The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

HDFC Bank

Youtube Subscribe

Open: 63.78 Close: 64.54 Change: 0.76

You'll be sorry if you don't use an AI to decide whether to invest in HDFC Bank Stock.

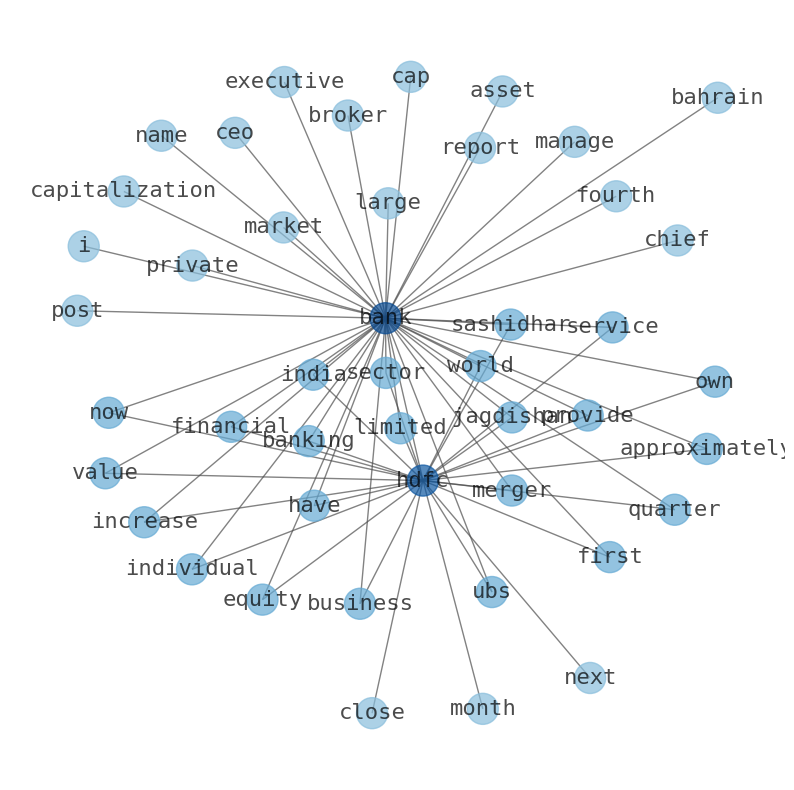

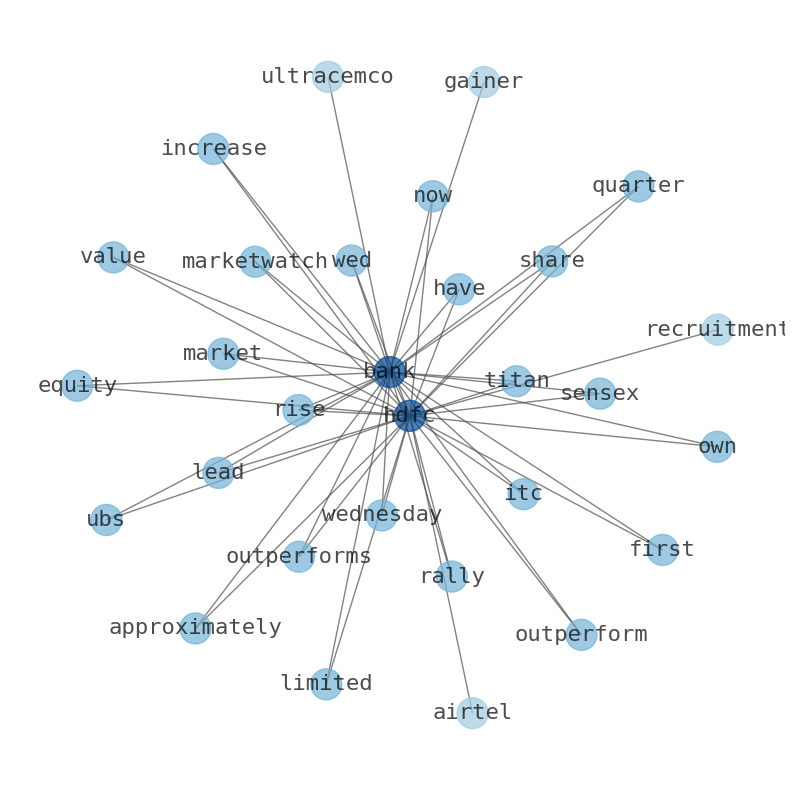

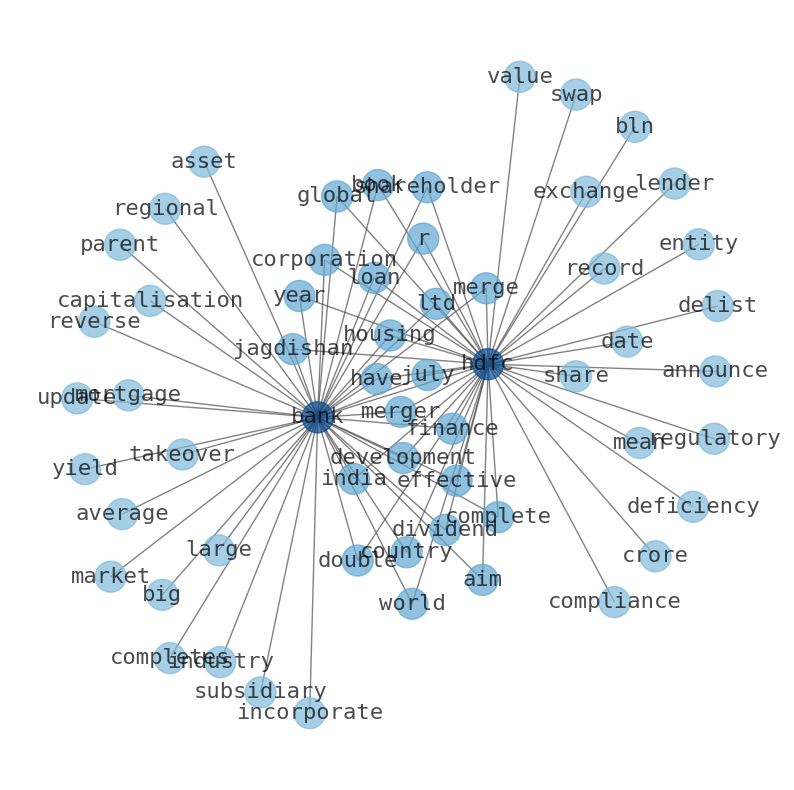

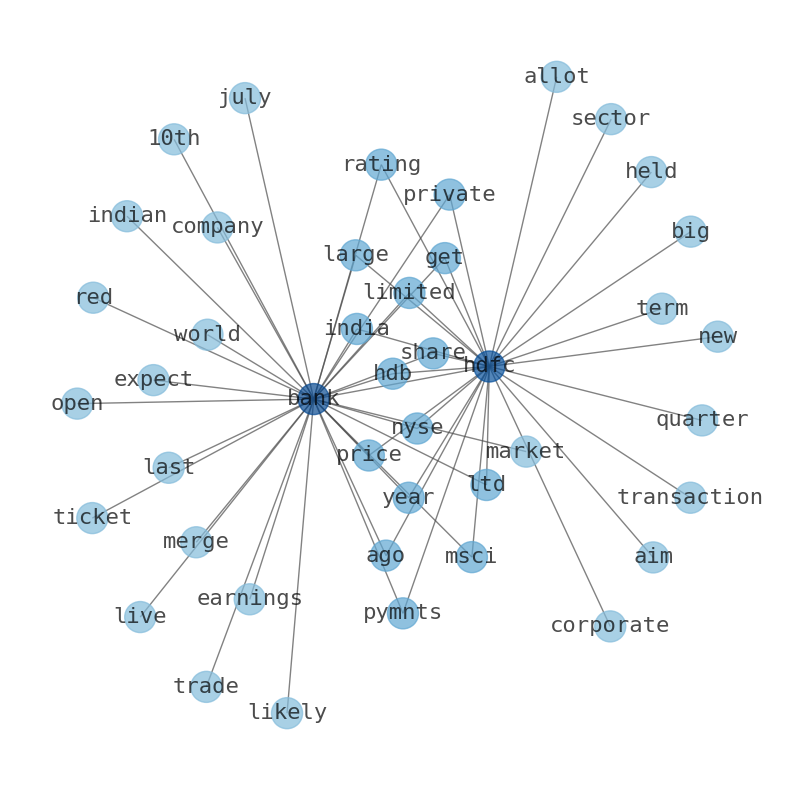

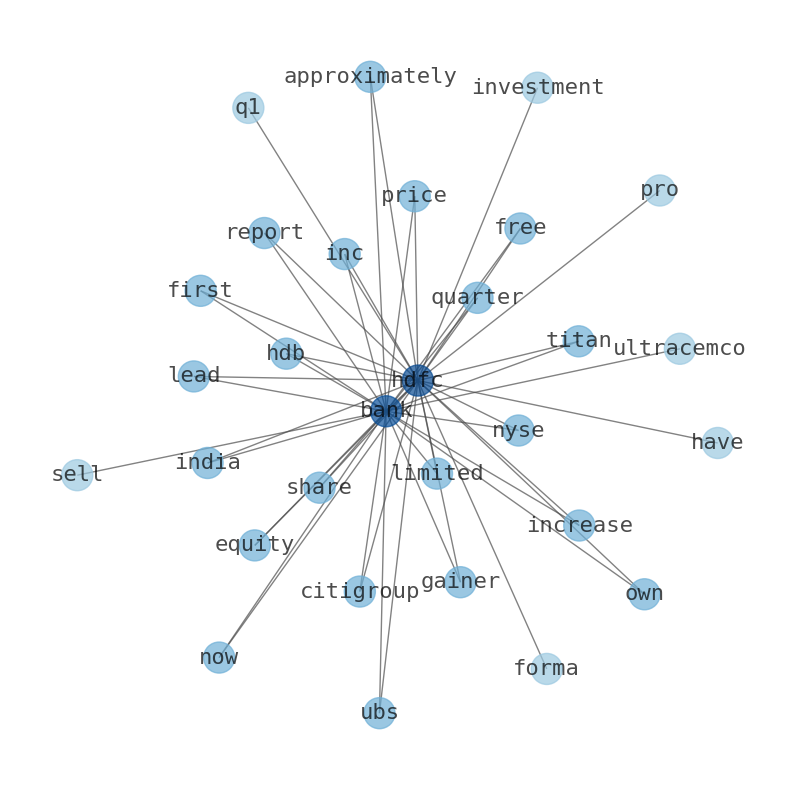

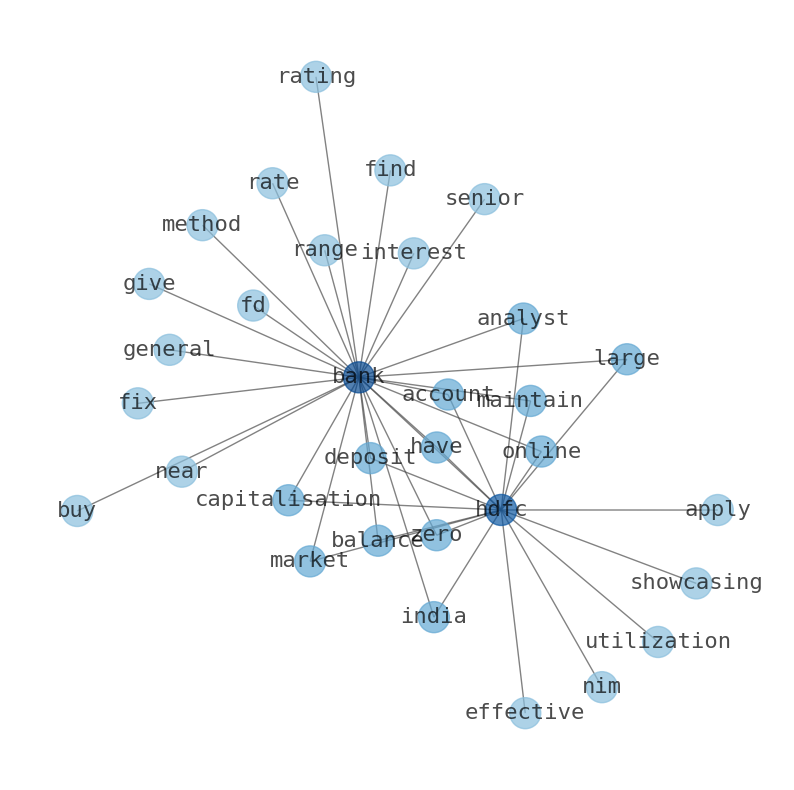

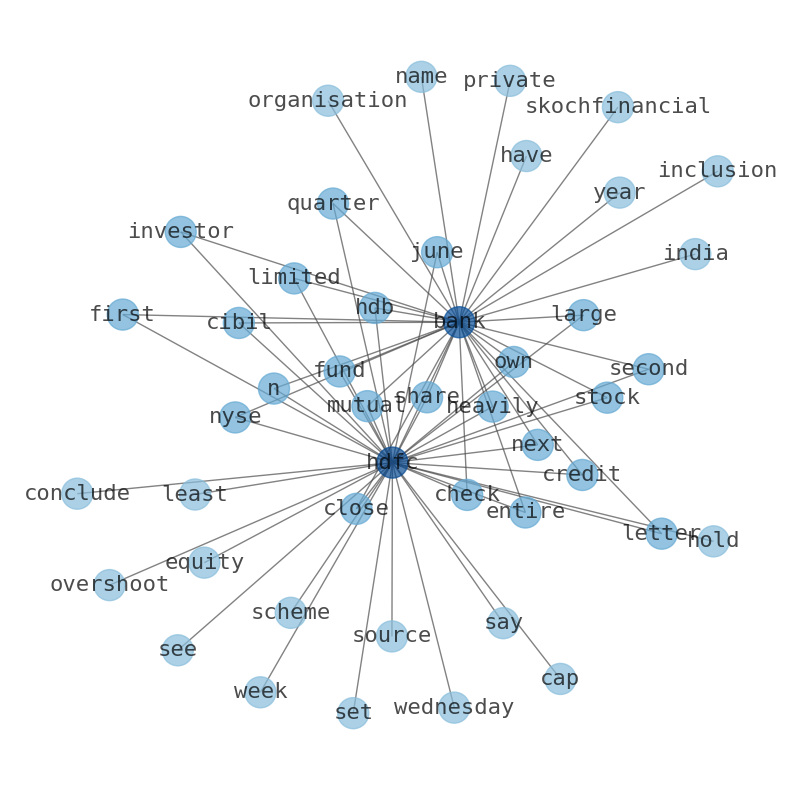

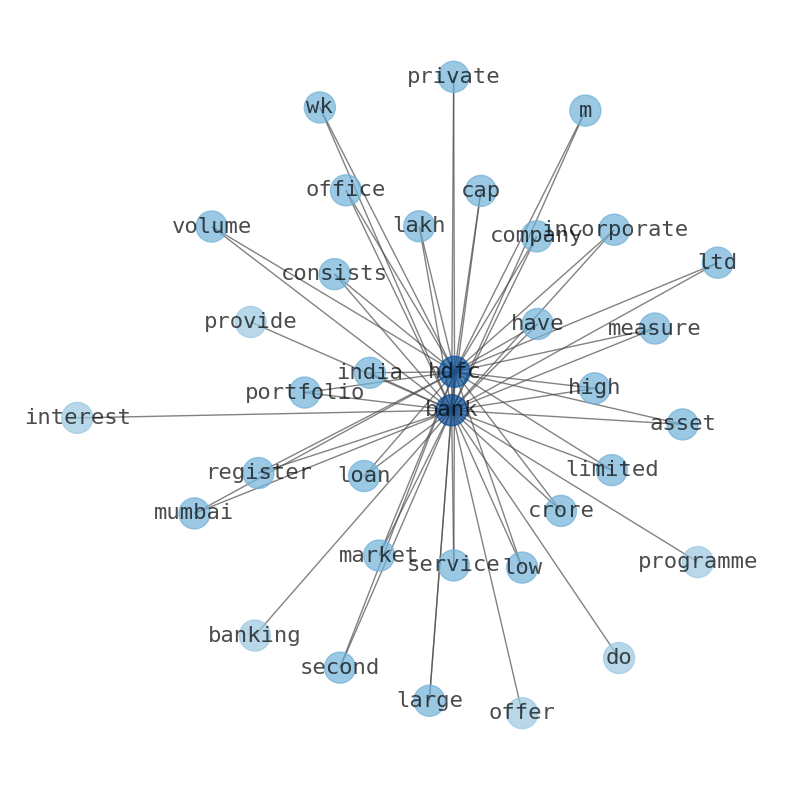

How much time have you spent trying to decide whether investing in HDFC Bank? Many investors start with the dream of being free. They expect to find on the stock market an option to have time to develop their own interests and hobbies. That is, a way to escape a 9 to 5 job. However, investment is complex and investors end up spending whole days (and nights) trying to figure out which the right stock to invest is. The dream of stock investing becomes the nightmare of facing infinity amounts of information. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about HDFC Bank are: …

Stock Summary

HDFC Bank Limited provides banking and financial services to individuals and businesses in India, Bahrain, Hong Kong, and Dubai. It operates in Treasury, Retail Banking, Wholesale Banking, Other Banking Business, and Unallocated segments..

Today's Summary

The share price of HDFC Bank share is expected to rise around Rs 3000 years in the next 5 years. The bank reported strong profit growth in the latest quarter. The company has 3.24 T in debt with debt to equity ratio of 7.89.

Today's News

Average annual Long-Term Debt growth rates for HDFC Bank Ltd have been 11% over the past three years, 10% over five years. Long-term Debt CAGR 5Y 10% Over the last year, the Long- Term Debt growth was 13%. The table reflects the share price target. The share price of HDFC Bank share is expected to rise around Rs 3000 years in the next 5 years. The bank reported strong profit growth in the latest quarter. HDFC Bank is