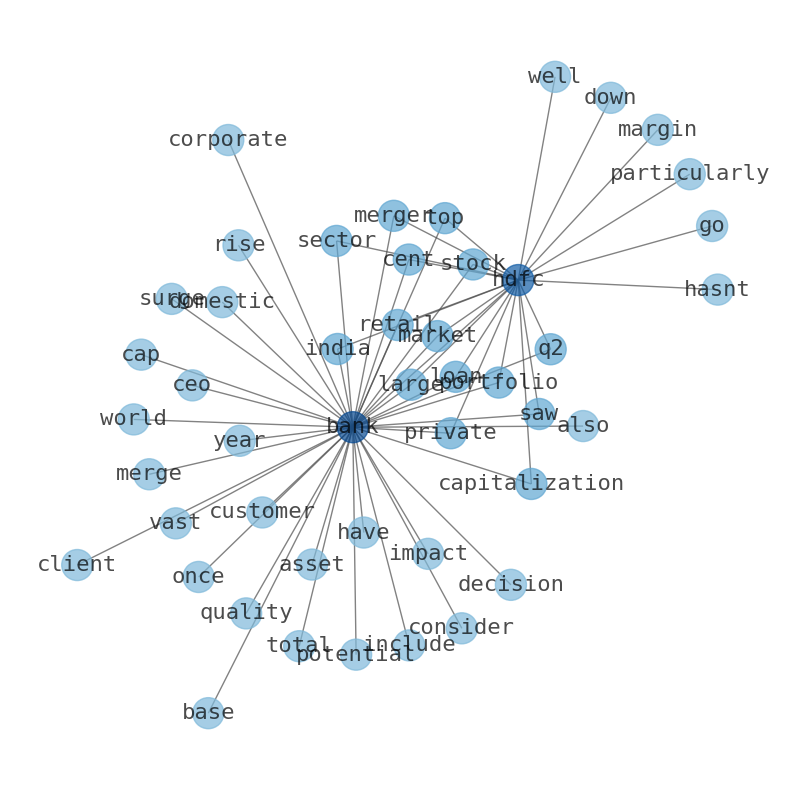

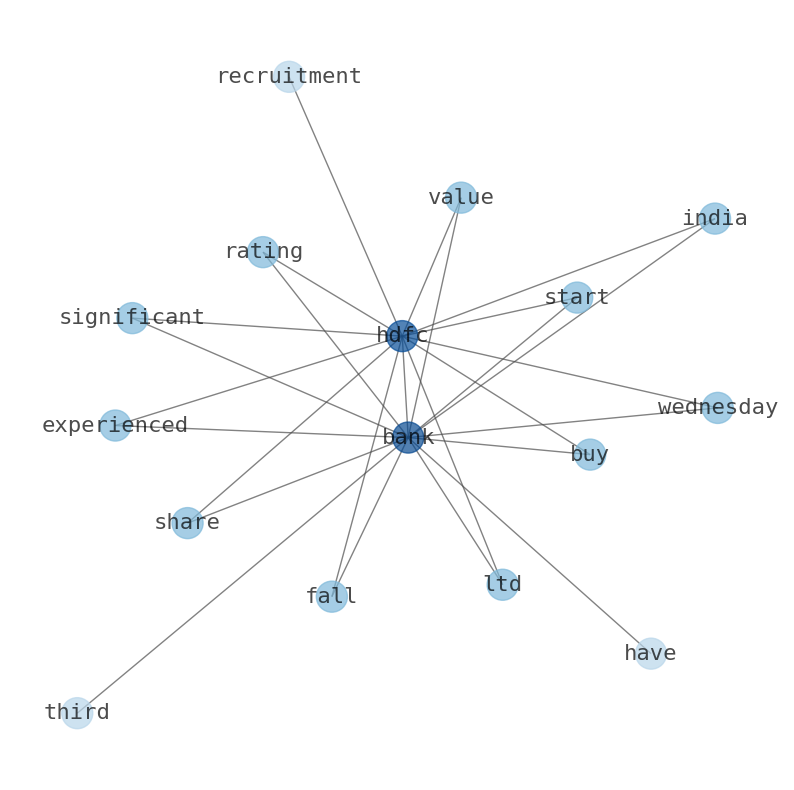

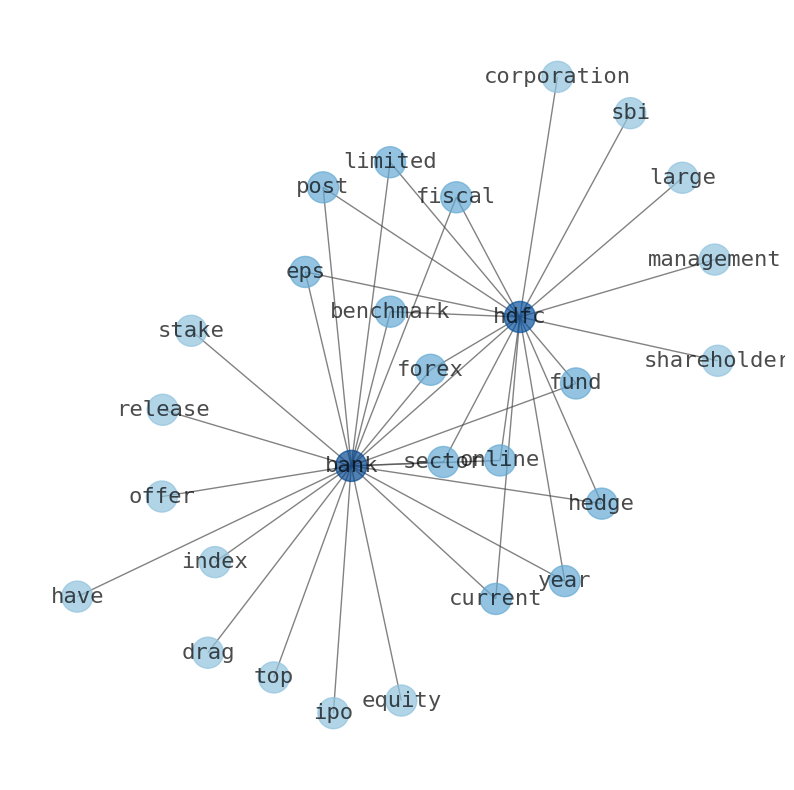

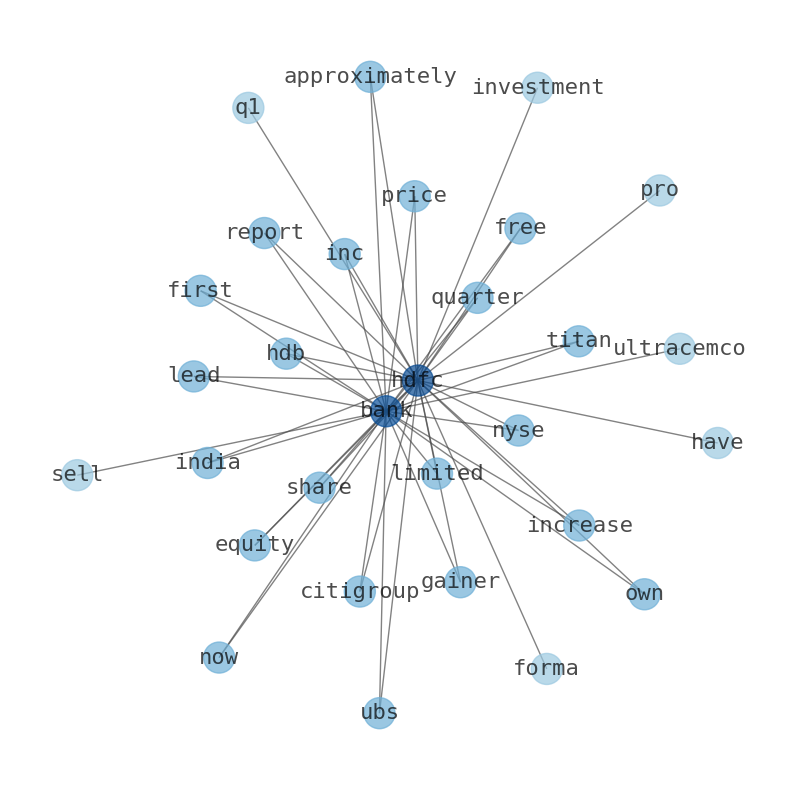

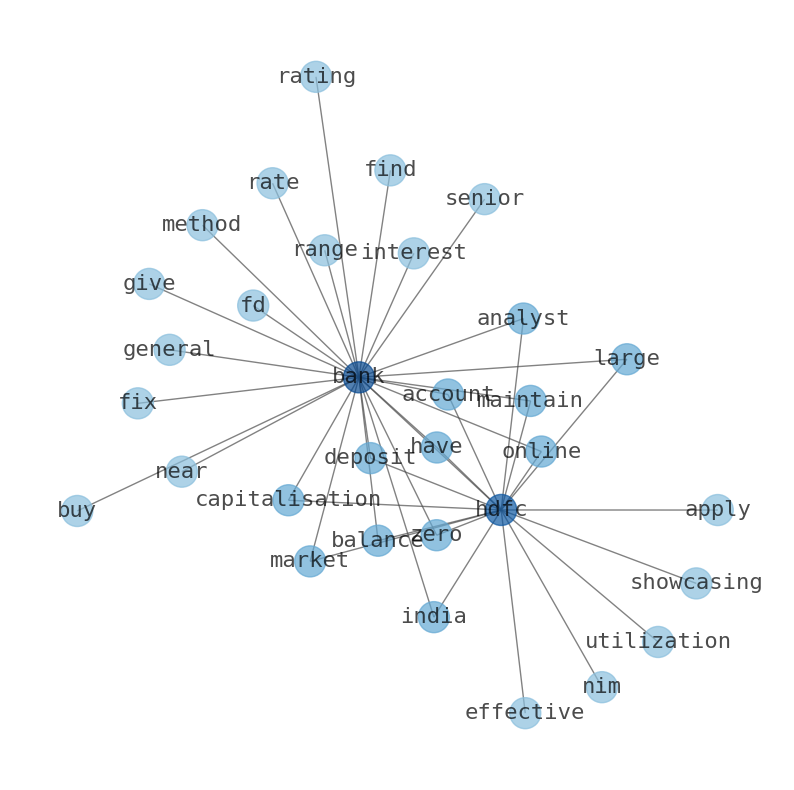

