The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

General Dynamics

Youtube Subscribe

Open: 274.0 Close: 273.7 Change: -0.3

An AI to read internet: The best strategy to evaluate General Dynamics Stock.

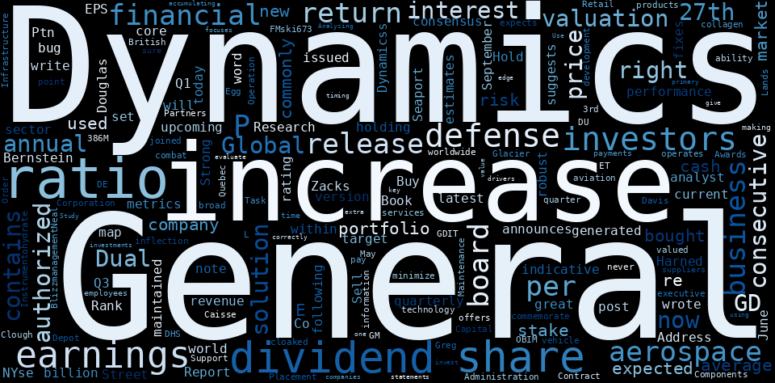

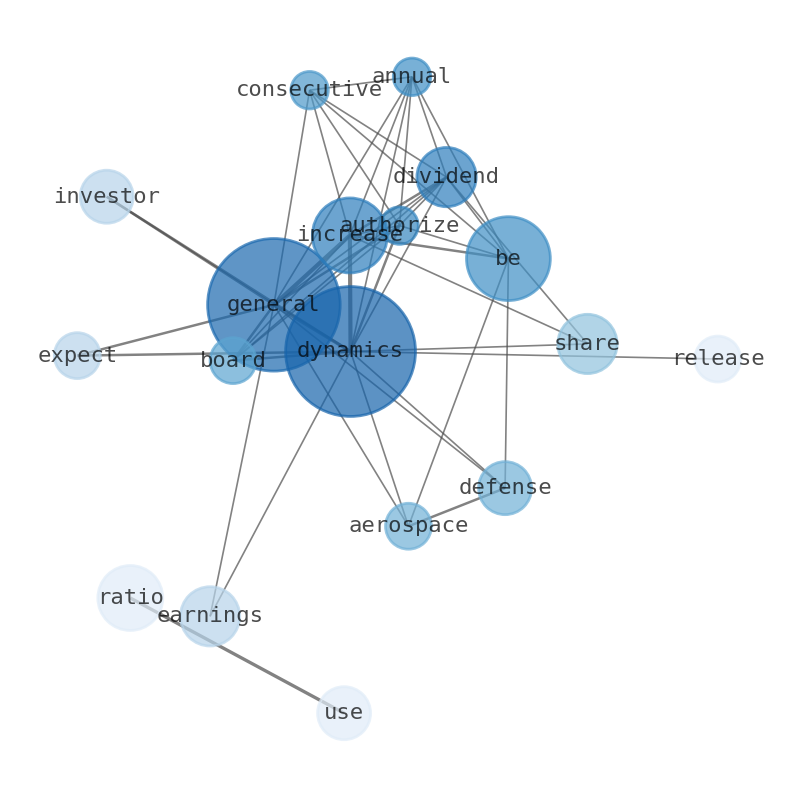

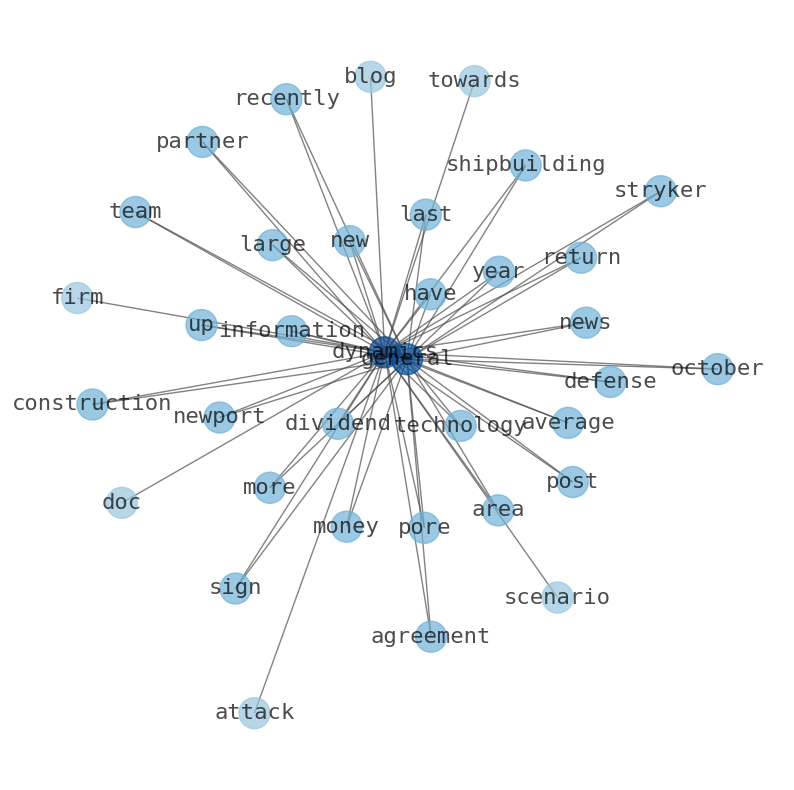

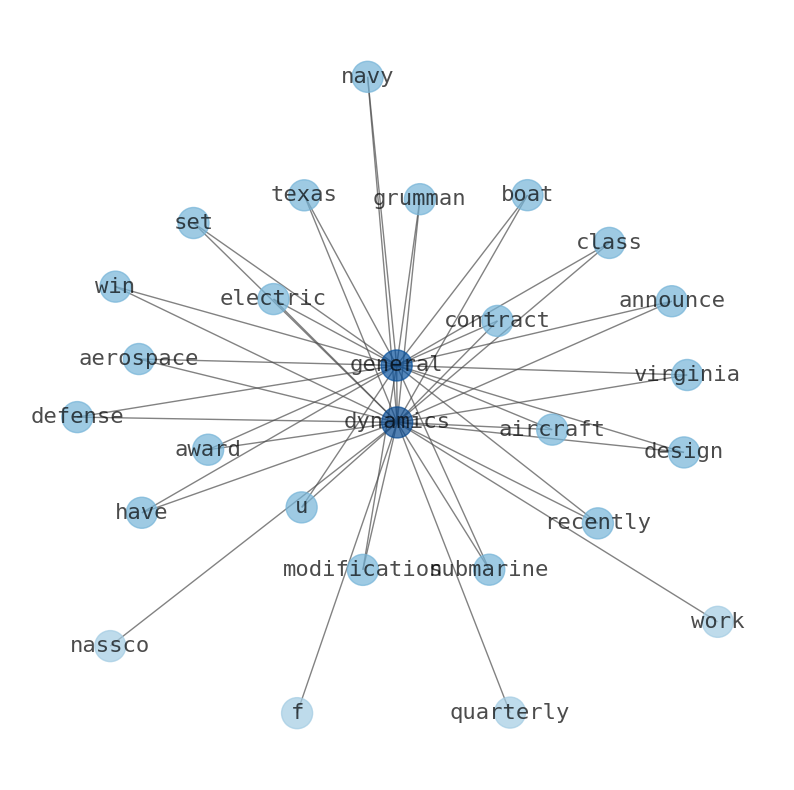

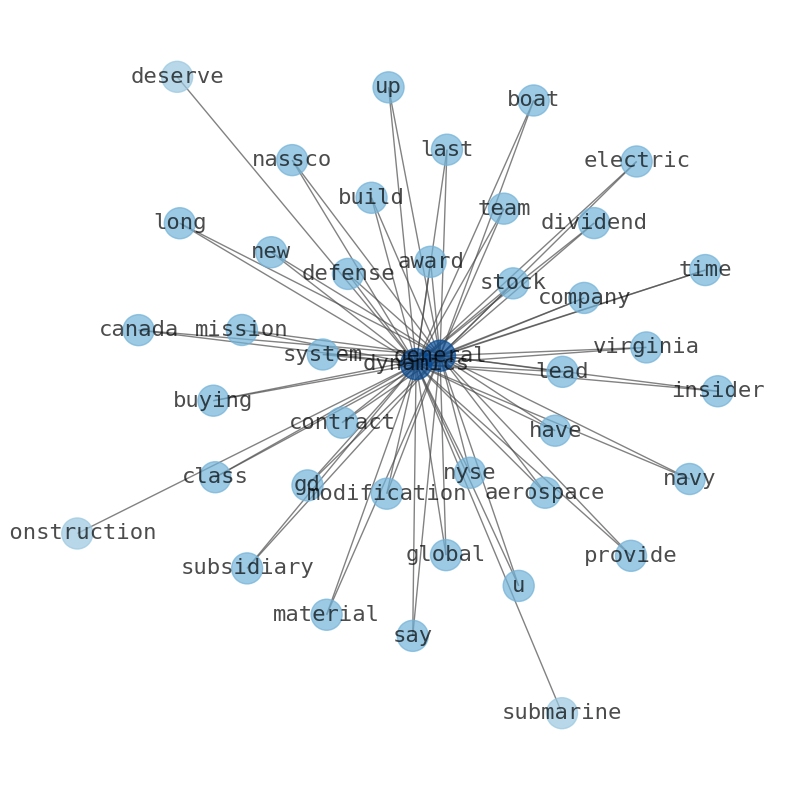

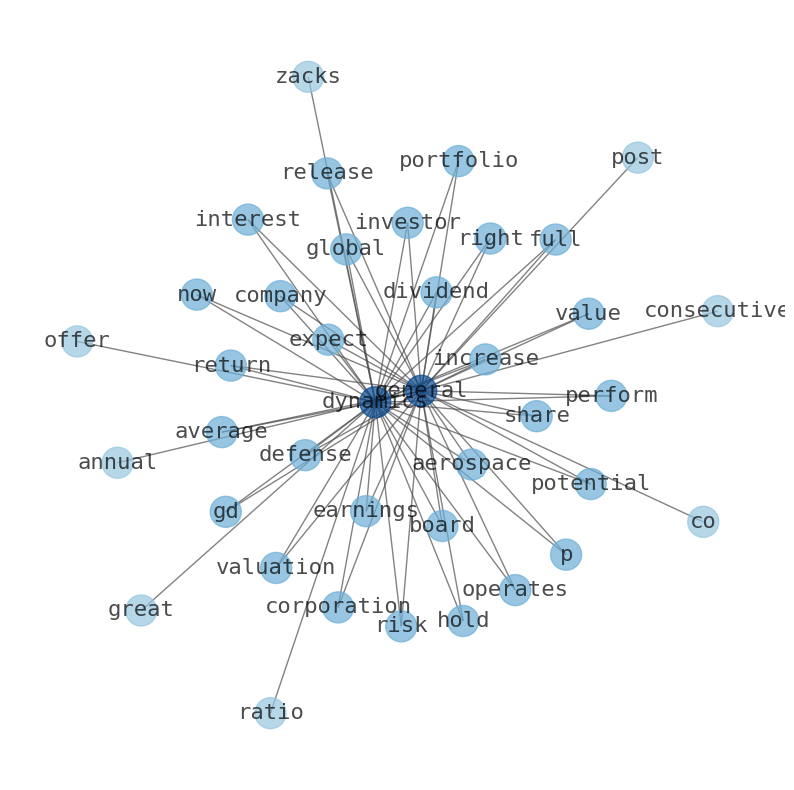

The game is changing. There is a new strategy to evaluate General Dynamics fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about General Dynamics are: General, Dynamics, increase, ratio, share, dividend, defense, …