among the top 10 banks in the world in 2023 by market cap. Total debt of this company is ₹ 21,39,212 Cr. Is HDFC bank debt free? The Total debt is � 21,39 Cr. HDFC Bank Limited provides banking and financial services to individuals and businesses in India, Bahrain, Hong Kong, and Dubai. The company has 3.24 T in debt with debt to equity (D/E) ratio of 7.89. HDFC Banks shareholders could walk away with nothing if the company cant fulfill its legal obligations. HDFC Bank has outperformed the market over the past 10 years by 3.6% on an annualized basis producing an average annual return of 13.31%. Currently, HDFC bank has a market capitalization of $159.56 billion. HDFC Bank is down 7.61% from its all-time high of INR1,757.50 apiece. The countrys largest private sector bank, HDFC, is currently struggling recently after its merger with HDFC. We will analyze the HDFC bank stock from various perspectives, such as its price history, recent news, strengths, weaknesses, weaknesses. HDFC Bank is one of the leading private sector banks in India, offering a wide range of financial products and services to various segments of customers. While HDFC Banks stock has a lot going for it, like any investment there are risks. HDFC Bank has reported strong growth in advances, with a year-on-year increase of 15.7% to INR16.3 lakh crores ($219bn) Asian equities traded in the US as American Depositary Receipts Trend Modestly Higher. Nifty bank index jumped around 1%, boosted by a climb in shares of HDFC Bank. The lender said over the weekend that the RBI had lifted restrictions on some of its activities under its digital program. HDFC Bank offers a range of NRI services to individuals living in India as well as individuals living abroad. HDFC has presence in 4 international locations with branches in 4 nations and representative offices in 3 other cities. Stock of Hdfc Bank (HDFCBANK) is trading above an important moving average line, and it has been above this line for quite some time now. This is a good sign, and the stock might keep rising and move higher!

