The Best Stock Graphs and Charts

Youtube Subscribe Blog GamificArtThe development of Artificial Intelligence (AI) is modifying the way investments are evaluated. We programmed an artificial intelligence (A.I.) to summarize the internet. Whether you’re trying to make money investing online, making financial decisions or just getting informed about Wall Street, this page is a way to get informed without reading hundred of pages. Our stock market summary graphs are produced using machine learning, an unbiased view to capture what internet is saying. Usually, the AI reads several hundred pages and summarize it to a short text and several charts.

AutoZone

Youtube Subscribe

Open: 2536.45 Close: 2546.65 Change: 10.2

You'll be sorry if you don't use an AI to decide whether to invest in AutoZone Company Inc Stock.

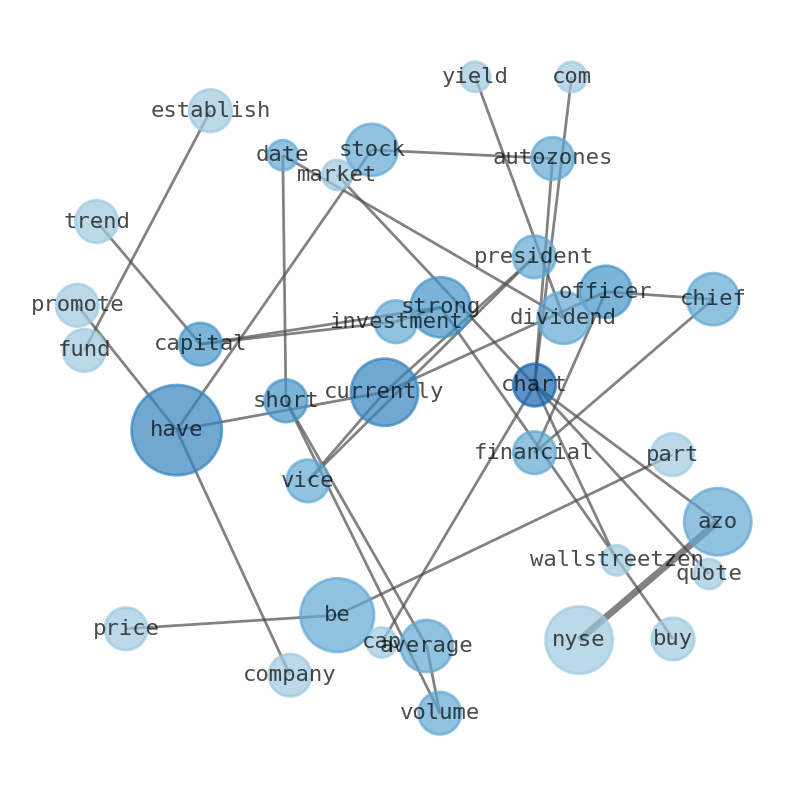

The game is changing. There is a new strategy to evaluate AutoZone fundamental value, possible risks and most salient advantages. Investors have traditionally relied in reading large amounts of text to evaluate the fundamental value of a stock or company. However, the development of Artificial Intelligence (AI) tools is modifying the way investments are evaluated in markets. Today, machine learning, natural language processing and bigdata allow making this process automatic, reducing large amounts of text to the elements that have a higher activation in a neural network. We programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about AutoZone are: AutoZone, Inc, currently, chief, officer, stock, Strong, and the …

Stock Summary

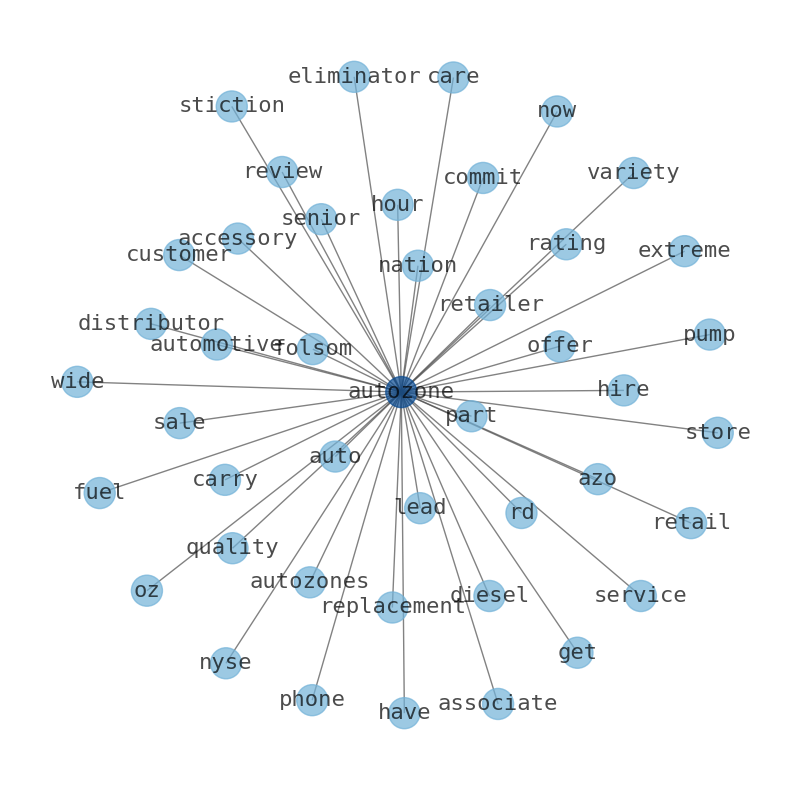

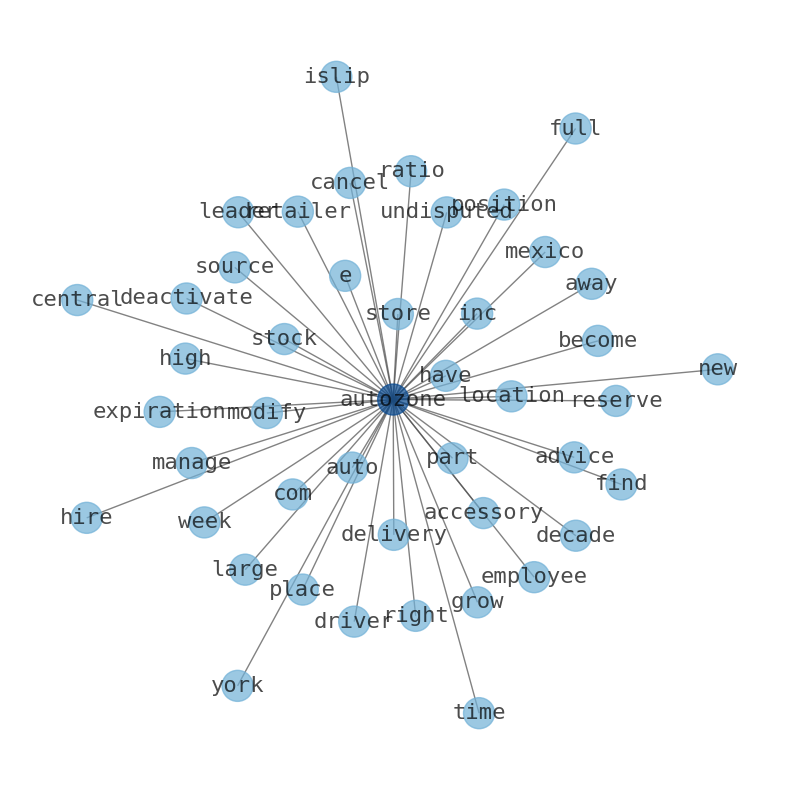

AutoZone, Inc. retails and distributes automotive replacement parts and accessories. The company offers various products for cars, sport utility vehicles, vans, vans and light trucks. Its products include A/C compressors, batteries and accessories.