Stock Summary

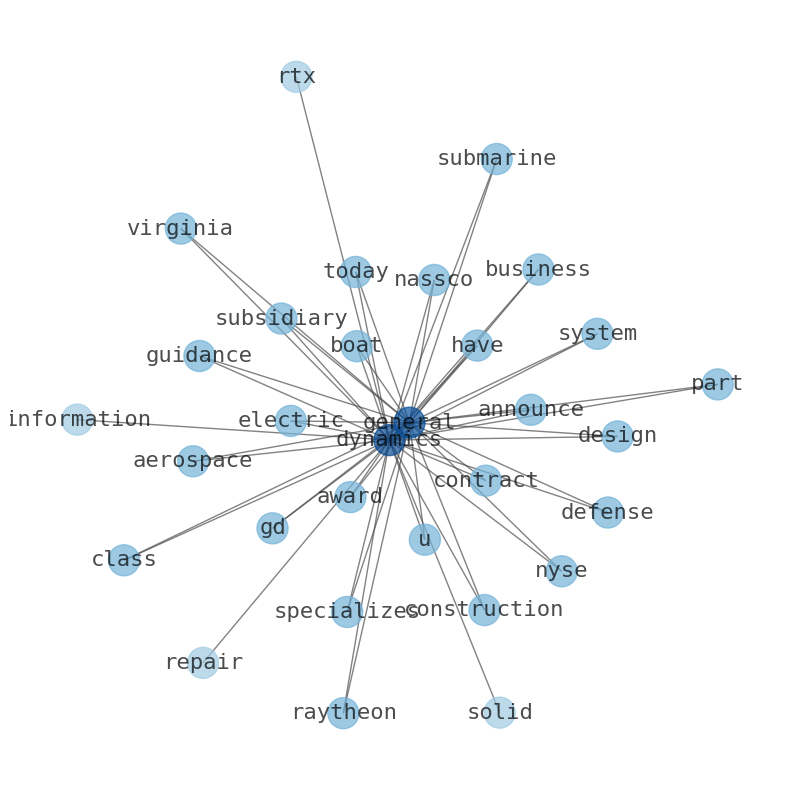

General Dynamics Corporation operates as an aerospace and defense company worldwide. The Aerospace segment produces and sells business jets, produces and manufactures business jets. The Marine Systems segment designs and builds nuclear-powered submarines, surface combatants, and auxiliary ships. The.

Today's Summary

Dividend increase is indicative of its robust performance within the aerospace and defense sector. General Dynamics generated $42.3 billion in revenue in 2023.