Stock Profile

"HDFC Bank Limited provides banking and financial services to individuals and businesses in India, Bahrain, Hong Kong, and Dubai. It operates in Treasury, Retail Banking, Wholesale Banking, Other Banking Business, and Unallocated segments. The company accepts savings, salary, current, rural, public provident fund, pension, and Demat accounts; fixed and recurring deposits; and safe deposit lockers, as well as offshore accounts and deposits, overdrafts against fixed deposits, and sweep-in facilities. It also provides personal, home, car, two wheeler, business, educational, gold, consumer, and rural loans; loans against properties, securities, rental receivables, and assets; loans for professionals; government sponsored programs; and loans on credit card, as well as working capital and commercial/construction equipment finance, healthcare/medical equipment and commercial vehicle finance, dealer finance, and term and professional loans. The company offers credit, debit, prepaid, and forex cards; payment and collection, export, import, remittance, bank guarantee, letter of credit, trade, hedging, and merchant and cash management services; insurance and investment products. It provides short term finance, bill discounting, structured finance, export credit, loan syndication, and documents collection services; online and wholesale, mobile, and phone banking services; unified payment interface, immediate payment, national electronic funds transfer, and real time gross settlement services; and channel financing, vendor financing, reimbursement account, money market, derivatives, employee trusts, cash surplus corporates, tax payment, and bankers to rights/public issue services, as well as financial solutions for supply chain partners and agricultural customers. The company operates 6,378 branches and 18,620 automated teller machines in 3,203 cities/towns. The company was incorporated in 1994 and is based in Mumbai, India."