Today's Summary

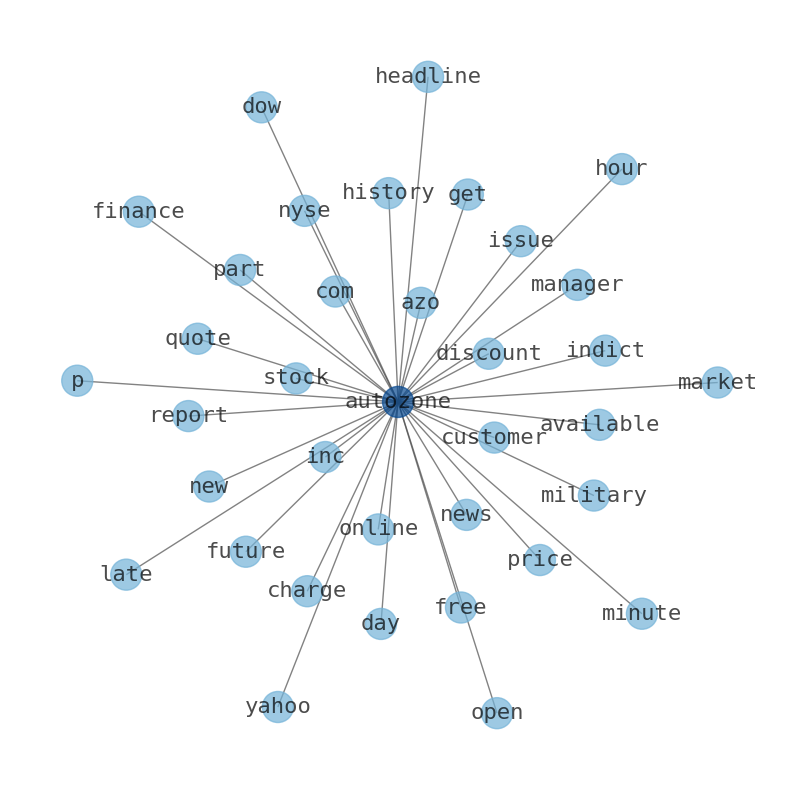

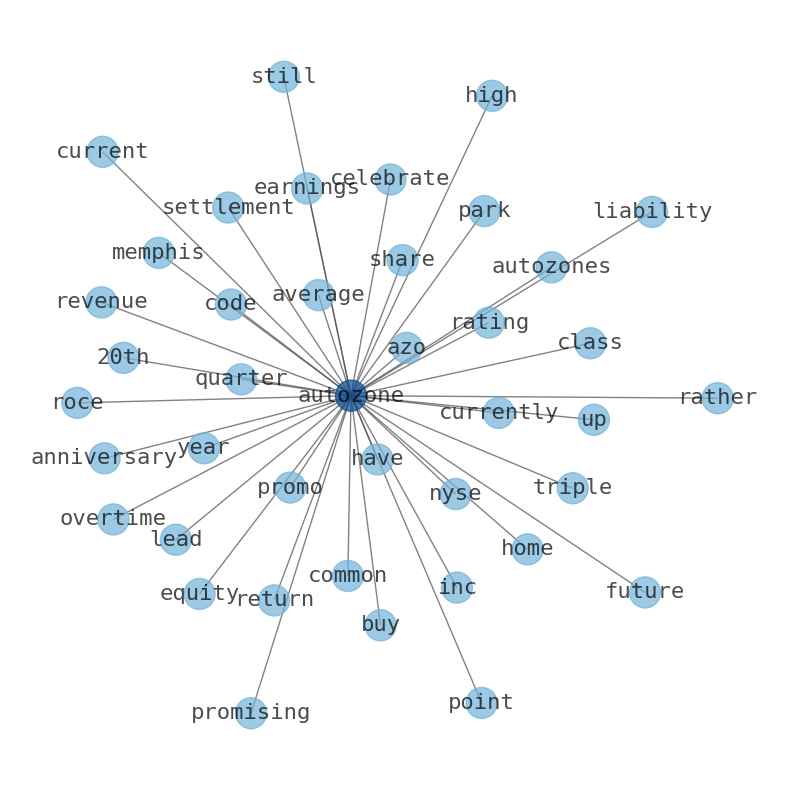

AutoZone is the largest supplier of aftermarket auto parts in the US. AutoZones stock hovers around $2537.79, implying a 14.42% upside from current levels. AutoZone does not appear to pay any dividends.