Today's News

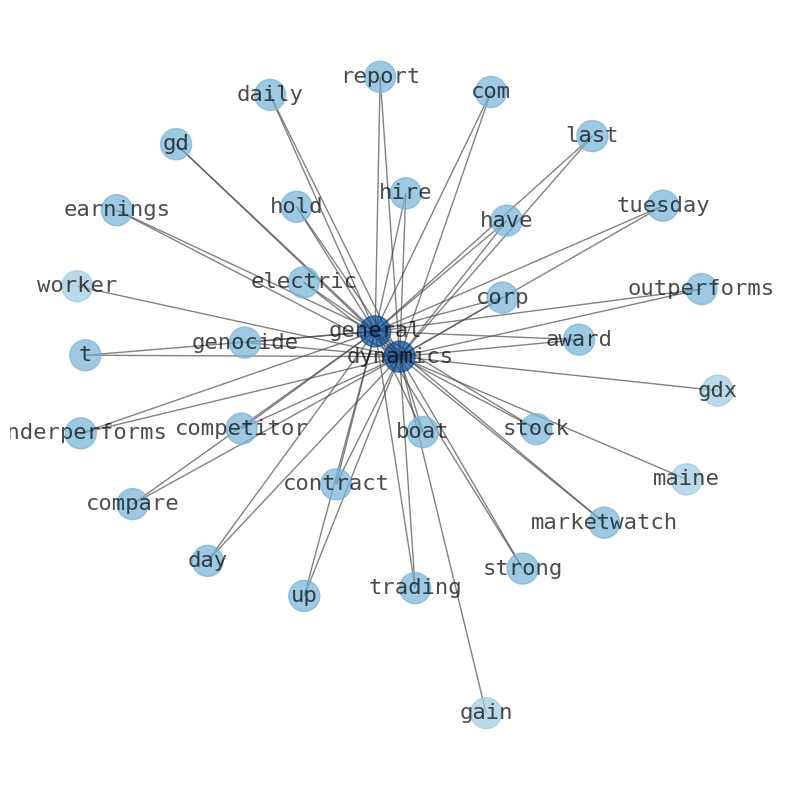

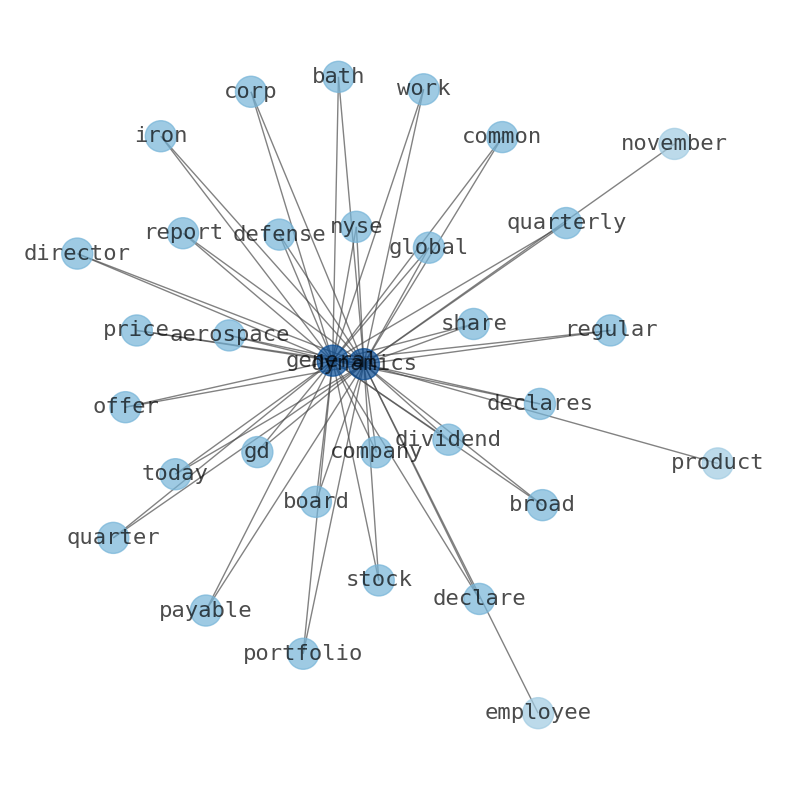

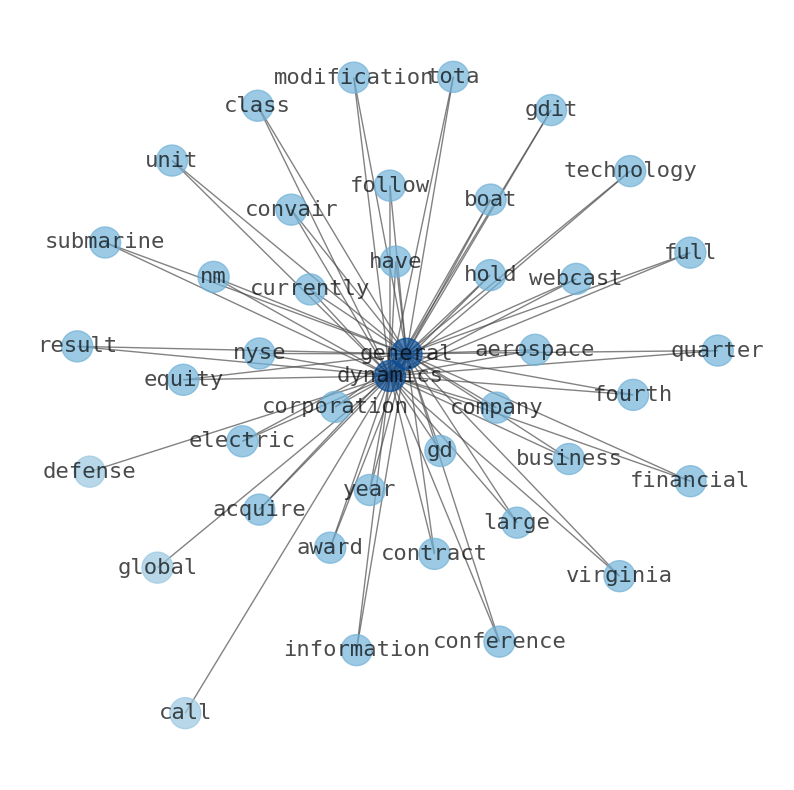

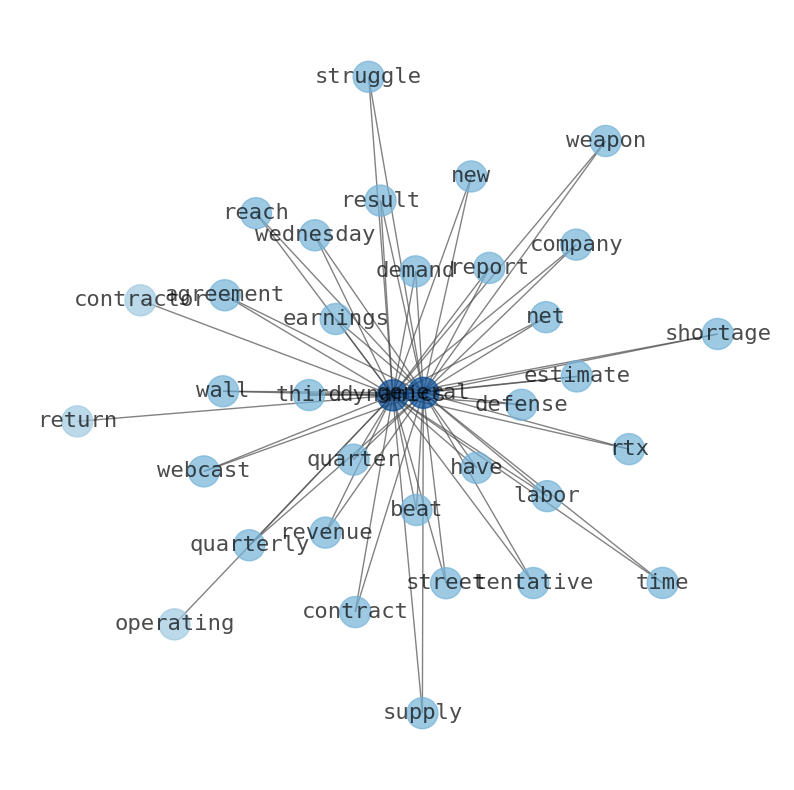

General Dynamics announces a 7.6% increase in its quarterly dividend to $1.42 per share. This is the 27th consecutive annual dividend increase authorized by the General Dynamics board. Dividend increase is indicative of its robust performance within the aerospace and defense sector. General Dynamics generated $42.3 billion in revenue in 2023. The upcoming earnings release of General Dynamics will be of great interest to investors. General Dynamics is holding a Zacks Rank of #4 (Sell) right now. Investors should also note General Dynamicss current valuation metrics. The September 2023 release of Dual-write Global Address Book solution contains the following bug fixes. The June release of the Dual-wrote core solution 1.0.35.0 contains the latest map version. Bernstein analyst Douglas Harned maintained a Hold rating on General Dynamics (GD – Research Report ) today and set a price target of $280.00. The word on The Street in general, suggests a Strong Buy consensus. General Dynamics Co. expected to post Q1 2025 earnings of $3.57 per share (NYse:gd) - defense world.com. Seaport Res Ptn issued estimates for General Dynamics Q3 2025 earnings at $4.12 EPS. General Dynamics Corporation operates as an aerospace and defense company worldwide. General Dynamics expects combat vehicle inflection point in 2024. Caisse DE Depot ET Placement DU Quebec bought a new stake in shares of General Dynamics during the 3rd quarter valued at about $16,0777,000. Clough Capital Partners L P bought a. new. stake in. shares of GM Dynamics during the British Retail Administration commemorate Egg Glacier BlizzmanagementNeal Instrumentohydrate collagen cloaked FMski673 General Dynamics board increases dividend of $1.42 per share on May 10, 2024. Contract Awards GDIT Lands $386M DHS OBIM Infrastructure Components Operation, Maintenance Support Task Order. Greg Davis, a business development executive, has joined the information technology business of General. This is the 27th consecutive annual dividend increase authorized by the General Dynamics board. General Dynamics is a global aerospace and defense company that offers a broad portfolio of products and services in business aviation. Investors should never minimize General Dynamics ability to pay suppliers or employees on time, making sure interest payments are not accumulating or correctly timing where and how to re-invest extra cash. Analyzing the key financial ratios in General Dynamics financial statements can give you an edge over other investors. The P/E ratio is the most commonly used of these ratios because it focuses on the General Dynamics earnings, one of the primary drivers of an investments value. Use valuation ratios to evaluate the companies financials using commonly used ratios such as the price-to-earnings (P/E) ratio. Study the cash flow inflows and outflows to understand General Dynamics liquidity and solvency. General Dynamics is performing at about 11% of its full potential on average monthly moving average. As returns on the market increase, General Dynamics returns are expected to increase less than the market. General Dynamics right now retains a risk of 0.95%. You can increase risk-adjusted return of General Dynamics by adding it to a well-diversified portfolio.

Stock Profile

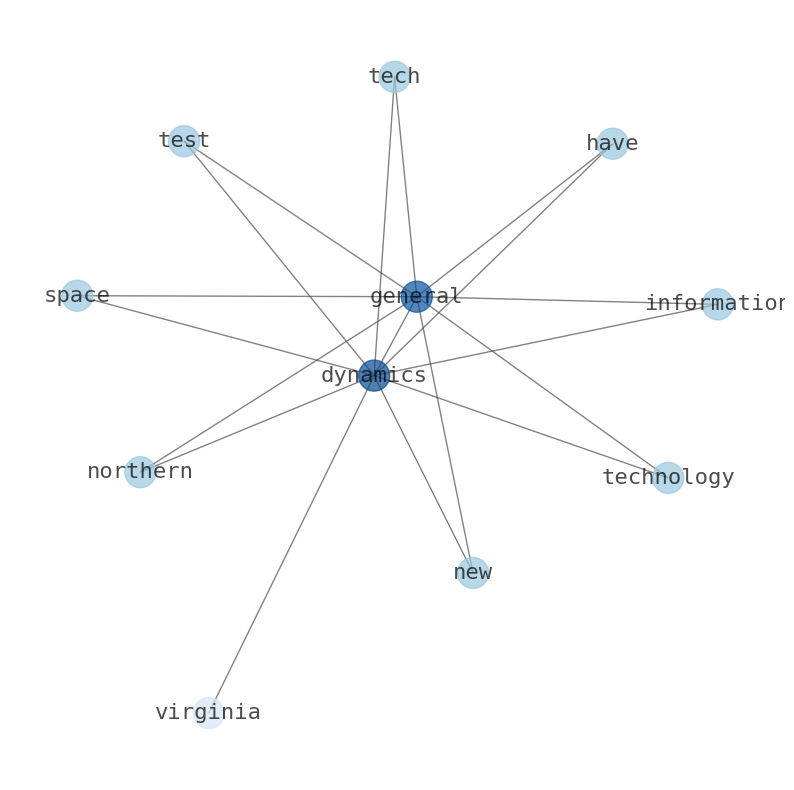

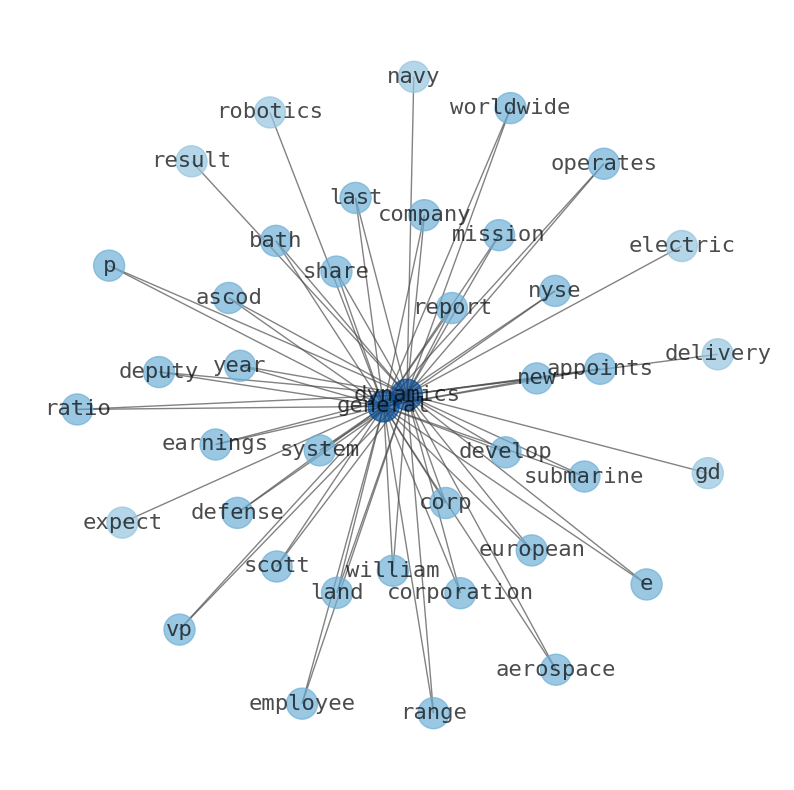

"General Dynamics Corporation operates as an aerospace and defense company worldwide. It operates through four segments: Aerospace, Marine Systems, Combat Systems, and Technologies. The Aerospace segment produces and sells business jets; and offers aircraft maintenance and repair, management, aircraft-on-ground support and completion, charter, staffing, and fixed-base operator services. The Marine Systems segment designs and builds nuclear-powered submarines, surface combatants, and auxiliary ships for the United States Navy and Jones Act ships for commercial customers, as well as builds crude oil and product tankers, and container and cargo ships; provides maintenance, modernization, and lifecycle support services for navy ships; offers and program management, planning, engineering, and design support services for submarine construction programs. The Combat Systems segment manufactures land combat solutions, such as wheeled and tracked combat vehicles, Stryker wheeled combat vehicles, piranha vehicles, weapons systems, munitions, mobile bridge systems with payloads, tactical vehicles, main battle tanks, armored vehicles, and armaments; and offers modernization programs, engineering, support, and sustainment services. The Technologies segment provides information technology solutions and mission support services; mobile communication, computers, and command-and-control mission systems; intelligence, surveillance, and reconnaissance solutions to military, intelligence, and federal civilian customers; cloud computing, artificial intelligence; machine learning; big data analytics; development, security, and operations; and unmanned undersea vehicle manufacturing and assembly services. The company was founded in 1899 and is headquartered in Reston, Virginia."