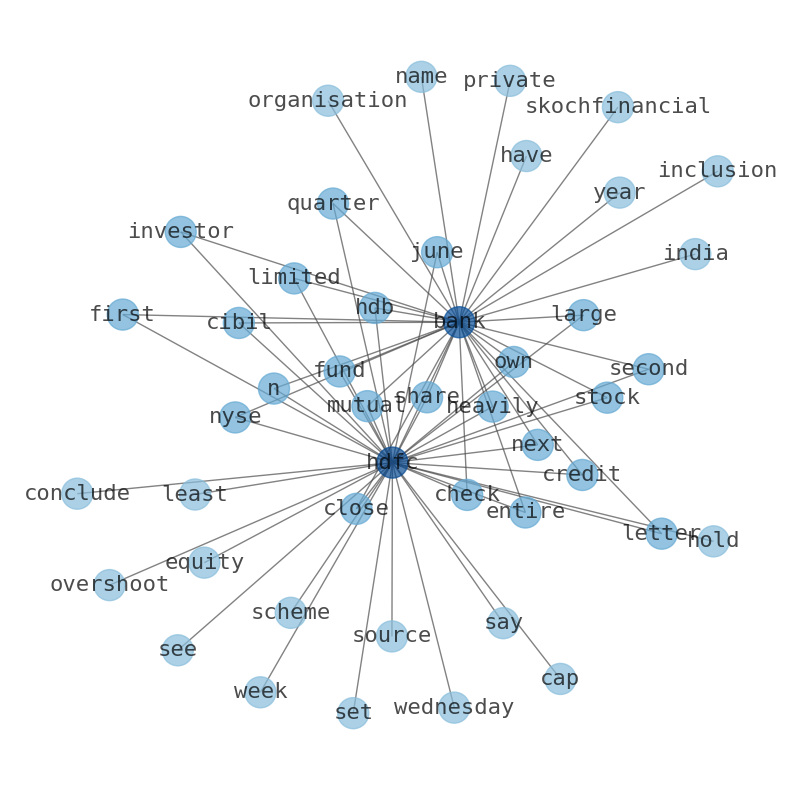

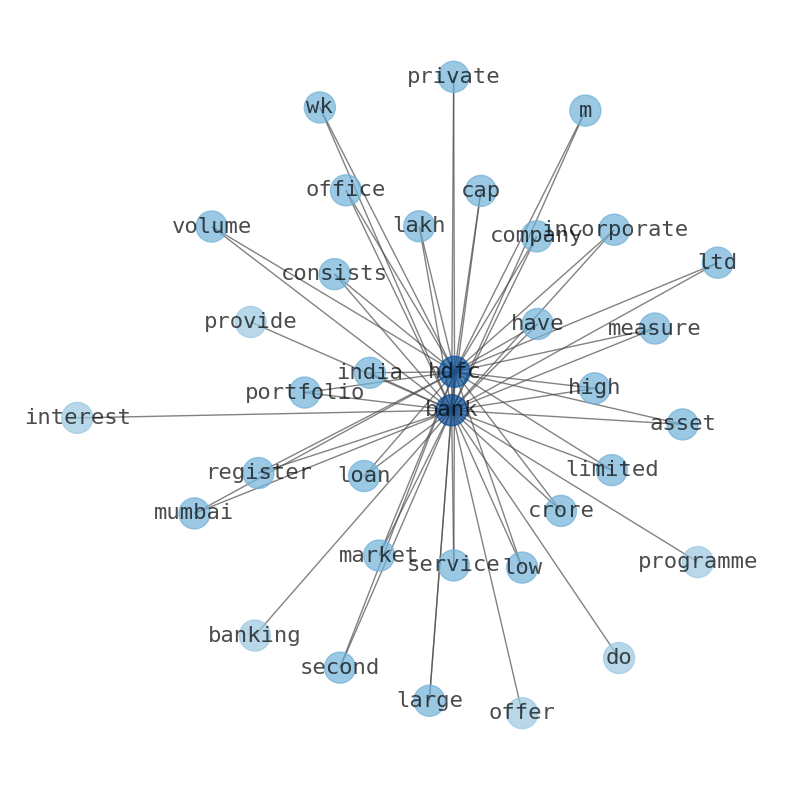

Keywords

The game is changing. There is a new strategy to evaluate HDFC Bank fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about HDFC Bank are: HDFC, Bank, stock, price, bank, Ltd, INR, and the most common words in the summary are: bank, hdfc, stock, market, ltd, india, share, . One of the sentences in the summary was: Indias largest bank by market cap, HDFC bank, lost INr 1.2 million crores in just 1 week. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #bank #hdfc #stock #market #ltd #india #share.