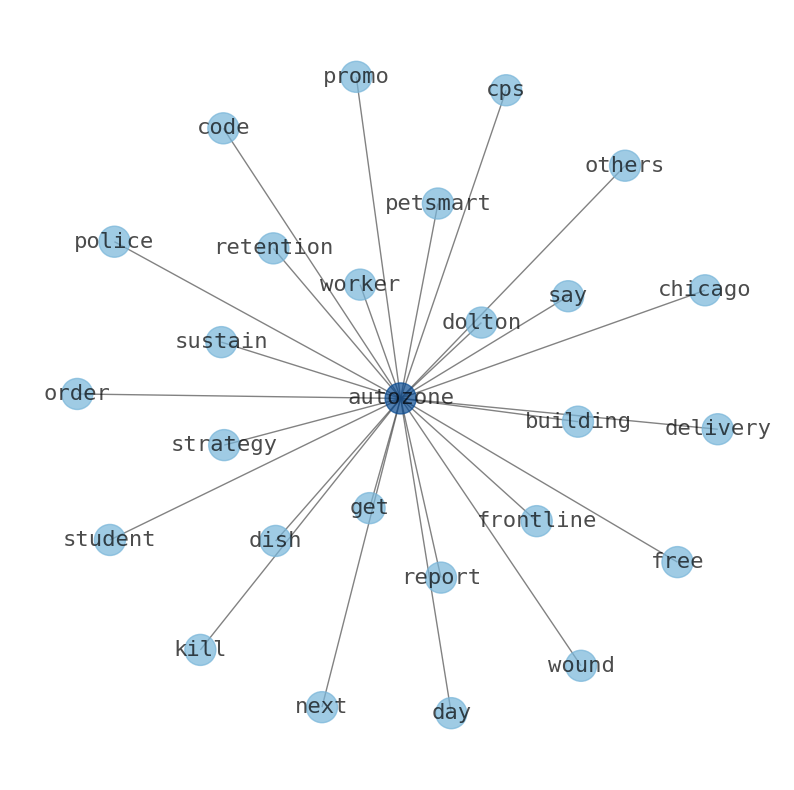

Today's News

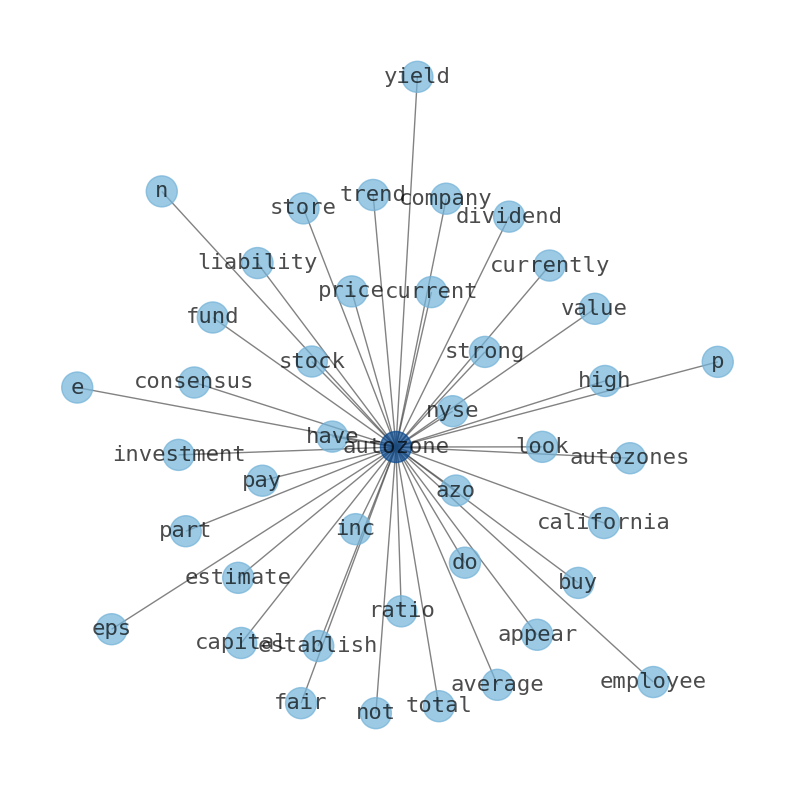

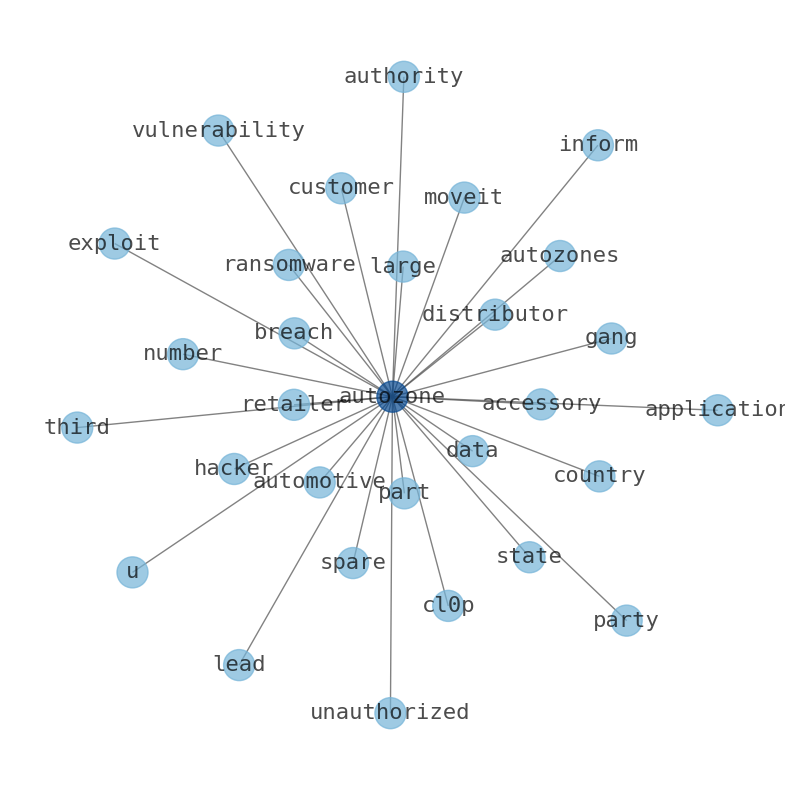

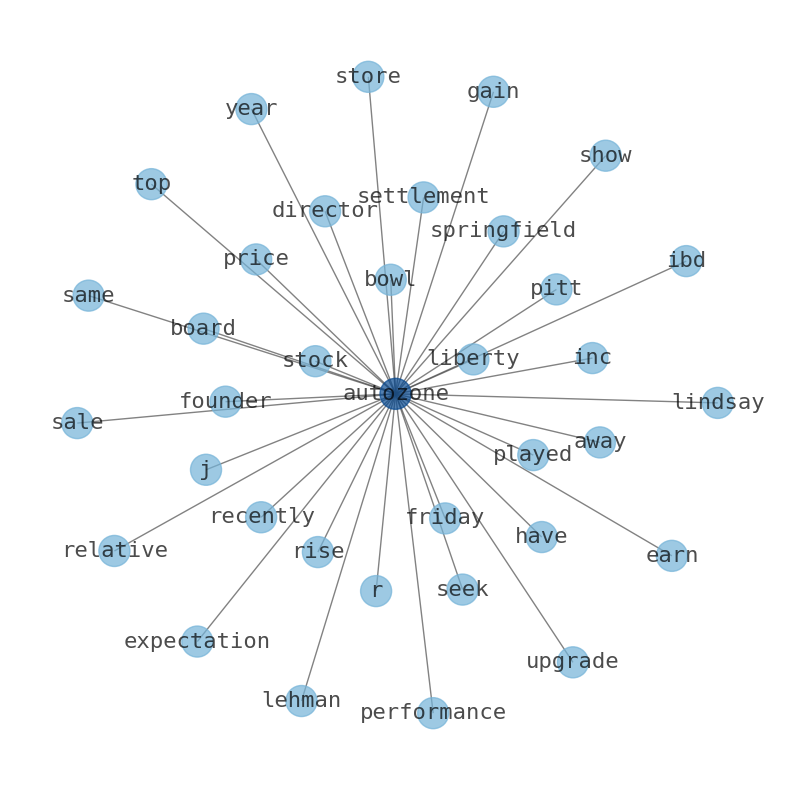

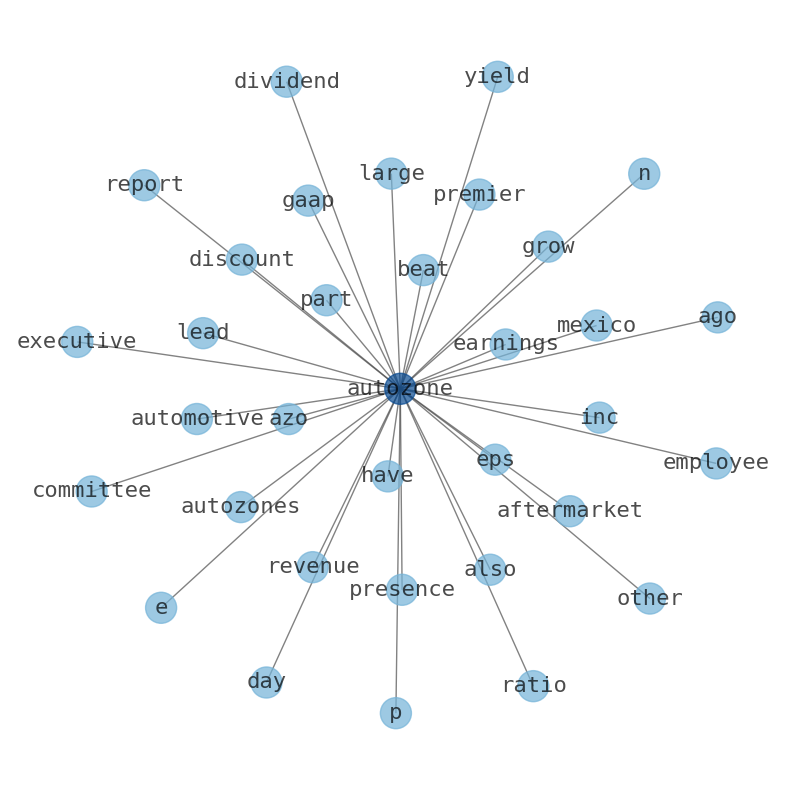

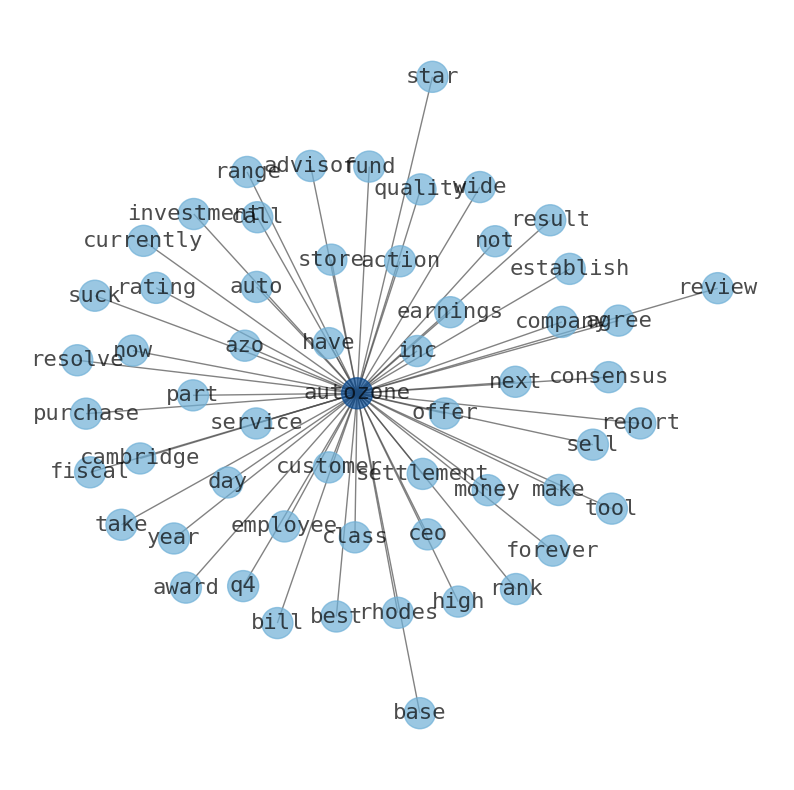

AutoZone Inc. per Employee $148.42K P/E Ratio 18.48 EPS $137.78 Yield N/A Dividend N/a Ex-Dividend Date N//A Short Interest 313.97K 12/29/23 % of Float Shorted 1.82% Average Volume 142.38K Performance 5 Day -0.42% 1 Month -3.4%; 15138ulton spend675 checkout shuts counterfeit Lindsey dexterityplanetン AutoZone announced in June that longtime CEO Bill Rhodes will be stepping down. AutoZone said the company has promoted Tom Newbern, currently executive vice president, operations, sales and technology, to chief operating officer. Jamere Jackson, currently chief financial officer, has been promoted to chief financial officers. Bill Hackney, a 38-year AutoZoner, currently senior vice president merchandising, has Zinglous203ldeanned emancipation MAD sequence patented SPACE Bosnia stun AutoZone Inc. has agreed to establish a $4.5 million class action settlement fund to resolve the litigation. AutoZone denies any wrongdoing but agrees to establish the fund to pay California workers a portion of the settlement amount. Anyone who worked in an hourly position at an AutoZone store in California within the past 10 years may be able. AutoZone stock price today (nyse: azo) quote, market cap, chart, chart | wallstreetzen.com: AutoZone. AutoZones stores carry product lines for cars, sport utility vehicles, vans and light trucks, as well as accessories and non-automotive products. AutoZone is the premier automotive parts retailer with over 7,000 locations in the Americas. The company has reduced its share count by approximately 89% since 1998. AutoZone is the largest supplier of aftermarket auto parts in the US. AutoZones stock hovers around $2537. Currently, AutoZone stock has a Strong Buy consensus rating. Capital Investment Trends At AutoZone (NYse:azo) Look Strong Capital Investment trends at AutoZone look strong. AutoZone has a high ratio of current liabilities to total assets of 54%. AutoZone does have some risks, we noticed 3 