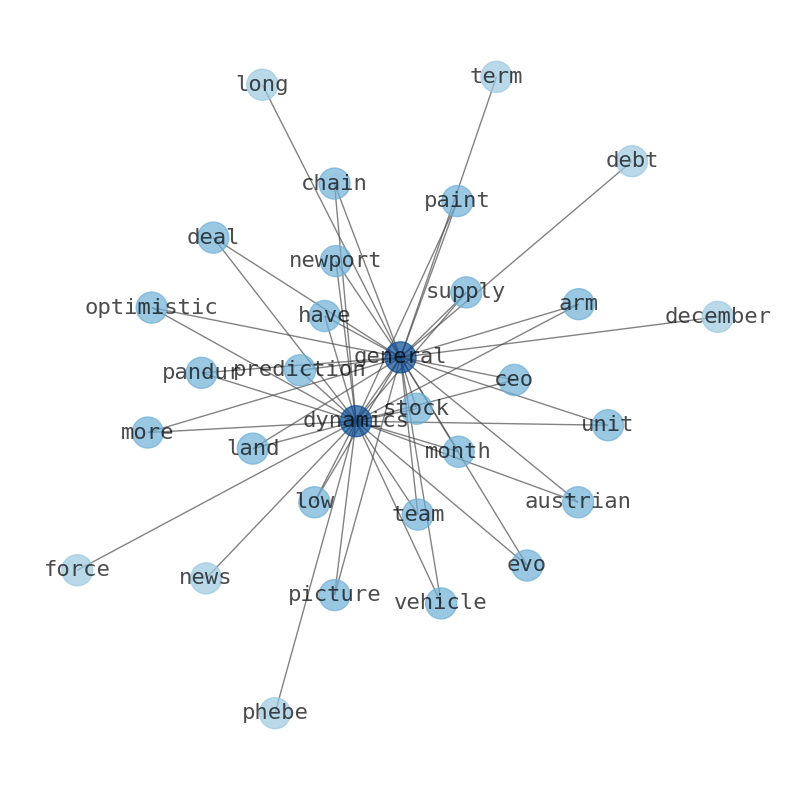

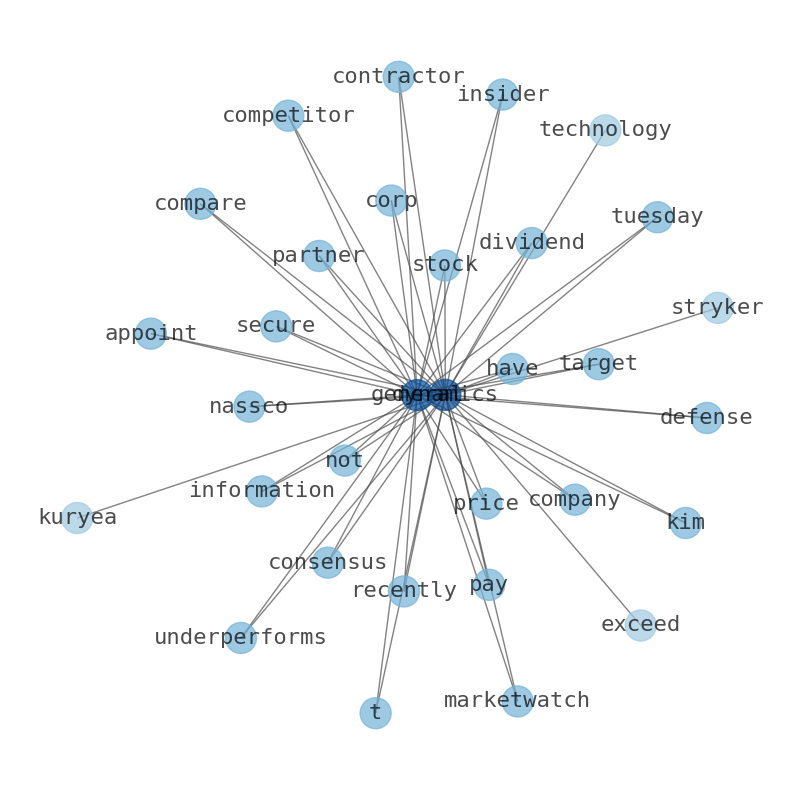

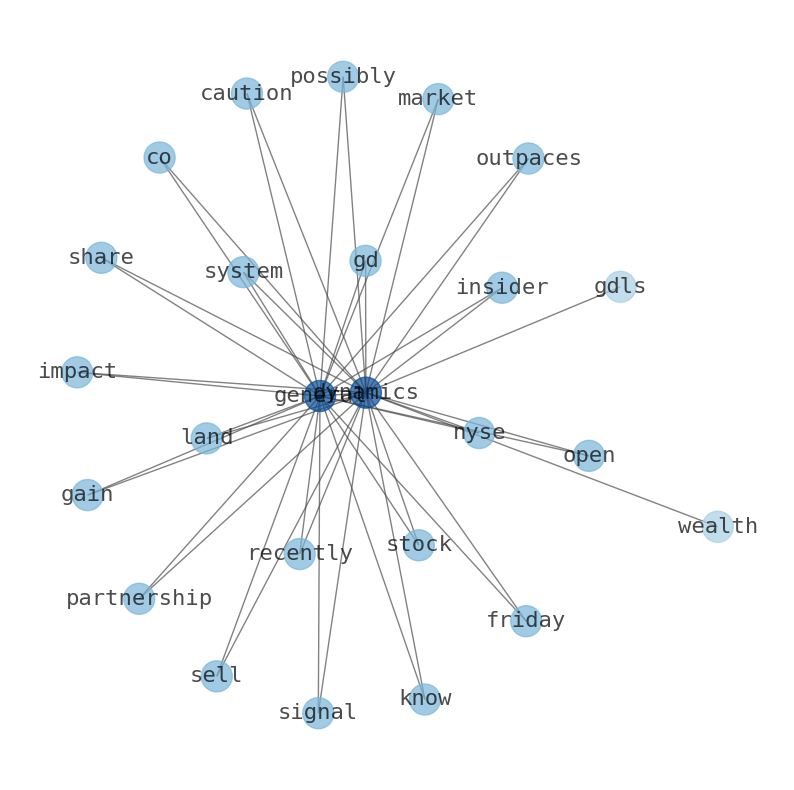

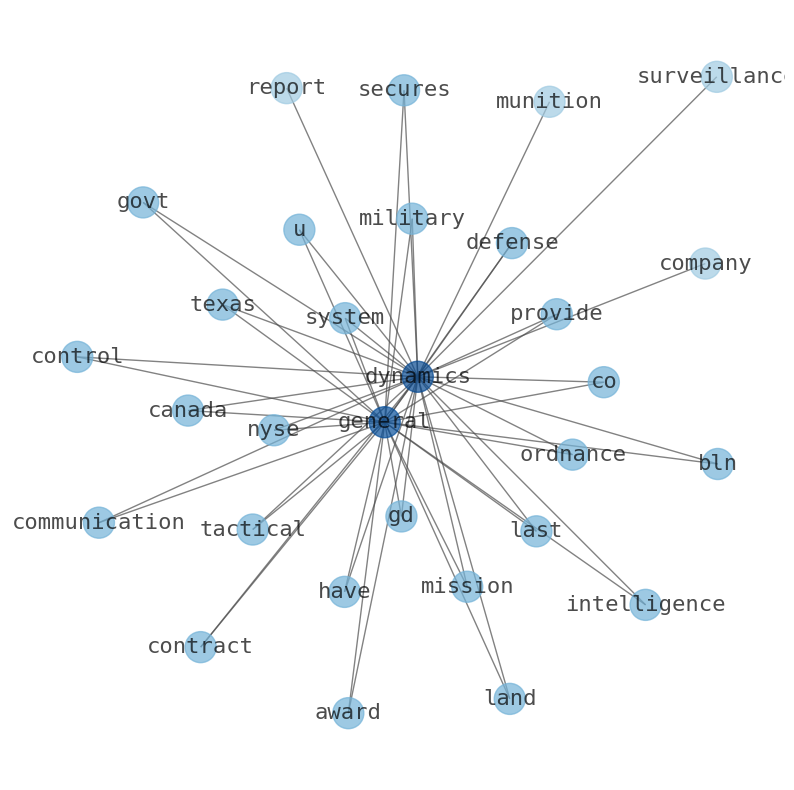

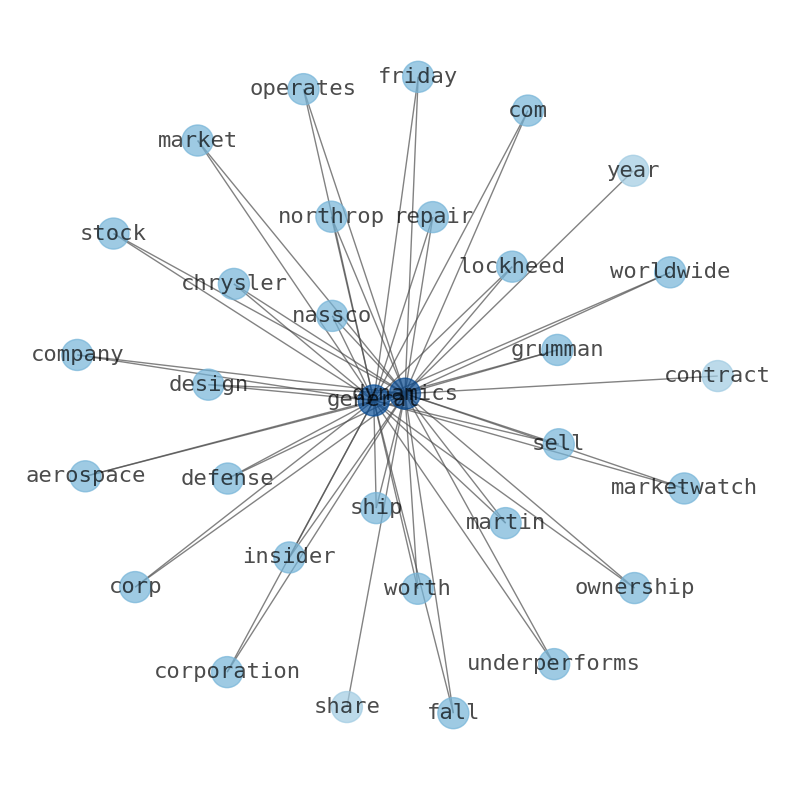

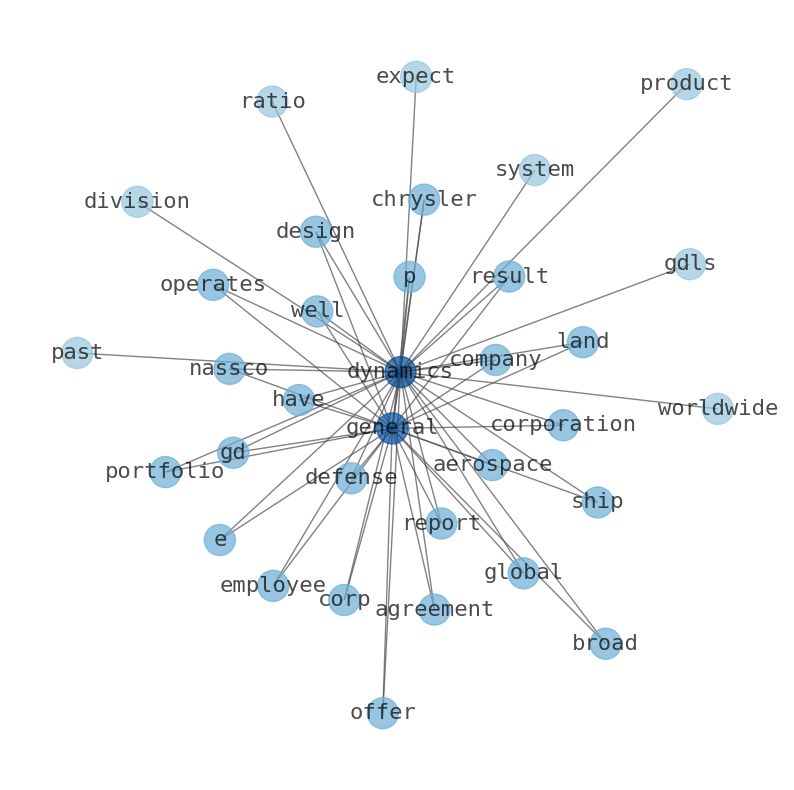

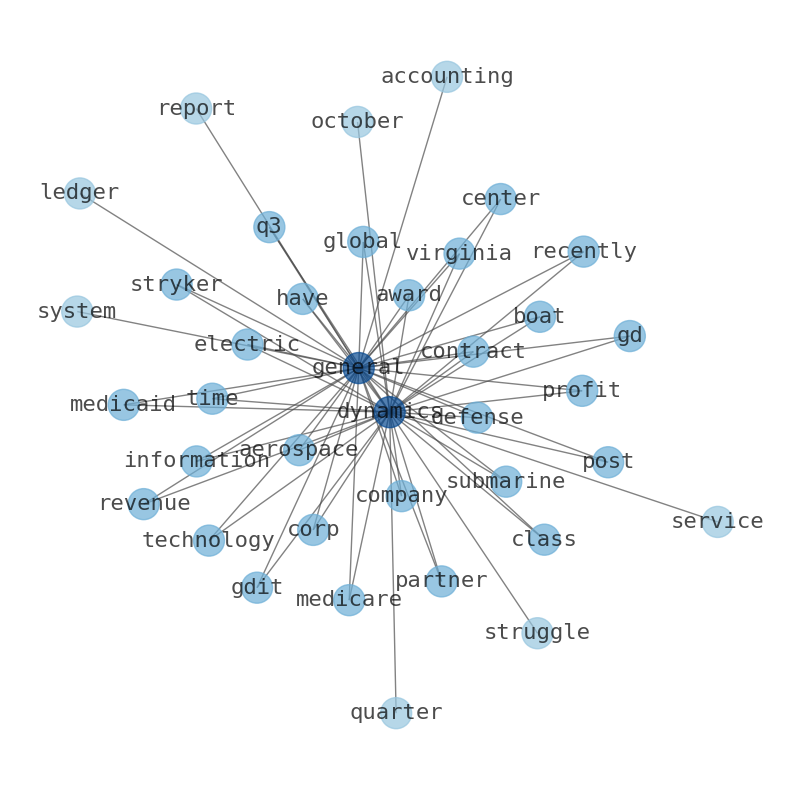

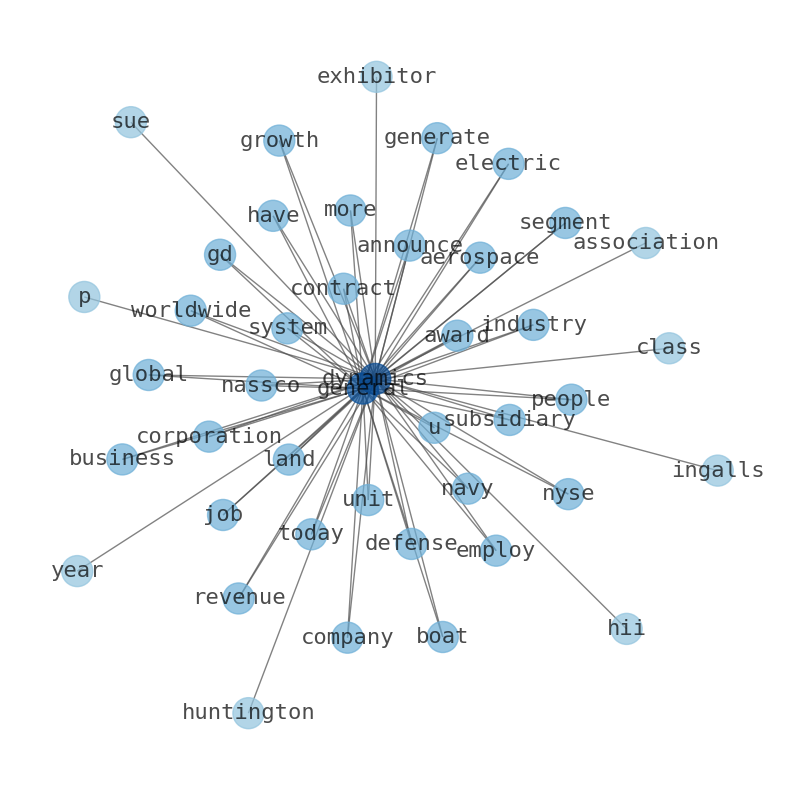

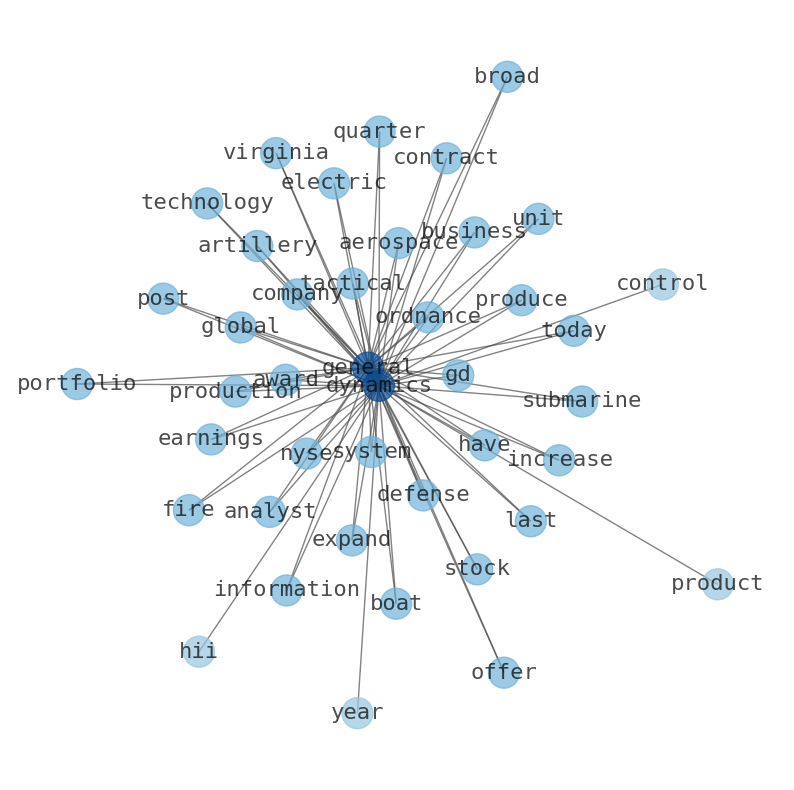

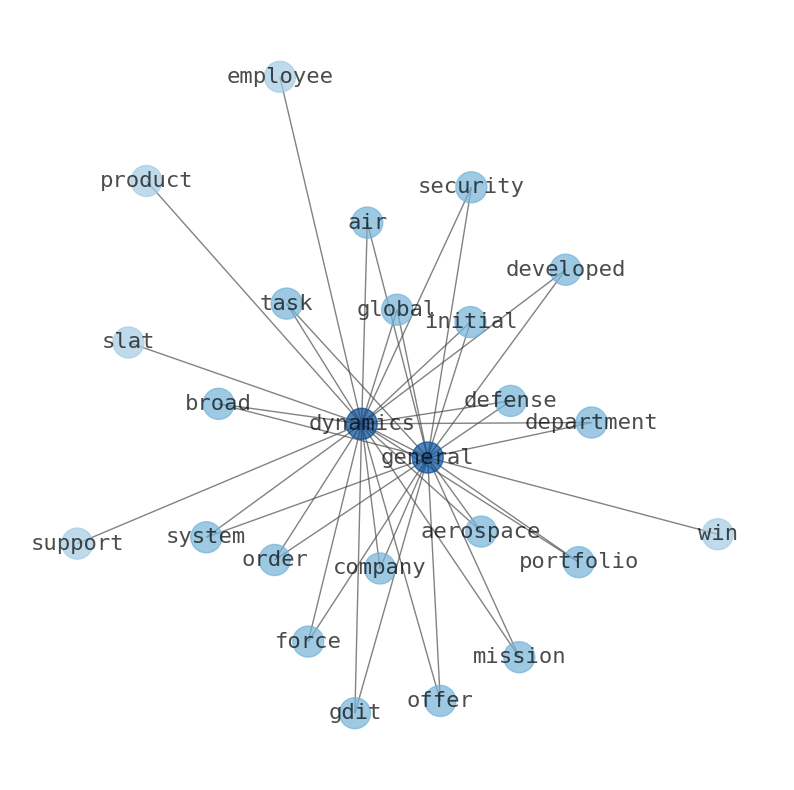

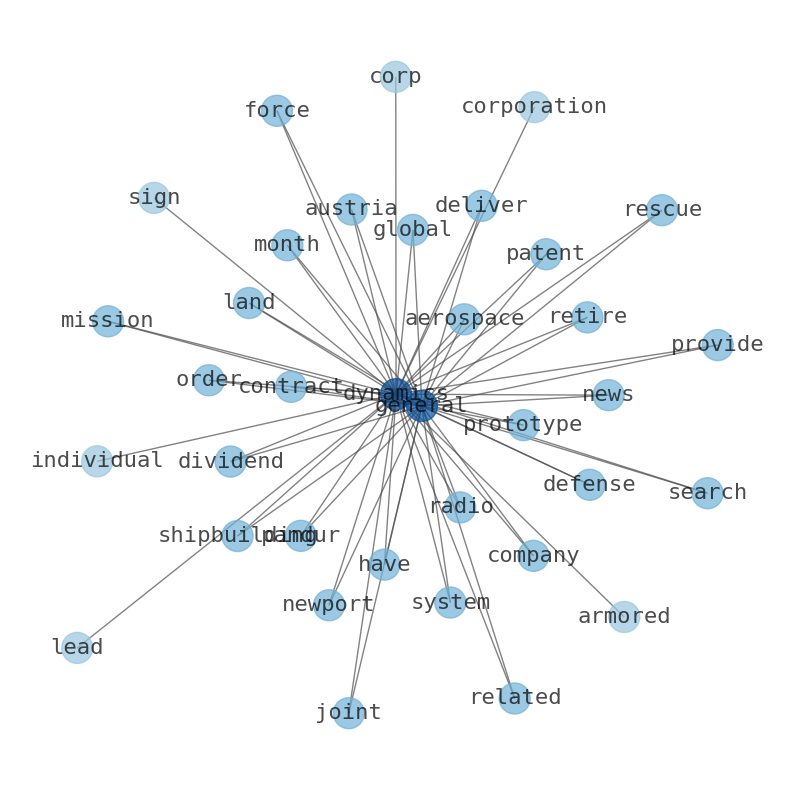

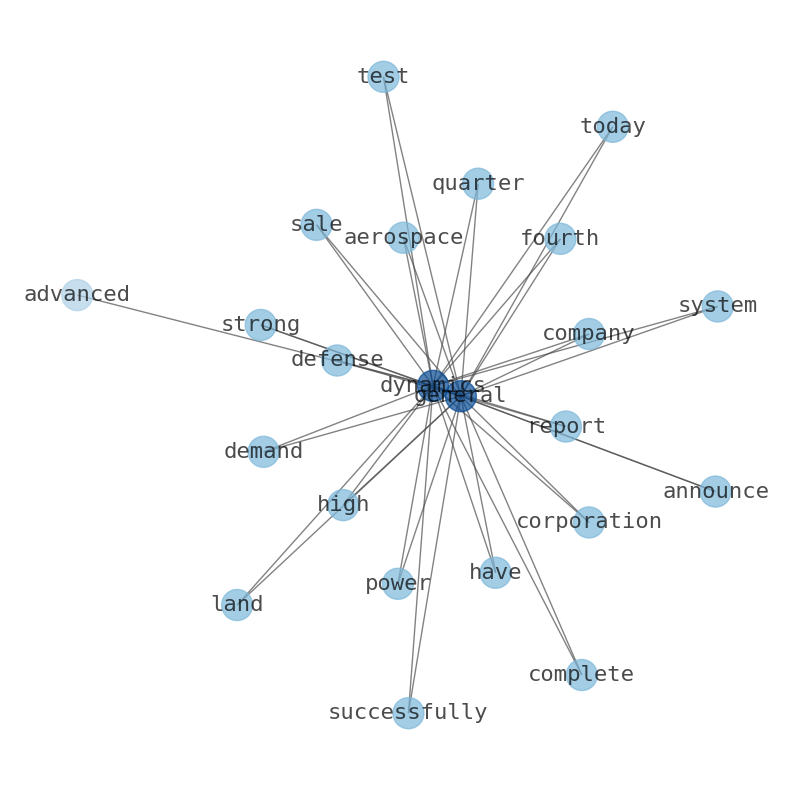

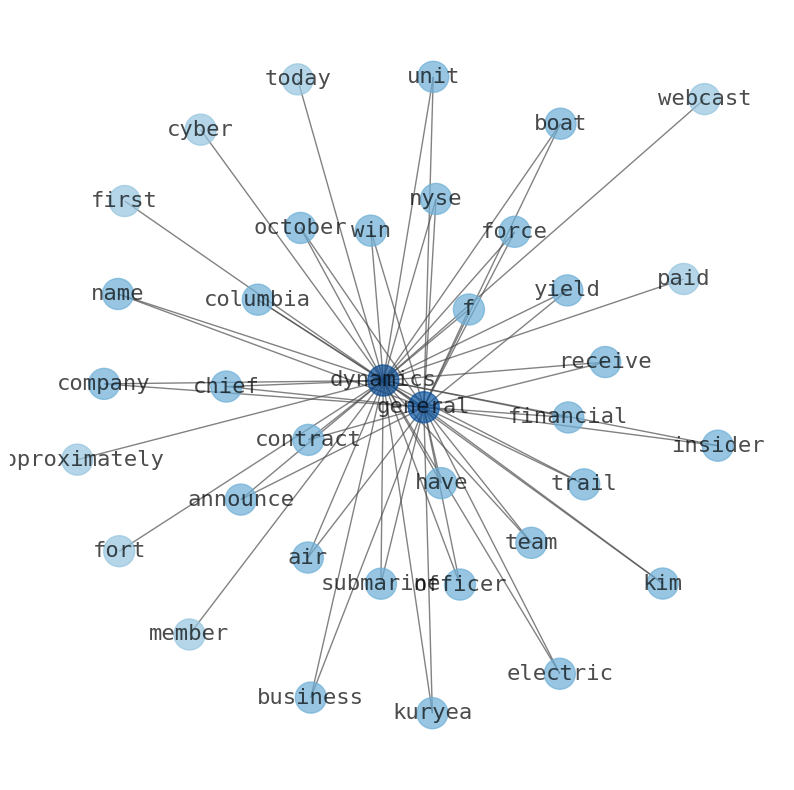

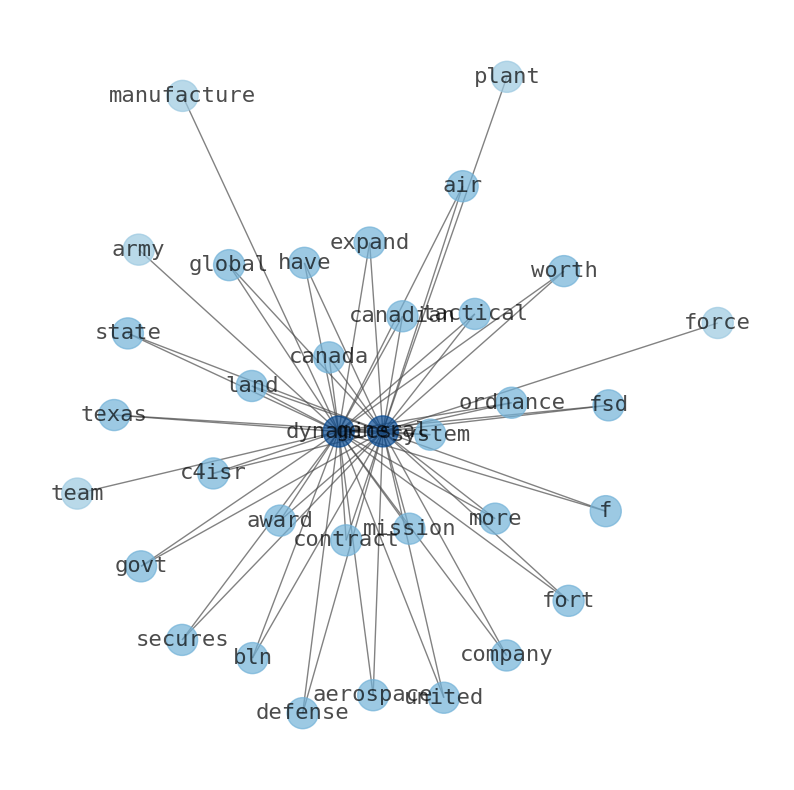

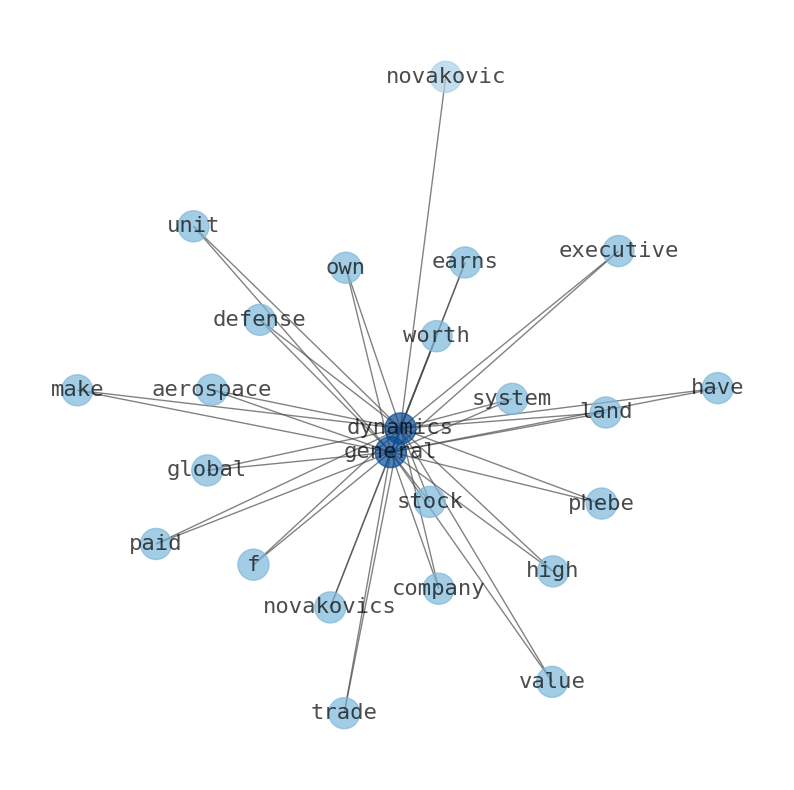

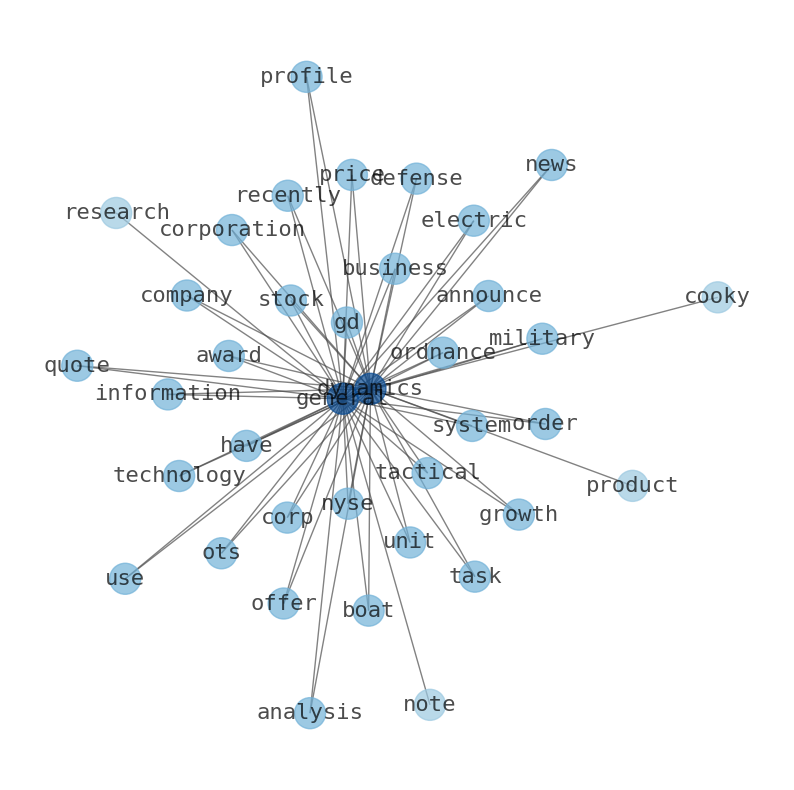

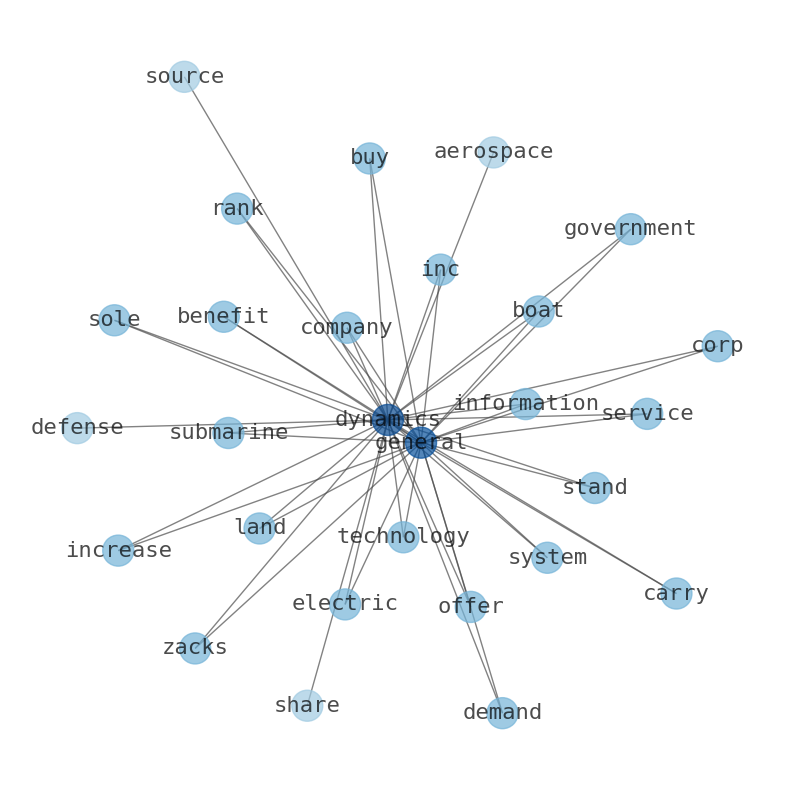

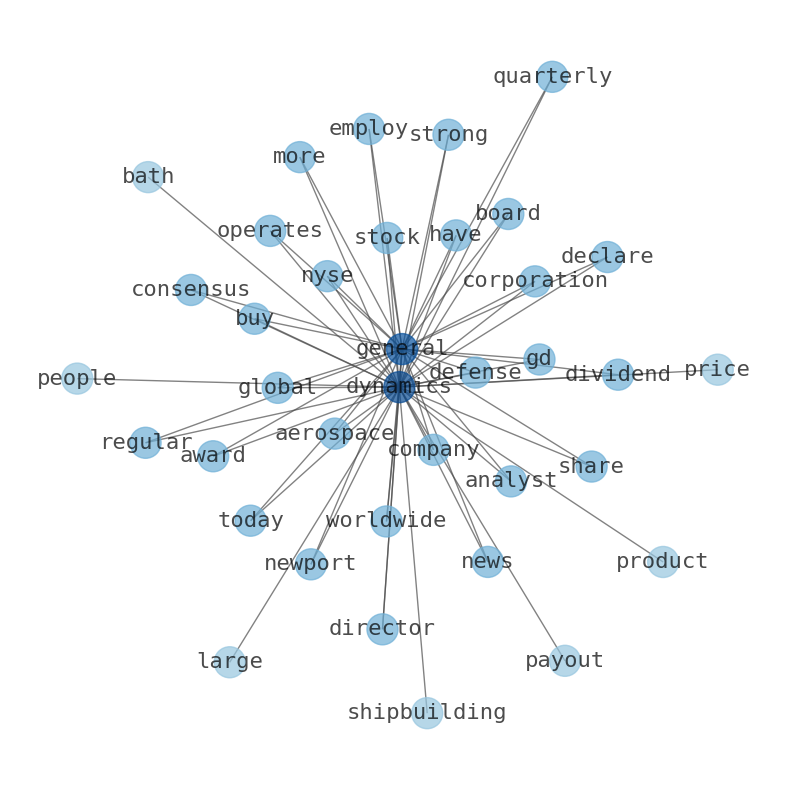

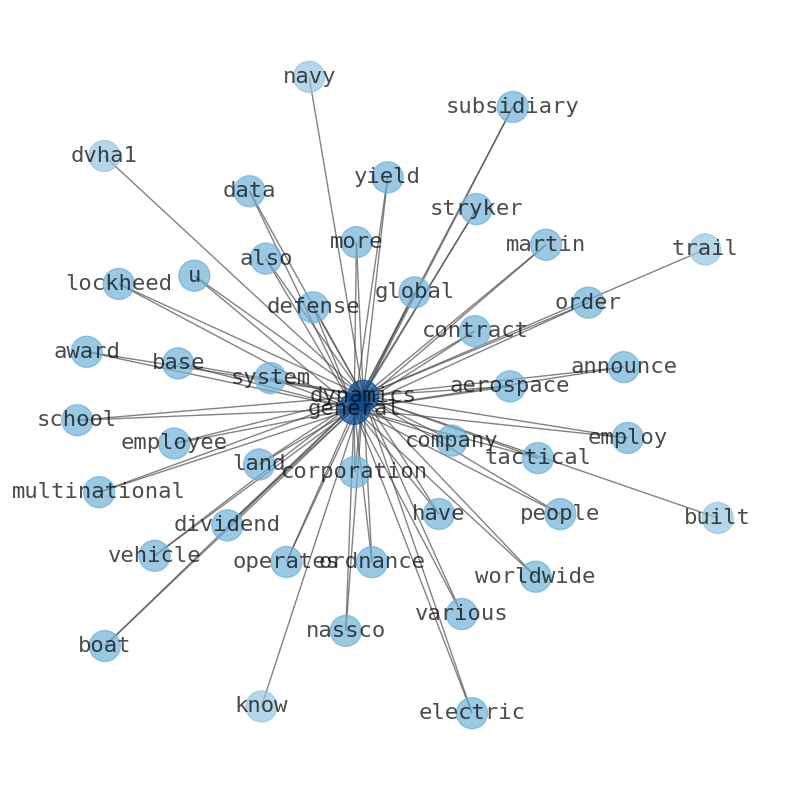

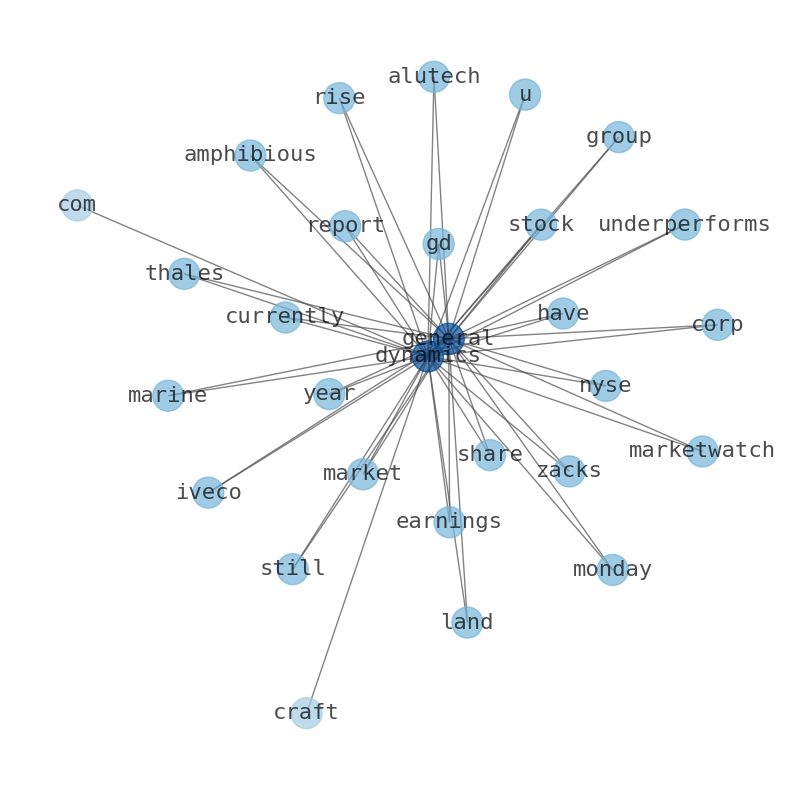

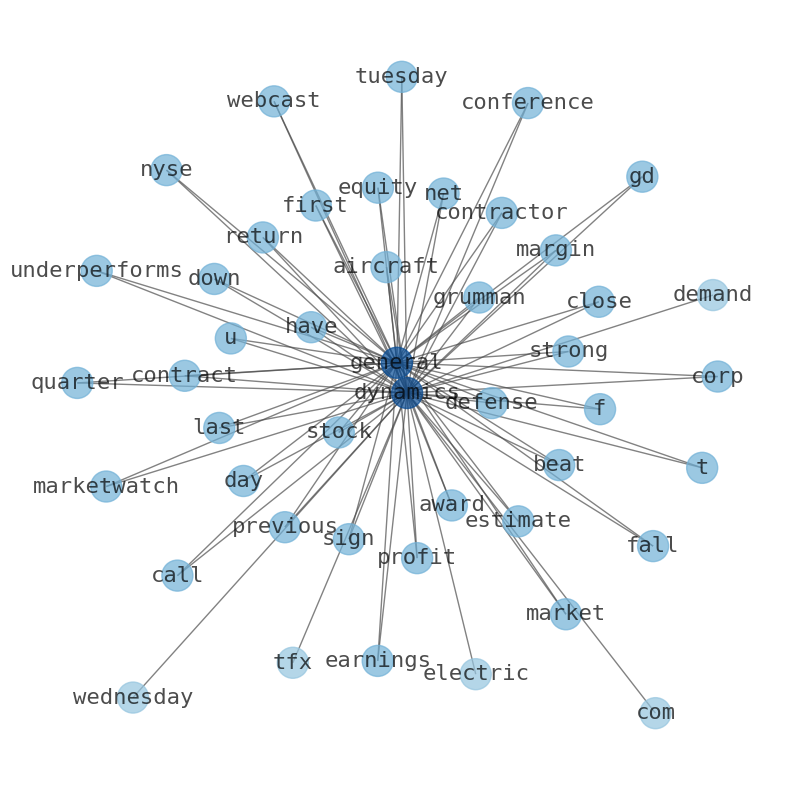

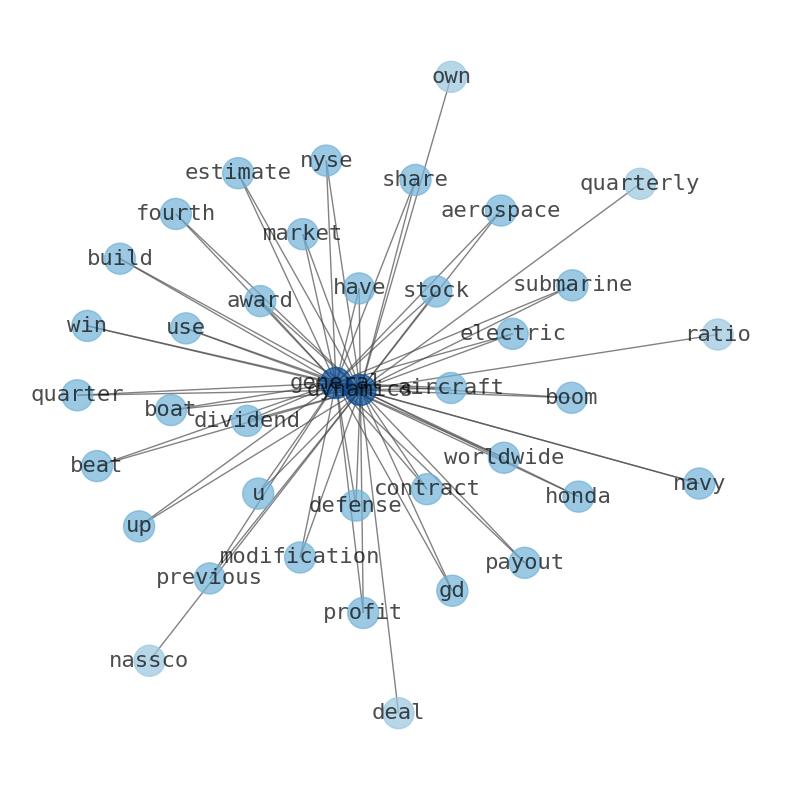

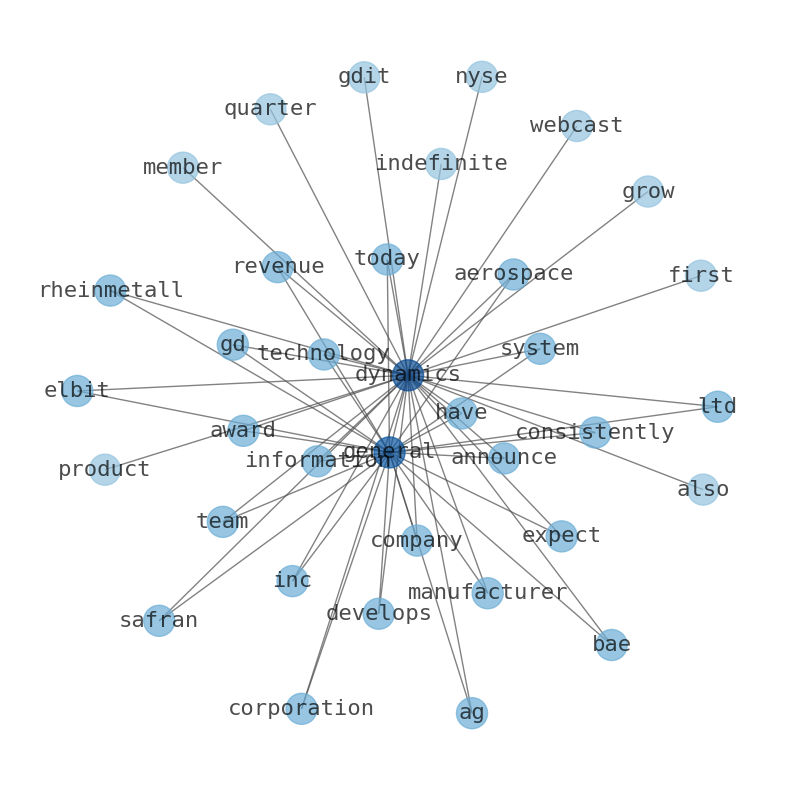

Keywords

This document will help you to evaluate General Dynamics without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about General Dynamics are: General, Dynamics, increase, ratio, share, dividend, defense, and