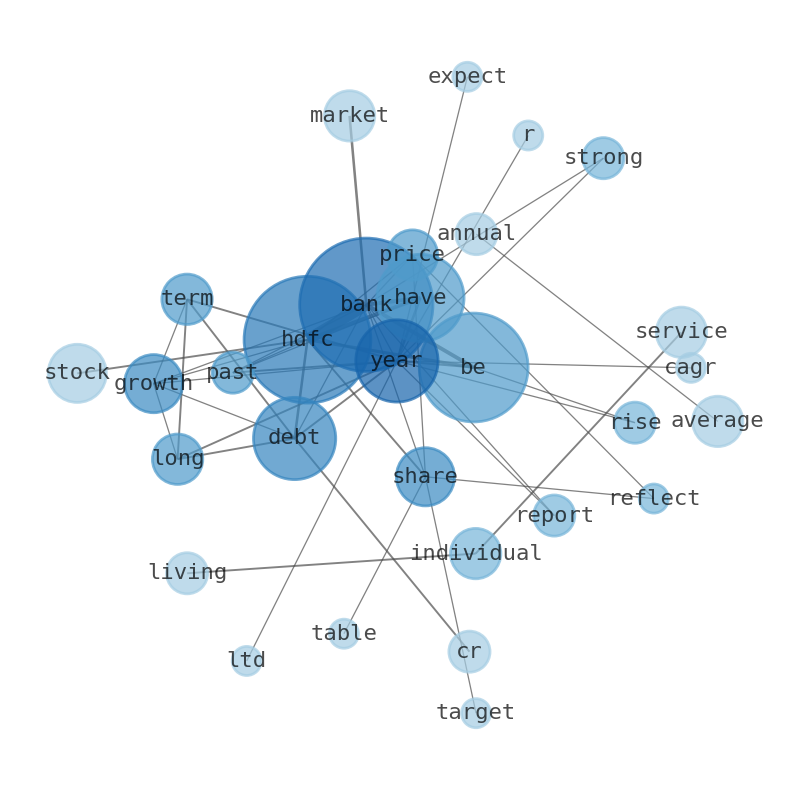

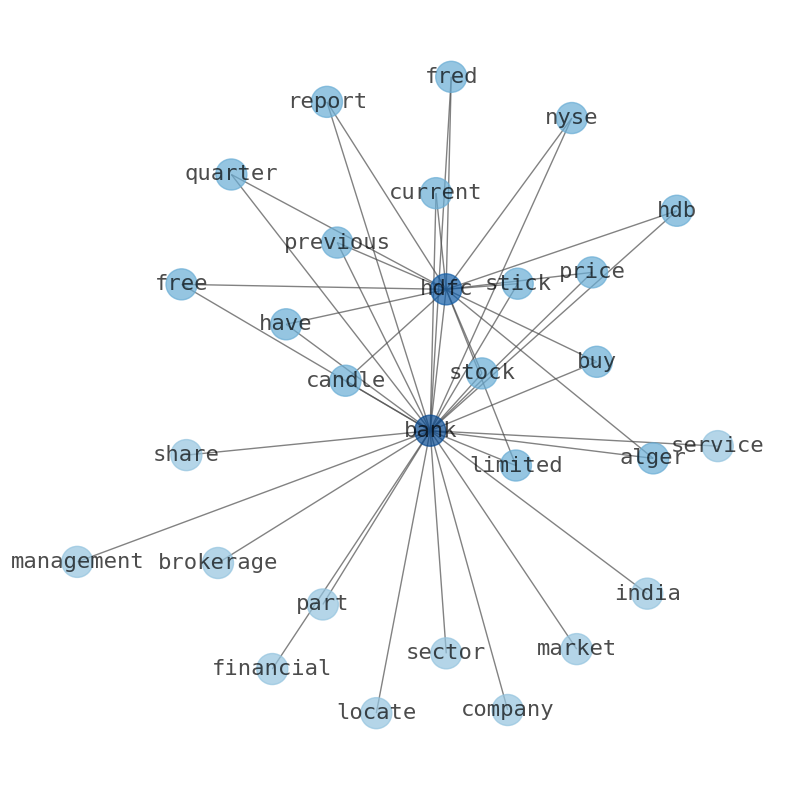

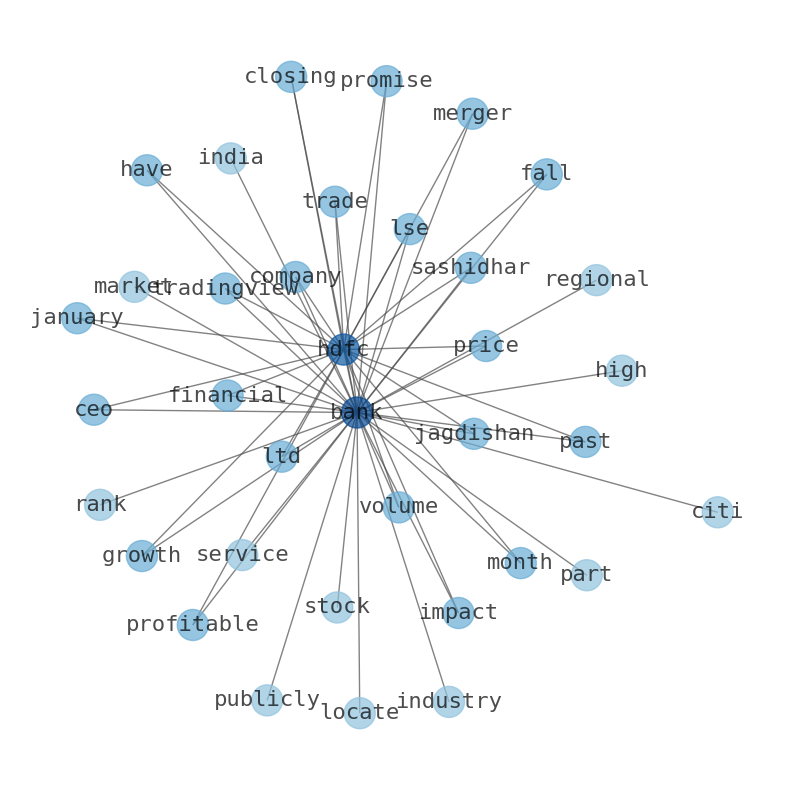

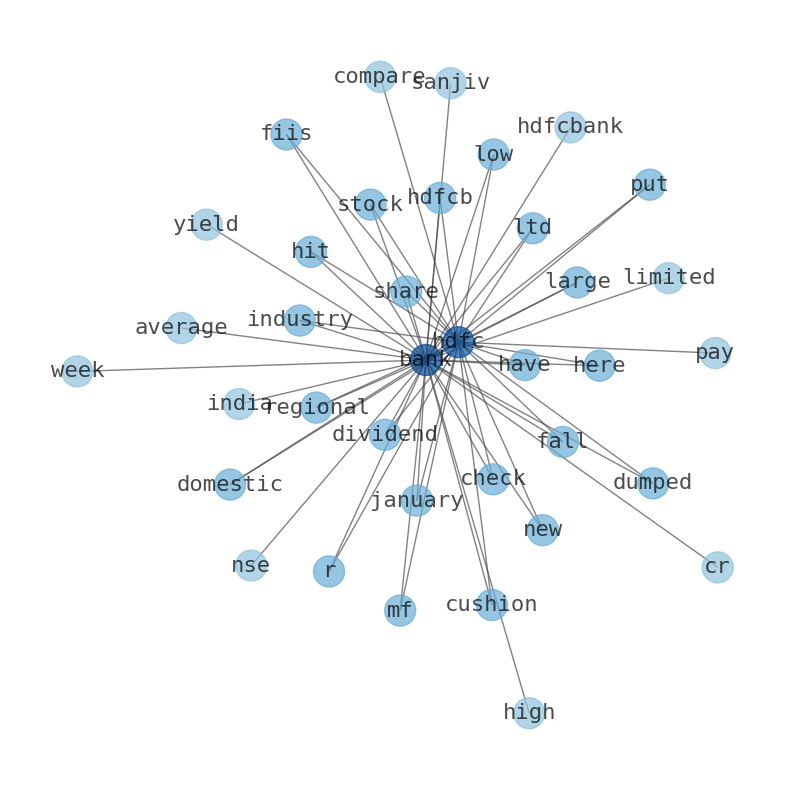

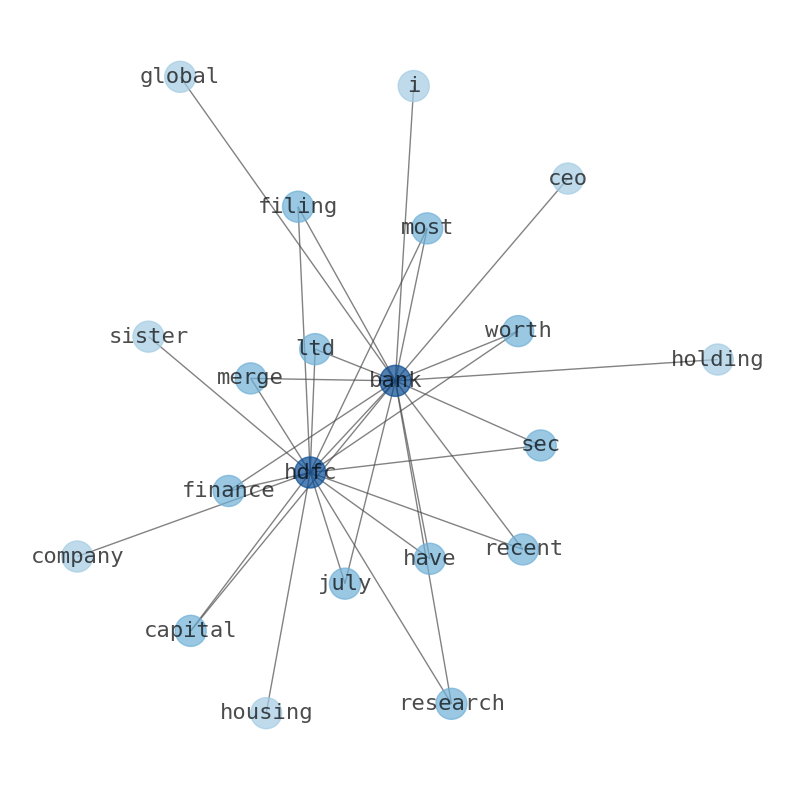

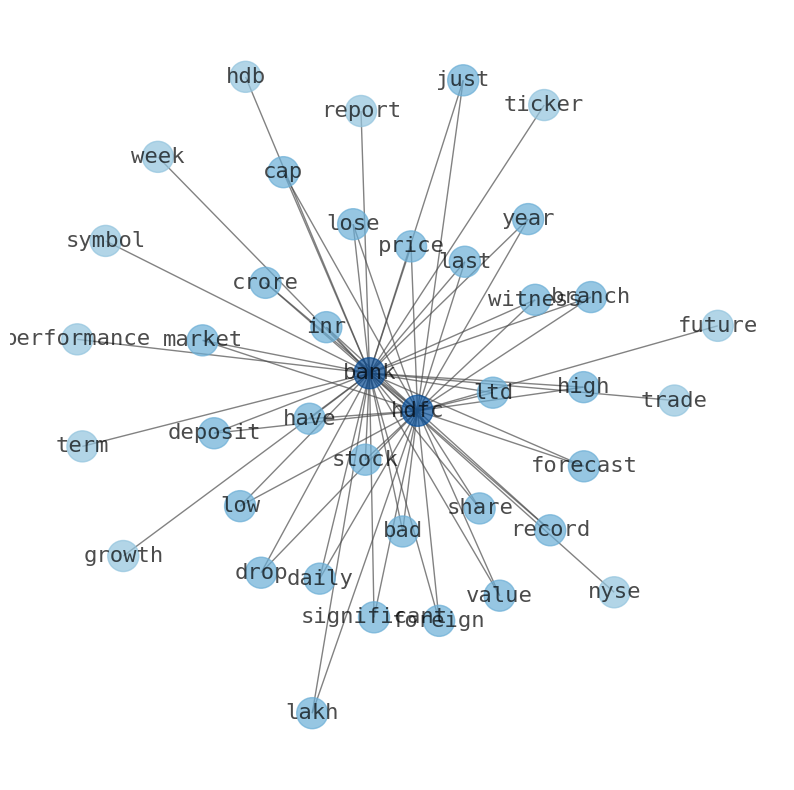

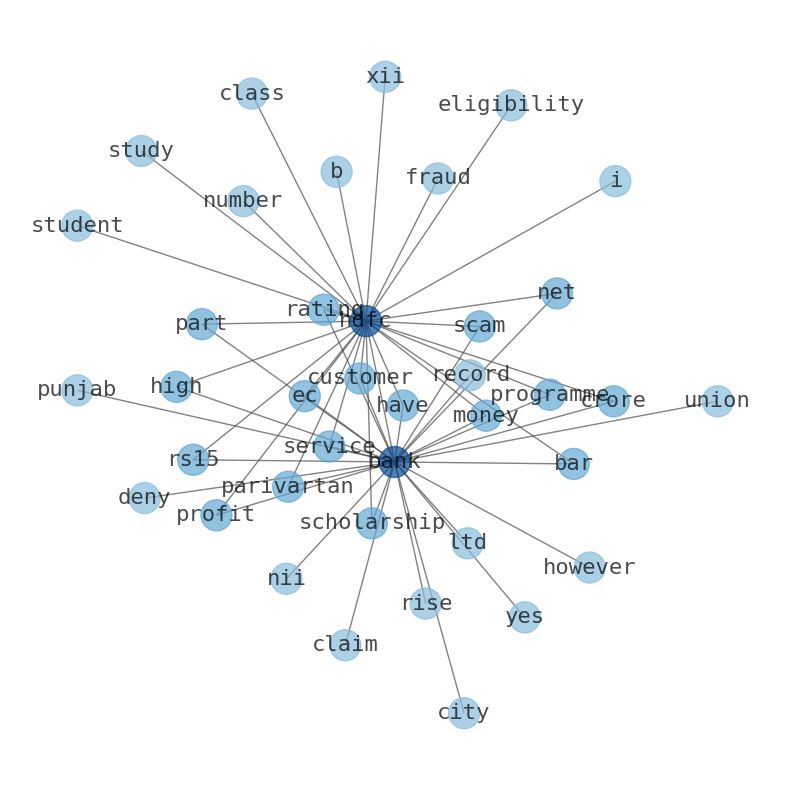

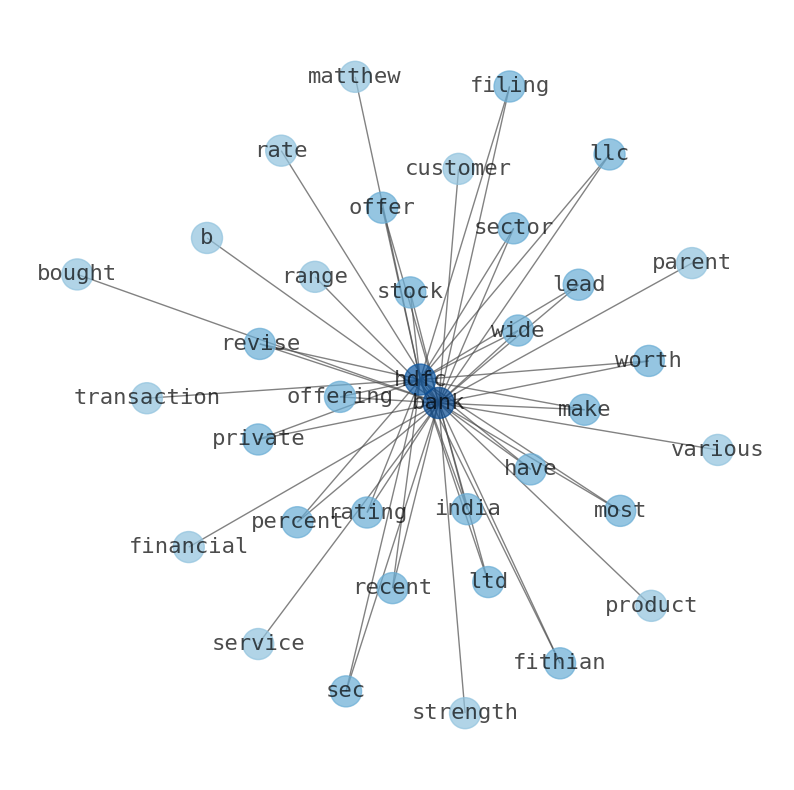

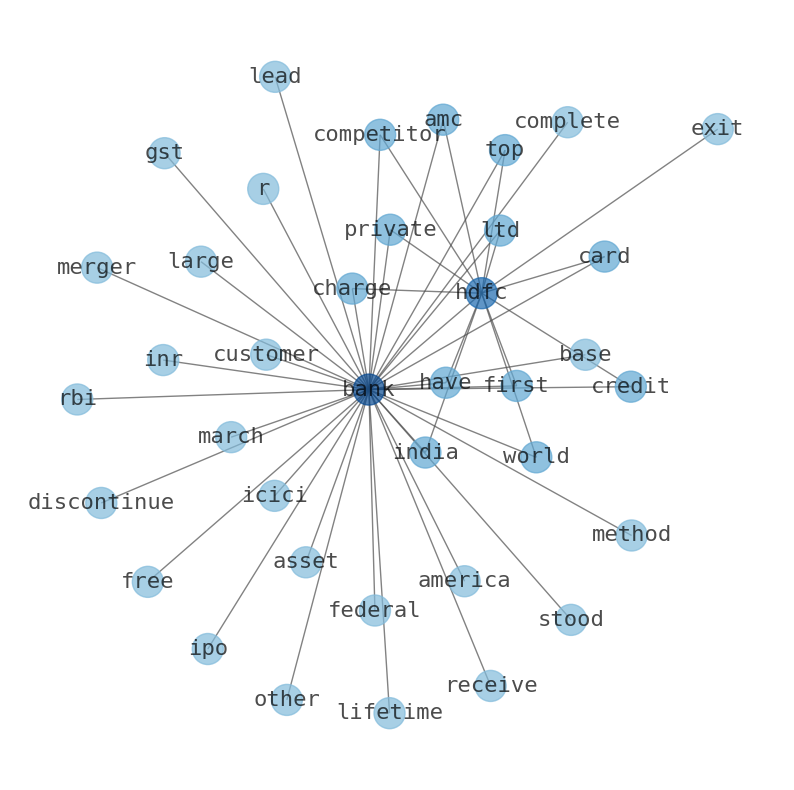

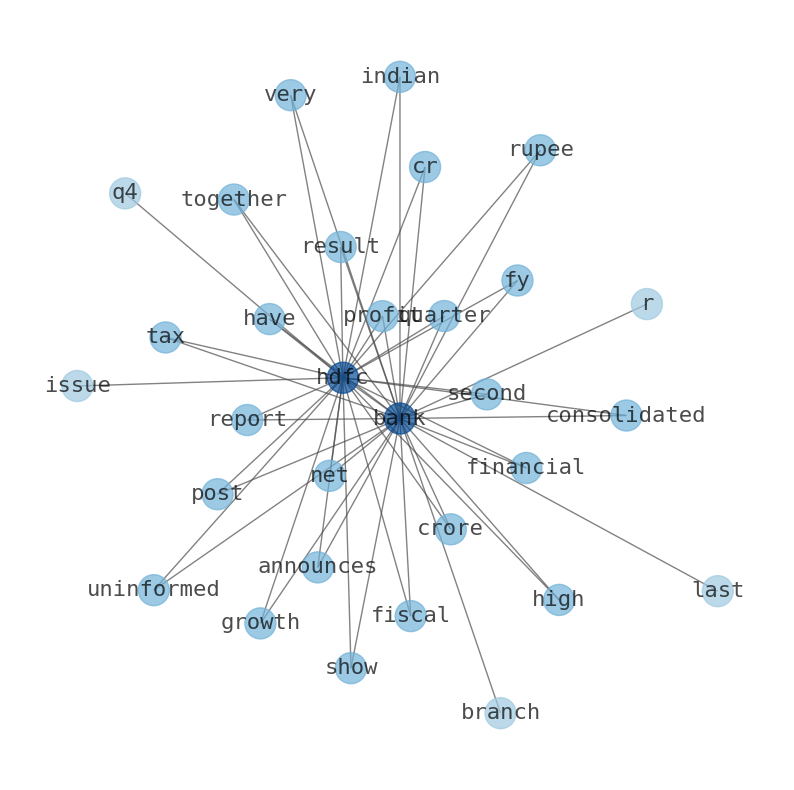

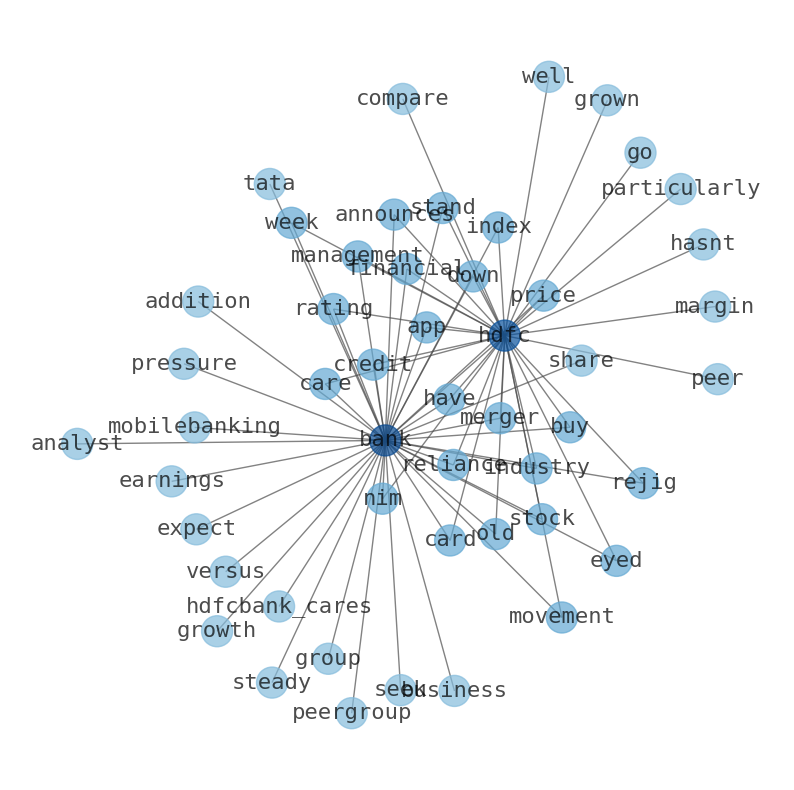

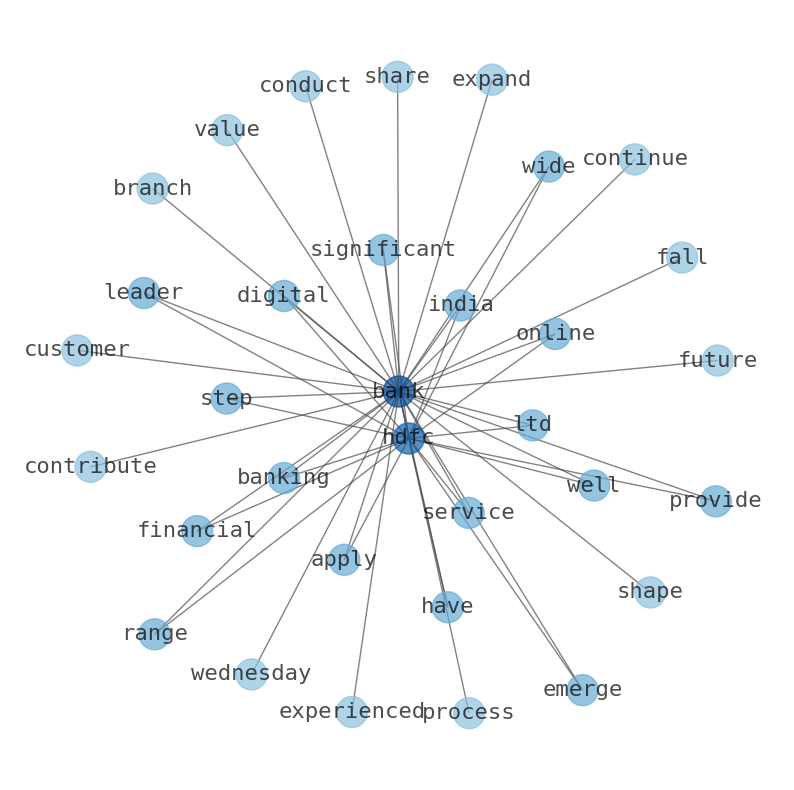

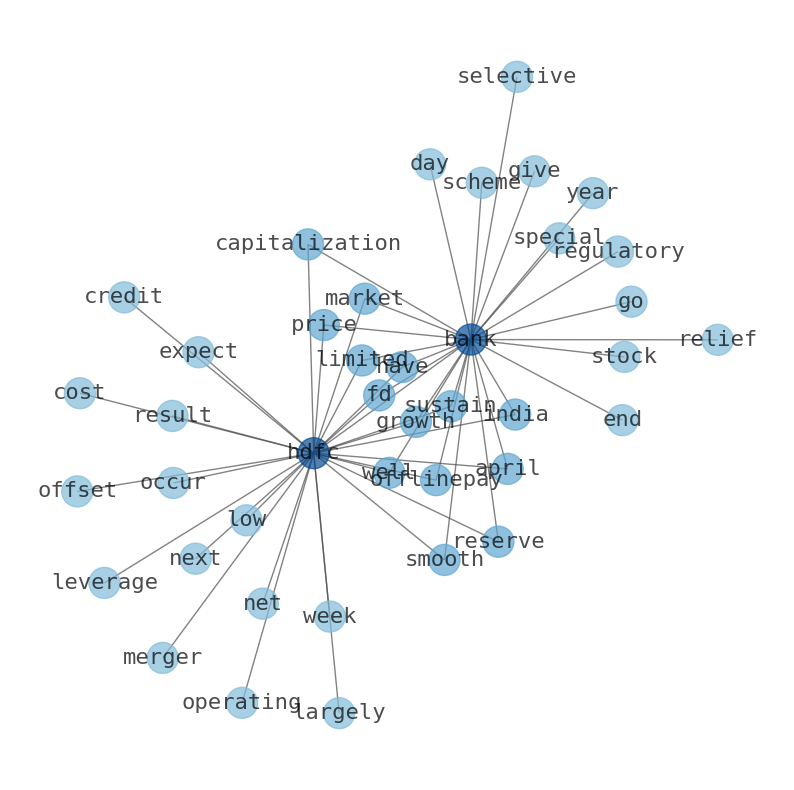

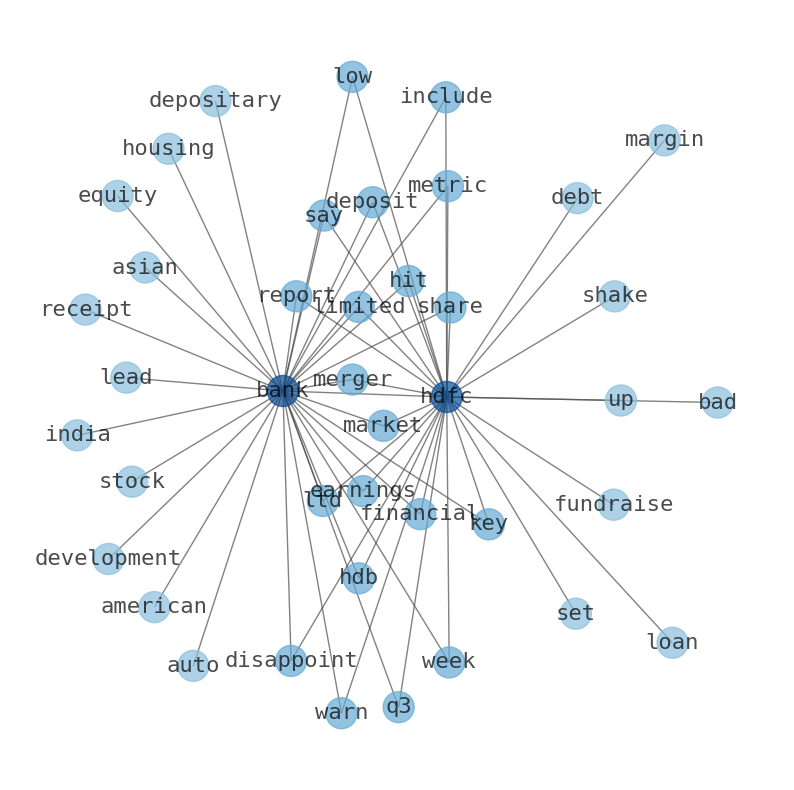

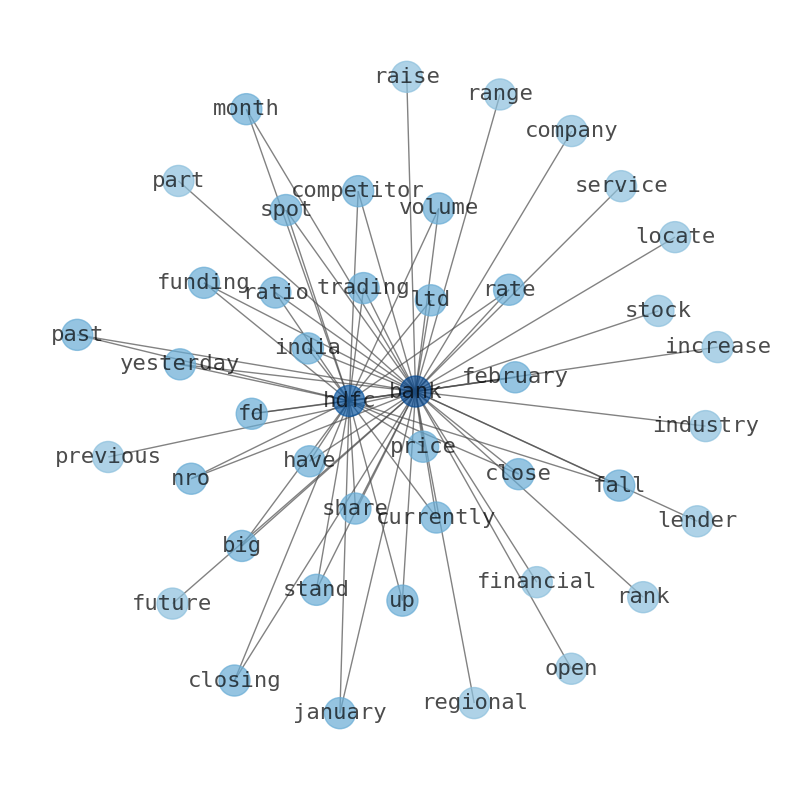

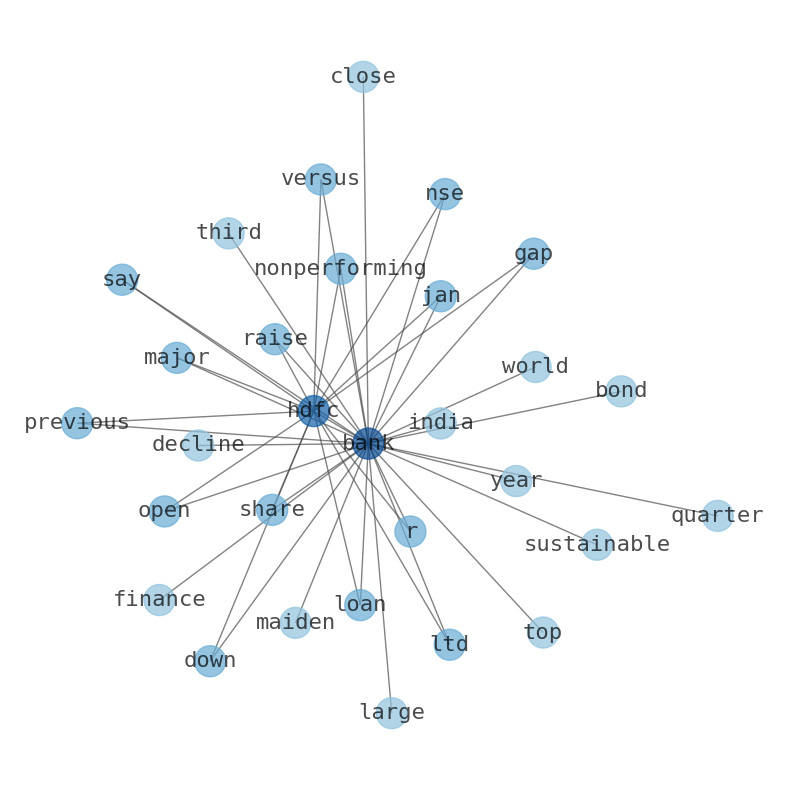

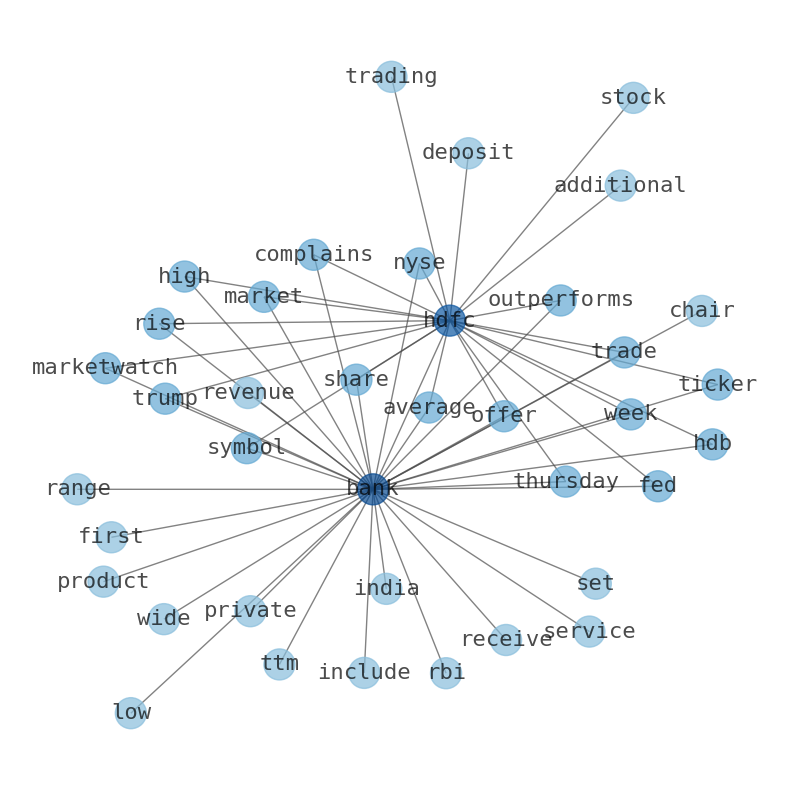

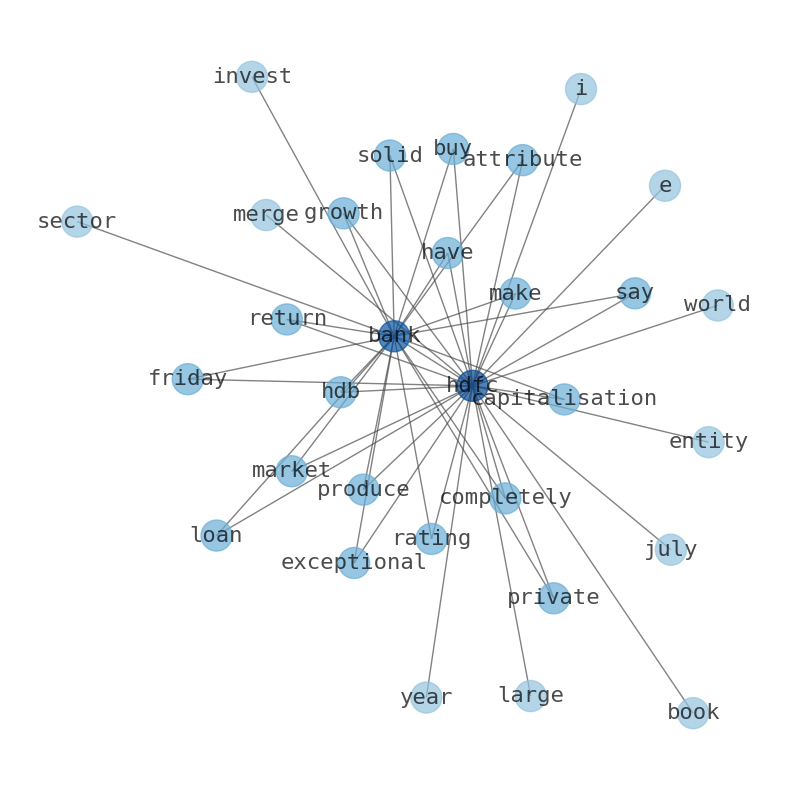

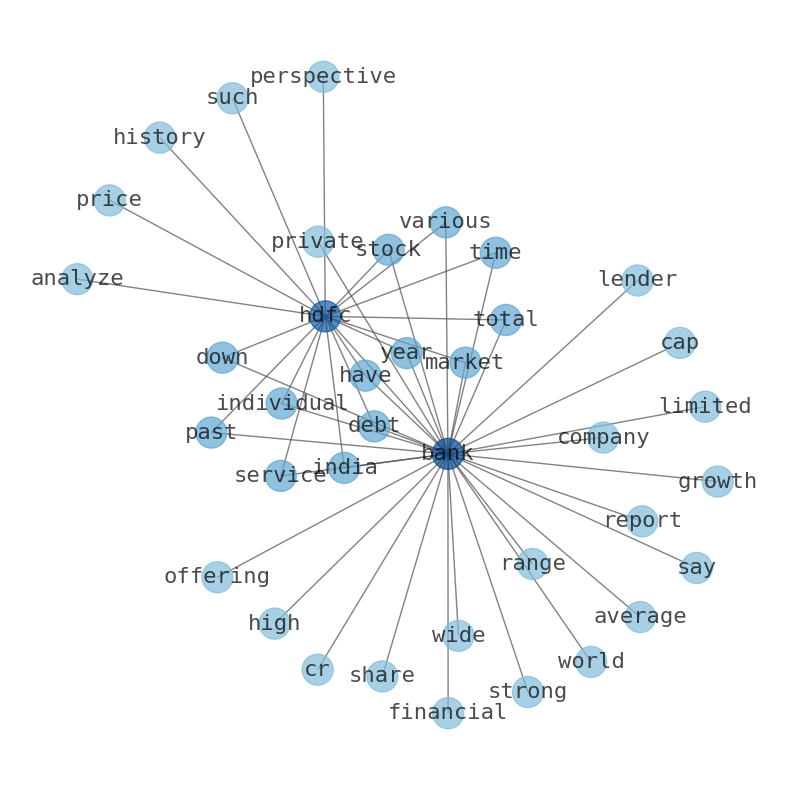

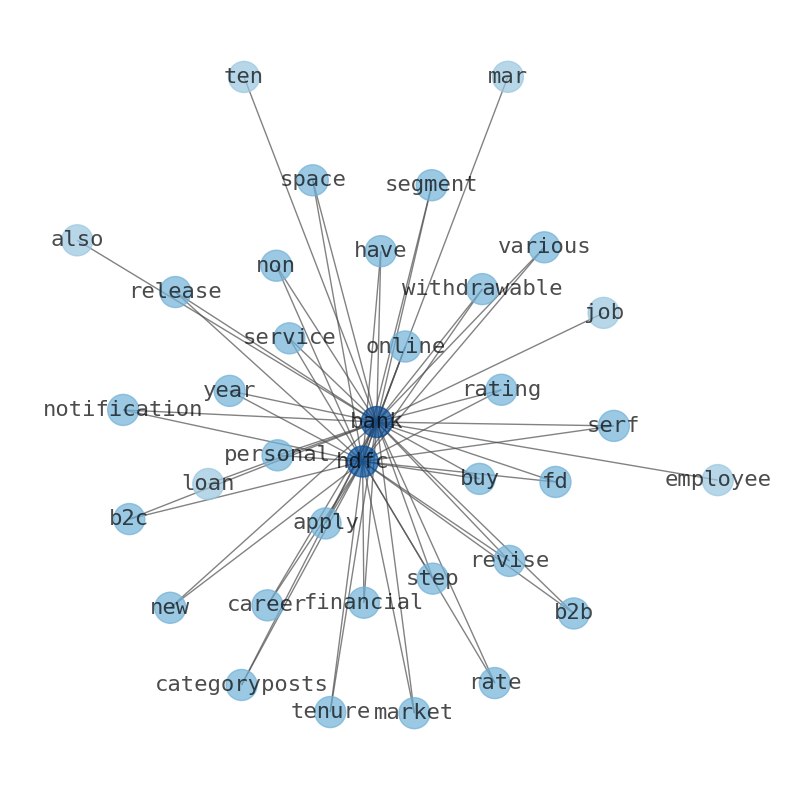

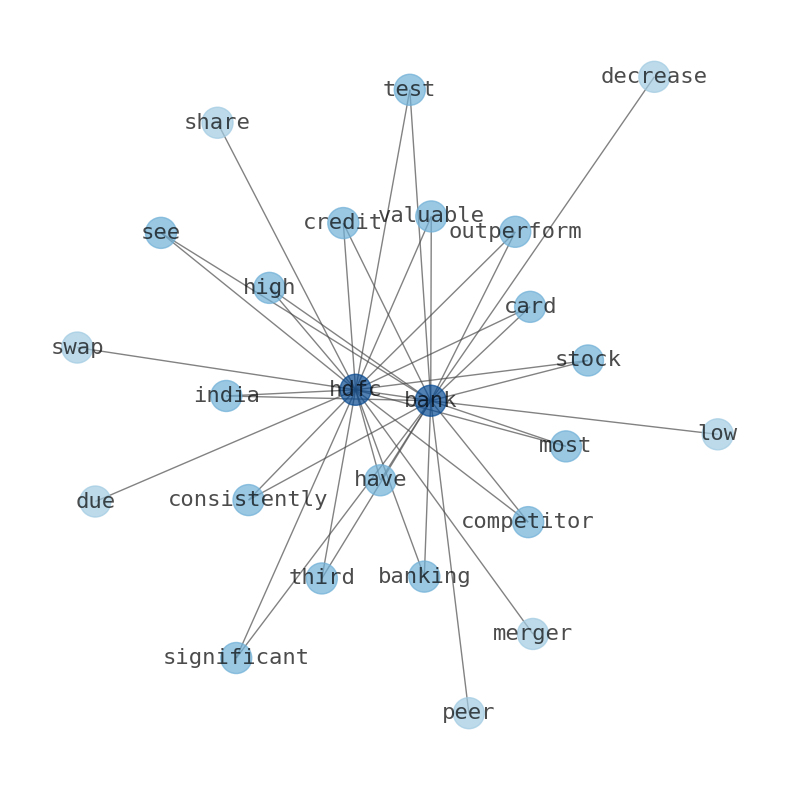

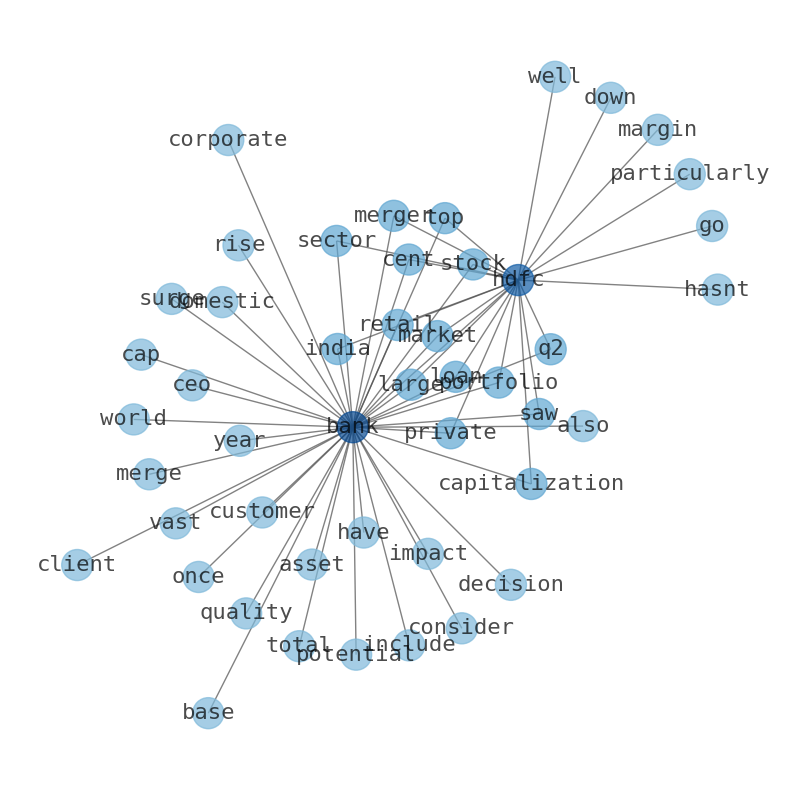

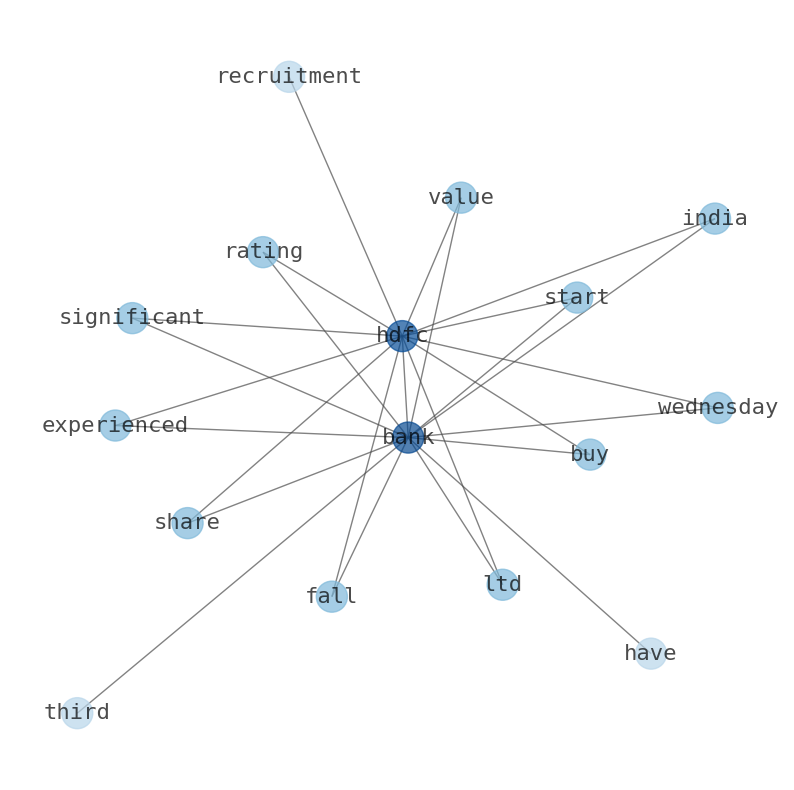

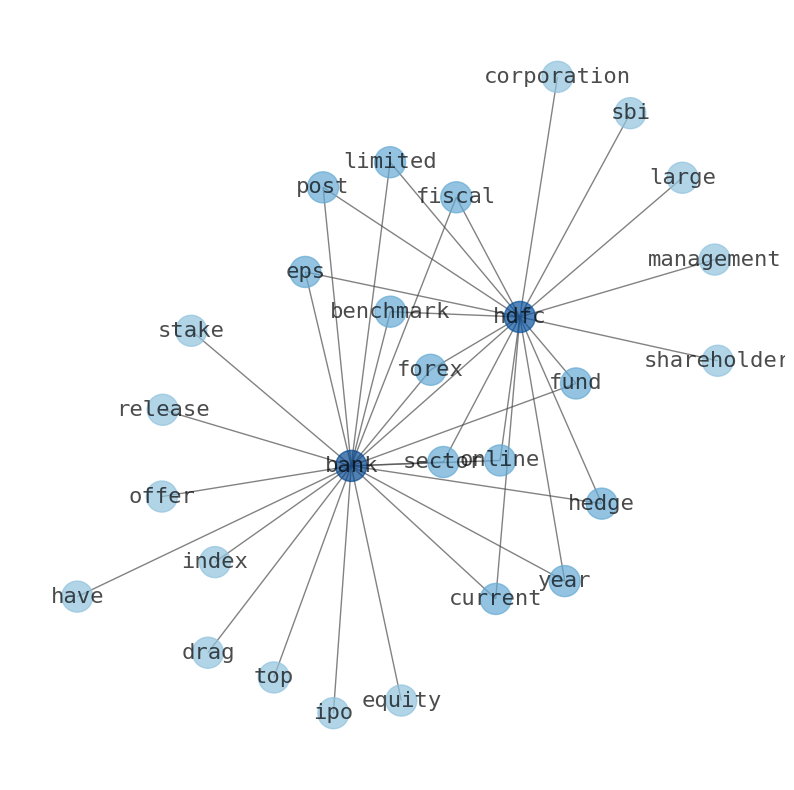

Keywords