warning signs. The analyst consensus on AutoZone is a Strong Buy with an average price target of $2,937.79, implying a 14.42% upside from current levels. AutoZone has an average volume of 141.9K. Currently, AutoZone does not appear to pay any dividends. AutoZone, Inc. (NYSE:AZO) Estimating The Fair Value Of AutoZone (NYse:azo) Estimates the fair value of autozone, inc. (nyse:azO)

Stock Profile

"AutoZone, Inc. retails and distributes automotive replacement parts and accessories. The company offers various products for cars, sport utility vehicles, vans, and light trucks, including new and remanufactured automotive hard parts, maintenance items, accessories, and non-automotive products. Its products include A/C compressors, batteries and accessories, bearings, belts and hoses, calipers, chassis, clutches, CV axles, engines, fuel pumps, fuses, ignition and lighting products, mufflers, radiators, starters and alternators, thermostats, and water pumps, as well as tire repairs. In addition, the company offers maintenance products, such as antifreeze and windshield washer fluids; brake drums, rotors, shoes, and pads; brake and power steering fluids, and oil and fuel additives; oil and transmission fluids; oil, cabin, air, fuel, and transmission filters; oxygen sensors; paints and accessories; refrigerants and accessories; shock absorbers and struts; spark plugs and wires; and windshield wipers. Further, it provides air fresheners, cell phone accessories, drinks and snacks, floor mats and seat covers, interior and exterior accessories, mirrors, performance products, protectants and cleaners, sealants and adhesives, steering wheel covers, stereos and radios, tools, and wash and wax products, as well as towing services. Additionally, the company provides a sales program that offers commercial credit and delivery of parts and other products; sells automotive diagnostic and repair software under the ALLDATA brand through alldata.com and alldatadiy.com; and automotive hard parts, maintenance items, accessories, and non-automotive products through autozone.com. It has stores in the United States, Mexico, and Brazil. The company was founded in 1979 and is based in Memphis, Tennessee."