the most common words in the summary are: general, dynamic, stock, market, availability, job, price, . One of the sentences in the summary was: General Dynamics generated $42.3 billion in revenue in 2023.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #general #dynamic #stock #market #availability #job #price.

Read more →Related Results

General Dynamics

Open: 336.4 Close: 336.41 Change: 0.01

Read more →

General Dynamics

Open: 273.68 Close: 274.31 Change: 0.63

Read more →

General Dynamics

Open: 272.5 Close: 274.14 Change: 1.64

Read more →

General Dynamics

Open: 254.29 Close: 250.65 Change: -3.64

Read more →

General Dynamics

Open: 258.52 Close: 259.67 Change: 1.15

Read more →

General Dynamics

Open: 253.12 Close: 249.56 Change: -3.56

Read more →

General Dynamics

Open: 245.0 Close: 243.21 Change: -1.79

Read more →

General Dynamics

Open: 242.0 Close: 242.7 Change: 0.7

Read more →

General Dynamics

Open: 237.88 Close: 238.25 Change: 0.37

Read more →

General Dynamics

Open: 239.5 Close: 243.04 Change: 3.54

Read more →

General Dynamics

Open: 221.5 Close: 222.93 Change: 1.43

Read more →

General Dynamics

Open: 224.15 Close: 224.69 Change: 0.54

Read more →

General Dynamics

Open: 226.69 Close: 224.01 Change: -2.68

Read more →

General Dynamics

Open: 212.16 Close: 214.96 Change: 2.8

Read more →

General Dynamics

Open: 209.99 Close: 209.25 Change: -0.74

Read more →

General Dynamics

Open: 204.08 Close: 205.24 Change: 1.16

Read more →

General Dynamics

Open: 204.71 Close: 205.25 Change: 0.54

Read more →

General Dynamics

Open: 274.0 Close: 273.7 Change: -0.3

Read more →

General Dynamics

Open: 274.19 Close: 273.02 Change: -1.17

Read more →

General Dynamics

Open: 252.32 Close: 261.18 Change: 8.86

Read more →

General Dynamics

Open: 251.34 Close: 254.81 Change: 3.47

Read more →

General Dynamics

Open: 251.0 Close: 252.43 Change: 1.43

Read more →

General Dynamics

Open: 255.4 Close: 252.81 Change: -2.59

Read more →

General Dynamics

Open: 245.0 Close: 244.02 Change: -0.98

Read more →

General Dynamics

Open: 237.88 Close: 238.25 Change: 0.37

Read more →

General Dynamics

Open: 239.37 Close: 237.95 Change: -1.42

Read more →

General Dynamics

Open: 217.55 Close: 216.75 Change: -0.8

Read more →

General Dynamics