The game is changing. There is a new strategy to evaluate HDFC Bank fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about HDFC Bank are: HDFC, Bank, bank, year, debt, growth, share, and the most common words in the summary are: bank, hdfc, share, stock, price, india, target, . One of the sentences in the summary was: The company has 3.24 T in debt with debt to equity ratio of 7.89.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #bank #hdfc #share #stock #price #india #target.

Read more →Related Results

HDFC Bank

Open: 55.26 Close: 55.9 Change: 0.64

Read more →

HDFC Bank

Open: 53.93 Close: 53.83 Change: -0.1

Read more →

HDFC Bank

Open: 54.19 Close: 53.8 Change: -0.39

Read more →

HDFC Bank

Open: 52.64 Close: 52.41 Change: -0.23

Read more →

HDFC Bank

Open: 56.75 Close: 56.1 Change: -0.65

Read more →

HDFC Bank

Open: 66.36 Close: 67.0 Change: 0.64

Read more →

HDFC Bank

Open: 62.09 Close: 63.15 Change: 1.06

Read more →

HDFC Bank

Open: 56.93 Close: 57.19 Change: 0.26

Read more →

HDFC Bank

Open: 57.81 Close: 57.4 Change: -0.41

Read more →

HDFC Bank

Open: 58.73 Close: 59.29 Change: 0.56