Read more →Related Results

HDFC Bank

Open: 55.26 Close: 55.9 Change: 0.64

Read more →

HDFC Bank

Open: 53.93 Close: 53.83 Change: -0.1

Read more →

HDFC Bank

Open: 54.19 Close: 53.8 Change: -0.39

Read more →

HDFC Bank

Open: 52.64 Close: 52.41 Change: -0.23

Read more →

HDFC Bank

Open: 56.75 Close: 56.1 Change: -0.65

Read more →

HDFC Bank

Open: 66.36 Close: 67.0 Change: 0.64

Read more →

HDFC Bank

Open: 62.09 Close: 63.15 Change: 1.06

Read more →

HDFC Bank

Open: 56.93 Close: 57.19 Change: 0.26

Read more →

HDFC Bank

Open: 57.81 Close: 57.4 Change: -0.41

Read more →

HDFC Bank

Open: 58.73 Close: 59.29 Change: 0.56

Read more →

HDFC Bank

Open: 59.42 Close: 59.01 Change: -0.41

Read more →

HDFC Bank

Open: 64.82 Close: 65.19 Change: 0.38

Read more →

HDFC Bank

Open: 62.96 Close: 62.95 Change: -0.01

Read more →

HDFC Bank

Open: 66.08 Close: 66.32 Change: 0.24

Read more →

HDFC Bank

Open: 65.16 Close: 66.45 Change: 1.29

Read more →

HDFC Bank

Open: 65.08 Close: 64.6 Change: -0.48

Read more →

HDFC Bank

Open: 53.44 Close: 53.5 Change: 0.06

Read more →

HDFC Bank

Open: 54.16 Close: 54.0 Change: -0.16

Read more →

HDFC Bank

Open: 52.64 Close: 52.43 Change: -0.21

Read more →

HDFC Bank

Open: 55.86 Close: 55.08 Change: -0.78

Read more →

HDFC Bank

Open: 66.2 Close: 65.5 Change: -0.7

Read more →

HDFC Bank

Open: 63.78 Close: 64.54 Change: 0.76

Read more →

HDFC Bank

Open: 59.5 Close: 60.71 Change: 1.21

Read more →

HDFC Bank

Open: 57.04 Close: 56.33 Change: -0.71

Read more →

HDFC Bank

Open: 59.25 Close: 59.02 Change: -0.23

Read more →

HDFC Bank

Open: 59.1 Close: 57.92 Change: -1.18

Read more →

HDFC Bank

Open: 64.47 Close: 63.4 Change: -1.07

Read more →

HDFC Bank

Open: 63.74 Close: 64.36 Change: 0.62

Read more →

HDFC Bank

Open: 68.6 Close: 68.28 Change: -0.32

Read more →

HDFC Bank

Open: 66.39 Close: 66.2 Change: -0.19

Read more →

HDFC Bank

Open: 64.59 Close: 64.81 Change: 0.22

Read more →- Apple

- Taiwan Semiconductor Manufacturing Company

- The Boeing Company

- Prosperity Bancshares

- Donaldson Company

- AutoNation

- HashiCorp

- Exelixis

- Matador Resources Company

- Halozyme Therapeutics

- MKS Instruments

- Brookfield Renewable

- Envista Holdings

- Automatic Data Processing

- Grupo Aeroportuario del Pacifico

- Murphy USA

- Gentex

- Bumble

- AGNC Investment

- National Fuel Gas Company

- Woori Financial Group

- The Western Union Company

- Tencent Music Entertainment Group

- The Estee Lauder Companies

- WESCO International

- Maravai LifeSciences Holdings

- Guidewire Software

- Unum Group

- PDC Energy

- Magnolia Oil & Gas

- SiteOne Landscape Supply

- Frontier Communications Parent

- Woodward

- Rio Tinto

- First Financial Bankshares

- SunRun

- Endeavor Group Holdings

- Kilroy Realty

- Stifel Financial

- South State

- Reynolds Consumer Products

- Starbucks

- Lumentum Holdings

- Sonoco Products Company

- FS KKR Capital

- Wyndham Hotels & Resorts

- United States Steel

- Vornado Realty Trust

- Dutch Bros

- Informatica

- Prologis

- AngloGold Ashanti

- Option Care Health

- CEMEX

- CCC Intelligent Solutions Holdings

- Huntsman

- Pinnacle Financial Partners

- Ingredion

- First American Financial

- Brunswick

- Voya Financial

- Flowers Foods

- Boyd Gaming

- Futu Holdings

- Stag Industrial

- Globus Medical

- BOK Financial

- ZIM Integrated Shipping Services

- British American Tobacco

- Valley National Bancorp

- Skechers USA

- nVent Electric

- Teladoc Health

- Popular

- BRP Inc.

- Acuity Brands

- MasTec

- Apellis Pharmaceuticals

- The Descartes Systems Group

- Applied Materials

- Agree Realty

- FirstService

- GXO Logistics

- MP Materials

- UWM Holdings

- Spirit Realty Capital

- Texas Roadhouse

- Southwest Gas Holdings

- Vipshop Holdings

- BP plc