Open: 222.06 Close: 222.39 Change: 0.33

Read more →

General Dynamics

Open: 226.69 Close: 224.01 Change: -2.68

Read more →

General Dynamics

Open: 215.33 Close: 215.15 Change: -0.18

Read more →

General Dynamics

Open: 212.16 Close: 214.96 Change: 2.8

Read more →

General Dynamics

Open: 204.99 Close: 204.18 Change: -0.81

Read more →

General Dynamics

Open: 204.08 Close: 205.24 Change: 1.16

Read more →

General Dynamics

Open: 210.1 Close: 208.05 Change: -2.05

Read more →- Apple

- Taiwan Semiconductor Manufacturing Company

- The Boeing Company

- Prosperity Bancshares

- Donaldson Company

- AutoNation

- HashiCorp

- Exelixis

- Matador Resources Company

- Halozyme Therapeutics

- MKS Instruments

- Brookfield Renewable

- Envista Holdings

- Automatic Data Processing

- Grupo Aeroportuario del Pacifico

- Murphy USA

- Gentex

- Bumble

- AGNC Investment

- National Fuel Gas Company

- Woori Financial Group

- The Western Union Company

- Tencent Music Entertainment Group

- The Estee Lauder Companies

- WESCO International

- Maravai LifeSciences Holdings

- Guidewire Software

- Unum Group

- PDC Energy

- Magnolia Oil & Gas

- SiteOne Landscape Supply