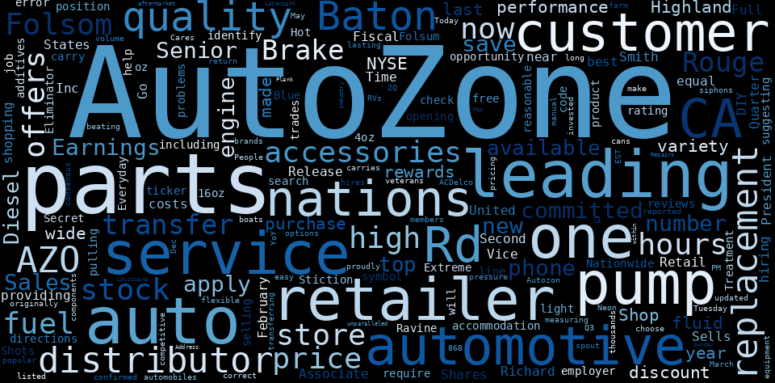

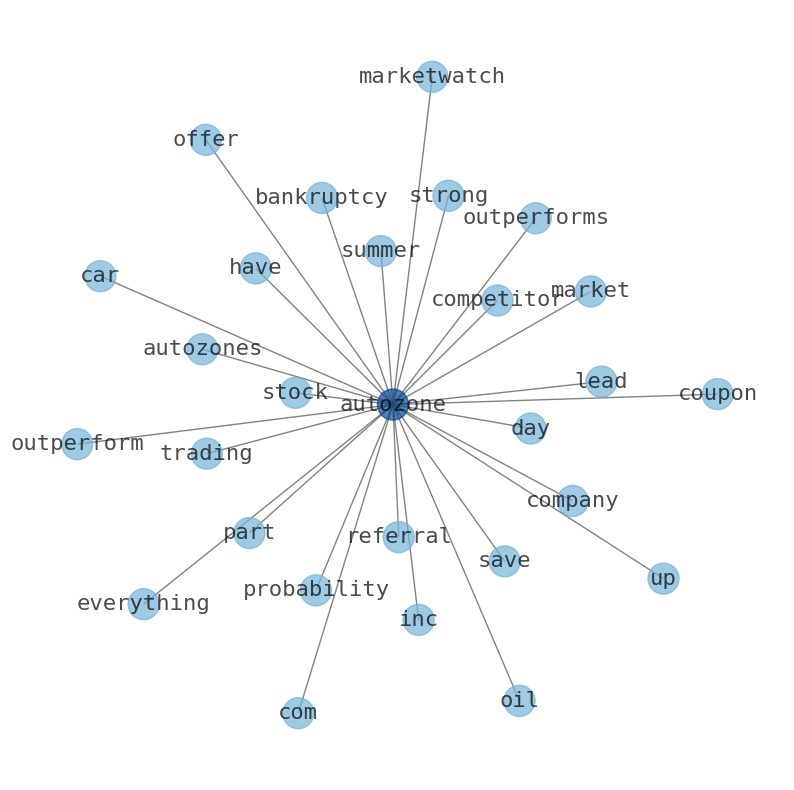

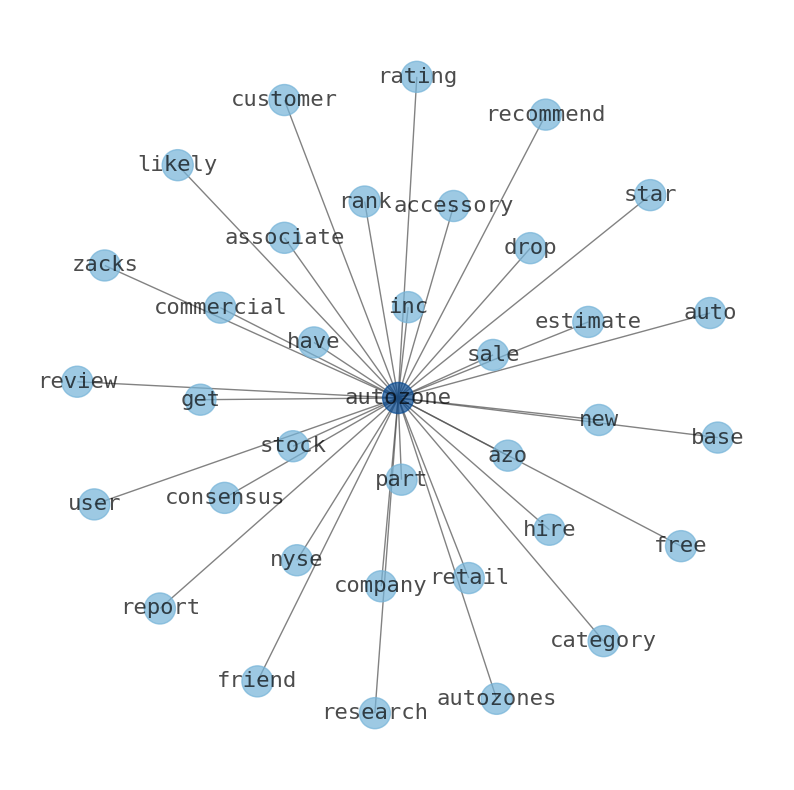

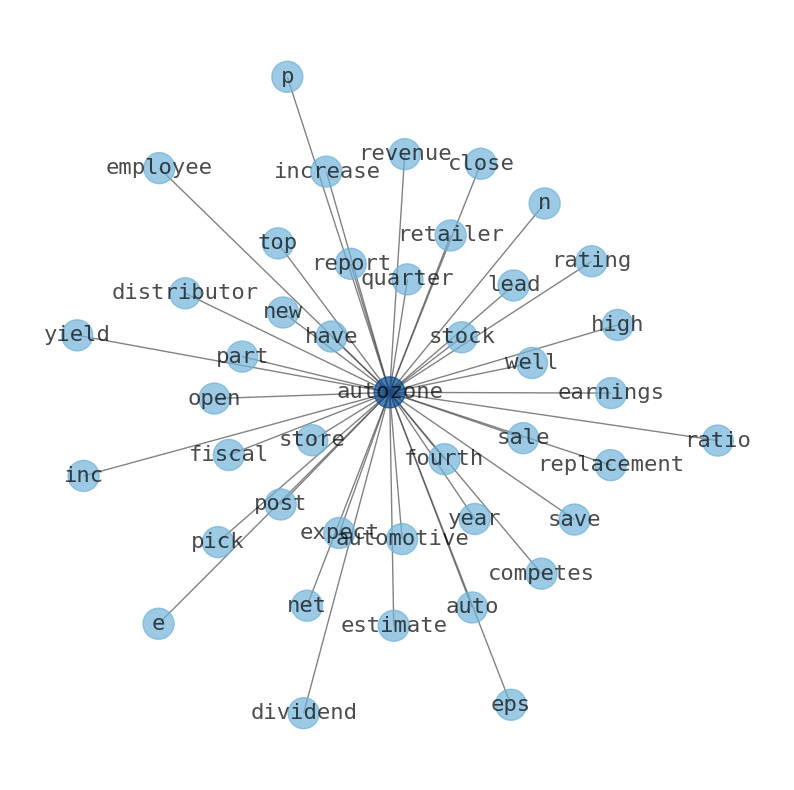

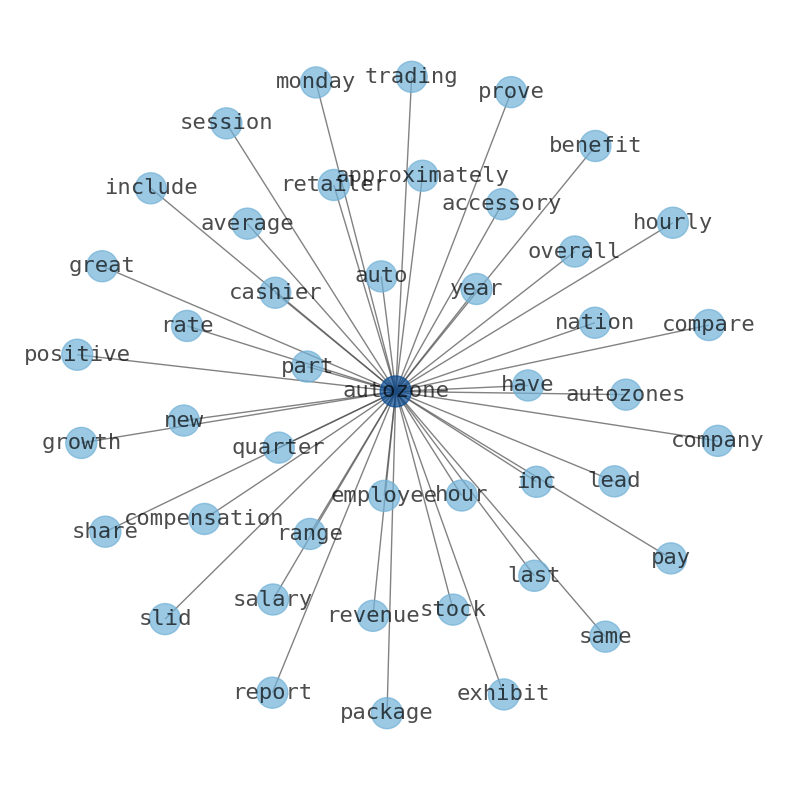

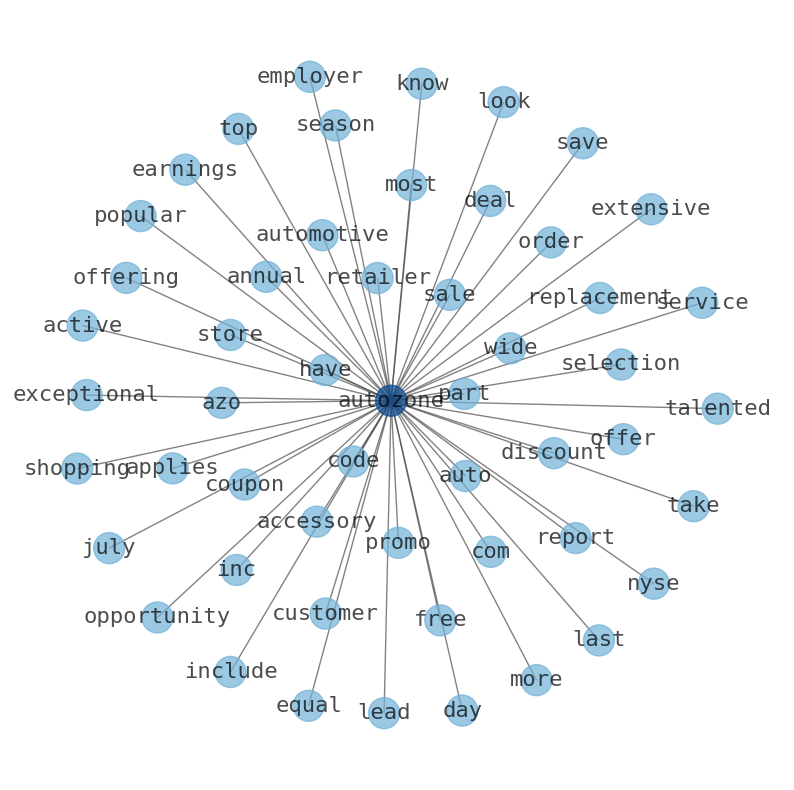

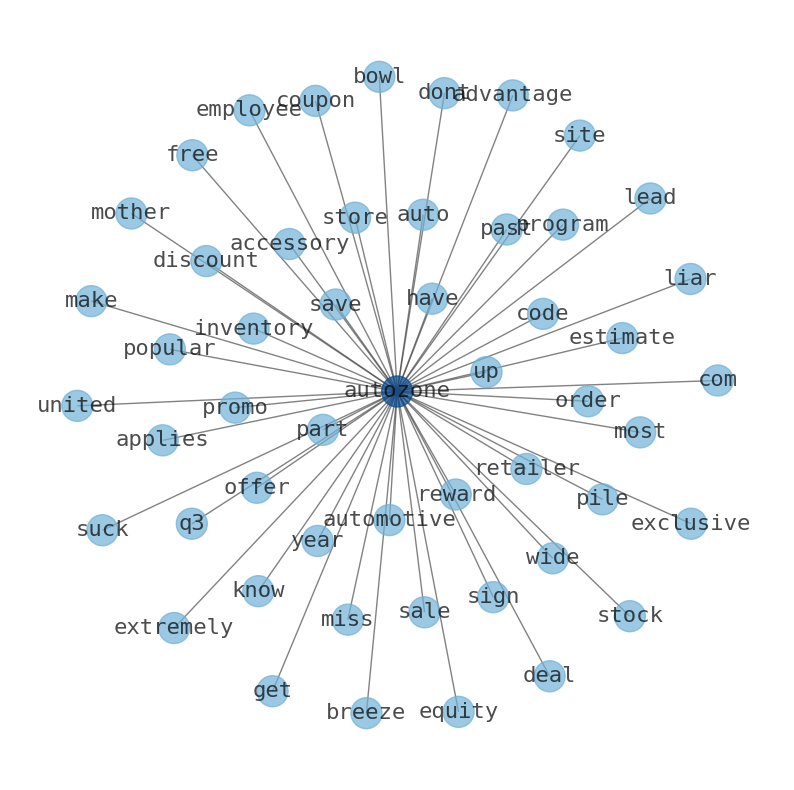

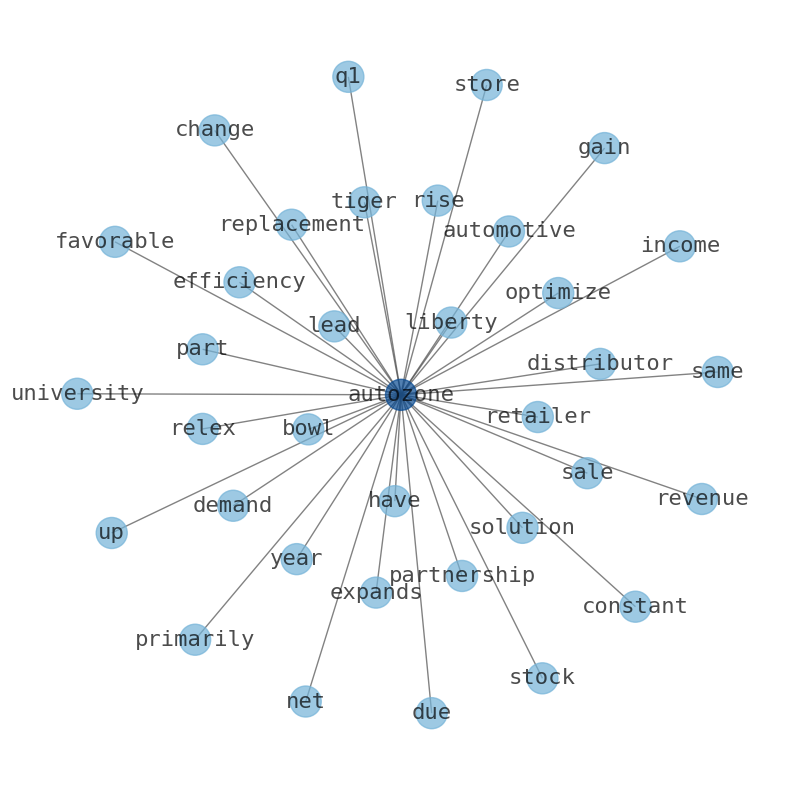

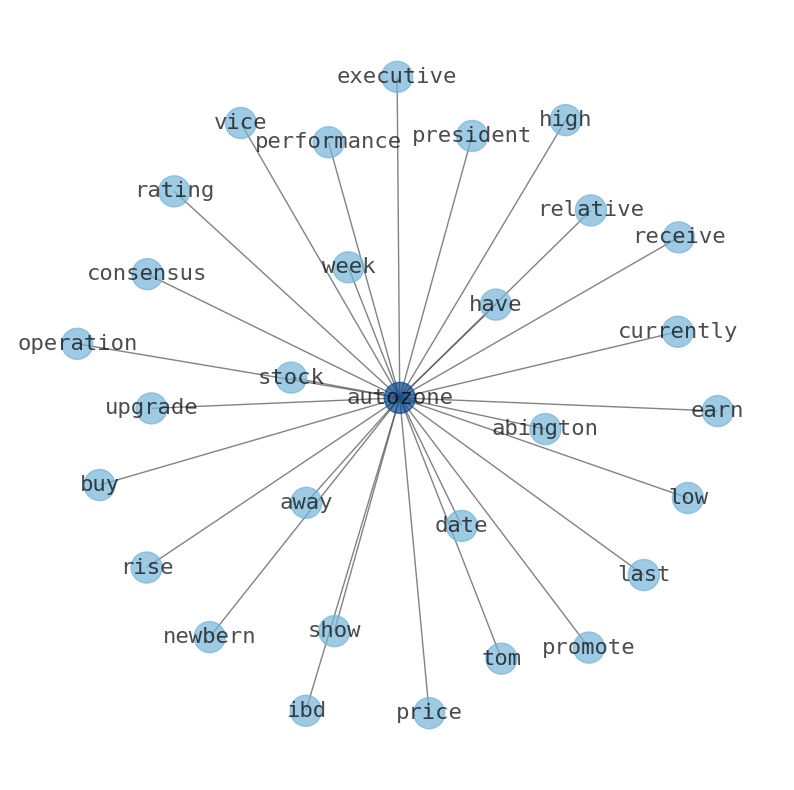

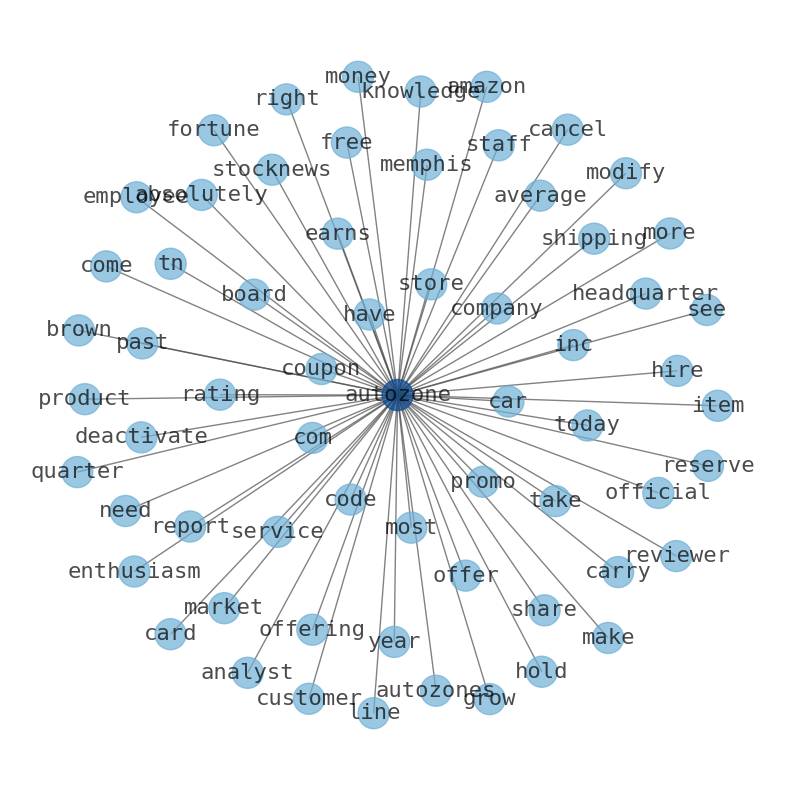

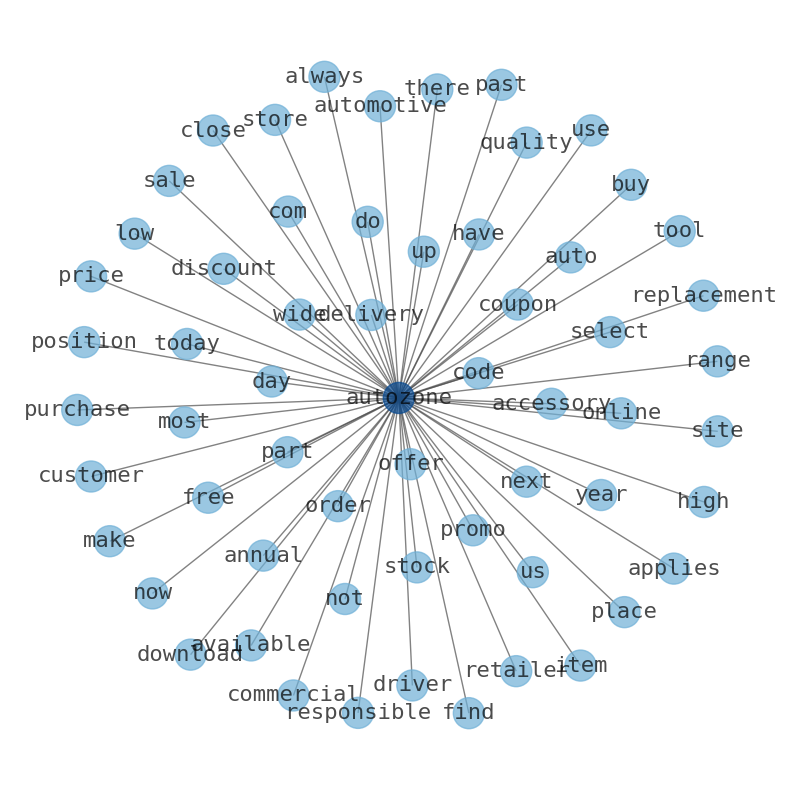

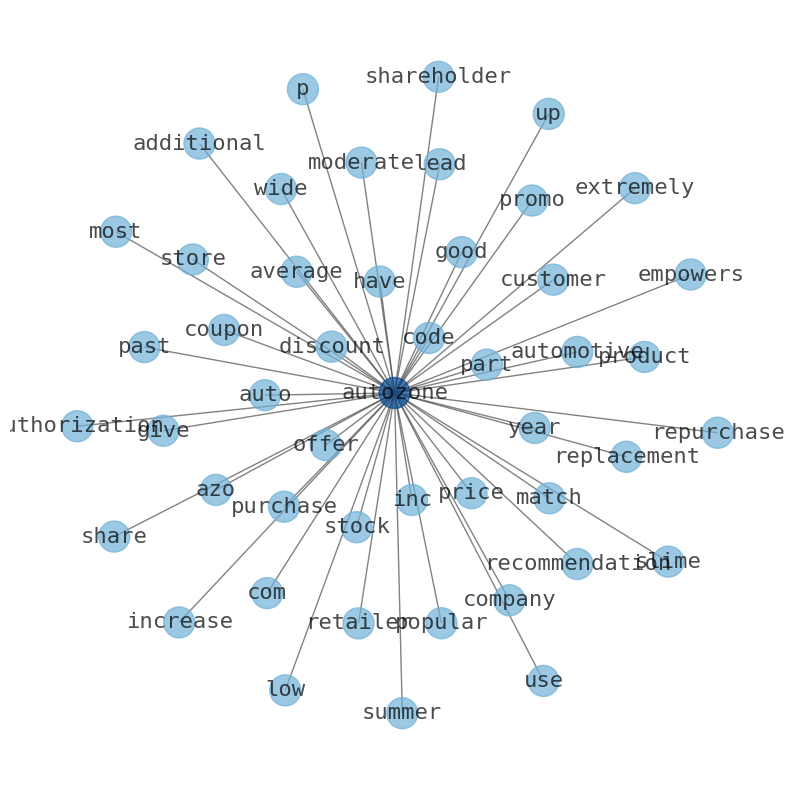

Keywords

This document will help you to evaluate AutoZone without reading an infinite amount of sources. Relying only on stock quotes or prices to make investment decisions is a mistake. Analyzing and observing stock charts, highs and lows and other numerical data does not allow to evaluate the real value of a company. Stock quotes and prices are the result of underlying characteristics of a company and of events and news happening around them. For this reason, investing must be based on information, not numbers. As a solution, we programmed an artificial intelligence that reads the whole internet and the uses natural language processing and vectorizers to summarize the information. Usually, the AI reads several hundred pages and summarize it to a short document. This document presents our results. We