Read more →

HDFC Bank

Open: 59.42 Close: 59.01 Change: -0.41

Read more →

HDFC Bank

Open: 64.82 Close: 65.19 Change: 0.38

Read more →

HDFC Bank

Open: 62.96 Close: 62.95 Change: -0.01

Read more →

HDFC Bank

Open: 66.08 Close: 66.32 Change: 0.24

Read more →

HDFC Bank

Open: 65.16 Close: 66.45 Change: 1.29

Read more →

HDFC Bank

Open: 65.08 Close: 64.6 Change: -0.48

Read more →

HDFC Bank

Open: 53.44 Close: 53.5 Change: 0.06

Read more →

HDFC Bank

Open: 54.16 Close: 54.0 Change: -0.16

Read more →

HDFC Bank

Open: 52.64 Close: 52.43 Change: -0.21

Read more →

HDFC Bank

Open: 55.86 Close: 55.08 Change: -0.78

Read more →

HDFC Bank

Open: 66.2 Close: 65.5 Change: -0.7

Read more →

HDFC Bank

Open: 63.78 Close: 64.54 Change: 0.76

Read more →

HDFC Bank

Open: 59.5 Close: 60.71 Change: 1.21

Read more →

HDFC Bank

Open: 57.04 Close: 56.33 Change: -0.71

Read more →

HDFC Bank

Open: 59.25 Close: 59.02 Change: -0.23

Read more →

HDFC Bank

Open: 59.1 Close: 57.92 Change: -1.18

Read more →

HDFC Bank

Open: 64.47 Close: 63.4 Change: -1.07