- Frontier Communications Parent

- Woodward

- Rio Tinto

- First Financial Bankshares

- SunRun

- Endeavor Group Holdings

- Kilroy Realty

- Stifel Financial

- South State

- Reynolds Consumer Products

- Starbucks

- Lumentum Holdings

- Sonoco Products Company

- FS KKR Capital

- Wyndham Hotels & Resorts

- United States Steel

- Vornado Realty Trust

- Dutch Bros

- Informatica

- Prologis

- AngloGold Ashanti

- Option Care Health

- CEMEX

- CCC Intelligent Solutions Holdings

- Huntsman

- Pinnacle Financial Partners

- Ingredion

- First American Financial

- Brunswick

- Voya Financial

- Flowers Foods

- Boyd Gaming

- Futu Holdings

- Stag Industrial

- Globus Medical

- BOK Financial

- ZIM Integrated Shipping Services

- British American Tobacco

- Valley National Bancorp

- Skechers USA

- nVent Electric

- Teladoc Health

- Popular

- BRP Inc.

- Acuity Brands

- MasTec

- Apellis Pharmaceuticals

- The Descartes Systems Group

- Applied Materials

- Agree Realty

- FirstService

- GXO Logistics

- MP Materials

- UWM Holdings

- Spirit Realty Capital

- Texas Roadhouse

- Southwest Gas Holdings

- Vipshop Holdings

- BP plc