found that the most common words in the internet about AutoZone are: AutoZone, Inc, currently, chief, officer, stock, Strong, and the most common words in the summary are: autozone, stock, job, coupon, store, back, azo, . One of the sentences in the summary was: AutoZone does not appear to pay any dividends.. Other searches related to this term that the AI found were: stockmarketlive, livestock, stockmarketforbeginners, thestockmarket, stockmarkettoday, stockmarkettrading, stockmarketstocks, todaystockmarket, thestockmarket, marketnews, stockmarketnews, whatisstockmarket, usstockmarket, stockmarketopen. #autozone #stock #job #coupon #store #back #azo.

Read more →Related Results

AutoZone

Open: 3127.92 Close: 3124.01 Change: -3.91

Read more →

AutoZone

Open: 2735.04 Close: 2680.0 Change: -55.04

Read more →

AutoZone

Open: 2751.85 Close: 2798.15 Change: 46.3

Read more →

AutoZone

Open: 2536.45 Close: 2546.65 Change: 10.2

Read more →

AutoZone

Open: 2670.04 Close: 2688.0 Change: 17.96

Read more →

AutoZone

Open: 2658.55 Close: 2652.85 Change: -5.7

Read more →

AutoZone

Open: 2652.74 Close: 2641.95 Change: -10.79

Read more →

AutoZone

Open: 2563.91 Close: 2580.3 Change: 16.39

Read more →

AutoZone

Open: 2462.85 Close: 2453.4 Change: -9.45

Read more →

AutoZone