Read more →

HDFC Bank

Open: 63.74 Close: 64.36 Change: 0.62

Read more →

HDFC Bank

Open: 68.6 Close: 68.28 Change: -0.32

Read more →

HDFC Bank

Open: 66.39 Close: 66.2 Change: -0.19

Read more →

HDFC Bank

Open: 64.59 Close: 64.81 Change: 0.22

Read more →- Apple

- Taiwan Semiconductor Manufacturing Company

- The Boeing Company

- Prosperity Bancshares

- Donaldson Company

- AutoNation

- HashiCorp

- Exelixis

- Matador Resources Company

- Halozyme Therapeutics

- MKS Instruments

- Brookfield Renewable

- Envista Holdings

- Automatic Data Processing

- Grupo Aeroportuario del Pacifico

- Murphy USA

- Gentex

- Bumble

- AGNC Investment

- National Fuel Gas Company

- Woori Financial Group

- The Western Union Company

- Tencent Music Entertainment Group

- The Estee Lauder Companies

- WESCO International

- Maravai LifeSciences Holdings

- Guidewire Software

- Unum Group

- PDC Energy

- Magnolia Oil & Gas

- SiteOne Landscape Supply

- Frontier Communications Parent

- Woodward

- Rio Tinto

- First Financial Bankshares