Open: 2481.35 Close: 2469.51 Change: -11.84

Read more →

AutoZone

Open: 2376.39 Close: 2339.95 Change: -36.44

Read more →

AutoZone

Open: 2701.51 Close: 2726.15 Change: 24.64

Read more →

AutoZone

Open: 2801.12 Close: 2769.82 Change: -31.3

Read more →

AutoZone

Open: 2676.2 Close: 2669.21 Change: -6.99

Read more →

AutoZone

Open: 2714.55 Close: 2632.7 Change: -81.85

Read more →

AutoZone

Open: 2676.28 Close: 2627.05 Change: -49.23

Read more →

AutoZone

Open: 2491.39 Close: 2488.55 Change: -2.84

Read more →

AutoZone

Open: 2555.93 Close: 2559.48 Change: 3.55

Read more →

AutoZone

Open: 2452.83 Close: 2469.13 Change: 16.3

Read more →

AutoZone

Open: 2478.42 Close: 2501.22 Change: 22.8

Read more →

AutoZone

Open: 2470.51 Close: 2493.36 Change: 22.85

Read more →- Apple

- Taiwan Semiconductor Manufacturing Company

- The Boeing Company

- Prosperity Bancshares

- Donaldson Company

- AutoNation

- HashiCorp

- Exelixis

- Matador Resources Company

- Halozyme Therapeutics

- MKS Instruments

- Brookfield Renewable

- Envista Holdings

- Automatic Data Processing

- Grupo Aeroportuario del Pacifico

- Murphy USA

- Gentex

- Bumble

- AGNC Investment

- National Fuel Gas Company

- Woori Financial Group

- The Western Union Company

- Tencent Music Entertainment Group

- The Estee Lauder Companies