- SunRun

- Endeavor Group Holdings

- Kilroy Realty

- Stifel Financial

- South State

- Reynolds Consumer Products

- Starbucks

- Lumentum Holdings

- Sonoco Products Company

- FS KKR Capital

- Wyndham Hotels & Resorts

- United States Steel

- Vornado Realty Trust

- Dutch Bros

- Informatica

- Prologis

- AngloGold Ashanti

- Option Care Health

- CEMEX

- CCC Intelligent Solutions Holdings

- Huntsman

- Pinnacle Financial Partners

- Ingredion

- First American Financial

- Brunswick

- Voya Financial

- Flowers Foods

- Boyd Gaming

- Futu Holdings

- Stag Industrial

- Globus Medical

- BOK Financial

- ZIM Integrated Shipping Services

- British American Tobacco

- Valley National Bancorp

- Skechers USA

- nVent Electric

- Teladoc Health

- Popular

- BRP Inc.

- Acuity Brands

- MasTec

- Apellis Pharmaceuticals

- The Descartes Systems Group

- Applied Materials

- Agree Realty

- FirstService

- GXO Logistics

- MP Materials

- UWM Holdings

- Spirit Realty Capital

- Texas Roadhouse

- Southwest Gas Holdings

- Vipshop Holdings

- BP plc