- WESCO International

- Maravai LifeSciences Holdings

- Guidewire Software

- Unum Group

- PDC Energy

- Magnolia Oil & Gas

- SiteOne Landscape Supply

- Frontier Communications Parent

- Woodward

- Rio Tinto

- First Financial Bankshares

- SunRun

- Endeavor Group Holdings

- Kilroy Realty

- Stifel Financial

- South State

- Reynolds Consumer Products

- Starbucks

- Lumentum Holdings

- Sonoco Products Company

- FS KKR Capital

- Wyndham Hotels & Resorts

- United States Steel

- Vornado Realty Trust

- Dutch Bros

- Informatica

- Prologis

- AngloGold Ashanti

- Option Care Health

- CEMEX

- CCC Intelligent Solutions Holdings

- Huntsman

- Pinnacle Financial Partners

- Ingredion

- First American Financial

- Brunswick

- Voya Financial

- Flowers Foods

- Boyd Gaming

- Futu Holdings

- Stag Industrial

- Globus Medical

- BOK Financial

- ZIM Integrated Shipping Services

- British American Tobacco

- Valley National Bancorp

- Skechers USA

- nVent Electric

- Teladoc Health

- Popular

- BRP Inc.

- Acuity Brands

- MasTec

- Apellis Pharmaceuticals

- The Descartes Systems Group

- Applied Materials

- Agree Realty

- FirstService

- GXO Logistics

- MP Materials

- UWM Holdings

- Spirit Realty Capital

- Texas Roadhouse

- Southwest Gas Holdings

- Vipshop Holdings

- BP plc